- published: 23 Jun 2015

- views: 2613

-

remove the playlistHigh-yield Debt

- remove the playlistHigh-yield Debt

- published: 28 May 2015

- views: 928

- published: 26 May 2015

- views: 617

- published: 03 Sep 2013

- views: 2075

- published: 22 Oct 2014

- views: 6463

- published: 13 Feb 2013

- views: 4722

- published: 27 Nov 2015

- views: 603

- published: 03 Dec 2015

- views: 181

- published: 15 Dec 2014

- views: 1726

- published: 15 Jun 2015

- views: 1002

In finance, a high-yield bond (non-investment-grade bond, speculative-grade bond, or junk bond) is a bond that is rated below investment grade. These bonds have a higher risk of default or other adverse credit events, but typically pay higher yields than better quality bonds in order to make them attractive to investors.

Global issue of high-yield bonds more than doubled in 2003 to nearly $146 billion in securities issued from less than $63 billion in 2002, although this is still less than the record of $150 billion in 1998. Issue is disproportionately centered in the United States, although issuers in Europe, Asia and South Africa have recently turned to high-yield debt in connection with refinancings and acquisitions. In 2006, European companies issued over €31 billion of high-yield bonds. 2010 was a record year for European Junk Bond issuance, with as much as €50bn expected.

The holder of any debt is subject to interest rate risk and credit risk, inflationary risk, currency risk, duration risk, convexity risk, repayment of principal risk, streaming income risk, liquidity risk, default risk, maturity risk, reinvestment risk, market risk, political risk, and taxation adjustment risk. Interest rate risk refers to the risk of the market value of a bond changing in value due to changes in the structure or level of interest rates or credit spreads or risk premiums. The credit risk of a high-yield bond refers to the probability and probable loss upon a credit event (i.e., the obligor defaults on scheduled payments or files for bankruptcy, or the bond is restructured), or a credit quality change is issued by a rating agency including Fitch, Moody's, or Standard & Poors.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

3:03

3:03What is a high yield bond?

What is a high yield bond?What is a high yield bond?

When is "junk" valuable? When there's high yield to be had, of course. Paddy Hirsch explains this potentially riskier, potentially more rewarding end of the bond market, which has famously backed many of the biggest leveraged buyouts and aggressive M&A; deals ever undertaken. For more news, analysis, and trends on the high yield bond market check out http://www.highyieldbond.com, a free site powered by S&P; Capital IQ/LCD to promote the asset class. You can also check out http://www.leveragedloan.com for news and analysis on that market, and LCD's Leveraged Loan Market Primer/Almanac, a free guide detailing quarterly market and historical trends, as well as market mechanics. http://http://www.leveragedloan.com/primer/ Follow LCD Twitter http://www.twitter.com/lcdnews Facebook https://www.facebook.com/lcdcomps LinkedIn https://www.linkedin.com/grp/home?gid=2092432 Follow Paddy Hirsch http://www.twitter.com/paddyhirsch -

4:18

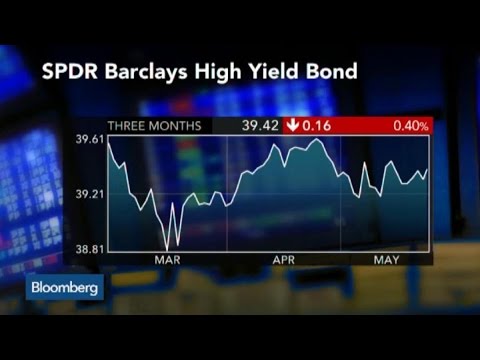

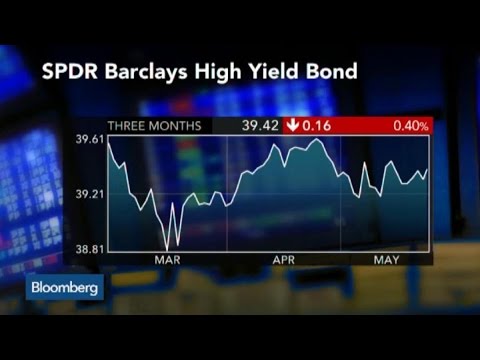

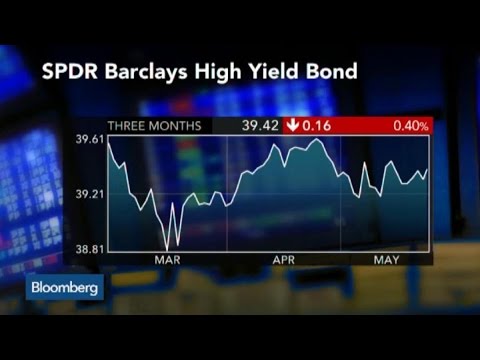

4:18How Will Higher Interest Rates Affect High Yield Bonds?

How Will Higher Interest Rates Affect High Yield Bonds?How Will Higher Interest Rates Affect High Yield Bonds?

May 28 -- Franklin Templeton Fixed Income Group Senior Vice President Eric Takaha discusses the bond markets. He speaks on “Market Makers.” -- Subscribe to Bloomberg on YouTube: http://www.youtube.com/Bloomberg Bloomberg Television offers extensive coverage and analysis of international business news and stories of global importance. It is available in more than 310 million households worldwide and reaches the most affluent and influential viewers in terms of household income, asset value and education levels. With production hubs in London, New York and Hong Kong, the network provides 24-hour continuous coverage of the people, companies and ideas that move the markets. -

3:25

3:25Make Money From the Coming Collapse in High Yield Bonds

Make Money From the Coming Collapse in High Yield BondsMake Money From the Coming Collapse in High Yield Bonds

A default wave will soon be hitting high yield bonds and investors better be prepared for it, says Steve Blumenthal, CEO of CMG Capital. Still, Blumenthal says there is a bright side to the coming washout in junk bonds. 'The good news is that the selloff will create one of the greatest buying opportunities of a lifetime in the not too distant future. Remember the 20% yields on high yield bonds in 2008? My two cents is that the coming opportunity will be even better,' says Blumenthal. Blumenthal says tactical trend analysis enables investors to identify the primary movements in high yield bonds. His strategy is to stay invested during the up trending cycles and shorten maturities when the trend turns down. In other words, buy the iShares iBoxx High Yield Corporate Bond ETF (HYG) or the SPDR Barclays High Yield Bond ETF (JNK) when trends are turning up. Subscribe to TheStreetTV on YouTube: http://t.st/TheStreetTV For more content from TheStreet visit: http://thestreet.com Check out all our videos: http://youtube.com/user/TheStreetTV Follow TheStreet on Twitter: http://twitter.com/thestreet Like TheStreet on Facebook: http://facebook.com/TheStreet Follow TheStreet on LinkedIn: http://linkedin.com/company/theStreet Follow TheStreet on Google+: http://plus.google.com/+TheStreet -

4:18

4:18Short Term High Yield Bonds

Short Term High Yield BondsShort Term High Yield Bonds

The current low interest rate environment means that bond investors have to take more risk in order to gain an attractive return on their invested money. The current low interest rates also present a risk that if interest rates and inflation rise in the future, then bond prices may fall and portfolios could suffer losses. -

2:34

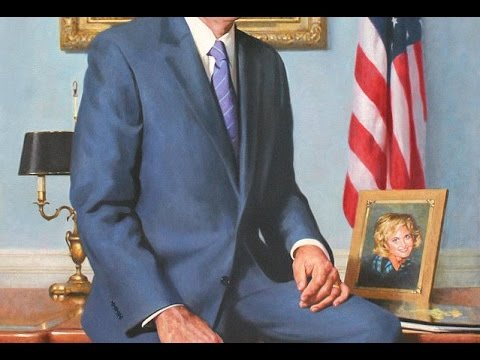

2:34Carl Icahn: 'No-Brainer' High-Yield Market Is in a Bubble

Carl Icahn: 'No-Brainer' High-Yield Market Is in a BubbleCarl Icahn: 'No-Brainer' High-Yield Market Is in a Bubble

Oct. 21 (Bloomberg) -- Billionaire Carl Icahn explains why he think the high-yield market is in a bubble. He speaks with Bloomberg's Stephanie Ruhle at the Robin Hood Investors Conference. (Source: Bloomberg) -- Subscribe to Bloomberg on YouTube: http://www.youtube.com/Bloomberg Bloomberg Television offers extensive coverage and analysis of international business news and stories of global importance. It is available in more than 310 million households worldwide and reaches the most affluent and influential viewers in terms of household income, asset value and education levels. With production hubs in London, New York and Hong Kong, the network provides 24-hour continuous coverage of the people, companies and ideas that move the markets. -

2:00

2:00How Do Bonds Work?

How Do Bonds Work?How Do Bonds Work?

The topic is Bonds: Government Bonds. Where is a safe place to put your money that will result in steady growth? You have to defeat the nefarious forces of inflation, after all, and loaning your money to the government's always been a safe option. While you can put some of your trust in steadfast bonds, keep in mind that today's government treasury bonds are nothing like they were in the heyday of the 1980s, when they reached an all-time high interest rate! Though now their rates have normalized, the long term nature of bonds (usually 10 years) creates an interesting market for trading bonds at different rates. To learn more about bonds, interest rates or inflation, surf over to FinLitTV.com or click Subscribe for more FLiCs. -

4:11

4:11USD High Yield Debt at risk?

USD High Yield Debt at risk?USD High Yield Debt at risk?

Long-term T/A on USD high yield debt. Nils Baranger, ChartGuidance. You can view this video and the full video archive on the Dukascopy TV page: http://www.dukascopy.com/tv/en/#171215 Смотрите Dukascopy TV на вашем языке: http://www.youtube.com/user/dukascopytvrussian 用您的语言观看杜高斯贝电视: http://www.youtube.com/user/dukascopytvchinese Miren Dukascopy TV en su idioma: http://www.youtube.com/user/dukascopytvspanish Schauen Sie Dukascopy TV in Ihrer Sprache: http://www.youtube.com/user/dukascopytvgerman Regardez la Dukascopy TV dans votre langue: http://www.youtube.com/user/dukascopytvfrench Veja a TV Dukascopy na sua língua: http://www.youtube.com/user/dukascopytvpt -

3:34

3:34USD High Yield Debt at risk?

USD High Yield Debt at risk?USD High Yield Debt at risk?

A/T moyen terme de la Dette High Yield USD Nils Baranger, ChartGuidance Vous pouvez voir cette vidéo et toutes les archives vidéo sur la page de Dukascopy TV: http://www.dukascopy.com/tv/fr/#171215 Watch Dukascopy TV in your language: https://www.youtube.com/user/dukascopytv Смотрите Dukascopy TV на вашем языке: http://www.youtube.com/user/dukascopytvrussian 用您的语言观看杜高斯贝电视: http://www.youtube.com/user/dukascopytvchinese Miren Dukascopy TV en su idioma: http://www.youtube.com/user/dukascopytvspanish Schauen Sie Dukascopy TV in Ihrer Sprache: http://www.youtube.com/user/dukascopytvgerman Veja a TV Dukascopy na sua língua: http://www.youtube.com/user/dukascopytvpt -

20:40

20:40How Corrupt Are Securities Markets? The High-Yield Debt Market & Private Equity (1988)

How Corrupt Are Securities Markets? The High-Yield Debt Market & Private Equity (1988)How Corrupt Are Securities Markets? The High-Yield Debt Market & Private Equity (1988)

Private equity in the 1980s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks. The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. The 1980s saw the first major boom and bust cycle in private equity. The cycle which is typically marked by the 1982 acquisition of Gibson Greetings and ending just over a decade later was characterized by a dramatic surge in leveraged buyout (LBO) activity financed by junk bonds. The period culminated in the massive buyout of RJR Nabisco before the near collapse of the leveraged buyout industry in the late 1980s and early 1990s marked by the collapse of Drexel Burnham Lambert and the high-yield debt market. Although the "corporate raider" moniker is rarely applied to contemporary private equity investors, there is no formal distinction between a "corporate raid" and other private equity investments acquisitions of existing businesses. The label was typically ascribed by constituencies within the acquired company or the media. However, a corporate raid would typically feature a leveraged buyout that would involve a hostile takeover of the company, perceived asset stripping, major layoffs or other significant corporate restructuring activities. Management of many large publicly traded corporations reacted negatively to the threat of potential hostile takeover or corporate raid and pursued drastic defensive measures including poison pills, golden parachutes and increasing debt levels on the company's balance sheet. Additionally, the threat of the corporate raid would lead to the practice of "greenmail", where a corporate raider or other party would acquire a significant stake in the stock of a company and receive an incentive payment (effectively a bribe) from the company in order to avoid pursuing a hostile takeover of the company. Greenmail represented a transfer payment from a company's existing shareholders to a third party investor and provided no value to existing shareholders but did benefit existing managers. The practice of "greenmail" is not typically considered a tactic of private equity investors and is not condoned by market participants. Among the most notable corporate raiders of the 1980s included Carl Icahn, Victor Posner, Nelson Peltz, Robert M. Bass, T. Boone Pickens, Harold Clark Simmons, Kirk Kerkorian, Sir James Goldsmith, Saul Steinberg and Asher Edelman. Carl Icahn developed a reputation as a ruthless corporate raider after his hostile takeover of TWA in 1985.[28] The result of that takeover was Icahn systematically selling TWA's assets to repay the debt he used to purchase the company, which was described as asset stripping.[29] In later years, many of the corporate raiders would be re-characterized as "Activist shareholders". Many of the corporate raiders were onetime clients of Michael Milken, whose investment banking firm, Drexel Burnham Lambert helped raise blind pools of capital with which corporate raiders could make a legitimate attempt to takeover a company and provided high-yield debt financing of the buyouts. Drexel Burnham raised a $100 million blind pool in 1984 for Nelson Peltz and his holding company Triangle Industries (later Triarc) to give credibility for takeovers, representing the first major blind pool raised for this purpose. Two years later, in 1986, Wickes Companies, a holding company run by Sanford Sigoloff would raise a $1.2 billion blind pool.[30] In 1985, Milken raised a $750 million for a similar blind pool for Ronald Perelman which would ultimate prove instrumental in acquiring his biggest target: The Revlon Corporation. In 1980, Ronald Perelman, the son of a wealthy Philadelphia businessman, and future "corporate raider" having made several small but successful buyouts, acquired MacAndrews & Forbes, a distributor of licorice extract and chocolate, that Perelman's father had tried and failed to acquire it 10 years earlier.[31] Perelman would ultimately divest the company's core business and use MacAndrews & Forbes as a holding company investment vehicle for subsequent leveraged buyouts including Technicolor, Inc., Pantry Pride and Revlon. http://en.wikipedia.org/wiki/Private_equity_in_the_1980s -

4:03

4:03Gundlach Issues Warning on High-Yield Bonds | Wall Street Week | Episode 1

Gundlach Issues Warning on High-Yield Bonds | Wall Street Week | Episode 1Gundlach Issues Warning on High-Yield Bonds | Wall Street Week | Episode 1

Bond king Jeffrey Gundlach, CEO/CIO of DoubleLine Capital, issues a stern warning on potential danger ahead in the high-yield bond market when interest rates rise.

- Accountant

- Accrual bond

- Acquisitions

- Agency debt

- Angel investor

- Arrears

- Auditor

- AXA

- AXA Center

- Bank

- Basis point

- Bond (finance)

- Bond convexity

- Bond duration

- Bond market

- Bond market index

- Bond option

- Bond valuation

- Buy–sell agreement

- By-law

- Call option

- Callable bond

- Capital call

- Capital structure

- Carried interest

- Cash flow

- Clean price

- Commercial bank

- Commercial paper

- Commodity market

- Common stock

- Convertible bond

- Convexity (finance)

- Corporate bond

- Corporate finance

- Coupon (bond)

- Credit derivative

- Credit event

- Credit rating

- Credit rating agency

- Credit risk

- Credit spread (bond)

- Currency

- Current yield

- Debenture

- Debt overhang

- Default (finance)

- Depreciating asset

- Derivatives market

- Dirty price

- Distressed debt

- Divisional buyout

- EBITDA

- Economy of Greece

- Embedded option

- Emerging market debt

- Enron

- Entrepreneurship

- Envy ratio

- Equity co-investment

- Exchange rate

- Exchangeable bond

- Extendible bond

- Family office

- Finance

- Financial endowment

- Financial market

- Financial portfolio

- Financial regulation

- Financial sponsor

- Fitch Ratings

- Fixed income

- Fixed rate bond

- Floating rate note

- Forward contract

- Fund of funds

- Futures exchange

- Government bond

- Greek Government

- Growth capital

- H0A0

- High-yield debt

- Hybrid security

- I-spread

- ICMA

- Insurance company

- Interest rate risk

- Investment bank

- Investment banker

- Investment grade

- Lehman Brothers

- Leverage (finance)

- Leveraged buyout

- Limited partnership

- Liquidity risk

- Management buyout

- Management fee

- Market

- Market liquidity

- Marketplace

- Martin S. Fridson

- Merchant bank

- Meredith Whitney

- Mezzanine capital

- Michael Milken

- Money market

- Moody's

- Mortgage yield

- Municipal bond

- Nominal yield

- North America

- Option (finance)

- Paul Krugman

- Pension fund

- Perpetual bond

- Personal finance

- Pledge fund

- Portugal

- Post-money valuation

- Pre-money valuation

- Preferred stock

- Private equity

- Private equity fund

- Private foundation

- Public finance

- Puttable bond

- Real estate market

- Recession

- Refinancing

- Registered share

- Reinsurance market

- Reverse convertible

- Securities

- Securitization

- Seed money

- Senior debt

- SIFMA

- Spot market

- Standard & Poor's

- Standard and Poor's

- Startup company

- State debt

- Stock

- Stock certificate

- Stock exchange

- Stock market

- Subordinated debt

- Subprime mortgage

- Swap (finance)

- Template Bond market

- The New York Times

- Timothy Geithner

- Toxic assets

- Trader (finance)

- Tranche

- Undercapitalization

- Venture capital

- Venture debt

- Venture round

- Volatility (finance)

- Voting share

- Yield to maturity

- Z-spread

- Zero-coupon bond

- Zombie bank

-

What is a high yield bond?

When is "junk" valuable? When there's high yield to be had, of course. Paddy Hirsch explains this potentially riskier, potentially more rewarding end of the bond market, which has famously backed many of the biggest leveraged buyouts and aggressive M&A; deals ever undertaken. For more news, analysis, and trends on the high yield bond market check out http://www.highyieldbond.com, a free site powered by S&P; Capital IQ/LCD to promote the asset class. You can also check out http://www.leveragedloan.com for news and analysis on that market, and LCD's Leveraged Loan Market Primer/Almanac, a free guide detailing quarterly market and historical trends, as well as market mechanics. http://http://www.leveragedloan.com/primer/ Follow LCD Twitter http://www.twitter.com/lcdnews Facebook https:/... -

How Will Higher Interest Rates Affect High Yield Bonds?

May 28 -- Franklin Templeton Fixed Income Group Senior Vice President Eric Takaha discusses the bond markets. He speaks on “Market Makers.” -- Subscribe to Bloomberg on YouTube: http://www.youtube.com/Bloomberg Bloomberg Television offers extensive coverage and analysis of international business news and stories of global importance. It is available in more than 310 million households worldwide and reaches the most affluent and influential viewers in terms of household income, asset value and education levels. With production hubs in London, New York and Hong Kong, the network provides 24-hour continuous coverage of the people, companies and ideas that move the markets. -

Make Money From the Coming Collapse in High Yield Bonds

A default wave will soon be hitting high yield bonds and investors better be prepared for it, says Steve Blumenthal, CEO of CMG Capital. Still, Blumenthal says there is a bright side to the coming washout in junk bonds. 'The good news is that the selloff will create one of the greatest buying opportunities of a lifetime in the not too distant future. Remember the 20% yields on high yield bonds in 2008? My two cents is that the coming opportunity will be even better,' says Blumenthal. Blumenthal says tactical trend analysis enables investors to identify the primary movements in high yield bonds. His strategy is to stay invested during the up trending cycles and shorten maturities when the trend turns down. In other words, buy the iShares iBoxx High Yield Corporate Bond ETF (HYG) or the SPDR... -

Short Term High Yield Bonds

The current low interest rate environment means that bond investors have to take more risk in order to gain an attractive return on their invested money. The current low interest rates also present a risk that if interest rates and inflation rise in the future, then bond prices may fall and portfolios could suffer losses. -

Carl Icahn: 'No-Brainer' High-Yield Market Is in a Bubble

Oct. 21 (Bloomberg) -- Billionaire Carl Icahn explains why he think the high-yield market is in a bubble. He speaks with Bloomberg's Stephanie Ruhle at the Robin Hood Investors Conference. (Source: Bloomberg) -- Subscribe to Bloomberg on YouTube: http://www.youtube.com/Bloomberg Bloomberg Television offers extensive coverage and analysis of international business news and stories of global importance. It is available in more than 310 million households worldwide and reaches the most affluent and influential viewers in terms of household income, asset value and education levels. With production hubs in London, New York and Hong Kong, the network provides 24-hour continuous coverage of the people, companies and ideas that move the markets. -

How Do Bonds Work?

The topic is Bonds: Government Bonds. Where is a safe place to put your money that will result in steady growth? You have to defeat the nefarious forces of inflation, after all, and loaning your money to the government's always been a safe option. While you can put some of your trust in steadfast bonds, keep in mind that today's government treasury bonds are nothing like they were in the heyday of the 1980s, when they reached an all-time high interest rate! Though now their rates have normalized, the long term nature of bonds (usually 10 years) creates an interesting market for trading bonds at different rates. To learn more about bonds, interest rates or inflation, surf over to FinLitTV.com or click Subscribe for more FLiCs. -

USD High Yield Debt at risk?

Long-term T/A on USD high yield debt. Nils Baranger, ChartGuidance. You can view this video and the full video archive on the Dukascopy TV page: http://www.dukascopy.com/tv/en/#171215 Смотрите Dukascopy TV на вашем языке: http://www.youtube.com/user/dukascopytvrussian 用您的语言观看杜高斯贝电视: http://www.youtube.com/user/dukascopytvchinese Miren Dukascopy TV en su idioma: http://www.youtube.com/user/dukascopytvspanish Schauen Sie Dukascopy TV in Ihrer Sprache: http://www.youtube.com/user/dukascopytvgerman Regardez la Dukascopy TV dans votre langue: http://www.youtube.com/user/dukascopytvfrench Veja a TV Dukascopy na sua língua: http://www.youtube.com/user/dukascopytvpt -

USD High Yield Debt at risk?

A/T moyen terme de la Dette High Yield USD Nils Baranger, ChartGuidance Vous pouvez voir cette vidéo et toutes les archives vidéo sur la page de Dukascopy TV: http://www.dukascopy.com/tv/fr/#171215 Watch Dukascopy TV in your language: https://www.youtube.com/user/dukascopytv Смотрите Dukascopy TV на вашем языке: http://www.youtube.com/user/dukascopytvrussian 用您的语言观看杜高斯贝电视: http://www.youtube.com/user/dukascopytvchinese Miren Dukascopy TV en su idioma: http://www.youtube.com/user/dukascopytvspanish Schauen Sie Dukascopy TV in Ihrer Sprache: http://www.youtube.com/user/dukascopytvgerman Veja a TV Dukascopy na sua língua: http://www.youtube.com/user/dukascopytvpt -

How Corrupt Are Securities Markets? The High-Yield Debt Market & Private Equity (1988)

Private equity in the 1980s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks. The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. The 1980s saw the first major boom and bust cycle in private equity. The cycle which is typically marked by the 1982 acquisition of Gibson Greetings and ending just over a decade later was characterized by a dramatic surge in leveraged buyout (LBO) activity financed by junk bonds. The period culminated in the massive buyout of RJR Nabisco b... -

Gundlach Issues Warning on High-Yield Bonds | Wall Street Week | Episode 1

Bond king Jeffrey Gundlach, CEO/CIO of DoubleLine Capital, issues a stern warning on potential danger ahead in the high-yield bond market when interest rates rise.

What is a high yield bond?

- Order: Reorder

- Duration: 3:03

- Updated: 23 Jun 2015

- views: 2613

- published: 23 Jun 2015

- views: 2613

How Will Higher Interest Rates Affect High Yield Bonds?

- Order: Reorder

- Duration: 4:18

- Updated: 28 May 2015

- views: 928

- published: 28 May 2015

- views: 928

Make Money From the Coming Collapse in High Yield Bonds

- Order: Reorder

- Duration: 3:25

- Updated: 26 May 2015

- views: 617

- published: 26 May 2015

- views: 617

Short Term High Yield Bonds

- Order: Reorder

- Duration: 4:18

- Updated: 03 Sep 2013

- views: 2075

- published: 03 Sep 2013

- views: 2075

Carl Icahn: 'No-Brainer' High-Yield Market Is in a Bubble

- Order: Reorder

- Duration: 2:34

- Updated: 22 Oct 2014

- views: 6463

- published: 22 Oct 2014

- views: 6463

How Do Bonds Work?

- Order: Reorder

- Duration: 2:00

- Updated: 13 Feb 2013

- views: 4722

- published: 13 Feb 2013

- views: 4722

USD High Yield Debt at risk?

- Order: Reorder

- Duration: 4:11

- Updated: 27 Nov 2015

- views: 603

- published: 27 Nov 2015

- views: 603

USD High Yield Debt at risk?

- Order: Reorder

- Duration: 3:34

- Updated: 03 Dec 2015

- views: 181

- published: 03 Dec 2015

- views: 181

How Corrupt Are Securities Markets? The High-Yield Debt Market & Private Equity (1988)

- Order: Reorder

- Duration: 20:40

- Updated: 15 Dec 2014

- views: 1726

- published: 15 Dec 2014

- views: 1726

Gundlach Issues Warning on High-Yield Bonds | Wall Street Week | Episode 1

- Order: Reorder

- Duration: 4:03

- Updated: 15 Jun 2015

- views: 1002

- published: 15 Jun 2015

- views: 1002

- Playlist

- Chat

- Playlist

- Chat

What is a high yield bond?

- Report rights infringement

- published: 23 Jun 2015

- views: 2613

How Will Higher Interest Rates Affect High Yield Bonds?

- Report rights infringement

- published: 28 May 2015

- views: 928

Make Money From the Coming Collapse in High Yield Bonds

- Report rights infringement

- published: 26 May 2015

- views: 617

Short Term High Yield Bonds

- Report rights infringement

- published: 03 Sep 2013

- views: 2075

Carl Icahn: 'No-Brainer' High-Yield Market Is in a Bubble

- Report rights infringement

- published: 22 Oct 2014

- views: 6463

How Do Bonds Work?

- Report rights infringement

- published: 13 Feb 2013

- views: 4722

USD High Yield Debt at risk?

- Report rights infringement

- published: 27 Nov 2015

- views: 603

USD High Yield Debt at risk?

- Report rights infringement

- published: 03 Dec 2015

- views: 181

How Corrupt Are Securities Markets? The High-Yield Debt Market & Private Equity (1988)

- Report rights infringement

- published: 15 Dec 2014

- views: 1726

Gundlach Issues Warning on High-Yield Bonds | Wall Street Week | Episode 1

- Report rights infringement

- published: 15 Jun 2015

- views: 1002

‘The Voice’ singer Christina Grimmie shot dead while signing autographs at Florida concert

Edit The Malta Independent 11 Jun 2016Italian daily publishes Hitler's 'Mein Kampf' to anger

Edit The Associated Press 11 Jun 2016The Latest: Fans fighting after Russia draws with England

Edit Atlanta Journal 11 Jun 2016Israel demolishes home of Palestinian killer of mother of 6

Edit Stars and Stripes 11 Jun 2016Indian govt is going to be America's 'great ally': Paul Ryan

Edit The Times of India 11 Jun 2016Snapchat, Instagram boost self-promotion

Edit Arabnews 12 Jun 2016BJP dreaming big: Congress

Edit The Hindu 12 Jun 2016News of the Day From Across the Nation

Edit San Francisco Chronicle 12 Jun 2016The investment world has a new 'haute couture'

Edit Yahoo Daily News 12 Jun 2016Lew, Germans Say ‘Bremain’; Trump Back to Form: Saturday Wrap

Edit Bloomberg 12 Jun 2016Do not let a tight budget put you in danger

Edit The Examiner 12 Jun 2016Your guide to the perfect timing to nab bargain airfares

Edit Sydney Morning Herald 12 Jun 2016Alliance Trust PLC : Net Asset Value(s) (Alliance Trust plc)

Edit Public Technologies 12 Jun 2016Marco Pierre White's son cooks up a Big Brother deal to pay off his debts writes ...

Edit The Daily Mail 12 Jun 2016Ireland hold on with 14 men to seal historic first win in South Africa

Edit The Observer 12 Jun 2016- 1

- 2

- 3

- 4

- 5

- Next page »