- published: 29 Aug 2013

- views: 125922

-

remove the playlistBalance Sheet

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistBalance Sheet

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 15 Apr 2011

- views: 160291

- published: 15 Mar 2008

- views: 411280

- published: 29 Oct 2011

- views: 237329

- published: 01 Oct 2011

- views: 162055

- published: 08 Sep 2015

- views: 1360

- published: 10 Feb 2013

- views: 68718

- published: 08 Jun 2015

- views: 20367

- published: 07 Aug 2014

- views: 7447

- published: 24 Jun 2012

- views: 61578

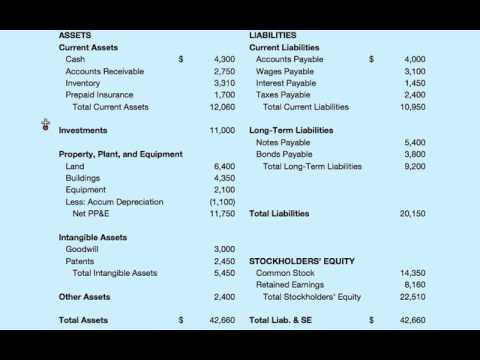

In financial accounting, a balance sheet or statement of financial position is a summary of the financial balances of a sole proprietorship, a business partnership, a corporation or other business organization, such as an LLC or an LLP. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a "snapshot of a company's financial condition". Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time of a business' calendar year.

A standard company balance sheet has three parts: assets, liabilities and ownership equity. The main categories of assets are usually listed first, and typically in order of liquidity. Assets are followed by the liabilities. The difference between the assets and the liabilities is known as equity or the net assets or the net worth or capital of the company and according to the accounting equation, net worth must equal assets minus liabilities.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

10:26

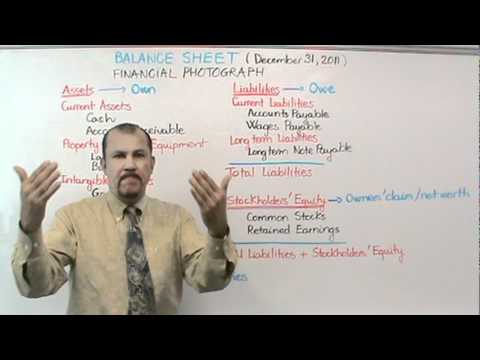

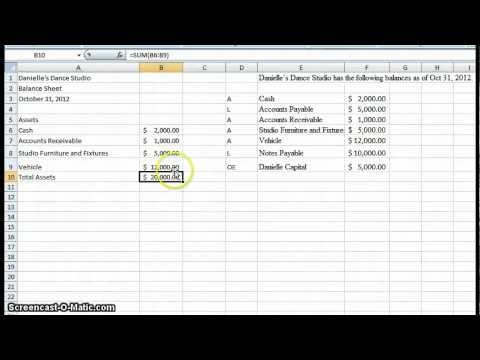

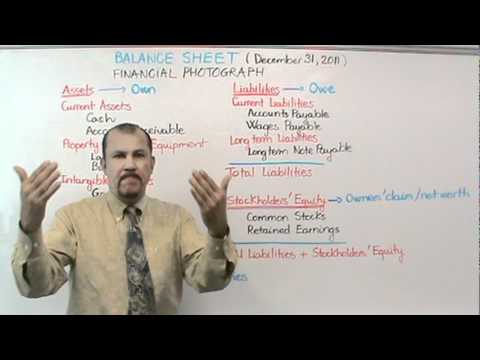

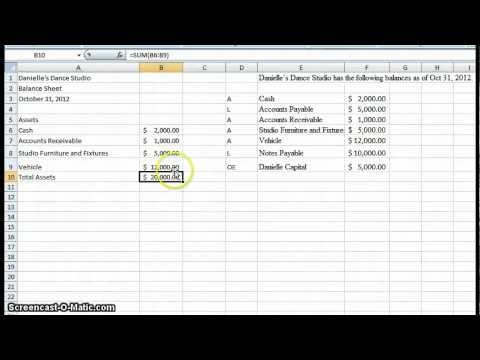

10:26Financial Accounting - Balance Sheet

Financial Accounting - Balance SheetFinancial Accounting - Balance Sheet

This video goes over the accounting equation and how it relates to the Balance Sheet. It also explains the balance sheet both comparative and classified -

13:10

13:10What is a balance sheet? - MoneyWeek Investment Tutorials

What is a balance sheet? - MoneyWeek Investment TutorialsWhat is a balance sheet? - MoneyWeek Investment Tutorials

Tim Bennett explains what a balance sheet is, and the type of information it contains, and how you can use it. Visit http://moneyweek.com/youtube for extra videos not found on YouTube. Related links… • What is profit? https://www.youtube.com/watch?v=IQuYnADhuwo • What is a cash flow statement? https://www.youtube.com/watch?v=GkGdlgX3xYI • What is the 'time value of money'? https://www.youtube.com/watch?v=h3nlIOhxBF4 • What are "depreciation" and "amortisation" all about? https://www.youtube.com/watch?v=ItkCkna0p20 • What is EV / EBITDA? https://www.youtube.com/watch?v=vb_QUjQ2-SU MoneyWeek videos are designed to help you become a better investor, and to give you a better understanding of the markets. They’re aimed at both beginners and more experienced investors. In all our videos we explain things in an easy-to-understand way. Some videos are about important ideas and concepts. Others are about investment stories and themes in the news. The emphasis is on clarity and brevity. We don’t want to waste your time with a 20-minute video that could easily be so much shorter. -

9:54

9:54Introduction to Balance Sheets

Introduction to Balance SheetsIntroduction to Balance Sheets

Using a home purchase to illustrate assets, liabilities and owner's equity. More free lessons at: http://www.khanacademy.org/video?v=mxsYHiDVNlk -

5:37

5:37How To Do A Balance Sheet

How To Do A Balance SheetHow To Do A Balance Sheet

http://www.accounting101.org/how-to-do-a-balance-sheet How to do a balance sheet: a balance sheet is a financial document that shows the assets, liabilities, and owners' equity of a company at a given point in time. It's different from the income statement in that it is a snapshot on any given day, whereas the income statement spans a time period. Most companies prepare their balance sheets quarterly and yearly. How To Do A Balance Sheet To put together a balance sheet, you'll obviously need all of the financial data from your different trial balances. In reality, the information for a balance sheet starts with the individual transactions, but the purpose of this article is just to show you how to organize a balance sheet. First of all, there are two sides to the balance sheet: the right and left side. On the left side, you'll have your assets. On the right side, you'll have two sections: liabilities and owners' equity. The left and right side will always be equal, and the main balance sheet equation is: Assets = Liabilities + Owners' Equity This makes sense because the Assets are on the left side, and it will always equal what is on the right side, which is the Liabilities and Owners' Equity accounts added together. -

13:39

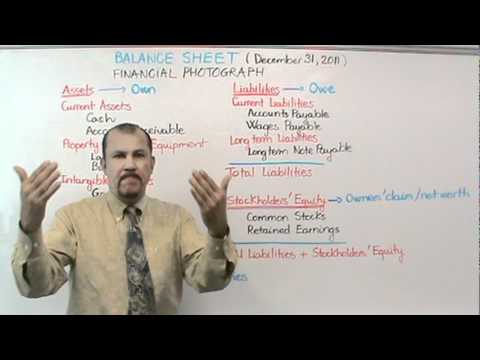

13:39Accounting: Balance Sheet

Accounting: Balance Sheet -

6:50

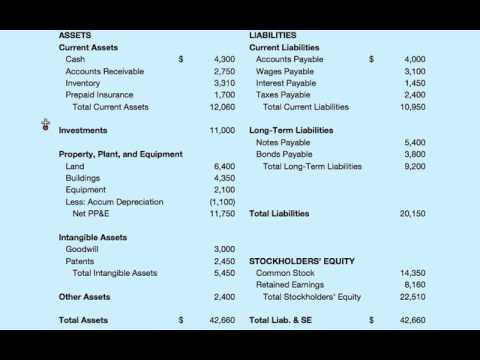

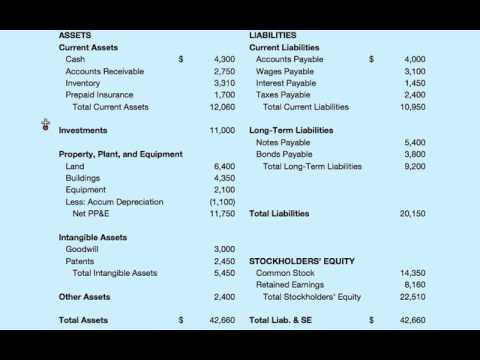

6:50A Balance Sheet Example

A Balance Sheet ExampleA Balance Sheet Example

http://www.accounting101.org/balance-sheet-example The balance sheet is easy to understand... once you understand why what goes where. The balance sheet example on this page, as well as the video, will help explain what the balance sheet is, how it's organized, and how to interpret the information on it. The balance sheet is an extremely useful tool for all users to quickly get an idea of how a company is doing. The balance sheet is usually described as a snapshot of a company's financial position. This is because the balance sheet is accounting for a single moment in time; not over a period such as the income statement. You'll notice in the example below, that the date is December 31, 2011. It basically means, "this is what we have, and this is who owns it as of today, December 31st, 2011." In contrast, the income statement would show a time period, such as "for the period ending December 31, 2011." As you can see in the example above, there are three major parts or sections that make up the balance sheet. These are: Assets Liabilities Owners' Equity Assets are the things the company owns. These are things such as cash, accounts receivable, inventory, prepaid insurance, prepaid rent, and goodwill. There are basically two classifications of assets; current assets and fixed (or long-term) assets. Current assets are assets that will be used within one year. Current assets include cash, accounts receivable, inventory, prepaid insurance, and prepaid rent. There are other types of current assets, but those are the most common. Fixed assets are assets that will be around for longer than one year. Fixed assets include buildings, equipment, goodwill, and land. Asset accounts have a debit balance. Liabilities are the obligations that a company has to repay. A liability could be amounts owed to a creditor, or to a vendor for supplies and inventory. Some examples of liability titles that you'll see are notes payable, accounts payable, wages payable, interest payable, income taxes payable, bonds payable, and unearned revenue. An easy way to spot a liability is anything that has the word "payable" in it. This obviously means an amount that still has to be paid, and will always represent a liability. Another type of liability is when a company receives payment for a product or service that they haven't delivered yet. This is called unearned revenue. Like assets, liabilities are also classified into both current and long-term liabilities. The same rules apply: a current liability is an obligation that has to be repaid within one year, and a long-term liability is an obligation doesn't need to be repaid within a year. Liability accounts have a credit balance. Owners' equity, or stockholders' equity is basically the portion of the assets that the owners of company own. Since assets=liabilities+owners' equity, the assets of the company are either owned by someone external such as a creditor, or they are owned by the owners of the company, usually in the form of stockholders. The account titles in the owners' equity portion of the balance sheet are usually common stock, preferred stock, paid-in capital in excess of par, and retained earnings. Owners' equity accounts have a credit balance. -

5:20

5:20Balance Sheet Explained | Accounting | MBA in Pills | 4wMBA

Balance Sheet Explained | Accounting | MBA in Pills | 4wMBABalance Sheet Explained | Accounting | MBA in Pills | 4wMBA

The balance sheet is one of the main financial statements used in financial accounting. The purpose of the balance sheet is to report the way the resources to run the operations of the business were acquired. The Balance Sheet helps us to assess the risk of the business. By looking at it you will be able to answer to questions, such as: What is the leverage? Is the company liquid enough? Remember, leverage means the proportion between equity and debt, while liquidity is the capacity of the business to repay for its short-term obligations, to run the operations. Do you want to learn more? Join our course at this link https://www.udemy.com/become-a-financial-analyst-from-scratch-n1/?couponCode=websitecoupon The Balance Sheet is comprised of two main sections: - Assets - Liability and Equity The Assets sections i comprised of: CURRENT ASSETS: -Cash -Petty Cash -Temporary Investments -Accounts Receivable -Inventory NON - CURRENT ASSETS - Plant, Furniture, Equipment… and so on. Liabilities are comprised of: CURRENT LIABILITIES - Accounts Payable - Accrued Expenses - Short-term loans NON CURRENT LIABILITIES - Long-term loan Equity is comprised of: - Owner's Equity - Retained Earnings The balance sheet is together with Income Statement and Cash Flow statement, one of the three financial statements, in financial accounting. Do you want to learn more? Join our course at https://www.udemy.com/become-a-financial-analyst-from-scratch-n1/?couponCode=websitecoupon -

44:06

44:06How to Read a Balance Sheet - Part 1

How to Read a Balance Sheet - Part 1How to Read a Balance Sheet - Part 1

Safal Niveshak explains how investors can analyse the Equity and Liability side of a company's Balance Sheet. -

48:59

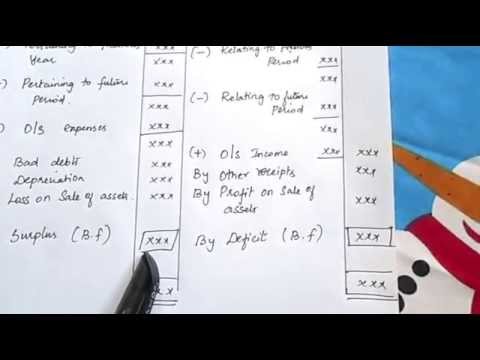

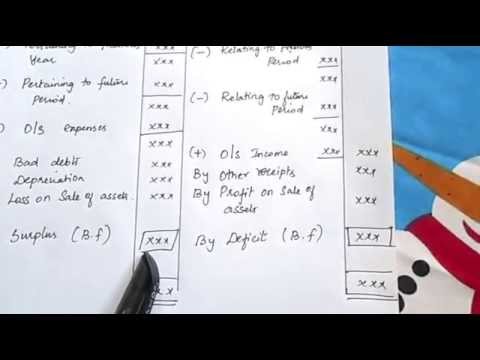

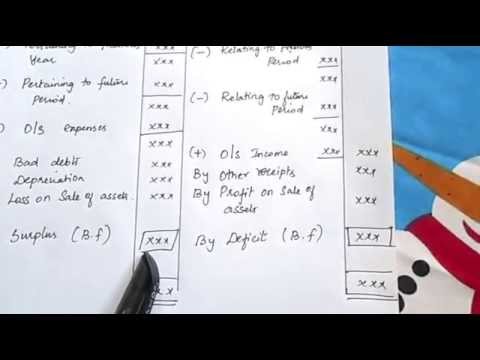

48:59Income and Expenditure A/c & Balance Sheet (with solved problem) in Financial accounting tutorial

Income and Expenditure A/c & Balance Sheet (with solved problem) in Financial accounting tutorialIncome and Expenditure A/c & Balance Sheet (with solved problem) in Financial accounting tutorial

(*)If you like this video please: like, comment, share and subscribe (*)For any accounting tasks (it may have charge) contact @ kauserwiseacdiscussions@gmail.com (*)To view my tutorial collections and get email alert for my upcoming video uploads pls visit and subscribe(free subscription) my channel: https://www.youtube.com/c/kauserwise Income and Expenditure A/c & Balance Sheet (with solved problem) in Financial accounting tutorial ( Receipts and payments, Income and expenditure, Balance sheet, Non - profit aorganization) -

14:05

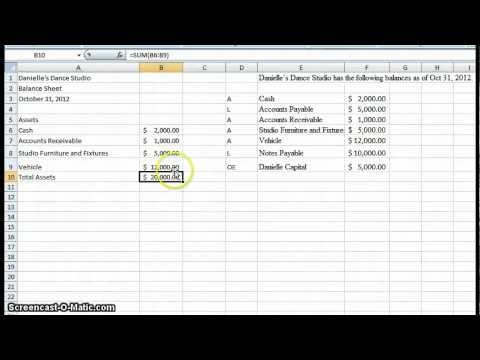

14:05Create a simple Balance Sheet

Create a simple Balance Sheet -

8:58

8:58How to read a Balance Sheet? (or What is a Balance Sheet?)

How to read a Balance Sheet? (or What is a Balance Sheet?)How to read a Balance Sheet? (or What is a Balance Sheet?)

Simple explanation of the most popular Financial Statement: The Balance Sheet. understanding the balance sheet; liabilities and Assets explained; Debt Equity explained; Presented by Dr. C. Venugopal Camera and Editing: M. Rajamanickam -

19:48

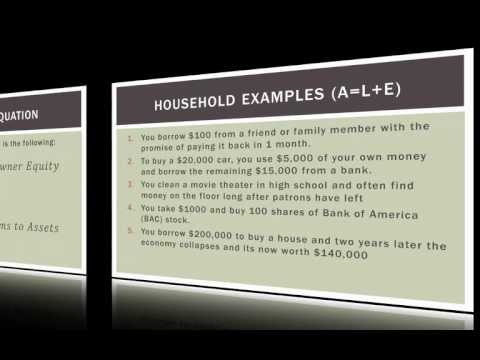

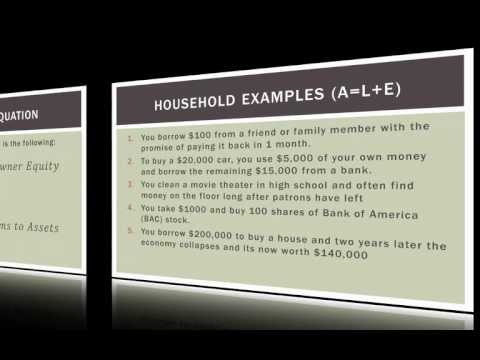

19:48Accounting 101: The Balance Sheet

Accounting 101: The Balance SheetAccounting 101: The Balance Sheet

This video series is for those new to accounting or individuals who just want to know a little more about accounting basics. That is my target audience. In this video I explain the Balance Sheet. To make the concept more concrete, I compare the personal/household balance sheet to a business balance sheet using several common transactions. I also walk the viewer through an actual balance sheet explaining how it is organized and how information on the statement is related. Thank you for watching! Source: Warren, C.S. (2008). Survey of Accounting (Fourth Edition). Mason, OH: South-Western Cengage Learning. (I really like this book so check it out!) For my complete video library organized by playlist, please go to my video page here: http://www.youtube.com/user/BCFoltz/videos?flow=list&view;=1&live;_view=500&sort;=dd -

15:59

15:59Balance Sheet Basics: What We Have, What We Owe, What We're Worth

Balance Sheet Basics: What We Have, What We Owe, What We're WorthBalance Sheet Basics: What We Have, What We Owe, What We're Worth

Confused about balance sheets? Balance Sheet Basics refreshes key terminology. Additionally, learn how the balance sheet works with your income statement and how to report restricted funds on your balance sheet. -

11:07

11:07How to read your balance sheet

How to read your balance sheet

- Accountant

- Accounting equation

- Accounting period

- Accounts Payable

- Accounts payable

- Accounts receivable

- Accounts Receivable

- Accounts receivables

- Accrual

- Annual report

- Asset

- Associate company

- Audit

- Auditor's report

- Available for sale

- Balance Sheet

- Balance sheet

- Bookkeeping

- Cash equivalents

- Cash flow statement

- Chart of accounts

- Chartered Accountant

- Checking account

- Common stock

- Contract

- Corporate bond

- Corporation

- Cost accounting

- Cost basis

- Cost of goods sold

- Current asset

- Current Asset

- Debits and credits

- Deferred Tax

- Deferred tax

- Equity method

- Finance lease

- Financial accounting

- Financial audit

- Financial statement

- Financial statements

- Financial year

- Fixed Asset

- Fixed asset

- Forensic accounting

- Fund accounting

- General journal

- General ledger

- Historical cost

- IFRS

- Income statement

- Intangible asset

- Intangible assets

- Internal audit

- Inventory

- Investments

- John Wiley & Sons

- Liquidity

- LLP

- Loan

- Market value

- Matching principle

- Minority interest

- Model audit

- Mortgage loan

- National accounts

- Net assets

- Net worth

- Off-balance-sheet

- Option (finance)

- Ordinary Shares

- Ownership equity

- Paid-in Capital

- Par value

- Parent company

- Partnership

- Patent

- Preference Shares

- Prepaid Expense

- Prepaid expenses

- Promissory note

- Real estate

- Reserve (accounting)

- Retained Earnings

- Revenue recognition

- Sarbanes–Oxley Act

- Savings account

- Security (finance)

- Share (finance)

- Share Capital

- Share Premium

- Shareholders' equity

- Sole proprietorship

- Special journal

- Subsidiary

- Talk Balance sheet

- Tax

- Template Accounting

- Trade credit

- Treasury Share

- Treasury share

- Trial balance

- Warranties

- Wikipedia Merging

- XBRL

-

Financial Accounting - Balance Sheet

This video goes over the accounting equation and how it relates to the Balance Sheet. It also explains the balance sheet both comparative and classified -

What is a balance sheet? - MoneyWeek Investment Tutorials

Tim Bennett explains what a balance sheet is, and the type of information it contains, and how you can use it. Visit http://moneyweek.com/youtube for extra videos not found on YouTube. Related links… • What is profit? https://www.youtube.com/watch?v=IQuYnADhuwo • What is a cash flow statement? https://www.youtube.com/watch?v=GkGdlgX3xYI • What is the 'time value of money'? https://www.youtube.com/watch?v=h3nlIOhxBF4 • What are "depreciation" and "amortisation" all about? https://www.youtube.com/watch?v=ItkCkna0p20 • What is EV / EBITDA? https://www.youtube.com/watch?v=vb_QUjQ2-SU MoneyWeek videos are designed to help you become a better investor, and to give you a better understanding of the markets. They’re aimed at both beginners and more experienced investors. In all our videos ... -

Introduction to Balance Sheets

Using a home purchase to illustrate assets, liabilities and owner's equity. More free lessons at: http://www.khanacademy.org/video?v=mxsYHiDVNlk -

How To Do A Balance Sheet

http://www.accounting101.org/how-to-do-a-balance-sheet How to do a balance sheet: a balance sheet is a financial document that shows the assets, liabilities, and owners' equity of a company at a given point in time. It's different from the income statement in that it is a snapshot on any given day, whereas the income statement spans a time period. Most companies prepare their balance sheets quarterly and yearly. How To Do A Balance Sheet To put together a balance sheet, you'll obviously need all of the financial data from your different trial balances. In reality, the information for a balance sheet starts with the individual transactions, but the purpose of this article is just to show you how to organize a balance sheet. First of all, there are two sides to the balance sheet: the right ... -

-

A Balance Sheet Example

http://www.accounting101.org/balance-sheet-example The balance sheet is easy to understand... once you understand why what goes where. The balance sheet example on this page, as well as the video, will help explain what the balance sheet is, how it's organized, and how to interpret the information on it. The balance sheet is an extremely useful tool for all users to quickly get an idea of how a company is doing. The balance sheet is usually described as a snapshot of a company's financial position. This is because the balance sheet is accounting for a single moment in time; not over a period such as the income statement. You'll notice in the example below, that the date is December 31, 2011. It basically means, "this is what we have, and this is who owns it as of today, December 31st, 201... -

Balance Sheet Explained | Accounting | MBA in Pills | 4wMBA

The balance sheet is one of the main financial statements used in financial accounting. The purpose of the balance sheet is to report the way the resources to run the operations of the business were acquired. The Balance Sheet helps us to assess the risk of the business. By looking at it you will be able to answer to questions, such as: What is the leverage? Is the company liquid enough? Remember, leverage means the proportion between equity and debt, while liquidity is the capacity of the business to repay for its short-term obligations, to run the operations. Do you want to learn more? Join our course at this link https://www.udemy.com/become-a-financial-analyst-from-scratch-n1/?couponCode=websitecoupon The Balance Sheet is comprised of two main sections: - Assets - Liability and E... -

How to Read a Balance Sheet - Part 1

Safal Niveshak explains how investors can analyse the Equity and Liability side of a company's Balance Sheet. -

Income and Expenditure A/c & Balance Sheet (with solved problem) in Financial accounting tutorial

(*)If you like this video please: like, comment, share and subscribe (*)For any accounting tasks (it may have charge) contact @ kauserwiseacdiscussions@gmail.com (*)To view my tutorial collections and get email alert for my upcoming video uploads pls visit and subscribe(free subscription) my channel: https://www.youtube.com/c/kauserwise Income and Expenditure A/c & Balance Sheet (with solved problem) in Financial accounting tutorial ( Receipts and payments, Income and expenditure, Balance sheet, Non - profit aorganization) -

-

How to read a Balance Sheet? (or What is a Balance Sheet?)

Simple explanation of the most popular Financial Statement: The Balance Sheet. understanding the balance sheet; liabilities and Assets explained; Debt Equity explained; Presented by Dr. C. Venugopal Camera and Editing: M. Rajamanickam -

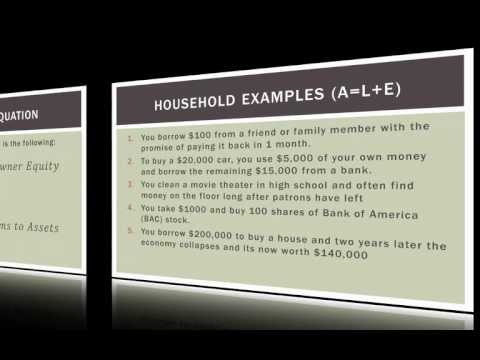

Accounting 101: The Balance Sheet

This video series is for those new to accounting or individuals who just want to know a little more about accounting basics. That is my target audience. In this video I explain the Balance Sheet. To make the concept more concrete, I compare the personal/household balance sheet to a business balance sheet using several common transactions. I also walk the viewer through an actual balance sheet explaining how it is organized and how information on the statement is related. Thank you for watching! Source: Warren, C.S. (2008). Survey of Accounting (Fourth Edition). Mason, OH: South-Western Cengage Learning. (I really like this book so check it out!) For my complete video library organized by playlist, please go to my video page here: http://www.youtube.com/user/BCFoltz/videos?flo... -

Balance Sheet Basics: What We Have, What We Owe, What We're Worth

Confused about balance sheets? Balance Sheet Basics refreshes key terminology. Additionally, learn how the balance sheet works with your income statement and how to report restricted funds on your balance sheet. -

-

Balance Sheet and Income Statement Relationship

Balance Sheet and Income Statement Relationship More free lessons at: http://www.khanacademy.org/video?v=hZvjH3Az87A -

Balance Sheet Analysis - Beginners Guide

Explanation of how to analyze the balance sheet. This 5 part series was initially developed to train credit and collection professionals. Free eBook on our web site of the 5 part series Introduction to Financial Statement Analysis has been downloaded almost 10,000 times. Brought to you by commercial collection agency The Kaplan Group www.kaplancollectionagency.com. -

Balance Sheet Of Life 31/05/2015 B K Shivani

Jurists Conference on Revisiting Law & Spirituality The Stunning Convergence 29th May to 2nd June, 2015 Venue - Brahma Kumaris, Shantivan Complex, Abu Road, Rajasthan -

-

Understanding Balance Sheet Fundamental Analysis Basics 1[Hindi]

The exact basics of fundamental analysis. Understanding balance sheet http://investorji.in बेलेंस शीट क्या होती है और उसके आंकडो को कैसे समझे https://www.facebook.com/investorji https://twitter.com/abhishek25 Abhishek Shukla -

Balance Sheet - Beginners Guide to Understanding

Explanation of the balance sheet - its components and what they represent, This 5 part series was initially developed to train credit and collection professionals. Free eBook on our web site of the 5 part series Introduction to Financial Statement Analysis has been downloaded almost 10,000 times. Brought to you by commercial collection agency The Kaplan Group www.kaplancollectionagency.com. -

How to Understand the Balance Sheet - SvTuition Investment Tutorials

If you do not understand balance sheet of company, it can easily misguide to you. So, before taking any investment decision, you should watch our this video tutorial. In this video tutorial, we showed a presentation in which we told that it is so easy to convert Rs. 50,000 in Rs. 150,000 assets through balance sheet without any earning or fresh capital. If you are interested learn written text, you can read at http://www.svtuition.org/2012/02/how-to-understand-balance-sheet.html -

lecture 1: balance sheets part 1

1st in series of accounting lectures - appox 8 minutes: the origin of the balance sheet -

Balance Sheet and Income Statement

Depreciation https://www.youtube.com/watch?v=9wk0aWwduoY Pro Forma Income Statement https://www.youtube.com/watch?v=IQRlXiXBjcE Statement of Cash Flows https://www.youtube.com/watch?v=3WMnkSdk64E Financial Statement Articulation https://www.youtube.com/watch?v=kgJDE-JKgNs

Financial Accounting - Balance Sheet

- Order: Reorder

- Duration: 10:26

- Updated: 29 Aug 2013

- views: 125922

- published: 29 Aug 2013

- views: 125922

What is a balance sheet? - MoneyWeek Investment Tutorials

- Order: Reorder

- Duration: 13:10

- Updated: 15 Apr 2011

- views: 160291

- published: 15 Apr 2011

- views: 160291

Introduction to Balance Sheets

- Order: Reorder

- Duration: 9:54

- Updated: 15 Mar 2008

- views: 411280

- published: 15 Mar 2008

- views: 411280

How To Do A Balance Sheet

- Order: Reorder

- Duration: 5:37

- Updated: 29 Oct 2011

- views: 237329

- published: 29 Oct 2011

- views: 237329

Accounting: Balance Sheet

- Order: Reorder

- Duration: 13:39

- Updated: 16 Jun 2011

- views: 178284

A Balance Sheet Example

- Order: Reorder

- Duration: 6:50

- Updated: 01 Oct 2011

- views: 162055

- published: 01 Oct 2011

- views: 162055

Balance Sheet Explained | Accounting | MBA in Pills | 4wMBA

- Order: Reorder

- Duration: 5:20

- Updated: 08 Sep 2015

- views: 1360

- published: 08 Sep 2015

- views: 1360

How to Read a Balance Sheet - Part 1

- Order: Reorder

- Duration: 44:06

- Updated: 10 Feb 2013

- views: 68718

- published: 10 Feb 2013

- views: 68718

Income and Expenditure A/c & Balance Sheet (with solved problem) in Financial accounting tutorial

- Order: Reorder

- Duration: 48:59

- Updated: 08 Jun 2015

- views: 20367

- published: 08 Jun 2015

- views: 20367

Create a simple Balance Sheet

- Order: Reorder

- Duration: 14:05

- Updated: 26 Jun 2011

- views: 211473

How to read a Balance Sheet? (or What is a Balance Sheet?)

- Order: Reorder

- Duration: 8:58

- Updated: 07 Aug 2014

- views: 7447

- published: 07 Aug 2014

- views: 7447

Accounting 101: The Balance Sheet

- Order: Reorder

- Duration: 19:48

- Updated: 24 Jun 2012

- views: 61578

- published: 24 Jun 2012

- views: 61578

Balance Sheet Basics: What We Have, What We Owe, What We're Worth

- Order: Reorder

- Duration: 15:59

- Updated: 06 Oct 2011

- views: 78811

- published: 06 Oct 2011

- views: 78811

How to read your balance sheet

- Order: Reorder

- Duration: 11:07

- Updated: 20 Jan 2014

- views: 15343

- published: 20 Jan 2014

- views: 15343

Balance Sheet and Income Statement Relationship

- Order: Reorder

- Duration: 3:41

- Updated: 30 Mar 2011

- views: 328275

- published: 30 Mar 2011

- views: 328275

Balance Sheet Analysis - Beginners Guide

- Order: Reorder

- Duration: 12:18

- Updated: 07 Dec 2013

- views: 25990

- published: 07 Dec 2013

- views: 25990

Balance Sheet Of Life 31/05/2015 B K Shivani

- Order: Reorder

- Duration: 93:51

- Updated: 05 Jun 2015

- views: 10806

- published: 05 Jun 2015

- views: 10806

FINANCIAL STATEMENTS (PART 1) PROFIT & LOSS ACCOUNT AND BALANCE SHEET)

- Order: Reorder

- Duration: 26:51

- Updated: 03 Mar 2013

- views: 89498

Understanding Balance Sheet Fundamental Analysis Basics 1[Hindi]

- Order: Reorder

- Duration: 17:32

- Updated: 28 Dec 2014

- views: 16689

- published: 28 Dec 2014

- views: 16689

Balance Sheet - Beginners Guide to Understanding

- Order: Reorder

- Duration: 9:35

- Updated: 07 Dec 2013

- views: 9593

- published: 07 Dec 2013

- views: 9593

How to Understand the Balance Sheet - SvTuition Investment Tutorials

- Order: Reorder

- Duration: 7:37

- Updated: 23 Sep 2013

- views: 7466

- published: 23 Sep 2013

- views: 7466

lecture 1: balance sheets part 1

- Order: Reorder

- Duration: 7:54

- Updated: 25 Jul 2008

- views: 188086

- published: 25 Jul 2008

- views: 188086

Balance Sheet and Income Statement

- Order: Reorder

- Duration: 9:30

- Updated: 16 Jul 2012

- views: 29717

- published: 16 Jul 2012

- views: 29717

-

FIN 580 Midterm Exam

Buy here:http://www.devrygenius.com/product/fin-580-midterm-exam 1. (TCO A) Alan and Barbara have liquid assets of $10,000 and other assets of $90,000. Their total liabilities equal $20,000. What is their net worth? (Show all work.) 2. (TCO A) Construct a balance sheet from the following information. Be sure the format is correct. (Show all work.) Cash on hand $500 Bank credit card balance 750 Taxes due 500 Utility bills (over due) 120 Auto loan balance 6,000 Mortgage 45,000 Primary residence 60,000 Jewelry 1,200 Stocks 6,000 Coin collection 2,500 2001 Toyota 7,500 Auto payment 250 3. (TCO A) The following questions are worth 5 points each. Please show all work. a. Inflation is expected to average 5% for the long term and Mr. Smith earned $74,000 this year, how much must he earn in 20 yea... -

ACCT 555 Midterm part 2

Buy here:http://www.devrygenius.com/product/acct-555-midterm-part-2 1. (TCO A) Match the following definitions to the appropriate terms. 2. (TCO B) The following is a portion of a qualified audit report issued for a private company. To the shareholders of Tamarak Corporation, We have audited the accompanying balance sheet of Tamarak Corporation as of October 31, 2009, and the related statements of income, retained earnings, and cash flows for the past year. These financial statements are the responsibility of the company's management. Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform... -

Jim Rickards – Cyber financial warfare, Fed balance sheet, gold price, windfall tax on gold

Jim Rickards – Cyber financial warfare, Fed balance sheet, gold price, windfall tax on gold -

Jim Rickards – Cyber financial warfare, Fed balance sheet, gold price, windfall tax on gold 1

Jim Rickards – Cyber financial warfare, Fed balance sheet, gold price, windfall tax on gold 1 -

Who says face-to-face meetings are essential?

Who says face-to-face meetings are essential? Let's do a balance sheet. In favour is that it's much easier to reach decisions: we can talk to people in different ways - formally, informally, at the flipchart, over lunch and so forth. And of course, it is great for team building. But let's look at the negative side. We may have an end of phase meeting in a project that needs to go ahead and the business cost of delaying it can be significant. So if we have to bring people from different places, there will be a delay setting up the meeting. And then of course there are the costs of travel and maybe hotels flights and so on. And then we also lose business efficiency because you can't work as well while you're traveling. Some people try to, but really you can't work as efficiently while... -

FIN 370 Final Exam

Buy here:https://newstudentoffortune.com/products/fin-370-final-exam Which financial statement reports the amounts of cash that the firm generated and distributed during a particular time period? statement of retained earnings Income statement Statement of cash flows Balance sheet Which of these provide a forum in which demanders of funds raise funds by issuing new financial instruments, such as stocks and bonds? Money markets Investment banks Primary markets Secondary markets The top part of Mars, Inc.’s 2013 balance sheet is listed as follows (in millions of dollars). What are Mars, Inc.’s current ratio, quick ratio, and cash ratio for 2013? 4.2, 1.0, 0.2 2.3333, 0.5556, 0.1111 10.5, 6.0, 1.0 0.1111, 0.5556, 0.2 Which of these ratios show the combine... -

Download How to Read a Balance Sheet: The Bottom Line on What You Need to Know about Cash Flow, PDF

http://j.mp/1LyXkEE -

Frederic Chopin Corporation is preparing its December 31, 2014, balance sheet

BUY HERE:http://onlinehomework.guru/frederic-chopin-corporation-is-preparing-its-december-31-2014-balance-sheet/ Frederic Chopin Corporation is preparing its December 31, 2014, balance sheet. The following items may be reported as either a current or long-term liability 1. On December 15, 2014, Chopin declared a cash dividend of $3.82 per share to stockholders of record on December 31. The dividend is payable on January 15, 2015. Chopin has issued 1,000,000 shares of common stock, of which 50,000 shares are held in treasury. 2. At December 31, bonds payable of $114,850,000 are outstanding. The bonds pay 12% interest every September 30 and mature in installments of $29,801,000 every September 30, beginning September 30, 2015. 3. At December 31, 2013, customer advances were $14,349,000. Du... -

Basel iii leverage ratio

Welcome to the Reading Room of the Basel 3 Compliance Professionals Association, the largest association of Basel iii Professionals in the world. An underlying cause of the global financial crisis, was the build-up of excessive on balance sheet, and off balance sheet leverage in the banking system. In many cases, banks built up excessive leverage, while apparently maintaining strong risk-based capital ratios. At the height of the crisis, financial markets forced the banking sector to reduce its leverage, in a manner that amplified downward pressures on asset prices. The Basel 3 framework introduced a simple, transparent, non-risk based leverage ratio, to act as a credible supplementary measure to the risk-based capital requirements. The leverage ratio is intended to: First, res... -

The Balance Sheet

-

Balance sheet Word Pronunciation

Learn every word Pronunciation and improve Vocabulary For Meaning ,Example and Related Images checkout below channel link https://www.youtube.com/channel/UCW4mTVXENCIZ6d7ov1VG8Og Just Type in YOUTUBE ["Word" Meaning With Example ] For Example Fabulous Word Meaning With Example Facebook Link : https://www.facebook.com/LEARN-ENG-WORDS-1552403398414120/?ref=hl -

Dr William L Pierce The Balance Sheet HD

-

How to Read a Balance Sheet The Bottom Line on What You Need to Know about Cash Flow, Assets, Debt,

-

GAO Audit: Federal Governmen's Balance Sheet $18 Trillion in the Red

GAO Audit: Federal Government’s Balance Sheet $18 Trillion in the Red - by Barbara Hollingsworth At the end of Fiscal Year 2015, the federal government’s liabilities exceeded its assets by more than $18 trillion, according to a February 26 audit report released by the U.S. Government Accountability Office (GAO). http://www.cnsnews.com/print/489076 Disclaimer: This YouTube channel is in no way endorsed by or affiliated with the author of this article or CNSNews.com. The brief text used in this video has been reproduced under section 107 of the Copyright Act 1976, for "fair use" for the purposes of news reporting, teaching, education and research only. No infringement of copyright or intellectual property intended. -

Reading a balance sheet for valuation

Learn what key indicators to look at when reading a balance sheet, to help determine if a company is overvalued or undervalued. The balance sheet and income statement are important data points for investing! -

Difference Between Balance Sheet and Statement of Financial Position

Difference Between Balance Sheet and Statement of Financial Position . , . . . . Difference between balance sheet and statement of financial differencebetween difference between balance sheet and vs statement of financial position a class "_zkb" href " url?q webcache.Googleusercontent search. Here are some more compilation of topics and latest discussions relates to this video, which we found thorough the internet. Hope this information will helpful to get idea in brief about this. Both, balance sheet and statement of financial position, are financial statements that offer an overview of the manner in which the organization's assets, liabilities, capital, income and expenses have been managed in a nonprofit, the name of this financial statement is the statement of financial pos... -

2 Balance Sheet Printing

-

301 The Balance Sheet - Accounting in Only ONE Hour

Accounting in Only ONE Hour A Quick Introduction Learn the basics in one hour! That's right, 60 minutes! Do you want to learn the basics of accounting incredibly quickly? Like in an hour. Do you want a professor that works the problems with you? Rather than just talks at you. Do you want an interactive and fun course? With this class you will learn the basics of accounting and you can complete it in only one hour! You will work with me on the handouts like you are sitting in the classroom. This is a proven technique that I’ve used over the past 8 years. YouTube Channel Optimization,Wordpress For Beginners,Earn With People Per Hour In Urdu-Hindi,Earn Money Building Mobile Apps, Earn Money with Mobile Apps, Building Mobile Apps without Coding,How to Monetize Youtube Video,How to Monetize ... -

Difference Between Statement of Affairs and Balance Sheet

Difference Between Statement of Affairs and Balance Sheet . , . . . . Differences between balance sheet and statement of affairs. Balance sheet is prepared on the basis of double entry system of book keeping. Statement of affairs is prepared on the basis of incomplete records. Balance sheet is prepared to present financial position of the business here are some more compilation of topics and latest discussions relates to this video, which we found thorough the internet. Hope this information will helpful to get idea in brief about this. Statement of affairs is a statement showing assets, liabilities and capital of the entity prepared on the basis of a single entry system of bookkeeping. A balance sheet is a statement showing assets, liabilities and equity of the company prepare... -

Bank Balance Sheet Friday March 11

Bank Balance Sheet cash securities loans deposits borrowing Fed Funds Purchased Fed Funds Sold -

Merger and Acquistions Modeling - Balance Sheet Adjusments

In class today we conceptualized and modeled balance sheet adjustments - a process for merging two balance sheets in a merger, consolidation, or acquisition. -

[Business Daily 25] What is a balance sheet

IN TODAY’S Business Daily… Balance sheet allows you to see what a company owns as well as what it owes to other parties as of the date indicated at the top of the balance sheet The reason I really like to look at a balance sheet is because you can see some really important financial ratios and statistics that you can generate from looking at the numbers The balance sheet presents a company’s financial position at the end of a specified date. Some actually describe the balance sheet as a “snapshot” of the company’s financial position at the point which you produced the balance sheet CHALLENGE FOR THE DAY: What can you do today to make sure you understand your business better by knowing the way your balance sheet works? QUOTE OF THE DAY: “The balance sheet is all about und... -

Matt Bellingham - Improving your balance sheet

Matt Bellingham, Director at Bellingham Wallace and Chartered Accountant, shares his top tips on improving your balance sheet. For more information about our programmes and workshops visit our website: https://www.theicehouse.co.nz/business

FIN 580 Midterm Exam

- Order: Reorder

- Duration: 0:11

- Updated: 21 Mar 2016

- views: 0

- published: 21 Mar 2016

- views: 0

ACCT 555 Midterm part 2

- Order: Reorder

- Duration: 0:10

- Updated: 21 Mar 2016

- views: 0

- published: 21 Mar 2016

- views: 0

Jim Rickards – Cyber financial warfare, Fed balance sheet, gold price, windfall tax on gold

- Order: Reorder

- Duration: 54:07

- Updated: 21 Mar 2016

- views: 6

- published: 21 Mar 2016

- views: 6

Jim Rickards – Cyber financial warfare, Fed balance sheet, gold price, windfall tax on gold 1

- Order: Reorder

- Duration: 54:07

- Updated: 21 Mar 2016

- views: 3

- published: 21 Mar 2016

- views: 3

Who says face-to-face meetings are essential?

- Order: Reorder

- Duration: 1:30

- Updated: 21 Mar 2016

- views: 15

- published: 21 Mar 2016

- views: 15

FIN 370 Final Exam

- Order: Reorder

- Duration: 0:10

- Updated: 20 Mar 2016

- views: 0

- published: 20 Mar 2016

- views: 0

Download How to Read a Balance Sheet: The Bottom Line on What You Need to Know about Cash Flow, PDF

- Order: Reorder

- Duration: 0:30

- Updated: 20 Mar 2016

- views: 0

Frederic Chopin Corporation is preparing its December 31, 2014, balance sheet

- Order: Reorder

- Duration: 0:11

- Updated: 20 Mar 2016

- views: 0

- published: 20 Mar 2016

- views: 0

Basel iii leverage ratio

- Order: Reorder

- Duration: 3:25

- Updated: 18 Mar 2016

- views: 4

- published: 18 Mar 2016

- views: 4

The Balance Sheet

- Order: Reorder

- Duration: 10:49

- Updated: 18 Mar 2016

- views: 12

- published: 18 Mar 2016

- views: 12

Balance sheet Word Pronunciation

- Order: Reorder

- Duration: 0:12

- Updated: 18 Mar 2016

- views: 0

- published: 18 Mar 2016

- views: 0

Dr William L Pierce The Balance Sheet HD

- Order: Reorder

- Duration: 10:49

- Updated: 17 Mar 2016

- views: 119

- published: 17 Mar 2016

- views: 119

How to Read a Balance Sheet The Bottom Line on What You Need to Know about Cash Flow, Assets, Debt,

- Order: Reorder

- Duration: 0:30

- Updated: 16 Mar 2016

- views: 0

- published: 16 Mar 2016

- views: 0

GAO Audit: Federal Governmen's Balance Sheet $18 Trillion in the Red

- Order: Reorder

- Duration: 2:03

- Updated: 15 Mar 2016

- views: 6

- published: 15 Mar 2016

- views: 6

Reading a balance sheet for valuation

- Order: Reorder

- Duration: 10:21

- Updated: 14 Mar 2016

- views: 4

- published: 14 Mar 2016

- views: 4

Difference Between Balance Sheet and Statement of Financial Position

- Order: Reorder

- Duration: 1:20

- Updated: 14 Mar 2016

- views: 1

- published: 14 Mar 2016

- views: 1

2 Balance Sheet Printing

- Order: Reorder

- Duration: 0:39

- Updated: 13 Mar 2016

- views: 2

- published: 13 Mar 2016

- views: 2

301 The Balance Sheet - Accounting in Only ONE Hour

- Order: Reorder

- Duration: 3:07

- Updated: 13 Mar 2016

- views: 0

- published: 13 Mar 2016

- views: 0

Difference Between Statement of Affairs and Balance Sheet

- Order: Reorder

- Duration: 1:44

- Updated: 12 Mar 2016

- views: 5

- published: 12 Mar 2016

- views: 5

Bank Balance Sheet Friday March 11

- Order: Reorder

- Duration: 5:50

- Updated: 11 Mar 2016

- views: 1

- published: 11 Mar 2016

- views: 1

Merger and Acquistions Modeling - Balance Sheet Adjusments

- Order: Reorder

- Duration: 62:18

- Updated: 10 Mar 2016

- views: 67

- published: 10 Mar 2016

- views: 67

[Business Daily 25] What is a balance sheet

- Order: Reorder

- Duration: 6:24

- Updated: 10 Mar 2016

- views: 8

- published: 10 Mar 2016

- views: 8

Matt Bellingham - Improving your balance sheet

- Order: Reorder

- Duration: 10:52

- Updated: 10 Mar 2016

- views: 4

- published: 10 Mar 2016

- views: 4

-

How to Read a Balance Sheet - Part 3

Safal Niveshak explains how investors can analyse the Current Assets side of a company's Balance Sheet. -

Balance Sheet of Life - Sis.Shivani at Hyd Shanti Sarovar 25th Jan 2015

Sis.Shivani Talk at Global Peace Auditorium, Brahma Kumaris, Shanti Sarovar, Hyderabad on 25th January 2015. Chief Guest - Bro.Mohd.Mohamood Ali, Hon'ble Deputy Chief Minister of Telangana. Spl Guest : Bro.Suresh Oberoi, Bollywood actor, Chief Host : Rajyogini, BK.Kuldeep, Director, Brahma Kumaris Hyderabad. www.shantisarovar.org -

Balance sheet Ch 5 p 1- Intermediate accounting CPA exam

-

Tally erp 9 Balance Sheet - Opening Balance

Learn how to start new financial year and how to carry forward balances for new financial year with live project. This Class is prepared by City Commerce Academy, Chandigarh -

CFA level 1: Financial Reporting Analysis : Understanding Balance sheet

In this video we'll take you through concept of Balance Sheet of a company. I very important chapter of Financial statement analysis for CFA Level 1 -

CFA Level I Balance Sheet Video Lecture by Mr. Arif Irfanullah Part 1

This CFA Level I video covers concepts related to: • Balance Sheet • Assets and Liabilities created from Accruals Process • Components of Balance Sheet • Format of the Balance Sheet • Current Assets and Liabilities • Non Current Assets and Liabilities • Minority Interests • Measurement Basis • Footnotes • Current Assets • Inventory • Current Liabilities • Tangible Assets • Intangible Assets • Goodwill • Financial Instruments and Securities For more updated CFA videos, Please visit www.arifirfanullah.com. -

Balance Sheet as per Schedule VI

https://www.meraskill.com/ca-cpt/accounts/introduction-to-company-account-reissue-and-forfeiture-of-shares -

-

CFA Level 1- 2015- FRA- Understanding Balance Sheet- Part 1 (of 3)

FinTree website link: http://www.fintreeindia.com FB Page link :http://www.facebook.com/Fin... We love what we do, and we make awesome video lectures for CFA and FRM exams. Our Video Lectures are comprehensive, easy to understand and most importantly, fun to study with! This Video lecture was recorded by our popular trainer for CFA, Mr. Utkarsh Jain, during one of his live CFA Level I Classes in Pune (India). -

Final Accounts Schedule 3 Balance Sheet. Video Classes for CA IPCC CS CMA Video Lectures.

Purchase DVD Lectures and Video Classes by CA M K Jain who is a GOLD MEDALIST and a NORTH INDIA TOPPER of CA and CMA. He is A Graduate of SRCC. These DVDs contain Very Very Very Very Very ......... large number of Solved Questions. These are MUCH MUCH MUCH MUCH ........ better than FACE to FACE Lectures. To judge watch this Demo Video Lectures and Video Classes for CA CS CMA B.Com and M.Com Students. For Details 1. Email:- micecareer@gmail.com videoclasses4ca@gmail.com for CA VIDEO CLASSES and CA VIDEO LECTURES csvideoclasses@gmail.com for CS VIDEO CLASSES and CS VIDEO LECTURES cmavideoclasses@gmail.com for CMA VIDEO CLASSES and CMA VIDEO LECTURES 2. SMS:- 99901112455 3. Visit http://www.micecareer.com 4. More Demo Videos on our Channel http://youtube.com/micecareer 5. More ... -

33. What is Goodwill on a Balance Sheet

Download Preston's 1 page checklist for finding great stock picks: http://buffettsbooks.com/checklist Preston Pysh is the #1 selling Amazon author of two books on Warren Buffett. The books can be found at the following location: http://www.amazon.com/gp/product/0982967624/ref=as_li_tl?ie=UTF8&camp;=1789&creative;=9325&creativeASIN;=0982967624&linkCode;=as2&tag;=pypull-20&linkId;=EOHYVY7DPUCW3WD4 http://www.amazon.com/gp/product/1939370159/ref=as_li_tl?ie=UTF8&camp;=1789&creative;=9325&creativeASIN;=1939370159&linkCode;=as2&tag;=pypull-20&linkId;=XRE5CA2QJ3I2OWSW -

Mod-02 Lec-04 Balance Sheet

Managerial Accounting by Dr. Varadraj Bapat,Department of Management,IIT Bombay.For more details on NPTEL visit http://nptel.ac.in -

Intermediate Accounting I (Balance Sheet; Statement of Cash Flows 1) - Rebecca Bloch

Intermediate Accounting I Lecture 3: Balance Sheet, Statement of Cash Flows (Part 1) by Rebecca Bloch In the beginning of the lecture, the professor discusses the usefulness and limitations of the Balance Sheet. The professor also discusses liquidity and solvency, as well as classification of assets and liabilities. The professor also talks about Financial Disclosures, management discussion and analysis, and how the Accrual Basis Financial Statements do not tell the whole story. The professor goes in an in depth discussion of the Statement of Cash Flows: operating, investing and financing activities, and methods of reporting a Statement of Cash Flows. The professor uses examples and exercises to reinforce the lecture topics. The balance sheet, while useful, has its limitations. Assets mi... -

-

POA Trading and Profit and Loss account and Balance Sheet

-

Companies Financial Statements: The Balance Sheet

Download the Show Notes: THIS VIDEO EXPLAINS CLOSING ENTRIES FROM TRIAL BALANCE. ALSO EXPLAINED IS THE PREPARATION OF TRADING & PROFIT AND LOSS A/C AND BALANCE SHEET (WITHOUT ADJUSTM. To view additional video lectures as well as connect to our social media pages access the following links: YouTube Channel: Website. I explain the basics on balance sheets and income statements using an example business. I also explain all of the following: Assets, Equity, Liabilities, Acc. The balance sheet is easy to understand. once you understand why what goes where. The balance sheet exam. - Providing CPA Services at Bookkeeper Prices since 2008. Small Business Development - Learn These 4 Financial Reports: Balance Sheet. In this video we'll take you through concept of Balance Sheet of a company... -

-

Excel Finance Class 09: Balance Sheet, Working Capital, Liquidity, Debt, Equity, Market Value

Download Excel workbook http://people.highline.edu/mgirvin/ExcelIsFun.htm Learn about Balance Sheet, Working Capital, Liquidity, Debt, Equity, Market Value and some Excel formulas associated with the Balance Sheet. Highline Community College Busn 233 Financial Management with Excel taught by Michael Girvin. -

Mod-01 Lec-04 Balance Sheet Fundamentals

Business Analysis for Engineers by Dr. S. Vaidhyasubramaniam,Department of Management,IIT Madras.For more details on NPTEL visit http://nptel.ac.in

How to Read a Balance Sheet - Part 3

- Order: Reorder

- Duration: 33:21

- Updated: 21 Feb 2013

- views: 11246

- published: 21 Feb 2013

- views: 11246

Balance Sheet of Life - Sis.Shivani at Hyd Shanti Sarovar 25th Jan 2015

- Order: Reorder

- Duration: 127:51

- Updated: 27 Jan 2015

- views: 92638

- published: 27 Jan 2015

- views: 92638

Balance sheet Ch 5 p 1- Intermediate accounting CPA exam

- Order: Reorder

- Duration: 68:16

- Updated: 25 Jan 2016

- views: 197

- published: 25 Jan 2016

- views: 197

Tally erp 9 Balance Sheet - Opening Balance

- Order: Reorder

- Duration: 31:50

- Updated: 28 Apr 2014

- views: 28569

- published: 28 Apr 2014

- views: 28569

CFA level 1: Financial Reporting Analysis : Understanding Balance sheet

- Order: Reorder

- Duration: 57:26

- Updated: 06 Sep 2013

- views: 10321

- published: 06 Sep 2013

- views: 10321

CFA Level I Balance Sheet Video Lecture by Mr. Arif Irfanullah Part 1

- Order: Reorder

- Duration: 30:53

- Updated: 30 Aug 2011

- views: 24126

- published: 30 Aug 2011

- views: 24126

Balance Sheet as per Schedule VI

- Order: Reorder

- Duration: 22:16

- Updated: 12 Nov 2014

- views: 1808

- published: 12 Nov 2014

- views: 1808

Balance sheet of Life by BK Shivani (SURAT, Guj.) LIVE 11/05/2014 at 7.00pm

- Order: Reorder

- Duration: 104:30

- Updated: 11 May 2014

- views: 53100

CFA Level 1- 2015- FRA- Understanding Balance Sheet- Part 1 (of 3)

- Order: Reorder

- Duration: 36:34

- Updated: 19 Aug 2015

- views: 1270

- published: 19 Aug 2015

- views: 1270

Final Accounts Schedule 3 Balance Sheet. Video Classes for CA IPCC CS CMA Video Lectures.

- Order: Reorder

- Duration: 26:08

- Updated: 10 Dec 2013

- views: 6236

- published: 10 Dec 2013

- views: 6236

33. What is Goodwill on a Balance Sheet

- Order: Reorder

- Duration: 24:37

- Updated: 18 Jul 2012

- views: 27683

- published: 18 Jul 2012

- views: 27683

Mod-02 Lec-04 Balance Sheet

- Order: Reorder

- Duration: 50:00

- Updated: 04 Mar 2015

- views: 1809

- published: 04 Mar 2015

- views: 1809

Intermediate Accounting I (Balance Sheet; Statement of Cash Flows 1) - Rebecca Bloch

- Order: Reorder

- Duration: 96:39

- Updated: 15 May 2013

- views: 28257

- published: 15 May 2013

- views: 28257

Balance Sheet | Financial management in gulf - Guest KV Shamsudheen (Episode 11)

- Order: Reorder

- Duration: 23:27

- Updated: 18 Oct 2015

- views: 1744

POA Trading and Profit and Loss account and Balance Sheet

- Order: Reorder

- Duration: 55:33

- Updated: 13 Nov 2012

- views: 10398

- published: 13 Nov 2012

- views: 10398

Companies Financial Statements: The Balance Sheet

- Order: Reorder

- Duration: 86:24

- Updated: 04 May 2014

- views: 1400

- published: 04 May 2014

- views: 1400

Balance sheet of Life by BK Shivani Date:30-08-2014 Venue: Mulund, Mumbai, Part 1 of 4

- Order: Reorder

- Duration: 38:11

- Updated: 31 Aug 2014

- views: 22675

Excel Finance Class 09: Balance Sheet, Working Capital, Liquidity, Debt, Equity, Market Value

- Order: Reorder

- Duration: 34:47

- Updated: 23 Sep 2010

- views: 44153

- published: 23 Sep 2010

- views: 44153

Mod-01 Lec-04 Balance Sheet Fundamentals

- Order: Reorder

- Duration: 50:30

- Updated: 23 Dec 2014

- views: 1426

- published: 23 Dec 2014

- views: 1426

- Playlist

- Chat

- Playlist

- Chat

Financial Accounting - Balance Sheet

- Report rights infringement

- published: 29 Aug 2013

- views: 125922

What is a balance sheet? - MoneyWeek Investment Tutorials

- Report rights infringement

- published: 15 Apr 2011

- views: 160291

Introduction to Balance Sheets

- Report rights infringement

- published: 15 Mar 2008

- views: 411280

How To Do A Balance Sheet

- Report rights infringement

- published: 29 Oct 2011

- views: 237329

A Balance Sheet Example

- Report rights infringement

- published: 01 Oct 2011

- views: 162055

Balance Sheet Explained | Accounting | MBA in Pills | 4wMBA

- Report rights infringement

- published: 08 Sep 2015

- views: 1360

How to Read a Balance Sheet - Part 1

- Report rights infringement

- published: 10 Feb 2013

- views: 68718

Income and Expenditure A/c & Balance Sheet (with solved problem) in Financial accounting tutorial

- Report rights infringement

- published: 08 Jun 2015

- views: 20367

Create a simple Balance Sheet

- Report rights infringement

- published: 26 Jun 2011

- views: 211473

How to read a Balance Sheet? (or What is a Balance Sheet?)

- Report rights infringement

- published: 07 Aug 2014

- views: 7447

Accounting 101: The Balance Sheet

- Report rights infringement

- published: 24 Jun 2012

- views: 61578

Balance Sheet Basics: What We Have, What We Owe, What We're Worth

- Report rights infringement

- published: 06 Oct 2011

- views: 78811

How to read your balance sheet

- Report rights infringement

- published: 20 Jan 2014

- views: 15343

- Playlist

- Chat

FIN 580 Midterm Exam

- Report rights infringement

- published: 21 Mar 2016

- views: 0

ACCT 555 Midterm part 2

- Report rights infringement

- published: 21 Mar 2016

- views: 0

Jim Rickards – Cyber financial warfare, Fed balance sheet, gold price, windfall tax on gold

- Report rights infringement

- published: 21 Mar 2016

- views: 6

Jim Rickards – Cyber financial warfare, Fed balance sheet, gold price, windfall tax on gold 1

- Report rights infringement

- published: 21 Mar 2016

- views: 3

Who says face-to-face meetings are essential?

- Report rights infringement

- published: 21 Mar 2016

- views: 15

FIN 370 Final Exam

- Report rights infringement

- published: 20 Mar 2016

- views: 0

Download How to Read a Balance Sheet: The Bottom Line on What You Need to Know about Cash Flow, PDF

- Report rights infringement

- published: 20 Mar 2016

- views: 0

Frederic Chopin Corporation is preparing its December 31, 2014, balance sheet

- Report rights infringement

- published: 20 Mar 2016

- views: 0

Basel iii leverage ratio

- Report rights infringement

- published: 18 Mar 2016

- views: 4

The Balance Sheet

- Report rights infringement

- published: 18 Mar 2016

- views: 12

Balance sheet Word Pronunciation

- Report rights infringement

- published: 18 Mar 2016

- views: 0

Dr William L Pierce The Balance Sheet HD

- Report rights infringement

- published: 17 Mar 2016

- views: 119

How to Read a Balance Sheet The Bottom Line on What You Need to Know about Cash Flow, Assets, Debt,

- Report rights infringement

- published: 16 Mar 2016

- views: 0

GAO Audit: Federal Governmen's Balance Sheet $18 Trillion in the Red

- Report rights infringement

- published: 15 Mar 2016

- views: 6

- Playlist

- Chat

How to Read a Balance Sheet - Part 3

- Report rights infringement

- published: 21 Feb 2013

- views: 11246

Balance Sheet of Life - Sis.Shivani at Hyd Shanti Sarovar 25th Jan 2015

- Report rights infringement

- published: 27 Jan 2015

- views: 92638

Balance sheet Ch 5 p 1- Intermediate accounting CPA exam

- Report rights infringement

- published: 25 Jan 2016

- views: 197

Tally erp 9 Balance Sheet - Opening Balance

- Report rights infringement

- published: 28 Apr 2014

- views: 28569

CFA level 1: Financial Reporting Analysis : Understanding Balance sheet

- Report rights infringement

- published: 06 Sep 2013

- views: 10321

CFA Level I Balance Sheet Video Lecture by Mr. Arif Irfanullah Part 1

- Report rights infringement

- published: 30 Aug 2011

- views: 24126

Balance Sheet as per Schedule VI

- Report rights infringement

- published: 12 Nov 2014

- views: 1808

Balance sheet of Life by BK Shivani (SURAT, Guj.) LIVE 11/05/2014 at 7.00pm

- Report rights infringement

- published: 11 May 2014

- views: 53100

CFA Level 1- 2015- FRA- Understanding Balance Sheet- Part 1 (of 3)

- Report rights infringement

- published: 19 Aug 2015

- views: 1270

Final Accounts Schedule 3 Balance Sheet. Video Classes for CA IPCC CS CMA Video Lectures.

- Report rights infringement

- published: 10 Dec 2013

- views: 6236

33. What is Goodwill on a Balance Sheet

- Report rights infringement

- published: 18 Jul 2012

- views: 27683

Mod-02 Lec-04 Balance Sheet

- Report rights infringement

- published: 04 Mar 2015

- views: 1809

Intermediate Accounting I (Balance Sheet; Statement of Cash Flows 1) - Rebecca Bloch

- Report rights infringement

- published: 15 May 2013

- views: 28257

Balance Sheet | Financial management in gulf - Guest KV Shamsudheen (Episode 11)

- Report rights infringement

- published: 18 Oct 2015

- views: 1744

-

Lyrics list:text lyricsplay full screenplay karaoke

The Brussels Attacks and the New Normal of Terrorism in Western Europe

Edit Huffington Post 22 Mar 2016Two explosions heard at Brussels airport

Edit The Guardian 22 Mar 2016At least 10 dead, 30 wounded after explosions at Brussels airport, metro station

Edit Dawn 22 Mar 2016European Command: U.S. Air Force Officer, Family Injured in Brussels Explosions

Edit WorldNews.com 22 Mar 2016Delhi Court seeks Congress balance sheet

Edit Indian Express 22 Mar 2016ECB balance sheet expanded last week

Edit Reuters 22 Mar 2016MONDO TV: Mondo TV Spain approved the reporting package for the consolidated balance sheet of the holding company (Mondo Tv SpA)

Edit Public Technologies 22 Mar 2016Petrobras says balance sheet reflects potential losses from HR probe

Edit Reuters 22 Mar 2016(Research Paper) Productivity Slowdown in Japan's Lost Decades (Bank of Japan)

Edit Public Technologies 22 Mar 2016The Bank of Israel Publishes its Financial Statements for 2015 (Bank of Israel)

Edit Public Technologies 22 Mar 2016Move to cut red tape will mean fewer firms face the audit test

Edit Belfast Telegraph 22 Mar 2016Vodafone Group plc, Unilever plc And Schroders plc

Edit The Motley Fool 22 Mar 2016How One Company Fast-Tracked Its Scale-Up

Edit Huffington Post 22 Mar 2016Full results (IQE plc)

Edit Public Technologies 22 Mar 2016Fitch Affirms Aon's Ratings; Outlook Stable

Edit Business Wire 22 Mar 2016Fitch Affirms Marsh & McLennan's Ratings at 'A-'; Outlook Stable

Edit Business Wire 22 Mar 2016New Media’s Propel Marketing Acquires ThriveHive, an Award-Winning Marketing Software Company to Expand Growth

Edit Business Wire 22 Mar 2016- 1

- 2

- 3

- 4

- 5

- Next page »