This article is based on a talk given at conference “Local Resistance, Global Crisis” at National University of Ireland, Maynooth, 13th of June 2014

Does Ireland need a new left party?

Yes.

Why?

We are involved in a colossal class struggle and we are not winning.

We need to confront the very system that is demanding ever more drastic redistribution of wealth from below to above, accelerated accumulation by dispossession, continuing dismantling of the public sphere in favour of private property and commodified culture.

It is not enough to go issue to issue, to oppose cuts, to denounce austerity.

We need to win consent to a counter-narrative to the dominant view of the crisis. We need to break the grip of the belief that there is no alternative.

We need to fashion a force that will challenge for power that will make the long march through all the institutions of society: schools, universities, media, trade unions, local councils, national and international parliaments, production, distribution and exchange.

We need the best possible left. We need to maximise our efforts.

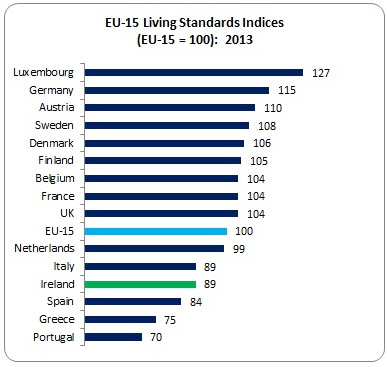

We need to build on electoral gains by the left in elections of 2011 and 2014. The last general election saw the greatest overturning in Dail Eireann in its history and the next will outdo it, we have every reason to believe. The last elections and recent polls indicate a huge shift, primarily to the left, in Irish politics.

We need to aim to form a left government in the next decade or so.

For this, we need a new left party. A party of a new type. By which I don’t mean a Marxist-Leninist vanguard party. Traditionally parties of the left have been communist, Trotskyist or social democratic parties. This would be different.

We have a multiplicity of left parties of the traditional types, quite a few of them M-L vanguard parties. All of these have maxed out their potential in their present form. Some are still vital, while others have been in decline for some time.

In the first category are the Socialist Workers Party and Socialist Party, each of which have formed broader fronts, the People Before Profit Alliance and Anti-Austerity Alliance. In the second category are the Communist Party of Ireland and Workers Party. The two Trotskyist parties and their broader fronts have been especially active on the streets and in electoral politics and they have achieved considerable success. They also built and broke the United Left Alliance.

None of these formations, in and of themselves, form the basis for the sort of new left party we need. They will be important in the future of any new left formation, but a new left party cannot be ULA 2.0.

We also have two bigger parties of the left, although some may contest whether they are left: the Labour Party and Sinn Fein. They are left, but not as left as what we need. This is primarily because they do not engage in systemic analysis and therefore they do not move in the direction of systemic transformation.

There is a big empty space where a big party to the left of LP and SF should be. We need a new left party to fill this space.

What kind of new left party should this be?

Like this:

Like Loading...

Read Post →