- published: 30 Jun 2015

- views: 174550

-

remove the playlistCredit Card

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistCredit Card

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 16 Nov 2012

- views: 95522

- published: 27 Jun 2014

- views: 613852

- published: 02 Mar 2010

- views: 244485

- published: 12 Jul 2015

- views: 4469

- published: 02 Jan 2014

- views: 134618

- published: 02 Sep 2015

- views: 126513

- published: 04 Apr 2014

- views: 74108

- published: 01 Oct 2015

- views: 1326749

- published: 29 Jul 2015

- views: 17531

A credit card is a small plastic card issued to users as a system of payment. It allows its holder to buy goods and services based on the holder's promise to pay for these goods and services. The issuer of the card creates a revolving account and grants a line of credit to the consumer (or the user) from which the user can borrow money for payment to a merchant or as a cash advance to the user.

A credit card is different from a charge card: a charge card requires the balance to be paid in full each month. In contrast, credit cards allow the consumers a continuing balance of debt, subject to interest being charged. A credit card also differs from a cash card, which can be used like currency by the owner of the card.

The size of most credit cards is 85.60 × 53.98 mm (33/8 × 21/8 in), and conform to the ISO/IEC 7810 ID-1 standard. Credit cards have an embossed bank card number complying with the ISO/IEC 7812 numbering standard.

The concept of using a card for purchases was described in 1887 by Edward Bellamy in his utopian novel Looking Backward. Bellamy used the term credit card eleven times in this novel.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

41:55

41:55Credit Card * 2015 * Bangla Full Video Natok - Mehazabien,Tawsif - HD 1080p )

Credit Card * 2015 * Bangla Full Video Natok - Mehazabien,Tawsif - HD 1080p )Credit Card * 2015 * Bangla Full Video Natok - Mehazabien,Tawsif - HD 1080p )

-

4:41

4:415 Credit Card Mistakes to Avoid at All Costs!

5 Credit Card Mistakes to Avoid at All Costs!5 Credit Card Mistakes to Avoid at All Costs!

Credit cards are both an opportunity and a risk... approach them wisely! "Making smart decisions about credit, on the other hand, isn't difficult and can improve your credit scores, help you land a job and provide welcome relief in an emergency." Via MSN Money. Watch the video and find out what John Iadarola and Lisa Ferguson think on TYT University! Part #2 will be along in just a couple of days with more tips for you! What do you think about our credit card and finance tips? Do you currently have a line of credit? Are you being financially responsible with it? Do you have more tips for us? Let us know what you think down below! Find out more here: http://money.msn.com/credit-cards/5-credit-card-mistakes-to-avoid And if you liked this video, PLEASE "Like" it as well! :) Subscribe to TYT U for more videos: http://tinyurl.com/9o8kpf4 Follow us on twitter!!! https://twitter.com/#!/tytuniversity https://twitter.com/#!/lisa_ferg https://twitter.com/#!/jiadarola TYT University covers all the news you need to know happening at colleges around the country and across the globe! From student loans to frat parties and dating, we've got it all. -

5:21

5:21Credit Card Thieves Caught on Tape Using Skimmers | Nightline | ABC News

Credit Card Thieves Caught on Tape Using Skimmers | Nightline | ABC NewsCredit Card Thieves Caught on Tape Using Skimmers | Nightline | ABC News

Police say thieves have swiped customers' credit card info from fast food drive-thrus and gas pumps. SUBSCRIBE for the latest news and updates from ABC News ► http://www.youtube.com/subscription_center?add_user=abcnews To read the full story and others, visit http://www.abcnews.com Watch more news stories from ABC News! More Nightline ► https://www.youtube.com/watch?v=Dn3Ldv_mePs&list;=PL31751769A1264A20 Similar headlines from ABC News ► https://www.youtube.com/watch?v=rAfsR58ocXY&list;=PLQOa26lW-uI9OI6p4YJKUUUnLZHwhF_u4 --To read the full story and others, visit http://www.abcnews.com Follow ABC News across the web! Facebook: http://www.facebook.com/abcnews Twitter: http://twitter.com/ABC Instagram: https://instagram.com/ABCNews/ Watch as criminal investigations unfold, and witness the technology that helps the real life crime scene investigations (CSI) bring criminals to justice. Watch the stories of ordinary crime and the work of criminal masterminds. Advance through the justice system and the aftermath that follows a high profile investigation. From the start to finish ABC News is your source for the breaking stories of the rising crime rate in our nation. Stay informed on the latest crime news with abcnews.com. Nightline is a 30 minute late-night news program currently airing weeknights on ABC at 12:35am | 1:35am ET. Hosts Juju Chang, Dan Abrams and Dan Harris bring you in-depth reporting on the major stories, hot topics, and the day’s breaking news. You can catch Nightline every night just after Jimmy Kimmel Live! Make ABC News your daily news outlet for breaking national and world news, broadcast video coverage, and exclusive interviews that will help you stay up to date on the events shaping our world. ABC News’ show roster has both leaders in daily evening and morning programming. Kick start your weekday mornings with news updates from Good Morning America (GMA) and Sundays with This Week with George Stephanopoulos. Get your evening fix with 20/20, Nightline, and ABC World News Tonight with David Muir. Head to abc.go.com for programming schedule and more information on ABC News. -

2:36

2:36IT WORKS!! CREDIT CARD MADE FROM CARDBOARD AND OLD VHS TAPE

IT WORKS!! CREDIT CARD MADE FROM CARDBOARD AND OLD VHS TAPEIT WORKS!! CREDIT CARD MADE FROM CARDBOARD AND OLD VHS TAPE

The least secure credit card ever made. -

3:25

3:25Credit Card Debt Explained With a Glass of Water

Credit Card Debt Explained With a Glass of WaterCredit Card Debt Explained With a Glass of Water

http://www.totaldebtrelief.net uses a pitcher and a glass of water demonstrate the effects of minimum credit card payments. This video uses a simple analogy to describe how the average American is throwing away their money to the credit card companies. Visit totaldebtrelief.net for more information on credit card debt relief. -

7:33

7:33MAXED OUT MY CREDIT CARD!!

MAXED OUT MY CREDIT CARD!! -

5:51

5:51Improve Your Credit Score QUICKLY! (Credit Card Utilization)

Improve Your Credit Score QUICKLY! (Credit Card Utilization)Improve Your Credit Score QUICKLY! (Credit Card Utilization)

In this video I explain: -how your credit score is calculated -how to improve your score quickly by keeping your utilization low I also share a helpful trick to remember these rules, "Divide by 10... THEN spend!" Link to my previous video: https://www.youtube.com/watch?v=SO-xx4acDEM SUBSCRIBE ladies and gents! -

4:30

4:30What's wrong with using credit cards if we pay them off?

What's wrong with using credit cards if we pay them off?What's wrong with using credit cards if we pay them off?

Josh in Indianapolis uses a credit card for the rewards and pays it off every month. Is it really that bad? Dave answers and gives his reasons. Find A Financial Peace class near you! http://www.daveramsey.com/fpu/classfinder?ectid=70.11.970 Check out Chris Hogan’s book “Retire Inspired” http://www.daveramsey.com/store/books/retire-inspired-by-chris-hogan/prodD078.html?ectid=70.11.969 Do you want to take control of your money? Get “The Total Money Makeover” book here. http://www.daveramsey.com/store/books/dave-s-bestsellers/the-total-money-makeover/prodtmmoclassic.html?ectid=70.11.968 Do you need help with your taxes? Find an Endorsed Local Provider near you! https://www.daveramsey.com/elp/tax-services?ectid=70.11.966 Need help selling or buying a home? Click the link to find an Endorsed Local Provider in your area. https://www.daveramsey.com/elp/residential-real-estate?ectid=70.11.965 Do you have questions about investing? Let one of our Endorsed Local Providers help. https://www.daveramsey.com/elp/investing?ectid=70.11.964 IN THIS VIDEO: Dave Ramsey, The Dave Ramsey Show, Financial Peace University, FPU, The Total Money Makeover, budget, envelope system, emergency fund, baby steps, radio show, debt freedom, EntreLeadership, mortgage, ELP, daveramsey.com, money, finance, economy, investing, saving, retirement, cash, mutual fund, stock market, business, leadership, credit, drtlgi -

4:30

4:30Four Year Strong "Stolen Credit Card" Official Music Video

Four Year Strong "Stolen Credit Card" Official Music VideoFour Year Strong "Stolen Credit Card" Official Music Video

CD/LP: http://fouryearstrong.merchnow.com/ itunes: http://geni.us/GsT?app=itunes TOUR DATES TICKETS: http://fouryearstrongmusic.com/ Defeater, Expire & Speak Low (full band) Sept 1 - Cleveland, OH @ Grog Shop Sept 2 - Detroit, MI @ The Shelter Sept 3 - Chicago, IL @ The Bottom Lounge Sept 4 - Minneapolis, MN @ Triple Rock Social Club Sept 5 - St. Louis, MO @ Firebird* Sept 6 - Omaha, NE @ The Waiting Room Sept 8 - Denver, CO @ Marquis Theater Sept 9 - Salt Lake City, UT @ The Complex Sept 11 - Seattle, WA @ The Crocodile Sept 12 - Portland, OR @ Hawthorne Theatre *no Expire Defeater, Expire & My Iron Lung Sept 14 - Orangevale, CA @ The Boardwalk Sept 15 - San Diego, CA @ SOMA Sept 16 - Anaheim, CA @ Chain Reaction Sept 17 - Anaheim, CA @ Chain Reaction Sept 18 - Tempe, AZ @ Club Red Sept 19 - Albuquerque, NM @ The Launchpad (Matinee) Sept 21 - Dallas, TX @ Gas Monkey Bar & Grill Sept 22 - Austin, TX @ The Sidewinder Sept 23 - Houston, TX @ Warehouse Live Studio Defeater, Superheaven & Elder Brother (acoustic) Sept 25 - Orlando, FL @ The Social Sept 26 - Margate, FL @ O'Malley's Sept 27 - St. Petersburg, FL @ Local 662 Sept 28 - Atlanta, GA @ Masquerade - Hell Sept 29 - Nashville, TN @ Exit / In Sept 30 - Louisville, KY @ Headliner's Music Hall Oct 1 - Pittsburgh, PA @ Altar Bar Oct 2 - Washington, DC @ Rock and Roll Hotel Oct 3 - Virginia Beach, VA @ Shakas Live Oct 4- Philadelphia, PA @ Union Transfer Oct 6 - New York, NY @ Gramercy Theatre Oct 7 - Poughkeepsie, NY @ The Chance Oct 8 - Montreal, QC @ Cabaret La Tulipe Oct 9 - Toronto, ON @ The Opera House Oct 10 - Buffalo, NY @ The Waiting Room Oct 11 - Boston, MA @ The Middle East Downstairs writer, producer, director I KYLE THRASH http://kylethrash.com/#/ director of photography I JOHN KOMAR, KYLE PAHLOW, VINCENT TUTHS 1st ac I MIKE KOZIEL gaffer I JACOB OVERHOLT props I EVAN KAUCHER construction & location manager I MARC TOBASH, CASEY WORON editor I JOHN KOMAR colorist I SAMUEL GURSKY @ http://irvingharvey.com CAST business man I JAMES RICH waitress I EMILY FLEISCHER teenage girl I MIA RISNER teenager boy I BILLY BRANNIGAN boss I BRAD BOLLE -

8:10

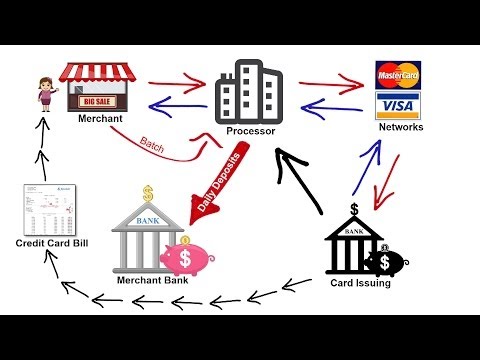

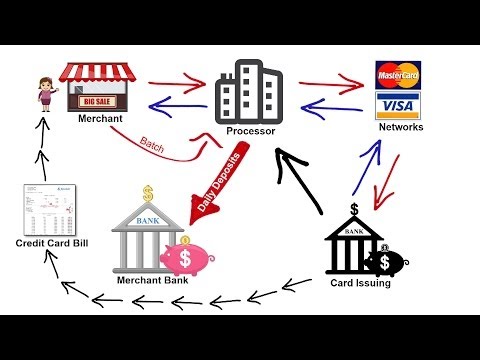

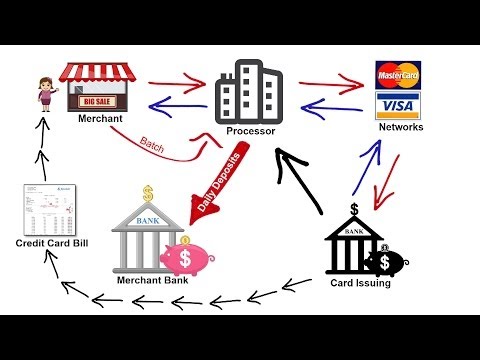

8:10How Credit Card Processing Works - Transaction Cycle & 2 Pricing Models

How Credit Card Processing Works - Transaction Cycle & 2 Pricing ModelsHow Credit Card Processing Works - Transaction Cycle & 2 Pricing Models

How Credit Card Processing Works : http://www.bancardsales.com How Does Credit Card Processing Work This video explains how credit card payments are passed from the cardholder to the merchant bank account. Included in the video is the transaction cycle, and a detailed explanation of the two main pricing models. If you've ever wondered: How Does Credit Card Processing Work? How To Process Credit Cards? How Credit Card Processing Works? How To Accept Credit Card Payments At Your Business or Understanding the transaction flow, then you'll want to watch this video. It's part of a credit card processing basics video series so be sure to check back for more updates and additional videos in the series. Additionally, you can check out http://www.bancardsales.com for more tips and tutorials on how merchant account processing works. https://www.youtube.com/watch?v=avRkRuQsZ6M -

1:36

1:36Adam Ruins Everything - Why Your Credit Card Is Never Secure (Excerpt)

Adam Ruins Everything - Why Your Credit Card Is Never Secure (Excerpt)Adam Ruins Everything - Why Your Credit Card Is Never Secure (Excerpt)

Think your bank account is safe? Think again. Adam reveals the unsettling truth about credit card fraud. Subscribe: http://full.sc/1s9KQGe In Adam Ruins Everything, host Adam Conover employs a combination of comedy, history and science to dispel widespread misconceptions about everything we take for granted. A blend of entertainment and enlightenment, Adam Ruins Everything is like that friend who knows a little bit too much about everything and is going to tell you about it... whether you like it or not. truTV Official Site: http://www.trutv.com/ Like truTV on Facebook: https://www.facebook.com/truTV Follow truTV on Twitter: https://twitter.com/truTV Follow truTV on Tumblr: http://trutv.tumblr.com/ Get the truTV app on Google Play: http://bit.ly/1eYxjPP Get the truTV app on iTunes: http://apple.co/1JiGkjh truTV The New truTV Is Way More Fun! Watch clips, sneak peeks and exclusives from original shows like Adam Ruins Everything, Friends of the People, Hack My Life and more – plus fresh video from hit shows like Impractical Jokers and The Carbonaro Effect. Adam Ruins Everything - Why Your Credit Card Is Never Secure -

5:48

5:48Why Should I Get A Credit Card? | Business Video!

Why Should I Get A Credit Card? | Business Video!Why Should I Get A Credit Card? | Business Video!

Link To Same Student Card I Have/Use: http://bit.ly/1ONaRFD SUBSCRIBE: http://goo.gl/e2KnUX Twitter: http://twitter.com/TheRealTBlake Instagram: http://Instagram.com/TylerJBlake Video to help answer common questions about getting a credit card and how it can help you build credit history and make money back on purchases. Disclaimer: This video serves as a conversation and gives best practices for owning a credit card based on personal experience and research. The intent of this video is to arm viewers with information to help them make the best decision for them personally. Contact: http://TBlake.info http://KicksUnderCost.com -

3:16

3:16What's a Credit Card?

What's a Credit Card?What's a Credit Card?

Animation dealing with credit cards and problems you can avoid when using them. -

23:21

23:21DAHIL SA UTANG SA CREDIT CARD, SINIBAK NG AMO!

DAHIL SA UTANG SA CREDIT CARD, SINIBAK NG AMO!

- Access (credit card)

- Acquirer

- Acquiring bank

- Addressograph

- American Express

- APACS

- Arbitration

- Arthur O' Sullivan

- ATM card

- Authorization hold

- Automobile

- Balance transfer

- Bank

- Bank card number

- Bank Central Asia

- Bank of America

- BankAmericard

- Bankcard

- Bankruptcy

- Barclaycard

- Basis point

- BC Card

- Bruce Kovner

- Business plan

- Card enclosure

- Card security code

- Card Security Code

- Cardwatch.org.uk

- Carl Levin

- Carte Bleue

- Cash

- Cash advance

- Cash card

- Caxton Associates

- Celluloid

- Charge card

- Charge-off

- Chargeback

- Chargebacks

- Check 21 Act

- Cheque

- China UnionPay

- Chip and PIN

- Choice (credit card)

- Cisco Systems

- Citibank

- Clerks

- Collection agency

- College

- Compulsive shopping

- Consumer

- Contactless payment

- Cooperative

- Corporate action

- Counterfeiting

- Credit (finance)

- Credit card

- Credit card cashback

- Credit card fraud

- Credit card interest

- Credit card number

- Credit card terminal

- Credit history

- Credit limit

- Credit rating agency

- Credit risk

- Credit union

- Dankort

- Debit

- Debit card

- Debit card cashback

- Debit MasterCard

- Debt

- Deposit account

- Diners Club

- Discount fee

- Discover Card

- Dog tag (identifier)

- Dragon's Den

- Economic boom

- Edward Bellamy

- EFTPOS

- Electronic commerce

- Electronic money

- Electronics

- ELO (credit card)

- Employee benefit

- Employment contract

- EMV

- Entrust Bankcard

- Equifax

- Estate planning

- Everything Card

- Exonumia

- Expense

- Federal savings bank

- Fiber

- Financial adviser

- Financial planner

- First Premier Bank

- Floor limit

- Forgery

- France

- Frank X. McNamara

- Frequent flyer

- Fresno, California

- Friendly fraud

- Fuel

- Girocard

- Glass–Steagall Act

- Good (economics)

- Grace period

- Hard disks

- Hollywood Shuffle

- Hologram

- Home equity

- ID card

- Identity theft

- Interac

- Interbank network

- Interchange fee

- Interchange rate

- Interest

- Interest rate

- Internet fraud

- Introductory rate

- Ireland

- ISO IEC 7810

- ISO IEC 7812

- Japan

- Japan Credit Bureau

- JPMorgan Chase

- Kevin Smith

- Larry Page

- Laser (debit card)

- Late fee

- Legal liability

- Legislator

- Len Bosack

- Life (magazine)

- Line of credit

- Loans

- Lonely Planet

- Looking Backward

- Loyalty program

- Maestro (debit card)

- Magnetic stripe

- Magnetic stripe card

- Mail order

- MasterCard

- Merchant

- Merchant account

- Merchants

- Metal

- Money market account

- National bank

- NetworkWorld.com

- New York Times

- Nordic countries

- Numismatics

- Off-line

- Offshore credit card

- Online

- Online banking

- Operating cost

- Optoutprescreen.com

- Pawnbroker

- Payday loan

- Payment

- PCI DSS

- Pension

- Personal budget

- Personal finance

- Plastic

- Point of sale

- Polyvinyl chloride

- Portfolio (finance)

- Profit margin

- Receipt

- Reimbursement

- Retirement

- Revolving account

- Revolving credit

- RuPay

- Salary

- Sandy Lerner

- Savings account

- Savings deposit

- Schumer box

- Sergey Brin

- Service (economics)

- Signature

- Smart card

- Social security

- Solo (debit card)

- Stoozing

- Stored-value card

- Student loan

- Substitute check

- Switch (debit card)

- Tax

- Teaser rate

- The Everything Card

- Trailing interest

- Truth in Lending Act

- Tuition

- Typewriter ribbon

- United Kingdom

- United States

- Universal default

- Usury

- V PAY

- Visa (company)

- VISA (credit card)

- Visa Debit

- Visa Electron

- Visa Inc.

- Wage

- Watermark

- Western Union

- Wikipedia Link rot

- Wire transfer

- Wood's lamp

- WP splitting

-

Credit Card * 2015 * Bangla Full Video Natok - Mehazabien,Tawsif - HD 1080p )

-

5 Credit Card Mistakes to Avoid at All Costs!

Credit cards are both an opportunity and a risk... approach them wisely! "Making smart decisions about credit, on the other hand, isn't difficult and can improve your credit scores, help you land a job and provide welcome relief in an emergency." Via MSN Money. Watch the video and find out what John Iadarola and Lisa Ferguson think on TYT University! Part #2 will be along in just a couple of days with more tips for you! What do you think about our credit card and finance tips? Do you currently have a line of credit? Are you being financially responsible with it? Do you have more tips for us? Let us know what you think down below! Find out more here: http://money.msn.com/credit-cards/5-credit-card-mistakes-to-avoid And if you liked this video, PLEASE "Like" it as well! :) Subscribe to ... -

Credit Card Thieves Caught on Tape Using Skimmers | Nightline | ABC News

Police say thieves have swiped customers' credit card info from fast food drive-thrus and gas pumps. SUBSCRIBE for the latest news and updates from ABC News ► http://www.youtube.com/subscription_center?add_user=abcnews To read the full story and others, visit http://www.abcnews.com Watch more news stories from ABC News! More Nightline ► https://www.youtube.com/watch?v=Dn3Ldv_mePs&list;=PL31751769A1264A20 Similar headlines from ABC News ► https://www.youtube.com/watch?v=rAfsR58ocXY&list;=PLQOa26lW-uI9OI6p4YJKUUUnLZHwhF_u4 --To read the full story and others, visit http://www.abcnews.com Follow ABC News across the web! Facebook: http://www.facebook.com/abcnews Twitter: http://twitter.com/ABC Instagram: https://instagram.com/ABCNews/ Watch as criminal investigations unfold, and witnes... -

IT WORKS!! CREDIT CARD MADE FROM CARDBOARD AND OLD VHS TAPE

The least secure credit card ever made. -

Credit Card Debt Explained With a Glass of Water

http://www.totaldebtrelief.net uses a pitcher and a glass of water demonstrate the effects of minimum credit card payments. This video uses a simple analogy to describe how the average American is throwing away their money to the credit card companies. Visit totaldebtrelief.net for more information on credit card debt relief. -

-

Improve Your Credit Score QUICKLY! (Credit Card Utilization)

In this video I explain: -how your credit score is calculated -how to improve your score quickly by keeping your utilization low I also share a helpful trick to remember these rules, "Divide by 10... THEN spend!" Link to my previous video: https://www.youtube.com/watch?v=SO-xx4acDEM SUBSCRIBE ladies and gents! -

What's wrong with using credit cards if we pay them off?

Josh in Indianapolis uses a credit card for the rewards and pays it off every month. Is it really that bad? Dave answers and gives his reasons. Find A Financial Peace class near you! http://www.daveramsey.com/fpu/classfinder?ectid=70.11.970 Check out Chris Hogan’s book “Retire Inspired” http://www.daveramsey.com/store/books/retire-inspired-by-chris-hogan/prodD078.html?ectid=70.11.969 Do you want to take control of your money? Get “The Total Money Makeover” book here. http://www.daveramsey.com/store/books/dave-s-bestsellers/the-total-money-makeover/prodtmmoclassic.html?ectid=70.11.968 Do you need help with your taxes? Find an Endorsed Local Provider near you! https://www.daveramsey.com/elp/tax-services?ectid=70.11.966 Need help selling or buying a home? Click the link to find an Endo... -

Four Year Strong "Stolen Credit Card" Official Music Video

CD/LP: http://fouryearstrong.merchnow.com/ itunes: http://geni.us/GsT?app=itunes TOUR DATES TICKETS: http://fouryearstrongmusic.com/ Defeater, Expire & Speak Low (full band) Sept 1 - Cleveland, OH @ Grog Shop Sept 2 - Detroit, MI @ The Shelter Sept 3 - Chicago, IL @ The Bottom Lounge Sept 4 - Minneapolis, MN @ Triple Rock Social Club Sept 5 - St. Louis, MO @ Firebird* Sept 6 - Omaha, NE @ The Waiting Room Sept 8 - Denver, CO @ Marquis Theater Sept 9 - Salt Lake City, UT @ The Complex Sept 11 - Seattle, WA @ The Crocodile Sept 12 - Portland, OR @ Hawthorne Theatre *no Expire Defeater, Expire & My Iron Lung Sept 14 - Orangevale, CA @ The Boardwalk Sept 15 - San Diego, CA @ SOMA Sept 16 - Anaheim, CA @ Chain Reaction Sept 17 - Anaheim, CA @ Chain Reaction Sept 18 - Tempe, AZ @ Club Red S... -

How Credit Card Processing Works - Transaction Cycle & 2 Pricing Models

How Credit Card Processing Works : http://www.bancardsales.com How Does Credit Card Processing Work This video explains how credit card payments are passed from the cardholder to the merchant bank account. Included in the video is the transaction cycle, and a detailed explanation of the two main pricing models. If you've ever wondered: How Does Credit Card Processing Work? How To Process Credit Cards? How Credit Card Processing Works? How To Accept Credit Card Payments At Your Business or Understanding the transaction flow, then you'll want to watch this video. It's part of a credit card processing basics video series so be sure to check back for more updates and additional videos in the series. Additionally, you can check out http://www.bancardsales.com for more tips and tutori... -

Adam Ruins Everything - Why Your Credit Card Is Never Secure (Excerpt)

Think your bank account is safe? Think again. Adam reveals the unsettling truth about credit card fraud. Subscribe: http://full.sc/1s9KQGe In Adam Ruins Everything, host Adam Conover employs a combination of comedy, history and science to dispel widespread misconceptions about everything we take for granted. A blend of entertainment and enlightenment, Adam Ruins Everything is like that friend who knows a little bit too much about everything and is going to tell you about it... whether you like it or not. truTV Official Site: http://www.trutv.com/ Like truTV on Facebook: https://www.facebook.com/truTV Follow truTV on Twitter: https://twitter.com/truTV Follow truTV on Tumblr: http://trutv.tumblr.com/ Get the truTV app on Google Play: http://bit.ly/1eYxjPP Get the truTV app on iTunes: ht... -

Why Should I Get A Credit Card? | Business Video!

Link To Same Student Card I Have/Use: http://bit.ly/1ONaRFD SUBSCRIBE: http://goo.gl/e2KnUX Twitter: http://twitter.com/TheRealTBlake Instagram: http://Instagram.com/TylerJBlake Video to help answer common questions about getting a credit card and how it can help you build credit history and make money back on purchases. Disclaimer: This video serves as a conversation and gives best practices for owning a credit card based on personal experience and research. The intent of this video is to arm viewers with information to help them make the best decision for them personally. Contact: http://TBlake.info http://KicksUnderCost.com -

What's a Credit Card?

Animation dealing with credit cards and problems you can avoid when using them. -

-

How Credit Cards Are Made

The closely guarded process of making credit cards : Showing the actual making of the cards to the tight security and safeguards behind them. -

American Underworld - Credit card theft.

So easy a black can do it lol. The host is a tool. -

Watch: Starbucks customer confronts employee for stealing credit card info

A woman figures out a Starbucks employee stole her credit card information and then confronts her at the drive thru. CBSN's Contessa Brewer has footage of the tense interaction. -

Homeless Credit Card Experiment

Become a Breaker for new episodes of Prank Bank! ► http://bit.ly/BreakSubscribe It has been getting harder and harder to beg for money on the streets. Now days no one ever seems to have cash on them. So we thought we would give strangers the option of using credit cards to help out their fellow man. -

Wife Catches Starbucks Barista Stealing $212 From Her Credit Card ft. Chris Dinh & David So

A military wife confronts a Starbucks drive-thru cashier who admits to stealing $212 worth on her credit card Previous Video: http://bit.ly/1IVdJlv Follow Us On SoundCloud: https://soundcloud.com/justkiddingnews Subscribe To JustKiddingNews Podcasts on iTunes: http://bit.do/justkiddingnews Baristealer News - http://www.dailymail.co.uk/news/article-3383500/California-customer-confronts-Starbucks-employee-credit-card-theft.html Special Thanks to Our Guest & Friend: Chris Dinh • YouTube: https://www.youtube.com/user/WongFuProductions • Facebook: https://www.facebook.com/wongfuproductions • Twitter: https://www.twitter.com/chrisdinh • Instagram: https://www.instagram.com/chrisdinh David So • YouTube: http://youtube.com/davidsocomedy • Facebook: http://facebook.com/dsocomedy • Twitter:... -

Look! Cyber Thieves Install Credit Card Skimmer In 3 Seconds

www.undergroundworldnews.com A video showing a man installing a credit card skimmer at a store counter within three seconds demonstrates just how easy it is to set up the illegal devices. Footage of the quick fire installation was captured on a CCTV camera at a gas station in Miami, Florida and released by police. Learn More: https://www.rt.com/viral/335712-card-skimmer-install-video/ -

New Credit Card Chip Unveiled and Important Information You Need to Know

Find out the best way to protect yourself and maximize perks and rewards on your card. -

Fake a Credit Card

Fraudsters rack up millions of dollars in merchandise using fake credit cards with legit numbers hacked off the Internet. Detective Bob Watts of Newport Beach PD shows how it's done. -

Best Cash Back Credit Cards for 2015

The best credit cards to apply for to get the most cash back in 2015. Sign up, get rewards, then cancel the card, rinse repeat. The cards mentioned are: Citi Double Cash Citi Thank You Premier Fidelity Investment Rewards American Express Blue Cash

Credit Card * 2015 * Bangla Full Video Natok - Mehazabien,Tawsif - HD 1080p )

- Order: Reorder

- Duration: 41:55

- Updated: 30 Jun 2015

- views: 174550

- published: 30 Jun 2015

- views: 174550

5 Credit Card Mistakes to Avoid at All Costs!

- Order: Reorder

- Duration: 4:41

- Updated: 16 Nov 2012

- views: 95522

- published: 16 Nov 2012

- views: 95522

Credit Card Thieves Caught on Tape Using Skimmers | Nightline | ABC News

- Order: Reorder

- Duration: 5:21

- Updated: 27 Jun 2014

- views: 613852

- published: 27 Jun 2014

- views: 613852

IT WORKS!! CREDIT CARD MADE FROM CARDBOARD AND OLD VHS TAPE

- Order: Reorder

- Duration: 2:36

- Updated: 21 Feb 2016

- views: 1112

- published: 21 Feb 2016

- views: 1112

Credit Card Debt Explained With a Glass of Water

- Order: Reorder

- Duration: 3:25

- Updated: 02 Mar 2010

- views: 244485

- published: 02 Mar 2010

- views: 244485

MAXED OUT MY CREDIT CARD!!

- Order: Reorder

- Duration: 7:33

- Updated: 06 Feb 2016

- views: 30249

Improve Your Credit Score QUICKLY! (Credit Card Utilization)

- Order: Reorder

- Duration: 5:51

- Updated: 12 Jul 2015

- views: 4469

- published: 12 Jul 2015

- views: 4469

What's wrong with using credit cards if we pay them off?

- Order: Reorder

- Duration: 4:30

- Updated: 02 Jan 2014

- views: 134618

- published: 02 Jan 2014

- views: 134618

Four Year Strong "Stolen Credit Card" Official Music Video

- Order: Reorder

- Duration: 4:30

- Updated: 02 Sep 2015

- views: 126513

- published: 02 Sep 2015

- views: 126513

How Credit Card Processing Works - Transaction Cycle & 2 Pricing Models

- Order: Reorder

- Duration: 8:10

- Updated: 04 Apr 2014

- views: 74108

- published: 04 Apr 2014

- views: 74108

Adam Ruins Everything - Why Your Credit Card Is Never Secure (Excerpt)

- Order: Reorder

- Duration: 1:36

- Updated: 01 Oct 2015

- views: 1326749

- published: 01 Oct 2015

- views: 1326749

Why Should I Get A Credit Card? | Business Video!

- Order: Reorder

- Duration: 5:48

- Updated: 29 Jul 2015

- views: 17531

- published: 29 Jul 2015

- views: 17531

What's a Credit Card?

- Order: Reorder

- Duration: 3:16

- Updated: 14 Sep 2010

- views: 78739

- published: 14 Sep 2010

- views: 78739

DAHIL SA UTANG SA CREDIT CARD, SINIBAK NG AMO!

- Order: Reorder

- Duration: 23:21

- Updated: 19 May 2015

- views: 71940

How Credit Cards Are Made

- Order: Reorder

- Duration: 6:09

- Updated: 02 Jul 2009

- views: 813737

- published: 02 Jul 2009

- views: 813737

American Underworld - Credit card theft.

- Order: Reorder

- Duration: 13:13

- Updated: 30 Sep 2011

- views: 261638

- published: 30 Sep 2011

- views: 261638

Watch: Starbucks customer confronts employee for stealing credit card info

- Order: Reorder

- Duration: 2:10

- Updated: 05 Jan 2016

- views: 27005

- published: 05 Jan 2016

- views: 27005

Homeless Credit Card Experiment

- Order: Reorder

- Duration: 4:08

- Updated: 05 Jun 2014

- views: 481068

- published: 05 Jun 2014

- views: 481068

Wife Catches Starbucks Barista Stealing $212 From Her Credit Card ft. Chris Dinh & David So

- Order: Reorder

- Duration: 10:18

- Updated: 11 Jan 2016

- views: 472391

- published: 11 Jan 2016

- views: 472391

Look! Cyber Thieves Install Credit Card Skimmer In 3 Seconds

- Order: Reorder

- Duration: 1:12

- Updated: 16 Mar 2016

- views: 1200

- published: 16 Mar 2016

- views: 1200

New Credit Card Chip Unveiled and Important Information You Need to Know

- Order: Reorder

- Duration: 1:45

- Updated: 02 Oct 2015

- views: 6339

- published: 02 Oct 2015

- views: 6339

Fake a Credit Card

- Order: Reorder

- Duration: 3:38

- Updated: 24 Dec 2008

- views: 1770118

- published: 24 Dec 2008

- views: 1770118

Best Cash Back Credit Cards for 2015

- Order: Reorder

- Duration: 4:26

- Updated: 07 Aug 2015

- views: 17873

- published: 07 Aug 2015

- views: 17873

-

How to Make apple ID for free with out CreditCard Details Online

Make apple ID for free with out credit or Debit Card Details and download Free apps from app store iTunes download Link : http://www.apple.com/itunes/download/ Like us on Facebook https://www.facebook.com/iphoneunlock... Subscribe us on Youtube : https://www.youtube.com/subscription_... Followus on Twitter : https://www.twitter.com/iphoneunlocknp -

How to Repair Bad Credit in 20 Days using Simple Letter that Works!

How to Repair Bad Credit in 20 Days using Simple Letter that Works! Qualitycreditrepair-individual http://bit.ly/21uFdBA Download or Visit here http://bit.ly/21uFdBA If you are online looking for: - Debt Management Tips - how to get out of credit card debt - credit card consolidation - credit card relief - free credit report - debt consolidation - how to get out of debt - debt consolidation loan - freedom debt relief - debt consolidation companies - debt consolidation information - free debt advice - Suze Orman - Zeitgeist - Credit Card Debt -

How to Repair Bad Credit in 20 Days using Simple Letter that Works!

How to Repair Bad Credit in 20 Days using Simple Letter that Works! Qualitycreditrepair-individual http://bit.ly/21uFdBA Download or Visit here http://bit.ly/21uFdBA If you are online looking for: - Debt Management Tips - how to get out of credit card debt - credit card consolidation - credit card relief - free credit report - debt consolidation - how to get out of debt - debt consolidation loan - freedom debt relief - debt consolidation companies - debt consolidation information - free debt advice - Suze Orman - Zeitgeist - Credit Card Debt -

How I Fixed Credit Fast: Removed Collections, Charge-off, and Adverse Accounts - 30 Days - Secret!

How I Fixed Credit Fast: Removed Collections, Charge-off, and Adverse Accounts - 30 Days - Secret! RepairDebt http://bit.ly/1WpDn3L Download or Visit here http://bit.ly/1WpDn3L If you are online looking for: - Debt Management Tips - how to get out of credit card debt - credit card consolidation - credit card relief - free credit report - debt consolidation - how to get out of debt - debt consolidation loan - freedom debt relief - debt consolidation companies - debt consolidation information - free debt advice - Suze Orman - Zeitgeist - Credit Card Debt -

ADVERSE CREDIT REMORTGAGES - LOANS FOR BAD CREDIT

ADVERSE CREDIT REMORTGAGES - LOANS FOR BAD CREDIT Remortgages http://bit.ly/1QWIUP2 Download or Visit here http://bit.ly/1QWIUP2 If you are online looking for: - Debt Management Tips - how to get out of credit card debt - credit card consolidation - credit card relief - free credit report - debt consolidation - how to get out of debt - debt consolidation loan - freedom debt relief - debt consolidation companies - debt consolidation information - free debt advice - Suze Orman - Zeitgeist - Credit Card Debt -

Credit card

-

7 Habits of Women With High Credit Scores

7 Habits of Women With High Credit Scores and how you can model them! https://CreditCEO.com My name is Jesse Rodriguez and I am the author of The Credit Blueprint. I am frequently asked, “As a woman what can I do to improve my credit and have really good credit scores?” Well, I'm going to break it down for you right now! 1. Check Your Credit Regularly I recommend that you sign up for a paid credit monitoring service that we reviews all Three Credit Bureaus and sends you a notification when something changes. You can go to our website and order your 3 Bureau Credit Report, with credit monitoring, and it will include a Million Dollars of identity theft protection insurance. Link: https://CreditCEO.com/Report 2. Never Make Unnecessary Purchases on Your Credit Cards You don't want to b... -

Home Deport credit card breach: How to protect yourself

It's happened again. Home Depot has confirmed a massive breach of credit card data, possibly the biggest ever. Last night the company confirmed that hackers may have been stealing customer data since last April. People close to the situation say as many as 60 million credit card numbers may have been stolen. That would make this the biggest attack of its kind in history. -

-

Foothill Credit Union EMV Chip Card

Foothill Credit Union MasteCards now come with chip-enabled security features. -

4650 42 DELETE Payables Record Marked As PAID BY CREDIT CARD

How to delete a payables transaction (vendor bill) that was marked as paid by Credit Card. -

how to create apple id free without credit card

hello friends today i will show how to make free apple id 100%free if you want to know please flow my video please visit -- http://besttutorial-e-m.blogspot.ae/ iTunes 64bit -- https://www.dropbox.com/s/oa060yywey4dfp7/iTunes%2064bit.rar?dl=0 iTunes 32bit -- https://www.dropbox.com/s/79ne1dqaiugl125/iTunes%2032bit.zip?dl=0 -

-

Money Belt with RFID Blocking to Protect Credit Card Chip

You can wear this travel wallet when you're out and about all over town. Get your monies worth in use with this travel wallet/money belt. It is thinner and lighter than a bulky fanny pack. Visit www.RhinoOutlet.com to learn more and order one today! Amazon: http://www.amazon.com/dp/B01668DRFE -

The Iain Sinclair Cardsharp Credit Card Folding Safety Knife is a really neat concept

The Iain Sinclair Cardsharp Credit Card Folding Safety Knife is a really neat concept For the full details, please find on: http://amzn.to/1UWVnE2 -

Making the most of your credit card rewards

Whether its getting cash back, airline miles or just boosting your credit, we all want to feel like were winning the credit card rewards game. -

Here's exactly how much your stolen credit card info is worth to hackers

The more data a cyber thief can collect from your cards, the more its worth. -

The do's and donts of using credit cards during the holidays

The holidays are in full swing and so is the spending that comes along with them. In the frenzy of last-minute shopping, you could make some credit card mistakes that will stick around much longer than that hangover on New Years Day. Follow a few simple do's and donts this holiday season to be proactive when paying with plastic. -

Reviewing A New Credit Card Holder

A review of the new credit card holder from https://www.ehauer.com/ by Black Cab Product Reviews. In this video Black Cab Product Reviews take a look at the new Ehauer credit card holder to see how it improves the lifestyle of anyone purchasing one for personal or business use. The card holder is supplied in a ready made gift box so buying it as a gift for someone makes perfect sense. During the review it is made clear that the black metal case is a really slim design made out of stainless steel which adds to its strength. Further information about card holders can be found here: https://www.youtube.com/playlist?list=PL9KGpGhobZZ_D5Ft95D2dpjedbmrnUMJl Once the metal case is opened the reviewer points out there are six individual pockets to hold each card separately to provide protecti... -

Money Minute: Credit card perks you never knew about

Yahoo Finance's Mandi Woodruff explains credit card perks you never knew about in this weeks' Money Minute. -

2 Credit card RFID protector. #sefcard

-

Smarter U Video Series: Building Credit with a Starter Credit Card

Are you just starting to build your credit? We can help. In this Smarter U video, you'll learn how to choose the right credit card to help you build a solid credit history. -

HOW TO GET FREE UNLIMITED PLAYSTATION/PS4 PLUS GLITCH (NO CREDIT CARD) 2016

Thanks for watching Introducing the World Premiere of my YouTube Channel trailer how to download free games. how to download play station games. how to download free sega games. how to update games. how to download games crack. how to get free xbox games how to get free ps4 games how to get free ps3 games how to get steam free games And much more :) PlayStation games. Tutorials how to play games How to download free Ps4 games. PlayStation vs Xbox. PlayStation review. I hope you will join me on my journey through life. Please Give it a big thumbs up !! Thanks for opening the description, and watching the video! Please make sure to smack that like button and subscribe for more awesome videos just like this one! Also comment below if you have any suggestions or need help with anything....

How to Make apple ID for free with out CreditCard Details Online

- Order: Reorder

- Duration: 7:08

- Updated: 30 Mar 2016

- views: 2

- published: 30 Mar 2016

- views: 2

How to Repair Bad Credit in 20 Days using Simple Letter that Works!

- Order: Reorder

- Duration: 5:40

- Updated: 30 Mar 2016

- views: 0

- published: 30 Mar 2016

- views: 0

How to Repair Bad Credit in 20 Days using Simple Letter that Works!

- Order: Reorder

- Duration: 6:11

- Updated: 30 Mar 2016

- views: 0

- published: 30 Mar 2016

- views: 0

How I Fixed Credit Fast: Removed Collections, Charge-off, and Adverse Accounts - 30 Days - Secret!

- Order: Reorder

- Duration: 6:06

- Updated: 30 Mar 2016

- views: 0

- published: 30 Mar 2016

- views: 0

ADVERSE CREDIT REMORTGAGES - LOANS FOR BAD CREDIT

- Order: Reorder

- Duration: 5:07

- Updated: 30 Mar 2016

- views: 0

- published: 30 Mar 2016

- views: 0

Credit card

- Order: Reorder

- Duration: 0:06

- Updated: 30 Mar 2016

- views: 4

- published: 30 Mar 2016

- views: 4

7 Habits of Women With High Credit Scores

- Order: Reorder

- Duration: 3:44

- Updated: 30 Mar 2016

- views: 7

- published: 30 Mar 2016

- views: 7

Home Deport credit card breach: How to protect yourself

- Order: Reorder

- Duration: 2:20

- Updated: 29 Mar 2016

- views: 0

- published: 29 Mar 2016

- views: 0

алиэкспресс обзоры iphone 7 Кредитка мультитул 11в1 credit card multi tool

- Order: Reorder

- Duration: 6:24

- Updated: 29 Mar 2016

- views: 1

Foothill Credit Union EMV Chip Card

- Order: Reorder

- Duration: 1:29

- Updated: 29 Mar 2016

- views: 0

- published: 29 Mar 2016

- views: 0

4650 42 DELETE Payables Record Marked As PAID BY CREDIT CARD

- Order: Reorder

- Duration: 8:29

- Updated: 29 Mar 2016

- views: 4

- published: 29 Mar 2016

- views: 4

how to create apple id free without credit card

- Order: Reorder

- Duration: 11:15

- Updated: 29 Mar 2016

- views: 8

- published: 29 Mar 2016

- views: 8

66 Ad Packs. Credit Card Traffic Monsoon!!!

- Order: Reorder

- Duration: 2:20

- Updated: 29 Mar 2016

- views: 5

Money Belt with RFID Blocking to Protect Credit Card Chip

- Order: Reorder

- Duration: 0:55

- Updated: 29 Mar 2016

- views: 1

- published: 29 Mar 2016

- views: 1

The Iain Sinclair Cardsharp Credit Card Folding Safety Knife is a really neat concept

- Order: Reorder

- Duration: 6:32

- Updated: 29 Mar 2016

- views: 0

- published: 29 Mar 2016

- views: 0

Making the most of your credit card rewards

- Order: Reorder

- Duration: 2:26

- Updated: 29 Mar 2016

- views: 5

- published: 29 Mar 2016

- views: 5

Here's exactly how much your stolen credit card info is worth to hackers

- Order: Reorder

- Duration: 1:02

- Updated: 29 Mar 2016

- views: 0

- published: 29 Mar 2016

- views: 0

The do's and donts of using credit cards during the holidays

- Order: Reorder

- Duration: 1:34

- Updated: 29 Mar 2016

- views: 1

- published: 29 Mar 2016

- views: 1

Reviewing A New Credit Card Holder

- Order: Reorder

- Duration: 2:07

- Updated: 29 Mar 2016

- views: 0

- published: 29 Mar 2016

- views: 0

Money Minute: Credit card perks you never knew about

- Order: Reorder

- Duration: 1:12

- Updated: 29 Mar 2016

- views: 1

- published: 29 Mar 2016

- views: 1

2 Credit card RFID protector. #sefcard

- Order: Reorder

- Duration: 0:04

- Updated: 29 Mar 2016

- views: 0

- published: 29 Mar 2016

- views: 0

Smarter U Video Series: Building Credit with a Starter Credit Card

- Order: Reorder

- Duration: 2:25

- Updated: 29 Mar 2016

- views: 0

- published: 29 Mar 2016

- views: 0

HOW TO GET FREE UNLIMITED PLAYSTATION/PS4 PLUS GLITCH (NO CREDIT CARD) 2016

- Order: Reorder

- Duration: 6:13

- Updated: 29 Mar 2016

- views: 61

- published: 29 Mar 2016

- views: 61

-

Peter R de Vries De Zaak CREDITCARD Oplichters + aantal moorden 1/2

-

Peter R de Vries De Zaak CREDITCARD Oplichters + aantal moorden 2/2

-

Finite - Credit Card Interest

Not all math centers around algebra and geometry. Here's a lesson in consumer math, regarding how the credit card companies assess interest on debt using the average daily balance method. A hugely important topic for all of us, especially in today's economy, it 'pays' to be wiser. YAY MATH! Please visit yaymath.org Videos copyright (c) Yay Math -

Credit Card Ka Khooni Raaz - Episode 547

CID has found a skull in a resort and there is nothing at the first sight that could lead to anything possibly. Will CID be able to solve this case with just a credit card? The first thrilling investigative series on Indian Television, is today one of the most popular shows on Sony Entertainment Television. Dramatic and absolutely unpredictable, C.I.D. has captivated viewers over the last eleven years and continues to keep audiences glued to their television sets with its thrilling plots and excitement. Also interwoven in its fast paced plots are the personal challenges that the C.I.D. team faces with non-stop adventure, tremendous pressure and risk, all in the name of duty. The series consists of hard-core police procedural stories dealing with investigation, detection and suspense. The... -

Drama Time - That Credit Card

Everyone has a story to tell, share yours with us at drama@preachgaming.com -

Sar e Aam Your Credit Cards,ATM Cards And Bank Accounts Are Unprotected

Sar e Aam Your Credit Cards,ATM Cards And Bank Accounts Are Unprotected Sar e Aam Your Credit Cards,ATM Cards And Bank Accounts Are Unprotected Sar e Aam Your Credit Cards,ATM Cards And Bank Accounts Are Unprotected -

Handling Credit Cards

-

Handling Credit Cards

Learn how to record purchases and payment, interest and fees and most importantly how to budget your way out of debt. -

How Credit-Card Debt is Choking American Prosperity: College Students & Personal Debt (2002)

Declines in credit card debt are often misinterpreted because they fail to include information about charge-offs. The possible causes for a decline in credit card debt are consumers paying down their debt, credit card companies writing charged-off debt off their books, or a combination of the two. Inclusion of charged-off debt can therefore significantly impact debt trends and the characterization of a nation's financial health.[5] For example, the $10.3 billion decrease in outstanding credit card debt in Q3 2010 relative to the previous quarter might at first glance seem to be a significant consumer pay down. However, considering that the Q3 credit card charge-off rate was $16.9 billion,[2] consumers actually increased their overall debt by $6.6 billion during this quarter. Consumers also... -

QuickBooks Online Tutorial - how to enter credit card in the new QuickBooks Online (QBO)

http://newQBO.com ●●► This quick and easy tutorial video shows you how to manually enter credit card transactions (charges, payments and credits) in the new QuickBooks Online (QBO). 1) how to enter credit card charges 2) how enter credit card payments 3) how to enter credit card credit for returned items or bonus credit Another top-rated tutorial video offered by VPController for newQBO.com -

Naya Mahi Sagar | Credit Card Challenge | Ep 25

Big Magic presents Naya Mahi Sagar Ep 25 Credit Card Challenge. In this episode mahi ask ansuiya how to use credit card but ansuiya make laugh of mahi so mahi take it as a challenge.Watch full episode to know what happen next. BIG MAGIC the flagship national Hindi general entertainment channel from the Reliance Broadcast Network and is positioned as the one stop destination for humor. The Channel offers a comical line up of hilarious sitcoms, a side splitting historical comedy, laugh out loud weekend specials, festive specials and comedy blockbuster films. Subscribe to our Youtube channel by clicking this link http://www.youtube.com/user/RBNLgroup?sub_confirmation=1 You can also connect to us on our social handles mentioned below Facebook: https://www.facebook.com/BIGMagicChannel Googl... -

-

Inside a Professional Credit Card Fraud Operation - The Art of Charm Podcast Bonus Episode

http://theArtofCharmPodcast.com http://theArtofCharm.com "Fool me once, Shame on you. Fool me twice, Shame on me." -- Chinese Proverb Jordan Harbinger of The Art of Charm takes a rare glimpse inside the business and mind of a professional credit card fraudster and social engineer. In this episode, we will: -Learn about the internet criminal underworld even before the infamous Silk Road -Meet one of the former top dogs from the site, and hear how he started his credit card fraud business -How he went to jail and why -How he made thousands from fraud and how easy it was -How to reprogram credit cards -How social engineering is crucial to the scam's success -How he took his credit card factory mobile -How he got caught and became an informant for the FBI -How he snitched on the Russian mafi... -

DEFCON 13: Credit Cards: Everything You have Ever Wanted to Know

Speaker: Robert "hackajar" Imhoff-Dousharm, Merchant Credit Card Consultant, Hackajar Group Identity theft is at an all time high. With businesses, universities and banks being compromised the threat is real right now. The media covers these area's but miss one important location that your most suseptiable to fraud, everywhere you swipe your credit card. We will pull out all the stops to help you understand credit cards, their history and how to protect yourself. Ever wonder what was in the magnetic strip of a card? Where that information goes? Who keeps your personal information, and for how long? Who is data mining this information? Who do they sell it to? All these questions and more will be answered in this presentation Defcon 11 we talked about social engineering to steal your cred... -

Knife Review : Iain Sinclair "CardSharp 2" [Credit Card Size Folding Knife]

http://www.amazon.com/gp/product/B008QB68R4/ref=as_li_tl?ie=UTF8&camp;=211189&creative;=373489&creativeASIN;=B008QB68R4&link;_code=as3&tag;=cutlerylover-20&linkId;=ZA6AVMKDH2DM3RZI http://www.amazon.com/gp/product/B0001WOKWQ/ref=as_li_tl?ie=UTF8&camp;=211189&creative;=373489&creativeASIN;=B0001WOKWQ&link;_code=as3&tag;=cutlerylover-20&linkId;=QN44GUODRY4ZTHQ6 -

-

Sare Aam Bank Credit Card Fraud Nothing Safe in Pakistan 2015

Sare Aam Bank Credit Card Fraud Nothing Safe in Pakistan 2015 -

Bank & Credit Card Debt is False Money Owed - Get Out Of Debt Free - John Witterick

A rtunes video. Johh Witterick explains how Banks manufacture money out of thin air but yet charge you interest you have to work hard for to pay off. Fractional Reserve Banking has been a bane on society and when you buy a house the money is not in the bank....it is created from nothing with your signature and promise to pay. Your work validates the money. Money created out of nothing lent out to you at exhorbitant interest rates. Be it the Bank of England or the Federal Reserve...they operate much the same way. Its called The Fiat Money System. (disclaimer: Views presented here are not necessarily those of the video maker and are presented for educational and informational purposes only ) -

'Bangla Natok' 2015 'Credit Card' Natok Ft Mehjabin eid natok

-

In Debt We Trust Documentary - English Documentary -How Money and Credit Control Your Life

Debt is like a disease that can enable us from living a happy and normal life by taking control over our lives. Most of us don't even know how we end up in the situation we are in. Buying every thing we own with credit has become our culture. But don't let debt control your life any more. You can take over your life again. Imagine life with out debt! -

Credit Card Debt

Peter R de Vries De Zaak CREDITCARD Oplichters + aantal moorden 1/2

- Order: Reorder

- Duration: 30:28

- Updated: 18 Dec 2015

- views: 5862

- published: 18 Dec 2015

- views: 5862

Peter R de Vries De Zaak CREDITCARD Oplichters + aantal moorden 2/2

- Order: Reorder

- Duration: 30:31

- Updated: 18 Dec 2015

- views: 6129

- published: 18 Dec 2015

- views: 6129

Finite - Credit Card Interest

- Order: Reorder

- Duration: 27:22

- Updated: 26 Feb 2013

- views: 12670

- published: 26 Feb 2013

- views: 12670

Credit Card Ka Khooni Raaz - Episode 547

- Order: Reorder

- Duration: 38:55

- Updated: 01 Jul 2011

- views: 212621

- published: 01 Jul 2011

- views: 212621

Drama Time - That Credit Card

- Order: Reorder

- Duration: 54:27

- Updated: 08 Aug 2014

- views: 74079

- published: 08 Aug 2014

- views: 74079

Sar e Aam Your Credit Cards,ATM Cards And Bank Accounts Are Unprotected

- Order: Reorder

- Duration: 32:44

- Updated: 23 Aug 2015

- views: 15736

- published: 23 Aug 2015

- views: 15736

Handling Credit Cards

- Order: Reorder

- Duration: 59:32

- Updated: 29 Oct 2015

- views: 2077

- published: 29 Oct 2015

- views: 2077

Handling Credit Cards

- Order: Reorder

- Duration: 26:12

- Updated: 05 Apr 2013

- views: 40700

- published: 05 Apr 2013

- views: 40700

How Credit-Card Debt is Choking American Prosperity: College Students & Personal Debt (2002)

- Order: Reorder

- Duration: 50:24

- Updated: 25 Sep 2013

- views: 16201

- published: 25 Sep 2013

- views: 16201

QuickBooks Online Tutorial - how to enter credit card in the new QuickBooks Online (QBO)

- Order: Reorder

- Duration: 20:13

- Updated: 21 May 2014

- views: 18026

- published: 21 May 2014

- views: 18026

Naya Mahi Sagar | Credit Card Challenge | Ep 25

- Order: Reorder

- Duration: 21:01

- Updated: 28 Mar 2016

- views: 139

- published: 28 Mar 2016

- views: 139

PowLitie - Credit card fraude

- Order: Reorder

- Duration: 24:33

- Updated: 29 Apr 2014

- views: 45297

Inside a Professional Credit Card Fraud Operation - The Art of Charm Podcast Bonus Episode

- Order: Reorder

- Duration: 45:56

- Updated: 27 Jun 2014

- views: 34422

- published: 27 Jun 2014

- views: 34422

DEFCON 13: Credit Cards: Everything You have Ever Wanted to Know

- Order: Reorder

- Duration: 48:38

- Updated: 01 Feb 2011

- views: 7773

- published: 01 Feb 2011

- views: 7773

Knife Review : Iain Sinclair "CardSharp 2" [Credit Card Size Folding Knife]

- Order: Reorder

- Duration: 20:25

- Updated: 06 Apr 2013

- views: 279497

- published: 06 Apr 2013

- views: 279497

Highway Patrol 21 in Credit Card

- Order: Reorder

- Duration: 25:58

- Updated: 03 Jun 2014

- views: 25487

Sare Aam Bank Credit Card Fraud Nothing Safe in Pakistan 2015

- Order: Reorder

- Duration: 27:25

- Updated: 25 May 2015

- views: 1157

Bank & Credit Card Debt is False Money Owed - Get Out Of Debt Free - John Witterick

- Order: Reorder

- Duration: 67:19

- Updated: 02 Nov 2012

- views: 77914

- published: 02 Nov 2012

- views: 77914

'Bangla Natok' 2015 'Credit Card' Natok Ft Mehjabin eid natok

- Order: Reorder

- Duration: 43:48

- Updated: 20 Nov 2015

- views: 2004

- published: 20 Nov 2015

- views: 2004

In Debt We Trust Documentary - English Documentary -How Money and Credit Control Your Life

- Order: Reorder

- Duration: 86:25

- Updated: 23 Apr 2013

- views: 231433

- published: 23 Apr 2013

- views: 231433

Credit Card Debt

- Order: Reorder

- Duration: 35:25

- Updated: 06 Nov 2014

- views: 1866

- published: 06 Nov 2014

- views: 1866

- Playlist

- Chat

- Playlist

- Chat

Credit Card * 2015 * Bangla Full Video Natok - Mehazabien,Tawsif - HD 1080p )

- Report rights infringement

- published: 30 Jun 2015

- views: 174550

5 Credit Card Mistakes to Avoid at All Costs!

- Report rights infringement

- published: 16 Nov 2012

- views: 95522

Credit Card Thieves Caught on Tape Using Skimmers | Nightline | ABC News

- Report rights infringement

- published: 27 Jun 2014

- views: 613852

IT WORKS!! CREDIT CARD MADE FROM CARDBOARD AND OLD VHS TAPE

- Report rights infringement

- published: 21 Feb 2016

- views: 1112

Credit Card Debt Explained With a Glass of Water

- Report rights infringement

- published: 02 Mar 2010

- views: 244485

MAXED OUT MY CREDIT CARD!!

- Report rights infringement

- published: 06 Feb 2016

- views: 30249

Improve Your Credit Score QUICKLY! (Credit Card Utilization)

- Report rights infringement

- published: 12 Jul 2015

- views: 4469

What's wrong with using credit cards if we pay them off?

- Report rights infringement

- published: 02 Jan 2014

- views: 134618

Four Year Strong "Stolen Credit Card" Official Music Video

- Report rights infringement

- published: 02 Sep 2015

- views: 126513

How Credit Card Processing Works - Transaction Cycle & 2 Pricing Models

- Report rights infringement

- published: 04 Apr 2014

- views: 74108

Adam Ruins Everything - Why Your Credit Card Is Never Secure (Excerpt)

- Report rights infringement

- published: 01 Oct 2015

- views: 1326749

Why Should I Get A Credit Card? | Business Video!

- Report rights infringement

- published: 29 Jul 2015

- views: 17531

What's a Credit Card?

- Report rights infringement

- published: 14 Sep 2010

- views: 78739

DAHIL SA UTANG SA CREDIT CARD, SINIBAK NG AMO!

- Report rights infringement

- published: 19 May 2015

- views: 71940

- Playlist

- Chat

How to Make apple ID for free with out CreditCard Details Online

- Report rights infringement

- published: 30 Mar 2016

- views: 2

How to Repair Bad Credit in 20 Days using Simple Letter that Works!

- Report rights infringement

- published: 30 Mar 2016

- views: 0

How to Repair Bad Credit in 20 Days using Simple Letter that Works!

- Report rights infringement

- published: 30 Mar 2016

- views: 0

How I Fixed Credit Fast: Removed Collections, Charge-off, and Adverse Accounts - 30 Days - Secret!

- Report rights infringement

- published: 30 Mar 2016

- views: 0

ADVERSE CREDIT REMORTGAGES - LOANS FOR BAD CREDIT

- Report rights infringement

- published: 30 Mar 2016

- views: 0

Credit card

- Report rights infringement

- published: 30 Mar 2016

- views: 4

7 Habits of Women With High Credit Scores

- Report rights infringement

- published: 30 Mar 2016

- views: 7

Home Deport credit card breach: How to protect yourself

- Report rights infringement

- published: 29 Mar 2016

- views: 0

алиэкспресс обзоры iphone 7 Кредитка мультитул 11в1 credit card multi tool

- Report rights infringement

- published: 29 Mar 2016

- views: 1

Foothill Credit Union EMV Chip Card

- Report rights infringement

- published: 29 Mar 2016

- views: 0

4650 42 DELETE Payables Record Marked As PAID BY CREDIT CARD

- Report rights infringement

- published: 29 Mar 2016

- views: 4

how to create apple id free without credit card

- Report rights infringement

- published: 29 Mar 2016

- views: 8

Money Belt with RFID Blocking to Protect Credit Card Chip

- Report rights infringement

- published: 29 Mar 2016

- views: 1

- Playlist

- Chat

Peter R de Vries De Zaak CREDITCARD Oplichters + aantal moorden 1/2

- Report rights infringement

- published: 18 Dec 2015

- views: 5862

Peter R de Vries De Zaak CREDITCARD Oplichters + aantal moorden 2/2

- Report rights infringement

- published: 18 Dec 2015

- views: 6129

Finite - Credit Card Interest

- Report rights infringement

- published: 26 Feb 2013

- views: 12670

Credit Card Ka Khooni Raaz - Episode 547

- Report rights infringement

- published: 01 Jul 2011

- views: 212621

Drama Time - That Credit Card

- Report rights infringement

- published: 08 Aug 2014

- views: 74079

Sar e Aam Your Credit Cards,ATM Cards And Bank Accounts Are Unprotected

- Report rights infringement

- published: 23 Aug 2015

- views: 15736

Handling Credit Cards

- Report rights infringement

- published: 29 Oct 2015

- views: 2077

Handling Credit Cards

- Report rights infringement

- published: 05 Apr 2013

- views: 40700

How Credit-Card Debt is Choking American Prosperity: College Students & Personal Debt (2002)

- Report rights infringement

- published: 25 Sep 2013

- views: 16201

QuickBooks Online Tutorial - how to enter credit card in the new QuickBooks Online (QBO)

- Report rights infringement

- published: 21 May 2014

- views: 18026

Naya Mahi Sagar | Credit Card Challenge | Ep 25

- Report rights infringement

- published: 28 Mar 2016

- views: 139

PowLitie - Credit card fraude

- Report rights infringement

- published: 29 Apr 2014

- views: 45297

Inside a Professional Credit Card Fraud Operation - The Art of Charm Podcast Bonus Episode

- Report rights infringement

- published: 27 Jun 2014

- views: 34422

DEFCON 13: Credit Cards: Everything You have Ever Wanted to Know

- Report rights infringement

- published: 01 Feb 2011

- views: 7773

-

Lyrics list:text lyricsplay full screenplay karaoke

Porn and the Threat to Virility

Edit Time Magazine 31 Mar 2016Kim Kardashian, Emily Ratajkowski post topless bathroom pic

Edit New York Daily News 30 Mar 2016Archaeologists Find Rare Etruscan Stone From 2,500 years Ago in Florence

Edit WorldNews.com 30 Mar 2016At least 14 killed, 70 injured as flyover collapses in Kolkata, India

Edit Dawn 31 Mar 2016Test Your News Knowledge With WN.com's March News Quiz

Edit WorldNews.com 31 Mar 2016City of Decatur credit card holders often dine on the taxpayer dime

Edit Atlanta Journal 31 Mar 2016The 10 Cities Where Young Adults Have the Highest Credit Card Utilization Rate (Credit Karma Inc)

Edit Public Technologies 31 Mar 2016Costco's new credit card has some of the best rewards in the market

Edit Yahoo Daily News 31 Mar 2016Tax office to access credit card holder info, transaction data

Edit Jakarta Post 31 Mar 2016Govt to Observe Credit Card Data for Taxation Purpose

Edit Indonesian Business Daily 31 Mar 2016Fire Victims' Credit Card Allegedly Stolen From Their Charred House

Edit St Louis Post-Dispatch 31 Mar 2016American Express Launches Two New Co-Branded Cards with Charles Schwab (American Express Company)

Edit Public Technologies 31 Mar 2016Walmart’s Family of Cards Makes it as Easy as 3-2-1 to Manage Finances for Less (Green Dot Corporation)

Edit Public Technologies 31 Mar 2016Walmart’s Family of Cards Makes it as Easy as 3-2-1 to Manage Finances for Less (Wal-Mart Stores Inc)

Edit Public Technologies 31 Mar 2016Walmart’s Family of Cards Makes it as Easy as 3-2-1 (Synchrony Financial Inc)

Edit Public Technologies 31 Mar 201630/03/2016 | AirPlus Fiscal Year 2015: International growth strategy proves itself (Lufthansa AirPlus Servicekarten GmbH)

Edit Public Technologies 31 Mar 2016- 1

- 2

- 3

- 4

- 5

- Next page »