- published: 02 Jul 2014

- views: 42764

-

remove the playlistMerchandising

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistMerchandising

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 06 Jul 2011

- views: 46775

- published: 03 Mar 2015

- views: 7670

- published: 05 Jul 2012

- views: 48378

- published: 01 Sep 2011

- views: 103379

- published: 03 May 2016

- views: 1180

- published: 30 Oct 2014

- views: 10726

- published: 12 Aug 2014

- views: 7742

- published: 19 Jun 2013

- views: 16505

- published: 09 Jul 2014

- views: 6090

Merchandising is the methods, practices, and operations used to promote and sustain certain categories of commercial activity. In the broadest sense, merchandising is any practice which contributes to the sale of products to a retail consumer. At a retail in-store level, merchandising refers to the variety of products available for sale and the display of those products in such a way that it stimulates interest and entices customers to make a purchase.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

7:51

7:51Visual Merchandising Basics

Visual Merchandising BasicsVisual Merchandising Basics

Founder of ZenGenius, Joe Baer, explores the basics of Visual Merchandising in this educational video. Contact us today for your own Visual Merchandising training initiative at info@zengenius.com -

4:24

4:24Basic Retail Merchandising

Basic Retail MerchandisingBasic Retail Merchandising

Business consultant Donna Wetterstrand takes you through some simple and basic principles of effective merchandising and marketing in a retail space. Helping you maximize your sales is just one of the business services that Donna Wetterstrand offers. She is also a professional transformational counselor and life coach, both of which can be valuable to business owners and managers: www.lightsoncoaching.com -

46:44

46:44পেশা হিসেবে গার্মেন্টস মার্চেন্ডাইজিং || Garments or Apparel Merchandising as a Career

পেশা হিসেবে গার্মেন্টস মার্চেন্ডাইজিং || Garments or Apparel Merchandising as a Careerপেশা হিসেবে গার্মেন্টস মার্চেন্ডাইজিং || Garments or Apparel Merchandising as a Career

http://www.pigft.com http://www.pigft.blogspot.com Hello Visitor, Greetings! This is a channel organized by PIGFT (Panorama Institute of Garments and Fashion Technology), a leading institute in Dhaka with the excellence of education regarding Garments, Fashion and Technology. This institute has been offering outstanding courses on Garments or Apparel Merchandising, Fashion Design, Quality Inspection, Buying House or other Business Operation and Basic English from the inauguration. Most of our learners have already been successful in building a dream career after the successful course completion from our institute. If you are high-ambitious and determined to design your bustling career in 100% Export-oriented Garment Sector and willing to avail a course, please come to us straightly without any hesitation. We are the best in practical teaching and to make your dream comes true. -

6:55

6:55Visual Merchandising - Mundo Empresarial

Visual Merchandising - Mundo EmpresarialVisual Merchandising - Mundo Empresarial

Informe - Visual Merchandising. Si los escaparates están dirigidos a llamar la atención del público exterior, el Visual Merchandising es la técnica de colocar correctamente el producto dentro del establecimiento, de modo que se visualice la marca y se facilite la búsqueda del producto por parte del cliente. La representante de Toulouse Lautrec, Liz Ángeles, da declaraciones. Fuente: CANAL 8 / MUNDO EMPRESARIAL 03 de Julio -

5:26

5:26Life as a Trainee Merchandiser

Life as a Trainee MerchandiserLife as a Trainee Merchandiser

A lot of people don't get what merchandising really is. Some people think its visual merchandising - dressing shop windows - and others think it's all to do with figure crunching. So we thought it would be a good idea to put together a few videos to clear things up once and for all! -

1:33

1:33Merchandising LoveFútbol de Soloporteros

Merchandising LoveFútbol de SoloporterosMerchandising LoveFútbol de Soloporteros

Si tienes que hacer un regalo o quieres llevar tu pasión por el fútbol fuera del terreno de juego, no te pierdas nuestra nueva colección de productos LoveFútbol. Échale un ojo a nuestros imanes de futbolistas retro o nuestros productos para el día a día de un friki del fútbol como nosotros. Date un capricho de vez en cuando o regálaselo a un compañero de vestuario. http://www.soloporteros.com/es/categoria/accesorios-de-futbol/merchandising soloporteros_portada_es -

10:27

10:27Cours merchandising ( darija )

Cours merchandising ( darija )Cours merchandising ( darija )

la première du partie du module technique du merchandising -

5:27

5:27Chapter 6: The Key to Effective Store Merchandising

Chapter 6: The Key to Effective Store MerchandisingChapter 6: The Key to Effective Store Merchandising

An Insider’s Guide to Running a Successful Retail Store Chapter 6: The Key to Effective Store Merchandising Merchandising a retail store has a tremendous amount of science and psychology behind it. They tell us that we should merchandise for the five senses, but the truth is, we have more than five senses. Video Highlights: 0:23 Our subconscious senses 0:40 How to set the mood/environment of your store 0:55 Case Study: Hollister 3:13 Rules to follow 3:50 Case Study: Target 4:38 Case Study: Gucci, Prada, Louis Vuitton This video is a part of Shopify's Ecommerce University's 11 part video series on running a successful retail store. Watch all 11 free videos » http://bit.ly/103EZbF For more free videos, ebooks, tools, and guides on ecommerce, marketing, check out Shopify's Ecommerce University » http://bit.ly/1FVxHrx -

13:11

13:11ACCTBA1 - Accounting for Merchandising Businesses

ACCTBA1 - Accounting for Merchandising BusinessesACCTBA1 - Accounting for Merchandising Businesses

COB CHANNEL Your one stop online tutorial channel A project of the Student Services Committee under the College Government of Business ACCTBA1 - Accounting for Merchandising Businesses Tutorial By: Kim Tanhui (JPIA) Edited By: Gaston Arcega (CGB) Brought to you by CGB and JPIA -

78:57

78:57Financial Accounting: Merchandising Operations

Financial Accounting: Merchandising OperationsFinancial Accounting: Merchandising Operations

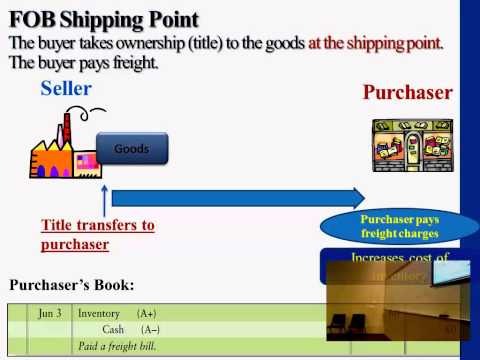

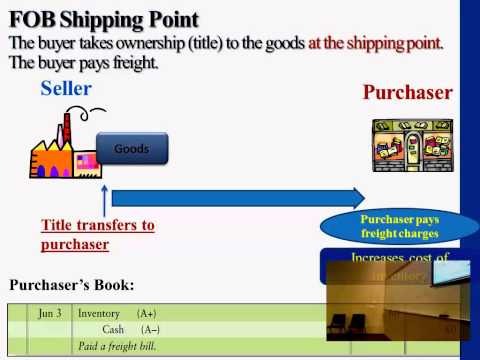

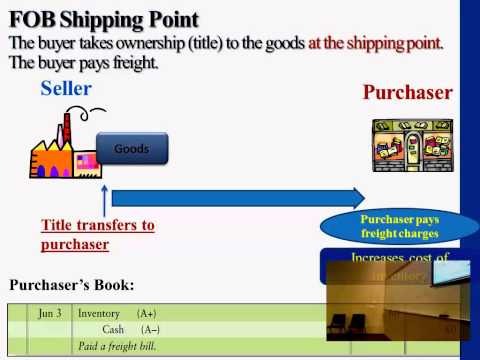

Introduction to Financial Accounting Merchandising Operations (Chapter 5) February 25th, 2013 by Professor Victoria Chiu The main objectives of this lecture is to describe and illustrate merchandising operations & the two main types of inventory systems. We also aim to master how to account for the purchase & sale of inventory using a perpetual system. How to adjust & close the accounts of a merchandising business, as well as preparing merchandisers' financial statements is covered, as well as using the gross profit percentage & inventory turnover to evaluate the health of a business. The operating cycle consists of the company purchasing inventory from the vendor / supplier, & then collects cash by selling the inventory to a customer. Merchandisers are businesses that sell a product to customers. New accounts that they use (that we didn't already cover) include inventory (a current asset account listed on the balance sheet). Inventory is the merchandise that a company holds for sale to customers. Sales revenue and cost of goods sold (type of expense) are also two new accounts we deal with (listed on the income statement). Sales revenue is the retail price of the inventory sold to the customer & cost of goods sold is the cost (to the company) of the inventory sold to the customer. A perpetual inventory system keeps a running computerized record of inventory (thanks to bar codes). A contemporary perpetual inventory system constantly records units purchased & cost amount, the units sold & sales & cost amounts, & the quantity of inventory on hand & its cost. It also better controls inventory due to the fact the inventory & purchasing systems are integrated with accounts receivable & sales. Despite it being computerized, physical counts do occur once every year to double check that the ending inventory listed is the correct amount (since spoilage, theft, & other factors may result in loss of inventory without a sale). The perpetual system is most popular. Bar cods are used by businesses today to streamline many formerly repetitive & labor intensive processes related to inventory. It is used to record sales & cost of goods sold, as well as to update the inventory count. It also updates purchasing & generates purchase orders (replenishes inventory by communicating with the company's purchasing systems). Under the periodic inventory system, goods are counted periodically to determine quantity. Under this system, businesses physically count their inventories periodically to determine the quantities on hand. It is used by small businesses, restaurants, & small retail stores (that lack optical-scanning cash registers). It is normally used for relatively inexpensive goods. However, it is less popular than the perpetual system due to computerized inventory systems being much easier & more convenient to use. When inventory is purchased, the inventory account ( a current asset) is increased with each purchase. The vendor submits an invoice for payment (the seller's request for payment from the buyer). The invoice contains the seller, the purchaser, the date of purchase / shipment, the credit terms, the total amount due, & the due date. It should be noted that the inventory account is also impacted by shipping costs, returned purchased items, & early payment discounts. The journal entry to purchase inventory is simply a debit to the inventory account & a credit to the accounts payable account for the same amount. If purchased with cash rather than with credit, simply credit cash instead of crediting accounts payable. Purchase discounts involve the customer getting a discount for making an early payment within a given period (determined by the seller). For example, the buyer is legible for a 3% discount if the buyer pays for the goods within 15 days. If the buyer does not pay within 15 days, they are responsible for the full amount (within 30 days). The above example would be denoted 3/15, n/30. EOM stands for end of month. Purchase Returns & allowances are also discussed, as well as transportation & freight costs (FOB destination & shipping point). ------QUICK NAVIGATION------ Video begins with overview of learning objectives Operating Cycle: 3:31 Merchandisers: 6:11 Balance Sheet Diff: 10:18 Income Statement Diff: 10:59 Perpetual Inventory System: 12:59 Bar Codes: 16:19 Periodic Inventory System: 17:35 Purchasing Inventory: 20:03 Journal Entry for Purchase of Inventory: 22:53 Purchase Discounts: 24:46 Payment Within Discount Period: 29:53 Purchase Returns and Allowances: 34:23 Journal Entry for Purchase Returns & Allowances: 37:34 Transportation Costs: 40:22 FOB Shipping Point: 45:20 Purchase Discount - Shipping is Added to Invoice: 46:06 FOB Destination: 49:56 Summary of Purchase Returns & Allowances, Discounts, & Transportation Costs: 52:53 Exercise S5-2 - (Analyzing Purchase Transactions - Perpetual Inventory): 55:50 Midterm Review: 1:04:54 -

8:16

8:16O Poder do Merchandising

O Poder do MerchandisingO Poder do Merchandising

O vídeo apresenta os conceitos essenciais e a influência do Merchandising no processo de decisão do Shopper a partir de um estudo inédito feito num supermercado. -

4:35

4:35LE MERCHANDISING

LE MERCHANDISINGLE MERCHANDISING

- Arts and crafts

- Boston Celtics

- Boxing Day

- Brand

- Buffalo, New York

- Cap

- Christmas decoration

- Christmas in July

- Closeout

- Commerce

- Consumer electronics

- Digital camera

- Discounting

- Easter

- Fathers Day

- Film

- Flag Day

- Florida

- Genre

- Graduation

- Gundam

- Halloween

- Harley-Davidson

- Horror fiction

- Labor Day

- Marketing

- Mashimaro

- Memorial Day

- Merchandising

- Merchandization

- Model kit

- Mothers Day

- Mountain range

- New Year's Day

- Overstock

- Packaging

- PepsiCo

- Pricing

- Product design

- Professional sports

- Prop replica

- Retail chain

- Sales

- Science fiction

- Shoplifting

- Snow skiing

- Snowblower

- Snowboarding

- Southern California

- St. Patrick's Day

- Star Trek

- Supply chain

- Television

- Tie-in

- Todd McFarlane

- Trademark

- Valentine's Day

- Visual merchandising

- Walgreens

- Water skiing

-

Visual Merchandising Basics

Founder of ZenGenius, Joe Baer, explores the basics of Visual Merchandising in this educational video. Contact us today for your own Visual Merchandising training initiative at info@zengenius.com -

Basic Retail Merchandising

Business consultant Donna Wetterstrand takes you through some simple and basic principles of effective merchandising and marketing in a retail space. Helping you maximize your sales is just one of the business services that Donna Wetterstrand offers. She is also a professional transformational counselor and life coach, both of which can be valuable to business owners and managers: www.lightsoncoaching.com -

পেশা হিসেবে গার্মেন্টস মার্চেন্ডাইজিং || Garments or Apparel Merchandising as a Career

http://www.pigft.com http://www.pigft.blogspot.com Hello Visitor, Greetings! This is a channel organized by PIGFT (Panorama Institute of Garments and Fashion Technology), a leading institute in Dhaka with the excellence of education regarding Garments, Fashion and Technology. This institute has been offering outstanding courses on Garments or Apparel Merchandising, Fashion Design, Quality Inspection, Buying House or other Business Operation and Basic English from the inauguration. Most of our learners have already been successful in building a dream career after the successful course completion from our institute. If you are high-ambitious and determined to design your bustling career in 100% Export-oriented Garment Sector and willing to avail a course, please come to us straightly withou... -

Visual Merchandising - Mundo Empresarial

Informe - Visual Merchandising. Si los escaparates están dirigidos a llamar la atención del público exterior, el Visual Merchandising es la técnica de colocar correctamente el producto dentro del establecimiento, de modo que se visualice la marca y se facilite la búsqueda del producto por parte del cliente. La representante de Toulouse Lautrec, Liz Ángeles, da declaraciones. Fuente: CANAL 8 / MUNDO EMPRESARIAL 03 de Julio -

Life as a Trainee Merchandiser

A lot of people don't get what merchandising really is. Some people think its visual merchandising - dressing shop windows - and others think it's all to do with figure crunching. So we thought it would be a good idea to put together a few videos to clear things up once and for all! -

Merchandising LoveFútbol de Soloporteros

Si tienes que hacer un regalo o quieres llevar tu pasión por el fútbol fuera del terreno de juego, no te pierdas nuestra nueva colección de productos LoveFútbol. Échale un ojo a nuestros imanes de futbolistas retro o nuestros productos para el día a día de un friki del fútbol como nosotros. Date un capricho de vez en cuando o regálaselo a un compañero de vestuario. http://www.soloporteros.com/es/categoria/accesorios-de-futbol/merchandising soloporteros_portada_es -

Cours merchandising ( darija )

la première du partie du module technique du merchandising -

Chapter 6: The Key to Effective Store Merchandising

An Insider’s Guide to Running a Successful Retail Store Chapter 6: The Key to Effective Store Merchandising Merchandising a retail store has a tremendous amount of science and psychology behind it. They tell us that we should merchandise for the five senses, but the truth is, we have more than five senses. Video Highlights: 0:23 Our subconscious senses 0:40 How to set the mood/environment of your store 0:55 Case Study: Hollister 3:13 Rules to follow 3:50 Case Study: Target 4:38 Case Study: Gucci, Prada, Louis Vuitton This video is a part of Shopify's Ecommerce University's 11 part video series on running a successful retail store. Watch all 11 free videos » http://bit.ly/103EZbF For more free videos, ebooks, tools, and guides on ecommerce, marketing, check out Shopify's Ecommerc... -

ACCTBA1 - Accounting for Merchandising Businesses

COB CHANNEL Your one stop online tutorial channel A project of the Student Services Committee under the College Government of Business ACCTBA1 - Accounting for Merchandising Businesses Tutorial By: Kim Tanhui (JPIA) Edited By: Gaston Arcega (CGB) Brought to you by CGB and JPIA -

Financial Accounting: Merchandising Operations

Introduction to Financial Accounting Merchandising Operations (Chapter 5) February 25th, 2013 by Professor Victoria Chiu The main objectives of this lecture is to describe and illustrate merchandising operations & the two main types of inventory systems. We also aim to master how to account for the purchase & sale of inventory using a perpetual system. How to adjust & close the accounts of a merchandising business, as well as preparing merchandisers' financial statements is covered, as well as using the gross profit percentage & inventory turnover to evaluate the health of a business. The operating cycle consists of the company purchasing inventory from the vendor / supplier, & then collects cash by selling the inventory to a customer. Merchandisers are businesses that sell a product... -

O Poder do Merchandising

O vídeo apresenta os conceitos essenciais e a influência do Merchandising no processo de decisão do Shopper a partir de um estudo inédito feito num supermercado. -

LE MERCHANDISING

Visual Merchandising Basics

- Order: Reorder

- Duration: 7:51

- Updated: 02 Jul 2014

- views: 42764

- published: 02 Jul 2014

- views: 42764

Basic Retail Merchandising

- Order: Reorder

- Duration: 4:24

- Updated: 06 Jul 2011

- views: 46775

- published: 06 Jul 2011

- views: 46775

পেশা হিসেবে গার্মেন্টস মার্চেন্ডাইজিং || Garments or Apparel Merchandising as a Career

- Order: Reorder

- Duration: 46:44

- Updated: 03 Mar 2015

- views: 7670

- published: 03 Mar 2015

- views: 7670

Visual Merchandising - Mundo Empresarial

- Order: Reorder

- Duration: 6:55

- Updated: 05 Jul 2012

- views: 48378

- published: 05 Jul 2012

- views: 48378

Life as a Trainee Merchandiser

- Order: Reorder

- Duration: 5:26

- Updated: 01 Sep 2011

- views: 103379

- published: 01 Sep 2011

- views: 103379

Merchandising LoveFútbol de Soloporteros

- Order: Reorder

- Duration: 1:33

- Updated: 03 May 2016

- views: 1180

- published: 03 May 2016

- views: 1180

Cours merchandising ( darija )

- Order: Reorder

- Duration: 10:27

- Updated: 27 Sep 2014

- views: 7648

- published: 27 Sep 2014

- views: 7648

Chapter 6: The Key to Effective Store Merchandising

- Order: Reorder

- Duration: 5:27

- Updated: 30 Oct 2014

- views: 10726

- published: 30 Oct 2014

- views: 10726

ACCTBA1 - Accounting for Merchandising Businesses

- Order: Reorder

- Duration: 13:11

- Updated: 12 Aug 2014

- views: 7742

- published: 12 Aug 2014

- views: 7742

Financial Accounting: Merchandising Operations

- Order: Reorder

- Duration: 78:57

- Updated: 19 Jun 2013

- views: 16505

- published: 19 Jun 2013

- views: 16505

O Poder do Merchandising

- Order: Reorder

- Duration: 8:16

- Updated: 09 Jul 2014

- views: 6090

- published: 09 Jul 2014

- views: 6090

LE MERCHANDISING

- Order: Reorder

- Duration: 4:35

- Updated: 31 Dec 2013

- views: 7718

- published: 31 Dec 2013

- views: 7718

-

Nuestro Patio TV ( Merchandising y Marca personal )

Segunda edición del programa producido por estudiantes del programa del programa de Mercadeo y Publicidad de la Universidad de Santander sede Cúcuta. -

Merchandising Lacan Cosméticos no Programa Mulheres 04 05 2016

A Lacan é uma marca de produtos para tratamento cosmético capilar com performance profissional. Os produtos são encontrados nas melhores perfumarias. Abaixo os itens destacados no programa Mulheres e apresentados por Catia Fonseca e Sylvio Rezende. Confira: Linha BB CREAM para nutrição profunda dos fios - 15 benefícios: - Fios mais Fortes - Hidratação Prolongada - Auxilia no crescimento - Antifrizz - Elasticidade Intense - Suavidade - Umectação - Espessamento do fio - Melhor penteabilidade - Brilho - Maciez - Nutrição - Proteção UV - Proteção Térmica - Termoativado Linha BARDANA DETOX CARE - Cabelos Mais Fortes - Couro Cabeludo Saudável - Controle da Oleosidade - Estímulo do Crescimento - Ação Anticaspa - Antiqueda Saiba todos os detalhes da linha completa no site: www.lacan.com.br -

Merchandising SICOOB UNIDAS

Merchandising SICOOB UNIDAS -

Merchandising LoveFútbol by Soloporteros

We keep expanding out product line so our clients can share with us their love for football. We present the Love Fútbol Merchandising The #1 on-line football store in Spain Soloporteros is considered to be the best football store in Spain with over 70 employees, 12 physical stores and over 10 years selling our products on the Internet -

SERVICIO DE PUBLICIDAD, MERCHANDISING.

Servicio de Publicidad Corporativa. Diseño Gráfico, Merchandising, Papelería Corporativa, Formateria, Banner, Gigantografia, Brochure, volantes, Afiches, Caja Publicitarias. -

Merchandising Alterosa em Alerta Implantar 03 05 2016 12 35 hs

-

Merchandising Alterosa em Alerta Implantar 28 04 2016 13 34 hs

-

Ação de merchandising cliente Acquaclin.

Descrição -

Vizibee

Vizibee is an ‘And Marketing’ initiative, a leading player in the field of merchandising and in-store activations. The product is backed by more than 25 man-years of domain expertise to cover each aspect of merchandising. Vizibee is designed specifically to facilitate the brands do merchandising audit of their markets on various aspects like stock availability, display of POSM material and measurement of Share of Shelf parameters. Currently being used by a few industry leaders, The product is quickly adaptable for various industries with minor customization and is dynamic enough to handle different questionnaire formats. The app is seamlessly integrated with back end database to fetch relevant data like distributor and retailer lists based -- Created using PowToon -- Free sign up at http:/... -

TaeWannaPlay Fashion Merchandising Productions Commerical

www.TaewannaPlayFashion.com -

Merchandising LoveFútbol Soloporteros

A paixão pelo Futebol vai muito para além dos relvados...Respiramos futebol em todo o nosso dia a dia! A loja on-line de futebol nº 1 em Espanha A soloporteros é considerada a melhor loja de futebol em Espanha. Atualmente conta com mais de 90 trabalhadores, 12 lojas e mais de 10 anos de vendas através da internet -

2016 UNBOXING HAUL MERCHANDISING ALIEXPRESS

UNBOXING HAUL MERCHANDISING ALIEXPRESS Top Aliexpress Discount : http://is.gd/eb5rn2i58ou ¡LINKS AQUIIIIIIIIIIIIIIIIIIII Y REDES SOCIALES! CARCASA IRON MAN : http://es.aliexpress.com/item/Iron-Man-Mask-Classic-Case-For-Nexus-6-5-4-LG-G2-G3-For-Xperia-Z3/32301032152.html CARTERA DE BATMAN : http://es.aliexpress.com/item/Free-shipping-bolsa-vintage-Genuine-Leather-man-wallet-mens-Crazy-leather-bag-anime-wallets-marvel-superhero/32370736683.html?adminSeq=221867674shopNumber=1543490 CARCASA MINION: http://es.aliexpress.com/item/Animal-Simple-Style-Cover-Case-FOR-Sony-Xperia-Z1-case-for-Sony-Xperia-Z1-L39H-Cell/2053040840.html?adminSeq=205739801shopNumber=1186104 CAMISETA BETTER CALL SAUL : http://es.aliexpress.com/item/Breaking-Bad-Los-Pollos-Hermanos-Better-Call-Saul-Tshirts-Man-Fashion-N...

Nuestro Patio TV ( Merchandising y Marca personal )

- Order: Reorder

- Duration: 7:10

- Updated: 05 May 2016

- views: 13

- published: 05 May 2016

- views: 13

Merchandising Lacan Cosméticos no Programa Mulheres 04 05 2016

- Order: Reorder

- Duration: 2:55

- Updated: 05 May 2016

- views: 5

- published: 05 May 2016

- views: 5

Merchandising SICOOB UNIDAS

- Order: Reorder

- Duration: 1:55

- Updated: 05 May 2016

- views: 2

Merchandising LoveFútbol by Soloporteros

- Order: Reorder

- Duration: 1:33

- Updated: 05 May 2016

- views: 16

- published: 05 May 2016

- views: 16

SERVICIO DE PUBLICIDAD, MERCHANDISING.

- Order: Reorder

- Duration: 1:00

- Updated: 05 May 2016

- views: 6

- published: 05 May 2016

- views: 6

Merchandising Alterosa em Alerta Implantar 03 05 2016 12 35 hs

- Order: Reorder

- Duration: 3:05

- Updated: 05 May 2016

- views: 1

- published: 05 May 2016

- views: 1

Merchandising Alterosa em Alerta Implantar 28 04 2016 13 34 hs

- Order: Reorder

- Duration: 1:36

- Updated: 05 May 2016

- views: 1

- published: 05 May 2016

- views: 1

Ação de merchandising cliente Acquaclin.

- Order: Reorder

- Duration: 1:18

- Updated: 05 May 2016

- views: 2

- published: 05 May 2016

- views: 2

Vizibee

- Order: Reorder

- Duration: 1:02

- Updated: 05 May 2016

- views: 16

- published: 05 May 2016

- views: 16

TaeWannaPlay Fashion Merchandising Productions Commerical

- Order: Reorder

- Duration: 0:31

- Updated: 05 May 2016

- views: 0

- published: 05 May 2016

- views: 0

Merchandising LoveFútbol Soloporteros

- Order: Reorder

- Duration: 1:33

- Updated: 05 May 2016

- views: 39

- published: 05 May 2016

- views: 39

2016 UNBOXING HAUL MERCHANDISING ALIEXPRESS

- Order: Reorder

- Duration: 8:23

- Updated: 04 May 2016

- views: 9

- published: 04 May 2016

- views: 9

-

¿Qué es el Visual Merchandising?

El Visual Merchandising es una herramienta vital a la hora de optimizar las ventas de productos en puntos de venta tales como tiendas de moda y hasta supermercados. Se trata de cómo ubicar los productos y cómo pensar el interiorismo y decoración del local para que de esta manera los productos resalten y el espacio resulta atractivo e incite a la compra. -

Merchandising Techniques 2 27 15

-

3 Critical Merchandising Mistakes Retailers Make by Anne Obarski

Merchandising and displays are your silent salesperson, yet many retailers overlook three areas that customers use to evaluate your store. Those evaluations can cause them to go down the street or to the Internet. Attendees will discover: • What critical Halloween merchandising and inventory skills to use for 2012. • Three things your top customers say to do to retain their business. • How to make a strategic plan for 2012! Successful retailers offer the experience that creates social media excitement. Don't get caught up in "we've always done it this way." Doing business as usual could mean not doing business at all. Make your Halloween business a contagious, infectious, exciting and spreadable "not to miss" experience! -

Qué hacen los que más venden. Merchandising para detallistas. 1ª Parte

1ª parte de la ponencia de Ricardo Palomares Borja, de la empresa MRS Ibérica en el ciclo de conferencias que desarrolló FEVALCO "Innovación en el Comercio para ser Competitivo". Esta ponencia tuvo por objetivo indicar: qué productos agrupar estratégicamente, cómo presentar las diferentes categorías de productos sobre el lineal desarrollado, cómo desarrollar una estrategiaa de comunicación y promoción eficaz en el punto de venta, entre otros. -

Accounting 1: Program #20 - "Merchandising Operations: Conclusion"

Accounting 1 Program #20 Chapter 5 "Merchandising Operations: Conclusion" dkrug@jccc.edu -

PALESTRA: MERCHANDISING EM PONTO DE VENDA 30 06

Assista a Palestra: Merchandising em Ponto de Venda ministrada pela consultora Heloísa Omine na sede do SAMPAPÃO em parceria com a FIESP e aprenda técnicas importantes de divulgação dentro da padaria. -

Chap 05-1 Lecture: Merchandising (perpetual)

This introduction to merchandising includes new accounts, new terminology and terms of sale, new transactions from buyer's and seller's points of view, and new format for income statement. Shipping terms of FOB shipping and FOB destination are also explained. -

Power Merchandising (Part 2): The Art of Visual Merchandising & Lighting

Chris Miller, Pacific Store Designs Take your merchandising to the next level with this advanced course. Learn how to enhance your selling environment and make your store a fun place to shop. Topics include using lighting to trigger impulse sales, increasing customer awareness with props and mannequins, designing and building an effective window display, and using signage in your store. -

-

¿Qué es el Visual Merchandising?

- Order: Reorder

- Duration: 78:08

- Updated: 13 Jun 2013

- views: 51009

- published: 13 Jun 2013

- views: 51009

Merchandising Techniques 2 27 15

- Order: Reorder

- Duration: 33:58

- Updated: 16 Jun 2015

- views: 657

- published: 16 Jun 2015

- views: 657

3 Critical Merchandising Mistakes Retailers Make by Anne Obarski

- Order: Reorder

- Duration: 33:08

- Updated: 29 Aug 2012

- views: 16119

- published: 29 Aug 2012

- views: 16119

Qué hacen los que más venden. Merchandising para detallistas. 1ª Parte

- Order: Reorder

- Duration: 30:09

- Updated: 22 Mar 2012

- views: 16394

- published: 22 Mar 2012

- views: 16394

Accounting 1: Program #20 - "Merchandising Operations: Conclusion"

- Order: Reorder

- Duration: 50:55

- Updated: 17 Oct 2011

- views: 28693

- published: 17 Oct 2011

- views: 28693

PALESTRA: MERCHANDISING EM PONTO DE VENDA 30 06

- Order: Reorder

- Duration: 41:49

- Updated: 11 Jul 2015

- views: 192

- published: 11 Jul 2015

- views: 192

Chap 05-1 Lecture: Merchandising (perpetual)

- Order: Reorder

- Duration: 56:31

- Updated: 28 Sep 2011

- views: 21577

Power Merchandising (Part 2): The Art of Visual Merchandising & Lighting

- Order: Reorder

- Duration: 28:14

- Updated: 03 Apr 2015

- views: 188

- published: 03 Apr 2015

- views: 188

Visual Merchandising Presentation Raz Dagan

- Order: Reorder

- Duration: 30:00

- Updated: 19 Dec 2014

- views: 243

Merchandising Webinar at Today's Garden Center with Terri and Laurie

- Order: Reorder

- Duration: 45:02

- Updated: 13 Dec 2012

- views: 836

- Playlist

- Chat

- Playlist

- Chat

Visual Merchandising Basics

- Report rights infringement

- published: 02 Jul 2014

- views: 42764

Basic Retail Merchandising

- Report rights infringement

- published: 06 Jul 2011

- views: 46775

পেশা হিসেবে গার্মেন্টস মার্চেন্ডাইজিং || Garments or Apparel Merchandising as a Career

- Report rights infringement

- published: 03 Mar 2015

- views: 7670

Visual Merchandising - Mundo Empresarial

- Report rights infringement

- published: 05 Jul 2012

- views: 48378

Life as a Trainee Merchandiser

- Report rights infringement

- published: 01 Sep 2011

- views: 103379

Merchandising LoveFútbol de Soloporteros

- Report rights infringement

- published: 03 May 2016

- views: 1180

Cours merchandising ( darija )

- Report rights infringement

- published: 27 Sep 2014

- views: 7648

Chapter 6: The Key to Effective Store Merchandising

- Report rights infringement

- published: 30 Oct 2014

- views: 10726

ACCTBA1 - Accounting for Merchandising Businesses

- Report rights infringement

- published: 12 Aug 2014

- views: 7742

Financial Accounting: Merchandising Operations

- Report rights infringement

- published: 19 Jun 2013

- views: 16505

O Poder do Merchandising

- Report rights infringement

- published: 09 Jul 2014

- views: 6090

LE MERCHANDISING

- Report rights infringement

- published: 31 Dec 2013

- views: 7718

- Playlist

- Chat

Nuestro Patio TV ( Merchandising y Marca personal )

- Report rights infringement

- published: 05 May 2016

- views: 13

Merchandising Lacan Cosméticos no Programa Mulheres 04 05 2016

- Report rights infringement

- published: 05 May 2016

- views: 5

Merchandising SICOOB UNIDAS

- Report rights infringement

- published: 05 May 2016

- views: 2

Merchandising LoveFútbol by Soloporteros

- Report rights infringement

- published: 05 May 2016

- views: 16

SERVICIO DE PUBLICIDAD, MERCHANDISING.

- Report rights infringement

- published: 05 May 2016

- views: 6

Merchandising Alterosa em Alerta Implantar 03 05 2016 12 35 hs

- Report rights infringement

- published: 05 May 2016

- views: 1

Merchandising Alterosa em Alerta Implantar 28 04 2016 13 34 hs

- Report rights infringement

- published: 05 May 2016

- views: 1

Ação de merchandising cliente Acquaclin.

- Report rights infringement

- published: 05 May 2016

- views: 2

Vizibee

- Report rights infringement

- published: 05 May 2016

- views: 16

TaeWannaPlay Fashion Merchandising Productions Commerical

- Report rights infringement

- published: 05 May 2016

- views: 0

Merchandising LoveFútbol Soloporteros

- Report rights infringement

- published: 05 May 2016

- views: 39

2016 UNBOXING HAUL MERCHANDISING ALIEXPRESS

- Report rights infringement

- published: 04 May 2016

- views: 9

- Playlist

- Chat

¿Qué es el Visual Merchandising?

- Report rights infringement

- published: 13 Jun 2013

- views: 51009

Merchandising Techniques 2 27 15

- Report rights infringement

- published: 16 Jun 2015

- views: 657

3 Critical Merchandising Mistakes Retailers Make by Anne Obarski

- Report rights infringement

- published: 29 Aug 2012

- views: 16119

Qué hacen los que más venden. Merchandising para detallistas. 1ª Parte

- Report rights infringement

- published: 22 Mar 2012

- views: 16394

Accounting 1: Program #20 - "Merchandising Operations: Conclusion"

- Report rights infringement

- published: 17 Oct 2011

- views: 28693

PALESTRA: MERCHANDISING EM PONTO DE VENDA 30 06

- Report rights infringement

- published: 11 Jul 2015

- views: 192

Chap 05-1 Lecture: Merchandising (perpetual)

- Report rights infringement

- published: 28 Sep 2011

- views: 21577

Power Merchandising (Part 2): The Art of Visual Merchandising & Lighting

- Report rights infringement

- published: 03 Apr 2015

- views: 188

Visual Merchandising Presentation Raz Dagan

- Report rights infringement

- published: 19 Dec 2014

- views: 243

Merchandising Webinar at Today's Garden Center with Terri and Laurie

- Report rights infringement

- published: 13 Dec 2012

- views: 836

Oil tanker washes up on Liberia beach with no crew or lifeboats

Edit The Guardian 06 May 2016RNC Chairman Says Trump "Trying" To Rein In Craziness Surrounding His Campaign

Edit WorldNews.com 06 May 2016Obama Tells Trump: 'This Is Not a Reality Show'

Edit Newsweek 07 May 2016London mayor: The Sadiq Khan story

Edit BBC News 07 May 2016Papua New Guinea tells UN it accepts court decision on Manus Island illegality

Edit The Guardian 07 May 2016How can prices be justified for Mystery Plays merchandise? (letter)

Edit York Press 07 May 2016Five Below coming to Crossgates

Edit Times Union 07 May 2016Creativity was the challenge: Chilaka

Edit The Times of India 07 May 2016Govt raises support for exports under MEIS scheme

Edit Yahoo Daily News 07 May 2016Now, ease of doing biz for exports: Govt raises support under MEIS scheme

Edit Yahoo Daily News 07 May 2016Check out Graham Zusi's Spotify playlist (Sporting Kansas City)

Edit Public Technologies 07 May 2016Market Indices Post Worst Week Since Early '16 Struggles

Edit Voa News 07 May 2016Mother's Day 2016: Gift ideas; store ads; shopping apps

Edit Atlanta Journal 07 May 2016Mother's Day 2016: Last-minute gift ideas; store ads; shopping apps; deals

Edit Springfield News-Sun 07 May 2016Philippines and EFTA States Sign Free Trade Agreement (Department of Foreign Affairs of the Republic of the Philippines)

Edit Public Technologies 07 May 2016Your guide: Nottingham Forest (Milton Keynes Dons Ltd)

Edit Public Technologies 07 May 2016The Spirit of Nelson Mandela in Palestine: Is His Real Legacy Being Upheld?

Edit Antiwar 07 May 2016Tyrod Taylor projected to be a top NFL merchandise seller

Edit Business Journal 06 May 2016- 1

- 2

- 3

- 4

- 5

- Next page »