News applications, databases and interactive graphics

News apps and graphics

Featured

Fewer than half of Australian adults to own a home: study

Fewer than half of Australian adults to own a home: study

The great Australian dream of owning a home is slipping out of reach for many, according to a new survey.

Nothing Ezy as Wooworths unpicks the past

Nothing Ezy as Wooworths unpicks the past

The epic Woolworths clean-up job has cost shareholders more than $4 billion in writedowns in 2016 alone.

Dick Smith was an accident waiting to happen

Dick Smith was an accident waiting to happen

If you believe the former executives and directors of Dick Smith, this collapse should never have happened.

Election 2016 data and visualisations

Election 2016 data and visualisations

Delve into the 2016 federal election with our exclusive collection of databases and interactives.

The long, slow decline of the major parties

The long, slow decline of the major parties

Voters are tracking back towards a situation where up to one-third choose a side other than Labor or the Coalition.

Worst performance from the top 20 stocks since 1989

Worst performance from the top 20 stocks since 1989

Unfortunately for investors, the new financial year won't bring an end to the market's anxious mood.

Brexit vote sinks global markets

Brexit vote sinks global markets

Global markets had their worst day since the global financial crisis as Britain voted to leave the European Union.

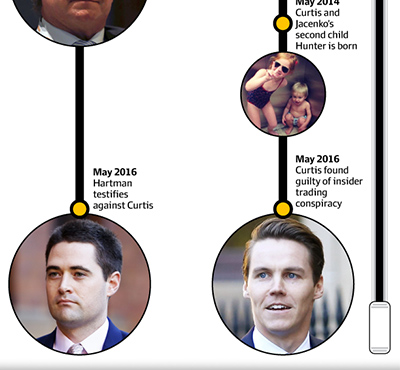

Oliver Curtis jailed for insider trading

Oliver Curtis jailed for insider trading

Oliver Curtis will be spending at least one year in Silverwater Prison after he was sentenced to jail for insider trading.

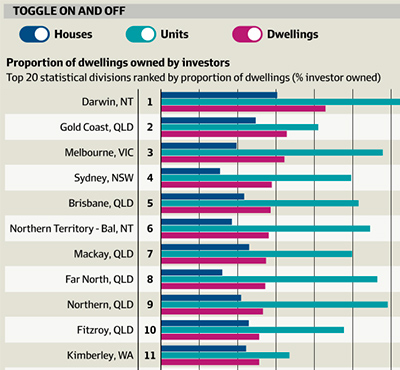

What Australia's 2m real estate investors pay in tax

What Australia's 2m real estate investors pay in tax

Australia's housing investors earned more than $50 billion in gross capital gains in 2015.

BRW Rich 200: Property the path to ultra-wealth

BRW Rich 200: Property the path to ultra-wealth

The most common path to ultra-wealth is property, with 50 of the BRW Rich 200 making their fortune from real estate.

BRW Rich 200: Triguboff number one for the first time

BRW Rich 200: Triguboff number one for the first time

Property developer Harry Triguboff tops the 2016 BRW Rich 200 list thanks to a surging real estate market.

BRW Rich 200: The rise and fall of Gina Rinehart's wealth

BRW Rich 200: The rise and fall of Gina Rinehart's wealth

The impact of the mining boom and the BRW Rich 200 can be summarised in a single figure: $24 billion.

Where the best-paid jobs for women are on the ASX

Where the best-paid jobs for women are on the ASX

The key to riches for women working in listed companies is to become the head of technology, operations or finance.

Budget 2016-17 data interactives

Budget 2016-17 data interactives

Delve into every major aspect of the federal budget with our exclusive Budget Explorer interactives.

The Panama Papers

The Panama Papers

A leak of 11.5 million files from Panamanian law firm Mossack Fonseca reveals the inside workings of a shadowy financial system that allows the wealthy and powerful to hide capital around the world.

US election race

US election race

Explore the Financial Review's overview of battle to become the next President of the United States.

Why it's time to rebalance your portfolio

Why it's time to rebalance your portfolio

There was a time not so long ago when a few Australian stocks, a bit of cash and a few hybrid notes would have been enough of a spread to score you an adequate to impressive investment return.

How to build a portfolio of reliable dividend payers

How to build a portfolio of reliable dividend payers

From early March to the end of April, more than $19 billion in dividend cheques will have hit the mailboxes of Australian shareholders. Of that figure, about $3.2 billion will be paid to readers like you, members of the million-strong SMSF movement.

Smaller ASX listed companies are letting the side down on diversity

Smaller ASX listed companies are letting the side down on diversity

Smaller listed companies continue to ignore the advantages of getting some diversity on their boards and are sticking with the "stale, pale and male" directors with whom they feel so comfortable.

Arrium's landlords need steely resolve

Arrium's landlords need steely resolve

Some of Australia's biggest landlords have admitted a heightened level of risk surrounding their debt-laden steelmaker tenant Arrium after the company fell into administration on Thursday.

Compare you super balance

Compare you super balance

Interactive fun: See how your super balance compares to others your age and gender and income.

Widescreen tax database

Widescreen tax database

The ATO has published, for the first time, revenue, taxable income and tax payable for 321 private resident companies with earnings of $200 million or more and 1539 public companies with earnings of $100 million or more.

Investing in start-ups

Investing in start-ups

PwC highlights the various stages investors will buy in to an early stage investment and what they can expect.

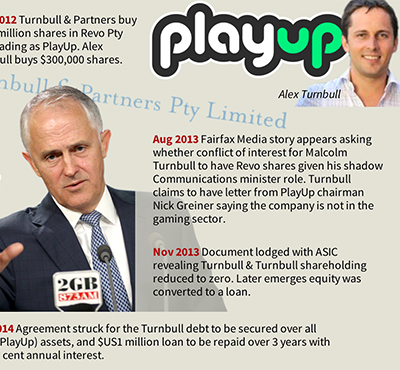

Turnbull, Greiner and the $US1m loan

Turnbull, Greiner and the $US1m loan

Prime Minister Malcolm Turnbull and his family have retrieved some of their investment in a failed tech start-up as other wealthy and famous investors face losing $100 million

There's an app for that

There's an app for that

How does someone who earns $500,000 a year land themselves in a situation where they are living month to month. Here's five smartphone apps to help you manage your personal wealth.

Defence White Paper

Defence White Paper

Australia will significantly expand its military capability in a $450 billion spend over the next decade in acknowledgement that the rise of China has tilted long-standing strategic balances.

Property bubble

Property bubble

These charts show why Jonathan Tepper and John Hempton believe Australia is in the midst of "one of the biggest housing bubbles in history". Read all about it, and see more charts here.

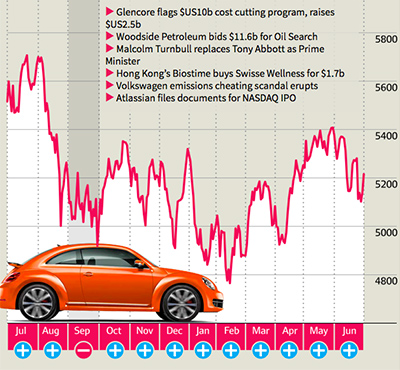

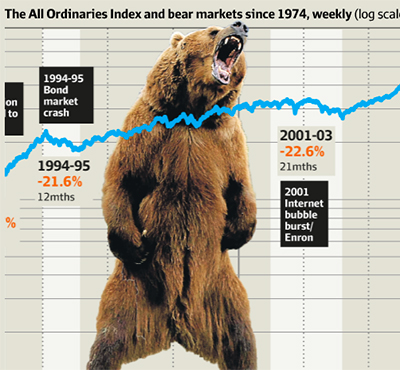

Grizzly or gummy bear market

Grizzly or gummy bear market

The Australian sharemarket tumbled into bear territory this week and investors, scarred from the global financial crisis, are fearing the worst, but statistics may be on their side.

Aussie bank shorts on the rise

Aussie bank shorts on the rise

So far 2016 has not been kind to investors in the world's biggest banks. They've borne the brunt of the brutal January sell-off, and Aussie banks have been slammed too.

Paul Bassat's journey

Paul Bassat's journey

Start-up whizz to venture capitalist. The future is where Paul Bassat says he lives too much. "The restless person thinks about the future, which is the mode I'm in," he says.