- published: 11 Jun 2010

- views: 2362

-

remove the playlistFiscal Year

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistFiscal Year

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 01 Dec 2014

- views: 1828

- published: 21 Jul 2015

- views: 8122

- published: 31 Jan 2015

- views: 2612

- published: 23 Feb 2013

- views: 3246

- published: 25 Apr 2014

- views: 9194

- published: 10 Feb 2016

- views: 72

A fiscal year (or financial year, or sometimes budget year) is a period used for calculating annual ("yearly") financial statements in businesses and other organizations. In many jurisdictions, regulatory laws regarding accounting and taxation require such reports once per twelve months, but do not require that the period reported on constitutes a calendar year (that is, 1 January to 31 December). Fiscal years vary between businesses and countries. The "fiscal year" may also refer to the year used for income tax reporting.

Some companies choose to end their fiscal year on the same day of the week, such day being the one closest to a particular date (for example, the Friday closest to December 31). Under such a system, some fiscal years will have 52 weeks and others 53 weeks. Major corporations that adopt this approach include Cisco Systems.

In the United Kingdom, a number of major corporations that were once government owned, such as BT Group and the National Grid, continue to use the government's financial year, which ends on the last day of March, as they have found no reason to change since privatisation.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

2:59

2:59Fiscal Year, "Calendar Fiscal"

Fiscal Year, "Calendar Fiscal"Fiscal Year, "Calendar Fiscal"

What does a company's Fiscal Year establish? What relevance is my Fiscal Year year have to the timing of my reporting? What does Calendar Fiscal mean? Why do some companies not have a Calendar Fiscal year? -

13:25

13:25SAP FICO FISCAL YEAR LESSON - 4

SAP FICO FISCAL YEAR LESSON - 4 -

2:48

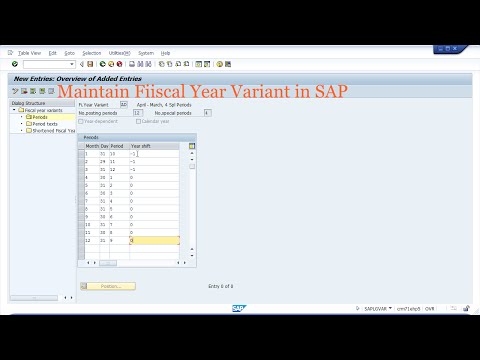

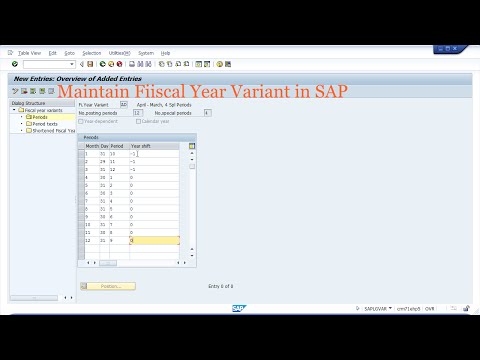

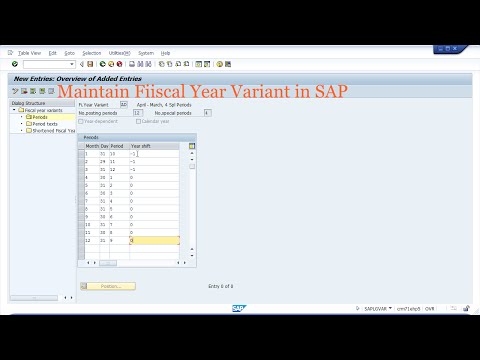

2:48How to create Fiscal year variant in SAP FICO

How to create Fiscal year variant in SAP FICOHow to create Fiscal year variant in SAP FICO

Next configuration step is defining fiscal year variant in SAP. What is fiscal year variant? - It is used to define financial year, it contains 12 posting periods and 4 special periods. Special periods are used to perform year end activities. We can create fiscal year variant by using transaction code "OB29" or Menu path: - Reference IMG – Financial Accounting – Global Settings – Fiscal Year – Maintain Fiscal Year Variant. For more details- http://www.saponlinetutorials.com/create-fiscal-year-variant-in-sap-fiscal-year-accounting-period/ -

20:28

20:28SAP FICO Training - Basic Settings2-Variants Fiscal Year (Video4) | SAP FICO

SAP FICO Training - Basic Settings2-Variants Fiscal Year (Video4) | SAP FICOSAP FICO Training - Basic Settings2-Variants Fiscal Year (Video4) | SAP FICO

SAP FICO Financial Accounting Training Please email to - info@studynest.org , call +61413159465 (Australia) or directly enroll here http://studynest.org/ SAP FICO - SAP Financial Accounting is one the largest functional core Module in SAP. It handles all the processes from “Record to Report”. The main operations this module handles are general ledger accounting, accounts payable, asset accounting, banking ledger etc. WHO SHOULD ATTEND - Those interested in gaining in-depth knowledge of SAP FI. (Example: Business analyst, project team members, consultants, SAP end users etc.) PREREQUISTIE - Basic knowledge of financial accounting is preferred. LEVEL - Basic to Intermediate. OBJECTIVES : • Understand and configure the SAP FI Organizational units, Master Data and documents. • Understand and utilise the SAP financial transactions involving General Ledger Accounting, Accounts Payable, Accounts Receivable and Banking. • Understand the configuration and applications of Asset Accounting. • Understand the integration between Asset Accounting and SAP Financials. • Utilize validations and Substitutions. -

56:44

56:44SAP FICO Fiscal Year Variant and Posting Period Variant

SAP FICO Fiscal Year Variant and Posting Period VariantSAP FICO Fiscal Year Variant and Posting Period Variant

Sekhar Gem Mobile 0091-9177234578 Email: sekhar.gem@gmail.com Skype : sekhar.gem -

6:05

6:05Microsoft Access Fiscal Year Calculations

Microsoft Access Fiscal Year CalculationsMicrosoft Access Fiscal Year Calculations

This video tutorial will teach you how to calculate a simple fiscal year in Microsoft Access (also called a tax year, or financial year). To learn more about fiscal year calculations, visit http://599CD.com/XHBY0M -

8:51

8:51Excel Magic Trick 1103: Formulas for Quarters, Fiscal Quarters & Fiscal Years

Excel Magic Trick 1103: Formulas for Quarters, Fiscal Quarters & Fiscal YearsExcel Magic Trick 1103: Formulas for Quarters, Fiscal Quarters & Fiscal Years

Download Excel File: http://people.highline.edu/mgirvin/ExcelIsFun.htm Formulas for Quarters, Fiscal Quarters & Fiscal Years: 1. (00:07 min) Quarters using CEILING and MONTH function 2. (02:48 min) Fiscal Quarter using LOOKUP and MONTH (barry Houdini trick!) 3. (05:24 min) Fiscal Quarter using IF, MONTH and CEILING 4. (06:40 min) Fiscal Year using YEAR and Boolean Math 5. -

5:38

5:38AutoCount Video 07 Manage Fiscal Year (with subtitle).wmv

AutoCount Video 07 Manage Fiscal Year (with subtitle).wmvAutoCount Video 07 Manage Fiscal Year (with subtitle).wmv

-

5:25

5:25Excel 2010 Working with Dates and Times Calculating fiscal years and quarters

Excel 2010 Working with Dates and Times Calculating fiscal years and quarters -

0:00

0:00U.S. Department of Veterans Affairs Budget Request for Fiscal Year 2017

U.S. Department of Veterans Affairs Budget Request for Fiscal Year 2017U.S. Department of Veterans Affairs Budget Request for Fiscal Year 2017

U.S. Department of Veterans Affairs Budget Request for Fiscal Year 2017 House Committee on Veterans' Affairs | 334 Cannon House Office Building Washington, DC 20515 | Feb 10, 2016 10:00am Witnesses Panel 1 The Honorable Robert A. McDonald, Secretary U.S. Department of Veterans Affairs Accompanied by: The Honorable David J. Shulkin, Under Secretary for Health, U.S. Department of Veterans Affairs Accompanied by: Danny Pummill Acting Under Secretary for Benefits Veterans Benefits Administration U.S. Department of Veterans Affairs Accompanied by: Mr. Ronald E. Walters, Acting Under Secretary for Memorial Affairs, National Cemetery Administration, U.S. Department of Veterans Affairs Accompanied by: The Honorable LaVerne Council Assistant Secretary for Information and Technology and Chief Information Officer, Office of Information and Technology, U.S. Department of Veterans Affairs Accompanied by: Ed Murray, Interim Secretary for Management, and Interim Chief Financial Officer, U.S. Department of Veterans Affairs Submissions for the Record Government Accountability Office Co-Authors of the Independent Budget AMVETS The American Legion

- 4-4-5 Calendar

- Accountancy

- Accountant

- Accounting

- Accounting period

- Accrual

- Akan calendar

- Armenian calendar

- Assyrian calendar

- Audit

- Auditor's report

- Australia

- Aztec calendar

- Babylonian calendar

- Bahá'í calendar

- Balance Sheet

- Balinese calendar

- Bengali calendar

- Berber calendar

- Bookkeeping

- Broadcast calendar

- BT Group

- Buddhist calendar

- Bulgar calendar

- Business

- Business group

- Byzantine calendar

- Calendar

- Calendar era

- Calendar of saints

- Calendar round

- Calendar year

- Canada

- Cash flow statement

- Celtic calendar

- Charlie McCreevy

- Chart of accounts

- Chartered Accountant

- Chinese calendar

- Cisco Systems

- Colombia

- Coptic calendar

- Corporate tax

- Cost accounting

- Cost of goods sold

- Costa Rica

- Darian calendar

- Debits and credits

- Discordian calendar

- Dreamspell

- Economic calendar

- Egypt

- Egyptian calendar

- Ethiopian calendar

- Fasli Calendar

- Financial audit

- Financial statement

- Fiscal year

- Forensic accounting

- Fund accounting

- General journal

- General ledger

- Georgian calendar

- Germanic calendar

- Germany

- Gregorian Calendar

- Gregorian calendar

- Haab'

- Hebrew calendar

- Hellenic calendars

- Hindu calendar

- Historical cost

- Hong Kong

- Igbo calendar

- Inca calendar

- Income statement

- Income tax

- India

- Internal audit

- Iranian calendars

- Irish calendar

- Islamic calendar

- ISO week date

- Japan

- Japanese calendar

- Javanese calendar

- Juche

- Julian calendar

- Julian Calendar

- Korean calendar

- Kurdish calendar

- Lady Day

- Law

- List of calendars

- Lithuanian calendar

- Liturgical year

- Lunar calendar

- Lunisolar calendar

- Malayalam calendar

- Matching principle

- Maya calendar

- Mexico

- Minguo calendar

- Mongolian calendar

- Myanmar

- Nanakshahi calendar

- National Grid (UK)

- Nepal Sambat

- New Year

- New Zealand

- Pakistan

- Pentecontad calendar

- Perpetual calendar

- Portugal

- Privatisation

- Rapa Nui calendar

- Republic of China

- Republic of Ireland

- Revenue recognition

- Roman calendar

- Rumi calendar

- Runic calendar

- Sarbanes–Oxley Act

- School year

- Singapore

- Solar calendar

- South Africa

- Soviet calendar

- Spain

- Special journal

- Stardate

- Sweden

- Swedish calendar

- Tamil calendar

- Tax

- Tax consolidation

- Template Accounting

- Template Calendars

- Thai lunar calendar

- Thai solar calendar

- The World Calendar

- Tibetan calendar

- Tonalpohualli

- Trade credit

- Trial balance

- Tzolk'in

- Tết

- United Arab Emirates

- United Kingdom

- United States

- Universities

- Vikram Samvat

- Vira Nirvana Samvat

- Wall calendar

- XBRL

- Xhosa calendar

- Xiuhpohualli

- Year zero

- Yoruba calendar

- Zoroastrian calendar

-

Fiscal Year, "Calendar Fiscal"

What does a company's Fiscal Year establish? What relevance is my Fiscal Year year have to the timing of my reporting? What does Calendar Fiscal mean? Why do some companies not have a Calendar Fiscal year? -

-

How to create Fiscal year variant in SAP FICO

Next configuration step is defining fiscal year variant in SAP. What is fiscal year variant? - It is used to define financial year, it contains 12 posting periods and 4 special periods. Special periods are used to perform year end activities. We can create fiscal year variant by using transaction code "OB29" or Menu path: - Reference IMG – Financial Accounting – Global Settings – Fiscal Year – Maintain Fiscal Year Variant. For more details- http://www.saponlinetutorials.com/create-fiscal-year-variant-in-sap-fiscal-year-accounting-period/ -

SAP FICO Training - Basic Settings2-Variants Fiscal Year (Video4) | SAP FICO

SAP FICO Financial Accounting Training Please email to - info@studynest.org , call +61413159465 (Australia) or directly enroll here http://studynest.org/ SAP FICO - SAP Financial Accounting is one the largest functional core Module in SAP. It handles all the processes from “Record to Report”. The main operations this module handles are general ledger accounting, accounts payable, asset accounting, banking ledger etc. WHO SHOULD ATTEND - Those interested in gaining in-depth knowledge of SAP FI. (Example: Business analyst, project team members, consultants, SAP end users etc.) PREREQUISTIE - Basic knowledge of financial accounting is preferred. LEVEL - Basic to Intermediate. OBJECTIVES : • Understand and configure the SAP FI Organizational units, Master Data and documents. • Understa... -

SAP FICO Fiscal Year Variant and Posting Period Variant

Sekhar Gem Mobile 0091-9177234578 Email: sekhar.gem@gmail.com Skype : sekhar.gem -

Microsoft Access Fiscal Year Calculations

This video tutorial will teach you how to calculate a simple fiscal year in Microsoft Access (also called a tax year, or financial year). To learn more about fiscal year calculations, visit http://599CD.com/XHBY0M -

Excel Magic Trick 1103: Formulas for Quarters, Fiscal Quarters & Fiscal Years

Download Excel File: http://people.highline.edu/mgirvin/ExcelIsFun.htm Formulas for Quarters, Fiscal Quarters & Fiscal Years: 1. (00:07 min) Quarters using CEILING and MONTH function 2. (02:48 min) Fiscal Quarter using LOOKUP and MONTH (barry Houdini trick!) 3. (05:24 min) Fiscal Quarter using IF, MONTH and CEILING 4. (06:40 min) Fiscal Year using YEAR and Boolean Math 5. -

AutoCount Video 07 Manage Fiscal Year (with subtitle).wmv

-

-

U.S. Department of Veterans Affairs Budget Request for Fiscal Year 2017

U.S. Department of Veterans Affairs Budget Request for Fiscal Year 2017 House Committee on Veterans' Affairs | 334 Cannon House Office Building Washington, DC 20515 | Feb 10, 2016 10:00am Witnesses Panel 1 The Honorable Robert A. McDonald, Secretary U.S. Department of Veterans Affairs Accompanied by: The Honorable David J. Shulkin, Under Secretary for Health, U.S. Department of Veterans Affairs Accompanied by: Danny Pummill Acting Under Secretary for Benefits Veterans Benefits Administration U.S. Department of Veterans Affairs Accompanied by: Mr. Ronald E. Walters, Acting Under Secretary for Memorial Affairs, National Cemetery Administration, U.S. Department of Veterans Affairs Accompanied by: The Honorable LaVerne Council Assistant Secretary for Information and Technology and Chief I...

Fiscal Year, "Calendar Fiscal"

- Order: Reorder

- Duration: 2:59

- Updated: 11 Jun 2010

- views: 2362

- published: 11 Jun 2010

- views: 2362

SAP FICO FISCAL YEAR LESSON - 4

- Order: Reorder

- Duration: 13:25

- Updated: 22 May 2014

- views: 6159

How to create Fiscal year variant in SAP FICO

- Order: Reorder

- Duration: 2:48

- Updated: 01 Dec 2014

- views: 1828

- published: 01 Dec 2014

- views: 1828

SAP FICO Training - Basic Settings2-Variants Fiscal Year (Video4) | SAP FICO

- Order: Reorder

- Duration: 20:28

- Updated: 21 Jul 2015

- views: 8122

- published: 21 Jul 2015

- views: 8122

SAP FICO Fiscal Year Variant and Posting Period Variant

- Order: Reorder

- Duration: 56:44

- Updated: 31 Jan 2015

- views: 2612

- published: 31 Jan 2015

- views: 2612

Microsoft Access Fiscal Year Calculations

- Order: Reorder

- Duration: 6:05

- Updated: 23 Feb 2013

- views: 3246

- published: 23 Feb 2013

- views: 3246

Excel Magic Trick 1103: Formulas for Quarters, Fiscal Quarters & Fiscal Years

- Order: Reorder

- Duration: 8:51

- Updated: 25 Apr 2014

- views: 9194

- published: 25 Apr 2014

- views: 9194

AutoCount Video 07 Manage Fiscal Year (with subtitle).wmv

- Order: Reorder

- Duration: 5:38

- Updated: 26 Sep 2012

- views: 3745

- published: 26 Sep 2012

- views: 3745

Excel 2010 Working with Dates and Times Calculating fiscal years and quarters

- Order: Reorder

- Duration: 5:25

- Updated: 13 Feb 2014

- views: 1279

U.S. Department of Veterans Affairs Budget Request for Fiscal Year 2017

- Order: Reorder

- Duration: 0:00

- Updated: 10 Feb 2016

- views: 72

- published: 10 Feb 2016

- views: 72

-

Marsabit County to employ 100 nurses

http://www.nation.co.ke Marsabit county government is set employ 100 nurses in the next fiscal year. Yusuf Ibrahim , Marsabit County Referral Hospital administrator said the facility was seeking more funds to employ more staff especially nurses to improve service delivery. -

Pakistan's biggest Per-Budget Transmission for FY 2016-17

Pre-Budget transmission for Fiscal Year 2016-17 with host Tarique Khan Javed & Co-Host Mahnoor Ali, where in show guest Dr. Mirza Ikhtiar Baig (Former Advisor to PM on Textile) and Malik M. Bostan (President, Forex Association of Pakistan) to discussed budget. -

Pakistan's biggest Post-Budget Transmission for FY 2016-17

Pakistan biggest Post-Budget Transmission for Fiscal Year 2016-17 with host Raja Suhail and Co-Host Rabeea Shehzad and having specialists Liaquat Ali, Director, Hascol Petroleum Limited, Arif Habib, Chairman, Arif Habib Group and Sirajuddin Aziz, President & CEO, Habib Metropolitan Bank Ltd, to discussed Budget 2016-17 -

-

Pakistan Budget 2016 by Ishaq Dar|HumQadam TV (ہم قدم ٹی وی)

Pakistan Budget 2016 -17 speech by Ishaq Dar (Part 03) Finance Minister Ishaq Dar presented the budget for the upcoming fiscal year 2016-17 on Friday, with an outlay of Rs4.394 trillion – a 7.3 per cent increase over the previous year – and a growth target set at 5.7pc. With Dar's concession that the agriculture sector's negative growth of -0.19pc dragged the economy down, there were expectations that the budget would come up with new measures to spur growth in the sector. -

Webinar: Grants & Federal Assistance

The Fiscal Year is about to began. Its time to get to work. This is a free webinar designed to introduce you to the world of grant writing. Please spread the word and I hope to see you on the Webinar. You can view the event via www.dynamicpowerpages.com -

1276 billion rupees deficit budget

The Finance Minister of Pakistan for the upcoming fiscal year 94 billion rupees worth of 43 trillion federal budget is announced, which is 7.3% more than last year. Finance Minister Hashish Dar announced a proposed budget for the fiscal year 2016-2017, which is the fourth of the budget the Government of Muslim League-Nazca. -

June 3, 2016 Financial News - Business News - Stock Exchange - Market News

June 3, 2016 Financial News - Business News - Stock Exchange - NYSE - Market News CLICK HERE➡ ➡ http://FinancialBuzz.com Business News - Financial News - Stock News -- New York Stock Exchange -- Market News 2016 Business News - Financial News - Stock Exchange -- Wall Street -- Market News - New York Stock Exchange 2016 This was a shortened holiday trading week but also a very busy, data heavy week for the U.S. economy. On Tuesday, the last trading day of May, stocks were mixed, personal spending jumped 1 percent in April, and the biggest increase in more than six years. Personal income rose 0.4 percent but consumer confidence declined in May to 92.6. The Chicago PMI reading for May fell to 49.3, indicating a slight contraction in manufacturing activity in the Midwest region. On We... -

Rock Band 4 News Madcatz Loses A Shit Ton Of Money on Disappointing Rock Band 4 Sales!

Rock Band 4 was a good game, but sales were tepid. So much so that publisher Mad Catz' quarterly earning report in February began with the layoff of 37% of its workforce and the resignations of several key executives. The yearly financials for the company are now out, and the numbers still aren't pretty. For fiscal year 2015, Mad Catz showing a profit of $4.7 million. However, this fiscal year ended with an $11.6 million loss. This despite that fact that earnings were supposedly up 55 percent. Mad Catz CEO Karen McGinnis said the company incurred about $6.8 million in charges in the final quarter because it had to write down and discount so many copies of the game with retailers. Rock Band 4 developer Harmonix ended its co-publishing deal with Mad Catz to team up with PDP, but Mad Catz st... -

Mayor Lee presents proposed Balanced Budget for Fiscal Years 2016-17 & 2017-18

Mayor’s Two-Year Budget Ensures San Francisco Remains a Safe & Resilient City with Additional Services to Address Homelessness, Invests in City’s Diverse Neighborhoods to Improve Quality of Life, Funds Comprehensive Police Reforms, Violence Prevention & Public Safety While Preserving High Level of City Services

Marsabit County to employ 100 nurses

- Order: Reorder

- Duration: 1:39

- Updated: 05 Jun 2016

- views: 13

- published: 05 Jun 2016

- views: 13

Pakistan's biggest Per-Budget Transmission for FY 2016-17

- Order: Reorder

- Duration: 41:58

- Updated: 04 Jun 2016

- views: 37

- published: 04 Jun 2016

- views: 37

Pakistan's biggest Post-Budget Transmission for FY 2016-17

- Order: Reorder

- Duration: 33:49

- Updated: 04 Jun 2016

- views: 56

- published: 04 Jun 2016

- views: 56

Budget of the United States Government, Fiscal Year 2012 by

- Order: Reorder

- Duration: 0:19

- Updated: 04 Jun 2016

- views: 0

Pakistan Budget 2016 by Ishaq Dar|HumQadam TV (ہم قدم ٹی وی)

- Order: Reorder

- Duration: 31:44

- Updated: 04 Jun 2016

- views: 33

- published: 04 Jun 2016

- views: 33

Webinar: Grants & Federal Assistance

- Order: Reorder

- Duration: 0:00

- Updated: 04 Jun 2016

- views: 0

- published: 04 Jun 2016

- views: 0

1276 billion rupees deficit budget

- Order: Reorder

- Duration: 0:31

- Updated: 04 Jun 2016

- views: 4

- published: 04 Jun 2016

- views: 4

June 3, 2016 Financial News - Business News - Stock Exchange - Market News

- Order: Reorder

- Duration: 3:51

- Updated: 03 Jun 2016

- views: 48

- published: 03 Jun 2016

- views: 48

Rock Band 4 News Madcatz Loses A Shit Ton Of Money on Disappointing Rock Band 4 Sales!

- Order: Reorder

- Duration: 1:39

- Updated: 03 Jun 2016

- views: 77

- published: 03 Jun 2016

- views: 77

Mayor Lee presents proposed Balanced Budget for Fiscal Years 2016-17 & 2017-18

- Order: Reorder

- Duration: 13:19

- Updated: 03 Jun 2016

- views: 4

- published: 03 Jun 2016

- views: 4

-

-

The Fiscal Year 2017 DOE Budget

More here: http://1.usa.gov/1TMKSUf -

20160427- Markup of H.R. 4909 NDAA for Fiscal Year 2017 Part 2 (ID: 104832)

As the markup goes on, the live stream will occasionally restart due to YouTube's 8 hour livestream limit. If you find yourself disconnected, check back on the HASC YouTube Channel page for the current livestream. -

20160315 "Fiscal Year 2017 Budget Request for National Security Space" (ID: 104620)

Hearing: Fiscal Year 2017 Budget Request for National Security Space Subcommittee on Strategic Forces (Committee on Armed Services) Tuesday, March 15, 2016 (3:30 PM) 2118 RHOB Washington, D.C. Witnesses Lieutenant General David Buck Commander, Joint Functional Component Command for Space Mr. Frank Calvelli The Honorable Robert Cardillo Director, National Geospatial Intelligence Agency General John Hyten Commander, Air Force Space Command The Honorable Doug Loverro Deputy Assistant Secretary of Defense for Space Policy, Department of Defense Mr. Dyke Weatherington -

-

-

20160316 The Fiscal Year 2017 National Defense Authorization Budget... (ID: 104662)

Hearing: The Fiscal Year 2017 National Defense Authorization Budget Request from the Military Committee on Armed Services Wednesday, March 16, 2016 (10:00 AM) 2118 RHOB Washington, D.C. Witnesses The Honorable Deborah L James Secretary of the Air Force, U.S. Air Force The Honorable Ray Mabus Secretary of the Navy, U.S. Navy General Mark A Milley Chief of Staff of the Army, U.S. Army Mr. Patrick J Murphy Acting Secretary of the Army, U.S. Army General Robert Neller Commandant of the Marine Corps, U.S. Marine Coprs Admiral John M Richardson Chief of Naval Operations, U.S. Navy General Mark A Welsh III Chief of Staff of the Air Force, U.S. Air Force

Budget Speech for Fiscal Year 2073/74

- Order: Reorder

- Duration: 92:55

- Updated: 28 May 2016

- views: 93

The Fiscal Year 2017 DOE Budget

- Order: Reorder

- Duration: 185:41

- Updated: 02 Mar 2016

- views: 138

20160427- Markup of H.R. 4909 NDAA for Fiscal Year 2017 Part 2 (ID: 104832)

- Order: Reorder

- Duration: 0:00

- Updated: 27 Apr 2016

- views: 1

- published: 27 Apr 2016

- views: 1

20160315 "Fiscal Year 2017 Budget Request for National Security Space" (ID: 104620)

- Order: Reorder

- Duration: 0:00

- Updated: 10 Mar 2016

- views: 0

- published: 10 Mar 2016

- views: 0

Executive Budget Recommendation - Fiscal Year 2017

- Order: Reorder

- Duration: 61:03

- Updated: 15 Jan 2016

- views: 896

Closing the Fiscal Year In Microsoft Dynamics NAV 2009

- Order: Reorder

- Duration: 47:54

- Updated: 29 Jan 2013

- views: 4491

20160316 The Fiscal Year 2017 National Defense Authorization Budget... (ID: 104662)

- Order: Reorder

- Duration: 0:00

- Updated: 10 Mar 2016

- views: 0

- published: 10 Mar 2016

- views: 0

- Playlist

- Chat

- Playlist

- Chat

Fiscal Year, "Calendar Fiscal"

- Report rights infringement

- published: 11 Jun 2010

- views: 2362

SAP FICO FISCAL YEAR LESSON - 4

- Report rights infringement

- published: 22 May 2014

- views: 6159

How to create Fiscal year variant in SAP FICO

- Report rights infringement

- published: 01 Dec 2014

- views: 1828

SAP FICO Training - Basic Settings2-Variants Fiscal Year (Video4) | SAP FICO

- Report rights infringement

- published: 21 Jul 2015

- views: 8122

SAP FICO Fiscal Year Variant and Posting Period Variant

- Report rights infringement

- published: 31 Jan 2015

- views: 2612

Microsoft Access Fiscal Year Calculations

- Report rights infringement

- published: 23 Feb 2013

- views: 3246

Excel Magic Trick 1103: Formulas for Quarters, Fiscal Quarters & Fiscal Years

- Report rights infringement

- published: 25 Apr 2014

- views: 9194

AutoCount Video 07 Manage Fiscal Year (with subtitle).wmv

- Report rights infringement

- published: 26 Sep 2012

- views: 3745

Excel 2010 Working with Dates and Times Calculating fiscal years and quarters

- Report rights infringement

- published: 13 Feb 2014

- views: 1279

U.S. Department of Veterans Affairs Budget Request for Fiscal Year 2017

- Report rights infringement

- published: 10 Feb 2016

- views: 72

- Playlist

- Chat

Marsabit County to employ 100 nurses

- Report rights infringement

- published: 05 Jun 2016

- views: 13

Pakistan's biggest Per-Budget Transmission for FY 2016-17

- Report rights infringement

- published: 04 Jun 2016

- views: 37

Pakistan's biggest Post-Budget Transmission for FY 2016-17

- Report rights infringement

- published: 04 Jun 2016

- views: 56

Budget of the United States Government, Fiscal Year 2012 by

- Report rights infringement

- published: 04 Jun 2016

- views: 0

Pakistan Budget 2016 by Ishaq Dar|HumQadam TV (ہم قدم ٹی وی)

- Report rights infringement

- published: 04 Jun 2016

- views: 33

Webinar: Grants & Federal Assistance

- Report rights infringement

- published: 04 Jun 2016

- views: 0

1276 billion rupees deficit budget

- Report rights infringement

- published: 04 Jun 2016

- views: 4

June 3, 2016 Financial News - Business News - Stock Exchange - Market News

- Report rights infringement

- published: 03 Jun 2016

- views: 48

Rock Band 4 News Madcatz Loses A Shit Ton Of Money on Disappointing Rock Band 4 Sales!

- Report rights infringement

- published: 03 Jun 2016

- views: 77

Mayor Lee presents proposed Balanced Budget for Fiscal Years 2016-17 & 2017-18

- Report rights infringement

- published: 03 Jun 2016

- views: 4

- Playlist

- Chat

Budget Speech for Fiscal Year 2073/74

- Report rights infringement

- published: 28 May 2016

- views: 93

The Fiscal Year 2017 DOE Budget

- Report rights infringement

- published: 02 Mar 2016

- views: 138

20160427- Markup of H.R. 4909 NDAA for Fiscal Year 2017 Part 2 (ID: 104832)

- Report rights infringement

- published: 27 Apr 2016

- views: 1

20160315 "Fiscal Year 2017 Budget Request for National Security Space" (ID: 104620)

- Report rights infringement

- published: 10 Mar 2016

- views: 0

Executive Budget Recommendation - Fiscal Year 2017

- Report rights infringement

- published: 15 Jan 2016

- views: 896

Closing the Fiscal Year In Microsoft Dynamics NAV 2009

- Report rights infringement

- published: 29 Jan 2013

- views: 4491

20160316 The Fiscal Year 2017 National Defense Authorization Budget... (ID: 104662)

- Report rights infringement

- published: 10 Mar 2016

- views: 0

Los Angeles Jury Sentences Suspect Known As 'Grim Sleeper' Killer To Death

Edit WorldNews.com 06 Jun 2016Libyan Government Forces Take Air Base Back From Islamic State

Edit WorldNews.com 06 Jun 2016Woman dies in second fatal Australian shark attack in a week

Edit CNN 06 Jun 2016In hunt for spies, Islamic State kills dozens of its own in Syria

Edit Indian Express 06 Jun 2016Restoration Work Begins On Jesus' Tomb In Jerusalem

Edit WorldNews.com 07 Jun 2016Press Release, 07.06.2016 Financial year 2015: Positive business trend despite headwinds (Burckhardt Compression Holding AG)

Edit Public Technologies 07 Jun 2016Governor set to brief lawmakers on budget cuts

Edit The Oklahoman 07 Jun 2016Small turnout for Providence budget plan hearing

Edit The Providence Journal 07 Jun 2016PM COMPLIMENTS FINANCE MINISTER (Prime Minister's Office of the Islamic Republic of Pakistan)

Edit Public Technologies 07 Jun 2016Do we really prefer robberies to rescued kids?

Edit Chicago Sun-Times 07 Jun 2016Public safety officials lay out budget proposals, request more staff

Edit Austin American Statesman 07 Jun 2016Monetary Base and the Bank of Japan's Transactions (May) [PDF 137KB] (Bank of Japan)

Edit Public Technologies 07 Jun 2016Cult of the leader

Edit Indian Express 07 Jun 2016Ron Kimble named interim city manager (City of Charlotte, NC)

Edit Public Technologies 07 Jun 2016RBI monetary policy review: It does not matter whether rate cut happens, says Abheek Barua

Edit Yahoo Daily News 07 Jun 2016Japan Trading Houses Knocking on Cuba’s Door Amid U.S. Opening

Edit Bloomberg 07 Jun 2016REMARKS BY SASC CHAIRMAN McCAIN OPENING DEBATE ON THE NATIONAL DEFENSE AUTHORIZATION ACT FOR FY17 (John McCain)

Edit Public Technologies 07 Jun 2016Alibaba starts building team for India foray

Edit The Times of India 07 Jun 2016- 1

- 2

- 3

- 4

- 5

- Next page »