- published: 23 Jan 2013

- views: 4000

-

remove the playlistChief Financial Officer

- remove the playlistChief Financial Officer

- published: 02 Dec 2013

- views: 2726

- published: 02 Feb 2015

- views: 99

- published: 27 Mar 2015

- views: 6479

- published: 30 Oct 2013

- views: 5674

- published: 04 Feb 2013

- views: 1712

- published: 05 Sep 2012

- views: 1709

- published: 02 Apr 2012

- views: 2080

- published: 17 Apr 2013

- views: 1661

The chief financial officer (CFO) or Chief financial and operating officer (CFOO) is a corporate officer primarily responsible for managing the financial risks of the corporation. This officer is also responsible for financial planning and record-keeping, as well as financial reporting to higher management. In some sectors the CFO is also responsible for analysis of data. The title is equivalent to finance director, a common title in the United Kingdom. The CFO typically reports to the chief executive officer and to the board of directors, and may additionally sit on the board.

Most CFOs of large companies have finance qualifications such as an MBA or come from an accounting background. A finance department would usually contain some accountants with Certified Public Accountant or equivalent status. The Sarbanes–Oxley Act of 2002, enacted in the aftermath of several major U.S. accounting scandals, requires at least one member of a public company's audit committee to be a financial expert.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

2:15

2:15How to be a CFO - financial modelling

How to be a CFO - financial modellingHow to be a CFO - financial modelling

12 Hour MBA for Chief Financial Officers Comprehensive online training course for senior finance professionals in any industry Simple yet comprehensive explanation of finance fundamentals: - Understand the duties and responsibilities of a Chief Financial Officer - Learn how to add value to your company - Build models to analyse your organisation's performance - Evaluate the latest trends and oportunities Our expert trainer will walk you through the complexities of the financial management function. You'll explore all the critical issues, challenges and opportunities. In just 12 hours you will: - Understand a CFO's duties and liabilities and its future role - Learn how to influence board members and shareholders - Learn how to contrast price vs. cost and the implications for your company - Manage and drive your organisation's performance using business analytics For more information: http://www.terrapinntraining.com/training/12-Hour-MBA-for-Chief-Financial-Officers -

1:09

1:0960 seconds of inspiration: Chief Financial Officer

60 seconds of inspiration: Chief Financial Officer60 seconds of inspiration: Chief Financial Officer

Meet Hans Ola Meyer, Chief Financial Officer at Atlas Copco as he discussed value of integrated reporting. Produced in 2013 -

3:20

3:20Hot Job # 26 - Financial Manager/Chief Financial Officer

Hot Job # 26 - Financial Manager/Chief Financial OfficerHot Job # 26 - Financial Manager/Chief Financial Officer

Average Salary: $94,390 Education and Training: Doctoral or Professional Degree Major Industry: Finance More information at www.HoosierHot50.com -

4:33

4:33Inside Google’s New CFO’s $70M Pay Package

Inside Google’s New CFO’s $70M Pay PackageInside Google’s New CFO’s $70M Pay Package

March 27 -- Google agreed to pay new Chief Financial Officer Ruth Porat more than $70 million after she takes the post in May, putting her among the highest-paid CFOs in the industry. Bloomberg’s Cory Johnson reports on “Market Makers.” -- Subscribe to Bloomberg on YouTube: http://www.youtube.com/Bloomberg Bloomberg Television offers extensive coverage and analysis of international business news and stories of global importance. It is available in more than 310 million households worldwide and reaches the most affluent and influential viewers in terms of household income, asset value and education levels. With production hubs in London, New York and Hong Kong, the network provides 24-hour continuous coverage of the people, companies and ideas that move the markets. -

10:24

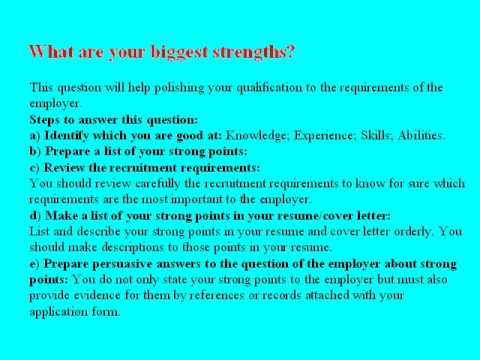

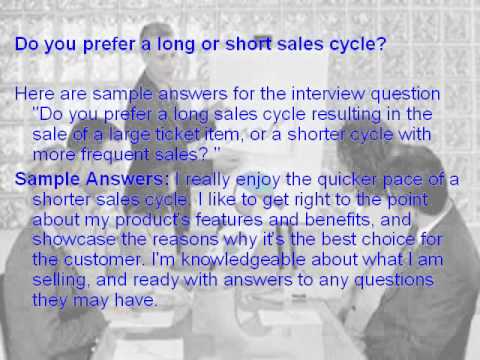

10:249 chief financial officer interview questions and answers

9 chief financial officer interview questions and answers9 chief financial officer interview questions and answers

Interview questions and answers ebook: http://interviewquestionsebooks.com/103-interview-questions-and-answers/, 100 finance interview questions Other useful interview materials: - Free ebook 75 common interview questions and answers: http://interviewquestionsaz.blogspot.com/p/free-ebook-75-interview-questions-and.html - Top 10 interview secrets to win every job interview: http://interviewquestionsaz.blogspot.com/2013/07/top-10-secrets-to-win-every-job.html - 13 types of interview questions and how to face them: http://interviewquestionsaz.blogspot.com/p/13-types-of-interview-questions.html - Top 12 common mistakes in job interviews: http://interviewquestionsaz.blogspot.com/2013/07/top-12-common-mistakes-in-job-interviews.html - Top 3 interview thank you letter samples: http://interviewquestionsaz.blogspot.com/2013/07/top-3-interview-thank-you-letter-samples.html - Practice types of job interview such as screening interview, phone interview, second interview, situational interview, behavioral interview (competency based), technical interview, group interview... -

7:35

7:35Chief financial officer interview questions

Chief financial officer interview questionsChief financial officer interview questions

Source: http://interviewquestionsebooks.com/103-interview-questions-and-answers/ and 100 finance interview questions and answers The above interview questions and answers/tips are used for all positions related and job interview process (includes phone interview, second interview, behavioral interview...). -

4:20

4:20The Role of the Chief Financial Officer

The Role of the Chief Financial OfficerThe Role of the Chief Financial Officer

-

5:37

5:37Chief Financial Officer - A complex role - Deloitte Luxembourg

Chief Financial Officer - A complex role - Deloitte LuxembourgChief Financial Officer - A complex role - Deloitte Luxembourg

Georges Kioes, partner at Deloitte Luxembourg and leader of the CFO services, discusses and highlights the key results of the Deloitte Luxembourg CFO survey, the role of a CFO in an organisation, as well as it's growing complexity. -

2:32

2:32Interview With Chief Financial Officer Stephane Bello

Interview With Chief Financial Officer Stephane BelloInterview With Chief Financial Officer Stephane Bello

http://ar.thomsonreuters.com - In this interview from the 2011 Thomson Reuters Annual Report, Chief Financial Officer Stephane Bello discusses building value for our shareholders, customers and employees. -

1:24

1:24Jean Marc Huët - Chief Financial Officer

Jean Marc Huët - Chief Financial OfficerJean Marc Huët - Chief Financial Officer

-

3:51

3:51Challenges of a CFO: John Rogers, Chief Financial Officer, Sainsbury's

Challenges of a CFO: John Rogers, Chief Financial Officer, Sainsbury'sChallenges of a CFO: John Rogers, Chief Financial Officer, Sainsbury's

Challenges of a CFO: John Rogers, Chief Financial Officer, Sainsbury's, discusses how the retailer plans to grow in the current challenging economic environment, and what skills financial professionals of today must have. -

15:12

15:12TUSD1 - TUSD Chief Financial Officer Karla Soto Budget Presentation

TUSD1 - TUSD Chief Financial Officer Karla Soto Budget Presentation -

5:53

5:53Kevin Jacobs '94, Executive Vice President & Chief Financial Officer, Hilton Worldwide

Kevin Jacobs '94, Executive Vice President & Chief Financial Officer, Hilton WorldwideKevin Jacobs '94, Executive Vice President & Chief Financial Officer, Hilton Worldwide

Kevin Jacobs '94 gave the Dean's Distinguished Lecture at the Cornell School of Hotel Administration on September 26, 2014. In this DDLS conversation, Mr. Jacobs talks about mobile technology innovations currently happening in hospitality industry, corporate responsibility, and fundamental tenets of leadership. -

1:50

1:50Andy Long, Chief Financial Officer and Executive Director, Pentland Brands

Andy Long, Chief Financial Officer and Executive Director, Pentland BrandsAndy Long, Chief Financial Officer and Executive Director, Pentland Brands

Andy Long is Chief Financial Officer and Executive Director of Pentland Brands, a brand licensing company which works with lifestyle brands such as Speedo. Andy completed his Chartered Institute of Management Accountants (CIMA) qualification with BPP in 1995.

- Accounting scandals

- Analysis

- Audit committee

- Board of directors

- CFO (disambiguation)

- Chairman

- Chief brand officer

- Chief data officer

- Chief legal officer

- Chief risk officer

- Chief stores officer

- Chief web officer

- Comptroller

- Controller

- Corporate governance

- Corporate title

- Corporation

- Creative director

- Executive director

- Executive pay

- Finance

- Financial planning

- France

- General counsel

- Germany

- Head of Finance

- Italy

- Managing director

- Public company

- Risk

- Sarbanes–Oxley Act

- Senior management

- Supervisory board

- Talent management

- Treasurer

- United Kingdom

'Chief Financial Officer' is featured as a movie character in the following productions:

Online Now (2012)

Actors: Brooks Hunter (actor), Jake Dolgy (editor), Jake Dolgy (writer), Jake Dolgy (actor), Jake Ross (editor), Jake Dolgy (director), Jake Ross (writer), Jake Ross (actor), Jake Ross (director), Dalila Jovanovic (producer), Martin Lindquist (actor), Dalila Jovanovic (actress), Michael Pillarella (actor), Will Ennis (actor), Marissa Spada (actress),

Genres: Drama, Short,Taglines: Inspired by True Events

Behind the Startup: Icevan.com (2002)

Actors: Sharon Zezima (writer), Sharon Zezima (producer), Sharon Zezima (director), Sharon Zezima (actress), Kal Deutsch (writer), Kal Deutsch (producer), Kal Deutsch (director), Jay Komas (actor), Jeff Koppelmaa (actor), Elliott Kopstein (actor), Nick Colburn (actor), Julie Kanberg (actress), Ila Kriplani (actress), Barb Stuckey (actress), Sandy Feinland (actress),

Plot: Styled after VH1's "Behind the Music," this mockumentary profiles the rise and fall of an Internet startup, called IceVan.com. The company offered "ice in an hour" delivery and ice-related accessories, like tongs, buckets and gourmet ice.

Keywords: business, character-name-in-title, internet, internet-domain-in-title, mock-documentaryGenres: Comedy, Documentary, Short,

-

How to be a CFO - financial modelling

12 Hour MBA for Chief Financial Officers Comprehensive online training course for senior finance professionals in any industry Simple yet comprehensive explanation of finance fundamentals: - Understand the duties and responsibilities of a Chief Financial Officer - Learn how to add value to your company - Build models to analyse your organisation's performance - Evaluate the latest trends and oportunities Our expert trainer will walk you through the complexities of the financial management function. You'll explore all the critical issues, challenges and opportunities. In just 12 hours you will: - Understand a CFO's duties and liabilities and its future role - Learn how to influence board members and shareholders - Learn how to contrast price vs. cost and the implications for your compa... -

60 seconds of inspiration: Chief Financial Officer

Meet Hans Ola Meyer, Chief Financial Officer at Atlas Copco as he discussed value of integrated reporting. Produced in 2013 -

Hot Job # 26 - Financial Manager/Chief Financial Officer

Average Salary: $94,390 Education and Training: Doctoral or Professional Degree Major Industry: Finance More information at www.HoosierHot50.com -

Inside Google’s New CFO’s $70M Pay Package

March 27 -- Google agreed to pay new Chief Financial Officer Ruth Porat more than $70 million after she takes the post in May, putting her among the highest-paid CFOs in the industry. Bloomberg’s Cory Johnson reports on “Market Makers.” -- Subscribe to Bloomberg on YouTube: http://www.youtube.com/Bloomberg Bloomberg Television offers extensive coverage and analysis of international business news and stories of global importance. It is available in more than 310 million households worldwide and reaches the most affluent and influential viewers in terms of household income, asset value and education levels. With production hubs in London, New York and Hong Kong, the network provides 24-hour continuous coverage of the people, companies and ideas that move the markets. -

9 chief financial officer interview questions and answers

Interview questions and answers ebook: http://interviewquestionsebooks.com/103-interview-questions-and-answers/, 100 finance interview questions Other useful interview materials: - Free ebook 75 common interview questions and answers: http://interviewquestionsaz.blogspot.com/p/free-ebook-75-interview-questions-and.html - Top 10 interview secrets to win every job interview: http://interviewquestionsaz.blogspot.com/2013/07/top-10-secrets-to-win-every-job.html - 13 types of interview questions and how to face them: http://interviewquestionsaz.blogspot.com/p/13-types-of-interview-questions.html - Top 12 common mistakes in job interviews: http://interviewquestionsaz.blogspot.com/2013/07/top-12-common-mistakes-in-job-interviews.html - Top 3 interview thank you letter samples: http://interv... -

Chief financial officer interview questions

Source: http://interviewquestionsebooks.com/103-interview-questions-and-answers/ and 100 finance interview questions and answers The above interview questions and answers/tips are used for all positions related and job interview process (includes phone interview, second interview, behavioral interview...). -

The Role of the Chief Financial Officer

-

Chief Financial Officer - A complex role - Deloitte Luxembourg

Georges Kioes, partner at Deloitte Luxembourg and leader of the CFO services, discusses and highlights the key results of the Deloitte Luxembourg CFO survey, the role of a CFO in an organisation, as well as it's growing complexity. -

Interview With Chief Financial Officer Stephane Bello

http://ar.thomsonreuters.com - In this interview from the 2011 Thomson Reuters Annual Report, Chief Financial Officer Stephane Bello discusses building value for our shareholders, customers and employees. -

Jean Marc Huët - Chief Financial Officer

-

Challenges of a CFO: John Rogers, Chief Financial Officer, Sainsbury's

Challenges of a CFO: John Rogers, Chief Financial Officer, Sainsbury's, discusses how the retailer plans to grow in the current challenging economic environment, and what skills financial professionals of today must have. -

-

Kevin Jacobs '94, Executive Vice President & Chief Financial Officer, Hilton Worldwide

Kevin Jacobs '94 gave the Dean's Distinguished Lecture at the Cornell School of Hotel Administration on September 26, 2014. In this DDLS conversation, Mr. Jacobs talks about mobile technology innovations currently happening in hospitality industry, corporate responsibility, and fundamental tenets of leadership. -

Andy Long, Chief Financial Officer and Executive Director, Pentland Brands

Andy Long is Chief Financial Officer and Executive Director of Pentland Brands, a brand licensing company which works with lifestyle brands such as Speedo. Andy completed his Chartered Institute of Management Accountants (CIMA) qualification with BPP in 1995. -

ACCA member Shalini Popat, chief financial officer

http://www.accaglobal.com - ACCA member Shalini Popat talks about her role as a financial controller at Southern Cross Safaris Ltd, Kenya. What does Shalini's work involve? What is the best part of this role? Discover more about working in this area of accountancy. -

-

Nikhil Madgavkar, Chief Financial Officer, Mother Diary Fruit & Vegetable

Nikhil Madgavkar, Chief Financial Officer, Mother Diary Fruit & Vegetable in conversation with Payal Bhattar, PING Network talks about the biggest challenges or risk for Indian comapnies in the VUCA environment. He also say's" The challenge for Indian companies is the profitable growth." -

Former Uchumi CEO and his chief finance officer may have manipulated financial figures

Sacked Uchumi Chief Executive Officer, Jonathan Ciano and his chief finance officer Chadwick Okumu may have falsified and manipulated figures to reflect a relatively sound financial statement according to a classified report authored by audit firm KPMG. The report reveals a far deeper crisis at the flagship supermarket brand that what was given to the Nairobi Securities Exchange. The two top officers were sacked following claims of impropriety. Ken Mijungu report. For more news visit http://www.ntv.co.ke Follow us on Twitter http://www.twitter.com/ntvkenya Like our FaceBook page http://www.facebook.com/NtvKenya Like us on Instagram http://www.instagram.com/ntvkenyaofficial -

Learn Business English 187 (Chief financial officer, COO, CIO, CTO)

Today's words: Chief financial officer, COO, CIO, CTO. I teach ESL EFL English as a second language, mostly business English these days, but I do all lessons. Read, write, talk speak practice right here with the free teacher Phil! -

Chief Financial Officer Mobile Vikings getuigt

-

Chief Financial Officer (Episode 94)

Viviana meets a chief financial officer of a Vancouver chocolate manufacturer. Touring the factory, she learns about the financial side of business management and his roles as a leader and executive team member of a growing company. Check out these websites to learn more about choosing a career and finding a job in British Columbia: http://www.careertrekbc.ca http://www.workbc.ca Follow us on Twitter: http://twitter.com/workbc.ca Like us on Facebook: http://facebook.com/workbc -

Bob Shanks, Chief Financial Officer for Ford - #PreMarket Prep for April 28, 2015

Listen to the daily broadcast live: http://premarket.benzinga.com/pre-market-show/ Bob Shanks was named Ford Motor's executive vice president and chief financial officer, effective April 1, 2012. Shanks has overall responsibility for the company's financial operations, including the controller's office, treasury and investor relations. In his previous role, Shanks served as Ford's vice president and controller. -

Part-Time CFO | Interim CFO | Virtual CFO | Chief Financial Officer | Financial Director

Part-Time CFO | Interim CFO | Virtual CFO | Chief Financial Officer | Financial Director http://cfo-pro.com/ Part-time CFO also known as Interim CFO, Virtual CFO and Fractional CFO provides businesses who don't require a full time CFO an excellent alternative. John Lafferty can be reached for a free consultation at 630-269-7646 or by email at jlafferty@cfo-pro.com This interview with John Y Lafferty of CFO-Pro explores some of the most beneficial services he offers his clients. John is one of the most experienced Interim CFOs in the country. Part-Time CFO | Interim CFO | Virtual CFO | Chief Financial Officer | Financial Director Kersten: Hi and welcome back to the show. Today we're going to be talking about CFOs and start up businesses in general and how do you get involved in starting u...

How to be a CFO - financial modelling

- Order: Reorder

- Duration: 2:15

- Updated: 23 Jan 2013

- views: 4000

- published: 23 Jan 2013

- views: 4000

60 seconds of inspiration: Chief Financial Officer

- Order: Reorder

- Duration: 1:09

- Updated: 02 Dec 2013

- views: 2726

- published: 02 Dec 2013

- views: 2726

Hot Job # 26 - Financial Manager/Chief Financial Officer

- Order: Reorder

- Duration: 3:20

- Updated: 02 Feb 2015

- views: 99

- published: 02 Feb 2015

- views: 99

Inside Google’s New CFO’s $70M Pay Package

- Order: Reorder

- Duration: 4:33

- Updated: 27 Mar 2015

- views: 6479

- published: 27 Mar 2015

- views: 6479

9 chief financial officer interview questions and answers

- Order: Reorder

- Duration: 10:24

- Updated: 30 Oct 2013

- views: 5674

- published: 30 Oct 2013

- views: 5674

Chief financial officer interview questions

- Order: Reorder

- Duration: 7:35

- Updated: 04 Feb 2013

- views: 1712

- published: 04 Feb 2013

- views: 1712

The Role of the Chief Financial Officer

- Order: Reorder

- Duration: 4:20

- Updated: 06 Mar 2012

- views: 787

- published: 06 Mar 2012

- views: 787

Chief Financial Officer - A complex role - Deloitte Luxembourg

- Order: Reorder

- Duration: 5:37

- Updated: 05 Sep 2012

- views: 1709

- published: 05 Sep 2012

- views: 1709

Interview With Chief Financial Officer Stephane Bello

- Order: Reorder

- Duration: 2:32

- Updated: 02 Apr 2012

- views: 2080

- published: 02 Apr 2012

- views: 2080

Jean Marc Huët - Chief Financial Officer

- Order: Reorder

- Duration: 1:24

- Updated: 11 Jan 2013

- views: 9897

- published: 11 Jan 2013

- views: 9897

Challenges of a CFO: John Rogers, Chief Financial Officer, Sainsbury's

- Order: Reorder

- Duration: 3:51

- Updated: 17 Apr 2013

- views: 1661

- published: 17 Apr 2013

- views: 1661

TUSD1 - TUSD Chief Financial Officer Karla Soto Budget Presentation

- Order: Reorder

- Duration: 15:12

- Updated: 12 Mar 2015

- views: 665

Kevin Jacobs '94, Executive Vice President & Chief Financial Officer, Hilton Worldwide

- Order: Reorder

- Duration: 5:53

- Updated: 29 May 2015

- views: 245

- published: 29 May 2015

- views: 245

Andy Long, Chief Financial Officer and Executive Director, Pentland Brands

- Order: Reorder

- Duration: 1:50

- Updated: 05 Jan 2012

- views: 1834

- published: 05 Jan 2012

- views: 1834

ACCA member Shalini Popat, chief financial officer

- Order: Reorder

- Duration: 3:32

- Updated: 18 Jun 2012

- views: 3148

- published: 18 Jun 2012

- views: 3148

Royal Dutch Shell plc - Strategy Update 2011 -- Simon Henry, Chief Financial Officer

- Order: Reorder

- Duration: 3:23

- Updated: 15 Mar 2011

- views: 2015

Nikhil Madgavkar, Chief Financial Officer, Mother Diary Fruit & Vegetable

- Order: Reorder

- Duration: 7:08

- Updated: 05 Dec 2014

- views: 11945

- published: 05 Dec 2014

- views: 11945

Former Uchumi CEO and his chief finance officer may have manipulated financial figures

- Order: Reorder

- Duration: 2:16

- Updated: 16 Mar 2016

- views: 57

- published: 16 Mar 2016

- views: 57

Learn Business English 187 (Chief financial officer, COO, CIO, CTO)

- Order: Reorder

- Duration: 2:35

- Updated: 09 Feb 2010

- views: 3152

- published: 09 Feb 2010

- views: 3152

Chief Financial Officer Mobile Vikings getuigt

- Order: Reorder

- Duration: 2:10

- Updated: 01 Apr 2015

- views: 2475

- published: 01 Apr 2015

- views: 2475

Chief Financial Officer (Episode 94)

- Order: Reorder

- Duration: 5:15

- Updated: 28 Apr 2016

- views: 8

- published: 28 Apr 2016

- views: 8

Bob Shanks, Chief Financial Officer for Ford - #PreMarket Prep for April 28, 2015

- Order: Reorder

- Duration: 7:06

- Updated: 28 Apr 2015

- views: 98

- published: 28 Apr 2015

- views: 98

Part-Time CFO | Interim CFO | Virtual CFO | Chief Financial Officer | Financial Director

- Order: Reorder

- Duration: 6:17

- Updated: 28 Feb 2014

- views: 619

- published: 28 Feb 2014

- views: 619

- Playlist

- Chat

- Playlist

- Chat

How to be a CFO - financial modelling

- Report rights infringement

- published: 23 Jan 2013

- views: 4000

60 seconds of inspiration: Chief Financial Officer

- Report rights infringement

- published: 02 Dec 2013

- views: 2726

Hot Job # 26 - Financial Manager/Chief Financial Officer

- Report rights infringement

- published: 02 Feb 2015

- views: 99

Inside Google’s New CFO’s $70M Pay Package

- Report rights infringement

- published: 27 Mar 2015

- views: 6479

9 chief financial officer interview questions and answers

- Report rights infringement

- published: 30 Oct 2013

- views: 5674

Chief financial officer interview questions

- Report rights infringement

- published: 04 Feb 2013

- views: 1712

The Role of the Chief Financial Officer

- Report rights infringement

- published: 06 Mar 2012

- views: 787

Chief Financial Officer - A complex role - Deloitte Luxembourg

- Report rights infringement

- published: 05 Sep 2012

- views: 1709

Interview With Chief Financial Officer Stephane Bello

- Report rights infringement

- published: 02 Apr 2012

- views: 2080

Jean Marc Huët - Chief Financial Officer

- Report rights infringement

- published: 11 Jan 2013

- views: 9897

Challenges of a CFO: John Rogers, Chief Financial Officer, Sainsbury's

- Report rights infringement

- published: 17 Apr 2013

- views: 1661

TUSD1 - TUSD Chief Financial Officer Karla Soto Budget Presentation

- Report rights infringement

- published: 12 Mar 2015

- views: 665

Kevin Jacobs '94, Executive Vice President & Chief Financial Officer, Hilton Worldwide

- Report rights infringement

- published: 29 May 2015

- views: 245

Andy Long, Chief Financial Officer and Executive Director, Pentland Brands

- Report rights infringement

- published: 05 Jan 2012

- views: 1834

In Malawi, people with albinism face ‘total extinction’– UN rights expert

Edit United Nations 29 Apr 2016Will easily defeat Hillary Clinton in November, says Donald Trump

Edit One India 30 Apr 2016Cache Of Roman Coins Found In Spain

Edit WorldNews.com 29 Apr 2016Beyonce Wows in Balmain at the ‘Formation World Tour’ in Miami

Edit Pinkvilla 29 Apr 2016Florida’s deputy insurance chief gets top job

Edit Tampa Bay Online 30 Apr 2016TransMontaigne Partners L.P. Schedules Conference Call and Webcast

Edit Stockhouse 30 Apr 2016TransMontaigne Partners L.P. Schedules Conference Call and Webcast (TransMontaigne Partners LP)

Edit Public Technologies 30 Apr 2016Orlando business owner accused in $300K payroll scheme

Edit Orlando Sentinel 30 Apr 2016Clarity on regulations for online marketplaces is better: Amazon

Edit Yahoo Daily News 30 Apr 2016David Altmaier’s quick rise to state insurance commissioner

Edit The Miami Herald 30 Apr 2016India invention wows Amazon, to invest more

Edit The Times of India 30 Apr 2016Advisory - FP Newspapers Inc. Announces First Quarter Results Conference Call

Edit Stockhouse 30 Apr 2016Trump Said to Lack Plan for Fundraising, Running Mate Vetting

Edit Bloomberg 30 Apr 2016MRV Reports First Quarter 2006 Financial Results (MRV Communications Inc)

Edit Public Technologies 30 Apr 2016Frequency Electronics Appoints New Chief Financial Officer (Frequency Electronics Inc)

Edit Public Technologies 29 Apr 2016Frequency Electronics Appoints New Chief Financial Officer

Edit Stockhouse 29 Apr 2016Excelsior Appoints New Chief Financial Officer

Edit Stockhouse 29 Apr 2016- 1

- 2

- 3

- 4

- 5

- Next page »