- published: 05 Jul 2013

- views: 175910

- published: 22 Feb 2013

- views: 154882

- published: 23 Sep 2014

- views: 32624

- published: 16 Feb 2014

- views: 55621

- published: 17 Feb 2014

- views: 31372

- published: 29 Jan 2015

- views: 18817

- published: 21 Feb 2014

- views: 17140

- published: 10 Apr 2014

- views: 22902

- published: 26 Feb 2016

- views: 16897

- Loading...

-

10:50

10:50How to value a company using discounted cash flow (DCF) - MoneyWeek Investment Tutorials

How to value a company using discounted cash flow (DCF) - MoneyWeek Investment TutorialsHow to value a company using discounted cash flow (DCF) - MoneyWeek Investment Tutorials

Every investor should have a basic grasp of the discounted cash flow (DCF) technique. Here, Tim Bennett explains what DCF is and explains how you can use it to value a company. Visit http://moneyweek.com/youtube for extra videos not found on YouTube. MoneyWeek videos are designed to help you become a better investor, and to give you a better understanding of the markets. They’re aimed at both beginners and more experienced investors. In all our videos we explain things in an easy-to-understand way. Some videos are about important ideas and concepts. Others are about investment stories and themes in the news. The emphasis is on clarity and brevity. We don’t want to waste your time with a 20-minute video that could easily be so much shorter. Related links: - The six numbers every investor should know... http://moneyweek.com/videos/video-tutorial-six-numbers-every-investor-should-know-13201/ - MoneyWeek's favourite valuation ratio: https://www.youtube.com/watch?v=FwxJYH5DcAI - What is enterprise value? https://www.youtube.com/watch?v=Au15IrXW4iU - How to value a company using net assets https://www.youtube.com/watch?v=rV68zoBKTJE - How to value a company using multiples https://www.youtube.com/watch?v=g4_eKPJmy1E -

11:07

11:07Financial Modeling Quick Lesson: Building a Discounted Cash Flow (DCF) Model - Part 1

Financial Modeling Quick Lesson: Building a Discounted Cash Flow (DCF) Model - Part 1Financial Modeling Quick Lesson: Building a Discounted Cash Flow (DCF) Model - Part 1

Learn the building blocks of a simple one-page discounted cash flow (DCF) model consistent with the best practices you would find in investment banking. If you are preparing for investment banking interviews, know that the DCF is the source of a TON of investment banking interview questions. To download the backup Excel file, go to www.wallstreetprep.com/blog/financial-modeling-quick-lesson-building-a-discounted-cash-flow-dcf-model-part-1/ The DCF modeled here is a simplified version of a fully-integrated DCF model. For a deeper dive into DCF modeling in Excel, please visit www.wallstreetprep.com. -

17:56

17:56WACC, Cost of Equity, and Cost of Debt in a DCF

WACC, Cost of Equity, and Cost of Debt in a DCFWACC, Cost of Equity, and Cost of Debt in a DCF

In this WACC and Cost of Equity tutorial, you'll learn how changes to assumptions in a DCF impact variables like the Cost of Equity, Cost of Debt. By http://breakingintowallstreet.com/ "Financial Modeling Training And Career Resources For Aspiring Investment Bankers" You'll also learn about WACC (Weighted Average Cost of Capital) - and why it is not always so straightforward to answer these questions in interviews. Table of Contents: 2:22 Why Everything is Interrelated 4:22 Summary of Factors That Impact a DCF 6:37 Changes to Debt Percentages in the Capital Structure 11:38 The Risk-Free Rate, Equity Risk Premium, and Beta 12:49 The Tax Rate 14:55 Recap and Summary Why Do WACC, the Cost of Equity, and the Cost of Debt Matter? This is a VERY common interview question: "If a company goes from 10% debt to 30% debt, does its WACC increase or decrease?" "What if the Risk-Free Rate changes? How is everything else impacted?" "What if the company is bigger / smaller?" Plus, you need to use these concepts on the job all the time when valuing companies… these "costs" represent your opportunity cost from investing in a specific company, and you use them to evaluate that company's cash flows and determine how much the company is worth to you. EX: If you can get a 10% yield by investing in other, similar companies in this market, you'd evaluate this company's cash flows against that 10% "discount rate"… …and if this company's debt, tax rate, or overall size changes, you better know how the discount rate also changes! It could easily change the company's value to you, the investor. The Most Important Concept… Everything is interrelated - in other words, more debt will impact BOTH the equity AND the debt investors! Why? Because additional leverage makes the company riskier for everyone involved. The chance of bankruptcy is higher, so the "cost" even to the equity investors increases. AND: Other variables like the Risk-Free Rate will end up impacting everything, including Cost of Equity and Cost of Debt, because both of them are tied to overall interest rates on "safe" government bonds. Tricky: Some changes only make an impact when a company actually has debt (changes to the tax rate), and you can't always predict how the value derived from a DCF will change in response to this. Changes to the DCF Analysis and the Impact on Cost of Equity, Cost of Debt, WACC, and Implied Value: Smaller Company: Cost of Debt, Equity, and WACC are all higher. Bigger Company: Cost of Debt, Equity, and WACC are all lower. * Assuming the same capital structure percentages - if the capital structure is NOT the same, this could go either way. Emerging Market: Cost of Debt, Equity, and WACC are all higher. No Debt to Some Debt: Cost of Equity and Cost of Debt are higher. WACC is lower at first, but eventually higher. Some Debt to No Debt: Cost of Equity and Cost of Debt are lower. It's impossible to say how WACC changes because it depends on where you are in the "U-shaped curve" - if you're above the debt % that minimizes WACC, WACC will decrease. Otherwise, if you're at that minimum or below it, WACC will increase. Higher Risk-Free Rate: Cost of Equity, Debt, and WACC are all higher; they're all lower with a lower Risk-Free Rate. Higher Equity Risk Premium and Higher Beta: Cost of Equity is higher, and so is WACC; Cost of Debt doesn't change in a predictable way in response to these. When these are lower, Cost of Equity and WACC are both lower. Higher Tax Rate: Cost of Equity, Debt, and WACC are all lower; they're higher when the tax rate is lower. ** Assumes the company has debt - if it does not, taxes don't make an impact because there is no tax benefit to interest paid on debt. -

18:16

18:16Discounted Cash Flow (Part 1 of 2): Valuation

Discounted Cash Flow (Part 1 of 2): ValuationDiscounted Cash Flow (Part 1 of 2): Valuation

In this vide, I discuss the Discounted Cash Flow, or DCF, Model as an approach to estimating the intrinsic value of a company's stock. I review the theoretical motivation behind the model and discuss the model's required inputs, assumptions, and forecasts. I walk through building a basic implementation of the DCF model in Microsoft Excel. Part 2 of the video (http://youtu.be/ijpPg8eAhv4) shows the application of the basic Excel DCF model to a real firm, including illustrations of where to find data to support the inputs, assumptions, and forecasts. The music is "Gnomone a Piacere" by MAT64 (http://www.mat64.org/). -

29:18

29:18Discounted Cash Flow (Part 2 of 2): DCF Applied to a Real Firm

Discounted Cash Flow (Part 2 of 2): DCF Applied to a Real FirmDiscounted Cash Flow (Part 2 of 2): DCF Applied to a Real Firm

This video follows Part 1 (available here: http://youtu.be/77ivvN2Uk28), which reviewed the basics of a DCF Model, including how to program a basic model in an Excel spreadsheet. This video illustrates a Discounted Cash Flow Model applied to a real firm. In particular, I discuss the various sources that help inform the inputs, assumptions, and forecasts for the DCF model, including freely available sources on the web, as well as Bloomberg Professional. Disclaimer: This video is for educational purposes only. It is not investment advice. It is not intended to recommend either positively or negatively the company that is used in the illustrative example. The music is "Gnomone a Piacere" by MAT64 (http://www.mat64.org/). -

86:16

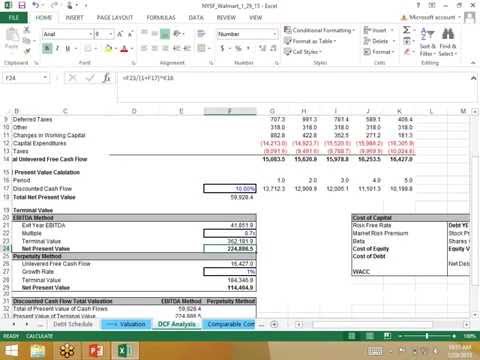

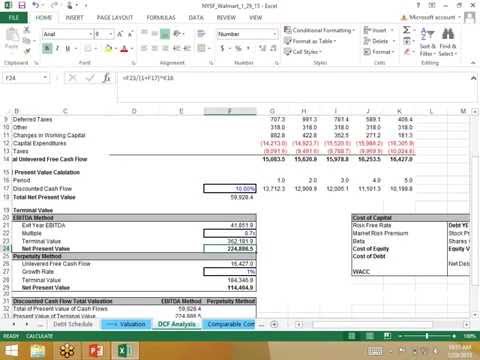

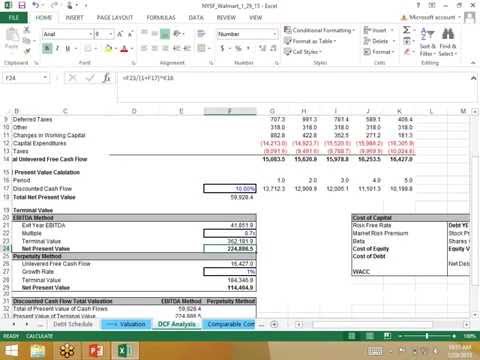

86:16Valuation and Discounted Cash Flow Analysis (DCF)

Valuation and Discounted Cash Flow Analysis (DCF)Valuation and Discounted Cash Flow Analysis (DCF)

Here's a quick overview on Valuation. We also construct an entire discounted cash flow analysis on WalMart in conjunction with my book Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private Equity http://www.amazon.com/Financial-Modeling-Valuation-Practical-Investment/dp/1118558766/ref=sr_1_8?ie=UTF8&qid;=1422553204&sr;=8-8&keywords;=valuation -

4:29

4:29What is Discounted Cash Flow (DCF)?

What is Discounted Cash Flow (DCF)?What is Discounted Cash Flow (DCF)?

An overview of what Discounted Cash Flow is, how to work it out and how it can be used by organisations. -

3:52

3:52DCF - JOHN CUSACK

DCF - JOHN CUSACKDCF - JOHN CUSACK

https://twitter.com/princeDCF https://www.facebook.com/princeDCF https://soundcloud.com/princeDCF Directed by: DCF & Nicole Powell Produced by: Nicole Powell http://partparcelco.com in collaboration with DollFace Films DOP: Jackson Parrell Art Director: Thea Hollatz Edited by: Katy Maravala -

6:41

6:41Kansas DCF caught on camera kidnapping infant

Kansas DCF caught on camera kidnapping infantKansas DCF caught on camera kidnapping infant

For the full story, go to: http://kansasexposed.org/2016/02/25/kansas-dcf-caught-on-camera-kidnapping-infant/ -

8:13

8:13Child Protective Investigators: A Day in the Life

Child Protective Investigators: A Day in the Life

-

How to value a company using discounted cash flow (DCF) - MoneyWeek Investment Tutorials

Every investor should have a basic grasp of the discounted cash flow (DCF) technique. Here, Tim Bennett explains what DCF is and explains how you can use it to value a company. Visit http://moneyweek.com/youtube for extra videos not found on YouTube. MoneyWeek videos are designed to help you become a better investor, and to give you a better understanding of the markets. They’re aimed at both beginners and more experienced investors. In all our videos we explain things in an easy-to-understand way. Some videos are about important ideas and concepts. Others are about investment stories and themes in the news. The emphasis is on clarity and brevity. We don’t want to waste your time with a 20-minute video that could easily be so much shorter. Related links: - The six numbers every inv... -

Financial Modeling Quick Lesson: Building a Discounted Cash Flow (DCF) Model - Part 1

Learn the building blocks of a simple one-page discounted cash flow (DCF) model consistent with the best practices you would find in investment banking. If you are preparing for investment banking interviews, know that the DCF is the source of a TON of investment banking interview questions. To download the backup Excel file, go to www.wallstreetprep.com/blog/financial-modeling-quick-lesson-building-a-discounted-cash-flow-dcf-model-part-1/ The DCF modeled here is a simplified version of a fully-integrated DCF model. For a deeper dive into DCF modeling in Excel, please visit www.wallstreetprep.com. -

WACC, Cost of Equity, and Cost of Debt in a DCF

In this WACC and Cost of Equity tutorial, you'll learn how changes to assumptions in a DCF impact variables like the Cost of Equity, Cost of Debt. By http://breakingintowallstreet.com/ "Financial Modeling Training And Career Resources For Aspiring Investment Bankers" You'll also learn about WACC (Weighted Average Cost of Capital) - and why it is not always so straightforward to answer these questions in interviews. Table of Contents: 2:22 Why Everything is Interrelated 4:22 Summary of Factors That Impact a DCF 6:37 Changes to Debt Percentages in the Capital Structure 11:38 The Risk-Free Rate, Equity Risk Premium, and Beta 12:49 The Tax Rate 14:55 Recap and Summary Why Do WACC, the Cost of Equity, and the Cost of Debt Matter? This is a VERY common interview question: "If a compan... -

Discounted Cash Flow (Part 1 of 2): Valuation

In this vide, I discuss the Discounted Cash Flow, or DCF, Model as an approach to estimating the intrinsic value of a company's stock. I review the theoretical motivation behind the model and discuss the model's required inputs, assumptions, and forecasts. I walk through building a basic implementation of the DCF model in Microsoft Excel. Part 2 of the video (http://youtu.be/ijpPg8eAhv4) shows the application of the basic Excel DCF model to a real firm, including illustrations of where to find data to support the inputs, assumptions, and forecasts. The music is "Gnomone a Piacere" by MAT64 (http://www.mat64.org/). -

Discounted Cash Flow (Part 2 of 2): DCF Applied to a Real Firm

This video follows Part 1 (available here: http://youtu.be/77ivvN2Uk28), which reviewed the basics of a DCF Model, including how to program a basic model in an Excel spreadsheet. This video illustrates a Discounted Cash Flow Model applied to a real firm. In particular, I discuss the various sources that help inform the inputs, assumptions, and forecasts for the DCF model, including freely available sources on the web, as well as Bloomberg Professional. Disclaimer: This video is for educational purposes only. It is not investment advice. It is not intended to recommend either positively or negatively the company that is used in the illustrative example. The music is "Gnomone a Piacere" by MAT64 (http://www.mat64.org/). -

Valuation and Discounted Cash Flow Analysis (DCF)

Here's a quick overview on Valuation. We also construct an entire discounted cash flow analysis on WalMart in conjunction with my book Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private Equity http://www.amazon.com/Financial-Modeling-Valuation-Practical-Investment/dp/1118558766/ref=sr_1_8?ie=UTF8&qid;=1422553204&sr;=8-8&keywords;=valuation -

What is Discounted Cash Flow (DCF)?

An overview of what Discounted Cash Flow is, how to work it out and how it can be used by organisations. -

DCF - JOHN CUSACK

https://twitter.com/princeDCF https://www.facebook.com/princeDCF https://soundcloud.com/princeDCF Directed by: DCF & Nicole Powell Produced by: Nicole Powell http://partparcelco.com in collaboration with DollFace Films DOP: Jackson Parrell Art Director: Thea Hollatz Edited by: Katy Maravala -

Kansas DCF caught on camera kidnapping infant

For the full story, go to: http://kansasexposed.org/2016/02/25/kansas-dcf-caught-on-camera-kidnapping-infant/ -

How to value a company using discounted cash flow (DCF) - MoneyWeek Investment Tutorials

- Order: Reorder

- Duration: 10:50

- Updated: 05 Jul 2013

- views: 175910

- published: 05 Jul 2013

- views: 175910

Financial Modeling Quick Lesson: Building a Discounted Cash Flow (DCF) Model - Part 1

- Order: Reorder

- Duration: 11:07

- Updated: 22 Feb 2013

- views: 154882

- published: 22 Feb 2013

- views: 154882

WACC, Cost of Equity, and Cost of Debt in a DCF

- Order: Reorder

- Duration: 17:56

- Updated: 23 Sep 2014

- views: 32624

- published: 23 Sep 2014

- views: 32624

Discounted Cash Flow (Part 1 of 2): Valuation

- Order: Reorder

- Duration: 18:16

- Updated: 16 Feb 2014

- views: 55621

- published: 16 Feb 2014

- views: 55621

Discounted Cash Flow (Part 2 of 2): DCF Applied to a Real Firm

- Order: Reorder

- Duration: 29:18

- Updated: 17 Feb 2014

- views: 31372

- published: 17 Feb 2014

- views: 31372

Valuation and Discounted Cash Flow Analysis (DCF)

- Order: Reorder

- Duration: 86:16

- Updated: 29 Jan 2015

- views: 18817

- published: 29 Jan 2015

- views: 18817

What is Discounted Cash Flow (DCF)?

- Order: Reorder

- Duration: 4:29

- Updated: 21 Feb 2014

- views: 17140

- published: 21 Feb 2014

- views: 17140

DCF - JOHN CUSACK

- Order: Reorder

- Duration: 3:52

- Updated: 10 Apr 2014

- views: 22902

- published: 10 Apr 2014

- views: 22902

Kansas DCF caught on camera kidnapping infant

- Order: Reorder

- Duration: 6:41

- Updated: 26 Feb 2016

- views: 16897

- published: 26 Feb 2016

- views: 16897

Child Protective Investigators: A Day in the Life

- Order: Reorder

- Duration: 8:13

- Updated: 31 Jul 2014

- views: 4907

- Playlist

- Chat

- Playlist

- Chat

How to value a company using discounted cash flow (DCF) - MoneyWeek Investment Tutorials

- Report rights infringement

- published: 05 Jul 2013

- views: 175910

Financial Modeling Quick Lesson: Building a Discounted Cash Flow (DCF) Model - Part 1

- Report rights infringement

- published: 22 Feb 2013

- views: 154882

WACC, Cost of Equity, and Cost of Debt in a DCF

- Report rights infringement

- published: 23 Sep 2014

- views: 32624

Discounted Cash Flow (Part 1 of 2): Valuation

- Report rights infringement

- published: 16 Feb 2014

- views: 55621

Discounted Cash Flow (Part 2 of 2): DCF Applied to a Real Firm

- Report rights infringement

- published: 17 Feb 2014

- views: 31372

Valuation and Discounted Cash Flow Analysis (DCF)

- Report rights infringement

- published: 29 Jan 2015

- views: 18817

What is Discounted Cash Flow (DCF)?

- Report rights infringement

- published: 21 Feb 2014

- views: 17140

DCF - JOHN CUSACK

- Report rights infringement

- published: 10 Apr 2014

- views: 22902

Kansas DCF caught on camera kidnapping infant

- Report rights infringement

- published: 26 Feb 2016

- views: 16897

Child Protective Investigators: A Day in the Life

- Report rights infringement

- published: 31 Jul 2014

- views: 4907

-

Lyrics list:lyrics

-

Youth Anthem

-

What You Want (this Is Me)

-

The Escapade

-

Swing Swing

-

Summer Nights

-

Stupid Reason

-

Signs

-

Pardon Me

-

One Way's The Highway

-

Lyrical Ride

-

-

Youth Anthem

This is just where the story begins,

so get up, pull your head in

The pride, the guts, the strength, the will,

of the youth is born, and we’ll never be torn

You’ll find us anywhere and everywhere,

at anytime but this time is the time we care

Reach out, sing out “brace your self for the ride you got to hold on tight”

Reach out, and realize, we are the youth this year call out so all can hear

Punch your words in the air, we are the youth who care

Seek for, one more lover & friend, wait for it to all begin

With hands up high, we say good bye, to the things we fear,

come on join in my dear

You’ll find us anywhere and everywhere,

at anytime but this time is the time we care,

it’s the time we care

This is just were the story begins

The Pride, the guts, the strength,

the will of the youth is born

Over 100 nude women pose against Donald Trump in Cleveland

Edit The Times of India 18 Jul 2016U.S. Ambassador To Turkey John Bass Categorically Denies US Role In Failed Coup

Edit WorldNews.com 18 Jul 2016Taylor Swift defends herself in latest salvo in Kanye battle

Edit NZ Herald 18 Jul 2016Baltimore Judge Clears Another Officer Of All Charges In Freddie Gray Case

Edit WorldNews.com 18 Jul 2016Will “Political Violence Contagion” Follow Trump to RNC?

Edit WorldNews.com 18 Jul 2016Homeless youth numbers startling

Edit The Miami Herald 18 Jul 2016Maxwell: Tebow, Trump, Rubio, Pokemon and more

Edit Orlando Sentinel 15 Jul 2016SGX reprimands YuuZoo Corporation Limited on a May 2015 announcement regarding a research report (SGX - Singapore Exchange Limited)

Edit Public Technologies 15 Jul 2016Tampa Boy, 16, Arrested For Allegedly Raping 3-Year-Old Child During Nap Time In Mother’s In-Home Daycare

Edit Inquisitr 15 Jul 2016Shaw & Partners - Initiation of Coverage (Zipmoney Ltd)

Edit Public Technologies 15 Jul 2016Asia-Pacific outlook highlighted at global UN forums on 2030 Agenda in New York (ESCAP - Economic and Social Commission for Asia and the Pacific)

Edit Public Technologies 14 Jul 2016Maxwell: Florida does right by LGBT foster kids

Edit Orlando Sentinel 14 Jul 2016MKM Upgrades Interval Leisure Group, Sees 'Large Opportunity To Unlock Significant Value'

Edit Stockhouse 14 Jul 2016Disney Conservation Fund Celebrates 20-Year Anniversary by Unveiling New Initiative to Protect the Planet (The Walt Disney Company)

Edit Public Technologies 13 Jul 2016DC listens to grievances of people at meeting

Edit Deccan Herald 13 Jul 2016Governor Walker Kicks Off Cabinet on the Road, Travels Throughout Western Wisconsin (The Office of the Governor of the State of Wisconsin)

Edit Public Technologies 12 Jul 2016July 11, 2016 - DCA Commissioner Richman Selected for 2016 Commissioner’s Award from the New Jersey Department of Children and Families (State of New Jersey Department of Community Affairs)

Edit Public Technologies 11 Jul 2016July 6, 2016 - Christie Administration Reminds Parents and Guardians to Never Leave Children Alone in a Vehicle (State of New Jersey Department of Children and Families)

Edit Public Technologies 11 Jul 2016- 1

- 2

- 3

- 4

- 5

- Next page »