- published: 10 Dec 2013

- views: 437172

-

remove the playlistCall Option

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistCall Option

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 22 Oct 2010

- views: 81680

- published: 05 Mar 2011

- views: 52058

- published: 29 May 2014

- views: 4524

- published: 21 Aug 2010

- views: 127648

- published: 16 Dec 2012

- views: 10230

- published: 27 Jan 2013

- views: 4706

- published: 28 Dec 2011

- views: 26971

Call option

A call option, often simply labeled a "call", is a financial contract between two parties, the buyer and the seller of this type of option. The buyer of the call option has the right, but not the obligation, to buy an agreed quantity of a particular commodity or financial instrument (the underlying) from the seller of the option at a certain time (the expiration date) for a certain price (the strike price). The seller (or "writer") is obligated to sell the commodity or financial instrument to the buyer if the buyer so decides. The buyer pays a fee (called a premium) for this right.

When you buy a call option, you are buying the right to buy a stock at the strike price, regardless of the stock price in the future before the expiration date. Conversely, you can short or "write" the call option, giving the buyer the right to buy that stock from you anytime before the option expires. To compensate you for that risk taken, the buyer pays you a premium, also known as the price of the call. The seller of the call is said to have shorted the call option, and keeps the premium (the amount the buyer pays to buy the option) whether or not the buyer ever exercises the option.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

7:56

7:56Call Options & Put Options Explained Simply In 8 Minutes (How To Trade Options For Beginners)

Call Options & Put Options Explained Simply In 8 Minutes (How To Trade Options For Beginners)Call Options & Put Options Explained Simply In 8 Minutes (How To Trade Options For Beginners)

How To Trade Options: Calls & Puts Call options & put options are explained simply in this entertaining and informative 8 minute training video which uses 2 cartoon-based scenarios to help you learn how to trade call options and how to trade put options. If you've ever been confused by calls and puts in the past, this video will clear up any confusion you may have had. Also, if you're looking to learn how to trade options, you will learn some simple options trading strategies in this short video. For more training, get my free "dummies" guide to options trading here: http://www.prtradingresearch.com/simple-options-youtube3 -

1:27

1:27Investopedia Video: Call Option Basics

Investopedia Video: Call Option BasicsInvestopedia Video: Call Option Basics

Call options offer investors a way to leverage their capital for greater investment returns. Find out more about these financial contracts and how they work. Be the first to check out our latest videos on Investopedia Video: http://www.investopedia.com/video/ -

11:09

11:09Call option & put option : (CSC tutor)

Call option & put option : (CSC tutor)Call option & put option : (CSC tutor)

http://www.ilmcanada.com CSC, IFC, LLQP, Lean Six Sigma, PMP training in Toronto, Canada and worldwide on Skype. Tel 647-292-8786 aizad423@yahoo.ca -

5:10

5:10Andy Crowder: When To Buy a Call Option

Andy Crowder: When To Buy a Call OptionAndy Crowder: When To Buy a Call Option

Visit our website: http://www.wyattresearch.com/ Option strategist Andy Crowder explains when to buy an option. ----------------------------------------------------------------------------------------- Top Options Secrets Revealed: Keep it simple and follow a sound options strategy that makes money over the long haul. This special report reveals the #1 rule to win a high win-rate in every options trade. For your free copy, just click here: http://bit.ly/1lLlmOm. ----------------------------------------------------------------------------------------- Subscribe to Wyatt Investment Research's YouTube Channel: http://www.youtube.com/user/WyattResearchTV Or, follow our Google+ page: https://plus.google.com/+Wyattresearch/posts Join our Facebook community: https://www.facebook.com/WyattResearch Follow us on Twitter: https://twitter.com/wyattresearch -

12:18

12:18Call and Put option for dummies

Call and Put option for dummiesCall and Put option for dummies

http://www.garguniversity.com -

8:23

8:23Call Options Trading for Beginners in 9 min. - Put and Call Options Explained

Call Options Trading for Beginners in 9 min. - Put and Call Options ExplainedCall Options Trading for Beginners in 9 min. - Put and Call Options Explained

Clicked here http://www.MBAbullshit.com/ and OMG wow! I'm SHOCKED how easy.. Despite the fact that there is often significant amounts of reward in dealing or investing in shares of stock, you have a boatload of high risk, considering that the value of your share of stock can go down. How can you protect yourself alongside this risk? Have a glimpse at this story. Let's say that you buy a stock of XYZ Company at $10 per share. You aspire to keep this stock for long-lasting investment, with the likelihood of selling it at a really good price in the future; maybe even as high as $15 in the future (maybe 3 years from now). Of course, you're also worried about the danger that your XYZ $10 stock may go down in price, like possibly to $5. If this comes about, you will have lost half of your money. Therefore, what steps do you take? You enter into an understanding with ABC Company (different from XYZ), which pledges that even when the value of your XYZ $10 stock drops in the stock market to $5 or possibly zero, ABC will guarantee that they are going to be prepared to receive your share at the same $10 for which you acquired your share of stock for (and this is just in case you elect to sell the share of stock to them). That way, you are protected against "downside" harm if the stock fails, however you still are able to get any plausible "upside" reward if your share goes up in value. So that you can formalize this contract, ABC Company issues you a sheet of paper as evidence that your particular agreement exists. What exactly is this piece of paper termed? It's known as an "option" or a "stock option". For what reason is it labelled as an 'option'? Because you, the owner of your option, currently have the "choice" or "option" to sell your stock to ABC Company at the particular $10 price if ever you opt to use or "exercise" the option. When you are the possessor of the option, ABC Company will be the one providing you with that choice, thus it is known as "issuer" of your option. The option talked over above, by which you have got the choice to sell a stock to ABC Company at a set worth even if your stock price goes down is more specifically labelled a "put" option. There's also another option defined as a "call" option, which, in a way, is the "opposite" of a put option. Instead of having the choice to sell a stock at a certain selling price even when the worth goes down, you have got the choice to buy a stock at a specified selling price even if the price rises. Considering that the idea of a call option is just as lengthy as a put option, it will best be handled in its own sole video which you can watch above. Be sure to note that in real life, you usually do not procure options straight from the issuing company (in our example above, it was ABC Company). Rather, you would definitely obtain or sell options from an options "exchange" which happens to be analogous to a stock exchange although where options are bought in place of stocks. http://www.youtube.com/watch?v=q_z1Zx_BALo -

4:57

4:57Meaning and Importance of Call Option - What is the advantage of Call Options - Hindi

Meaning and Importance of Call Option - What is the advantage of Call Options - HindiMeaning and Importance of Call Option - What is the advantage of Call Options - Hindi

What is Options, Uderstanding of Options Strategies, Options Pricing Model, Spot Price, Strike Price, Time to Maturity, Annual Volatility, Rate of Interest, Implied Volatility, Bull Call Spread, Bull Put Spread, How to make Options Strategies, In the Money Option, At the Money Option, Out of the money Option, Low Volatility Vs High Volatilty, How to learn Option Strategy, Delta, Gamma, Vega, Theta, Rho Hope you will like this. Please dont forget to subscribe our You Tube Channel. We love to see your comments. FinIdeas on Social Networks : Website : www.finideas.com E-mail : info@finideas.com Facebook : www.facebook.com/finideas Blog : http://finideasmspl.blogspot.in/ Youtube : www.youtube.com/finideas Twitter : www.twitter.com/finideas Contact us : 09374985600 || 09375204812 -

4:50

4:50Call option (example )

Call option (example )Call option (example )

Sally has a call option to buy 800 Wesizwe Platinum shares at R70 a share. It is an American option and expires on 30 April 2013.Explain whether or not she will exercise this option given the following situations: (i) On 28 February 2013 the price of Wesizwe Platinum shares is R74 per share. (ii) On 30 March 2013 the price of Wesizwe Platinum shares is R68 per share.. (iii) On 15 May 2013 the price of price of Wesizwe Platinum shares is R72 per share. -

9:33

9:33Long Call Option Strategy

Long Call Option StrategyLong Call Option Strategy

http://optionalpha.com - Long Call Option Strategy ================== Listen to our #1 rated investing podcast on iTunes: http://optionalpha.com/podcast ================== Download a free copy of the "The Ultimate Options Strategy Guide": http://optionalpha.com/ebook ================== Still working a day job? Then our "Take 5" segment is for you. 5 mins videos each day on 1 thing you can apply trading options: http://www.youtube.com/playlist?list=PLhKnvfWKsu40z0EnsX0TNqCgUzb8tmM04 ================== Start our 4-part video course (HINT: these videos are NOT posted anywhere else online): http://optionalpha.com/free-options-trading-course ================== Just getting started or new to options trading? Here's a quick resource page we made that you'll love: http://optionalpha.com/start-here ================== Register for one of our 5-star reviewed webinars: http://optionalpha.com/webinars ================== - Kirk & The Option Alpha Team -

3:04

3:04Call Option as Leverage

Call Option as Leverage

-

Call Options & Put Options Explained Simply In 8 Minutes (How To Trade Options For Beginners)

How To Trade Options: Calls & Puts Call options & put options are explained simply in this entertaining and informative 8 minute training video which uses 2 cartoon-based scenarios to help you learn how to trade call options and how to trade put options. If you've ever been confused by calls and puts in the past, this video will clear up any confusion you may have had. Also, if you're looking to learn how to trade options, you will learn some simple options trading strategies in this short video. For more training, get my free "dummies" guide to options trading here: http://www.prtradingresearch.com/simple-options-youtube3 -

Investopedia Video: Call Option Basics

Call options offer investors a way to leverage their capital for greater investment returns. Find out more about these financial contracts and how they work. Be the first to check out our latest videos on Investopedia Video: http://www.investopedia.com/video/ -

Call option & put option : (CSC tutor)

http://www.ilmcanada.com CSC, IFC, LLQP, Lean Six Sigma, PMP training in Toronto, Canada and worldwide on Skype. Tel 647-292-8786 aizad423@yahoo.ca -

Andy Crowder: When To Buy a Call Option

Visit our website: http://www.wyattresearch.com/ Option strategist Andy Crowder explains when to buy an option. ----------------------------------------------------------------------------------------- Top Options Secrets Revealed: Keep it simple and follow a sound options strategy that makes money over the long haul. This special report reveals the #1 rule to win a high win-rate in every options trade. For your free copy, just click here: http://bit.ly/1lLlmOm. ----------------------------------------------------------------------------------------- Subscribe to Wyatt Investment Research's YouTube Channel: http://www.youtube.com/user/WyattResearchTV Or, follow our Google+ page: https://plus.google.com/+Wyattresearch/posts Join our Facebook community: https://www.facebook.com/Wya... -

Call and Put option for dummies

http://www.garguniversity.com -

Call Options Trading for Beginners in 9 min. - Put and Call Options Explained

Clicked here http://www.MBAbullshit.com/ and OMG wow! I'm SHOCKED how easy.. Despite the fact that there is often significant amounts of reward in dealing or investing in shares of stock, you have a boatload of high risk, considering that the value of your share of stock can go down. How can you protect yourself alongside this risk? Have a glimpse at this story. Let's say that you buy a stock of XYZ Company at $10 per share. You aspire to keep this stock for long-lasting investment, with the likelihood of selling it at a really good price in the future; maybe even as high as $15 in the future (maybe 3 years from now). Of course, you're also worried about the danger that your XYZ $10 stock may go down in price, like possibly to $5. If this comes about, you will have lost half of your mo... -

Meaning and Importance of Call Option - What is the advantage of Call Options - Hindi

What is Options, Uderstanding of Options Strategies, Options Pricing Model, Spot Price, Strike Price, Time to Maturity, Annual Volatility, Rate of Interest, Implied Volatility, Bull Call Spread, Bull Put Spread, How to make Options Strategies, In the Money Option, At the Money Option, Out of the money Option, Low Volatility Vs High Volatilty, How to learn Option Strategy, Delta, Gamma, Vega, Theta, Rho Hope you will like this. Please dont forget to subscribe our You Tube Channel. We love to see your comments. FinIdeas on Social Networks : Website : www.finideas.com E-mail : info@finideas.com Facebook : www.facebook.com/finideas Blog : http://finideasmspl.blogspot.in/ Youtube : www.youtube.com/finideas Twitter : www.twitter.com/finideas Contact us : 09374985600 || 09375204812 -

Call option (example )

Sally has a call option to buy 800 Wesizwe Platinum shares at R70 a share. It is an American option and expires on 30 April 2013.Explain whether or not she will exercise this option given the following situations: (i) On 28 February 2013 the price of Wesizwe Platinum shares is R74 per share. (ii) On 30 March 2013 the price of Wesizwe Platinum shares is R68 per share.. (iii) On 15 May 2013 the price of price of Wesizwe Platinum shares is R72 per share. -

Long Call Option Strategy

http://optionalpha.com - Long Call Option Strategy ================== Listen to our #1 rated investing podcast on iTunes: http://optionalpha.com/podcast ================== Download a free copy of the "The Ultimate Options Strategy Guide": http://optionalpha.com/ebook ================== Still working a day job? Then our "Take 5" segment is for you. 5 mins videos each day on 1 thing you can apply trading options: http://www.youtube.com/playlist?list=PLhKnvfWKsu40z0EnsX0TNqCgUzb8tmM04 ================== Start our 4-part video course (HINT: these videos are NOT posted anywhere else online): http://optionalpha.com/free-options-trading-course ================== Just getting started or new to options trading? Here's a quick resource page we made that you'll love: http://optionalpha.com/... -

Call Options & Put Options Explained Simply In 8 Minutes (How To Trade Options For Beginners)

- Order: Reorder

- Duration: 7:56

- Updated: 10 Dec 2013

- views: 437172

- published: 10 Dec 2013

- views: 437172

Investopedia Video: Call Option Basics

- Order: Reorder

- Duration: 1:27

- Updated: 22 Oct 2010

- views: 81680

- published: 22 Oct 2010

- views: 81680

Call option & put option : (CSC tutor)

- Order: Reorder

- Duration: 11:09

- Updated: 05 Mar 2011

- views: 52058

- published: 05 Mar 2011

- views: 52058

Andy Crowder: When To Buy a Call Option

- Order: Reorder

- Duration: 5:10

- Updated: 29 May 2014

- views: 4524

- published: 29 May 2014

- views: 4524

Call and Put option for dummies

- Order: Reorder

- Duration: 12:18

- Updated: 13 Aug 2013

- views: 48847

Call Options Trading for Beginners in 9 min. - Put and Call Options Explained

- Order: Reorder

- Duration: 8:23

- Updated: 21 Aug 2010

- views: 127648

- published: 21 Aug 2010

- views: 127648

Meaning and Importance of Call Option - What is the advantage of Call Options - Hindi

- Order: Reorder

- Duration: 4:57

- Updated: 16 Dec 2012

- views: 10230

- published: 16 Dec 2012

- views: 10230

Call option (example )

- Order: Reorder

- Duration: 4:50

- Updated: 27 Jan 2013

- views: 4706

- published: 27 Jan 2013

- views: 4706

Long Call Option Strategy

- Order: Reorder

- Duration: 9:33

- Updated: 28 Dec 2011

- views: 26971

- published: 28 Dec 2011

- views: 26971

Call Option as Leverage

- Order: Reorder

- Duration: 3:04

- Updated: 16 Mar 2011

- views: 107257

-

Cash a call option with no expiration date

-

One put one call option to know about for dupont

-

When is a call option considered to be in the money

-

When is a call option considered to be in the money

-

What is the difference between a long position and a call option

-

When does one sell a put option and when does one sell a call option

-

When does one sell a put option and when does one sell a call option

-

sell call option strategy -3 in hindi

i this lesson i explained when sell call option how get premium from option with option greeks -

stratégie en option - option strategies part 1(stock market/index call put)

Vous pouvez commencer ici - https://goo.gl/tg002B -

Put call option

Make money with just 3 clicks! START RIGHT NOW AND GET THE WINNING STRATEGY “BINARY GAMBIT” TO YOUR EMAIL - minimal deposit from $10 - trade amount from $1 - account currencies – dollar, euro - opportunity to earn real money Complete a simple registration on the site and start earning right now https://goo.gl/qnerGg

Cash a call option with no expiration date

- Order: Reorder

- Duration: 9:34

- Updated: 02 Jul 2016

- views: 0

- published: 02 Jul 2016

- views: 0

One put one call option to know about for dupont

- Order: Reorder

- Duration: 6:47

- Updated: 02 Jul 2016

- views: 0

- published: 02 Jul 2016

- views: 0

When is a call option considered to be in the money

- Order: Reorder

- Duration: 1:38

- Updated: 02 Jul 2016

- views: 0

- published: 02 Jul 2016

- views: 0

When is a call option considered to be in the money

- Order: Reorder

- Duration: 1:48

- Updated: 02 Jul 2016

- views: 0

- published: 02 Jul 2016

- views: 0

What is the difference between a long position and a call option

- Order: Reorder

- Duration: 1:43

- Updated: 02 Jul 2016

- views: 0

- published: 02 Jul 2016

- views: 0

When does one sell a put option and when does one sell a call option

- Order: Reorder

- Duration: 2:13

- Updated: 01 Jul 2016

- views: 0

- published: 01 Jul 2016

- views: 0

When does one sell a put option and when does one sell a call option

- Order: Reorder

- Duration: 2:24

- Updated: 01 Jul 2016

- views: 0

- published: 01 Jul 2016

- views: 0

sell call option strategy -3 in hindi

- Order: Reorder

- Duration: 7:00

- Updated: 01 Jul 2016

- views: 14

- published: 01 Jul 2016

- views: 14

stratégie en option - option strategies part 1(stock market/index call put)

- Order: Reorder

- Duration: 4:27

- Updated: 30 Jun 2016

- views: 0

Put call option

- Order: Reorder

- Duration: 1:32

- Updated: 29 Jun 2016

- views: 0

- published: 29 Jun 2016

- views: 0

-

Options Trading - Live $2,000 NFLX Call Option

Live trading options and discussing the analysis, trade management and a few other items related to price targets and support/resistance. http://www.landsharkanalytics.com/remora-options-trading.html Disclaimer Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past Performance is not indicative of future results. With regard to any testimonials posted on this site, please note that any references to performance depends on each individual’s unique skills, time commitment effort and capital. Individuals sharing their results have not been compensated and any results have not been independently verified. Results may not be typical and individual results may vary. -

Clase sobre Opciones de Compra (Call Option)

Opciones de Compra (Call Option) Universidad Pompeu Fabra. Por Xavier Puig. www.pali-capital.com -

call option

احد دروس الاوبشن ١٠١ لدورة النخبة ٤ تويتر twitter @Ahmad_suli -

Basic Call Option

This video help CA,CS and MBA student in FM(Derivatives). -

Financial Derivatives: Probability that Call Option Will Expire Into Money

http://www.readyfreddie.com/ --- ► Subscribe to Its Ready Freddie Channel Here - http://bit.ly/ItsReadyFreddieSubscribe --- Calculation of the probability that call option on the stock will expire into money. We assume that return on the stock follows Geometric Brownian motion (GMB). I recommend: 1. Neil Chriss, Black-Scholes and Beyond 2. John Hull, Options, Futures, and Other Derivatives 3. http://youtube.com/bionicturtledotcom -

Why you never exercise an American Call Option on a non-Dividend Paying stock

I created this video with the YouTube Video Editor (https://www.youtube.com/editor) -

How to Manage Call Options in a Trending Market

http://www.TheOptionClub.com - Managing call options when the market is trending. -

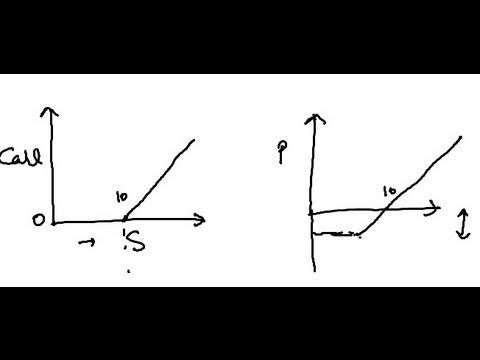

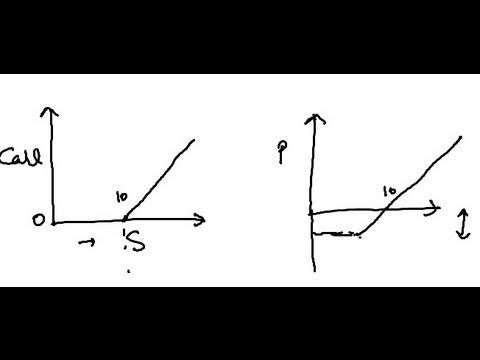

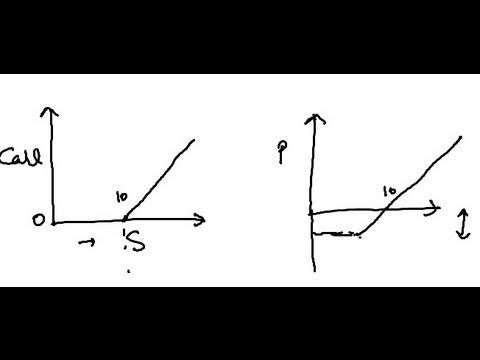

Option Payoff and Profit Diagrams.mp4

Financial Management Lecture by Arif Irfanullah www.arifirfanullah.com -

Call option trader Chuck Hughes profits off trading call options

Call option trader Chuck Hughes at http://www.tradewins.com/Promo%20Emails/WCA%20Affiliate%20Series/Landing4.html - Chuck Hughes explains how he profits off trading call and puts. He cashed in big on a trade with APPL, and tells how you can do the same here: http://youtu.be/c5m8mpo3Dj8 -

Options Trading - Live $2,000 NFLX Call Option

- Order: Reorder

- Duration: 26:32

- Updated: 04 Aug 2015

- views: 1793

- published: 04 Aug 2015

- views: 1793

Clase sobre Opciones de Compra (Call Option)

- Order: Reorder

- Duration: 37:27

- Updated: 02 Apr 2012

- views: 15714

- published: 02 Apr 2012

- views: 15714

call option

- Order: Reorder

- Duration: 71:13

- Updated: 15 May 2016

- views: 685

- published: 15 May 2016

- views: 685

Basic Call Option

- Order: Reorder

- Duration: 63:24

- Updated: 04 Apr 2014

- views: 590

Financial Derivatives: Probability that Call Option Will Expire Into Money

- Order: Reorder

- Duration: 52:06

- Updated: 15 Aug 2008

- views: 54134

- published: 15 Aug 2008

- views: 54134

Why you never exercise an American Call Option on a non-Dividend Paying stock

- Order: Reorder

- Duration: 22:08

- Updated: 28 Feb 2016

- views: 50

- published: 28 Feb 2016

- views: 50

How to Manage Call Options in a Trending Market

- Order: Reorder

- Duration: 101:48

- Updated: 23 Apr 2015

- views: 145

- published: 23 Apr 2015

- views: 145

Option Payoff and Profit Diagrams.mp4

- Order: Reorder

- Duration: 21:03

- Updated: 30 Apr 2012

- views: 7773

- published: 30 Apr 2012

- views: 7773

Call option trader Chuck Hughes profits off trading call options

- Order: Reorder

- Duration: 21:58

- Updated: 02 Oct 2013

- views: 2293

- published: 02 Oct 2013

- views: 2293

CFA Level I Risk Management Applications of Options Strategies Video Lecture by Mr. Arif Irfanullah

- Order: Reorder

- Duration: 33:23

- Updated: 01 Nov 2011

- views: 15423

- Playlist

- Chat

- Playlist

- Chat

Call Options & Put Options Explained Simply In 8 Minutes (How To Trade Options For Beginners)

- Report rights infringement

- published: 10 Dec 2013

- views: 437172

Investopedia Video: Call Option Basics

- Report rights infringement

- published: 22 Oct 2010

- views: 81680

Call option & put option : (CSC tutor)

- Report rights infringement

- published: 05 Mar 2011

- views: 52058

Andy Crowder: When To Buy a Call Option

- Report rights infringement

- published: 29 May 2014

- views: 4524

Call and Put option for dummies

- Report rights infringement

- published: 13 Aug 2013

- views: 48847

Call Options Trading for Beginners in 9 min. - Put and Call Options Explained

- Report rights infringement

- published: 21 Aug 2010

- views: 127648

Meaning and Importance of Call Option - What is the advantage of Call Options - Hindi

- Report rights infringement

- published: 16 Dec 2012

- views: 10230

Call option (example )

- Report rights infringement

- published: 27 Jan 2013

- views: 4706

Long Call Option Strategy

- Report rights infringement

- published: 28 Dec 2011

- views: 26971

Call Option as Leverage

- Report rights infringement

- published: 16 Mar 2011

- views: 107257

- Playlist

- Chat

Cash a call option with no expiration date

- Report rights infringement

- published: 02 Jul 2016

- views: 0

One put one call option to know about for dupont

- Report rights infringement

- published: 02 Jul 2016

- views: 0

When is a call option considered to be in the money

- Report rights infringement

- published: 02 Jul 2016

- views: 0

When is a call option considered to be in the money

- Report rights infringement

- published: 02 Jul 2016

- views: 0

What is the difference between a long position and a call option

- Report rights infringement

- published: 02 Jul 2016

- views: 0

When does one sell a put option and when does one sell a call option

- Report rights infringement

- published: 01 Jul 2016

- views: 0

When does one sell a put option and when does one sell a call option

- Report rights infringement

- published: 01 Jul 2016

- views: 0

sell call option strategy -3 in hindi

- Report rights infringement

- published: 01 Jul 2016

- views: 14

stratégie en option - option strategies part 1(stock market/index call put)

- Report rights infringement

- published: 30 Jun 2016

- views: 0

Put call option

- Report rights infringement

- published: 29 Jun 2016

- views: 0

- Playlist

- Chat

Options Trading - Live $2,000 NFLX Call Option

- Report rights infringement

- published: 04 Aug 2015

- views: 1793

Clase sobre Opciones de Compra (Call Option)

- Report rights infringement

- published: 02 Apr 2012

- views: 15714

call option

- Report rights infringement

- published: 15 May 2016

- views: 685

Basic Call Option

- Report rights infringement

- published: 04 Apr 2014

- views: 590

Financial Derivatives: Probability that Call Option Will Expire Into Money

- Report rights infringement

- published: 15 Aug 2008

- views: 54134

Why you never exercise an American Call Option on a non-Dividend Paying stock

- Report rights infringement

- published: 28 Feb 2016

- views: 50

How to Manage Call Options in a Trending Market

- Report rights infringement

- published: 23 Apr 2015

- views: 145

Option Payoff and Profit Diagrams.mp4

- Report rights infringement

- published: 30 Apr 2012

- views: 7773

Call option trader Chuck Hughes profits off trading call options

- Report rights infringement

- published: 02 Oct 2013

- views: 2293

CFA Level I Risk Management Applications of Options Strategies Video Lecture by Mr. Arif Irfanullah

- Report rights infringement

- published: 01 Nov 2011

- views: 15423

Turkish Military in Attempted Coup, Prime Minister Says

Edit Bloomberg 15 Jul 2016Former Fox News Commentator Sentenced For False Claims Of CIA Ties

Edit WorldNews.com 15 Jul 2016Newly Released Pages Say Saudis May Have Helped 9/11 Attackers

Edit WorldNews.com 15 Jul 2016Nice Terrorist Attack: At Least 77 Dead, Police Kill Suspect

Edit WorldNews.com 15 Jul 2016Apple iPhone 7 rumours: Device pictures, Pricing, colours leaked online

Edit Indian Express 16 Jul 2016Don't Miss The Action & Purchase A 2016/17 Season Ticket (Derby County Ltd)

Edit Public Technologies 16 Jul 2016Rahul Gandhi may become Congress President in August or November

Edit The Times of India 16 Jul 2016HEALTH CARE Orszag: Let vets get health care in civilian hospitals

Edit Richmond Times Dispatch 16 Jul 2016Spread the cost of your 2017 membership over 12 months (Leeds Rhinos - Leeds CF&A; Co Ltd)

Edit Public Technologies 16 Jul 2016Morneau among 3 White Sox roster moves

Edit Colorado Springs Gazette 16 Jul 2016France proposes 200-strong UN police force for Burundi

Edit Modern Ghana 16 Jul 2016Minister for cost-effective waste management technologies

Edit The Hindu 16 Jul 2016NSB library shows free movies (Volusia County, FL)

Edit Public Technologies 16 Jul 2016Sebi strikes at promoters of suspended cos

Edit The Times of India 16 Jul 2016Leader comment: May and Sturgeon on a collision course

Edit Scotsman 16 Jul 2016Pune: Chaos at DyDE office as hundreds turn up, demand choice of colleges

Edit Indian Express 16 Jul 2016Get fall draw results sooner with AZGFD Customer Portal account (Arizona Game and Fish Department)

Edit Public Technologies 16 Jul 2016- 1

- 2

- 3

- 4

- 5

- Next page »