Asian stocks make strong weekly gain

Reassuring Chinese GDP data has helped stocks, commodity markets and the US dollar consolidate strong weekly gains, as focus turned to a meeting of top oil producers about a potential output freeze.

Moves in most markets were small in Europe as investors eased back after a 2.5 per cent weekly rally in world shares, a upward turn in the US dollar and an 11 per cent surge in oil prices this month.

Data from China on Friday drew approval as it showed the country's giant economy grew at 6.7 per cent in the first quarter year-on-year, bolstering the view its slowdown may be bottoming out.

The major currencies seen as most dependent on China were the main gainers. The Australian and New Zealand dollars rose 0.3 and 0.9 per cent respectively, also helped by the week's gains in key commodity prices.

The US dollar was starting to ease back on the pedal again too, having made more than 1 per cent against both the yen and the euro this week.

Traders were waiting for IMF and G20 meetings in Washington later for signs from financial leaders on the next stages of their efforts to drag most of the developed world out of a debilitating cycle of debt and very low inflation.

Speculation was also still circling about whether top oil producers led by Saudi Arabia and Russia will be able to hammer a deal in Doha, Qatar on Sunday to curb output which is currently churning out around 2 million barrels of excess oil a day.

"This week we had some interesting movements especially in euro/dollar and dollar/yen and a widespread rebound in market sentiment," said Rabobank economist Philip Marey, adding Thursday's surprise move by Singapore's central bank to ease policy had fuelled hopes of another round of global stimulus.

The temptation to lock in profits was proving strong.

European shares edged down 0.4 per cent as traders top-sliced some the 3.5 per cent gains they have made this week.

Nerves about Greece's finances are also resurfacing.

Greek bond yields were set to record their biggest weekly rise in two months as investors start to fret about delays to Athens' bailout package and over the extent to which the IMF will participate in a new deal.

The head of IMF, Christine Lagarde had reiterated on Thursday the eurozone needed to write off some of Athens' debt and rework plans to get the country back on track.

"We will not walk away," Lagarde said during a question-and-answer session. "Our form of participation may vary depending on the commitments of Greece and the undertaking of the European partners, but we will not walk away."

In a sign of re-emerging risk appetite, the Baltic Dry index which reflects global shipping and trade and is seen as somewhat of a bellwether of the global economy, was on course for a ninth straight weekly rise, its best run since 2003.

"Chinese economic data is showing signs of stabilisation, including recent PMI numbers, as well as the latest figures on industrial production and retail sales," said Suan Teck Kin, economist at the United Overseas Bank in Singapore.

Japan's Nikkei, one of the biggest losers of 2016 so far, closed down 0.3 per cent on the day but 6.5 per cent higher for the week following the drop back in the yen.

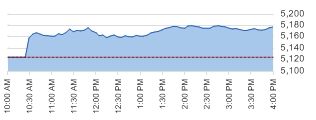

MSCI's broadest index of Asia-Pacific shares outside Japan crept up 0.1 per cent. That index has gained about 3.6 per cent on the week during which it hit a five-month high, helped by a slight thaw in pessimism over the Chinese economy and an earlier surge in crude oil prices.

It is part of a global rise. Both the MSCI All World index and the S&P 500 have hit their highest points of the year this week.

The Hang Seng index fell 0.1 per cent, to 21,316.47, but for the week, the gauge jumped 4.6 per cent, the best weekly performance in nearly two months.

Easing from three-month highs hit on Thursday, both the blue-chip CSI300 index and the Shanghai Composite Index dipped 0.1 per cent, to 3272.21 points and 3078.12 points, respectively.

But for the week, CSI300 rose 2.7 per cent and SSEC was up 3.1 per cent.

With oil traders waiting for the Doha meeting, US crude oil dropped 50 cents to $41 a barrel, while Brent was $43.50 a barrel.

Safe-haven gold was on course for a weekly loss, while sterling was steady and up slightly on the week at $1.4155 as it moved away from a low of $1.4091 hit after Bank of England policymakers voted unanimously to keep interest rates at a record low of 0.5 per cent.

Originally published as Asian stocks make strong weekly gain