7:59

Synthetic collateralized debt obligation (synthetic CDO)

The key difference between a cash and synthetic CDO is: instead of selling the reference p...

published: 19 Mar 2008

author: bionicturtledotcom

Synthetic collateralized debt obligation (synthetic CDO)

Synthetic collateralized debt obligation (synthetic CDO)

The key difference between a cash and synthetic CDO is: instead of selling the reference portfolio (loans), the originator (bank) purchases credit protection...- published: 19 Mar 2008

- views: 27663

- author: bionicturtledotcom

9:28

CDS and Synthetic CDOs Explained

Nationally renowned forensic accounting expert, Thomas A. Myers, explains the fundamentals...

published: 03 Aug 2010

author: TAMCOForensicGroup

CDS and Synthetic CDOs Explained

CDS and Synthetic CDOs Explained

Nationally renowned forensic accounting expert, Thomas A. Myers, explains the fundamentals of credit defaults swaps and synthetic CDOs (collateralized debt o...- published: 03 Aug 2010

- views: 15821

- author: TAMCOForensicGroup

8:53

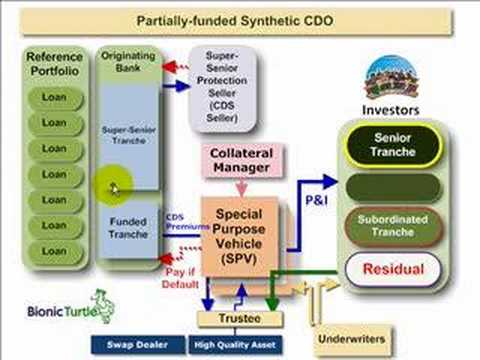

Synthetic CDO that fails in subprime securitization

This illustrates a partially-funded synthetic CDO typical of the failed structure in the s...

published: 25 Mar 2008

author: bionicturtledotcom

Synthetic CDO that fails in subprime securitization

Synthetic CDO that fails in subprime securitization

This illustrates a partially-funded synthetic CDO typical of the failed structure in the subprime meltdown. "Partially-funded" refers to the fact that only a...- published: 25 Mar 2008

- views: 30751

- author: bionicturtledotcom

9:40

Goldman Sachs Abacus SCDO

A review of the Goldman Sachs Abacus SCDO transaction. Study notes: 1. it's a "synthetic C...

published: 16 Jun 2010

author: bionicturtledotcom

Goldman Sachs Abacus SCDO

Goldman Sachs Abacus SCDO

A review of the Goldman Sachs Abacus SCDO transaction. Study notes: 1. it's a "synthetic CDO" b/c the SPV writes CDS to Paulson (instead of buying mortgages ...- published: 16 Jun 2010

- views: 7709

- author: bionicturtledotcom

4:16

Standard & Poor's U.S. Synthetic CDO Sector: The Most Widel

In addition to cash flow collateralized debt obligations (CDOs) and nontraditional asset c...

published: 14 Oct 2011

author: SPTVbroadcast

Standard & Poor's U.S. Synthetic CDO Sector: The Most Widel

Standard & Poor's U.S. Synthetic CDO Sector: The Most Widel

In addition to cash flow collateralized debt obligations (CDOs) and nontraditional asset classes, Standard & Poor's also rates about 600 corporate synthetic ...- published: 14 Oct 2011

- views: 145

- author: SPTVbroadcast

2:42

Market Madness #3: Carl Tweets

This week on Money or Die's Market Madness: Apple chirps, Synthetic CDO FAIL, and an Airli...

published: 16 Aug 2013

Market Madness #3: Carl Tweets

Market Madness #3: Carl Tweets

This week on Money or Die's Market Madness: Apple chirps, Synthetic CDO FAIL, and an Airline merger is busted. Produced by The Final Edition http://thefinaledition.com Subscribe to MakinSense Babe: http://makinsensebabe.com https://www.facebook.com/pages/MakinSense-Babe/315903058448000 https://twitter.com/makinsensebabe- published: 16 Aug 2013

- views: 183

9:42

Collateralized Debt Obligation (CDO)

Learn more: http://www.khanacademy.org/video?v=XjoJ9UF2hqg Introduction to collateralized ...

published: 01 Sep 2007

author: khanacademy

Collateralized Debt Obligation (CDO)

Collateralized Debt Obligation (CDO)

Learn more: http://www.khanacademy.org/video?v=XjoJ9UF2hqg Introduction to collateralized debt obligations (to be listen to after series on mortgage-backed s...- published: 01 Sep 2007

- views: 259306

- author: khanacademy

2:24

Warren Buffett on the Credit Ratings, CDOs and Mortgage Backed Securities, Debt & Equities

Collateralized debt obligations (CDOs) are a type of structured asset-backed security (ABS...

published: 22 Aug 2013

Warren Buffett on the Credit Ratings, CDOs and Mortgage Backed Securities, Debt & Equities

Warren Buffett on the Credit Ratings, CDOs and Mortgage Backed Securities, Debt & Equities

Collateralized debt obligations (CDOs) are a type of structured asset-backed security (ABS) with multiple "tranches" that are issued by special purpose entities and collateralized by debt obligations including bonds and loans. Each tranche offers a varying degree of risk and return so as to meet investor demand. CDOs' value and payments are derived from a portfolio of fixed-income underlying assets. CDO securities are split into different risk classes, or tranches, whereby "senior" tranches are considered the safest securities. Interest and principal payments are made in order of seniority, so that junior tranches offer higher coupon payments (and interest rates) or lower prices to compensate for additional default risk. CDO can be created as long as global investors are willing to provide the money to purchase the pool of bonds the CDO owns. CDO volume grew significantly between 2000--2006, then declined dramatically in the wake of the subprime mortgage crisis, which began in 2007. Many of the assets held by these CDOs had been subprime mortgage-backed bonds. Global investors began to stop funding CDOs in 2007, contributing to the collapse of certain structured investments held by major investment banks and the bankruptcy of several subprime lenders.[1][2] A few academics, analysts and investors such as Warren Buffett and the IMF's former chief economist Raghuram Rajan warned that CDOs, other asset-backed securities and other derivatives spread risk and uncertainty about the value of the underlying assets more widely, rather than reduce risk through diversification. Following the onset of the subprime mortgage crisis in 2007, this view has gained substantial credibility. Credit rating agencies failed to account adequately for large risks (like a nationwide collapse of housing values) when rating CDOs and other ABSs with the highest possible grade. Many CDOs are marked to market and thus experienced substantial write-downs as their market value collapsed during the subprime crisis, with banks writing down the value of their CDO holdings mainly in the 2007-2008 period. The first CDO was issued in 1987 by bankers at now-defunct Drexel Burnham Lambert Inc. for Imperial Savings Association, a savings institution that later became insolvent and was taken over by the Resolution Trust Corporation on June 22, 1990.[3][4][5] A decade later, CDOs emerged as the fastest growing sector of the asset-backed synthetic securities market. This growth may reflect the increasing appeal of CDOs for a growing number of asset managers and investors, which now include insurance companies, mutual fund companies, unit trusts, investment trusts, commercial banks, investment banks, pension fund managers, private banking organizations, other CDOs and structured investment vehicles. CDOs offered returns that were sometimes 2-3 percentage points higher than corporate bonds with the same credit rating. Economist Mark Zandi of Moody's Analytics wrote that various factors had kept interest rates low globally in the years CDO volume grew, because of fears of deflation, the bursting of the dot-com bubble, a U.S. recession, and the U.S. trade deficit. This made U.S. CDOs backed by mortgages a relatively more attractive investment versus, say, U.S. treasury bonds or other low-yielding, safe investments. This search for yield by global investors caused many to purchase CDOs, trusting the credit rating, without fully understanding the risks.[6] CDO issuance grew from an estimated $20 billion in Q1 2004 to its peak of over $180 billion by Q1 2007, then declined back under $20 billion by Q1 2008. Further, the credit quality of CDOs declined from 2000--2007, as the level of subprime and other non-prime mortgage debt increased from 5% to 36% of CDO assets; yet the credit ratings of the CDOs did not change.[7] In addition, financial innovations such as credit default swaps and synthetic CDOs enabled speculation on CDOs. This dramatically increased the amount of money that moved among market participants. In effect, multiple insurance policies or wagers could be stacked on the same CDO. If the CDO did not perform per contractual requirements, one counterparty (typically a large investment bank or hedge fund) had to pay another. Michael Lewis referred to this speculation as part of the "Doomsday Machine" that contributed to the failure of major banking institutions and smaller hedge funds, at the core of the subprime mortgage crisis.[8] There are allegations that at least one hedge fund encouraged the creation of poor quality CDOs so bets could be made against them. http://en.wikipedia.org/wiki/Collateralized_debt_obligation- published: 22 Aug 2013

- views: 8

8:42

ABCs of CDO (CLO, CBO, CDO of ABS)

After illustrating several CDO variations, I illustrate a generic CDO and consider the key...

published: 27 Mar 2008

author: bionicturtledotcom

ABCs of CDO (CLO, CBO, CDO of ABS)

ABCs of CDO (CLO, CBO, CDO of ABS)

After illustrating several CDO variations, I illustrate a generic CDO and consider the key differences that give rise to the alphabet soup of collateralized ...- published: 27 Mar 2008

- views: 41094

- author: bionicturtledotcom

4:39

How Greece's Debt Restructuring Could Affect U.S. Synthetic

As discussions over Greece's sovereign debt continue, investors are wondering if rated U.S...

published: 14 Oct 2011

author: SPTVbroadcast

How Greece's Debt Restructuring Could Affect U.S. Synthetic

How Greece's Debt Restructuring Could Affect U.S. Synthetic

As discussions over Greece's sovereign debt continue, investors are wondering if rated U.S. synthetic collateralized debt obligations (SCDOs) will be affecte...- published: 14 Oct 2011

- views: 151

- author: SPTVbroadcast

1:29

The Infamous Fabulous Fab: Mortgage Collapse Agent

July 15 (Bloomberg) -- Who is "The Fabulous Fab?" Former Goldman Sachs banker Fabrice Tour...

published: 15 Jul 2013

author: Bloomberg

The Infamous Fabulous Fab: Mortgage Collapse Agent

The Infamous Fabulous Fab: Mortgage Collapse Agent

July 15 (Bloomberg) -- Who is "The Fabulous Fab?" Former Goldman Sachs banker Fabrice Tourre heads to trial today in New York, facing charges of misleading i...- published: 15 Jul 2013

- views: 859

- author: Bloomberg

8:15

Don't Panic!!!! The dollar and the stock market will collapse THIS WEEK Pt 1

Reinhardt exploration

His website is dark; now only reads I Told You So ;-) 6 for 6

...

published: 20 Oct 2012

Don't Panic!!!! The dollar and the stock market will collapse THIS WEEK Pt 1

Don't Panic!!!! The dollar and the stock market will collapse THIS WEEK Pt 1

Reinhardt exploration His website is dark; now only reads I Told You So ;-) 6 for 6 Best place to discuss Reinhardt is either wiredpirate.com or www.godlikeproductions.com. I suggest you stay away from his actual site for a bit Peace (If you're looking for reinhardt background, a lot of his pages are in google cache - search for reinhardts journal ( MONTH DATE ) He has publicly declared Feb 9 and Feb 13 as the dates of the next financial 'Event'. He's big on cryptic posts He also warned about dodgy items on Citigroups official balance sheets... Citigroup Hides Mystery Meat in Balance Sheet: http://www.bloomberg.com/apps/news?pid=20601039&sid;=aQdj5yq_WnDI What's he on about? These are tax liabilities for the future. Either he's pointing out how dodgy they are, or he's pointing out they stand to gain Billions! Legatus Video: http://www.youtube.com/watch?v=5yf1bpq9p9Y Legatus: http://www.legatus.org/public/index.asp There is an odd connection here to look at: http://avewatch.com/?p=43 Also, they appear to be involved in Building both Ave Maria University and the town of Ave Maria, Florida. Check on Google Earth - there's nothing there... Yet there are some very nice pictures of the place on Panorama, and the rectory. And a pic of a very drunk teenager showing her knickers! Reinhardt predictions on Sept 5: http://finance.google.com/group/google.finance.983582/browse_thread/thread/aad550b590f931bf?pli=1 Lets Look at FEBRUARY and what REINHARDT has to say..: http://www.godlikeproductions.com/forum1/message642806/pg1 Reinhardt Right Again (GM) (FORD): http://www.godlikeproductions.com/forum1/message683762/pg1 Last week's page suggests UBS is in trouble. The YouTube videos had an explanation of synthetic CDOs and a clip from War Games. Done now, sorry i didn't grab it - maybe someone else did? Article on synthetic CDOs: http://www.businessspectator.com.au/bs.nsf/Article/A-tsunami-of-hope-or-terror-LHRJP?OpenDocument Synthetic CDO's are complex little known financial instruments (insurance contracts) that are on the brink of triggering "the most colossal rights issue in the history of the world, all at once .. mandatory." The triggering of default on the trillions of synthetic CDOs could be a disaster that tips the world from recession into depression. Nobody knows, but it wont be a small event. They [synthetic CDOs] have a variety of twists and turns, but it usually goes something like this: if seven of the 100 reference entities default, the SPV has to pay the bank a third of the money; if eight default, its two-thirds; and if nine default, the whole amount is repayable. Now, reinhardts predictions are around the banks. Guess which ones are listed in most of the synthetic CDO? the three Icelandic banks, Lehman Brothers, Bear Stearns, Freddie Mac, Fannie Mae, American Insurance Group, Ambac, MBIA, Countrywide Financial, Countrywide Home Loans, PMI, WashingtonMutual General Motors, Ford a lot of US home builders Six have gone already, if 1 more goes, it starts. If 2 or 3 go down - then we are in an entirely new world of pain. It will take out a lot of investors. Municipalities, Companies, Charities, Contries and Investors and some smaller banks. Money will simply vanish from their accounts. Straight back to the banks. http://www.metafilter.com/77018/Synthetic-CDOs-tsunami-event-when-major-bankruptcies-reaches-9-currently-6 Who's gonna take the hit? Places like this- Wisconsin Schools Shocked By Bad Investment: http://www.npr.org/templates/story/story.php?storyId=96723051 Do you think the government knows? OF COURSE THEY DO! That's why they are panicking! BTW - This is the Seventh bank to fail in the US this year. Regions Bank, Birmingham, AL, Acquires All the Deposits of FirstBank Financial Services, McDonough, GA: http://www.fdic.gov/news/news/press/2009/pr09017.html PREPARE - NOW!- published: 20 Oct 2012

- views: 31725

Vimeo results:

4:03

citizens demands Wall Street Sales Tax

A Wall Street Financial Tax is a tax to increase public revenues while decreasing parasiti...

published: 08 Nov 2011

author: Soul Shake Down

citizens demands Wall Street Sales Tax

A Wall Street Financial Tax is a tax to increase public revenues while decreasing parasitical speculation thus incentivizing real investment.

By 2010, high-frequency algorithmic computer trading, NOT HUMANS, accounted for over 70% of financial trading taking place in the US.

According to Webster Tarpley,

"Derivatives which escape prohibition under blanket bans on credit default swaps and synthetic CDOs must then be subjected to their fair share of the tax burden.

In a time when haircuts, bowling alleys, and restaurants are threatened with new taxation, it is simply inconceivable that the financial turnover of US financial markets should remain immune to all taxation.

...Rather than crush the US economy under an ill-advised and oppressive Value Added Tax (VAT) or national sales tax, we must institute a Wall Street sales tax of 1% on all financial transactions and turnover, including derivatives.

This is the levy known as the Tobin tax, the Wall Street sales tax, the financial transactions tax, the trading tax, the securities transfer tax, or the Robin Hood tax.

A low-ball conservative estimate of US financial turnover (including derivatives) in any given year might be about one quadrillion dollars.

In that case, a 1% Wall Street sales tax would yield $10 trillion, $5 trillion of which could be used to confront the federal budget deficit, the costs of entitlements, and the various unfunded liabilities of the federal government.

The other $5 trillion would be available for revenue sharing with the states, who could use these funds to deal with their own budget crises, which currently threaten police, firemen, health services, and other indispensable parts of the fabric of civilization itself.

One of the main causes for budget deficits of all levels of government in the United States is the glaringly obvious exemption of financial turnover from all taxation, while financial speculators use various tricks to escape paying the corporate income tax.

The proceeds from such a Wall Street sales tax would almost certainly decline as speculation became less attractive, but in the meantime they would provide much-needed relief for the public treasury.

"Needless to say, any idea of paying the proceeds of such a tax to the International Monetary Fund is out of the question. Many other countries are in the process of instituting a Tobin tax on financial turnover, so the inevitable objection that a Wall Street sales tax would represent a crippling competitive disadvantage for US financial markets is increasingly untenable." (See tarpley.net)

DEMAND A 1%

WALL STREET

SALES TAX!

24:13

Falling Off Your Horse

The cattle are all gone. Horses too. They took our boots, hats, guns, spurs, and shiny b...

published: 21 May 2010

author: The Hat & Cattle Boys

Falling Off Your Horse

The cattle are all gone. Horses too. They took our boots, hats, guns, spurs, and shiny belt buckles. Dang rustlers!

Our heroes nurse their wounds and walk painfully to the nearest town. With the last of their money (Jim stashed it you don't want to know where), the boys drown their sorrows at the local watering hole. Hours later, after a night of drinking and gambling, they stumble out of the saloon and fall into the gutter. Before passing out, they raise their fists and fill the air with their drunken shouts: "Darn you synthetic CDO traders! Dag-nab animal spirits!"

Did the recession knock you off your horse? Join the boys as they discuss setbacks and starting fresh.

If you want a bit more of this sort of thing, check out: http://tiny.cc/ovjb3

3:37

Power & Peril -- Goldman Sachs

Long format investigative journalism for CNBC. Exploring the Wall Street world of syntheti...

published: 26 Feb 2013

author: Thom Shafer

Power & Peril -- Goldman Sachs

Long format investigative journalism for CNBC. Exploring the Wall Street world of synthetic CDO's!

Youtube results:

9:59

Don't Panic!!!! The dollar and the stock market will collapse THIS WEEK Pt 2

Reinhardt exploration His website is dark; now only reads I Told You So ;-) 6 for 6 Best p...

published: 20 Oct 2012

author: FeverIAm

Don't Panic!!!! The dollar and the stock market will collapse THIS WEEK Pt 2

Don't Panic!!!! The dollar and the stock market will collapse THIS WEEK Pt 2

Reinhardt exploration His website is dark; now only reads I Told You So ;-) 6 for 6 Best place to discuss Reinhardt is either wiredpirate.com or www.godlikep...- published: 20 Oct 2012

- views: 35092

- author: FeverIAm

1:39

Goldman SEC charges to spark cases against others

The SEC's charge against Goldman, Sachs and Co. (NYSE:GS) for failing to disclose that hed...

published: 22 Apr 2010

author: TheDealVideo

Goldman SEC charges to spark cases against others

Goldman SEC charges to spark cases against others

The SEC's charge against Goldman, Sachs and Co. (NYSE:GS) for failing to disclose that hedge fund Paulson & Co. helped structure a synthetic CDO that was mar...- published: 22 Apr 2010

- views: 148

- author: TheDealVideo

4:02

One Group's Fight for Understandable Language

This is the VOA Special English Economics Report, from http://voaspecialenglish.com | http...

published: 27 May 2010

author: VOA Learning English

One Group's Fight for Understandable Language

One Group's Fight for Understandable Language

This is the VOA Special English Economics Report, from http://voaspecialenglish.com | http://facebook.com/voalearningenglish Sometimes, financial news can be...- published: 27 May 2010

- views: 8561

- author: VOA Learning English

2:28

CDO (Collateralized Debt Obligation) that caused the global financial crisis

The global financial meltdown, at a cost of over $20 trillion, resulted in millions of peo...

published: 03 Apr 2012

author: kmfchannel

CDO (Collateralized Debt Obligation) that caused the global financial crisis

CDO (Collateralized Debt Obligation) that caused the global financial crisis

The global financial meltdown, at a cost of over $20 trillion, resulted in millions of people losing their homes and jobs in the worst recession since the Gr...- published: 03 Apr 2012

- views: 4486

- author: kmfchannel