71:12

Structured Finance, Lecture 2 - Credit Derivatives - Part 1

Introduction to Credit derivatives and Credit Default Swaps. Dr. Krassimir Petrov, AUBG Pr...

published: 25 Apr 2011

author: kmpetrov

Structured Finance, Lecture 2 - Credit Derivatives - Part 1

Structured Finance, Lecture 2 - Credit Derivatives - Part 1

Introduction to Credit derivatives and Credit Default Swaps. Dr. Krassimir Petrov, AUBG Professor: Krassimir Petrov, Ph. D.- published: 25 Apr 2011

- views: 10744

- author: kmpetrov

10:57

Credit Default Swaps

Learn more: http://www.khanacademy.org/video?v=a1lVOO9Y080 Introduction to credit default ...

published: 28 Sep 2008

author: khanacademy

Credit Default Swaps

Credit Default Swaps

Learn more: http://www.khanacademy.org/video?v=a1lVOO9Y080 Introduction to credit default swaps.- published: 28 Sep 2008

- views: 244637

- author: khanacademy

10:13

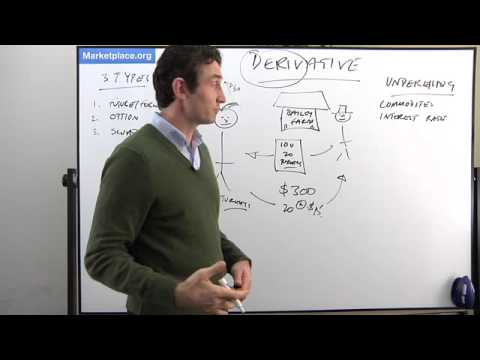

Derivatives

Credit default swaps? Theyre complicated -- and scary! The receipt you get when you pre-or...

published: 15 Oct 2009

author: APM Marketplace

Derivatives

Derivatives

Credit default swaps? Theyre complicated -- and scary! The receipt you get when you pre-order your Thanksgiving turkey? Not so much. But they have a lot in c...- published: 15 Oct 2009

- views: 128475

- author: APM Marketplace

71:10

Structured Finance, Lecture 3 - Credit Derivatives, Part 2

Provides a survey of all major credit derivative instruments - credit default swaps, credi...

published: 25 Apr 2011

author: kmpetrov

Structured Finance, Lecture 3 - Credit Derivatives, Part 2

Structured Finance, Lecture 3 - Credit Derivatives, Part 2

Provides a survey of all major credit derivative instruments - credit default swaps, credit default options, indemnity agreements, total return swaps, credit...- published: 25 Apr 2011

- views: 6611

- author: kmpetrov

5:08

Credit Default Swaps explained clearly in five minutes

BBC Newsnight feature by Alex Ritson on Credit Default Swaps - until recently a little-kno...

published: 17 Oct 2008

author: thebigscreen

Credit Default Swaps explained clearly in five minutes

Credit Default Swaps explained clearly in five minutes

BBC Newsnight feature by Alex Ritson on Credit Default Swaps - until recently a little-known financial product that Lehmans Brothers, AIG and the Icelandic b...- published: 17 Oct 2008

- views: 149835

- author: thebigscreen

87:19

CFA Level II 2013 - Reading 53 - Credit Derivatives: An Overview

We believe that we offer the most comprehensive, thorough and easy-to-understand study mat...

published: 19 Apr 2013

author: Elanguidesvideos

CFA Level II 2013 - Reading 53 - Credit Derivatives: An Overview

CFA Level II 2013 - Reading 53 - Credit Derivatives: An Overview

We believe that we offer the most comprehensive, thorough and easy-to-understand study materials for the CFA exams. That is why we are offering you some of o...- published: 19 Apr 2013

- views: 1226

- author: Elanguidesvideos

3:54

Warren Buffett on the Selling of Credit Insurance, AIG and Risks

In finance, a credit derivative refers to any one of "various instruments and techniques d...

published: 19 Sep 2013

Warren Buffett on the Selling of Credit Insurance, AIG and Risks

Warren Buffett on the Selling of Credit Insurance, AIG and Risks

In finance, a credit derivative refers to any one of "various instruments and techniques designed to separate and then transfer the credit risk" of the underlying loan. It is a securitized derivative whereby the credit risk is transferred to an entity other than the lender. Where credit protection is bought and sold between bilateral counterparties, this is known as an unfunded credit derivative. If the credit derivative is entered into by a financial institution or a special purpose vehicle (SPV) and payments under the credit derivative are funded using securitization techniques, such that a debt obligation is issued by the financial institution or SPV to support these obligations, this is known as a funded credit derivative. This synthetic securitization process has become increasingly popular over the last decade, with the simple versions of these structures being known as synthetic CDOs; credit-linked notes; single tranche CDOs, to name a few. In funded credit derivatives, transactions are often rated by rating agencies, which allows investors to take different slices of credit risk according to their risk appetite. The market in credit derivatives started from nothing in 1993 after having been pioneered by J.P. Morgan's Peter Hancock.[5] By 1996 there was around $40 billion of outstanding transactions, half of which involved the debt of developing countries.[1] Credit default products are the most commonly traded credit derivative product[6] and include unfunded products such as credit default swaps and funded products such as collateralized debt obligations (see further discussion below). On May 15, 2007, in a speech concerning credit derivatives and liquidity risk, Geithner stated: "Financial innovation has improved the capacity to measure and manage risk." [7] The ISDA[8] reported in April 2007 that total notional amount on outstanding credit derivatives was $35.1 trillion with a gross market value of $948 billion (ISDA's Website). As reported in The Times on September 15, 2008, the "Worldwide credit derivatives market is valued at $62 trillion".[9] Although the credit derivatives market is a global one, London has a market share of about 40%, with the rest of Europe having about 10%.[6] The main market participants are banks, hedge funds, insurance companies, pension funds, and other corporates.[6] Credit derivatives are fundamentally divided into two categories: funded credit derivatives and unfunded credit derivatives. An unfunded credit derivative is a bilateral contract between two counterparties, where each party is responsible for making its payments under the contract (i.e. payments of premiums and any cash or physical settlement amount) itself without recourse to other assets. A funded credit derivative involves the protection seller (the party that assumes the credit risk) making an initial payment that is used to settle any potential credit events. (The protection buyer, however, still may be exposed to the credit risk of the protection seller itself. This is known as counterparty risk.) Unfunded credit derivative products include the following products: Credit default swap (CDS) Total return swap Constant maturity credit default swap (CMCDS) First to Default Credit Default Swap Portfolio Credit Default Swap Secured Loan Credit Default Swap Credit Default Swap on Asset Backed Securities Credit default swaption Recovery lock transaction Credit Spread Option CDS index products Funded credit derivative products include the following products: Credit linked note (CLN) Synthetic collateralized debt obligation (CDO) Constant Proportion Debt Obligation (CPDO) Synthetic Constant Proportion Portfolio Insurance (Synthetic CPPI) http://en.wikipedia.org/wiki/Credit_derivative- published: 19 Sep 2013

- views: 11

1:26

Warren Buffett: Derivatives As Financial Instruments, Credit Default Swaps, Auto Insurance

A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will ...

published: 03 Aug 2013

author: The Film Archive

Warren Buffett: Derivatives As Financial Instruments, Credit Default Swaps, Auto Insurance

Warren Buffett: Derivatives As Financial Instruments, Credit Default Swaps, Auto Insurance

A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a loan default or other credit...- published: 03 Aug 2013

- views: 114

- author: The Film Archive

0:03

Credit Derivative Strategies New Thinking on Managing Risk and Return скача

Найти Credit Derivative Strategies: New Thinking on Managing Risk and Return можно вот тут...

published: 01 Dec 2013

Credit Derivative Strategies New Thinking on Managing Risk and Return скача

Credit Derivative Strategies New Thinking on Managing Risk and Return скача

Найти Credit Derivative Strategies: New Thinking on Managing Risk and Return можно вот тут http://tinyurl.com/nhh3glj. Автор книги- published: 01 Dec 2013

- views: 0

2:49

The Problem with Derivatives: Dangerous Financial Instruments & Auditing - Warren Buffett

A derivative is a financial instrument which derives its value from the value of underlyin...

published: 27 Jul 2013

author: The Film Archive

The Problem with Derivatives: Dangerous Financial Instruments & Auditing - Warren Buffett

The Problem with Derivatives: Dangerous Financial Instruments & Auditing - Warren Buffett

A derivative is a financial instrument which derives its value from the value of underlying entities such as an asset, index, or interest rate—it has no intr...- published: 27 Jul 2013

- views: 444

- author: The Film Archive

10:32

MAX KEISER: PEAK GULF OIL SPILL, PEAK OTC CREDIT DERIVATIVES 6-1-2010

This is what happens when the reason for the Collapse of the Federal Reserve System is dis...

published: 01 Jun 2010

author: traynickel

MAX KEISER: PEAK GULF OIL SPILL, PEAK OTC CREDIT DERIVATIVES 6-1-2010

MAX KEISER: PEAK GULF OIL SPILL, PEAK OTC CREDIT DERIVATIVES 6-1-2010

This is what happens when the reason for the Collapse of the Federal Reserve System is discussed on Russian Television. http://executees.net/- published: 01 Jun 2010

- views: 3531

- author: traynickel

62:36

Investment Banking and Structured Finance - 02/16 - Pricing of credit derivatives (Part 1)

Investment Banking and Structured Finance 02 - Pricing of credit derivatives (Part 1) Prof...

published: 28 May 2009

author: UniBocconi

Investment Banking and Structured Finance - 02/16 - Pricing of credit derivatives (Part 1)

Investment Banking and Structured Finance - 02/16 - Pricing of credit derivatives (Part 1)

Investment Banking and Structured Finance 02 - Pricing of credit derivatives (Part 1) Prof. Andrea Fabbri The course focuses on the business of structured fi...- published: 28 May 2009

- views: 6931

- author: UniBocconi

Vimeo results:

3:05

Muñeca - Short Film (2013)

A grim tale of hidden undercurrents: desires, fears, manipulation, and animal instincts vi...

published: 28 Jun 2013

author: Sergio Herencias

Muñeca - Short Film (2013)

A grim tale of hidden undercurrents: desires, fears, manipulation, and animal instincts vie with each other in a maelstrom of passions and pitfalls. In some of the ideas and images, dream merges with reality. The result is portrayed as a hall of mirrors, with female oppression and male dominance and egocentricity.

The narrative is based on the fear and bewilderment of the main character’s nightmare, interacting with her deep-rooted fear of her own, subconscious lusts. A pretty young woman, driven by the sadism of an egomaniac and her own, apparently unwilling oppression, mutates into a human marionette, «muñeca».

She seeks oblivion, attempts to flee from herself, her experiences, and her dreams. One of her acquaintances – a real person – becomes a symbol of evil in a bizarre dream and drags her soul into a yawning chasm of fear and humiliation. Her inner power struggle begins. Will she find an exit? What is reality, and what is surreal?

THE MEANING OF «Muñeca»

It is as famous as Grimms’ Fairy Tales and is a standard character of both the miniature and big stage: the puppet called «muñeca» (spanish) or marionette.

Its origin does not lie in the puppet theater or in politics. No, the marionette, whose limbs are moved by strings, actually has its roots in Catholicism. Its name is derived from the French term mariolette, the diminutive of mariole, the figure of the Virgin Mary so popular in the Middle Ages. The marionette is therefore, to some extent, the great-great-grandchild of the Blessed Virgin.

-----------------------------

SYNOPSIS (German)

Eine düstere Geschichte über das tief verborgenen Kräftespiel zwischen Wünschen, Angst, Manipulation und animalischen Trieben – Gedankenbilder die manchmal Traum und Wirklichkeit verschmelzen lassen - ein Laboratorium der Leidenschaften und Abgründe. Dargestellt als Spiegelkabinett mit weiblicher Unterwerfung und männlicher Dominanz und Egozentrik.

Die Erzählweise lehnt sich an die Angst und Verstörung eines Alptraums der Hauptfigur, in Komplementarität mit der Urangst vor seinem eigenen, unterbewussten, lustvollen Begehren. Eine junge, schöne Frau, die durch den Sadismus eines Egomanen und ihrer augenscheinlich unfreiwilligen Unterwerfung zur menschlichen Marionette - „Muneca“ - mutiert.

Sie sucht das Vergessen, versucht zu fliehen - vor sich selbst, Ihren Erlebnissen und Träumen. Eine reale, ihr bekannte Person wird zum Sinnbild des Bösen in einem bizarren Traum und reisst Ihre Seele in einen tiefen Schlund aus Angst und Demütigung. Ihr innerer Kampf der Mächte beginnt - findet sie einen Ausweg? Was ist wahrhaftig - und was irreal?

BEDEUTUNG «Muñeca»

Sie ist so bekannt wie die Märchen der Gebrüder Grimm und zählt zum Stammpersonal der kleinen und grossen Bühne: Die Puppe «Muñeca» (w, spanisch) oder „Marionette“ genannt.

Ihr Ursprung hat nichts mit Puppentheater oder Politik zu tun, nein: Die Marionette, jene bewegliche, an Fäden aufgehängte Gliederpuppe, kommt vielmehr aus dem Katholizismus. Ihr Name stammt vom französischen „mariolette“, dem Diminutiv von „mario“, jener im Mittelalter so beliebten Marienfigur. Die Marionette ist also gewissermassen die Urenkelin der heiligen Maria.

-----------------------------

CREDITS

Written & Directed by Sergio Herencias

Produced by: Sinneszellen

in Association with: Guave Motion

Senior Producer: Michelle Edelmann

Co-Producer: Sergio Herencias

Cast

Nathalie Schwander ( http://fotogen.ch/models/1005-nathalie-s-0.aspx )

Vladimir Mitrovic

Tamara Maritz

Simone Auderset

Director of Photography: Sergio Herencias

1st Assistant DP: Oliver Muff

Styling AD & Wardrobe: Michelle Edelmann

Assistant to Director: Bruce Pimenta & Francis Pimenta

Hair & Make-up Design: Michelle Edelmann

Best Boy: Patricia Frei, Francis Pimenta, Bruce Pimenta

Light & Grip Technician: Oliver Muff

Editor: Sergio Herencias

VFX Artist: David Fritsche

Senior Digital Colorist: Stefan King

Title Design: Debby Bürgisser

Sound Design: Sergio Herencias

Special Thanks to: Cello & Cyrill Weiss

Shot on Red Epic

www.sinneszellen.com

www.guavemotion.com

www.sergioherencias.com

-----------------------------

ACCOLADES AND AWARDS

- 2013 - Nomination Best Cinematography at the 1st Malta Horror FilmFestival

- 2013 - Int. Fashion Film Network / Top 10 — Rank #3

- 2013 - Official Selection LCFF 2013 London City Int. Film Festival

- 2013 - Official Selection FILMZ 2013 Festival des deutschen Kinos

2:07

One - Pete Philly [official video]

Credits:

Collaboration Pablo Delfos & Niek Pulles

(Art) Director: Pablo Delfos

Design: Ni...

published: 16 Jan 2012

author: HEYNIEK

One - Pete Philly [official video]

Credits:

Collaboration Pablo Delfos & Niek Pulles

(Art) Director: Pablo Delfos

Design: Niek Pulles

http://www.manjaotten.com

-------------------------------------------------------

DOP: Tobias Pekelharing

AC: Suraj ‘Paco’ Kumar

Editors: Taco Potma & Rigel Kilston

Grading: Taco Potma (Circus Family)

-------------------------------------------------------

Special thanks to:

De Grot

http://www.degrot.com/

Circus Family

http://www.circus.fm/

Clothing: ONTOUR

http://ontour.nl

TAX-videclipfonds

-------------------------------------------------------

Artist: PETE PHILLY

www.petephilly.com

-------------------------------------------------------

www.heyniek.com

www.pablodelfos.com

Pete Philly's - ONE- by Pablo Delfos & Niek Pulles is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Unported License.

Based on a work at www.cakexmanjaotten.com.

Permissions beyond the scope of this license may be available at http://www.cakexmanjaotten.com/pablo-delfos/music-video/pete-philly/.

10:13

Derivatives

Credit default swaps? They’re complicated -- and scary! The receipt you get when you pre-o...

published: 15 Oct 2009

author: Marketplace

Derivatives

Credit default swaps? They’re complicated -- and scary! The receipt you get when you pre-order your Thanksgiving turkey? Not so much. But they have a lot in common: They’re both derivatives. Senior Editor Paddy Hirsch explains. More coverage of the financial crisis is at marketplace.org/financialcrisis

0:00

SEX strip tease COMEDY Watch Free Movie Online boy who never slept

This movie has been RELEASED for FREE online as one of the first full length OPEN SOURCE M...

published: 23 May 2006

author: solomonrothman

SEX strip tease COMEDY Watch Free Movie Online boy who never slept

This movie has been RELEASED for FREE online as one of the first full length OPEN SOURCE MOVIES!!! Watch and download the entire Movie for FREE along with the source files at:

http://www.solomonrothman.com/boywhoneverslept

Boy Who Never Slept is a free full length movie that anyone can watch, share, and even use in their own derivative works (open source). It%u2019s a sexy dramatic comedy that centers on the life of an insomniac writer who meets a teenage girl online and a friendship that grows into an unlikely love story wrapped in harsh reality.

More free movies are in the works. If you would like to support more free films please visit:

http://www.solomonrothman.com/boywhoneverslept

Donate a $1 and put your name in the credits of my next movie and get a link off my website!!!

Some words that describe this movie include: comedy sex drama dramatic sexy love strip tease alcohol drama love boy girl teen hot chick story drunk naked nude date girls teenage party dance and writer.

I hope you enjoy my work and if you don't, remember it was free.

Youtube results:

11:45

Professor Malick - Credit Derivatives @ Department of Statistics.wmv

In-House Corporate Training @ Department of Statistics by Professor Malick (PhD Finance) o...

published: 26 Nov 2010

author: aventisbaruch

Professor Malick - Credit Derivatives @ Department of Statistics.wmv

Professor Malick - Credit Derivatives @ Department of Statistics.wmv

In-House Corporate Training @ Department of Statistics by Professor Malick (PhD Finance) on Credit Derivatives and Financial Instruments. Find out more about...- published: 26 Nov 2010

- views: 245

- author: aventisbaruch

7:38

Shadow Banking, Criminality in Credit Default Swaps, Non-Transparent Derivative Products

UNEDITED CUT: Where is the criminal activity behind selling non-transparent derivative pro...

published: 11 Mar 2012

author: Mark Melin

Shadow Banking, Criminality in Credit Default Swaps, Non-Transparent Derivative Products

Shadow Banking, Criminality in Credit Default Swaps, Non-Transparent Derivative Products

UNEDITED CUT: Where is the criminal activity behind selling non-transparent derivative products? What is the fallacy behind Credit Default Swaps (CDS). Will ...- published: 11 Mar 2012

- views: 580

- author: Mark Melin

10:00

Explaining Credit Default Swaps (1/10)

Listen or download at http://itsrainmakingtime.com/2010/creditdefaultswaps/ Many of us bel...

published: 08 Sep 2011

author: ItsRainmakingTime

Explaining Credit Default Swaps (1/10)

Explaining Credit Default Swaps (1/10)

Listen or download at http://itsrainmakingtime.com/2010/creditdefaultswaps/ Many of us believe that a financial instrument called a credit default swap is to...- published: 08 Sep 2011

- views: 293

- author: ItsRainmakingTime

2:26

"TOO BIG TO JAIL SCAM" WON'T BE OUT THERE FOREVER!

Thirteen of the world's biggest "investment banks" were accused by the European Union of c...

published: 08 Jul 2013

author: ZeroPoint2013

"TOO BIG TO JAIL SCAM" WON'T BE OUT THERE FOREVER!

"TOO BIG TO JAIL SCAM" WON'T BE OUT THERE FOREVER!

Thirteen of the world's biggest "investment banks" were accused by the European Union of colluding to curb competition in the $10 trillion "credit derivative...- published: 08 Jul 2013

- views: 70

- author: ZeroPoint2013