9:51

What are derivatives? - MoneyWeek Investment Tutorials

MoneyWeek's deputy editor Tim Bennett explains what derivatives are, and how you can use t...

published: 03 Jan 2012

author: MoneyWeekVideos

What are derivatives? - MoneyWeek Investment Tutorials

What are derivatives? - MoneyWeek Investment Tutorials

MoneyWeek's deputy editor Tim Bennett explains what derivatives are, and how you can use them to your advantage. Don't miss out on Tim Bennett's video tutori...- published: 03 Jan 2012

- views: 84684

- author: MoneyWeekVideos

4:18

What are Derivatives ?

An introduction to Derivatives....

published: 20 Feb 2012

author: graphitishow

What are Derivatives ?

What are Derivatives ?

An introduction to Derivatives.- published: 20 Feb 2012

- views: 82834

- author: graphitishow

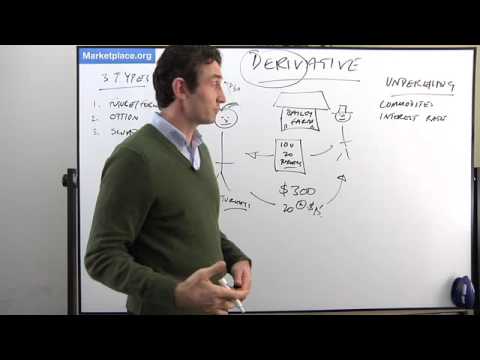

6:24

Introduction to Financial Derivatives

http://www.kanjoh.com. disclaimer - none of these videos is meant to be personalized finan...

published: 15 Jul 2009

author: kanjohvideo

Introduction to Financial Derivatives

Introduction to Financial Derivatives

http://www.kanjoh.com. disclaimer - none of these videos is meant to be personalized financial advice.- published: 15 Jul 2009

- views: 63953

- author: kanjohvideo

9:29

Financial Derivatives: What are They? - Housing Bubble Collapse - Unregulated Insurance

Was the lack of regulation on financial derivatives the main cause of our economic collaps...

published: 17 May 2009

author: jbranstetter04

Financial Derivatives: What are They? - Housing Bubble Collapse - Unregulated Insurance

Financial Derivatives: What are They? - Housing Bubble Collapse - Unregulated Insurance

Was the lack of regulation on financial derivatives the main cause of our economic collapse? Or was it the easy money that Fanny Mae and Freddie Mac were giv...- published: 17 May 2009

- views: 49771

- author: jbranstetter04

52:06

Financial Derivatives: Probability that Call Option Will Expire Into Money

Calculation of the probability that call option on the stock will expire into money. We as...

published: 15 Aug 2008

author: vorojtsov

Financial Derivatives: Probability that Call Option Will Expire Into Money

Financial Derivatives: Probability that Call Option Will Expire Into Money

Calculation of the probability that call option on the stock will expire into money. We assume that return on the stock follows Geometric Brownian motion (GM...- published: 15 Aug 2008

- views: 46103

- author: vorojtsov

24:18

Financial Derivatives - Binomial Option Pricing - The One-Period Model Formula

Series playlist: http://www.youtube.com/playlist?list=PLG59E6Un18vhANdpTHZCFnfj-jwFEqZ0Q&f...;

published: 01 Feb 2013

author: BurbsCast

Financial Derivatives - Binomial Option Pricing - The One-Period Model Formula

Financial Derivatives - Binomial Option Pricing - The One-Period Model Formula

Series playlist: http://www.youtube.com/playlist?list=PLG59E6Un18vhANdpTHZCFnfj-jwFEqZ0Q&feature;=view_all In this tutorial, I introduce the Binomial Option P...- published: 01 Feb 2013

- views: 2139

- author: BurbsCast

45:08

Lynn Stout: The Origin and Use of Derivatives in Financial Services [AIER Lectures]

Prof. Lynn A. Stout Distinguished Professor of Corporate and Business Law Jack G. Clarke B...

published: 03 Aug 2012

author: AIERvideo

Lynn Stout: The Origin and Use of Derivatives in Financial Services [AIER Lectures]

Lynn Stout: The Origin and Use of Derivatives in Financial Services [AIER Lectures]

Prof. Lynn A. Stout Distinguished Professor of Corporate and Business Law Jack G. Clarke Business Law Institute Cornell Law School.- published: 03 Aug 2012

- views: 764

- author: AIERvideo

4:48

Finance Explained: Derivatives

I've wanted to do some short explanations of financial terms for a while now, mostly as a ...

published: 23 Jun 2011

author: Chris Hemmens

Finance Explained: Derivatives

Finance Explained: Derivatives

I've wanted to do some short explanations of financial terms for a while now, mostly as a reaction to the way people keep talking about them without any idea...- published: 23 Jun 2011

- views: 8492

- author: Chris Hemmens

71:12

Structured Finance, Lecture 2 - Credit Derivatives - Part 1

Introduction to Credit derivatives and Credit Default Swaps. Dr. Krassimir Petrov, AUBG Pr...

published: 25 Apr 2011

author: kmpetrov

Structured Finance, Lecture 2 - Credit Derivatives - Part 1

Structured Finance, Lecture 2 - Credit Derivatives - Part 1

Introduction to Credit derivatives and Credit Default Swaps. Dr. Krassimir Petrov, AUBG Professor: Krassimir Petrov, Ph. D.- published: 25 Apr 2011

- views: 10744

- author: kmpetrov

5:49

What are Financial Derivatives?

This is short doc about financial derivatives. I wanted to make it without using graphs or...

published: 14 Nov 2010

author: TheMotionInPictures .

What are Financial Derivatives?

What are Financial Derivatives?

This is short doc about financial derivatives. I wanted to make it without using graphs or being like a business presentation. So I used 2.5D style pictures....- published: 14 Nov 2010

- views: 5770

- author: TheMotionInPictures .

7:45

A brief Introduction to Financial Derivatives

A high level introduction to financial derivatives. This will be the first of about 10 vi...

published: 20 Aug 2013

A brief Introduction to Financial Derivatives

A brief Introduction to Financial Derivatives

A high level introduction to financial derivatives. This will be the first of about 10 videos on derivatives for my finance classes.- published: 20 Aug 2013

- views: 12

2:49

The Problem with Derivatives: Dangerous Financial Instruments & Auditing - Warren Buffett

A derivative is a financial instrument which derives its value from the value of underlyin...

published: 27 Jul 2013

author: The Film Archive

The Problem with Derivatives: Dangerous Financial Instruments & Auditing - Warren Buffett

The Problem with Derivatives: Dangerous Financial Instruments & Auditing - Warren Buffett

A derivative is a financial instrument which derives its value from the value of underlying entities such as an asset, index, or interest rate—it has no intr...- published: 27 Jul 2013

- views: 444

- author: The Film Archive

81:00

Predicting the Next Financial Crisis: Derivatives and Risk Management (1994)

Critics such as economist Paul Krugman and U.S. Treasury Secretary Timothy Geithner have a...

published: 18 Sep 2013

Predicting the Next Financial Crisis: Derivatives and Risk Management (1994)

Predicting the Next Financial Crisis: Derivatives and Risk Management (1994)

Critics such as economist Paul Krugman and U.S. Treasury Secretary Timothy Geithner have argued that the regulatory framework did not keep pace with financial innovation, such as the increasing importance of the shadow banking system, derivatives and off-balance sheet financing. A recent OECD study[86] suggest that bank regulation based on the Basel accords encourage unconventional business practices and contributed to or even reinforced the financial crisis. In other cases, laws were changed or enforcement weakened in parts of the financial system. Key examples include: Jimmy Carter's Depository Institutions Deregulation and Monetary Control Act of 1980 (DIDMCA) phased out a number of restrictions on banks' financial practices, broadened their lending powers, allowed credit unions and savings and loans to offer checkable deposits, and raised the deposit insurance limit from $40,000 to $100,000 (thereby potentially lessening depositor scrutiny of lenders' risk management policies).[87] In October 1982, U.S. President Ronald Reagan signed into law the Garn--St. Germain Depository Institutions Act, which provided for adjustable-rate mortgage loans, began the process of banking deregulation,[citation needed] and contributed to the savings and loan crisis of the late 1980s/early 1990s.[88] In November 1999, U.S. President Bill Clinton signed into law the Gramm--Leach--Bliley Act, which repealed part of the Glass--Steagall Act of 1933. This repeal has been criticized for reducing the separation between commercial banks (which traditionally had fiscally conservative policies) and investment banks (which had a more risk-taking culture).[89][90] However, the vast majority of failures were at institutions that were created by Glass-Steagall.[91] In 2004, the U.S. Securities and Exchange Commission relaxed the net capital rule, which enabled investment banks to substantially increase the level of debt they were taking on, fueling the growth in mortgage-backed securities supporting subprime mortgages. The SEC has conceded that self-regulation of investment banks contributed to the crisis.[92][93] Financial institutions in the shadow banking system are not subject to the same regulation as depository banks, allowing them to assume additional debt obligations relative to their financial cushion or capital base.[94] This was the case despite the Long-Term Capital Management debacle in 1998, where a highly leveraged shadow institution failed with systemic implications. Regulators and accounting standard-setters allowed depository banks such as Citigroup to move significant amounts of assets and liabilities off-balance sheet into complex legal entities called structured investment vehicles, masking the weakness of the capital base of the firm or degree of leverage or risk taken. One news agency estimated that the top four U.S. banks will have to return between $500 billion and $1 trillion to their balance sheets during 2009.[95] This increased uncertainty during the crisis regarding the financial position of the major banks.[96] Off-balance sheet entities were also used by Enron as part of the scandal that brought down that company in 2001.[97] As early as 1997, Federal Reserve chairman Alan Greenspan fought to keep the derivatives market unregulated.[98] With the advice of the President's Working Group on Financial Markets,[99] the U.S. Congress and President allowed the self-regulation of the over-the-counter derivatives market when they enacted the Commodity Futures Modernization Act of 2000. Derivatives such as credit default swaps (CDS) can be used to hedge or speculate against particular credit risks. The volume of CDS outstanding increased 100-fold from 1998 to 2008, with estimates of the debt covered by CDS contracts, as of November 2008, ranging from US$33 to $47 trillion. Total over-the-counter (OTC) derivative notional value rose to $683 trillion by June 2008.[100] Warren Buffett famously referred to derivatives as "financial weapons of mass destruction" in early 2003. http://en.wikipedia.org/wiki/Financial_crisis_of_2008- published: 18 Sep 2013

- views: 22

1:11

What are Financial Derivatives?

What are Financial Derivatives: http://www.mylifeplan.info Financial derivatives are secur...

published: 25 Sep 2012

author: mylifeplaninfo

What are Financial Derivatives?

What are Financial Derivatives?

What are Financial Derivatives: http://www.mylifeplan.info Financial derivatives are securities whose price is dependent upon or derived from one or more und...- published: 25 Sep 2012

- views: 248

- author: mylifeplaninfo

Youtube results:

4:22

Introduction to Financial Derivatives (music - [Merlin] Ninja Tune Ltd)

An introduction to Financial Derivatives. Why do we have them and why are they important? ...

published: 05 Jul 2012

author: ETPGRockChannel

Introduction to Financial Derivatives (music - [Merlin] Ninja Tune Ltd)

Introduction to Financial Derivatives (music - [Merlin] Ninja Tune Ltd)

An introduction to Financial Derivatives. Why do we have them and why are they important? Recommended for everyone who wants the corporate perspective also. ...- published: 05 Jul 2012

- views: 1090

- author: ETPGRockChannel

3:41

Cyprus Bailout, & Disastrous Financial Derivatives

"...European leaders said a chaotic national bankruptcy that might have forced Cyprus from...

published: 26 Mar 2013

author: TheYoungTurks

Cyprus Bailout, & Disastrous Financial Derivatives

Cyprus Bailout, & Disastrous Financial Derivatives

"...European leaders said a chaotic national bankruptcy that might have forced Cyprus from the euro and upset Europe's economy was averted - though investors...- published: 26 Mar 2013

- views: 25749

- author: TheYoungTurks

4:43

Understanding Financial Derivatives

Using the analogy of a bar business this video explains how derivates are created and what...

published: 25 Oct 2011

author: joe2by2

Understanding Financial Derivatives

Understanding Financial Derivatives

Using the analogy of a bar business this video explains how derivates are created and what can go wrong.- published: 25 Oct 2011

- views: 728

- author: joe2by2

26:05

Wall Street casino: The derivatives crisis

The derivatives market is the Las Vegas of the world's financial super elite, worth anywhe...

published: 25 Apr 2013

author: PressTVGlobalNews

Wall Street casino: The derivatives crisis

Wall Street casino: The derivatives crisis

The derivatives market is the Las Vegas of the world's financial super elite, worth anywhere between 2 to 8 quadrillion dollars compared to about 70 trillion...- published: 25 Apr 2013

- views: 4498

- author: PressTVGlobalNews