- published: 04 Sep 2013

- views: 3792

-

remove the playlistPoverty Threshold

- remove the playlistPoverty Threshold

- published: 29 Jul 2015

- views: 307

- published: 01 Nov 2014

- views: 975

- published: 06 Oct 2015

- views: 20

- published: 14 Jul 2014

- views: 23164

- published: 18 Jul 2007

- views: 1200

- published: 21 Feb 2015

- views: 201

- published: 01 Jun 2015

- views: 32

- published: 01 Dec 2011

- views: 2207

- published: 27 Jun 2012

- views: 1531

The poverty threshold, or poverty line, is the minimum level of income deemed adequate in a given country. In practice, like the definition of poverty, the official or common understanding of the poverty line is significantly higher in developed countries than in developing countries.

The common international poverty line has in the past been roughly $1 a day. In 2008, the World Bank came out with a revised figure of $1.25 at 2005 purchasing-power parity (PPP).

Determining the poverty line is usually done by finding the total cost of all the essential resources that an average human adult consumes in one year. The largest of these expenses is typically the rent required to live in an apartment, so historically, economists have paid particular attention to the real estate market and housing prices as a strong poverty line affector.

Individual factors are often used to account for various circumstances, such as whether one is a parent, elderly, a child, married, etc. The poverty threshold may be adjusted each year.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

2:02

2:02Federal Poverty Level - FPL explained

Federal Poverty Level - FPL explainedFederal Poverty Level - FPL explained

Explanation of the Federal Poverty Guidelines and a Texas Medicaid example -

7:46

7:46Americans living below the poverty line

Americans living below the poverty line -

3:45

3:45Calculating Poverty Line Vs. Reality

Calculating Poverty Line Vs. RealityCalculating Poverty Line Vs. Reality

The official poverty line, as I wrote yesterday, is a dated and crude statistical concept that in many ways fails to capture America's historical success at fighting economic need. It was based on the cost of food in 1963, mostly because the Department of Agriculture had some idea of what a basic grocery budget should look like, whereas there wasn't any real agreement on what families needed to spend on other essentials. Since then, it's mostly just been adjusted for inflation. STORY: http://www.theatlantic.com/business/archive/2014/01/the-poverty-line-was-designed-assuming-every-family-had-a-housewife-who-was-a-skillful-cook/282931/?utm_source=SFFB Join #FOWLERNATION!! http://bit.ly/SubscribeFowlerNation Become a Patron! http://Patreon.com/FowlerShow 3 Steps To Join #FowlerNation! 1. Subscribe To The Fowler Show: http://bit.ly/SubscribeFowlerNation 2. 'Like' The Richard Fowler Show on Facebook http://www.facebook.com/RichardFowlerShow 3. 'Follow' Us on Twitter http://www.twitter.com/fowlershow These Patrons make the Fowler Show possible ($20+ monthly donation on Patreon.com/FowlerShow) & we couldn't do it without them! Truthservers.com Are you a fan of The Fowler Show? Become a Patron & help support independent media! Learn more here: http://www.patreon.com/fowlershow Want to help out but don't have any money to donate? Donate your account & help us get our stories out on social media. Learn more here: http://www.donateyouraccount.com/fowlershow If you liked this clip, share it with your friends and hit that "like" button! 1,500 Subscriber Behind The Scenes Reward Video - http://www.youtube.com/watch?v=LT9x1PvQTBU Subscribe to our Podcast on iTunes for free! https://itunes.apple.com/us/podcast/the-richard-fowler-show/id510713880 @fowlershow @richardafowler http://www.facebook.com/richardfowlershow http://www.fowlershow.com http://fowlershow.tumblr.com/ -

2:46

2:46Forty-five million Americans still live below poverty line

Forty-five million Americans still live below poverty lineForty-five million Americans still live below poverty line

It has been five years since the Great U.S. Recession ended. Economic growth has returned to America, and unemployment rates have dropped. However, according to a U.S. Census Bureau report, 45 million Americans still live below the poverty line, and that number is staying fairly steady. CCTV America's Hendrik Sybrandy reports. -

2:52

2:52UNH's Stephen Pimpare on World Bank Poverty Threshold

UNH's Stephen Pimpare on World Bank Poverty ThresholdUNH's Stephen Pimpare on World Bank Poverty Threshold

Stephen Pimpare discussing new World Bank poverty threshold with Kamahl Santamaria on Al Jazeera, October 4, 2015 -

2:53

2:53The Line: Poverty in America

The Line: Poverty in AmericaThe Line: Poverty in America

Poverty in America is probably not what you think. Emmy Award-winning producer Linda Midgett shows us in this groundbreaking documentary a new face of poverty in America. About 50 million people in the United States live below the poverty line (In 2014- $23,850 for a family of 4) and one in four American children lives in poverty. But what is poverty in America? What defines "the line" and how can the church and community make a difference? -

0:30

0:30US poverty threshold, it's problems and solutions

US poverty threshold, it's problems and solutionsUS poverty threshold, it's problems and solutions

Poverty is a huge and for the most part ignored problem in the US. One of the main culprits in poverty is the US poverty threshold (aka poverty line). The poverty threshold is broken and under-reports the amount of US families who are poor. This creates a catch 22 where families earn too much to meet the poverty threshold and hence can not receive government assistance all the while they are, in reality, poor and are not meeting the basic US quality of life. -

1:45

1:45Highest number of Germans below poverty line since reunification

Highest number of Germans below poverty line since reunificationHighest number of Germans below poverty line since reunification

Over 12.5 million Germans are now living below the poverty line which is the highest number on record since reunification 25 years ago. Berlin, the capital of the eurozone's economic powerhouse is one of the poorest regions in Germany. The figures come in a report by one of the country's welfare organisations. The poverty threshold was calculated at 892 euros a month for a single household and 1,873 euros for a family of four. Berlin with 21.4 percent falling into the poor category is well … READ MORE : http://www.euronews.com/2015/02/20/highest-number-of-germans-below-poverty-line-since-reunification euronews business brings you latest updates from the world of finance and economy, in-depth analysis, interviews, infographics and more Subscribe for daily dose of business news: http://bit.ly/1pcHCzj Made by euronews, the most watched news channel in Europe. -

4:34

4:34West Wing Week 05 22 15 or, “@POTUS”The Poverty Threshold: Analyzing Needs and Wants

West Wing Week 05 22 15 or, “@POTUS”The Poverty Threshold: Analyzing Needs and WantsWest Wing Week 05 22 15 or, “@POTUS”The Poverty Threshold: Analyzing Needs and Wants

http://money.howstuffworks.com/personal-finance/budgeting/how-much-money-to-live.htm The Poverty Threshold: Analyzing Needs and Wants Governments routinely measure poverty, but finding the most appropriate standard is difficult and controversial. Some nations gauge relative poverty -- compared to other people or the median income. Other nations, like the United States, measure absolute poverty -- based on the costs of essential items like food and housing. To help us draw the line, in the 1960s, research analyst Mollie Orshansky created the basic formula that the U.S. still uses to determine the amount of money sufficient to live on. It uses the prices of food items that make up an adequate diet, based on the Department of Agriculture's guidelines. After adding up a year's worth of food, Orshansky multiplied the cost by three -- relying on a 1955 study that showed that a household spends a third of its income on food [source: Michael]. The resulting number represents the before-tax income one person could reasonably live on. The U.S. Census Bureau adopted Orshansky's method as its official poverty threshold -- meaning that those who make less than the threshold amount are in poverty. The Census Bureau began updating this figure annually, using changes in food costs to account for inflation. In 2007, the threshold was $10,590 for one person and $21,027 for a family of four with two children under 18 [source: U.S. Census Bureau]. However, some people raise objections to this method when it comes to determining who ranks as "poor." They say that the cost of living varies depending on whether a person lives in a rural or urban region. Other people say that the poverty threshold is outdated and point to studies showing that currently only one-seventh of the American family's spending is for food [source: CSM]. Yet other people argue that a person's income should include government assistance programs like food stamps, so that we can more accurately assess whether government programs ease poverty problems [source: CBS]. You may be surprised to learn that 97 percent of America's poor own televisions and that 62 percent have cable or satellite programming [source: Rector]. Some people consider these statistics evidence that the threshold is too high. Other people believe that additional factors are at work behind these reports. Both excessive social pressures and the accessibility of credit may encourage people who are already struggling to make unnecessary purchases. Despite the complications and variables involved in determining exactly how much one person needs to live, there are a few factors to consider when assessing your needs. To find out how much you're currently spending, read How Fixed Expenses Work and How Non-Fixed Expenses Work, then try our Monthly Cash Flow Calculator. In addition to discovering the amount of money it takes to live on a day-to-day basis, it's smart to consider emergencies and retirement needs. To get down to the nitty-gritty, let's take a look at some tips to help us live within our means. WAGING WAR ON POVERTY The U.S. poverty threshold can help us gauge if poverty is decreasing or increasing. But can raising the federal minimum wage reduce poverty? This is an ongoing debate. Those who support raising the minimum wage believe that putting more money in the pockets of minimum wage workers will help them rise from poverty. However, opponents cite the effects of a minimum wage hike on businesses, who will likely lay off workers and decrease hours for the remaining employees to offset the increased cost [source: Sherk]. http://money.howstuffworks.com/personal-finance/budgeting/how-much-money-to-live3.htm -

1:31

1:31Poverty Threshold (Joseph's Hobo Adventures Pt. 1)

Poverty Threshold (Joseph's Hobo Adventures Pt. 1) -

1:53

1:53Chinese Regime Lifts Poverty Line Closer to World Standard

Chinese Regime Lifts Poverty Line Closer to World StandardChinese Regime Lifts Poverty Line Closer to World Standard

For more news and videos visit ☛ http://english.ntdtv.com Follow us on Twitter ☛ http://twitter.com/NTDTelevision Add us on Facebook ☛ http://me.lt/9P8MUn The Chinese regime has lifted the country's poverty line, to people making one dollar or less a day. It reflects a more realistic figure of the number of poor people living in China. But, even with the increase, China's poverty line is still lower than the standard set by the World Bank, which may mean that more people who still need help remain uncounted. China now has more poor people on its record despite its flourishing economy. On Tuesday, the Chinese regime lifted its poverty standard up to about one US dollar—almost twice the old figure. The increase classifies everyone who earns $360 or less per year as "officially poor." It means 128-million Chinese, especially those in the rural and remote regions, will be reclassified as poor. This is a 100-million increase from the 28-million under the old poverty standard. State-run newspaper China Daily cited Renmin University rural development expert Wang Sangui saying, "The previous poverty line underestimated the number of poor people in rural China." Wang said, "Only 2.8-percent of the rural population was officially considered poor" under the old standard. So the revised standard shows a more accurate number of poor people in China—and closer to the worldwide standard. But it's still below the World Bank threshold... with people making $1.25 a day. The Associated Press reported that China experts from the World Bank had collectively pushed the Chinese regime to lift its poverty standard. The revised standard means more Chinese will be eligible for assistance. According to China Daily, the poverty aid fund will also increase by over 20 percent to more than four billion dollars. -

0:45

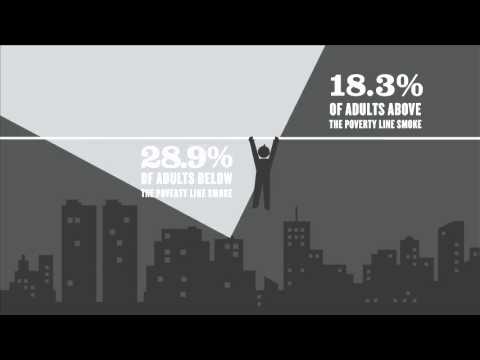

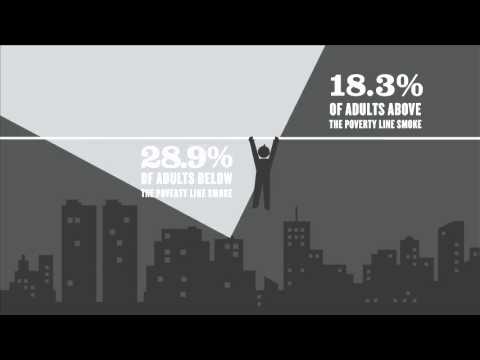

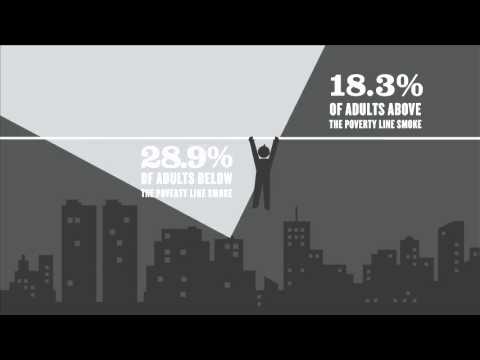

0:45Poverty Line

Poverty LinePoverty Line

Protecting vulnerable populations from smoking is a matter of social justice. -

1:48

1:48Report: 200,000 British households to fall below poverty line by 2020

Report: 200,000 British households to fall below poverty line by 2020Report: 200,000 British households to fall below poverty line by 2020

A new report suggests that up to 200,000 households with working members in Britain will push into poverty by the government's latest welfare reforms.The Resolution Foundation, a British think tank, published the report just a day after Prime Minister pledged an "all-out assault on poverty" and urged the government to protect the most vulnerable and lowest-paid workers. Live @ http://www.presstv.ir/live.html Twitter @ http://twitter.com/PressTV LiveLeak @ http://www.liveleak.com/c/PressTV Facebook @ http://www.facebook.com/PRESSTV Google+ @ http://plus.google.com/+VideosPTV Instagram @ http://instagram.com/presstvchannel -

7:23

7:23Understanding China's fight against poverty

Understanding China's fight against povertyUnderstanding China's fight against poverty

A new report by the Asian Development Bank has proposed raising the poverty threshold from $1.25 per day to $2 per day. That estimate would mean that 30 percent of people in China would fall below the poverty line. Watch this video for an analysis of the report, its implications and China’s sustained efforts in reducing poverty.

- Basic needs

- Body Mass Index

- Cable television

- Canada

- Clothing

- Communication

- Credit (finance)

- Debraj Ray

- Developed countries

- Developing countries

- Extreme poverty

- Food

- Food stamps

- Fraser Institute

- Furniture

- Health care

- Heritage Foundation

- Home insurance

- Hygiene

- Income

- Income deficit

- Income distribution

- Income inequality

- Latrine

- Laundry

- Measuring poverty

- Median

- Medicaid

- Numerical data

- Poverty

- Poverty in China

- Poverty in India

- Poverty threshold

- Relative deprivation

- Renting

- School lunch

- Section 8 (housing)

- Standard of living

- Transportation

- UN

- Water

- World Bank

-

Federal Poverty Level - FPL explained

Explanation of the Federal Poverty Guidelines and a Texas Medicaid example -

-

Calculating Poverty Line Vs. Reality

The official poverty line, as I wrote yesterday, is a dated and crude statistical concept that in many ways fails to capture America's historical success at fighting economic need. It was based on the cost of food in 1963, mostly because the Department of Agriculture had some idea of what a basic grocery budget should look like, whereas there wasn't any real agreement on what families needed to spend on other essentials. Since then, it's mostly just been adjusted for inflation. STORY: http://www.theatlantic.com/business/archive/2014/01/the-poverty-line-was-designed-assuming-every-family-had-a-housewife-who-was-a-skillful-cook/282931/?utm_source=SFFB Join #FOWLERNATION!! http://bit.ly/SubscribeFowlerNation Become a Patron! http://Patreon.com/FowlerShow 3 Steps To Join #FowlerNation! 1. ... -

Forty-five million Americans still live below poverty line

It has been five years since the Great U.S. Recession ended. Economic growth has returned to America, and unemployment rates have dropped. However, according to a U.S. Census Bureau report, 45 million Americans still live below the poverty line, and that number is staying fairly steady. CCTV America's Hendrik Sybrandy reports. -

UNH's Stephen Pimpare on World Bank Poverty Threshold

Stephen Pimpare discussing new World Bank poverty threshold with Kamahl Santamaria on Al Jazeera, October 4, 2015 -

The Line: Poverty in America

Poverty in America is probably not what you think. Emmy Award-winning producer Linda Midgett shows us in this groundbreaking documentary a new face of poverty in America. About 50 million people in the United States live below the poverty line (In 2014- $23,850 for a family of 4) and one in four American children lives in poverty. But what is poverty in America? What defines "the line" and how can the church and community make a difference? -

US poverty threshold, it's problems and solutions

Poverty is a huge and for the most part ignored problem in the US. One of the main culprits in poverty is the US poverty threshold (aka poverty line). The poverty threshold is broken and under-reports the amount of US families who are poor. This creates a catch 22 where families earn too much to meet the poverty threshold and hence can not receive government assistance all the while they are, in reality, poor and are not meeting the basic US quality of life. -

Highest number of Germans below poverty line since reunification

Over 12.5 million Germans are now living below the poverty line which is the highest number on record since reunification 25 years ago. Berlin, the capital of the eurozone's economic powerhouse is one of the poorest regions in Germany. The figures come in a report by one of the country's welfare organisations. The poverty threshold was calculated at 892 euros a month for a single household and 1,873 euros for a family of four. Berlin with 21.4 percent falling into the poor category is well … READ MORE : http://www.euronews.com/2015/02/20/highest-number-of-germans-below-poverty-line-since-reunification euronews business brings you latest updates from the world of finance and economy, in-depth analysis, interviews, infographics and more Subscribe for daily dose of business news: http:... -

West Wing Week 05 22 15 or, “@POTUS”The Poverty Threshold: Analyzing Needs and Wants

http://money.howstuffworks.com/personal-finance/budgeting/how-much-money-to-live.htm The Poverty Threshold: Analyzing Needs and Wants Governments routinely measure poverty, but finding the most appropriate standard is difficult and controversial. Some nations gauge relative poverty -- compared to other people or the median income. Other nations, like the United States, measure absolute poverty -- based on the costs of essential items like food and housing. To help us draw the line, in the 1960s, research analyst Mollie Orshansky created the basic formula that the U.S. still uses to determine the amount of money sufficient to live on. It uses the prices of food items that make up an adequate diet, based on the Department of Agriculture's guidelines. After adding up a year's worth of food, O... -

-

Chinese Regime Lifts Poverty Line Closer to World Standard

For more news and videos visit ☛ http://english.ntdtv.com Follow us on Twitter ☛ http://twitter.com/NTDTelevision Add us on Facebook ☛ http://me.lt/9P8MUn The Chinese regime has lifted the country's poverty line, to people making one dollar or less a day. It reflects a more realistic figure of the number of poor people living in China. But, even with the increase, China's poverty line is still lower than the standard set by the World Bank, which may mean that more people who still need help remain uncounted. China now has more poor people on its record despite its flourishing economy. On Tuesday, the Chinese regime lifted its poverty standard up to about one US dollar—almost twice the old figure. The increase classifies everyone who earns $360 or less per year as "officially po... -

Poverty Line

Protecting vulnerable populations from smoking is a matter of social justice. -

Report: 200,000 British households to fall below poverty line by 2020

A new report suggests that up to 200,000 households with working members in Britain will push into poverty by the government's latest welfare reforms.The Resolution Foundation, a British think tank, published the report just a day after Prime Minister pledged an "all-out assault on poverty" and urged the government to protect the most vulnerable and lowest-paid workers. Live @ http://www.presstv.ir/live.html Twitter @ http://twitter.com/PressTV LiveLeak @ http://www.liveleak.com/c/PressTV Facebook @ http://www.facebook.com/PRESSTV Google+ @ http://plus.google.com/+VideosPTV Instagram @ http://instagram.com/presstvchannel -

Understanding China's fight against poverty

A new report by the Asian Development Bank has proposed raising the poverty threshold from $1.25 per day to $2 per day. That estimate would mean that 30 percent of people in China would fall below the poverty line. Watch this video for an analysis of the report, its implications and China’s sustained efforts in reducing poverty. -

Poverty in Europe

Today in Europe, one person in six lives below the poverty threshold. 2010 is the European year for combating poverty and social exclusion. -

Getting out of Poverty - Mikko - Finland

Mikko is a 23 year old film maker. Due to difficult relations with his family he spent three years in a youth centre. At the age of 18 he went to live on his own. Finland's 'at risk-of-poverty' threshold is 991 Euros, and 14% of the population is at risk of poverty and social exclusion. Without financial and moral support, Mikko became socially excluded and could not make ends meet. This changed when he started working at the Satakunta film centre; the project young people the opportunity to make movies and gives them a new sense of self-esteem. -

Getting out of Poverty - Ljudmilla -- Estonia

In Estonia, the "at risk of poverty threshold" is 277 Euros with 20% of the population subsequently at risk of poverty and social exclusion. Ljudmilla, 32 years old, along with her husband and four children, lives in social housing in North Tallinn. The apartment they rent is about 15 m², yet, just a few years ago, Ljudmilla and her husband had bought their own flat. However the economic crisis swept those dreams away: Ljudmilla's husband lost his job and the family went into a spiral of debt. Bethel's Centre, gives food packages and clothes and directs to other social services to find more long-term solutions. -

Hunger in Alabama

The growth of the Alabama Food Bank network is directly related to the growing number of hungry people in Alabama. More than 720,000 Alabama residents live below the federal poverty level. The numbers are staggering, but the Food Bank network is committed to the fight against hunger. There are many other persons who are just above the poverty threshold. Often referred to as the "working poor," they have a difficult time meeting financial obligations and are highly vulnerable to unemployment, illness and other unexpected events that can create financial havoc. -

Getting out of Poverty - Temel - Belgium

Temel, 46 years old, was unemployed for more than 10 years. Having to pay alimony to his ex-wife and taking care of the 2 children from his current marriage, he ran up serious debts. In Belgium, the "at risk of poverty threshold" is 899 Euros with 15% of the population at risk of poverty and social exclusion. Today, thanks to the OCMW, the public organisation for social welfare, which helps him to manage his income, Temel's situation has improved a lot. But still, every euro counts. That's why Temel welcomes the social grocery-initiative, where people supported by the OCMW, can buy basic products at a significant discount. -

Getting out of Poverty - Miroslav - Czech Republic

In the Czech Republic, the "at risk of poverty threshold" is 303 Euros with 9% of the population currently at risk of poverty and social exclusion. Miroslav is 44 years old and lives in Prague. After spending two years in prison, Miroslav was released a year ago. For over 6 months he was jobless, homeless and had many debts too. Thanks to the SPJ, an association which works on projects that help individuals who have committed a crime and served time or are on probation, Miroslav is reintegrating step by step into society. -

Four Directions Walk to End Poverty

According to the 2011 Child and Family Poverty Report Card, issued by the Social Planning Council of Winnipeg: - 92,650 children in Manitoba live in families under the poverty threshold - 29,000 children in Manitoba live in families with annual incomes insufficient for meeting basic needs - 29,563 Manitoban children use food banks each month because their families cannot afford to purchase the necessary food they require - 59,734 Manitobans accessed Employment and Income Assistance - The richest 20% of Manitoban families have more total income than the poorest 60% of the population The Council says these statistics have not changed significantly since 1989, the year the House of Commons pledged to end child poverty in Canada by the year 2000. What is to be done? A group of Ma... -

BR1M and Malaysia's Poverty Line

October 9, 2015 (Kuala Lumpur) -- The government's BR1M initiative to assist low-income groups is set to see higher allocation in the upcoming Budget 2016. Bloomberg TV Malaysia's Jacalyn Kow explains the different criteria for the program as tabled in the last budget. -

'Over 30% Israelis close to poverty line'

A new report shows that over one third of Israelis are at risk of falling below the poverty line, almost twice the rate of poverty risk in the European Union, itself plagued by a financial crisis. According to a report released by Israel's Central Bureau of Statistics (CBS) on Wednesday, about 31 percent of Israelis are close to the poverty line. The current figure is up from 26 percent in 2001. The report also indicates that some 40 percent of Israeli children are facing the risk of poverty, which is also double the rate in Europe. The rate in 2011, the same as this year's, was even higher than in debt-ridden Spain and Greece, where 20 percent of the population was at risk of poverty. Momi Dahan, an official at Hebrew University in al-Quds (Jerusalem), said the high poverty rate i...

Federal Poverty Level - FPL explained

- Order: Reorder

- Duration: 2:02

- Updated: 04 Sep 2013

- views: 3792

- published: 04 Sep 2013

- views: 3792

Americans living below the poverty line

- Order: Reorder

- Duration: 7:46

- Updated: 08 May 2014

- views: 3493

Calculating Poverty Line Vs. Reality

- Order: Reorder

- Duration: 3:45

- Updated: 29 Jul 2015

- views: 307

- published: 29 Jul 2015

- views: 307

Forty-five million Americans still live below poverty line

- Order: Reorder

- Duration: 2:46

- Updated: 01 Nov 2014

- views: 975

- published: 01 Nov 2014

- views: 975

UNH's Stephen Pimpare on World Bank Poverty Threshold

- Order: Reorder

- Duration: 2:52

- Updated: 06 Oct 2015

- views: 20

- published: 06 Oct 2015

- views: 20

The Line: Poverty in America

- Order: Reorder

- Duration: 2:53

- Updated: 14 Jul 2014

- views: 23164

- published: 14 Jul 2014

- views: 23164

US poverty threshold, it's problems and solutions

- Order: Reorder

- Duration: 0:30

- Updated: 18 Jul 2007

- views: 1200

- published: 18 Jul 2007

- views: 1200

Highest number of Germans below poverty line since reunification

- Order: Reorder

- Duration: 1:45

- Updated: 21 Feb 2015

- views: 201

- published: 21 Feb 2015

- views: 201

West Wing Week 05 22 15 or, “@POTUS”The Poverty Threshold: Analyzing Needs and Wants

- Order: Reorder

- Duration: 4:34

- Updated: 01 Jun 2015

- views: 32

- published: 01 Jun 2015

- views: 32

Poverty Threshold (Joseph's Hobo Adventures Pt. 1)

- Order: Reorder

- Duration: 1:31

- Updated: 07 Mar 2013

- views: 54

Chinese Regime Lifts Poverty Line Closer to World Standard

- Order: Reorder

- Duration: 1:53

- Updated: 01 Dec 2011

- views: 2207

- published: 01 Dec 2011

- views: 2207

Poverty Line

- Order: Reorder

- Duration: 0:45

- Updated: 27 Jun 2012

- views: 1531

- published: 27 Jun 2012

- views: 1531

Report: 200,000 British households to fall below poverty line by 2020

- Order: Reorder

- Duration: 1:48

- Updated: 09 Oct 2015

- views: 351

- published: 09 Oct 2015

- views: 351

Understanding China's fight against poverty

- Order: Reorder

- Duration: 7:23

- Updated: 17 Sep 2014

- views: 317

- published: 17 Sep 2014

- views: 317

Poverty in Europe

- Order: Reorder

- Duration: 1:17

- Updated: 10 Mar 2010

- views: 2654

- published: 10 Mar 2010

- views: 2654

Getting out of Poverty - Mikko - Finland

- Order: Reorder

- Duration: 3:43

- Updated: 08 Nov 2010

- views: 1011

- published: 08 Nov 2010

- views: 1011

Getting out of Poverty - Ljudmilla -- Estonia

- Order: Reorder

- Duration: 3:27

- Updated: 08 Nov 2010

- views: 979

- published: 08 Nov 2010

- views: 979

Hunger in Alabama

- Order: Reorder

- Duration: 7:11

- Updated: 30 Sep 2014

- views: 426

- published: 30 Sep 2014

- views: 426

Getting out of Poverty - Temel - Belgium

- Order: Reorder

- Duration: 3:22

- Updated: 08 Nov 2010

- views: 569

- published: 08 Nov 2010

- views: 569

Getting out of Poverty - Miroslav - Czech Republic

- Order: Reorder

- Duration: 3:40

- Updated: 08 Nov 2010

- views: 1272

- published: 08 Nov 2010

- views: 1272

Four Directions Walk to End Poverty

- Order: Reorder

- Duration: 30:00

- Updated: 24 Oct 2011

- views: 398

- published: 24 Oct 2011

- views: 398

BR1M and Malaysia's Poverty Line

- Order: Reorder

- Duration: 3:53

- Updated: 09 Oct 2015

- views: 174

- published: 09 Oct 2015

- views: 174

'Over 30% Israelis close to poverty line'

- Order: Reorder

- Duration: 4:16

- Updated: 18 Oct 2013

- views: 169

- published: 18 Oct 2013

- views: 169

- Playlist

- Chat

- Playlist

- Chat

Federal Poverty Level - FPL explained

- Report rights infringement

- published: 04 Sep 2013

- views: 3792

Americans living below the poverty line

- Report rights infringement

- published: 08 May 2014

- views: 3493

Calculating Poverty Line Vs. Reality

- Report rights infringement

- published: 29 Jul 2015

- views: 307

Forty-five million Americans still live below poverty line

- Report rights infringement

- published: 01 Nov 2014

- views: 975

UNH's Stephen Pimpare on World Bank Poverty Threshold

- Report rights infringement

- published: 06 Oct 2015

- views: 20

The Line: Poverty in America

- Report rights infringement

- published: 14 Jul 2014

- views: 23164

US poverty threshold, it's problems and solutions

- Report rights infringement

- published: 18 Jul 2007

- views: 1200

Highest number of Germans below poverty line since reunification

- Report rights infringement

- published: 21 Feb 2015

- views: 201

West Wing Week 05 22 15 or, “@POTUS”The Poverty Threshold: Analyzing Needs and Wants

- Report rights infringement

- published: 01 Jun 2015

- views: 32

Poverty Threshold (Joseph's Hobo Adventures Pt. 1)

- Report rights infringement

- published: 07 Mar 2013

- views: 54

Chinese Regime Lifts Poverty Line Closer to World Standard

- Report rights infringement

- published: 01 Dec 2011

- views: 2207

Poverty Line

- Report rights infringement

- published: 27 Jun 2012

- views: 1531

Report: 200,000 British households to fall below poverty line by 2020

- Report rights infringement

- published: 09 Oct 2015

- views: 351

Understanding China's fight against poverty

- Report rights infringement

- published: 17 Sep 2014

- views: 317

Islamic State Turns Mosul University Chemistry Lab into Bomb Factory

Edit Breitbart 04 Apr 2016Up to 300,000 Wisconsin Voters Could Be Barred from Polls Thanks to Scott Walker

Edit Democracy Now 04 Apr 2016Behind Isis lines: 'You are not prisoners. Prisoners don't get to choose what they want for breakfast'

Edit The Guardian 04 Apr 2016Police Pull Mississippi Man From Car, Taser Him, Pepper Spray Him, For Playing Loud Music

Edit WorldNews.com 04 Apr 2016Why NATO Is a Necessity

Edit Time Magazine 04 Apr 2016Just 10 percent of world military spending could knock off poverty

Edit The Jerusalem Post 05 Apr 2016A Wage for Living

Edit Huffington Post 05 Apr 2016Statement from School Board of Education President Steve Zimmer on new legislation that raises the state’s minimum wage (Los Angeles Unified School District)

Edit Public Technologies 05 Apr 2016Why Colorado should "ban the box" on job applications

Edit Denver Post 05 Apr 2016Jerry Brown signs $15 minimum wage in California

Edit The Charlotte Observer 05 Apr 2016How the Federal Government Plans to Stop the 'Worst-Case' Housing Crisis

Edit CityLab 05 Apr 2016Iain Duncan Smith 'wept about plight of single mother' in TV interview

Edit The Guardian 05 Apr 2016Calabasas turns 25 Tuesday, and it’s about more than Justin Bieber and the Kardashians

Edit LA Daily News 05 Apr 201610 Albums You Should Hear Now

Edit Rhapsody 05 Apr 2016Tel Aviv suspends cement deliveries to besieged Gaza Strip

Edit Press TV 05 Apr 2016EU begins sending people back across the sea, despite human rights outcry

Edit The Columbus Dispatch 05 Apr 2016- 1

- 2

- 3

- 4

- 5

- Next page »