- published: 31 May 2012

- views: 7979

-

remove the playlistDue Diligence

- remove the playlistDue Diligence

- published: 10 Feb 2011

- views: 58818

- published: 25 Aug 2012

- views: 4836

- published: 11 Jul 2014

- views: 1134

- published: 06 Mar 2009

- views: 19243

- published: 05 Dec 2014

- views: 4251

- published: 14 May 2007

- views: 28138

- published: 23 Sep 2012

- views: 5763

- published: 28 Jan 2015

- views: 1066

- published: 23 Jan 2014

- views: 1008

"Due diligence" is a term used for a number of concepts involving either an investigation of a business or person prior to signing a contract, or an act with a certain standard of care. It can be a legal obligation, but the term will more commonly apply to voluntary investigations. A common example of due diligence in various industries is the process through which a potential acquirer evaluates a target company or its assets for acquisition.

The term "due diligence" first came into common use as a result of the United States' Securities Act of 1933.

This Act included a defence at Sec. 11, referred to as the "Due Diligence" defence, which could be used by broker-dealers when accused of inadequate disclosure to investors of material information with respect to the purchase of securities.

As long as broker-dealers exercised "due diligence" in their investigation into the company whose equity they were selling, and disclosed to the investor what they found, they would not be held liable for non-disclosure of information that was not discovered in the process of that investigation.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

6:44

6:44Due Diligence, What is it and What to expect

Due Diligence, What is it and What to expectDue Diligence, What is it and What to expect

Join Amanda Reale from Pacific Business Brokers Inc. to learn why Due Diligence is so critical in the purchase and sale of a business, what the different Due Diligence segments are and what to look for whether you are a buyer preparing to buy or a seller preparing to sell. -

77:36

77:36Private Equity: The Consolidation Play and Due Diligence - John Poerink, Linley Capital

Private Equity: The Consolidation Play and Due Diligence - John Poerink, Linley CapitalPrivate Equity: The Consolidation Play and Due Diligence - John Poerink, Linley Capital

A consolidation play looks like an easy winner in the private equity world. Roll up a number of companies in the same industry and you've got scale and pricing power, among other good things. There's just one problem -- such plays are really hard to pull off. Due diligence is the key, the more thorough the better. But even then, surprises can lurk and assumptions can prove wrong. For more on this class session, see: http://knowledge.wharton.upenn.edu/pe/class-05.cfm -

1:37

1:37Due Diligence Meaning

Due Diligence MeaningDue Diligence Meaning

An Easy Overview Of Due Diligence Created under Creative Commons: http://en.wikipedia.org/wiki/Due_diligence -

8:48

8:48Due diligence checklist

Due diligence checklistDue diligence checklist

How to use this due diligence checklist - download free here http://www.nickbettes.co.uk/download-due-diligence-checklist/ -

9:29

9:29Due Diligence During the M&A; Process - Part 1

Due Diligence During the M&A; Process - Part 1Due Diligence During the M&A; Process - Part 1

Information as Currency - Why a Seller Short-changes Due Diligence at its own Peril. George P. Shenas, Esq. hosts Marcus H. Klebe, Esq., Attorney with George P. Shenas, Incorporated. George asks Marcus about the importance of due diligence in M&A; transactions, and Marcus begins by defining due diligence and then explaining how undertaking a systematic review of ones own enterprise gives a seller leverage during subsequent negotiations. Marcus and George encourage the full and honest disclosure of facts, even unfavorable ones, as part of the process the key is placing all facts in their proper context, and painting a comprehensive picture of the enterprise that will hold up under close scrutiny and yet secure the highest possible purchase price. Marcus emphasizes the need to maintain the buyers confidence throughout the due diligence process, because trust is an essential component to speedy and mutually-favorable negotiations. George and Marcus agree that any financial or other projections relayed by the seller at the outset of the M&A; negotiations must be met, or preferably exceeded, during the weeks and months leading up to closing in order to avoid the risk of significant price erosion. -

30:01

30:01Secretarial Audit, Compliance and Due Diligence for CS Professional by Siddharth Academy

Secretarial Audit, Compliance and Due Diligence for CS Professional by Siddharth AcademySecretarial Audit, Compliance and Due Diligence for CS Professional by Siddharth Academy

Secretarial Audit, Compliance Management and Due Diligence by Vandita Doshi -

2:55

2:55Due Diligence

Due Diligence -

12:22

12:22Due Diligence

Due DiligenceDue Diligence

Due Diligence outlines the safety responsibilities of employers, supervisors, and workers. Using clips from WCB videos and commercials, Due Diligence vividly portrays the human cost of workplace accidents. -

3:10

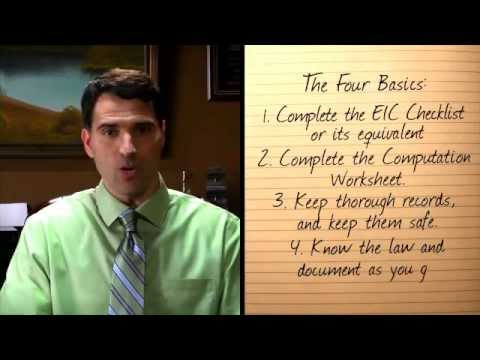

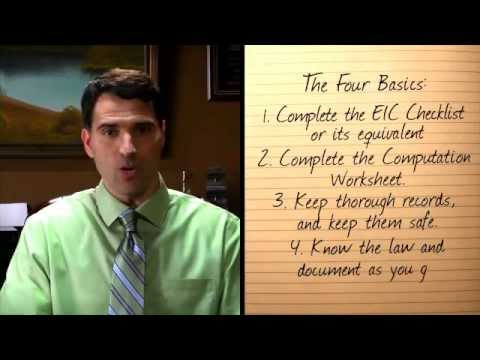

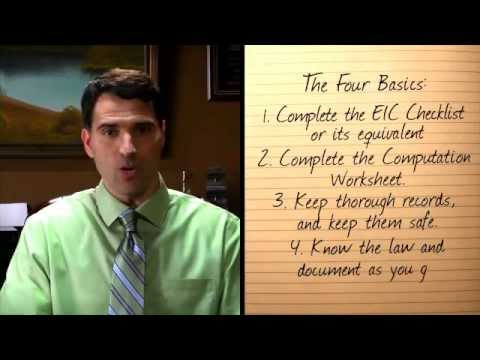

3:10Tax Preparation - Part 1 - IRS EITC Due Diligence Video Series

Tax Preparation - Part 1 - IRS EITC Due Diligence Video SeriesTax Preparation - Part 1 - IRS EITC Due Diligence Video Series

The Preparer walks through the four basics of EITC due diligence, and how tax preparers can ensure they are following IRS requirements in The Case for Due Diligence. NOTE: This video was produced by the IRS, which is solely responsible for its content. The information presented was current as of the date of publication but may now, in whole or in part, be invalid. EasyFile Software is providing this material for the convenience of current and future customers and makes no guarantees as to the accuracy or validity of the material presented. -

26:58

26:58The due diligence process

The due diligence processThe due diligence process

-

6:54

6:54Financial Due Diligence

Financial Due DiligenceFinancial Due Diligence

To ensure your deal is completed smoothly, it is vital to have a thorough due diligence report – here is our Corporate Finance Associate Director, Ben Williamson, with more details. -

17:20

17:20Understanding operational due diligence - a case study. Chapter 1 - Management entities.

Understanding operational due diligence - a case study. Chapter 1 - Management entities.Understanding operational due diligence - a case study. Chapter 1 - Management entities.

Understanding operational due diligence - a case study. Chapter 1 - Management entities. -

4:08

4:08What are your obligations in relation to Customer Due Diligence

What are your obligations in relation to Customer Due DiligenceWhat are your obligations in relation to Customer Due Diligence

In this video we cover Customer Due Diligence, also known as CDD. Along with record keeping and suspicious transaction reporting, CDD is a cornerstone of preventing money laundering and terrorist financing. -

33:23

33:23Understanding operational due diligence - a case study. Introduction.

Understanding operational due diligence - a case study. Introduction.Understanding operational due diligence - a case study. Introduction.

Understanding operational due diligence - a case study. Introduction.

- Administrative law

- Admiralty law

- Aksjeselskap

- Aktiebolag

- Aktiengesellschaft

- Aktieselskab

- Ansvarlig selskap

- Attornment

- Aviation law

- Bank regulation

- Bankruptcy

- Benefit corporation

- Bias ratio (finance)

- Broker-dealer

- Building code

- Bureaucracy

- Business

- C corporation

- Canon law

- Case law

- Category Law

- Chinese law

- Civil procedure

- Civil society

- CMBS

- Commercial law

- Common law

- Companies law

- Company

- Comparative law

- Competition law

- Conflict of laws

- Constitution

- Constitutional law

- Consumer protection

- Contract

- Cooperative

- Corporate governance

- Corporation

- Criminal law

- Criminal procedure

- Custodian bank

- Custom (law)

- Cyberlaw

- Data Room

- Decree

- Due diligence

- Edict

- Election commission

- Election law

- Energy law

- Entertainment law

- Environmental law

- Equity (law)

- Evidence (law)

- Exculpatory evidence

- Executive order

- Family law

- Financial regulation

- Foreign official

- General partnership

- Halakha

- Health law

- Hedge fund

- HVAC

- Immigration law

- Integrity Management

- John Ruggie

- Judiciary

- Jurisprudence

- Kabushiki gaisha

- Know your customer

- Labour law

- Law

- Law and economics

- Law of obligations

- Lawyer

- Legal history

- Legal theory

- Legislature

- Limited company

- Limited liability

- Limited partnership

- Mens rea

- Military

- Military justice

- Model audit

- Nevada corporation

- OECD

- Osakeyhtiö

- Outline of law

- Partnership

- Personal service

- Police

- Portal Law

- Precedent

- Procedural law

- Procurement

- Product liability

- Property law

- Proprietary company

- Public law

- Public liability

- Restitution

- Rochdale Principles

- Roman law

- Rulemaking

- S corporation

- S.A. (corporation)

- Securities

- Series LLC

- Sharia

- Socialist law

- Sociology of law

- Sole proprietorship

- Sources of law

- Space law

- Special assessments

- Sports law

- Standard of care

- Statute

- Statutory law

- Stock

- Strict liability

- Superfund

- Talk Due diligence

- Tax law

- Template Law

- Template talk Law

- Title insurance

- Tort

- Trust law

- Ultra vires

- United States

- Unjust enrichment

- Unlimited company

- Virtual Data Room

- Will (law)

- Xeer

- Zoning

-

Due Diligence, What is it and What to expect

Join Amanda Reale from Pacific Business Brokers Inc. to learn why Due Diligence is so critical in the purchase and sale of a business, what the different Due Diligence segments are and what to look for whether you are a buyer preparing to buy or a seller preparing to sell. -

Private Equity: The Consolidation Play and Due Diligence - John Poerink, Linley Capital

A consolidation play looks like an easy winner in the private equity world. Roll up a number of companies in the same industry and you've got scale and pricing power, among other good things. There's just one problem -- such plays are really hard to pull off. Due diligence is the key, the more thorough the better. But even then, surprises can lurk and assumptions can prove wrong. For more on this class session, see: http://knowledge.wharton.upenn.edu/pe/class-05.cfm -

Due Diligence Meaning

An Easy Overview Of Due Diligence Created under Creative Commons: http://en.wikipedia.org/wiki/Due_diligence -

Due diligence checklist

How to use this due diligence checklist - download free here http://www.nickbettes.co.uk/download-due-diligence-checklist/ -

Due Diligence During the M&A; Process - Part 1

Information as Currency - Why a Seller Short-changes Due Diligence at its own Peril. George P. Shenas, Esq. hosts Marcus H. Klebe, Esq., Attorney with George P. Shenas, Incorporated. George asks Marcus about the importance of due diligence in M&A; transactions, and Marcus begins by defining due diligence and then explaining how undertaking a systematic review of ones own enterprise gives a seller leverage during subsequent negotiations. Marcus and George encourage the full and honest disclosure of facts, even unfavorable ones, as part of the process the key is placing all facts in their proper context, and painting a comprehensive picture of the enterprise that will hold up under close scrutiny and yet secure the highest possible purchase price. Marcus emphasizes the need to maintain the... -

Secretarial Audit, Compliance and Due Diligence for CS Professional by Siddharth Academy

Secretarial Audit, Compliance Management and Due Diligence by Vandita Doshi -

-

Due Diligence

Due Diligence outlines the safety responsibilities of employers, supervisors, and workers. Using clips from WCB videos and commercials, Due Diligence vividly portrays the human cost of workplace accidents. -

Tax Preparation - Part 1 - IRS EITC Due Diligence Video Series

The Preparer walks through the four basics of EITC due diligence, and how tax preparers can ensure they are following IRS requirements in The Case for Due Diligence. NOTE: This video was produced by the IRS, which is solely responsible for its content. The information presented was current as of the date of publication but may now, in whole or in part, be invalid. EasyFile Software is providing this material for the convenience of current and future customers and makes no guarantees as to the accuracy or validity of the material presented. -

The due diligence process

-

Financial Due Diligence

To ensure your deal is completed smoothly, it is vital to have a thorough due diligence report – here is our Corporate Finance Associate Director, Ben Williamson, with more details. -

Understanding operational due diligence - a case study. Chapter 1 - Management entities.

Understanding operational due diligence - a case study. Chapter 1 - Management entities. -

What are your obligations in relation to Customer Due Diligence

In this video we cover Customer Due Diligence, also known as CDD. Along with record keeping and suspicious transaction reporting, CDD is a cornerstone of preventing money laundering and terrorist financing. -

Understanding operational due diligence - a case study. Introduction.

Understanding operational due diligence - a case study. Introduction. -

How to Do Your Due Diligence on A New Business

http://www.absystems.com Join Patrick Phillips, Founder and CEO of American Business Systems and Eric Ogea, Director of Research and Development as they discuss why and how you should do your due diligence on a new business before investing. Important details on: - How to check out the company - Funding your new business - Should you "pre-market" to test your marketplace? - How to do a market analysis - The importance of taking to current owners - How to check out the industry - Should you plan a visit? - How to build a business plan - Ask to see a live "demo" ...and more. -

Vidéo Technique - Une Due Diligence par un Consultant en Transaction Services

Un Consultant en Transaction Services décortique un exemple de Due Diligence http://www.wallfinance.com -

D is for Due Diligence - The Elite Investor Club's A - Z of Investing

Join the Elite Investor Club here at - http://www.eliteinvestorclub.com/ We’ve reached the letter D in the Elite Investor Club A-Z of investing. Once again it’s a really important topic and it applies to every single investment you ever make. And I have double the value for you in this episode, because I have two Ds that stand for Due Diligence. You’re probably aware that we can’t give advice here at Elite Investor Club. We can introduce you to some extraordinary investments in the portfolio section of the website, but you have to do your own research and make your own decision about whether they are right for you. That research is called due diligence. It’s a lawyer’s term that simply means satisfying yourself that the potential rewards of a given investment justify whatever you regard ... -

M&A; Process Step 3: Due Diligence

Originally presented at our Using Acquisitions as a Growth Strategy seminar, this short video clip looks at step three in the M&A; process: due diligence. Due diligence determines whether the risks associated with the transaction outweigh the potential benefits and helps you assess whether you should move forward with the transaction. -

Applying Enhanced Due Diligence to High Risk Customers What's Going Here sample

Financial institutions' Customer Due Diligence and Extended Due Diligence programs are coming under increased scrutiny to ensure their ability to identify not only activity that might involve money laundering or terrorist financing. The effectiveness of your institution's CDD program and the EDD procedures you employ to monitor high-risk customers for potentially suspicious activity is now more important than ever before. -

Mitigating risks while doing due diligence

Learn more at PwC.com - http://pwc.to/16JJjMD As companies look to grow through deals, it's crucial that business leaders know where the specter of dispute tends to reside in the M&A; process. PwC Partner Patricia Etzold asks the questions they need answers to in this informative interview with Transaction Services Partner Brian Vickrey and Kevin Kreb, PwC Forensic Services Partner, who discuss key risk areas, due diligence, and the importance of accounting methods and the legal language within purchase agreements. -

Video #10 - FINANCIAL DUE DILIGENCE

This is part of a 50 video series on mergers & acquisitions. www.isabellabrusati.com -

Fico nevie čo je to due diligence (Takže Tak, zostrih z 21.Februára 2016)

Dokumentárny film o hrubej nekompetentnosti vlády SR pri udeľovaní investičných stimulov. http://www.rudovasky.com -

venture capital seminar adam claypool on due diligence 640x424

Due Diligence, What is it and What to expect

- Order: Reorder

- Duration: 6:44

- Updated: 31 May 2012

- views: 7979

- published: 31 May 2012

- views: 7979

Private Equity: The Consolidation Play and Due Diligence - John Poerink, Linley Capital

- Order: Reorder

- Duration: 77:36

- Updated: 10 Feb 2011

- views: 58818

- published: 10 Feb 2011

- views: 58818

Due Diligence Meaning

- Order: Reorder

- Duration: 1:37

- Updated: 25 Aug 2012

- views: 4836

- published: 25 Aug 2012

- views: 4836

Due diligence checklist

- Order: Reorder

- Duration: 8:48

- Updated: 11 Jul 2014

- views: 1134

- published: 11 Jul 2014

- views: 1134

Due Diligence During the M&A; Process - Part 1

- Order: Reorder

- Duration: 9:29

- Updated: 06 Mar 2009

- views: 19243

- published: 06 Mar 2009

- views: 19243

Secretarial Audit, Compliance and Due Diligence for CS Professional by Siddharth Academy

- Order: Reorder

- Duration: 30:01

- Updated: 05 Dec 2014

- views: 4251

- published: 05 Dec 2014

- views: 4251

Due Diligence

- Order: Reorder

- Duration: 2:55

- Updated: 05 Jul 2013

- views: 5158

Due Diligence

- Order: Reorder

- Duration: 12:22

- Updated: 14 May 2007

- views: 28138

- published: 14 May 2007

- views: 28138

Tax Preparation - Part 1 - IRS EITC Due Diligence Video Series

- Order: Reorder

- Duration: 3:10

- Updated: 23 Sep 2012

- views: 5763

- published: 23 Sep 2012

- views: 5763

The due diligence process

- Order: Reorder

- Duration: 26:58

- Updated: 31 Aug 2012

- views: 8000

- published: 31 Aug 2012

- views: 8000

Financial Due Diligence

- Order: Reorder

- Duration: 6:54

- Updated: 28 Jan 2015

- views: 1066

- published: 28 Jan 2015

- views: 1066

Understanding operational due diligence - a case study. Chapter 1 - Management entities.

- Order: Reorder

- Duration: 17:20

- Updated: 23 Jan 2014

- views: 1008

- published: 23 Jan 2014

- views: 1008

What are your obligations in relation to Customer Due Diligence

- Order: Reorder

- Duration: 4:08

- Updated: 03 Jul 2015

- views: 1136

- published: 03 Jul 2015

- views: 1136

Understanding operational due diligence - a case study. Introduction.

- Order: Reorder

- Duration: 33:23

- Updated: 14 Jan 2014

- views: 2819

- published: 14 Jan 2014

- views: 2819

How to Do Your Due Diligence on A New Business

- Order: Reorder

- Duration: 53:40

- Updated: 22 Apr 2015

- views: 296

- published: 22 Apr 2015

- views: 296

Vidéo Technique - Une Due Diligence par un Consultant en Transaction Services

- Order: Reorder

- Duration: 4:40

- Updated: 10 Feb 2011

- views: 4049

- published: 10 Feb 2011

- views: 4049

D is for Due Diligence - The Elite Investor Club's A - Z of Investing

- Order: Reorder

- Duration: 5:05

- Updated: 25 Jun 2015

- views: 388

- published: 25 Jun 2015

- views: 388

M&A; Process Step 3: Due Diligence

- Order: Reorder

- Duration: 8:04

- Updated: 02 Apr 2014

- views: 946

- published: 02 Apr 2014

- views: 946

Applying Enhanced Due Diligence to High Risk Customers What's Going Here sample

- Order: Reorder

- Duration: 10:04

- Updated: 23 Dec 2013

- views: 1361

- published: 23 Dec 2013

- views: 1361

Mitigating risks while doing due diligence

- Order: Reorder

- Duration: 5:07

- Updated: 20 Mar 2013

- views: 1095

- published: 20 Mar 2013

- views: 1095

Video #10 - FINANCIAL DUE DILIGENCE

- Order: Reorder

- Duration: 4:36

- Updated: 28 Aug 2012

- views: 1283

- published: 28 Aug 2012

- views: 1283

Fico nevie čo je to due diligence (Takže Tak, zostrih z 21.Februára 2016)

- Order: Reorder

- Duration: 19:39

- Updated: 23 Feb 2016

- views: 6010

- published: 23 Feb 2016

- views: 6010

venture capital seminar adam claypool on due diligence 640x424

- Order: Reorder

- Duration: 35:43

- Updated: 03 Feb 2013

- views: 281

- published: 03 Feb 2013

- views: 281

- Playlist

- Chat

- Playlist

- Chat

Due Diligence, What is it and What to expect

- Report rights infringement

- published: 31 May 2012

- views: 7979

Private Equity: The Consolidation Play and Due Diligence - John Poerink, Linley Capital

- Report rights infringement

- published: 10 Feb 2011

- views: 58818

Due Diligence Meaning

- Report rights infringement

- published: 25 Aug 2012

- views: 4836

Due diligence checklist

- Report rights infringement

- published: 11 Jul 2014

- views: 1134

Due Diligence During the M&A; Process - Part 1

- Report rights infringement

- published: 06 Mar 2009

- views: 19243

Secretarial Audit, Compliance and Due Diligence for CS Professional by Siddharth Academy

- Report rights infringement

- published: 05 Dec 2014

- views: 4251

Due Diligence

- Report rights infringement

- published: 05 Jul 2013

- views: 5158

Due Diligence

- Report rights infringement

- published: 14 May 2007

- views: 28138

Tax Preparation - Part 1 - IRS EITC Due Diligence Video Series

- Report rights infringement

- published: 23 Sep 2012

- views: 5763

The due diligence process

- Report rights infringement

- published: 31 Aug 2012

- views: 8000

Financial Due Diligence

- Report rights infringement

- published: 28 Jan 2015

- views: 1066

Understanding operational due diligence - a case study. Chapter 1 - Management entities.

- Report rights infringement

- published: 23 Jan 2014

- views: 1008

What are your obligations in relation to Customer Due Diligence

- Report rights infringement

- published: 03 Jul 2015

- views: 1136

Understanding operational due diligence - a case study. Introduction.

- Report rights infringement

- published: 14 Jan 2014

- views: 2819

North Korea 'fires submarine-launched ballistic missile'

Edit BBC News 23 Apr 2016'Adorable' Prince George wows Obama in pyjamas

Edit Deccan Herald 23 Apr 2016Saudi Arabia may be in for a nasty shock when Obama steps down

Edit The Independent 22 Apr 20163 kids survive slaying of 8 family members in Ohio

Edit CNN 23 Apr 2016Brazil president vows trade bloc appeal if ousted

Edit Taipei Times 23 Apr 2016Quarterly Report - March 2016 (Altona Mining Limited)

Edit Public Technologies 24 Apr 2016JNU footage: Delhi government takes three TV channels to court

Edit Yahoo Daily News 24 Apr 2016Surprise goaltenders make big impacts on playoffs' 1st round

Edit Boston Herald 24 Apr 2016Delhi govt takes three TV channels to court

Edit Indian Express 24 Apr 2016In high court, Uttarakhand assembly speaker seeks dismissal of rebels' plea

Edit The Times of India 23 Apr 2016Rebels violated defection law, dismiss their petition: Speaker to HC

Edit The Times of India 23 Apr 2016EC Working with local Assemblies to clean voter's register

Edit Peace FM Online 23 Apr 2016Activists submit 21-point checklist for new BRTS

Edit The Times of India 23 Apr 2016Maccagnan: Jets Inquired About No. 1 Overall Selection (New York Jets)

Edit Public Technologies 23 Apr 2016Mosaic Capital Corporation Reports Annual 2015 Financial Results

Edit Stockhouse 23 Apr 2016Jets GM on Fitzpatrick negotiations: It'll work itself out (NFL - National Football League)

Edit Public Technologies 22 Apr 2016Jets tried QB draft power play amid Ryan Fitzpatrick standstill

Edit New York Post 22 Apr 2016Funding Update (Herencia Resources plc)

Edit Public Technologies 22 Apr 2016- 1

- 2

- 3

- 4

- 5

- Next page »