- published: 14 Mar 2013

- views: 44654

-

remove the playlistSales Tax

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistSales Tax

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 12 Aug 2013

- views: 4847

- published: 30 Mar 2012

- views: 77525

- published: 22 May 2009

- views: 38311

- published: 22 Dec 2014

- views: 4233

- published: 29 Apr 2008

- views: 18932

- published: 27 Oct 2014

- views: 12354

Sales tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow (or require) the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the exemption of certain goods or services from sales and use tax.

Types

Conventional or retail sales tax is levied on the sale of a good to its final end user and is charged every time that item is sold retail. Sales to businesses that later resell the goods are not charged the tax. A purchaser not an end user is usually issued a "resale certificate" by the taxing authority and required to provide the certificate (or its ID number) to a seller at the point of purchase, along with a statement that the item is for resale. The tax is otherwise charged on each item sold to purchasers without such a certificate and who are under the jurisdiction of the taxing authority.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Sales

A sale is the exchange of a commodity or money as the price of a good or a service.Sales (plural only) is activity related to selling or the amount of sold goods or services in a given time period.

The seller or the provider of the goods or services completes a sale in response to an acquisition, appropriation,requisition or a direct interaction with the buyer at the point of sale. There is a passing of title (property or ownership) of the item, and the settlement of a price, in which agreement is reached on a price for which transfer of ownership of the item will occur. The seller, not the purchaser generally executes the sale and it may be completed prior to the obligation of payment. In the case of indirect interaction, a person who sells goods or service on behalf of the owner is known as salesman or saleswoman.

In common law countries, sales are governed generally by the common law and commercial codes. In the United States, the laws governing sales of goods are somewhat uniform to the extent that most jurisdictions have adopted Article 2 of the Uniform Commercial Code, albeit with some non-uniform variations.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

6:08

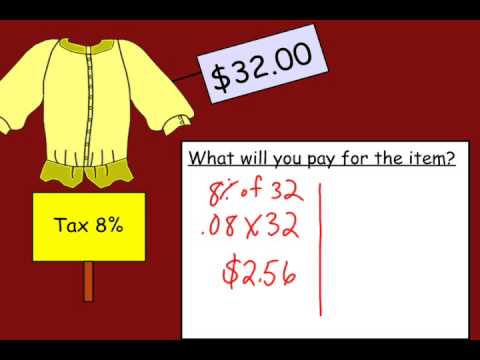

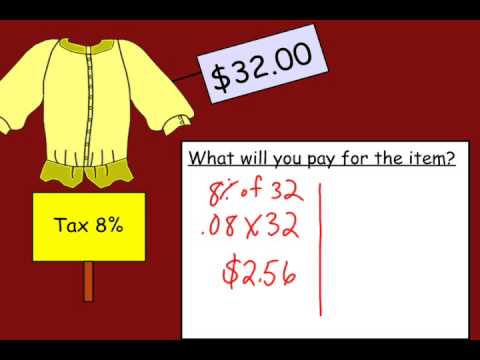

6:08Calculating Sales Tax

Calculating Sales TaxCalculating Sales Tax

-

66:24

66:24Central Sales Tax - CST - AY 14-15 - Lecture 1

Central Sales Tax - CST - AY 14-15 - Lecture 1Central Sales Tax - CST - AY 14-15 - Lecture 1

To Buy our CA / CS video lectures call at 0551-6050551. -

5:40

5:40What is Sales Tax?

What is Sales Tax?What is Sales Tax?

Starting a new business, or just thinking about it? Need a refresher on what the state requires of you as a retailer? This Minnesota Department of Revenue video lays out the basics of what you need to know about your state sales tax obligations. It covers what items are taxable and what aren't and what the tax rate is. It also brings you up-to-date on some of the changes made to sales tax by the Legislature in 2013. For more information, go to our website at http://revenue.state.mn.us. Click on "Sales & Use Tax" under the "For Businesses" heading. -

15:24

15:24Central Sales Tax - CST

Central Sales Tax - CST -

6:57

6:57Understanding VAT (Value Added Tax) & CST (Central Sales Tax) in India

Understanding VAT (Value Added Tax) & CST (Central Sales Tax) in IndiaUnderstanding VAT (Value Added Tax) & CST (Central Sales Tax) in India

VAT is a multi-point tax on value addition which is collected at different stages of sale. VAT is applicable to intra-state sales. CST is same as VAT and is applicable for Inter-state sales only. In this episode of "Whiteboad Friday", the eLagaan team explains, the concept behind Value Added Taxes popularly known as VAT & Central Sales Taxes popularly known as CST, who needs it & why it is needed. What are the various returns related to VAT & CST and what records do businesses need to maintain to stay compliant. - More @Pluggd.in/TV -

147:15

147:15Central Sales Tax : CST : AY 16-17

Central Sales Tax : CST : AY 16-17 -

1:04

1:04Math Help & Teaching : How to Calculate a Sales Tax

Math Help & Teaching : How to Calculate a Sales TaxMath Help & Teaching : How to Calculate a Sales Tax

Calculating sales tax can be very simple, but it's important to know the sales tax of a particular area. Find out how to use decimals and multiplication to calculate sales tax with help from an experienced teacher in this free video on basic math. Expert: Susan Goms Bio: Susan Goms has been a middle school teacher for more than 30 years, teaching special education in West Jordan, Utah. Filmmaker: Michael Burton -

9:10

9:10How to Set Up, File and Manage Sales Tax in QuickBooks Online

How to Set Up, File and Manage Sales Tax in QuickBooks OnlineHow to Set Up, File and Manage Sales Tax in QuickBooks Online

Learn how to set up sales tax, how to track them on transactions and also how to file sales tax in QuickBooks Online. Everything you need to know on this topic to ensure you are set up for success right the first time! To learn more about QuickBooks Online Accountant, Canada's industry-leading professional accounting software, visit our web site at: www.proadvisor.ca Or visit our customer support site at: http://support.intuit.ca/quickbooks/canada.jsp -

8:47

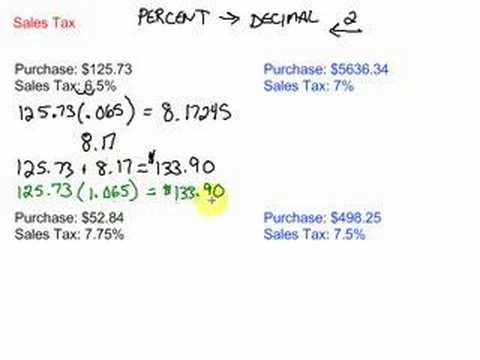

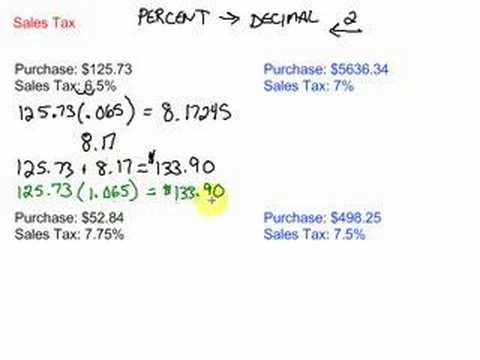

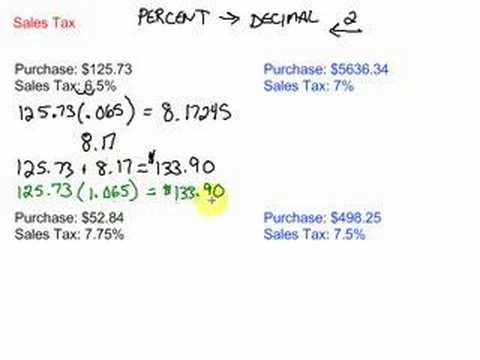

8:47Finding Sales Tax

Finding Sales TaxFinding Sales Tax

This video walks through a one and two-step method for finding sales tax. It includes 4 examples. -

5:01

5:01How to Calculate Sales Tax

How to Calculate Sales TaxHow to Calculate Sales Tax

A little math lesson I created this video with the YouTube Video Editor (http://www.youtube.com/editor)

-

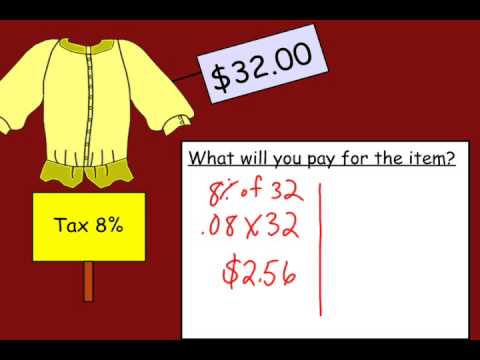

Calculating Sales Tax

-

Central Sales Tax - CST - AY 14-15 - Lecture 1

To Buy our CA / CS video lectures call at 0551-6050551. -

What is Sales Tax?

Starting a new business, or just thinking about it? Need a refresher on what the state requires of you as a retailer? This Minnesota Department of Revenue video lays out the basics of what you need to know about your state sales tax obligations. It covers what items are taxable and what aren't and what the tax rate is. It also brings you up-to-date on some of the changes made to sales tax by the Legislature in 2013. For more information, go to our website at http://revenue.state.mn.us. Click on "Sales & Use Tax" under the "For Businesses" heading. -

-

Understanding VAT (Value Added Tax) & CST (Central Sales Tax) in India

VAT is a multi-point tax on value addition which is collected at different stages of sale. VAT is applicable to intra-state sales. CST is same as VAT and is applicable for Inter-state sales only. In this episode of "Whiteboad Friday", the eLagaan team explains, the concept behind Value Added Taxes popularly known as VAT & Central Sales Taxes popularly known as CST, who needs it & why it is needed. What are the various returns related to VAT & CST and what records do businesses need to maintain to stay compliant. - More @Pluggd.in/TV -

-

Math Help & Teaching : How to Calculate a Sales Tax

Calculating sales tax can be very simple, but it's important to know the sales tax of a particular area. Find out how to use decimals and multiplication to calculate sales tax with help from an experienced teacher in this free video on basic math. Expert: Susan Goms Bio: Susan Goms has been a middle school teacher for more than 30 years, teaching special education in West Jordan, Utah. Filmmaker: Michael Burton -

How to Set Up, File and Manage Sales Tax in QuickBooks Online

Learn how to set up sales tax, how to track them on transactions and also how to file sales tax in QuickBooks Online. Everything you need to know on this topic to ensure you are set up for success right the first time! To learn more about QuickBooks Online Accountant, Canada's industry-leading professional accounting software, visit our web site at: www.proadvisor.ca Or visit our customer support site at: http://support.intuit.ca/quickbooks/canada.jsp -

Finding Sales Tax

This video walks through a one and two-step method for finding sales tax. It includes 4 examples. -

How to Calculate Sales Tax

A little math lesson I created this video with the YouTube Video Editor (http://www.youtube.com/editor)

Calculating Sales Tax

- Order: Reorder

- Duration: 6:08

- Updated: 14 Mar 2013

- views: 44654

- published: 14 Mar 2013

- views: 44654

Central Sales Tax - CST - AY 14-15 - Lecture 1

- Order: Reorder

- Duration: 66:24

- Updated: 27 May 2014

- views: 53608

- published: 27 May 2014

- views: 53608

What is Sales Tax?

- Order: Reorder

- Duration: 5:40

- Updated: 12 Aug 2013

- views: 4847

- published: 12 Aug 2013

- views: 4847

Central Sales Tax - CST

- Order: Reorder

- Duration: 15:24

- Updated: 20 Aug 2014

- views: 17055

Understanding VAT (Value Added Tax) & CST (Central Sales Tax) in India

- Order: Reorder

- Duration: 6:57

- Updated: 30 Mar 2012

- views: 77525

- published: 30 Mar 2012

- views: 77525

Central Sales Tax : CST : AY 16-17

- Order: Reorder

- Duration: 147:15

- Updated: 21 Dec 2015

- views: 10612

Math Help & Teaching : How to Calculate a Sales Tax

- Order: Reorder

- Duration: 1:04

- Updated: 22 May 2009

- views: 38311

- published: 22 May 2009

- views: 38311

How to Set Up, File and Manage Sales Tax in QuickBooks Online

- Order: Reorder

- Duration: 9:10

- Updated: 22 Dec 2014

- views: 4233

- published: 22 Dec 2014

- views: 4233

Finding Sales Tax

- Order: Reorder

- Duration: 8:47

- Updated: 29 Apr 2008

- views: 18932

- published: 29 Apr 2008

- views: 18932

How to Calculate Sales Tax

- Order: Reorder

- Duration: 5:01

- Updated: 27 Oct 2014

- views: 12354

- published: 27 Oct 2014

- views: 12354

-

Budget tightening makes sales tax holiday look doubtful

Massachusetts shoppers might not have a sales tax holiday this year, which could cost the state tens of millions of dollars. -

Leading Tax Group San Diego (Los Angeles Tax Attorney rated #1 Tax Lawyers in the country!)

Leading Tax Group is a premier collective of experienced Tax Attorneys, Enrolled Agents, Paralegals, CPAs and support staff. Leading Tax Group is the #1 Tax Resolution Firm in the Country! Our focused mission is to provide impeccable service and guidance to our clients from the very first day until your case is settled on YOUR terms, not the IRS's. The Experienced Tax Attorneys specialize in Offer in Compromise, IRS penalty & interest removal, IRS penalty reduction, Audit Representation, Payroll tax representation, Sales tax representation, Revenue Officer (RO) representation, EDD representation & More. The experienced Tax Lawyers can also help prevent IRS Bank Levies, IRS Wage Garnishments & even criminal charges. If you have a tax problem, this is the Firm to call. IRS Business tax d... -

Leading Tax Group Santa Monica (Los Angeles Tax Attorneys rated #1 in the country!)

Leading Tax Group is a premier collective of experienced Tax Attorneys, Enrolled Agents, Paralegals, CPAs and support staff. Leading Tax Group is the #1 Tax Resolution Firm in the Country! Our focused mission is to provide impeccable service and guidance to our clients from the very first day until your case is settled on YOUR terms, not the IRS's. The Experienced Tax Attorneys specialize in Offer in Compromise, IRS penalty & interest removal, IRS penalty reduction, Audit Representation, Payroll tax representation, Sales tax representation, Revenue Officer (RO) representation, EDD representation & More. The experienced Tax Lawyers can also help prevent IRS Bank Levies, IRS Wage Garnishments & even criminal charges. If you have a tax problem, this is the Firm to call. IRS Business tax d... -

Leading Tax Group Westlake Office (Los Angeles Tax Attorneys rated #1 Tax Lawyers in the country!)

Leading Tax Group is a premier collective of experienced Tax Attorneys, Enrolled Agents, Paralegals, CPAs and support staff. Leading Tax Group is the #1 Tax Resolution Firm in the Country! Our focused mission is to provide impeccable service and guidance to our clients from the very first day until your case is settled on YOUR terms, not the IRS's. The Experienced Tax Attorneys specialize in Offer in Compromise, IRS penalty & interest removal, IRS penalty reduction, Audit Representation, Payroll tax representation, Sales tax representation, Revenue Officer (RO) representation, EDD representation & More. The experienced Tax Lawyers can also help prevent IRS Bank Levies, IRS Wage Garnishments & even criminal charges. If you have a tax problem, this is the Firm to call. IRS Business tax d... -

Leading Tax Group Pasadena Office (Los Angeles Tax Attorneys rated #1 Tax Lawyers in the country!)

Leading Tax Group is a premier collective of experienced Tax Attorneys, Enrolled Agents, Paralegals, CPAs and support staff. Leading Tax Group is the #1 Tax Resolution Firm in the Country! Our focused mission is to provide impeccable service and guidance to our clients from the very first day until your case is settled on YOUR terms, not the IRS's. The Experienced Tax Attorneys specialize in Offer in Compromise, IRS penalty & interest removal, IRS penalty reduction, Audit Representation, Payroll tax representation, Sales tax representation, Revenue Officer (RO) representation, EDD representation & More. The experienced Tax Lawyers can also help prevent IRS Bank Levies, IRS Wage Garnishments & even criminal charges. If you have a tax problem, this is the Firm to call. IRS Business tax d... -

Leading Tax Group Beverly Hills Office (Los Angeles Tax Attorneys rated #1 in the country!)

Leading Tax Group is a premier collective of experienced Tax Attorneys, Enrolled Agents, Paralegals, CPAs and support staff. Leading Tax Group is the #1 Tax Resolution Firm in the Country! Our focused mission is to provide impeccable service and guidance to our clients from the very first day until your case is settled on YOUR terms, not the IRS's. The Experienced Tax Attorneys specialize in Offer in Compromise, IRS penalty & interest removal, IRS penalty reduction, Audit Representation, Payroll tax representation, Sales tax representation, Revenue Officer (RO) representation, EDD representation & More. The experienced Tax Lawyers can also help prevent IRS Bank Levies, IRS Wage Garnishments & even criminal charges. If you have a tax problem, this is the Firm to call. IRS Business tax d... -

We'll Pay Your Sales Tax! | EXTENDED 4th of July Sales Event | East Tennessee Dodge

Get Pre-Approved Here: http://www.easttennesseedodge.com/financing.htm Dealer Serving Crossville TN | Bad Credit Bankruptcy Auto Loan East Tennessee Dodge of Crossville sells high quality low cost Pre-owned & Certified Used Dodge, Chrysler and Jeep, cars, trucks, SUVs & minivans to customers in Crossville, Tennessee. We're honored to serve the Crossville, TN area. We promise that your experience at our dealership will exceed your expectations! See Our New Dodge, Chrysler and Jeep Inventory: http://www.easttennesseedodge.com/new-inventory/index.htm?reset=InventoryListing See Our Used Car Inventory: http://www.easttennesseedodge.com/used-inventory/index.htm?reset=InventoryListing Get An Instant Cash Trade-in Value Offer Here: http://www.easttennesseedodge.com/what-is-my-trade-worth.... -

-

We'll Pay Your Sales Tax! | Independence Day EXTENDED Sales Event | Victory Honda serving Elyria OH

Get Pre-Approved Here: http://www.victorysandusky.com/financing/application-short.htm Dealer Serving Sandusky & Cleveland OH | Bad Credit Bankruptcy Auto Loan Victory Honda of Sandusky sells high quality low cost Pre-owned & Certified Used Honda cars, trucks, SUVs & minivans to customers in Sandusky& Cleveland, Ohio. We're honored to serve the Sandusky & Cleveland, OH area. We promise that your experience at our dealership will exceed your expectations! See Our New Honda Inventory: http://www.victorysandusky.com/new-inventory/index.htm See Our Used Car Inventory: http://www.victorysandusky.com/used-inventory/index.htm Get Your Trade-in Value Offer Here: http://www.victorysandusky.com/value-your-trade.htm We will buy your car even if you don't buy ours. We will give you 125% of th... -

Clarifying the Home Sales Tax Exclusion

http://bottledbusinesssenseshow.com If you qualify for this exclusion, you may do anything you want with the tax-free proceeds from the sale. You are not required to reinvest the money in another house. But, if you do buy another home, you can qualify for the exclusion again when you sell that house. Indeed, you can use the exclusion any number of times over your lifetime as long as you satisfy the necessary requirements. Join us this Tuesday to learn more on the Bottled Business Sense Show. Bill Bernard – WFBLegalConsulting.com bill@wfblegalconsulting.com 949.698.6222 Rick Moscoso – Captivate365.com rick@captivate365.com 949.667.1182 The Bottled Business Sense Show provides practical business perspectives that uniquely emphasize both legal and media marketing strategies that protect ...

Budget tightening makes sales tax holiday look doubtful

- Order: Reorder

- Duration: 1:16

- Updated: 11 Jul 2016

- views: 2

- published: 11 Jul 2016

- views: 2

Leading Tax Group San Diego (Los Angeles Tax Attorney rated #1 Tax Lawyers in the country!)

- Order: Reorder

- Duration: 0:55

- Updated: 11 Jul 2016

- views: 0

- published: 11 Jul 2016

- views: 0

Leading Tax Group Santa Monica (Los Angeles Tax Attorneys rated #1 in the country!)

- Order: Reorder

- Duration: 0:56

- Updated: 11 Jul 2016

- views: 0

- published: 11 Jul 2016

- views: 0

Leading Tax Group Westlake Office (Los Angeles Tax Attorneys rated #1 Tax Lawyers in the country!)

- Order: Reorder

- Duration: 0:56

- Updated: 11 Jul 2016

- views: 1

- published: 11 Jul 2016

- views: 1

Leading Tax Group Pasadena Office (Los Angeles Tax Attorneys rated #1 Tax Lawyers in the country!)

- Order: Reorder

- Duration: 0:56

- Updated: 11 Jul 2016

- views: 1

- published: 11 Jul 2016

- views: 1

Leading Tax Group Beverly Hills Office (Los Angeles Tax Attorneys rated #1 in the country!)

- Order: Reorder

- Duration: 0:55

- Updated: 11 Jul 2016

- views: 2

- published: 11 Jul 2016

- views: 2

We'll Pay Your Sales Tax! | EXTENDED 4th of July Sales Event | East Tennessee Dodge

- Order: Reorder

- Duration: 0:31

- Updated: 11 Jul 2016

- views: 0

- published: 11 Jul 2016

- views: 0

City council to vote on sales tax increase

- Order: Reorder

- Duration: 2:04

- Updated: 11 Jul 2016

- views: 3

We'll Pay Your Sales Tax! | Independence Day EXTENDED Sales Event | Victory Honda serving Elyria OH

- Order: Reorder

- Duration: 0:31

- Updated: 11 Jul 2016

- views: 6

- published: 11 Jul 2016

- views: 6

Clarifying the Home Sales Tax Exclusion

- Order: Reorder

- Duration: 37:12

- Updated: 11 Jul 2016

- views: 0

- published: 11 Jul 2016

- views: 0

-

-

Sales Tax & ebay - Do I Need To Charge It? Why? How?

If you're an ebay seller, you need to aware of the laws in your state regarding sales tax. Do you have to charge it? If so, how do you set it up on ebay? We discuss. *IMPORTANT: The advice offered in this presentation is not professional tax advice. Please consult a professional. -

QuickBooks 2015 Tutorial Part 9: Manage Sales Tax | Setup | Code List | Use Tax | Pay Sales Tax

http://NewQuickBooks.com QuickBooks 2015 Tutorial Part 9: Manage Sales Tax | Setup Preferences | Code List | Liability | Use Tax | Pay Sales Tax 1) Sales Tax Preferences 2) Sales Tax Code List 3) Sales Tax Liability 4) Sales Tax Revenue Report 5) Adjust Sales Tax 6) Out of State / Use Tax 7) Pay Sales Tax http://NewQuickBooks.com -

Full Quickbooks Course Part 3 of 3 - Sales Tax

This video covers setting up and using the sales tax features of Quickbooks. In this three part instructional video course, professor Laura DeLaune goes over the ins and outs of how to use Intuit's Quickbooks. The version used is Quickbooks 2006, but the screens and methods are virtually unchanged and apply to the latest version of Quickbooks. Part 1 - Welcome To Quickbooks: https://www.youtube.com/watch?v=R247wAd7lko Part 2 - Set Up Your Company: https://www.youtube.com/watch?v=6CcVz3cM0dY Part 3 - Sales Tax: https://www.youtube.com/watch?v=5DsmxXa-D-w NOTICE: These videos are my property and should not be copied without my express permission. They were originally produced for the launch of a website called computershopvideo.com which never came into fruition because at that time yout... -

How to make & submit e - Sales Tax Return under Haryana Vat - A Detailed Procedure

Recently, The Excise and Taxation Department of Haryana has introduced Mandatory e filing of Vat Return. This video will help the people to understand the procedure of it. -

[UPDATED] Sales Tax Boot Camp for Amazon FBA Sellers

Learn the basics of sales tax collection and remittance for Amazon FBA sellers from industry expert Mark Faggiano of TaxJar. This webinar will take the mystery out of a complex topic with serious financial implications for your FBA business. Mark will cover when FBA sellers must collect sales tax, how to determine how much sales tax to collect, and what changes if the current federal sales tax legislation passes. After "Sales Tax Bootcamp," you will be armed with the tools and resources to take charge of this complicated part of your FBA business. -

Sales Tax Boot Camp for Shopify

Learn the basics of sales tax collection and remittance for Shopify from industry expert Mark Faggiano of TaxJar. This video will take the mystery out of a complex topic with serious financial implications for your business. Mark will cover when Shopify storeowners must collect sales tax, how to determine how much sales tax to collect, and what changes if the current federal sales tax legislation passes. After Sales Tax Bootcamp you will be armed with the tools and resources to take charge of this complicated part of your business. Presenter Mark Faggiano, industry expert and Founder and CEO of TaxJar - a service built to make post-transaction sales tax compliance easier for multi-channel ecommerce sellers. Mark previously co-founded and led FileLater to become the web's leading tax... -

Sales Tax 101 for Square Merchants Webinar

Learn the basics of sales tax collection and remittance from industry expert Mark Faggiano of TaxJar. This webinar will take the mystery out of a complex topic with serious financial implications for your business. Mark covers when Square merchants must collect sales tax and how to determine how much sales tax to collect. After "Sales Tax 101," you will be armed with the tools and resources to take charge of this complicated part of your Square business. Presenter Mark Faggiano, industry expert and Founder / CEO of TaxJar – a service built to make sales tax compliance easier for multi-channel ecommerce sellers. Mark previously co-founded and led FileLater to become the web’s leading tax extension service for both businesses and individual taxpayers.

Central Sales Tax - CST - AY 14-15 - Lecture 3

- Order: Reorder

- Duration: 101:48

- Updated: 31 May 2014

- views: 21711

Sales Tax & ebay - Do I Need To Charge It? Why? How?

- Order: Reorder

- Duration: 30:32

- Updated: 13 Feb 2015

- views: 3098

- published: 13 Feb 2015

- views: 3098

QuickBooks 2015 Tutorial Part 9: Manage Sales Tax | Setup | Code List | Use Tax | Pay Sales Tax

- Order: Reorder

- Duration: 33:32

- Updated: 03 Oct 2014

- views: 17227

- published: 03 Oct 2014

- views: 17227

Full Quickbooks Course Part 3 of 3 - Sales Tax

- Order: Reorder

- Duration: 21:21

- Updated: 07 Jan 2013

- views: 77431

- published: 07 Jan 2013

- views: 77431

How to make & submit e - Sales Tax Return under Haryana Vat - A Detailed Procedure

- Order: Reorder

- Duration: 31:41

- Updated: 08 Aug 2015

- views: 14176

- published: 08 Aug 2015

- views: 14176

[UPDATED] Sales Tax Boot Camp for Amazon FBA Sellers

- Order: Reorder

- Duration: 59:09

- Updated: 18 Jul 2014

- views: 8664

- published: 18 Jul 2014

- views: 8664

Sales Tax Boot Camp for Shopify

- Order: Reorder

- Duration: 38:37

- Updated: 04 Apr 2014

- views: 699

- published: 04 Apr 2014

- views: 699

Sales Tax 101 for Square Merchants Webinar

- Order: Reorder

- Duration: 50:58

- Updated: 14 Jan 2015

- views: 533

- published: 14 Jan 2015

- views: 533

- Playlist

- Chat

- Playlist

- Chat

Calculating Sales Tax

- Report rights infringement

- published: 14 Mar 2013

- views: 44654

Central Sales Tax - CST - AY 14-15 - Lecture 1

- Report rights infringement

- published: 27 May 2014

- views: 53608

What is Sales Tax?

- Report rights infringement

- published: 12 Aug 2013

- views: 4847

Central Sales Tax - CST

- Report rights infringement

- published: 20 Aug 2014

- views: 17055

Understanding VAT (Value Added Tax) & CST (Central Sales Tax) in India

- Report rights infringement

- published: 30 Mar 2012

- views: 77525

Central Sales Tax : CST : AY 16-17

- Report rights infringement

- published: 21 Dec 2015

- views: 10612

Math Help & Teaching : How to Calculate a Sales Tax

- Report rights infringement

- published: 22 May 2009

- views: 38311

How to Set Up, File and Manage Sales Tax in QuickBooks Online

- Report rights infringement

- published: 22 Dec 2014

- views: 4233

Finding Sales Tax

- Report rights infringement

- published: 29 Apr 2008

- views: 18932

How to Calculate Sales Tax

- Report rights infringement

- published: 27 Oct 2014

- views: 12354

- Playlist

- Chat

Budget tightening makes sales tax holiday look doubtful

- Report rights infringement

- published: 11 Jul 2016

- views: 2

Leading Tax Group San Diego (Los Angeles Tax Attorney rated #1 Tax Lawyers in the country!)

- Report rights infringement

- published: 11 Jul 2016

- views: 0

Leading Tax Group Santa Monica (Los Angeles Tax Attorneys rated #1 in the country!)

- Report rights infringement

- published: 11 Jul 2016

- views: 0

Leading Tax Group Westlake Office (Los Angeles Tax Attorneys rated #1 Tax Lawyers in the country!)

- Report rights infringement

- published: 11 Jul 2016

- views: 1

Leading Tax Group Pasadena Office (Los Angeles Tax Attorneys rated #1 Tax Lawyers in the country!)

- Report rights infringement

- published: 11 Jul 2016

- views: 1

Leading Tax Group Beverly Hills Office (Los Angeles Tax Attorneys rated #1 in the country!)

- Report rights infringement

- published: 11 Jul 2016

- views: 2

We'll Pay Your Sales Tax! | EXTENDED 4th of July Sales Event | East Tennessee Dodge

- Report rights infringement

- published: 11 Jul 2016

- views: 0

City council to vote on sales tax increase

- Report rights infringement

- published: 11 Jul 2016

- views: 3

We'll Pay Your Sales Tax! | Independence Day EXTENDED Sales Event | Victory Honda serving Elyria OH

- Report rights infringement

- published: 11 Jul 2016

- views: 6

Clarifying the Home Sales Tax Exclusion

- Report rights infringement

- published: 11 Jul 2016

- views: 0

- Playlist

- Chat

Central Sales Tax - CST - AY 14-15 - Lecture 3

- Report rights infringement

- published: 31 May 2014

- views: 21711

Sales Tax & ebay - Do I Need To Charge It? Why? How?

- Report rights infringement

- published: 13 Feb 2015

- views: 3098

QuickBooks 2015 Tutorial Part 9: Manage Sales Tax | Setup | Code List | Use Tax | Pay Sales Tax

- Report rights infringement

- published: 03 Oct 2014

- views: 17227

Full Quickbooks Course Part 3 of 3 - Sales Tax

- Report rights infringement

- published: 07 Jan 2013

- views: 77431

How to make & submit e - Sales Tax Return under Haryana Vat - A Detailed Procedure

- Report rights infringement

- published: 08 Aug 2015

- views: 14176

[UPDATED] Sales Tax Boot Camp for Amazon FBA Sellers

- Report rights infringement

- published: 18 Jul 2014

- views: 8664

Sales Tax Boot Camp for Shopify

- Report rights infringement

- published: 04 Apr 2014

- views: 699

Sales Tax 101 for Square Merchants Webinar

- Report rights infringement

- published: 14 Jan 2015

- views: 533

-

Lyrics list:lyrics

-

Sales Tax

-

Sales Tax

Sales Tax

These times now : ain't suiting me

*Account it* : costing a dollar three

Old Aunt Martha : live behind the jail

A sign on the wall : saying liquor for sale

I never seen : the likes since I been born

The women got the sales tax : on the South End home

You used to buy it : for a dollar round

Now sales tax is on it : all over town

I'm as loving : as a woman can be

The stuff I've got : will cost you a dollar and three

Now you may take me : to be a fool

Everything is sold : by the government rule

No US role in failed Turkish military coup: Kerry

Edit Deccan Herald 17 Jul 2016French PM says clear that Nice truck driver was radicalised quickly

Edit The Himalayan 17 Jul 2016Honor Killing: Pakistani Social Media Star Strangled to Death by brother

Edit Voa News 16 Jul 2016Why Mike Pence won't be Donald Trump's attack dog

Edit Business Insider 17 Jul 2016UK offered Brexit free trade deal with Australia

Edit BBC News 17 Jul 2016Shelby County property tax sale and Land Bank report record sales

Edit Commercial Appeal 17 Jul 2016Designer Tom Ford putting Santa Fe ranch up for sale

Edit The Miami Herald 17 Jul 2016DeKalb Commission may vote down sales tax for road repairs

Edit Atlanta Journal 17 Jul 2016Spykar eyes doubling sales to Rs 700 cr in 4 yrs

Edit The Times of India 17 Jul 2016Pre-Season: Fulham On General Sale (Crystal Palace Football Club (2000) Ltd)

Edit Public Technologies 17 Jul 2016WA Government divided on Western Power sale

Edit Australian Broadcasting Corporation 17 Jul 2016Insurance staff oppose stake sale

Edit The Hindu 17 Jul 2016Young family in Butler realizes 'short sales aren't short'

Edit North Jersey 17 Jul 2016Real Estate briefly: CBRE closes Swift & Swift sale in Orange for $4.45 million

Edit Orange County Register 17 Jul 2016Turkish bank postpones $300 million bond sale meeting

Edit Gulf News 17 Jul 2016- 1

- 2

- 3

- 4

- 5

- Next page »