- published: 13 Nov 2010

- views: 81685

-

remove the playlistTariff

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistTariff

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 05 Jun 2014

- views: 4355

- published: 10 Oct 2012

- views: 62930

- published: 30 May 2015

- views: 3159

- published: 26 Feb 2015

- views: 15644

- published: 22 Sep 2011

- views: 14680

A tariff is either (1) a tax on imports or exports (trade tariff) in and out of a country, or (2) a list or schedule of prices for such things as rail service, bus routes, and electrical usage (electrical tariff, etc.).

The word comes from the Italian word tariffa "list of prices, book of rates," which is derived from the Arabic ta'rif "to notify or announce."

Tariffs, often called customs, were by far the largest source of United States federal revenue from the 1790s to the eve of World War I, until they were surpassed by income taxes.

Neoclassical economic theorists tend to view tariffs as distortions to the free market. Typical analyses find that tariffs tend to benefit domestic producers and government at the expense of consumers, and that the net welfare effects of a tariff on the importing country are negative. Normative judgments often follow from these findings, namely that it may be disadvantageous for a country to artificially shield an industry from world markets, and that it might be better to allow a collapse to take place. Opposition to all tariffs is part of the free trade principle; the World Trade Organization aims to reduce tariffs and to avoid countries discriminating between differing countries when applying tariffs.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

6:44

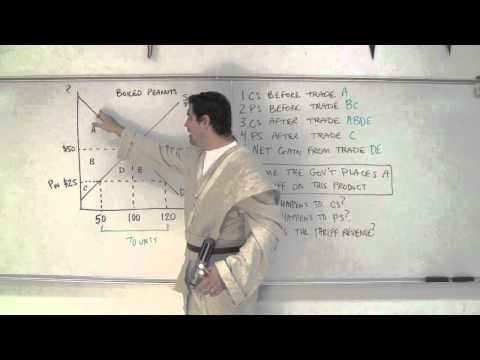

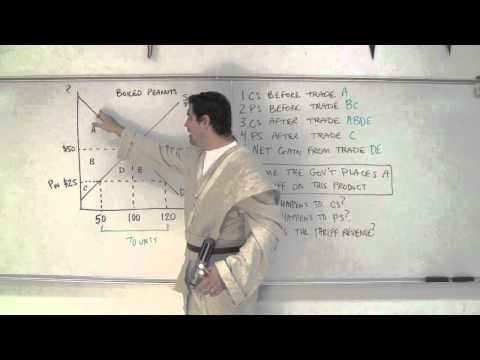

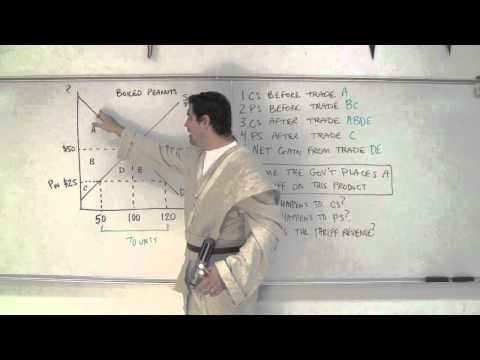

6:44How to calculate the impact of import and export tariffs.

How to calculate the impact of import and export tariffs.How to calculate the impact of import and export tariffs.

A tutorial on how import prices increases consumer surplus and decreases producer surplus, the impact of tariffs and the deadweight loss to society. Like us on: http://www.facebook.com/PartyMoreStudyLess -

6:42

6:42Tariffs in US History Explained: US History Review

Tariffs in US History Explained: US History ReviewTariffs in US History Explained: US History Review

Tariffs for some reason is a killer for kids on tests, so in this super fast lecture I explain their meaning, why they are used, who opposed them and a few examples of their use in US History. -

1:36

1:36Tariff Definition

Tariff Definition -

6:51

6:51Micro 2.8 Tariffs and Quotas

Micro 2.8 Tariffs and QuotasMicro 2.8 Tariffs and Quotas

Mr. Clifford explains how to show the effects tariffs and quotas on a supply and demand graph. The days I filmed this video were in "spirit week". One day was sports day (that's why I'm dressed like a coach) and the other day was Tomorowland day. I apologize for my bad southern accent. I led a training in Athens, GA in the summer and I loved it. Southern hospitality is real. Thanks for watching, Please subscribe. Get the Ultimate Review Packet http://www.acdcecon.com/#!review-packet/czji Macroeconomics Videos https://www.youtube.com/watch?v=XnFv3d8qllI Microeconomics Videos https://www.youtube.com/watch?v=swnoF533C_c Watch Econmovies https://www.youtube.com/playlist?list=PL1oDmcs0xTD9Aig5cP8_R1gzq-mQHgcAH Follow me on Twitter https://twitter.com/acdcleadership -

11:17

11:17Tariff (Trade Protectionism)

Tariff (Trade Protectionism)Tariff (Trade Protectionism)

Tariff (Trade Protectionism) - The impact of a tariff on a market, diagram and analysis -

14:51

14:51Tariffs and Protectionism

Tariffs and ProtectionismTariffs and Protectionism

We’ll look at the costs and consequences of tariffs, quotas, and protectionism. How do tariffs affect consumers? What about producers? Who wins and who loses? Find out with this video. We’ll apply the fundamentals we learned in the supply, demand, and equilibrium section of this course to real-world examples — like that of protectionism in the U.S. sugar industry — to determine lost gains from trade or deadweight loss, the tariff equilibrium vs. the free trade equilibrium, and the value of wasted resources as a result of tariffs. Microeconomics Course: http://mruniversity.com/courses/principles-economics-microeconomics Ask a question about the video: http://mruniversity.com/courses/principles-economics-microeconomics/tariffs-quotas-protectionism-definition#QandA Next video: http://mruniversity.com/courses/principles-economics-microeconomics/arguments-against-trade Help us caption & translate this video! http://amara.org/v/GLJi/ -

11:34

11:34Basic tariff analysis

Basic tariff analysis -

1:41

1:41The Tariff of Abominations! YouTube

The Tariff of Abominations! YouTubeThe Tariff of Abominations! YouTube

-

4:34

4:34International trade: Impact of Import tariffs

International trade: Impact of Import tariffsInternational trade: Impact of Import tariffs

The economic impact of import tariffs -

14:51

14:51Large country tariff basics

Large country tariff basics -

28:58

28:58Trade Barriers Tariff and Non tariff Barriers new

Trade Barriers Tariff and Non tariff Barriers newTrade Barriers Tariff and Non tariff Barriers new

-

10:02

10:02The effects of a tariff

The effects of a tariffThe effects of a tariff

This video provides a supply and demand analysis of the impact of a protectionist tariff on a good imported from another country -

2:31

2:31Electricity tariff increase In Nigeria

Electricity tariff increase In Nigeria -

3:39

3:39Trump Would Slap Tariffs on China

Trump Would Slap Tariffs on ChinaTrump Would Slap Tariffs on China

In tonight's GOP debate, Donald Trump said he's be open to a tariff on Chinese goods entering America.

- Ad valorem tax

- Arab Customs Union

- Balance of payments

- Balance of trade

- Black market

- Bus routes

- Capital account

- Capital gains tax

- Caribbean Community

- Cato Institute

- Consumer surplus

- Consumption tax

- Corporate tax

- Current account

- Customs

- Customs union

- Dead weight loss

- Deadweight loss

- Direct tax

- Dividend tax

- Double taxation

- Duty (economics)

- Economic integration

- Economic nationalism

- Election

- Electrical

- Embargo

- Environmental tariff

- Excess profits tax

- Excise

- Excise duty

- Export

- Exports

- Fair trade

- Fiscal policy

- Flat tax

- Free market

- Free trade

- Free trade zone

- Georgism

- Gift tax

- Globalization

- Government revenue

- Gross receipts tax

- Import

- Import quota

- Imports

- Income tax

- Income tax threshold

- Indirect tax

- Inheritance tax

- International trade

- Laffer curve

- Land value tax

- List of tariffs

- Mercantilism

- Mercosur

- Negative income tax

- Net capital outflow

- Nick Xenophon

- Non-tax revenue

- Optimal tax

- Outsourcing

- Payroll tax

- Per unit tax

- Pigovian tax

- Producer surplus

- Progressive tax

- Project Socrates

- Property tax

- Proportional tax

- Protectionism

- Purchasing power

- Rail transport

- Regressive tax

- Revenue service

- Revenue stamp

- Russian Tax Code

- Sales tax

- Sin tax

- Smuggling

- Spahn tax

- Stamp duty

- Swiss Formula

- Tariff

- Tariff Act of 1789

- Tariff war

- Tax

- Tax advantage

- Tax assessment

- Tax avoidance

- Tax bracket

- Tax collection

- Tax competition

- Tax credit

- Tax cut

- Tax deduction

- Tax equalization

- Tax evasion

- Tax exemption

- Tax farming

- Tax harmonization

- Tax haven

- Tax holiday

- Tax in rem

- Tax incentive

- Tax incidence

- Tax investigation

- Tax law

- Tax lien

- Tax noncompliance

- Tax policy

- Tax preparation

- Tax rate

- Tax reform

- Tax refund

- Tax residence

- Tax resistance

- Tax revenue

- Tax shelter

- Tax shield

- Tax shift

- Tax treaty

- Taxable income

- Taxation in Bhutan

- Taxation in Canada

- Taxation in Colombia

- Taxation in France

- Taxation in Germany

- Taxation in Greece

- Taxation in Iceland

- Taxation in India

- Taxation in Iran

- Taxation in Israel

- Taxation in Italy

- Taxation in Japan

- Taxation in Pakistan

- Taxation in Peru

- Taxation in Sweden

- Taxation in Tanzania

- Taxpayer groups

- Technology strategy

- Template talk Trade

- Template Taxation

- Template Trade

- Tobin tax

- Trade

- Trade barrier

- Trade bloc

- Trade justice

- Trade pact

- Trading nation

- Turnover tax

- Value added tax

- Windfall profits tax

- World Bank Group

- World War I

-

How to calculate the impact of import and export tariffs.

A tutorial on how import prices increases consumer surplus and decreases producer surplus, the impact of tariffs and the deadweight loss to society. Like us on: http://www.facebook.com/PartyMoreStudyLess -

Tariffs in US History Explained: US History Review

Tariffs for some reason is a killer for kids on tests, so in this super fast lecture I explain their meaning, why they are used, who opposed them and a few examples of their use in US History. -

-

Micro 2.8 Tariffs and Quotas

Mr. Clifford explains how to show the effects tariffs and quotas on a supply and demand graph. The days I filmed this video were in "spirit week". One day was sports day (that's why I'm dressed like a coach) and the other day was Tomorowland day. I apologize for my bad southern accent. I led a training in Athens, GA in the summer and I loved it. Southern hospitality is real. Thanks for watching, Please subscribe. Get the Ultimate Review Packet http://www.acdcecon.com/#!review-packet/czji Macroeconomics Videos https://www.youtube.com/watch?v=XnFv3d8qllI Microeconomics Videos https://www.youtube.com/watch?v=swnoF533C_c Watch Econmovies https://www.youtube.com/playlist?list=PL1oDmcs0xTD9Aig5cP8_R1gzq-mQHgcAH Follow me on Twitter https://twitter.com/acdcleadership -

Tariff (Trade Protectionism)

Tariff (Trade Protectionism) - The impact of a tariff on a market, diagram and analysis -

Tariffs and Protectionism

We’ll look at the costs and consequences of tariffs, quotas, and protectionism. How do tariffs affect consumers? What about producers? Who wins and who loses? Find out with this video. We’ll apply the fundamentals we learned in the supply, demand, and equilibrium section of this course to real-world examples — like that of protectionism in the U.S. sugar industry — to determine lost gains from trade or deadweight loss, the tariff equilibrium vs. the free trade equilibrium, and the value of wasted resources as a result of tariffs. Microeconomics Course: http://mruniversity.com/courses/principles-economics-microeconomics Ask a question about the video: http://mruniversity.com/courses/principles-economics-microeconomics/tariffs-quotas-protectionism-definition#QandA Next video: http://mruni... -

-

The Tariff of Abominations! YouTube

-

International trade: Impact of Import tariffs

The economic impact of import tariffs -

-

Trade Barriers Tariff and Non tariff Barriers new

-

The effects of a tariff

This video provides a supply and demand analysis of the impact of a protectionist tariff on a good imported from another country -

-

Trump Would Slap Tariffs on China

In tonight's GOP debate, Donald Trump said he's be open to a tariff on Chinese goods entering America. -

Lincoln's Tariff War | by Thomas J. DiLorenzo

How Capitalism Saved America | by Thomas J. DiLorenzo: http://amzn.to/1GUXmEK The Real Lincoln | by Thomas J. Dilorenzo: http://amzn.to/1kJwyga Lincoln Unmasked | by Thomas J. DiLorenzo: http://amzn.to/1GUXO5R My website: http://www.vforvoluntary.com/ Reddit: http://www.reddit.com/r/austrian_economics/ The 2006 Steven Berger Seminar: Thomas DiLorenzo on Liberty and American Civilization http://mises.org/events/86 June 5-9, 2006 LUDWIG VON MISES INSTITUTE - CREATIVE COMMONS ATTRIBUTION 3.0 MP3 files of this lecture series 1-5: http://www.mediafire.com/?lol1q61emb1ac98 6-10: http://www.mediafire.com/?bmrem3dswczfg5e -- I am reuploading this series because the previous upload got a copyright match because of guitar music in the intro. So aside from removing the intro, I've also improv... -

International Trade - Tariff

Mecham explains the graphical analysis of a tariff for a country in a competitive world market. -

The Solar Feed-in Tariff Explained

An easy to understand guide to the Government's solar feed-in tariff. http://www.gle-uk.co.uk/ -

Economics of the Two-Part Tariff or Two-part Pricing Strategy

This videos provides a numerical example of the two-part pricing strategy found in many microeconomics and managerial economics textbooks. -

8a- Big country introduces import tariff (Perfect Competitive Markets)

Chapter8-part a- Big country introduces import tariffs (pc) -

Как дичайше экономить на связи? Обзор Dr. Tariff

Подробный обзор сервиса Dr. Tariff. Скачать для Android: http://goo.gl/g0W0A9, для iOS: http://goo.gl/L0orqO Оплата мобильной связи превратилась в сплошную рутину? Не знаете, как сэкономить на разговорах, интернете и прочих услугах? Думаете, что оператор обманывает? Сегодня тестируем, рассказываем и показываем приложение Dr. Tariff, которое разрешит все ваши проблемы. -

The Hawley-Smoot Tariff in Under 5 Minutes - Hasty History

Less money, mo problems @HHProfessorS hastyhistoryprof@gmail.com -

-

BIG ISSUE | NEW ELECTRICITY TARIFF IN NIGERIA | TVC NEWS

How to calculate the impact of import and export tariffs.

- Order: Reorder

- Duration: 6:44

- Updated: 13 Nov 2010

- views: 81685

- published: 13 Nov 2010

- views: 81685

Tariffs in US History Explained: US History Review

- Order: Reorder

- Duration: 6:42

- Updated: 05 Jun 2014

- views: 4355

- published: 05 Jun 2014

- views: 4355

Tariff Definition

- Order: Reorder

- Duration: 1:36

- Updated: 16 Nov 2012

- views: 10813

Micro 2.8 Tariffs and Quotas

- Order: Reorder

- Duration: 6:51

- Updated: 10 Oct 2012

- views: 62930

- published: 10 Oct 2012

- views: 62930

Tariff (Trade Protectionism)

- Order: Reorder

- Duration: 11:17

- Updated: 30 May 2015

- views: 3159

- published: 30 May 2015

- views: 3159

Tariffs and Protectionism

- Order: Reorder

- Duration: 14:51

- Updated: 26 Feb 2015

- views: 15644

- published: 26 Feb 2015

- views: 15644

Basic tariff analysis

- Order: Reorder

- Duration: 11:34

- Updated: 25 Aug 2013

- views: 11774

The Tariff of Abominations! YouTube

- Order: Reorder

- Duration: 1:41

- Updated: 02 Feb 2012

- views: 23232

- published: 02 Feb 2012

- views: 23232

International trade: Impact of Import tariffs

- Order: Reorder

- Duration: 4:34

- Updated: 07 Jan 2011

- views: 30738

- published: 07 Jan 2011

- views: 30738

Large country tariff basics

- Order: Reorder

- Duration: 14:51

- Updated: 04 Oct 2013

- views: 14651

Trade Barriers Tariff and Non tariff Barriers new

- Order: Reorder

- Duration: 28:58

- Updated: 16 Apr 2014

- views: 4312

- published: 16 Apr 2014

- views: 4312

The effects of a tariff

- Order: Reorder

- Duration: 10:02

- Updated: 22 Sep 2011

- views: 14680

- published: 22 Sep 2011

- views: 14680

Electricity tariff increase In Nigeria

- Order: Reorder

- Duration: 2:31

- Updated: 09 Feb 2016

- views: 136

Trump Would Slap Tariffs on China

- Order: Reorder

- Duration: 3:39

- Updated: 15 Jan 2016

- views: 3738

- published: 15 Jan 2016

- views: 3738

Lincoln's Tariff War | by Thomas J. DiLorenzo

- Order: Reorder

- Duration: 96:53

- Updated: 09 Jul 2012

- views: 14610

- published: 09 Jul 2012

- views: 14610

International Trade - Tariff

- Order: Reorder

- Duration: 7:56

- Updated: 13 Nov 2010

- views: 12220

- published: 13 Nov 2010

- views: 12220

The Solar Feed-in Tariff Explained

- Order: Reorder

- Duration: 2:14

- Updated: 26 Aug 2014

- views: 1789

- published: 26 Aug 2014

- views: 1789

Economics of the Two-Part Tariff or Two-part Pricing Strategy

- Order: Reorder

- Duration: 4:05

- Updated: 14 May 2014

- views: 17211

- published: 14 May 2014

- views: 17211

8a- Big country introduces import tariff (Perfect Competitive Markets)

- Order: Reorder

- Duration: 12:01

- Updated: 03 Sep 2010

- views: 8240

Как дичайше экономить на связи? Обзор Dr. Tariff

- Order: Reorder

- Duration: 6:38

- Updated: 11 Nov 2014

- views: 79986

- published: 11 Nov 2014

- views: 79986

The Hawley-Smoot Tariff in Under 5 Minutes - Hasty History

- Order: Reorder

- Duration: 3:27

- Updated: 22 Apr 2015

- views: 391

Tariff diagram

- Order: Reorder

- Duration: 4:39

- Updated: 18 Feb 2013

- views: 1748

BIG ISSUE | NEW ELECTRICITY TARIFF IN NIGERIA | TVC NEWS

- Order: Reorder

- Duration: 53:53

- Updated: 04 Feb 2016

- views: 47

- published: 04 Feb 2016

- views: 47

-

Bengaluru, no power supply and now tariff hike- NEWS9

Come April first; get ready to shell out more on your electricity bill. And no, this is no April fool’s joke. In the latest shocker, the KERC has now hiked the prices of the electricity tariffs. For more news and updates, visit us at: http://www.youtube.com/user/news9tv https://www.facebook.com/news9live https://twitter.com/NEWS9TWEETS -

-

KERC Hikes Power Tariff in Karnataka

The Karnataka Electricity Regulatory Commission (KERC) hiked power tariff On March 30th 2016. New tariff will come to effect form April 1, 2016. KERC chairman M.K.Shankaralinge Gowda said, commission has ordered for 9 percent power tariff hike. Read more at: http://goo.gl/hQGxNp Watch more videos from Playlist : https://www.youtube.com/playlist?list=PLqfhn69j5FdQKLsi2vsd-JPYlMQ-GwOgY Catch us on: -Facebook: https://www.facebook.com/oneindiakannada/ -Twitter : https://twitter.com/OneindiaKannada - GPlus: https://plus.google.com/+OneindiaKannada/ -

Reliance Energy proposes average 5.26 pc power tariff hike in 2016-17

Consumers in Mumbai’s suburban areas are likely to see a slight increase in power tariff in the coming fiscal with Reliance Energy, which supplies electricity in these parts, having proposed an average hike of 5.26 per cent in power tariff across all categories. Subscribe to our channel for more news https://www.youtube.com/channel/UCmBLIcqOLWwrrAJ-jaCttqw?sub_confirmation=1 Like us on Facebook: https://www.facebook.com/JaiMaharashtranews Follow us on: https://twitter.com/JaiMaharashtraN Follow us on Google: https://plus.google.com/+Jaimaharashtranews/posts Find us on: http://jaimaharashtranews.tv For Caller Tunes & Ringtone: http://jaimaharashtranews.tv/images/music/JaiMaharashtraMusic.mp3 Jai maharashtra Live TV: http://jaimaharashtranews.tv/live-tv -

“Tariff Methodology and Tariff Proceedings”

-

Solar power tariff below Rs 5/unit not viable: Solargise

Raj Basu, founder of solar power company Solargise, tells NDTV Profit that solar power tariffs below Rs 5 per unit are not sustainable. He says the company will leverage advanced proprietary technology to stay competitive. Watch more videos: http://profit.ndtv.com/videos?yt Download the NDTV news app: https://play.google.com/store/apps/details?id=com.july.ndtv&referrer;=utm_source%3Dyoutubecards%26utm_medium%3Dcpc%26utm_campaign%3Dyoutube -

OUTA out to prevent Eskom's 9.4% tariff hike

The Organisation Undoing Tax Abuse - OUTA - is to approach the High Court in Pretoria for an interdict temporarily preventing Eskom from implementing the 9.4% electricity tariff increase. The electricity increases come into effect this Friday. Outa claims Eskom hasn't given enough reason for the increase and that the increase will affect the poor the most. For more News visit: http://www.sabc.co.za/news -

UCAS Tariff, A Level and GCSE Qualifications Update

-

OUTA opposes Eskom's 9.4% tariff hike

-

SESB can profit without TNB with lower tariff

Sidang Dewan Undangan Negeri Sabah ADUN Likas YB Junz Wong SESB can profit without TNB with lower tariff 15 November 2015 -

Trump's Tariff Plan Could Spark Trade Wars

Economists say Donald Trump's threats to slap steep tariffs on Chinese and Mexican imports would likely backfire, severely disrupting U.S. manufacturers that increasingly depend on global supply chains. Experts say the Republican presidential front-runner's campaign pledges to impose 45 percent tariffs on all imports from China and 35 percent on many goods from Mexico would spark financial market turmoil and possibly even a recession. Among those hardest hit would be the U.S. auto industry, which has fully integrated Mexico into its production network. http://feeds.reuters.com/~r/reuters/topNews/~3/Q3NktpMSuK8/story01.htm http://www.wochit.com This video was produced by YT Wochit News using http://wochit.com -

See waiting Electrical Tariff problem cause for Naija...

-

OERC ON AGRI TARIFF

Odishatv is the leading new channel in Odisha. -

Seatel: Economic tariff, best priced 4G VoLTE Phone, featured services.

តើនារីបុគ្គលិកការិយាល័យសម័យថ្មី ធ្វើការជ្រើសរើសទូរសព្ទ និងគម្រោងសេវាកម្មនៃបណ្តាញ 4G VoLTE100% របស់ក្រុមហ៊ុន Seatel ដោយរបៀបណា? សូមទស្សនាវីដេអូខាងក្រោម៖ Watch how an Office Lady choose Seatel 100% 4G VoLTE telecom service and mobile phone. -

The Wahala of Electricity Tariff- Directed by O.Ben Williams

In the wake of the increase in electricity tariff, Nigerians could not hold back their dissatisfaction. Unfortunately a journalist thought she should interview one man, little did she know she would be igniting a grammatical time-bomb waiting to explode. -

Water Minister @KapilMishraAAP talks about Mixed Tariff Abolition #AAPWaterRevolution

-

News360 - Business - GUTA prez calls for hold on ECOWAS tariff implementation - 17/3/2016

Visit http://www.tv3network.com for more. Subscribe for more Updates: http://goo.gl/70xoB TV3 First in News Best in Entertainment. We promise to develop and deliver acknowledged world class broadcast-based Sports,News Entertainment,Reality Show content, relevant for local and international markets. TV3 First in News Best in Entertainment. -

Tariff situation in parts of Accra worsens - Asem Kesee on Adom TV (17-3-16)

Tariff situation in parts of Accra worsens. -

Tariff Reform Program Project

-- Created using PowToon -- Free sign up at http://www.powtoon.com/youtube/ -- Create animated videos and animated presentations for free. PowToon is a free tool that allows you to develop cool animated clips and animated presentations for your website, office meeting, sales pitch, nonprofit fundraiser, product launch, video resume, or anything else you could use an animated explainer video. PowToon's animation templates help you create animated presentations and animated explainer videos from scratch. Anyone can produce awesome animations quickly with PowToon, without the cost or hassle other professional animation services require. -

Tariff Reform Program cjc

-- Created using PowToon -- Free sign up at http://www.powtoon.com/youtube/ -- Create animated videos and animated presentations for free. PowToon is a free tool that allows you to develop cool animated clips and animated presentations for your website, office meeting, sales pitch, nonprofit fundraiser, product launch, video resume, or anything else you could use an animated explainer video. PowToon's animation templates help you create animated presentations and animated explainer videos from scratch. Anyone can produce awesome animations quickly with PowToon, without the cost or hassle other professional animation services require. -

10 minute revision - the tariff diagram

The tariff diagram -

Maghrib Minute – Water tariff increased

PAEW announces increase in water tariff -

FTA Tariff Tool

The FTA Tariff Tool is an online tool found on Export.gov that helps companies and other stakeholders determine their tariff under the U.S. free trade agreements. The tool also assists companies in researching FTA partner markets. This video tutorial explains the tool in detail and guides users on how to use it. http://export.gov/fta/ftatarifftool/ March 11, 2016

Bengaluru, no power supply and now tariff hike- NEWS9

- Order: Reorder

- Duration: 3:27

- Updated: 30 Mar 2016

- views: 0

- published: 30 Mar 2016

- views: 0

Reliance Jio plan Rs 200 sim card will give you 75 GB, 4500 mins Tariff

- Order: Reorder

- Duration: 1:21

- Updated: 30 Mar 2016

- views: 24

KERC Hikes Power Tariff in Karnataka

- Order: Reorder

- Duration: 1:31

- Updated: 30 Mar 2016

- views: 13

- published: 30 Mar 2016

- views: 13

Reliance Energy proposes average 5.26 pc power tariff hike in 2016-17

- Order: Reorder

- Duration: 0:44

- Updated: 30 Mar 2016

- views: 5

- published: 30 Mar 2016

- views: 5

“Tariff Methodology and Tariff Proceedings”

- Order: Reorder

- Duration: 2:07

- Updated: 30 Mar 2016

- views: 3

- published: 30 Mar 2016

- views: 3

Solar power tariff below Rs 5/unit not viable: Solargise

- Order: Reorder

- Duration: 6:01

- Updated: 29 Mar 2016

- views: 6

- published: 29 Mar 2016

- views: 6

OUTA out to prevent Eskom's 9.4% tariff hike

- Order: Reorder

- Duration: 2:52

- Updated: 29 Mar 2016

- views: 31

- published: 29 Mar 2016

- views: 31

UCAS Tariff, A Level and GCSE Qualifications Update

- Order: Reorder

- Duration: 30:22

- Updated: 29 Mar 2016

- views: 6

- published: 29 Mar 2016

- views: 6

OUTA opposes Eskom's 9.4% tariff hike

- Order: Reorder

- Duration: 0:37

- Updated: 28 Mar 2016

- views: 3

- published: 28 Mar 2016

- views: 3

SESB can profit without TNB with lower tariff

- Order: Reorder

- Duration: 2:56

- Updated: 28 Mar 2016

- views: 45

- published: 28 Mar 2016

- views: 45

Trump's Tariff Plan Could Spark Trade Wars

- Order: Reorder

- Duration: 0:46

- Updated: 24 Mar 2016

- views: 48

- published: 24 Mar 2016

- views: 48

See waiting Electrical Tariff problem cause for Naija...

- Order: Reorder

- Duration: 1:00

- Updated: 23 Mar 2016

- views: 2

- published: 23 Mar 2016

- views: 2

OERC ON AGRI TARIFF

- Order: Reorder

- Duration: 2:55

- Updated: 23 Mar 2016

- views: 26

Seatel: Economic tariff, best priced 4G VoLTE Phone, featured services.

- Order: Reorder

- Duration: 0:33

- Updated: 23 Mar 2016

- views: 68

- published: 23 Mar 2016

- views: 68

The Wahala of Electricity Tariff- Directed by O.Ben Williams

- Order: Reorder

- Duration: 2:31

- Updated: 21 Mar 2016

- views: 36

- published: 21 Mar 2016

- views: 36

Water Minister @KapilMishraAAP talks about Mixed Tariff Abolition #AAPWaterRevolution

- Order: Reorder

- Duration: 0:28

- Updated: 18 Mar 2016

- views: 1

- published: 18 Mar 2016

- views: 1

News360 - Business - GUTA prez calls for hold on ECOWAS tariff implementation - 17/3/2016

- Order: Reorder

- Duration: 6:25

- Updated: 17 Mar 2016

- views: 3

- published: 17 Mar 2016

- views: 3

Tariff situation in parts of Accra worsens - Asem Kesee on Adom TV (17-3-16)

- Order: Reorder

- Duration: 23:21

- Updated: 17 Mar 2016

- views: 269

Tariff Reform Program Project

- Order: Reorder

- Duration: 5:06

- Updated: 17 Mar 2016

- views: 19

- published: 17 Mar 2016

- views: 19

Tariff Reform Program cjc

- Order: Reorder

- Duration: 0:52

- Updated: 17 Mar 2016

- views: 2

- published: 17 Mar 2016

- views: 2

10 minute revision - the tariff diagram

- Order: Reorder

- Duration: 12:00

- Updated: 16 Mar 2016

- views: 5

- published: 16 Mar 2016

- views: 5

Maghrib Minute – Water tariff increased

- Order: Reorder

- Duration: 1:33

- Updated: 16 Mar 2016

- views: 125

FTA Tariff Tool

- Order: Reorder

- Duration: 7:13

- Updated: 16 Mar 2016

- views: 81

- published: 16 Mar 2016

- views: 81

-

Tariffs: The Road to Civil War Part 1

An in-depth look at the history and controversy surrounding tariffs in the United States up until the Civil War. This is the third plank of Henry Clay's American System. Historical Topics Covered: Henry Clay's Senate Speech "In Defense of the American System" Protective Tariff, National Bank, Internal Improvements Article 1, Sect. 8 of U.S. Constitution Speech of Henry Clay on American Industry (1824) Alexander's Hamilton's 1791 Report on Manufactures Alexander Hamilton's Tariff Plan Mercantilism & Economics of Tariffs Division of Labor & Comparative Advantage The Tariff of 1816 John Randolph of Roanoke (1773 - 1833) Panic of 1819 John Taylor of Caroline's Response to Tariffs The Tariff Bill of 1820 -

TRADE BARRIERS TARIFF AND NON TARIFF BARRIERS

-

Trade Barriers Tariff and Non tariff Barriers

-

Introduction to customs tariffs and Market Access Map

Market Access Map (MAcMap) covers customs tariffs (import duties) and other measures applied by 188 importing countries to products from 239 countries and territories. MFN and preferential applied import tariff rates are shown for products at the most detailed national tariff line level. Market Access Map has been designed to support exporters, importers, trade promoters, policy analysts and trade negotiators. Use it to find a tariff. Compare yourself to your competitors. Or use its advanced features to prepare for trade negotiations by simulating the effects of tariff reductions. Written and Narrated by Christina Vonhame -

GHY University - Tariff Classification Part 1 2014 03 19, 12 07 PM

GHY University Webinar regarding Tariff Classification. Part 1 of 2 part series. -

-

Electricity Tariff Hike

The increase in electricity tariff in Nigeria and the consequences -

Electricity Tariff Hike In Nigeria

What Are Your Thoughts On The Increase In Electricity Tariff In Nigeria? Join Channels Beam Google Plus Hangout At 2:00pm As We Discuss The Energy Issues In Nigeria. -

Upwards tariff adjustment - Badwam on Adom TV (8-12-15)

Upwards tariff adjustment. -

Lincoln's Tariff War | Thomas J. DiLorenzo

Sponsored by Shenandoah Electronic Intelligence, Inc. and the Ludwig von Mises Institute, January 14-15, 2005, at the historic Boar's Head Inn at the University of Virginia, Charlottesville. http://mises.org DISCLAIMER: The Ludwig von Mises Institute has given permission under the Creative Commons license that this audio presentation can be publicly reposted as long as credit is given to the Mises Institute and other guidelines are followed. More info at: http://creativecommons.org/licenses/by/3.0/us/ This YouTube channel is in no way endorsed by or affiliated with the Ludwig von Mises Institute, any of its lecturers or staff members. -

Tariff and non-tariff barriers

-

-

Ayutha Ezhuthu - Power tariff hike : Administrative Irregularities or Pressure.?(12/12/14)

Ayutha Ezhuthu - Is the Hike in Power tariff due to Administrative Irregularities or Pressure..? Watch the Full debate unfold - (12/12/14) Catch us LIVE @ http://www.thanthitv.com/ Follow us on - Facebook @ https://www.facebook.com/ThanthiTV Follow us on - Twitter @ https://twitter.com/thanthitv -

LIVE: Eskom's tariff hike request to be granted?

NERSA media briefing on whether or not to grant Eskom's request for a tariff increase. -

Welfare Effects of Trade Policy

This video illustrates the differences between a closed economy, an open economy, and an open economy with a tariff. It also shows the impact on social welfare of these changes by illustrating the changes in consumer, producer, and total surplus. This done using linear demand and supply curves to simplify the analysis. -

-

How to Make VOIP VSR Reseller L3,L2,L1 and Tariff / Pin Free Tutorial

$$The Best & most Trusted PTC SITES $$ http://www.neobux.com/?rh=6B616D616C333230 https://useclix.com/index.php?r=5cfi1eGlp50= http://www.adzbazar.com/?ref=kamal320 http://wad.ojooo.com/index.php?r=jLjO09CHk6I= http://www.clixsense.com/?7815646 http://www.buxept.com/?ref=kamal320 for more information visit our website www.mrbangla.com -

LIVE: Public hearings on Eskom's tariff hike

Johannesburg, 24 June 2015 - National Energy Regulator holds public hearings on Eskom’s selective reopener application for the third Multi-Year Price Determination. -

Utility Tariff Increment - Joy News Interactive (27-3-15)

Public unhappy with increment in water and electricity tariffs.

Tariffs: The Road to Civil War Part 1

- Order: Reorder

- Duration: 21:04

- Updated: 18 Aug 2013

- views: 3190

- published: 18 Aug 2013

- views: 3190

TRADE BARRIERS TARIFF AND NON TARIFF BARRIERS

- Order: Reorder

- Duration: 21:18

- Updated: 02 Mar 2014

- views: 1778

- published: 02 Mar 2014

- views: 1778

Trade Barriers Tariff and Non tariff Barriers

- Order: Reorder

- Duration: 28:58

- Updated: 07 Mar 2014

- views: 501

- published: 07 Mar 2014

- views: 501

Introduction to customs tariffs and Market Access Map

- Order: Reorder

- Duration: 20:46

- Updated: 19 Dec 2011

- views: 3342

- published: 19 Dec 2011

- views: 3342

GHY University - Tariff Classification Part 1 2014 03 19, 12 07 PM

- Order: Reorder

- Duration: 40:03

- Updated: 19 Mar 2014

- views: 669

- published: 19 Mar 2014

- views: 669

ECG Tariff Overcharge - Newsfile on Joy News (23-1-16)

- Order: Reorder

- Duration: 61:28

- Updated: 23 Jan 2016

- views: 2643

Electricity Tariff Hike

- Order: Reorder

- Duration: 24:26

- Updated: 15 Feb 2016

- views: 95

Electricity Tariff Hike In Nigeria

- Order: Reorder

- Duration: 0:00

- Updated: 12 Feb 2016

- views: 0

- published: 12 Feb 2016

- views: 0

Upwards tariff adjustment - Badwam on Adom TV (8-12-15)

- Order: Reorder

- Duration: 31:03

- Updated: 08 Dec 2015

- views: 2045

Lincoln's Tariff War | Thomas J. DiLorenzo

- Order: Reorder

- Duration: 48:36

- Updated: 13 Feb 2012

- views: 1838

- published: 13 Feb 2012

- views: 1838

Tariff and non-tariff barriers

- Order: Reorder

- Duration: 22:31

- Updated: 01 Jan 2016

- views: 40

- published: 01 Jan 2016

- views: 40

Upwards Tariff Adjustment - PM Express on Joy News (7-12-15)

- Order: Reorder

- Duration: 53:07

- Updated: 09 Dec 2015

- views: 341

Ayutha Ezhuthu - Power tariff hike : Administrative Irregularities or Pressure.?(12/12/14)

- Order: Reorder

- Duration: 62:47

- Updated: 13 Dec 2014

- views: 2732

- published: 13 Dec 2014

- views: 2732

LIVE: Eskom's tariff hike request to be granted?

- Order: Reorder

- Duration: 46:59

- Updated: 29 Jun 2015

- views: 562

- published: 29 Jun 2015

- views: 562

Welfare Effects of Trade Policy

- Order: Reorder

- Duration: 30:19

- Updated: 27 Jan 2014

- views: 2701

- published: 27 Jan 2014

- views: 2701

Utility tariff Hikes -Today's Big Story on Joy News (20-1-16)

- Order: Reorder

- Duration: 29:10

- Updated: 21 Jan 2016

- views: 152

How to Make VOIP VSR Reseller L3,L2,L1 and Tariff / Pin Free Tutorial

- Order: Reorder

- Duration: 22:45

- Updated: 24 Jul 2015

- views: 1007

- published: 24 Jul 2015

- views: 1007

LIVE: Public hearings on Eskom's tariff hike

- Order: Reorder

- Duration: 499:28

- Updated: 24 Jun 2015

- views: 1047

- published: 24 Jun 2015

- views: 1047

Utility Tariff Increment - Joy News Interactive (27-3-15)

- Order: Reorder

- Duration: 23:35

- Updated: 28 Mar 2015

- views: 210

- Playlist

- Chat

- Playlist

- Chat

How to calculate the impact of import and export tariffs.

- Report rights infringement

- published: 13 Nov 2010

- views: 81685

Tariffs in US History Explained: US History Review

- Report rights infringement

- published: 05 Jun 2014

- views: 4355

Tariff Definition

- Report rights infringement

- published: 16 Nov 2012

- views: 10813

Micro 2.8 Tariffs and Quotas

- Report rights infringement

- published: 10 Oct 2012

- views: 62930

Tariff (Trade Protectionism)

- Report rights infringement

- published: 30 May 2015

- views: 3159

Tariffs and Protectionism

- Report rights infringement

- published: 26 Feb 2015

- views: 15644

Basic tariff analysis

- Report rights infringement

- published: 25 Aug 2013

- views: 11774

The Tariff of Abominations! YouTube

- Report rights infringement

- published: 02 Feb 2012

- views: 23232

International trade: Impact of Import tariffs

- Report rights infringement

- published: 07 Jan 2011

- views: 30738

Large country tariff basics

- Report rights infringement

- published: 04 Oct 2013

- views: 14651

Trade Barriers Tariff and Non tariff Barriers new

- Report rights infringement

- published: 16 Apr 2014

- views: 4312

The effects of a tariff

- Report rights infringement

- published: 22 Sep 2011

- views: 14680

Electricity tariff increase In Nigeria

- Report rights infringement

- published: 09 Feb 2016

- views: 136

Trump Would Slap Tariffs on China

- Report rights infringement

- published: 15 Jan 2016

- views: 3738

- Playlist

- Chat

Bengaluru, no power supply and now tariff hike- NEWS9

- Report rights infringement

- published: 30 Mar 2016

- views: 0

KERC Hikes Power Tariff in Karnataka

- Report rights infringement

- published: 30 Mar 2016

- views: 13

Reliance Energy proposes average 5.26 pc power tariff hike in 2016-17

- Report rights infringement

- published: 30 Mar 2016

- views: 5

“Tariff Methodology and Tariff Proceedings”

- Report rights infringement

- published: 30 Mar 2016

- views: 3

Solar power tariff below Rs 5/unit not viable: Solargise

- Report rights infringement

- published: 29 Mar 2016

- views: 6

OUTA out to prevent Eskom's 9.4% tariff hike

- Report rights infringement

- published: 29 Mar 2016

- views: 31

UCAS Tariff, A Level and GCSE Qualifications Update

- Report rights infringement

- published: 29 Mar 2016

- views: 6

OUTA opposes Eskom's 9.4% tariff hike

- Report rights infringement

- published: 28 Mar 2016

- views: 3

SESB can profit without TNB with lower tariff

- Report rights infringement

- published: 28 Mar 2016

- views: 45

Trump's Tariff Plan Could Spark Trade Wars

- Report rights infringement

- published: 24 Mar 2016

- views: 48

See waiting Electrical Tariff problem cause for Naija...

- Report rights infringement

- published: 23 Mar 2016

- views: 2

OERC ON AGRI TARIFF

- Report rights infringement

- published: 23 Mar 2016

- views: 26

Seatel: Economic tariff, best priced 4G VoLTE Phone, featured services.

- Report rights infringement

- published: 23 Mar 2016

- views: 68

- Playlist

- Chat

Tariffs: The Road to Civil War Part 1

- Report rights infringement

- published: 18 Aug 2013

- views: 3190

TRADE BARRIERS TARIFF AND NON TARIFF BARRIERS

- Report rights infringement

- published: 02 Mar 2014

- views: 1778

Trade Barriers Tariff and Non tariff Barriers

- Report rights infringement

- published: 07 Mar 2014

- views: 501

Introduction to customs tariffs and Market Access Map

- Report rights infringement

- published: 19 Dec 2011

- views: 3342

GHY University - Tariff Classification Part 1 2014 03 19, 12 07 PM

- Report rights infringement

- published: 19 Mar 2014

- views: 669

ECG Tariff Overcharge - Newsfile on Joy News (23-1-16)

- Report rights infringement

- published: 23 Jan 2016

- views: 2643

Electricity Tariff Hike

- Report rights infringement

- published: 15 Feb 2016

- views: 95

Electricity Tariff Hike In Nigeria

- Report rights infringement

- published: 12 Feb 2016

- views: 0

Upwards tariff adjustment - Badwam on Adom TV (8-12-15)

- Report rights infringement

- published: 08 Dec 2015

- views: 2045

Lincoln's Tariff War | Thomas J. DiLorenzo

- Report rights infringement

- published: 13 Feb 2012

- views: 1838

Tariff and non-tariff barriers

- Report rights infringement

- published: 01 Jan 2016

- views: 40

Upwards Tariff Adjustment - PM Express on Joy News (7-12-15)

- Report rights infringement

- published: 09 Dec 2015

- views: 341

Ayutha Ezhuthu - Power tariff hike : Administrative Irregularities or Pressure.?(12/12/14)

- Report rights infringement

- published: 13 Dec 2014

- views: 2732

LIVE: Eskom's tariff hike request to be granted?

- Report rights infringement

- published: 29 Jun 2015

- views: 562

-

Lyrics list:text lyricsplay full screenplay karaoke

Archaeologists Find Rare Etruscan Stone From 2,500 years Ago in Florence

Edit WorldNews.com 30 Mar 2016Kim Kardashian, Emily Ratajkowski post topless bathroom pic

Edit New York Daily News 30 Mar 2016‘Women Should Be Punished’ For Having Abortions

Edit Inquisitr 30 Mar 2016Trump 'flip-flops' his position on women and abortions in the same day

Edit The Examiner 31 Mar 2016Stock up 20% in a month: GAIL on a high post tariff revision for KG basin network

Edit The Times of India 31 Mar 2016Transportation Tariff to Decrease by 3%

Edit Indonesian Business Daily 31 Mar 2016Outa in court today to challenge Eskom’s tariff hike

Edit Eye Witness News 31 Mar 2016How Govt Imposed 'Illegal' Electricity Tariff On Citizens

Edit All Africa 31 Mar 2016Power Tariff: Government will intervene after MERC order

Edit DNA India 31 Mar 2016Nationalisation of Tata's UK steel assets not right answer: Sajid Javid

Edit DNA India 31 Mar 2016EU referendum: 'Could cause Irish trade barriers'

Edit BBC News 31 Mar 2016EDITORIAL: Transnet tariff escalation

Edit Business Day 31 Mar 201630 is the magic number (Hutchison 3G UK Limited)

Edit Public Technologies 31 Mar 2016Trade, at what price?

Edit The Economist 31 Mar 2016Announces 2015 Annual Results (China Singyes Solar Technologies Holdings Ltd)

Edit Public Technologies 31 Mar 2016Bill Jamieson: Between a rock and a hard place over steel

Edit Scotsman 31 Mar 2016- 1

- 2

- 3

- 4

- 5

- Next page »