- published: 02 Aug 2011

- views: 5932

-

remove the playlistOption (finance)

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistOption (finance)

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 10 Dec 2013

- views: 324779

- published: 05 Apr 2012

- views: 71946

- published: 20 Nov 2008

- views: 67077

- published: 27 Apr 2010

- views: 869

- published: 01 Jul 2015

- views: 220

- published: 19 May 2015

- views: 721

- published: 24 Apr 2013

- views: 22397

- published: 28 Oct 2013

- views: 45314

- published: 21 Mar 2014

- views: 244

In finance, an option is a derivative financial instrument that specifies a contract between two parties for a future transaction on an asset at a reference price (the strike). The buyer of the option gains the right, but not the obligation, to engage in that transaction, while the seller incurs the corresponding obligation to fulfill the transaction. The price of an option derives from the difference between the reference price and the value of the underlying asset (commonly a stock, a bond, a currency or a futures contract) plus a premium based on the time remaining until the expiration of the option. Other types of options exist, and options can in principle be created for any type of valuable asset.

An option which conveys the right to buy something at a specific price is called a call; an option which conveys the right to sell something at a specific price is called a put. The reference price at which the underlying asset may be traded is called the strike price or exercise price. The process of activating an option and thereby trading the underlying asset at the agreed-upon price is referred to as exercising it. Most options have an expiration date. If the option is not exercised by the expiration date, it becomes void and worthless.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Option may refer to:

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

5:12

5:12Finance: Options and Derivatives

Finance: Options and Derivatives -

7:56

7:56Call Options & Put Options Explained Simply In 8 Minutes (How To Trade Options For Beginners)

Call Options & Put Options Explained Simply In 8 Minutes (How To Trade Options For Beginners)Call Options & Put Options Explained Simply In 8 Minutes (How To Trade Options For Beginners)

How To Trade Options: Calls & Puts Call options & put options are explained simply in this entertaining and informative 8 minute training video which uses 2 cartoon-based scenarios to help you learn how to trade call options and how to trade put options. If you've ever been confused by calls and puts in the past, this video will clear up any confusion you may have had. Also, if you're looking to learn how to trade options, you will learn some simple options trading strategies in this short video. For more training, get my free "dummies" guide to options trading here: http://www.prtradingresearch.com/simple-options-guide-1.php?src=youtube-desc -

71:57

71:5717. Options Markets

17. Options Markets17. Options Markets

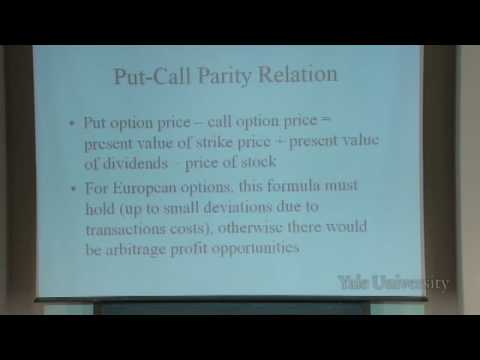

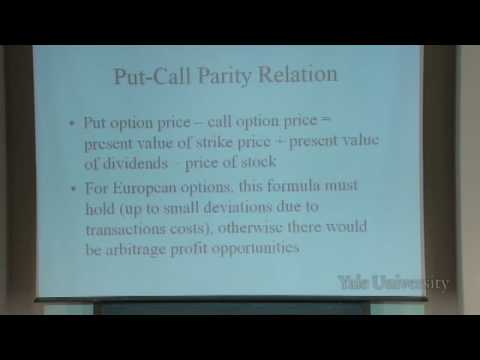

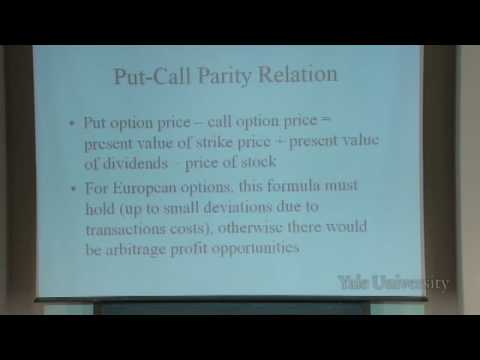

Financial Markets (2011) (ECON 252) After introducing the core terms and main ideas of options in the beginning of the lecture, Professor Shiller emphasizes two purposes of options, a theoretical and a behavioral purpose. Subsequently, he provides a graphical representation for the value of a call and a put option, and, in this context, addresses the put-call parity for European options. Within the framework of the Binomial Asset Pricing model, he derives the value of a call-option from the no-arbitrage-principle, and, as a continuous-time analogue to this formula, he presents the Black-Scholes Option Pricing formula. He contrasts implied volatility, as represented by the VIX index of the Chicago Board Options Exchange, which uses a different formula in the spirit of Black-Scholes, with the actual S&P; Composite volatility from 1986 until 2010. Professor Shiller concludes the lecture with some thoughts about options on single-family homes that he launched with his colleagues of the Chicago Mercantile Exchange in 2006. 00:00 - Chapter 1. Examples of Options Markets and Core Terms 07:11 - Chapter 2. Purposes of Option Contracts 17:11 - Chapter 3. Quoted Prices of Options and the Role of Derivatives Markets 24:54 - Chapter 4. Call and Put Options and the Put-Call Parity 34:56 - Chapter 5. Boundaries on the Price of a Call Option 39:07 - Chapter 6. Pricing Options with the Binomial Asset Pricing Model 51:02 - Chapter 7. The Black-Scholes Option Pricing Formula 55:49 - Chapter 8. Implied Volatility - The VIX Index in Comparison to Actual Market Volatility 01:09:33 - Chapter 9. The Potential for Options in the Housing Market Complete course materials are available at the Yale Online website: online.yale.edu This course was recorded in Spring 2011. -

67:51

67:5123. Options Markets

23. Options Markets23. Options Markets

Financial Markets (ECON 252) Options introduce an essential nonlineary into portfolio management. They are contracts between buyers and writers, who agree on exercise prices and dates at which the buyer can buy or sell the underlying (such as a stock). Options are priced based on the price and volatility of the underlying asset as well as the duration of the option contract. The Black-Scholes options pricing model is one of the most famous equations in finance and offers a useful first approximation for prices for option contracts. Options exchanges and futures exchanges both are involved in creating a liquid and transparent market for options. Options are not just for stocks; they are also important for other asset classes, such as real estate. 00:00 - Chapter 1. Options Vocabulary and the 1720 Stock Market Crash 14:58 - Chapter 2. The Standardization and Logic of Options: Options Exchanges 27:57 - Chapter 3. The Put-Call Parity Relation 36:32 - Chapter 4. Pricing an Option: The Black-Scholes Formula 51:35 - Chapter 5. Accounting for Volatility in the Black-Scholes Formula 01:00:08 - Chapter 6. Options on Home Prices as Risk Management Complete course materials are available at the Open Yale Courses website: http://open.yale.edu/courses This course was recorded in Spring 2008. -

15:20

15:20Andrew Lo (MIT) Option Pricing Physics and Finance

Andrew Lo (MIT) Option Pricing Physics and FinanceAndrew Lo (MIT) Option Pricing Physics and Finance

The history of Option Pricing, between physics and finance -

4:59

4:59Concepts of Options in Finance

Concepts of Options in FinanceConcepts of Options in Finance

This presentation will help you understand how the options market operate, what are the various types of options like call option, put option, etc. The option market operation has been explained through proper examples. -

3:33

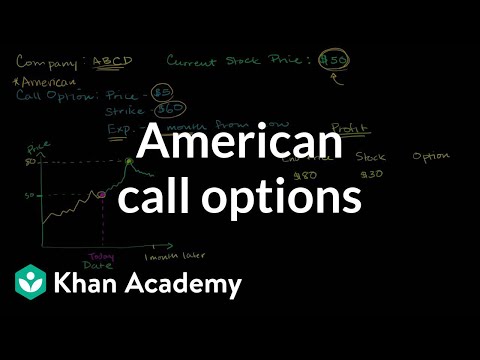

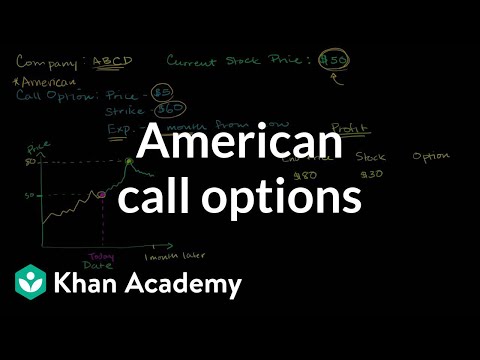

3:33American Call Options

American Call Options -

48:03

48:03Options and Corporate Finance

Options and Corporate FinanceOptions and Corporate Finance

Discusses different types of financial options, option pricing, and application of options to corporate finance decisions. -

30:32

30:32Finance with Excel: Options Graph

Finance with Excel: Options GraphFinance with Excel: Options Graph

This workbook teaches the user how to build a workbook that will demonstrate the shape of the payoff function for virtually any combination of put and call options. It is useful when teaching or trying to understand the mechanics behind various option strategies such as Butterfly, Collar, and other options strategies. -

6:07

6:07Binary Option Trading Strategy Using Cedar Finance Traders Choice 60 Seconds Strategy

Binary Option Trading Strategy Using Cedar Finance Traders Choice 60 Seconds StrategyBinary Option Trading Strategy Using Cedar Finance Traders Choice 60 Seconds Strategy

USA Friendly Broker: http://porterfinancecapital.com EU Licensed Broker: http://24optioncapital.com Candlestick Charts: http://www.fxempire.com/charts/live-forex-charts/ HOW TO USE THE SYSTEM Let me explain in detail system: Step Number One: Click on the Binary Options tab, then in Top Picks find EUR/USD check the Traders' Choice column in order to pick the right trading direction e.g. if you see that 69% of traders trade up, you also should trade up. Step Number Two: Chances for winning: 57.4%. Go to 60 seconds tab. First, choose EUR/USD in the box above the chart, then choose your investment amount. And finally choose your trading direction by clicking either CALL (meaning up) or PUT (meaning down). Now just click Start, OK, and wait for the outcome. If your trade is successful, go to step 1 again. If you lose a trade, go to step 3. Step Number Three: Chances for winning: 79.1%. Click the Binary Options tab again and check if the Traders' Choice column didn't change. Once you know in which direction you should trade, go back to 60 seconds and open another trade, this time your investment should be double the amount that you traded in your first trade in order to cover for the amount you've lost in the last trade. THE RULES Adhere to the rules below to increase your chances for success. Rule #1 If the Traders' Choice column indicates that both directions are traded with the same or almost same (even 2% difference) popularity, don't trade - it's too risky. The direction should be obvious in order for you to place any trades. Rule #2 You need to remember to trade quickly, there is no time to waste -- markets fluctuate very quickly. Try to trade in the same pace as I do in my video. Rule #3 Once you choose your trading direction, try to stick to it until you win. Changing the direction in between 3 steps might affect your chances for winning. Rule #4 Every time your trade is successful and before you enter another one remember to check the Traders' Choice column. Cedar Finance: http://cedarfinancecapital.com USA Friendly Broker: http://bosscapitaloptions.com binary option strategies trading binary options trading binary options scam cfd trading forex trading strategies options trading day trading trading stock online options traders banc de binary future trading fx trading futures trading binary options demo currency trading trading software share trading forex trading futures best trading software binary options 101 carbon trading call option binary options wiki trading platforms binary options software free binary options signals put option any option commodities trading trade forex fx options binary stock trading how to trade binary options what is a binary option trade option binary trading scams spread trading binary options uk binary options guide option trading binary option brokers commodities options trading binary trading reviews what are binary options binary options xposed binary options trading signals trading money commodity trading algorithmic trading trading strategies trading options trading tools -

98:34

98:34Option Greeks Part I

Option Greeks Part IOption Greeks Part I

In this Part I series on Option Basics we cover basic option terms and then we explore the basics around the attributes of both calls and puts. In addition, we look at both Long and Short positions using Calls and Puts while also showcasing Profit and Loss Graphs. https://www.traderusergroup.com https://www.traderusergroup.com/ https://www.traderusergroup.com/blog -

3:28

3:28Option Finance : les rencontres du financement de l'économie !

Option Finance : les rencontres du financement de l'économie !Option Finance : les rencontres du financement de l'économie !

Option Finance : les rencontres du financement de l'économie ! Des personnalités telles que Fleur Pellerin, Ministre chargée des Petites et Moyennes Entreprises, de l'Innovation et de l'économie numérique, Nicolase Dufourcq, Directeur général de BPI France, Michel Pébereau, Président d'honneur de PNB Paribas, Jean-Pierre Letartre, Président d'EY en France, Séverin Cabanne, Directeur général délégué de Société Générale ou encore Bernard Cazeneuve, Ministre délégué auprès du ministre de l'Economie et des Finances, chargé du budget étaient présentes ! "L'économie est française est bien financée !" "La crise de 2008 ne vient pas des petites et moyennes entreprises !" http://www.decideurstv.com/video/option-finance-les-rencontres-du-financement-de-leconomie-45950/ -

6:39

6:39Financing your business: the options

Financing your business: the optionsFinancing your business: the options

An overview of business finance and the options available to you. -

24:18

24:18Financial Derivatives - Binomial Option Pricing - The One-Period Model Formula

Financial Derivatives - Binomial Option Pricing - The One-Period Model FormulaFinancial Derivatives - Binomial Option Pricing - The One-Period Model Formula

Series playlist: http://www.youtube.com/playlist?list=PLG59E6Un18vhANdpTHZCFnfj-jwFEqZ0Q&feature;=view_all In this tutorial, I introduce the Binomial Option Pricing Model. The simplest version of this is the one-period model, in which we consider a single time-step before option expiry. The ingredients of this pricing method are models for the behaviour of the stock and a riskless bond over the time-step. The bond earns interest at the risk-free rate, while the stock is assumed to move either up or down by fixed factors. Given an option, I show how to build a replicating portfolio from the bond and stock. The portfolio matches the option values at expiry. By no-arbitrage, today's value of the option must be simply today's value of the portfolio. Finally, I demonstrate that the theoretical option value may be written as a discounted expected future value, provided that we move to the risk-neutral measure, in which the risk-neutral probability q replaces our real-world probability p. [The tutorial is aimed at beginner to intermediate level.]

- Ancient Greece

- Asian option

- Backspread

- Backwardation

- Bank

- Barrier option

- Basis swap

- Bear spread

- Binary option

- Black model

- Black–Scholes

- Bond (finance)

- Bond market

- Bond option

- Bond rating

- Bond valuation

- Box spread

- Bull spread

- Butterfly (options)

- Buy-write

- Calendar spread

- Call option

- Cliquet

- Collar (finance)

- Commodity futures

- Commodity market

- Common stock

- Compound option

- Consumer debt

- Contango

- Convertible bond

- Corporate bond

- Corporate finance

- Correlation swap

- Covered call

- Credit default swap

- Credit derivative

- Credit-linked note

- Currency

- Currency future

- Currency swap

- Debit spread

- Delta neutral

- Derivative (finance)

- Derivatives market

- Diagonal spread

- Discrete

- Dividend swap

- Edward O. Thorp

- Equity derivative

- Equity swap

- Equity-Linked Note

- Eurex

- Euronext.liffe

- Exchange rate

- Exercise (options)

- Exotic option

- Expectation value

- Expiration (options)

- Explicit method

- Fence (finance)

- Finance

- Financial future

- Financial instrument

- Financial market

- Financial regulation

- Fischer Black

- Fixed income

- Forward contract

- Forward market

- Forward price

- Forward rate

- Forward start option

- Fund derivative

- Futures contract

- Futures exchange

- Government bond

- Government debt

- Greeks (finance)

- Hagen Kleinert

- Heston model

- High-yield debt

- Hybrid security

- Implicit method

- Implied volatility

- Index future

- Inflation derivative

- Inflation swap

- Interest rate future

- Interest rate option

- Interest rate swap

- Intermarket Spread

- Investment bank

- Iron condor

- Ito's lemma

- John C. Cox

- Late 2000s recession

- LEAPS (finance)

- Leverage (finance)

- Line of credit

- Lookback option

- Louis Bachelier

- Margin (finance)

- Mark Rubinstein

- Market

- Mathematical model

- Money market

- Moneyness

- Mortgage loan

- Municipal bond

- Myron Scholes

- Nobel Prize

- NYSE Arca

- Olive

- Open interest

- Option (finance)

- Option (law)

- Option strategies

- Option style

- Option symbol

- Options spread

- Options strategies

- Personal finance

- Pin risk

- Pin risk (option)

- PnL Explained

- Preferred stock

- Prepayment of loan

- Price discovery

- Protective put

- Public finance

- Put option

- Put-call parity

- Put–call parity

- Rainbow option

- Ratio spread

- Real estate

- Real estate market

- Registered share

- Reinsurance market

- Richard A. Brealey

- Risk neutral

- Risk reversal

- Risk-free rate

- Robert C. Merton

- Roll-Geske-Whaley

- Secondary markets

- Securities

- Securitization

- Settlement (finance)

- Short rate model

- Single-stock futures

- Spot market

- Stewart Myers

- Stochastic calculus

- Stock

- Stock certificate

- Stock exchange

- Stock market

- Stock option return

- Stock options

- Straddle

- Strangle (options)

- Strike price

- Swap (finance)

- Swaption

- Swedish Central Bank

- Tax policy

- Term sheet

- Thales

- Total return swap

- Tractability

- Tractable

- Trader (finance)

- Trinomial tree

- Underlying

- Valuation of options

- Vanilla option

- Vanna Volga

- Variance swap

- Vertical spread

- Volatility (finance)

- Volatility smile

- Volatility swap

- Voting share

- Warrant (finance)

- William and Mary

-

-

Call Options & Put Options Explained Simply In 8 Minutes (How To Trade Options For Beginners)

How To Trade Options: Calls & Puts Call options & put options are explained simply in this entertaining and informative 8 minute training video which uses 2 cartoon-based scenarios to help you learn how to trade call options and how to trade put options. If you've ever been confused by calls and puts in the past, this video will clear up any confusion you may have had. Also, if you're looking to learn how to trade options, you will learn some simple options trading strategies in this short video. For more training, get my free "dummies" guide to options trading here: http://www.prtradingresearch.com/simple-options-guide-1.php?src=youtube-desc -

17. Options Markets

Financial Markets (2011) (ECON 252) After introducing the core terms and main ideas of options in the beginning of the lecture, Professor Shiller emphasizes two purposes of options, a theoretical and a behavioral purpose. Subsequently, he provides a graphical representation for the value of a call and a put option, and, in this context, addresses the put-call parity for European options. Within the framework of the Binomial Asset Pricing model, he derives the value of a call-option from the no-arbitrage-principle, and, as a continuous-time analogue to this formula, he presents the Black-Scholes Option Pricing formula. He contrasts implied volatility, as represented by the VIX index of the Chicago Board Options Exchange, which uses a different formula in the spirit of Black-Scholes, with t... -

23. Options Markets

Financial Markets (ECON 252) Options introduce an essential nonlineary into portfolio management. They are contracts between buyers and writers, who agree on exercise prices and dates at which the buyer can buy or sell the underlying (such as a stock). Options are priced based on the price and volatility of the underlying asset as well as the duration of the option contract. The Black-Scholes options pricing model is one of the most famous equations in finance and offers a useful first approximation for prices for option contracts. Options exchanges and futures exchanges both are involved in creating a liquid and transparent market for options. Options are not just for stocks; they are also important for other asset classes, such as real estate. 00:00 - Chapter 1. Options Vocabulary ... -

Andrew Lo (MIT) Option Pricing Physics and Finance

The history of Option Pricing, between physics and finance -

Concepts of Options in Finance

This presentation will help you understand how the options market operate, what are the various types of options like call option, put option, etc. The option market operation has been explained through proper examples. -

-

Options and Corporate Finance

Discusses different types of financial options, option pricing, and application of options to corporate finance decisions. -

Finance with Excel: Options Graph

This workbook teaches the user how to build a workbook that will demonstrate the shape of the payoff function for virtually any combination of put and call options. It is useful when teaching or trying to understand the mechanics behind various option strategies such as Butterfly, Collar, and other options strategies. -

Binary Option Trading Strategy Using Cedar Finance Traders Choice 60 Seconds Strategy

USA Friendly Broker: http://porterfinancecapital.com EU Licensed Broker: http://24optioncapital.com Candlestick Charts: http://www.fxempire.com/charts/live-forex-charts/ HOW TO USE THE SYSTEM Let me explain in detail system: Step Number One: Click on the Binary Options tab, then in Top Picks find EUR/USD check the Traders' Choice column in order to pick the right trading direction e.g. if you see that 69% of traders trade up, you also should trade up. Step Number Two: Chances for winning: 57.4%. Go to 60 seconds tab. First, choose EUR/USD in the box above the chart, then choose your investment amount. And finally choose your trading direction by clicking either CALL (meaning up) or PUT (meaning down). Now just click Start, OK, and wait for the outcome. If your trade is successful, go to st... -

Option Greeks Part I

In this Part I series on Option Basics we cover basic option terms and then we explore the basics around the attributes of both calls and puts. In addition, we look at both Long and Short positions using Calls and Puts while also showcasing Profit and Loss Graphs. https://www.traderusergroup.com https://www.traderusergroup.com/ https://www.traderusergroup.com/blog -

Option Finance : les rencontres du financement de l'économie !

Option Finance : les rencontres du financement de l'économie ! Des personnalités telles que Fleur Pellerin, Ministre chargée des Petites et Moyennes Entreprises, de l'Innovation et de l'économie numérique, Nicolase Dufourcq, Directeur général de BPI France, Michel Pébereau, Président d'honneur de PNB Paribas, Jean-Pierre Letartre, Président d'EY en France, Séverin Cabanne, Directeur général délégué de Société Générale ou encore Bernard Cazeneuve, Ministre délégué auprès du ministre de l'Economie et des Finances, chargé du budget étaient présentes ! "L'économie est française est bien financée !" "La crise de 2008 ne vient pas des petites et moyennes entreprises !" http://www.decideurstv.com/video/option-finance-les-rencontres-du-financement-de-leconomie-45950/ -

Financing your business: the options

An overview of business finance and the options available to you. -

Financial Derivatives - Binomial Option Pricing - The One-Period Model Formula

Series playlist: http://www.youtube.com/playlist?list=PLG59E6Un18vhANdpTHZCFnfj-jwFEqZ0Q&feature;=view_all In this tutorial, I introduce the Binomial Option Pricing Model. The simplest version of this is the one-period model, in which we consider a single time-step before option expiry. The ingredients of this pricing method are models for the behaviour of the stock and a riskless bond over the time-step. The bond earns interest at the risk-free rate, while the stock is assumed to move either up or down by fixed factors. Given an option, I show how to build a replicating portfolio from the bond and stock. The portfolio matches the option values at expiry. By no-arbitrage, today's value of the option must be simply today's value of the portfolio. Finally, I demonstrate that the theoretical ... -

Porter Finance Broker Review - U.S Clients AVAILABLE, 200$ MINIMUM DEP

TRY THE BROKER - 200$ MINIMUM DEPOSIT http://www.binaryoptionsproductreview.com/porterbroker Best Current Software - http://www.binaryoptionsproductreview.com/mikeautotrader Best Current Trend Indicator - http://www.binaryoptionsproductreview.com/xetrader My Website - http://www.binaryoptionsproductreview.com My Written Review - http://www.binaryoptionsproductreview.com/binary-options-features/medallion-app-scam-review - FOLLOW US ON SOCIAL MEDIA - FaceBook - https://www.facebook.com/binaryoptionsproductreview Twitter - https://twitter.com/BinaryOpProRe Youtube Channel - https://www.youtube.com/channel/UCZ2ACGjcNWtTXib8jclO_bA - BEST BROKERS - PORTER FINANCE - http://www.binaryoptionsproductreview.com/porterbroker RB OPTIONS - http://www.binaryoptionsproductreview.com/rboptions CHER... -

DERIVATIVES - Forwards, Futures & Options explained nicely!

www.elearnmarkets.com presents Derivatives - Forwards, Futures and Options - Learn from scratch. Understand what is an option, what is forward contract and what is future contract in details. Presented by Elearnmarkets.com For Offline i.e. Classroom Courses, Contact: Ms. Neelam Gupta: - +91-9748222555 neelam@kredentacademy.com For Online Live as well As Recorded classes, Contact: - Ms. Puja Shaw: - +91-9903432255 marketing@kredentacademy.com Quick! Subscribe! ►► http://bit.ly/1RP8RjE Visit Us on Twitter: https://twitter.com/elearnmarkets Join our page on Facebook: https://www.facebook.com/elearnmarkets -

Cedar Finance Binary Options 60 seconds Strategy ~ Winning Secrets For Beginners!

PRACTICE FOR FREE HERE http://bunitd.com/7zy 60 second binary options strategy is a short term trading strategy that makes use of 1 minute chart inorder to forecast the direction of the price after 60 seconds. If implemented correctly 60 seconds binary options strategy could be highly profitable. It is used to place trades at high frequency as the expiry time is very short. Prices for a volatile asset like currency pair could move couple of points in few seconds so you need to act fast as well as you need to make a firm decision regarding the trade direction. That is you need to analyze the markets fast enough to place trade with 1 minute expiry. It is ideal that you test the strategy on a demo account first, inorder to get comfortable with strategy by practising on a risk free account and... -

Option (finance)

In finance, an option is a contract which gives the buyer (the owner) the right, but not the obligation, to buy or sell an underlying asset or instrument at a specified strike price on or before a specified date. The seller has the corresponding obligation to fulfill the transaction – that is to sell or buy – if the buyer (owner) "exercises" the option. The buyer pays a premium to the seller for this right. An option which conveys to the owner the right to buy something at a specific price is referred to as a call; an option which conveys the right of the owner to sell something at a specific price is referred to as a put. Both are commonly traded, but for clarity, the call option is more frequently discussed. Options valuation is a topic of ongoing research in academic and practical finan... -

Porter Finance Review - Free Binary Options System

My favourite trading tool - http://www.freebinaryoptionsystem.com/try-optionbot Free Binary Option System with another binary options broker review. This time, it's UK based, Porter Finance. Is Porter Finance a scam? FBOS reveals all. See the full written review here http://www.freebinaryoptionsystem.com/reviews/porter-finance-review/ -

-

Porter Finance USA Friendly Binary Options Broker For 2016

http://porterfinancecapital.com Porter Finance is the web’s fastest growing binary options trading platform, offering unmatched 1500% maximum returns on digital options. With a fast learning curve, user friendly interface and excellent customer support, Porter Finance offers its traders the best online trading experience on the net. The binary options platform offers a wide variety of currencies, stocks, commodities and indices to trade binary options. In total, Porter Finance offers well over 100 different assets for trading options of all types. Offering one of the most comprehensive trading platforms, every investor is sure to find what he’s looking for at Porter Finance. The company was formed on the principal that knowledge is power and though knowledge comes success. Launched in 201... -

-

Finance: Options and Derivatives

- Order: Reorder

- Duration: 5:12

- Updated: 02 Aug 2011

- views: 5932

Call Options & Put Options Explained Simply In 8 Minutes (How To Trade Options For Beginners)

- Order: Reorder

- Duration: 7:56

- Updated: 10 Dec 2013

- views: 324779

- published: 10 Dec 2013

- views: 324779

17. Options Markets

- Order: Reorder

- Duration: 71:57

- Updated: 05 Apr 2012

- views: 71946

- published: 05 Apr 2012

- views: 71946

23. Options Markets

- Order: Reorder

- Duration: 67:51

- Updated: 20 Nov 2008

- views: 67077

- published: 20 Nov 2008

- views: 67077

Andrew Lo (MIT) Option Pricing Physics and Finance

- Order: Reorder

- Duration: 15:20

- Updated: 25 Mar 2014

- views: 1312

Concepts of Options in Finance

- Order: Reorder

- Duration: 4:59

- Updated: 27 Apr 2010

- views: 869

- published: 27 Apr 2010

- views: 869

American Call Options

- Order: Reorder

- Duration: 3:33

- Updated: 16 Mar 2011

- views: 198199

Options and Corporate Finance

- Order: Reorder

- Duration: 48:03

- Updated: 01 Jul 2015

- views: 220

- published: 01 Jul 2015

- views: 220

Finance with Excel: Options Graph

- Order: Reorder

- Duration: 30:32

- Updated: 19 May 2015

- views: 721

- published: 19 May 2015

- views: 721

Binary Option Trading Strategy Using Cedar Finance Traders Choice 60 Seconds Strategy

- Order: Reorder

- Duration: 6:07

- Updated: 24 Apr 2013

- views: 22397

- published: 24 Apr 2013

- views: 22397

Option Greeks Part I

- Order: Reorder

- Duration: 98:34

- Updated: 28 Oct 2013

- views: 45314

- published: 28 Oct 2013

- views: 45314

Option Finance : les rencontres du financement de l'économie !

- Order: Reorder

- Duration: 3:28

- Updated: 21 Mar 2014

- views: 244

- published: 21 Mar 2014

- views: 244

Financing your business: the options

- Order: Reorder

- Duration: 6:39

- Updated: 02 Oct 2012

- views: 8061

- published: 02 Oct 2012

- views: 8061

Financial Derivatives - Binomial Option Pricing - The One-Period Model Formula

- Order: Reorder

- Duration: 24:18

- Updated: 01 Feb 2013

- views: 16577

- published: 01 Feb 2013

- views: 16577

Porter Finance Broker Review - U.S Clients AVAILABLE, 200$ MINIMUM DEP

- Order: Reorder

- Duration: 12:52

- Updated: 25 Jan 2016

- views: 574

- published: 25 Jan 2016

- views: 574

DERIVATIVES - Forwards, Futures & Options explained nicely!

- Order: Reorder

- Duration: 20:53

- Updated: 29 Jan 2014

- views: 58949

- published: 29 Jan 2014

- views: 58949

Cedar Finance Binary Options 60 seconds Strategy ~ Winning Secrets For Beginners!

- Order: Reorder

- Duration: 10:01

- Updated: 31 Jan 2014

- views: 7477

- published: 31 Jan 2014

- views: 7477

Option (finance)

- Order: Reorder

- Duration: 28:23

- Updated: 03 Aug 2014

- views: 108

- published: 03 Aug 2014

- views: 108

Porter Finance Review - Free Binary Options System

- Order: Reorder

- Duration: 3:54

- Updated: 17 Feb 2015

- views: 4677

- published: 17 Feb 2015

- views: 4677

Consumer Financing Option- Explainer

- Order: Reorder

- Duration: 1:19

- Updated: 31 Jul 2014

- views: 141

Porter Finance USA Friendly Binary Options Broker For 2016

- Order: Reorder

- Duration: 4:29

- Updated: 08 Oct 2015

- views: 1103

- published: 08 Oct 2015

- views: 1103

NEW MILLIONAIRES HOW ARE THEY MAKING THEIR MONEY Documentary Finance Education

- Order: Reorder

- Duration: 57:48

- Updated: 01 Nov 2014

- views: 48338

Call Option as Leverage

- Order: Reorder

- Duration: 3:04

- Updated: 16 Mar 2011

- views: 103132

-

-

IQ Option | Finance App | Trading | Forex

What do people need? Is it a mobile phone? A tablet? People need to communicate, and in today’s society, users expect ubiquitous connection to everything from their remote offices to social media. Our traders want to be able to make money whether they are in an elevator or sitting at a traffic light. It is on this fundamental idea that IQ Option built it’s mobile platform. In the high stakes world of online trading, seconds count. *The difference* What sets the IQ Option App apart? Quite simply, we are different. All aspects of our platform were designed, and developed in house. When IQ Option was conceived, one of the founding principles was that we should never compromise our vision because of technological constraints. We didn’t think about what the platform could do. We thought about ... -

Binary option system and finance review - free binary options system

Full information you can find in our website or here - https://www.facebook.com/traderscom -

Giant Full E+1 2016 0% Finance and Demo Options

Trail adventure just got more exciting. This off-road trail ride combines Giant’s rear suspension expertise with Hybrid power to help you tackle more trails. Featuring 130mm of fully active SmartLink rear suspension, 140mm of front suspension and relaxed off-road trail geometry, you get smooth handling on rough descents and a boost of power on steep climbs. The SyncDrive Yamaha X94 central motor is compact, producing an astonishing 80Nm of torque which gives you an instant and even amount of power. From standstill, the motor gives you full support and the higher torque gives you more power at lower speed, keeping you in control even on the most demanding trails. Available in store at Giant Sheffield, 528 Queens Road, Sheffield, S2 4DU. -

Binary option system - porter finance review - free binary options system

All information you can find here - https://www.facebook.com/traderscom -

Binary option review - finance review - free binary options system

All information you can find here - https://www.facebook.com/traderscom -

Binary option review - finance review - free binary options system

All information you can find here - https://www.facebook.com/traderscom

Option Chain Scraping VBA Yahoo Finance

- Order: Reorder

- Duration: 2:10

- Updated: 03 May 2016

- views: 3

IQ Option | Finance App | Trading | Forex

- Order: Reorder

- Duration: 0:26

- Updated: 03 May 2016

- views: 7

- published: 03 May 2016

- views: 7

Binary option system and finance review - free binary options system

- Order: Reorder

- Duration: 4:41

- Updated: 22 Apr 2016

- views: 0

- published: 22 Apr 2016

- views: 0

Giant Full E+1 2016 0% Finance and Demo Options

- Order: Reorder

- Duration: 1:08

- Updated: 18 Apr 2016

- views: 36

- published: 18 Apr 2016

- views: 36

Binary option system - porter finance review - free binary options system

- Order: Reorder

- Duration: 4:27

- Updated: 07 Apr 2016

- views: 0

- published: 07 Apr 2016

- views: 0

Binary option review - finance review - free binary options system

- Order: Reorder

- Duration: 4:41

- Updated: 07 Apr 2016

- views: 0

- published: 07 Apr 2016

- views: 0

Binary option review - finance review - free binary options system

- Order: Reorder

- Duration: 4:20

- Updated: 06 Apr 2016

- views: 0

- published: 06 Apr 2016

- views: 0

-

What are options and covered warrants? - MoneyWeek Investment Tutorials

Options and covered warrants are two derivative products that have proved in recent times. Here, Tim Bennett explains what they are and the risks of using them. Visit http://moneyweek.com/youtube for extra videos not found on YouTube. MoneyWeek videos are designed to help you become a better investor, and to give you a better understanding of the markets. They’re aimed at both beginners and more experienced investors. In all our videos we explain things in an easy-to-understand way. Some videos are about important ideas and concepts. Others are about investment stories and themes in the news. The emphasis is on clarity and brevity. We don’t want to waste your time with a 20-minute video that could easily be so much shorter. Related links… - What are futures? http://moneyweek.com... -

What are futures? - MoneyWeek Investment Tutorials

What are futures? Tim Bennett explains the key features and basic principles of futures, which, alongside swaps, options and covered warrants, make up the derivatives market. Related links… - What are derivatives? https://www.youtube.com/watch?v=Wjlw7ZpZVK4 - What are options and covered warrants? https://www.youtube.com/watch?v=3196NpHDyec - What are futures? https://www.youtube.com/watch?v=nwR5b6E0Xo4 - What is a swap? https://www.youtube.com/watch?v=uVq384nqWqg - Why you should avoid structured products https://www.youtube.com/watch?v=Umx5ShOz2oU MoneyWeek videos are designed to help you become a better investor, and to give you a better understanding of the markets. They’re aimed at both beginners and more experienced investors. In all our videos we explain things in an easy-to-un... -

-

-

-

-

Financing Options for Real Estate Investors

-

The Alchemy of Finance by George Soros Full Audiobook

New chapter by Soros on the secrets to his success along with a new Preface and Introduction. New Foreword by renowned economist Paul Volcker "An extraordinary inside look into the decision-making process of the most successful money manager of our time. Fantastic." -The Wall Street Journal George Soros is unquestionably one of the most powerful and profitable investors in the world today. Dubbed by Business Week as "the Man who Moves Markets," Soros made a fortune competing with the British pound and remains active today in the global financial community. Now, in this special edition of the classic investment book, The Alchemy of Finance, Soros presents a theoretical and practical account of current financial trends and a new paradigm by which to understand the financial market today. Thi... -

Mediatwits #169: Can the Kiva Micro-Finance Option Help Journalists?

Kiva has been a star in online micro-finance for the past 10 years, and co-founder Jessica Jackley was a driving force that led to more than $744 million in micro-loans around the world, with an astounding 98% repayment rate. After leaving, Jackley went on to found the pioneering crowd-financing site for entrepreneurs, ProFounder, which was ahead of its time. Recently, Jackley recounted those efforts in the memoir, “Clay Water Brick,” an inspirational and instructional book for entrepreneurs around the world. But can micro-finance and crowdfunding work in journalism and media, where business models are in flux? We’ve seen a lot of crowdfunding in journalism, from TV shows to magazines to podcasts, such as the Radiotopia network. And there have been smaller efforts such as Spot.us, with dir... -

Financial Derivatives: Probability that Call Option Will Expire Into Money

Calculation of the probability that call option on the stock will expire into money. We assume that return on the stock follows Geometric Brownian motion (GMB). I recommend: 1. Neil Chriss, Black-Scholes and Beyond 2. John Hull, Options, Futures, and Other Derivatives 3. http://youtube.com/bionicturtledotcom --- If you like this video please subscribe to this channel and vorojtsov newletter at http://www.vorojtsov.net Thank you! --- -

MBA Intro Finance: 2. Option Valuation

Lecture 2 of Global Financial Management. 1st year MBA Finance. Recorded on November 2, 1995. Syllabus at: http://www.duke.edu/~charvey/Classes/ba350/SYL350.HTM The screen shots are of: http://www.duke.edu/~charvey/Classes/ba350/optval/optval.htm -

20. Option Price and Probability Duality

MIT 18.S096 Topics in Mathematics with Applications in Finance, Fall 2013 View the complete course: http://ocw.mit.edu/18-S096F13 Instructor: Stephen Blythe This guest lecture focuses on option price and probability duality. License: Creative Commons BY-NC-SA More information at http://ocw.mit.edu/terms More courses at http://ocw.mit.edu -

Global Finance 10 Currency Options

-

Career Opportunities in Finance and Financial Markets By Elearnmarkets.com

Learn about various aspects of finance and career opportunities for Students who are looking to make their career in financial markets. Speaker here is Mr.Vivek Bajaj. He is the Founder & Director of Kredent Academy & www.elearnmarkets.com. He has experience of more than 10 years as a trader - successfully implementing his option strategies in the currency & commodities market. Presented by Elearnmarkets.com. For Offline i.e. Classroom Courses, Contact: Ms. Neelam Gupta: - +91-9748222555 neelam@kredentacademy.com For Online Live as well As Recorded classes, Contact: - Ms. Puja Shaw: - +91-9903432255 marketing@kredentacademy.com Quick! Subscribe! ►► http://bit.ly/1RP8RjE Visit Us on Twitter: https://twitter.com/elearnmarkets Join our page on Facebook: https://www.facebook.com/elearnmark...

What are options and covered warrants? - MoneyWeek Investment Tutorials

- Order: Reorder

- Duration: 21:53

- Updated: 26 Aug 2011

- views: 100779

- published: 26 Aug 2011

- views: 100779

What are futures? - MoneyWeek Investment Tutorials

- Order: Reorder

- Duration: 20:30

- Updated: 30 Sep 2011

- views: 271824

- published: 30 Sep 2011

- views: 271824

Ses 10: Forward and Futures Contracts II & Options I

- Order: Reorder

- Duration: 79:50

- Updated: 10 May 2013

- views: 26210

Ses 11: Options II

- Order: Reorder

- Duration: 58:53

- Updated: 10 May 2013

- views: 18186

Ses 12: Options III & Risk and Return I

- Order: Reorder

- Duration: 67:01

- Updated: 10 May 2013

- views: 20997

Corporate Finance: Lecture - 009, Options

- Order: Reorder

- Duration: 33:55

- Updated: 21 Nov 2015

- views: 31

Financing Options for Real Estate Investors

- Order: Reorder

- Duration: 34:14

- Updated: 19 Sep 2013

- views: 5106

- published: 19 Sep 2013

- views: 5106

The Alchemy of Finance by George Soros Full Audiobook

- Order: Reorder

- Duration: 168:46

- Updated: 19 Apr 2014

- views: 46295

- published: 19 Apr 2014

- views: 46295

Mediatwits #169: Can the Kiva Micro-Finance Option Help Journalists?

- Order: Reorder

- Duration: 26:09

- Updated: 21 Aug 2015

- views: 113

- published: 21 Aug 2015

- views: 113

Financial Derivatives: Probability that Call Option Will Expire Into Money

- Order: Reorder

- Duration: 52:06

- Updated: 15 Aug 2008

- views: 53070

- published: 15 Aug 2008

- views: 53070

MBA Intro Finance: 2. Option Valuation

- Order: Reorder

- Duration: 119:50

- Updated: 05 Sep 2012

- views: 498

- published: 05 Sep 2012

- views: 498

20. Option Price and Probability Duality

- Order: Reorder

- Duration: 80:29

- Updated: 06 Jan 2015

- views: 7153

- published: 06 Jan 2015

- views: 7153

Global Finance 10 Currency Options

- Order: Reorder

- Duration: 38:10

- Updated: 07 Oct 2015

- views: 303

- published: 07 Oct 2015

- views: 303

Career Opportunities in Finance and Financial Markets By Elearnmarkets.com

- Order: Reorder

- Duration: 70:07

- Updated: 13 May 2015

- views: 937

- published: 13 May 2015

- views: 937

- Playlist

- Chat

- Playlist

- Chat

Finance: Options and Derivatives

- Report rights infringement

- published: 02 Aug 2011

- views: 5932

Call Options & Put Options Explained Simply In 8 Minutes (How To Trade Options For Beginners)

- Report rights infringement

- published: 10 Dec 2013

- views: 324779

17. Options Markets

- Report rights infringement

- published: 05 Apr 2012

- views: 71946

23. Options Markets

- Report rights infringement

- published: 20 Nov 2008

- views: 67077

Andrew Lo (MIT) Option Pricing Physics and Finance

- Report rights infringement

- published: 25 Mar 2014

- views: 1312

Concepts of Options in Finance

- Report rights infringement

- published: 27 Apr 2010

- views: 869

American Call Options

- Report rights infringement

- published: 16 Mar 2011

- views: 198199

Options and Corporate Finance

- Report rights infringement

- published: 01 Jul 2015

- views: 220

Finance with Excel: Options Graph

- Report rights infringement

- published: 19 May 2015

- views: 721

Binary Option Trading Strategy Using Cedar Finance Traders Choice 60 Seconds Strategy

- Report rights infringement

- published: 24 Apr 2013

- views: 22397

Option Greeks Part I

- Report rights infringement

- published: 28 Oct 2013

- views: 45314

Option Finance : les rencontres du financement de l'économie !

- Report rights infringement

- published: 21 Mar 2014

- views: 244

Financing your business: the options

- Report rights infringement

- published: 02 Oct 2012

- views: 8061

Financial Derivatives - Binomial Option Pricing - The One-Period Model Formula

- Report rights infringement

- published: 01 Feb 2013

- views: 16577

- Playlist

- Chat

Option Chain Scraping VBA Yahoo Finance

- Report rights infringement

- published: 03 May 2016

- views: 3

IQ Option | Finance App | Trading | Forex

- Report rights infringement

- published: 03 May 2016

- views: 7

Binary option system and finance review - free binary options system

- Report rights infringement

- published: 22 Apr 2016

- views: 0

Giant Full E+1 2016 0% Finance and Demo Options

- Report rights infringement

- published: 18 Apr 2016

- views: 36

Binary option system - porter finance review - free binary options system

- Report rights infringement

- published: 07 Apr 2016

- views: 0

Binary option review - finance review - free binary options system

- Report rights infringement

- published: 07 Apr 2016

- views: 0

Binary option review - finance review - free binary options system

- Report rights infringement

- published: 06 Apr 2016

- views: 0

- Playlist

- Chat

What are options and covered warrants? - MoneyWeek Investment Tutorials

- Report rights infringement

- published: 26 Aug 2011

- views: 100779

What are futures? - MoneyWeek Investment Tutorials

- Report rights infringement

- published: 30 Sep 2011

- views: 271824

Ses 10: Forward and Futures Contracts II & Options I

- Report rights infringement

- published: 10 May 2013

- views: 26210

Ses 11: Options II

- Report rights infringement

- published: 10 May 2013

- views: 18186

Ses 12: Options III & Risk and Return I

- Report rights infringement

- published: 10 May 2013

- views: 20997

Corporate Finance: Lecture - 009, Options

- Report rights infringement

- published: 21 Nov 2015

- views: 31

Financing Options for Real Estate Investors

- Report rights infringement

- published: 19 Sep 2013

- views: 5106

The Alchemy of Finance by George Soros Full Audiobook

- Report rights infringement

- published: 19 Apr 2014

- views: 46295

Mediatwits #169: Can the Kiva Micro-Finance Option Help Journalists?

- Report rights infringement

- published: 21 Aug 2015

- views: 113

Financial Derivatives: Probability that Call Option Will Expire Into Money

- Report rights infringement

- published: 15 Aug 2008

- views: 53070

MBA Intro Finance: 2. Option Valuation

- Report rights infringement

- published: 05 Sep 2012

- views: 498

20. Option Price and Probability Duality

- Report rights infringement

- published: 06 Jan 2015

- views: 7153

Global Finance 10 Currency Options

- Report rights infringement

- published: 07 Oct 2015

- views: 303

Career Opportunities in Finance and Financial Markets By Elearnmarkets.com

- Report rights infringement

- published: 13 May 2015

- views: 937

Pakistan oppose military action against Afghan Taliban leaders in its soil

Edit Khaama Press 04 May 2016Apple loses Chinese court fight over use of iPhone name

Edit Belfast Telegraph 04 May 2016[VIDEO]: Angry Woman Confronts Man Using Food Stamps At Walmart

Edit WorldNews.com 03 May 2016Kerry Sets Aug. 1 Deadline For New Syrian Government Or Vows New U.S. Action

Edit WorldNews.com 03 May 2016Kent State Massacre Also Massacred U.S. Constitution

Edit WorldNews.com 04 May 2016Gatekeeper Appoints Technology Veteran and Former VP Finance of Haywood Securities, Robert C. Hill, to ...

Edit Stockhouse 04 May 2016RGU gearing up for Postgraduate Open Evening (Robert Gordon University)

Edit Public Technologies 04 May 2016Kesselrun Resources Grants Stock Options

Edit Stockhouse 04 May 2016Pakistan may study other fighter aircraft options, US told

Edit Dawn 04 May 2016Form 8.5 (EPT/NON-RI)Deutsche Borse AG (ISE - The Irish Stock Exchange plc)

Edit Public Technologies 04 May 2016Consumer demand will fuel GCC financial technology growth

Edit The National 04 May 2016Form 8 (DD) - Deutsche Borse AG (ISE - The Irish Stock Exchange plc)

Edit Public Technologies 04 May 2016Eurobond Market Seen Shut for Russia as Sanctions Relief Far Off

Edit Bloomberg 04 May 2016Lateral Gold Announces Proposed RTO Transaction with CANHaul International

Edit Stockhouse 04 May 2016Diana Containerships Inc. Announces Time Charter Contract for m/v Puelo With MSC

Edit Stockhouse 04 May 2016Movie News

Edit IMDb 04 May 2016Quarterly Cash Flow Report (Jervois Mining Limited)

Edit Public Technologies 04 May 2016Ringgit Slumps With Won as Lockhart Comment Sparks Dollar Rally

Edit Bloomberg 04 May 2016- 1

- 2

- 3

- 4

- 5

- Next page »