- published: 09 Oct 2012

- views: 164440

-

remove the playlistStrategic Investments

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistStrategic Investments

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 15 Jul 2015

- views: 6882

- published: 07 Oct 2014

- views: 311505

- published: 24 Sep 2015

- views: 1934

- published: 27 Nov 2012

- views: 1558402

- published: 20 Nov 2008

- views: 29900

- published: 21 Jul 2015

- views: 4406

- published: 13 Oct 2016

- views: 16

- published: 17 Nov 2016

- views: 82

- published: 15 Dec 2016

- views: 1

MIT Blackjack Team

The MIT Blackjack Team was a group of students and ex-students from Massachusetts Institute of Technology, Harvard Business School, Harvard University, and other leading colleges who used card counting techniques and more sophisticated strategies to beat casinos at blackjack worldwide. The team and its successors operated successfully from 1979 through the beginning of the 21st century. Many other blackjack teams have been formed around the world with the goal of beating the casinos.

Blackjack and card counting

Blackjack can be legally beaten by a skilled player. Beyond the basic strategy of when to hit and when to stand, individual players can use card counting, shuffle tracking or hole carding to improve their odds. Since the early 1960s a large number of card counting schemes have been published, and casinos have adjusted the rules of play in an attempt to counter the most popular methods. The idea behind all card counting is that, because a low card is usually bad and a high card usually good, and as cards already seen since the last shuffle cannot be at the top of the deck and thus drawn, the counter can determine the high and low cards that have already been played. He or she thus knows the probability of getting a high card (10,J,Q,K,A) as compared to a low card (2,3,4,5,6).

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Warren Buffett

Warren Edward Buffett (/ˈbʌfᵻt/; born August 30, 1930) is an American business magnate, investor and philanthropist. He is the most successful investor in the world. Buffett is the chairman, CEO and largest shareholder of Berkshire Hathaway, and is consistently ranked among the world's wealthiest people. He was ranked as the world's wealthiest person in 2008 and as the third wealthiest in 2015. In 2012 Time named Buffett one of the world's most influential people.

Buffett is often referred to as the "Wizard of Omaha" or "Oracle of Omaha," or the "Sage of Omaha," and is noted for his adherence to value investing and for his personal frugality despite his immense wealth. Buffett is a notable philanthropist, having pledged to give away 99 percent of his fortune to philanthropic causes, primarily via the Gates Foundation. On April 11, 2012, he was diagnosed with prostate cancer, for which he successfully completed treatment in September 2012. Buffet is also active in contributing to political causes, having endorsed Democratic candidate Hillary Clinton for president during the 2016 campaign season.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Bill Ackman

William Albert Ackman (born May 11, 1966), is an American hedge fund manager. He is the founder and CEO of Pershing Square Capital Management LP, a hedge fund management company. Ackman is considered a contrarian investor. He considers himself an activist investor.

Early life

Ackman was raised in Chappaqua, New York, and he is the son of Ronnie I. (née Posner) and Lawrence David Ackman, the chairman of a New York real estate financing firm, Ackman-Ziff Real Estate Group. His family is Jewish.

Education

In 1988, he received a bachelor of arts degree magna cum laude in History from Harvard College. His thesis was "Scaling the Ivy Wall: the Jewish and Asian American Experience in Harvard Admissions." In 1992, he received an MBA from Harvard Business School.

Career

In 1992 Ackman founded the investment firm Gotham Partners with fellow Harvard graduate David P. Berkowitz. This investment firm made small investments in public companies. In 1995, Ackman partnered with the insurance and real estate firm Leucadia National to bid for Rockefeller Center. Although they did not win the deal, the high-profile nature of the bid caused investors to flock to Gotham Partners, growing it to $500 million in assets by 1998.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

11:26

11:26Secrets of Warren Buffett's Investing Strategy - Stock Market Passive Income How to Tips

Secrets of Warren Buffett's Investing Strategy - Stock Market Passive Income How to TipsSecrets of Warren Buffett's Investing Strategy - Stock Market Passive Income How to Tips

Take a look at the strategy of the world's greatest investor - Warren Buffett. - Following the Sage of Omaha's method may in fact be the best retirement investment strategy. Disclaimer: The content of this video is not intended to provide any form of financial, legal, or investment advice. For informational and entertainment purposes only. Video content licensed under creative commons license. Use of this video does not imply endorsement of Bright Enlightenment nor this youtube channel, its content, or any advertising on this website by the content creator(s) and/or copyright holder(s). -

2:11

2:11The European Fund for Strategic Investments

The European Fund for Strategic InvestmentsThe European Fund for Strategic Investments

Years of crisis have posed a threat to Europe’s potential for innovative growth and dulled our competitive edge. Competitiveness relies on investment. In Europe, good projects currently struggle to find investment. Money is available in the system but economic uncertainly stops many investors from taking risks. The Investment Plan for Europe is putting our money back to work – for the benefit of all Europeans. -

38:18

38:18Warren Buffett On Investment Strategy | Full Interview Fortune MPW

Warren Buffett On Investment Strategy | Full Interview Fortune MPWWarren Buffett On Investment Strategy | Full Interview Fortune MPW

The annual Fortune MPW interview with the world’s most successful investor - Warren Buffett, Chairman and CEO, Berkshire Hathaway. Want to see more Fortune Video? Subscribe to our channel http://www.youtube.com/subscription_center?add_user=FortuneMagazineVideo Connect with Fortune Online: Read more about Fortune Business Tech: http://fortune.com/tag/brainstorm-tech/ Find Fortunes’s Official Site: http://fortune.com/ Find Fortune on Facebook: https://www.facebook.com/FortuneMagazine Follow @FortuneMagazine on Twitter: https://twitter.com/FortuneMagazine Find Fortune on Youtube: https://www.youtube.com/user/FortuneMagazineVideo -

2:53

2:53Strategic Investment Management | London Business School

Strategic Investment Management | London Business SchoolStrategic Investment Management | London Business School

Subscribe on YouTube: http://bit.ly/lbsyoutube Follow on Twitter: http://twitter.com/lbs Learn more about the programme: https://goo.gl/ujUEOK Professors of Finance Stephen Schaefer and Narayan Naik give an overview of the Strategic Investment Management programme, explaining what you can learn on the programme, how it is taught, and who it is best suited for. -

43:57

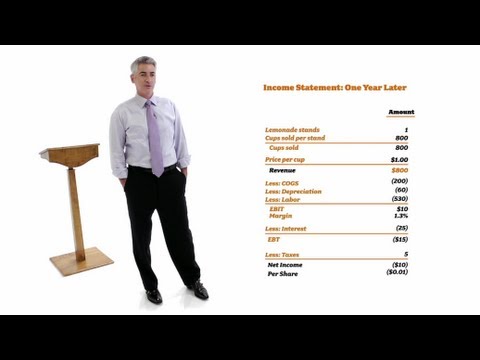

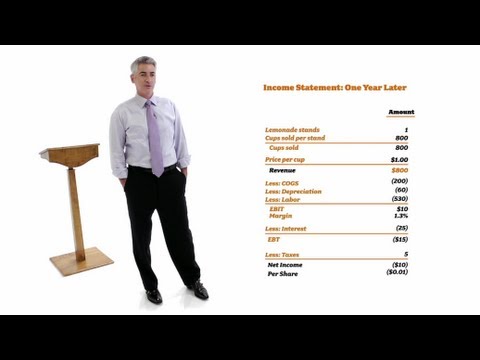

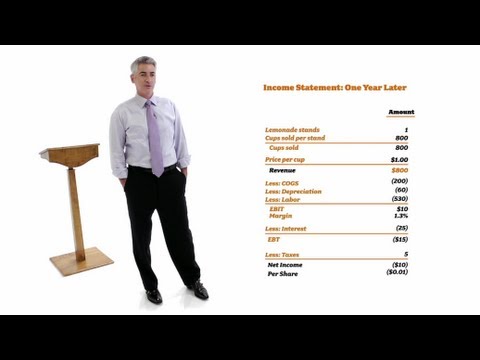

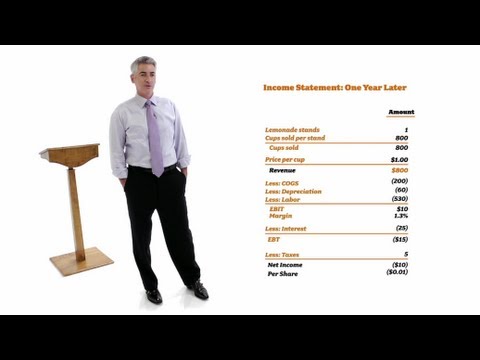

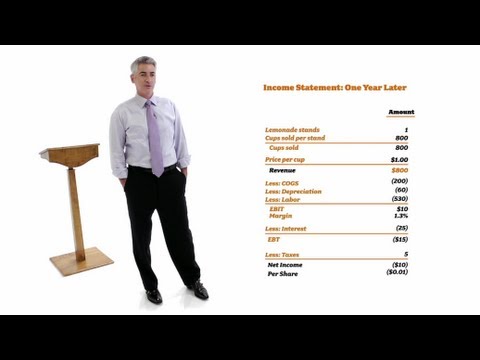

43:57William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

William Ackman: Everything You Need to Know About Finance and Investing in Under an HourWilliam Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour. WILLIAM ACKMAN, Activist Investor and Hedge-Fund Manager We all want to be financially stable and enjoy a well-funded retirement, and we don't want to throw out our hard earned money on poor investments. But most of us don't know the first thing about finance and investing. Acclaimed value investor William Ackman teaches you what it takes to finance and grow a successful business and how to make sound investments that will grant you to a cash-comfy retirement. The Floating University Originally released September 2011. Additional Lectures: Michio Kaku: The Universe in a Nutshell http://www.youtube.com/watch?v=0NbBjNiw4tk Joel Cohen: An Introduction to Demography (Malthus Miffed: Are People the Problem?) http://www.youtube.com/watch?v=2vr44C_G0-o Steven Pinker: Linguistics as a Window to Understanding the Brain http://www.youtube.com/watch?v=Q-B_ONJIEcE Leon Botstein: Art Now (Aesthetics Across Music, Painting, Architecture, Movies, and More.) http://www.youtube.com/watch?v=j6F-sHhmfrY Tamar Gendler: An Introduction to the Philosophy of Politics and Economics http://www.youtube.com/watch?v=mm8asJxdcds Nicholas Christakis: The Sociological Science Behind Social Networks and Social Influence http://www.youtube.com/watch?v=wadBvDPeE4E Paul Bloom: The Psychology of Everything: What Compassion, Racism, and Sex tell us about Human Nature http://www.youtube.com/watch?v=328wX2x_s5g Saul Levmore: Monopolies as an Introduction to Economics http://www.youtube.com/watch?v=FK2qHyF-8u8 Lawrence Summers: Decoding the DNA of Education in Search of Actual Knowledge http://www.youtube.com/watch?v=C6SY6N1iMcU Douglas Melton: Is Biomedical Research Really Close to Curing Anything? http://www.youtube.com/watch?v=Y95hT-koAC8 -

1:17:09

1:17:0919. Subgame perfect equilibrium: matchmaking and strategic investments

19. Subgame perfect equilibrium: matchmaking and strategic investments19. Subgame perfect equilibrium: matchmaking and strategic investments

Game Theory (ECON 159) We analyze three games using our new solution concept, subgame perfect equilibrium (SPE). The first game involves players' trusting that others will not make mistakes. It has three Nash equilibria but only one is consistent with backward induction. We show the other two Nash equilibria are not subgame perfect: each fails to induce Nash in a subgame. The second game involves a matchmaker sending a couple on a date. There are three Nash equilibria in the dating subgame. We construct three corresponding subgame perfect equilibria of the whole game by rolling back each of the equilibrium payoffs from the subgame. Finally, we analyze a game in which a firm has to decide whether to invest in a machine that will reduce its costs of production. We learn that the strategic effects of this decision--its effect on the choices of other competing firms--can be large, and if we ignore them we will make mistakes. 00:00 - Chapter 1. Sub-game Perfect Equilibria: Example 27:22 - Chapter 2. Sub-game Perfect Equilibria: Matchmaking 34:31 - Chapter 3. Matchmaking: SPEs of the Game 49:37 - Chapter 4. Sub-game Perfect Equilibria: Strategic Investments 01:13:15 - Chapter 5. Strategic Investments: Discussion Complete course materials are available at the Yale Online website: online.yale.edu This course was recorded in Fall 2007. -

5:43

5:43Investments in Equity Securities (Financial Accounting)

Investments in Equity Securities (Financial Accounting)Investments in Equity Securities (Financial Accounting)

This video outlines the proper accounting for investments in equity securities. The appropriate accounting treatment depends on the percentage of shares owned in the investee. Less than 20% ownership: use the Fair Value Method, with unrealized gains or losses going to Net Income (if Trading securities) or Other Comprehensive Income (if Available-for-Sale securities). 20%-50% ownership: use the Equity Method, with the investor recognizes a proportionate share of the investee's Net Income. More than 50% ownership: use the consolidation method to bring the investee's assets and liabilities onto the books of the investor. Education Unlocked is your source for business and financial education. To view the entire video library for free, visit http://www.EducationUnlocked.org/ To like us on Facebook, visit https://www.facebook.com/EducationUnlocked123 Education Unlocked is the creation of Michael McLaughlin, who went from teenage homelessness to a PhD. The goal of Michael's life is to increase access to education so all people can achieve their dreams. To learn more about Michael's story, visit http://www.MichaelMcLaughlin.com/ -

2:02

2:02Jobs for the boys at the European Fund for Strategic Investments

Jobs for the boys at the European Fund for Strategic InvestmentsJobs for the boys at the European Fund for Strategic Investments

European Parliament, Brussels, 12 October 2016 • William Dartmouth MEP, UK Independence Party (UKIP) - South West, Europe of Freedom and Direct Democracy group (EFDD) • Committee on International Trade (INTA) • Item on Agenda: 10.0 (INTA/8/06318) The implementation of the European Fund for Strategic Investments -

2:04

2:04Andrew Coyne (National Post) – Strategic Investments

Andrew Coyne (National Post) – Strategic InvestmentsAndrew Coyne (National Post) – Strategic Investments

The Student Budget Consultation is a civic education and financial literacy program for high school students across Canada. The process gives young people an opportunity to learn about government and current affairs, debate varying viewpoints about public policy and offer their own opinion on the priorities of the federal budget. Visit the Student Budget Consultation website: http://budgetconsultation.ca/ Register your school today: http://studentvote.ca/sbc/ -

2:01

2:01Strategic Investments

Strategic InvestmentsStrategic Investments

VIDEO FINANCIAL REPORTING Why invest in is the first financial video platform where you can easily search through thousands of videos describing global securities. About The Video: We believe that complex financial data could become more approachable using friendly motion-graphic representation combined with an accurate selection of financial data. To guarantee the most effective information prospective we drew inspiration from Benjamin Graham’s book: “The Intelligent Investor”, a pillar of financial philosophy. For this project any kind of suggestion or critic will be helpful in order to develop and provide the best service as we can. Please visit our site www.whyinvestin.com and leave a massage to us. Thank you and hope you'll enjoy. IMPORTANT INFORMATION - DISCLAIMER THIS VIDEO IS FOR INFORMATION PURPOSES ONLY AND SHOULD NOT BE RELIED UPON AS INVESTMENT ADVICE. This video has been prepared by Whyinvestin (together with its affiliates, “Whyinvestin”) and is not intended to be taken by, and should not be taken by, any individual recipient as investment advice, a recommendation to buy, hold or sell any security, or an offer to sell or a solicitation of offers to purchase any security. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. The performance of the companies discussed on this video is not necessarily indicative of the future performances. Investors should consider the content of this video in conjunction with investment reports, financial statements and other disclosures regarding the valuations and performance of the specific companies discussed herein. DO NOT RELY ON ANY OPINIONS, PREDICTIONS OR FORWARD-LOOKING STATEMENTS CONTAINED HEREIN. Certain of the information contained in this video constitutes “forward-looking statements” that are inherently unreliable and actual events or results may differ materially from those reflected or contemplated herein. None of Whyinvestin or any of its representatives makes any assurance as to the accuracy of those predictions or forward-looking statements. Whyinvestin expressly disclaims any obligation or undertaking to update or revise any such forward-looking statements. EXTERNAL SOURCES. Certain information contained herein has been obtained from third-party sources. Although Whyinvestin believes such sources to be reliable, we make no representation as to its accuracy or completeness. FINANCIAL DATA. Historical companies’ data, ratios, exchange rate, prices and estimates are provided by Factset research www.factset.com . Whyinvestin does not verify any data and disclaims any obligation to do so. Whyinvestin, its data or content providers, the financial exchanges and each of their affiliates and business partners (A) expressly disclaim the accuracy, adequacy, or completeness of any data and (B) shall not be liable for any errors, omissions or other defects in, delays or interruptions in such data, or for any actions taken in reliance thereon. Neither Whyinvestin nor any of our information providers will be liable for any damages relating to your use of the information provided herein. Please consult your broker or financial representative to verify pricing before executing any trade. Whyinvestin cannot guarantee the accuracy of the exchange rates used in the videos. You should confirm current rates before making any transactions that could be affected by changes in the exchange rates. You agree not to copy, modify, reformat, download, store, reproduce, reprocess, transmit or redistribute any data or information found herein or use any such data or information in a commercial enterprise without obtaining prior written consent. Please consult your broker or financial representative to verify pricing before executing any trade. COPYRIGHT “FAIR USE” Whyinvestin doesn’t own any logo different from the whyinvestin’ s logo contained in the video. The owner of the logos is the subject of the video itself (the company); and all the logos are not authorized by, sponsored by, or associated with the trademark owner . Whyinvestin uses exclusive rights held by the copyright owner for Educational purposes and for commentary and criticism as part of a news report or published article. If you are a company, subject of the video and for any reason want to get in contact with Whyinvestin please email: company@whyinvestin.com

-

Secrets of Warren Buffett's Investing Strategy - Stock Market Passive Income How to Tips

Take a look at the strategy of the world's greatest investor - Warren Buffett. - Following the Sage of Omaha's method may in fact be the best retirement investment strategy. Disclaimer: The content of this video is not intended to provide any form of financial, legal, or investment advice. For informational and entertainment purposes only. Video content licensed under creative commons license. Use of this video does not imply endorsement of Bright Enlightenment nor this youtube channel, its content, or any advertising on this website by the content creator(s) and/or copyright holder(s).

published: 09 Oct 2012 -

The European Fund for Strategic Investments

Years of crisis have posed a threat to Europe’s potential for innovative growth and dulled our competitive edge. Competitiveness relies on investment. In Europe, good projects currently struggle to find investment. Money is available in the system but economic uncertainly stops many investors from taking risks. The Investment Plan for Europe is putting our money back to work – for the benefit of all Europeans.

published: 15 Jul 2015 -

Warren Buffett On Investment Strategy | Full Interview Fortune MPW

The annual Fortune MPW interview with the world’s most successful investor - Warren Buffett, Chairman and CEO, Berkshire Hathaway. Want to see more Fortune Video? Subscribe to our channel http://www.youtube.com/subscription_center?add_user=FortuneMagazineVideo Connect with Fortune Online: Read more about Fortune Business Tech: http://fortune.com/tag/brainstorm-tech/ Find Fortunes’s Official Site: http://fortune.com/ Find Fortune on Facebook: https://www.facebook.com/FortuneMagazine Follow @FortuneMagazine on Twitter: https://twitter.com/FortuneMagazine Find Fortune on Youtube: https://www.youtube.com/user/FortuneMagazineVideo

published: 07 Oct 2014 -

Strategic Investment Management | London Business School

Subscribe on YouTube: http://bit.ly/lbsyoutube Follow on Twitter: http://twitter.com/lbs Learn more about the programme: https://goo.gl/ujUEOK Professors of Finance Stephen Schaefer and Narayan Naik give an overview of the Strategic Investment Management programme, explaining what you can learn on the programme, how it is taught, and who it is best suited for.

published: 24 Sep 2015 -

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour. WILLIAM ACKMAN, Activist Investor and Hedge-Fund Manager We all want to be financially stable and enjoy a well-funded retirement, and we don't want to throw out our hard earned money on poor investments. But most of us don't know the first thing about finance and investing. Acclaimed value investor William Ackman teaches you what it takes to finance and grow a successful business and how to make sound investments that will grant you to a cash-comfy retirement. The Floating University Originally released September 2011. Additional Lectures: Michio Kaku: The Universe in a Nutshell http://www.youtube.com/watch?v=0NbBjNiw4tk Joel Cohen: An Introduction to Demography (Malthus Miffed: Are People the P...

published: 27 Nov 2012 -

19. Subgame perfect equilibrium: matchmaking and strategic investments

Game Theory (ECON 159) We analyze three games using our new solution concept, subgame perfect equilibrium (SPE). The first game involves players' trusting that others will not make mistakes. It has three Nash equilibria but only one is consistent with backward induction. We show the other two Nash equilibria are not subgame perfect: each fails to induce Nash in a subgame. The second game involves a matchmaker sending a couple on a date. There are three Nash equilibria in the dating subgame. We construct three corresponding subgame perfect equilibria of the whole game by rolling back each of the equilibrium payoffs from the subgame. Finally, we analyze a game in which a firm has to decide whether to invest in a machine that will reduce its costs of production. We learn that the strategic e...

published: 20 Nov 2008 -

Investments in Equity Securities (Financial Accounting)

This video outlines the proper accounting for investments in equity securities. The appropriate accounting treatment depends on the percentage of shares owned in the investee. Less than 20% ownership: use the Fair Value Method, with unrealized gains or losses going to Net Income (if Trading securities) or Other Comprehensive Income (if Available-for-Sale securities). 20%-50% ownership: use the Equity Method, with the investor recognizes a proportionate share of the investee's Net Income. More than 50% ownership: use the consolidation method to bring the investee's assets and liabilities onto the books of the investor. Education Unlocked is your source for business and financial education. To view the entire video library for free, visit http://www.EducationUnlocked.org/ To...

published: 21 Jul 2015 -

Jobs for the boys at the European Fund for Strategic Investments

European Parliament, Brussels, 12 October 2016 • William Dartmouth MEP, UK Independence Party (UKIP) - South West, Europe of Freedom and Direct Democracy group (EFDD) • Committee on International Trade (INTA) • Item on Agenda: 10.0 (INTA/8/06318) The implementation of the European Fund for Strategic Investments

published: 13 Oct 2016 -

Andrew Coyne (National Post) – Strategic Investments

The Student Budget Consultation is a civic education and financial literacy program for high school students across Canada. The process gives young people an opportunity to learn about government and current affairs, debate varying viewpoints about public policy and offer their own opinion on the priorities of the federal budget. Visit the Student Budget Consultation website: http://budgetconsultation.ca/ Register your school today: http://studentvote.ca/sbc/

published: 17 Nov 2016 -

Strategic Investments

VIDEO FINANCIAL REPORTING Why invest in is the first financial video platform where you can easily search through thousands of videos describing global securities. About The Video: We believe that complex financial data could become more approachable using friendly motion-graphic representation combined with an accurate selection of financial data. To guarantee the most effective information prospective we drew inspiration from Benjamin Graham’s book: “The Intelligent Investor”, a pillar of financial philosophy. For this project any kind of suggestion or critic will be helpful in order to develop and provide the best service as we can. Please visit our site www.whyinvestin.com and leave a massage to us. Thank you and hope you'll enjoy. IMPORTANT INFORMATION - DISCLAIMER ...

published: 15 Dec 2016

Secrets of Warren Buffett's Investing Strategy - Stock Market Passive Income How to Tips

- Order: Reorder

- Duration: 11:26

- Updated: 09 Oct 2012

- views: 164440

- published: 09 Oct 2012

- views: 164440

The European Fund for Strategic Investments

- Order: Reorder

- Duration: 2:11

- Updated: 15 Jul 2015

- views: 6882

- published: 15 Jul 2015

- views: 6882

Warren Buffett On Investment Strategy | Full Interview Fortune MPW

- Order: Reorder

- Duration: 38:18

- Updated: 07 Oct 2014

- views: 311505

- published: 07 Oct 2014

- views: 311505

Strategic Investment Management | London Business School

- Order: Reorder

- Duration: 2:53

- Updated: 24 Sep 2015

- views: 1934

- published: 24 Sep 2015

- views: 1934

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

- Order: Reorder

- Duration: 43:57

- Updated: 27 Nov 2012

- views: 1558402

- published: 27 Nov 2012

- views: 1558402

19. Subgame perfect equilibrium: matchmaking and strategic investments

- Order: Reorder

- Duration: 1:17:09

- Updated: 20 Nov 2008

- views: 29900

- published: 20 Nov 2008

- views: 29900

Investments in Equity Securities (Financial Accounting)

- Order: Reorder

- Duration: 5:43

- Updated: 21 Jul 2015

- views: 4406

- published: 21 Jul 2015

- views: 4406

Jobs for the boys at the European Fund for Strategic Investments

- Order: Reorder

- Duration: 2:02

- Updated: 13 Oct 2016

- views: 16

- published: 13 Oct 2016

- views: 16

Andrew Coyne (National Post) – Strategic Investments

- Order: Reorder

- Duration: 2:04

- Updated: 17 Nov 2016

- views: 82

- published: 17 Nov 2016

- views: 82

Strategic Investments

- Order: Reorder

- Duration: 2:01

- Updated: 15 Dec 2016

- views: 1

- published: 15 Dec 2016

- views: 1

-

Secrets of Warren Buffett's Investing Strategy - Stock Market Passive Income How to Tips

Take a look at the strategy of the world's greatest investor - Warren Buffett. - Following the Sage of Omaha's method may in fact be the best retirement investment strategy. Disclaimer: The content of this video is not intended to provide any form of financial, legal, or investment advice. For informational and entertainment purposes only. Video content licensed under creative commons license. Use of this video does not imply endorsement of Bright Enlightenment nor this youtube channel, its content, or any advertising on this website by the content creator(s) and/or copyright holder(s).

published: 09 Oct 2012 -

The European Fund for Strategic Investments

Years of crisis have posed a threat to Europe’s potential for innovative growth and dulled our competitive edge. Competitiveness relies on investment. In Europe, good projects currently struggle to find investment. Money is available in the system but economic uncertainly stops many investors from taking risks. The Investment Plan for Europe is putting our money back to work – for the benefit of all Europeans.

published: 15 Jul 2015 -

Warren Buffett On Investment Strategy | Full Interview Fortune MPW

The annual Fortune MPW interview with the world’s most successful investor - Warren Buffett, Chairman and CEO, Berkshire Hathaway. Want to see more Fortune Video? Subscribe to our channel http://www.youtube.com/subscription_center?add_user=FortuneMagazineVideo Connect with Fortune Online: Read more about Fortune Business Tech: http://fortune.com/tag/brainstorm-tech/ Find Fortunes’s Official Site: http://fortune.com/ Find Fortune on Facebook: https://www.facebook.com/FortuneMagazine Follow @FortuneMagazine on Twitter: https://twitter.com/FortuneMagazine Find Fortune on Youtube: https://www.youtube.com/user/FortuneMagazineVideo

published: 07 Oct 2014 -

Strategic Investment Management | London Business School

Subscribe on YouTube: http://bit.ly/lbsyoutube Follow on Twitter: http://twitter.com/lbs Learn more about the programme: https://goo.gl/ujUEOK Professors of Finance Stephen Schaefer and Narayan Naik give an overview of the Strategic Investment Management programme, explaining what you can learn on the programme, how it is taught, and who it is best suited for.

published: 24 Sep 2015 -

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour. WILLIAM ACKMAN, Activist Investor and Hedge-Fund Manager We all want to be financially stable and enjoy a well-funded retirement, and we don't want to throw out our hard earned money on poor investments. But most of us don't know the first thing about finance and investing. Acclaimed value investor William Ackman teaches you what it takes to finance and grow a successful business and how to make sound investments that will grant you to a cash-comfy retirement. The Floating University Originally released September 2011. Additional Lectures: Michio Kaku: The Universe in a Nutshell http://www.youtube.com/watch?v=0NbBjNiw4tk Joel Cohen: An Introduction to Demography (Malthus Miffed: Are People the P...

published: 27 Nov 2012 -

19. Subgame perfect equilibrium: matchmaking and strategic investments

Game Theory (ECON 159) We analyze three games using our new solution concept, subgame perfect equilibrium (SPE). The first game involves players' trusting that others will not make mistakes. It has three Nash equilibria but only one is consistent with backward induction. We show the other two Nash equilibria are not subgame perfect: each fails to induce Nash in a subgame. The second game involves a matchmaker sending a couple on a date. There are three Nash equilibria in the dating subgame. We construct three corresponding subgame perfect equilibria of the whole game by rolling back each of the equilibrium payoffs from the subgame. Finally, we analyze a game in which a firm has to decide whether to invest in a machine that will reduce its costs of production. We learn that the strategic e...

published: 20 Nov 2008 -

Investments in Equity Securities (Financial Accounting)

This video outlines the proper accounting for investments in equity securities. The appropriate accounting treatment depends on the percentage of shares owned in the investee. Less than 20% ownership: use the Fair Value Method, with unrealized gains or losses going to Net Income (if Trading securities) or Other Comprehensive Income (if Available-for-Sale securities). 20%-50% ownership: use the Equity Method, with the investor recognizes a proportionate share of the investee's Net Income. More than 50% ownership: use the consolidation method to bring the investee's assets and liabilities onto the books of the investor. Education Unlocked is your source for business and financial education. To view the entire video library for free, visit http://www.EducationUnlocked.org/ To...

published: 21 Jul 2015 -

Jobs for the boys at the European Fund for Strategic Investments

European Parliament, Brussels, 12 October 2016 • William Dartmouth MEP, UK Independence Party (UKIP) - South West, Europe of Freedom and Direct Democracy group (EFDD) • Committee on International Trade (INTA) • Item on Agenda: 10.0 (INTA/8/06318) The implementation of the European Fund for Strategic Investments

published: 13 Oct 2016 -

Andrew Coyne (National Post) – Strategic Investments

The Student Budget Consultation is a civic education and financial literacy program for high school students across Canada. The process gives young people an opportunity to learn about government and current affairs, debate varying viewpoints about public policy and offer their own opinion on the priorities of the federal budget. Visit the Student Budget Consultation website: http://budgetconsultation.ca/ Register your school today: http://studentvote.ca/sbc/

published: 17 Nov 2016 -

Strategic Investments

VIDEO FINANCIAL REPORTING Why invest in is the first financial video platform where you can easily search through thousands of videos describing global securities. About The Video: We believe that complex financial data could become more approachable using friendly motion-graphic representation combined with an accurate selection of financial data. To guarantee the most effective information prospective we drew inspiration from Benjamin Graham’s book: “The Intelligent Investor”, a pillar of financial philosophy. For this project any kind of suggestion or critic will be helpful in order to develop and provide the best service as we can. Please visit our site www.whyinvestin.com and leave a massage to us. Thank you and hope you'll enjoy. IMPORTANT INFORMATION - DISCLAIMER ...

published: 15 Dec 2016

Secrets of Warren Buffett's Investing Strategy - Stock Market Passive Income How to Tips

- Order: Reorder

- Duration: 11:26

- Updated: 09 Oct 2012

- views: 164440

- published: 09 Oct 2012

- views: 164440

The European Fund for Strategic Investments

- Order: Reorder

- Duration: 2:11

- Updated: 15 Jul 2015

- views: 6882

- published: 15 Jul 2015

- views: 6882

Warren Buffett On Investment Strategy | Full Interview Fortune MPW

- Order: Reorder

- Duration: 38:18

- Updated: 07 Oct 2014

- views: 311505

- published: 07 Oct 2014

- views: 311505

Strategic Investment Management | London Business School

- Order: Reorder

- Duration: 2:53

- Updated: 24 Sep 2015

- views: 1934

- published: 24 Sep 2015

- views: 1934

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

- Order: Reorder

- Duration: 43:57

- Updated: 27 Nov 2012

- views: 1558402

- published: 27 Nov 2012

- views: 1558402

19. Subgame perfect equilibrium: matchmaking and strategic investments

- Order: Reorder

- Duration: 1:17:09

- Updated: 20 Nov 2008

- views: 29900

- published: 20 Nov 2008

- views: 29900

Investments in Equity Securities (Financial Accounting)

- Order: Reorder

- Duration: 5:43

- Updated: 21 Jul 2015

- views: 4406

- published: 21 Jul 2015

- views: 4406

Jobs for the boys at the European Fund for Strategic Investments

- Order: Reorder

- Duration: 2:02

- Updated: 13 Oct 2016

- views: 16

- published: 13 Oct 2016

- views: 16

Andrew Coyne (National Post) – Strategic Investments

- Order: Reorder

- Duration: 2:04

- Updated: 17 Nov 2016

- views: 82

- published: 17 Nov 2016

- views: 82

Strategic Investments

- Order: Reorder

- Duration: 2:01

- Updated: 15 Dec 2016

- views: 1

- published: 15 Dec 2016

- views: 1

-

Strategic Investment: Successfully Prepare for Business with Cuba

published: 07 Aug 2015 -

Strategic Investment Fund (SIF) Announcement

Strategic Investment Fund (SIF) Announcement today at McGill

published: 10 Mar 2017 -

Panel II: European Fund for Strategic Investments – opportunities for the EU and the Czech Republic

published: 24 Feb 2016 -

Art of the Deal: IP in Strategic Investments and Corporate Venture

published: 02 May 2013 -

Strategic Philanthropy: Investing in the Next Generation of Entrepreneurs

published: 14 Oct 2015 -

201304-18 14.07 Art of the Deal_ IP in Strategic Investments and Corporate Venture.wmv_1

published: 02 May 2013 -

-

-

"Building America's Future: Strategic Infrastructure Investment," Ed Rendell, OneSC2016

Former Pennsylvania governor Ed Rendell addressed OneSC2016 attendees on strategic infrastructure investment.

published: 12 May 2016 -

2012-12-23 - Conference Day 4 of 4 - Strategic Investments - Prophet E. Obeng

2012-12-23 - Conference Day 4 of 4 - Strategic Investments - Prophet E. Obeng

published: 02 Nov 2013

Strategic Investment: Successfully Prepare for Business with Cuba

- Order: Reorder

- Duration: 1:01:06

- Updated: 07 Aug 2015

- views: 160

- published: 07 Aug 2015

- views: 160

Strategic Investment Fund (SIF) Announcement

- Order: Reorder

- Duration: 30:14

- Updated: 10 Mar 2017

- views: 53

Panel II: European Fund for Strategic Investments – opportunities for the EU and the Czech Republic

- Order: Reorder

- Duration: 1:10:18

- Updated: 24 Feb 2016

- views: 82

- published: 24 Feb 2016

- views: 82

Art of the Deal: IP in Strategic Investments and Corporate Venture

- Order: Reorder

- Duration: 54:30

- Updated: 02 May 2013

- views: 86

- published: 02 May 2013

- views: 86

Strategic Philanthropy: Investing in the Next Generation of Entrepreneurs

- Order: Reorder

- Duration: 59:12

- Updated: 14 Oct 2015

- views: 280

- published: 14 Oct 2015

- views: 280

201304-18 14.07 Art of the Deal_ IP in Strategic Investments and Corporate Venture.wmv_1

- Order: Reorder

- Duration: 54:30

- Updated: 02 May 2013

- views: 4

- published: 02 May 2013

- views: 4

Your Most Strategic Investment

- Order: Reorder

- Duration: 40:17

- Updated: 02 Jun 2013

- views: 103

Romeo + Juliet 1996 Full Movie

- Order: Reorder

- Duration: 1:57:22

- Updated: 29 Sep 2016

- views: 41184

"Building America's Future: Strategic Infrastructure Investment," Ed Rendell, OneSC2016

- Order: Reorder

- Duration: 41:45

- Updated: 12 May 2016

- views: 112

- published: 12 May 2016

- views: 112

2012-12-23 - Conference Day 4 of 4 - Strategic Investments - Prophet E. Obeng

- Order: Reorder

- Duration: 1:57:40

- Updated: 02 Nov 2013

- views: 344

- published: 02 Nov 2013

- views: 344

- Playlist

- Chat

Secrets of Warren Buffett's Investing Strategy - Stock Market Passive Income How to Tips

- Report rights infringement

- published: 09 Oct 2012

- views: 164440

The European Fund for Strategic Investments

- Report rights infringement

- published: 15 Jul 2015

- views: 6882

Warren Buffett On Investment Strategy | Full Interview Fortune MPW

- Report rights infringement

- published: 07 Oct 2014

- views: 311505

Strategic Investment Management | London Business School

- Report rights infringement

- published: 24 Sep 2015

- views: 1934

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

- Report rights infringement

- published: 27 Nov 2012

- views: 1558402

19. Subgame perfect equilibrium: matchmaking and strategic investments

- Report rights infringement

- published: 20 Nov 2008

- views: 29900

Investments in Equity Securities (Financial Accounting)

- Report rights infringement

- published: 21 Jul 2015

- views: 4406

Jobs for the boys at the European Fund for Strategic Investments

- Report rights infringement

- published: 13 Oct 2016

- views: 16

Andrew Coyne (National Post) – Strategic Investments

- Report rights infringement

- published: 17 Nov 2016

- views: 82

Strategic Investments

- Report rights infringement

- published: 15 Dec 2016

- views: 1

- Playlist

- Chat

Secrets of Warren Buffett's Investing Strategy - Stock Market Passive Income How to Tips

- Report rights infringement

- published: 09 Oct 2012

- views: 164440

The European Fund for Strategic Investments

- Report rights infringement

- published: 15 Jul 2015

- views: 6882

Warren Buffett On Investment Strategy | Full Interview Fortune MPW

- Report rights infringement

- published: 07 Oct 2014

- views: 311505

Strategic Investment Management | London Business School

- Report rights infringement

- published: 24 Sep 2015

- views: 1934

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

- Report rights infringement

- published: 27 Nov 2012

- views: 1558402

19. Subgame perfect equilibrium: matchmaking and strategic investments

- Report rights infringement

- published: 20 Nov 2008

- views: 29900

Investments in Equity Securities (Financial Accounting)

- Report rights infringement

- published: 21 Jul 2015

- views: 4406

Jobs for the boys at the European Fund for Strategic Investments

- Report rights infringement

- published: 13 Oct 2016

- views: 16

Andrew Coyne (National Post) – Strategic Investments

- Report rights infringement

- published: 17 Nov 2016

- views: 82

Strategic Investments

- Report rights infringement

- published: 15 Dec 2016

- views: 1

- Playlist

- Chat

Strategic Investment: Successfully Prepare for Business with Cuba

- Report rights infringement

- published: 07 Aug 2015

- views: 160

Strategic Investment Fund (SIF) Announcement

- Report rights infringement

- published: 10 Mar 2017

- views: 53

Panel II: European Fund for Strategic Investments – opportunities for the EU and the Czech Republic

- Report rights infringement

- published: 24 Feb 2016

- views: 82

Art of the Deal: IP in Strategic Investments and Corporate Venture

- Report rights infringement

- published: 02 May 2013

- views: 86

Strategic Philanthropy: Investing in the Next Generation of Entrepreneurs

- Report rights infringement

- published: 14 Oct 2015

- views: 280

201304-18 14.07 Art of the Deal_ IP in Strategic Investments and Corporate Venture.wmv_1

- Report rights infringement

- published: 02 May 2013

- views: 4

Your Most Strategic Investment

- Report rights infringement

- published: 02 Jun 2013

- views: 103

Romeo + Juliet 1996 Full Movie

- Report rights infringement

- published: 29 Sep 2016

- views: 41184

"Building America's Future: Strategic Infrastructure Investment," Ed Rendell, OneSC2016

- Report rights infringement

- published: 12 May 2016

- views: 112

2012-12-23 - Conference Day 4 of 4 - Strategic Investments - Prophet E. Obeng

- Report rights infringement

- published: 02 Nov 2013

- views: 344

‘Miracle baby’ survives 12-hour operation, six heart attacks

Edit The Times of India 11 May 2017Bizarre beauty craze of ‘gritting’ promises to rid you of all blackheads… but can YOU ...

Edit The Sun 10 May 2017Egypt says it's found burial chamber dating back 3,700 years

Edit Fox News 10 May 2017Vermont Legislature Approves Marijuana Legalization

Edit WorldNews.com 10 May 2017Poll: Trump's Approval Rating Near Record Low

Edit WorldNews.com 10 May 2017Invest Ottawa's new president looking to hire consultants for 'strategic plan' development

Edit Canada Dot Com 11 May 2017Govt moving towards finalising partnership model to build high-tech weapons

Edit Hindustan Times 11 May 2017KIOSK Information Systems Announces Bill Butler as New CEO

Edit Market Watch 11 May 2017Turkey to buy 52 Super Mushshak training aircraft from Pakistan

Edit The News International 11 May 2017'Silk Road' plan stirs unease over China's strategic goals

Edit San Francisco Chronicle 11 May 2017WHO: Patients’ Safety in Nigeria Deplorable

Edit This Day 11 May 2017Japan using DPRK issue to beef up military

Edit China Daily 11 May 2017Sharif asks rivals to visit development projects

Edit Dawn 11 May 2017Mexico's drug-war death toll in 2016 reportedly exceeded murders...

Edit Topix 11 May 2017Doomed to repeat? How Syria could become Trump's Somalia

Edit Topix 11 May 2017Process ready to select private companies for mega defence orders

Edit The Economic Times 11 May 2017Varsities, colleges and experts vie for best location at event in Kuala Lumpur next month

Edit The Star 11 May 2017- 1

- 2

- 3

- 4

- 5

- Next page »