- published: 04 Jan 2014

- views: 5534

Create your page here

Wednesday, 20 April 2016

-

remove the playlistRisk Analysis

- remove the playlistRisk Analysis

back to playlist

Info

Level: Beginner

Presenter: Eli the Computer Guy

Date Created: October 12, 2010

Length of Class: 57 Minutes

Tracks

Computer Security /Integrity

Prerequisites

None

Purpose of Class

This class teaches students the basic concepts behind Risk Assessments.

Topics Covered

Defining Risk, Threat and Vulnerability

Types of Protections

Mitigation Concepts

Business Rational for Risk Assessment and Management

Class Notes

Introduction

The better you know technology the better you will do with Risk Assessment/ Management.

Risk

Risk = Treat x Vulnerability

Overview of Risk

Risk is defined as the likelihood of financial loss.

Risk is a business concepts not a technological one.

Down Time

Fraud

Legal data loss issues

Hacking -- Attacks from your network

Data Theft (Trade Secrets)

Overview of Threat

i. Natural Disatser

ii. Malicious Human

iii. Accidental Human

iv. System Failure

Impersonation

Interception

Interference

Overview of Vulnerability

Flooding

Theft of Systems

Hacking

Viruses

Overview of Protections Technoloigical Safe Guards

Physical/ Operational Security

Disaster Plan

Documentation

Technological Safeguards (Firewalls, Antivirus)

Concepts of Mitigation

Incident - Response - Debrief - Mitigation

Making Bad not so bad

You will never be safe

Security Buy In and Quantifying Risk

The business leaders will make the final decision on Risk Management

The better your BUSINESS argument the more likely you are to get the go ahead.

What is the cost of downtime

What is the legal cost

Cost of Security vs. Benefit

Final Thoughts

Risk is a BUSINESS concept! The more you understand about business and can talk about financial ramifications the more likely you are to get you fancy new security equipment.

Resources

US Computer Emergency Readiness Team

- published: 13 Dec 2010

- views: 98218

Find out how to conduct a formal four-step risk analysis with this short video.

- published: 02 Jun 2011

- views: 11223

This archived webcast is designed to provide an entry-level introduction into probabilistic analysis and will show how Monte Carlo simulation and other techniques can be applied to your everyday business analyses.

- published: 29 Jan 2014

- views: 39266

Summary

Defining assets in a risk analysis, identifying threats and the likelihood of the threats occurring, identifying the consequences of a threat occurring, and vulnerabilities that increase risk.

Also covers common safeguards to reduce the impact of threats, securing equipment/data, and incident response (should be included in security policy).

Reference Materials

Guide to Network Defense and Countermeasures - Chapter 2

Additional Information

NIST Guide on Risk Management:

http://csrc.nist.gov/publications/nistpubs/800-30/sp800-30.pdf

- published: 25 Jun 2014

- views: 1875

Subscribe to Channel: http://goo.gl/wN3c3p

View the Blog: http://myexcelcharts.blogspot.com

This video covers how to create a colored (green-yellow-red) risk assessment chart. This is used in project management to compare risk to probability for various task or projects to help aid in decision making.

Feel free to provide a comment or share it with a friend!

------------------------------------------------------------------------------------------------

WHERE TO GET THE TOOLS I USE (affiliate link):

Camtasia: http://goo.gl/qdDBnP

Microsoft products: http://goo.gl/KzkxCo

- published: 14 Dec 2014

- views: 27189

Learn more about how to evaluate project risks using quantitative risk analysis at http://bit.ly/1Rq5OAp

- published: 07 Feb 2015

- views: 829

Passionate Project Management, www.PassionatePM.com, is pleased to sponsor this Passionate Project Management YouTube channel. Passionate Project Management specializes in project management learning, development, and consulting. Passionate Project Management offers open enrollment and private on-site courses delivered by the leading instructors in the industry. Passionate Project Management provides PMP Exam Prep, CAPM Exam Prep, PMI-RMP (Risk Management) Exam Prep, and PMI-ACP (Agile) Exam prep.

This Video is a component of our Learning Concepts Series: 2. Qualitative versus Quantitative Risk Analysis narrated by Belinda Fremouw.

Belinda was the first woman in the world to achieve the original five PMI Credentials. Her experience spans multiple decades, crosses several industries, and includes domestic and international project experience. Belinda is a well-known public speaker and author.

Check out our website at www.PassionatePM.com for all of our course offerings and exam prep study materials.

www.PassionatePM.com

#PassionatePM #BelindaFremouw #BelindaPMP

- published: 30 Oct 2014

- views: 7601

(subtitles available in EN, FR, NL and ES)

We all hear these terms on a daily basis. So and so a chemical, physical or a biological agent poses a risk; This or that product is a hazard or behaving a certain way is unsafe.

A lot of the time “hazard” and “risk” are freely used to mean the same thing. However they are not.

Hazard is the potential to cause harm. Risk on the other hand is the likelihood of harm in defined circumstances.

In a nutshell, hazard and risk are not always aligned as the risk depends on the exposure to the hazard ; similarly, risk, safety and perception of risk are not always aligned; this can make political decisions regarding safety levels difficult to make, in these cases it is especially important to base them on facts rather than on subjective perceptions.

http://www.greenfacts.org

- published: 24 Nov 2014

- views: 61791

https://www.emerald-associates.com/services/avoid-/-manage-risk/risk-management.html

Oracle Primavera Risk Analysis (Pertmaster) software is used to explain the concept of uncertainty and its role in project based risk analysis for both cost and time. David Phillips walks us through some simple scenarios.

For more information on risk analysis please visit Emerald Associates at http://www.emerald.associates.com

- published: 24 Apr 2014

- views: 3690

Risk is part and parcel of any project. Risk identification, analysis and management are the foundations of successful project management.Successful project leaders always do two things very well.First they accept and approach a new project with the idea that the project is totally new irrespective of the fact that there could be similarities between earlier projects handled and also the experience base of the team.Second they go through a systematic and through risk analysis of the project as though there is no tomorrow.These qualities enable them to appreciate the project challenges well ahead and they are invariably ready to face the challenges with suitable actions so that the project objectives are achieved as defined in the project charter.

Project Management Body of Knowledge (PMBOK) by PMI also brings in very extensively as one of the nine knowledge areas that requires sufficient focus.An analysis of project management literature leads one to conclude that lack of clear risk understanding and management is the reason for the failure of majority of the projects, This is more so for complex and large projects.Risk , by nature ,is difficult for project managers to visualise due to their enthusiasm to go ahead and execute the projects.

Also self interest and personal agenda of the project team lead to assessing issues and challenges optimistically rather than realistically.This focus of this web cast will be the understanding of risks from strategic and execution perspectives and dwell of the methodologies for handling the risks.

- published: 15 Sep 2012

- views: 5966

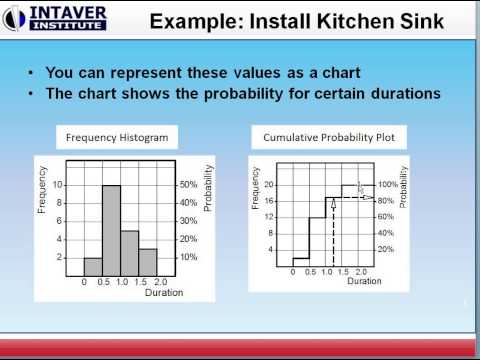

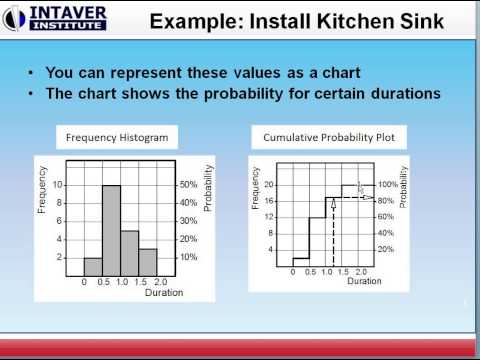

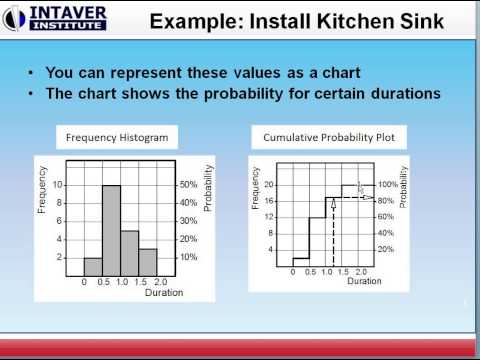

Video shows how schedule risk analysis is performed in RiskyProject project risk management and risk analysis software. Monte Carlo simulations require inputs to perform the analysis: duration estimates and statistical distributions. In this video, we describe what a statistical distribution for schedules is and use a real life example to gather the distribution data and describe them using frequency histograms and cumulative probability plots. Finally, we use the data we generated from this real life example, to create a risk analysis model in the software and run a Monte Carlo simulation.

For more information how to perform schedule risk analysis using RiskyProject software please visit Intaver Institute web site: http://www.intaver.com.

About Intaver Institute.

Intaver Institute Inc. develops project risk management and project risk analysis software. Intaver's flagship product is RiskyProject: project risk management software. RiskyProject integrates with Microsoft Project, Oracle Primavera, other project management software or can run standalone. RiskyProject comes in three configurations: RiskyProject Lite, RiskyProject Professional, and RiskyProject Enterprise.

- published: 20 Dec 2013

- views: 13221

Risk Analysis may refer to:

This page contains text from Wikipedia, the Free Encyclopedia -

http://en.wikipedia.org/wiki/Risk_analysis

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

3:41

3:41how to risk analysis framework

how to risk analysis frameworkhow to risk analysis framework

How to undertake a risk analysis assessment on your business -

57:18

57:18Introduction to Risk Assessment

Introduction to Risk AssessmentIntroduction to Risk Assessment

Info Level: Beginner Presenter: Eli the Computer Guy Date Created: October 12, 2010 Length of Class: 57 Minutes Tracks Computer Security /Integrity Prerequisites None Purpose of Class This class teaches students the basic concepts behind Risk Assessments. Topics Covered Defining Risk, Threat and Vulnerability Types of Protections Mitigation Concepts Business Rational for Risk Assessment and Management Class Notes Introduction The better you know technology the better you will do with Risk Assessment/ Management. Risk Risk = Treat x Vulnerability Overview of Risk Risk is defined as the likelihood of financial loss. Risk is a business concepts not a technological one. Down Time Fraud Legal data loss issues Hacking -- Attacks from your network Data Theft (Trade Secrets) Overview of Threat i. Natural Disatser ii. Malicious Human iii. Accidental Human iv. System Failure Impersonation Interception Interference Overview of Vulnerability Flooding Theft of Systems Hacking Viruses Overview of Protections Technoloigical Safe Guards Physical/ Operational Security Disaster Plan Documentation Technological Safeguards (Firewalls, Antivirus) Concepts of Mitigation Incident - Response - Debrief - Mitigation Making Bad not so bad You will never be safe Security Buy In and Quantifying Risk The business leaders will make the final decision on Risk Management The better your BUSINESS argument the more likely you are to get the go ahead. What is the cost of downtime What is the legal cost Cost of Security vs. Benefit Final Thoughts Risk is a BUSINESS concept! The more you understand about business and can talk about financial ramifications the more likely you are to get you fancy new security equipment. Resources US Computer Emergency Readiness Team -

3:01

3:01Risk Analysis

Risk AnalysisRisk Analysis

Find out how to conduct a formal four-step risk analysis with this short video. -

63:30

63:30Introduction to Monte Carlo Simulation and Risk Analysis using @RISK and RISKOptimizer

Introduction to Monte Carlo Simulation and Risk Analysis using @RISK and RISKOptimizerIntroduction to Monte Carlo Simulation and Risk Analysis using @RISK and RISKOptimizer

This archived webcast is designed to provide an entry-level introduction into probabilistic analysis and will show how Monte Carlo simulation and other techniques can be applied to your everyday business analyses. -

46:05

46:05Risk Analysis and Management

Risk Analysis and ManagementRisk Analysis and Management

Summary Defining assets in a risk analysis, identifying threats and the likelihood of the threats occurring, identifying the consequences of a threat occurring, and vulnerabilities that increase risk. Also covers common safeguards to reduce the impact of threats, securing equipment/data, and incident response (should be included in security policy). Reference Materials Guide to Network Defense and Countermeasures - Chapter 2 Additional Information NIST Guide on Risk Management: http://csrc.nist.gov/publications/nistpubs/800-30/sp800-30.pdf -

16:53

16:53Create a Risk Assessment Chart

Create a Risk Assessment ChartCreate a Risk Assessment Chart

Subscribe to Channel: http://goo.gl/wN3c3p View the Blog: http://myexcelcharts.blogspot.com This video covers how to create a colored (green-yellow-red) risk assessment chart. This is used in project management to compare risk to probability for various task or projects to help aid in decision making. Feel free to provide a comment or share it with a friend! ------------------------------------------------------------------------------------------------ WHERE TO GET THE TOOLS I USE (affiliate link): Camtasia: http://goo.gl/qdDBnP Microsoft products: http://goo.gl/KzkxCo -

4:40

4:40How to Evaluate Risks Using Quantitative Risk Analysis

How to Evaluate Risks Using Quantitative Risk AnalysisHow to Evaluate Risks Using Quantitative Risk Analysis

Learn more about how to evaluate project risks using quantitative risk analysis at http://bit.ly/1Rq5OAp -

4:15

4:15Project Management Concept #2: Qualitative Risk Analysis vs Quantitative Risk Analysis

Project Management Concept #2: Qualitative Risk Analysis vs Quantitative Risk AnalysisProject Management Concept #2: Qualitative Risk Analysis vs Quantitative Risk Analysis

Passionate Project Management, www.PassionatePM.com, is pleased to sponsor this Passionate Project Management YouTube channel. Passionate Project Management specializes in project management learning, development, and consulting. Passionate Project Management offers open enrollment and private on-site courses delivered by the leading instructors in the industry. Passionate Project Management provides PMP Exam Prep, CAPM Exam Prep, PMI-RMP (Risk Management) Exam Prep, and PMI-ACP (Agile) Exam prep. This Video is a component of our Learning Concepts Series: 2. Qualitative versus Quantitative Risk Analysis narrated by Belinda Fremouw. Belinda was the first woman in the world to achieve the original five PMI Credentials. Her experience spans multiple decades, crosses several industries, and includes domestic and international project experience. Belinda is a well-known public speaker and author. Check out our website at www.PassionatePM.com for all of our course offerings and exam prep study materials. www.PassionatePM.com #PassionatePM #BelindaFremouw #BelindaPMP -

5:31

5:31Hazard, Risk & Safety - Understanding Risk Assessment, Management and Perception

Hazard, Risk & Safety - Understanding Risk Assessment, Management and PerceptionHazard, Risk & Safety - Understanding Risk Assessment, Management and Perception

(subtitles available in EN, FR, NL and ES) We all hear these terms on a daily basis. So and so a chemical, physical or a biological agent poses a risk; This or that product is a hazard or behaving a certain way is unsafe. A lot of the time “hazard” and “risk” are freely used to mean the same thing. However they are not. Hazard is the potential to cause harm. Risk on the other hand is the likelihood of harm in defined circumstances. In a nutshell, hazard and risk are not always aligned as the risk depends on the exposure to the hazard ; similarly, risk, safety and perception of risk are not always aligned; this can make political decisions regarding safety levels difficult to make, in these cases it is especially important to base them on facts rather than on subjective perceptions. http://www.greenfacts.org -

11:12

11:12Risk Analysis and Uncertainty: A Simple Case Study

Risk Analysis and Uncertainty: A Simple Case StudyRisk Analysis and Uncertainty: A Simple Case Study

https://www.emerald-associates.com/services/avoid-/-manage-risk/risk-management.html Oracle Primavera Risk Analysis (Pertmaster) software is used to explain the concept of uncertainty and its role in project based risk analysis for both cost and time. David Phillips walks us through some simple scenarios. For more information on risk analysis please visit Emerald Associates at http://www.emerald.associates.com -

7:00

7:00What are the different Risk Analysis Techniques

What are the different Risk Analysis TechniquesWhat are the different Risk Analysis Techniques

Risk is part and parcel of any project. Risk identification, analysis and management are the foundations of successful project management.Successful project leaders always do two things very well.First they accept and approach a new project with the idea that the project is totally new irrespective of the fact that there could be similarities between earlier projects handled and also the experience base of the team.Second they go through a systematic and through risk analysis of the project as though there is no tomorrow.These qualities enable them to appreciate the project challenges well ahead and they are invariably ready to face the challenges with suitable actions so that the project objectives are achieved as defined in the project charter. Project Management Body of Knowledge (PMBOK) by PMI also brings in very extensively as one of the nine knowledge areas that requires sufficient focus.An analysis of project management literature leads one to conclude that lack of clear risk understanding and management is the reason for the failure of majority of the projects, This is more so for complex and large projects.Risk , by nature ,is difficult for project managers to visualise due to their enthusiasm to go ahead and execute the projects. Also self interest and personal agenda of the project team lead to assessing issues and challenges optimistically rather than realistically.This focus of this web cast will be the understanding of risks from strategic and execution perspectives and dwell of the methodologies for handling the risks. -

9:42

9:42Monte Carlo Schedule Risk analysis. Part 1: Introduction to schedule risk analysis techniques

Monte Carlo Schedule Risk analysis. Part 1: Introduction to schedule risk analysis techniquesMonte Carlo Schedule Risk analysis. Part 1: Introduction to schedule risk analysis techniques

Video shows how schedule risk analysis is performed in RiskyProject project risk management and risk analysis software. Monte Carlo simulations require inputs to perform the analysis: duration estimates and statistical distributions. In this video, we describe what a statistical distribution for schedules is and use a real life example to gather the distribution data and describe them using frequency histograms and cumulative probability plots. Finally, we use the data we generated from this real life example, to create a risk analysis model in the software and run a Monte Carlo simulation. For more information how to perform schedule risk analysis using RiskyProject software please visit Intaver Institute web site: http://www.intaver.com. About Intaver Institute. Intaver Institute Inc. develops project risk management and project risk analysis software. Intaver's flagship product is RiskyProject: project risk management software. RiskyProject integrates with Microsoft Project, Oracle Primavera, other project management software or can run standalone. RiskyProject comes in three configurations: RiskyProject Lite, RiskyProject Professional, and RiskyProject Enterprise. -

59:52

59:52PMP® | Risk Analysis-Qualitative & Quantitative Approaches

PMP® | Risk Analysis-Qualitative & Quantitative ApproachesPMP® | Risk Analysis-Qualitative & Quantitative Approaches

Agenda for the hangout Check out the queries raised at iZenBridge Forum http://goo.gl/pVUqF7 to be discussed during the session. https://plus.google.com/b/103624728377270787243/events/cbo8qceqi7v7a344311id8rp3ts Our Trainers will focus on the queries posted by participants for discussion in the hangout. https://twitter.com/iZenBridge You can also post your queries at the forum. How to join the hangout? You can watch the event live at Risk Analysis Hangout. The queries/ questions will be taken up by using Q & A app.during the hangout. You need to type in your questions just like before, but now, the Q & A app will make it more manageable for the participants. Only selected participants, who have raised queries in the forum, would get an opportunity to come inside the session by way of video to follow up on the queries they had raised. Only first 9 participants can avail this facility. To enter the live web session, the selected participants can use the link provided at Twitter. Search the link using #iZenPMP. Rest of the participants need to follow the link provided above in the mail. Only in case of technical problems during the hangout, communicate to us on Twitter by using #iZenPMP Speaker:+Saket Bansal -

8:07

8:07Security 101: Security Risk Analysis

Security 101: Security Risk AnalysisSecurity 101: Security Risk Analysis

HIPAA requires practices to assess their PHI as part of their risk management process. Learn more about a risk assessment and how your practice can benefit.

-

how to risk analysis framework

How to undertake a risk analysis assessment on your business -

Introduction to Risk Assessment

Info Level: Beginner Presenter: Eli the Computer Guy Date Created: October 12, 2010 Length of Class: 57 Minutes Tracks Computer Security /Integrity Prerequisites None Purpose of Class This class teaches students the basic concepts behind Risk Assessments. Topics Covered Defining Risk, Threat and Vulnerability Types of Protections Mitigation Concepts Business Rational for Risk Assessment and Management Class Notes Introduction The better you know technology the better you will do with Risk Assessment/ Management. Risk Risk = Treat x Vulnerability Overview of Risk Risk is defined as the likelihood of financial loss. Risk is a business concepts not a technological one. Down Time Fraud Legal data loss issues Hacking -- Attacks from your network Data Theft (Trade Secrets) Overview of Thr... -

Risk Analysis

Find out how to conduct a formal four-step risk analysis with this short video. -

Introduction to Monte Carlo Simulation and Risk Analysis using @RISK and RISKOptimizer

This archived webcast is designed to provide an entry-level introduction into probabilistic analysis and will show how Monte Carlo simulation and other techniques can be applied to your everyday business analyses. -

Risk Analysis and Management

Summary Defining assets in a risk analysis, identifying threats and the likelihood of the threats occurring, identifying the consequences of a threat occurring, and vulnerabilities that increase risk. Also covers common safeguards to reduce the impact of threats, securing equipment/data, and incident response (should be included in security policy). Reference Materials Guide to Network Defense and Countermeasures - Chapter 2 Additional Information NIST Guide on Risk Management: http://csrc.nist.gov/publications/nistpubs/800-30/sp800-30.pdf -

Create a Risk Assessment Chart

Subscribe to Channel: http://goo.gl/wN3c3p View the Blog: http://myexcelcharts.blogspot.com This video covers how to create a colored (green-yellow-red) risk assessment chart. This is used in project management to compare risk to probability for various task or projects to help aid in decision making. Feel free to provide a comment or share it with a friend! ------------------------------------------------------------------------------------------------ WHERE TO GET THE TOOLS I USE (affiliate link): Camtasia: http://goo.gl/qdDBnP Microsoft products: http://goo.gl/KzkxCo -

How to Evaluate Risks Using Quantitative Risk Analysis

Learn more about how to evaluate project risks using quantitative risk analysis at http://bit.ly/1Rq5OAp -

Project Management Concept #2: Qualitative Risk Analysis vs Quantitative Risk Analysis

Passionate Project Management, www.PassionatePM.com, is pleased to sponsor this Passionate Project Management YouTube channel. Passionate Project Management specializes in project management learning, development, and consulting. Passionate Project Management offers open enrollment and private on-site courses delivered by the leading instructors in the industry. Passionate Project Management provides PMP Exam Prep, CAPM Exam Prep, PMI-RMP (Risk Management) Exam Prep, and PMI-ACP (Agile) Exam prep. This Video is a component of our Learning Concepts Series: 2. Qualitative versus Quantitative Risk Analysis narrated by Belinda Fremouw. Belinda was the first woman in the world to achieve the original five PMI Credentials. Her experience spans multiple decades, crosses several industries, and... -

Hazard, Risk & Safety - Understanding Risk Assessment, Management and Perception

(subtitles available in EN, FR, NL and ES) We all hear these terms on a daily basis. So and so a chemical, physical or a biological agent poses a risk; This or that product is a hazard or behaving a certain way is unsafe. A lot of the time “hazard” and “risk” are freely used to mean the same thing. However they are not. Hazard is the potential to cause harm. Risk on the other hand is the likelihood of harm in defined circumstances. In a nutshell, hazard and risk are not always aligned as the risk depends on the exposure to the hazard ; similarly, risk, safety and perception of risk are not always aligned; this can make political decisions regarding safety levels difficult to make, in these cases it is especially important to base them on facts rather than on subjective perceptions. ... -

Risk Analysis and Uncertainty: A Simple Case Study

https://www.emerald-associates.com/services/avoid-/-manage-risk/risk-management.html Oracle Primavera Risk Analysis (Pertmaster) software is used to explain the concept of uncertainty and its role in project based risk analysis for both cost and time. David Phillips walks us through some simple scenarios. For more information on risk analysis please visit Emerald Associates at http://www.emerald.associates.com -

What are the different Risk Analysis Techniques

Risk is part and parcel of any project. Risk identification, analysis and management are the foundations of successful project management.Successful project leaders always do two things very well.First they accept and approach a new project with the idea that the project is totally new irrespective of the fact that there could be similarities between earlier projects handled and also the experience base of the team.Second they go through a systematic and through risk analysis of the project as though there is no tomorrow.These qualities enable them to appreciate the project challenges well ahead and they are invariably ready to face the challenges with suitable actions so that the project objectives are achieved as defined in the project charter. Project Management Body of Knowledge (PMBO... -

Monte Carlo Schedule Risk analysis. Part 1: Introduction to schedule risk analysis techniques

Video shows how schedule risk analysis is performed in RiskyProject project risk management and risk analysis software. Monte Carlo simulations require inputs to perform the analysis: duration estimates and statistical distributions. In this video, we describe what a statistical distribution for schedules is and use a real life example to gather the distribution data and describe them using frequency histograms and cumulative probability plots. Finally, we use the data we generated from this real life example, to create a risk analysis model in the software and run a Monte Carlo simulation. For more information how to perform schedule risk analysis using RiskyProject software please visit Intaver Institute web site: http://www.intaver.com. About Intaver Institute. Intaver Institute Inc.... -

PMP® | Risk Analysis-Qualitative & Quantitative Approaches

Agenda for the hangout Check out the queries raised at iZenBridge Forum http://goo.gl/pVUqF7 to be discussed during the session. https://plus.google.com/b/103624728377270787243/events/cbo8qceqi7v7a344311id8rp3ts Our Trainers will focus on the queries posted by participants for discussion in the hangout. https://twitter.com/iZenBridge You can also post your queries at the forum. How to join the hangout? You can watch the event live at Risk Analysis Hangout. The queries/ questions will be taken up by using Q & A app.during the hangout. You need to type in your questions just like before, but now, the Q & A app will make it more manageable for the participants. Only selected participants, who have raised queries in the forum, would get an opportunity to come inside the session by way ... -

Security 101: Security Risk Analysis

HIPAA requires practices to assess their PHI as part of their risk management process. Learn more about a risk assessment and how your practice can benefit. -

Intro to Monte Carlo Simulation for Project Schedule Risk Analysis using @RISK - Webcast

This webcast is designed to provide an entry-level introduction into probabilistic analysis and will show how Monte Carlo simulation and other techniques can be applied to your project schedule risk analysis. -

Risk Analysis in Capital Budgeting - Introduction

ADVANCED FINANCIAL MANAGEMENT ADVANCED FINANCIAL MANAGEMENT If you enjoyed this content, make sure to check full course. Here is a huge discount to get the course only $25 (Rs.1625). Click on the following link to avail discount. https://www.udemy.com/advanced-financial-management-a-comprehensive-study/?couponCode=YTB20+1 Welcome to this course on Advanced Financial Management - A Comprehensive Study. In this course you will be expose to the advanced concepts of Financial Management covering a) Mergers and Acquisitions. b) Capital Market Instruments c) Advanced Capital Budgeting Techniques. d) Risk Analysis in Capital Budgeting e) Sensitivity and Scenario Analysis in Capital Budgeting f) Leasing g) Basics of Derivatives. h) Portfolio Management - Quantitative Techniques. i) Dividend Deci... -

Chapter 16 - Country Risk Analysis

Factors, Techniques, and assements. -

Introduction to Schedule Risk Analysis

What is Schedule Risk Analysis? Benefits of Schedule Risk Analysis. Uses of Schedule Risk Analysis at different phases of the project life-cycle. -

The Audit Process, Planning, and Risk Analysis - Prof. Helen Brown

Lecture 7: The Audit Process, Planning, and Risk Analysis by Professor Helen Brown The lecture begins with the Professor discussing the three main reasons for planning, which are described as (1) to obtain sufficient competent evidence, (2) to help keep audit costs reasonable, and (3) to avoid misunderstanding with the client. Planning an audit and designing an audit approach involves several steps, among which include understanding the client's business and industry, assessing the client's business risk, performing preliminary analytical procedures, gathering information to assess fraud risks, and understanding internal control and assessing control risk (there are more of them). Each step is also discussed in detail. Following that, two case problems are performed. The first (Flash T... -

Reducing Project Costs and Risks with Oracle Primavera Risk Analysis

This one-hour webinar presents a comprehensive overview of Oracle Primavera's risk analysis package as well as project risk analysis concepts and key benefits. Covered are practical examples on how simulation is used to estimate budgets /costs within a project, set accurate dates and targets, analyze probabilistic cash flows, and how to link this up with stochastic portfolio modeling using Oracle Crystal ball. -

Qualitative vs quantitative risk analysis

Confused about ualitative and quantitative risk analysis? Watch the video, find out the difference! www.pmwars.com -

Business Impact Analysis and Risk Assessment

The BCM 101 series from Avalution explores each phase of the business continuity planning life-cycle, including: Business Impact Analysis (BIA) and Risk Assessment. To learn more about business continuity, check out the full BCM 101 series here: avalution.com/bcm-101 Business continuity planning is all that we do. If you're ready to get your program up and running, we can help. Let's connect and get started today! 866.533.0575 | contactus@avalution.com | avalution.com -

Evaluating Risks Using Qualitative Risk Analysis

Learn more about evaluating project risks at http://www.pmsouth.com/?p=232

how to risk analysis framework

- Order: Reorder

- Duration: 3:41

- Updated: 04 Jan 2014

- views: 5534

How to undertake a risk analysis assessment on your business

How to undertake a risk analysis assessment on your business

wn.com/How To Risk Analysis Framework

How to undertake a risk analysis assessment on your business

- published: 04 Jan 2014

- views: 5534

Introduction to Risk Assessment

- Order: Reorder

- Duration: 57:18

- Updated: 13 Dec 2010

- views: 98218

Info

Level: Beginner

Presenter: Eli the Computer Guy

Date Created: October 12, 2010

Length of Class: 57 Minutes

Tracks

Computer Security /Integrity

Prerequisi...

Info

Level: Beginner

Presenter: Eli the Computer Guy

Date Created: October 12, 2010

Length of Class: 57 Minutes

Tracks

Computer Security /Integrity

Prerequisites

None

Purpose of Class

This class teaches students the basic concepts behind Risk Assessments.

Topics Covered

Defining Risk, Threat and Vulnerability

Types of Protections

Mitigation Concepts

Business Rational for Risk Assessment and Management

Class Notes

Introduction

The better you know technology the better you will do with Risk Assessment/ Management.

Risk

Risk = Treat x Vulnerability

Overview of Risk

Risk is defined as the likelihood of financial loss.

Risk is a business concepts not a technological one.

Down Time

Fraud

Legal data loss issues

Hacking -- Attacks from your network

Data Theft (Trade Secrets)

Overview of Threat

i. Natural Disatser

ii. Malicious Human

iii. Accidental Human

iv. System Failure

Impersonation

Interception

Interference

Overview of Vulnerability

Flooding

Theft of Systems

Hacking

Viruses

Overview of Protections Technoloigical Safe Guards

Physical/ Operational Security

Disaster Plan

Documentation

Technological Safeguards (Firewalls, Antivirus)

Concepts of Mitigation

Incident - Response - Debrief - Mitigation

Making Bad not so bad

You will never be safe

Security Buy In and Quantifying Risk

The business leaders will make the final decision on Risk Management

The better your BUSINESS argument the more likely you are to get the go ahead.

What is the cost of downtime

What is the legal cost

Cost of Security vs. Benefit

Final Thoughts

Risk is a BUSINESS concept! The more you understand about business and can talk about financial ramifications the more likely you are to get you fancy new security equipment.

Resources

US Computer Emergency Readiness Team

wn.com/Introduction To Risk Assessment

Info

Level: Beginner

Presenter: Eli the Computer Guy

Date Created: October 12, 2010

Length of Class: 57 Minutes

Tracks

Computer Security /Integrity

Prerequisites

None

Purpose of Class

This class teaches students the basic concepts behind Risk Assessments.

Topics Covered

Defining Risk, Threat and Vulnerability

Types of Protections

Mitigation Concepts

Business Rational for Risk Assessment and Management

Class Notes

Introduction

The better you know technology the better you will do with Risk Assessment/ Management.

Risk

Risk = Treat x Vulnerability

Overview of Risk

Risk is defined as the likelihood of financial loss.

Risk is a business concepts not a technological one.

Down Time

Fraud

Legal data loss issues

Hacking -- Attacks from your network

Data Theft (Trade Secrets)

Overview of Threat

i. Natural Disatser

ii. Malicious Human

iii. Accidental Human

iv. System Failure

Impersonation

Interception

Interference

Overview of Vulnerability

Flooding

Theft of Systems

Hacking

Viruses

Overview of Protections Technoloigical Safe Guards

Physical/ Operational Security

Disaster Plan

Documentation

Technological Safeguards (Firewalls, Antivirus)

Concepts of Mitigation

Incident - Response - Debrief - Mitigation

Making Bad not so bad

You will never be safe

Security Buy In and Quantifying Risk

The business leaders will make the final decision on Risk Management

The better your BUSINESS argument the more likely you are to get the go ahead.

What is the cost of downtime

What is the legal cost

Cost of Security vs. Benefit

Final Thoughts

Risk is a BUSINESS concept! The more you understand about business and can talk about financial ramifications the more likely you are to get you fancy new security equipment.

Resources

US Computer Emergency Readiness Team

- published: 13 Dec 2010

- views: 98218

Risk Analysis

- Order: Reorder

- Duration: 3:01

- Updated: 02 Jun 2011

- views: 11223

Find out how to conduct a formal four-step risk analysis with this short video.

Find out how to conduct a formal four-step risk analysis with this short video.

wn.com/Risk Analysis

Find out how to conduct a formal four-step risk analysis with this short video.

- published: 02 Jun 2011

- views: 11223

Introduction to Monte Carlo Simulation and Risk Analysis using @RISK and RISKOptimizer

- Order: Reorder

- Duration: 63:30

- Updated: 29 Jan 2014

- views: 39266

This archived webcast is designed to provide an entry-level introduction into probabilistic analysis and will show how Monte Carlo simulation and other techniqu...

This archived webcast is designed to provide an entry-level introduction into probabilistic analysis and will show how Monte Carlo simulation and other techniques can be applied to your everyday business analyses.

wn.com/Introduction To Monte Carlo Simulation And Risk Analysis Using Risk And Riskoptimizer

This archived webcast is designed to provide an entry-level introduction into probabilistic analysis and will show how Monte Carlo simulation and other techniques can be applied to your everyday business analyses.

- published: 29 Jan 2014

- views: 39266

Risk Analysis and Management

- Order: Reorder

- Duration: 46:05

- Updated: 25 Jun 2014

- views: 1875

Summary

Defining assets in a risk analysis, identifying threats and the likelihood of the threats occurring, identifying the consequences of a threat occurring...

Summary

Defining assets in a risk analysis, identifying threats and the likelihood of the threats occurring, identifying the consequences of a threat occurring, and vulnerabilities that increase risk.

Also covers common safeguards to reduce the impact of threats, securing equipment/data, and incident response (should be included in security policy).

Reference Materials

Guide to Network Defense and Countermeasures - Chapter 2

Additional Information

NIST Guide on Risk Management:

http://csrc.nist.gov/publications/nistpubs/800-30/sp800-30.pdf

wn.com/Risk Analysis And Management

Summary

Defining assets in a risk analysis, identifying threats and the likelihood of the threats occurring, identifying the consequences of a threat occurring, and vulnerabilities that increase risk.

Also covers common safeguards to reduce the impact of threats, securing equipment/data, and incident response (should be included in security policy).

Reference Materials

Guide to Network Defense and Countermeasures - Chapter 2

Additional Information

NIST Guide on Risk Management:

http://csrc.nist.gov/publications/nistpubs/800-30/sp800-30.pdf

- published: 25 Jun 2014

- views: 1875

Create a Risk Assessment Chart

- Order: Reorder

- Duration: 16:53

- Updated: 14 Dec 2014

- views: 27189

Subscribe to Channel: http://goo.gl/wN3c3p

View the Blog: http://myexcelcharts.blogspot.com

This video covers how to create a colored (green-yellow-red) risk a...

Subscribe to Channel: http://goo.gl/wN3c3p

View the Blog: http://myexcelcharts.blogspot.com

This video covers how to create a colored (green-yellow-red) risk assessment chart. This is used in project management to compare risk to probability for various task or projects to help aid in decision making.

Feel free to provide a comment or share it with a friend!

------------------------------------------------------------------------------------------------

WHERE TO GET THE TOOLS I USE (affiliate link):

Camtasia: http://goo.gl/qdDBnP

Microsoft products: http://goo.gl/KzkxCo

wn.com/Create A Risk Assessment Chart

Subscribe to Channel: http://goo.gl/wN3c3p

View the Blog: http://myexcelcharts.blogspot.com

This video covers how to create a colored (green-yellow-red) risk assessment chart. This is used in project management to compare risk to probability for various task or projects to help aid in decision making.

Feel free to provide a comment or share it with a friend!

------------------------------------------------------------------------------------------------

WHERE TO GET THE TOOLS I USE (affiliate link):

Camtasia: http://goo.gl/qdDBnP

Microsoft products: http://goo.gl/KzkxCo

- published: 14 Dec 2014

- views: 27189

How to Evaluate Risks Using Quantitative Risk Analysis

- Order: Reorder

- Duration: 4:40

- Updated: 07 Feb 2015

- views: 829

Learn more about how to evaluate project risks using quantitative risk analysis at http://bit.ly/1Rq5OAp

Learn more about how to evaluate project risks using quantitative risk analysis at http://bit.ly/1Rq5OAp

wn.com/How To Evaluate Risks Using Quantitative Risk Analysis

Learn more about how to evaluate project risks using quantitative risk analysis at http://bit.ly/1Rq5OAp

- published: 07 Feb 2015

- views: 829

Project Management Concept #2: Qualitative Risk Analysis vs Quantitative Risk Analysis

- Order: Reorder

- Duration: 4:15

- Updated: 30 Oct 2014

- views: 7601

Passionate Project Management, www.PassionatePM.com, is pleased to sponsor this Passionate Project Management YouTube channel. Passionate Project Management spe...

Passionate Project Management, www.PassionatePM.com, is pleased to sponsor this Passionate Project Management YouTube channel. Passionate Project Management specializes in project management learning, development, and consulting. Passionate Project Management offers open enrollment and private on-site courses delivered by the leading instructors in the industry. Passionate Project Management provides PMP Exam Prep, CAPM Exam Prep, PMI-RMP (Risk Management) Exam Prep, and PMI-ACP (Agile) Exam prep.

This Video is a component of our Learning Concepts Series: 2. Qualitative versus Quantitative Risk Analysis narrated by Belinda Fremouw.

Belinda was the first woman in the world to achieve the original five PMI Credentials. Her experience spans multiple decades, crosses several industries, and includes domestic and international project experience. Belinda is a well-known public speaker and author.

Check out our website at www.PassionatePM.com for all of our course offerings and exam prep study materials.

www.PassionatePM.com

#PassionatePM #BelindaFremouw #BelindaPMP

wn.com/Project Management Concept 2 Qualitative Risk Analysis Vs Quantitative Risk Analysis

Passionate Project Management, www.PassionatePM.com, is pleased to sponsor this Passionate Project Management YouTube channel. Passionate Project Management specializes in project management learning, development, and consulting. Passionate Project Management offers open enrollment and private on-site courses delivered by the leading instructors in the industry. Passionate Project Management provides PMP Exam Prep, CAPM Exam Prep, PMI-RMP (Risk Management) Exam Prep, and PMI-ACP (Agile) Exam prep.

This Video is a component of our Learning Concepts Series: 2. Qualitative versus Quantitative Risk Analysis narrated by Belinda Fremouw.

Belinda was the first woman in the world to achieve the original five PMI Credentials. Her experience spans multiple decades, crosses several industries, and includes domestic and international project experience. Belinda is a well-known public speaker and author.

Check out our website at www.PassionatePM.com for all of our course offerings and exam prep study materials.

www.PassionatePM.com

#PassionatePM #BelindaFremouw #BelindaPMP

- published: 30 Oct 2014

- views: 7601

Hazard, Risk & Safety - Understanding Risk Assessment, Management and Perception

- Order: Reorder

- Duration: 5:31

- Updated: 24 Nov 2014

- views: 61791

(subtitles available in EN, FR, NL and ES)

We all hear these terms on a daily basis. So and so a chemical, physical or a biological agent poses a risk; This or...

(subtitles available in EN, FR, NL and ES)

We all hear these terms on a daily basis. So and so a chemical, physical or a biological agent poses a risk; This or that product is a hazard or behaving a certain way is unsafe.

A lot of the time “hazard” and “risk” are freely used to mean the same thing. However they are not.

Hazard is the potential to cause harm. Risk on the other hand is the likelihood of harm in defined circumstances.

In a nutshell, hazard and risk are not always aligned as the risk depends on the exposure to the hazard ; similarly, risk, safety and perception of risk are not always aligned; this can make political decisions regarding safety levels difficult to make, in these cases it is especially important to base them on facts rather than on subjective perceptions.

http://www.greenfacts.org

wn.com/Hazard, Risk Safety Understanding Risk Assessment, Management And Perception

(subtitles available in EN, FR, NL and ES)

We all hear these terms on a daily basis. So and so a chemical, physical or a biological agent poses a risk; This or that product is a hazard or behaving a certain way is unsafe.

A lot of the time “hazard” and “risk” are freely used to mean the same thing. However they are not.

Hazard is the potential to cause harm. Risk on the other hand is the likelihood of harm in defined circumstances.

In a nutshell, hazard and risk are not always aligned as the risk depends on the exposure to the hazard ; similarly, risk, safety and perception of risk are not always aligned; this can make political decisions regarding safety levels difficult to make, in these cases it is especially important to base them on facts rather than on subjective perceptions.

http://www.greenfacts.org

- published: 24 Nov 2014

- views: 61791

Risk Analysis and Uncertainty: A Simple Case Study

- Order: Reorder

- Duration: 11:12

- Updated: 24 Apr 2014

- views: 3690

https://www.emerald-associates.com/services/avoid-/-manage-risk/risk-management.html

Oracle Primavera Risk Analysis (Pertmaster) software is used to explain th...

https://www.emerald-associates.com/services/avoid-/-manage-risk/risk-management.html

Oracle Primavera Risk Analysis (Pertmaster) software is used to explain the concept of uncertainty and its role in project based risk analysis for both cost and time. David Phillips walks us through some simple scenarios.

For more information on risk analysis please visit Emerald Associates at http://www.emerald.associates.com

wn.com/Risk Analysis And Uncertainty A Simple Case Study

https://www.emerald-associates.com/services/avoid-/-manage-risk/risk-management.html

Oracle Primavera Risk Analysis (Pertmaster) software is used to explain the concept of uncertainty and its role in project based risk analysis for both cost and time. David Phillips walks us through some simple scenarios.

For more information on risk analysis please visit Emerald Associates at http://www.emerald.associates.com

- published: 24 Apr 2014

- views: 3690

What are the different Risk Analysis Techniques

- Order: Reorder

- Duration: 7:00

- Updated: 15 Sep 2012

- views: 5966

Risk is part and parcel of any project. Risk identification, analysis and management are the foundations of successful project management.Successful project lea...

Risk is part and parcel of any project. Risk identification, analysis and management are the foundations of successful project management.Successful project leaders always do two things very well.First they accept and approach a new project with the idea that the project is totally new irrespective of the fact that there could be similarities between earlier projects handled and also the experience base of the team.Second they go through a systematic and through risk analysis of the project as though there is no tomorrow.These qualities enable them to appreciate the project challenges well ahead and they are invariably ready to face the challenges with suitable actions so that the project objectives are achieved as defined in the project charter.

Project Management Body of Knowledge (PMBOK) by PMI also brings in very extensively as one of the nine knowledge areas that requires sufficient focus.An analysis of project management literature leads one to conclude that lack of clear risk understanding and management is the reason for the failure of majority of the projects, This is more so for complex and large projects.Risk , by nature ,is difficult for project managers to visualise due to their enthusiasm to go ahead and execute the projects.

Also self interest and personal agenda of the project team lead to assessing issues and challenges optimistically rather than realistically.This focus of this web cast will be the understanding of risks from strategic and execution perspectives and dwell of the methodologies for handling the risks.

wn.com/What Are The Different Risk Analysis Techniques

Risk is part and parcel of any project. Risk identification, analysis and management are the foundations of successful project management.Successful project leaders always do two things very well.First they accept and approach a new project with the idea that the project is totally new irrespective of the fact that there could be similarities between earlier projects handled and also the experience base of the team.Second they go through a systematic and through risk analysis of the project as though there is no tomorrow.These qualities enable them to appreciate the project challenges well ahead and they are invariably ready to face the challenges with suitable actions so that the project objectives are achieved as defined in the project charter.

Project Management Body of Knowledge (PMBOK) by PMI also brings in very extensively as one of the nine knowledge areas that requires sufficient focus.An analysis of project management literature leads one to conclude that lack of clear risk understanding and management is the reason for the failure of majority of the projects, This is more so for complex and large projects.Risk , by nature ,is difficult for project managers to visualise due to their enthusiasm to go ahead and execute the projects.

Also self interest and personal agenda of the project team lead to assessing issues and challenges optimistically rather than realistically.This focus of this web cast will be the understanding of risks from strategic and execution perspectives and dwell of the methodologies for handling the risks.

- published: 15 Sep 2012

- views: 5966

Monte Carlo Schedule Risk analysis. Part 1: Introduction to schedule risk analysis techniques

- Order: Reorder

- Duration: 9:42

- Updated: 20 Dec 2013

- views: 13221

Video shows how schedule risk analysis is performed in RiskyProject project risk management and risk analysis software. Monte Carlo simulations require inputs t...

Video shows how schedule risk analysis is performed in RiskyProject project risk management and risk analysis software. Monte Carlo simulations require inputs to perform the analysis: duration estimates and statistical distributions. In this video, we describe what a statistical distribution for schedules is and use a real life example to gather the distribution data and describe them using frequency histograms and cumulative probability plots. Finally, we use the data we generated from this real life example, to create a risk analysis model in the software and run a Monte Carlo simulation.

For more information how to perform schedule risk analysis using RiskyProject software please visit Intaver Institute web site: http://www.intaver.com.

About Intaver Institute.

Intaver Institute Inc. develops project risk management and project risk analysis software. Intaver's flagship product is RiskyProject: project risk management software. RiskyProject integrates with Microsoft Project, Oracle Primavera, other project management software or can run standalone. RiskyProject comes in three configurations: RiskyProject Lite, RiskyProject Professional, and RiskyProject Enterprise.

wn.com/Monte Carlo Schedule Risk Analysis. Part 1 Introduction To Schedule Risk Analysis Techniques

Video shows how schedule risk analysis is performed in RiskyProject project risk management and risk analysis software. Monte Carlo simulations require inputs to perform the analysis: duration estimates and statistical distributions. In this video, we describe what a statistical distribution for schedules is and use a real life example to gather the distribution data and describe them using frequency histograms and cumulative probability plots. Finally, we use the data we generated from this real life example, to create a risk analysis model in the software and run a Monte Carlo simulation.

For more information how to perform schedule risk analysis using RiskyProject software please visit Intaver Institute web site: http://www.intaver.com.

About Intaver Institute.

Intaver Institute Inc. develops project risk management and project risk analysis software. Intaver's flagship product is RiskyProject: project risk management software. RiskyProject integrates with Microsoft Project, Oracle Primavera, other project management software or can run standalone. RiskyProject comes in three configurations: RiskyProject Lite, RiskyProject Professional, and RiskyProject Enterprise.

- published: 20 Dec 2013

- views: 13221

PMP® | Risk Analysis-Qualitative & Quantitative Approaches

- Order: Reorder

- Duration: 59:52

- Updated: 07 Feb 2014

- views: 14571

Agenda for the hangout

Check out the queries raised at iZenBridge Forum http://goo.gl/pVUqF7 to be discussed during the session.

https://plus.google.com/b/10...

Agenda for the hangout

Check out the queries raised at iZenBridge Forum http://goo.gl/pVUqF7 to be discussed during the session.

https://plus.google.com/b/103624728377270787243/events/cbo8qceqi7v7a344311id8rp3ts

Our Trainers will focus on the queries posted by participants for discussion in the hangout. https://twitter.com/iZenBridge

You can also post your queries at the forum.

How to join the hangout?

You can watch the event live at Risk Analysis Hangout.

The queries/ questions will be taken up by using Q & A app.during the hangout. You need to type in your questions just like before, but now, the Q & A app will make it more manageable for the participants.

Only selected participants, who have raised queries in the forum, would get an opportunity to come inside the session by way of video to follow up on the queries they had raised. Only first 9 participants can avail this facility.

To enter the live web session, the selected participants can use the link provided at Twitter. Search the link using #iZenPMP. Rest of the participants need to follow the link provided above in the mail.

Only in case of technical problems during the hangout, communicate to us on Twitter by using #iZenPMP

Speaker:+Saket Bansal

wn.com/Pmp® | Risk Analysis Qualitative Quantitative Approaches

Agenda for the hangout

Check out the queries raised at iZenBridge Forum http://goo.gl/pVUqF7 to be discussed during the session.

https://plus.google.com/b/103624728377270787243/events/cbo8qceqi7v7a344311id8rp3ts

Our Trainers will focus on the queries posted by participants for discussion in the hangout. https://twitter.com/iZenBridge

You can also post your queries at the forum.

How to join the hangout?

You can watch the event live at Risk Analysis Hangout.

The queries/ questions will be taken up by using Q & A app.during the hangout. You need to type in your questions just like before, but now, the Q & A app will make it more manageable for the participants.

Only selected participants, who have raised queries in the forum, would get an opportunity to come inside the session by way of video to follow up on the queries they had raised. Only first 9 participants can avail this facility.

To enter the live web session, the selected participants can use the link provided at Twitter. Search the link using #iZenPMP. Rest of the participants need to follow the link provided above in the mail.

Only in case of technical problems during the hangout, communicate to us on Twitter by using #iZenPMP

Speaker:+Saket Bansal

- published: 07 Feb 2014

- views: 14571

Security 101: Security Risk Analysis

- Order: Reorder

- Duration: 8:07

- Updated: 17 Apr 2014

- views: 29457

HIPAA requires practices to assess their PHI as part of their risk management process. Learn more about a risk assessment and how your practice can benefit.

HIPAA requires practices to assess their PHI as part of their risk management process. Learn more about a risk assessment and how your practice can benefit.

wn.com/Security 101 Security Risk Analysis

HIPAA requires practices to assess their PHI as part of their risk management process. Learn more about a risk assessment and how your practice can benefit.

- published: 17 Apr 2014

- views: 29457

Intro to Monte Carlo Simulation for Project Schedule Risk Analysis using @RISK - Webcast

- Order: Reorder

- Duration: 62:50

- Updated: 29 Jan 2014

- views: 4997

This webcast is designed to provide an entry-level introduction into probabilistic analysis and will show how Monte Carlo simulation and other techniques can be...

This webcast is designed to provide an entry-level introduction into probabilistic analysis and will show how Monte Carlo simulation and other techniques can be applied to your project schedule risk analysis.

wn.com/Intro To Monte Carlo Simulation For Project Schedule Risk Analysis Using Risk Webcast

This webcast is designed to provide an entry-level introduction into probabilistic analysis and will show how Monte Carlo simulation and other techniques can be applied to your project schedule risk analysis.

- published: 29 Jan 2014

- views: 4997

Risk Analysis in Capital Budgeting - Introduction

- Order: Reorder

- Duration: 7:44

- Updated: 09 Sep 2015

- views: 587

ADVANCED FINANCIAL MANAGEMENT

ADVANCED FINANCIAL MANAGEMENT

If you enjoyed this content, make sure to check full course. Here is a huge discount to get the cour...

ADVANCED FINANCIAL MANAGEMENT

ADVANCED FINANCIAL MANAGEMENT

If you enjoyed this content, make sure to check full course. Here is a huge discount to get the course only $25 (Rs.1625). Click on the following link to avail discount.

https://www.udemy.com/advanced-financial-management-a-comprehensive-study/?couponCode=YTB20+1

Welcome to this course on Advanced Financial Management - A Comprehensive Study.

In this course you will be expose to the advanced concepts of Financial Management covering

a) Mergers and Acquisitions.

b) Capital Market Instruments

c) Advanced Capital Budgeting Techniques.

d) Risk Analysis in Capital Budgeting

e) Sensitivity and Scenario Analysis in Capital Budgeting

f) Leasing

g) Basics of Derivatives.

h) Portfolio Management - Quantitative Techniques.

i) Dividend Decisions.

The above topics were also available as separate courses. By taking this course, you need not take the separate courses taught by me in the above names.

This course is structured keeping Professional course students in mind like CA / CPA / CFA / CMA / MBA Finance, etc.

This course will equip you for approaching those professional examinations. This course is presented in simple language with examples. This course has video lectures (with writings on Black / Green Board / Note book, etc). You would feel you are attending a real class.

This course is structured in self paced learning style. You would require good internet connection for interruption free learning process. You have to go through the videos leisurely to grab the concepts with clarity.

Take this course to gain strong hold on Advanced Concepts in Financial Management.

• Category:

Business

What's in the Course?

1. Over 143 lectures and 16.5 hours of content!

2. Understand Mergers and Acquistions.

3. Understand Advanced Capital Budgeting Techniques

4. Understand Risk Analysis in Capital Budgeting

5. Understand Sensitivity and Scenario Analysis in Capital Budgeting

6. Understand Leasing

7. Understand Dividend Decisions

8. Understand Basics of Derivative Instruments

9. Understand Portfolio Management - Quanitative Techniques

Course Requirements:

1. Basic knowledge in Financial Management

2. Basic Knowledge in Accounting

Who Should Attend?

1. Professional Course students taking up courses like CA / CPA / CMA / CFA / CIMA / MBA Finance

2. Finance Professionals

wn.com/Risk Analysis In Capital Budgeting Introduction

ADVANCED FINANCIAL MANAGEMENT

ADVANCED FINANCIAL MANAGEMENT

If you enjoyed this content, make sure to check full course. Here is a huge discount to get the course only $25 (Rs.1625). Click on the following link to avail discount.

https://www.udemy.com/advanced-financial-management-a-comprehensive-study/?couponCode=YTB20+1

Welcome to this course on Advanced Financial Management - A Comprehensive Study.

In this course you will be expose to the advanced concepts of Financial Management covering

a) Mergers and Acquisitions.

b) Capital Market Instruments

c) Advanced Capital Budgeting Techniques.

d) Risk Analysis in Capital Budgeting

e) Sensitivity and Scenario Analysis in Capital Budgeting

f) Leasing

g) Basics of Derivatives.

h) Portfolio Management - Quantitative Techniques.

i) Dividend Decisions.

The above topics were also available as separate courses. By taking this course, you need not take the separate courses taught by me in the above names.

This course is structured keeping Professional course students in mind like CA / CPA / CFA / CMA / MBA Finance, etc.

This course will equip you for approaching those professional examinations. This course is presented in simple language with examples. This course has video lectures (with writings on Black / Green Board / Note book, etc). You would feel you are attending a real class.

This course is structured in self paced learning style. You would require good internet connection for interruption free learning process. You have to go through the videos leisurely to grab the concepts with clarity.

Take this course to gain strong hold on Advanced Concepts in Financial Management.

• Category:

Business

What's in the Course?

1. Over 143 lectures and 16.5 hours of content!

2. Understand Mergers and Acquistions.

3. Understand Advanced Capital Budgeting Techniques

4. Understand Risk Analysis in Capital Budgeting

5. Understand Sensitivity and Scenario Analysis in Capital Budgeting

6. Understand Leasing

7. Understand Dividend Decisions

8. Understand Basics of Derivative Instruments

9. Understand Portfolio Management - Quanitative Techniques

Course Requirements:

1. Basic knowledge in Financial Management

2. Basic Knowledge in Accounting

Who Should Attend?

1. Professional Course students taking up courses like CA / CPA / CMA / CFA / CIMA / MBA Finance

2. Finance Professionals

- published: 09 Sep 2015

- views: 587

Chapter 16 - Country Risk Analysis

- Order: Reorder

- Duration: 25:39

- Updated: 20 Apr 2015

- views: 836

Factors, Techniques, and assements.

Factors, Techniques, and assements.

wn.com/Chapter 16 Country Risk Analysis

Introduction to Schedule Risk Analysis

- Order: Reorder

- Duration: 14:44

- Updated: 29 Nov 2013

- views: 1262

What is Schedule Risk Analysis? Benefits of Schedule Risk Analysis. Uses of Schedule Risk Analysis at different phases of the project life-cycle.

What is Schedule Risk Analysis? Benefits of Schedule Risk Analysis. Uses of Schedule Risk Analysis at different phases of the project life-cycle.

wn.com/Introduction To Schedule Risk Analysis

What is Schedule Risk Analysis? Benefits of Schedule Risk Analysis. Uses of Schedule Risk Analysis at different phases of the project life-cycle.

- published: 29 Nov 2013

- views: 1262

The Audit Process, Planning, and Risk Analysis - Prof. Helen Brown

- Order: Reorder

- Duration: 172:06

- Updated: 27 Jul 2012

- views: 51060

Lecture 7: The Audit Process, Planning, and Risk Analysis

by Professor Helen Brown

The lecture begins with the Professor discussing the three main reasons for ...

Lecture 7: The Audit Process, Planning, and Risk Analysis

by Professor Helen Brown

The lecture begins with the Professor discussing the three main reasons for planning, which are described as (1) to obtain sufficient competent evidence, (2) to help keep audit costs reasonable, and (3) to avoid misunderstanding with the client.

Planning an audit and designing an audit approach involves several steps, among which include understanding the client's business and industry, assessing the client's business risk, performing preliminary analytical procedures, gathering information to assess fraud risks, and understanding internal control and assessing control risk (there are more of them). Each step is also discussed in detail.

Following that, two case problems are performed. The first (Flash Technologies) is discussed and after the discussion a risk analysis is performed for the company in the case. The second case discussed is the Pinnacle case

------QUICK NAVIGATION------

Three Main Reasons for Planning: 1:50

Planning an Audit and Designing an Audit Approach: 4:18

STEP 1: Initial Audit Planning Overview: 9:12

Initial Audit Planning (defined in-depth): 9:30

Identify Reasons for the Audit: 12:33

Obtaining an Understanding with the Client: 15:20

Develop an Overall Audit Strategy: 16:11

STEP 2: Understanding of the Client's Business and Industry: 18:43

STEP 3 - Assess Client Business Risk: 19:38

Flash Technologies Case Problem: 20:35

SILENCE (students discuss case among each other): 21:15

Relevant Professional Standards (PCAOB): 43:28

Discusses General Risks Identified

in Flash Technologies Case (a risk analysis): 47:41

General Areas of Risk Displayed: 1:04:20

Financial Accounting / Reporting Risks: 1:12:08

Comparing Flash Technologies (the company)

to its Respective Industry (ratios, profit): 1:14:25

Risk related to Business Strategies: 1:15:17

Positive Aspects of Flash Technologies: 1:16:34

Red Flags (indicators of negative aspects): 1:17:36

Financial Accounting & Reporting Risks (chart): 1:25:46

SILENCE (class break): 1:32:00

Performing Preliminary Analytical Procedures:1:37:38

Timing and Purposes of Analytical Procedures: 1:47:46

Five Types of Analytical Procedures: 1:53:39

Common Financial Ratios: 1:56:10

Pinnacle Manufacturing (Case Problem) Discussion: 1:56:55

Account Balances (for trend analysis): 1:59:06

Financial Ratios: 2:03:17

Financial Statement Analysis: 2:07:56

Potential Misstatements: 2:12:20

Further Financial Information (displays ratios

such as Accounts Receivable turnover): 2:24:50

Analysis of Inventory Balance: 2:32:54

Analysis of Short-term and Long-term Debt: 2:35:08

Is Pinnacle like to fail or not? (discussion) : 2:36:22

Materiality: 2:42:05

Materiality Concept: 2:43:22

What is Materiality? 2:46:15

When is it Material? 2:47:11

wn.com/The Audit Process, Planning, And Risk Analysis Prof. Helen Brown

Lecture 7: The Audit Process, Planning, and Risk Analysis

by Professor Helen Brown

The lecture begins with the Professor discussing the three main reasons for planning, which are described as (1) to obtain sufficient competent evidence, (2) to help keep audit costs reasonable, and (3) to avoid misunderstanding with the client.

Planning an audit and designing an audit approach involves several steps, among which include understanding the client's business and industry, assessing the client's business risk, performing preliminary analytical procedures, gathering information to assess fraud risks, and understanding internal control and assessing control risk (there are more of them). Each step is also discussed in detail.

Following that, two case problems are performed. The first (Flash Technologies) is discussed and after the discussion a risk analysis is performed for the company in the case. The second case discussed is the Pinnacle case

------QUICK NAVIGATION------

Three Main Reasons for Planning: 1:50

Planning an Audit and Designing an Audit Approach: 4:18

STEP 1: Initial Audit Planning Overview: 9:12

Initial Audit Planning (defined in-depth): 9:30

Identify Reasons for the Audit: 12:33

Obtaining an Understanding with the Client: 15:20

Develop an Overall Audit Strategy: 16:11

STEP 2: Understanding of the Client's Business and Industry: 18:43

STEP 3 - Assess Client Business Risk: 19:38

Flash Technologies Case Problem: 20:35

SILENCE (students discuss case among each other): 21:15

Relevant Professional Standards (PCAOB): 43:28

Discusses General Risks Identified

in Flash Technologies Case (a risk analysis): 47:41

General Areas of Risk Displayed: 1:04:20

Financial Accounting / Reporting Risks: 1:12:08

Comparing Flash Technologies (the company)

to its Respective Industry (ratios, profit): 1:14:25

Risk related to Business Strategies: 1:15:17

Positive Aspects of Flash Technologies: 1:16:34

Red Flags (indicators of negative aspects): 1:17:36

Financial Accounting & Reporting Risks (chart): 1:25:46

SILENCE (class break): 1:32:00

Performing Preliminary Analytical Procedures:1:37:38

Timing and Purposes of Analytical Procedures: 1:47:46

Five Types of Analytical Procedures: 1:53:39

Common Financial Ratios: 1:56:10

Pinnacle Manufacturing (Case Problem) Discussion: 1:56:55

Account Balances (for trend analysis): 1:59:06

Financial Ratios: 2:03:17

Financial Statement Analysis: 2:07:56

Potential Misstatements: 2:12:20

Further Financial Information (displays ratios

such as Accounts Receivable turnover): 2:24:50

Analysis of Inventory Balance: 2:32:54

Analysis of Short-term and Long-term Debt: 2:35:08

Is Pinnacle like to fail or not? (discussion) : 2:36:22

Materiality: 2:42:05

Materiality Concept: 2:43:22

What is Materiality? 2:46:15

When is it Material? 2:47:11

- published: 27 Jul 2012

- views: 51060

Reducing Project Costs and Risks with Oracle Primavera Risk Analysis

- Order: Reorder

- Duration: 61:44

- Updated: 27 Apr 2012

- views: 19468

This one-hour webinar presents a comprehensive overview of Oracle Primavera's risk analysis package as well as project risk analysis concepts and key benefits. ...

This one-hour webinar presents a comprehensive overview of Oracle Primavera's risk analysis package as well as project risk analysis concepts and key benefits. Covered are practical examples on how simulation is used to estimate budgets /costs within a project, set accurate dates and targets, analyze probabilistic cash flows, and how to link this up with stochastic portfolio modeling using Oracle Crystal ball.

wn.com/Reducing Project Costs And Risks With Oracle Primavera Risk Analysis

This one-hour webinar presents a comprehensive overview of Oracle Primavera's risk analysis package as well as project risk analysis concepts and key benefits. Covered are practical examples on how simulation is used to estimate budgets /costs within a project, set accurate dates and targets, analyze probabilistic cash flows, and how to link this up with stochastic portfolio modeling using Oracle Crystal ball.

- published: 27 Apr 2012

- views: 19468

Qualitative vs quantitative risk analysis

- Order: Reorder

- Duration: 3:00

- Updated: 22 Jun 2015

- views: 763

Confused about ualitative and quantitative risk analysis? Watch the video, find out the difference!

www.pmwars.com

Confused about ualitative and quantitative risk analysis? Watch the video, find out the difference!

www.pmwars.com

wn.com/Qualitative Vs Quantitative Risk Analysis

Confused about ualitative and quantitative risk analysis? Watch the video, find out the difference!

www.pmwars.com

- published: 22 Jun 2015

- views: 763

Business Impact Analysis and Risk Assessment

- Order: Reorder

- Duration: 2:40

- Updated: 06 Nov 2014

- views: 2120

The BCM 101 series from Avalution explores each phase of the business continuity planning life-cycle, including: Business Impact Analysis (BIA) and Risk Assessm...

The BCM 101 series from Avalution explores each phase of the business continuity planning life-cycle, including: Business Impact Analysis (BIA) and Risk Assessment.

To learn more about business continuity, check out the full BCM 101 series here: avalution.com/bcm-101

Business continuity planning is all that we do. If you're ready to get your program up and running, we can help. Let's connect and get started today!

866.533.0575 | contactus@avalution.com | avalution.com

wn.com/Business Impact Analysis And Risk Assessment

The BCM 101 series from Avalution explores each phase of the business continuity planning life-cycle, including: Business Impact Analysis (BIA) and Risk Assessment.

To learn more about business continuity, check out the full BCM 101 series here: avalution.com/bcm-101

Business continuity planning is all that we do. If you're ready to get your program up and running, we can help. Let's connect and get started today!

866.533.0575 | contactus@avalution.com | avalution.com

- published: 06 Nov 2014

- views: 2120

Evaluating Risks Using Qualitative Risk Analysis

- Order: Reorder

- Duration: 5:03

- Updated: 15 Jan 2015

- views: 600

Learn more about evaluating project risks at http://www.pmsouth.com/?p=232

Learn more about evaluating project risks at http://www.pmsouth.com/?p=232

wn.com/Evaluating Risks Using Qualitative Risk Analysis

Learn more about evaluating project risks at http://www.pmsouth.com/?p=232

- published: 15 Jan 2015

- views: 600

close fullscreen

- Playlist

- Chat

close fullscreen

- Playlist

- Chat

3:41

how to risk analysis framework

How to undertake a risk analysis assessment on your business

published: 04 Jan 2014

how to risk analysis framework

how to risk analysis framework

- Report rights infringement

- published: 04 Jan 2014

- views: 5534

57:18

Introduction to Risk Assessment

Info

Level: Beginner

Presenter: Eli the Computer Guy

Date Created: October 12, 2010

Lengt...

published: 13 Dec 2010

Introduction to Risk Assessment

Introduction to Risk Assessment

- Report rights infringement

- published: 13 Dec 2010