- published: 12 May 2011

- views: 126660

- published: 17 Jun 2014

- views: 69302

- published: 18 Mar 2013

- views: 74581

- published: 01 Nov 2016

- views: 1018

- published: 09 Mar 2016

- views: 4365

- published: 13 Oct 2015

- views: 4690

- published: 06 May 2011

- views: 4423

- published: 21 Feb 2013

- views: 48412

- published: 17 Nov 2014

- views: 13833

- Loading...

-

5:36

5:36Basic leveraged buyout (LBO) | Stocks and bonds | Finance & Capital Markets | Khan Academy

Basic leveraged buyout (LBO) | Stocks and bonds | Finance & Capital Markets | Khan AcademyBasic leveraged buyout (LBO) | Stocks and bonds | Finance & Capital Markets | Khan Academy

The mechanics of a simple leveraged buy-out. Created by Sal Khan. Watch the next lesson: https://www.khanacademy.org/economics-finance-domain/core-finance/stock-and-bonds/bonds-tutorial/v/corporate-debt-versus-traditional-mortgages?utm_source=YT&utm;_medium=Desc&utm;_campaign=financeandcapitalmarkets Missed the previous lesson? Watch here: https://www.khanacademy.org/economics-finance-domain/core-finance/stock-and-bonds/mergers-acquisitions/v/simple-merger-arb-with-share-acquisition?utm_source=YT&utm;_medium=Desc&utm;_campaign=financeandcapitalmarkets Finance and capital markets on Khan Academy: Private equity firms often borrow money (use leverage) to buy companies. This tutorial explains how they do it and pay the debt. About Khan Academy: Khan Academy offers practice exercises, instructional videos, and a personalized learning dashboard that empower learners to study at their own pace in and outside of the classroom. We tackle math, science, computer programming, history, art history, economics, and more. Our math missions guide learners from kindergarten to calculus using state-of-the-art, adaptive technology that identifies strengths and learning gaps. We've also partnered with institutions like NASA, The Museum of Modern Art, The California Academy of Sciences, and MIT to offer specialized content. For free. For everyone. Forever. #YouCanLearnAnything Subscribe to Khan Academy’s Finance and Capital Markets channel: https://www.youtube.com/channel/UCQ1Rt02HirUvBK2D2-ZO_2g?sub_confirmation=1 Subscribe to Khan Academy: https://www.youtube.com/subscription_center?add_user=khanacademy -

13:25

13:25Simple LBO Model - Case Study and Tutorial

Simple LBO Model - Case Study and TutorialSimple LBO Model - Case Study and Tutorial

In this LBO Model tutorial, you'll learn how to build a very simple LBO model "on paper" that you can use to answer quick questions in PE (and other) interviews. By http://breakingintowallstreet.com/ "Financial Modeling Training And Career Resources For Aspiring Investment Bankers" This matters because in many cases, they'll ask you to calculate numbers such as IRR and multiple of invested capital very quickly and will not actually ask you to build a more complex model until later in the process. You should always START this exercise by looking at the actual question or set of questions they are asking you: "Calculate the purchase price required for ABC Capital to obtain a 3.0x multiple of invested capital (MOIC) if it plans to sell OpCo after five years at an EV / EBITDA multiple of 6.0x." So they're giving you the exit multiple and the return on investment that the PE firm is targeting, and you have to figure out the initial purchase price by "working backwards." Here's how we interpret each line in this case study and use it in the model: "OpCo currently has EBITDA of $250mm, and ABC believes that the new management team could keep EBITDA flat for the next 5 years." This tells you to make the initial EBITDA $250mm and keep it at that level for 5 years - skip revenue, COGS, OpEx, and everything else because none of that matters if this is all they give you. "ABC Capital has obtained debt financing of $750mm at 10% interest, and OpCo expects working capital to be a source of funds at $6mm per year." The initial debt balance is $750mm and there's a 10% interest rate, so the interest expense will be $75mm per year. In the "Cash Flow Statement Adjustments", since Working Capital is a SOURCE of funds it will add $6mm to cash flow each year. "OpCo requires capital expenditures of $35mm per year, and it has a tax rate of 40%. Assume no transaction fees, zero minimum cash required, and that PP&E; on the balance sheet remains constant for the next 5 years." Also in the CFS section, CapEx = $35mm per year, and Depreciation also equals $35mm per year since the PP&E; balance does not change at all. So you can also fill in the Depreciation figure on the Income Statement. No transaction fees and no minimum cash requirement simplify the purchase price and debt repayment - although we don't even have debt repayment here. "Assume that excess cash is NOT used to repay debt, and instead simply accumulates on the Balance Sheet." This makes the final numbers easier to calculate, since interest expense will never change and you can simply add up cash generated to get to the final cash number at the end. PROCESS: 1. Start with the Income Statement - EBITDA is $250mm per year. Subtract Depreciation of $35mm per year, and interest of $75mm per year. So EBIT = $140mm. Taxes = $140mm * 40%, so Net Income = $140mm - $56mm = $84mm. 2. On the simplified CFS, Net Income = $84mm, Depreciation = $35mm, Change in Working Capital = $6mm, CapEx = ($35mm), so Cash Generated per year = $90mm. 3. EBITDA Exit Multiple = 6.0x, and final year EBITDA = $250mm, so Exit EV = $1.5B. Subtract the outstanding debt of $750mm and add the cash generated in this period of $450mm, so Equity Proceeds = $1.2B. 4. Targeted MOIC = 3.0x so the PE firm would have to invest $400mm in the beginning. $400mm equity + $750mm debt = $1.150B, so the purchase multiple is $1,150 / $250 = 4.6x. Further Resources http://youtube-breakingintowallstreet-com.s3.amazonaws.com/109-04-Simple-LBO-Model.pdf http://youtube-breakingintowallstreet-com.s3.amazonaws.com/109-04-Simple-LBO-Model.xlsx -

8:56

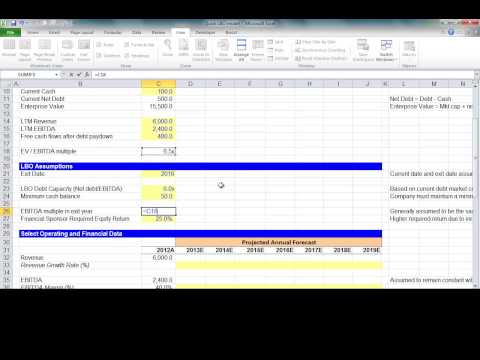

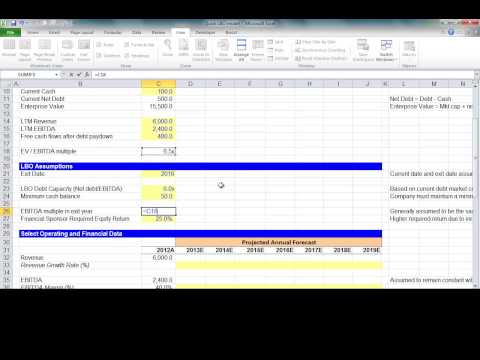

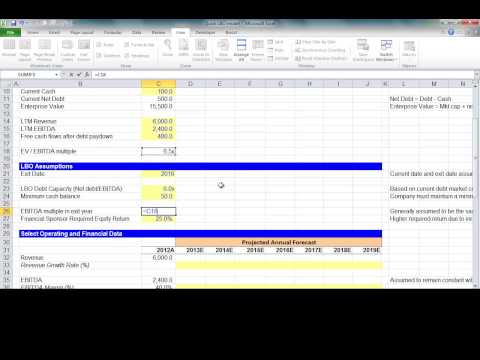

8:56Financial Modeling Quick Lesson: Simple LBO Model (1 of 3)

Financial Modeling Quick Lesson: Simple LBO Model (1 of 3)Financial Modeling Quick Lesson: Simple LBO Model (1 of 3)

Note: To download the Excel template that goes with this video, go to http://www.wallstreetprep.com/blog/financial-modeling-quick-lesson-simple-lbo-model/ In this video tutorial, we'll build a leveraged buyout (LBO) model, given some operating and valuation assumptions, in Excel. The goal of this video is to show you that an LBO model is actually a very simple transaction at its core - and quite similar to the mechanics involved when purchasing a home. If after watching this video you want to take your LBO modeling to the next level, see Wall Street Prep's advanced LBO modeling course at http://www.wallstreetprep.com/programs/self_study/advanced_lbo_modeling.php. -

18:49

18:49LBO Model Interview Questions: What to Expect

LBO Model Interview Questions: What to ExpectLBO Model Interview Questions: What to Expect

In this tutorial, you’ll learn about the most common LBO modeling-related questions and some tricks and rules of thumb you can use to approximate the IRR and solve for assumptions like the purchase price and EBITDA growth in leveraged buyouts. Table of Contents: 2:36 Question #1: LBO Model Walkthrough 5:34 Question #2: Ideal LBO Candidates 8:09 Question #3: How to Approximate IRR 11:46 Question #4: How to Solve for EBITDA or the Purchase Price 13:58 Question #5: How to Approximate the IRR in an IPO Exit 16:03 Recap, Summary, and Key Principles Lesson Outline: Will you get LBO-related questions in interviews? Yes, possibly, but full case studies are unlikely unless you’re interviewing for PE roles or more advanced IB roles. Interviewers now ask trickier questions about the fundamentals, they ask progressions of questions on the same topic or scenario, and they’re more likely to give you *simple* cases and numerical tests rather than complex ones. A typical progression for LBO models might be as follows: Question #1: LBO Model Walkthrough “In a leveraged buyout, a PE firm acquires a company using a combination of Debt and Equity, operates it for several years, and then sells it; the math works because leverage amplifies returns; the PE firm earns a higher return if the deal does well because it uses less of its own money upfront.” In Step 1, you make assumptions for the Purchase Price, Debt and Equity, Interest Rate on Debt, and Revenue Growth and Margins. In Step 2, you create a Sources & Uses schedule to calculate the Investor Equity paid by the PE firm. In Step 3, you adjust the Balance Sheet for the effects of the deal, such as the new Debt, Equity, and Goodwill. In Step 4, you project the company’s statements, or at least its cash flow, and determine how much Debt it repays each year. Finally, in Step 5, you make assumptions about the exit, usually using an EBITDA multiple, and calculate the MoM multiple and IRR. Question #2: Ideal LBO Candidates Price is the most important factor because almost any deal can work at the right price – but if the price is too high, the chances of failure increase substantially. Beyond that, stable and predictable cash flows are important, there shouldn’t be a huge need for ongoing CapEx or other big investments, and there should be a realistic path to exit, with returns driven by EBITDA growth and Debt paydown instead of multiple expansion. Question #3: Approximating IRR “A PE firm acquires a $100 million EBITDA company for a 10x multiple using 60% Debt. The company’s EBITDA grows to $150 million by Year 5, but the exit multiple drops to 9x. The company repays $250 million of Debt and generates no extra Cash. What’s the IRR?” Initial Investor Equity = $100 million * 10 * 40% = $400 million Exit Enterprise Value = $150 million * 9 = $1,350 million Debt Remaining Upon Exit = $600 million – $250 million = $350 million Exit Equity Proceeds = $1,350 million – $350 million = $1 billion IRR: 2.5x multiple over 5 years; 2x = 15% and 3x = 25%, so it’s ~20%. Question #4: Back-Solving for Assumptions “You buy a $100 EBITDA business for a 10x multiple, and you believe that you can sell it again in 5 years for 10x EBITDA. You use 5x Debt / EBITDA to fund the deal, and the company repays 50% of that Debt over 5 years, generating no extra Cash. How much EBITDA growth do you need to realize a 20% IRR?” Initial Investor Equity = $100 * 10 * 50% = $500 20% IRR Over 5 Years = ~2.5x multiple (2x = ~15% and 3x = ~25%) Exit Equity Proceeds = $500 * 2.5 = $1,250 Remaining Debt = $250, so Exit Enterprise Value = $1,500 Required EBITDA = $150, since $1,500 / 10 = $150 Question #5: Approximating IRR in an IPO Exit “A PE firm acquires a $200 EBITDA company for an 8x multiple using 50% Debt. The company’s EBITDA increases to $240 in 3 years, and it repays ALL the Debt. The PE firm takes it public and sells off its stake evenly over 3 years at a 10x multiple. What’s the IRR?” Initial Investor Equity = $200 * 8 * 50% = $800 Exit Enterprise Value = Exit Equity Proceeds = $240 * 10 = $2,400 “Average Year” to Exit = 1/3 * 3 + 1/3 * 4 + 1/3 * 5 = 4 years IRR: 3x over 3 years = ~45%, and 3x over 5 years = ~25% Approximate IRR: ~35% (This one’s a bit off – see Excel.) RESOURCES: https://youtube-breakingintowallstreet-com.s3.amazonaws.com/109-13-LBO-Model-Interview-Questions-Slides.pdf -

0:52

0:52Investment Banking Mock Interview: What is an LBO?

Investment Banking Mock Interview: What is an LBO?Investment Banking Mock Interview: What is an LBO?

In this video, Joshua Rosenbaum and Joshua Pearl, authors of the highly acclaimed and authoritative textbook, Investment Banking, walk you through some common technical questions asked during the investment banking interview process, specifically "What is an LBO?" You can access more investment banking mock interview and training videos at http://www.efficientlearning.com/investment-banking/ -

16:41

16:41LBO Candidates - Criteria and How to Pick Them

LBO Candidates - Criteria and How to Pick ThemLBO Candidates - Criteria and How to Pick Them

In this lesson, LBO Candidates - Criteria and How to Pick Them, you’ll learn what make an “ideal” leveraged buyout candidate, and how you can do a quick 1-2-minute financial screen of a company to see how suitable it would be for a leveraged buyout. http://breakingintowallstreet.com/ "Financial Modeling Training And Career Resources For Aspiring Investment Bankers" Table of Contents: 1:36 Criteria for Ideal LBO Candidates 6:48 Foot Locker – Analysis 10:07 Finish Line – Analysis 11:38 Burberry – Analysis 12:49 Michael Kors – Analysis 13:51 The Winner Lesson Outline: The criteria for leveraged buyout (LBO) candidates varies a bit depending on the private equity firm, but *in general* most firms seek the following qualities: • Financials: Low fixed costs, high(er) EBITDA margins, minimal debt, lots of excess cash, stable cash flows, and lower valuation multiples. • Industry: Fragmented, barriers to entry, leadership position, strong management team, lots of M&A; activity and/or IPOs so you can exit the investment. In terms of specific numbers, 2-3x Debt / EBITDA or less is ideal, since much of the IRR in an LBO comes from adding additional debt to the company’s capital structure and repaying it over time. If the company is already leveraged at 5-6x Debt / EBITDA, it’s tough to add any new debt and the PE firm will have to earn returns from other sources. EBITDA / Net Interest Expense should also ideally be above 2x so that the company has some additional cushion for higher interest expense resulting from more debt. The company’s margins should also be on the higher end for the industry you’re in: if the average EBITDA margin is 15%, don’t acquire a company with 5% margins. If you use Google Finance, you can use these criteria to rapidly judge each company in your set in 1-2 minutes. Foot Locker • Balance Sheet: ~$1000M of cash, and $132M of debt • EBITDA: ~$950M; 13% margin • Cash Flows: Grown steadily from ~$350M FCF to ~$500M FCF over 3 years • Valuation: 18x P / E multiple, 9.5x EV / EBITDA Foot Locker seems “decent”: very little debt, lots of excess cash, and good FCF generation and growth, though its valuation multiples seem a bit high. Finish Line • Balance Sheet: ~$100M of cash, and $0 of debt • EBITDA: ~$160M; 9% margin • Cash Flows: Fallen from ~$65M FCF to ~$14M FCF over 3 years • Valuation: 11x P / E multiple, 5x EV / EBITDA Finish Line is a worse candidate than Foot Locker because its excess cash and EBITDA margins are lower, and its FCF has actually declined in recent years. Burberry • Balance Sheet: ~$925M of cash, and ~$100M debt • EBITDA: ~$870M; 23% margin • Cash Flows: Increased from $371M FCF to $491M over 3 years • Valuation: 19x P / E multiple, 10x EV / EBITDA Burberry is better than both of the previous companies because it has even higher margins, it has also increased its cash flow significantly, and its valuation multiples are almost the same as Foot Locker’s. Michael Kors • Balance Sheet: ~$800M of cash, and $0 of debt • EBITDA: ~$1400M; 32% margin • Cash Flows: Increased from $27M FCF to $473M over 3 years • Valuation: 10x P / E multiple, 5x EV / EBITDA Michael Kors seems even better because it has about the same amount of excess cash, the highest EBITDA margins and best FCF growth, and amazingly it trades at the lowest multiples of any company in the set. The Clear Winner Michael Kors is the clear winner here because it has the highest margins, the lowest valuation multiples, the most excess cash, no debt, and the strongest FCF growth. The ranking would be: 1) Michael Kors 2) Burberry 3) Foot Locker 4) Finish Line. It’s also worth thinking about what might happen in a recession – there, the luxury retailers could be hurt far more than the mid-range/lower-end ones. RESOURCES: http://youtube-breakingintowallstreet-com.s3.amazonaws.com/109-10-LBO-Candidates-How-to-Pick.pdf -

5:08

5:08Entrepreneur, Gordon Bizar, explains to entrepreneurs leveraged buyout (LBO).

Entrepreneur, Gordon Bizar, explains to entrepreneurs leveraged buyout (LBO).Entrepreneur, Gordon Bizar, explains to entrepreneurs leveraged buyout (LBO).

http://gordonbizar.com http://gettingrichyourway.com Leveraged Buyout (LBO) has been taught at Bizar Financing for over 30 years. Mr.LBO, Gordon Bizar, explains how he bought his first business with no cash of his own to entrepreneurs. As a business coach, Gordon Bizar, has been a business mentor to over 300,000 entrepreneurs teaching how to use leveraged buyout (LBO) in the purchase of a business. So if you've always wanted to be your own boss and do not know how to purchase a business using leveraged buyout (LBO) learn how to get into that business from Entrepreneur, Gordon Bizar. -

2:41

2:41Acquérir une entreprise : Le LBO expliqué en 2 minutes

Acquérir une entreprise : Le LBO expliqué en 2 minutes -

23:12

23:12LBO Model Tutorial - Full DELL Case Study with Templates (Part 1)

LBO Model Tutorial - Full DELL Case Study with Templates (Part 1)LBO Model Tutorial - Full DELL Case Study with Templates (Part 1)

In this LBO Model tutorial, we walk through Silver Lake's $24 billion leveraged buyout of Dell and explain the tasks you might have to complete if you were to analyze this deal as part of a case study in a private equity interview. By http://www.mergersandinquisitions.com/ "Break Into Investment Banking or Private Equity, The Easy Way" Among other topics, we cover typical LBO case study questions to expect, why this particular deal was so unusual, and how to begin gathering data from industry reports, equity research, Dell's filings and investor presentations, and other sources. Then, we delve into how the transaction assumptions are set up, why the calculation for debt and equity is somewhat unusual, and how to factor in Michael Dell's equity rollover and cash contribution and the company's own excess cash usage. Finally, we conclude with a discussion of the Sources & Uses schedule and how that works, plus a description of the different types of debt used in the transaction. WANT MORE FREE FINANCIAL MODELING TUTORIALS? Receive a Free 3-Part Tutorial on **How to Build Your First Merger Model** based on the $16B United / Goodrich deal. Visit: www.breakingintowallstreet.com/biws MENTIONED RESOURCES http://www.mergersandinquisitions.com/leveraged-buyout-lbo-model-overview-capital-structure/ (Click to access the full case study and FREE downloadable templates) -

75:53

75:53Leveraged Buyout Case on Heinz

Leveraged Buyout Case on HeinzLeveraged Buyout Case on Heinz

Based on the Wiley Finance Leveraged Buyout book by Paul Pignataro, Mr. Pignataro will step through core Leveraged Buyout (LBO) fundamentals and an LBO analysis to better understand Part I of the book. The book, found below, is recommended to fully understand the material discussed. http://www.amazon.com/Leveraged-Buyouts-Website-Practical-Investment/dp/1118674545/ref=sr_1_1?ie=UTF8&qid;=1391540998&sr;=8-1&keywords;=leveraged+buyouts

-

Basic leveraged buyout (LBO) | Stocks and bonds | Finance & Capital Markets | Khan Academy

The mechanics of a simple leveraged buy-out. Created by Sal Khan. Watch the next lesson: https://www.khanacademy.org/economics-finance-domain/core-finance/stock-and-bonds/bonds-tutorial/v/corporate-debt-versus-traditional-mortgages?utm_source=YT&utm;_medium=Desc&utm;_campaign=financeandcapitalmarkets Missed the previous lesson? Watch here: https://www.khanacademy.org/economics-finance-domain/core-finance/stock-and-bonds/mergers-acquisitions/v/simple-merger-arb-with-share-acquisition?utm_source=YT&utm;_medium=Desc&utm;_campaign=financeandcapitalmarkets Finance and capital markets on Khan Academy: Private equity firms often borrow money (use leverage) to buy companies. This tutorial explains how they do it and pay the debt. About Khan Academy: Khan Academy offers practice exercises, instruc...

published: 12 May 2011 -

Simple LBO Model - Case Study and Tutorial

In this LBO Model tutorial, you'll learn how to build a very simple LBO model "on paper" that you can use to answer quick questions in PE (and other) interviews. By http://breakingintowallstreet.com/ "Financial Modeling Training And Career Resources For Aspiring Investment Bankers" This matters because in many cases, they'll ask you to calculate numbers such as IRR and multiple of invested capital very quickly and will not actually ask you to build a more complex model until later in the process. You should always START this exercise by looking at the actual question or set of questions they are asking you: "Calculate the purchase price required for ABC Capital to obtain a 3.0x multiple of invested capital (MOIC) if it plans to sell OpCo after five years at an EV / EBITDA multiple of 6....

published: 17 Jun 2014 -

Financial Modeling Quick Lesson: Simple LBO Model (1 of 3)

Note: To download the Excel template that goes with this video, go to http://www.wallstreetprep.com/blog/financial-modeling-quick-lesson-simple-lbo-model/ In this video tutorial, we'll build a leveraged buyout (LBO) model, given some operating and valuation assumptions, in Excel. The goal of this video is to show you that an LBO model is actually a very simple transaction at its core - and quite similar to the mechanics involved when purchasing a home. If after watching this video you want to take your LBO modeling to the next level, see Wall Street Prep's advanced LBO modeling course at http://www.wallstreetprep.com/programs/self_study/advanced_lbo_modeling.php.

published: 18 Mar 2013 -

LBO Model Interview Questions: What to Expect

In this tutorial, you’ll learn about the most common LBO modeling-related questions and some tricks and rules of thumb you can use to approximate the IRR and solve for assumptions like the purchase price and EBITDA growth in leveraged buyouts. Table of Contents: 2:36 Question #1: LBO Model Walkthrough 5:34 Question #2: Ideal LBO Candidates 8:09 Question #3: How to Approximate IRR 11:46 Question #4: How to Solve for EBITDA or the Purchase Price 13:58 Question #5: How to Approximate the IRR in an IPO Exit 16:03 Recap, Summary, and Key Principles Lesson Outline: Will you get LBO-related questions in interviews? Yes, possibly, but full case studies are unlikely unless you’re interviewing for PE roles or more advanced IB roles. Interviewers now ask trickier questions about the fundam...

published: 01 Nov 2016 -

Investment Banking Mock Interview: What is an LBO?

In this video, Joshua Rosenbaum and Joshua Pearl, authors of the highly acclaimed and authoritative textbook, Investment Banking, walk you through some common technical questions asked during the investment banking interview process, specifically "What is an LBO?" You can access more investment banking mock interview and training videos at http://www.efficientlearning.com/investment-banking/

published: 09 Mar 2016 -

LBO Candidates - Criteria and How to Pick Them

In this lesson, LBO Candidates - Criteria and How to Pick Them, you’ll learn what make an “ideal” leveraged buyout candidate, and how you can do a quick 1-2-minute financial screen of a company to see how suitable it would be for a leveraged buyout. http://breakingintowallstreet.com/ "Financial Modeling Training And Career Resources For Aspiring Investment Bankers" Table of Contents: 1:36 Criteria for Ideal LBO Candidates 6:48 Foot Locker – Analysis 10:07 Finish Line – Analysis 11:38 Burberry – Analysis 12:49 Michael Kors – Analysis 13:51 The Winner Lesson Outline: The criteria for leveraged buyout (LBO) candidates varies a bit depending on the private equity firm, but *in general* most firms seek the following qualities: • Financials: Low fixed costs, high(er) EBITDA margins, ...

published: 13 Oct 2015 -

Entrepreneur, Gordon Bizar, explains to entrepreneurs leveraged buyout (LBO).

http://gordonbizar.com http://gettingrichyourway.com Leveraged Buyout (LBO) has been taught at Bizar Financing for over 30 years. Mr.LBO, Gordon Bizar, explains how he bought his first business with no cash of his own to entrepreneurs. As a business coach, Gordon Bizar, has been a business mentor to over 300,000 entrepreneurs teaching how to use leveraged buyout (LBO) in the purchase of a business. So if you've always wanted to be your own boss and do not know how to purchase a business using leveraged buyout (LBO) learn how to get into that business from Entrepreneur, Gordon Bizar.

published: 06 May 2011 -

Acquérir une entreprise : Le LBO expliqué en 2 minutes

Cette vidéo explique comment financer l'acquisition d'une entreprise en utilisant le LBO. Tous les détails sont expliqués ici : http://www.gautier-girard.com/dossiers-entrepreneurs-et-managers/gestion-et-comptabilite/video-reprise-lbo/

published: 30 Apr 2013 -

LBO Model Tutorial - Full DELL Case Study with Templates (Part 1)

In this LBO Model tutorial, we walk through Silver Lake's $24 billion leveraged buyout of Dell and explain the tasks you might have to complete if you were to analyze this deal as part of a case study in a private equity interview. By http://www.mergersandinquisitions.com/ "Break Into Investment Banking or Private Equity, The Easy Way" Among other topics, we cover typical LBO case study questions to expect, why this particular deal was so unusual, and how to begin gathering data from industry reports, equity research, Dell's filings and investor presentations, and other sources. Then, we delve into how the transaction assumptions are set up, why the calculation for debt and equity is somewhat unusual, and how to factor in Michael Dell's equity rollover and cash contribution and the compan...

published: 21 Feb 2013 -

Leveraged Buyout Case on Heinz

Based on the Wiley Finance Leveraged Buyout book by Paul Pignataro, Mr. Pignataro will step through core Leveraged Buyout (LBO) fundamentals and an LBO analysis to better understand Part I of the book. The book, found below, is recommended to fully understand the material discussed. http://www.amazon.com/Leveraged-Buyouts-Website-Practical-Investment/dp/1118674545/ref=sr_1_1?ie=UTF8&qid;=1391540998&sr;=8-1&keywords;=leveraged+buyouts

published: 17 Nov 2014

Basic leveraged buyout (LBO) | Stocks and bonds | Finance & Capital Markets | Khan Academy

- Order: Reorder

- Duration: 5:36

- Updated: 12 May 2011

- views: 126660

- published: 12 May 2011

- views: 126660

Simple LBO Model - Case Study and Tutorial

- Order: Reorder

- Duration: 13:25

- Updated: 17 Jun 2014

- views: 69302

- published: 17 Jun 2014

- views: 69302

Financial Modeling Quick Lesson: Simple LBO Model (1 of 3)

- Order: Reorder

- Duration: 8:56

- Updated: 18 Mar 2013

- views: 74581

- published: 18 Mar 2013

- views: 74581

LBO Model Interview Questions: What to Expect

- Order: Reorder

- Duration: 18:49

- Updated: 01 Nov 2016

- views: 1018

- published: 01 Nov 2016

- views: 1018

Investment Banking Mock Interview: What is an LBO?

- Order: Reorder

- Duration: 0:52

- Updated: 09 Mar 2016

- views: 4365

- published: 09 Mar 2016

- views: 4365

LBO Candidates - Criteria and How to Pick Them

- Order: Reorder

- Duration: 16:41

- Updated: 13 Oct 2015

- views: 4690

- published: 13 Oct 2015

- views: 4690

Entrepreneur, Gordon Bizar, explains to entrepreneurs leveraged buyout (LBO).

- Order: Reorder

- Duration: 5:08

- Updated: 06 May 2011

- views: 4423

- published: 06 May 2011

- views: 4423

Acquérir une entreprise : Le LBO expliqué en 2 minutes

- Order: Reorder

- Duration: 2:41

- Updated: 30 Apr 2013

- views: 7116

LBO Model Tutorial - Full DELL Case Study with Templates (Part 1)

- Order: Reorder

- Duration: 23:12

- Updated: 21 Feb 2013

- views: 48412

- published: 21 Feb 2013

- views: 48412

Leveraged Buyout Case on Heinz

- Order: Reorder

- Duration: 75:53

- Updated: 17 Nov 2014

- views: 13833

- published: 17 Nov 2014

- views: 13833

- Playlist

- Chat

- Playlist

- Chat

Basic leveraged buyout (LBO) | Stocks and bonds | Finance & Capital Markets | Khan Academy

- Report rights infringement

- published: 12 May 2011

- views: 126660

Simple LBO Model - Case Study and Tutorial

- Report rights infringement

- published: 17 Jun 2014

- views: 69302

Financial Modeling Quick Lesson: Simple LBO Model (1 of 3)

- Report rights infringement

- published: 18 Mar 2013

- views: 74581

LBO Model Interview Questions: What to Expect

- Report rights infringement

- published: 01 Nov 2016

- views: 1018

Investment Banking Mock Interview: What is an LBO?

- Report rights infringement

- published: 09 Mar 2016

- views: 4365

LBO Candidates - Criteria and How to Pick Them

- Report rights infringement

- published: 13 Oct 2015

- views: 4690

Entrepreneur, Gordon Bizar, explains to entrepreneurs leveraged buyout (LBO).

- Report rights infringement

- published: 06 May 2011

- views: 4423

Acquérir une entreprise : Le LBO expliqué en 2 minutes

- Report rights infringement

- published: 30 Apr 2013

- views: 7116

LBO Model Tutorial - Full DELL Case Study with Templates (Part 1)

- Report rights infringement

- published: 21 Feb 2013

- views: 48412

Leveraged Buyout Case on Heinz

- Report rights infringement

- published: 17 Nov 2014

- views: 13833

-

Lyrics list:lyrics

-

Always Up, Lobo

-

My Friend Is Here, Lobo

-

My First Time, Lobo

-

Moonglow, Lobo

-

Long Loving Night, Lobo

-

My Head Needs Peace, Lobo

-

More, Lobo

-

Late Christmas Eve, Lobo

-

I'm In the Mood For Love, Lobo

-

Just The Sight Of You, Lobo

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Always Up

There may be times in my day when I feel down

And I may walk around like a floppy old hound

There are people in my life we don't get along

But I know a time when nothin' goes wrong

And I'm always up when I get up in the morning

I'm always up at the end of the night

The morning smiles it's sun on me

I look over and it's you I see

And I'm always up when I get up in the morning

I'm up in the morning

My life may get hard on a certain week

And the people that I work with we may not speak

I might get drunk and stay out all night

Cause in the morning I know you won't be up tight

Forget October Surprises, A November Bombshell Might Drop on Tuesday

Edit WorldNews.com 07 Nov 2016Kim Jong-un To Fire US Election Day Missile

Edit Opposing Views 07 Nov 2016Egypt Says Saudi Arabia Halted Fuel Shipments Indefinitely Due To Syria Stand

Edit WorldNews.com 07 Nov 2016Russians accused of organising plot to assassinate a European leader

Edit The Independent 07 Nov 2016WikiLeaks releases more DNC emails near eve of election

Edit CNN 07 Nov 2016Build-A-Bear 'For Sale' Sign Reads: Strong Brand, Attractive Financials, Turnaround Complete, Sale Process Ongoing

Edit Seeking Alpha 07 Nov 2016OFS Capital's (OFS) CEO Bilal Rashid on Q3 2016 Results - Earnings Call Transcript

Edit Seeking Alpha 05 Nov 2016PJT Partners' (PJT) CEO Nick Akins on Q3 2016 Results - Earnings Call Transcript

Edit Seeking Alpha 01 Nov 2016Another Mega Health Care Deal: Blackstone Buys Back TeamHealth

Edit The Street 31 Oct 2016Qualcomm's $47-Billion Mega-Deal for NXP: Where It Stacks Up in History

Edit The Street 27 Oct 2016Bill Ferko Executive in Residence (University of Wisconsin - Parkside)

Edit Public Technologies 25 Oct 2016Bel and MOM managers sign agreement to acquire the MOM group from LBO France, with MOM’s management remaining a shareholder (Fromageries Bel SA)

Edit Public Technologies 21 Oct 2016Benzinga's M&A; Chatter for Tuesday, October 18, 2016

Edit Stockhouse 19 Oct 2016Poland: Changes to Corporate Income Tax regulations: Taxation rules on interest payments to European Union/European Economic Area parent companies (Clearstream Banking SA)

Edit Public Technologies 11 Oct 2016Ardian acquires a majority stake in Weber Automotive and invests in future growth together with the founding family (Ardian SA)

Edit Public Technologies 07 Oct 2016UBS Sees $43-$44 Deal Value For Potential TeamHealth Sale

Edit Stockhouse 05 Oct 2016Pepper Hamilton Sponsoring ACG NY Event, 'Transformational Value Creation: You Paid 10X, Now What?' (Pepper Hamilton LLP)

Edit Public Technologies 28 Sep 2016- 1

- 2

- 3

- 4

- 5

- Next page »