- go to the top

- About WN

- Contact

- Feedback

- Privacy Policy

- © 2011 World News Inc., all Rights Reserved

- Order: Reorder

- Duration: 4:35

- Published: 12 May 2009

- Uploaded: 07 Nov 2011

- Author: economicsfun

- Order: Reorder

- Duration: 4:04

- Published: 21 Mar 2009

- Uploaded: 25 Nov 2011

- Author: econsteve12

- Order: Reorder

- Duration: 3:57

- Published: 06 May 2010

- Uploaded: 24 Oct 2011

- Author: UMassEconomics

- Order: Reorder

- Duration: 2:03

- Published: 27 Mar 2010

- Uploaded: 07 Oct 2011

- Author: intromediateecon

- Order: Reorder

- Duration: 25:33

- Published: 26 Aug 2011

- Uploaded: 26 Aug 2011

- Author: BurkeyAcademy

- Order: Reorder

- Duration: 5:38

- Published: 17 Dec 2008

- Uploaded: 29 Aug 2011

- Author: METALMathProject

- Order: Reorder

- Duration: 0:52

- Published: 19 Feb 2010

- Uploaded: 24 Oct 2011

- Author: gaccount1999

- Order: Reorder

- Duration: 3:14

- Published: 03 Nov 2010

- Uploaded: 21 Oct 2011

- Author: larryschmidt

- Order: Reorder

- Duration: 4:51

- Published: 18 May 2010

- Uploaded: 07 Nov 2011

- Author: UMassEconomics

- Order: Reorder

- Duration: 4:34

- Published: 19 Apr 2011

- Uploaded: 10 Aug 2011

- Author: Mindbitesdotcom

- Order: Reorder

- Duration: 3:08

- Published: 14 Apr 2011

- Uploaded: 28 Oct 2011

- Author: AdvancedEcon

- Order: Reorder

- Duration: 5:46

- Published: 11 Nov 2009

- Uploaded: 16 Jun 2011

- Author: humanzeeben

- Order: Reorder

- Duration: 5:01

- Published: 09 Nov 2010

- Uploaded: 14 May 2011

- Author: KylePurpuraLCS

- Order: Reorder

- Duration: 6:22

- Published: 05 Sep 2011

- Uploaded: 24 Oct 2011

- Author: economicsfun

- Order: Reorder

- Duration: 5:00

- Published: 01 Nov 2010

- Uploaded: 24 Apr 2011

- Author: KylePurpuraLCS

- Order: Reorder

- Duration: 4:34

- Published: 19 Apr 2011

- Uploaded: 19 Apr 2011

- Author: Mindbitesdotcom

- Order: Reorder

- Duration: 0:52

- Published: 23 Dec 2010

- Uploaded: 22 Nov 2011

- Author: gaccount1999

- Order: Reorder

- Duration: 2:55

- Published: 04 Dec 2009

- Uploaded: 24 Nov 2011

- Author: ACDCLeadership

- Order: Reorder

- Duration: 0:57

- Published: 17 Oct 2007

- Uploaded: 24 Aug 2010

- Author: XxSlipKnightxX

-

Weekend Dissent: Remnants of Imperial Footsteps

WorldNews.com

Weekend Dissent: Remnants of Imperial Footsteps

WorldNews.com

-

NATO helicopters "attack Pakistan post, eight killed"

Yahoo Daily News

NATO helicopters "attack Pakistan post, eight killed"

Yahoo Daily News

-

Mars Curiosity rover launch marks boldest ever interplanetary mission

The Observer

Mars Curiosity rover launch marks boldest ever interplanetary mission

The Observer

-

Pakistan stops NATO supplies after raid kills up to 28

The Star

Pakistan stops NATO supplies after raid kills up to 28

The Star

-

Violence, pepper spray mar Black Friday shopping

Yahoo Daily News

Violence, pepper spray mar Black Friday shopping

Yahoo Daily News

size: 23.8Kb

size: 5.5Kb

size: 1.3Kb

size: 1.9Kb

size: 7.3Kb

size: 1.1Kb

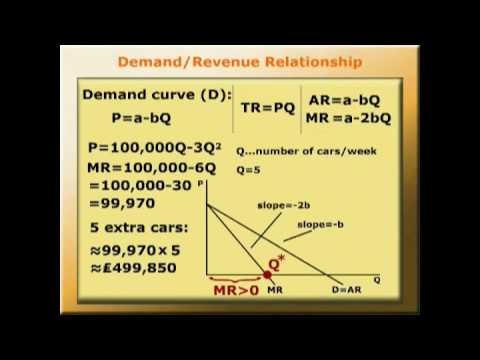

In microeconomics, marginal revenue (MR) is the extra revenue that an additional unit of product will bring. It is the additional income from selling one more unit of a good; sometimes equal to price. It can also be described as the change in total revenue divided by the change in the number of units sold.

Definition

More formally, marginal revenue is equal to the change in total revenue over the change in quantity when the change in quantity is equal to one unit. This can also be represented as a derivative when the units of output are arbitrarily small. (Total revenue) = (Price that can be charged consistent with selling a given quantity) times (Quantity) or . Thus, by the product rule:

For a firm facing perfectly competitive markets, price does not change with quantity sold (), so marginal revenue is equal to price. For a monopoly, the price received will decline with quantity sold (), so marginal revenue is less than price. This means that the profit-maximizing quantity, for which marginal revenue is equal to marginal cost (MC) will be lower for a monopoly than for a competitive firm, while the profit-maximizing price will be higher. When demand is elastic, marginal revenue is positive, and when demand is inelastic, marginal revenue is negative. When the price elasticity of demand is equal to 1, marginal revenue is equal to zero.

Marginal revenue curve

The marginal revenue curve is affected by the same factors as the demand curve - changes in income, change in the prices of complements and substitutes, change in populations. These factors can cause the MR curve to shift and rotate.

Relationship between marginal revenue and elasticity

The relationship between marginal revenue and the elasticity of demand by the firm's customers can be derived as follows::MR = dTR/dQ :MR = P+Q(dP/dQ) :MR = P[1 + (dP/dQ) (Q/P)] :MR = P(1 + 1/PED)

where PED is the price elasticity of demand. If demand is inelastic (PED < 1) then MR will be negative, because to sell a marginal (infinitesimal) unit the firm would have to lower the selling price so much that it would lose more revenue on the pre-existing units than it would gain on the incremental unit. If demand is elastic (PED > 1) MR will be positive, because the additional unit would not drive down the price by so much. If the firm is a perfect competitor, so that it is so small in the market that its quantity produced and sold has no effect on the price, then the price elasticity of demand is negative infinity, and marginal revenue simply equals the (market-determined) price.

Marginal revenue and rule of thumb pricing

Profit maximization requires that a firm produce where marginal revenue equals marginal costs. Firm managers are unlikely to have complete information concerning their marginal revenue function or their marginal costs. Fortunately the profit maximization conditions can be expressed in a “more easily applicable form” or rule of thumb.:MR = MC :MR = P(1 + 1/PED) :MC = P(1 + 1/PED) :MC = P + P/PED :(P - MC)/ P = - 1/PED

Markup is the difference between price and marginal cost. The formula states that markup as a percentage of price equals the negative of the inverse of elasticity of demand.Alternatively, the relationship can be expressed as:

:P = MC/(1 + 1/PED)

Thus if PED is - 2 and MC is $5.00 then price is $10.00.

(P - MC)/ P = - 1/PED is called the Lerner index after economist Abba Lerner. The Lerner index is a measure of market power - the ability of a firm to charge a price that exceeds marginal cost. The index varies from zero to 1. The greater the difference between price and marginal cost the closer the index value is to 1. The Lerner index increases as demand becomes less elastic.

See also

Notes

References

Category:Microeconomics Category:Marginal concepts Category:Economics terminology

ar:إيراد حدي ca:Ingrés marginal de:Grenzerlös es:Ingreso marginal fr:Revenu marginal ko:한계 수입 it:Ricavo marginale he:פדיון שולי hu:Határbevétel nl:Marginale opbrengst ja:限界収益 pl:Przychód krańcowy pt:Renda marginal ru:Предельный доход sr:Маргинални приход sv:MarginalintäktThis text is licensed under the Creative Commons CC-BY-SA License. This text was originally published on Wikipedia and was developed by the Wikipedia community.

![The Omega Speedmaster, a Swiss-made watch worn on the moon during the Apollo missions. In terms of value, Switzerland is responsible for half of the world production of watches.[33][67] The Omega Speedmaster, a Swiss-made watch worn on the moon during the Apollo missions. In terms of value, Switzerland is responsible for half of the world production of watches.[33][67]](http://web.archive.org./web/20111128104552im_/http://cdn1.wn.com/pd/08/60/f835e18970d61052b997930a6de7_small.jpg)

![The Hieronymites Monastery (Mosteiro dos Jerónimos, Portuguese pronunciation: [muʃˈtɐiɾu duʃ ʒɨˈɾɔnimuʃ]) is located in the Belém district of Lisbon, Portugal. This magnificent monastery can be considered one of the most prominent monuments in Lisbon and is certainly one of the most successful achievements of the Manueline style (Portuguese late-Gothic). In 1983, it was classified by the UNESCO, with nearby Belém Tower, as a World Heritage Site. The Hieronymites Monastery (Mosteiro dos Jerónimos, Portuguese pronunciation: [muʃˈtɐiɾu duʃ ʒɨˈɾɔnimuʃ]) is located in the Belém district of Lisbon, Portugal. This magnificent monastery can be considered one of the most prominent monuments in Lisbon and is certainly one of the most successful achievements of the Manueline style (Portuguese late-Gothic). In 1983, it was classified by the UNESCO, with nearby Belém Tower, as a World Heritage Site.](http://web.archive.org./web/20111128104552im_/http://cdn8.wn.com/pd/d7/7f/b4df9e935bb8a669d76f0c05055e_small.jpg)