- published: 13 Nov 2010

- views: 81685

-

remove the playlistImport Tariff

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistImport Tariff

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 10 Oct 2012

- views: 62930

- published: 03 Apr 2014

- views: 2406

- published: 20 Nov 2015

- views: 118870

- published: 29 Mar 2009

- views: 2225

- published: 31 Mar 2009

- views: 1479

- published: 31 Mar 2009

- views: 643

- published: 01 May 2014

- views: 1155

A tariff is either (1) a tax on imports or exports (trade tariff) in and out of a country, or (2) a list or schedule of prices for such things as rail service, bus routes, and electrical usage (electrical tariff, etc.).

The word comes from the Italian word tariffa "list of prices, book of rates," which is derived from the Arabic ta'rif "to notify or announce."

Tariffs, often called customs, were by far the largest source of United States federal revenue from the 1790s to the eve of World War I, until they were surpassed by income taxes.

Neoclassical economic theorists tend to view tariffs as distortions to the free market. Typical analyses find that tariffs tend to benefit domestic producers and government at the expense of consumers, and that the net welfare effects of a tariff on the importing country are negative. Normative judgments often follow from these findings, namely that it may be disadvantageous for a country to artificially shield an industry from world markets, and that it might be better to allow a collapse to take place. Opposition to all tariffs is part of the free trade principle; the World Trade Organization aims to reduce tariffs and to avoid countries discriminating between differing countries when applying tariffs.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

6:44

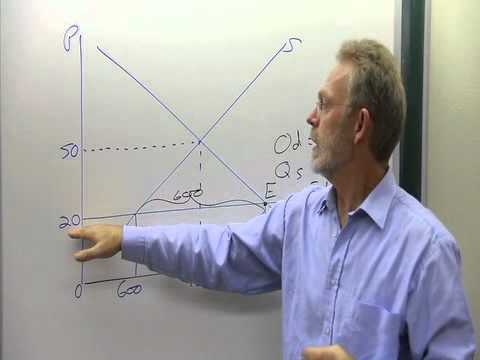

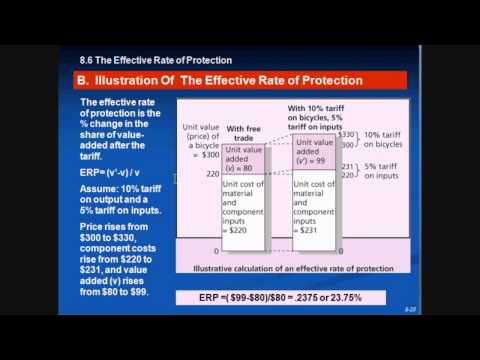

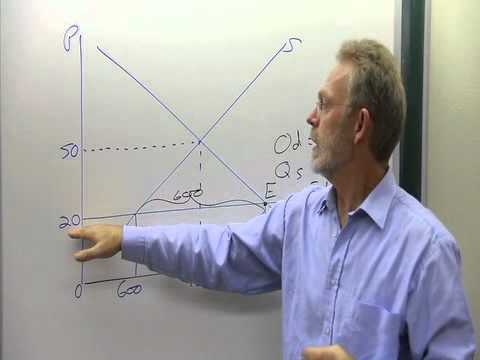

6:44How to calculate the impact of import and export tariffs.

How to calculate the impact of import and export tariffs.How to calculate the impact of import and export tariffs.

A tutorial on how import prices increases consumer surplus and decreases producer surplus, the impact of tariffs and the deadweight loss to society. Like us on: http://www.facebook.com/PartyMoreStudyLess -

4:34

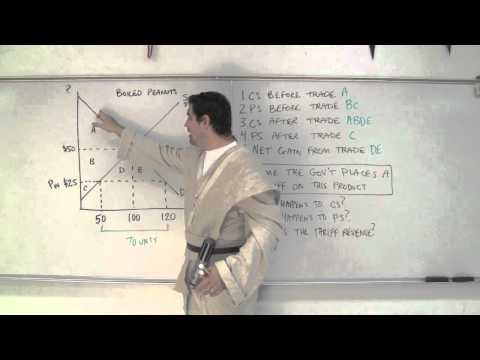

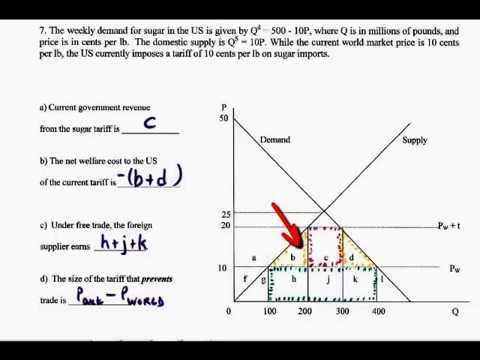

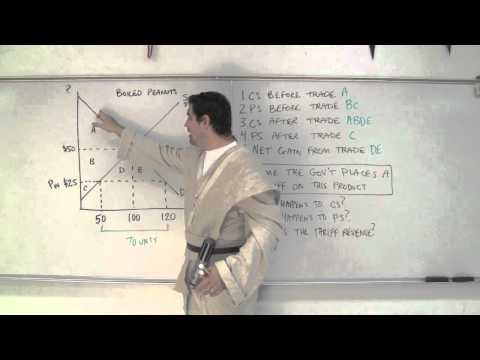

4:34International trade: Impact of Import tariffs

International trade: Impact of Import tariffsInternational trade: Impact of Import tariffs

The economic impact of import tariffs -

6:49

6:49Impact of an import tariff.mp4

Impact of an import tariff.mp4Impact of an import tariff.mp4

-

6:51

6:51Micro 2.8 Tariffs and Quotas

Micro 2.8 Tariffs and QuotasMicro 2.8 Tariffs and Quotas

Mr. Clifford explains how to show the effects tariffs and quotas on a supply and demand graph. The days I filmed this video were in "spirit week". One day was sports day (that's why I'm dressed like a coach) and the other day was Tomorowland day. I apologize for my bad southern accent. I led a training in Athens, GA in the summer and I loved it. Southern hospitality is real. Thanks for watching, Please subscribe. Get the Ultimate Review Packet http://www.acdcecon.com/#!review-packet/czji Macroeconomics Videos https://www.youtube.com/watch?v=XnFv3d8qllI Microeconomics Videos https://www.youtube.com/watch?v=swnoF533C_c Watch Econmovies https://www.youtube.com/playlist?list=PL1oDmcs0xTD9Aig5cP8_R1gzq-mQHgcAH Follow me on Twitter https://twitter.com/acdcleadership -

17:18

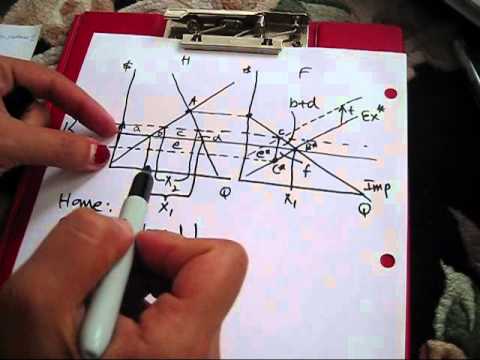

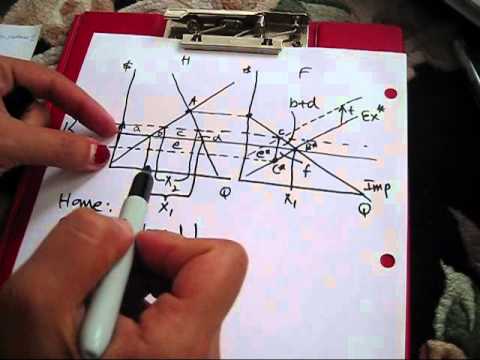

17:1811e: the effects of an import tariff

11e: the effects of an import tariff11e: the effects of an import tariff

This presentation considers the effects of an import tariff (i.e. a tax on imports) for cars. We show how the tariff harms domestic consumers but benefits domestic car producers. It raises the price for all cars but also raises some government revenue. The tariff leads to a net loss overall. -

14:51

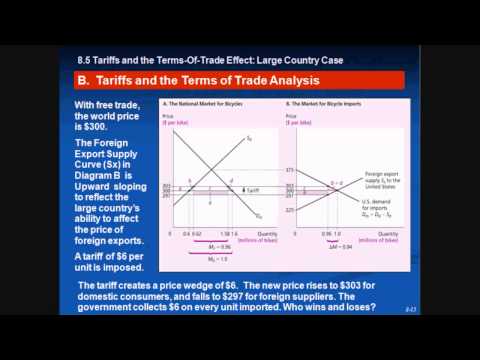

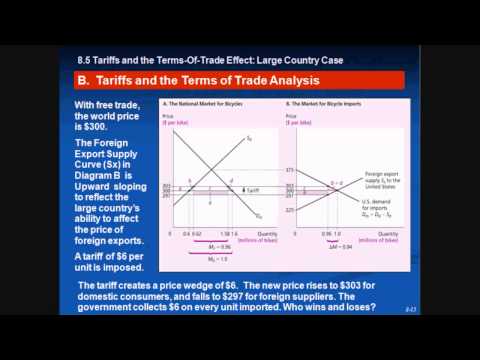

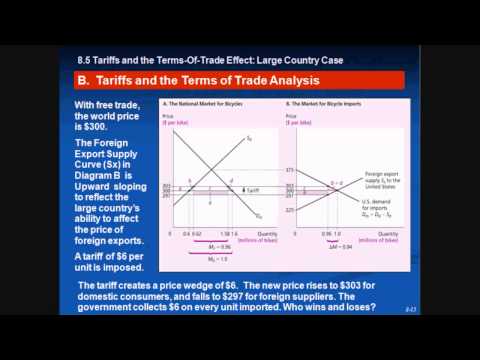

14:51Large country tariff basics

Large country tariff basics -

12:01

12:018a- Big country introduces import tariff (Perfect Competitive Markets)

8a- Big country introduces import tariff (Perfect Competitive Markets)8a- Big country introduces import tariff (Perfect Competitive Markets)

Chapter8-part a- Big country introduces import tariffs (pc) -

10:11

10:11Imports, Exports, and Exchange Rates: Crash Course Economics #15

Imports, Exports, and Exchange Rates: Crash Course Economics #15Imports, Exports, and Exchange Rates: Crash Course Economics #15

What is a trade deficit? Well, it all has to do with imports and exports and, well, trade. This week Jacob and Adriene walk you through the basics of imports, exports, and exchange. So, you remember the specialization and trade thing, right? So, that leads to imports and exports. Economically, in the aggregate, this is usually a good thing. Globalization and free trade do tend to increase overall wealth. But not everybody wins. Crash Course is on Patreon! You can support us directly by signing up at http://www.patreon.com/crashcourse Thanks to the following Patrons for their generous monthly contributions that help keep Crash Course free for everyone forever: Mark, Eric Kitchen, Jessica Wode, Jeffrey Thompson, Steve Marshall, Moritz Schmidt, Robert Kunz, Tim Curwick, Jason A Saslow, SR Foxley, Elliot Beter, Jacob Ash, Christian, Jan Schmid, Jirat, Christy Huddleston, Daniel Baulig, Chris Peters, Anna-Ester Volozh, Ian Dundore, Caleb Weeks -- Want to find Crash Course elsewhere on the internet? Facebook - http://www.facebook.com/YouTubeCrashCourse Twitter - http://www.twitter.com/TheCrashCourse Tumblr - http://thecrashcourse.tumblr.com Support Crash Course on Patreon: http://patreon.com/crashcourse CC Kids: http://www.youtube.com/crashcoursekids -

8:09

8:09Import Tariff part 1 HD

Import Tariff part 1 HDImport Tariff part 1 HD

Analysis of economic trade with a Governement Imposed Tariff. Including both small and large country analsys. -

9:56

9:56Import Tariff part 3 HD

Import Tariff part 3 HDImport Tariff part 3 HD

Analysis of economic trade with a Governement Imposed Tariff. Including both small and large country analsys. -

6:16

6:16Import Tariff part 4 HD

Import Tariff part 4 HDImport Tariff part 4 HD

Analysis of economic trade with a Governement Imposed Tariff. Including both small and large country analsys. -

6:56

6:56Small Country Analysis of an Import Tariff

Small Country Analysis of an Import TariffSmall Country Analysis of an Import Tariff

This analysis focuses on the "social welfare effects" of an import tariff in the "small country" case (small country's conditions do not affect the world price). -

0:46

0:46Govt hikes import tariff on gold, silver to prevent tax evasion

Govt hikes import tariff on gold, silver to prevent tax evasionGovt hikes import tariff on gold, silver to prevent tax evasion

Govt hikes import tariff on gold, silver to prevent tax evasion Connect with Puthiya Thalaimurai TV Online: SUBSCRIBE to get the latest updates : http://bit.ly/1O4soYP Visit Puthiya Thalaimurai TV WEBSITE: http://puthiyathalaimurai.tv/ Like Puthiya Thalaimurai TV on FACEBOOK: https://www.facebook.com/PTTVOnlineNews Follow Puthiya Thalaimurai TV TWITTER: https://twitter.com/PTTVOnlineNews About Puthiya Thalaimurai TV Puthiya Thalaimurai TV is a 24x7 live news channel in Tamil launched on August 24, 2011.Due to its independent editorial stance it became extremely popular in India and abroad within days of its launch and continues to remain so till date.The channel looks at issues through the eyes of the common man and serves as a platform that airs people's views.The editorial policy is built on strong ethics and fair reporting methods that does not favour or oppose any individual, ideology, group, government, organisation or sponsor.The channel’s primary aim is taking unbiased and accurate information to the socially conscious common man. Besides giving live and current information the channel broadcasts news on sports, business and international affairs. It also offers a wide array of week end programmes. The channel is promoted by Chennai based New Gen Media Corporation. The company also publishes popular Tamil magazines- Puthiya Thalaimurai and Kalvi. The news center is based in Chennai city, supported by a sprawling network of bureaus all over Tamil Nadu. It has a northern hub in the capital Delhi.The channel is proud of its well trained journalists and employs cutting edge technology for news gathering and processing. -

2:24

2:24USA: USA/JAPAN TRADE WAR: US AUTOMOBILE IMPORT TARIFF

USA: USA/JAPAN TRADE WAR: US AUTOMOBILE IMPORT TARIFFUSA: USA/JAPAN TRADE WAR: US AUTOMOBILE IMPORT TARIFF

English/Nat Almost six (b) billion dollars worth of Japanese imports have been targeted for tough sanctions by the United States. In the latest move in the U-S-Japan trade war, U-S Trade Representative Mickey Kantor released the target list which includes 13 models of Japanese automobiles. The items on the list, worth 5.9 (b) billion dollars, will be hit with a 100 per cent tariff. The tariff would double the cost of Japanese cars imported into the United States. The announcement had been anticipated for weeks, since talks between the U-S and Japan broke down in Vancouver earlier this month. U-S Trade Representative Mickey Kantor said that the United States had to show it's serious. On Tuesday, he did just that. SOUNDBITE: " Specifically we delivered a prefiling notification to W.T.O. Director- General Ruggiero indicating our intent to invoke the dispute settlement mechanism of the World Trade Organisation. This notification indicates our intent to challenge the continuing discrimination against United States autos and auto parts in Japan." SUPER CAPTION: U-S Trade Representative Mickey Kantor The proposed 100 per cent tariffs were aimed at 13 Japanese car models, ranging in price from 25-thousand to more than 50-thousand, and were designed to eliminate totally those sales from the American market as retaliation for Japan's failure to lower barriers to the sale of American cars and parts. SOUNDBITE: " Today I'm announcing the proposed sanctions list in the section 301 case regarding barriers in the Japanese after-market for replacement auto parts and automotive accessories. This follows the May 10 unfairness determination that acts, practices and policies of the government of Japan, with respect to the after-market, are unreasonable, and burden and restrict United States commerce. The list consists of imports of Japanese luxury cars which will be subject to duties of one hundred percent." SUPER CAPTION: U-S Trade Representative Mickey Kantor The 5.9 (b) billion dollars represents a record amount in U.S. trade sanctions, but the final list of products doesn't take effect until the end of June, after a public comment period. This also gives negotiators from both countries a chance to resolve the trade disagreement short of sanctions. It also allows President Bill Clinton to raise the issue personally with Japanese Prime Minister Tomiichi Murayama at the annual economic summit of the world's seven richest industrial countries, mid-June in Nova Scotia. SOUNDBITE: " If you look at the special problem of autos and auto parts and how long we have laboured over it, and how reasonable the United States have been, for years, even for more than a decade, I believe that this is something we have to go forward on. The Japanese government has acknowledged that we have important security interests and other interests in common, and that we cannot let our entire relationship be wrecked by this." SUPER CAPTION: U.S. President Bill Clinton The Clinton administration has insisted that its intent is not to impose punitive tariffs, but to force Japan to arrive at a negotiated settlement on three U-S demands. The United States wants Japanese automobile makers to use more American-made parts, more Japanese car dealers to stock U-S cars and safety rules relaxed that are keep U-S made auto parts out of Japanese garages. You can license this story through AP Archive: http://www.aparchive.com/metadata/youtube/15259da80c6bb21ffde9e34abdc991e0 Find out more about AP Archive: http://www.aparchive.com/HowWeWork

- Ad valorem tax

- Arab Customs Union

- Balance of payments

- Balance of trade

- Black market

- Bus routes

- Capital account

- Capital gains tax

- Caribbean Community

- Cato Institute

- Consumer surplus

- Consumption tax

- Corporate tax

- Current account

- Customs

- Customs union

- Dead weight loss

- Deadweight loss

- Direct tax

- Dividend tax

- Double taxation

- Duty (economics)

- Economic integration

- Economic nationalism

- Election

- Electrical

- Embargo

- Environmental tariff

- Excess profits tax

- Excise

- Excise duty

- Export

- Exports

- Fair trade

- Fiscal policy

- Flat tax

- Free market

- Free trade

- Free trade zone

- Georgism

- Gift tax

- Globalization

- Government revenue

- Gross receipts tax

- Import

- Import quota

- Imports

- Income tax

- Income tax threshold

- Indirect tax

- Inheritance tax

- International trade

- Laffer curve

- Land value tax

- List of tariffs

- Mercantilism

- Mercosur

- Negative income tax

- Net capital outflow

- Nick Xenophon

- Non-tax revenue

- Optimal tax

- Outsourcing

- Payroll tax

- Per unit tax

- Pigovian tax

- Producer surplus

- Progressive tax

- Project Socrates

- Property tax

- Proportional tax

- Protectionism

- Purchasing power

- Rail transport

- Regressive tax

- Revenue service

- Revenue stamp

- Russian Tax Code

- Sales tax

- Sin tax

- Smuggling

- Spahn tax

- Stamp duty

- Swiss Formula

- Tariff

- Tariff Act of 1789

- Tariff war

- Tax

- Tax advantage

- Tax assessment

- Tax avoidance

- Tax bracket

- Tax collection

- Tax competition

- Tax credit

- Tax cut

- Tax deduction

- Tax equalization

- Tax evasion

- Tax exemption

- Tax farming

- Tax harmonization

- Tax haven

- Tax holiday

- Tax in rem

- Tax incentive

- Tax incidence

- Tax investigation

- Tax law

- Tax lien

- Tax noncompliance

- Tax policy

- Tax preparation

- Tax rate

- Tax reform

- Tax refund

- Tax residence

- Tax resistance

- Tax revenue

- Tax shelter

- Tax shield

- Tax shift

- Tax treaty

- Taxable income

- Taxation in Bhutan

- Taxation in Canada

- Taxation in Colombia

- Taxation in France

- Taxation in Germany

- Taxation in Greece

- Taxation in Iceland

- Taxation in India

- Taxation in Iran

- Taxation in Israel

- Taxation in Italy

- Taxation in Japan

- Taxation in Pakistan

- Taxation in Peru

- Taxation in Sweden

- Taxation in Tanzania

- Taxpayer groups

- Technology strategy

- Template talk Trade

- Template Taxation

- Template Trade

- Tobin tax

- Trade

- Trade barrier

- Trade bloc

- Trade justice

- Trade pact

- Trading nation

- Turnover tax

- Value added tax

- Windfall profits tax

- World Bank Group

- World War I

-

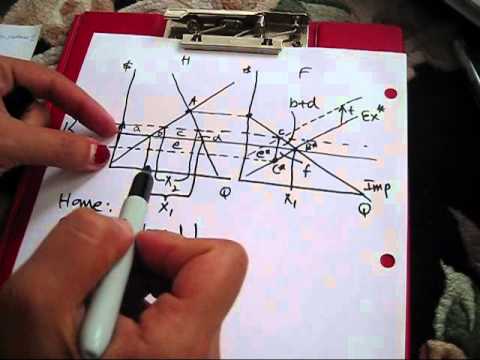

How to calculate the impact of import and export tariffs.

A tutorial on how import prices increases consumer surplus and decreases producer surplus, the impact of tariffs and the deadweight loss to society. Like us on: http://www.facebook.com/PartyMoreStudyLess -

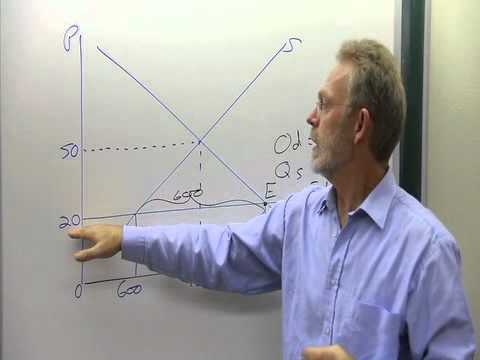

International trade: Impact of Import tariffs

The economic impact of import tariffs -

Impact of an import tariff.mp4

-

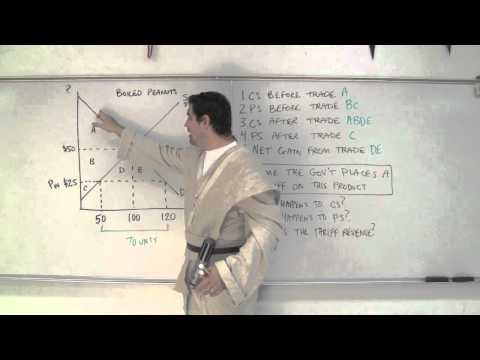

Micro 2.8 Tariffs and Quotas

Mr. Clifford explains how to show the effects tariffs and quotas on a supply and demand graph. The days I filmed this video were in "spirit week". One day was sports day (that's why I'm dressed like a coach) and the other day was Tomorowland day. I apologize for my bad southern accent. I led a training in Athens, GA in the summer and I loved it. Southern hospitality is real. Thanks for watching, Please subscribe. Get the Ultimate Review Packet http://www.acdcecon.com/#!review-packet/czji Macroeconomics Videos https://www.youtube.com/watch?v=XnFv3d8qllI Microeconomics Videos https://www.youtube.com/watch?v=swnoF533C_c Watch Econmovies https://www.youtube.com/playlist?list=PL1oDmcs0xTD9Aig5cP8_R1gzq-mQHgcAH Follow me on Twitter https://twitter.com/acdcleadership -

11e: the effects of an import tariff

This presentation considers the effects of an import tariff (i.e. a tax on imports) for cars. We show how the tariff harms domestic consumers but benefits domestic car producers. It raises the price for all cars but also raises some government revenue. The tariff leads to a net loss overall. -

-

8a- Big country introduces import tariff (Perfect Competitive Markets)

Chapter8-part a- Big country introduces import tariffs (pc) -

Imports, Exports, and Exchange Rates: Crash Course Economics #15

What is a trade deficit? Well, it all has to do with imports and exports and, well, trade. This week Jacob and Adriene walk you through the basics of imports, exports, and exchange. So, you remember the specialization and trade thing, right? So, that leads to imports and exports. Economically, in the aggregate, this is usually a good thing. Globalization and free trade do tend to increase overall wealth. But not everybody wins. Crash Course is on Patreon! You can support us directly by signing up at http://www.patreon.com/crashcourse Thanks to the following Patrons for their generous monthly contributions that help keep Crash Course free for everyone forever: Mark, Eric Kitchen, Jessica Wode, Jeffrey Thompson, Steve Marshall, Moritz Schmidt, Robert Kunz, Tim Curwick, Jason A Saslow, S... -

Import Tariff part 1 HD

Analysis of economic trade with a Governement Imposed Tariff. Including both small and large country analsys. -

Import Tariff part 3 HD

Analysis of economic trade with a Governement Imposed Tariff. Including both small and large country analsys. -

Import Tariff part 4 HD

Analysis of economic trade with a Governement Imposed Tariff. Including both small and large country analsys. -

Small Country Analysis of an Import Tariff

This analysis focuses on the "social welfare effects" of an import tariff in the "small country" case (small country's conditions do not affect the world price). -

Govt hikes import tariff on gold, silver to prevent tax evasion

Govt hikes import tariff on gold, silver to prevent tax evasion Connect with Puthiya Thalaimurai TV Online: SUBSCRIBE to get the latest updates : http://bit.ly/1O4soYP Visit Puthiya Thalaimurai TV WEBSITE: http://puthiyathalaimurai.tv/ Like Puthiya Thalaimurai TV on FACEBOOK: https://www.facebook.com/PTTVOnlineNews Follow Puthiya Thalaimurai TV TWITTER: https://twitter.com/PTTVOnlineNews About Puthiya Thalaimurai TV Puthiya Thalaimurai TV is a 24x7 live news channel in Tamil launched on August 24, 2011.Due to its independent editorial stance it became extremely popular in India and abroad within days of its launch and continues to remain so till date.The channel looks at issues through the eyes of the common man and serves as a platform that airs people's views.The editorial policy... -

USA: USA/JAPAN TRADE WAR: US AUTOMOBILE IMPORT TARIFF

English/Nat Almost six (b) billion dollars worth of Japanese imports have been targeted for tough sanctions by the United States. In the latest move in the U-S-Japan trade war, U-S Trade Representative Mickey Kantor released the target list which includes 13 models of Japanese automobiles. The items on the list, worth 5.9 (b) billion dollars, will be hit with a 100 per cent tariff. The tariff would double the cost of Japanese cars imported into the United States. The announcement had been anticipated for weeks, since talks between the U-S and Japan broke down in Vancouver earlier this month. U-S Trade Representative Mickey Kantor said that the United States had to show it's serious. On Tuesday, he did just that. SOUNDBITE: " Specifically we delivered a prefiling not... -

Import Tariff part 2

Analysis of economic trade with a Governement Imposed Tariff. Including both small and large country analsys. -

-

Effects of a tariff small country

This video screencast was created with Doceri on an iPad. Doceri is free in the iTunes app store. Learn more at http://www.doceri.com -

11f: the effects of an import quota

In this video we look at what happens when the government restricts the volume of imports. We show that a quota is similar to a tariff. But the big question relates to the government revenue. -

Channels Book Club: Stakeholders Debate Import Tariff Increase Prt 1

Executive Member, Nigeria Printers Association, Baba Fashanu and Executive Secretary, Nigeria Publishers Association, Banji Aladesuyi debate on the increase on import tariffs, by the Federal Government. For more information log on to www.channelstv.com. -

USA: USA/JAPAN TRADE WAR: US AUTOMOBILE IMPORT TARIFF UPDATE

English/Nat The United States has announced details of the trade sanctions it intends to impose against Japan over Tokyo's refusal l to open its automobile market to U-S competition. It will impose 100 per cent tariffs on 13 makes of Japanese luxury cars from Saturday, but with a 30 day public comment period. In response Tokyo says it will appeal to the World Trade Organization. It was the opening salvo in what could become a trade war between the United States and Japan. U-S Trade Ambassador Mickey Kantor announcing a sanctions list against certain Japanese automobiles. SOUNDBITE: "Today I am announcing our proposed sanctions list in the section 301- case regarding barriers in the Japanese aftermarket for replacement auto parts and automotive accessories. This follows... -

9c Small Monopolized country introduces import tariff

-

-

Chp9b: Small Monopolized country introduces import tariff

How to calculate the impact of import and export tariffs.

- Order: Reorder

- Duration: 6:44

- Updated: 13 Nov 2010

- views: 81685

- published: 13 Nov 2010

- views: 81685

International trade: Impact of Import tariffs

- Order: Reorder

- Duration: 4:34

- Updated: 07 Jan 2011

- views: 30738

- published: 07 Jan 2011

- views: 30738

Impact of an import tariff.mp4

- Order: Reorder

- Duration: 6:49

- Updated: 04 Aug 2011

- views: 7813

- published: 04 Aug 2011

- views: 7813

Micro 2.8 Tariffs and Quotas

- Order: Reorder

- Duration: 6:51

- Updated: 10 Oct 2012

- views: 62930

- published: 10 Oct 2012

- views: 62930

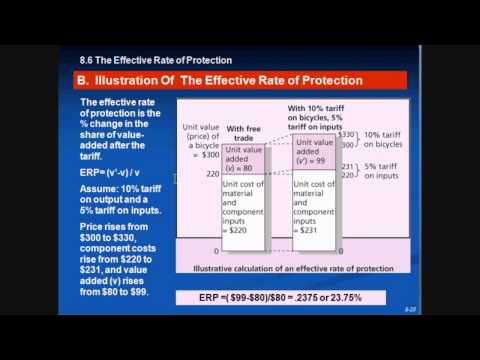

11e: the effects of an import tariff

- Order: Reorder

- Duration: 17:18

- Updated: 03 Apr 2014

- views: 2406

- published: 03 Apr 2014

- views: 2406

Large country tariff basics

- Order: Reorder

- Duration: 14:51

- Updated: 04 Oct 2013

- views: 14651

8a- Big country introduces import tariff (Perfect Competitive Markets)

- Order: Reorder

- Duration: 12:01

- Updated: 03 Sep 2010

- views: 8240

Imports, Exports, and Exchange Rates: Crash Course Economics #15

- Order: Reorder

- Duration: 10:11

- Updated: 20 Nov 2015

- views: 118870

- published: 20 Nov 2015

- views: 118870

Import Tariff part 1 HD

- Order: Reorder

- Duration: 8:09

- Updated: 29 Mar 2009

- views: 2225

- published: 29 Mar 2009

- views: 2225

Import Tariff part 3 HD

- Order: Reorder

- Duration: 9:56

- Updated: 31 Mar 2009

- views: 1479

- published: 31 Mar 2009

- views: 1479

Import Tariff part 4 HD

- Order: Reorder

- Duration: 6:16

- Updated: 31 Mar 2009

- views: 643

- published: 31 Mar 2009

- views: 643

Small Country Analysis of an Import Tariff

- Order: Reorder

- Duration: 6:56

- Updated: 01 May 2014

- views: 1155

- published: 01 May 2014

- views: 1155

Govt hikes import tariff on gold, silver to prevent tax evasion

- Order: Reorder

- Duration: 0:46

- Updated: 31 Oct 2015

- views: 122

- published: 31 Oct 2015

- views: 122

USA: USA/JAPAN TRADE WAR: US AUTOMOBILE IMPORT TARIFF

- Order: Reorder

- Duration: 2:24

- Updated: 21 Jul 2015

- views: 64

- published: 21 Jul 2015

- views: 64

Import Tariff part 2

- Order: Reorder

- Duration: 6:22

- Updated: 30 Mar 2009

- views: 1331

- published: 30 Mar 2009

- views: 1331

Import Tariff on U.S. Peanuts Diminishes Demand in China

- Order: Reorder

- Duration: 2:31

- Updated: 12 Jul 2013

- views: 339

Effects of a tariff small country

- Order: Reorder

- Duration: 5:13

- Updated: 14 Oct 2014

- views: 715

- published: 14 Oct 2014

- views: 715

11f: the effects of an import quota

- Order: Reorder

- Duration: 15:58

- Updated: 27 Apr 2014

- views: 7413

- published: 27 Apr 2014

- views: 7413

Channels Book Club: Stakeholders Debate Import Tariff Increase Prt 1

- Order: Reorder

- Duration: 13:22

- Updated: 09 Oct 2014

- views: 50

- published: 09 Oct 2014

- views: 50

USA: USA/JAPAN TRADE WAR: US AUTOMOBILE IMPORT TARIFF UPDATE

- Order: Reorder

- Duration: 3:01

- Updated: 21 Jul 2015

- views: 23

- published: 21 Jul 2015

- views: 23

9c Small Monopolized country introduces import tariff

- Order: Reorder

- Duration: 3:48

- Updated: 09 Sep 2010

- views: 380

- published: 09 Sep 2010

- views: 380

vietnam import tariff rates 2012, 2013

- Order: Reorder

- Duration: 0:59

- Updated: 11 Jul 2012

- views: 96

Chp9b: Small Monopolized country introduces import tariff

- Order: Reorder

- Duration: 3:19

- Updated: 09 Sep 2010

- views: 442

- published: 09 Sep 2010

- views: 442

-

sách biểu thuế xnk song ngữ anh việt năm 2016 phát hành mới nhất

sách biểu thuế xnk song ngữ anh việt tax export import tariff mới nhất hiện nay sách biểu thuế xnk song ngữ anh việt năm 2016 cuốn sách biểu thuế xnk song ngữ anh việt mới nhất cập nhật các thông tư . Thông tư 182/2015/TT-BTC, Thông tư 201/2015/TT-BTC, Thông tư 24/2015/TT-BTC, Thông tư 25/2015/TT-BTC, 165, 166,168,169… + Biểu thuế Nhập khẩu ưu đãi WTO tt 182/2015/TT-BTC – Thuế suất thuế Nhập khẩu thông thường. + Biểu thuế Nhập khẩu ưu đãi đặc biệt áp dụng trong phạm vi ASEAN TT 165. + Biểu thuế Nhập khẩu ưu đãi đặc biệt ASEAN – Trung quốc thông tư 166, ASEAN – Hàn Quốc tt 201/2015/TT-BTC, ASEAN – JAPAN TT 24/2015/TT-BTC TT 25/2015/TT-BTC, Australia – ASEAN – New Zealand, ASEAN – India. + Biểu thuế Nhập khẩu ưu đãi đặc biệt Vietnam-Japan, Vietnam-Chile. + Biểu thuế GTGT theo danh mục... -

Jer Bergin, the elimination of tariff duties on the import of fertilizers in the EU

Jer Bergin, president of the Irish Farmers Association (IFA), explains why the IFA ask for the elimination of tariff duties on the import of fertilizers in the EU and calls for an investigation on price-fixing practices in fertilizers industry at EU level. Filmed in Brussels 29/02/2016. -

Bernie Sanders's Tariff Plan Hurts Global and US Economy (Bernie Sanders Wrong on Chinese Imports)

Bernie Sanders has proudly touted his record of fighting against free trade agreements, especially ones which reduce taxes on imports. [1] This, despite the historical evidence which shows pro-tariff policies generally lead to retaliatory tariffs, with global trade obstructed in the process. [2] For instance, the Smoot-Hawely tariffs contributed to the Great Depression and are estimated to have been responsible for roughly 10 percent of the overall output decline. This harms families. TRADE IS GOOD FOR MIDDLE AND LOWER CLASS CONSUMERS: ● According to the President’s Council of Economic Advisers, middle-class Americans gain more than a quarter of their purchasing power from trade, with the lowest percentile gaining the most. ● “Perhaps the most broadly shared benefit of increased trade i... -

Egypt import tariffs raised to temper weakens

Egypt has raised tariff rates on a wide range of imports as authorities try to curb dollar spending that is affecting its current account. Custom duty has been increased from 30 to 40 percent on products which include household appliances, cosmetics, garments, footwear and nuts. The government hopes to raise 128 million dollars from the increases for the second quarter of the currenct fiscal year .. Yasser hakim has more -

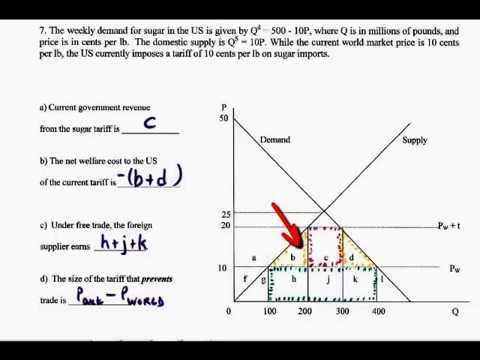

Final Q70

This example illustrates the effect of import tariff on consumer and producer surpluses, as well as government revenue. -

Zero tariff for 7,000 Thai products to Chile under FTA

Thailand and Chile have finalized a Free Trade Agreement (FTA) going into effect today, and import tariffs are waived for 7,855 items. -

Tariff on Chinese Bicycles

Duncan and John analyze and evaluate an import tariff placed on Chinese bicycles by the European Union. Watch Duncan and John break down the impact of this restriction on free trade! -

-

Govt Replaces Salt Imports Quotas With Tariffs

The government is eliminating the quota system for salt imports and replacing it with tariffs, so any business can import it with the appropriate levy. -

Opinions gathered on amended tariff draft law

The National Assembly Standing Committee discussed the amended export/import tariff draft law during its 41st session. The NA deputies agreed that amendments were needed to meet the requirement of trade agreements that Vietnam has signed. Within the next 10 years, trade liberalisation will cover 97-98% of all tariff lines. At the same time, attention should be paid to how the new tariff regulations affect the state budget and national financial security as well as marginalised groups such as farmers, fishermen and workers in support industries. The NA deputies also asked for additional review of the tariff-exempt sectors as well as the jurisdiction of ministries and departments regarding tariff-exempt products and services./. -

NewsLife: NEDA: PH must reain high tariff for rice imports || Sept. 21, 2015

NewsLife: NEDA: PH must reain high tariff for rice imports || September 21, 2015 (Reported by Robert Tan) For more news, visit: ►http://www.ptvnews.ph Subscribe to our YouTube channel: ►http://www.youtube.com/ptvphilippines Like our facebook page: ►PTV: http://facebook.com/PTVph ►Good Morning Boss: https://www.facebook.com/GMorningBoss ►NEWS@1: http://facebook.com/PTVnewsat1 ►NEWS@6: http://facebook.com/PTVnewsat6 ►NEWSLIFE: http://facebook.com/PTVnewslife ►PTV SPORTS: http://facebook.com/PTV4SPORTS Follow us at Twitter: ►http://twitter.com/PTVph Follow our livestream at ►http://ptvnews.ph/index.php/livestreammenu Ustream: ►http://www.ustream.tv/channel/ptv-livestream Watch our News Programs, every Monday to Friday RadyoBisyon - 6:00 am - 7:00 am Good Morning Boss - 7:00 am -... -

Is tariff protection the answer to S A's melting steel industry?

With the local steel industry is hanging by a thread, and failing to make profits, analysts say it might be on its way to becoming irrelevant to the economy. Some are calling for import duties on steel. But others say any move to turn things around might only offer a temporary solution. Joining CNBC Africa to discuss the outlook for the local steel industry is Finweek editor Jana Marais. -

Government has agreed to impose tariffs on steel imports

Government has agreed to impose tariffs on steel imports as a matter of urgency to try and save the local steel manufacturing industry from collapse. CEOs of steel companies and trade unions made the announcement a short while ago following the high level talks they had with government last Friday. But the big question is whether the measures agreed to will be enough to save tens of thousands of jobs that are currently on the line. For more News visit: http://www.sabc.co.za/news Follow us on Twitter: https://twitter.com/SABCNewsOnline?lang=en Like us on Facebook: https://www.facebook.com/SABCNewsOnline -

USA: BATTLE WITH EU OVER BEEF & BANANA IMPORTS

English/Nat XFA The United States is rolling out a new weapon in its battle with the European Union over beef and banana imports. In an effort to resolve a decade-long trade dispute, the U-S government has decided to use a stiffer tariff system to re-open Europe to American beef and bananas. President Clinton recently signed a bill allowing for a rotation system of high tariffs for certain goods coming from all E-U countries as punishment for a ban on American beef imports, and high tariffs on US-produced bananas. The system, dubbed "carousel retaliation," periodically switches tariff punishments to a different country within the European Union until the E-U eases trade restrictions. Currently France, Germany, Italy face the stiffest tariffs on certain food and manufactured ... -

EU to tariff cheap steel

1. Various interior steel manufacturing plant STORYLINE: Acting to shield Europe from a flood of cheap steel from countries hit by U.S. tariffs, the European Union decided on Monday to impose import tariffs of its own. Import taxes of up to 26 percent will apply to most of the same steel products hit last week by the protective US measure, an EU official said on condition of anonymity. The tariffs, to be formally approved on Wednesday by the EU's executive Commission, will apply starting April 3 to any imports of those 15 products above current levels of 11 (m)million tons a year, he said. The EU fears big steel-producing countries such as China and South Korea, blocked from the US market by tariffs of up to 30 percent, will try to unload their excess production on Europe, d... -

US steel workers react to imposition of import tariffs

1. Interior of "L" blast furnace at Bethlehem Steel plant, molten raw materials for steel 2. Close up of molten raw materials for steel 3. Molten steel raw materials poured into "L" blast furnace 4. Worker at computer in steel mill 5. Workers in computer room in steel mill 6. Rolled steel coming off production line 7. Establishing shot of Joseph Rosel 8. SOUNDBITE: (English) Joseph Rosel, Steelworkers' Union "If we don't draw a line in the sand on steel, if we lose the steel industry, then we'll lose the tyre industry, because tyres have steel cords in them. We'll start to lose the appliance industry. Why would you build autos in the United States if there's no steel industry?" 7. Establishing shot Van Reiner 8. SOUNDBITE: (English) Van Reiner, President, Bethlehem Steel "T... -

Car-tariff protesters beaten in Russia's Far East

Vladivostok 1. Wide of people walking round the square's christmas tree 2. Mid of people walking around tree 3. Wide of riot police 4. Mid of riot police dragging a protester away, people shouting 5. Mid of police pushing a man into a car 6. Various of riot police dragging protesters away 7. Wide of police pushing protesters into a truck Moscow 8. Wide of the Kremlin 9. Wide of street, cars driving by 10. Wide of drivers rally 11. Mid of people holding banner reading: (Russian) "Raise living standards, not tariffs!" 12. SOUNDBITE: (Russian) Vladimir Ryzhkov, independent politician: "Of course nobody will buy Zhiguli and Volga (Russian car brands) because they are of very poor quality. People would rather save money to buy a foreign car and curse the authorities or they ... -

Import Export Education Experts - Global Training Center

Importing or exporting goods in or out of the United States requires navigating a complex maze of customs paperwork, rules, and regulations. Global Training Center offers the most complete international trade and customs training available. With a wide range of classes and seminars covering import/export regulations, tariff classification procedures, NAFTA rules, and handling government audits, among other important topics. -

China cuts import taxes to boost consumer demand

China will cut import taxes on consumer goods by more than 50% on average in a bid to boost consumer spending. High tariffs for imported goods have prompted some Chinese consumers to shop abroad or through agents. By lowering the fees, China may hope to bring some of that consumer spending home. The government is particularly keen to promote domestic demand as the country is growing at its slowest rate since 2009. The tariff reduction is an "important measure to create stable growth and push forward structural reform", said the Ministry of Finance. From 1 June tariffs for Western-style clothing will be reduced to 7-10% from 14-23%. Taxes on ankle-high boots and sports shoes will be halved to 12%. Import tariffs on skincare products will fall from 5% to 2%. However, its not just impo...

sách biểu thuế xnk song ngữ anh việt năm 2016 phát hành mới nhất

- Order: Reorder

- Duration: 0:19

- Updated: 29 Mar 2016

- views: 1

- published: 29 Mar 2016

- views: 1

Jer Bergin, the elimination of tariff duties on the import of fertilizers in the EU

- Order: Reorder

- Duration: 1:36

- Updated: 07 Mar 2016

- views: 45

- published: 07 Mar 2016

- views: 45

Bernie Sanders's Tariff Plan Hurts Global and US Economy (Bernie Sanders Wrong on Chinese Imports)

- Order: Reorder

- Duration: 2:00

- Updated: 03 Feb 2016

- views: 42

- published: 03 Feb 2016

- views: 42

Egypt import tariffs raised to temper weakens

- Order: Reorder

- Duration: 2:35

- Updated: 02 Feb 2016

- views: 115

- published: 02 Feb 2016

- views: 115

Final Q70

- Order: Reorder

- Duration: 4:18

- Updated: 20 Dec 2015

- views: 1

- published: 20 Dec 2015

- views: 1

Zero tariff for 7,000 Thai products to Chile under FTA

- Order: Reorder

- Duration: 1:23

- Updated: 05 Nov 2015

- views: 6

- published: 05 Nov 2015

- views: 6

Tariff on Chinese Bicycles

- Order: Reorder

- Duration: 3:26

- Updated: 27 Oct 2015

- views: 3

- published: 27 Oct 2015

- views: 3

Tariff Converter - IDT

- Order: Reorder

- Duration: 0:28

- Updated: 25 Sep 2015

- views: 54

Govt Replaces Salt Imports Quotas With Tariffs

- Order: Reorder

- Duration: 0:43

- Updated: 23 Sep 2015

- views: 22

- published: 23 Sep 2015

- views: 22

Opinions gathered on amended tariff draft law

- Order: Reorder

- Duration: 0:40

- Updated: 22 Sep 2015

- views: 10

- published: 22 Sep 2015

- views: 10

NewsLife: NEDA: PH must reain high tariff for rice imports || Sept. 21, 2015

- Order: Reorder

- Duration: 0:44

- Updated: 21 Sep 2015

- views: 19

- published: 21 Sep 2015

- views: 19

Is tariff protection the answer to S A's melting steel industry?

- Order: Reorder

- Duration: 4:29

- Updated: 28 Aug 2015

- views: 32

- published: 28 Aug 2015

- views: 32

Government has agreed to impose tariffs on steel imports

- Order: Reorder

- Duration: 4:40

- Updated: 24 Aug 2015

- views: 38

- published: 24 Aug 2015

- views: 38

USA: BATTLE WITH EU OVER BEEF & BANANA IMPORTS

- Order: Reorder

- Duration: 1:47

- Updated: 21 Jul 2015

- views: 53

- published: 21 Jul 2015

- views: 53

EU to tariff cheap steel

- Order: Reorder

- Duration: 1:00

- Updated: 21 Jul 2015

- views: 10

- published: 21 Jul 2015

- views: 10

US steel workers react to imposition of import tariffs

- Order: Reorder

- Duration: 3:34

- Updated: 21 Jul 2015

- views: 271

- published: 21 Jul 2015

- views: 271

Car-tariff protesters beaten in Russia's Far East

- Order: Reorder

- Duration: 2:42

- Updated: 21 Jul 2015

- views: 19

- published: 21 Jul 2015

- views: 19

Import Export Education Experts - Global Training Center

- Order: Reorder

- Duration: 2:21

- Updated: 17 Jun 2015

- views: 383

- published: 17 Jun 2015

- views: 383

China cuts import taxes to boost consumer demand

- Order: Reorder

- Duration: 1:42

- Updated: 26 May 2015

- views: 17

- published: 26 May 2015

- views: 17

-

Introduction to customs tariffs and Market Access Map

Market Access Map (MAcMap) covers customs tariffs (import duties) and other measures applied by 188 importing countries to products from 239 countries and territories. MFN and preferential applied import tariff rates are shown for products at the most detailed national tariff line level. Market Access Map has been designed to support exporters, importers, trade promoters, policy analysts and trade negotiators. Use it to find a tariff. Compare yourself to your competitors. Or use its advanced features to prepare for trade negotiations by simulating the effects of tariff reductions. Written and Narrated by Christina Vonhame -

Importing Phones - Customs Duties, Shipping, Warranty & All you need to know! #AshAnswers E2

Over the years, I've received quite a lot of these questions... How do you buy stuff internationally? How do you import phones? What about customs? What are the shipping charges? How long does it take? In this video, I try to answer all these questions to the best of my knowledge... Hope you guys find this video useful, if you do, please share & subscribe :) -------------------------------------------------------------------------------- Contact Info: Twitter: @C4ETech (https://twitter.com/C4ETech) Facebook: http://www.facebook.com/C4ETech Google+: http://bit.ly/UeAzHW Instagram: http://instagram.com./c4etech Website: http://www.omegadroid.co -

-

Malaysian Palm Oil Council POTS KL 2012 - "Taxes, Tariffs and Palm Oil Prices" by Dr James Fry

Export Taxes and Import Tariff: Implications for Processing Margin and World Trade James Fry LMC International For more videos and information, visit www.palmoiltv.org -

Tariffs the Road to the Civil War

The South was 25% of the population and they were paying 80% of the taxes in the US which were being used to subsidize Northern industries. There is no way around that. The declaration of secession included language from every faction including minority factions like slave owners who had a lot of money. Slavery wasn't originally part of it. They pissed and moaned until they got everything included in it. These people were not the driving force of secession as secession and nullification movements started 30 years before the Civil War when slavery wasn't even on the table. Furthermore slavery WASN'T on the table in the Civil War either. The North via New York and Ohio introduced a constitutional amendment, the Corwin Amendment which forbid the interference in slavery. Congress passed it to... -

How to Find HS Codes and Calculate Duties and Taxes

Learn how to classify your products for customs and to calculate the full landed cost for your buyers. You will learn that your goods won't ship unless you know the ten-digit or Harmonized Code (also known as the tariff code). Learn what the code is, how it is used and how to find it using available on-line tools. Once you know the code, this webinar will also help you learn how to find and accurately estimate the duties and taxes on your goods charged by the importing country. With this information, you can accurately price your product and avoid unpleasant surprises and difficulties with customs officials. For more, visit http://export.gov/webinars/eg_main_023644.asp November 18, 2010 -

03-14-16-John And Heidi Show-AndyGause

Source: https://www.spreaker.com/user/bigjohnsmall/03-14-16-john-and-heidi-show-andygause John & Heidi share funny stories of people doing weird things... plus John chats with a currency expert (Andy Gause) about the concept of abolishing the IRS and bringing back the import tariff for foreign goods. LEARN MORE HERE - http://www.andygause.com/ Learn more about our radio program & podcast at www.JohnAndHeidiShow.com -

International Trade Part 4: Interventions

Welfare effects of tariffs. Import tariffs vs. import quotas. Restrictions on exports. Non-tariff barriers. -

Fate of the (Solar) Feed-in Tariff - Ben Stevens (4 of 5)

The feed-in tariff is the rate that owners of distributed electricity generation (including rooftop solar) are paid for electricity they export to the grid. In Tasmania this is currently equal to the rate they pay for energy they import from the grid (27.785c/kWh for tariff 31). With Aurora Energy set to be disbanded at the end of the year, the future of the feed-in tariff is uncertain. Minister for Energy, Bryan Green, released an Issues Paper recently, for which comment is invited by 7th June 2013. In other states, feed-in tariffs have been slashed to as low as 5.2c/kWh. This forum explores the impacts of changing the feed-in tariff, what would be a fair and reasonable feed-in tariff and what Tasmanians can do to have their say. It was held on 30th May 2013 by Sustainable Living Tasma... -

[502] China and trade: 256% tariffs on steel and a massive metals Ponzi scheme

Ameera David details how the US has called for a 256 percent tax on imports of Steel from China. That’s after a US Department of Commerce investigation found that corrosion-resistant steel products from the country were produced at unfairly low prices. Then, on Wednesday, a New Zealand court ruled that Internet entrepreneur Kim Dotcom, who’s being accused of masterminding one of the largest copyright infringements in history, can be extradited to face trial in the United States. Ameera David reports. Afterwards, to talk about the Trans-Pacific Partnership, Melinda St. Louis, International Campaigns Director for Global Trade Watch, is on the show. After the break, to continue the discussion on the TPP, Ameera spoke to Steve Hanke, professor of applied economics at Johns Hopkins University... -

Fate of the (Solar) Feed-in Tariff - Craig Memery (3 of 5)

The feed-in tariff is the rate that owners of distributed electricity generation (including rooftop solar) are paid for electricity they export to the grid. In Tasmania this is currently equal to the rate they pay for energy they import from the grid (27.785c/kWh for tariff 31). With Aurora Energy set to be disbanded at the end of the year, the future of the feed-in tariff is uncertain. Minister for Energy, Bryan Green, released an Issues Paper recently, for which comment is invited by 7th June 2013. In other states, feed-in tariffs have been slashed to as low as 5.2c/kWh. This forum explores the impacts of changing the feed-in tariff, what would be a fair and reasonable feed-in tariff and what Tasmanians can do to have their say. It was held on 30th May 2013 by Sustainable Living Tasma... -

Dependence on Foreign Oil: Economic Risks, Global Demands for Petroleum - Alan Greenspan (2006)

In the early 20th century the United States became a major oil supplier to the world. World War II prompted a Synthetic Liquid Fuels Program but it did not go beyond research. In mid-century the country shifted from being a major exporter to a net importer. An import quota imposed in 1959 limited imports to a fraction of domestic production until 1973.[10] America's dependence on foreign oil rose from 26 percent to 47 percent between 1985 to 1989.[11] After the 1973 oil crisis, the United States Department of Energy and Synthetic Fuels Corporation were created to address the problem of fuel import dependency. According to the Washington & Jefferson College Energy Index, by 2012, American energy independence had decreased by 22% since the tenure of President Harry Truman.[12] America's im... -

[Webinar] The U.S. Ban on Forced Labor Imports

President Obama has slammed shut a legal backdoor allowing importers of forced labor goods to place their products on the U.S. market. His government’s new law, the Trade Facilitation and Trade Enforcement Act 2015, has closed a loophole in the U.S. Tariff Act of 1930 that allowed forced labor imports in cases where consumer demand could not be met through alternative means. The bill was signed into law on February 24th and takes effect in early March. In this webinar join Assent’s Human Trafficking Subject Matter Expert, Kate Dunbar, as she explores the new law and reveals what its implementation will mean for your business. In this webinar, you will learn: Details about the Trade Facilitation and Trade Enforcement Act 2015 and its purpose What goods the Department of Labor has listed... -

GHY University - Basics of Importing Into Canada - June 17, 2015

A “How To” Guide for importing into Canada Giving you Tips and Showing you the Risks. Event Description: A " How To" guide for Basic Importing into Canada. In this session giving you tips and showing you the risks. Entry Process Tariff Classification Valuation Country of Origin Entry Summary Post Entry Record Keeping Valerie Michaud will be facilitating Basic Importing into Canada. Valerie brings 22 years of trade facilitation experience across all modes of Transport. Valerie holds both a Certified Customs Specialist (CCS) and Certified Trade Compliance Specialist (CTCS) Designations. Brittany King, a fellow team member, currently enrolled in Introductory customs course through the CSCB will co-present. -

Fate of the (Solar) Feed-in Tariff - Questions & comments (5 of 5)

The feed-in tariff is the rate that owners of distributed electricity generation (including rooftop solar) are paid for electricity they export to the grid. In Tasmania this is currently equal to the rate they pay for energy they import from the grid (27.785c/kWh for tariff 31). With Aurora Energy set to be disbanded at the end of the year, the future of the feed-in tariff is uncertain. Minister for Energy, Bryan Green, released an Issues Paper recently, for which comment is invited by 7th June 2013. In other states, feed-in tariffs have been slashed to as low as 5.2c/kWh. This forum explores the impacts of changing the feed-in tariff, what would be a fair and reasonable feed-in tariff and what Tasmanians can do to have their say. It was held on 30th May 2013 by Sustainable Living Tasma... -

NORA Webinar - Managing International Freight Costs

Understanding and managing freight and logistics costs are critical to enhancing competitiveness and increasing the profitability of businesses that import and export. This interactive webinar features freight & logistics discussing: - Harmonised tariff codes, duties, tariffs and other hidden costs - Incoterms® 2010 and why companies need to get them correct - Advice for managing freight costs and traps to avoid - Tips on choosing the right freight service provider -

Introduction to International Logistics & Trade Compliance

OVERVIEW An overview relating to the complexities of global trade, its impact on logistics, and key areas of concern for international logistics managers. Topics that are discussed include: Incoterms, global trade compliance, harmonized tariff schedules, US import and export regulations, US Free Trade Agreements, and supply chain security. ABOUT THE PRESENTER Dan Gardner is an SCL professional education instructor and President of Trade Facilitators, Inc., a supply chain consulting and training firm. A PDF version of the presentation can be downloaded at http://www.scl.gatech.edu/sites/default/files/downloads/gtscl-intllog_20150916.pdf. Learn more about our "Introduction to International Logistics and Compliance " course and our certificate series at http://www.scl.gatech.edu/intllo... -

Donald Trump on China's Currency Devaluation, Free Trade, Education (2014)

Renminbi currency value is an issue that affects the Chinese currency unit, the renminbi (Chinese: 人民币; Code:CNY) and which as of 2013 is at the forefront of world economic discussion. Since the 1980s, China has emerged as a growing economic power due to its vast population, resources, economic reforms and industrialization. The renminbi is classified as a fixed exchange rate currency "with reference to a basket of currencies"[1] is drawing attention or scrutiny from other western industrialized nations which have freely floated currency and has become a source of trade friction. Some commentators have argued that with current economic conditions, the value of the renminbi should be allowed to appreciate in value by between 20 and 40 percent against the US dollar. According to the Interna... -

Trade Barriers Tariff and Non tariff Barriers new

-

Chapter 9. Application: International Trade. Principle of Economics. Gregory Mankiw

Explanation of Chapter 9. Application: International Trade. Principle of Economics. Gregory Mankiw. The determinants of trade- The equilibrium without trade. The determinants of trade-The world price and comparative advantage. The winners and losers from trade-The gains and losses of an exporting country. The winners and losers from trade-The gains and losses of an importing country. The effects of a tariff. The effects of an import quota. The lessons for trade policy. The argument for restricting trade-The jobs argument. The argument for restricting trade-The national-security argument. The argument for restricting trade-The infant-industry argument. The argument for restricting trade-The unfair-competition argument. The argument for restricting trade-The protection-as-a-bargaining-chip a... -

The Wizard's Apprentice Evolved II

The W.A.E. II By Mark Bugs http://markbugs.com/ The W.A.E. II is a 21mm E-Cig Mod designed and made in Romania by mod maker Mark Bugs. This mod houses the DNA30 Chipset & Board from Evolve. Features of this mod offer, battery adjustment for 18650 batteries from flat top to button top 18650's by using the bottom cap as rotatable adjustment feature, bottom cap does have venting in case of battery ventilation, top cap features an adjustable 510 brass center pin for flush mounting any atomizer, top cap is also removable for the future of a 21mm hybrid atomizer that will be designed by Mark Bugs, the other feature of this mod is the DNA30 chipset and board allowing for a range of wattage from 7 to 30 watts. From personal testing I was able to get sub ohm levels down to .4 ohms to fire, howe... -

General Agreement on Tariffs and Trade (GATT) and North American Free Trade Agreement (NAFTA)

The General Agreement on Tariffs and Trade (GATT) is a multilateral agreement regulating international trade. According to its preamble, its purpose is the "substantial reduction of tariffs and other trade barriers and the elimination of preferences, on a reciprocal and mutually advantageous basis." It was negotiated during the UN Conference on Trade and Employment and was the outcome of the failure of negotiating governments to create the International Trade Organization (ITO). GATT was signed in 1947 and lasted until 1993, when it was replaced by the World Trade Organization in 1995. The original GATT text (GATT 1947) is still in effect under the WTO framework, subject to the modifications of GATT 1994. The Uruguay Round began in 1986. It was the most ambitious round to date, hoping to... -

Cod: The Fish that Changed the World - History, Recipes, Fishing Stocks (1998)

Cod is the common name for the genus Gadus of demersal fishes, belonging to the family Gadidae. Cod is also used as part of the common name for a number of other fish species, and there are species suggested to belong to genus Gadus that are not called cod (the Alaska pollock). The two most important species of cod are the Atlantic cod (Gadus morhua), which lives in the colder waters and deeper sea regions throughout the North Atlantic, and the Pacific cod (Gadus macrocephalus), found in both eastern and western regions of the northern Pacific. Gadus morhua was named by Linnaeus in 1758. (However, G. morhua callarias, a low-salinity, non-migratory race restricted to parts of the Baltic, was originally described as Gadus callarias by Linnaeus.) Cod is popular as a food with a mild flavour...

Introduction to customs tariffs and Market Access Map

- Order: Reorder

- Duration: 20:46

- Updated: 19 Dec 2011

- views: 3342

- published: 19 Dec 2011

- views: 3342

Importing Phones - Customs Duties, Shipping, Warranty & All you need to know! #AshAnswers E2

- Order: Reorder

- Duration: 21:21

- Updated: 22 Aug 2014

- views: 42591

- published: 22 Aug 2014

- views: 42591

Pricing Products for Export or Import

- Order: Reorder

- Duration: 26:36

- Updated: 28 Apr 2014

- views: 776

Malaysian Palm Oil Council POTS KL 2012 - "Taxes, Tariffs and Palm Oil Prices" by Dr James Fry

- Order: Reorder

- Duration: 34:05

- Updated: 07 Jul 2013

- views: 68

- published: 07 Jul 2013

- views: 68

Tariffs the Road to the Civil War

- Order: Reorder

- Duration: 38:51

- Updated: 13 Jul 2015

- views: 5278

- published: 13 Jul 2015

- views: 5278

How to Find HS Codes and Calculate Duties and Taxes

- Order: Reorder

- Duration: 44:38

- Updated: 27 Sep 2011

- views: 36903

- published: 27 Sep 2011

- views: 36903

03-14-16-John And Heidi Show-AndyGause

- Order: Reorder

- Duration: 47:26

- Updated: 15 Mar 2016

- views: 0

- published: 15 Mar 2016

- views: 0

International Trade Part 4: Interventions

- Order: Reorder

- Duration: 24:26

- Updated: 21 Sep 2013

- views: 840

- published: 21 Sep 2013

- views: 840

Fate of the (Solar) Feed-in Tariff - Ben Stevens (4 of 5)

- Order: Reorder

- Duration: 20:45

- Updated: 05 Jun 2013

- views: 87

- published: 05 Jun 2013

- views: 87

[502] China and trade: 256% tariffs on steel and a massive metals Ponzi scheme

- Order: Reorder

- Duration: 27:46

- Updated: 24 Dec 2015

- views: 5241

- published: 24 Dec 2015

- views: 5241

Fate of the (Solar) Feed-in Tariff - Craig Memery (3 of 5)

- Order: Reorder

- Duration: 25:51

- Updated: 05 Jun 2013

- views: 79

- published: 05 Jun 2013

- views: 79

Dependence on Foreign Oil: Economic Risks, Global Demands for Petroleum - Alan Greenspan (2006)

- Order: Reorder

- Duration: 156:20

- Updated: 20 Oct 2015

- views: 44

- published: 20 Oct 2015

- views: 44

[Webinar] The U.S. Ban on Forced Labor Imports

- Order: Reorder

- Duration: 24:37

- Updated: 10 Mar 2016

- views: 1

- published: 10 Mar 2016

- views: 1

GHY University - Basics of Importing Into Canada - June 17, 2015

- Order: Reorder

- Duration: 36:40

- Updated: 19 Jun 2015

- views: 72

- published: 19 Jun 2015

- views: 72

Fate of the (Solar) Feed-in Tariff - Questions & comments (5 of 5)

- Order: Reorder

- Duration: 38:51

- Updated: 05 Jun 2013

- views: 129

- published: 05 Jun 2013

- views: 129

NORA Webinar - Managing International Freight Costs

- Order: Reorder

- Duration: 55:45

- Updated: 09 Feb 2016

- views: 63

- published: 09 Feb 2016

- views: 63

Introduction to International Logistics & Trade Compliance

- Order: Reorder

- Duration: 66:29

- Updated: 17 Sep 2015

- views: 448

- published: 17 Sep 2015

- views: 448

Donald Trump on China's Currency Devaluation, Free Trade, Education (2014)

- Order: Reorder

- Duration: 31:01

- Updated: 22 Jan 2016

- views: 50

- published: 22 Jan 2016

- views: 50

Trade Barriers Tariff and Non tariff Barriers new

- Order: Reorder

- Duration: 28:58

- Updated: 16 Apr 2014

- views: 4312

- published: 16 Apr 2014

- views: 4312

Chapter 9. Application: International Trade. Principle of Economics. Gregory Mankiw

- Order: Reorder

- Duration: 42:58

- Updated: 11 Mar 2016

- views: 58

- published: 11 Mar 2016

- views: 58

The Wizard's Apprentice Evolved II

- Order: Reorder

- Duration: 27:57

- Updated: 14 Jul 2014

- views: 261

- published: 14 Jul 2014

- views: 261

General Agreement on Tariffs and Trade (GATT) and North American Free Trade Agreement (NAFTA)

- Order: Reorder

- Duration: 96:42

- Updated: 03 Jul 2012

- views: 72946

- published: 03 Jul 2012

- views: 72946

Cod: The Fish that Changed the World - History, Recipes, Fishing Stocks (1998)

- Order: Reorder

- Duration: 52:09

- Updated: 29 Nov 2015

- views: 379

- published: 29 Nov 2015

- views: 379

- Playlist

- Chat

- Playlist

- Chat

How to calculate the impact of import and export tariffs.

- Report rights infringement

- published: 13 Nov 2010

- views: 81685

International trade: Impact of Import tariffs

- Report rights infringement

- published: 07 Jan 2011

- views: 30738

Impact of an import tariff.mp4

- Report rights infringement

- published: 04 Aug 2011

- views: 7813

Micro 2.8 Tariffs and Quotas

- Report rights infringement

- published: 10 Oct 2012

- views: 62930

11e: the effects of an import tariff

- Report rights infringement

- published: 03 Apr 2014

- views: 2406

Large country tariff basics

- Report rights infringement

- published: 04 Oct 2013

- views: 14651

8a- Big country introduces import tariff (Perfect Competitive Markets)

- Report rights infringement

- published: 03 Sep 2010

- views: 8240

Imports, Exports, and Exchange Rates: Crash Course Economics #15

- Report rights infringement

- published: 20 Nov 2015

- views: 118870

Import Tariff part 1 HD

- Report rights infringement

- published: 29 Mar 2009

- views: 2225

Import Tariff part 3 HD

- Report rights infringement

- published: 31 Mar 2009

- views: 1479

Import Tariff part 4 HD

- Report rights infringement

- published: 31 Mar 2009

- views: 643

Small Country Analysis of an Import Tariff

- Report rights infringement

- published: 01 May 2014

- views: 1155

Govt hikes import tariff on gold, silver to prevent tax evasion

- Report rights infringement

- published: 31 Oct 2015

- views: 122

USA: USA/JAPAN TRADE WAR: US AUTOMOBILE IMPORT TARIFF

- Report rights infringement

- published: 21 Jul 2015

- views: 64

- Playlist

- Chat

sách biểu thuế xnk song ngữ anh việt năm 2016 phát hành mới nhất

- Report rights infringement

- published: 29 Mar 2016

- views: 1

Jer Bergin, the elimination of tariff duties on the import of fertilizers in the EU

- Report rights infringement

- published: 07 Mar 2016

- views: 45

Bernie Sanders's Tariff Plan Hurts Global and US Economy (Bernie Sanders Wrong on Chinese Imports)

- Report rights infringement

- published: 03 Feb 2016

- views: 42

Egypt import tariffs raised to temper weakens

- Report rights infringement

- published: 02 Feb 2016

- views: 115

Final Q70

- Report rights infringement

- published: 20 Dec 2015

- views: 1

Zero tariff for 7,000 Thai products to Chile under FTA

- Report rights infringement

- published: 05 Nov 2015

- views: 6

Tariff on Chinese Bicycles

- Report rights infringement

- published: 27 Oct 2015

- views: 3

Tariff Converter - IDT

- Report rights infringement

- published: 25 Sep 2015

- views: 54

Govt Replaces Salt Imports Quotas With Tariffs

- Report rights infringement

- published: 23 Sep 2015

- views: 22

Opinions gathered on amended tariff draft law

- Report rights infringement

- published: 22 Sep 2015

- views: 10

NewsLife: NEDA: PH must reain high tariff for rice imports || Sept. 21, 2015

- Report rights infringement

- published: 21 Sep 2015

- views: 19

Is tariff protection the answer to S A's melting steel industry?

- Report rights infringement

- published: 28 Aug 2015

- views: 32

Government has agreed to impose tariffs on steel imports

- Report rights infringement

- published: 24 Aug 2015

- views: 38

USA: BATTLE WITH EU OVER BEEF & BANANA IMPORTS

- Report rights infringement

- published: 21 Jul 2015

- views: 53

- Playlist

- Chat

Introduction to customs tariffs and Market Access Map

- Report rights infringement

- published: 19 Dec 2011

- views: 3342

Importing Phones - Customs Duties, Shipping, Warranty & All you need to know! #AshAnswers E2

- Report rights infringement

- published: 22 Aug 2014

- views: 42591

Pricing Products for Export or Import

- Report rights infringement

- published: 28 Apr 2014

- views: 776

Malaysian Palm Oil Council POTS KL 2012 - "Taxes, Tariffs and Palm Oil Prices" by Dr James Fry

- Report rights infringement

- published: 07 Jul 2013

- views: 68

Tariffs the Road to the Civil War

- Report rights infringement

- published: 13 Jul 2015

- views: 5278

How to Find HS Codes and Calculate Duties and Taxes

- Report rights infringement

- published: 27 Sep 2011

- views: 36903

03-14-16-John And Heidi Show-AndyGause

- Report rights infringement

- published: 15 Mar 2016

- views: 0

International Trade Part 4: Interventions

- Report rights infringement

- published: 21 Sep 2013

- views: 840

Fate of the (Solar) Feed-in Tariff - Ben Stevens (4 of 5)

- Report rights infringement

- published: 05 Jun 2013

- views: 87

[502] China and trade: 256% tariffs on steel and a massive metals Ponzi scheme

- Report rights infringement

- published: 24 Dec 2015

- views: 5241

Fate of the (Solar) Feed-in Tariff - Craig Memery (3 of 5)

- Report rights infringement

- published: 05 Jun 2013

- views: 79

Dependence on Foreign Oil: Economic Risks, Global Demands for Petroleum - Alan Greenspan (2006)

- Report rights infringement

- published: 20 Oct 2015

- views: 44

[Webinar] The U.S. Ban on Forced Labor Imports

- Report rights infringement

- published: 10 Mar 2016

- views: 1

GHY University - Basics of Importing Into Canada - June 17, 2015

- Report rights infringement

- published: 19 Jun 2015

- views: 72

Archaeologists Find Rare Etruscan Stone From 2,500 years Ago in Florence

Edit WorldNews.com 30 Mar 2016Kim Kardashian, Emily Ratajkowski post topless bathroom pic

Edit New York Daily News 30 Mar 2016Trump 'flip-flops' his position on women and abortions in the same day

Edit The Examiner 31 Mar 2016‘Women Should Be Punished’ For Having Abortions

Edit Inquisitr 30 Mar 2016Stock up 20% in a month: GAIL on a high post tariff revision for KG basin network

Edit The Times of India 31 Mar 2016Transportation Tariff to Decrease by 3%

Edit Indonesian Business Daily 31 Mar 2016Outa in court today to challenge Eskom’s tariff hike

Edit Eye Witness News 31 Mar 2016How Govt Imposed 'Illegal' Electricity Tariff On Citizens

Edit All Africa 31 Mar 2016Power Tariff: Government will intervene after MERC order

Edit DNA India 31 Mar 2016Nationalisation of Tata's UK steel assets not right answer: Sajid Javid

Edit DNA India 31 Mar 2016EU referendum: 'Could cause Irish trade barriers'

Edit BBC News 31 Mar 2016EDITORIAL: Transnet tariff escalation

Edit Business Day 31 Mar 2016Three’s New 30GB Data Tariff is as Close to Unlimited Tethering as We’re Getting

Edit Gizmodo 31 Mar 201630 is the magic number (Hutchison 3G UK Limited)

Edit Public Technologies 31 Mar 2016Trade, at what price?

Edit The Economist 31 Mar 2016Announces 2015 Annual Results (China Singyes Solar Technologies Holdings Ltd)

Edit Public Technologies 31 Mar 2016- 1

- 2

- 3

- 4

- 5

- Next page »