- published: 03 Dec 2016

- views: 2853

-

remove the playlistShare Price

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistShare Price

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 13 Apr 2016

- views: 1527

- published: 06 Nov 2012

- views: 55410

- published: 21 Apr 2012

- views: 13500

- published: 06 Apr 2017

- views: 1010

- published: 07 Apr 2017

- views: 81

- published: 27 Jul 2016

- views: 4740

- published: 07 Nov 2015

- views: 10902

Share price

A share price is the price of a single share of a number of saleable stocks of a company, derivative or other financial asset. In layman's terms, the stock price is the highest amount someone is willing to pay for the stock, or the lowest amount that it can be bought for.

Behavior of share prices

In economics and financial theory, analysts use random walk techniques to model behavior of asset prices, in particular share prices on stock markets, currency exchange rates and commodity prices. This practice has its basis in the presumption that investors act rationally and without biases, and that at any moment they estimate the value of an asset based on future expectations. Under these conditions, all existing information affects the price, which changes only when new information comes out. By definition, new information appears randomly and influences the asset price randomly.

Empirical studies have demonstrated that prices do not completely follow random walks. Low serial correlations (around 0.05) exist in the short term, and slightly stronger correlations over the longer term. Their sign and the strength depend on a variety of factors.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Stock market

A stock market or equity market or share market is the aggregation of buyers and sellers (a loose network of economic transactions, not a physical facility or discrete entity) of stocks (also called shares); these may include securities listed on a stock exchange as well as those only traded privately.

Size of the market

Stocks can be categorized in various ways. One common way is by the country where the company is domiciled. For example, Nestlé and Novartis are domiciled in Switzerland, so they may be considered as part of the Swiss stock market, although their stock may also be traded at exchanges in other countries.

At the close of 2012, the size of the world stock market (total market capitalisation) was about US$55 trillion. By country, the largest market was the United States (about 34%), followed by Japan (about 6%) and the United Kingdom (about 6%). This went up more in 2013.

Stock exchange

A stock exchange is a place or organization by which stock traders (people and companies) can trade stocks. Companies may want to get their stock listed on a stock exchange. Other stocks may be traded "over the counter", that is, through a dealer. A large company will usually have its stock listed on many exchanges across the world.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

9:51

9:51How stock/share prices are decided?

How stock/share prices are decided?How stock/share prices are decided?

There is always a difficulty to explain how stock markets exactly work. Even many of the people who are of regular investors can't really explain how exactly they work. I tried to explain the same but with different approach I hope you'll understand everything or if not, read the articles from the following links and watch the video couple of time. Subscribe Here https://goo.gl/fsQayx More details links: https://goo.gl/Zi7Gug https://goo.gl/TSX6Xx https://goo.gl/gt8tjM https://goo.gl/tpFV9E https://goo.gl/jDf4dk My gears https://goo.gl/csuCq0 https://goo.gl/tEuBwb Facebook: https://www.facebook.com/HARSHFACTS1/ Twitter: https://twitter.com/HarshFacts_ Website: http://harshfacts.com/ Patreon: https://www.patreon.com/harshfacts Licenses to the content https://creativecommons.org/licenses/by-nd/2.0/ https://creativecommons.org/licenses/by-sa/2.0/ https://creativecommons.org/licenses/by-sa/3.0/ https://creativecommons.org/licenses/by/4.0/ https://creativecommons.org/licenses/by-sa/4.0/ https://creativecommons.org/licenses/by/2.0/ https://creativecommons.org/publicdomain/zero/1.0/ https://creativecommons.org/licenses/by-sa/2.1/jp/deed.en_US https://creativecommons.org/licenses/by-sa/2.5/ Music. “Tracks Of My Fears" https://www.youtube.com/audiolibrary/music https://youtu.be/bC22GTrDuxw -

![Inox Wind Why Share Price Falling continuously ?[in Hindi]; updated 07 Sep 2016; published 07 Sep 2016](http://web.archive.org./web/20170407102113im_/https://i.ytimg.com/vi/E4EsXQyNOzk/0.jpg) 5:16

5:16Inox Wind Why Share Price Falling continuously ?[in Hindi]

Inox Wind Why Share Price Falling continuously ?[in Hindi] -

15:39

15:39Shares, Share Prices and Market Capitalisation

Shares, Share Prices and Market CapitalisationShares, Share Prices and Market Capitalisation

In this revision video, Jim Riley from tutor2u introduces the concept of shares and shareholdings. He explores the factors that influence share prices and how changes in share prices translate into the market capitalisation of a company. -

7:51

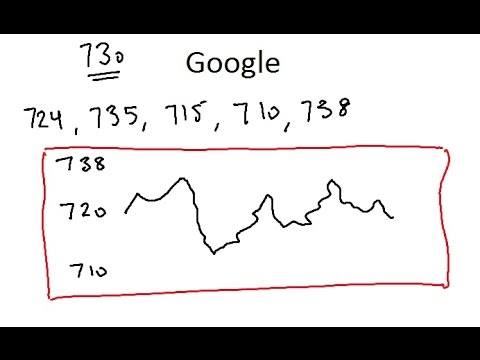

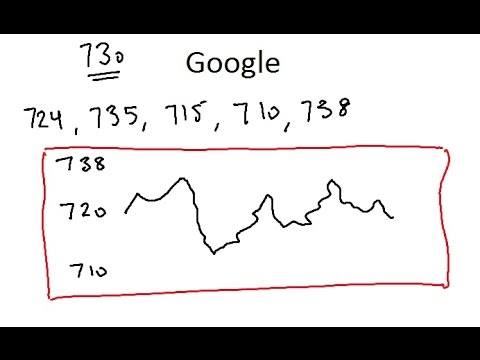

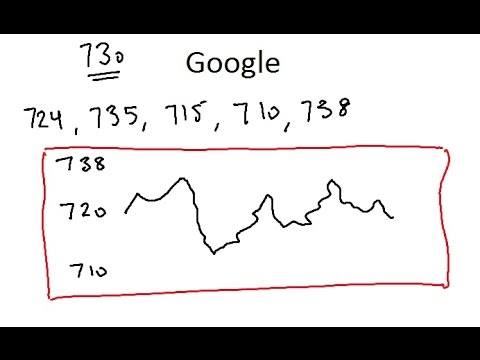

7:51Predicting Stock Price movement statistically

Predicting Stock Price movement statisticallyPredicting Stock Price movement statistically

Predicting Stock Price movement statistically. Here we use historical data to predict the movement of stock price for next day. It is completely mathematically valid. The mathematical model of Brownian motion has several real-world applications. Stock market fluctuations are often cited, although Benoit Mandelbrot rejected its applicability to stock price movements in part because these are discontinuous. This is a momentum indicator used in technical analysis, which compares the stock's closing price to its price over the course of a particular time frame. During an upward trend in the market, a stock's share price will close near its high (highest price traded), and when in a downward-trending market, the security's price will close near the low (lowest price traded). This may determine whether a stock is overbought or oversold, thus predicting a possible momentum change. http://www.garguniversity.com -

7:05

7:05Stock Market Basics - How The Stock Price Is Set

Stock Market Basics - How The Stock Price Is SetStock Market Basics - How The Stock Price Is Set

http://www.howtobeastockmarketplayer.com This video explains how the price of stock is set. -

1:56

1:56Why do share prices go up and down

Why do share prices go up and downWhy do share prices go up and down

Gcse history -

9:13

9:13How Stock Market Works | Reason behind the change in share price explained with live example |Hindi

How Stock Market Works | Reason behind the change in share price explained with live example |HindiHow Stock Market Works | Reason behind the change in share price explained with live example |Hindi

Hi Friends, in this video I am explaining how stock market works and what is the reason behind change in share price, all explained with live example and live share trading session, all your doubts regarding basic knowledge of share market will be solved in this video and i hope you people will like it and share with your friends. this video is about:- How stock market works ? how to trade in stock market ? how price of a share changes ? concept of demand and supply in shares ? live trading session and much more. I will try to decode more business models on my channel. So pl subscribe and also share this video Follow me :- Facebook :- fb.com/Thinmister Twitter :- @tweetmrthin Youtube :- http://www.youtube.com/c/MrThin Email :- mailmrthin@gmail.com PLEASE SUBSCRIBE :) Background Music credit :- http://www.bensound.com -

6:18

6:18Why Berkshire Hathaway Share Price So High [Hindi|

Why Berkshire Hathaway Share Price So High [Hindi|Why Berkshire Hathaway Share Price So High [Hindi|

Why Berkshire Hathaway Share Price So High Why Berkshire doesn't gives dividend, splits the share -

3:16

3:16What Makes Stock Prices Move Up and Down

What Makes Stock Prices Move Up and DownWhat Makes Stock Prices Move Up and Down

To understand what makes stocks and shares price move you must first understand a few things about the current pricing of a stock. At any given time during regular trading hours a stock has 3 values associated with it. A bid, an ask, and a current price. The bid is the highest amount someone is currently willing to pay for a share of stock, while the ask is the lowest amount someone is currently willing to accept for a share of stock. Each number will usually be shown next to the number of shares the investor is offering or asking for. The price of a stock at any given time is simply the last price a share of that stock sold for. Usually the bid and the ask are relatively close to the current share price. The difference between the bid and the ask is called the spread and it is usually healthier for a stock to have a smaller spread. Now we will talk about what makes the price of stock change. If you have ever taken a beginners economics course you probably remember learning about supply and demand. The concept is quite simple. If there is a larger supply of a product than there is demand, the price will likely drop. If there is a greater demand and not enough supply to match, than the price will probably rise. This is also true with stocks and shares. As was explained in lesson 1, the stock market is a literal market where a product, namely ownership of a company, is bought and sold. This means it runs on similar economic principles. If there are a lot of investors trying to sell a stock, and a much smaller number of investors looking to buy that same stock, the price will of the stock will begin dropping. Let’s look closer at the reasoning behind the price drop by creating a mini-market with five people; John, Jessica, Jeremy, Janet, and Jimmy. We will pretend that all five of these investors own 100 shares of stock in Company A. One day they find out that Company A messed up on a new product and it will be delayed for a year. Four of them decide to sell their shares in the company and put them up for sale. Unfortunately, due to the news, there is only one investor that is interested in buying the stock for its current price. John sells his shares, but that leaves Jessica, Jeremy, and Janet, all with shares they still would like to sell. There is nobody willing to buy at the current price, but one investor has offered to buy at a price $1 lower than the current price. Jessica sells to the investor, and the current stock price adjusts to show a current worth that is $1 less than before. If Jeremy and Janet decide to sell as well, they may push the current price even lower as they seek to find investors to purchase their shares of stock. Sometimes when a company announces extremely bad news you can see the worth of a single share of stock drop more than 50% in a single day. To learn more about the stock market and how to make money with stock try one of our stock market courses! You can learn from and interact with professional traders. -

11:33

11:33Predicting Stock Price Mathematically

Predicting Stock Price MathematicallyPredicting Stock Price Mathematically

There are two prices that are critical for any investor to know: the current price of the investment he or she owns, or plans to own, and its future selling price. Despite this, investors are constantly reviewing past pricing history and using it to influence their future investment decisions. Some investors won't buy a stock or index that has risen too sharply, because they assume that it's due for a correction, while other investors avoid a falling stock, because they fear that it will continue to deteriorate. http://www.garguniversity.com

-

How stock/share prices are decided?

There is always a difficulty to explain how stock markets exactly work. Even many of the people who are of regular investors can't really explain how exactly they work. I tried to explain the same but with different approach I hope you'll understand everything or if not, read the articles from the following links and watch the video couple of time. Subscribe Here https://goo.gl/fsQayx More details links: https://goo.gl/Zi7Gug https://goo.gl/TSX6Xx https://goo.gl/gt8tjM https://goo.gl/tpFV9E https://goo.gl/jDf4dk My gears https://goo.gl/csuCq0 https://goo.gl/tEuBwb Facebook: https://www.facebook.com/HARSHFACTS1/ Twitter: https://twitter.com/HarshFacts_ Website: http://harshfacts.com/ Patreon: https://www.patreon.com/harshfacts Licenses to the content https://creativecom...

published: 03 Dec 2016 -

Inox Wind Why Share Price Falling continuously ?[in Hindi]

लगातार साल दर साल मुनाफा बढ़ने के बावजूद क्यों गिर रहा है आयनोक्स विंड का शेयर ?? Despite continuous year on year increase in net profit price of Inox wind share is falling continuously. Know the reason why ?? http://investorji.in

published: 07 Sep 2016 -

Shares, Share Prices and Market Capitalisation

In this revision video, Jim Riley from tutor2u introduces the concept of shares and shareholdings. He explores the factors that influence share prices and how changes in share prices translate into the market capitalisation of a company.

published: 13 Apr 2016 -

Predicting Stock Price movement statistically

Predicting Stock Price movement statistically. Here we use historical data to predict the movement of stock price for next day. It is completely mathematically valid. The mathematical model of Brownian motion has several real-world applications. Stock market fluctuations are often cited, although Benoit Mandelbrot rejected its applicability to stock price movements in part because these are discontinuous. This is a momentum indicator used in technical analysis, which compares the stock's closing price to its price over the course of a particular time frame. During an upward trend in the market, a stock's share price will close near its high (highest price traded), and when in a downward-trending market, the security's price will close near the low (lowest price traded). This may determin...

published: 06 Nov 2012 -

Stock Market Basics - How The Stock Price Is Set

http://www.howtobeastockmarketplayer.com This video explains how the price of stock is set.

published: 21 Apr 2012 -

-

How Stock Market Works | Reason behind the change in share price explained with live example |Hindi

Hi Friends, in this video I am explaining how stock market works and what is the reason behind change in share price, all explained with live example and live share trading session, all your doubts regarding basic knowledge of share market will be solved in this video and i hope you people will like it and share with your friends. this video is about:- How stock market works ? how to trade in stock market ? how price of a share changes ? concept of demand and supply in shares ? live trading session and much more. I will try to decode more business models on my channel. So pl subscribe and also share this video Follow me :- Facebook :- fb.com/Thinmister Twitter :- @tweetmrthin Youtube :- http://www.youtube.com/c/MrThin Email :- mailmrthin@gmail.com PLEASE SUBSCRIBE :) Background Music...

published: 06 Apr 2017 -

Why Berkshire Hathaway Share Price So High [Hindi|

Why Berkshire Hathaway Share Price So High Why Berkshire doesn't gives dividend, splits the share

published: 07 Apr 2017 -

What Makes Stock Prices Move Up and Down

To understand what makes stocks and shares price move you must first understand a few things about the current pricing of a stock. At any given time during regular trading hours a stock has 3 values associated with it. A bid, an ask, and a current price. The bid is the highest amount someone is currently willing to pay for a share of stock, while the ask is the lowest amount someone is currently willing to accept for a share of stock. Each number will usually be shown next to the number of shares the investor is offering or asking for. The price of a stock at any given time is simply the last price a share of that stock sold for. Usually the bid and the ask are relatively close to the current share price. The difference between the bid and the ask is called the spread and it is usually he...

published: 27 Jul 2016 -

Predicting Stock Price Mathematically

There are two prices that are critical for any investor to know: the current price of the investment he or she owns, or plans to own, and its future selling price. Despite this, investors are constantly reviewing past pricing history and using it to influence their future investment decisions. Some investors won't buy a stock or index that has risen too sharply, because they assume that it's due for a correction, while other investors avoid a falling stock, because they fear that it will continue to deteriorate. http://www.garguniversity.com

published: 07 Nov 2015

How stock/share prices are decided?

- Order: Reorder

- Duration: 9:51

- Updated: 03 Dec 2016

- views: 2853

- published: 03 Dec 2016

- views: 2853

Inox Wind Why Share Price Falling continuously ?[in Hindi]

- Order: Reorder

- Duration: 5:16

- Updated: 07 Sep 2016

- views: 1235

Shares, Share Prices and Market Capitalisation

- Order: Reorder

- Duration: 15:39

- Updated: 13 Apr 2016

- views: 1527

- published: 13 Apr 2016

- views: 1527

Predicting Stock Price movement statistically

- Order: Reorder

- Duration: 7:51

- Updated: 06 Nov 2012

- views: 55410

- published: 06 Nov 2012

- views: 55410

Stock Market Basics - How The Stock Price Is Set

- Order: Reorder

- Duration: 7:05

- Updated: 21 Apr 2012

- views: 13500

- published: 21 Apr 2012

- views: 13500

Why do share prices go up and down

- Order: Reorder

- Duration: 1:56

- Updated: 23 Oct 2012

- views: 10669

How Stock Market Works | Reason behind the change in share price explained with live example |Hindi

- Order: Reorder

- Duration: 9:13

- Updated: 06 Apr 2017

- views: 1010

- published: 06 Apr 2017

- views: 1010

Why Berkshire Hathaway Share Price So High [Hindi|

- Order: Reorder

- Duration: 6:18

- Updated: 07 Apr 2017

- views: 81

- published: 07 Apr 2017

- views: 81

What Makes Stock Prices Move Up and Down

- Order: Reorder

- Duration: 3:16

- Updated: 27 Jul 2016

- views: 4740

- published: 27 Jul 2016

- views: 4740

Predicting Stock Price Mathematically

- Order: Reorder

- Duration: 11:33

- Updated: 07 Nov 2015

- views: 10902

- published: 07 Nov 2015

- views: 10902

-

Share Price

published: 07 Nov 2016 -

@tif Share price

published: 10 Dec 2016 -

-

-

Magar share prices change on a daily basis, right?

published: 16 Nov 2015 -

How To Increase Your Share Price

published: 08 Dec 2015 -

-

What makes a share price rise?

published: 24 May 2016 -

-

Share Price

- Order: Reorder

- Duration: 3:15

- Updated: 07 Nov 2016

- views: 2

- published: 07 Nov 2016

- views: 2

@tif Share price

- Order: Reorder

- Duration: 4:55

- Updated: 10 Dec 2016

- views: 3

- published: 10 Dec 2016

- views: 3

@tif share price

- Order: Reorder

- Duration: 4:42

- Updated: 30 Nov 2016

- views: 8

@tif share price

- Order: Reorder

- Duration: 4:07

- Updated: 30 Nov 2016

- views: 7

Magar share prices change on a daily basis, right?

- Order: Reorder

- Duration: 0:13

- Updated: 16 Nov 2015

- views: 44346

- published: 16 Nov 2015

- views: 44346

How To Increase Your Share Price

- Order: Reorder

- Duration: 2:36

- Updated: 08 Dec 2015

- views: 964

- published: 08 Dec 2015

- views: 964

birds Kingfisher Airlines Share Price

- Order: Reorder

- Duration: 2:06

- Updated: 13 Mar 2017

- views: 2

What makes a share price rise?

- Order: Reorder

- Duration: 1:29

- Updated: 24 May 2016

- views: 155

- published: 24 May 2016

- views: 155

Ali baba share price

- Order: Reorder

- Duration: 4:42

- Updated: 07 Dec 2016

- views: 6

Ali baba share price

- Order: Reorder

- Duration: 4:55

- Updated: 11 Dec 2016

- views: 8

-

2016-5-19 Your Money Your Charts

Australian Shares Price Charts ASX Shares http://profithunters.com.au/events

published: 19 May 2016 -

韓国と日本へのフライト | Korea boeing share price

published: 02 Oct 2016 -

-

Romantic Movie XYZ 韓国と日本へのフライト Korea boeing share price

published: 03 Oct 2016 -

韓国と日本へのフライト | Korea boeing share price

published: 02 Oct 2016 -

韓国と日本へのフライト | Korea boeing share price

published: 02 Oct 2016 -

韓国と日本へのフライト | Korea boeing share price

published: 02 Oct 2016 -

3.1.2 Forms of Business

Sole traders/ Plc/ Ltd/ Liability/ Dividends/ Influence on Share Price/ Market Capitilisation

published: 07 Sep 2016 -

Bank Chor (2016) Full Hindi Dubbed Movie | Mahesh Babu, Bipasha Basu, Lisa Ray, Rahul Dev

The movie starts with Shaka killing his own brother for information, which is also known to another man, Veeru Dada. In the encounter, Veeru Dada jumps off into a river from a cliff. After 18 years, we have Veeru Dada with a leg cut off giving info to Raja, a mischievous thief who robs banks in style. Raja gives Veeru Dada a share of 50% for all his tip offs. Raja becomes more daring as the price tag on his head increases by thousands. There is another mischievous thief, Panasa, who with uncle follows Raju so that she can dupe him and escape with all the looted money. As the things go on a frolicking way between Panasa and Raja, the desperate Shaka is searching for Veeru Dada. Veeru Dada realizes that Shaka will kill him soon. Hence, Veeru Dada offers a big diamond to Raja and asks him to ...

published: 25 Mar 2016 -

Operation Jackpot (2016) Telugu Film Dubbed Into Hindi Full Movie | Mahesh Babu, Lisa Ray

The movie starts with Shaka killing his own brother for information, which is also known to another man, Veeru Dada. In the encounter, Veeru Dada jumps off into a river from a cliff. After 18 years, we have Veeru Dada with a leg cut off giving info to Raja, a mischievous thief who robs banks in style. Raja gives Veeru Dada a share of 50% for all his tip offs. Raja becomes more daring as the price tag on his head increases by thousands. There is another mischievous thief, Panasa, who with uncle follows Raju so that she can dupe him and escape with all the looted money. As the things go on a frolicking way between Panasa and Raja, the desperate Shaka is searching for Veeru Dada. Veeru Dada realizes that Shaka will kill him soon. Hence, Veeru Dada offers a big diamond to Raja and asks him to ...

published: 01 Sep 2016

2016-5-19 Your Money Your Charts

- Order: Reorder

- Duration: 51:06

- Updated: 19 May 2016

- views: 92

- published: 19 May 2016

- views: 92

韓国と日本へのフライト | Korea boeing share price

- Order: Reorder

- Duration: 1:09:01

- Updated: 02 Oct 2016

- views: 733

- published: 02 Oct 2016

- views: 733

Oct 24 BMGT 443 Bull Bear Target

- Order: Reorder

- Duration: 1:10:44

- Updated: 24 Oct 2016

- views: 432

Romantic Movie XYZ 韓国と日本へのフライト Korea boeing share price

- Order: Reorder

- Duration: 1:09:01

- Updated: 03 Oct 2016

- views: 36

- published: 03 Oct 2016

- views: 36

韓国と日本へのフライト | Korea boeing share price

- Order: Reorder

- Duration: 1:09:01

- Updated: 02 Oct 2016

- views: 37

- published: 02 Oct 2016

- views: 37

韓国と日本へのフライト | Korea boeing share price

- Order: Reorder

- Duration: 1:33:54

- Updated: 02 Oct 2016

- views: 75

- published: 02 Oct 2016

- views: 75

韓国と日本へのフライト | Korea boeing share price

- Order: Reorder

- Duration: 1:09:01

- Updated: 02 Oct 2016

- views: 78

- published: 02 Oct 2016

- views: 78

3.1.2 Forms of Business

- Order: Reorder

- Duration: 34:24

- Updated: 07 Sep 2016

- views: 214

- published: 07 Sep 2016

- views: 214

Bank Chor (2016) Full Hindi Dubbed Movie | Mahesh Babu, Bipasha Basu, Lisa Ray, Rahul Dev

- Order: Reorder

- Duration: 2:41:05

- Updated: 25 Mar 2016

- views: 3451153

- published: 25 Mar 2016

- views: 3451153

Operation Jackpot (2016) Telugu Film Dubbed Into Hindi Full Movie | Mahesh Babu, Lisa Ray

- Order: Reorder

- Duration: 2:17:14

- Updated: 01 Sep 2016

- views: 1475144

- published: 01 Sep 2016

- views: 1475144

- Playlist

- Chat

How stock/share prices are decided?

- Report rights infringement

- published: 03 Dec 2016

- views: 2853

Inox Wind Why Share Price Falling continuously ?[in Hindi]

- Report rights infringement

- published: 07 Sep 2016

- views: 1235

Shares, Share Prices and Market Capitalisation

- Report rights infringement

- published: 13 Apr 2016

- views: 1527

Predicting Stock Price movement statistically

- Report rights infringement

- published: 06 Nov 2012

- views: 55410

Stock Market Basics - How The Stock Price Is Set

- Report rights infringement

- published: 21 Apr 2012

- views: 13500

Why do share prices go up and down

- Report rights infringement

- published: 23 Oct 2012

- views: 10669

How Stock Market Works | Reason behind the change in share price explained with live example |Hindi

- Report rights infringement

- published: 06 Apr 2017

- views: 1010

Why Berkshire Hathaway Share Price So High [Hindi|

- Report rights infringement

- published: 07 Apr 2017

- views: 81

What Makes Stock Prices Move Up and Down

- Report rights infringement

- published: 27 Jul 2016

- views: 4740

Predicting Stock Price Mathematically

- Report rights infringement

- published: 07 Nov 2015

- views: 10902

- Playlist

- Chat

Share Price

- Report rights infringement

- published: 07 Nov 2016

- views: 2

@tif Share price

- Report rights infringement

- published: 10 Dec 2016

- views: 3

Magar share prices change on a daily basis, right?

- Report rights infringement

- published: 16 Nov 2015

- views: 44346

How To Increase Your Share Price

- Report rights infringement

- published: 08 Dec 2015

- views: 964

birds Kingfisher Airlines Share Price

- Report rights infringement

- published: 13 Mar 2017

- views: 2

What makes a share price rise?

- Report rights infringement

- published: 24 May 2016

- views: 155

- Playlist

- Chat

2016-5-19 Your Money Your Charts

- Report rights infringement

- published: 19 May 2016

- views: 92

韓国と日本へのフライト | Korea boeing share price

- Report rights infringement

- published: 02 Oct 2016

- views: 733

Romantic Movie XYZ 韓国と日本へのフライト Korea boeing share price

- Report rights infringement

- published: 03 Oct 2016

- views: 36

韓国と日本へのフライト | Korea boeing share price

- Report rights infringement

- published: 02 Oct 2016

- views: 37

韓国と日本へのフライト | Korea boeing share price

- Report rights infringement

- published: 02 Oct 2016

- views: 75

韓国と日本へのフライト | Korea boeing share price

- Report rights infringement

- published: 02 Oct 2016

- views: 78

3.1.2 Forms of Business

- Report rights infringement

- published: 07 Sep 2016

- views: 214

Bank Chor (2016) Full Hindi Dubbed Movie | Mahesh Babu, Bipasha Basu, Lisa Ray, Rahul Dev

- Report rights infringement

- published: 25 Mar 2016

- views: 3451153

Operation Jackpot (2016) Telugu Film Dubbed Into Hindi Full Movie | Mahesh Babu, Lisa Ray

- Report rights infringement

- published: 01 Sep 2016

- views: 1475144

-

Lyrics list:lyrics

-

Showerbeers!, Bomb The Music Industry!

Showerbeers!

I just got paid/lost my job so it's a heavy night of drinking.

You can smoke in the bar so when I come home I'm stinking.

The smell on my clothes is offending to the nose

But that's not the reason that I'm stepping in.

Syria Decries ‘Aggression’ as U.S. Launches Missile Attack

Edit Time Magazine 07 Apr 2017Feral Girl Found With Monkeys In A Forest In India

Edit IFL Science 06 Apr 2017Trump Weighs Military Response To Chemical Attack In Syria

Edit WorldNews.com 06 Apr 2017New Study Finds Half of American Adults Are Infected With HPV

Edit WorldNews.com 07 Apr 2017Russia Bans Picture of Putin Dressed As Gay Clown

Edit WorldNews.com 07 Apr 2017Westshore Terminals Investment Corporation Announces Normal Course Issuer Bid

Edit Market Watch 07 Apr 2017DryShips: The Inevitable Has Come

Edit Seeking Alpha 07 Apr 2017Pakistan stocks end down in thin trade

Edit The News International 07 Apr 2017Flint wants Mich.court to rule it an arm of state during water crisis

Edit Detroit Free Press 07 Apr 2017Save on long-term capital gains – sell your loss-making investments

Edit DNA India 07 Apr 2017Grasim gets minority shareholders' nod for ABNL merger

Edit DNA India 07 Apr 2017Jackson's Brian Stuard (5 over) whipped by winds in Masters debut

Edit Detroit Free Press 07 Apr 2017Syria: US launches missile strikes near Homs – live

Edit The Guardian 07 Apr 201710 pictures to prove Sonakshi Sinha has amped her fashion game post weight loss!

Edit The Times of India 07 Apr 2017VEON announces pricing of offering of 70,000,000 common shares by selling shareholder Telenor East Holding II AS

Edit Market Watch 07 Apr 2017Facebook to use photo-matching to block repeat 'revenge porn'

Edit DNA India 07 Apr 2017In a good sign for Okta's IPO on Friday, the company priced its shares high with a $1.5 billion valuation

Edit Business Insider 07 Apr 2017- 1

- 2

- 3

- 4

- 5

- Next page »