Covered calls enable you to have your share-portfolio cake and eat it, too (well, almost)

Jeannie has a problem – she has a small share portfolio she’s been slowly building by tucking away a few dollars from each pay packet. She tracks her shares with the ASX app on her smartphone, is comfortable with her portfolio’s performance and, as a value investor with a long-term view, tends to hold her shares.

But Jeannie wants to grow her exposure to the market faster than her meagre savings have so far allowed and increase income from her shares beyond occasional dividends. And she wants to diversify her portfolio to be more in line with the market index.

Put yourself in Jeannie’s shoes: perhaps you’re saving for the kids’ school fees, house deposit or just tucking aside for retirement. How would you make a bit extra from your shares while benefiting from overall market moves?

Consider that share options may offer options neither of you has contemplated before. So why would either of you get into options?

- To start an investment-trading strategy relatively cheaply

- To protect a share portfolio

- To generate income in a flat market

- To diversify a portfolio.

For this example, we’re looking at how Jeannie might use options to generate income and diversify her interests to manage risk and capitalise on overall market trends.

What are Exchange-traded options?

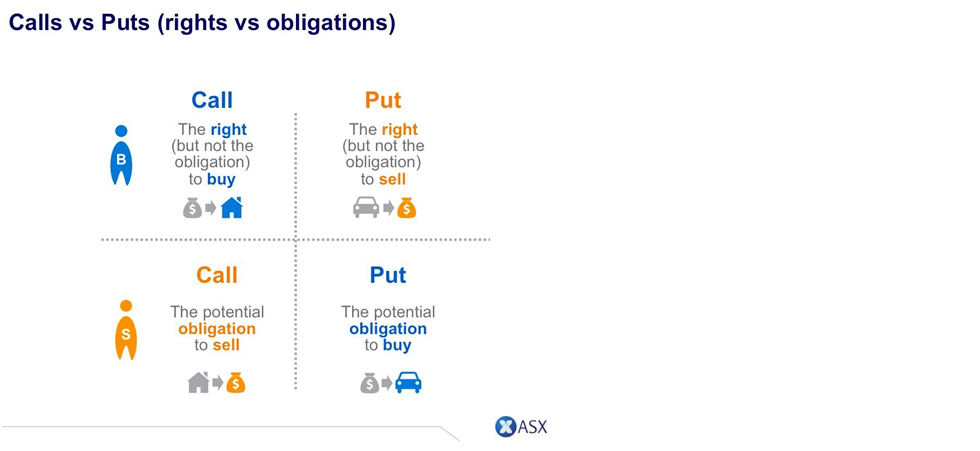

An option traded on the ASX is a contract between two parties that gives the buyer (‘taker’, in trading parlance) the right—but not the obligation—to a seller’s (‘writer’) underlying shares at a specified price (‘premium’) on or before a set or ‘exercise’ date.

Importantly, a writer must sell their underlying shares should the taker call on them. Such ‘call’ options are written on any of 71 shares traded on the ASX or over the index of top-200 stocks (ASX-200). An investor like Jeannie may get started in options more easily using the index approach because it’s similarly flexible as options over stocks she already holds but exposes her to the whole market, thereby diversifying her investments. An Index option may also help her better manage risk because she’s no longer exposed to fluctuations on the relatively small number of stocks she holds directly.

Another advantage of Index options is they can be a cheap way to start investing relative to buying all the stocks comprising the ASX-200. This makes them ideal for those who wish to start a portfolio. And they take the fatigue out of choosing a particular stock against which to write an option (a ‘buy-write’) – your Index options will track the overall trend in the market.

Alternatively, Jeannie might prefer what’s known as the ‘covered call’ option to balance risk and returns, and generate income. In a covered call, Jeannie offers other investors the option to buy her shares for a set price in the future. Covered calls enable Jeannie to make money in a flat market and she may still be able to hold her shares at the end of the period. As the option seller, she has two income-generating strategies: buy back the option at the exercise date (or contract expiry) for less than the original premium or let the option expire (and keep the premium paid to her).

According to ASX’s equity derivatives manager and options specialist Graham O’Brien, a covered call is one of the few ways an investor can generate returns when the market (or a share) is flat or stabilising. And he points to the Buy-write Encyclopaedia, ASX-sponsored research from the University of Sydney, that shows such options generally outperformed their underlying shares.

“It means you’re taking on an obligation to sell shares that you own at a predetermined price in the future,” O’Brien says. “For this, you receive a premium. If the share price remains steady or falls, the option is not likely to be exercised and you keep the premium and the stock.” Typically, Jeannie would hold the options contract for just two to three months, he says.

Another way to look at covered-call options is they are similar to putting your house on AirBnB, with an important caveat: “When you lease out your house, the tenant can’t take it off you but, with a written-call option, the buyer can take the stock at a particular price”.

So how would Jeannie write her first covered call?

Before she decides on which shares she’ll write options, Jeannie must do her homework. Here’s what she should do first:

- Know the risks she faces. As an options buyer, Jeannie may choose to buy at the specified (‘strike’) price or let the option expire, in which case she only loses the premium she paid. But as a seller, she may be obliged to sell at the strike price on or before the contract end date. And as the seller, a slumping stock may wipe out her premium, erasing profit. Conversely, a rallying stock may exceed her options price and she foregoes further profit. Also, if the option is called before the contract end date, expected dividends that might have been paid in this time could be foregone.

- Choose her stock to sell, preferably one with a relatively stable price (volatile stocks like those subject to takeover speculation expose the investor to significant risk of loss or underperformance).

- Set the price at which she’s willing to sell her shares. Jeannie checks out the ASX charting library to get an idea of the likely floor (‘support’) and ceiling (‘resistance’) prices of her stock.

- Choose when to sell because the longer Jeannie holds the option, the more risk she takes on.

How to weigh share price rises against guaranteed options returns

When it comes to options, Hugh Denning literally wrote the book. For 25 years, his Equity Options: Valuation, Trading and Practical Strategies has been a standard textbook for those seeking to understand how options can work for them.

Denning, who is chief operating officer and portfolio manager of equity income fund manager Denning-Pryce, says writing a covered-call option is for investors who “are a bit more active” with their portfolios.

“When you sell an option, you’re selling part of the risk of holding a share. If you have a $10.00 share and you sell a $10.50 call option, you’re selling the exposure to that share above $10.50 for that period, the life of the option,” says Denning, who manages funds using income-generating options for institutional investors.

“Someone might pay you 50c for a $10.50 call option. You’ve said you would rather have 50c of a guaranteed income than the likelihood of any potential value of the share above $10.50 over a defined three-month period.”

Investors considering writing options over their shares must weigh up the guaranteed premium they receive against the possibility of a larger gain in the share’s price.

“So you’re accepting a defined income stream in place of possible future gain.”

But he cautions against recklessness.

“One of the misconceptions people have is that selling options against their shares is free money. You still have the downside risk of the share. You receive 50c (or 5 per cent) now, restricting your maximum return during the life of the option to 10 per cent. You may be able to take this 5 per cent income several times but if the share falls 25 per cent you keep all the premiums you have taken, but your share price still falls,” he says.

“If the shares jump 25 per cent you have accepted a sale price of $10.50 plus all your option premiums, so you may miss out on some of the upswing but you’re expecting lots of little returns to add up. So you don’t lose as much when a share price falls [and] you don’t make as much on the big rises, but you reduce the volatility of the return, and do very well when shares don’t move very much.”

A newcomers’ guide to options

The ASX asked experienced options investors for their top tips to starting out. Here’s what they advised:

- Attend ASX courses

- Understand the risks

- Make rational rather than emotional decisions

- Complete an options trading trial

- Be realistic and not greedy (“Get out with reasonable profit rather than no profit”)

- Follow the trend

- Stick to blue chips and avoid speculative options

- Start

Visualising the options process

Source: ASX options investor research

Keen to leverage the growth opportunity of shares, but worried about recent market volatility? With strategies that have the potential to protect, grow or diversify your portfolio, Options could be the investment heroes you’re looking for. Learn how to apply these strategies at The Power of Options education seminar, brought to you by ASX.