- published: 03 Sep 2014

- views: 7513

-

remove the playlistCommon Stock

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistCommon Stock

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 04 Mar 2013

- views: 26786

- published: 22 Jul 2013

- views: 18565

- published: 14 Jun 2013

- views: 6593

- published: 25 Jun 2012

- views: 18219

- published: 14 Jun 2010

- views: 22222

- published: 01 Sep 2011

- views: 1598

- published: 26 Aug 2012

- views: 15435

- published: 29 Aug 2014

- views: 5937

Common stock

Common stock is a form of corporate equity ownership, a type of security. The terms "voting share" or "ordinary share" are also used frequently in other parts of the world; "common stock" being primarily used in the United States.

It is called "common" to distinguish it from preferred stock. If both types of stock exist, common stockholders cannot be paid dividends until all preferred stock dividends are paid in full.

In the event of bankruptcy, common stock investors receive any remaining funds after bondholders, creditors (including employees), and preferred stockholders are paid. As such, common stock investors often receive nothing after a bankruptcy.

On the other hand, common shares on average perform better than preferred shares or bonds over time.

Shareholders' rights

Common stock usually carries with it the right to vote on certain matters, such as electing the board of directors. However, a company can have both a "voting" and "non-voting" class of common stock.

Holders of voting common stock are able to influence the corporation through votes on establishing corporate objectives and policy, stock splits, and electing the company's board of directors. Some holders of common stock also receive preemptive rights, which enable them to retain their proportional ownership in a company should it issue another stock offering. There is no fixed dividend paid out to common stockholders and so their returns are uncertain, contingent on earnings, company reinvestment, efficiency of the market to value and sell stock.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

6:40

6:40Common Stock (what it is and how to record it)

Common Stock (what it is and how to record it)Common Stock (what it is and how to record it)

This video explains what common stock is in the context of financial accounting. An example is provided to illustrate the journal entry required to record the issuance of common stock. -

3:11

3:11Types of Stocks

Types of StocksTypes of Stocks

Watch this video to learn more about Common stock vs. Preferred stock and the differences you should consider when deciding which stock to add to your portfolio. This educational video is part of Zions Direct University’s Beginner series. Questions or Comments? Have a question or topic you’d like to learn more about? Let us know: Twitter: @ZionsDirectTV Facebook: www.facebook.com/zionsdirect Or leave a comment on one of our videos. Open an Account: Begin investing today by opening a brokerage account or IRA at www.zionsdirect.com Bid in our Auctions: Participate in our fixed-income security auctions with no commissions or mark-ups charged by Zions Direct at www.auctions.zionsdirect.com -

5:10

5:10Episode 120: Common and Preferred Stock

Episode 120: Common and Preferred StockEpisode 120: Common and Preferred Stock

Go Premium for only $9.99 a year and access exclusive ad-free videos from Alanis Business Academy. Click here for a 14 day free trial: http://bit.ly/1Iervwb View additional videos from Alanis Business Academy and interact with us on our social media pages: YouTube Channel: http://bit.ly/1kkvZoO Website: http://bit.ly/1ccT2QA Facebook: http://on.fb.me/1cpuBhW Twitter: http://bit.ly/1bY2WFA Google+: http://bit.ly/1kX7s6P Both large institutional investors like pension funds and insurance companies, as well as smaller investors saving for retirement have a number of different investment options. Some of the primary options include stocks, bonds, mutual funds, and exchange traded funds. In this video we're going to focus on the characteristics of two types of stock, common stock and preferred stock. Stock is a type of investment security that signifies partial ownership of a corporation and a claim on on that corporation's assets as well as earnings. Stock is a form of equity financing, which allows a corporation access to potentially large amounts of money during initial as well as secondary public offerings. The corporation first must determine how much money it wants to raise. Then the corporation, with the help of an investment bank, will establish what percentage of ownership it must give up to obtain the investment that it is seeking. This chunk of ownership is then sliced up into individuals shares and sold for a price set by the corporation and its investment bank, each share of course representing fractional ownership in the corporation. In exchange for the investors hard earn money, the corporation provides ownership rights and a claim on the corporation's assets and earnings. Investors acquire shares with the hope that the stock increases in value. Investors can then sell their shares for more than they acquired them, which would earn them more money. Investors may also receive a dividend, which is a quarterly payment made to stockholders as a way of rewarded them for their investment. Although both common and preferred stock provide ownership rights and a claim on assets and earnings, they differ in several areas. Common stock gives the owner with the opportunity to vote in board member elections and other issues outlined in the corporate bylaws. This allows investors the opportunity to elect a board member who they feel will best represent their own interests. Common stock also provides a right to dividends. Now this right is not the same as a guarantee, so a corporation is under no obligation to pay a dividend. However, if a corporation authorizes a dividend then shareholders have a right to that dividend assuming they own it by the dividend cut-off date. In addition to a right to dividends, common stockholders also receive a right to capital gains.This right is not a guarantee and stockholders may even lose their investment, which makes the stock a riskier investment. Some corporation's may be even provide certain shareholders with pre-emptive rights, which grant shareholders the opportunity to purchase additional shares if the corporation decides to sell shares to the public. This prevents current shareholders ownership from being diluted, since they would have the same number of shares but more shares would be outstanding after the secondary offering. Typically pre-emptive rights are only granted to large shareholders who have invested a significant amount of money in a corporation. Preferred stock is a type of security that grants the holder preference over common stockholders in certain areas. Although both securities provide owners with a claim on assets and earnings, the claim of preferred stockholders is given priority to that of common stockholders.In addition to a preceding claim on assets, preferred stockholders are also given preference with dividend payments. Like common stockholders, preferred stockholders are not guaranteed a dividend, but must be paid a dividend in the event that the corporation grants a dividend to common stockholders. Also, a dividend to preferred stockholders tends to be a fixed amount while a dividend for common stockholders may fluctuate. Because preferred stockholders are given preference over common stockholders in these areas, the price of acquiring a share of preferred stock is more expensive. Also, preferred stockholders do not receive voting rights, meaning they cannot vote in board member elections or other matters as outlined in the corporate bylaws. Lastly, opportunities to purchase preferred stock are also more difficult to come by. -

1:42

1:42Types of Common Stock

Types of Common StockTypes of Common Stock

Four commonly used types of common stock are: authorized, issued, treasury, and outstanding stock. Learn how companies strategically manage how these four types of common stock are held or offered to investors. Questions or Comments? Have a question or topic you’d like to learn more about? Let us know: Twitter: @ZionsDirectTV Facebook: www.facebook.com/zionsdirect Or leave a comment on one of our videos. Open an Account: Begin investing today by opening a brokerage account or IRA at www.zionsdirect.com Bid in our Auctions: Participate in our fixed-income security auctions with no commissions or mark-ups charged by Zions Direct at www.auctions.zionsdirect.com -

8:37

8:37Session 08: Objective 1 - Common Stock Valuation

Session 08: Objective 1 - Common Stock ValuationSession 08: Objective 1 - Common Stock Valuation

The Finance Coach: Introduction to Corporate Finance with Greg Pierce Textbook: Fundamentals of Corporate Finance Ross, Westerfield, Jordan Chapter 8: Stock Valuation Objective 1 - Key Concepts: Stock Growth (Zero Dividend vs. Constant Dividend vs. Non-constant Growth vs. Supernormal Growth) Required Return (D1/P0 + g) Present Value of Future Dividends More Information at: http://thefincoach.com/ -

2:31

2:31Common and Preferred Stock

Common and Preferred StockCommon and Preferred Stock

What are the primary differences between Common and Preferred Stock? Why do they call it preferred stock? What are some of the basic protections and rights that preferred stock shareholders get? -

2:28

2:28What is a common stock? Created with ShowMe iPad App

What is a common stock? Created with ShowMe iPad AppWhat is a common stock? Created with ShowMe iPad App

Kahn Academy style presentation by CFP(r) Professional of what is a common stock created with the ShowMe Interactive Whiteboard iPad App -

7:40

7:40Common Stock Issued With Par Value Vs No Par Value Accounting Detailed

Common Stock Issued With Par Value Vs No Par Value Accounting DetailedCommon Stock Issued With Par Value Vs No Par Value Accounting Detailed

Accounting for the issuing common stock with par value versus no par value, issuing with par value creates a liability where stockholders equity can not be reduced below the par value of the stock for dividend payments or thru any other contra equity account, when issuing with no par value APIC (Additional Paid In Capital) does not exist full amount is recorded in the common stock account, example includes the accounting journal entries (T accounts) for common stock equity accounts and stock issuing costs as organizational costs amortized as an expense, detailed accounting calculations based on number of shares issued, par value and stock price along with recorded balance sheet and income statement journal entries by Allen Mursau -

6:30

6:30Capital Stock (Common Stock and Preferred Stock)

Capital Stock (Common Stock and Preferred Stock)Capital Stock (Common Stock and Preferred Stock)

This video explains the capital stock section of stockholders' equity by discussing the par value and the number of shares authorized, issued, and outstanding. -

4:50

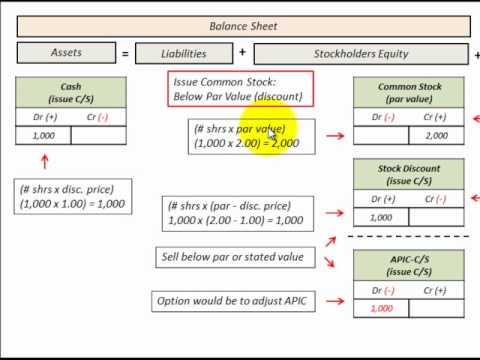

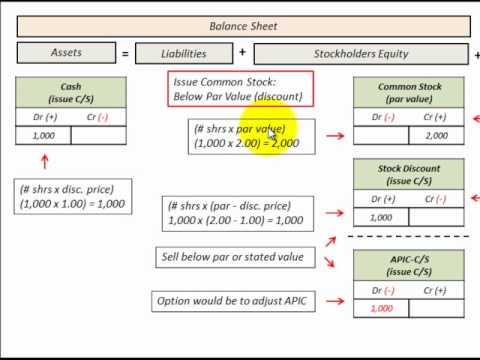

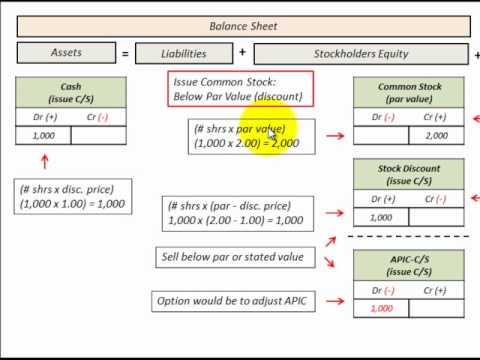

4:50Financial Accounting: Issuance of Common Stock

Financial Accounting: Issuance of Common Stock

-

Common Stock (what it is and how to record it)

This video explains what common stock is in the context of financial accounting. An example is provided to illustrate the journal entry required to record the issuance of common stock. -

Types of Stocks

Watch this video to learn more about Common stock vs. Preferred stock and the differences you should consider when deciding which stock to add to your portfolio. This educational video is part of Zions Direct University’s Beginner series. Questions or Comments? Have a question or topic you’d like to learn more about? Let us know: Twitter: @ZionsDirectTV Facebook: www.facebook.com/zionsdirect Or leave a comment on one of our videos. Open an Account: Begin investing today by opening a brokerage account or IRA at www.zionsdirect.com Bid in our Auctions: Participate in our fixed-income security auctions with no commissions or mark-ups charged by Zions Direct at www.auctions.zionsdirect.com -

Episode 120: Common and Preferred Stock

Go Premium for only $9.99 a year and access exclusive ad-free videos from Alanis Business Academy. Click here for a 14 day free trial: http://bit.ly/1Iervwb View additional videos from Alanis Business Academy and interact with us on our social media pages: YouTube Channel: http://bit.ly/1kkvZoO Website: http://bit.ly/1ccT2QA Facebook: http://on.fb.me/1cpuBhW Twitter: http://bit.ly/1bY2WFA Google+: http://bit.ly/1kX7s6P Both large institutional investors like pension funds and insurance companies, as well as smaller investors saving for retirement have a number of different investment options. Some of the primary options include stocks, bonds, mutual funds, and exchange traded funds. In this video we're going to focus on the characteristics of two types of stock, common stock and preferr... -

Types of Common Stock

Four commonly used types of common stock are: authorized, issued, treasury, and outstanding stock. Learn how companies strategically manage how these four types of common stock are held or offered to investors. Questions or Comments? Have a question or topic you’d like to learn more about? Let us know: Twitter: @ZionsDirectTV Facebook: www.facebook.com/zionsdirect Or leave a comment on one of our videos. Open an Account: Begin investing today by opening a brokerage account or IRA at www.zionsdirect.com Bid in our Auctions: Participate in our fixed-income security auctions with no commissions or mark-ups charged by Zions Direct at www.auctions.zionsdirect.com -

Session 08: Objective 1 - Common Stock Valuation

The Finance Coach: Introduction to Corporate Finance with Greg Pierce Textbook: Fundamentals of Corporate Finance Ross, Westerfield, Jordan Chapter 8: Stock Valuation Objective 1 - Key Concepts: Stock Growth (Zero Dividend vs. Constant Dividend vs. Non-constant Growth vs. Supernormal Growth) Required Return (D1/P0 + g) Present Value of Future Dividends More Information at: http://thefincoach.com/ -

Common and Preferred Stock

What are the primary differences between Common and Preferred Stock? Why do they call it preferred stock? What are some of the basic protections and rights that preferred stock shareholders get? -

What is a common stock? Created with ShowMe iPad App

Kahn Academy style presentation by CFP(r) Professional of what is a common stock created with the ShowMe Interactive Whiteboard iPad App -

Common Stock Issued With Par Value Vs No Par Value Accounting Detailed

Accounting for the issuing common stock with par value versus no par value, issuing with par value creates a liability where stockholders equity can not be reduced below the par value of the stock for dividend payments or thru any other contra equity account, when issuing with no par value APIC (Additional Paid In Capital) does not exist full amount is recorded in the common stock account, example includes the accounting journal entries (T accounts) for common stock equity accounts and stock issuing costs as organizational costs amortized as an expense, detailed accounting calculations based on number of shares issued, par value and stock price along with recorded balance sheet and income statement journal entries by Allen Mursau -

Capital Stock (Common Stock and Preferred Stock)

This video explains the capital stock section of stockholders' equity by discussing the par value and the number of shares authorized, issued, and outstanding. -

Common Stock (what it is and how to record it)

- Order: Reorder

- Duration: 6:40

- Updated: 03 Sep 2014

- views: 7513

- published: 03 Sep 2014

- views: 7513

Types of Stocks

- Order: Reorder

- Duration: 3:11

- Updated: 04 Mar 2013

- views: 26786

- published: 04 Mar 2013

- views: 26786

Episode 120: Common and Preferred Stock

- Order: Reorder

- Duration: 5:10

- Updated: 22 Jul 2013

- views: 18565

- published: 22 Jul 2013

- views: 18565

Types of Common Stock

- Order: Reorder

- Duration: 1:42

- Updated: 14 Jun 2013

- views: 6593

- published: 14 Jun 2013

- views: 6593

Session 08: Objective 1 - Common Stock Valuation

- Order: Reorder

- Duration: 8:37

- Updated: 25 Jun 2012

- views: 18219

- published: 25 Jun 2012

- views: 18219

Common and Preferred Stock

- Order: Reorder

- Duration: 2:31

- Updated: 14 Jun 2010

- views: 22222

- published: 14 Jun 2010

- views: 22222

What is a common stock? Created with ShowMe iPad App

- Order: Reorder

- Duration: 2:28

- Updated: 01 Sep 2011

- views: 1598

- published: 01 Sep 2011

- views: 1598

Common Stock Issued With Par Value Vs No Par Value Accounting Detailed

- Order: Reorder

- Duration: 7:40

- Updated: 26 Aug 2012

- views: 15435

- published: 26 Aug 2012

- views: 15435

Capital Stock (Common Stock and Preferred Stock)

- Order: Reorder

- Duration: 6:30

- Updated: 29 Aug 2014

- views: 5937

- published: 29 Aug 2014

- views: 5937

Financial Accounting: Issuance of Common Stock

- Order: Reorder

- Duration: 4:50

- Updated: 13 Jul 2015

- views: 412

-

Common Garter Snake Slithering out of hiding - CCL Free Stock Footage

This video is free for personal and commercial usage, but please include the following in the video description. "Footage used under Creative Commons License with Permission: Garter Snake Slithering by KyZaK Media." And leave a comment on this video or email info@kyzakmedia.com with a link to your project as I'd love to see how you used my footage. Visit KyZaKmedia.com for more details on our services. -

What is the difference between preferred stock and common stock

-

What is the difference between preferred stock and common stock

-

Should i care about the book value per common share when dealing with a blue chip stock

-

What is common stock and preferred stock

-

What are the pros and cons of owning preferred stock instead of common stock

-

What are the benefits and drawbacks of owning preferred stock and common stock

-

What are the most common market indicators to follow the indian stock market and economy

-

Does common stock offer the best investment vehicle in a company or sector

-

Birks Group Inc. Common Stock - BGI Stock Chart Technical Analysis for 07-05-16

Birks Group Inc. Common Stock - BGI Stock Chart Technical Analysis for 07-05-16 Free Guide - The 5 Tools I Use To Find Stocks To Trade: https://claytrader.com/lp/Free-Guide-Trading-Tools/?utm_source=social&utm;_medium=youtube&utm;_campaign=resource%20guide Learn how to read stock charts and identify technical patterns as ClayTrader does a quick stock chart review on Birks Group Inc. Common Stock (BGI). Watch more BGI Technical Analysis Videos: https://claytrader.com/stock_chart/BGI/ The Stock Trading Reality Podcast - https://claytrader.com/podcast/ ClayTrader.com and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever and we are not qualified to give financial advice. Invest...

Common Garter Snake Slithering out of hiding - CCL Free Stock Footage

- Order: Reorder

- Duration: 3:46

- Updated: 06 Jul 2016

- views: 8

- published: 06 Jul 2016

- views: 8

What is the difference between preferred stock and common stock

- Order: Reorder

- Duration: 1:48

- Updated: 06 Jul 2016

- views: 0

- published: 06 Jul 2016

- views: 0

What is the difference between preferred stock and common stock

- Order: Reorder

- Duration: 1:41

- Updated: 06 Jul 2016

- views: 0

- published: 06 Jul 2016

- views: 0

Should i care about the book value per common share when dealing with a blue chip stock

- Order: Reorder

- Duration: 1:34

- Updated: 06 Jul 2016

- views: 0

- published: 06 Jul 2016

- views: 0

What is common stock and preferred stock

- Order: Reorder

- Duration: 1:49

- Updated: 06 Jul 2016

- views: 0

- published: 06 Jul 2016

- views: 0

What are the pros and cons of owning preferred stock instead of common stock

- Order: Reorder

- Duration: 3:03

- Updated: 06 Jul 2016

- views: 0

- published: 06 Jul 2016

- views: 0

What are the benefits and drawbacks of owning preferred stock and common stock

- Order: Reorder

- Duration: 2:02

- Updated: 06 Jul 2016

- views: 0

- published: 06 Jul 2016

- views: 0

What are the most common market indicators to follow the indian stock market and economy

- Order: Reorder

- Duration: 2:03

- Updated: 06 Jul 2016

- views: 0

- published: 06 Jul 2016

- views: 0

Does common stock offer the best investment vehicle in a company or sector

- Order: Reorder

- Duration: 3:35

- Updated: 06 Jul 2016

- views: 0

- published: 06 Jul 2016

- views: 0

Birks Group Inc. Common Stock - BGI Stock Chart Technical Analysis for 07-05-16

- Order: Reorder

- Duration: 3:32

- Updated: 05 Jul 2016

- views: 245

- published: 05 Jul 2016

- views: 245

-

Common Stocks and Uncommon Profits by Philip Fisher - Audiobook

-

-

Corporate Finance: Lecture - 004, Common Stock Valuation

This video lecture discusses about basic concepts related to common stock valuation, how the dividends play a major role in valuing the business, discounted cash flow formula in terms of business valuation is discussed. If you need private lessons you may contact at he@Leprofesseur.org Do not forget to subscribe { Leprofesseur } YouTube channel. This helps to keep you up-to-date with latest videos. Sincerely, H. -

Issue common stock, authorized, issued and outstanding Ch 13 p 2-Principles of Financial Accounting

Par value, no=par value, stated value, shares authorized, shares issued, shares outstanding, common stock, preferred stock, shareholder equity, additional paid in capital, preferred stock, treasury stock, stated value, incremental method, proportional method, stock issue for non cash consideration, underwriting cost, -

Accounting for Investments in Common Stock

An overview of the different ways of accounting for common stock investments. The Cost Method, Equity Method, Fair Value Method, and Consolidation are discussed. -

Let's Review Common Stocks & Uncommon Profits by Philip Fisher

If anyone watches through to the end, it unfortunately does cut off because of my camera's maximum video length capacity. I got through most of what I wanted to say and was simply finishing up with reviewing some of the points that Fisher made. If there's enough demand, I will upload another video finishing up what I wanted to say on this (which would just be more on Fisher's 15 points). If you like these videos, subscribe to be notified when new videos are out, it's free: http://bit.ly/WillYouLaugh Follow me on twitter: http://twitter.com/willyoulaugh Facebook: http://facebook.com/willyoulaugh Instagram: TheWillChou Vine:WillChou Blog: http://highhopesanddreams.wordpress.com Leave a comment below with your opinions! -

Issue common and preferred stock ch 13 p 2 -Principles of Financial Accounting CPA exam

Par value, no-par value, stated value, shares authorized, shares issued, shares outstanding, common stock, preferred stock, shareholder equity, additional paid in capital, preferred stock, treasury stock, stated value, incremental method, proportional method, stock issue for non cash consideration, preferred stock, preferred stock, convertible, callable preferred, non voting, cumulative, participating, redeemable CPA exam -

Common Stock Overview Ch 6 Part one

Chapter Six -

Intro to common stock, characteristics of corporation, rights of stockholders CH 13 p 1 -CPA exam

Corporate Form of Organization, characteristics of the corporate form, capital stock, articles of incorporation, corporation charter, share proportionately, share proportionately in assets, preemptive right, Common stock, residual corporate interest, Preferred stock , dividend preference, Retained earnings, additional paid in capital, common stock , preferred stock, CPA exam -

Common Stocks and Uncommon Profits by Philip Fisher - Audiobook

- Order: Reorder

- Duration: 349:05

- Updated: 22 Feb 2016

- views: 2815

- published: 22 Feb 2016

- views: 2815

Common Stock Valuation Chapter 10

- Order: Reorder

- Duration: 67:37

- Updated: 24 Mar 2015

- views: 411

Corporate Finance: Lecture - 004, Common Stock Valuation

- Order: Reorder

- Duration: 32:36

- Updated: 27 Sep 2015

- views: 389

- published: 27 Sep 2015

- views: 389

Issue common stock, authorized, issued and outstanding Ch 13 p 2-Principles of Financial Accounting

- Order: Reorder

- Duration: 37:28

- Updated: 01 Nov 2013

- views: 1472

- published: 01 Nov 2013

- views: 1472

Accounting for Investments in Common Stock

- Order: Reorder

- Duration: 20:00

- Updated: 30 May 2012

- views: 5059

- published: 30 May 2012

- views: 5059

Let's Review Common Stocks & Uncommon Profits by Philip Fisher

- Order: Reorder

- Duration: 27:00

- Updated: 27 Jul 2014

- views: 1425

- published: 27 Jul 2014

- views: 1425

Issue common and preferred stock ch 13 p 2 -Principles of Financial Accounting CPA exam

- Order: Reorder

- Duration: 24:31

- Updated: 10 Nov 2013

- views: 2719

- published: 10 Nov 2013

- views: 2719

Common Stock Overview Ch 6 Part one

- Order: Reorder

- Duration: 43:41

- Updated: 12 Mar 2014

- views: 255

Intro to common stock, characteristics of corporation, rights of stockholders CH 13 p 1 -CPA exam

- Order: Reorder

- Duration: 38:22

- Updated: 01 Nov 2013

- views: 876

- published: 01 Nov 2013

- views: 876

Anayzing Common Stock Ch 7 Part II

- Order: Reorder

- Duration: 68:52

- Updated: 31 Mar 2014

- views: 196

- Playlist

- Chat

- Playlist

- Chat

Common Stock (what it is and how to record it)

- Report rights infringement

- published: 03 Sep 2014

- views: 7513

Types of Stocks

- Report rights infringement

- published: 04 Mar 2013

- views: 26786

Episode 120: Common and Preferred Stock

- Report rights infringement

- published: 22 Jul 2013

- views: 18565

Types of Common Stock

- Report rights infringement

- published: 14 Jun 2013

- views: 6593

Session 08: Objective 1 - Common Stock Valuation

- Report rights infringement

- published: 25 Jun 2012

- views: 18219

Common and Preferred Stock

- Report rights infringement

- published: 14 Jun 2010

- views: 22222

What is a common stock? Created with ShowMe iPad App

- Report rights infringement

- published: 01 Sep 2011

- views: 1598

Common Stock Issued With Par Value Vs No Par Value Accounting Detailed

- Report rights infringement

- published: 26 Aug 2012

- views: 15435

Capital Stock (Common Stock and Preferred Stock)

- Report rights infringement

- published: 29 Aug 2014

- views: 5937

Financial Accounting: Issuance of Common Stock

- Report rights infringement

- published: 13 Jul 2015

- views: 412

- Playlist

- Chat

Common Garter Snake Slithering out of hiding - CCL Free Stock Footage

- Report rights infringement

- published: 06 Jul 2016

- views: 8

What is the difference between preferred stock and common stock

- Report rights infringement

- published: 06 Jul 2016

- views: 0

What is the difference between preferred stock and common stock

- Report rights infringement

- published: 06 Jul 2016

- views: 0

Should i care about the book value per common share when dealing with a blue chip stock

- Report rights infringement

- published: 06 Jul 2016

- views: 0

What is common stock and preferred stock

- Report rights infringement

- published: 06 Jul 2016

- views: 0

What are the pros and cons of owning preferred stock instead of common stock

- Report rights infringement

- published: 06 Jul 2016

- views: 0

What are the benefits and drawbacks of owning preferred stock and common stock

- Report rights infringement

- published: 06 Jul 2016

- views: 0

What are the most common market indicators to follow the indian stock market and economy

- Report rights infringement

- published: 06 Jul 2016

- views: 0

Does common stock offer the best investment vehicle in a company or sector

- Report rights infringement

- published: 06 Jul 2016

- views: 0

Birks Group Inc. Common Stock - BGI Stock Chart Technical Analysis for 07-05-16

- Report rights infringement

- published: 05 Jul 2016

- views: 245

- Playlist

- Chat

Common Stocks and Uncommon Profits by Philip Fisher - Audiobook

- Report rights infringement

- published: 22 Feb 2016

- views: 2815

Common Stock Valuation Chapter 10

- Report rights infringement

- published: 24 Mar 2015

- views: 411

Corporate Finance: Lecture - 004, Common Stock Valuation

- Report rights infringement

- published: 27 Sep 2015

- views: 389

Issue common stock, authorized, issued and outstanding Ch 13 p 2-Principles of Financial Accounting

- Report rights infringement

- published: 01 Nov 2013

- views: 1472

Accounting for Investments in Common Stock

- Report rights infringement

- published: 30 May 2012

- views: 5059

Let's Review Common Stocks & Uncommon Profits by Philip Fisher

- Report rights infringement

- published: 27 Jul 2014

- views: 1425

Issue common and preferred stock ch 13 p 2 -Principles of Financial Accounting CPA exam

- Report rights infringement

- published: 10 Nov 2013

- views: 2719

Common Stock Overview Ch 6 Part one

- Report rights infringement

- published: 12 Mar 2014

- views: 255

Intro to common stock, characteristics of corporation, rights of stockholders CH 13 p 1 -CPA exam

- Report rights infringement

- published: 01 Nov 2013

- views: 876

Anayzing Common Stock Ch 7 Part II

- Report rights infringement

- published: 31 Mar 2014

- views: 196

Turkish Military in Attempted Coup, Prime Minister Says

Edit Bloomberg 15 Jul 2016Newly Released Pages Say Saudis May Have Helped 9/11 Attackers

Edit WorldNews.com 15 Jul 2016Former Fox News Commentator Sentenced For False Claims Of CIA Ties

Edit WorldNews.com 15 Jul 2016Nice Terrorist Attack: At Least 77 Dead, Police Kill Suspect

Edit WorldNews.com 15 Jul 2016Sebi strikes at promoters of suspended cos

Edit The Times of India 16 Jul 2016Gainey McKenna & Egleston Announces A Class Action Lawsuit Has Been Filed Against Stericycle, Inc. ...

Edit Stockhouse 16 Jul 2016Nepse extends trading hours

Edit The Himalayan 16 Jul 2016Liquor Stores N.A. Ltd. Announces July Cash Dividend (Liquor Stores NA Ltd)

Edit Public Technologies 16 Jul 2016Cardero Announces Voluntary Delisting from the TSX and Concurrent Listing on the TSX Venture

Edit Stockhouse 16 Jul 2016Cardero Announces Voluntary Delisting from the TSX and Concurrent Listing on the TSX Venture (Cardero Resources Corporation)

Edit Public Technologies 16 Jul 2016Wells Fargo profit drops as loan provisions rise

Edit Arabnews 16 Jul 2016Canadian stocks slip as crude fluctuates amid France attack

Edit Xinhua 16 Jul 2016Andean style

Edit Topix 16 Jul 2016European shares slip; safe-havens gain on attempted Turkish coup

Edit Asia Times 16 Jul 2016Defying the laws of economic gravity

Edit The Oklahoman 16 Jul 2016VIDEO: ‘Things won’t end simple’, rejected guard warned spouse

Edit Jamaica Observer 16 Jul 2016- 1

- 2

- 3

- 4

- 5

- Next page »