IRR vs. Cash on Cash Multiples in Leveraged Buyouts and Investments

In this

IRR vs

Cash tutorial, you’ll learn the key distinctions between the internal rate of return (IRR).

By

http://breakingintowallstreet.com/ "Financial Modeling

Training And

Career Resources For Aspiring

Investment Bankers"

You will also learn further distinctions on the cash-on-cash multiple or money-on multiple when evaluating deals and investments – and you’ll understand why venture capital (VC) firms target one set of numbers, whereas private equity (PE) firms target a different set of numbers.

http://youtube-breakingintowallstreet-com.s3.amazonaws.com/109-05-IRR-vs-Cash-on-Cash-Multiples

.xlsx

Table of Contents:

1:35 Why Do IRR and Cash-on-Cash

Multiples Both

Matter?

3:05 What Do

Private Equity vs.

Venture Capital vs. Other

Firms Care About?

8:30 How to Use These

Metrics in

Real Life

11:08

Key Takeaways

Lesson Outline:

1. Why

Does This Matter?

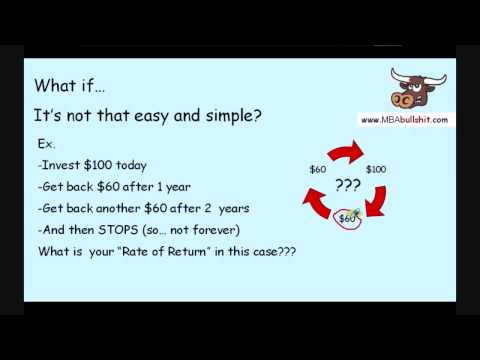

Because there are DIFFERENT ways to judge the success of a deal - 2 of the main ones for leveraged buyouts (LBOs), growth equity investments, and venture capital investments are the internal rate of return (IRR) and the cash-on-cash (CoC) or money-on-money (MoM) multiple.

Many investment firms will care a lot about one of these, but not the other, and will try to find investments that yield a high IRR or a high multiple… but not both.

The Difference: IRR factors in the time value of money - it's the effective, compounded interest rate on an investment. Whereas the multiple is simpler and ignores timing (e.g., $

1000 / $

100 = 10x multiple).

2. What Do

Different Firms Care About?

Most venture capital (VC) firms and early-stage investors want to earn a multiple of their money back - they don't care that much about IRR, because they're going to be invested for a VERY LONG time and it's not exactly liquid… and they don't care what the stock market does.

VC firms must be able to cover their losses with “the winners”! If they get 2x their capital back in 1 year (100% IRR) and then lose everything on another investment in 5 years’ time (0% IRR), the first result is completely irrelevant because they've only earned back 1x their capital.

Perfect Example: Harmonix, maker of

Guitar Hero - got VC investment in the mid-1990's, generated $0 in revenue for 5+ years, and then in

2005 released the hit video game Guitar Hero.

Sold for $

175 million to Viacom in

2006!

Massive multiple, but likely a pathetic IRR since it took 10+ years to get there.

Later-stage investors and private equity firms care more about IRR because the multiples will never be that high in late-stage deals, and because they are benchmarked against the public markets (e.g., the

S&P; 500) more

.

If the firm's IRR can't beat the stock market, why should you invest?

Most PE firms target at least a 20-25% IRR depending on the economy, deal environment, valuations, etc… less when things are bad, more in frothy times.

This makes it common to do "quick flip" deals where the company is bought and then sold at a MUCH higher multiple right after - simply to get a high IRR.

Real-Life Example:

Thoma Bravo (mid-market tech PE firm) bought

Digital Insight from

Intuit for $1.025 billion, and then sold it 4 months later for $1.65 billion to

NCR.

VERY high IRR - 316%! But only a ~1.6x money multiple, assuming no debt / no debt repayment.

http://dealbook.nytimes.com/

2013/12/02/sale-to-ncr-is-a-quick-profitable-flip-for-a-private-equity-firm/

3.

How Do You Use These Metrics

In Real Life?

How to calculate them: see the Atlassian or J.

Crew models. IRR is straightforward and uses built-in

Excel functions, but for the CoC or MoM multiple, you need to sum up all positive cash flows in the period and divide by the sum of all negative cash flows in that period, and flip

the

sign.

In the case of Atlassian, the deal is great for Accel because they earn a 15x multiple, even though the IRR is "only" 35%

... they do not care AT ALL because they are targeting the multiple, not the IRR.

For

T. Rowe Price, the multiple of 1.9x isn't great, but they do at least get a 14% IRR which is probably what they care about more since they are late-stage investors.

For the J. Crew deal, both the IRR and the multiple are very low and below what PE firms typically target, so this deal would be problematic to pursue, at least with these assumptions.

4. Key Takeaways

IRR and Cash-on-Cash or Money-on-Money multiples are related, but often move in opposite directions when the time period changes.

Different firms target different rates and metrics (VC/early stage - multiples, ideally over 10x or 3-5x later on; PE/late stage - IRR, ideally 20%+).

Calculation: IRR is simple, use the built-in IRR or XIRR in Excel; for the multiple, sum the positive returns/cash flows, divide by the negative returns/cash flows and flip the sign.

Judging deals:

Focus on multiples for earlier stage deals (and if you're pitching VCs to fund your company), and focus on IRR for later stage / growth equity / PE deals.