- published: 19 Jul 2014

- views: 3396

-

remove the playlistWire Transfer

- remove the playlistWire Transfer

- published: 10 Feb 2009

- views: 8150

- published: 20 Dec 2013

- views: 4273

- published: 07 Aug 2014

- views: 38554

Wire transfer or credit transfer is a method of electronic funds transfer from one person or institution (entity) to another. A wire transfer can be made from one bank account to another bank account or through a transfer of cash at a cash office. Wire transfer systems are intended to provide more individualized transactions than bulk payment systems such as ACH and Check21.

Different wire transfer systems and operators provide a variety of options relative to the immediacy and finality of settlement and the cost, value, and volume of transactions. Central bank wire transfer systems, such as the Federal Reserve's FedWire system in the United States are more likely to be Real time gross settlement (RTGS) systems. RTGS systems provide the quickest availability of funds because they provide immediate "real-time" and final "irrevocable" settlement by posting the gross (complete) entry against electronic accounts of the wire transfer system operator. Other systems such as CHIPS provide net settlement on a periodic basis. More immediate settlement systems tend to process higher monetary value time-critical transactions, have higher transaction costs, and a smaller volume of payments. Currency transaction risk (because of market fluctuations) may be reduced (in part) by immediacy of settlement.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

12:48

12:48Wire transfer

Wire transferWire transfer

Wire transfer or credit transfer is a method of electronic funds transfer from one person or institution (entity) to another. A wire transfer can be made from one bank account to another bank account or through a transfer of cash at a cash office. Different wire transfer systems and operators provide a variety of options relative to the immediacy and finality of settlement and the cost, value, and volume of transactions. Central bank wire transfer systems, such as the Federal Reserve's FedWire system in the United States are more likely to be real time gross settlement (RTGS) systems. RTGS systems provide the quickest availability of funds because they provide immediate "real-time" and final "irrevocable" settlement by posting the gross (complete) entry against electronic accounts of the wire transfer system operator. Other systems such as CHIPS provide net settlement on a periodic basis. More immediate settlement systems tend to process higher monetary value time-critical transactions, have higher transaction costs, and a smaller volume of payments. A faster settlement process allows less time for currency fluctuations while money is in transit. This video is targeted to blind users. Attribution: Article text available under CC-BY-SA Creative Commons image source in video -

1:19

1:19Money Management : How to Do an International Wire Transfer

Money Management : How to Do an International Wire TransferMoney Management : How to Do an International Wire Transfer

Do an international wire transfer by contacting a bank, providing them with the routing number and ABA bank number of the receiving bank, and paying any transfer fees. Prepare to pay a fee if the wire transfer includes a currency exchange with information from a registered financial consultant in this free video on wire transfers. Expert: Patrick Munro Contact: www.northstarnavigator.com Bio: Patrick Munro is a registered financial consultant (RFC) with outstanding sales volume of progressive financial products and solutions to the senior and boomer marketplace. Filmmaker: Reel Media LLC -

0:38

0:38Online Banking | Make a Wire Transfer

Online Banking | Make a Wire TransferOnline Banking | Make a Wire Transfer

-

7:56

7:56Real Estate Closing and Wire Transfers

Real Estate Closing and Wire TransfersReal Estate Closing and Wire Transfers

A In Depth look at wire transfers and speed in which they are able to be credited in a closing. The process is discussed so you know more about the timing in your closings. Real estate closing wire transfer. Be sure to choose the HD SETTING! Presented by: Candice N. Carr, Esq. and Adam J. Ouellette, Esq. candice@broward-law.com www.spectrumtitlellc.com www.realpropertyu.com GENERAL: This video recording has been prepared as a general resource and the materials outlined in this video are provided for informational purposes only. The information on the webinar and recording does not constitute legal advice, and is not guaranteed to be correct, complete, or up-to-date. ATTORNEY-CLIENT RELATIONSHIP: This webinar is not intended to create an attorney-client relationship between you and the law firm and lawyers who make up Ouellette Carr, LLC, and you should not act or rely on any information in this site without first seeking the advice of an attorney. COMMUNICATION WITH OUR LAW FIRM THROUGH THIS WEBINAR DOES NOT CREATE AN ATTORNEY-CLIENT RELATIONSHIP, AND THE CONTENT OF ANY SUCH COMMUNICATION IS NOT PRIVILEGED UNLESS THE CLIENT AND LAWYER HAVE AGREED UPON LEGAL REPRESENTATION. wire transfer closing day wire transfer closing house wire transfer real estate closing wire transfer for home loan closing home closing wire transfer -

3:11

3:11ONLINE BANKING 3 - WIRE TRANSFER

ONLINE BANKING 3 - WIRE TRANSFER -

2:44

2:44BBB: Look out for email wire transfer scam

BBB: Look out for email wire transfer scamBBB: Look out for email wire transfer scam

A sophisticated email scam has reached Idaho. -

5:35

5:35How to send an international money transfer

How to send an international money transferHow to send an international money transfer

If you have friends or family members overseas, sending an international money transfer through online banking is easy, convenient and 100% secure. This video will guide you through the simple steps for sending money from the comfort of home. Learn more about international money transfers - http://www.rbcroyalbank.com/international-money-transfer/ -

42:07

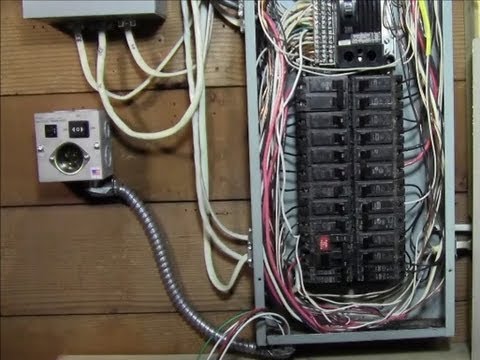

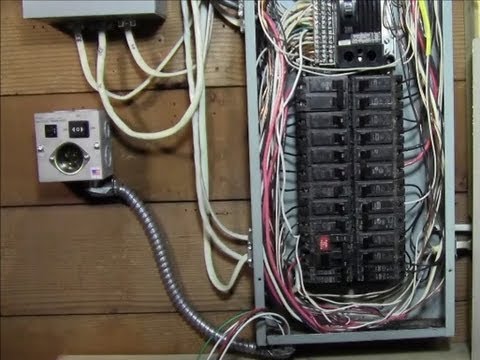

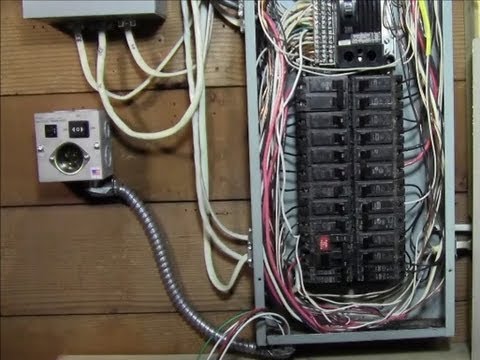

42:07RicksDIY How to Wire generator transfer switch to a circuit breaker panel DIY install Instructions

RicksDIY How to Wire generator transfer switch to a circuit breaker panel DIY install InstructionsRicksDIY How to Wire generator transfer switch to a circuit breaker panel DIY install Instructions

Wiring a 15 Amp single circuit generator transfer switch to a circuit breaker panel for a gas furnace, easy DIY instructions for a simple manual transfer switch. Heezy HTS15. Gas Furnace, boiler, well pump systems up to 1875 watts and 15 amps

- Bad Homburg

- Bank

- Bank fraud

- Belgium

- Brussels

- Chargeback

- Check21

- Cheque

- CMC Markets

- Correspondent bank

- Deutsche Bank

- Euro

- European Commission

- European Union

- Eurozone

- Federal Reserve

- Fedwire

- Frankfurt

- Germany

- IBAN

- Iceland

- ISO 9362

- La Hulpe

- Liechtenstein

- Money-laundering

- Natwest

- Net settlement

- Norway

- Scam

- Settlement (finance)

- SWIFT

- Terrorist group

- United Nations

- United States

- Western Union

- Wire transfer

-

Wire transfer

Wire transfer or credit transfer is a method of electronic funds transfer from one person or institution (entity) to another. A wire transfer can be made from one bank account to another bank account or through a transfer of cash at a cash office. Different wire transfer systems and operators provide a variety of options relative to the immediacy and finality of settlement and the cost, value, and volume of transactions. Central bank wire transfer systems, such as the Federal Reserve's FedWire system in the United States are more likely to be real time gross settlement (RTGS) systems. RTGS systems provide the quickest availability of funds because they provide immediate "real-time" and final "irrevocable" settlement by posting the gross (complete) entry against electronic accounts of the w... -

Money Management : How to Do an International Wire Transfer

Do an international wire transfer by contacting a bank, providing them with the routing number and ABA bank number of the receiving bank, and paying any transfer fees. Prepare to pay a fee if the wire transfer includes a currency exchange with information from a registered financial consultant in this free video on wire transfers. Expert: Patrick Munro Contact: www.northstarnavigator.com Bio: Patrick Munro is a registered financial consultant (RFC) with outstanding sales volume of progressive financial products and solutions to the senior and boomer marketplace. Filmmaker: Reel Media LLC -

Online Banking | Make a Wire Transfer

-

Real Estate Closing and Wire Transfers

A In Depth look at wire transfers and speed in which they are able to be credited in a closing. The process is discussed so you know more about the timing in your closings. Real estate closing wire transfer. Be sure to choose the HD SETTING! Presented by: Candice N. Carr, Esq. and Adam J. Ouellette, Esq. candice@broward-law.com www.spectrumtitlellc.com www.realpropertyu.com GENERAL: This video recording has been prepared as a general resource and the materials outlined in this video are provided for informational purposes only. The information on the webinar and recording does not constitute legal advice, and is not guaranteed to be correct, complete, or up-to-date. ATTORNEY-CLIENT RELATIONSHIP: This webinar is not intended to create an attorney-client relationship between you and the... -

-

BBB: Look out for email wire transfer scam

A sophisticated email scam has reached Idaho. -

How to send an international money transfer

If you have friends or family members overseas, sending an international money transfer through online banking is easy, convenient and 100% secure. This video will guide you through the simple steps for sending money from the comfort of home. Learn more about international money transfers - http://www.rbcroyalbank.com/international-money-transfer/ -

RicksDIY How to Wire generator transfer switch to a circuit breaker panel DIY install Instructions

Wiring a 15 Amp single circuit generator transfer switch to a circuit breaker panel for a gas furnace, easy DIY instructions for a simple manual transfer switch. Heezy HTS15. Gas Furnace, boiler, well pump systems up to 1875 watts and 15 amps

Wire transfer

- Order: Reorder

- Duration: 12:48

- Updated: 19 Jul 2014

- views: 3396

- published: 19 Jul 2014

- views: 3396

Money Management : How to Do an International Wire Transfer

- Order: Reorder

- Duration: 1:19

- Updated: 10 Feb 2009

- views: 8150

- published: 10 Feb 2009

- views: 8150

Online Banking | Make a Wire Transfer

- Order: Reorder

- Duration: 0:38

- Updated: 29 Dec 2015

- views: 2659

- published: 29 Dec 2015

- views: 2659

Real Estate Closing and Wire Transfers

- Order: Reorder

- Duration: 7:56

- Updated: 20 Dec 2013

- views: 4273

- published: 20 Dec 2013

- views: 4273

ONLINE BANKING 3 - WIRE TRANSFER

- Order: Reorder

- Duration: 3:11

- Updated: 18 Jul 2014

- views: 618

BBB: Look out for email wire transfer scam

- Order: Reorder

- Duration: 2:44

- Updated: 21 Sep 2015

- views: 169

How to send an international money transfer

- Order: Reorder

- Duration: 5:35

- Updated: 07 Aug 2014

- views: 38554

- published: 07 Aug 2014

- views: 38554

RicksDIY How to Wire generator transfer switch to a circuit breaker panel DIY install Instructions

- Order: Reorder

- Duration: 42:07

- Updated: 14 Mar 2013

- views: 226036

- Playlist

- Chat

- Playlist

- Chat

Wire transfer

- Report rights infringement

- published: 19 Jul 2014

- views: 3396

Money Management : How to Do an International Wire Transfer

- Report rights infringement

- published: 10 Feb 2009

- views: 8150

Online Banking | Make a Wire Transfer

- Report rights infringement

- published: 29 Dec 2015

- views: 2659

Real Estate Closing and Wire Transfers

- Report rights infringement

- published: 20 Dec 2013

- views: 4273

ONLINE BANKING 3 - WIRE TRANSFER

- Report rights infringement

- published: 18 Jul 2014

- views: 618

BBB: Look out for email wire transfer scam

- Report rights infringement

- published: 21 Sep 2015

- views: 169

How to send an international money transfer

- Report rights infringement

- published: 07 Aug 2014

- views: 38554

RicksDIY How to Wire generator transfer switch to a circuit breaker panel DIY install Instructions

- Report rights infringement

- published: 14 Mar 2013

- views: 226036

Is Donald Trump right about Hillary Clinton?

Edit CNN 23 Jun 2016[VIDEO]: Texas Woman Awakens From Surgery With British Accent

Edit WorldNews.com 23 Jun 2016

Britain and the EU: the story of a very rocky marriage

Edit The Guardian 23 Jun 2016Watch: This tiny Swiss electric car set world acceleration record

Edit DNA India 23 Jun 2016Amjad Sabri laid to rest in Karachi, thousands attend funeral

Edit Dawn 23 Jun 2016IRS Impersonation Scams on the Rise (City of Merriam, KS)

Edit Public Technologies 23 Jun 2016Former Group Insurance Commission Finance Director Indicted in Connection with Stealing More than $122,000 (Attorney General of Massachusetts)

Edit Public Technologies 22 Jun 2016‘Making a Murderer': 6 Steven Avery-Brendan Dassey Email Revelations (Photos)

Edit The Wrap 22 Jun 2016Notice on payment of dividend (Unipetrol as)

Edit Public Technologies 22 Jun 2016‘Making a Murderer': Steven Avery, Brendan Dassey Prison Emails Released After 5 Months

Edit The Wrap 22 Jun 2016Protect against today’s attacks with AsyncOS 10.0 for Cisco Email Security (Cisco Systems Inc)

Edit Public Technologies 21 Jun 2016Why Some Global Tech Startups Are Offshoring to Delaware

Edit Bloomberg 21 Jun 2016Unique: George Airbag Protects Against Cybercrime (Erste Group Bank AG)

Edit Public Technologies 20 Jun 2016Watch bankers attempt life without a bank account

Edit The Times Picayune 20 Jun 2016Businesses Lose $3.1 Billion to Email Scams, FBI Warns

Edit Slashdot 18 Jun 2016ADDITIONAL CHARGES FILED FOR FORMER CITY OF PLACENTIA FINANCE SERVICES MANAGER CHARGED WITH EMBEZZLING $5.2 MILLION (Orange County District Attorney)

Edit Public Technologies 17 Jun 2016- 1

- 2

- 3

- 4

- 5

- Next page »