- published: 15 Jul 2013

- views: 16430

-

remove the playlistEarnings Per Share

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistEarnings Per Share

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 21 Apr 2011

- views: 57335

- published: 02 Jul 2015

- views: 4650

- published: 22 Oct 2010

- views: 75370

- published: 15 May 2011

- views: 43776

- published: 06 Apr 2012

- views: 46772

- published: 15 Jul 2013

- views: 21578

- published: 28 Jan 2014

- views: 11638

- published: 08 Nov 2015

- views: 2877

- published: 24 Jan 2011

- views: 31570

Earnings per share (EPS) is the amount of earnings per each outstanding share of a company's stock.

In the United States, the Financial Accounting Standards Board (FASB) requires companies' income statements to report EPS for each of the major categories of the income statement: continuing operations, discontinued operations, extraordinary items, and net income.

The EPS formula does not include preferred dividends for categories outside of continued operations and net income. Earnings per share for continuing operations and net income are more complicated in that any preferred dividends are removed from net income before calculating EPS. This is because preferred stock rights have precedence over common stock. If preferred dividends total $100,000, then that is money not available to distribute to each share of common stock.

Failed to parse (Missing texvc executable; please see math/README to configure.): \mbox{Earnings Per Share}=\frac{\mbox{Profit}}{\mbox{Weighted Average Common Shares}}

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

7:23

7:23EPS (Earnings Per Share) explained

EPS (Earnings Per Share) explainedEPS (Earnings Per Share) explained

This video explains what EPS (Earnings Per Share) is and why it is a useful measure. -

12:57

12:57What does 'earnings per share' mean? - MoneyWeek Investment Tutorials

What does 'earnings per share' mean? - MoneyWeek Investment TutorialsWhat does 'earnings per share' mean? - MoneyWeek Investment Tutorials

Like this MoneyWeek Video? Want to find out more about earnings per share? Go to http://www.moneyweekvideos.com/what-does-earnings-per-share-mean/ now and you'll get free bonus material on this topic, plus a whole host of other videos. Search our whole archive of useful MoneyWeek Videos, including: · The six numbers every investor should know... http://www.moneyweekvideos.com/six-numbers-every-investor-should-know/ · What is GDP? http://www.moneyweekvideos.com/what-is-gdp/ · Why does Starbucks pay so little tax? http://www.moneyweekvideos.com/why-does-starbucks-pay-so-little-tax/ · How capital gains tax works... http://www.moneyweekvideos.com/how-capital-gains-tax-works/ · What is money laundering? http://www.moneyweekvideos.com/what-is-money-laundering/ -

4:40

4:40Earnings Per Share: Basic - Lesson 1

Earnings Per Share: Basic - Lesson 1Earnings Per Share: Basic - Lesson 1

In the video, 16.01 - Earnings Per Share: Basic - Lesson 1, Roger Philipp, CPA, CGMA, gives a conceptual overview of Earnings Per Share (EPS), one of the most-talked about numbers in a company’s financial statements. EPS is the amount that, theoretically, each common shareholder would receive if the company paid out all of its income in the form of a dividend. Basic and diluted EPS are required to be disclosed on the face of the income statement for both net income and income from continuing operations. EPS from discontinued operations, and formerly extraordinary items, must be shown on either the face of the income statement or in the footnote disclosures. Roger explains the difference between basic and diluted EPS. The ‘basic’ in Basic EPS refers to a simple capital structure in which there are no potentially dilutive items that could be converted into common stock. Examples of items that can potentially be converted into common stock are: convertible bonds, stock options, stock rights and stock warrants. The ‘diluted’ in Diluted EPS refers to a complex capital structure and is calculated upon the assumption that anything which could potentially get converted into common stock does get converted. In other words, think of diluted EPS as fully diluted EPS. Website: https://www.rogercpareview.com Blog: https://www.rogercpareview.com/blog Facebook: https://www.facebook.com/RogerCPAReview Twitter: https://twitter.com/rogercpareview LinkedIn: https://www.linkedin.com/company/roger-cpa-review Are you accounting faculty looking for FREE CPA Exam resources in the classroom? Visit our Professor Resource Center: https://www.rogercpareview.com/professor-resource-center/ Video Transcript Sneak Peek: Alright, let's move on to another fun and exciting area. Welcome, welcome, to what, Earnings per Share, EPS. Now, what is earnings per share? Earnings per share is one of the most talked about numbers in the financial statements. Creditors want to know about it. Investors want to know about it. Basically, they're saying, "Hey, I need this information." It is information that is required to be disclosed on the face of the income statement for publicly held companies, we'll expand on that in a minute. -

1:11

1:11Investopedia Video: Earnings Per Share Explained (EPS)

Investopedia Video: Earnings Per Share Explained (EPS)Investopedia Video: Earnings Per Share Explained (EPS)

Be the first to check out our latest videos on Investopedia Video: http://www.investopedia.com/video/ Earnings per share is one of the most carefully followed metrics in investing. We show you why this ratio matters and how to calculate it. For more on Earnings Per Share (EPS), and how it can help your trading success -- check out; The 5 Types Of Earnings Per Share http://www.investopedia.com/articles/analyst/091901.asp CFA Level 1 Exam Prep: Determining The EPS Of A Company http://www.investopedia.com/exam-guide/cfa-level-1/equity-investments/determining-eps-earnings-per-share.asp How To Evaluate The Quality Of EPS http://www.investopedia.com/articles/analyst/03/091703.asp Assess Shareholder Wealth With EPS http://www.investopedia.com/articles/basics/07/eps.asp -

10:40

10:40EPS Earnings Per Share Explained in 11 minutes - Financial Ratio Analysis Tutorial

EPS Earnings Per Share Explained in 11 minutes - Financial Ratio Analysis TutorialEPS Earnings Per Share Explained in 11 minutes - Financial Ratio Analysis Tutorial

Clicked here http://www.MBAbullshit.com/ and OMG wow! I'm SHOCKED how easy.. No wonder others goin crazy sharing this??? Share it with your other friends too! Let's say that ABC Company's Net income last year is one thousand dollars and there are one hundred shares outstanding. What is its earnings per share? Well its super simple, earnings per share is simply the total net income last year of the whole company divided by the number of shares outstanding. Now, if you do this equation you'd find that the earnings per share is exactly ten dollars, a nice simple easy round number. Now this is the most easy part of financial ratio which is to compute the actual number. What's more important is what does this mean? This means that every share earns ten dollars a year in profit, or last year every share earned ten dollars a year in profit. Meaning, you get the whole profit of the company and you divide that by the total number of shares. Then every shareholder, assuming every shareholder owns exactly one share, then every shareholder gets ten dollars a year in profit. Now I'd like to stress that this is ten dollars a year in profit not in dividend. EPS Earnings Per Share in 11 minutes - Financial Ratio Analysis Tutorial http://www.youtube.com/watch?v=2bbsAsnX1nM -

51:50

51:50FAR Exam Earnings Per Share

FAR Exam Earnings Per ShareFAR Exam Earnings Per Share

Don't miss this opportunity to study for free with the industry's top instructor! Pulled straight from the FAR section of our CPA Review Course, this exclusive webcast features Roger Philipp, CPA, CGMA, teaching "Earnings Per Share." Connect with us: Website: https://www.rogercpareview.com Blog: https://www.rogercpareview.com/blog Facebook: https://www.facebook.com/RogerCPAReview Twitter: https://twitter.com/rogercpareview LinkedIn: https://www.linkedin.com/company/roger-cpa-review Are you accounting faculty looking for FREE CPA Exam resources in the classroom? Visit our Professor Resource Center: https://www.rogercpareview.com/professor-resource-center/ Video Transcript Sneak Peek: Now, earnings per share is one of the most talked about numbers in the financial statements because both investors and creditors want to know, “Hey, if I invest in the company, will my stock go up in value and will I get a dividend?” Creditors want to know, “If I loan you money, will I get the principal back? Will I get the interest? What are your earnings per share?” -

4:29

4:29How to Calculate EPS (Earnings Per Share)

How to Calculate EPS (Earnings Per Share)How to Calculate EPS (Earnings Per Share)

This video explains how to calculate Earnings Per Share (EPS) and uses the formula to solve an example problem. -

17:24

17:24Intermediate Accounting: Basic and diluted earnings per share

Intermediate Accounting: Basic and diluted earnings per shareIntermediate Accounting: Basic and diluted earnings per share

This starts with a short theory lecture and then works a series of problems with you. -

19:32

19:32Basic earnings per share (EPS) ch 16 p 5 -Intermediate Accounting CPA exam

Basic earnings per share (EPS) ch 16 p 5 -Intermediate Accounting CPA examBasic earnings per share (EPS) ch 16 p 5 -Intermediate Accounting CPA exam

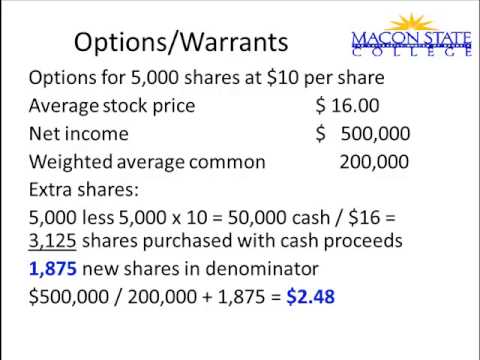

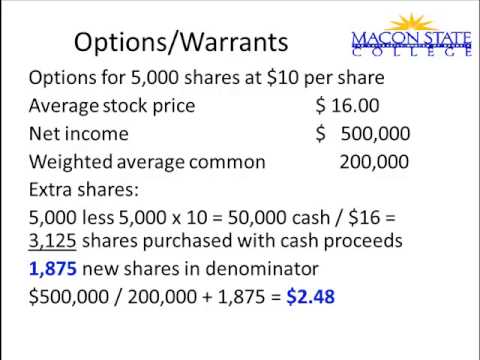

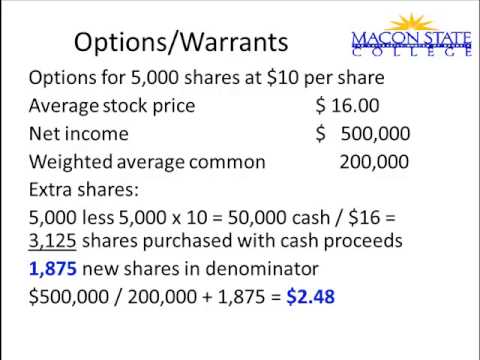

Earnings per share, simple, earnings per share, diluted earnings per share, complex earning per share, dilutive, antidilutive, weighted average number of shares, cpa exam, if converted method, warrants, stock warrants, proportional method, incremental method, stock options, stock warrant, paid-in capital, detachable, nondetachable warrant. stock rights, preemptive right, preemptive privilege, stock option, treasury method -

9:36

9:36Earnings per share (EPS), basic and diluted

Earnings per share (EPS), basic and dilutedEarnings per share (EPS), basic and diluted

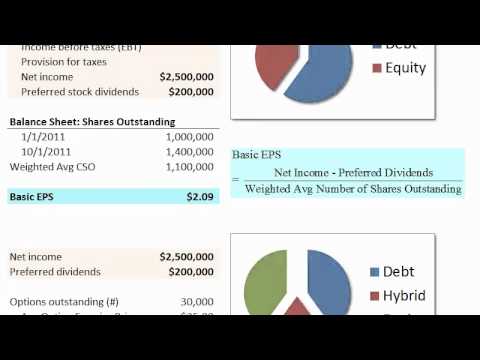

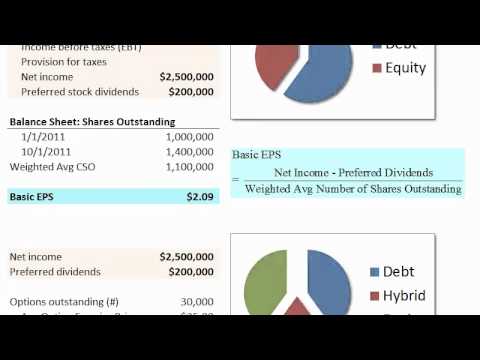

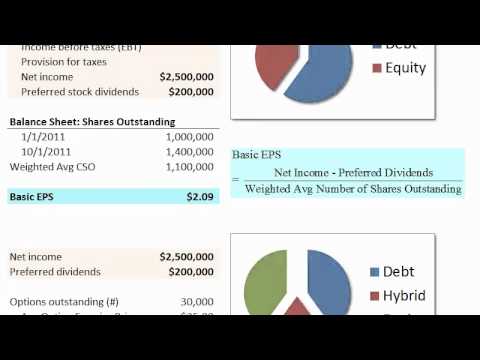

Basic EPS = net income (- preferred stock dividends) / Weighted average common shares outstanding. Diluted EPS has the same numerator but adds the additional dilution impact of any hybrid instruments ("if converted")

- Accountant

- Accounting period

- Accrual

- Arrears

- Audit

- Auditor's report

- Balance Sheet

- Bookkeeping

- Cash flow statement

- Chart of accounts

- Chartered Accountant

- Common stock

- Cost accounting

- Cost of goods sold

- Debits and credits

- Dividends

- Earnings per share

- Financial audit

- Financial statement

- Forensic accounting

- Fund accounting

- General journal

- General ledger

- Historical cost

- Income statement

- Internal audit

- Matching principle

- Net income

- P E ratio

- Preferred stock

- Revenue recognition

- Sarbanes–Oxley Act

- Special journal

- Template Accounting

- Trade credit

- Trial balance

- United States

- Wikipedia Merging

- XBRL

-

EPS (Earnings Per Share) explained

This video explains what EPS (Earnings Per Share) is and why it is a useful measure. -

What does 'earnings per share' mean? - MoneyWeek Investment Tutorials

Like this MoneyWeek Video? Want to find out more about earnings per share? Go to http://www.moneyweekvideos.com/what-does-earnings-per-share-mean/ now and you'll get free bonus material on this topic, plus a whole host of other videos. Search our whole archive of useful MoneyWeek Videos, including: · The six numbers every investor should know... http://www.moneyweekvideos.com/six-numbers-every-investor-should-know/ · What is GDP? http://www.moneyweekvideos.com/what-is-gdp/ · Why does Starbucks pay so little tax? http://www.moneyweekvideos.com/why-does-starbucks-pay-so-little-tax/ · How capital gains tax works... http://www.moneyweekvideos.com/how-capital-gains-tax-works/ · What is money laundering? http://www.moneyweekvideos.com/what-is-m... -

Earnings Per Share: Basic - Lesson 1

In the video, 16.01 - Earnings Per Share: Basic - Lesson 1, Roger Philipp, CPA, CGMA, gives a conceptual overview of Earnings Per Share (EPS), one of the most-talked about numbers in a company’s financial statements. EPS is the amount that, theoretically, each common shareholder would receive if the company paid out all of its income in the form of a dividend. Basic and diluted EPS are required to be disclosed on the face of the income statement for both net income and income from continuing operations. EPS from discontinued operations, and formerly extraordinary items, must be shown on either the face of the income statement or in the footnote disclosures. Roger explains the difference between basic and diluted EPS. The ‘basic’ in Basic EPS refers to a simple capital structure in which ... -

Investopedia Video: Earnings Per Share Explained (EPS)

Be the first to check out our latest videos on Investopedia Video: http://www.investopedia.com/video/ Earnings per share is one of the most carefully followed metrics in investing. We show you why this ratio matters and how to calculate it. For more on Earnings Per Share (EPS), and how it can help your trading success -- check out; The 5 Types Of Earnings Per Share http://www.investopedia.com/articles/analyst/091901.asp CFA Level 1 Exam Prep: Determining The EPS Of A Company http://www.investopedia.com/exam-guide/cfa-level-1/equity-investments/determining-eps-earnings-per-share.asp How To Evaluate The Quality Of EPS http://www.investopedia.com/articles/analyst/03/091703.asp Assess Shareholder Wealth With EPS http://www.investopedia.com/articles/basics/07/eps.asp -

EPS Earnings Per Share Explained in 11 minutes - Financial Ratio Analysis Tutorial

Clicked here http://www.MBAbullshit.com/ and OMG wow! I'm SHOCKED how easy.. No wonder others goin crazy sharing this??? Share it with your other friends too! Let's say that ABC Company's Net income last year is one thousand dollars and there are one hundred shares outstanding. What is its earnings per share? Well its super simple, earnings per share is simply the total net income last year of the whole company divided by the number of shares outstanding. Now, if you do this equation you'd find that the earnings per share is exactly ten dollars, a nice simple easy round number. Now this is the most easy part of financial ratio which is to compute the actual number. What's more important is what does this mean? This means that every share earns ten dollars a year in profit, or last year e... -

FAR Exam Earnings Per Share

Don't miss this opportunity to study for free with the industry's top instructor! Pulled straight from the FAR section of our CPA Review Course, this exclusive webcast features Roger Philipp, CPA, CGMA, teaching "Earnings Per Share." Connect with us: Website: https://www.rogercpareview.com Blog: https://www.rogercpareview.com/blog Facebook: https://www.facebook.com/RogerCPAReview Twitter: https://twitter.com/rogercpareview LinkedIn: https://www.linkedin.com/company/roger-cpa-review Are you accounting faculty looking for FREE CPA Exam resources in the classroom? Visit our Professor Resource Center: https://www.rogercpareview.com/professor-resource-center/ Video Transcript Sneak Peek: Now, earnings per share is one of the most talked about numbers in the financial statements because bo... -

How to Calculate EPS (Earnings Per Share)

This video explains how to calculate Earnings Per Share (EPS) and uses the formula to solve an example problem. -

Intermediate Accounting: Basic and diluted earnings per share

This starts with a short theory lecture and then works a series of problems with you. -

Basic earnings per share (EPS) ch 16 p 5 -Intermediate Accounting CPA exam

Earnings per share, simple, earnings per share, diluted earnings per share, complex earning per share, dilutive, antidilutive, weighted average number of shares, cpa exam, if converted method, warrants, stock warrants, proportional method, incremental method, stock options, stock warrant, paid-in capital, detachable, nondetachable warrant. stock rights, preemptive right, preemptive privilege, stock option, treasury method -

Earnings per share (EPS), basic and diluted

Basic EPS = net income (- preferred stock dividends) / Weighted average common shares outstanding. Diluted EPS has the same numerator but adds the additional dilution impact of any hybrid instruments ("if converted")

EPS (Earnings Per Share) explained

- Order: Reorder

- Duration: 7:23

- Updated: 15 Jul 2013

- views: 16430

- published: 15 Jul 2013

- views: 16430

What does 'earnings per share' mean? - MoneyWeek Investment Tutorials

- Order: Reorder

- Duration: 12:57

- Updated: 21 Apr 2011

- views: 57335

- published: 21 Apr 2011

- views: 57335

Earnings Per Share: Basic - Lesson 1

- Order: Reorder

- Duration: 4:40

- Updated: 02 Jul 2015

- views: 4650

- published: 02 Jul 2015

- views: 4650

Investopedia Video: Earnings Per Share Explained (EPS)

- Order: Reorder

- Duration: 1:11

- Updated: 22 Oct 2010

- views: 75370

- published: 22 Oct 2010

- views: 75370

EPS Earnings Per Share Explained in 11 minutes - Financial Ratio Analysis Tutorial

- Order: Reorder

- Duration: 10:40

- Updated: 15 May 2011

- views: 43776

- published: 15 May 2011

- views: 43776

FAR Exam Earnings Per Share

- Order: Reorder

- Duration: 51:50

- Updated: 06 Apr 2012

- views: 46772

- published: 06 Apr 2012

- views: 46772

How to Calculate EPS (Earnings Per Share)

- Order: Reorder

- Duration: 4:29

- Updated: 15 Jul 2013

- views: 21578

- published: 15 Jul 2013

- views: 21578

Intermediate Accounting: Basic and diluted earnings per share

- Order: Reorder

- Duration: 17:24

- Updated: 28 Jan 2014

- views: 11638

- published: 28 Jan 2014

- views: 11638

Basic earnings per share (EPS) ch 16 p 5 -Intermediate Accounting CPA exam

- Order: Reorder

- Duration: 19:32

- Updated: 08 Nov 2015

- views: 2877

- published: 08 Nov 2015

- views: 2877

Earnings per share (EPS), basic and diluted

- Order: Reorder

- Duration: 9:36

- Updated: 24 Jan 2011

- views: 31570

- published: 24 Jan 2011

- views: 31570

-

The 5 types of earnings per share

-

What is the difference between earnings per share and dividends per share

-

What is the difference between earnings per share and dividends per share

-

What is the formula for calculating earnings per share eps

-

What is the formula for calculating earnings per share eps

-

why is earnings per share eps also known as the bottom line

-

Can a company declare a dividend that exceeds its earnings per share

-

Calculating earnings per share

We ask a series of questions at the outset to establish your learning requirements and how the course releates to your job role. Our platform then uses your responses to remove content that's not useful. This leaves you with an individually tailored course. Please Subscribe this Channel to get more update videos.

The 5 types of earnings per share

- Order: Reorder

- Duration: 7:47

- Updated: 23 Jun 2016

- views: 0

- published: 23 Jun 2016

- views: 0

What is the difference between earnings per share and dividends per share

- Order: Reorder

- Duration: 1:45

- Updated: 23 Jun 2016

- views: 0

- published: 23 Jun 2016

- views: 0

What is the difference between earnings per share and dividends per share

- Order: Reorder

- Duration: 1:37

- Updated: 23 Jun 2016

- views: 0

- published: 23 Jun 2016

- views: 0

What is the formula for calculating earnings per share eps

- Order: Reorder

- Duration: 2:43

- Updated: 23 Jun 2016

- views: 0

- published: 23 Jun 2016

- views: 0

What is the formula for calculating earnings per share eps

- Order: Reorder

- Duration: 2:31

- Updated: 07 Jun 2016

- views: 1

- published: 07 Jun 2016

- views: 1

why is earnings per share eps also known as the bottom line

- Order: Reorder

- Duration: 1:18

- Updated: 23 Jun 2016

- views: 6

- published: 23 Jun 2016

- views: 6

Can a company declare a dividend that exceeds its earnings per share

- Order: Reorder

- Duration: 1:26

- Updated: 23 Jun 2016

- views: 1

- published: 23 Jun 2016

- views: 1

Calculating earnings per share

- Order: Reorder

- Duration: 1:55

- Updated: 10 Jun 2016

- views: 1

- published: 10 Jun 2016

- views: 1

-

AS – 20 Earning per Share AS20

Short description about Accounting Standard - 20 - Earning Per Share. -

Diluted Earnings Per Share (Step-By-Step Process With Multiple Convertible Securities, EPS)

Accounting for diluted earnings per share when multiple convertible securities are involved, set-by-step process is required to determine the diluted earnings per share for a company, requires determining the incremental numerator and denominator effect for the EPS for each security, (A) Incremental numerator effect for EPS, (B) Incremental denominator effect for EPS, Step-1: Determine for each security EPS effect,Step-2: Rank EPS Effect from smallest to largest, Step-3: Recomputed EPS To Determine Diluted EPS, each step explained & demonstrated in detail to determine EPS, example is based on stock options & warrants, bonds & preferred stock on how each will affect EPS, No effect on numerator for stock options & warrants, Pay no dividend on convertible P/S for the year, Pay no interest on ... -

-

-

Complex capital structure EPS what if method ch 16 p 6 -Intermediate Accounting CPA

Earnings per share, simple, earnings per share, diluted earnings per share, complex earning per share, dilutive, antidilutive, weighted average number of shares, cpa exam, if converted method, warrants, stock warrants, proportional method, incremental method, stock options, stock warrant, paid-in capital, detachable, nondetachable warrant. stock rights, preemptive right, preemptive privilege, stock option, treasury method -

CFA Level I- Income Statement- Basic Earning Per Share (EPS)

FinTree website link: http://www.fintreeindia.com FB Page link :http://www.facebook.com/Fin... We love what we do, and we make awesome video lectures for CFA and FRM exams. Our Video Lectures are comprehensive, easy to understand and most importantly, fun to study with! This Video was recorded during a one of the CFA Classes in Pune by Mr. Utkarsh Jain. -

R3M3MB3R.IT CFA Level 1 - Earning Per Share

Experience a memory efficient lesson, and find out everything you'll every need to know about Earnings Per Share (EPS). -

Ind AS 33 Lecture 1 - Earnings Per Share by CA Vinod Kumar Agarwal

-

Earnings per share Chat 5

This is our second chat session related to earnings per share. In this session we focus on stock compensation programs

AS – 20 Earning per Share AS20

- Order: Reorder

- Duration: 22:22

- Updated: 23 Apr 2015

- views: 3222

- published: 23 Apr 2015

- views: 3222

Diluted Earnings Per Share (Step-By-Step Process With Multiple Convertible Securities, EPS)

- Order: Reorder

- Duration: 20:11

- Updated: 01 May 2013

- views: 4004

- published: 01 May 2013

- views: 4004

CA IPCC - AS 20 - Earnings Per Share by CA Jayesh Popat - Class 1 of 2

- Order: Reorder

- Duration: 114:52

- Updated: 23 Feb 2016

- views: 567

Webinar IAS 33 Earnings per share

- Order: Reorder

- Duration: 52:36

- Updated: 10 Nov 2015

- views: 1343

Complex capital structure EPS what if method ch 16 p 6 -Intermediate Accounting CPA

- Order: Reorder

- Duration: 24:55

- Updated: 08 Nov 2015

- views: 1976

- published: 08 Nov 2015

- views: 1976

CFA Level I- Income Statement- Basic Earning Per Share (EPS)

- Order: Reorder

- Duration: 26:28

- Updated: 28 Jul 2014

- views: 1217

- published: 28 Jul 2014

- views: 1217

R3M3MB3R.IT CFA Level 1 - Earning Per Share

- Order: Reorder

- Duration: 50:56

- Updated: 28 Apr 2015

- views: 143

- published: 28 Apr 2015

- views: 143

Ind AS 33 Lecture 1 - Earnings Per Share by CA Vinod Kumar Agarwal

- Order: Reorder

- Duration: 40:33

- Updated: 11 Apr 2016

- views: 122

- published: 11 Apr 2016

- views: 122

Earnings per share Chat 5

- Order: Reorder

- Duration: 32:06

- Updated: 14 Mar 2016

- views: 27

- published: 14 Mar 2016

- views: 27

- Playlist

- Chat

- Playlist

- Chat

EPS (Earnings Per Share) explained

- Report rights infringement

- published: 15 Jul 2013

- views: 16430

What does 'earnings per share' mean? - MoneyWeek Investment Tutorials

- Report rights infringement

- published: 21 Apr 2011

- views: 57335

Earnings Per Share: Basic - Lesson 1

- Report rights infringement

- published: 02 Jul 2015

- views: 4650

Investopedia Video: Earnings Per Share Explained (EPS)

- Report rights infringement

- published: 22 Oct 2010

- views: 75370

EPS Earnings Per Share Explained in 11 minutes - Financial Ratio Analysis Tutorial

- Report rights infringement

- published: 15 May 2011

- views: 43776

FAR Exam Earnings Per Share

- Report rights infringement

- published: 06 Apr 2012

- views: 46772

How to Calculate EPS (Earnings Per Share)

- Report rights infringement

- published: 15 Jul 2013

- views: 21578

Intermediate Accounting: Basic and diluted earnings per share

- Report rights infringement

- published: 28 Jan 2014

- views: 11638

Basic earnings per share (EPS) ch 16 p 5 -Intermediate Accounting CPA exam

- Report rights infringement

- published: 08 Nov 2015

- views: 2877

Earnings per share (EPS), basic and diluted

- Report rights infringement

- published: 24 Jan 2011

- views: 31570

- Playlist

- Chat

The 5 types of earnings per share

- Report rights infringement

- published: 23 Jun 2016

- views: 0

What is the difference between earnings per share and dividends per share

- Report rights infringement

- published: 23 Jun 2016

- views: 0

What is the difference between earnings per share and dividends per share

- Report rights infringement

- published: 23 Jun 2016

- views: 0

What is the formula for calculating earnings per share eps

- Report rights infringement

- published: 23 Jun 2016

- views: 0

What is the formula for calculating earnings per share eps

- Report rights infringement

- published: 07 Jun 2016

- views: 1

why is earnings per share eps also known as the bottom line

- Report rights infringement

- published: 23 Jun 2016

- views: 6

Can a company declare a dividend that exceeds its earnings per share

- Report rights infringement

- published: 23 Jun 2016

- views: 1

Calculating earnings per share

- Report rights infringement

- published: 10 Jun 2016

- views: 1

- Playlist

- Chat

AS – 20 Earning per Share AS20

- Report rights infringement

- published: 23 Apr 2015

- views: 3222

Diluted Earnings Per Share (Step-By-Step Process With Multiple Convertible Securities, EPS)

- Report rights infringement

- published: 01 May 2013

- views: 4004

CA IPCC - AS 20 - Earnings Per Share by CA Jayesh Popat - Class 1 of 2

- Report rights infringement

- published: 23 Feb 2016

- views: 567

Webinar IAS 33 Earnings per share

- Report rights infringement

- published: 10 Nov 2015

- views: 1343

Complex capital structure EPS what if method ch 16 p 6 -Intermediate Accounting CPA

- Report rights infringement

- published: 08 Nov 2015

- views: 1976

CFA Level I- Income Statement- Basic Earning Per Share (EPS)

- Report rights infringement

- published: 28 Jul 2014

- views: 1217

R3M3MB3R.IT CFA Level 1 - Earning Per Share

- Report rights infringement

- published: 28 Apr 2015

- views: 143

Ind AS 33 Lecture 1 - Earnings Per Share by CA Vinod Kumar Agarwal

- Report rights infringement

- published: 11 Apr 2016

- views: 122

Earnings per share Chat 5

- Report rights infringement

- published: 14 Mar 2016

- views: 27

This July 4th Americans Will Be Debating Identity Instead of Celebrating Independence

Edit WorldNews.com 04 Jul 2016Bank of Israel buying 'hundreds of millions' of dollars: Sources

Edit The Times of India 04 Jul 2016UK government faces pre-emptive legal action over Brexit decision

Edit The Guardian 04 Jul 2016Rapist who threatened to upload footage of crime to internet jailed

Edit Australian Broadcasting Corporation 04 Jul 2016Global Food Prices Set to Stagnate as Population Growth Slowing

Edit Bloomberg 04 Jul 2016BRIEF-Sabvest sees H1 HEPS to be at least 20 pct lower

Edit Reuters 04 Jul 2016Bonds are telling a scary story! Either stocks will crash, or yields will shoot up

Edit The Times of India 04 Jul 2016Athlete Foot's owner bulks up with Hype buy

Edit Sydney Morning Herald 04 Jul 2016Bank of America, Citigroup and Goldman Sachs: Doug Kass' Views

Edit The Street 04 Jul 2016Acquisition of Hype DC (RCG Corporation Limited)

Edit Public Technologies 04 Jul 2016Exercise of Share Options (Avingtrans plc)

Edit Public Technologies 04 Jul 2016TeamLease buys ASAP Info Systems for Rs 67 crore

Edit The Times of India 04 Jul 2016Abu Dhabi banks jump on FGB/NBAD merger details

Edit Arabnews 04 Jul 2016TeamLease acquires ASAP Info Systems, gets into IT staffing

Edit The Times of India 04 Jul 2016Disposal (Low & Bonar plc)

Edit Public Technologies 04 Jul 2016Feng Tay unfazed by Nike slowdown

Edit Taipei Times 04 Jul 2016Heliocentris Energy Solutions AG publishes figures for Q1/2016 (Heliocentris Energy Solutions AG)

Edit Public Technologies 04 Jul 2016- 1

- 2

- 3

- 4

- 5

- Next page »