- published: 25 Feb 2013

- views: 1302

-

remove the playlistDebt Restructuring

- remove the playlistDebt Restructuring

- published: 17 Dec 2013

- views: 1441

- published: 16 Mar 2012

- views: 3246

- published: 26 Feb 2013

- views: 967

- published: 22 Feb 2013

- views: 1135

- published: 20 May 2013

- views: 778

- published: 28 Sep 2015

- views: 92

- published: 21 Sep 2013

- views: 661

- published: 11 Sep 2015

- views: 1129

Debt restructuring is a process that allows a private or public company – or a sovereign entity – facing cash flow problems and financial distress, to reduce and renegotiate its delinquent debts in order to improve or restore liquidity and rehabilitate so that it can continue its operations.

Replacement of old debt by new debt when not under financial distress is referred to as refinancing.

Out-of court restructurings, also known as workouts, are increasingly becoming a global reality.[citation needed]

A debt restructuring is usually less expensive and a preferable alternative to bankruptcy. The main costs associated with a business debt restructuring are the time and effort to negotiate with bankers, creditors, vendors and tax authorities. Debt restructurings typically involve a reduction of debt and an extension of payment terms.

In the United States, small business bankruptcy filings cost at least $50,000 in legal and court fees, and filing costs in excess of $100,000 are common. By some measures, only 20% of firms survive Chapter 11 bankruptcy filings.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

17:14

17:14Troubled Debt Restructuring (Modification Of Terms With LossTo Creditor, Creditors Prospective)

Troubled Debt Restructuring (Modification Of Terms With LossTo Creditor, Creditors Prospective)Troubled Debt Restructuring (Modification Of Terms With LossTo Creditor, Creditors Prospective)

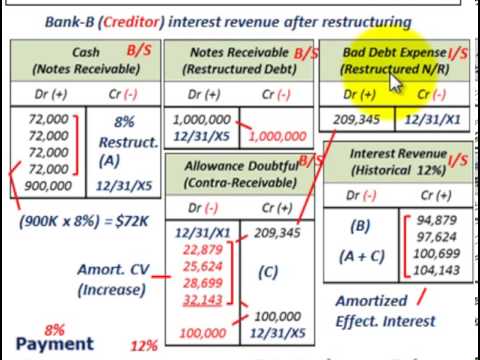

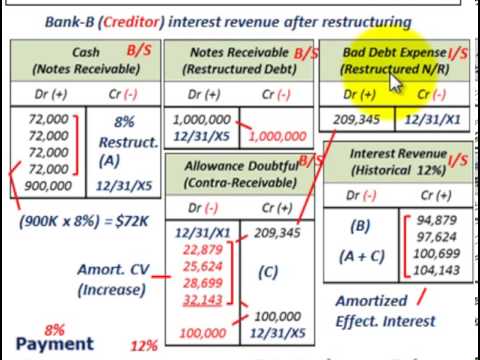

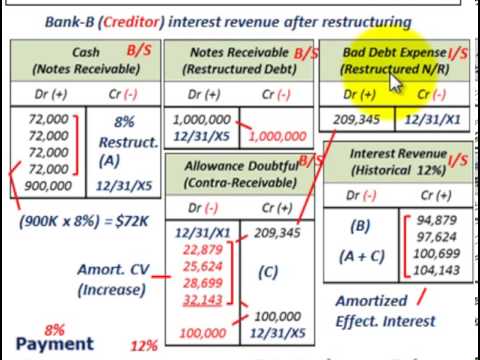

Accounting for restructuring of debt by modification of terms of a loan (notes receivable), realizing loss by reducing debt obligation from the creditors prospective, example is On 12/31/20X1 Bank-B enters into a debt restructuring agreement with Corp-A, which is experiencing financial difficulties, Bank-B restructures a $1 mil Loan receivable issued at par (interest is paid to date), note restructured by: 1-Reducing principal obligation from $1,000,000 to $900,000, 2-Extending the maturity date from 12/31/20X1 to 12/31/20X5, 3-Reducing the interest rate from 12% to 8% per year, 4-Reduction or deferral accrued interest (paid up, not required), Bank-B (Creditor) must calculate its Loss based on the expected future cash flows discounted at the historical effective interest rate of the Loan (Notes Receivable), detailed accounting by Allen Mursau -

2:27

2:27Corporate Debt Restructuring

Corporate Debt RestructuringCorporate Debt Restructuring

Two Minutes Concept Series gives you a clear understanding of all important concepts of Financial Markets, Macroeconomics, Investments, Public Finance and Central Bank Policies. -

2:46

2:46Debt Restructuring Explained

Debt Restructuring ExplainedDebt Restructuring Explained

An Easy Overview Of Debt Restructuring. Created under Creative Commons: http://en.wikipedia.org/wiki/Debt_restructuring -

2:35

2:35Why can corporate debt restructuring fail? | Dejargoned

Why can corporate debt restructuring fail? | DejargonedWhy can corporate debt restructuring fail? | Dejargoned

In the first five months of this financial year, at least four large cases with loans worth about Rs 14,000 crore have failed and exited from the corporate debt restructuring (CDR) cell, according to data from the CDR cell. Watch this video to know more. -

16:22

16:22Troubled Debt Restructuring (Modification Of Terms With Gain To Debtor, Debtors Prospective)

Troubled Debt Restructuring (Modification Of Terms With Gain To Debtor, Debtors Prospective)Troubled Debt Restructuring (Modification Of Terms With Gain To Debtor, Debtors Prospective)

Accounting for restructuring of debt by modification of terms of a loan (notes payable), realizing a gain by reducing debt obligation from the debtors prospective, (1) realizing the total gain at the date of loan restructuring and (2) amortizing the gain over the life of the loan, example On 12/31/20X1 Bank-B enters into a debt restructuring agreement with Corp-A, which is experiencing financial difficulties, Bank-B restructures a $1 mil Loan receivable issued at par (interest is paid to date), note restructured by: 1-Reducing principal obligation from $1,000,000 to $700,000, 2-Extending the maturity date from 12/31/20X1 to 12/31/20X5, 3-Reducing the interest rate from 12% to 8% per year, 4-Reduction or deferral accrued interest (paid up, not required), Total future cash flow after restructuring: ($700,000 principal + $224,000 interest) = $924,000, Less than total pre-structuring CV $1 mil, debtor records gain & reduces carrying amount of payable $76,000 ($1 mil - $924,000), detailed accounting by Allen Mursau -

4:08

4:08Troubled Debt Restructuring - Overview & Definition of TDR

Troubled Debt Restructuring - Overview & Definition of TDRTroubled Debt Restructuring - Overview & Definition of TDR

This first video covers the definition of a TDR. -

87:54

87:54Sovereign Debt Restructuring

Sovereign Debt RestructuringSovereign Debt Restructuring

Sovereign debt restructuring 14h00-15h30 10-4-15 -

10:40

10:40Troubled Debt Restructuring (Settlement Of Debt Thru Transfer Of Assets, Debtor & Creditor)

Troubled Debt Restructuring (Settlement Of Debt Thru Transfer Of Assets, Debtor & Creditor)Troubled Debt Restructuring (Settlement Of Debt Thru Transfer Of Assets, Debtor & Creditor)

Accounting for troubled debt restructuring by the settlement of debt thru the transfer of assets, settling a debt obligation can involve either a transfer of non-cash assets or the issuance of the debtor's stock, the creditor should account for the noncash assets or equity interest received at their fair value, example Corp-A owes $400,000 plus $36,000 of accrued interest to Bank-B, debt is a 10-year 10% note, Corp-A's business has deteriorated and they can not pay the note (Loan), on (12/31/20X1) Bank-B agrees to accept an machine and cancel the entire debt, machine has a cost of $780,000, accumulated depreciation of $442,000 and fair market value of $360,000, Transfer of Property by Corp-A (Debtor) to Bank-B, (A) Gain or Loss on disposal of asset transferred, (B) Carrying amount of payable over fair value of assets or equity transferred (gain) Debt Restructure, Transfer of Property to Bank-B (Creditor) from Corp-A, (A) Noncash asset received at fair value, (B) Charge excess (Loss) against Allowance for Doubtful acct. as a reduction of a receivable, detailed accounting by Allen Mursau -

4:34

4:34Europe's failure on debt restructuring

Europe's failure on debt restructuringEurope's failure on debt restructuring

The past year has probably been the most important in sovereign debt history. Lee Buccheit, partner at Clearly Gottlieb and advisor to most countries in financial distress, tells the FT's Robin Wigglesworth why Europe should have acted faster. Related Article: http://www.ft.com/cms/s/0/1c2ce2fc-bd59-11e2-a735-00144feab7de.html For more video content from the Financial Times, visit http://www.FT.com/video -

2:35

2:35Sovereign Debt Restructuring Workshop

Sovereign Debt Restructuring WorkshopSovereign Debt Restructuring Workshop

CIGI Senior Fellow Martin Guzman shares commentary on the heels of a Sovereign Debt Restructuring Workshop co-hosted by the Centre for International Governance Innovation (CIGI) and Columbia University's Initiative for Policy Dialogue (IPD) on September 22, 2015 in New York. -

4:01

4:01Argentina's Debt Restructuring is a Complex Case

Argentina's Debt Restructuring is a Complex CaseArgentina's Debt Restructuring is a Complex Case

CCTV's Karina Huber sits down with Marcelo Etchebarne, Cabanellas Etchebarne Kelly Managing Partner, to discuss the complexities of Argentina's debt restructuring. Etchebarne is one of the lawyers who worked on restructuring Argentina's debt. -

17:37

17:37UN approves debt restructuring resolution

UN approves debt restructuring resolutionUN approves debt restructuring resolution

The principles included the right of the sovereign state to restructure their debt; good faith; transparency; impartiality; equitable treatment; legitimacy; sustainability; and majority restructuring. -

4:32

4:32IMF tackles sovereign debt restructuring

IMF tackles sovereign debt restructuringIMF tackles sovereign debt restructuring

The International Monetary Fund is looking at sovereign debt restructuring, worried that it is bailing out private creditors. Gabriel Sterne, an economist at Exotix, explains to Fast FT deputy editor Robin Wigglesworth why the proposal for automatic bail-ins would not be wise. For more video content from the Financial Times, visit http://www.FT.com/video Subscribe to the Financial Times on YouTube; http://goo.gl/vUQx5k Twitter https://twitter.com/ftvideo Facebook https://www.facebook.com/financialtimes -

14:01

14:01Troubled Debt Restructuring (Modification Of Terms With No Gain To Debtor, Debtors Prospective)

Troubled Debt Restructuring (Modification Of Terms With No Gain To Debtor, Debtors Prospective)Troubled Debt Restructuring (Modification Of Terms With No Gain To Debtor, Debtors Prospective)

Accounting for restructuring of debt by modification of terms of a loan (notes payable), realizing no gain by reducing debt obligation from the debtors prospective, example is On 12/31/20X1 Bank-B enters into a debt restructuring agreement with Corp-A, which is experiencing financial difficulties, Bank-B restructures a $1 mil Loan receivable issued at par (interest is paid to date), note restructured by: 1-Reducing principal obligation from $1,000,000 to $900,000, 2-Extending the maturity date from 12/31/20X1 to 12/31/20X5, 3-Reducing the interest rate from 12% to 8% per year, 4-Reduction or deferral accrued interest (paid up, not required), on restructured debt calculate a new effective interest rate and use it to amortize the loan down from $1,000,000 to $900,000, no gain to debtor because the total future cash flow of $1,188,000 is greater than the pre-structring carrying value of $1 mil and make no adjustment to issued carrying amount of the payable, detailed accounting by Allen Mursau

- Bad debt

- Bankruptcy

- Bond (finance)

- Book building

- Bookrunner

- Business valuation

- Buy side

- Capital structure

- Charge-off

- Collection agency

- Consumer debt

- Consumer lending

- Control premium

- Convertible bond

- Corporate bond

- Corporate debt

- Corporate finance

- Cost of capital

- Creditor

- Debenture

- Debt

- Debt bondage

- Debt buyer

- Debt collection

- Debt compliance

- Debt consolidation

- Debt evasion

- Debt management plan

- Debt relief

- Debt restructuring

- Debt-snowball method

- Debtors' prison

- Default (finance)

- Defendants

- Demerger

- Deposit account

- DIP financing

- Discounted cash flow

- Divestment

- Drag-along right

- Economic Value Added

- Enterprise value

- Equity carve-out

- Exchangeable bond

- External debt

- Fairness opinion

- Financial covenants

- Financial distress

- Financial modeling

- Financial sponsor

- Fixed income

- Follow-on offering

- Free cash flow

- Garnishment

- Going concern

- Government bond

- Government debt

- Greenshoe

- High-yield debt

- Insolvency

- Interest

- Interest rate

- Internal debt

- Investment banking

- Jeffrey Sachs

- Joseph Stiglitz

- Leverage (finance)

- Leveraged buyout

- Liquidity

- Loan

- Loan shark

- Market value added

- Mezzanine capital

- Minority interest

- Money market

- Municipal bond

- Municipal debt

- Net present value

- Pari passu

- Payday loan

- Phantom debt

- Pitch book

- Poison pill

- Pre-emption right

- Predatory lending

- Preferred stock

- Private equity

- Private placement

- Project finance

- Proxy fight

- Refinancing

- Restructuring

- Reverse greenshoe

- Reverse takeover

- Rights issue

- Second lien loan

- Secured loan

- Securitization

- Sell side

- Senior debt

- Shareholder loan

- Shareholder's equity

- Spin out

- Squeeze out

- Stock

- Stock valuation

- Strategic default

- Subordinated debt

- Switzerland

- Tag-along right

- Takeover

- Tax shield

- Template Debt

- Template talk Debt

- Tender offer

- Underwriter

- Usury

- Valuation (finance)

- Venture debt

- Warrant (finance)

-

Troubled Debt Restructuring (Modification Of Terms With LossTo Creditor, Creditors Prospective)

Accounting for restructuring of debt by modification of terms of a loan (notes receivable), realizing loss by reducing debt obligation from the creditors prospective, example is On 12/31/20X1 Bank-B enters into a debt restructuring agreement with Corp-A, which is experiencing financial difficulties, Bank-B restructures a $1 mil Loan receivable issued at par (interest is paid to date), note restructured by: 1-Reducing principal obligation from $1,000,000 to $900,000, 2-Extending the maturity date from 12/31/20X1 to 12/31/20X5, 3-Reducing the interest rate from 12% to 8% per year, 4-Reduction or deferral accrued interest (paid up, not required), Bank-B (Creditor) must calculate its Loss based on the expected future cash flows discounted at the historical effective interest rate of the Loan (... -

Corporate Debt Restructuring

Two Minutes Concept Series gives you a clear understanding of all important concepts of Financial Markets, Macroeconomics, Investments, Public Finance and Central Bank Policies. -

Debt Restructuring Explained

An Easy Overview Of Debt Restructuring. Created under Creative Commons: http://en.wikipedia.org/wiki/Debt_restructuring -

Why can corporate debt restructuring fail? | Dejargoned

In the first five months of this financial year, at least four large cases with loans worth about Rs 14,000 crore have failed and exited from the corporate debt restructuring (CDR) cell, according to data from the CDR cell. Watch this video to know more. -

Troubled Debt Restructuring (Modification Of Terms With Gain To Debtor, Debtors Prospective)

Accounting for restructuring of debt by modification of terms of a loan (notes payable), realizing a gain by reducing debt obligation from the debtors prospective, (1) realizing the total gain at the date of loan restructuring and (2) amortizing the gain over the life of the loan, example On 12/31/20X1 Bank-B enters into a debt restructuring agreement with Corp-A, which is experiencing financial difficulties, Bank-B restructures a $1 mil Loan receivable issued at par (interest is paid to date), note restructured by: 1-Reducing principal obligation from $1,000,000 to $700,000, 2-Extending the maturity date from 12/31/20X1 to 12/31/20X5, 3-Reducing the interest rate from 12% to 8% per year, 4-Reduction or deferral accrued interest (paid up, not required), Total future cash flow after restruc... -

Troubled Debt Restructuring - Overview & Definition of TDR

This first video covers the definition of a TDR. -

Sovereign Debt Restructuring

Sovereign debt restructuring 14h00-15h30 10-4-15 -

Troubled Debt Restructuring (Settlement Of Debt Thru Transfer Of Assets, Debtor & Creditor)

Accounting for troubled debt restructuring by the settlement of debt thru the transfer of assets, settling a debt obligation can involve either a transfer of non-cash assets or the issuance of the debtor's stock, the creditor should account for the noncash assets or equity interest received at their fair value, example Corp-A owes $400,000 plus $36,000 of accrued interest to Bank-B, debt is a 10-year 10% note, Corp-A's business has deteriorated and they can not pay the note (Loan), on (12/31/20X1) Bank-B agrees to accept an machine and cancel the entire debt, machine has a cost of $780,000, accumulated depreciation of $442,000 and fair market value of $360,000, Transfer of Property by Corp-A (Debtor) to Bank-B, (A) Gain or Loss on disposal of asset transferred, (B) Carrying amount of pay... -

Europe's failure on debt restructuring

The past year has probably been the most important in sovereign debt history. Lee Buccheit, partner at Clearly Gottlieb and advisor to most countries in financial distress, tells the FT's Robin Wigglesworth why Europe should have acted faster. Related Article: http://www.ft.com/cms/s/0/1c2ce2fc-bd59-11e2-a735-00144feab7de.html For more video content from the Financial Times, visit http://www.FT.com/video -

Sovereign Debt Restructuring Workshop

CIGI Senior Fellow Martin Guzman shares commentary on the heels of a Sovereign Debt Restructuring Workshop co-hosted by the Centre for International Governance Innovation (CIGI) and Columbia University's Initiative for Policy Dialogue (IPD) on September 22, 2015 in New York. -

Argentina's Debt Restructuring is a Complex Case

CCTV's Karina Huber sits down with Marcelo Etchebarne, Cabanellas Etchebarne Kelly Managing Partner, to discuss the complexities of Argentina's debt restructuring. Etchebarne is one of the lawyers who worked on restructuring Argentina's debt. -

UN approves debt restructuring resolution

The principles included the right of the sovereign state to restructure their debt; good faith; transparency; impartiality; equitable treatment; legitimacy; sustainability; and majority restructuring. -

IMF tackles sovereign debt restructuring

The International Monetary Fund is looking at sovereign debt restructuring, worried that it is bailing out private creditors. Gabriel Sterne, an economist at Exotix, explains to Fast FT deputy editor Robin Wigglesworth why the proposal for automatic bail-ins would not be wise. For more video content from the Financial Times, visit http://www.FT.com/video Subscribe to the Financial Times on YouTube; http://goo.gl/vUQx5k Twitter https://twitter.com/ftvideo Facebook https://www.facebook.com/financialtimes -

Troubled Debt Restructuring (Modification Of Terms With No Gain To Debtor, Debtors Prospective)

Accounting for restructuring of debt by modification of terms of a loan (notes payable), realizing no gain by reducing debt obligation from the debtors prospective, example is On 12/31/20X1 Bank-B enters into a debt restructuring agreement with Corp-A, which is experiencing financial difficulties, Bank-B restructures a $1 mil Loan receivable issued at par (interest is paid to date), note restructured by: 1-Reducing principal obligation from $1,000,000 to $900,000, 2-Extending the maturity date from 12/31/20X1 to 12/31/20X5, 3-Reducing the interest rate from 12% to 8% per year, 4-Reduction or deferral accrued interest (paid up, not required), on restructured debt calculate a new effective interest rate and use it to amortize the loan down from $1,000,000 to $900,000, no gain to debtor becau... -

-

Sovereign Debt Restructuring in Europe: Lessons from Latin America

ORIGINALLY RECORDED May 3, 2011 Experts discuss the current state of European sovereign debt restructuring, as well as the economic lessons Latin America has to offer. This event was part of the McKinsey Executive Roundtable series in International Economics. SPEAKERS: Adam Lerrick, Visiting Scholar, American Enterprise Institute for Public Policy Research; Chairman, Sovereign Debt Solutions Limited William R. Rhodes, President and Chief Executive Officer, William R. Rhodes Global Advisers, LLC; Senior Adviser, Citigroup, Inc. Ernesto Zedillo Ponce de León, Director, Center for the Study of Globalization, Yale University; Former President, Mexico PRESIDER: Roger C. Altman, Founder and Chairman, Evercore Partners, Inc. http://www.cfr.org/economics/sovereign-debt-restructuring-... -

Natalie Jaresko on Ukraine Debt Restructuring

Speaking on the sidelines of the ERBD Annual Meeting in Georgia, Ukraine's Finance Minister Natalie Jaresko makes an impassioned plea for creditors to come to the table to discuss debt restructuring. -

Speech of President Cristina Kirchner, after the UN approval of a framework for restructuring debt

http://www.telam.com.ar -

Greece: Varoufakis calls hypocrisy in the processes of debt restructuring

Greek Finance Minister Yanis Varoufakis stated that "political constraints" were stopping the Greek Government and its European's lenders to enter a "rational debate," while speaking at the Emergency Economic Summit for Greece in Athens, Tuesday. Varoufakis recalled the stock exchange's habits on restructuring unpayable debts and regretted the "official" rules preventing Greece from doing the same with their loans. The difference between the private rules of finance and the rules pertaining to nations, Varoufakis lamented, create the conditions for failure - and a perpetuation of "pretending and extending." Video ID: 20150519-069 Video on Demand: http://www.ruptly.tv Contact: cd@ruptly.tv Twitter: http://twitter.com/Ruptly Facebook: http://www.facebook.com/Ruptly LiveLeak: http://www.liv... -

Troubled Debt Restructuring (Settlement Of Debt Thru Transfer Of Equity, Debtor & Creditor)

Accounting for troubled debt restructuring by the settlement of debt thru the transfer of assets, settling a debt obligation can involve either a transfer of non-cash assets or the issuance of the debtor's stock, the creditor should account for the noncash assets or equity interest received at their fair value, example Corp-A owes $400,000 plus $36,000 of accrued interest to Bank-B, debt is a 10-year 10% note, Corp-A's business has deteriorated and they can not pay the note (Loan), on (12/31/20X1) Bank-B agrees to accept Corp-A's common stock (equity interest in Corp-A) and cancel the entire debt, stock includes 15,000 shares ($20 par), fair value of $360,000, Transfer of Stock by Corp-A (Debtor) to Bank-B, Carrying amount of payable over fair value of equity transferred (gain) on Debt Re... -

Bruegel's Interview: Debt Restructuring & Greece

Is Greece's debt unsustainable? Do the negotiations among eurozone finance ministers beg for a re-think of a need for a globally recognised, legal framework for debt restructuring? Featuring: - John Milios, Chief Economist, Syriza, Greece - Ludger Schuknecht, Director General, Federal Ministry of Finances, Germany - Hérnan Lorenzino, Ambassador of Argentina to the EU interviewed by Sandra Gathmann Gonzalez. You can watch the full recording of Bruegel's event on Debt Restructuring on: http://www.bruegel.org/nc/events/event-detail/event/500-sovereign-debt-restructuring-legal-frameworks-and-european-challenges/ -

The Greek Bail Out and Debt Restructuring

This serie combines a number of key topics in modern financial and economic practice, such as bond trading and investing, the Eurozone crisis, cutting edge derivatives products like credit default swaps and GDP-linked warrants, the legal intricacies of debt restructuring, and the role of official institutions like the European Central Bank and the IMF. This serie will be given by Pablo Triana, professor of Finance at ESADE Business School. -

Ukraine Debt Restructuring: Jaresko upbeat on cinching agreement with Ukrainian bondholders

"Ukraine's deal with bondholders announced on August 27 meets all targets set by the IMF's bailout programme" - Natalie Jaresko On August 27 Ukraine agreed to a restructuring deal with creditors after five months of talks that will avert default and bolster an economy dragged down by Russia's invasion of Ukraine. Check out our website: http://uatoday.tv Facebook: https://facebook.com/uatodaytv Twitter: https://twitter.com/uatodaytv

Troubled Debt Restructuring (Modification Of Terms With LossTo Creditor, Creditors Prospective)

- Order: Reorder

- Duration: 17:14

- Updated: 25 Feb 2013

- views: 1302

- published: 25 Feb 2013

- views: 1302

Corporate Debt Restructuring

- Order: Reorder

- Duration: 2:27

- Updated: 17 Dec 2013

- views: 1441

- published: 17 Dec 2013

- views: 1441

Debt Restructuring Explained

- Order: Reorder

- Duration: 2:46

- Updated: 16 Mar 2012

- views: 3246

- published: 16 Mar 2012

- views: 3246

Why can corporate debt restructuring fail? | Dejargoned

- Order: Reorder

- Duration: 2:35

- Updated: 10 Sep 2014

- views: 1441

Troubled Debt Restructuring (Modification Of Terms With Gain To Debtor, Debtors Prospective)

- Order: Reorder

- Duration: 16:22

- Updated: 26 Feb 2013

- views: 967

- published: 26 Feb 2013

- views: 967

Troubled Debt Restructuring - Overview & Definition of TDR

- Order: Reorder

- Duration: 4:08

- Updated: 20 Dec 2013

- views: 2823

Sovereign Debt Restructuring

- Order: Reorder

- Duration: 87:54

- Updated: 30 Apr 2015

- views: 234

Troubled Debt Restructuring (Settlement Of Debt Thru Transfer Of Assets, Debtor & Creditor)

- Order: Reorder

- Duration: 10:40

- Updated: 22 Feb 2013

- views: 1135

- published: 22 Feb 2013

- views: 1135

Europe's failure on debt restructuring

- Order: Reorder

- Duration: 4:34

- Updated: 20 May 2013

- views: 778

- published: 20 May 2013

- views: 778

Sovereign Debt Restructuring Workshop

- Order: Reorder

- Duration: 2:35

- Updated: 28 Sep 2015

- views: 92

- published: 28 Sep 2015

- views: 92

Argentina's Debt Restructuring is a Complex Case

- Order: Reorder

- Duration: 4:01

- Updated: 21 Sep 2013

- views: 661

- published: 21 Sep 2013

- views: 661

UN approves debt restructuring resolution

- Order: Reorder

- Duration: 17:37

- Updated: 11 Sep 2015

- views: 1129

- published: 11 Sep 2015

- views: 1129

IMF tackles sovereign debt restructuring

- Order: Reorder

- Duration: 4:32

- Updated: 24 Feb 2014

- views: 782

- published: 24 Feb 2014

- views: 782

Troubled Debt Restructuring (Modification Of Terms With No Gain To Debtor, Debtors Prospective)

- Order: Reorder

- Duration: 14:01

- Updated: 25 Feb 2013

- views: 3147

- published: 25 Feb 2013

- views: 3147

The Tyranny of Bond Holders

- Order: Reorder

- Duration: 18:02

- Updated: 29 Jul 2011

- views: 5307

Sovereign Debt Restructuring in Europe: Lessons from Latin America

- Order: Reorder

- Duration: 65:40

- Updated: 18 May 2011

- views: 1210

- published: 18 May 2011

- views: 1210

Natalie Jaresko on Ukraine Debt Restructuring

- Order: Reorder

- Duration: 0:56

- Updated: 15 May 2015

- views: 717

- published: 15 May 2015

- views: 717

Speech of President Cristina Kirchner, after the UN approval of a framework for restructuring debt

- Order: Reorder

- Duration: 17:37

- Updated: 11 Sep 2015

- views: 252

Greece: Varoufakis calls hypocrisy in the processes of debt restructuring

- Order: Reorder

- Duration: 1:47

- Updated: 19 May 2015

- views: 701

- published: 19 May 2015

- views: 701

Troubled Debt Restructuring (Settlement Of Debt Thru Transfer Of Equity, Debtor & Creditor)

- Order: Reorder

- Duration: 12:59

- Updated: 22 Feb 2013

- views: 374

- published: 22 Feb 2013

- views: 374

Bruegel's Interview: Debt Restructuring & Greece

- Order: Reorder

- Duration: 4:28

- Updated: 13 Feb 2015

- views: 1018

- published: 13 Feb 2015

- views: 1018

The Greek Bail Out and Debt Restructuring

- Order: Reorder

- Duration: 84:10

- Updated: 11 Apr 2012

- views: 694

- published: 11 Apr 2012

- views: 694

Ukraine Debt Restructuring: Jaresko upbeat on cinching agreement with Ukrainian bondholders

- Order: Reorder

- Duration: 2:08

- Updated: 27 Aug 2015

- views: 378

- published: 27 Aug 2015

- views: 378

- Playlist

- Chat

- Playlist

- Chat

Troubled Debt Restructuring (Modification Of Terms With LossTo Creditor, Creditors Prospective)

- Report rights infringement

- published: 25 Feb 2013

- views: 1302

Corporate Debt Restructuring

- Report rights infringement

- published: 17 Dec 2013

- views: 1441

Debt Restructuring Explained

- Report rights infringement

- published: 16 Mar 2012

- views: 3246

Why can corporate debt restructuring fail? | Dejargoned

- Report rights infringement

- published: 10 Sep 2014

- views: 1441

Troubled Debt Restructuring (Modification Of Terms With Gain To Debtor, Debtors Prospective)

- Report rights infringement

- published: 26 Feb 2013

- views: 967

Troubled Debt Restructuring - Overview & Definition of TDR

- Report rights infringement

- published: 20 Dec 2013

- views: 2823

Sovereign Debt Restructuring

- Report rights infringement

- published: 30 Apr 2015

- views: 234

Troubled Debt Restructuring (Settlement Of Debt Thru Transfer Of Assets, Debtor & Creditor)

- Report rights infringement

- published: 22 Feb 2013

- views: 1135

Europe's failure on debt restructuring

- Report rights infringement

- published: 20 May 2013

- views: 778

Sovereign Debt Restructuring Workshop

- Report rights infringement

- published: 28 Sep 2015

- views: 92

Argentina's Debt Restructuring is a Complex Case

- Report rights infringement

- published: 21 Sep 2013

- views: 661

UN approves debt restructuring resolution

- Report rights infringement

- published: 11 Sep 2015

- views: 1129

IMF tackles sovereign debt restructuring

- Report rights infringement

- published: 24 Feb 2014

- views: 782

Troubled Debt Restructuring (Modification Of Terms With No Gain To Debtor, Debtors Prospective)

- Report rights infringement

- published: 25 Feb 2013

- views: 3147

T-Rex Fossil Skull 'Discovery' on Mars Excites UFO Community On Earth

Edit WorldNews.com 09 Mar 2016Vote-rigging means Donald Trump wins if US election ends in a tie

Edit The Independent 09 Mar 2016Snowden: FBI's claim it can't unlock the San Bernardino iPhone is 'bullshit'

Edit The Guardian 09 Mar 2016Islamic State's Top Chemical Weapon's Engineer Captured By U.S. Special Forces

Edit WorldNews.com 09 Mar 2016Abu Dhabi International Airport closed, Dubai airport operational

Edit Khaleej Times 09 Mar 2016U.A.E. Banks Agree Measures to Help Struggling SME Businesses

Edit Bloomberg 09 Mar 2016Abengoa Said to Be Reviewing Creditors' Restructuring Proposal

Edit Bloomberg 09 Mar 2016Lehman Lawyer Warns China Distressed Debt Investors: Expect Pain

Edit Bloomberg 09 Mar 2016Linn Energy Looks to Ease Tax Hit on Investors

Edit Wall Street Journal 09 Mar 2016Hong Kong tech company proposes HK$500 million lifeline for embattled broadcaster ATV

Edit South China Morning Post 09 Mar 2016BERNANKE: Here's what China should do to solve its 'trilemma'

Edit Business Insider 09 Mar 2016Northern States Financial Corporation Reports 2015 Net Income of $23.1 million

Edit Stockhouse 09 Mar 2016Aurizon, WICET, losers in Cockatoo Coal restructure

Edit Sydney Morning Herald 08 Mar 2016PSU banks' NPAs rise by Rs 1 lakh cr in 9 mths of FY'16: FM

Edit Deccan Herald 08 Mar 2016PSU banks’ NPAs rise by Rs 1 lakh crore in nine months

Edit The Hindu 08 Mar 2016Unaudited Interim Results for the six months ended 31 December 2015 (Ten Alps plc)

Edit Public Technologies 08 Mar 2016Kazakhstan Mixed-Use Project Obtains $367.5M Funding Agreement from Capital Corp Merchant Banking Capital Corp Merchant Banking has come into a funding agreement with its client, a local developer, to the sum of USD $367.5M, to develop a mixed-use community in Astana, Kazakhstan's capital city. Astana will soon host one of the largest international expos of the decade, EXPO 2017.

Edit PR Newswire 08 Mar 2016- 1

- 2

- 3

- 4

- 5

- Next page »