- published: 13 Jan 2015

- views: 1205

-

remove the playlistPrice Stability

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistPrice Stability

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 06 Jul 2015

- views: 163

- published: 06 Mar 2016

- views: 941

- published: 23 Mar 2015

- views: 97

- published: 28 Apr 2015

- views: 81

- published: 30 Aug 2014

- views: 131

- published: 29 Feb 2016

- views: 0

- published: 17 Nov 2010

- views: 638

- published: 27 Oct 2015

- views: 108

- published: 03 Apr 2013

- views: 1193

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). This should not be confused with disinflation, a slow-down in the inflation rate (i.e. when inflation declines to lower levels). Inflation reduces the real value of money over time; conversely, deflation increases the real value of money – the currency of a national or regional economy. This allows one to buy more goods with the same amount of money over time.

Economists generally believe that deflation is a problem in a modern economy because they believe it may lead to a deflationary spiral. Historically not all episodes of deflation correspond with periods of poor economic growth.

In the IS/LM model (Investment and Saving equilibrium/ Liquidity Preference and Money Supply equilibrium model), deflation is caused by a shift in the supply-and-demand curve for goods and services, particularly a fall in the aggregate level of demand. That is, there is a fall in how much the whole economy is willing to buy, and the going price for goods. Because the price of goods is falling, consumers have an incentive to delay purchases and consumption until prices fall further, which in turn reduces overall economic activity. Since this idles the productive capacity, investment also falls, leading to further reductions in aggregate demand. This is the deflationary spiral. An answer to falling aggregate demand is stimulus, either from the central bank, by expanding the money supply, or by the fiscal authority to increase demand, and to borrow at interest rates which are below those available to private entities.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Paul Davis Ryan (born January 29, 1970) is the U.S. Representative for Wisconsin's 1st congressional district, serving since 1999. He is a member of the Republican Party, and has been ranked among the party's most influential voices on economic policy.

Born and raised in Janesville, Wisconsin, Ryan graduated from Miami University in Ohio and later worked as a marketing consultant for Ryan Incorporated Central, run by a branch of his family. In the mid to late 1990s, he worked as an aide to United States Senator Bob Kasten, as legislative director for Senator Sam Brownback of Kansas, and as a speechwriter for former U.S. Representative and 1996 Republican vice presidential nominee Jack Kemp of New York. In 1998, Ryan won election to the United States House of Representatives, succeeding the two-term incumbent, fellow Republican Mark Neumann.

Ryan currently chairs the House Budget Committee, where he has played a prominent public role in drafting and promoting the Republican Party's long-term budget proposal. He introduced a plan, The Path to Prosperity, in April 2011 as an alternative to the budget proposal of President Barack Obama, and helped introduce The Path to Prosperity: A Blueprint for American Renewal in March 2012, in response to Obama's 2013 budget. Ryan is one of the three co-founders of the Young Guns Program, an electoral recruitment and campaign effort by House Republicans. He endorsed Republican presidential candidate and former Governor of Massachusetts Mitt Romney for the 2012 United States presidential election. Ryan has been considered as a possible running mate for Romney.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Alan Greenspan (/ˈælɨn ˈɡriːnspæn/; born March 6, 1926) is an American economist who served as Chairman of the Federal Reserve of the United States from 1987 to 2006. He currently works as a private adviser and provides consulting for firms through his company, Greenspan Associates LLC. First appointed Federal Reserve chairman by President Ronald Reagan in August 1987, he was reappointed at successive four-year intervals until retiring on January 31, 2006 after the second-longest tenure in the position.

Greenspan came to the Federal Reserve Board from a successful consulting career, holding political views influenced by Ayn Rand. Although he was subdued in his public appearances, favorable media coverage raised his profile to a point that several observers likened him to a "rock star". Democratic leaders of Congress criticized him for politicizing his office because of his support for Social Security privatization and tax cuts that they felt would increase the deficit. The easy-money policies of the Fed during Greenspan's tenure has been suggested to be a leading cause of the subprime mortgage crisis, which occurred within months of his departure from the Fed, and has, said the Wall Street Journal, "tarnished his image".

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

5:09

5:09Price stability

Price stabilityPrice stability

What is behind the terms "euro system", "inflation" and "deflation"? The animated film explains these terms and other contexts easy to understand. -

8:18

8:18European Central Bank - Lesson 1: Price Stability

European Central Bank - Lesson 1: Price Stability -

2:24

2:24Segment 403: Price Stability

Segment 403: Price StabilitySegment 403: Price Stability

Learn why price stability is important to a healthy economy; how long-run, sustained inflation can be caused by allowing the money supply to grow too rapidly for too long; and how high levels of inflation can adversely affect individuals and businesses. -

8:33

8:33Ubisoft's Price Stability | Feature Creep

Ubisoft's Price Stability | Feature CreepUbisoft's Price Stability | Feature Creep

Visit my sub-reddit: http://www.reddit.com/r/Tarmack Ubisoft says that the game industry is getting less hit driven and more stable in revenue. Let's talk about what they actually means given that Ubi has also said that they're toning back the yearly release schedule of some of their franchises. Feature Creep is a weekly game industry news editorial on all manner of video game industry news, rumors and drama. Previous Episode: https://youtu.be/ihE0SWl2VQ8 Subscribe: http://www.youtube.com/subscription_center?add_user=thegnomecast http://www.twitter.com/gnomecast http://www.twitch.tv/tarmackgaming -

21:49

21:49Price Stability- Monetary Policy and Central Banking (BSBA-Project)

Price Stability- Monetary Policy and Central Banking (BSBA-Project)Price Stability- Monetary Policy and Central Banking (BSBA-Project)

Credit to BSBA-3D Batch 2014-2015 Bukidnon State University External Studies Center -

0:35

0:35Price stability Meaning

Price stability MeaningPrice stability Meaning

Video shows what price stability means. A state of economy characterized by low inflation, and thus a stable value of money. Price stability is one of the central goals of most governments and central banks.. Price stability Meaning. How to pronounce, definition audio dictionary. How to say price stability. Powered by MaryTTS, Wiktionary -

5:30

5:30Economic Myths #6 – Price Stability

Economic Myths #6 – Price StabilityEconomic Myths #6 – Price Stability

This video explains why price stability is a futile and destructive economic policy. The full text version is available at http://duncanwhitmore.com/2014/08/30/economic-myths-6-price-stability/ -

0:34

0:34Oil Price Stability

Oil Price StabilityOil Price Stability

President Muhammadu Buhari has emphasized the need for member states of organisation of petroleum exporting countries and non-opec members to cooperate and find a common ground to stabilize crude oil prices. Watch all the latest stories making headlines on Silverbird Television at the comfort of your mobile device, tablet or PC. Click www.silverbirdtv.com -

1:26

1:26Paul Ryan on the need to focus on price stability

Paul Ryan on the need to focus on price stabilityPaul Ryan on the need to focus on price stability

I've never seen a country devalue its way to prosperity but it's a quick fix at the expense of the long term and the medium term. There's nothing more insidious that a government can do to its people than debase its currency, and my fear is that with this new QE2 move, the upside is so small but the downside is potentially so large. It is very dangerous in my opinion, and I think the Federal Reserve ought to be focused on price stability, not on this dual mandate. I've had legislation for years that says- just like the ECB, the European Central Bank, your job is price stability, maintaining the value of our currency, and keeping prices stable. That's a necessary precondition for economic growth, not trying to micromanage employment because that comes oftentimes at the expense of price stability. Full video: http://www.charlierose.com/view/interview/11292 http://www.facebook.com/reppaulryan http://twitter.com/reppaulryan http://paulryan.house.gov/ http://www.americanroadmap.org/ http://house.gov/budget_republicans -

29:49

29:49Alan Greenspan: Economic Issues, Price Stability & Risk Management (2004)

Alan Greenspan: Economic Issues, Price Stability & Risk Management (2004)Alan Greenspan: Economic Issues, Price Stability & Risk Management (2004)

In economics, deflation is a decrease in the general price level of goods and services.[1] Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). This should not be confused with disinflation, a slow-down in the inflation rate (i.e., when inflation declines to lower levels).[2] Inflation reduces the real value of money over time; conversely, deflation increases the real value of money — the currency of a national or regional economy. This allows one to buy more goods with the same amount of money over time. Economists generally believe that deflation is a problem in a modern economy because it increases the real value of debt, and may aggravate recessions and lead to a deflationary spiral.[3] Although the values of capital assets are often casually said to "deflate" when they decline, this should not be confused with deflation as a defined term; a more accurate description for a decrease in the value of a capital asset is economic depreciation (which should not be confused with the accounting convention of depreciation, which are standards to determine a decrease in values of capital assets when market values are not readily available or practical). There have been four significant periods of deflation in the United States. The first and most severe was during the depression from 1818-21 when prices of agricultural commodities declined by almost 50%. A credit contraction caused by a financial crisis in England drained specie out of the U.S. The Bank of the United States also contracted its lending. The price of agricultural commodities fell by almost 50% from the high in 1815 to the low in 1821, and did not recover until the late 1830s, although to a significantly lower price level. Most damaging was the price of cotton, the U.S.'s main export. Food crop prices, which had been high because of the famine of 1816 that was caused by the year without a summer, fell after the return of normal harvests in 1818. Improved transportation, mainly from turnpikes, and to a minor extent the introduction of steamboats, significantly lowered transportation costs.[15] The second was the depression of the late 1830s to 1843, following the Panic of 1837, when the currency in the United States contracted by about 34% with prices falling by 33%. The magnitude of this contraction is only matched by the Great Depression.[39] (See: Historical examples of credit deflation) This "deflation" satisfies both definitions, that of a decrease in prices and a decrease in the available quantity of money. Despite the deflation and depression, GDP rose 16% from 1839-43.[39] The third was after the Civil War, sometimes called The Great Deflation. It was possibly spurred by return to a gold standard, retiring paper money printed during the Civil War. "The Great Sag of 1873-96 could be near the top of the list. Its scope was global. It featured cost-cutting and productivity-enhancing technologies. It flummoxed the experts with its persistence, and it resisted attempts by politicians to understand it, let alone reverse it. It delivered a generation’s worth of rising bond prices, as well as the usual losses to unwary creditors via defaults and early calls. Between 1875 and 1896, according to Milton Friedman, prices fell in the United States by 1.7% a year, and in Britain by 0.8% a year.[40] (Note: David A. Wells (1890) gives an account of the period and discusses the great advances in productivity which Wells argues were the cause of the deflation. The productivity gains matched the deflation.[41] Murray Rothbard (2002) gives a similar account.[42]) The fourth was between 1930–1933 when the rate of deflation was approximately 10 percent/year, part of the United States' slide into the Great Depression, where banks failed and unemployment peaked at 25%. The deflation of the Great Depression occurred partly because there was an enormous contraction of credit (money), bankruptcies creating an environment where cash was in frantic demand, and when the Federal Reserve was supposed to accommodate that demand, it instead contracted the money supply by 30% in enforcement of its new real bills doctrine, so banks toppled one-by-one (because they were unable to meet the sudden demand for cash— see Fractional-reserve banking). From the standpoint of the Fisher equation (see above), there was a concomitant drop both in money supply (credit) and the velocity of money which was so profound that price deflation took hold despite the increases in money supply spurred by the Federal Reserve. https://en.wikipedia.org/wiki/Deflation -

22:53

22:5315.0 - Price Stability - Economics with Tully

15.0 - Price Stability - Economics with Tully -

1:13

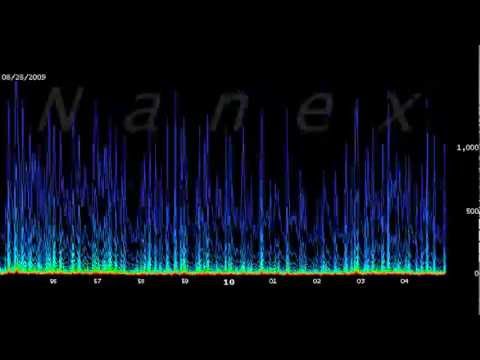

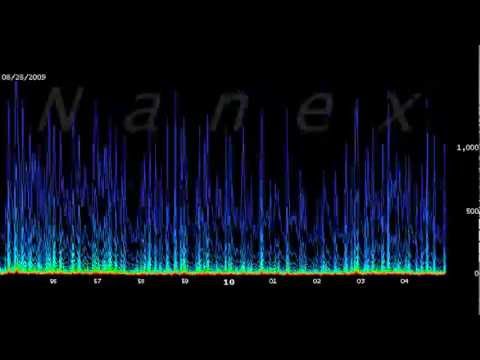

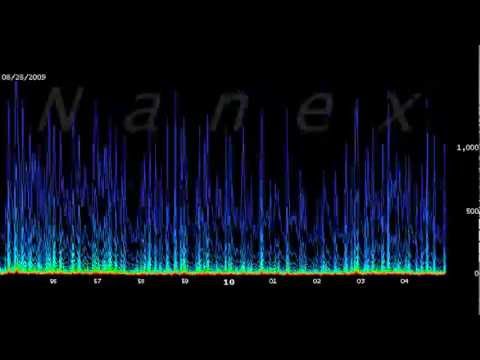

1:13US Stock Market Price Stability at 10am from 2006 to April 2013

US Stock Market Price Stability at 10am from 2006 to April 2013US Stock Market Price Stability at 10am from 2006 to April 2013

Each frame of this video shows 10 minutes of 1-second data between 9:55 and 10:05am for 1 trading day. Spikes indicate a market disruption: the magnitude corresponding to the number of stocks impacted. Each line indicates the number of stocks that had a change in its quote spread from 1 (Violet) to 25 cents or more (Red). Pay attention to the appearance and rapid rise in market disruptions and note how they become more pronounced over time. We crunched about a trillion data points to create this video. -

14:56

14:56Libya, Price Stability and The Bank for International Settlements

Libya, Price Stability and The Bank for International SettlementsLibya, Price Stability and The Bank for International Settlements

No conclusive answers this week, as we consider possible motivations behind the recent attacks on Libya that underlie the rather overused cover story of humanitarian intervention. As an introduction, we read Ellen Brown's article Libya: All about Oil or All About Banking?. This sets the stage for our main presentation, by Vijay Prashad, a professor of international relations, whose invaluable insights and pieces of history you are unlikely to hear on commercial media. -

2:34

2:34Global commodities: price stability ahead -- PIMCO's Nicholas J. Johnson

Global commodities: price stability ahead -- PIMCO's Nicholas J. JohnsonGlobal commodities: price stability ahead -- PIMCO's Nicholas J. Johnson

Terms and conditions: pimco.com/socialmedia

- Aggregate demand

- Arthur O' Sullivan

- Asset

- Austrian Economist

- Austrian economists

- Austrian School

- Autarky

- Bank of Japan

- Bankruptcies

- Behavioral economics

- Ben Bernanke

- Biflation

- Bloomberg L.P.

- Bretton Woods System

- Bubble (economics)

- Business economics

- Carry (investment)

- Category Economics

- Classical economists

- Colorado

- Competition

- Consumer price index

- Credit (finance)

- Cultural economics

- David Ames Wells

- De-growth

- Debt deflation

- Debt relief

- Debt-deflation

- Deflation

- Demand

- Disinflation

- Dollarization

- Dot-com bubble

- East Asia

- Ecological economics

- Econometrics

- Economic geography

- Economic growth

- Economic history

- Economic methodology

- Economic stagnation

- Economic system

- Economics

- Economy

- Economy of Africa

- Economy of Asia

- Economy of Europe

- Economy of Oceania

- Education economics

- Efficiency

- Equities

- Federal funds rate

- Federal Reserve

- Financial economics

- Fisher equation

- Friedrich Hayek

- Game theory

- General glut

- Glut

- Great Depression

- Greenback

- Greenback (money)

- Health economics

- Heterodox economics

- Hong Kong

- Hong Kong dollar

- Hyperinflation

- Inflation

- Inflation rate

- Irving Fisher

- IS LM model

- Keynesian economics

- Kondratiev wave

- Labour economics

- Law and economics

- Liquidity trap

- List of economists

- Long Depression

- M2 (economics)

- Macroeconomic

- Macroeconomics

- Mainland China

- Mainstream economics

- Managerial economics

- Microeconomics

- Milton Friedman

- Minimum wage

- Monetarism

- Monetary base

- Monetary economics

- Money

- Money supply

- Murray N. Rothbard

- National accounting

- Nouriel Roubini

- Outline of economics

- Panic of 1837

- Personnel economics

- Pound sterling

- Price bubble

- Price index

- Procyclical

- Public economics

- Purchasing power

- Quantitative easing

- Real bills doctrine

- Real estate

- Real estate bubble

- Regional science

- Republic of Ireland

- Rural economics

- Stagflation

- Stimulus (economic)

- Talk Deflation

- The Denver Post

- The Economist

- The Great Deflation

- Unemployment

- United Kingdom

- United States

- Urban economics

- US Dollar

- Velocity of money

- Wall Street Journal

- Welfare

- Welfare economics

- Wikipedia Link rot

- World War I

- World War II

- WP NPOVD

- Zimbabwe

-

Price stability

What is behind the terms "euro system", "inflation" and "deflation"? The animated film explains these terms and other contexts easy to understand. -

-

Segment 403: Price Stability

Learn why price stability is important to a healthy economy; how long-run, sustained inflation can be caused by allowing the money supply to grow too rapidly for too long; and how high levels of inflation can adversely affect individuals and businesses. -

Ubisoft's Price Stability | Feature Creep

Visit my sub-reddit: http://www.reddit.com/r/Tarmack Ubisoft says that the game industry is getting less hit driven and more stable in revenue. Let's talk about what they actually means given that Ubi has also said that they're toning back the yearly release schedule of some of their franchises. Feature Creep is a weekly game industry news editorial on all manner of video game industry news, rumors and drama. Previous Episode: https://youtu.be/ihE0SWl2VQ8 Subscribe: http://www.youtube.com/subscription_center?add_user=thegnomecast http://www.twitter.com/gnomecast http://www.twitch.tv/tarmackgaming -

Price Stability- Monetary Policy and Central Banking (BSBA-Project)

Credit to BSBA-3D Batch 2014-2015 Bukidnon State University External Studies Center -

Price stability Meaning

Video shows what price stability means. A state of economy characterized by low inflation, and thus a stable value of money. Price stability is one of the central goals of most governments and central banks.. Price stability Meaning. How to pronounce, definition audio dictionary. How to say price stability. Powered by MaryTTS, Wiktionary -

Economic Myths #6 – Price Stability

This video explains why price stability is a futile and destructive economic policy. The full text version is available at http://duncanwhitmore.com/2014/08/30/economic-myths-6-price-stability/ -

Oil Price Stability

President Muhammadu Buhari has emphasized the need for member states of organisation of petroleum exporting countries and non-opec members to cooperate and find a common ground to stabilize crude oil prices. Watch all the latest stories making headlines on Silverbird Television at the comfort of your mobile device, tablet or PC. Click www.silverbirdtv.com -

Paul Ryan on the need to focus on price stability

I've never seen a country devalue its way to prosperity but it's a quick fix at the expense of the long term and the medium term. There's nothing more insidious that a government can do to its people than debase its currency, and my fear is that with this new QE2 move, the upside is so small but the downside is potentially so large. It is very dangerous in my opinion, and I think the Federal Reserve ought to be focused on price stability, not on this dual mandate. I've had legislation for years that says- just like the ECB, the European Central Bank, your job is price stability, maintaining the value of our currency, and keeping prices stable. That's a necessary precondition for economic growth, not trying to micromanage employment because that comes oftentimes at the expense of price s... -

Alan Greenspan: Economic Issues, Price Stability & Risk Management (2004)

In economics, deflation is a decrease in the general price level of goods and services.[1] Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). This should not be confused with disinflation, a slow-down in the inflation rate (i.e., when inflation declines to lower levels).[2] Inflation reduces the real value of money over time; conversely, deflation increases the real value of money — the currency of a national or regional economy. This allows one to buy more goods with the same amount of money over time. Economists generally believe that deflation is a problem in a modern economy because it increases the real value of debt, and may aggravate recessions and lead to a deflationary spiral.[3] Although the values of capital assets are often casually said to "... -

-

US Stock Market Price Stability at 10am from 2006 to April 2013

Each frame of this video shows 10 minutes of 1-second data between 9:55 and 10:05am for 1 trading day. Spikes indicate a market disruption: the magnitude corresponding to the number of stocks impacted. Each line indicates the number of stocks that had a change in its quote spread from 1 (Violet) to 25 cents or more (Red). Pay attention to the appearance and rapid rise in market disruptions and note how they become more pronounced over time. We crunched about a trillion data points to create this video. -

Libya, Price Stability and The Bank for International Settlements

No conclusive answers this week, as we consider possible motivations behind the recent attacks on Libya that underlie the rather overused cover story of humanitarian intervention. As an introduction, we read Ellen Brown's article Libya: All about Oil or All About Banking?. This sets the stage for our main presentation, by Vijay Prashad, a professor of international relations, whose invaluable insights and pieces of history you are unlikely to hear on commercial media. -

Global commodities: price stability ahead -- PIMCO's Nicholas J. Johnson

Terms and conditions: pimco.com/socialmedia -

Is 3000% Inflation Really Price Stability? | McAlvany Commentary

-Contentious monetary policies -Shocking Shanghai gold demand -Silver's road ahead, currency or commodity? 65 Week Moving Average Chart: http://www.mcalvanyica.com/market-reports/ QnA w/DavidMcAlvany: http://www.youtube.com/watch?v=npwqu4ouoHw The Fuse is Lit Part III: http://www.youtube.com/watch?v=OhlvKj-hgU0 http://mcalvany.com 1-800-525-9556 -

Gold Fails for Price Stability

CPI inflation, FRED Maoist Rebel News book store: http://lulu.com/spotlight/MaoistRebelNews Add me on Facebook: http://www.fb.com/MaoistRebelNews Follow me on Twitter: http://twitter.com/MaoistRebelNews Read more news at: http://maoistrebelnews.wordpress.com/ Get More Commentary on Tumblr: http://maoistrebelnews.tumblr.com/ These videos are offered under private trust. Downloading constitutes acceptance of private trust terms. All private trust rights reserved. -

Oil price stability on the horizon as companies cut jobs and costs

OPEC says it expects oil prices to become more stable over the next year. Despite oil prices dropping over 50 percent since 2014 the organisation decided in June to keep production unchanged to protect its market share. Russia adopted the same stance. It was at a "meeting in Moscow":http://www.opec.org/opec_web/en/press_room/3127.htm on Thursday that the OPEC Secretary-General Abdullah al-Badri outlined his views on oil prices. "We see signs of a more balanced market by the end of this ye… READ MORE : http://www.euronews.com/2015/07/30/oil-price-stability-on-the-horizon-as-companies-cut-jobs-and-costs euronews business brings you latest updates from the world of finance and economy, in-depth analysis, interviews, infographics and more Subscribe for daily dose of business news: htt... -

Amy Farrell Discusses Long-Term Price Stability

ANGA VP of Market Development discusses natural gas price stability at the Think About Energy Briefing in Bethlehem, Pennsylvania. -

Bernanke Price Stability & Full Employment 10July13)

-

Is 3000% Inflation Really Price Stability?

This week: http://youtu.be/FhmyoMW8-N8?t=22s -Contentious monetary policies -Shocking Shanghai gold demand -Silver's road ahead, currency or commodity? 65 Week Moving Average Chart: http://www.mcalvanyica.com/market-reports/ QnA w/DavidMcAlvany: http://www.youtube.com/watch?v=npwqu4ouoHw The Fuse is Lit Part III: http://www.youtube.com/watch?v=OhlvKj-hgU0 http://mcalvany.com 1-800-525-9556 -

-

The Chain Gang - Bitcoin Trading and Price Stability with Dave Scotese

The Chain Gang discusses Bitcoin trading and price stability with our friend Dave. -

Cryptotheft at Gunpoint, Price Stability, & More Bitcoin Headlines - #YMBLive 6-10-15

MP3: http://youmeandbtc.com/podcast/cryptotheft-at-gunpoint-price-stability-more-bitcoin-headlines-ymblive-6-10-15/ This week’s show features an EXCLUSIVE interview with Todd Kantor, the victim of a Bitcoin theft at gunpoint. He’ll share how he was attacked and how we can reduce the level of trust necessary in the Bitcoin space. Tune in now!! Interact with us on our #YMBLive landing page! http://youmeandbtc.com/live This Week’s Bitcoin Headlines: - Ecuador’s e-Money Initiative Outlaws Bitcoin, Makes Mandatory for Banks to Follow Dictate - Bitcoin Price Stability - New York City man robbed at gunpoint for … bitcoin? – EXCLUSIVE Interview! - MasterCard makes the case that it’s safer and faster than Bitcoin - New CoinDesk Report Reveals Who Really Uses Bitcoin - Reason Magazine Subpoena S...

Price stability

- Order: Reorder

- Duration: 5:09

- Updated: 13 Jan 2015

- views: 1205

- published: 13 Jan 2015

- views: 1205

European Central Bank - Lesson 1: Price Stability

- Order: Reorder

- Duration: 8:18

- Updated: 22 Sep 2009

- views: 13589

Segment 403: Price Stability

- Order: Reorder

- Duration: 2:24

- Updated: 06 Jul 2015

- views: 163

- published: 06 Jul 2015

- views: 163

Ubisoft's Price Stability | Feature Creep

- Order: Reorder

- Duration: 8:33

- Updated: 06 Mar 2016

- views: 941

- published: 06 Mar 2016

- views: 941

Price Stability- Monetary Policy and Central Banking (BSBA-Project)

- Order: Reorder

- Duration: 21:49

- Updated: 23 Mar 2015

- views: 97

- published: 23 Mar 2015

- views: 97

Price stability Meaning

- Order: Reorder

- Duration: 0:35

- Updated: 28 Apr 2015

- views: 81

- published: 28 Apr 2015

- views: 81

Economic Myths #6 – Price Stability

- Order: Reorder

- Duration: 5:30

- Updated: 30 Aug 2014

- views: 131

- published: 30 Aug 2014

- views: 131

Oil Price Stability

- Order: Reorder

- Duration: 0:34

- Updated: 29 Feb 2016

- views: 0

- published: 29 Feb 2016

- views: 0

Paul Ryan on the need to focus on price stability

- Order: Reorder

- Duration: 1:26

- Updated: 17 Nov 2010

- views: 638

- published: 17 Nov 2010

- views: 638

Alan Greenspan: Economic Issues, Price Stability & Risk Management (2004)

- Order: Reorder

- Duration: 29:49

- Updated: 27 Oct 2015

- views: 108

- published: 27 Oct 2015

- views: 108

15.0 - Price Stability - Economics with Tully

- Order: Reorder

- Duration: 22:53

- Updated: 11 Oct 2013

- views: 288

US Stock Market Price Stability at 10am from 2006 to April 2013

- Order: Reorder

- Duration: 1:13

- Updated: 03 Apr 2013

- views: 1193

- published: 03 Apr 2013

- views: 1193

Libya, Price Stability and The Bank for International Settlements

- Order: Reorder

- Duration: 14:56

- Updated: 30 May 2011

- views: 1207

- published: 30 May 2011

- views: 1207

Global commodities: price stability ahead -- PIMCO's Nicholas J. Johnson

- Order: Reorder

- Duration: 2:34

- Updated: 07 Oct 2015

- views: 828

Is 3000% Inflation Really Price Stability? | McAlvany Commentary

- Order: Reorder

- Duration: 45:12

- Updated: 07 Aug 2013

- views: 1718

- published: 07 Aug 2013

- views: 1718

Gold Fails for Price Stability

- Order: Reorder

- Duration: 3:41

- Updated: 16 Feb 2014

- views: 731

- published: 16 Feb 2014

- views: 731

Oil price stability on the horizon as companies cut jobs and costs

- Order: Reorder

- Duration: 1:23

- Updated: 31 Jul 2015

- views: 49

- published: 31 Jul 2015

- views: 49

Amy Farrell Discusses Long-Term Price Stability

- Order: Reorder

- Duration: 1:31

- Updated: 03 Nov 2014

- views: 100

- published: 03 Nov 2014

- views: 100

Bernanke Price Stability & Full Employment 10July13)

- Order: Reorder

- Duration: 15:23

- Updated: 23 Oct 2013

- views: 77

- published: 23 Oct 2013

- views: 77

Is 3000% Inflation Really Price Stability?

- Order: Reorder

- Duration: 1:03

- Updated: 07 Aug 2013

- views: 1098

- published: 07 Aug 2013

- views: 1098

Bitcoin friends Jeffrey Tucker and Gabe Sukenik on price stability and innovation

- Order: Reorder

- Duration: 23:00

- Updated: 29 Jul 2014

- views: 381

The Chain Gang - Bitcoin Trading and Price Stability with Dave Scotese

- Order: Reorder

- Duration: 33:24

- Updated: 13 Feb 2015

- views: 38

- published: 13 Feb 2015

- views: 38

Cryptotheft at Gunpoint, Price Stability, & More Bitcoin Headlines - #YMBLive 6-10-15

- Order: Reorder

- Duration: 112:24

- Updated: 10 Jun 2015

- views: 94

- published: 10 Jun 2015

- views: 94

-

Iraq and the price of stability in the Middle East

-

Maintaining Price Stability | Central Bank of Armenia

This video was prepared by students of the American University of Armenia, which thoroughly presents the process of how price stability is achieved. Hope that you will find this helpful. -

US Federal Reserve leaves interest rates unchanged

The U.S. Federal Reserve on Thursday left interest rates unchanged after the monthly meeting of the Federal Open Markets Committee. The Fed said in a statement: "To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate." The Turkish lira gained slightly against the dollar to about 2.99 after the announcement. -

-

Main Issues of Nuclear New Build Projects

Drivers for the development of nuclear energy after Fukushima remain the same: the desire or the need for energy independence, the growing demand for electricity, low cost in comparison with renewable energy sources and price stability in comparison with fossil sources. In practice the consequence of these conditions is a serious quantitative growth of NPP construction, which is planned to be operational from 2017 to 2030. This means the construction of about 70 nuclear units at the present time. Moderator: Andrey Popov, Director for Legal and Corporate Affairs and Property-related Issues, Director of the Department for Legal and Corporate Affairs, State Atomic Energy Corporation "Rosatom" -

Germany - Financial Stability Pact

T/I: 11:05:09 Bundesbank President Hans Tietmeyer in Frankfurt on Friday (17/11) backed a financial "stability pact" for EU member countries, stressing that such an agreement would not require modification of the European Union's Maastricht Treaty on economic and monetary union (EMU). SHOWS: OLD OPERA HOUSE, FRANKFURT, GERMANY, 17/11: top view meeting delegates seated in audience (man in pin-stripe suit is Hilmar Kopper chairman of Deutschebank and woman is lord mayor of frankfurt Petra Roth) Bundesbank President Hans Tietmeyer sot (english) ...."re advantage of monetary union being that it should be in all countries..." gv meeting more Tietmeyer sot re future of european central bank.... "there should be no difference between countries participating..." gv meeti... -

Do you think price stability will encourage a recovery in the HDB resale market in H2 2015?

With prices expected to remain muted in H1 2015, industry leaders explain whether there is a possibility it will cause a spike in transactions as a result -

Segment 105: Monetary Policy

Discover how the Fed conducts monetary policy to work toward its goals of price stability and maximum employment. -

Segment 310: Price Stability

Listen while Federal Reserve leaders discuss the importance of price stability -

What does price stability mean?

What does price stability mean? A spoken definition of price stability. Intro Sound: Typewriter - Tamskp Licensed under CC:BA 3.0 Outro Music: Groove Groove - Kevin MacLeod (incompetech.com) Licensed under CC:BA 3.0 Intro/Outro Photo: The best days are not planned - Marcus Hansson Licensed under CC-BY-2.0 Book Image: Open Book template PSD - DougitDesign Licensed under CC:BA 3.0 Text derived from: http://en.wiktionary.org/wiki/price_stability Text to Speech powered by TTS-API.COM -

Best Price FREE Shipping STOTT PILATES Split-Pedal Stability Chair with Handles

Best Price FREE Shipping STOTT PILATES Split-Pedal Stability Chair with Handles CLICK HERE: http://bit.ly/1FUdjK1 Product Description The only Stability Chair built with a double-steel frame for increased durability and stability, this is a multi-functional Pilates machine that can be adjusted to train most muscle groups. This sturdy piece of equipment helps the exerciser achieve upper- and lower-body strength and conditioning, enhance stability and improve body control. Ideal for rehab clients or those who need to stay in a seated or upright position, helping re-balance muscles while providing a full-body workout. It also facilitates high-performance exercises for athletes and fitness enthusiasts. The smaller base of support and dual pedals allow for bilateral, unilateral and reciproca... -

cap

Good Morning traders. I’m Natalie MacDonald, it’s Thursday 26th March and you’re watching the Daily Update with Capital Index, where we bring you a rundown of the news and market events which could be shaping your trades on this Thursday. No major releases on the Aussie session today which could mean some price stability for the Australian Dollar. We start the European Day at 7am with the GfK German Consumer Sentiment. Then at 9am we have the Eurozone M3 Money Supply and Private Loans numbers. That’s followed shortly after at 9.30am by UK Retail Sales. At 12.30pm we’ll receive information regarding US Unemployment Claims and shortly after this at 1pm FOMC Member Lockhart will be speaking. At 1.30pm Bank of Canada Governor Poloz will be speaking and at 8pm we’ll receive Canada’s Annual Budg... -

Iraq and the price of stability in the Middle East

- Order: Reorder

- Duration: 0:00

- Updated: 06 Mar 2016

- views: 0

- published: 06 Mar 2016

- views: 0

Maintaining Price Stability | Central Bank of Armenia

- Order: Reorder

- Duration: 10:07

- Updated: 01 Nov 2015

- views: 24

- published: 01 Nov 2015

- views: 24

US Federal Reserve leaves interest rates unchanged

- Order: Reorder

- Duration: 0:29

- Updated: 18 Sep 2015

- views: 1

- published: 18 Sep 2015

- views: 1

Government Looking For Permanent Solution For The Price Stability Of Onions

- Order: Reorder

- Duration: 2:22

- Updated: 21 Aug 2015

- views: 23

Main Issues of Nuclear New Build Projects

- Order: Reorder

- Duration: 128:32

- Updated: 04 Aug 2015

- views: 6

- published: 04 Aug 2015

- views: 6

Germany - Financial Stability Pact

- Order: Reorder

- Duration: 2:11

- Updated: 21 Jul 2015

- views: 0

- published: 21 Jul 2015

- views: 0

Do you think price stability will encourage a recovery in the HDB resale market in H2 2015?

- Order: Reorder

- Duration: 3:20

- Updated: 21 Jul 2015

- views: 108

- published: 21 Jul 2015

- views: 108

Segment 105: Monetary Policy

- Order: Reorder

- Duration: 4:19

- Updated: 06 Jul 2015

- views: 112

- published: 06 Jul 2015

- views: 112

Segment 310: Price Stability

- Order: Reorder

- Duration: 2:45

- Updated: 06 Jul 2015

- views: 66

- published: 06 Jul 2015

- views: 66

What does price stability mean?

- Order: Reorder

- Duration: 0:43

- Updated: 18 Jun 2015

- views: 10

- published: 18 Jun 2015

- views: 10

Best Price FREE Shipping STOTT PILATES Split-Pedal Stability Chair with Handles

- Order: Reorder

- Duration: 0:53

- Updated: 26 May 2015

- views: 184

- published: 26 May 2015

- views: 184

cap

- Order: Reorder

- Duration: 0:55

- Updated: 25 Mar 2015

- views: 4

- published: 25 Mar 2015

- views: 4

Download Understanding Modern Money The Key to Full Employment and Price Stability Hardcover PDF

- Order: Reorder

- Duration: 0:16

- Updated: 13 Mar 2015

- views: 27

-

Modern Money & Public Purpose 1: The Historical Evolution of Money and Debt

Moderator: William V. Harris, William R. Shepherd Professor of History and Director, Center for the Ancient Mediterranean, Columbia University Speaker 1: L. Randall Wray, Research Director of the Center for Full Employment and Price Stability and Professor of Economics, University of Missouri-Kansas City Speaker 2: Michael Hudson, President, Institute for the Study of Long-Term Economic Trends and Distinguished Research Professor, University of Missouri-Kansas City Tuesday, September 11, 2012 About the Seminar Series: Modern Money and Public Purpose is an eight-part, interdisciplinary seminar series held at Columbia Law School over the 2012-2013 academic year. The series aims to present new perspectives and progressive policy proposals on a range of contemporary issues facing the U.S.... -

The Science of Monetary Policy - Professor Jagjit Chadha

The role of macroeconomics in recent years: http://www.gresham.ac.uk/lectures-and-events/the-science-of-monetary-policy The near loss of price stability in the 1970s led to serious attention being paid to the role of expectations in economic management and the need to find monetary rules that respected changing incentives faced by households and firms under different economic environments. Models were then developed that mostly yielded arguments for price stability under an interest rate feedback rule and for a decade or so, under the Long Expansion, all seemed well. The transcript and downloadable versions of the lecture are available from the Gresham College website: http://www.gresham.ac.uk/lectures-and-events/the-science-of-monetary-policy Gresham College has been giving free public... -

L. Randall Wray -- MODERN MONEY: the way a sovereign currency "works"

Economics Professor Randy Wray answers the questions: What is Money? Why is at accepted? What is the relationship between money & government? What backs up our money? Can the US government run out of money? You may be surprised by the answers! From the first seminar of the "Modern Money and Public Purpose" series at Columbia Law School. To watch the full seminar, including Q&As;, and for a list of suggested readings, please visit the Modern Money & Public Purpose website: http://www.modernmoneyandpublicpurpose.com/seminar-1.html SPEAKER BIO: L. Randall Wray, Ph.D. is a Professor of Economics and Research Director for the Center for Full Employment and Price Stability at the University of Missouri-Kansas City. He is also a Senior Scholar at the Levy Economics Institute of Bard College. ... -

Conversations with the Fed - Understanding Inflation

Part of the Federal Reserve’s mandate is to promote price stability. What does that mean? How are price stability and inflation measured? What factors affect inflation? And why is price stability important for the economy? Senior Vice President and Director of Research Sam Schulhofer-Wohl answers these, and takes audience questions on September 24, 2015 -

MMT's Economic Fix as Explained by Pavlina Tcherneva to Ben Merens

This is Pavalina R Tcherneva, Assistant Professor of Economics, Franklin and Marshall College, and research scholar, Levy Economics Institute and the Center for Full Employment and Price Stability. She is being interviewed on the show "At Issue with Ben Merens". Pavlina explains why the so-called debt crises is a false issue and that Aggregate Demand is the real issue we should be worried about. This is from an October 17, 2011 Broadcast. -

Ron Paul Hearing with Tom Hoenig: The Fed's Impact on the Economy -- 7/26/11

This hearing of the Domestic Monetary Policy Subcommittee focused on the regional Federal Reserve Bank perspective of the role of the Federal Reserve in the economy, especially with regard to its mandate of price stability and full employment. The Subcommittee examined the extensive liquidity operations undertaken by the Federal Reserve over the past few years; actions by the Federal Reserve going forward, including the potential, as indicated by Federal Reserve Chairman Ben Bernanke, of an additional program of quantitative easing; and the outlook for inflation, unemployment, and GDP growth. The hearing also discussed the exit strategies available to the Federal Reserve given its considerable involvement in the economy, the size of its balance sheet, and the excess reserves held by the ba... -

Rich - The Fed's Dual Mandate

Robert W. Rich, Assistant Vice President, Research and Statistics Group, "The Federal Reserve in the 21st Century" Symposium. Presentation Summary: - How the Fed achieves its objectives: Maximum employment & price stability - How policymakers monitor inflation and gauge whether the economy is operating at maximum employment - Performance vs. objectives: Introduction to the Summary of Economic Projections & forward guidance This video presentation is part of a series by Federal Reserve Bank of New York economists and senior staff focus on post-crisis issues in monetary and financial stability policy and can serve as reference material for macroeconomics and money, banking and financial markets courses. All videos were recorded on March 4 and 5, 2013 during the symposium and are appropria... -

Why Does Unemployment and Inflation Affect the Economy? Alan Greenspan (1990)

A job guarantee (JG) is an economic policy proposal aimed at providing a sustainable solution to the dual problems of inflation and unemployment. Its aim is to create full employment and price stability. It is related to the concept of employer of last resort (ELR).[1] The economic policy stance currently dominant around the world uses unemployment as a policy tool to control inflation; when cost pressures rise, the standard monetary policy carried out by the monetary authority (central bank) tightens interest rates, creating a buffer stock of unemployed people, which reduces wage demands, and ultimately inflation. When inflationary expectations subside, these people will get their jobs back. In Marxian terms, the unemployed serve as a reserve army of labor. By contrast, in a job guarante... -

How the U.S. Dollar Impacts Other Currencies, Commodities, Oil & Gold - Forex (2009)

The 6th paragraph of Section 8 of Article 1 of the U.S. Constitution provides that the U.S. Congress shall have the power to "coin money" and to "regulate the value" of domestic and foreign coins. Congress exercised those powers when it enacted the Coinage Act of 1792. That Act provided for the minting of the first U.S. dollar and it declared that the U.S. dollar shall have "the value of a Spanish milled dollar as the same is now current". The table to the right shows the equivalent amount of goods that, in a particular year, could be purchased with $1. The table shows that from 1774 through 2012 the U.S. dollar has lost about 97.0% of its buying power.[60] The decline in the value of the U.S. dollar corresponds to price inflation, which is a rise in the general level of prices of goods ... -

Peter Praet, Keynote: Monetary Policy Measures in a Persistent Low Inflation World

Peter Praet, Chief Economist and Member, Governing Council, ECB, delivers the luncheon keynote speech, "New Monetary Policy Measures for the Euro Area's Pursuit of Price Stability," at the conference "Monetary Policy Measures in a Persistent Low Inflation World," on February 5, 2015, in Frankfurt am Main. The conference was cohosted by the Peterson Institute for International Economics and Moody's Investor Service. For more information, visit: http://www.piie.com/events/event_detail.cfm?EventID=373 -

FOMC Chairman Ben Bernanke Press Conference HD 19 June 2013

Federal Reserve issues FOMC statement: "Information received since the Federal Open Market Committee met in May suggests that economic activity has been expanding at a moderate pace. Labor market conditions have shown further improvement in recent months, on balance, but the unemployment rate remains elevated. Household spending and business fixed investment advanced, and the housing sector has strengthened further, but fiscal policy is restraining economic growth. Partly reflecting transitory influences, inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable. Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate ... -

CGEP: Impacts of the Oil Price Drop

The Center on Global Energy Policy hosted a panel discussion focused on the geopolitical and global economic implications of the recent oil price drop. Our distinguished group of experts discussed what the decline means for national budgets, internal political stability, currency fluctuations, diplomatic relations, and energy sanctions, among other topics, for key countries like Venezuela, Iran, Nigeria, Russia, Mexico, China and others. Center Director Jason Bordoff moderated the discussion with our panelists: Helima Croft, Managing Director and Chief Commodities Strategist, RBC Capital Markets; Adrian Lajous, Fellow, Center on Global Energy Policy and former CEO, Pemex; Guillermo Mondino, Managing Director and Head of Emerging Markets Economics and Strategy, Citi Research; Dr. Steve ... -

AIC 2014 Keynote: What Direction does US Economic Policy Need to Take in order to Achieve its Goals?

Beyond the U.S. Federal Reserve's dual mandate goals of maximum employment and price stability in the American economy, the Fed recognizes the impact its decisions have on markets around the world, and needs to make its intentions as clear as possible. That was the message from Charles Evans, President and CEO of the Federal Reserve Bank of Chicago, in a keynote address on Friday at the Credit Suisse Asian Investment Conference in Hong Kong. Read more on the Credit Suisse Asian Investment Conference website: http://bit.ly/1frS3MM ----------------------------------------------------------------------------------------- Check out our playlist for more videos from the Asian Investment Conference: http://www.youtube.com/playlist?list=PLFEB52471209C7056 Subscribe to our channel: http://ww... -

Why Renewables? by Dr. Donald Swift-Hook

In spite of the fact that there is no overall shortage of energy resources globally, almost all countries are currently pursuing renewable energy technologies. Their rate of growth is escalating rapidly, doubling every 2 or 3 years. This is because they offer security of supply with price stability to countries traditionally reliant on external sources of oil and coal, as well as being low carbon emission technologies that can grow virtually without limit. They can also have low transmission and generation costs. Today's dramatic progress will be reviewed, especially in wind power, solar power, marine, and biomass technologies. DONALD SWIFT-HOOK spent the first part of his career in industrial research, first with GEC, and then with the Electricity Supply Industry before it was privatise... -

The Gold Forecast: The Bull is Back. Special Report 2012 - 13 Forecast

This special editional includes the Weekly Review from today 8.31,2012 and my 2012- 2013 forecast from Sunday 8.26.2012 published as part of "Chart This" for Kitco News For a FREE trial go to: http://thegoldsilverforecast.com/amember/signup/index There are a number of observations that Federal Reserve Chairman Ben Bernanke made today at the conclusion of the Jackson Hole "summit" that clearly affected gold's price today in New York. The first noteworthy statement was: "I'll talk about the implications for the Federal Reserve's ongoing efforts to promote a return to maximum employment in a context of price stability. "The use of the word "ongoing" tells us that there is more intervention on the way. Consensus seems to be split as to whether, if and how much. The FOMC meeting of September ...

Modern Money & Public Purpose 1: The Historical Evolution of Money and Debt

- Order: Reorder

- Duration: 105:03

- Updated: 22 Sep 2012

- views: 33614

- published: 22 Sep 2012

- views: 33614

The Science of Monetary Policy - Professor Jagjit Chadha

- Order: Reorder

- Duration: 52:47

- Updated: 08 Apr 2015

- views: 1541

- published: 08 Apr 2015

- views: 1541

L. Randall Wray -- MODERN MONEY: the way a sovereign currency "works"

- Order: Reorder

- Duration: 27:04

- Updated: 24 Sep 2012

- views: 12628

- published: 24 Sep 2012

- views: 12628

Conversations with the Fed - Understanding Inflation

- Order: Reorder

- Duration: 54:42

- Updated: 15 Oct 2015

- views: 40

- published: 15 Oct 2015

- views: 40

MMT's Economic Fix as Explained by Pavlina Tcherneva to Ben Merens

- Order: Reorder

- Duration: 29:48

- Updated: 27 Oct 2011

- views: 5160

- published: 27 Oct 2011

- views: 5160

Ron Paul Hearing with Tom Hoenig: The Fed's Impact on the Economy -- 7/26/11

- Order: Reorder

- Duration: 85:52

- Updated: 27 Jul 2011

- views: 5651

- published: 27 Jul 2011

- views: 5651

Rich - The Fed's Dual Mandate

- Order: Reorder

- Duration: 32:45

- Updated: 17 Oct 2013

- views: 387

- published: 17 Oct 2013

- views: 387

Why Does Unemployment and Inflation Affect the Economy? Alan Greenspan (1990)

- Order: Reorder

- Duration: 112:34

- Updated: 28 Oct 2015

- views: 70

- published: 28 Oct 2015

- views: 70

How the U.S. Dollar Impacts Other Currencies, Commodities, Oil & Gold - Forex (2009)

- Order: Reorder

- Duration: 29:39

- Updated: 16 Jan 2015

- views: 1149

- published: 16 Jan 2015

- views: 1149

Peter Praet, Keynote: Monetary Policy Measures in a Persistent Low Inflation World

- Order: Reorder

- Duration: 56:27

- Updated: 25 Mar 2015

- views: 91

- published: 25 Mar 2015

- views: 91

FOMC Chairman Ben Bernanke Press Conference HD 19 June 2013

- Order: Reorder

- Duration: 58:14

- Updated: 19 Jun 2013

- views: 3749

- published: 19 Jun 2013

- views: 3749

CGEP: Impacts of the Oil Price Drop

- Order: Reorder

- Duration: 85:20

- Updated: 09 Dec 2014

- views: 5723

- published: 09 Dec 2014

- views: 5723

AIC 2014 Keynote: What Direction does US Economic Policy Need to Take in order to Achieve its Goals?

- Order: Reorder

- Duration: 52:53

- Updated: 29 Mar 2014

- views: 118

- published: 29 Mar 2014

- views: 118

Why Renewables? by Dr. Donald Swift-Hook

- Order: Reorder

- Duration: 60:07

- Updated: 14 Jan 2013

- views: 167

- published: 14 Jan 2013

- views: 167

The Gold Forecast: The Bull is Back. Special Report 2012 - 13 Forecast

- Order: Reorder

- Duration: 22:52

- Updated: 01 Sep 2012

- views: 2200

- published: 01 Sep 2012

- views: 2200

- Playlist

- Chat

- Playlist

- Chat

Price stability

- Report rights infringement

- published: 13 Jan 2015

- views: 1205

European Central Bank - Lesson 1: Price Stability

- Report rights infringement

- published: 22 Sep 2009

- views: 13589

Segment 403: Price Stability

- Report rights infringement

- published: 06 Jul 2015

- views: 163

Ubisoft's Price Stability | Feature Creep

- Report rights infringement

- published: 06 Mar 2016

- views: 941

Price Stability- Monetary Policy and Central Banking (BSBA-Project)

- Report rights infringement

- published: 23 Mar 2015

- views: 97

Price stability Meaning

- Report rights infringement

- published: 28 Apr 2015

- views: 81

Economic Myths #6 – Price Stability

- Report rights infringement

- published: 30 Aug 2014

- views: 131

Oil Price Stability

- Report rights infringement

- published: 29 Feb 2016

- views: 0

Paul Ryan on the need to focus on price stability

- Report rights infringement

- published: 17 Nov 2010

- views: 638

Alan Greenspan: Economic Issues, Price Stability & Risk Management (2004)

- Report rights infringement

- published: 27 Oct 2015

- views: 108

15.0 - Price Stability - Economics with Tully

- Report rights infringement

- published: 11 Oct 2013

- views: 288

US Stock Market Price Stability at 10am from 2006 to April 2013

- Report rights infringement

- published: 03 Apr 2013

- views: 1193

Libya, Price Stability and The Bank for International Settlements

- Report rights infringement

- published: 30 May 2011

- views: 1207

Global commodities: price stability ahead -- PIMCO's Nicholas J. Johnson

- Report rights infringement

- published: 07 Oct 2015

- views: 828

- Playlist

- Chat

Iraq and the price of stability in the Middle East

- Report rights infringement

- published: 06 Mar 2016

- views: 0

Maintaining Price Stability | Central Bank of Armenia

- Report rights infringement

- published: 01 Nov 2015

- views: 24

US Federal Reserve leaves interest rates unchanged

- Report rights infringement

- published: 18 Sep 2015

- views: 1

Government Looking For Permanent Solution For The Price Stability Of Onions

- Report rights infringement

- published: 21 Aug 2015

- views: 23

Main Issues of Nuclear New Build Projects

- Report rights infringement

- published: 04 Aug 2015

- views: 6

Germany - Financial Stability Pact

- Report rights infringement

- published: 21 Jul 2015

- views: 0

Do you think price stability will encourage a recovery in the HDB resale market in H2 2015?

- Report rights infringement

- published: 21 Jul 2015

- views: 108

Segment 105: Monetary Policy

- Report rights infringement

- published: 06 Jul 2015

- views: 112

Segment 310: Price Stability

- Report rights infringement

- published: 06 Jul 2015

- views: 66

What does price stability mean?

- Report rights infringement

- published: 18 Jun 2015

- views: 10

Best Price FREE Shipping STOTT PILATES Split-Pedal Stability Chair with Handles

- Report rights infringement

- published: 26 May 2015

- views: 184

cap

- Report rights infringement

- published: 25 Mar 2015

- views: 4

Download Understanding Modern Money The Key to Full Employment and Price Stability Hardcover PDF

- Report rights infringement

- published: 13 Mar 2015

- views: 27

- Playlist

- Chat

Modern Money & Public Purpose 1: The Historical Evolution of Money and Debt

- Report rights infringement

- published: 22 Sep 2012

- views: 33614

The Science of Monetary Policy - Professor Jagjit Chadha

- Report rights infringement

- published: 08 Apr 2015

- views: 1541

L. Randall Wray -- MODERN MONEY: the way a sovereign currency "works"

- Report rights infringement

- published: 24 Sep 2012

- views: 12628

Conversations with the Fed - Understanding Inflation

- Report rights infringement

- published: 15 Oct 2015

- views: 40

MMT's Economic Fix as Explained by Pavlina Tcherneva to Ben Merens

- Report rights infringement

- published: 27 Oct 2011

- views: 5160

Ron Paul Hearing with Tom Hoenig: The Fed's Impact on the Economy -- 7/26/11

- Report rights infringement

- published: 27 Jul 2011

- views: 5651

Rich - The Fed's Dual Mandate

- Report rights infringement

- published: 17 Oct 2013

- views: 387

Why Does Unemployment and Inflation Affect the Economy? Alan Greenspan (1990)

- Report rights infringement

- published: 28 Oct 2015

- views: 70

How the U.S. Dollar Impacts Other Currencies, Commodities, Oil & Gold - Forex (2009)

- Report rights infringement

- published: 16 Jan 2015

- views: 1149

Peter Praet, Keynote: Monetary Policy Measures in a Persistent Low Inflation World

- Report rights infringement

- published: 25 Mar 2015

- views: 91

FOMC Chairman Ben Bernanke Press Conference HD 19 June 2013

- Report rights infringement

- published: 19 Jun 2013

- views: 3749

CGEP: Impacts of the Oil Price Drop

- Report rights infringement

- published: 09 Dec 2014

- views: 5723

AIC 2014 Keynote: What Direction does US Economic Policy Need to Take in order to Achieve its Goals?

- Report rights infringement

- published: 29 Mar 2014

- views: 118

Why Renewables? by Dr. Donald Swift-Hook

- Report rights infringement

- published: 14 Jan 2013

- views: 167

Abu Dhabi International Airport closed, Dubai airport operational

Edit Khaleej Times 09 Mar 2016Chloe Grace Moretz, Bette Midler Slam Kim Kardashian’s Nude Selfie

Edit The Wrap 08 Mar 2016Snowden: FBI's claim it can't unlock the San Bernardino iPhone is 'bullshit'

Edit The Guardian 09 Mar 2016Sanders is surprise victor in Michigan; Trump keeps winning

Edit Stars and Stripes 09 Mar 2016Should You Buy Lloyds Banking Group PLC After It Soars By 20% In A Month?

Edit The Motley Fool 09 Mar 2016Pound Strengthens as U.K. Manufacturing Growth Boosts Optimism

Edit Bloomberg 09 Mar 2016U.S. 2016 natgas production, consumption at record highs - EIA

Edit Petroleum World 09 Mar 2016Leaving is the UK's biggest risk, warns Mark Carney

Edit Belfast Telegraph 09 Mar 2016Negative gearing: we're becoming a nation of landlords and serfs

Edit Sydney Morning Herald 09 Mar 2016Paying Lip Service to Broader Reform No Cure for Market Anxiety

Edit Caixin Online 09 Mar 2016Oil prices above $40, European shares bounce back

Edit Yahoo Daily News 09 Mar 2016S&P; 500 Futures Signal Stocks to Rise on Bull-Market Anniversary

Edit Bloomberg 09 Mar 2016Curbing negative gearing could be good for banks

Edit Sydney Morning Herald 09 Mar 2016Don't Let Rally Fool You: Commodity Firms Still Face Debt Cliff

Edit Bloomberg 09 Mar 2016Vodafone Group plc, SSE PLC And Pearson plc

Edit The Motley Fool 09 Mar 2016Raging River Exploration Inc. Announces the Closing of $108.1 Million Bought Deal Financing and Updated ...

Edit Stockhouse 09 Mar 2016Police: 1 dead, 14 wounded in Tuesday shootings

Edit Chicago Sun-Times 09 Mar 2016- 1

- 2

- 3

- 4

- 5

- Next page »