- published: 06 Jul 2014

- views: 609280

-

remove the playlistFederal Reserve Bank

- remove the playlistFederal Reserve Bank

- published: 25 Dec 2012

- views: 62958

- published: 19 Oct 2013

- views: 136757

- published: 13 Jun 2012

- views: 71778

- published: 01 Feb 2014

- views: 72645

- published: 17 May 2013

- views: 1368

- published: 08 Apr 2011

- views: 1635000

- published: 22 Feb 2006

- views: 1018468

The 12 Federal Reserve Banks form a major part of the Federal Reserve System, the central banking system of the United States. The 12 federal reserve banks together divide the nation into 12 Federal Reserve Districts, the 12 banking districts created by the Federal Reserve Act of 1913. The twelve Federal Reserve Banks are jointly responsible for implementing the monetary policy set by the Federal Open Market Committee. Each federal reserve bank is also responsible for the regulation of the commercial banks within its own particular district.

Alexander Hamilton, the first Secretary of Treasury, started a movement advocating the creation of a central bank. The Bank Bill created by Alexander Hamilton was a proposal to institute a National Bank, in order to improve the economic stability of the nation after its independence from Britain. Although the national bank was to be used as a tool for the government, it was to be privately owned. Hamilton wrote several articles providing information regarding his national bank idea. The articles expressed the validity and "would be" success of the national bank based upon: incentives for the rich to invest, ownerships of bonds and shares, rooted in fiscal management, and stable monetary system.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

A central bank, reserve bank, or monetary authority is a public institution that manages a nation's currency, money supply, and interest rates. Central banks also usually oversee the commercial banking system of their respective countries. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the nation's monetary base, and usually also prints the national currency, which usually serves as the nation's legal tender. Examples include the European Central Bank (ECB), the Federal Reserve of the United States, and the People's Bank of China.

The primary function of a central bank is to manage the nation's money supply (monetary policy), through active duties such as managing interest rates, setting the reserve requirement, and acting as a lender of last resort to the banking sector during times of bank insolvency or financial crisis. Central banks usually also have supervisory powers, intended to prevent commercial banks and other financial institutions from reckless or fraudulent behavior. Central banks in most developed nations are institutionally designed to be independent from political interference.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

The Federal Reserve System (also known as the Federal Reserve, and informally as the Fed) is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907. Over time, the roles and responsibilities of the Federal Reserve System have expanded and its structure has evolved. Events such as the Great Depression were major factors leading to changes in the system.

The Congress established three key objectives for monetary policy—maximum employment, stable prices, and moderate long-term interest rates—in the Federal Reserve Act. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and today, according to official Federal Reserve documentation, include conducting the nation's monetary policy, supervising and regulating banking institutions, maintaining the stability of the financial system and providing financial services to depository institutions, the U.S. government, and foreign official institutions. The Fed also conducts research into the economy and releases numerous publications, such as the Beige Book.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

90:12

90:12Century of Enslavement: The History of The Federal Reserve

Century of Enslavement: The History of The Federal ReserveCentury of Enslavement: The History of The Federal Reserve

TRANSCRIPT AND RESOURCES: http://www.corbettreport.com/federalreserve What is the Federal Reserve system? How did it come into existence? Is it part of the federal government? How does it create money? Why is the public kept in the dark about these important matters? In this feature-length documentary film, The Corbett Report explores these important question and pulls back the curtain on America's central bank. -

13:59

13:59The U.S. Federal Reserve Bank - How it Works, and What it Does - Money, Dollars, & Currency

The U.S. Federal Reserve Bank - How it Works, and What it Does - Money, Dollars, & CurrencyThe U.S. Federal Reserve Bank - How it Works, and What it Does - Money, Dollars, & Currency

The U.S. Federal Reserve Bank - How it Works & What it Does - Money, Currency, & the Dollar - SUBSCRIBE to Bright Enlightenment: http://www.youtube.com/BrightEnlightenment - LIKE our page on Facebook: http://www.Facebook.com/BrightEnlightenment - TWITTER: http://www.twitter.com/BrightEnlight WEBSITE: http://www.BrightEnlightenment.com/ -

93:35

93:35Anonymous Message - WHO OWNS THE FEDERAL RESERVE

Anonymous Message - WHO OWNS THE FEDERAL RESERVE -

30:00

30:00FIRST LOOK inside the FEDERAL RESERVE (28.04.2013) - Full Lenght -

FIRST LOOK inside the FEDERAL RESERVE (28.04.2013) - Full Lenght - -

5:10

5:10Who owns the Federal Reserve

Who owns the Federal ReserveWho owns the Federal Reserve

-

4:14

4:14Who owns the Federal Reserve?

Who owns the Federal Reserve?Who owns the Federal Reserve?

Through the management of currency and interest, the Federal Reserve attempts to keep banks secure -- but some believe it has another purpose. Tune in and learn about the origins of the Fed in this episode. SUBSCRIBE | http://bit.ly/stdwytk-sub WEBSITE | http://bit.ly/stdwytk-home AUDIO PODCAST | http://bit.ly/stdwytk-audio-itunes TWITTER | http://bit.ly/stdwytk-twitter FACEBOOK | http://bit.ly/stdwytk-fb EMAIL | Conspiracy@HowStuffWorks.com STORE | http://stufftheydontwantyoutoknow.spreadshirt.com Here are the facts. Join Ben and Matt to learn the Stuff They Don't Want You To Know about everything from ancient history to UFOs, government secrets, and the future of civilization. Here's where it gets crazy. We appreciate your time and aim to expand your mind. Thank you for joining us. HowStuffWorks.com | http://bit.ly/stdwytk-hsw-home Stuff You Should Know | http://bit.ly/stdwytk-sysk-home BrainStuff | http://bit.ly/stdwytk-brainstuff-home Stuff to Blow Your Mind | http://bit.ly/stdwytk-stbym-home Stuff You Missed in History Class | http://bit.ly/stdwytk-symhc-home Stuff Mom Never Told You | http://bit.ly/stdwytk-smnty-home - Who owns the Federal Reserve? http://www.youtube.com/user/ConspiracyStuff -

30:34

30:34The Federal Reserve American Dream Explained

The Federal Reserve American Dream ExplainedThe Federal Reserve American Dream Explained

Short Animated film called The American Dream, explains how the Federal Reserve and the banks are the BIG problem, they are the reason our economies fail, they are the reason nations are going bankrupt, and its all part of a satanic plot that goes back hundreds of years, if you want the total truth about whats going on today, visit www.the-complete-truth.blogspot.com -

47:23

47:23Federal Reserve Bank and International Bankers Exposed

Federal Reserve Bank and International Bankers Exposed -

51:55

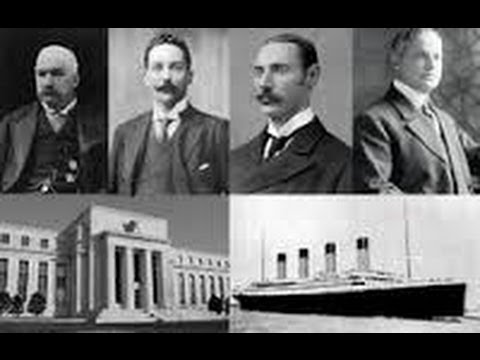

51:55This is how JP Morgan sunk his unsikable Titanic to create the Federal Reserve Bank

This is how JP Morgan sunk his unsikable Titanic to create the Federal Reserve BankThis is how JP Morgan sunk his unsikable Titanic to create the Federal Reserve Bank

The Titanic (Olympic) was deleberly sunk to drown the opposition to the federal reserve in 1912 and on 1913 the federal reserve was created and than in 1914 world war 1 started financed in both sides by this federal bank by making mony out of thin air in order to build a new world order for jewish supremacy -

15:01

15:01FIRST-LOOK-Inside-the-FEDERAL-RESERVE,-USD,-CASH,-GOLD-monetary-SYSTEM-Americas-Money-Vault-PART-1

FIRST-LOOK-Inside-the-FEDERAL-RESERVE,-USD,-CASH,-GOLD-monetary-SYSTEM-Americas-Money-Vault-PART-1FIRST-LOOK-Inside-the-FEDERAL-RESERVE,-USD,-CASH,-GOLD-monetary-SYSTEM-Americas-Money-Vault-PART-1

FIRST LOOK Inside the FEDERAL RESERVE, USD, CASH, GOLD monetary SYSTEM - Americas Money Vault, National Geographic Full Episode PART 1 For the first time, National Geographic takes you inside the heart of the money machine to places that you're not allowed to bring a camera ...straight into the vaults of some of the world's largest stashes of what you want, need and bust your butt to get: Money. Hidden deep under the streets of New York City, hundreds of billion dollars in gold bars are tucked away in a bunker that is anchored to the bedrock of Manhattan Island itself. In the latest in a string of high-profile hacking disclosures, the Federal Reserve confirmed on Wednesday that one of its websites was broken into by cyber hackers in a breach that reportedly leaked the contact information of thousands of bankers. While the central bank said the incident didn't "affect critical operations" of the Federal Reserve System, the disclosure is sure to fuel concerns about the cyber security of government websites and critical financial infrastructure. The Fed hack appears to be tied to an Anonymous group that published on Twitter the credentials of more than 4,000 commercial bankers early Monday morning. The group, Operation Last Resort, said it received the documents "via the FED." Call it the Rick Perry gold rush: The governor wants to bring the state's gold reserves back from a New York vault to Texas. And he may have legislative support to do it. Freshman Rep. Giovanni Capriglione, R-Southlake, is carrying a bill that would establish the Texas Bullion Depository, a secure state-based bank to house $1 billion worth of gold bars owned by the University of Texas Investment Management Co., or UTIMCO, and stored by the Federal Reserve. "If you think gold is a hedge, or a protection, you always want it as close to the individual and the entity as possible," Paul told The Texas Tribune on Thursday. "Texas is better served if it knows exactly where the gold is rather than depending on the security of the Federal Reserve." Sadly, most Americans don't even realize that a private banking cartel has a monopoly over all money creation in this country. In recent years they have abused this power by wildly printing money ("quantitative easing"), and by making more than 16 trillion dollars in secret loans to their friends during the last financial crisis. "Neither the Treasury Department nor the Federal Reserve believes that the law can or should be used to facilitate the production of platinum coins for the purpose of avoiding an increase in the debt limit" remaining alternative to Congress raising the nation's borrowing limit, which would utilize a loophole in federal law to mint a $1 trillion coin to be deposited in the Federal Reserve and ensure the federal government could pay all bills and debt obligations. gold, money, cash fed, "federal reserve" ,bank ,banking ,bankers ,system, matrix ,monetary ,vault, "armored vehicle", police, cops, control, mafia, episode, tv, show, america ,u.s, "united states", american, nyc, "new york" ,"new york city" ,"gold bullion" ,"scrap gold", "buy gold", "sell gold" ,"silver coins" ,"silver bullion", "u.s. mint" ,inside, "first look" ,usd ,dollar ,crash, crisis, trust, etf, "paper gold" ,stocks, trading, investment, investing, future, world, global, supply, debt, 2013, forces, vault ,control, illuminati, new world order ,alex jones, infowars, gerald celente, david icke ,farrakhan ,lindsey williams, tvfirst123 You can thank the reckless money printing that the Federal Reserve has been doing for the incredible bull market that we have seen in recent months. When the Federal Reserve does more "quantitative easing", it is the financial markets that benefit the most. The Dow and the S&P; 500 have both hit levels not seen since 2007 this month, and many analysts are projecting that 2013 will be a banner year for stocks. But is a rising stock market really a sign that the overall economy is rapidly improving as many are suggesting? Of course not. Just because the Federal Reserve has inflated another false stock market bubble Barack Obama has been president, 40 percent of all American workers are making $20,000 a year or less, median household income has declined for four years in a row, and poverty in the United States is absolutely exploding. So quantitative easing has definitely not made things better for the middle class. But all of the money printing that the Fed has been doing has worked out wonderfully for Wall Street. Profits are soaring at Goldman Sachs and luxury estates in the Hamptons are selling briskly. Unfortunately, this is how things work in America these days. Our "leaders" seem far more concerned with the welfare of Wall Street than they do about the welfare of the American people. When things get rocky, their first priority always seems to be to do whatever it takes to pump up the financial markets Category Entertainment License Standard YouTube License -

39:41

39:41Glenn Beck Exposes the Private Fed; Gets Fired by Fox

Glenn Beck Exposes the Private Fed; Gets Fired by FoxGlenn Beck Exposes the Private Fed; Gets Fired by Fox

I never liked Glenn Beck much, but it is quite a coincidence that he comes out with the real truth about the private Federal Reserve, and then loses his show on Fox News. Like Ron Paul always says, the Fed is the true facilitator of big government. They could never tax enough, or borrow enough to pay for the wars and corporate welfare without the printing press and world reserve currency status. Do your own research; read G. Edward Griffin's classic "The Creature from Jekyll Island." The creation of the Fed WAS A CONSPIRACY. No theorizing needed. Our forefathers fought since the founding to deny the bankers a monopoly over the control of currency and credit. We have fallen under the control of the banking establishment, and they have tied their fraudulent debt to the fiscal wellbeing of America. If you consider yourself a proponent of limited, Constitutional government, you have an obligation to fight the Federal Reserve. The neocon talkers like Limbaugh, Hannity, Levin, Ingraham, and even Savage will not explain the truth. While popular outrage is focused at the Fed, the neocons are trying RIGHT NOW to shift the focus to Chinese policy and their alleged (get this) currency manipulation! Ever heard of QE2? Aired on March 25, 2011 - Fox News Channel's "Glenn Beck" This video clip may contain copyrighted material. Such material is made available for educational purposes only. This constitutes a 'fair use' of any such copyrighted material as provided for in Title 17 U.S.C. section 107 of the US Copyright Law. -

42:09

42:09Money, Banking and the Federal Reserve

Money, Banking and the Federal ReserveMoney, Banking and the Federal Reserve

Thomas Jefferson and Andrew Jackson understood "The Monster". But to most Americans today, "Federal Reserve" is just a name on the dollar bill. They have no idea of what the central bank does to the economy, or to their own economic lives; of how and why it was founded and operates; or of the sound money and banking that could end the statism, inflation, and business cycles that the Fed generates. Dedicated to Murray N. Rothbard, steeped in American history and Austrian economics, and featuring Ron Paul, Joseph Salerno, Hans Hoppe, and Lew Rockwell, this extraordinary documentary is the clearest, most compelling explanation ever offered of the Fed, and why curbing it must be our first priority. Alan Greenspan was not, we're told, happy about this 1996 blockbuster. Watch it, and you'll understand why. This is economics and history as they are meant to be: fascinating, informative, and motivating. This movie is changing America. -

91:03

91:03Understanding How the Federal Reserve Works - Documentary Films

Understanding How the Federal Reserve Works - Documentary FilmsUnderstanding How the Federal Reserve Works - Documentary Films

Understanding How the Federal Reserve Works - Documentary Films For over a century, the privately owned and operated Federal Reserve Banking system has controlled this nation's money supply and credit. This institution and its economic policies are an enigma to most government officials and American citizens. To understand the Federal Reserve Bank, we have to first look at how it operates. We can then understand why our founding fathers were opposed to such a system for the United States of America. The Federal Reserve is what is known as a central bank. This bank is not regulated by the United States government. It creates the nation's money supply, loans it back to the government at interest, and regulates interest rates on the money it loaned out. However, the Federal Reserve, also commonly called "the Fed," does not loan out money held in its vaults. Instead, it creates new money for circulation by adding credits to an account. Thus, they are creating new money that never existed before. How much money can be created out of nothing? The Fed is only required to hold ten percent in reserves, and can loan out ninety percent. One of the Federal Reserve's publications states, "Of course, they (the banks) do not really pay out loans from the money received from deposits. What they do when they make loans is to accept promissory notes (money) for credits to the borrowers account." Actual currency is relative to the amount of new loans in demand. In short our system is based on debt. New money cannot be created unless banks issue new loans. The Federal Reserve is a private bank. It loans America it's currency at interest like any other bank, and process works like this. The federal government needs to make more money. It has the Federal Reserve print reserve notes (money) worth a set value. The federal government then prints treasury bonds, which is basically a promissory note to pay back the loan of the currency at interest. In simple terms our government is in debt to the Federal Reserve as soon as the money is created. If the government is in debt to the Fed, who makes the money, and the only way to get out debt is make more money, and the people who make the money are charging interest; how would the debt ever be paid off? It doesn't. As stated by the great scientist and creator of the light bulb, Thomas Edison wrote, "If our nation can issue a dollar bond, it can issue a dollar bill. The element that makes the bond good, makes the bill good, also. The difference between the bond and the bill is that the bond lets money brokers collect twice the amount of the bond and an additional 20%, whereas the currency pays nobody but those who contribute directly in some useful way. It is absurd to say that our country can issue $30 million in bonds and not $30 million in currency. Both are promises to pay, but one promise fattens the usurers and the other helps the people." Understanding How the Federal Reserve Works - Documentary Films -

4:54

4:54How the Federal Reserve's central banking system works in under 5 mins.

How the Federal Reserve's central banking system works in under 5 mins.How the Federal Reserve's central banking system works in under 5 mins.

How the Federal Reserve's central banking system works in under 5 mins.

- Aldrich–Vreeland Act

- Alexander Hamilton

- Arthur O' Sullivan

- Baltimore

- Beige Book

- Bimetallic standard

- Birmingham, Alabama

- Central bank

- Cincinnati

- Corporations

- Denver

- Detroit

- Discount window

- El Paso, Texas

- Federal banking

- Federal funds

- Federal funds rate

- Federal Reserve Act

- Federal Reserve Bank

- Federal Reserve Note

- Fedspeak

- Financial audit

- Helena, Montana

- Houston

- Liquidity

- Loan

- Louisville, Kentucky

- Memphis, Tennessee

- Miami

- Missouri

- Monetary policy

- Nashville, Tennessee

- New Orleans

- Ohio

- Oklahoma City

- Omaha, Nebraska

- Panic of 1907

- Pennsylvania

- Pittsburgh

- Portland, Oregon

- Primary dealer

- Salt Lake City

- San Antonio

- Seattle

- Stock

- Tennessee

- U.S. state

- World's Work

-

Century of Enslavement: The History of The Federal Reserve

TRANSCRIPT AND RESOURCES: http://www.corbettreport.com/federalreserve What is the Federal Reserve system? How did it come into existence? Is it part of the federal government? How does it create money? Why is the public kept in the dark about these important matters? In this feature-length documentary film, The Corbett Report explores these important question and pulls back the curtain on America's central bank. -

The U.S. Federal Reserve Bank - How it Works, and What it Does - Money, Dollars, & Currency

The U.S. Federal Reserve Bank - How it Works & What it Does - Money, Currency, & the Dollar - SUBSCRIBE to Bright Enlightenment: http://www.youtube.com/BrightEnlightenment - LIKE our page on Facebook: http://www.Facebook.com/BrightEnlightenment - TWITTER: http://www.twitter.com/BrightEnlight WEBSITE: http://www.BrightEnlightenment.com/ -

-

-

Who owns the Federal Reserve

-

Who owns the Federal Reserve?

Through the management of currency and interest, the Federal Reserve attempts to keep banks secure -- but some believe it has another purpose. Tune in and learn about the origins of the Fed in this episode. SUBSCRIBE | http://bit.ly/stdwytk-sub WEBSITE | http://bit.ly/stdwytk-home AUDIO PODCAST | http://bit.ly/stdwytk-audio-itunes TWITTER | http://bit.ly/stdwytk-twitter FACEBOOK | http://bit.ly/stdwytk-fb EMAIL | Conspiracy@HowStuffWorks.com STORE | http://stufftheydontwantyoutoknow.spreadshirt.com Here are the facts. Join Ben and Matt to learn the Stuff They Don't Want You To Know about everything from ancient history to UFOs, government secrets, and the future of civilization. Here's where it gets crazy. We appreciate your time and aim to expand your mind. Thank you f... -

The Federal Reserve American Dream Explained

Short Animated film called The American Dream, explains how the Federal Reserve and the banks are the BIG problem, they are the reason our economies fail, they are the reason nations are going bankrupt, and its all part of a satanic plot that goes back hundreds of years, if you want the total truth about whats going on today, visit www.the-complete-truth.blogspot.com -

-

This is how JP Morgan sunk his unsikable Titanic to create the Federal Reserve Bank

The Titanic (Olympic) was deleberly sunk to drown the opposition to the federal reserve in 1912 and on 1913 the federal reserve was created and than in 1914 world war 1 started financed in both sides by this federal bank by making mony out of thin air in order to build a new world order for jewish supremacy -

FIRST-LOOK-Inside-the-FEDERAL-RESERVE,-USD,-CASH,-GOLD-monetary-SYSTEM-Americas-Money-Vault-PART-1

FIRST LOOK Inside the FEDERAL RESERVE, USD, CASH, GOLD monetary SYSTEM - Americas Money Vault, National Geographic Full Episode PART 1 For the first time, National Geographic takes you inside the heart of the money machine to places that you're not allowed to bring a camera ...straight into the vaults of some of the world's largest stashes of what you want, need and bust your butt to get: Money. Hidden deep under the streets of New York City, hundreds of billion dollars in gold bars are tucked away in a bunker that is anchored to the bedrock of Manhattan Island itself. In the latest in a string of high-profile hacking disclosures, the Federal Reserve confirmed on Wednesday that one of its websites was broken into by cyber hackers in a breach that reportedly leaked the contact informatio... -

Glenn Beck Exposes the Private Fed; Gets Fired by Fox

I never liked Glenn Beck much, but it is quite a coincidence that he comes out with the real truth about the private Federal Reserve, and then loses his show on Fox News. Like Ron Paul always says, the Fed is the true facilitator of big government. They could never tax enough, or borrow enough to pay for the wars and corporate welfare without the printing press and world reserve currency status. Do your own research; read G. Edward Griffin's classic "The Creature from Jekyll Island." The creation of the Fed WAS A CONSPIRACY. No theorizing needed. Our forefathers fought since the founding to deny the bankers a monopoly over the control of currency and credit. We have fallen under the control of the banking establishment, and they have tied their fraudulent debt to the fiscal wellbeing of Am... -

Money, Banking and the Federal Reserve

Thomas Jefferson and Andrew Jackson understood "The Monster". But to most Americans today, "Federal Reserve" is just a name on the dollar bill. They have no idea of what the central bank does to the economy, or to their own economic lives; of how and why it was founded and operates; or of the sound money and banking that could end the statism, inflation, and business cycles that the Fed generates. Dedicated to Murray N. Rothbard, steeped in American history and Austrian economics, and featuring Ron Paul, Joseph Salerno, Hans Hoppe, and Lew Rockwell, this extraordinary documentary is the clearest, most compelling explanation ever offered of the Fed, and why curbing it must be our first priority. Alan Greenspan was not, we're told, happy about this 1996 blockbuster. Watch it, and you'... -

Understanding How the Federal Reserve Works - Documentary Films

Understanding How the Federal Reserve Works - Documentary Films For over a century, the privately owned and operated Federal Reserve Banking system has controlled this nation's money supply and credit. This institution and its economic policies are an enigma to most government officials and American citizens. To understand the Federal Reserve Bank, we have to first look at how it operates. We can then understand why our founding fathers were opposed to such a system for the United States of America. The Federal Reserve is what is known as a central bank. This bank is not regulated by the United States government. It creates the nation's money supply, loans it back to the government at interest, and regulates interest rates on the money it loaned out. However, the Federal Reserve, also c... -

How the Federal Reserve's central banking system works in under 5 mins.

How the Federal Reserve's central banking system works in under 5 mins. -

The Federal Reserve Explained in 3 Minutes

See More Videos Here: http://www.schoolhouseshock.com Money - whether its a tangible piece of paper or a number on a screen - is intrinsically worthless, yet it fuels the modern world. In America the ultimate control of money rests with the bankers of the Federal Reserve System. Because of this it is detrimental that we as citizens understand how this shadowy - private - organization works and how it's ultimate goal is to forever enslave us in a descending pit of debt that we will never crawl out of. -

Federal Reserve - Die mächtigste Bank der Welt

-

FIRSTLOOK-Inside-the-FEDERAL-RESERVE,-USD,-CASH,-GOLD-monetary-SYSTEM-Americas-Money-Vault-PART-2

For the first time, National Geographic takes you inside the heart of the money machine to places that you're not allowed to bring a camera ...straight into the vaults of some of the world's largest stashes of what you want, need and bust your butt to get: Money. Hidden deep under the streets of New York City, hundreds of billion dollars in gold bars are tucked away in a bunker that is anchored to the bedrock of Manhattan Island itself. In the latest in a string of high-profile hacking disclosures, the Federal Reserve confirmed on Wednesday that one of its websites was broken into by cyber hackers in a breach that reportedly leaked the contact information of thousands of bankers. While the central bank said the incident didn't "affect critical operations" of the Federal Reserve System, ... -

How Banks Work - History of Banks Documentary - Documentary Films

How Banks Work - History of Banks Documentary The history and purpose of the Federal Reserve Bank is not what is commonly believed to be the truth. Its function in the financial affairs of the United States carries a definite dark side to it - one that would shock the average US citizen. Here are some details about this 5-part article series exposing the real truth behind this very powerful agency and why the nation listens when it speaks. This first article lays the foundation of the history of the Federal Reserve by pointing out why there ever was an attempt to grab the controls of the reigns of agencies that produce the money in the US. Going back to England, it was shown that central banks have known for centuries that controlling the making and lending of currency to a nation ultima... -

The Biggest Scam In The History Of Mankind - Who Owns The Federal Reserve? Hidden Secrets of Money 4

Bonus Presentation here: http://www.hiddensecretsofmoney.com Who owns the Federal reserve? You are about to learn one of the biggest secrets in the history of the world... it's a secret that has huge effects for everyone who lives on this planet. Most people can feel deep down that something isn't quite right with the world economy, but few know what it is. Gone are the days where a family can survive on just one paycheck... every day it seems that things are more and more out of control, yet only one in a million understand why. You are about to discover the system that is ultimately responsible for most of the inequality in our world today. The powers that be DO NOT want you to know about this, as this system is what has kept them at the top of the financial food-chain for the last ... -

Rothschild Conspiracy International Banking Cartel and The Federal Reserve

Rothschild Conspiracy: A documentary looking at banking tycoons: from the Rothschild family in Europe to JP Morgan and others in the US. How banks not only control governments but also appoint politicians through huge campaign donations. Governments at the service of the major banks, the best example: the Obama administration and the history's biggest bail out of the same institutions that caused the Great Recession. Also looking at the International Banking Cartel led by the Bank for International Settlement (in Basel, Switzerland) known as the bank of central banks (58 central banks) and The US Federal reserve System. -

Anonymous Hacks into Federal Reserve Bank

As officials in Washington continue to discuss and warn about cyber-attacks, members of Anonymous claimed to have breached a computer system that the Federal Reserve uses to communicate with bankers in emergencies such as natural disasters and potential acts of terrorism. On Super Bowl Sunday, members of the group tweeted that they had compromised 4,000 bankers' credentials from the Federal Reserve. "Now we have your attention America: Anonymous's [sic] Superbowl Commercial 4k banker d0x via the FED," the group tweeted, using the @OpLastResort handle on Twitter. "The Federal Reserve System is aware that information was obtained by exploiting a temporary vulnerability in a website vendor product," A Federal Reserve spokesman said in a statement. "The exposure was fixed shortly after discove... -

I have an account at the FEDERAL RESERVE BANK?

Was about the Federal Reserve and Central Banks controlling the price of gold (measured in ounces abbreviated as Oz). In the book, Dorothy had silver slippers not ruby, which represented the silver backed currency, similar to what JFK tried to do 5-months prior to his assassination when he tried to end the reign of the Federal Reserve. The yellow brick road (gold standard), the Scarecrow (farmers), the Tin Man (industrial workers), the Wicked Witch of the West (J.D. Rockefeller) and the Wicked Witch of the East (J.P. Morgan), the Emerald City (Debt free USA-issued Greenback money "Abraham Lincoln"), the illusory power of the Wizard in the capitol city (who monopolized power by deceit), The Cowardly Lion (is the population, its you and me) The characters (scarecrow, tin man, lion)... -

FED - Federal Reserve Finanz System Betrug Teil 1 (US-Notenbank-Betrug)

Wir zeigen ihnen transparent und nachvollziehbar, wie Sie wahre, finanzielle Unabhängigkeit innerhalb von nur 3 Jahren erreichen. Und die wahre, finanzielle Unabhängigkeit werden Sie in Zukunft auch brauchen! Dafür haben wir einen transparenten Fachvortrag und Info-Abend entwickelt, indem Sie sich über Wege jenseits vom Mittelmass informieren können. Fragen Sie bei uns nach.... ZITAT "Focus Money" vom 18.07.2012: "Sparer werden enteignet. Alle Geldanlagen zu meiden, mit denen der Staat irgendetwas zu tun hat. Nur in etwas Reales investieren. Also etwas zum Anfassen und keine reinen Finanzwerte." ZITAT "Frankfurter Allgemeine Zeitung" vom 12.03.2012: "Die finanzielle Bildung in Deutschland ist ungenügend." ZITAT "Frankfurter Allgemeine Zeitung" vom 17.11.2012: DIe Altersvorsorge zwingt ...

Century of Enslavement: The History of The Federal Reserve

- Order: Reorder

- Duration: 90:12

- Updated: 06 Jul 2014

- views: 609280

- published: 06 Jul 2014

- views: 609280

The U.S. Federal Reserve Bank - How it Works, and What it Does - Money, Dollars, & Currency

- Order: Reorder

- Duration: 13:59

- Updated: 25 Dec 2012

- views: 62958

- published: 25 Dec 2012

- views: 62958

Anonymous Message - WHO OWNS THE FEDERAL RESERVE

- Order: Reorder

- Duration: 93:35

- Updated: 23 Aug 2015

- views: 67240

FIRST LOOK inside the FEDERAL RESERVE (28.04.2013) - Full Lenght -

- Order: Reorder

- Duration: 30:00

- Updated: 09 May 2013

- views: 179386

Who owns the Federal Reserve

- Order: Reorder

- Duration: 5:10

- Updated: 04 Jun 2011

- views: 382707

- published: 04 Jun 2011

- views: 382707

Who owns the Federal Reserve?

- Order: Reorder

- Duration: 4:14

- Updated: 19 Oct 2013

- views: 136757

- published: 19 Oct 2013

- views: 136757

The Federal Reserve American Dream Explained

- Order: Reorder

- Duration: 30:34

- Updated: 13 Jun 2012

- views: 71778

- published: 13 Jun 2012

- views: 71778

Federal Reserve Bank and International Bankers Exposed

- Order: Reorder

- Duration: 47:23

- Updated: 21 Jun 2012

- views: 17843

This is how JP Morgan sunk his unsikable Titanic to create the Federal Reserve Bank

- Order: Reorder

- Duration: 51:55

- Updated: 01 Feb 2014

- views: 72645

- published: 01 Feb 2014

- views: 72645

FIRST-LOOK-Inside-the-FEDERAL-RESERVE,-USD,-CASH,-GOLD-monetary-SYSTEM-Americas-Money-Vault-PART-1

- Order: Reorder

- Duration: 15:01

- Updated: 17 May 2013

- views: 1368

- published: 17 May 2013

- views: 1368

Glenn Beck Exposes the Private Fed; Gets Fired by Fox

- Order: Reorder

- Duration: 39:41

- Updated: 08 Apr 2011

- views: 1635000

- published: 08 Apr 2011

- views: 1635000

Money, Banking and the Federal Reserve

- Order: Reorder

- Duration: 42:09

- Updated: 22 Feb 2006

- views: 1018468

- published: 22 Feb 2006

- views: 1018468

Understanding How the Federal Reserve Works - Documentary Films

- Order: Reorder

- Duration: 91:03

- Updated: 22 Dec 2015

- views: 232

- published: 22 Dec 2015

- views: 232

How the Federal Reserve's central banking system works in under 5 mins.

- Order: Reorder

- Duration: 4:54

- Updated: 29 Jul 2010

- views: 62373

- published: 29 Jul 2010

- views: 62373

The Federal Reserve Explained in 3 Minutes

- Order: Reorder

- Duration: 3:01

- Updated: 22 Feb 2013

- views: 369255

- published: 22 Feb 2013

- views: 369255

Federal Reserve - Die mächtigste Bank der Welt

- Order: Reorder

- Duration: 49:59

- Updated: 08 Oct 2013

- views: 22301

- published: 08 Oct 2013

- views: 22301

FIRSTLOOK-Inside-the-FEDERAL-RESERVE,-USD,-CASH,-GOLD-monetary-SYSTEM-Americas-Money-Vault-PART-2

- Order: Reorder

- Duration: 15:01

- Updated: 17 May 2013

- views: 1615

- published: 17 May 2013

- views: 1615

How Banks Work - History of Banks Documentary - Documentary Films

- Order: Reorder

- Duration: 44:53

- Updated: 09 Dec 2015

- views: 1393

- published: 09 Dec 2015

- views: 1393

The Biggest Scam In The History Of Mankind - Who Owns The Federal Reserve? Hidden Secrets of Money 4

- Order: Reorder

- Duration: 29:35

- Updated: 15 Oct 2013

- views: 4532649

- published: 15 Oct 2013

- views: 4532649

Rothschild Conspiracy International Banking Cartel and The Federal Reserve

- Order: Reorder

- Duration: 25:58

- Updated: 09 May 2013

- views: 447268

- published: 09 May 2013

- views: 447268

Anonymous Hacks into Federal Reserve Bank

- Order: Reorder

- Duration: 2:01

- Updated: 07 Feb 2013

- views: 100515

- published: 07 Feb 2013

- views: 100515

I have an account at the FEDERAL RESERVE BANK?

- Order: Reorder

- Duration: 11:19

- Updated: 07 Oct 2011

- views: 25467

- published: 07 Oct 2011

- views: 25467

FED - Federal Reserve Finanz System Betrug Teil 1 (US-Notenbank-Betrug)

- Order: Reorder

- Duration: 7:59

- Updated: 17 Mar 2011

- views: 27489

- published: 17 Mar 2011

- views: 27489

- Playlist

- Chat

- Playlist

- Chat

Century of Enslavement: The History of The Federal Reserve

- Report rights infringement

- published: 06 Jul 2014

- views: 609280

The U.S. Federal Reserve Bank - How it Works, and What it Does - Money, Dollars, & Currency

- Report rights infringement

- published: 25 Dec 2012

- views: 62958

Anonymous Message - WHO OWNS THE FEDERAL RESERVE

- Report rights infringement

- published: 23 Aug 2015

- views: 67240

FIRST LOOK inside the FEDERAL RESERVE (28.04.2013) - Full Lenght -

- Report rights infringement

- published: 09 May 2013

- views: 179386

Who owns the Federal Reserve

- Report rights infringement

- published: 04 Jun 2011

- views: 382707

Who owns the Federal Reserve?

- Report rights infringement

- published: 19 Oct 2013

- views: 136757

The Federal Reserve American Dream Explained

- Report rights infringement

- published: 13 Jun 2012

- views: 71778

Federal Reserve Bank and International Bankers Exposed

- Report rights infringement

- published: 21 Jun 2012

- views: 17843

This is how JP Morgan sunk his unsikable Titanic to create the Federal Reserve Bank

- Report rights infringement

- published: 01 Feb 2014

- views: 72645

FIRST-LOOK-Inside-the-FEDERAL-RESERVE,-USD,-CASH,-GOLD-monetary-SYSTEM-Americas-Money-Vault-PART-1

- Report rights infringement

- published: 17 May 2013

- views: 1368

Glenn Beck Exposes the Private Fed; Gets Fired by Fox

- Report rights infringement

- published: 08 Apr 2011

- views: 1635000

Money, Banking and the Federal Reserve

- Report rights infringement

- published: 22 Feb 2006

- views: 1018468

Understanding How the Federal Reserve Works - Documentary Films

- Report rights infringement

- published: 22 Dec 2015

- views: 232

How the Federal Reserve's central banking system works in under 5 mins.

- Report rights infringement

- published: 29 Jul 2010

- views: 62373

In A “New York Minute” Everything Can Change For Trump And Sanders

Edit WorldNews.com 18 Apr 2016Japan Earthquake Relief Effort Grows As U.S. Pitches In

Edit WorldNews.com 18 Apr 201636 killed during Myanmar's water festival

Edit One India 18 Apr 2016

British Airways flight hits UFO during landing at Heathrow

Edit Ars Technica 18 Apr 2016Gravitational wave mission passes 'sanity check'

Edit BBC News 18 Apr 2016Richmond Fed Examines Whether Living Wills Can Alleviate ‘Too Big to Fail’ (Federal Reserve Bank of Richmond)

Edit Public Technologies 18 Apr 2016Texas Added 500 Jobs in March; State Employment Forecast Revised Up To 1 Percent For 2016 (Federal Reserve Bank of Dallas)

Edit Public Technologies 18 Apr 2016Wells Fargo Securities Designated a Primary Dealer by the Federal Reserve Bank of New York

Edit Stockhouse 18 Apr 2016Fed's Kashkari favors higher capital requirements, smaller banks

Edit Yahoo Daily News 18 Apr 2016Bangladeshi CID finds 20 foreigners' link in reserve heist

Edit Topix 18 Apr 2016Minneapolis Fed CEO Neel Kashkari pushes back in 'Too Big to Fail' fight

Edit Business Journal 18 Apr 2016Bangladesh identifies 20 foreign suspects in central bank cyber heist

Edit Dawn 18 Apr 2016FSR No. 20: Financial stability in the digital era (Banque de France)

Edit Public Technologies 18 Apr 2016Treasuries Decline as Fed's Dudley Cites Growth in U.S., Europe

Edit Bloomberg 18 Apr 2016Longtime Nonprofit Executive Named Director of Strategic Partnerships (City of Jacksonville, FL)

Edit Public Technologies 18 Apr 2016How America’s Coastal Cities Left the Heartland Behind

Edit The Atlantic 18 Apr 2016- 1

- 2

- 3

- 4

- 5

- Next page »