- published: 20 Dec 2013

- views: 226

-

remove the playlistName Authority File

-

remove the playlistLongest Videos

- remove the playlistName Authority File

- remove the playlistLongest Videos

- published: 17 Jun 2013

- views: 59467

- published: 07 Jul 2012

- views: 561

- published: 04 Dec 2015

- views: 20

- published: 29 Jun 2012

- views: 1888

- published: 01 Oct 2014

- views: 119

- published: 23 Sep 2015

- views: 56

- published: 24 Dec 2015

- views: 0

- published: 17 Nov 2014

- views: 9

- published: 16 Nov 2014

- views: 130055

- published: 18 Oct 2013

- views: 94480550

- published: 05 Sep 2015

- views: 85775

Authority control is the practice of creating and maintaining index terms for bibliographic material in a catalog in library and information science. Authority control fulfills two important functions. First, it enables catalogers to disambiguate items with similar or identical headings. For example, two authors who happen to have published under the same name can be distinguished from each other by adding middle initials, birth and/or death (or flourished, if these are unknown) dates, or a descriptive epithet to the heading of one (or both) authors. Second, authority control is used by catalogers to collocate materials that logically belong together, although they present themselves differently. For example, authority records are used to establish uniform titles, which can collocate all versions of a given work together even when they are issued under different titles.

Although theoretically any piece of information on a given book is amenable to authority control, catalogers typically focus on authors and titles. Subject headings fulfill a function similar to authority records, although they are usually considered separately.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

58:50

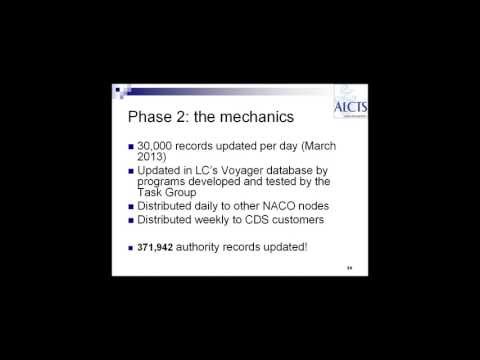

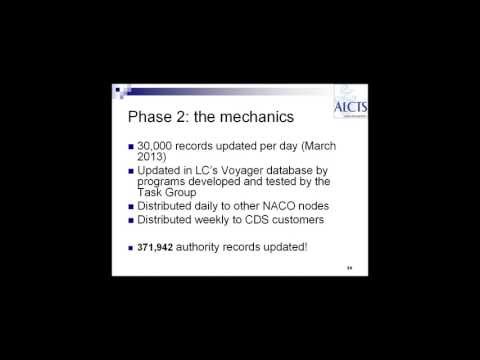

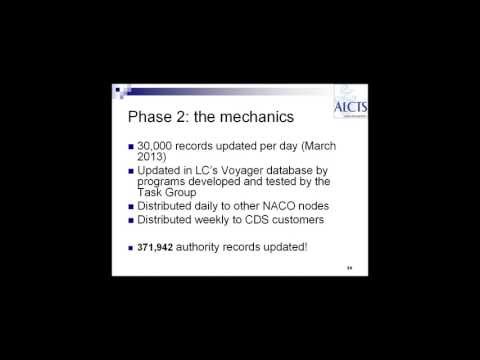

58:50Programmatic Changes to the LC/NACO Authority File for RDA

Programmatic Changes to the LC/NACO Authority File for RDAProgrammatic Changes to the LC/NACO Authority File for RDA

http://ala.org/alcts An ALCTS webinar. This hour-long webinar covers the changes to the LC/NACO authority file related to RDA. The phased approach to changes adopted by the PCC will be discused, such as records with the 667 update notice added during Phase 1, as well as records updated as part of Phase 2 of Changes to the LC/NACO Authority File. Changes to the LC/NACO authority file came from the work of two PCC task forces, most recently the PCC Acceptable Headings Implementation Task Group. Presented on May 8, 2013 by Dave Reser. -

11:33

11:33DNS Records

DNS RecordsDNS Records

Check out http://YouTube.com/ITFreeTraining or http://itfreetraining.com for more of our always free training videos. In order to find resources on the network, computers need a system to look up the location of resources. This video looks at the DNS records that contain information about resources and services on the network. The client can request these records from a DNS server in order to locate resources like web sites, Active Directory Domains and Mail Servers just to name a few. http://ITFreeTraining.com/handouts/dns/dnsrecords.pdf In this video This video will look at the following DNS records: Host (A and AAAA): Contains IP Addresses for IPv4 and IPv6 hosts Alias (CNAME): Works just like a shortcut for files except for DNS records. Mail Exchange (MX): Holds the address of mail servers for that domain. Service Record (SRV): Holds the address of services on the network. E.g. Active Directory DC's. Start of Authority (SOA): Contains information and configuration for a zone file. Name Server (NS): Contain the address of other DNS servers for that zone. Pointer (PTR): Reverse look up record allowing a hostname for an IP Address to be look up. Host (A and AAAA) The host record is used to store the address of a hostname. "A" is used for IPv4 and AAAA (Quad A) for IPv6. These can be created manually in DNS or if dynamic DNS is enabled and the client can register its hostname and thus its IP Address with the DNS server. Alias (CName) A canonical name or CName record provides an alias service in DNS. A CName effectively points to another A or Quad A record. When the client requests the hostname that is contained in the CName, they are given the IP Address that is contained in the A record or Quad A record. The advantage of a CName is that it can provide a simple name to the user rather than a more complex server name. For example, instead of having to remember FS27 for the local file server, a CName of FS could be used to point towards the server FS27. CName's can also be used to transparently redirect network traffic. For example, if you changed you mind and wanted to redirect the user to FS28 you would only need to change the CName record to point to FS28 rather than FS27. It should be remembered that the old record may exist in the client cache and may take some time to expire. Mail Exchange (MX) The mail exchange record contains a mail server that is able to process mail for that domain name. When a mail server wants to deliver mail, it will perform a DNS lookup asking the DNS server for an MX record for that DNS Domain name. The mail server will then attempt to deliver mail to that server. The mail server does not need to have the same DNS name as the mail that is being delivered, it simply needs to understand how to process mail for that DNS domain name. The MX record also has priority value that can be configured. If two or more MX Exchange records exist for the same DNS Doman name, the MX record with the lowest priority will be tried first. If this fails, the MX record with the next lowest value will be tried until the mail is delivered. Often large companies will have multiple mail severs for incoming mail. In some cases, these additional mail servers may be located on different sides of the globe in case there is a long network outage. Service Record (SRV) Service records allow clients on the network to find resources on the network. Active Directory creates a number of service records in DNS to allow clients to find resources like Domain Controllers. This is why Active Directory cannot operate without DNS. A single service record has a number of data fields associated with it. These include, service, target, port and priority. Service records are normally created automatically by applications assuming that your DNS server allows dynamic updates. Start of Authority (SOA) There is one start of authority record (SOA) for each zone. Even though the SOA is technically a DNS record, essentially modification of the SOA record is performed through the properties of the DNS zone. Looking at the data in the SOA record, you can configure options for the zone like the primary name server for that zone (DNS servers that hold the master records for the zone), the e-mail address of an administrator, serial number (Incremented each time a change is made in the DNS zone) and the refresh time for the zone (How often a secondary zone should query a master for changes). Video description to long for YouTube. For full description please see http://itfreetraining.com/70-642/dns-records See http://YouTube.com/ITFreeTraining or http://itfreetraining.com for our always free training videos. This is only one video from the many free courses available on YouTube. References "MCTS 70-640 Configuring Windows Server 2008 Active Directory Second edition" pg 458 -- 459 "Installing and Configuring Windows Server 2012 Exam Ref 70-410" pg 236-237 "SRV record" http://en.wikipedia.org/wiki/SRV_record -

5:02

5:02Video SEO Begins with Your File Name

Video SEO Begins with Your File NameVideo SEO Begins with Your File Name

Learn how to POWERFULLY communicate your HIGHEST value to the world & attract the most committed people READY to work with you! Watch my FREE video series NOW at www.http://authoritymarketingfilms.com/results Google search is all about quality of the results. Quality is measured by user experience. User experience is measured by relevance. Relevance is determined by Intention. No matter how we may try to get one over on search engines, by doing a bunch of tricks with our keywords, it all comes down to "why did you create this video and what is the value to people?" It is becoming less about what are you saying this video is about, it is what was the intention behind the video, what do other people say about this video, how does it resonate or repel them? For more information about Authority Marketing Films, visit us at www.AuthorityMarketingFilms.com to see all of our trainings and services. Thanks for watching! -

3:12

3:129. Cataloging with Default Data and Authority Files

9. Cataloging with Default Data and Authority Files9. Cataloging with Default Data and Authority Files

In PastPerfect 5.0, you are able to assign a current catalog record as a default record or create a new record strictly for default data. If you are using Security, each user will have their own default data record in the catalog, allowing each user to customize the default data screen for consistent data entry. -

5:37

5:37Linking Library Data to Wikipedia, Part I

Linking Library Data to Wikipedia, Part ILinking Library Data to Wikipedia, Part I

OCLC Research Wikipedian in Residence Max Klein and Senior Program Officer Merrilee Proffitt discuss a project aimed at enhancing name disambiguation in Wikipedia by establishing reciprocal links with Virtual International Authority File (VIAF) records. Comment on this project at http://en.wikipedia.org/wiki/Wikipedia:Authority_control_integration_proposal/RFC or http://tinyurl.com/6th7cmy. Follow Max on Twitter @notconfusing. -

17:42

17:42Authority control

Authority controlAuthority control

In library science, authority control is a process that organizes library catalog and bibliographic information by using a single, distinct name for each topic. The word authority in authority control derives from the idea that the names of people, places, things, and concepts are authorized, i.e., they are established in one particular form. These one-of-a-kind headings are applied consistently throughout the catalog, and work with other organizing data such as linkages and cross references. Each heading is described briefly in terms of its scope and usage, and this organization helps the library staff maintain the catalog and make it user-friendly for researchers. Cataloguers assign each subject—such as an author, book, series or corporation—a particular unique heading term which is then used consistently, uniquely, and unambiguously to describe all references to that same subject, even if there are variations such as different spellings, pen names, or aliases. The unique header can guide users to all relevant information including related or collocated subjects. Authority records can be combined into a database and called an authority file, and maintaining and updating these files as well as "logical linkages" to other files within them is the work of librarians and other information cataloguers. Accordingly, authority control is an example of controlled vocabulary and of bibliographic control. This video is targeted to blind users. Attribution: Article text available under CC-BY-SA Creative Commons image source in video -

29:35

29:35ELAG 2015 I Managing Work and Expression entities in WorldCat

ELAG 2015 I Managing Work and Expression entities in WorldCatELAG 2015 I Managing Work and Expression entities in WorldCat

Managing Work and Expression entities in WorldCat –the limits to existing authority files and how data mining can extend them Name of presenter: Thom Hickey WorldCat is a large, global file of nearly 400M bibliographic records created by library staff and another 1.3B records from other sources covering material such as journal articles. Since there can be many records describing the same thing (whether the thing is a work, expression (edition) or manifestation following the FRBR structure), it is important to know how the records relate to each other. As WorldCat has become more comprehensive, the VIAF team has found that we can mine selected content in WorldCat as an aid to control other content in WorldCat, in a process of successive refinement. For instance, to bring together records into ‘works,’ it is important to be able to identify the creators of the work. It is not always possible to identify creators for all the records associated with a work, but often it is possible to identify some of them. Once these creators are linked, it becomes easier to identify variations in the description of the work in records not yet linked to the work. This in turn makes it possible to bring in more information about how the work is described, which then allows the software to link records to a work for which we were previously unable to link the creators. Once these associations are made, we generate fairly standard work and expression authority records from them for inclusion in VIAF, to inform subsequent entification of WorldCat. Of course, the algorithms cannot do everything, so there is a need to manage the generated authority records. By concentrating on some of the more complicated works – especially those with translations — we have found that we can create and hand edit summary records about works. These summaries guide the generation of thousands of more standard authority records for VIAF that are fed into our FRBR processing. This is the first time we have felt that, with relatively low effort, we can clean up the FRBR relationships in large numbers of bibliographic records beyond the prior capability of our algorithms. An added benefit of this process is the identification of multilingual descriptions of works and translators of expressions which should help support a richer discovery environment. -

1:46

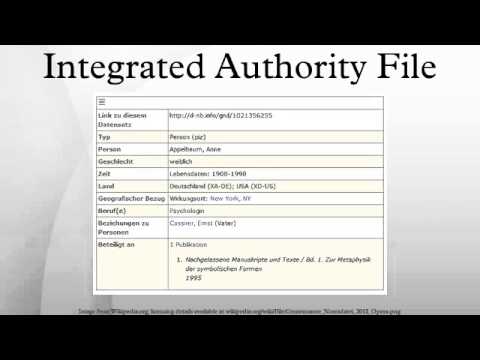

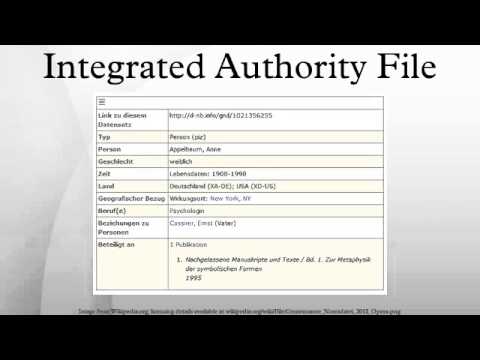

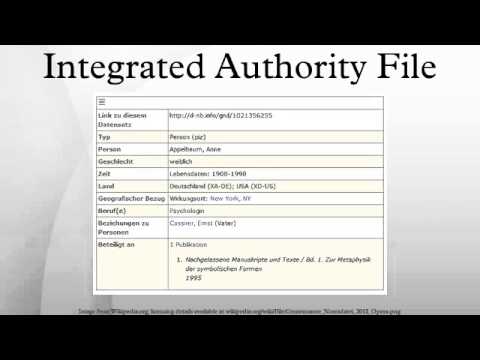

1:46Integrated Authority File

Integrated Authority FileIntegrated Authority File

Integrated Authority File ☆Video is targeted to blind users Attribution: Article text available under CC-BY-SA image source in video -

2:05

2:05Integrated Authority File

Integrated Authority FileIntegrated Authority File

The Integrated Authority File (German: Gemeinsame Normdatei, also known as: Universal Authority File) or GND is an international authority file for the organisation of personal names, subject headings and corporate bodies from catalogues. It is used mainly for documentation in libraries and increasingly also by archives and museums. The GND is managed by the German National Library in cooperation with various library networks in German-speaking Europe and other partners. The GND falls under the Creative Commons Zero (CC0) license. The GND specification provides a hierarchy of high-level entities and sub-classes, useful in library classification, and an approach to unambiguous identification of single elements. It also comprises an ontology intended for knowledge representation in the semantic web, available in the RDF format. This video is targeted to blind users. Attribution: Article text available under CC-BY-SA Creative Commons image source in video -

2:01

2:01WWE: The Authority Theme Song Pack

WWE: The Authority Theme Song PackWWE: The Authority Theme Song Pack

Just a little something. Download Links: (m4a/mp3, iTunes) "King of Kings" by Motörhead (0:00) https://www.sendspace.com/file/44avnj http://bit.ly/RVTF8v "Welcome to the Queendom" by Jim Johnston (0:31) https://www.sendspace.com/file/i33vr6 http://bit.ly/1rM9Vs1 "Veil of Fire" by Jim Johnston (1:00) https://www.sendspace.com/file/u7xffl http://bit.ly/1xKkXAc "The Second Coming" by CFO$ (1:31) https://www.sendspace.com/file/q5m939 http://bit.ly/1uDNN0u Download Wallpaper: (1920x1080, PNG) http://bit.ly/1uzIzGI All WWE programming, talent names, images, likenesses, slogans, wrestling moves, trademarks, logos and copyrights are the exclusive property of WWE, Inc. and its subsidiaries. All other trademarks, logos and copyrights are the property of their respective owners. © 2014 WWE, Inc. All Rights Reserved. -

3:41

3:41American Authors - Best Day Of My Life

American Authors - Best Day Of My LifeAmerican Authors - Best Day Of My Life

American Authors debut album "Oh, What A Life" on iTunes - http://smarturl.it/iOWAL Deluxe bundle -http://myplay.me/18ap Click To Subscribe - http://bit.ly/1jdvbRw Sign Up: http://smarturl.it/SUAmericanAuthors?IQid=youtube Tour dates: http://smarturl.it/AATourDates Official Website: http://weareamericanauthors.com/ Facebook: https://www.facebook.com/americanauthors Twitter: https://twitter.com/aauthorsmusic Instagram: http://instagram.com/americanauthors -

3:19

3:19Lenovo Phab Plus First Look!

Lenovo Phab Plus First Look!Lenovo Phab Plus First Look!

We look at Lenovo's newest phone-tablet hybrid, the Phab Plus. Talk about Android in our forums: http://www.androidauthority.com/community Subscribe to our YouTube channel: http://www.youtube.com/subscription_center?add_user=androidauthority ---------------------------------------------------- Stay connected to Android Authority: - http://www.androidauthority.com - http://google.com/+androidauthority - http://facebook.com/androidauthority/ - http://twitter.com/androidauth/ - http://instagram.com/androidauthority/ Follow the Team: Josh Vergara: https://plus.google.com/+JoshuaVergara Joe Hindy: https://plus.google.com/+JosephHindy Lanh Nguyen: https://plus.google.com/+LanhNguyenFilms Jayce Broda: https://plus.google.com/+JayceBroda Gary Sims: https://plus.google.com/+GarySims Ash Tailor: https://plus.google.com/+AshTailor -

1:06

1:06Cheshire police Authority virus removal

Cheshire police Authority virus removalCheshire police Authority virus removal

The newest virus that is making the round is the Cheshire Police Authority Virus or call it Cheshire metropolitan police PC scam. It's also known under a variety of different names including but not limited to Strathclyde Police Ukash virus, and various extensions bearing Reveton or lockscreen in their file name. For more details visit on :- http://guides.yoosecurity.com/computer-locked-by-cheshire-police-authority-virus/ -

28:49

28:49Autocompletion

AutocompletionAutocompletion

A walkthough of simple and more complex autocompletion in the EPrints Workflow [index by Alan Stiles] 00:00 introduction 00:25 what is autocompletion? 01:20 intro - add simple-file autocomplete to corporate creators field 01:38 create autocompletion file 03:02 add autocompletion to workflow 04:28 check which lookup scripts available via github 05:28 check eprints wiki for calling CGI script with parameter 06:30 add parameters code to workflow 07:28 demonstrate autocompletion working in workflow 08:37 autocompleting multiple fields with an authority file 09:45 describing the authority file 12:00 styling items in authority file 13:00 adding the field values to populate 15:12 single lining the field values 15:52 move values into lookup value line 16:40 check the autocomplete file layout 17:05 edit workflow to include new lookup 18:30 testing the new lookup 18:48 debugging why the lookup is not working 20:00 fixing the lookup file name 20:30 testing again 20:42 completion of other fields works, still some errors 21:15 debugging the publication field issue 21:35 fixing the publication field issue 22:01 final testing 22:30 describing autocompletion from other data sources 23:40 behind the scenes at autocomplete lookup script responses 25:15 reusing the autocomplete file for lookups on other fields 26:05 altering the autocomplete file to match for various fields 26:45 amending the workflow to add autocomplete to other field. 28:00 summary of wiki documentation

-

Programmatic Changes to the LC/NACO Authority File for RDA

http://ala.org/alcts An ALCTS webinar. This hour-long webinar covers the changes to the LC/NACO authority file related to RDA. The phased approach to changes adopted by the PCC will be discused, such as records with the 667 update notice added during Phase 1, as well as records updated as part of Phase 2 of Changes to the LC/NACO Authority File. Changes to the LC/NACO authority file came from the work of two PCC task forces, most recently the PCC Acceptable Headings Implementation Task Group. Presented on May 8, 2013 by Dave Reser. -

DNS Records

Check out http://YouTube.com/ITFreeTraining or http://itfreetraining.com for more of our always free training videos. In order to find resources on the network, computers need a system to look up the location of resources. This video looks at the DNS records that contain information about resources and services on the network. The client can request these records from a DNS server in order to locate resources like web sites, Active Directory Domains and Mail Servers just to name a few. http://ITFreeTraining.com/handouts/dns/dnsrecords.pdf In this video This video will look at the following DNS records: Host (A and AAAA): Contains IP Addresses for IPv4 and IPv6 hosts Alias (CNAME): Works just like a shortcut for files except for DNS records. Mail Exchange (MX): Holds the address of mail s... -

Video SEO Begins with Your File Name

Learn how to POWERFULLY communicate your HIGHEST value to the world & attract the most committed people READY to work with you! Watch my FREE video series NOW at www.http://authoritymarketingfilms.com/results Google search is all about quality of the results. Quality is measured by user experience. User experience is measured by relevance. Relevance is determined by Intention. No matter how we may try to get one over on search engines, by doing a bunch of tricks with our keywords, it all comes down to "why did you create this video and what is the value to people?" It is becoming less about what are you saying this video is about, it is what was the intention behind the video, what do other people say about this video, how does it resonate or repel them? For more information about ... -

9. Cataloging with Default Data and Authority Files

In PastPerfect 5.0, you are able to assign a current catalog record as a default record or create a new record strictly for default data. If you are using Security, each user will have their own default data record in the catalog, allowing each user to customize the default data screen for consistent data entry. -

Linking Library Data to Wikipedia, Part I

OCLC Research Wikipedian in Residence Max Klein and Senior Program Officer Merrilee Proffitt discuss a project aimed at enhancing name disambiguation in Wikipedia by establishing reciprocal links with Virtual International Authority File (VIAF) records. Comment on this project at http://en.wikipedia.org/wiki/Wikipedia:Authority_control_integration_proposal/RFC or http://tinyurl.com/6th7cmy. Follow Max on Twitter @notconfusing. -

Authority control

In library science, authority control is a process that organizes library catalog and bibliographic information by using a single, distinct name for each topic. The word authority in authority control derives from the idea that the names of people, places, things, and concepts are authorized, i.e., they are established in one particular form. These one-of-a-kind headings are applied consistently throughout the catalog, and work with other organizing data such as linkages and cross references. Each heading is described briefly in terms of its scope and usage, and this organization helps the library staff maintain the catalog and make it user-friendly for researchers. Cataloguers assign each subject—such as an author, book, series or corporation—a particular unique heading term which is then... -

ELAG 2015 I Managing Work and Expression entities in WorldCat

Managing Work and Expression entities in WorldCat –the limits to existing authority files and how data mining can extend them Name of presenter: Thom Hickey WorldCat is a large, global file of nearly 400M bibliographic records created by library staff and another 1.3B records from other sources covering material such as journal articles. Since there can be many records describing the same thing (whether the thing is a work, expression (edition) or manifestation following the FRBR structure), it is important to know how the records relate to each other. As WorldCat has become more comprehensive, the VIAF team has found that we can mine selected content in WorldCat as an aid to control other content in WorldCat, in a process of successive refinement. For instance, to bring together records... -

Integrated Authority File

Integrated Authority File ☆Video is targeted to blind users Attribution: Article text available under CC-BY-SA image source in video -

Integrated Authority File

The Integrated Authority File (German: Gemeinsame Normdatei, also known as: Universal Authority File) or GND is an international authority file for the organisation of personal names, subject headings and corporate bodies from catalogues. It is used mainly for documentation in libraries and increasingly also by archives and museums. The GND is managed by the German National Library in cooperation with various library networks in German-speaking Europe and other partners. The GND falls under the Creative Commons Zero (CC0) license. The GND specification provides a hierarchy of high-level entities and sub-classes, useful in library classification, and an approach to unambiguous identification of single elements. It also comprises an ontology intended for knowledge representation in the seman... -

WWE: The Authority Theme Song Pack

Just a little something. Download Links: (m4a/mp3, iTunes) "King of Kings" by Motörhead (0:00) https://www.sendspace.com/file/44avnj http://bit.ly/RVTF8v "Welcome to the Queendom" by Jim Johnston (0:31) https://www.sendspace.com/file/i33vr6 http://bit.ly/1rM9Vs1 "Veil of Fire" by Jim Johnston (1:00) https://www.sendspace.com/file/u7xffl http://bit.ly/1xKkXAc "The Second Coming" by CFO$ (1:31) https://www.sendspace.com/file/q5m939 http://bit.ly/1uDNN0u Download Wallpaper: (1920x1080, PNG) http://bit.ly/1uzIzGI All WWE programming, talent names, images, likenesses, slogans, wrestling moves, trademarks, logos and copyrights are the exclusive property of WWE, Inc. and its subsidiaries. All other trademarks, logos and copyrights are the property of their respective owners. © 2014 W... -

American Authors - Best Day Of My Life

American Authors debut album "Oh, What A Life" on iTunes - http://smarturl.it/iOWAL Deluxe bundle -http://myplay.me/18ap Click To Subscribe - http://bit.ly/1jdvbRw Sign Up: http://smarturl.it/SUAmericanAuthors?IQid=youtube Tour dates: http://smarturl.it/AATourDates Official Website: http://weareamericanauthors.com/ Facebook: https://www.facebook.com/americanauthors Twitter: https://twitter.com/aauthorsmusic Instagram: http://instagram.com/americanauthors -

Lenovo Phab Plus First Look!

We look at Lenovo's newest phone-tablet hybrid, the Phab Plus. Talk about Android in our forums: http://www.androidauthority.com/community Subscribe to our YouTube channel: http://www.youtube.com/subscription_center?add_user=androidauthority ---------------------------------------------------- Stay connected to Android Authority: - http://www.androidauthority.com - http://google.com/+androidauthority - http://facebook.com/androidauthority/ - http://twitter.com/androidauth/ - http://instagram.com/androidauthority/ Follow the Team: Josh Vergara: https://plus.google.com/+JoshuaVergara Joe Hindy: https://plus.google.com/+JosephHindy Lanh Nguyen: https://plus.google.com/+LanhNguyenFilms Jayce Broda: https://plus.google.com/+JayceBroda Gary Sims: https://plus.google.com/+GarySims Ash Tailor: ... -

Cheshire police Authority virus removal

The newest virus that is making the round is the Cheshire Police Authority Virus or call it Cheshire metropolitan police PC scam. It's also known under a variety of different names including but not limited to Strathclyde Police Ukash virus, and various extensions bearing Reveton or lockscreen in their file name. For more details visit on :- http://guides.yoosecurity.com/computer-locked-by-cheshire-police-authority-virus/ -

Autocompletion

A walkthough of simple and more complex autocompletion in the EPrints Workflow [index by Alan Stiles] 00:00 introduction 00:25 what is autocompletion? 01:20 intro - add simple-file autocomplete to corporate creators field 01:38 create autocompletion file 03:02 add autocompletion to workflow 04:28 check which lookup scripts available via github 05:28 check eprints wiki for calling CGI script with parameter 06:30 add parameters code to workflow 07:28 demonstrate autocompletion working in workflow 08:37 autocompleting multiple fields with an authority file 09:45 describing the authority file 12:00 styling items in authority file 13:00 adding the field values to populate 15:12 single lining the field values 15:52 move values into lookup value line 16:40 check the autocomplete file layout 17:0... -

Major Retailers Are Closing Down - The Truth Will Shock You

The following are 13 major retailers that are closing down stores… #1 Sears lost 580 million dollars in the fourth quarter of 2015 alone, and they are scheduled to close at least 50 more “unprofitable stores” by the end of this year. #2 It is being reported that Sports Authority will file for bankruptcy in March. Some news reports have indicated that around 200 stores may close, but at this point it is not known how many of their 450 stores will be able to stay open. #3 For decades, Kohl’s has been growing aggressively, but now it plans to shutter 18 stores in 2016. #4 Target has just finished closing 13 stores in the United States. #5 Best Buy closed 30 stores last year, and it says that more store closings are likely in the months to come. #6 Office Depot plans to close a total of... -

3 ways 2 cancel an electronic Letter of Authority

FOR SELF-EMPLOYED AND MIXED INCOME INDIVIDUALS Tax Form BIR Form 1901- Application for Registration for Self-Employed and Mixed Income Individuals, Estates/Trusts Documentary Requirements 1. For single proprietors, mixed income earners › Photocopy of Mayor’s Business Permit (or duly received Application for Mayor’s Business Permit, if the former is still in process with the LGU) and/or PTR issued by the LGU; and NSO Certified Birth Certificate of the applicant; 2. For Professionals where PTR is not required (e.i. Consultants, Agents, Artist, Underwriters & the like): a) Occupational Tax Receipt (OTR)/Professional Tax Receipt (PTR); b) NSO Birth Certificate; c) Marriage Contract, if the applicant is a married woman; d) Contract/Company Certification. b) DTI Certificate of Registr... -

-

How to Report a Copyright Complaint in YouTube - DMCA

How to Report a Copyright Complaint in YouTube DMCA -- Derral Eves explains what to do when someone uses your content and claims it as their own and how to submit and file that copyright complaint and infringement to YouTube. Share this Video: http://youtu.be/vOd_d8FhFyE Get More Great Tips - Subscribe ➜ http://goo.gl/dWNo9H My Favorite YouTube Tool TubeBuddy Download TubeBuddy Free Today! ➜ http://goo.gl/PrGfLe http://www.derraleves.com Derral Eves is an expert in social media marketing, mobile marketing, internet marketing, and video marketing. Report Stolen Videos with copyright Copyright Claims Get More Great Tips - Subscribe ➜ http://goo.gl/dWNo9H My Favorite YouTube Tool TubeBuddy Download TubeBuddy Free Today! ➜ http://goo.gl/PrGfLe SCHEDULE Tuesdays: Facebook Train... -

How to: Create a Privilege Elevation Rule with Privilege Authority

See how to create and target rules. Rules can be granularly targeted to username, computer name, user and computer groups, OU, OS, IP address range, registry key, file and more. Privilege Authority Professional is the lowest cost Windows privilege management solution that provides the core features IT administrators need to simply and quickly elevate and manage user rights. -

Registering a domain name with GoDaddy.com

This video will look at the process of registering a domain name with the domain registrar GoDaddy.com. The video not only looks at how to register a domain name, but it also looks at the DNS components on the internet that make the whole process work. Download the PDF handout http://ITFreeTraining.com/handouts/dns/godaddy.pdf Registering example.com Information about top level domains are kept on trusted DNS servers on the internet. Top level domains are domains like .com, .edu and .au. With the expanding internet, certain trusted domain name registering companies have the ability to make changes to the DNS server holding these top level domains. When a domain name is registered, the DNS registrar has the ability to make changes to these top level domain servers on your behalf. If you h... -

Abu Dhabi Investment Authority to invest US$7.5 billion in Citigroup

SHOTLIST AP Television FILE: New York - Date Unknown 1. Tilt down Citigroup building 2. Flags waving AP Television New York - 27 November, 2007 3. SOUNDBITE (English): Neil Weinberg, senior editor at Forbes: "This is a fund that has about one trillion dollars to invest. So, they're going to be investing it all over world. They're looking for a lot of places that can absorb a lot of money and it turns out that Citigroup because of the problems it is having in the mortgage market and the housing crisis here in the United States, needs a lot of money. So, this is obviously a deal which makes sense from both sides." AP Television FILE: New York - Date Unknown 4. Various of Citibank building AP Television New York - 27 November, 2007 5. SOUNDBITE (English): Neil Weinberg, se... -

Freedom of Information Act Files from the Black Vault - John Greenewald, Jr

Ancient of Days Conference, Roswell NM See also http://AncientofDays.net for DVDs Or http://ChristianSymposium.com for recent events John Greenewald, Jr. has been researching UFOs since the age of 15. He began simply with the question of whether any true evidence or documentation of UFOs exists, when he learned of the Freedom of Information Act. His persistent requests for previously classified documentation on UFO sightings and investigations through legal (but often hard to navigate) channels has resulted in his now famous website "The Black Vault." Sometimes referred to as "the motherlode" of official, government UFO related documents, The Black Vault contains over 100,000 government documents detailing their investigations into UFOs. From the image on the right, you will see, however... -

The Different Types of Authority Granted by the Probate Court in Estate Administrations/Probate

http://www.assetprotectioncenter.com - When you file a probate administration on behalf of a loved one that passed without any estate plan or with a Will alone it is challenging to understand the maze of probate court. One of the the things that occurs is the Court will have to approve of the individual (often times a family member) who will act as the "Administrator" or "Executor" of the deceased persons' estate. The Court will determine whether this person will be given Full or Limited Authority. This is a really important point as one gives the person a lot more power to do things and the other is more limited exactly as the name sounds. Attorney Shaffer briefly explains the differences between these two types of authority and how it is determined which one is given to the person steppi...

Programmatic Changes to the LC/NACO Authority File for RDA

- Order: Reorder

- Duration: 58:50

- Updated: 20 Dec 2013

- views: 226

- published: 20 Dec 2013

- views: 226

DNS Records

- Order: Reorder

- Duration: 11:33

- Updated: 17 Jun 2013

- views: 59467

- published: 17 Jun 2013

- views: 59467

Video SEO Begins with Your File Name

- Order: Reorder

- Duration: 5:02

- Updated: 07 Jul 2012

- views: 561

- published: 07 Jul 2012

- views: 561

9. Cataloging with Default Data and Authority Files

- Order: Reorder

- Duration: 3:12

- Updated: 04 Dec 2015

- views: 20

- published: 04 Dec 2015

- views: 20

Linking Library Data to Wikipedia, Part I

- Order: Reorder

- Duration: 5:37

- Updated: 29 Jun 2012

- views: 1888

- published: 29 Jun 2012

- views: 1888

Authority control

- Order: Reorder

- Duration: 17:42

- Updated: 01 Oct 2014

- views: 119

- published: 01 Oct 2014

- views: 119

ELAG 2015 I Managing Work and Expression entities in WorldCat

- Order: Reorder

- Duration: 29:35

- Updated: 23 Sep 2015

- views: 56

- published: 23 Sep 2015

- views: 56

Integrated Authority File

- Order: Reorder

- Duration: 1:46

- Updated: 24 Dec 2015

- views: 0

- published: 24 Dec 2015

- views: 0

Integrated Authority File

- Order: Reorder

- Duration: 2:05

- Updated: 17 Nov 2014

- views: 9

- published: 17 Nov 2014

- views: 9

WWE: The Authority Theme Song Pack

- Order: Reorder

- Duration: 2:01

- Updated: 16 Nov 2014

- views: 130055

- published: 16 Nov 2014

- views: 130055

American Authors - Best Day Of My Life

- Order: Reorder

- Duration: 3:41

- Updated: 18 Oct 2013

- views: 94480550

- published: 18 Oct 2013

- views: 94480550

Lenovo Phab Plus First Look!

- Order: Reorder

- Duration: 3:19

- Updated: 05 Sep 2015

- views: 85775

- published: 05 Sep 2015

- views: 85775

Cheshire police Authority virus removal

- Order: Reorder

- Duration: 1:06

- Updated: 07 Apr 2014

- views: 132

- published: 07 Apr 2014

- views: 132

Autocompletion

- Order: Reorder

- Duration: 28:49

- Updated: 23 Oct 2015

- views: 46

- published: 23 Oct 2015

- views: 46

Major Retailers Are Closing Down - The Truth Will Shock You

- Order: Reorder

- Duration: 24:48

- Updated: 29 Feb 2016

- views: 624

- published: 29 Feb 2016

- views: 624

3 ways 2 cancel an electronic Letter of Authority

- Order: Reorder

- Duration: 31:35

- Updated: 04 Feb 2016

- views: 45

- published: 04 Feb 2016

- views: 45

How To Take Ownership & Authority Of A File

- Order: Reorder

- Duration: 1:08

- Updated: 16 Jul 2008

- views: 1551

How to Report a Copyright Complaint in YouTube - DMCA

- Order: Reorder

- Duration: 6:00

- Updated: 20 Mar 2014

- views: 25231

- published: 20 Mar 2014

- views: 25231

How to: Create a Privilege Elevation Rule with Privilege Authority

- Order: Reorder

- Duration: 2:23

- Updated: 11 Aug 2011

- views: 291

- published: 11 Aug 2011

- views: 291

Registering a domain name with GoDaddy.com

- Order: Reorder

- Duration: 16:25

- Updated: 08 Apr 2014

- views: 24724

- published: 08 Apr 2014

- views: 24724

Abu Dhabi Investment Authority to invest US$7.5 billion in Citigroup

- Order: Reorder

- Duration: 2:08

- Updated: 21 Jul 2015

- views: 195

- published: 21 Jul 2015

- views: 195

Freedom of Information Act Files from the Black Vault - John Greenewald, Jr

- Order: Reorder

- Duration: 72:04

- Updated: 19 Jun 2013

- views: 3137

- published: 19 Jun 2013

- views: 3137

The Different Types of Authority Granted by the Probate Court in Estate Administrations/Probate

- Order: Reorder

- Duration: 6:16

- Updated: 15 May 2013

- views: 1768

- published: 15 May 2013

- views: 1768

-

Researchers' Identity Management in the 21st Century Networked World

Talk by Anchalee Panigabutra-Roberts, American University in Cairo, Egypt. Title: Researchers' Identity Management in the 21st Century Networked World: A Case Study of AUC Faculty Publications Abstract: This project will explore how American University in Cairo (AUC) faculty members distributed their scholarly and creative works, and how their names are identified in author identifier systems and/or on the Web. The goal is to explore how best to present their data as linked data. The project will use the AUC faculty’s names listed in AUC Faculty Publications: 2012 Calendar Year. Their names will be used to search in author identifier systems to answer; 1. If they are registered on these sites, 2. if their names are consistent, or with variants and how the variants are handled, 3. what met... -

Kenneth E Hagin The Believer's Authority 01 The Believer's Authority 103188

-

The KrisAnne Hall Show - KrisAnne Hall Stands Up for Sherrif Nick Finch

This week Liberty County Florida Sheriff, Nick Finch was arrested by Governor Rick Scott for standing in defense of the Constitution and honoring his oath of office. Sheriff Finch believes the Second Amendment means what it says, our Right to keep and bear arms SHALL NOT BE INFRINGED. What Sheriff Finch did was well within his authority and in full compliance with the rules and regulations for records retention and destruction. What Sheriff Finch did was stand in the gap where the government is trying to erode your Liberty. Sheriff Finch made the decision to not pursue a charge against Floyd Parish; well within the authority of the Sheriff to do. Upon making that decision, Sheriff Finch removed Parish’s file from the records and removed his name from the jail log. Well within his authorit... -

SEO Tutorial Full Course Part -2 Bangla

This videos all cadit goes to our favourite elder brother SEO expart MD sajib rahman. all copyright reserved SEO Tutoial Full Course Part -2 Bangla This tutoial cover this topics 1. What is PageRank 2. How to increase your PageRank? 3. What is Domain Authority and how to increase it 4. What is Backlink? Type Of Backlinks 5. Why Backlink are so important What is Google PageRank : PageRank is a link analysis algorithm used by Google to help determine the relative importance of a website. How To Increase How To Increase PageRank Build Quality Dofollow Backlink Writing Quality Content Optimize your pages Capitalize on social networks Create sitemap, robots.txt file Internal Linking What is Domain Authority Domain authority is a measure of the power of a domain name and is one of many... -

Body Snatchers in the Desert : The Horrible Truth of The Roswell Incident? - Nick Redfern

Ancient of Days Conference, The Disclosure Debate, Roswell NM See also http://AncientofDays.net for DVDs Or http://ChristianSymposium.com for recent events Nick Redfern has been interested in UFOs since 1978. His main area of research centers around determining what has been learned about the UFO subject at an official level in Britain. He has spent hundreds of hours at the Public Record Office in London, and has uncovered thousands of pages of previously-classified Royal Air Force, Air Ministry and Ministry of Defense files on UFOs dating from the Second World War. Nick is the author of several best-selling books on UFOs including: FINAL EVENTS and the Secret Government Group on Demonic UFOs and the Afterlife, and Body Snatchers in the Desert: The Horrible Truth at the Heart of the Rosw... -

Burial, Mixed by Xiy

320k MP3 is now online, thanks for your comments everyone. Remember to *buy* this music if you enjoy it. Download: http://www.sendspace.com/file/bf47h6 Kindred Mixed here: http://www.youtube.com/watch?v=fbjNYTmHlVo I (as Xiy) originally mixed this for an amazing new artist by the name of Context (formerly Context MC). You may have heard his epic tune 'Listening to Burial' and it's remix by Cinematic recently on BBC Radio 1, 1Xtra and MTV. I was inspired by the mix Burial and Kode9 did for Mary Anne Hobbs; the pirate radio feel, crackly and low quality, with the idea of, like I have, passing from one pirate station to the next as I drift through London. Some of the mixing is a bit out in places, but mixing Burial is non-stop pressure. His beats are so complex and off-time that I'm still ... -

FOUNDATION Two (Modern Prophets & Priesthood Authority)

This video coincides with the second chapter of the book FOUNDATION (https://drive.google.com/file/d/0BwuXF6C6jrjgUVZ3RTJqRHpnbFk/view?usp=sharing) and covers the following topics: What did Historic Christians Teach About Modern Prophets and Institutions? What did Historic Christians Teach About Proper Priesthood Authority to Baptize? -

IRS Frivoulous Letter Response Part 2

Therefore, please provide: 1) Nihil-dicit default judgment signed by the Federal Judge that I owe $5000 for 2013 1040EZ and 1040X Returns submitted – if such an Official declaration exists under 15USC, 1692g Validation of Debts. 2) An Official VERIFIED ASSESSMENT from Internal Revenue for the $5000 2013 Frivolous Allegation - if such document exists. 3) Specific reasons for Carl W. Ochs accusing Frivolous Filing of 2013 1040X Return or 1040EZ Return – Officially Signed per IRC26, 6065 if the Return is Officially Filed by an Official Office as such send undersigned a copy of said filing including IR and IRS escalation procedures – all signed copies of documents in 2013 record, like such higher level processing by said Internal Revenue - Department of treasury bureau (assesses bills under... -

Pom Wonderful, LLC v. The Coca-Cola Company: Oral Argument - April 21, 2014

Facts: Pom Wonderful, LLC (Pom Wonderful), a California-based beverage company, sold various types of juice, including a pomegranate blueberry juice blend. In 2007, Coca-Cola Company (Coca-Cola) announced its own version of a pomegranate blueberry juice. In 2008, Pom Wonderful sued Coca-Cola in federal district court and argued that Coca-Cola misled consumers into believing that Coca-Cola's product contained pomegranate and blueberry juices when it actually contained 99% apple and grape juices and only 0.5% pomegranate and blueberry juice. Specifically, Pom Wonderful claimed that Coca-Cola violated provisions of the Lanham Act, a federal law prohibiting false advertising, as well as California's false advertising and unfair competition laws. The lawsuit challenged the name, labeling, marke... -

USTERRORALERT ALEXANDER BACKMAN INTERVIEW ON FLOW OF WISDOM WITH SEAN ANTHONY MAY 11 2014

ALEXANDER BACKMAN WAS ON THE FLOW OF WISDOM SHOW WITH HIP HOP RADIO HOST SEAN ANTHONY -GET MOTIVATED! Posted here: http://alexanderbackman.wordpress.com/2014/05/11/usterroralert%E2%96%BA-sean-anthony-interviews-alexander-backman-head-the-codes/ Below is the link to the commercial free MP3 to the show. http://concienciaradio.com/podcastgen/download.php?filename=2014-05-11_ab_sean_anthony_0511141_commfree.mp3 Prayers that Destroy Terrorism Please pray with us against terrorism: Download this PDF file and accompany us in prayer to stop the enemy. An Excerpt from page 98 of the book Prayers that Rout Demons by John Eckhart. Published by Charisma House, ISBN: 978-1-59979-246-0 (By this book at any bookstore) Transcribed by Alexander Backman, Soldier of Yahshua (SOY). Sep 22, 2011. Link: http... -

Tutorial 002 Mikrotik SSTP VPN server Windows SSTP VPN client

Mikrotik 2011UAS-2HnD RouterOS 6.7 L5 as SSTP server Windows 7 PL 32bit as SSTP VPN client SSTP ~= "PPTP + CA" Mikrotik /server, ca.crt+ca.key/ - internal LAN: 192.168.0.0/24, IP: 192.168.0.1 - external IP - XXX.XXX.86.23 Windows PC /client, only ca.crt/ - external IP: Tmobile 3G PL - LAN 192.168.1.0/24, HTC Wildfire S - WiFi Hotspot config I - Mikrotik SSTP pool 192.168.0.100 - 192.168.0.150 - Windows PC IP is in Mikrotik local LAN pool - client decides where goes internet traffic config II - Windows client PC all internet traffic going through SSTP VPN gateway - Mikrotik SSTP pool 192.168.2.1 - 192.168.2.200 - Windows PC IP is in Mikrotik SSTP pool - if client disable traffic rediret then looses SSTP pool acces and Mikrotik internal LAN acces Tip: 1. CA /certificate authority/ CN /c... -

Weekly SEO Q&A; - Hump Day Hangouts - Episode 51

For more SEO training, visit: http://semanticmastery.com 0:00 Intro and announcements 6:00 When creating webpages what is the best way to structure for keyword phrases. For example if your target is “ripe red apples” and you have ripe in the domain name already, would you name the html file ripe red apples or just red apples since ripe is already in the url. 9:00 High Authority, DA80+ Local Citation List from Marketers Center -- a client asked us to create citations for him on DA 80+ sites only. I didn’t think there would be a whole lot of citations that meet this specification, so I was surprised when we uncovered about 50+ in total. http://www.marketerscenter.com/files/High-DA-Master-List.xlsx 11:00 Quick explanation of http://serpspace.com services and idea behind the project ... -

-

Inside Story - Palestine: What is in a name (change)?

Subscribe to our channel http://bit.ly/AJSubscribe Subscribe to our channel http://bit.ly/AJSubscribe Palestinian President Mahmoud Abbas has officially renamed the area he controls. He has called for all official documents - including passports, drivers licenses, postage stamps and car number plates - to now bear the name 'State of Palestine', instead of the generally used 'Palestinian National Authority', Abbas has also ordered foreign ministries and embassies around the world to start using the title. At Al Jazeera English, we focus on people and events that affect people's lives. We bring topics to light that often go under-reported, listening to all sides of the story and giving a 'voice to the voiceless.' Reaching more than 270 million households in over 140 countries across th... -

linux tutorial for beginners 6 Unix Security Model and Utilities-II

linux tutorial for beginners 6 Unix Security Model and Utilities-II. To Learn or Teach Linux visit www.theskillpedia.com, A Marketplace for Learners and Trainers. For Corporate Training Requirements Visit My Website www.rnsangwan.com Slides Contents The Linux Security Model Users and groups are used to control access to files and resources. User log in to the system by supplying their user name and password. Every file on the system is owned by a user and associated with a group. Every process has a owner and group affiliation, and can only access the resources it’s owner or group can access. Users Every user of the system is assigned a unique User ID number. Users’ names and uids are stored in /etc/passwd Users are assigned a home directory and a program that is run when they log on. Us... -

ernie wayne ter telgte (tertelgte) before Three Forks Justice Court hearing - What your NAME means

A video of a friend explaining what your all capital letter name means to the government and courts. Its about 30 min long, however a simple explanation come at around 22 minutes. The video is a bit shaky, but the words are very clear! The way your name is written indicates your status under Roman, and thus Corporate Maritime Law.. There were three changes of state or condition attended with different consequences, maxima, media, and minima. The greatest, CAPITIS DIMINUTIO MAXIMA, involved the loss of liberty, citizenship, and family (e.g. being made a slave or prisoner of war). The next change of state, Capitis DIminutio Media, consisted of a loss of citizenship and family without any forfeiture of personal liberty. capitis dIminutio minima, consisted of a person ceasing to belong ... -

ION Toronto - Deploying DNSSEC: A .CA Case Study

Jacques Latour of the Canadian Internet Registration Authority (CIRA) explains how CIRA has completed two phases of a three-phased approach to implement DNSSEC on the .CA country code Top Level Domain (ccTLD). First, they released a DNSSEC Practice Statement for comment, providing an operational outline of how CIRA plans to develop, maintain and manage DNSSEC deployment for .CA. Next, they held a key signing ceremony where they generated the cryptographic digital key that is used to secure the .CA zone. On January 21, 2013, CIRA published a signed .CA zone file, and on January 23, the .CA DS record was submitted to the Internet Assigned Numbers Authority (IANA). The next phase of CIRA's work in implementing DNSSEC is to make the necessary upgrades to ready the registry system for transacti...

Researchers' Identity Management in the 21st Century Networked World

- Order: Reorder

- Duration: 23:12

- Updated: 18 Dec 2015

- views: 24

- published: 18 Dec 2015

- views: 24

Kenneth E Hagin The Believer's Authority 01 The Believer's Authority 103188

- Order: Reorder

- Duration: 77:58

- Updated: 28 Jan 2011

- views: 376904

- published: 28 Jan 2011

- views: 376904

The KrisAnne Hall Show - KrisAnne Hall Stands Up for Sherrif Nick Finch

- Order: Reorder

- Duration: 39:58

- Updated: 07 Aug 2015

- views: 375

- published: 07 Aug 2015

- views: 375

SEO Tutorial Full Course Part -2 Bangla

- Order: Reorder

- Duration: 84:39

- Updated: 25 Apr 2016

- views: 3

- published: 25 Apr 2016

- views: 3

Body Snatchers in the Desert : The Horrible Truth of The Roswell Incident? - Nick Redfern

- Order: Reorder

- Duration: 112:07

- Updated: 20 Jun 2013

- views: 36054

- published: 20 Jun 2013

- views: 36054

Burial, Mixed by Xiy

- Order: Reorder

- Duration: 51:06

- Updated: 04 Nov 2011

- views: 41382

- published: 04 Nov 2011

- views: 41382

FOUNDATION Two (Modern Prophets & Priesthood Authority)

- Order: Reorder

- Duration: 33:35

- Updated: 22 Nov 2014

- views: 18

- published: 22 Nov 2014

- views: 18

IRS Frivoulous Letter Response Part 2

- Order: Reorder

- Duration: 21:20

- Updated: 17 Apr 2016

- views: 0

- published: 17 Apr 2016

- views: 0

Pom Wonderful, LLC v. The Coca-Cola Company: Oral Argument - April 21, 2014

- Order: Reorder

- Duration: 62:10

- Updated: 25 Mar 2016

- views: 0

- published: 25 Mar 2016

- views: 0

USTERRORALERT ALEXANDER BACKMAN INTERVIEW ON FLOW OF WISDOM WITH SEAN ANTHONY MAY 11 2014

- Order: Reorder

- Duration: 77:29

- Updated: 12 May 2014

- views: 3300

- published: 12 May 2014

- views: 3300

Tutorial 002 Mikrotik SSTP VPN server Windows SSTP VPN client

- Order: Reorder

- Duration: 20:32

- Updated: 29 Dec 2013

- views: 11404

- published: 29 Dec 2013

- views: 11404

Weekly SEO Q&A; - Hump Day Hangouts - Episode 51

- Order: Reorder

- Duration: 58:20

- Updated: 21 Oct 2015

- views: 544

- published: 21 Oct 2015

- views: 544

7-24-2014 The Federal Trade commission and Its Section 5 Authority: Prosecutor, Judge, and Jury

- Order: Reorder

- Duration: 165:39

- Updated: 24 Jul 2014

- views: 1839

Inside Story - Palestine: What is in a name (change)?

- Order: Reorder

- Duration: 25:01

- Updated: 08 Jan 2013

- views: 2407

- published: 08 Jan 2013

- views: 2407

linux tutorial for beginners 6 Unix Security Model and Utilities-II

- Order: Reorder

- Duration: 74:40

- Updated: 21 Dec 2014

- views: 494

- published: 21 Dec 2014

- views: 494

ernie wayne ter telgte (tertelgte) before Three Forks Justice Court hearing - What your NAME means

- Order: Reorder

- Duration: 29:01

- Updated: 06 Nov 2013

- views: 103544

- published: 06 Nov 2013

- views: 103544

ION Toronto - Deploying DNSSEC: A .CA Case Study

- Order: Reorder

- Duration: 27:44

- Updated: 16 Jan 2014

- views: 283

- published: 16 Jan 2014

- views: 283

- Playlist

- Chat

- Playlist

- Chat

Programmatic Changes to the LC/NACO Authority File for RDA

- Report rights infringement

- published: 20 Dec 2013

- views: 226

DNS Records

- Report rights infringement

- published: 17 Jun 2013

- views: 59467

Video SEO Begins with Your File Name

- Report rights infringement

- published: 07 Jul 2012

- views: 561

9. Cataloging with Default Data and Authority Files

- Report rights infringement

- published: 04 Dec 2015

- views: 20

Linking Library Data to Wikipedia, Part I

- Report rights infringement

- published: 29 Jun 2012

- views: 1888

Authority control

- Report rights infringement

- published: 01 Oct 2014

- views: 119

ELAG 2015 I Managing Work and Expression entities in WorldCat

- Report rights infringement

- published: 23 Sep 2015

- views: 56

Integrated Authority File

- Report rights infringement

- published: 24 Dec 2015

- views: 0

Integrated Authority File

- Report rights infringement

- published: 17 Nov 2014

- views: 9

WWE: The Authority Theme Song Pack

- Report rights infringement

- published: 16 Nov 2014

- views: 130055

American Authors - Best Day Of My Life

- Report rights infringement

- published: 18 Oct 2013

- views: 94480550

Lenovo Phab Plus First Look!

- Report rights infringement

- published: 05 Sep 2015

- views: 85775

Cheshire police Authority virus removal

- Report rights infringement

- published: 07 Apr 2014

- views: 132

Autocompletion

- Report rights infringement

- published: 23 Oct 2015

- views: 46

- Playlist

- Chat

Researchers' Identity Management in the 21st Century Networked World

- Report rights infringement

- published: 18 Dec 2015

- views: 24

Kenneth E Hagin The Believer's Authority 01 The Believer's Authority 103188

- Report rights infringement

- published: 28 Jan 2011

- views: 376904

The KrisAnne Hall Show - KrisAnne Hall Stands Up for Sherrif Nick Finch

- Report rights infringement

- published: 07 Aug 2015

- views: 375

SEO Tutorial Full Course Part -2 Bangla

- Report rights infringement

- published: 25 Apr 2016

- views: 3

Body Snatchers in the Desert : The Horrible Truth of The Roswell Incident? - Nick Redfern

- Report rights infringement

- published: 20 Jun 2013

- views: 36054

Burial, Mixed by Xiy

- Report rights infringement

- published: 04 Nov 2011

- views: 41382

FOUNDATION Two (Modern Prophets & Priesthood Authority)

- Report rights infringement

- published: 22 Nov 2014

- views: 18

IRS Frivoulous Letter Response Part 2

- Report rights infringement

- published: 17 Apr 2016

- views: 0

Pom Wonderful, LLC v. The Coca-Cola Company: Oral Argument - April 21, 2014

- Report rights infringement

- published: 25 Mar 2016

- views: 0

USTERRORALERT ALEXANDER BACKMAN INTERVIEW ON FLOW OF WISDOM WITH SEAN ANTHONY MAY 11 2014

- Report rights infringement

- published: 12 May 2014

- views: 3300

Tutorial 002 Mikrotik SSTP VPN server Windows SSTP VPN client

- Report rights infringement

- published: 29 Dec 2013

- views: 11404

Weekly SEO Q&A; - Hump Day Hangouts - Episode 51

- Report rights infringement

- published: 21 Oct 2015

- views: 544

7-24-2014 The Federal Trade commission and Its Section 5 Authority: Prosecutor, Judge, and Jury

- Report rights infringement

- published: 24 Jul 2014

- views: 1839

Inside Story - Palestine: What is in a name (change)?

- Report rights infringement

- published: 08 Jan 2013

- views: 2407

Italian Authorities Crush Islamic Plot To Bomb Vatican, Israeli Embassy In Rome

Edit WorldNews.com 28 Apr 2016Ted Cruz Is A ‘Miserable Son Of A Bitch’

Edit Breitbart 28 Apr 2016FBI Arrests Trio In Connection With San Bernardino Shootings

Edit WorldNews.com 28 Apr 2016Prince Never Knew Middle Of Humanity, Only Extremity Of Both Ends

Edit WorldNews.com 28 Apr 2016Cruz Fires Back At Boehner Comments, Says Ex-Speaker Beholden To Buddy Trump

Edit WorldNews.com 28 Apr 2016AIADMK candidates file papers in 6 constituencies

Edit The Hindu 29 Apr 2016AIADMK candidates file papers

Edit The Hindu 29 Apr 2016Racist statements lead lawmakers to reject John Wayne Day

Edit Austin American Statesman 29 Apr 2016Case in UP court against DU V-C, writers

Edit Indian Express 29 Apr 2016Indian-American couple convicted for H-1B visa fraud

Edit Deccan Herald 29 Apr 2016Trial begins for LA County deputy accused of beating 3 inmates

Edit LA Daily News 29 Apr 2016HC notice to govt on women wrestlers' jobs plea

Edit The Times of India 29 Apr 2016Tobacco majors win interim relief over pack warnings

Edit The Times of India 29 Apr 2016ANNUAL GENERAL MEETING FORM OF PROXY (Fosun International Limited)

Edit Public Technologies 29 Apr 2016Disclosure Of Interest/ Changes In Interest Of Trustee-Manager/ Responsible Person :: Disclosure Of Interest/Changes In Interest Of Trustee-Manager/Responsible Person (CDL Hospitality Trusts)

Edit Public Technologies 29 Apr 2016What’s the latest with Enrique Marquez, alleged conspirator with terrorists

Edit LA Daily News 29 Apr 2016Form of Proxy for Use at the Annual General Meeting to be Held at 11:30 a.m. on Tuesday, 7 June 2016 and Any Adjournment Thereof (King Stone Energy Group Ltd)

Edit Public Technologies 29 Apr 2016- 1

- 2

- 3

- 4

- 5

- Next page »