- published: 11 Sep 2015

- views: 2800

-

remove the playlistCapital Flight

- remove the playlistCapital Flight

- published: 22 Jan 2016

- views: 1127

- published: 25 Jan 2016

- views: 88

- published: 11 Mar 2015

- views: 126

- published: 30 Mar 2011

- views: 1364

- published: 27 Sep 2013

- views: 401

- published: 25 Nov 2012

- views: 2658

- published: 17 Dec 2015

- views: 48

- published: 04 May 2013

- views: 14934

Capital flight, in economics, occurs when assets or money rapidly flow out of a country, due to an event of economic consequence. Such events could be an increase in taxes on capital or capital holders or the government of the country defaulting on its debt that disturbs investors and causes them to lower their valuation of the assets in that country, or otherwise to lose confidence in its economic strength.

This leads to a disappearance of wealth, and is usually accompanied by a sharp drop in the exchange rate of the affected country - depreciation in a variable exchange rate regime, or a forced devaluation in a fixed exchange rate regime.

This fall is particularly damaging when the capital belongs to the people of the affected country, because not only are the citizens now burdened by the loss of faith in the economy and devaluation of their currency, but probably also their assets have lost much of their nominal value. This leads to dramatic decreases in the purchasing power of the country's assets and makes it increasingly expensive to import goods.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

1:51

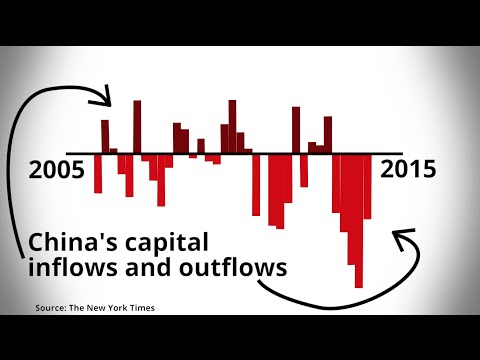

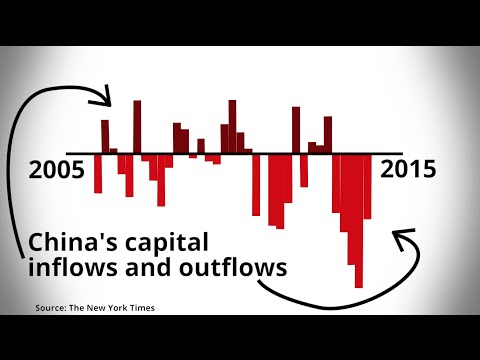

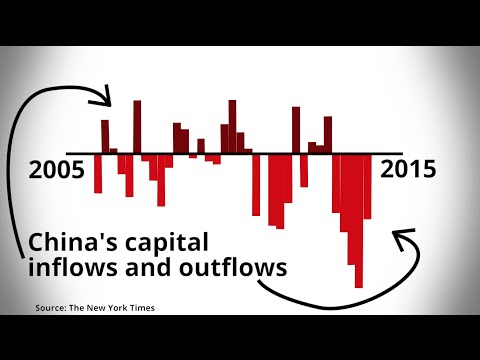

1:51China’s capital flight explained | FT World

China’s capital flight explained | FT WorldChina’s capital flight explained | FT World

► Subscribe to the Financial Times on YouTube: http://bit.ly/FTimeSubs James Kynge, FT emerging markets editor, explains in 90 seconds how record capital outflows from China and tightening controls by Beijing are affecting companies and individuals. For more video content from the Financial Times, visit http://www.FT.com/video Twitter https://twitter.com/ftvideo Facebook https://www.facebook.com/financialtimes -

4:14

4:14China's capital flight | FT Markets

China's capital flight | FT MarketsChina's capital flight | FT Markets

China's economy is grappling with massive capital outflows as jittery investors pull out of emerging markets. FT emerging markets editors James Kynge and Jonathan Wheatley explain how the country is coping with the exodus of overseas investors. ► Subscribe to the Financial Times on YouTube: http://bit.ly/FTimeSubs For more video content from the Financial Times, visit http://www.FT.com/video Twitter https://twitter.com/ftvideo Facebook https://www.facebook.com/financialtimes -

1:57

1:57Darlene's Lesson #14: Capital Flight

Darlene's Lesson #14: Capital FlightDarlene's Lesson #14: Capital Flight

A rapid flow of capital out of a nation is called Capital Flight. -

4:21

4:21Will Capital Flight Kill the Chinese Economic Miracle?

Will Capital Flight Kill the Chinese Economic Miracle?Will Capital Flight Kill the Chinese Economic Miracle?

http://profitableinvestingtips.com/stock-investing/will-capital-flight-kill-the-chinese-economic-miracle Will Capital Flight Kill the Chinese Economic Miracle? By www.ProfitableInvestingTips.com The business news is full of reports and speculation about capital flight out of China. Foreign investment was essential to China’s rapid growth over the last decades. Foreign investors are pulling money out and wealthy Chinese are moving their money offshore. Will capital flight kill the Chinese economic miracle? If so, how does that effect the rest of us? Bloomberg Business writes about the weak spot in China’s $3.3 trillion foreign reserve stockpile. By almost all measures, China’s $3.3 trillion foreign reserves, the world’s largest, look formidable. Except one. Compared with the amount of yuan sloshing around in the economy, a proxy for potential capital outflows, China’s firepower seems limited. The dollar reserves account for 15.5 percent of M2, a broad measure of money in circulation. That’s the lowest since 2004 and is less than levels in most Asian economies including Thailand, Singapore, Taiwan, Philippines and Malaysia, according to data compiled by Bloomberg. The low coverage on the money supply does highlight the risk that the buffer can run down quickly if capital outflows, which approached $1 trillion over the last year through November, accelerate. That is perhaps why China has tightened capital controls and stepped up its defense of the currency to damp expectations of further depreciation, which may lead to more money leaving the country. Rich Chinese who made fortunes as China’s economy grew, are not interested in seeing their wealth depreciate along with the Yuan. So, many are moving money offshore from China. This flight of capital drives down the value of the Yuan versus the US dollar making it more urgent for other wealthy Chinese to convert their wealth into dollars, yen, Euros or British pounds. $3.3 trillion foreign reserve stockpile is huge unless you consider that half a trillion was spent last year supporting the value of the Yuan and several hundreds of billion more were spent propping up their stock market. Capital flight is a symptom of China’s problems and a contributor to more trouble. But, why should we care? Capital Flight from Developing Nations Capital flight is not just limited to China. According to the South African Rand Daily Mail there is a trillion dollar exodus from emerging markets. More than a trillion dollars of investment flows has fled emerging markets over the past 18 months but the exodus may not even be halfway done, as once-booming economies appear trapped in a slow-bleeding cycle of weak growth and investment. While developing economies are no stranger to financial crises, with several currency and debt cataclysms infecting all emerging markets in waves over recent decades, leaders gathering for this year's World Economic Forum in Davos in the Swiss Alps are fearful that this episode is much harder to shake off. Seeded by fears of tighter U.S. credit and a rising U.S. dollar, and coming alongside a secular slowdown of China's economy and an implosion of the related commodity 'supercycle', there's growing anxiety that there will be no sharp rebound at the end of this downturn to reward investors who braved out the worst moments. Many emerging economies such as Brazil have suffered greatly as China’s economic miracle has slowed down. Brazil is in a recession as bad as the Great Depression. The issue for North America, Europe and Japan is that when business slows across the globe no one has any money to invest or import foreign products. As capital flight kills the economic miracle in China and elsewhere advanced economies suffer as well. https://youtu.be/Z--LKZDp66M -

3:23

3:23Capital Flight and the Depreciation of the RMB

Capital Flight and the Depreciation of the RMBCapital Flight and the Depreciation of the RMB

Should China's central bank be concerned about the capital outflow and will the depreciation of the RMB accelerate? -

10:12

10:12QE2 and Inflation 4 - US Capital Flight and Depreciation

QE2 and Inflation 4 - US Capital Flight and DepreciationQE2 and Inflation 4 - US Capital Flight and Depreciation

QE2 and Inflation - US Capital Flight and Depreciation http://www.thespellmanreport.com -

25:51

25:51Fragile States, Capital Flight and Tax Havens

Fragile States, Capital Flight and Tax HavensFragile States, Capital Flight and Tax Havens

Building on the findings of the Chatham House Report 'Yemen: Corruption, Capital Flight and Global Drivers of Conflict', the panel discussed the structural problems inherent within the global financial system and the impact this has on fragile states' development, drawing on Yemen as a case study. Event info: http://cht.hm/1aoXl6P -

3:04

3:04Everything you need to know about China's capital flight

Everything you need to know about China's capital flightEverything you need to know about China's capital flight

-

9:52

9:52Africa Lost 1.6 Trillion in Capital Flight and Odious Debt Over Forty Years

Africa Lost 1.6 Trillion in Capital Flight and Odious Debt Over Forty YearsAfrica Lost 1.6 Trillion in Capital Flight and Odious Debt Over Forty Years

Léonce Ndikumana: $619 billion of embezzled capital flight from North Africa with connivance of big banks according to new research -

7:58

7:58Human capital flight _ Brain Drain

Human capital flight _ Brain DrainHuman capital flight _ Brain Drain

all about Brain Drain -

4:55

4:55Russian Capital Flight

Russian Capital FlightRussian Capital Flight

http://www.forexconspiracyreport.com/russian-capital-flight/ Russian Capital Flight By www.ForexConspiracyReport.com The Russian ruble lost about half its value against the U.S. dollar starting at the beginning of 2014. The precipitous drop in the price of oil and sanctions placed on Russia by the EU and USA because their annexation of Crimea and support of a secessionist civil war in Eastern Ukraine have further damaged the currency. However, a French economist blames the weakness of the Ruble on income inequality and capital flight. Bloomberg Business reports the story. Count Russian reserves as another casualty of income inequality that Thomas Piketty believes is reshaping the world’s biggest economies. Russia, which is struggling to rebuild holdings depleted during last year’s currency crisis, has missed out on building a bigger stockpile in the past 15 years by failing to create a more transparent financial system to ease inequality and distribute the spoils of a boom in commodities prices, said Piketty, the author of the bestselling “Capital in the 21st Century.” Jailing “a couple of billionaires from time to time” is no way to address the challenge, the French economist said in an interview in Moscow on Thursday. “In the long term, Russia should have much more reserves, given the level of its trade surplus,” he said. “It’s important to realize that Russia is being stolen money from, by capital flight and by the fact that billionaires and millionaires outside Russia and sometimes inside Russia are able to benefit from natural resources of Russia much more than they should.” According to the Global Wealth Report by Credit Suisse, the top ten percent of Russians control eighty-seven percent of household wealth. This is far higher than any other major economic power. The oligarchs are siphoning off the wealth of Russia and using it to buy villas on the Riviera and condos in London while the Ruble suffers. Foreign Direct Investment The Profitable Investing Tips website wrote about foreign direct investment. Money goes where there is the prospect of profit and that requires stability and a sound currency, both of which are currently lacking as Russia faces currency flight. If you are looking for offshore investment ideas, take a look at where foreign direct investment goes year after year after year. There have been changes afoot regarding where foreign direct investment is going. A very useful reference in this regard is the just published United Nations study, World Investment Report 2013. We have used 2007 and 2012 as bookend comparison years as 2007 was just before the onset of the worst recession in three quarters of a century and 2012 is the most recent year reported. Of note is that direct foreign investment has fallen in the large majority of nations but there are exceptions that should help guide investors with their fundamental analysis of where to put their money in the years ahead. First take a look at the data and then read about foreign direct investment. Russia is one of the nations that lost foreign investors between 2007 and 2012. That only got worse when Putin annexed Crimea and sent Russian troops into neighboring Ukraine. But, the basis of Russian capital flight is the large amount of wealth being siphoned off by a small percentage of Russians who then spend and invest outside of Russia where they believe economies and politics are more secure. China Too Rich Chinese are already taking what money they can and buying property or setting up businesses offshore. Investors expect a thirty percent devaluation of the Yuan in the coming months. Add Chinese capital flight to Russian capital flight and it adds investing capital in the West and it damages both China and Russia. “The downside scenario for China seems more intimidating than ever before,” billionaire Dan Loeb wrote on Oct. 30 to investors at Third Point, which manages $18 billion. “The new question is not whether but how severe the slowdown of the world’s foremost growth machine will be.” Russia is taking steps to keep capital in the country. It may be too late for China. https://youtu.be/4F0L0NR6cUY -

2:32

2:32Capital Flight: Crisis & despair chase poor Greeks out of large cities

Capital Flight: Crisis & despair chase poor Greeks out of large citiesCapital Flight: Crisis & despair chase poor Greeks out of large cities

The EU is facing another year of recession and job losses. The unemployment rate across the eurozone is expected to rise over 12 per cent this year, peaking at 27 per cent in heavily-indebted Greece. And in their search for work many are forced from big cities into the countryside. RT's Tom Barton went to hear their stories. RT LIVE http://rt.com/on-air Subscribe to RT! http://www.youtube.com/subscription_center?add_user=RussiaToday Like us on Facebook http://www.facebook.com/RTnews Follow us on Twitter http://twitter.com/RT_com Follow us on Google+ http://plus.google.com/+RT RT (Russia Today) is a global news network broadcasting from Moscow and Washington studios. RT is the first news channel to break the 500 million YouTube views benchmark. -

4:07

4:07The Business on Emerging Market Capital Flight

The Business on Emerging Market Capital FlightThe Business on Emerging Market Capital Flight

Segment from ABC's The Business aired 22 August 2013. Original video here: http://www.abc.net.au/news/2013-08-22/asian-crisis-mark-two-or-has-the-talk-of-tapering/4906840 -

1:23

1:23Adluh Capital Flight

Adluh Capital Flight

- Argentina

- Asia

- Asset

- Bank of Spain

- Capital (economics)

- Capital flight

- Capital strike

- Country

- Default (finance)

- Depreciation

- Devaluation

- Economics

- Economy of Spain

- Exchange rate

- External debt

- Fixed exchange rate

- France

- Greece

- Guernsey

- Human capital flight

- Import

- Investor

- Isle of Man

- Jersey

- Johannesburg

- Latin America

- Money

- Purchasing power

- Real interest rate

- Reserve currency

- Russia

- South Africa

- Suburb

- Tax

- Tax exporting

- The Times

- The Washington Post

- United Kingdom

- United States

- Venezuela

- Wealth

- Wealth tax

-

China’s capital flight explained | FT World

► Subscribe to the Financial Times on YouTube: http://bit.ly/FTimeSubs James Kynge, FT emerging markets editor, explains in 90 seconds how record capital outflows from China and tightening controls by Beijing are affecting companies and individuals. For more video content from the Financial Times, visit http://www.FT.com/video Twitter https://twitter.com/ftvideo Facebook https://www.facebook.com/financialtimes -

China's capital flight | FT Markets

China's economy is grappling with massive capital outflows as jittery investors pull out of emerging markets. FT emerging markets editors James Kynge and Jonathan Wheatley explain how the country is coping with the exodus of overseas investors. ► Subscribe to the Financial Times on YouTube: http://bit.ly/FTimeSubs For more video content from the Financial Times, visit http://www.FT.com/video Twitter https://twitter.com/ftvideo Facebook https://www.facebook.com/financialtimes -

Darlene's Lesson #14: Capital Flight

A rapid flow of capital out of a nation is called Capital Flight. -

Will Capital Flight Kill the Chinese Economic Miracle?

http://profitableinvestingtips.com/stock-investing/will-capital-flight-kill-the-chinese-economic-miracle Will Capital Flight Kill the Chinese Economic Miracle? By www.ProfitableInvestingTips.com The business news is full of reports and speculation about capital flight out of China. Foreign investment was essential to China’s rapid growth over the last decades. Foreign investors are pulling money out and wealthy Chinese are moving their money offshore. Will capital flight kill the Chinese economic miracle? If so, how does that effect the rest of us? Bloomberg Business writes about the weak spot in China’s $3.3 trillion foreign reserve stockpile. By almost all measures, China’s $3.3 trillion foreign reserves, the world’s largest, look formidable. Except one. Compared with the amount of y... -

Capital Flight and the Depreciation of the RMB

Should China's central bank be concerned about the capital outflow and will the depreciation of the RMB accelerate? -

QE2 and Inflation 4 - US Capital Flight and Depreciation

QE2 and Inflation - US Capital Flight and Depreciation http://www.thespellmanreport.com -

Fragile States, Capital Flight and Tax Havens

Building on the findings of the Chatham House Report 'Yemen: Corruption, Capital Flight and Global Drivers of Conflict', the panel discussed the structural problems inherent within the global financial system and the impact this has on fragile states' development, drawing on Yemen as a case study. Event info: http://cht.hm/1aoXl6P -

Everything you need to know about China's capital flight

-

Africa Lost 1.6 Trillion in Capital Flight and Odious Debt Over Forty Years

Léonce Ndikumana: $619 billion of embezzled capital flight from North Africa with connivance of big banks according to new research -

Human capital flight _ Brain Drain

all about Brain Drain -

Russian Capital Flight

http://www.forexconspiracyreport.com/russian-capital-flight/ Russian Capital Flight By www.ForexConspiracyReport.com The Russian ruble lost about half its value against the U.S. dollar starting at the beginning of 2014. The precipitous drop in the price of oil and sanctions placed on Russia by the EU and USA because their annexation of Crimea and support of a secessionist civil war in Eastern Ukraine have further damaged the currency. However, a French economist blames the weakness of the Ruble on income inequality and capital flight. Bloomberg Business reports the story. Count Russian reserves as another casualty of income inequality that Thomas Piketty believes is reshaping the world’s biggest economies. Russia, which is struggling to rebuild holdings depleted during last year’s curre... -

Capital Flight: Crisis & despair chase poor Greeks out of large cities

The EU is facing another year of recession and job losses. The unemployment rate across the eurozone is expected to rise over 12 per cent this year, peaking at 27 per cent in heavily-indebted Greece. And in their search for work many are forced from big cities into the countryside. RT's Tom Barton went to hear their stories. RT LIVE http://rt.com/on-air Subscribe to RT! http://www.youtube.com/subscription_center?add_user=RussiaToday Like us on Facebook http://www.facebook.com/RTnews Follow us on Twitter http://twitter.com/RT_com Follow us on Google+ http://plus.google.com/+RT RT (Russia Today) is a global news network broadcasting from Moscow and Washington studios. RT is the first news channel to break the 500 million YouTube views benchmark. -

The Business on Emerging Market Capital Flight

Segment from ABC's The Business aired 22 August 2013. Original video here: http://www.abc.net.au/news/2013-08-22/asian-crisis-mark-two-or-has-the-talk-of-tapering/4906840 -

-

Russia: West behind $3.5 trillion capital flight from BRICS - Russian security official

Nikolai Patrushev, one of Russia's top security officials, said Western-influenced capital outflow from the BRICS amounted to $3.5 trillion (€3.2 trillion) as he spoke at a security meeting with BRICS representatives in Moscow, Tuesday. Video ID: 20150526-050 Video on Demand: http://www.ruptly.tv Contact: cd@ruptly.tv Twitter: http://twitter.com/Ruptly Facebook: http://www.facebook.com/Ruptly LiveLeak: http://www.liveleak.com/c/Ruptly Vine: https://vine.co/Ruptly Instagram: http://www.instagram.com/Ruptly YouTube: http://www.youtube.com/user/RuptlyTV DailyMotion: http://www.dailymotion.com/ruptly -

Human Capital Flight: Lanie

Michigan State University Journalism student Lanie Blackmer discusses jobs she wants and why Michigan doesn't fit the bill for jobs post-graduation. -

Matina Stevis on Human and Capital Flight into and out of Europe!

Follow us @ http://twitter.com/laurenlyster http://twitter.com/coveringdelta Welcome to Capital Account. I'm Lauren Lyster in Washington D.C. Just when you thought the eurozone crisis was getting a little boring, same old news - what do you know...riot police clashing with protesters in front of Greek Parliament in the first major general strike we've seen under the new Greek government. We've seen these protests before, so is it any different this time? And Catalonia, Spain's most economically important region wants out. Catalonia, in a growing drive to secede announces snap election tapped as a referendum on independence. This as Madrid barricades parliament against protesters. What impact will this apparently growing dissent have? Plus, we've talked about bank capital flight in eu... -

Victor Shih - The Dangers of Capital Fleeing China

A giant that shrinks when coming closer -- that's what Victor Shih sees when looking at China's three trillion dollars of foreign exchange reserves. Shih is Assistant Professor of Political Science at Northwestern University, and he tells us how China could run out of reserves pretty quickly in the event of a crisis. Shih has collected data on banks and wealthy households in China, and he warns that the wealthiest 1% of households hold enough deposits in the banking system that if they start moving money out of the country, $3T could start to seem like a much smaller number. Capital flight on the order of half a trillion -- that's no problem for China's banking system, Shih says, because China has the world's highest required reserve ratios, acting as cushion. But at around the $1T mark... -

Russian anxieties spark capital flight

Subscribe to our channel http://bit.ly/AJSubscribe Investors in Russia are pulling billions of dollars out of the country. In the last few months, an estimated $30bn has left the country. Russia is one of the few places in the world where foreign investors can buy into the country's massive oil, gas and natural-resources wealth. But the outflow of money is happening even despite oil prices remaining high. When the Soviet Union collapsed, the country went through a series of social, economic and political upheavals that today are largely under control. But Russians fear that a sudden shift of power could upset the balance. Investors are concerned about who will lead the country next year. The race is expected to be run between the country's two most powerful men. President D... -

Russia won't block capital flight despite weakening rouble - economy

Russia's central bank says it is not going to block people moving their money out of the country. This comes as bank governor Elvira Nabiullina - a protege of President Putin's - tries to find policies to cope with the rouble's rapid decline, while facing major economic problems from sanctions. Flight of capital has accelerated since the Crimea crisis. The equivalent of $35 billion left the country in January and February alone Economy Minister Alexey Ulyukaev said. That compares with an e... READ MORE : http://www.euronews.com/2014/03/18/russia-won-t-block-capital-flight-despite-weakening-rouble What is in the news today? Click to watch: http://eurone.ws/1kb2gOl euronews: the most watched news channel in Europe Subscribe! http://eurone.ws/10ZCK4a euronews is available in 14 langu... -

IMF warns Europe on capital flight

http://www.euronews.com/ The International Monetary Fund has warned that the flight of capital from struggling eurozone countries could shrink bank assets by trillions of euros. It is yet another stark warning from the IMF, which is preparing for its twice annual meeting in Tokyo. A report from the Fund urged European decision makers to strengthen financial ties within the euro area urgently to restore confidence in the global financial system. The report predicts that European banks are likely to lose 2.2 trillion euros over two years but the worst case scenario puts the outflow at 3.5 trillion and that would have a similarly bleak impact on jobs and investment. The director of the IMF's monetary and capital markets department José Viñals said: "Vigilance is necessary and measures are... -

Capital Flight: Berliners evicted as regional migrants occupy prime spots

The remains of the German capital's notorious landmark, the Berlin Wall, could soon make way for a 14-story luxury apartment block. And it seems the trend for reshaping Berlin is only gaining momentum, with more new buildings emerging as fast as the real estate prices keep growing. RT's Peter Oliver reports on how this is affecting the lives of the city's life-long residents. RT LIVE http://rt.com/on-air Subscribe to RT! http://www.youtube.com/subscription_center?add_user=RussiaToday Like us on Facebook http://www.facebook.com/RTnews Follow us on Twitter http://twitter.com/RT_com Follow us on Google+ http://plus.google.com/+RT RT (Russia Today) is a global news network broadcasting from Moscow and Washington studios. RT is the first news channel to break the 500 million YouTube views... -

Capital Flight Festival Flow

Josh Young and Christine Moonbeam skill share some works in progress at DC's Capital Flight Festival September 13th, 2014

China’s capital flight explained | FT World

- Order: Reorder

- Duration: 1:51

- Updated: 11 Sep 2015

- views: 2800

- published: 11 Sep 2015

- views: 2800

China's capital flight | FT Markets

- Order: Reorder

- Duration: 4:14

- Updated: 22 Jan 2016

- views: 1127

- published: 22 Jan 2016

- views: 1127

Darlene's Lesson #14: Capital Flight

- Order: Reorder

- Duration: 1:57

- Updated: 04 Aug 2015

- views: 81

Will Capital Flight Kill the Chinese Economic Miracle?

- Order: Reorder

- Duration: 4:21

- Updated: 25 Jan 2016

- views: 88

- published: 25 Jan 2016

- views: 88

Capital Flight and the Depreciation of the RMB

- Order: Reorder

- Duration: 3:23

- Updated: 11 Mar 2015

- views: 126

- published: 11 Mar 2015

- views: 126

QE2 and Inflation 4 - US Capital Flight and Depreciation

- Order: Reorder

- Duration: 10:12

- Updated: 30 Mar 2011

- views: 1364

- published: 30 Mar 2011

- views: 1364

Fragile States, Capital Flight and Tax Havens

- Order: Reorder

- Duration: 25:51

- Updated: 27 Sep 2013

- views: 401

- published: 27 Sep 2013

- views: 401

Everything you need to know about China's capital flight

- Order: Reorder

- Duration: 3:04

- Updated: 10 Mar 2016

- views: 121

- published: 10 Mar 2016

- views: 121

Africa Lost 1.6 Trillion in Capital Flight and Odious Debt Over Forty Years

- Order: Reorder

- Duration: 9:52

- Updated: 25 Nov 2012

- views: 2658

- published: 25 Nov 2012

- views: 2658

Human capital flight _ Brain Drain

- Order: Reorder

- Duration: 7:58

- Updated: 10 Dec 2015

- views: 37

Russian Capital Flight

- Order: Reorder

- Duration: 4:55

- Updated: 17 Dec 2015

- views: 48

- published: 17 Dec 2015

- views: 48

Capital Flight: Crisis & despair chase poor Greeks out of large cities

- Order: Reorder

- Duration: 2:32

- Updated: 04 May 2013

- views: 14934

- published: 04 May 2013

- views: 14934

The Business on Emerging Market Capital Flight

- Order: Reorder

- Duration: 4:07

- Updated: 23 Aug 2013

- views: 597

- published: 23 Aug 2013

- views: 597

Adluh Capital Flight

- Order: Reorder

- Duration: 1:23

- Updated: 10 Sep 2015

- views: 64

Russia: West behind $3.5 trillion capital flight from BRICS - Russian security official

- Order: Reorder

- Duration: 1:29

- Updated: 26 May 2015

- views: 1357

- published: 26 May 2015

- views: 1357

Human Capital Flight: Lanie

- Order: Reorder

- Duration: 1:17

- Updated: 22 Apr 2010

- views: 108

- published: 22 Apr 2010

- views: 108

Matina Stevis on Human and Capital Flight into and out of Europe!

- Order: Reorder

- Duration: 28:03

- Updated: 26 Sep 2012

- views: 7173

- published: 26 Sep 2012

- views: 7173

Victor Shih - The Dangers of Capital Fleeing China

- Order: Reorder

- Duration: 6:21

- Updated: 21 Jul 2011

- views: 5962

- published: 21 Jul 2011

- views: 5962

Russian anxieties spark capital flight

- Order: Reorder

- Duration: 1:59

- Updated: 16 Jul 2011

- views: 3241

- published: 16 Jul 2011

- views: 3241

Russia won't block capital flight despite weakening rouble - economy

- Order: Reorder

- Duration: 0:46

- Updated: 18 Mar 2014

- views: 421

- published: 18 Mar 2014

- views: 421

IMF warns Europe on capital flight

- Order: Reorder

- Duration: 1:15

- Updated: 10 Oct 2012

- views: 797

- published: 10 Oct 2012

- views: 797

Capital Flight: Berliners evicted as regional migrants occupy prime spots

- Order: Reorder

- Duration: 3:12

- Updated: 05 Mar 2013

- views: 4517

- published: 05 Mar 2013

- views: 4517

Capital Flight Festival Flow

- Order: Reorder

- Duration: 5:03

- Updated: 01 Oct 2014

- views: 70

- published: 01 Oct 2014

- views: 70

- Playlist

- Chat

- Playlist

- Chat

China’s capital flight explained | FT World

- Report rights infringement

- published: 11 Sep 2015

- views: 2800

China's capital flight | FT Markets

- Report rights infringement

- published: 22 Jan 2016

- views: 1127

Darlene's Lesson #14: Capital Flight

- Report rights infringement

- published: 04 Aug 2015

- views: 81

Will Capital Flight Kill the Chinese Economic Miracle?

- Report rights infringement

- published: 25 Jan 2016

- views: 88

Capital Flight and the Depreciation of the RMB

- Report rights infringement

- published: 11 Mar 2015

- views: 126

QE2 and Inflation 4 - US Capital Flight and Depreciation

- Report rights infringement

- published: 30 Mar 2011

- views: 1364

Fragile States, Capital Flight and Tax Havens

- Report rights infringement

- published: 27 Sep 2013

- views: 401

Everything you need to know about China's capital flight

- Report rights infringement

- published: 10 Mar 2016

- views: 121

Africa Lost 1.6 Trillion in Capital Flight and Odious Debt Over Forty Years

- Report rights infringement

- published: 25 Nov 2012

- views: 2658

Human capital flight _ Brain Drain

- Report rights infringement

- published: 10 Dec 2015

- views: 37

Russian Capital Flight

- Report rights infringement

- published: 17 Dec 2015

- views: 48

Capital Flight: Crisis & despair chase poor Greeks out of large cities

- Report rights infringement

- published: 04 May 2013

- views: 14934

The Business on Emerging Market Capital Flight

- Report rights infringement

- published: 23 Aug 2013

- views: 597

Adluh Capital Flight

- Report rights infringement

- published: 10 Sep 2015

- views: 64

Joe Biden says US feels 'overwhelming frustration' with Israeli government

Edit The Guardian 19 Apr 2016'Elite Overproduction' That Doomed Roman Republic Seen As Threat To U.S. Democracy

Edit WorldNews.com 18 Apr 2016Flooding Cripples Houston Area

Edit WorldNews.com 18 Apr 2016Boko Haram still a threat months after 'technical victory'

Edit Tampa Bay Online 19 Apr 2016Bernie Sanders backs bill to let Americans sue Saudi Arabia over 9/11 terror attacks

Edit The Independent 19 Apr 2016Correlation between oil prices, stocks weakens

Edit Yahoo Daily News 19 Apr 2016Yuan bears rebuffed, at least for now, by forceful central bank

Edit Sydney Morning Herald 19 Apr 2016To Lorient for a place at the Stade de France (PSG - Paris Saint-Germain Football SA)

Edit Public Technologies 19 Apr 2016These Panama Papers: Avoiding Or Evading Taxes?

Edit Modern Ghana 19 Apr 2016We should strengthen alliances, not isolate ourselves by leaving the EU

Edit Belfast Telegraph 19 Apr 2016Euler Hermes: Global growth hits 2016 hard patch; 70% of world economy to remain subdued (Euler Hermes Group SA)

Edit Public Technologies 18 Apr 2016The Impossible Challenge of Simulating Africa in a Video Game

Edit Kotaku 18 Apr 2016Getting the Yuan Right Means Ignoring What Chinese Leaders Say

Edit Bloomberg 17 Apr 2016Stolen Monies Can Be Return, If Liberians Leadership Is Ready!!!

Edit Modern Ghana 17 Apr 2016Transcript of the International Monetary and Financial Committee (IMFC) Press Conference - Thirty-Third Meeting of the IMFC (IMF - International Monetary Fund)

Edit Public Technologies 16 Apr 2016Fitch Affirms Russia at 'BBB-'; Outlook Negative (Fitch Inc)

Edit Public Technologies 15 Apr 2016Billionaire Prokhorov's Onexim Being Checked by Tax Service

Edit Bloomberg 14 Apr 2016- 1

- 2

- 3

- 4

- 5

- Next page »