- published: 07 May 2012

- views: 175534

-

remove the playlistCurrent Account

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistCurrent Account

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 17 Apr 2014

- views: 32875

- published: 07 Dec 2013

- views: 2137

- published: 24 Feb 2012

- views: 70122

- published: 14 Mar 2015

- views: 19586

- published: 14 Mar 2015

- views: 47419

- published: 17 Apr 2014

- views: 27745

- published: 20 Jan 2010

- views: 14435

- published: 23 Oct 2015

- views: 1372

An accountant is a practitioner of accountancy (UK) or accounting (US), which is the measurement, disclosure or provision of assurance about financial information that helps managers, investors, tax authorities and others make decisions about allocating resources.

The Big Four auditors are the largest employers of accountants worldwide. However, most accountants are employed in commerce, industry and the public sector.

In the Commonwealth of Nations, which includes the United Kingdom, Canada, Australia, New Zealand, Hong Kong pre 1997 and several dozen other states, commonly recognised accounting qualifications are Chartered Accountant (CA or ACA), Chartered Certified Accountant (ACCA), Chartered Management Accountant (ACMA) and International Accountant (AAIA). Other qualifications in particular countries include Certified Public Accountant (CPA – Ireland and CPA – Hong Kong), Certified Management Accountant (CMA – Canada), Certified General Accountant (CGA – Canada), Certified Practising Accountant (CPA – Australia) and members of the Institute of Public Accountants (Australia), and Certified Public Practising Accountant (CPPA – New Zealand).

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

6:29

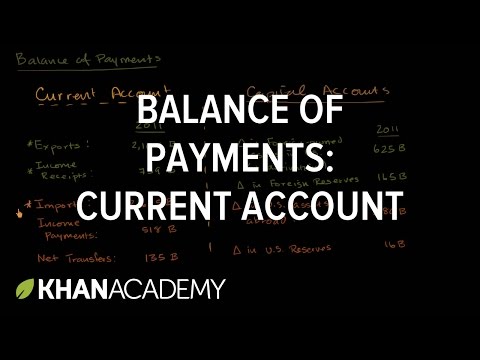

6:29Balance of payments: Current account | Foreign exchange and trade | Macroeconomics | Khan Academy

Balance of payments: Current account | Foreign exchange and trade | Macroeconomics | Khan AcademyBalance of payments: Current account | Foreign exchange and trade | Macroeconomics | Khan Academy

Understanding the United States Current Account in 2011 Watch the next lesson: https://www.khanacademy.org/economics-finance-domain/macroeconomics/forex-trade-topic/current-capital-account/v/balance-of-payments-capital-account?utm_source=YT&utm;_medium=Desc&utm;_campaign=macroeconomics Missed the previous lesson? https://www.khanacademy.org/economics-finance-domain/macroeconomics/income-and-expenditure-topic/is-lm-model-tutorial/v/government-spending-and-the-is-lm-model?utm_source=YT&utm;_medium=Desc&utm;_campaign=macroeconomics Macroeconomics on Khan Academy: Topics covered in a traditional college level introductory macroeconomics course About Khan Academy: Khan Academy offers practice exercises, instructional videos, and a personalized learning dashboard that empower learners to study at their own pace in and outside of the classroom. We tackle math, science, computer programming, history, art history, economics, and more. Our math missions guide learners from kindergarten to calculus using state-of-the-art, adaptive technology that identifies strengths and learning gaps. We've also partnered with institutions like NASA, The Museum of Modern Art, The California Academy of Sciences, and MIT to offer specialized content. For free. For everyone. Forever. #YouCanLearnAnything Subscribe to Khan Academy's Macroeconomics channel: https://www.youtube.com/channel/UCBytY7pnP0GAHB3C8vDeXvg Subscribe to Khan Academy: https://www.youtube.com/subscription_center?add_user=khanacademy -

6:07

6:07AS/IB 11) Current Account of the Balance of Payments

AS/IB 11) Current Account of the Balance of PaymentsAS/IB 11) Current Account of the Balance of Payments

AS/IB 11) Current Account of the Balance of Payments - An understanding of the Balance of Payments focusing on the current account and the four sections within it Twitter: https://twitter.com/econplusdal Facebook: https://www.facebook.com/EconplusDal-1651992015061685/?ref=aymt_homepage_panel -

6:01

6:01Current Account and Capital Account

Current Account and Capital AccountCurrent Account and Capital Account

-

3:49

3:49What is Current Account Deficit - HDFC Bank MONEY TALK

What is Current Account Deficit - HDFC Bank MONEY TALKWhat is Current Account Deficit - HDFC Bank MONEY TALK

Watch Ashish Parthasarthy, Treasurer, HDFC Bank explain to you the concept & impact of Current Account Deficit -

16:16

16:16The relationship between the Current Account Balance and Exchange Rates

The relationship between the Current Account Balance and Exchange RatesThe relationship between the Current Account Balance and Exchange Rates

A nation's balance of payments measures all economic transactions between that nation's people and the people of all other nations. A country that spends more on imports than it earns from the sale of its exports is said to have a trade deficit. Such imbalances have become controversial topics of debate in political and economic circles, particularly over the last decade as the Chinese economy has emerged as the world's largest exporter. As goods and services flow from one country to another, the exchange rates of those countries' currencies tend to fluctuate to promote balanced trade between the two nations. However, in some cases, most notably China, a country's central bank will intervene in the market for its own currency to manage its exchange rate against that of a trading partner. When such interventions occur, the normal, moderating effect that rising and falling exchange rates has on trade flows is disrupted, and trade imbalances can become persistent. This lesson will illustrate how trade flows should lead to appreciation and depreciation of currencies in a floating exchange rate system, and then explain how in the case of China, central bank policy aimed at buying large quantities of US government debt keeps the supply of Chinese currency high in the US and the demand for US dollars high in China. This means the dollar remains stronger than it otherwise might relative to the Chinese RMB, contributing to the persistent trade deficits the US exhibits in its trade with China. http://www.econclassroom.com/?p=3057 -

6:13

6:13Current Account Deficit Consequences

Current Account Deficit ConsequencesCurrent Account Deficit Consequences

Current Account Deficit Consequences - An understanding of the consequences of a current account deficit on the balance of payments -

12:21

12:21Balance of Payments (Current Account, Financial Account and Capital Account)

Balance of Payments (Current Account, Financial Account and Capital Account)Balance of Payments (Current Account, Financial Account and Capital Account)

Balance of Payments (Current Account, Financial Account and Capital Account) - A detailed look at the structure of the balance of payments including the current account, financial account and capital account whilst also considering how the balance of payments must balance Twitter: https://twitter.com/econplusdal Facebook: https://www.facebook.com/EconplusDal-1651992015061685/?ref=aymt_homepage_panel Theory Video: https://www.youtube.com/watch?v=mvq6Fjzdjd8 -

8:35

8:35AS/IB 12) Causes and Consequences of a Current Account Deficit

AS/IB 12) Causes and Consequences of a Current Account DeficitAS/IB 12) Causes and Consequences of a Current Account Deficit

AS/IB 12) Causes and Consequences of a Current Account Deficit - An understanding of the Causes and Consequences of a Current Account Deficit looking at causes from the demand and supply side of the economy Twitter: https://twitter.com/econplusdal Facebook: https://www.facebook.com/EconplusDal-1651992015061685/?ref=aymt_homepage_panel -

4:46

4:4610 UNDERSTANDING THE CURRENT ACCOUNT

10 UNDERSTANDING THE CURRENT ACCOUNT10 UNDERSTANDING THE CURRENT ACCOUNT

10 UNDERSTANDING THE CURRENT ACCOUNT Check out the entire free forex course (in process): http://www.informedtrades.com/f7/ The Free Forex Academy is a partner of InformedTrades.com, a community of traders dedicated to learning. At the Free Forex Academy, we are in the beginning stages of creating an entire comprehensive series of courses on forex trading. This vid applies not just to forex, but to all markets, or for those simply interested in economics. Music: Danse Macabre - Low Strings Finale (Theme) Kevin MacLeod incompetech.com Manolo Camp - Hold on a sec http://opsound.org/ Practice forex trading with real time charts and live price feeds for free while you learn. Get a totally free virtual trading account here- http://clk.atdmt.com/FXM/go/166058821/direct/01/ -

6:49

6:49Balance of Payments - the Current Account

Balance of Payments - the Current AccountBalance of Payments - the Current Account

This lesson introduces the balance of payments and the components of the Current Account

- Accountant

- Accounting period

- Accrual

- Audit

- Auditor's report

- Australia

- Bachelor's degree

- Balance Sheet

- Big Four auditors

- Bookkeeper

- Bookkeeping

- British Columbia

- Business

- Canada

- Cash flow statement

- Chart of accounts

- Chartered Accountant

- Cost accounting

- Cost of goods sold

- CPA Australia

- Credit manager

- Debits and credits

- Financial audit

- Financial statement

- Forensic accounting

- Fund accounting

- General journal

- General ledger

- Historical cost

- HKICPA

- Hong Kong

- Income statement

- Internal audit

- Matching principle

- New Zealand

- Ontario

- Prince Edward Island

- Professional body

- Public sector

- Revenue recognition

- Royal Charter

- Sarbanes–Oxley Act

- Special journal

- Talk Accountant

- Template Accounting

- Template Cleanup doc

- Trade credit

- Trial balance

- United Kingdom

- University

- Wikipedia Cleanup

- WP INDISCRIMINATE

- XBRL

-

Balance of payments: Current account | Foreign exchange and trade | Macroeconomics | Khan Academy

Understanding the United States Current Account in 2011 Watch the next lesson: https://www.khanacademy.org/economics-finance-domain/macroeconomics/forex-trade-topic/current-capital-account/v/balance-of-payments-capital-account?utm_source=YT&utm;_medium=Desc&utm;_campaign=macroeconomics Missed the previous lesson? https://www.khanacademy.org/economics-finance-domain/macroeconomics/income-and-expenditure-topic/is-lm-model-tutorial/v/government-spending-and-the-is-lm-model?utm_source=YT&utm;_medium=Desc&utm;_campaign=macroeconomics Macroeconomics on Khan Academy: Topics covered in a traditional college level introductory macroeconomics course About Khan Academy: Khan Academy offers practice exercises, instructional videos, and a personalized learning dashboard that empower learners to study a... -

AS/IB 11) Current Account of the Balance of Payments

AS/IB 11) Current Account of the Balance of Payments - An understanding of the Balance of Payments focusing on the current account and the four sections within it Twitter: https://twitter.com/econplusdal Facebook: https://www.facebook.com/EconplusDal-1651992015061685/?ref=aymt_homepage_panel -

Current Account and Capital Account

-

What is Current Account Deficit - HDFC Bank MONEY TALK

Watch Ashish Parthasarthy, Treasurer, HDFC Bank explain to you the concept & impact of Current Account Deficit -

The relationship between the Current Account Balance and Exchange Rates

A nation's balance of payments measures all economic transactions between that nation's people and the people of all other nations. A country that spends more on imports than it earns from the sale of its exports is said to have a trade deficit. Such imbalances have become controversial topics of debate in political and economic circles, particularly over the last decade as the Chinese economy has emerged as the world's largest exporter. As goods and services flow from one country to another, the exchange rates of those countries' currencies tend to fluctuate to promote balanced trade between the two nations. However, in some cases, most notably China, a country's central bank will intervene in the market for its own currency to manage its exchange rate against that of a trading partner. ... -

Current Account Deficit Consequences

Current Account Deficit Consequences - An understanding of the consequences of a current account deficit on the balance of payments -

Balance of Payments (Current Account, Financial Account and Capital Account)

Balance of Payments (Current Account, Financial Account and Capital Account) - A detailed look at the structure of the balance of payments including the current account, financial account and capital account whilst also considering how the balance of payments must balance Twitter: https://twitter.com/econplusdal Facebook: https://www.facebook.com/EconplusDal-1651992015061685/?ref=aymt_homepage_panel Theory Video: https://www.youtube.com/watch?v=mvq6Fjzdjd8 -

AS/IB 12) Causes and Consequences of a Current Account Deficit

AS/IB 12) Causes and Consequences of a Current Account Deficit - An understanding of the Causes and Consequences of a Current Account Deficit looking at causes from the demand and supply side of the economy Twitter: https://twitter.com/econplusdal Facebook: https://www.facebook.com/EconplusDal-1651992015061685/?ref=aymt_homepage_panel -

10 UNDERSTANDING THE CURRENT ACCOUNT

10 UNDERSTANDING THE CURRENT ACCOUNT Check out the entire free forex course (in process): http://www.informedtrades.com/f7/ The Free Forex Academy is a partner of InformedTrades.com, a community of traders dedicated to learning. At the Free Forex Academy, we are in the beginning stages of creating an entire comprehensive series of courses on forex trading. This vid applies not just to forex, but to all markets, or for those simply interested in economics. Music: Danse Macabre - Low Strings Finale (Theme) Kevin MacLeod incompetech.com Manolo Camp - Hold on a sec http://opsound.org/ Practice forex trading with real time charts and live price feeds for free while you learn. Get a totally free virtual trading account here- http://clk.atdmt.com/FXM/go/166058821/direct/01/ -

Balance of Payments - the Current Account

This lesson introduces the balance of payments and the components of the Current Account

Balance of payments: Current account | Foreign exchange and trade | Macroeconomics | Khan Academy

- Order: Reorder

- Duration: 6:29

- Updated: 07 May 2012

- views: 175534

- published: 07 May 2012

- views: 175534

AS/IB 11) Current Account of the Balance of Payments

- Order: Reorder

- Duration: 6:07

- Updated: 17 Apr 2014

- views: 32875

- published: 17 Apr 2014

- views: 32875

Current Account and Capital Account

- Order: Reorder

- Duration: 6:01

- Updated: 09 Apr 2013

- views: 12557

- published: 09 Apr 2013

- views: 12557

What is Current Account Deficit - HDFC Bank MONEY TALK

- Order: Reorder

- Duration: 3:49

- Updated: 07 Dec 2013

- views: 2137

- published: 07 Dec 2013

- views: 2137

The relationship between the Current Account Balance and Exchange Rates

- Order: Reorder

- Duration: 16:16

- Updated: 24 Feb 2012

- views: 70122

- published: 24 Feb 2012

- views: 70122

Current Account Deficit Consequences

- Order: Reorder

- Duration: 6:13

- Updated: 14 Mar 2015

- views: 19586

- published: 14 Mar 2015

- views: 19586

Balance of Payments (Current Account, Financial Account and Capital Account)

- Order: Reorder

- Duration: 12:21

- Updated: 14 Mar 2015

- views: 47419

- published: 14 Mar 2015

- views: 47419

AS/IB 12) Causes and Consequences of a Current Account Deficit

- Order: Reorder

- Duration: 8:35

- Updated: 17 Apr 2014

- views: 27745

- published: 17 Apr 2014

- views: 27745

10 UNDERSTANDING THE CURRENT ACCOUNT

- Order: Reorder

- Duration: 4:46

- Updated: 20 Jan 2010

- views: 14435

- published: 20 Jan 2010

- views: 14435

Balance of Payments - the Current Account

- Order: Reorder

- Duration: 6:49

- Updated: 23 Oct 2015

- views: 1372

- published: 23 Oct 2015

- views: 1372

-

Short & Sweet Home Loan from IDFC Bank : Save Time & Money

Reduce your interest and speed up your loan with Short & Sweet Home Loan, a current account linked loan that helps you save on interest at IDFC Bank. Click here for more details: http://bit.ly/ShortandSweetHomeLoan -

bank

Do not forget to Subscribe and Share. A bank is a financial institution that accepts deposits from the public and creates credit. Lending activities can be performed either directly or indirectly through capital markets. Due to their importance in the financial system and influence on national economies, banks are highly regulated in most countries. Most nations have institutionalized a system known as fractional reserve banking under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, known as the Basel Accords. Standard business Large door to an old bank vault. Banks act as payment ... -

Korea's current account surplus with China dips 19.5% in 2015

작년 對중국 경상흑자 19.5% 급감…수출감소 영향 Korea's current account surplus with China is heading downhill... with the figure down for the second straight year. And, that's no good news for Korea - it could very well spell trouble as Beijing accounts for about a quarter of Korea's total exports. Kim Min-ji explains why Seoul may need a new export strategy. Korea's current account surplus with China is on a downward spiral. According to the Bank of Korea,... the country's current account surplus with China came to 45-point-1 billion U.S. dollars last year. That's down by almost 20 percent from a year ago,... and marks the second straight year of decline,... after a record high in 2013. Still,... China makes up over 40 percent of Korea's total current account surplus, which sat at 105-point-8 ... -

Korea's current account surplus with China dips 19.5% in 2015

작년 對중국 경상흑자 19.5% 급감…수출감소 영향 Korea's current account surplus with China is heading downhill.... and that could mean trouble, as Beijing accounts for about a quarter of Korea's total exports. Kim Min-ji explains why Seoul may need a new export strategy. Korea's current account surplus with China is on a downward spiral. According to the Bank of Korea,... the country's current account surplus with China came to 45-point-1 billion U.S. dollars last year. That's down by almost 20 percent from a year ago,... and marks the second straight year of decline,... after a record high in 2013. Still,... China makes up over 40 percent of Korea's total current account surplus, which sat at 105-point-8 billion last year. The central bank says a drop in exports of chemical products and displa... -

The C-operative bank current account launch

The television launch of The Co-operative bank's current account. Calm and serene in the middle of the daytime direct response television shouting competition - hence it working so utterly well. -

-

-

Bobby Hemmitt | Millenium Bug - Pt. 2 of 3

Watch the full lecture now! Just create an account here: http://siriustimes.com/estore/authentication?back=identity or log in to your current account. You will then have access to the members-only video programs we are adding to the site. Bobby Hemmitt | Millenium Bug - Pt. 2 of 3 https://youtu.be/-BnHgPs9rSk -

Bobby Hemmitt | Millenium Bug - Pt. 3 of 3

Watch the full lecture now! Just create an account here: http://siriustimes.com/estore/authentication?back=identity or log in to your current account. You will then have access to the members-only video programs we are adding to the site. Bobby Hemmitt | Millenium Bug - Pt. 3 of 3 https://youtu.be/GrhmfrHAngI -

Bobby Hemmitt | Agents of Chaos | Prelude to Moorish Science Conf. - Pt. 3 of 3

Watch the full lecture now! Just create an account here: http://siriustimes.com/estore/authentication?back=identity or log in to your current account. You will then have access to the members-only video programs we are adding to the site. Bobby Hemmitt | Agents of Chaos | Prelude to Moorish Science Conf. - Pt. 3 of 3 https://youtu.be/slYZxc1pg4c

Short & Sweet Home Loan from IDFC Bank : Save Time & Money

- Order: Reorder

- Duration: 0:55

- Updated: 18 Jun 2016

- views: 253

- published: 18 Jun 2016

- views: 253

bank

- Order: Reorder

- Duration: 3:06

- Updated: 17 Jun 2016

- views: 9

- published: 17 Jun 2016

- views: 9

Korea's current account surplus with China dips 19.5% in 2015

- Order: Reorder

- Duration: 2:06

- Updated: 17 Jun 2016

- views: 73

- published: 17 Jun 2016

- views: 73

Korea's current account surplus with China dips 19.5% in 2015

- Order: Reorder

- Duration: 1:59

- Updated: 17 Jun 2016

- views: 50

- published: 17 Jun 2016

- views: 50

The C-operative bank current account launch

- Order: Reorder

- Duration: 0:31

- Updated: 16 Jun 2016

- views: 0

- published: 16 Jun 2016

- views: 0

CNBC-TV18 Excl: CAD Surprises On The Positive Side

- Order: Reorder

- Duration: 2:36

- Updated: 16 Jun 2016

- views: 16

First OCE.

- Order: Reorder

- Duration: 0:16

- Updated: 16 Jun 2016

- views: 95

Bobby Hemmitt | Millenium Bug - Pt. 2 of 3

- Order: Reorder

- Duration: 61:33

- Updated: 15 Jun 2016

- views: 911

- published: 15 Jun 2016

- views: 911

Bobby Hemmitt | Millenium Bug - Pt. 3 of 3

- Order: Reorder

- Duration: 37:30

- Updated: 15 Jun 2016

- views: 825

- published: 15 Jun 2016

- views: 825

Bobby Hemmitt | Agents of Chaos | Prelude to Moorish Science Conf. - Pt. 3 of 3

- Order: Reorder

- Duration: 18:18

- Updated: 15 Jun 2016

- views: 675

- published: 15 Jun 2016

- views: 675

-

FEMA = Part 3 (Current Account Transactions)

A FREE Short Video By Prof. Shantanu Pethe (CACSCMA COACH) On FEMA 1999 / Current Account Transaction Rules, 2000 Definition of CAT [Sec 2(j)] Dealing in CAT [Sec 5] Foreign Exchange Management (CAT) Rules 2000 • Prohibited CAT (Schedule – I) • CAT required CG approval (Schedule-II) • CAT require RBI approval (Schedule-III) Current Account Transactions Definition of CAT [Sec 2(j)] Dealing in CAT [Sec 5] Foreign Exchange Management (CAT) Rules 2000 • Prohibited CAT (Schedule – I) • CAT required CG approval (Schedule-II) • CAT require RBI approval (Schedule-III) Definition: CURRENT ACCOUNT TRANSACTIONS [Section 2(j)]: Means a transaction other than a capital account transaction & Includes • Payments due in connection with foreign trad... -

L3/P1: Balance of Payment (BoP) & Current Account Deficit

Language: Hindi, Topics Covered: - Brief recap of the previous lectures - What is balance of payment (BoP)? Definition, methodology. - How is World’s balance of payment zero? - How is India’s balance of payment zero? and if so, why did we have a balance of payment crisis in 1991? - Two components of BoP: current account and capital account - Components current account balance: visible and invisible part. - Current Account: Services, income, transfer, gifts donations and remittances - Concepts: Balance of trade, trade deficit and trade surplus. Major imports and exports of India. - Calculating current account deficit and current account surplus. - Difference between FDI and FII - What is forex reserves? How is it built? What are the components of forex reserves? Powerpoint available at htt... -

Balance of payments and Current Account Deficit

Balance of Payments, BoP, Current account, Current account deficit, Forex, Forex reserves, Capital account, Balance of trade, Balance of invisibles, exports, imports, can be found here http://youtu.be/jOcVOt1xr60 -

ANURAG JAIN CLASSES - FEMA 1999 - CAPITAL ACCOUNT AND CURRENT ACCOUNT TRANSACTIONS

Classes for commerce education like CA, CS, ICWA, CMA. An introduction class of FEMA Do share it with your friends if you like the video Foreign Exchange Management (Current Account. Classes for commerce education like CA, CS, ICWA, CMA. An introduction class of FEMA Do share it with your friends if you like the video Foreign Exchange Management (Current Account Transactions) Rules, 2000 Company Secretary Executive Program Solved Question and Answers Naresh, an Indian Citi. -

The U.S. Current Account Deficit & the Global Economy

Recorded in October 2004, Lawrence H. Summers discusses the economic future of the U.S. in the global world. -

Introduction to Partnership [Preparation of Capital A/C] with Solved problem

To watch more tutorials, Just visit my YouTube channel link https://www.youtube.com/c/kauserwise and select play list, pls don't forget to subscribe. Accounts of partnership - Preparation of Capital Account with Solved problem, in this video we discussed about partnership deed, profit sharing ratio, interest on loan,interest on capital, salary of partner, interest on drawings, what is fluctuating method, fixed capital method, capital account and current account. -

The Big Picture - India's Current Account Deficit: Is it a crisis yet?

India's Current Account Deficit is at a historic high of 5.4% of the GDP. This is the highest CAD since 1949. P Chidambaram has suggested making gold imports costlier among other measures. An out of control "twin deficit" has compelled rating agencies like Fitch and Standard & Poor's to threaten to downgrade India's credit rating to 'Junk'. Anchor : Athar Khan -

The Balance of Payments On The Current Account - Economics AS Level Unit 2

This is a short revision video on the Balance of Payments on the Current Account :) It covers stuff required for AQA AS Level Economics :) -

[104] No Good Greek Current Account Surplus w/Yanis Varoufakis and Tech w/ Alex Daley

Our lead story: Toyota, the company that introduced the world to the first commercially successful gasoline elective hybrid car, better known as the PRIUS, is back with a new and radical concept car. Toyota Motors will launch a hydrogen-powered car in the United States, Japan, and Europe next year. Erin brings you the details. Then, Professor and economist Yanis Varoufakis throws some cold water on the sanguine attitudes of the markets towards Greek debt. His view is that things are much worse than the Greek bond sale suggests. For our second interview, Erin brings back Alex Daley of Casey Research to give us his expert tech views on security and crowdfunding in tech. This week's Accrued Interest takes a look at the past 100 episodes and gives you some of the clips viewers most liked as... -

Exchange rate manipulation, current account imbalances, and monetary policy

Workshop "Exchange Rate Regimes in Developing Countries" June 2013 at HTW Berlin. Exchange rate manipulation, current account imbalances, and monetary policy by Prof. Claus Thomasberger (HTW Berlin)

FEMA = Part 3 (Current Account Transactions)

- Order: Reorder

- Duration: 27:28

- Updated: 30 Nov 2015

- views: 5996

- published: 30 Nov 2015

- views: 5996

L3/P1: Balance of Payment (BoP) & Current Account Deficit

- Order: Reorder

- Duration: 54:38

- Updated: 21 Feb 2015

- views: 97957

- published: 21 Feb 2015

- views: 97957

Balance of payments and Current Account Deficit

- Order: Reorder

- Duration: 32:08

- Updated: 20 Oct 2013

- views: 25380

- published: 20 Oct 2013

- views: 25380

ANURAG JAIN CLASSES - FEMA 1999 - CAPITAL ACCOUNT AND CURRENT ACCOUNT TRANSACTIONS

- Order: Reorder

- Duration: 60:27

- Updated: 15 Jun 2014

- views: 8727

- published: 15 Jun 2014

- views: 8727

The U.S. Current Account Deficit & the Global Economy

- Order: Reorder

- Duration: 80:25

- Updated: 29 Apr 2009

- views: 3822

- published: 29 Apr 2009

- views: 3822

Introduction to Partnership [Preparation of Capital A/C] with Solved problem

- Order: Reorder

- Duration: 20:41

- Updated: 16 Feb 2016

- views: 9186

- published: 16 Feb 2016

- views: 9186

The Big Picture - India's Current Account Deficit: Is it a crisis yet?

- Order: Reorder

- Duration: 27:13

- Updated: 04 Jan 2013

- views: 2509

- published: 04 Jan 2013

- views: 2509

The Balance of Payments On The Current Account - Economics AS Level Unit 2

- Order: Reorder

- Duration: 20:32

- Updated: 29 Apr 2014

- views: 5374

- published: 29 Apr 2014

- views: 5374

[104] No Good Greek Current Account Surplus w/Yanis Varoufakis and Tech w/ Alex Daley

- Order: Reorder

- Duration: 27:59

- Updated: 18 Apr 2014

- views: 3564

- published: 18 Apr 2014

- views: 3564

Exchange rate manipulation, current account imbalances, and monetary policy

- Order: Reorder

- Duration: 34:06

- Updated: 22 Jul 2013

- views: 424

- published: 22 Jul 2013

- views: 424

- Playlist

- Chat

- Playlist

- Chat

Balance of payments: Current account | Foreign exchange and trade | Macroeconomics | Khan Academy

- Report rights infringement

- published: 07 May 2012

- views: 175534

AS/IB 11) Current Account of the Balance of Payments

- Report rights infringement

- published: 17 Apr 2014

- views: 32875

Current Account and Capital Account

- Report rights infringement

- published: 09 Apr 2013

- views: 12557

What is Current Account Deficit - HDFC Bank MONEY TALK

- Report rights infringement

- published: 07 Dec 2013

- views: 2137

The relationship between the Current Account Balance and Exchange Rates

- Report rights infringement

- published: 24 Feb 2012

- views: 70122

Current Account Deficit Consequences

- Report rights infringement

- published: 14 Mar 2015

- views: 19586

Balance of Payments (Current Account, Financial Account and Capital Account)

- Report rights infringement

- published: 14 Mar 2015

- views: 47419

AS/IB 12) Causes and Consequences of a Current Account Deficit

- Report rights infringement

- published: 17 Apr 2014

- views: 27745

10 UNDERSTANDING THE CURRENT ACCOUNT

- Report rights infringement

- published: 20 Jan 2010

- views: 14435

Balance of Payments - the Current Account

- Report rights infringement

- published: 23 Oct 2015

- views: 1372

- Playlist

- Chat

Short & Sweet Home Loan from IDFC Bank : Save Time & Money

- Report rights infringement

- published: 18 Jun 2016

- views: 253

bank

- Report rights infringement

- published: 17 Jun 2016

- views: 9

Korea's current account surplus with China dips 19.5% in 2015

- Report rights infringement

- published: 17 Jun 2016

- views: 73

Korea's current account surplus with China dips 19.5% in 2015

- Report rights infringement

- published: 17 Jun 2016

- views: 50

The C-operative bank current account launch

- Report rights infringement

- published: 16 Jun 2016

- views: 0

CNBC-TV18 Excl: CAD Surprises On The Positive Side

- Report rights infringement

- published: 16 Jun 2016

- views: 16

First OCE.

- Report rights infringement

- published: 16 Jun 2016

- views: 95

Bobby Hemmitt | Millenium Bug - Pt. 2 of 3

- Report rights infringement

- published: 15 Jun 2016

- views: 911

Bobby Hemmitt | Millenium Bug - Pt. 3 of 3

- Report rights infringement

- published: 15 Jun 2016

- views: 825

Bobby Hemmitt | Agents of Chaos | Prelude to Moorish Science Conf. - Pt. 3 of 3

- Report rights infringement

- published: 15 Jun 2016

- views: 675

- Playlist

- Chat

FEMA = Part 3 (Current Account Transactions)

- Report rights infringement

- published: 30 Nov 2015

- views: 5996

L3/P1: Balance of Payment (BoP) & Current Account Deficit

- Report rights infringement

- published: 21 Feb 2015

- views: 97957

Balance of payments and Current Account Deficit

- Report rights infringement

- published: 20 Oct 2013

- views: 25380

ANURAG JAIN CLASSES - FEMA 1999 - CAPITAL ACCOUNT AND CURRENT ACCOUNT TRANSACTIONS

- Report rights infringement

- published: 15 Jun 2014

- views: 8727

The U.S. Current Account Deficit & the Global Economy

- Report rights infringement

- published: 29 Apr 2009

- views: 3822

Introduction to Partnership [Preparation of Capital A/C] with Solved problem

- Report rights infringement

- published: 16 Feb 2016

- views: 9186

The Big Picture - India's Current Account Deficit: Is it a crisis yet?

- Report rights infringement

- published: 04 Jan 2013

- views: 2509

The Balance of Payments On The Current Account - Economics AS Level Unit 2

- Report rights infringement

- published: 29 Apr 2014

- views: 5374

[104] No Good Greek Current Account Surplus w/Yanis Varoufakis and Tech w/ Alex Daley

- Report rights infringement

- published: 18 Apr 2014

- views: 3564

Exchange rate manipulation, current account imbalances, and monetary policy

- Report rights infringement

- published: 22 Jul 2013

- views: 424

France trolls the UK over Brexit result: 'Don't trust a nation that can't behead its Queen'

Edit The Independent 25 Jun 2016Naked Taylor Swift, Kim Kardashian star in Kayne West music video

Edit Toronto Sun 25 Jun 2016Can wounds ever heal in divided UK?

Edit CNN 26 Jun 2016Archaeologists Find Skeletons, Gold Coins In Buried Pompeii Shop

Edit WorldNews.com 24 Jun 2016Gunmen take guests hostage after blast at Somalia hotel

Edit Boston Herald 25 Jun 2016Economic Resilience Maintained in Indonesia despite Brexit (Bank Indonesia)

Edit Public Technologies 26 Jun 2016Indira Gandhi converted India into a 'dynastic regime': Arun Jaitley

Edit The Times of India 26 Jun 2016Red Cross Responds to Grassley Memo: Defends Transparency and Spending of Donor Dollars in Haiti (The American National Red Cross)

Edit Public Technologies 26 Jun 2016Emergency a blot on Congress history, Jaitley slams 'dictator' Indira

Edit Deccan Chronicle 26 Jun 201623 dead in West Virginia floods

Edit Arabnews 26 Jun 2016Department of Defense will lift ban on transgenders serving in the military

Edit The Examiner 26 Jun 2016Shane Warne’s ex-girlfriend Emily Scott shares nude pictures

Edit Deccan Chronicle 26 Jun 2016Could the TTC end up running the UP Express?

Edit Toronto Sun 26 Jun 2016Commentary: Have citizens set ethics standards for pols

Edit Philadelphia Daily News 26 Jun 2016The eco guide to having a drink

Edit The Observer 26 Jun 2016Arizona's Death Penalty Fades Away

Edit The Atlantic 26 Jun 2016Expanded Panama Canal: Bigger ships, more benefits for beans, coal, gas

Edit Indian Express 26 Jun 2016Exports from SEZs up marginally at Rs 4.67 lakh cr in FY16

Edit The Times of India 26 Jun 2016- 1

- 2

- 3

- 4

- 5

- Next page »