- published: 19 Jun 2014

- views: 31112

Create your page here

-

remove the playlist1040

- remove the playlist1040

back to playlist

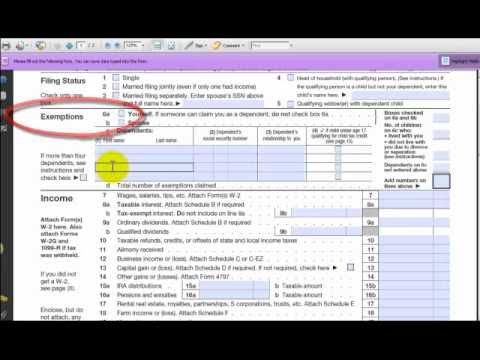

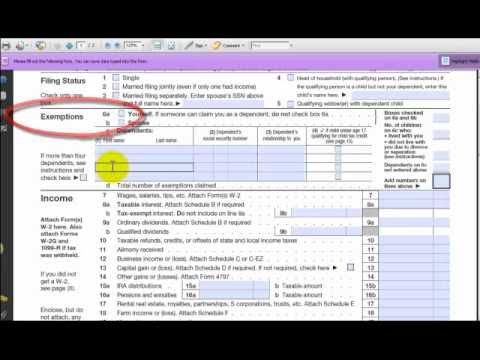

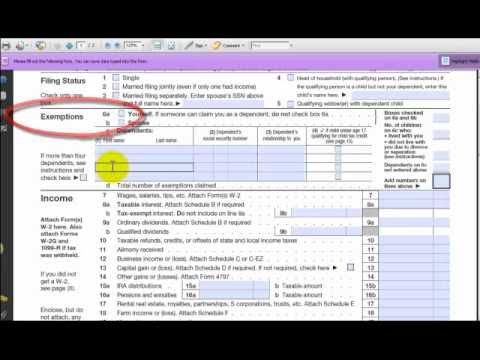

How to fill out Form 1040 - Watch this video by a certified public accountant (http://www.evanhcpa.com) to help you understand the flow of the Form 1040.

In the video, a CPA based in Nashville (Evan Hutcheson, CPA, LLC, 2303 21st Ave S #201 Nashville, TN 37212) shows you what each line of the 1040 means and how the each line is affected by other lines within the form.

The best way for you to file if you're going to file using the IRS forms is to go to their website to free fillable forms. It's a simple process and they do a lot of the calculations for you.

The Form 1040 is two pages. It is broken up into sections, including income, adjusted gross income, taxes and credits, etc.

Each part of the 1040 is affected in different ways by other parts, and there are many variables involved. For example, to calculate tax, you can not just simply multiply your taxable income by your tax rate. Different parts of you income are taxed at different rates.

I go into this, and much more, in greater detail in the video, so please have a look at it to find out whether or not you will be able to deduct your rental property losses on your individual tax return.

You can find the IRS Form 1040 online here:

http://www.irs.gov/pub/irs-pdf/f1040.pdf

Please share this video on how to fill out Form 1040:

http://www.youtube.com/watch?v=SG0C5KdeqnE

Subscribe to my Channel:

http://www.youtube.com/user/EvanHutchesonCPA

Follow Me:

http://www.facebook.com/EvanHutchesonCpa

http://twitter.com/Nashville_CPA

http://plus.google.com/+Evanhcpa/about

http://www.linkedin.com/pub/evan-hutcheson/30/909/746

You might like this video too:

http://www.youtube.com/watch?v=ijo-JNPJ6Bg

1040 Instructions | How to Fill Out Form 1040

2015 and 2014 1040 Tax Form Updates: The 2015 1040 Tax form has the same line number and information as the 2014. (the amounts will be different). The purpose of this video is to help you understand what is on the main tax form so you can get ready to fill out your taxes. You can fill out your tax forms by hand or via a computerized program or have an accountant do it for you, but it is helpful to know what is in the tax form. You will usually save money if you " know before you go".

2015 and 2014 Tax form 1040 updates are put in the red bubbles in this video. For 2015 updates or other 2015 tax forms go to http:// www.IRS.gov. The main form that you file when you file your income tax is IRS Form 1040. This video explains how to fill out your tax form and how you can get more tax credits and deductions. The 1040 Tax Form does not change much from year to year. Some changes for 2015 and 2014 are explained in the little bubbles.

The Health Insurance topic can be very confusing.

Additional changes for 2015 and 2014 are about the new health care law (Affordable Care Act), And how to report and get your tax credit. Health Insurance.

There are 3 lines on the 1040 Tax form that refer to the Health Care Law. Line 46 "Excess Advance premium tax credit repayment" Fill out another form (Form 8962) if this applies to you.

Line 61 "Health Care: Individual responsibility" and you fill out form 8965 if this applies to you. Most people only have to check the box on line 61 and do not need to fill out the form.

Line 69 "Net premium tax credit" If this applies to you then fill out Form 8962.

When you use a computerized tax form or service to fill out your taxes then these extra tax forms will automatically pop up for you to fill in.

IRS Warning: The IRS reminds individuals who owe the payment that it should be made only with their tax return or in response to a letter from the IRS. The payment should never be made directly to an individual or return preparer. Most people don’t owe the payment at all because they have health coverage or qualify for a coverage exemption.

The IRS has received several reports of this kind of unscrupulous activity. In some cases, return preparers have told taxpayers to make the payment directly to them, even though the taxpayer had Medicaid or other health coverage and doesn’t need to make the shared responsibility payment at all. In some parts of the country, unscrupulous return preparers are targeting taxpayers with limited English proficiency and, in particular, those who primarily speak Spanish.

These preparers are asking for direct payment to them, but their reasons vary. Methods include:

• telling individuals that they must make an individual shared responsibility payment directly to the preparer because of their immigration status,

• promising to lower the payment amount if the client pays it directly to the preparer, or

• demanding money from individuals who are exempt from the individual shared responsibility payment.

From: HCTT-2015-17:

- published: 18 Mar 2011

- views: 179900

Khooni Laash - Deepika, Sagar and Mihir had to attend a wedding in the morning. Manager urgently calls Deepika as neither Sagar nor Mihir were responding. Deepika requests a Couple to urgently call CID as she was severely injured. Sagar and Mihir were found dead in their Hotel room. Who killed Sagar and Mihir? To find out, watch this thrilling episode of CID.

"The first thrilling investigative series on Indian Television, is today one of the most popular shows on Sony Entertainment Television. Dramatic and absolutely unpredictable, C.I.D. has captivated viewers over the last eleven years and continues to keep audiences glued to their television sets with its thrilling plots and excitement. Also interwoven in its fast paced plots are the personal challenges that the C.I.D. team faces with non-stop adventure, tremendous pressure and risk, all in the name of duty.The series consists of hard-core police procedural stories dealing with investigation, detection and suspense. The protagonists of the serial are an elite group of police officers belonging to the Crime Investigation Department of the police force, led by ACP Pradyuman [played by the dynamic Shivaji Satam]. While the stories are plausible, there is an emphasis on dramatic plotting and technical complexities faced by the police. At every stage, the plot throws up intriguing twists and turns keeping the officers on the move as they track criminals, led by the smallest of clues."For more information on your favourite show do visit

www.facebook.com/SonyLiv and follow us on

www.twitter.com/SonyLiv"

"

- published: 01 Feb 2014

- views: 846058

http://www.milescpareview.com/

Form 1040, U.S. Individual Income Tax Return, is one of three forms used for personal (individual) federal income tax returns filed with the IRS. Individuals can file this form that have varied incomes and would like to take various deductions. A very practical topic of the CPA curriculum. Master this crucial topic from REG section of Miles CPA Review Course using Varun's unique iCPA delivery model. Make sure you like us on Facebook.

http://www.milescpareview.com/

- published: 08 Oct 2013

- views: 66603

For Self-employed, Independent Contractors (Sole Proprietorship), the "Schedule C" is your friend. You don't need a degree in Accounting. It's basic math - how much did your business make minus how much did your business spend equal net profit (or loss).

Understanding the nuances of it will help you best keep track of your expenses so you can decrease your tax liability.

- published: 26 Apr 2014

- views: 7224

Video tutorial de los componentes de la planilla 1040 en español. La planilla 1040 del 2012 consiste de dos paginas y 11 secciones. El conocer mas sobre su planilla le ayuda a cumplir con su responsabilidad tributario y reducir sus impuestos. Encuentre mas informacion sobre taxes y las planillas 1040 en http://menostax.com

- published: 03 Jan 2013

- views: 7200

Visit: http://legal-forms.laws.com/tax/form-1040-es-estimated-tax-for-individuals

To download the Form 1040-ES in printable format and to know about

the use of this form, who can use this Form 1040-ES and when one should use this Form 1040-ES form.

To Learn how to fill Various legal form,

Go to http://www.youtube.com/user/FreeLegalForms

- published: 22 Aug 2012

- views: 23755

HP EliteBook Folio 1040 G3 initial impressions: The HP Elitebook Folio 1040 G3 comes with an Intel Core i5 processor, 8 GB of RAM and Windows 10 pro. This is a business class notebook with a great aluminium design and fingerprint scanner along with several connectivity options like USB Type C port, SD card slot, USB 3.0 port and more.

Watch on as we try our hands out on this device and try to find out whether it's good enough or not!

HP EliteBook Folio 1040 G3 is now available in India at the starting price of INR 90,000/-

Don't forget to hit the thumbs up and do subscribe to our channel!

//**Follow Inspire2rise**//

Follow us on Facebook: https://facebook.com/Inspire2rise

Follow us on Twitter: https://twitter.com/inspire2rise

Add us to your circles: https://plus.google.com/+Inspire2rise/

You were watching HP EliteBook Folio 1040 G3 initial impressions on Inspire2rise!

- published: 06 Jun 2016

- views: 28

Year 1040 (MXL) was a leap year starting on Tuesday (link will display the full calendar) of the Julian calendar.

This page contains text from Wikipedia, the Free Encyclopedia -

http://en.wikipedia.org/wiki/1040

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

27:31

27:311040 Instructions - How To Fill Out Form 1040

1040 Instructions - How To Fill Out Form 10401040 Instructions - How To Fill Out Form 1040

How to fill out Form 1040 - Watch this video by a certified public accountant (http://www.evanhcpa.com) to help you understand the flow of the Form 1040. In the video, a CPA based in Nashville (Evan Hutcheson, CPA, LLC, 2303 21st Ave S #201 Nashville, TN 37212) shows you what each line of the 1040 means and how the each line is affected by other lines within the form. The best way for you to file if you're going to file using the IRS forms is to go to their website to free fillable forms. It's a simple process and they do a lot of the calculations for you. The Form 1040 is two pages. It is broken up into sections, including income, adjusted gross income, taxes and credits, etc. Each part of the 1040 is affected in different ways by other parts, and there are many variables involved. For example, to calculate tax, you can not just simply multiply your taxable income by your tax rate. Different parts of you income are taxed at different rates. I go into this, and much more, in greater detail in the video, so please have a look at it to find out whether or not you will be able to deduct your rental property losses on your individual tax return. You can find the IRS Form 1040 online here: http://www.irs.gov/pub/irs-pdf/f1040.pdf Please share this video on how to fill out Form 1040: http://www.youtube.com/watch?v=SG0C5KdeqnE Subscribe to my Channel: http://www.youtube.com/user/EvanHutchesonCPA Follow Me: http://www.facebook.com/EvanHutchesonCpa http://twitter.com/Nashville_CPA http://plus.google.com/+Evanhcpa/about http://www.linkedin.com/pub/evan-hutcheson/30/909/746 You might like this video too: http://www.youtube.com/watch?v=ijo-JNPJ6Bg 1040 Instructions | How to Fill Out Form 1040 -

9:59

9:59How to Fill Out your Income Tax Form 1040

How to Fill Out your Income Tax Form 1040How to Fill Out your Income Tax Form 1040

2015 and 2014 1040 Tax Form Updates: The 2015 1040 Tax form has the same line number and information as the 2014. (the amounts will be different). The purpose of this video is to help you understand what is on the main tax form so you can get ready to fill out your taxes. You can fill out your tax forms by hand or via a computerized program or have an accountant do it for you, but it is helpful to know what is in the tax form. You will usually save money if you " know before you go". 2015 and 2014 Tax form 1040 updates are put in the red bubbles in this video. For 2015 updates or other 2015 tax forms go to http:// www.IRS.gov. The main form that you file when you file your income tax is IRS Form 1040. This video explains how to fill out your tax form and how you can get more tax credits and deductions. The 1040 Tax Form does not change much from year to year. Some changes for 2015 and 2014 are explained in the little bubbles. The Health Insurance topic can be very confusing. Additional changes for 2015 and 2014 are about the new health care law (Affordable Care Act), And how to report and get your tax credit. Health Insurance. There are 3 lines on the 1040 Tax form that refer to the Health Care Law. Line 46 "Excess Advance premium tax credit repayment" Fill out another form (Form 8962) if this applies to you. Line 61 "Health Care: Individual responsibility" and you fill out form 8965 if this applies to you. Most people only have to check the box on line 61 and do not need to fill out the form. Line 69 "Net premium tax credit" If this applies to you then fill out Form 8962. When you use a computerized tax form or service to fill out your taxes then these extra tax forms will automatically pop up for you to fill in. IRS Warning: The IRS reminds individuals who owe the payment that it should be made only with their tax return or in response to a letter from the IRS. The payment should never be made directly to an individual or return preparer. Most people don’t owe the payment at all because they have health coverage or qualify for a coverage exemption. The IRS has received several reports of this kind of unscrupulous activity. In some cases, return preparers have told taxpayers to make the payment directly to them, even though the taxpayer had Medicaid or other health coverage and doesn’t need to make the shared responsibility payment at all. In some parts of the country, unscrupulous return preparers are targeting taxpayers with limited English proficiency and, in particular, those who primarily speak Spanish. These preparers are asking for direct payment to them, but their reasons vary. Methods include: • telling individuals that they must make an individual shared responsibility payment directly to the preparer because of their immigration status, • promising to lower the payment amount if the client pays it directly to the preparer, or • demanding money from individuals who are exempt from the individual shared responsibility payment. From: HCTT-2015-17: -

45:31

45:31CID - Khooni Laash - Episode 1040 - 31st January 2014

CID - Khooni Laash - Episode 1040 - 31st January 2014CID - Khooni Laash - Episode 1040 - 31st January 2014

Khooni Laash - Deepika, Sagar and Mihir had to attend a wedding in the morning. Manager urgently calls Deepika as neither Sagar nor Mihir were responding. Deepika requests a Couple to urgently call CID as she was severely injured. Sagar and Mihir were found dead in their Hotel room. Who killed Sagar and Mihir? To find out, watch this thrilling episode of CID. "The first thrilling investigative series on Indian Television, is today one of the most popular shows on Sony Entertainment Television. Dramatic and absolutely unpredictable, C.I.D. has captivated viewers over the last eleven years and continues to keep audiences glued to their television sets with its thrilling plots and excitement. Also interwoven in its fast paced plots are the personal challenges that the C.I.D. team faces with non-stop adventure, tremendous pressure and risk, all in the name of duty.The series consists of hard-core police procedural stories dealing with investigation, detection and suspense. The protagonists of the serial are an elite group of police officers belonging to the Crime Investigation Department of the police force, led by ACP Pradyuman [played by the dynamic Shivaji Satam]. While the stories are plausible, there is an emphasis on dramatic plotting and technical complexities faced by the police. At every stage, the plot throws up intriguing twists and turns keeping the officers on the move as they track criminals, led by the smallest of clues."For more information on your favourite show do visit www.facebook.com/SonyLiv and follow us on www.twitter.com/SonyLiv" " -

62:18

62:18Individual Income Tax Return = Form 1040 | Regulation | Miles CPA Review ( REG-1 Binder-1)

Individual Income Tax Return = Form 1040 | Regulation | Miles CPA Review ( REG-1 Binder-1)Individual Income Tax Return = Form 1040 | Regulation | Miles CPA Review ( REG-1 Binder-1)

http://www.milescpareview.com/ Form 1040, U.S. Individual Income Tax Return, is one of three forms used for personal (individual) federal income tax returns filed with the IRS. Individuals can file this form that have varied incomes and would like to take various deductions. A very practical topic of the CPA curriculum. Master this crucial topic from REG section of Miles CPA Review Course using Varun's unique iCPA delivery model. Make sure you like us on Facebook. http://www.milescpareview.com/ -

12:49

12:49Filling out IRS Schedule C for the 1040

Filling out IRS Schedule C for the 1040Filling out IRS Schedule C for the 1040

For Self-employed, Independent Contractors (Sole Proprietorship), the "Schedule C" is your friend. You don't need a degree in Accounting. It's basic math - how much did your business make minus how much did your business spend equal net profit (or loss). Understanding the nuances of it will help you best keep track of your expenses so you can decrease your tax liability. -

3:57

3:57Form 1040 Tax Tutorial Overview by www.taxfriendonline.com

Form 1040 Tax Tutorial Overview by www.taxfriendonline.com -

2:54

2:54Itemized Deductions Form 1040 Schedule A

Itemized Deductions Form 1040 Schedule AItemized Deductions Form 1040 Schedule A

-

31:38

31:38La Planilla 1040 del 2012

La Planilla 1040 del 2012La Planilla 1040 del 2012

Video tutorial de los componentes de la planilla 1040 en español. La planilla 1040 del 2012 consiste de dos paginas y 11 secciones. El conocer mas sobre su planilla le ayuda a cumplir con su responsabilidad tributario y reducir sus impuestos. Encuentre mas informacion sobre taxes y las planillas 1040 en http://menostax.com -

2:00

2:00Learn How to Fill the Form 1040-ES Estimated Tax for Individuals

Learn How to Fill the Form 1040-ES Estimated Tax for IndividualsLearn How to Fill the Form 1040-ES Estimated Tax for Individuals

Visit: http://legal-forms.laws.com/tax/form-1040-es-estimated-tax-for-individuals To download the Form 1040-ES in printable format and to know about the use of this form, who can use this Form 1040-ES and when one should use this Form 1040-ES form. To Learn how to fill Various legal form, Go to http://www.youtube.com/user/FreeLegalForms -

2:29

2:29HP EliteBook Folio 1040 G3 initial impressions

HP EliteBook Folio 1040 G3 initial impressionsHP EliteBook Folio 1040 G3 initial impressions

HP EliteBook Folio 1040 G3 initial impressions: The HP Elitebook Folio 1040 G3 comes with an Intel Core i5 processor, 8 GB of RAM and Windows 10 pro. This is a business class notebook with a great aluminium design and fingerprint scanner along with several connectivity options like USB Type C port, SD card slot, USB 3.0 port and more. Watch on as we try our hands out on this device and try to find out whether it's good enough or not! HP EliteBook Folio 1040 G3 is now available in India at the starting price of INR 90,000/- Don't forget to hit the thumbs up and do subscribe to our channel! //**Follow Inspire2rise**// Follow us on Facebook: https://facebook.com/Inspire2rise Follow us on Twitter: https://twitter.com/inspire2rise Add us to your circles: https://plus.google.com/+Inspire2rise/ You were watching HP EliteBook Folio 1040 G3 initial impressions on Inspire2rise!

- 1010s

- 1020s

- 1030s

- 1037

- 1038

- 1039

- 1040

- 1040 (film)

- 1040s

- 1041

- 1042

- 1043

- 1050s

- 1060s

- 1070s

- 1095

- 10th century

- 1105

- 11th century

- 12th century

- 2nd millennium

- 997

- Ab urbe condita

- Al-Bakri

- Armenian calendar

- Assyrian calendar

- August 15

- Bahá'í calendar

- Battle of Dandanaqan

- Bengali calendar

- Berber calendar

- Brewery

- Buddhist calendar

- Byzantine calendar

- Category 1040

- Category 1040 births

- Category 1040 deaths

- China

- Chinese calendar

- Coptic calendar

- Duncan I of Scotland

- Ethiopian calendar

- February 22

- Form 1040

- Ghaznavid

- Ghaznavids

- Gregorian calendar

- Guido d'Arezzo

- Harold Harefoot

- Hebrew calendar

- Hindu calendar

- Holocene calendar

- Hugh, Count of Suio

- Iranian calendar

- Islamic calendar

- Italy

- Japanese calendar

- Julian calendar

- June 17

- June 27

- Kali Yuga

- King of England

- King of Scotland

- Korean calendar

- List of centuries

- List of decades

- List of years

- March 17

- May 23

- Millennium

- Minguo calendar

- October 1

- Rashi

- Regnal year

- Republic of China

- Roman numerals

- Sandwich, Kent

- Seljuk Turks

- Sexagenary cycle

- Shalu Monastery

- Thai solar calendar

- Tibet

- Vikram Samvat

- Weihenstephan

-

1040 Instructions - How To Fill Out Form 1040

How to fill out Form 1040 - Watch this video by a certified public accountant (http://www.evanhcpa.com) to help you understand the flow of the Form 1040. In the video, a CPA based in Nashville (Evan Hutcheson, CPA, LLC, 2303 21st Ave S #201 Nashville, TN 37212) shows you what each line of the 1040 means and how the each line is affected by other lines within the form. The best way for you to file if you're going to file using the IRS forms is to go to their website to free fillable forms. It's a simple process and they do a lot of the calculations for you. The Form 1040 is two pages. It is broken up into sections, including income, adjusted gross income, taxes and credits, etc. Each part of the 1040 is affected in different ways by other parts, and there are many variables involved. F... -

How to Fill Out your Income Tax Form 1040

2015 and 2014 1040 Tax Form Updates: The 2015 1040 Tax form has the same line number and information as the 2014. (the amounts will be different). The purpose of this video is to help you understand what is on the main tax form so you can get ready to fill out your taxes. You can fill out your tax forms by hand or via a computerized program or have an accountant do it for you, but it is helpful to know what is in the tax form. You will usually save money if you " know before you go". 2015 and 2014 Tax form 1040 updates are put in the red bubbles in this video. For 2015 updates or other 2015 tax forms go to http:// www.IRS.gov. The main form that you file when you file your income tax is IRS Form 1040. This video explains how to fill out your tax form and how you can get more tax cr... -

CID - Khooni Laash - Episode 1040 - 31st January 2014

Khooni Laash - Deepika, Sagar and Mihir had to attend a wedding in the morning. Manager urgently calls Deepika as neither Sagar nor Mihir were responding. Deepika requests a Couple to urgently call CID as she was severely injured. Sagar and Mihir were found dead in their Hotel room. Who killed Sagar and Mihir? To find out, watch this thrilling episode of CID. "The first thrilling investigative series on Indian Television, is today one of the most popular shows on Sony Entertainment Television. Dramatic and absolutely unpredictable, C.I.D. has captivated viewers over the last eleven years and continues to keep audiences glued to their television sets with its thrilling plots and excitement. Also interwoven in its fast paced plots are the personal challenges that the C.I.D. team faces with ... -

Individual Income Tax Return = Form 1040 | Regulation | Miles CPA Review ( REG-1 Binder-1)

http://www.milescpareview.com/ Form 1040, U.S. Individual Income Tax Return, is one of three forms used for personal (individual) federal income tax returns filed with the IRS. Individuals can file this form that have varied incomes and would like to take various deductions. A very practical topic of the CPA curriculum. Master this crucial topic from REG section of Miles CPA Review Course using Varun's unique iCPA delivery model. Make sure you like us on Facebook. http://www.milescpareview.com/ -

Filling out IRS Schedule C for the 1040

For Self-employed, Independent Contractors (Sole Proprietorship), the "Schedule C" is your friend. You don't need a degree in Accounting. It's basic math - how much did your business make minus how much did your business spend equal net profit (or loss). Understanding the nuances of it will help you best keep track of your expenses so you can decrease your tax liability. -

-

Itemized Deductions Form 1040 Schedule A

-

La Planilla 1040 del 2012

Video tutorial de los componentes de la planilla 1040 en español. La planilla 1040 del 2012 consiste de dos paginas y 11 secciones. El conocer mas sobre su planilla le ayuda a cumplir con su responsabilidad tributario y reducir sus impuestos. Encuentre mas informacion sobre taxes y las planillas 1040 en http://menostax.com -

Learn How to Fill the Form 1040-ES Estimated Tax for Individuals

Visit: http://legal-forms.laws.com/tax/form-1040-es-estimated-tax-for-individuals To download the Form 1040-ES in printable format and to know about the use of this form, who can use this Form 1040-ES and when one should use this Form 1040-ES form. To Learn how to fill Various legal form, Go to http://www.youtube.com/user/FreeLegalForms -

HP EliteBook Folio 1040 G3 initial impressions

HP EliteBook Folio 1040 G3 initial impressions: The HP Elitebook Folio 1040 G3 comes with an Intel Core i5 processor, 8 GB of RAM and Windows 10 pro. This is a business class notebook with a great aluminium design and fingerprint scanner along with several connectivity options like USB Type C port, SD card slot, USB 3.0 port and more. Watch on as we try our hands out on this device and try to find out whether it's good enough or not! HP EliteBook Folio 1040 G3 is now available in India at the starting price of INR 90,000/- Don't forget to hit the thumbs up and do subscribe to our channel! //**Follow Inspire2rise**// Follow us on Facebook: https://facebook.com/Inspire2rise Follow us on Twitter: https://twitter.com/inspire2rise Add us to your circles: https://plus.google.com/+Inspire2rise/...

1040 Instructions - How To Fill Out Form 1040

- Order: Reorder

- Duration: 27:31

- Updated: 19 Jun 2014

- views: 31112

How to fill out Form 1040 - Watch this video by a certified public accountant (http://www.evanhcpa.com) to help you understand the flow of the Form 1040.

In t...

How to fill out Form 1040 - Watch this video by a certified public accountant (http://www.evanhcpa.com) to help you understand the flow of the Form 1040.

In the video, a CPA based in Nashville (Evan Hutcheson, CPA, LLC, 2303 21st Ave S #201 Nashville, TN 37212) shows you what each line of the 1040 means and how the each line is affected by other lines within the form.

The best way for you to file if you're going to file using the IRS forms is to go to their website to free fillable forms. It's a simple process and they do a lot of the calculations for you.

The Form 1040 is two pages. It is broken up into sections, including income, adjusted gross income, taxes and credits, etc.

Each part of the 1040 is affected in different ways by other parts, and there are many variables involved. For example, to calculate tax, you can not just simply multiply your taxable income by your tax rate. Different parts of you income are taxed at different rates.

I go into this, and much more, in greater detail in the video, so please have a look at it to find out whether or not you will be able to deduct your rental property losses on your individual tax return.

You can find the IRS Form 1040 online here:

http://www.irs.gov/pub/irs-pdf/f1040.pdf

Please share this video on how to fill out Form 1040:

http://www.youtube.com/watch?v=SG0C5KdeqnE

Subscribe to my Channel:

http://www.youtube.com/user/EvanHutchesonCPA

Follow Me:

http://www.facebook.com/EvanHutchesonCpa

http://twitter.com/Nashville_CPA

http://plus.google.com/+Evanhcpa/about

http://www.linkedin.com/pub/evan-hutcheson/30/909/746

You might like this video too:

http://www.youtube.com/watch?v=ijo-JNPJ6Bg

1040 Instructions | How to Fill Out Form 1040

wn.com/1040 Instructions How To Fill Out Form 1040

How to fill out Form 1040 - Watch this video by a certified public accountant (http://www.evanhcpa.com) to help you understand the flow of the Form 1040.

In the video, a CPA based in Nashville (Evan Hutcheson, CPA, LLC, 2303 21st Ave S #201 Nashville, TN 37212) shows you what each line of the 1040 means and how the each line is affected by other lines within the form.

The best way for you to file if you're going to file using the IRS forms is to go to their website to free fillable forms. It's a simple process and they do a lot of the calculations for you.

The Form 1040 is two pages. It is broken up into sections, including income, adjusted gross income, taxes and credits, etc.

Each part of the 1040 is affected in different ways by other parts, and there are many variables involved. For example, to calculate tax, you can not just simply multiply your taxable income by your tax rate. Different parts of you income are taxed at different rates.

I go into this, and much more, in greater detail in the video, so please have a look at it to find out whether or not you will be able to deduct your rental property losses on your individual tax return.

You can find the IRS Form 1040 online here:

http://www.irs.gov/pub/irs-pdf/f1040.pdf

Please share this video on how to fill out Form 1040:

http://www.youtube.com/watch?v=SG0C5KdeqnE

Subscribe to my Channel:

http://www.youtube.com/user/EvanHutchesonCPA

Follow Me:

http://www.facebook.com/EvanHutchesonCpa

http://twitter.com/Nashville_CPA

http://plus.google.com/+Evanhcpa/about

http://www.linkedin.com/pub/evan-hutcheson/30/909/746

You might like this video too:

http://www.youtube.com/watch?v=ijo-JNPJ6Bg

1040 Instructions | How to Fill Out Form 1040

- published: 19 Jun 2014

- views: 31112

How to Fill Out your Income Tax Form 1040

- Order: Reorder

- Duration: 9:59

- Updated: 18 Mar 2011

- views: 179900

2015 and 2014 1040 Tax Form Updates: The 2015 1040 Tax form has the same line number and information as the 2014. (the amounts will be different). The purpose...

2015 and 2014 1040 Tax Form Updates: The 2015 1040 Tax form has the same line number and information as the 2014. (the amounts will be different). The purpose of this video is to help you understand what is on the main tax form so you can get ready to fill out your taxes. You can fill out your tax forms by hand or via a computerized program or have an accountant do it for you, but it is helpful to know what is in the tax form. You will usually save money if you " know before you go".

2015 and 2014 Tax form 1040 updates are put in the red bubbles in this video. For 2015 updates or other 2015 tax forms go to http:// www.IRS.gov. The main form that you file when you file your income tax is IRS Form 1040. This video explains how to fill out your tax form and how you can get more tax credits and deductions. The 1040 Tax Form does not change much from year to year. Some changes for 2015 and 2014 are explained in the little bubbles.

The Health Insurance topic can be very confusing.

Additional changes for 2015 and 2014 are about the new health care law (Affordable Care Act), And how to report and get your tax credit. Health Insurance.

There are 3 lines on the 1040 Tax form that refer to the Health Care Law. Line 46 "Excess Advance premium tax credit repayment" Fill out another form (Form 8962) if this applies to you.

Line 61 "Health Care: Individual responsibility" and you fill out form 8965 if this applies to you. Most people only have to check the box on line 61 and do not need to fill out the form.

Line 69 "Net premium tax credit" If this applies to you then fill out Form 8962.

When you use a computerized tax form or service to fill out your taxes then these extra tax forms will automatically pop up for you to fill in.

IRS Warning: The IRS reminds individuals who owe the payment that it should be made only with their tax return or in response to a letter from the IRS. The payment should never be made directly to an individual or return preparer. Most people don’t owe the payment at all because they have health coverage or qualify for a coverage exemption.

The IRS has received several reports of this kind of unscrupulous activity. In some cases, return preparers have told taxpayers to make the payment directly to them, even though the taxpayer had Medicaid or other health coverage and doesn’t need to make the shared responsibility payment at all. In some parts of the country, unscrupulous return preparers are targeting taxpayers with limited English proficiency and, in particular, those who primarily speak Spanish.

These preparers are asking for direct payment to them, but their reasons vary. Methods include:

• telling individuals that they must make an individual shared responsibility payment directly to the preparer because of their immigration status,

• promising to lower the payment amount if the client pays it directly to the preparer, or

• demanding money from individuals who are exempt from the individual shared responsibility payment.

From: HCTT-2015-17:

wn.com/How To Fill Out Your Income Tax Form 1040

2015 and 2014 1040 Tax Form Updates: The 2015 1040 Tax form has the same line number and information as the 2014. (the amounts will be different). The purpose of this video is to help you understand what is on the main tax form so you can get ready to fill out your taxes. You can fill out your tax forms by hand or via a computerized program or have an accountant do it for you, but it is helpful to know what is in the tax form. You will usually save money if you " know before you go".

2015 and 2014 Tax form 1040 updates are put in the red bubbles in this video. For 2015 updates or other 2015 tax forms go to http:// www.IRS.gov. The main form that you file when you file your income tax is IRS Form 1040. This video explains how to fill out your tax form and how you can get more tax credits and deductions. The 1040 Tax Form does not change much from year to year. Some changes for 2015 and 2014 are explained in the little bubbles.

The Health Insurance topic can be very confusing.

Additional changes for 2015 and 2014 are about the new health care law (Affordable Care Act), And how to report and get your tax credit. Health Insurance.

There are 3 lines on the 1040 Tax form that refer to the Health Care Law. Line 46 "Excess Advance premium tax credit repayment" Fill out another form (Form 8962) if this applies to you.

Line 61 "Health Care: Individual responsibility" and you fill out form 8965 if this applies to you. Most people only have to check the box on line 61 and do not need to fill out the form.

Line 69 "Net premium tax credit" If this applies to you then fill out Form 8962.

When you use a computerized tax form or service to fill out your taxes then these extra tax forms will automatically pop up for you to fill in.

IRS Warning: The IRS reminds individuals who owe the payment that it should be made only with their tax return or in response to a letter from the IRS. The payment should never be made directly to an individual or return preparer. Most people don’t owe the payment at all because they have health coverage or qualify for a coverage exemption.

The IRS has received several reports of this kind of unscrupulous activity. In some cases, return preparers have told taxpayers to make the payment directly to them, even though the taxpayer had Medicaid or other health coverage and doesn’t need to make the shared responsibility payment at all. In some parts of the country, unscrupulous return preparers are targeting taxpayers with limited English proficiency and, in particular, those who primarily speak Spanish.

These preparers are asking for direct payment to them, but their reasons vary. Methods include:

• telling individuals that they must make an individual shared responsibility payment directly to the preparer because of their immigration status,

• promising to lower the payment amount if the client pays it directly to the preparer, or

• demanding money from individuals who are exempt from the individual shared responsibility payment.

From: HCTT-2015-17:

- published: 18 Mar 2011

- views: 179900

CID - Khooni Laash - Episode 1040 - 31st January 2014

- Order: Reorder

- Duration: 45:31

- Updated: 01 Feb 2014

- views: 846058

Khooni Laash - Deepika, Sagar and Mihir had to attend a wedding in the morning. Manager urgently calls Deepika as neither Sagar nor Mihir were responding. Deepi...

Khooni Laash - Deepika, Sagar and Mihir had to attend a wedding in the morning. Manager urgently calls Deepika as neither Sagar nor Mihir were responding. Deepika requests a Couple to urgently call CID as she was severely injured. Sagar and Mihir were found dead in their Hotel room. Who killed Sagar and Mihir? To find out, watch this thrilling episode of CID.

"The first thrilling investigative series on Indian Television, is today one of the most popular shows on Sony Entertainment Television. Dramatic and absolutely unpredictable, C.I.D. has captivated viewers over the last eleven years and continues to keep audiences glued to their television sets with its thrilling plots and excitement. Also interwoven in its fast paced plots are the personal challenges that the C.I.D. team faces with non-stop adventure, tremendous pressure and risk, all in the name of duty.The series consists of hard-core police procedural stories dealing with investigation, detection and suspense. The protagonists of the serial are an elite group of police officers belonging to the Crime Investigation Department of the police force, led by ACP Pradyuman [played by the dynamic Shivaji Satam]. While the stories are plausible, there is an emphasis on dramatic plotting and technical complexities faced by the police. At every stage, the plot throws up intriguing twists and turns keeping the officers on the move as they track criminals, led by the smallest of clues."For more information on your favourite show do visit

www.facebook.com/SonyLiv and follow us on

www.twitter.com/SonyLiv"

"

wn.com/Cid Khooni Laash Episode 1040 31St January 2014

Khooni Laash - Deepika, Sagar and Mihir had to attend a wedding in the morning. Manager urgently calls Deepika as neither Sagar nor Mihir were responding. Deepika requests a Couple to urgently call CID as she was severely injured. Sagar and Mihir were found dead in their Hotel room. Who killed Sagar and Mihir? To find out, watch this thrilling episode of CID.

"The first thrilling investigative series on Indian Television, is today one of the most popular shows on Sony Entertainment Television. Dramatic and absolutely unpredictable, C.I.D. has captivated viewers over the last eleven years and continues to keep audiences glued to their television sets with its thrilling plots and excitement. Also interwoven in its fast paced plots are the personal challenges that the C.I.D. team faces with non-stop adventure, tremendous pressure and risk, all in the name of duty.The series consists of hard-core police procedural stories dealing with investigation, detection and suspense. The protagonists of the serial are an elite group of police officers belonging to the Crime Investigation Department of the police force, led by ACP Pradyuman [played by the dynamic Shivaji Satam]. While the stories are plausible, there is an emphasis on dramatic plotting and technical complexities faced by the police. At every stage, the plot throws up intriguing twists and turns keeping the officers on the move as they track criminals, led by the smallest of clues."For more information on your favourite show do visit

www.facebook.com/SonyLiv and follow us on

www.twitter.com/SonyLiv"

"

- published: 01 Feb 2014

- views: 846058

Individual Income Tax Return = Form 1040 | Regulation | Miles CPA Review ( REG-1 Binder-1)

- Order: Reorder

- Duration: 62:18

- Updated: 08 Oct 2013

- views: 66603

http://www.milescpareview.com/

Form 1040, U.S. Individual Income Tax Return, is one of three forms used for personal (individual) federal income tax returns fil...

http://www.milescpareview.com/

Form 1040, U.S. Individual Income Tax Return, is one of three forms used for personal (individual) federal income tax returns filed with the IRS. Individuals can file this form that have varied incomes and would like to take various deductions. A very practical topic of the CPA curriculum. Master this crucial topic from REG section of Miles CPA Review Course using Varun's unique iCPA delivery model. Make sure you like us on Facebook.

http://www.milescpareview.com/

wn.com/Individual Income Tax Return Form 1040 | Regulation | Miles Cpa Review ( Reg 1 Binder 1)

http://www.milescpareview.com/

Form 1040, U.S. Individual Income Tax Return, is one of three forms used for personal (individual) federal income tax returns filed with the IRS. Individuals can file this form that have varied incomes and would like to take various deductions. A very practical topic of the CPA curriculum. Master this crucial topic from REG section of Miles CPA Review Course using Varun's unique iCPA delivery model. Make sure you like us on Facebook.

http://www.milescpareview.com/

- published: 08 Oct 2013

- views: 66603

Filling out IRS Schedule C for the 1040

- Order: Reorder

- Duration: 12:49

- Updated: 26 Apr 2014

- views: 7224

For Self-employed, Independent Contractors (Sole Proprietorship), the "Schedule C" is your friend. You don't need a degree in Accounting. It's basic math - ho...

For Self-employed, Independent Contractors (Sole Proprietorship), the "Schedule C" is your friend. You don't need a degree in Accounting. It's basic math - how much did your business make minus how much did your business spend equal net profit (or loss).

Understanding the nuances of it will help you best keep track of your expenses so you can decrease your tax liability.

wn.com/Filling Out Irs Schedule C For The 1040

For Self-employed, Independent Contractors (Sole Proprietorship), the "Schedule C" is your friend. You don't need a degree in Accounting. It's basic math - how much did your business make minus how much did your business spend equal net profit (or loss).

Understanding the nuances of it will help you best keep track of your expenses so you can decrease your tax liability.

- published: 26 Apr 2014

- views: 7224

Form 1040 Tax Tutorial Overview by www.taxfriendonline.com

- Order: Reorder

- Duration: 3:57

- Updated: 19 Feb 2012

- views: 13141

Turbo Tax Federal FREE EDITION: http://tinyurl.com/easyturbotax

We are an authorized Turbo Tax Affiliate

Visit http://www.taxfriendonline.com for any tax ...

Turbo Tax Federal FREE EDITION: http://tinyurl.com/easyturbotax

We are an authorized Turbo Tax Affiliate

Visit http://www.taxfriendonline.com for any tax questions.

..

wn.com/Form 1040 Tax Tutorial Overview By Www.Taxfriendonline.Com

Itemized Deductions Form 1040 Schedule A

- Order: Reorder

- Duration: 2:54

- Updated: 30 Sep 2012

- views: 14102

- published: 30 Sep 2012

- views: 14102

La Planilla 1040 del 2012

- Order: Reorder

- Duration: 31:38

- Updated: 03 Jan 2013

- views: 7200

Video tutorial de los componentes de la planilla 1040 en español. La planilla 1040 del 2012 consiste de dos paginas y 11 secciones. El conocer mas sobre su plan...

Video tutorial de los componentes de la planilla 1040 en español. La planilla 1040 del 2012 consiste de dos paginas y 11 secciones. El conocer mas sobre su planilla le ayuda a cumplir con su responsabilidad tributario y reducir sus impuestos. Encuentre mas informacion sobre taxes y las planillas 1040 en http://menostax.com

wn.com/La Planilla 1040 Del 2012

Video tutorial de los componentes de la planilla 1040 en español. La planilla 1040 del 2012 consiste de dos paginas y 11 secciones. El conocer mas sobre su planilla le ayuda a cumplir con su responsabilidad tributario y reducir sus impuestos. Encuentre mas informacion sobre taxes y las planillas 1040 en http://menostax.com

- published: 03 Jan 2013

- views: 7200

Learn How to Fill the Form 1040-ES Estimated Tax for Individuals

- Order: Reorder

- Duration: 2:00

- Updated: 22 Aug 2012

- views: 23755

Visit: http://legal-forms.laws.com/tax/form-1040-es-estimated-tax-for-individuals

To download the Form 1040-ES in printable format and to know about

the use of...

Visit: http://legal-forms.laws.com/tax/form-1040-es-estimated-tax-for-individuals

To download the Form 1040-ES in printable format and to know about

the use of this form, who can use this Form 1040-ES and when one should use this Form 1040-ES form.

To Learn how to fill Various legal form,

Go to http://www.youtube.com/user/FreeLegalForms

wn.com/Learn How To Fill The Form 1040 Es Estimated Tax For Individuals

Visit: http://legal-forms.laws.com/tax/form-1040-es-estimated-tax-for-individuals

To download the Form 1040-ES in printable format and to know about

the use of this form, who can use this Form 1040-ES and when one should use this Form 1040-ES form.

To Learn how to fill Various legal form,

Go to http://www.youtube.com/user/FreeLegalForms

- published: 22 Aug 2012

- views: 23755

HP EliteBook Folio 1040 G3 initial impressions

- Order: Reorder

- Duration: 2:29

- Updated: 06 Jun 2016

- views: 28

HP EliteBook Folio 1040 G3 initial impressions: The HP Elitebook Folio 1040 G3 comes with an Intel Core i5 processor, 8 GB of RAM and Windows 10 pro. This is a ...

HP EliteBook Folio 1040 G3 initial impressions: The HP Elitebook Folio 1040 G3 comes with an Intel Core i5 processor, 8 GB of RAM and Windows 10 pro. This is a business class notebook with a great aluminium design and fingerprint scanner along with several connectivity options like USB Type C port, SD card slot, USB 3.0 port and more.

Watch on as we try our hands out on this device and try to find out whether it's good enough or not!

HP EliteBook Folio 1040 G3 is now available in India at the starting price of INR 90,000/-

Don't forget to hit the thumbs up and do subscribe to our channel!

//**Follow Inspire2rise**//

Follow us on Facebook: https://facebook.com/Inspire2rise

Follow us on Twitter: https://twitter.com/inspire2rise

Add us to your circles: https://plus.google.com/+Inspire2rise/

You were watching HP EliteBook Folio 1040 G3 initial impressions on Inspire2rise!

wn.com/Hp Elitebook Folio 1040 G3 Initial Impressions

HP EliteBook Folio 1040 G3 initial impressions: The HP Elitebook Folio 1040 G3 comes with an Intel Core i5 processor, 8 GB of RAM and Windows 10 pro. This is a business class notebook with a great aluminium design and fingerprint scanner along with several connectivity options like USB Type C port, SD card slot, USB 3.0 port and more.

Watch on as we try our hands out on this device and try to find out whether it's good enough or not!

HP EliteBook Folio 1040 G3 is now available in India at the starting price of INR 90,000/-

Don't forget to hit the thumbs up and do subscribe to our channel!

//**Follow Inspire2rise**//

Follow us on Facebook: https://facebook.com/Inspire2rise

Follow us on Twitter: https://twitter.com/inspire2rise

Add us to your circles: https://plus.google.com/+Inspire2rise/

You were watching HP EliteBook Folio 1040 G3 initial impressions on Inspire2rise!

- published: 06 Jun 2016

- views: 28

close fullscreen

- Playlist

- Chat

close fullscreen

- Playlist

- Chat

27:31

1040 Instructions - How To Fill Out Form 1040

How to fill out Form 1040 - Watch this video by a certified public accountant (http://www....

published: 19 Jun 2014

1040 Instructions - How To Fill Out Form 1040

1040 Instructions - How To Fill Out Form 1040

- Report rights infringement

- published: 19 Jun 2014

- views: 31112

9:59

How to Fill Out your Income Tax Form 1040

2015 and 2014 1040 Tax Form Updates: The 2015 1040 Tax form has the same line number and ...

published: 18 Mar 2011

How to Fill Out your Income Tax Form 1040

How to Fill Out your Income Tax Form 1040

- Report rights infringement

- published: 18 Mar 2011

- views: 179900

45:31

CID - Khooni Laash - Episode 1040 - 31st January 2014

Khooni Laash - Deepika, Sagar and Mihir had to attend a wedding in the morning. Manager ur...

published: 01 Feb 2014

CID - Khooni Laash - Episode 1040 - 31st January 2014

CID - Khooni Laash - Episode 1040 - 31st January 2014

- Report rights infringement

- published: 01 Feb 2014

- views: 846058

62:18

Individual Income Tax Return = Form 1040 | Regulation | Miles CPA Review ( REG-1 Binder-1)

http://www.milescpareview.com/

Form 1040, U.S. Individual Income Tax Return, is one of thr...

published: 08 Oct 2013

Individual Income Tax Return = Form 1040 | Regulation | Miles CPA Review ( REG-1 Binder-1)

Individual Income Tax Return = Form 1040 | Regulation | Miles CPA Review ( REG-1 Binder-1)

- Report rights infringement

- published: 08 Oct 2013

- views: 66603

12:49

Filling out IRS Schedule C for the 1040

For Self-employed, Independent Contractors (Sole Proprietorship), the "Schedule C" is your...

published: 26 Apr 2014

Filling out IRS Schedule C for the 1040

Filling out IRS Schedule C for the 1040

- Report rights infringement

- published: 26 Apr 2014

- views: 7224

3:57

Form 1040 Tax Tutorial Overview by www.taxfriendonline.com

Turbo Tax Federal FREE EDITION: http://tinyurl.com/easyturbotax

We are an authorized Tu...

published: 19 Feb 2012

Form 1040 Tax Tutorial Overview by www.taxfriendonline.com

2:54

Itemized Deductions Form 1040 Schedule A

published: 30 Sep 2012

Itemized Deductions Form 1040 Schedule A

Itemized Deductions Form 1040 Schedule A

- Report rights infringement

- published: 30 Sep 2012

- views: 14102

31:38

La Planilla 1040 del 2012

Video tutorial de los componentes de la planilla 1040 en español. La planilla 1040 del 201...

published: 03 Jan 2013

La Planilla 1040 del 2012

La Planilla 1040 del 2012

- Report rights infringement

- published: 03 Jan 2013

- views: 7200

2:00

Learn How to Fill the Form 1040-ES Estimated Tax for Individuals

Visit: http://legal-forms.laws.com/tax/form-1040-es-estimated-tax-for-individuals

To down...

published: 22 Aug 2012

Learn How to Fill the Form 1040-ES Estimated Tax for Individuals

Learn How to Fill the Form 1040-ES Estimated Tax for Individuals

- Report rights infringement

- published: 22 Aug 2012

- views: 23755

2:29

HP EliteBook Folio 1040 G3 initial impressions

HP EliteBook Folio 1040 G3 initial impressions: The HP Elitebook Folio 1040 G3 comes with ...

published: 06 Jun 2016

HP EliteBook Folio 1040 G3 initial impressions

HP EliteBook Folio 1040 G3 initial impressions

- Report rights infringement

- published: 06 Jun 2016

- views: 28

Labour MP Jo Cox Dies From Injuries Sustained In Birstall Shooting

Edit WorldNews.com 16 Jun 2016

Labour MP Jo Cox has died after being shot and stabbed by a man reportedly shouting “Britain first” at lunchtime in Birstall, West Yorkshire during her constituency advice surgery, The Belfast Telegraph reported. "I am now very sad to have to report that she has died as a result of her injuries.” – Dee Collins, temporary chief constable for West Yorkshire ... "The death of Jo Cox is a tragedy. She was a committed and caring MP....

[VIDEO]: Senate Democrats Yield Filibuster After Compromise Reached

Edit WorldNews.com 16 Jun 2016

With assurances of a vote on two proposed gun-control measures from Republican Party leaders, Senate Democrats ended their nearly 15-hour filibuster early Thursday, NBC News reported.Connecticut Democrat Sen ... "We did not have that commitment when we started today. I've had enough. I've had enough of the ongoing slaughter of innocents, and I've had enough of inaction in this body.” – Connecticut Sen....

Why our nuclear deal with Iran is turning to dust

Edit The Independent 16 Jun 2016

The Middle East is littered with missed opportunities, lost chances and dreams turned to dust. The Iranian nuclear deal is now heading in the same direction ... But he’s beginning to look like a patsy ... The sanctions have been lifted – but they haven’t been lifted ... Washington both giveth and taketh away; it’s a slogan that every Iranian president should learn ... don’t trust America. ....

Recovered EgyptAir Flight 804 Black Box Returning To Egypt For Analysis

Edit WorldNews.com 16 Jun 2016

A specialist ship owned by a Mauritian company recovered one of the two black box recorders from EgyptAir Flight 804 found deep in the Mediterranean Thursday, Egyptian authorities have told The Daily Telegraph.The discovery of the cockpit voice recorder (CVR) is a key element in determining what brought down the doomed flight – including evidence whether it was brought down by a terrorist’s bomb or a technical fault....

JP Morgan and Bank of America in cluster bomb investors 'Hall of Shame'

Edit The Guardian 16 Jun 2016

@LGamGam. More than 150 financial institutions including JPMorgan Chase and Bank of America invested $28bn in companies that produce cluster bombs despite an international ban, according to a new report by the Netherlands-based peace organization PAX ... A Shared Responsibility ... Cluster bombs are banned under international law by the Convention on Cluster Munitions, a 2008 Oslo treaty which was signed by more than 100 countries ... Related ... ....

« back to news headlines

New Year’s Eve pair killed revelers over spilled drink, get life in prison

Edit Sacramento Bee 16 Jun 2016

It was just a spilled drink, Carlito Montoya said he tells himself now ... A fight over the drink that spilled on Fowler-Scholz’s wife, Amber Scholz, preceded gunshots that brought a brutal end to the revelry at Sports Corner Café on Dec ... Both men will die in prison. Darrell Smith. 916-321-1040, @dvaughnsmith ....

PANOSTAJA OYJ CONFIRMS THE FINAL ADDITIONAL PURCHASE PRICE OF FLEXIM SECURITY (Panostaja Oyj)

Edit Public Technologies 16 Jun 2016

(Source. Panostaja Oyj). Panostaja Oyj Stock Exchange Bulletin June 16, 201610.15 a.m. The parties have today confirmed the additional purchase price of the sale of Flexim Security Oy ... Panostaja OyjJuha Sarsama. CEO. Further information ... Original documenthttp.//otp.investis.com/clients/fi/panostaja_oyj/omx/omx-story.aspx?cid=1040&newsid=49333&culture=en-US ... (noodl....

IRS Scam Warning (Sarasota County Sheriff's Office)

Edit Public Technologies 16 Jun 2016

(Source. Sarasota County Sheriff's Office) The Sarasota County Sheriff's Office is again warning citizens to be cautious about telephone scams, this time, it's one commonly known as the 'IRS Scam.' ... They may know details about the victim or trick them into revealing private information ... Finally if you know or think you might owe taxes, call the IRS directly at 1-800-829-1040 ... (noodl. 34133216) ....

'Caps appeal Morales red card, Kudo update, new face in training (Vancouver Whitecaps FC)

Edit Public Technologies 15 Jun 2016

(Source. Vancouver Whitecaps FC). VANCOUVER, BC - After a rare few days off, it's back to business for Vancouver Whitecaps FC. The 'Caps met with the media today ahead of Saturday's tilt vs. New England Revolution (4 p.m. PT on TSN1 and TSN 1040 - tickets still available). Here are some news and notes from the day. APPEAL DENIED ... Pretty important ones, too, in centre back Kendall Waston, midfielder Pedro Morales, and striker Octavio Rivero....

Hands-on review: PC Specialist Voyager III Pro

Edit TechRadar 15 Jun 2016

As years go by, it becomes difficult for laptop vendors to differentiate their offerings. After all, notebook components are manufactured by a slowly diminishing number of companies ... As for alternatives, the Lenovo ThinkPad E560, the Dell Inspiron 15 5000 and the HP EliteBook 1040 G3 are within a similar price bracket but with different feature sets.10 essential features your next business laptop should absolutely have ....

Update on Sale of Barge (Tyranna Resources Limited)

Edit Public Technologies 14 Jun 2016

(Source. Tyranna Resources Limited) Microsoft Word - 076_UpdateSaleBarge. ASX CODE. TYX. DIRECTORS Ian Finch. Chairman Bruno Seneque. Managing Director Neil McKay. Company Secretary and Non-Executive Director. SHARE REGISTRY Advanced Share Registry Services. 110 Stirling Highway. Nedlands WA 6009. T. +61 8 9389 8033. F. +61 8 9389 7871. REGISTERED OFFICE. Level 2 679 Murray Street West Perth WA 6005 ... +61 8 9485 1040 ... T +61 (08) 9485 1040 ....

Calgary Flames GM says field of candidates for new head coach has been narrowed down

Edit Toronto Sun 14 Jun 2016

The Calgary Flames’ coaching search is almost over. “We are much closer to the end than we are the beginning, that’s for sure,” said general manager Brad Treliving ... Reports out of Vancouver’s TSN 1040 radio suggest that Treliving’s final three candidates are Canucks assistant coach Glen Gulutzan, Randy Carlyle, and Washington Capitals assistant Todd Reirden ... “But we’re still not there yet....

Courageous team complete 54mile charity challenge 14-06-16 (Forth Ports Ltd)

Edit Public Technologies 14 Jun 2016

(Source. Forth Ports Ltd). Cateran Yomp Challenge success for Team from Forth Ports. A team from Forth Ports successfully completed the gruelling 54mile Cateran Yomp challenge over the weekend to raise money for the Soldiers' Charity. Writing about the tough challenge, Jason Thirwall said. ... 07.10 Saturday morning ... We did it! ... We raised a load of cash and our team made top ten out of 1040 competitors, we smashed it! ... What an achievement!'....

Siemens to Improve Spectrum Management, Coverage and Capacity for its Customers with Federated Wireless’ CINQ ...

Edit Stockhouse 14 Jun 2016

Siemens to Improve Spectrum Management, Coverage and Capacity for its Customers with Federated Wireless’ CINQ XP™ Spectrum Access System. Siemens and Federated Wireless, Inc., a subsidiary of Allied Minds (LSE ... Siemens, which supplies rugged wireless broadband solutions for harsh environment applications, provides its WiMAX radio equipment in this, as well as other, bands ... http.//bit.ly/WiMaxRC ... Ravi Pimplaskar, 703-593-1040 ... or. Siemens....

06-14-2016 - UPDATED District 9 Travel Report - Week Ending June 18, 2016 (Ohio Department of Transportation)

Edit Public Technologies 14 Jun 2016

(Source. Ohio Department of Transportation). District 9 Travel Report For the week ending June 18, 2016.The following traffic advisory includes road construction and major maintenance projects requiring long-term lane restrictions and/or closures along the state and federal highway system within ODOT District 9 ... DISTRICTWIDE. A districtwide herbicidal spraying project is scheduled to begin in late April ... to 6 p.m ... (#16-1016) ... (#16-1040) ... 62....

North American Income Trust (The) - Net Asset Value(s) (The North American Income Trust plc)

Edit Public Technologies 13 Jun 2016

(Source. The North American Income Trust plc). RNS Number . 0150B. North American Income Trust (The). 13 June 2016. Aberdeen Asset Management PLC announces the unaudited net asset values (NAVs) of the following investment companies as at close of business on 10 June 2016 ... In particular ... The North American Income Trust PLC Undiluted. Excluding Income ... Ordinary ... 1040.94p....

Announcements and Notices - Change of Company Secretary, Authorised Representative and Service Agent (Wuyi International Pharmaceutical Co Ltd)

Edit Public Technologies 13 Jun 2016

(Source. Wuyi International Pharmaceutical Co Ltd) Microsoft Word - E1889 Resignation of SEC (20160610) (1040) GH cmt ... WUYI INTERNATIONAL PHARMACEUTICAL COMPANY LIMITED. 武武武武夷夷夷夷國國國國際際際際藥藥藥藥業業業業有有有有限限限限公公公公司司司司. (Incorporated in the Cayman Islands with limited liability). (Stock Code. 1889) CHANGE OF COMPANY SECRETARY, AUTHORISED REPRESENTATIVE AND SERVICE AGENT ... Kung Wai Chiu, Marco ("Mr ... Mr ... Kung, Mr. Luk Ting Fung ("Mr ... Mr ... Mr ... Ltd....

- 1

- 2

- 3

- 4

- 5

- Next page »