Introduction to S Corporations & LLC's - Part 1

Part 1- Lecture

Content

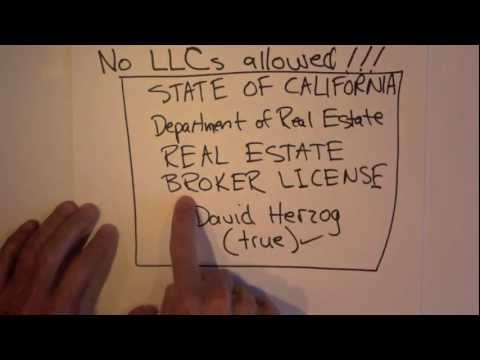

S corporations and

Limited Liability Companies (

LLC) are common entity choices for small business owners.

S corporation shareholders and LLC members often benefit from certain tax advantages that are available to them. At the same time failure to correctly adhere to tax laws affecting these entity types can result in erroneous tax return filings that can result in significant

IRS penalties.

Introduction to S Corporations and LLCs is a two-part series which provides tax professionals with an in-depth look at the rules for preparing Forms 1120S and 1065.

* Part 1 focuses on entity classification choices and provides instructions for the completion of

Form 1065, US

Return of

Partnership Income.

* Part 2 focuses on the preparation of Form 1120S, US

Income Tax Return for an

S Corporation.

Topics

Covered

* Overview of the different entity types a business may operate as including: sole proprietorship, qualified joint venture, partnership, corporation and S corporation

* Advantages and disadvantages if the different entity types * businesses operate under

* How different business entity types are taxed

* How an unincorporated entity can elect to be taxed as a corporation

*

Instructions for completion of Form 8832

Entity Classification Election

* Instructions for late filing relief for Form 8832 Entity Classification Election

*

Rules relating to the reporting of income and expenses by a partnership

* Instructions for preparation of Form 1065

U.S. Return of Partnership Income

* Preparation of Form 1065 Schedules K and

K-1

*

Analysis of net income of a partnership

* Preparation of

Schedule L, partnership

Balance Sheet per

Books

* Schedule

M-1, Reconcilliation of Income (

Loss) per Books with Income (Loss) per Return

* Schedule

M-2, Analysis of

Partner's

Capital Accounts

* Form 1125-A, Cost of

Good Sold

* Determining partner's adjusted basis in a partnership

* Reporting portfolio income of a partnership or S corporation

* Reporting rental income of a partnership or S corporation

*

Grouping of activities

You can purchase the manual for this course for $5.99 at

http://pnwtaxschool.com/oc-catalog/selfpaced/section-1100?formats=8

Pacific Northwest Tax

School is approved by the following organizations as a provider of continuing education:

*

The IRS

*

NASBA QAS (NASBA

Sponsor #109290),

*

Oregon Tax

Board,

* The

Texas State Board of

Public Accountancy (

Texas Sponsor #009794)

*

The New York State Board for Public Accountancy (Sponsor

License #002479)

You can receive 5 hours of CE for $80 by enrolling in this course at http://pnwtaxschool.com/oc-catalog/all/section-1015

Terms of Use or Enrollment

Pacific Northwest Tax School's course materials and teaching techniques are valuable proprietary information of Pacific Northwest Tax School, and all such information is subject to copyright, including written, recorded, internet based as well as all other electronic media. Each

Student agrees that she/he will use the information only for purposes of education and training; and as a condition of enrollment, that they will not disseminate the information to any third party and will treat the materials as confidential information of Pacific Northwest Tax School. As a condition of enrollment, Students pledge not use any information in any competitive fashion, including to create or derive competitive materials. Students further agree that any breach of these terms and conditions shall cause the school irreparable harm, entitling Pacific Northwest Tax School to injunctive relief, as well as any other remedy that may be available at law or equity. Students shall have twelve months from date of enrollment in any continuing education course, to successfully complete the course and receive their

Certificate of Completion.