- published: 03 May 2013

- views: 9179

-

remove the playlistHedge (finance)

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistHedge (finance)

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 27 Jul 2014

- views: 989

- published: 05 May 2014

- views: 1076

- published: 07 Aug 2013

- views: 346027

- published: 12 Feb 2014

- views: 650

- published: 23 Oct 2013

- views: 20244

- published: 05 Dec 2013

- views: 34651

- published: 17 Dec 2012

- views: 117920

- published: 04 Oct 2013

- views: 39978

- published: 18 Oct 2011

- views: 7125

- published: 27 Nov 2012

- views: 1192892

- published: 01 Nov 2014

- views: 398431

A hedge is an investment position intended to offset potential losses that may be incurred by a companion investment. In simple language, Hedge (Hedging Technique) is used to reduce any substantial losses suffered by an individual or an organization.

A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, many types of over-the-counter and derivative products, and futures contracts.

Public futures markets were established in the 19th century to allow transparent, standardized, and efficient hedging of agricultural commodity prices; they have since expanded to include futures contracts for hedging the values of energy, precious metals, foreign currency, and interest rate fluctuations.

Hedging is the practice of taking a position in one market to offset and balance against the risk adopted by assuming a position in a contrary or opposing market or investment. The word hedge is from Old English hecg, originally any fence, living or artificial. The use of the word as a verb in the sense of "dodge, evade" is first recorded in the 1590s; that of insure oneself against loss, as in a bet, is from 1670s.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

6:07

6:07AC3059 Financial Management - Money Market Hedge

AC3059 Financial Management - Money Market Hedge -

5:03

5:03Hedge funds and Investment: What is hedging in Finance?

Hedge funds and Investment: What is hedging in Finance?Hedge funds and Investment: What is hedging in Finance?

Hedge funds and Investment: What is hedging in Finance? Hedging is the practice of reducing risk whilst maximising return on investment. The concept of hedging is explained in this video with simple examples that can be easily related to funds and assets. Also, an exploration of what correlation is, how it works, and why hedging is theoretically a smart form of investment. Hope you enjoy this video!^^ Subscribe to my channel https://www.youtube.com/user/FinanceYi More information on Hedge funds and hedging http://www.investopedia.com/terms/h/hedgefund.asp Even more explanation on hedge funds http://www.barclayhedge.com/research/educational-articles/hedge-fund-strategy-definition/what-is-a-hedge-fund.html Google Plus https://plus.google.com/114412735034814417877/posts -

4:48

4:485 (Financial Instrument) What is Hedge ? Give a Example

5 (Financial Instrument) What is Hedge ? Give a Example5 (Financial Instrument) What is Hedge ? Give a Example

Case FE 4 - What is hedge? Give a example! Solution - By Amlan Dutta Hedging means to protect ...now as far as finance is concerned , there is risk which needs to be protected ...risk can be due to currency , risk due to forex variation , environment (war etc etc ) , business risk etc etc The science of hedging is made simple by the financial instruments available at one's disposal ...forwards, futures , currency swaps etc offer wonderful solutions to the risky environment Let's make all this clear with a example Say , i am a exporter and say i have exported 100 $ worth consignment to IBM , USA ... The payment is due after 6 months .... Presently dollar to Rs is at 60 Rs ....so , i am thinking that i will be receiving 100 x 60 = 6000 Rs after 6 month's...... But there can be so many thing's that happen in this 6 months ....Our economy further strengthen's because of stable Govt formation hope ...People's hope of seeing BJP come in centre comes true and a step of economic measures are taken for the good ! However , the Rs strengthens and goes to 54 ...now when i get 100 $ , it will translate to just 100 x 54 = 5400 Rs after 6 months .... What i can do , however is hedge my risk by entering into a forwards with Authorised dealer ( bank permitted to deal with forex) I go and tell SBI ---hey look , i am getting this 100 4 after 6 months ---it is floating at 60 Rs presently ...i want to book a forward at this rate so that after 6 months, when i get the 100 $ , i can still encash it at 60 Rs per dollar irrespective of the dollar rupee fluctuation .... The bank agrees to hedge my risk taking a certain percent for the transaction ...say 1 % of the contract - 1% of 100 $ = 1 $ = 50 rS So , at a marginal cost , i have now reduced my risk to forex fluctuation I have demonstrated just 1 small demo of hedging , similar hundred other instruments are available to hedge various different risks which come attached with a financial transaction both withinborders (domestic ) and outside (international), Go and share knowledge ...make it open source , If you hide , before you succeed , i will finish it off , Humble regards , Amlan Dutta -

68:12

68:12How to Make Money Like Top Hedge Fund Managers: Secrets of America's Finance Industry (2013)

How to Make Money Like Top Hedge Fund Managers: Secrets of America's Finance Industry (2013)How to Make Money Like Top Hedge Fund Managers: Secrets of America's Finance Industry (2013)

A hedge fund is a collective investment scheme, often structured as a limited partnership, that invests private capital speculatively to maximize capital appreciation. Hedge funds tend to invest in a diverse range of markets, investment instruments, and strategies; today the term "hedge fund" refers more to the structure of the investment vehicle than the investment techniques. Though they are privately owned and operated, hedge funds are subject to the regulatory restrictions of their respective countries. U.S. regulations, for example, limit hedge fund participation to certain classes of investors and also limit the total number of investors allowed in the fund. Hedge funds are often open-ended and allow additions or withdrawals by their investors. A hedge fund's value is calculated as a share of the fund's net asset value, meaning that increases and decreases in the value of the fund's investment assets (and fund expenses) are directly reflected in the amount an investor can later withdraw. Most hedge fund investment strategies aim to achieve a positive return on investment regardless of whether markets are rising or falling ("absolute return"). Hedge fund managers typically invest money of their own in the fund they manage, which serves to align their own interests with those of the investors in the fund. A hedge fund typically pays its investment manager an annual management fee, which is a percentage of the assets of the fund, and a performance fee if the fund's net asset value increases during the year. Some hedge funds have several billion dollars of assets under management (AUM). As of 2009, hedge funds represented 1.1% of the total funds and assets held by financial institutions. As of April 2012, the estimated size of the global hedge fund industry was US$2.13 trillion. Because hedge funds are not sold to the general public or retail investors, the funds and their managers have historically been exempt from some of the regulation that governs other funds and investment managers with regard to how the fund may be structured and how strategies and techniques are employed. Regulations passed in the United States and Europe after the 2008 credit crisis were intended to increase government oversight of hedge funds and eliminate certain regulatory gaps. During the US bull market of the 1920s, there were numerous private investment vehicles available to wealthy investors. Of that period, the best known today, is the Graham-Newman Partnership founded by Benjamin Graham and Jerry Newman which was cited by Warren Buffett, in a 2006 letter to the Museum of American Finance, as an early hedge fund. Financial journalist Alfred W. Jones is credited with coining the phrase "hedged fund" and is erroneously credited with creating the first hedge fund structure in 1949. Jones referred to his fund as being "hedged", a term then commonly used on Wall Street, to describe the management of investment risk due to changes in the financial markets. In 1968 there were almost 200 hedge funds, and the first fund of funds that utilized hedge funds were created in 1969 in Geneva. In the 1970s, hedge funds specialized in a single strategy, and most fund managers followed the long/short equity model. Many hedge funds closed during the recession of 1969--70 and the 1973--1974 stock market crash due to heavy losses. They received renewed attention in the late 1980s. During the 1990s, the number of hedge funds increased significantly, funded with wealth created during the 1990s stock market rise.[9] The increased interest was due to the aligned-interest compensation structure (i.e. common financial interests) and the promise of above high returns. Over the next decade hedge fund strategies expanded to include: credit arbitrage, distressed debt, fixed income, quantitative, and multi-strategy. US institutional investors such as pension and endowment funds began allocating greater portions of their portfolios to hedge funds. http://en.wikipedia.org/wiki/Hedge_fund -

1:40

1:40Hedge Fund Series #2 - What is Hedging?

Hedge Fund Series #2 - What is Hedging?Hedge Fund Series #2 - What is Hedging?

A financial expert Chand Sooran explains what the term 'hedging' means. For more financial knowledge visit The Financial Pipeline website (www.finpipe.com). Financial Education for the Rest of Us -

109:42

109:42How Do Hedge Funds Operate? Financial Markets, Compensation, Taxes, Regulations, Risks (2008)

How Do Hedge Funds Operate? Financial Markets, Compensation, Taxes, Regulations, Risks (2008)How Do Hedge Funds Operate? Financial Markets, Compensation, Taxes, Regulations, Risks (2008)

In June 2006, prompted by a letter from Gary J. Aguirre, the Senate Judiciary Committee began an investigation into the links between hedge funds and independent analysts. Aguirre was fired from his job with the SEC when, as lead investigator of insider trading allegations against Pequot Capital Management, he tried to interview John Mack, then being considered for chief executive officer at Morgan Stanley.[197] The Judiciary Committee and the US Senate Finance Committee issued a scathing report in 2007, which found that Aguirre had been illegally fired in reprisal[198] for his pursuit of Mack and in 2009, the SEC was forced to re-open its case against Pequot. Pequot settled with the SEC for US$28 million and Arthur J. Samberg, chief investment officer of Pequot, was barred from working as an investment advisor.[199] Pequot closed its doors under the pressure of investigations.[200] The systemic practice of hedge funds submitting periodic electronic questionnaires to stock analysts as a part of market research was reported in by The New York Times in July 2012. According to the report, one motivation for the questionnaires was to obtain subjective information not available to the public and possible early notice of trading recommendations that could produce short term market movements. According to modern portfolio theory, rational investors will seek to hold portfolios that are mean/variance efficient (that is, portfolios offer the highest level of return per unit of risk, and the lowest level of risk per unit of return). One of the attractive features of hedge funds (in particular market neutral and similar funds) is that they sometimes have a modest correlation with traditional assets such as equities. This means that hedge funds have a potentially quite valuable role in investment portfolios as diversifiers, reducing overall portfolio risk.[69] However, there are three reasons why one might not wish to allocate a high proportion of assets into hedge funds. These reasons are: Hedge funds are highly individual and it is hard to estimate the likely returns or risks; Hedge funds' low correlation with other assets tends to dissipate during stressful market events, making them much less useful for diversification than they may appear; and Hedge fund returns are reduced considerably by the high fee structures that are typically charged. Several studies have suggested that hedge funds are sufficiently diversifying to merit inclusion in investor portfolios, but this is disputed for example by Mark Kritzman[202][203] who performed a mean-variance optimization calculation on an opportunity set that consisted of a stock index fund, a bond index fund, and ten hypothetical hedge funds. The optimizer found that a mean-variance efficient portfolio did not contain any allocation to hedge funds, largely because of the impact of performance fees. To demonstrate this, Kritzman repeated the optimization using an assumption that the hedge funds incurred no performance fees. The result from this second optimization was an allocation of 74% to hedge funds. The other factor reducing the attractiveness of hedge funds in a diversified portfolio is that they tend to under-perform during equity bear markets, just when an investor needs part of their portfolio to add value.[69] For example, in January--September 2008, the Credit Suisse/Tremont Hedge Fund Index[204] was down 9.87%. According to the same index series, even "dedicated short bias" funds had a return of −6.08% during September 2008. In other words, even though low average correlations may appear to make hedge funds attractive this may not work in turbulent period, for example around the collapse of Lehman Brothers in September 2008. http://en.wikipedia.org/wiki/Hedge_funds -

11:23

11:23Hedge Accounting IAS 39 vs. IFRS 9

Hedge Accounting IAS 39 vs. IFRS 9Hedge Accounting IAS 39 vs. IFRS 9

http://www.ifrsbox.com Get free report Top 7 IFRS Mistakes! On 19 November 2013, new rules for hedge accounting were issued in the amendment to IFRS 9. A hedging is making an investment or acquiring some derivative or non-derivative instruments in order to offset potential losses (or gains) that may be incurred on some items as a result of particular risk. A hedge accounting means designating one or more hedging instruments so that their change in fair value offsets the change in fair value or the change in cash flows of a hedged item. Hedge accounting rules in IAS 39 are too complex and strict. Many companies that actively pursued hedging strategies could not apply hedge accounting in line with IAS 39 because the rules did not allow it. As a result, new hedging rules in IFRS 9 were issued. What do IAS 39 and IFRS 9 have in common: 1. Optional: A hedge accounting is an option, not an obligation -- both in line with IAS 39 and IFRS 9. 2. Terminology: Both standards use the same most important terms: hedged item, hedging instrument, fair value hedge, cash flow hedge, hedge effectiveness, etc. 3. Hedge documentation: Both IAS 39 and IFRS 9 require hedge documentation in order to qualify for a hedge accounting. 4. Categories of hedges: Both IAS 39 and IFRS 9 arrange the hedge accounting for the same categories: fair value hedge, cash flow hedge and net investment hedge. 5. Hedge ineffectiveness: Both IAS 39 and IFRS 9 require accounting for any hedge ineffectiveness in profit or loss. 6. Use of written options as hedging instruments is prohibited by both standards. Differences in hedge accounting between IAS 39 and IFRS 9 Under new IFRS 9 rules, you can apply hedge accounting to more situations as before because the rules are more practical, principle based and less strict. The most important changes: 1. What can be used as a hedging instrument IFRS 9 allows you to use broader range of hedging instruments, so now you can use any non-derivative financial asset or liability measured at fair value through profit or loss. 2. What can be your hedged item With regard to non-financial items IAS 39 allows hedging only a non-financial item in its entirety and not just some risk component of it. IFRS 9 allows hedging a risk component of a non-financial item if that component is separately identifiable and measurable. 3. Testing hedge effectiveness IAS 39 requires numerical tests of hedge effectiveness, both prospectively and retrospectively. IFRS 9 outlines more principle-based criteria with no specific numerical thresholds. 4. Rebalancing IAS 39 required terminating the current hedge relationship and starting the new one. IFRS 9 makes it easier, because it allows certain changes to the hedge relationship without necessity to terminate it and to start the new one. 5. Discontinuing hedge accounting IAS 39 allowed companies to discontinue hedge accounting voluntarily, when the company wants to. IFRS 9 does not permit that. 6. Other differences There is a number of other differences between hedge accounting under IAS 39 and IFRS 9 -- please check this video to learn more! -

7:02

7:0230 Under 30: Wall Street Veteran

30 Under 30: Wall Street Veteran30 Under 30: Wall Street Veteran

Jennifer Fan started working in finance when she was still a teenager, a decade later she is trading commodities for her own $650 million hedge fund. -

2:40

2:40Not Your Mama's Finance Lesson: "What the Heck is a Hedge Fund?"

Not Your Mama's Finance Lesson: "What the Heck is a Hedge Fund?"Not Your Mama's Finance Lesson: "What the Heck is a Hedge Fund?"

Nicole Lapin—financial expert, CNN, CNBC, and Bloomberg anchor—explains what a hedge fund is...in plain English. © 2013 Nothing But Gold Productions -

5:44

5:44Finance Explained: Hedge Funds

Finance Explained: Hedge FundsFinance Explained: Hedge Funds

Today I do my best to explain the theory behind hedge funds. Quick note: When I say "lose nothing", I mean "lose everything". I hope that's an obvious mistake when I say it. I'm not going to re-record it because I'll just end up making a bigger mistake. Next video: Market bubbles. -

43:57

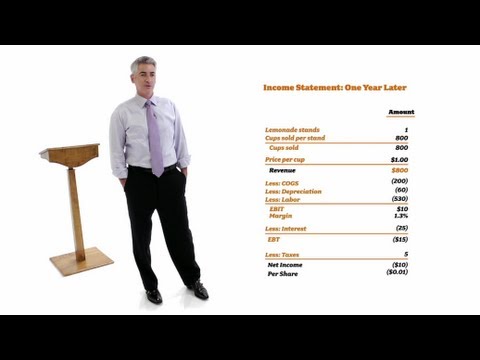

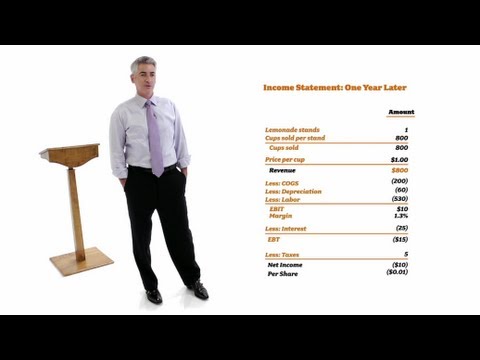

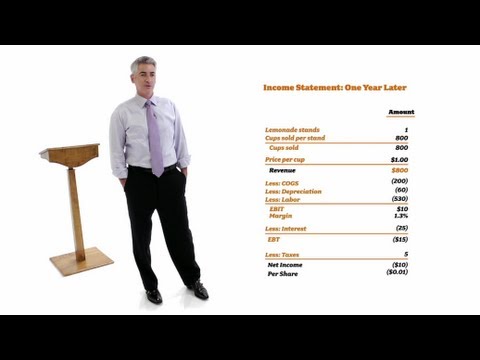

43:57William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

William Ackman: Everything You Need to Know About Finance and Investing in Under an HourWilliam Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour. WILLIAM ACKMAN, Activist Investor and Hedge-Fund Manager We all want to be financially stable and enjoy a well-funded retirement, and we don't want to throw out our hard earned money on poor investments. But most of us don't know the first thing about finance and investing. Acclaimed value investor William Ackman teaches you what it takes to finance and grow a successful business and how to make sound investments that will grant you to a cash-comfy retirement. The Floating University Originally released September 2011. Additional Lectures: Michio Kaku: The Universe in a Nutshell http://www.youtube.com/watch?v=0NbBjNiw4tk Joel Cohen: An Introduction to Demography (Malthus Miffed: Are People the Problem?) http://www.youtube.com/watch?v=2vr44C_G0-o Steven Pinker: Linguistics as a Window to Understanding the Brain http://www.youtube.com/watch?v=Q-B_ONJIEcE Leon Botstein: Art Now (Aesthetics Across Music, Painting, Architecture, Movies, and More.) http://www.youtube.com/watch?v=j6F-sHhmfrY Tamar Gendler: An Introduction to the Philosophy of Politics and Economics http://www.youtube.com/watch?v=mm8asJxdcds Nicholas Christakis: The Sociological Science Behind Social Networks and Social Influence http://www.youtube.com/watch?v=wadBvDPeE4E Paul Bloom: The Psychology of Everything: What Compassion, Racism, and Sex tell us about Human Nature http://www.youtube.com/watch?v=328wX2x_s5g Saul Levmore: Monopolies as an Introduction to Economics http://www.youtube.com/watch?v=FK2qHyF-8u8 Lawrence Summers: Decoding the DNA of Education in Search of Actual Knowledge http://www.youtube.com/watch?v=C6SY6N1iMcU Douglas Melton: Is Biomedical Research Really Close to Curing Anything? http://www.youtube.com/watch?v=Y95hT-koAC8 -

58:39

58:39Traders Millions By The Minute Season 1 Episode 1 Full Episode

Traders Millions By The Minute Season 1 Episode 1 Full EpisodeTraders Millions By The Minute Season 1 Episode 1 Full Episode

Traders: Millions By The Minute takes a look at the fast and fiercely competitive world of financial traders and talks to the men and women who play the markets in London, New York, Chicago and Amsterdam. Season 1, Episode 01 Manhattan hedge fund manager Karen thinks that money is power and as she deal with two sets of twins, a busy social calendar and her $200 million fund on a daily basis. Bob has spent over thirty years jostling for position on Chicago’s cattle futures trading floor, but now he believes that is could be time give up his “trading addiction”. Will and Piers use their expertise to train others in the art of making money from tiny moves in the markets in London. Trading Strategies Live Trade Coaching Binary Options CFD's Futures Equities Commodities FX -

57:55

57:55How to Make More Money Than God: Investment Insights, Hedge Funds and Finance (2010)

How to Make More Money Than God: Investment Insights, Hedge Funds and Finance (2010)How to Make More Money Than God: Investment Insights, Hedge Funds and Finance (2010)

More Money Than God: Hedge Funds and the Making of a New Elite (2010) is a financial book by Sebastian Mallaby. It is a history of the hedge fund industry in the United States looking at the people, institutions, investment tools and concepts of hedge funds. It claims to be the "first authoritative history of the hedge fund industry." It is written for a general audience and originally published by Penguin Press. It was nominated for the 2010 Financial Times and Goldman Sachs Business Book of the Year Award and was one the Wall Street Journal's 10-Best Books of 2010. The Journal said it was "The fullest account we have so far of a too-little-understood business that changed the shape of finance and no doubt will continue to do so." In each chapter, Mallaby takes a narrative focus on one individual or company that played an important role in the history of hedge funds. Mallaby then weaves in other people, ideas or companies related to the star of the chapter. The following are some of the major people, institutions and concepts on a per chapter basis. The first in each list is the central character of that chapter. Ch 1 Big Daddy: A. W. Jones, Hedge fund Ch 2 The Block Trader: Michael Steinhardt, Steinhardt, Fine, Berkowitz & Co., Block trade, Monetary policy Ch 3 Paul Samuelson's Secret: Commodities Corporation, Paul Samuelson, Bruce Kovner (Caxton Corporation), Trend trading, Automated trading system Ch 4 The Alchemist: George Soros, Quantum Fund, Reflexivity, Jim Rogers Ch 5 Top Cat: Julian Robertson, Tiger Management Ch 6 Rock-and-Roll Cowboy: Paul Tudor Jones II Ch 7 White Wednesday: Black Wednesday, Stanley Druckenmiller & George Sorros Ch 8 Hurricane Greenspan: Shadow banking system, Bond market crisis of 1994, Stanley Druckenmiller & George Sorros Ch 9 Soros vs Soros: 1997 Asian financial crisis, 1998 Russian financial crisis, Stanley Druckenmiller & George Sorros Ch 10 The Enemy Is Us: Long-Term Capital Management, John Meriwether Ch 11 The Dot-Com Double: Dot-com bubble, Tiger Management & Quantum Fund Ch 12 The Yale Men: David Swensen, Tom Steyer, Event-driven investing Ch 13 The Code Breakers: Renaissance Technologies, James Simons, David E. Shaw Ch 14 Premonitions of a Crisis: Amaranth Advisors, Brian Hunter Ch 15 Riding the Storm: John Paulson, Subprime mortgage crisis Ch 16 "How Could They Do This": Financial crisis (2007--present) http://en.wikipedia.org/wiki/More_Money_Than_God -

69:08

69:082. The Universal Principle of Risk Management: Pooling and the Hedging of Risks

2. The Universal Principle of Risk Management: Pooling and the Hedging of Risks2. The Universal Principle of Risk Management: Pooling and the Hedging of Risks

Financial Markets (ECON 252) Statistics and mathematics underlie the theories of finance. Probability Theory and various distribution types are important to understanding finance. Risk management, for instance, depends on tools such as variance, standard deviation, correlation, and regression analysis. Financial analysis methods such as present values and valuing streams of payments are fundamental to understanding the time value of money and have been in practice for centuries. 00:00 - Chapter 1. The Etymology of Probability 10:01 - Chapter 2. The Beginning of Probability Theory 15:38 - Chapter 3. Measures of Central Tendency: Independence and Geometric Average 33:12 - Chapter 4. Measures of Dispersion and Statistical Applications 50:39 - Chapter 5. Present Value 01:03:46 - Chapter 6. The Expected Utility Theory and Conclusion Complete course materials are available at the Open Yale Courses website: http://open.yale.edu/courses This course was recorded in Spring 2008.

- Accounting scandals

- Activist shareholder

- Airline

- Algorithmic trading

- Alpha (investment)

- Arbitrage

- Audit

- Bank

- Beta (finance)

- Bond (finance)

- Bond market

- Call option

- Capital budgeting

- Capital Control

- Cash

- Cash flow hedge

- Category Hedge funds

- Central bank

- Commodity

- Commodity market

- Commodity risk

- Competitor

- Concentration risk

- Consumer credit risk

- Consumer debt

- Convergence trade

- Corporate finance

- Credit (finance)

- Credit derivative

- Credit rating agency

- Credit risk

- Crude oil

- Currency option

- Currency risk

- Day trading

- Dedicated short

- Deficit spending

- Delta neutral

- Deposit account

- Derivative (finance)

- Derivatives market

- Economic history

- Electricity market

- Employment contract

- Energy

- Equity risk

- Exchange-traded fund

- Exotic option

- Expected return

- Family office

- FASB 133

- Finance

- Financial economics

- Financial endowment

- Financial instrument

- Financial market

- Financial planner

- Financial regulation

- Financial risk

- Financial statement

- Fixed bill

- Foreign currency

- Forward contract

- Fuel hedging

- Fund of hedge funds

- Fundamental analysis

- Futures contract

- Futures contracts

- Futures market

- Global macro

- Government budget

- Government debt

- Government spending

- Hard currency

- Hazard

- Hedge (finance)

- Hedge accounting

- Hedge fund

- Hedge funds

- Hurricane Katrina

- IAS 39

- Insurance

- Insurance company

- Insurance policy

- Interest rate

- Interest rate parity

- Interest rate risk

- Interest rate swaps

- Investment Bank

- Investor

- Iraq War

- ISO 31000

- Jet fuel

- Legal risk

- Leveraged buyout

- Liquidity risk

- Lists of banks

- Loan

- Long (finance)

- Long short equity

- Market neutral

- Market portfolio

- Market risk

- Married put

- Mathematical finance

- Merchant Bank

- Merger arbitrage

- Money market

- Money supply

- Non-tax revenue

- Obligor

- Operational risk

- Option (finance)

- Options (finance)

- Out of the money

- Pairs trade

- Pension fund

- Personal finance

- Political risk

- Portfolio (finance)

- Precious metal

- Prime brokerage

- Private equity

- Profit (economics)

- Profit risk

- Program trading

- Proprietary trading

- Public finance

- Put option

- Real estate

- Recession

- Refinancing risk

- Reputational risk

- Retail

- Retirement

- Risk

- Risk arbitrage

- Risk parity

- Risk pool

- Risk reversal

- Securitization

- Security (finance)

- Settlement risk

- Sharpe ratio

- Short (finance)

- Short selling

- Southwest Airlines

- Speculation

- Spot market

- Spread

- Stock

- Stock market

- Stock market bubble

- Stock market crash

- Stock trader

- Strike price

- Structured finance

- Superhedging price

- Supply and demand

- Swap (finance)

- Systematic risk

- Systemic risk

- Tax

- Technical analysis

- Template Hedge funds

- Time deposit

- Transfer payment

- Trend following

- Value at risk

- Venture capital

- Volatility arbitrage

- Volatility risk

- Volumetric risk

- Warrant of payment

- Wheat

- Widget (economics)

-

-

Hedge funds and Investment: What is hedging in Finance?

Hedge funds and Investment: What is hedging in Finance? Hedging is the practice of reducing risk whilst maximising return on investment. The concept of hedging is explained in this video with simple examples that can be easily related to funds and assets. Also, an exploration of what correlation is, how it works, and why hedging is theoretically a smart form of investment. Hope you enjoy this video!^^ Subscribe to my channel https://www.youtube.com/user/FinanceYi More information on Hedge funds and hedging http://www.investopedia.com/terms/h/hedgefund.asp Even more explanation on hedge funds http://www.barclayhedge.com/research/educational-articles/hedge-fund-strategy-definition/what-is-a-hedge-fund.html Google Plus https://plus.google.com/114412735034814417877/posts -

5 (Financial Instrument) What is Hedge ? Give a Example

Case FE 4 - What is hedge? Give a example! Solution - By Amlan Dutta Hedging means to protect ...now as far as finance is concerned , there is risk which needs to be protected ...risk can be due to currency , risk due to forex variation , environment (war etc etc ) , business risk etc etc The science of hedging is made simple by the financial instruments available at one's disposal ...forwards, futures , currency swaps etc offer wonderful solutions to the risky environment Let's make all this clear with a example Say , i am a exporter and say i have exported 100 $ worth consignment to IBM , USA ... The payment is due after 6 months .... Presently dollar to Rs is at 60 Rs ....so , i am thinking that i will be receiving 100 x 60 = 6000 Rs after 6 month's...... But there can be so... -

How to Make Money Like Top Hedge Fund Managers: Secrets of America's Finance Industry (2013)

A hedge fund is a collective investment scheme, often structured as a limited partnership, that invests private capital speculatively to maximize capital appreciation. Hedge funds tend to invest in a diverse range of markets, investment instruments, and strategies; today the term "hedge fund" refers more to the structure of the investment vehicle than the investment techniques. Though they are privately owned and operated, hedge funds are subject to the regulatory restrictions of their respective countries. U.S. regulations, for example, limit hedge fund participation to certain classes of investors and also limit the total number of investors allowed in the fund. Hedge funds are often open-ended and allow additions or withdrawals by their investors. A hedge fund's value is calculated as ... -

Hedge Fund Series #2 - What is Hedging?

A financial expert Chand Sooran explains what the term 'hedging' means. For more financial knowledge visit The Financial Pipeline website (www.finpipe.com). Financial Education for the Rest of Us -

How Do Hedge Funds Operate? Financial Markets, Compensation, Taxes, Regulations, Risks (2008)

In June 2006, prompted by a letter from Gary J. Aguirre, the Senate Judiciary Committee began an investigation into the links between hedge funds and independent analysts. Aguirre was fired from his job with the SEC when, as lead investigator of insider trading allegations against Pequot Capital Management, he tried to interview John Mack, then being considered for chief executive officer at Morgan Stanley.[197] The Judiciary Committee and the US Senate Finance Committee issued a scathing report in 2007, which found that Aguirre had been illegally fired in reprisal[198] for his pursuit of Mack and in 2009, the SEC was forced to re-open its case against Pequot. Pequot settled with the SEC for US$28 million and Arthur J. Samberg, chief investment officer of Pequot, was barred from working as... -

Hedge Accounting IAS 39 vs. IFRS 9

http://www.ifrsbox.com Get free report Top 7 IFRS Mistakes! On 19 November 2013, new rules for hedge accounting were issued in the amendment to IFRS 9. A hedging is making an investment or acquiring some derivative or non-derivative instruments in order to offset potential losses (or gains) that may be incurred on some items as a result of particular risk. A hedge accounting means designating one or more hedging instruments so that their change in fair value offsets the change in fair value or the change in cash flows of a hedged item. Hedge accounting rules in IAS 39 are too complex and strict. Many companies that actively pursued hedging strategies could not apply hedge accounting in line with IAS 39 because the rules did not allow it. As a result, new hedging rules in IFRS 9 were issue... -

30 Under 30: Wall Street Veteran

Jennifer Fan started working in finance when she was still a teenager, a decade later she is trading commodities for her own $650 million hedge fund. -

Not Your Mama's Finance Lesson: "What the Heck is a Hedge Fund?"

Nicole Lapin—financial expert, CNN, CNBC, and Bloomberg anchor—explains what a hedge fund is...in plain English. © 2013 Nothing But Gold Productions -

Finance Explained: Hedge Funds

Today I do my best to explain the theory behind hedge funds. Quick note: When I say "lose nothing", I mean "lose everything". I hope that's an obvious mistake when I say it. I'm not going to re-record it because I'll just end up making a bigger mistake. Next video: Market bubbles. -

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour. WILLIAM ACKMAN, Activist Investor and Hedge-Fund Manager We all want to be financially stable and enjoy a well-funded retirement, and we don't want to throw out our hard earned money on poor investments. But most of us don't know the first thing about finance and investing. Acclaimed value investor William Ackman teaches you what it takes to finance and grow a successful business and how to make sound investments that will grant you to a cash-comfy retirement. The Floating University Originally released September 2011. Additional Lectures: Michio Kaku: The Universe in a Nutshell http://www.youtube.com/watch?v=0NbBjNiw4tk Joel Cohen: An Introduction to Demography (Malthus Miffed: Are People the P... -

Traders Millions By The Minute Season 1 Episode 1 Full Episode

Traders: Millions By The Minute takes a look at the fast and fiercely competitive world of financial traders and talks to the men and women who play the markets in London, New York, Chicago and Amsterdam. Season 1, Episode 01 Manhattan hedge fund manager Karen thinks that money is power and as she deal with two sets of twins, a busy social calendar and her $200 million fund on a daily basis. Bob has spent over thirty years jostling for position on Chicago’s cattle futures trading floor, but now he believes that is could be time give up his “trading addiction”. Will and Piers use their expertise to train others in the art of making money from tiny moves in the markets in London. Trading Strategies Live Trade Coaching Binary Options CFD's Futures Equities Commodities FX -

How to Make More Money Than God: Investment Insights, Hedge Funds and Finance (2010)

More Money Than God: Hedge Funds and the Making of a New Elite (2010) is a financial book by Sebastian Mallaby. It is a history of the hedge fund industry in the United States looking at the people, institutions, investment tools and concepts of hedge funds. It claims to be the "first authoritative history of the hedge fund industry." It is written for a general audience and originally published by Penguin Press. It was nominated for the 2010 Financial Times and Goldman Sachs Business Book of the Year Award and was one the Wall Street Journal's 10-Best Books of 2010. The Journal said it was "The fullest account we have so far of a too-little-understood business that changed the shape of finance and no doubt will continue to do so." In each chapter, Mallaby takes a narrative focus on one i... -

2. The Universal Principle of Risk Management: Pooling and the Hedging of Risks

Financial Markets (ECON 252) Statistics and mathematics underlie the theories of finance. Probability Theory and various distribution types are important to understanding finance. Risk management, for instance, depends on tools such as variance, standard deviation, correlation, and regression analysis. Financial analysis methods such as present values and valuing streams of payments are fundamental to understanding the time value of money and have been in practice for centuries. 00:00 - Chapter 1. The Etymology of Probability 10:01 - Chapter 2. The Beginning of Probability Theory 15:38 - Chapter 3. Measures of Central Tendency: Independence and Geometric Average 33:12 - Chapter 4. Measures of Dispersion and Statistical Applications 50:39 - Chapter 5. Present Value 01:03:46 ... -

Financial Mentor - Hedge Funds, Happiness, & Over 15 Years of Early Retirement

http://www.madfientist.com - Todd Tresidder from Financial Mentor joined me for an episode of the Financial Independence Podcast to talk about active investing, finding happiness, and other important lessons learned during 15+ years of early retirement! HIGHLIGHTS - Building wealth with paper assets, real estate, and entrepreneurship - Protecting your money during turbulent times - Pursuing good goals vs. bad goals - Finding happiness both before and after achieving financial independence SHOW LINK http://www.madfientist.com/financial-mentor-interview/ -

1st Annual Finance Conference: Hedge Funds

October 13, 2007. Discussion about hedge funds and the markets. Mr. Scott Barker, Analytic Investors. Mr. Dana Hobson. Bailard. Mr. Peter Sasaki. Logos Capital Management. Dr. Ludwig Chincarini. For more info: www.ludwigbc.com. Ludwig Chincarini productions. To get the book Crisis of Crowding: http://www.amazon.com/The-Crisis-Crowding-Copycats-Bloomberg/dp/1118250028/ref=sr_1_1?ie=UTF8&qid;=1339689840&sr;=8-1&keywords;=the+crisis+of+crowding -

A Rare Interview with the Mathematician Who Cracked Wall Street | Jim Simons | TED Talks

Jim Simons was a mathematician and cryptographer who realized: the complex math he used to break codes could help explain patterns in the world of finance. Billions later, he’s working to support the next generation of math teachers and scholars. TED’s Chris Anderson sits down with Simons to talk about his extraordinary life in numbers. TEDTalks is a daily video podcast of the best talks and performances from the TED Conference, where the world's leading thinkers and doers give the talk of their lives in 18 minutes (or less). Look for talks on Technology, Entertainment and Design -- plus science, business, global issues, the arts and much more. Find closed captions and translated subtitles in many languages at http://www.ted.com/translate Follow TED news on Twitter: http://www.twitter.co... -

The Battle Between Investment Banks, Hedge Funds, and Private Equity on Wall Street (2009)

The investment banking industry, and many individual investment banks, have come under criticism for a variety of reasons, including perceived conflicts of interest, overly large pay packages, cartel-like or oligopolic behavior, taking both sides in transactions, and more. Investment banking has also been criticized for its opacity. Conflicts of interest may arise between different parts of a bank, creating the potential for market manipulation, according to critics. Authorities that regulate investment banking (the FSA in the United Kingdom and the SEC in the United States) require that banks impose a "Chinese wall" to prevent communication between investment banking on one side and equity research and trading on the other. Critics say such a barrier does not always exist in practice, ho... -

WST: Overview of Financial Mkts - Alternatives & Hedge Funds

Wall St. Training Self-Study Instructor, Hamilton Lin, CFA introduces the major jargon and finance terminology in finance. What exactly is the sell-side and the buy-side and do they affect the capital markets and why do they have a symbiotic relationship? What exactly is investment banking, sales & trading and research? How is it that asset management is the flip opposite and yet very similar at the same time? Put those questions to rest with this Overview of Financial Markets overview. This course is offered FREE for six months at: http://www.wstselfstudy.com Register for this course FREE at: http://www.wstselfstudy.com/register Wall St. Training Self-Study Instructor, Hamilton Lin, CFA introduces the major jargon and finance terminology in finance. What exactly is the sell-side ... -

Hedge Fund Honesty Policy : Finance FAQs

Subscribe Now: http://www.youtube.com/subscription_center?add_user=Ehowfinance Watch More: http://www.youtube.com/Ehowfinance Hedge funds typically have an honesty policy that you need to be aware of. Learn about hedge fund honesty policies with help from a certified financial planner in this free video clip. Expert: Wayne Blanchard Contact: www.moneyprofessionals.com Bio: Wayne Blanchard became a Certified Financial Planner in 1986. He has taught money management seminars in college throughout the Florida panhandle. Filmmaker: Andrew Stickel Series Description: The world of finance is a complicated one, so you should always be aware of all of your options before entering into any type of transaction or investment. Get tips on finance with help from a certified financial planner in thi... -

Hedge Funds - Strategies

Get our latest video feeds directly in your browser - add our Live bookmark feeds - http://goo.gl/SXUApX For Google Chrome users download Foxish live RSS to use the Live Feed - http://goo.gl/fd8MPl Academy of Financial Training's Video Tutorials on CFA® Level 1 2014 -- Alternative Investments This session explains the varied types of investment strategies typically followed by Hedge Funds For Ad Free Viewing Please visit : http://goo.gl/NgJSjn SUBSCRIBE for Updates on our Upcoming Training Videos Visit us: http://www.ftacademy.in/ About Us: Academy of Financial Training is training services company that specializes in providing a complete range of finance training services and solutions Since its incorporation AFT has trained more than 5,000 attendees in various finance domains, an... -

Money Management & Personal Finance : What Is a Hedge Fund Accountant?

A hedge fund accountant is the person looking over the books from a hedge fund to determine if investments are making or losing money. Get reports on the health of a hedge fund from a special accountant with advice from a financial consultant in this free video on money management and personal finance. Expert: Roger Groh Bio: Roger Groh is the founder of Groh Asset Management. Filmmaker: Bing Hu -

One Step Ahead: Private Equity and Hedge Funds after the Global Financial Crisis

Part of LSE Department of Law's 'Law & Financial Markets Project' -- for more information, visit http://www.lse.ac.uk/collections/law/projects/lfm.htm The Law and Financial Markets Project is based in the LSE's Law Department. The project provides a framework for a research group of LSE faculty and associated participants from outside academia to explore the interactions of law, regulation, financial markets and financial institutions, principally within the EU and the UK.

AC3059 Financial Management - Money Market Hedge

- Order: Reorder

- Duration: 6:07

- Updated: 03 May 2013

- views: 9179

Hedge funds and Investment: What is hedging in Finance?

- Order: Reorder

- Duration: 5:03

- Updated: 27 Jul 2014

- views: 989

- published: 27 Jul 2014

- views: 989

5 (Financial Instrument) What is Hedge ? Give a Example

- Order: Reorder

- Duration: 4:48

- Updated: 05 May 2014

- views: 1076

- published: 05 May 2014

- views: 1076

How to Make Money Like Top Hedge Fund Managers: Secrets of America's Finance Industry (2013)

- Order: Reorder

- Duration: 68:12

- Updated: 07 Aug 2013

- views: 346027

- published: 07 Aug 2013

- views: 346027

Hedge Fund Series #2 - What is Hedging?

- Order: Reorder

- Duration: 1:40

- Updated: 12 Feb 2014

- views: 650

- published: 12 Feb 2014

- views: 650

How Do Hedge Funds Operate? Financial Markets, Compensation, Taxes, Regulations, Risks (2008)

- Order: Reorder

- Duration: 109:42

- Updated: 23 Oct 2013

- views: 20244

- published: 23 Oct 2013

- views: 20244

Hedge Accounting IAS 39 vs. IFRS 9

- Order: Reorder

- Duration: 11:23

- Updated: 05 Dec 2013

- views: 34651

- published: 05 Dec 2013

- views: 34651

30 Under 30: Wall Street Veteran

- Order: Reorder

- Duration: 7:02

- Updated: 17 Dec 2012

- views: 117920

- published: 17 Dec 2012

- views: 117920

Not Your Mama's Finance Lesson: "What the Heck is a Hedge Fund?"

- Order: Reorder

- Duration: 2:40

- Updated: 04 Oct 2013

- views: 39978

- published: 04 Oct 2013

- views: 39978

Finance Explained: Hedge Funds

- Order: Reorder

- Duration: 5:44

- Updated: 18 Oct 2011

- views: 7125

- published: 18 Oct 2011

- views: 7125

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

- Order: Reorder

- Duration: 43:57

- Updated: 27 Nov 2012

- views: 1192892

- published: 27 Nov 2012

- views: 1192892

Traders Millions By The Minute Season 1 Episode 1 Full Episode

- Order: Reorder

- Duration: 58:39

- Updated: 01 Nov 2014

- views: 398431

- published: 01 Nov 2014

- views: 398431

How to Make More Money Than God: Investment Insights, Hedge Funds and Finance (2010)

- Order: Reorder

- Duration: 57:55

- Updated: 05 Sep 2013

- views: 28573

- published: 05 Sep 2013

- views: 28573

2. The Universal Principle of Risk Management: Pooling and the Hedging of Risks

- Order: Reorder

- Duration: 69:08

- Updated: 19 Nov 2008

- views: 166185

- published: 19 Nov 2008

- views: 166185

Financial Mentor - Hedge Funds, Happiness, & Over 15 Years of Early Retirement

- Order: Reorder

- Duration: 49:01

- Updated: 24 Nov 2015

- views: 502

- published: 24 Nov 2015

- views: 502

1st Annual Finance Conference: Hedge Funds

- Order: Reorder

- Duration: 13:31

- Updated: 25 Jul 2015

- views: 23

- published: 25 Jul 2015

- views: 23

A Rare Interview with the Mathematician Who Cracked Wall Street | Jim Simons | TED Talks

- Order: Reorder

- Duration: 23:08

- Updated: 25 Sep 2015

- views: 193699

- published: 25 Sep 2015

- views: 193699

The Battle Between Investment Banks, Hedge Funds, and Private Equity on Wall Street (2009)

- Order: Reorder

- Duration: 50:18

- Updated: 10 Aug 2014

- views: 18429

- published: 10 Aug 2014

- views: 18429

WST: Overview of Financial Mkts - Alternatives & Hedge Funds

- Order: Reorder

- Duration: 8:17

- Updated: 08 Jul 2008

- views: 4913

- published: 08 Jul 2008

- views: 4913

Hedge Fund Honesty Policy : Finance FAQs

- Order: Reorder

- Duration: 3:08

- Updated: 16 Sep 2012

- views: 1719

- published: 16 Sep 2012

- views: 1719

Hedge Funds - Strategies

- Order: Reorder

- Duration: 7:57

- Updated: 18 Jun 2014

- views: 4766

- published: 18 Jun 2014

- views: 4766

Money Management & Personal Finance : What Is a Hedge Fund Accountant?

- Order: Reorder

- Duration: 1:01

- Updated: 08 Feb 2009

- views: 1514

- published: 08 Feb 2009

- views: 1514

One Step Ahead: Private Equity and Hedge Funds after the Global Financial Crisis

- Order: Reorder

- Duration: 86:04

- Updated: 17 Jan 2014

- views: 2902

- published: 17 Jan 2014

- views: 2902

-

How to Make Money Like Top Hedge Fund Managers Secrets of America s Finance Industry 2013

-

How to Hedge and Take a Short Position

1-on-1 Mentorship for a Finance Career Path with an industry expert. Learn with 300+ free online training modules, quizzes and certificates BlueBook Academy will help you land your first finance job, build a model or pass the CFA exam. https://bluebookacademy.com -

Derivatives outlook: FTSE and DAX to succumb to selling pressure? – Hedge Ratio Analysis

Today's indices derivative market outlook with Richard Jones, Managing Editor of Hedge Ratio Analysis. We look at the futures and options market and the outlook for the US Indices – Nasdaq, S&P; 500, Dow Jones Index, and the European indices – FTSE and DAX, from a hedge ratio perspective. Joined by Zak Mir, Technical Analyst at Zak's Traders Café, and Mike Ingram, Strategist for BGC Partners. Tip TV Finance is a live video show, broadcasted weekdays from 10 am sharp. Based in St Paul's, in the heart of the City of London, Tip TV prides itself on being able to attract the very best quality guests on the show to offer viewers informed, insightful and actionable infotainment. The Tip TV Daily Finance Show covers all asset classes ranging from currencies (forex), equities, bonds, commoditi... -

Download [EBOOK] Hedge Fund Investing: A Practical Approach to Understanding Investor Moti

detail http://bit.ly/1XneJ4g Hedge Fund Investing: A Practical Approach to Understanding Investor Motivation, Manager Profits, and Fund Performance (Wiley Finance) About Our Writers Investopedia DailyForex.com is a leading portal for financial news and Forex broker reviews. The company's goal is to provide Forex traders all of the information they'll need ... Wilmott Article Search Results Dr. Paul Wilmott on how mathematical finance has become both boring and dangerous. Chapter 18 A survey of behavioral finance - ScienceDirect Behavioral finance argues that some financial phenomena can plausibly be understood using models in which some agents are not fully rational. The field has two Reading Room - Articles/Papers - Altruist Ian Ayres and Barry J. Nalebuff "Diversification Across Time" Ya... -

MAF334 - Money Market Hedge Export

This example explains how an EXPORTER might use a money market hedge to protect itself against foreign currency fluctuations. -

MAF334 - Money Market Hedge Import

This example explains how an IMPORTER might use a money market hedge to protect itself against foreign currency fluctuations. -

Student Led Hedge Fund Just Getting Started

When you think of a hedge fund manager, oftentimes you think of an older man in dapper clothing. These first years are changing the status quo. Iowa State first-year Matt Tjaden and Drake first-year Zack Krawiec are two students that are part of a new investment company featuring eleven freshman in college. The men are part of a group that was founded by a high school buddy, Jacob Phillips, who wanted to start his own investment company. Phillips reached out to his high school friends, who brought in their friends from college. The hedge fund is called Cicero, and the students are looking to learn a little bit more about finance during the process. “I thought it would be A, lots of good experience for me because I’m studying finance. And, B, a real opportunity to make some m... -

Comprehensive Hedge Funds Video1

-

Comprehensive Hedge Funds Video2

-

Comprehensive Hedge Funds Video3

-

Download Funds: Private Equity, Hedge and All Core Structures (The Wiley Finance Series) PDF

http://j.mp/1ReZObz -

Trading Education: How to emulate hedge funds?

“Hedge funds are supposed to be the cream of cream”, says ex-hedge fund manager and trading mentor, Dr. Corvin Codirla, as he explains how FX traders can leverage from the way these huge funds work. This is the second part of the Tip TV education series ‘The Hedge Fund Way’. Key questions answered: How do hedge funds work? How to use the hedge fund approach to outperform? Where hedge funds fit into the market system Subscribe to our email newsletter here, and follow us on twitter @TipTVEducation to get an email update when the Part 2 of ‘How to become a trader’ is made live. Dr. Corvin Codirla is a Fund Manager, and a mentor. www.FXMasterCourse.com Tip TV Finance is a live video show, broadcasted weekdays from 10 am sharp. Based in St Paul's, in the heart of the City of London,... -

Tip TV Hedge: Information Technology challenges for new funds

The Tip TV Hedge Show with George Ralph, MD at RFA, interviewed by Jerry Lees, Chairman, Linear Investments Ltd. We discuss the challenges the new funds face with respect to I.T systems, and how information technology plays a key role in solving risk management problems. Tip TV Finance is a live video show, broadcasted weekdays from 10 am sharp. Based in St Paul's, in the heart of the City of London, Tip TV prides itself on being able to attract the very best quality guests on the show to offer viewers informed, insightful and actionable infotainment. The Tip TV Daily Finance Show covers all asset classes ranging from currencies (forex), equities, bonds, commodities, futures and options. Guests share their high conviction market opportunities, covering fundamental, technical, inter-mar... -

Hedge Funds: How to appease institutional investors?

The Tip TV Hedge Show with Collin Lloyd, Author of Macro Investment Letter Service “In the Long Run”, with a diverse experience in the financial markets, and interviewed by Jerry Lees, Chairman, Linear Investments Ltd. Watch how the experts discuss the hedge fund industry, the key parameters to attract institutional investment, and what a startup hedge fund needs to boom in these markets Tip TV Finance is a live video show, broadcasted weekdays from 10 am sharp. Based in St Paul's, in the heart of the City of London, Tip TV prides itself on being able to attract the very best quality guests on the show to offer viewers informed, insightful and actionable infotainment. The Tip TV Daily Finance Show covers all asset classes ranging from currencies (forex), equities, bonds, commodities, fu... -

Hedge Funds: Systematic trading, and mistakes new funds should avoid

Simon Wajcenberg, CEO, K1T Capital, speaks on the journey of their algo trading hedge fund, the current performance, and the mistakes which newer funds should avoid. Interviewed by Jerry Lees, Chairman, Linear Investments Ltd. Tip TV Finance is a live video show, broadcasted weekdays from 10 am sharp. Based in St Paul's, in the heart of the City of London, Tip TV prides itself on being able to attract the very best quality guests on the show to offer viewers informed, insightful and actionable infotainment. The Tip TV Daily Finance Show covers all asset classes ranging from currencies (forex), equities, bonds, commodities, futures and options. Guests share their high conviction market opportunities, covering fundamental, technical, inter-market and quantitative analysis, with the aim of... -

Linear Talk Tip TV Hedge: Markets are in a spin, what next for Hedge?

Tip TV Finance is a live video show, broadcasted weekdays from 10 am sharp. Based in St Paul's, in the heart of the City of London, Tip TV prides itself on being able to attract the very best quality guests on the show to offer viewers informed, insightful and actionable infotainment. The Tip TV Daily Finance Show covers all asset classes ranging from currencies (forex), equities, bonds, commodities, futures and options. Guests share their high conviction market opportunities, covering fundamental, technical, inter-market and quantitative analysis, with the aim of demystifying financial markets for viewers at home. See More At: www.tiptv.co.uk Twitter: @OfficialTipTV Facebook: https://www.facebook.com/officialtiptv -

Linear Talk: Risk in the Hedge Fund World

We are joined by Andrew Herriot the Head of Risk for Linear Investments to discuss how to judge risk and invest intelligently. Tip TV Finance is a live video show, broadcasted weekdays from 10 am sharp. Based in St Paul's, in the heart of the City of London, Tip TV prides itself on being able to attract the very best quality guests on the show to offer viewers informed, insightful and actionable infotainment. The Tip TV Daily Finance Show covers all asset classes ranging from currencies (forex), equities, bonds, commodities, futures and options. Guests share their high conviction market opportunities, covering fundamental, technical, inter-market and quantitative analysis, with the aim of demystifying financial markets for viewers at home. See More At: www.tiptv.co.uk Twitter: @Offici... -

Linear Talk: Hedge Fund Investment outlook

We are joined by Ian Burden the Chief Investment Officer for Linear Asset Management to discuss the latest activity in the market. Tip TV Finance is a live video show, broadcasted weekdays from 10 am sharp. Based in St Paul's, in the heart of the City of London, Tip TV prides itself on being able to attract the very best quality guests on the show to offer viewers informed, insightful and actionable infotainment. The Tip TV Daily Finance Show covers all asset classes ranging from currencies (forex), equities, bonds, commodities, futures and options. Guests share their high conviction market opportunities, covering fundamental, technical, inter-market and quantitative analysis, with the aim of demystifying financial markets for viewers at home. See More At: www.tiptv.co.uk Twitter: @Of... -

Linear Talk: Sales in Hedge Funds

We are joined by Mark Burchell the Head of Global Sales for Linear Investments. We discuss the latest updates in the Hedge Fund world. Tip TV Finance is a live video show, broadcasted weekdays from 10 am sharp. Based in St Paul's, in the heart of the City of London, Tip TV prides itself on being able to attract the very best quality guests on the show to offer viewers informed, insightful and actionable infotainment. The Tip TV Daily Finance Show covers all asset classes ranging from currencies (forex), equities, bonds, commodities, futures and options. Guests share their high conviction market opportunities, covering fundamental, technical, inter-market and quantitative analysis, with the aim of demystifying financial markets for viewers at home. See More At: www.tiptv.co.uk Twitter:... -

Linear Talk: Trading in a Hedge Fund, Mike Stables

Tip TV Finance is a live video show, broadcasted weekdays from 10 am sharp. Based in St Paul's, in the heart of the City of London, Tip TV prides itself on being able to attract the very best quality guests on the show to offer viewers informed, insightful and actionable infotainment. The Tip TV Daily Finance Show covers all asset classes ranging from currencies (forex), equities, bonds, commodities, futures and options. Guests share their high conviction market opportunities, covering fundamental, technical, inter-market and quantitative analysis, with the aim of demystifying financial markets for viewers at home. See More At: www.tiptv.co.uk Twitter: @OfficialTipTV Facebook: https://www.facebook.com/officialtiptv -

Module 3 The Hedge Fund Trader

-

Module 1 The Hedge Fund Industry

-

Tip TV Hedge - Linear Talk: News from the Hedge Fund world

In today's Hedge fund show we are joined by Jerry Lees, Chairman for Linear Investments, Geoff WIlkinson, Principal for CenTimeMetrics, Pinar Emirdag for Complymatic, Jeremy Davies, Co-Founder for RSRCHXchange and Dr Deborah Harrison, Linear Investments. We discuss the latest ongoings in the Hedge fund world and discuss the latest news to hit the shelves. Tip TV Finance is a live video show, broadcasted weekdays from 10 am sharp. Based in St Paul's, in the heart of the City of London, Tip TV prides itself on being able to attract the very best quality guests on the show to offer viewers informed, insightful and actionable infotainment. The Tip TV Daily Finance Show covers all asset classes ranging from currencies (forex), equities, bonds, commodities, futures and options. Guests shar...

How to Make Money Like Top Hedge Fund Managers Secrets of America s Finance Industry 2013

- Order: Reorder

- Duration: 68:12

- Updated: 25 Apr 2016

- views: 5

- published: 25 Apr 2016

- views: 5

How to Hedge and Take a Short Position

- Order: Reorder

- Duration: 1:55

- Updated: 23 Apr 2016

- views: 1

Derivatives outlook: FTSE and DAX to succumb to selling pressure? – Hedge Ratio Analysis

- Order: Reorder

- Duration: 7:35

- Updated: 20 Apr 2016

- views: 15

- published: 20 Apr 2016

- views: 15

Download [EBOOK] Hedge Fund Investing: A Practical Approach to Understanding Investor Moti

- Order: Reorder

- Duration: 0:16

- Updated: 09 Apr 2016

- views: 0

- published: 09 Apr 2016

- views: 0

MAF334 - Money Market Hedge Export

- Order: Reorder

- Duration: 3:40

- Updated: 07 Apr 2016

- views: 176

- published: 07 Apr 2016

- views: 176

MAF334 - Money Market Hedge Import

- Order: Reorder

- Duration: 5:12

- Updated: 05 Apr 2016

- views: 121

- published: 05 Apr 2016

- views: 121

Student Led Hedge Fund Just Getting Started

- Order: Reorder

- Duration: 1:37

- Updated: 30 Mar 2016

- views: 22

- published: 30 Mar 2016

- views: 22

Comprehensive Hedge Funds Video1

- Order: Reorder

- Duration: 2:24

- Updated: 23 Mar 2016

- views: 3

- published: 23 Mar 2016

- views: 3

Comprehensive Hedge Funds Video2

- Order: Reorder

- Duration: 2:44

- Updated: 23 Mar 2016

- views: 9

- published: 23 Mar 2016

- views: 9

Comprehensive Hedge Funds Video3

- Order: Reorder

- Duration: 2:25

- Updated: 23 Mar 2016

- views: 7

- published: 23 Mar 2016

- views: 7

Download Funds: Private Equity, Hedge and All Core Structures (The Wiley Finance Series) PDF

- Order: Reorder

- Duration: 0:32

- Updated: 23 Mar 2016

- views: 0

Trading Education: How to emulate hedge funds?

- Order: Reorder

- Duration: 8:12

- Updated: 14 Mar 2016

- views: 11

- published: 14 Mar 2016

- views: 11

Tip TV Hedge: Information Technology challenges for new funds

- Order: Reorder

- Duration: 10:39

- Updated: 04 Mar 2016

- views: 111

- published: 04 Mar 2016

- views: 111

Hedge Funds: How to appease institutional investors?

- Order: Reorder

- Duration: 13:34

- Updated: 04 Mar 2016

- views: 4

- published: 04 Mar 2016

- views: 4

Hedge Funds: Systematic trading, and mistakes new funds should avoid

- Order: Reorder

- Duration: 11:08

- Updated: 04 Mar 2016

- views: 67

- published: 04 Mar 2016

- views: 67

Linear Talk Tip TV Hedge: Markets are in a spin, what next for Hedge?

- Order: Reorder

- Duration: 28:52

- Updated: 15 Feb 2016

- views: 179

- published: 15 Feb 2016

- views: 179

Linear Talk: Risk in the Hedge Fund World

- Order: Reorder

- Duration: 4:17

- Updated: 12 Feb 2016

- views: 38

- published: 12 Feb 2016

- views: 38

Linear Talk: Hedge Fund Investment outlook

- Order: Reorder

- Duration: 9:58

- Updated: 12 Feb 2016

- views: 3

- published: 12 Feb 2016

- views: 3

Linear Talk: Sales in Hedge Funds

- Order: Reorder

- Duration: 6:02

- Updated: 12 Feb 2016

- views: 49

- published: 12 Feb 2016

- views: 49

Linear Talk: Trading in a Hedge Fund, Mike Stables

- Order: Reorder

- Duration: 7:20

- Updated: 12 Feb 2016

- views: 61

- published: 12 Feb 2016

- views: 61

Module 3 The Hedge Fund Trader

- Order: Reorder

- Duration: 47:54

- Updated: 09 Feb 2016

- views: 5

- published: 09 Feb 2016

- views: 5

Module 1 The Hedge Fund Industry

- Order: Reorder

- Duration: 69:34

- Updated: 09 Feb 2016

- views: 8

- published: 09 Feb 2016

- views: 8

Tip TV Hedge - Linear Talk: News from the Hedge Fund world

- Order: Reorder

- Duration: 28:31

- Updated: 28 Jan 2016

- views: 81

- published: 28 Jan 2016

- views: 81

-

Foreign Exchange Hedging, James Tompkins

This is the eleventh lecture in the "International Finance" series in which I discuss how corporations and other entities can protect themselves from unexpected exchange rate movements. So far this class has been about obtaining an in-depth understanding as to why and how different currencies move up and down in value. To the extent that unexpected exchange rate movements are a risk, we now look at managing this risk. In particular, in this lecture, we look at managing this risk in the short term. My approach is to use a very simple example, and for the same example explore different alternatives to hedging including the use of forwards, futures, options, money market hedges and others. The goal is not only to understand how each hedge works, but the advantages and disadvantages of each. -

Hedge (finance)

Hedge (finance) A hedge is an investment position intended to offset potential losses/gains that may be incurred by a companion investment.In simple language, a hedge is used to reduce any substantial losses/gains suffered by an individual or an organization. =======Image-Copyright-Info======== License: Creative Commons Attribution-Share Alike 4.0 (CC BY-SA 4.0) LicenseLink: http://creativecommons.org/licenses/by-sa/4.0 Author-Info: Hou710 Image Source: https://en.wikipedia.org/wiki/File:Hou710_HedgeCorridor.svg =======Image-Copyright-Info======== -Video is targeted to blind users Attribution: Article text available under CC-BY-SA image source in video https://www.youtube.com/watch?v=PYLTpdCT08U -

Financial System 2.0 London 2013: Panel on Hedge Funds 2.0

London Finance Forum – Thursday, June 13, 2013 Moderated by: Gillian Tett, Assistant Editor and Markets/Finance Commentator, Financial Times Panelists: Patrik Edsparr, PhD '94, CIO and Co-Founder, TOR Investment Management; Sadeq Sayeed, SM '85, Chairman, Metage Capital Limited; André Stern, Founding Partner and Principal, OxFORD Asset Management -

Hedge Fund Regulation, Fund Managers Panel

Hedge Fund Regulation, Fund Managers Panel - House Oversight Committee - 2008-11-13 - Product 282391-2-DVD - House Committee on Government Reform and Oversight. Hedge Fund Managers and financial experts testified about federal regulation of financial markets, operation of hedge funds, and the recent global financial crisis. The hearing focused on several issues including executive compensation, proposed regulations and tax reforms, and the nature of risk within financial markets. Filmed by C-SPAN. Non-commercial use only. For more information see http://www.c-spanvideo.org/program/282391-2 -

How Should the Financial Industry Be Regulated? Pension/Hedge Funds, Investment Banks (2009)

As of May 2010, both the House and Senate bills had been passed, but the differences between the bills were to be worked out in United States congressional conference committee. Differences which must be resolved include:[8] whether the new consumer protection agency would be independent (Senate) or part of the Federal Reserve; whether to require banks to issue credit derivatives in separately capitalized affiliates (Senate); how exactly the Federal Deposit Insurance Corporation (FDIC) will wind down or bail out large institutions which fail; the circumstances under which large institutions could be broken up; a 15 to 1 leverage limit in the House bill; the terms of a Fed audit (continuous as in the House bill or one-time as in the Senate bill); both bills include the Volcker rule which pr... -

Make Money Like Top Hedge Fund Managers: Secrets of America's Finance Industry

A hedge fund is a collective investment scheme, often structured as a limited partnership, that invests private capital speculatively to maximize capital . Full Documentary, Documentary,documentary films,documentary history channel,documentary 2014,documentary history,documentary on serial killers, . welcome like and subscribe to my channel for more vidéo ! A hedge fund is a collective investment scheme, often structured as a limited partnership, that invests . -

ATG Best. Вебинар от 07.07.15. Программы Finance (Рента) и Hedge Fund.

Регистрация в компанию ATG Best и Информация по всем программам инвестирования: http://bbingo.ru/atg-best/ Все вебинары ATG Best https://www.youtube.com/playlist?list=PLVSXoJS_49QYZoz2uyy6SRr5wiUDaYlMu ATG Best предлагает выгодные программы для инвесторов с небольшими инвестициями - на любой вкус и кошелек, для активного и пассивного участия. Выберите нужный инструмент для Вашего инвестирования, или используйте сразу несколько механизмов получения дохода! Помогу разобраться и отвечу на Ваши вопросы в скайпе katifriz1 Деньги не должны лежать впустую! -

ATG Best. Вебинар от 14.07.15. Программы Finance (Рента) и Hedge Fund

Регистрация в компанию ATG Best и Информация по всем программам инвестирования: http://bbingo.ru/atg-best/ Все вебинары ATG Best https://www.youtube.com/playlist?list=PLVSXoJS_49QYZoz2uyy6SRr5wiUDaYlMu ATG Best предлагает выгодные программы для инвесторов с небольшими инвестициями - на любой вкус и кошелек, для активного и пассивного участия. Выберите нужный инструмент для Вашего инвестирования, или используйте сразу несколько механизмов получения дохода! Помогу разобраться и отвечу на Ваши вопросы в скайпе katifriz1 Деньги не должны лежать впустую! -

Wall Street & Movies: Film Financing, Banks, Hedge Funds, Private Equity (1998)

Film finance is a subset of project finance, meaning the film project's generated cash flows rather than external sources are used to repay investors. The main factors determining the commercial success of a film include public taste, artistic merit, competition from other films released at the same time, the quality of the script, the quality of the cast, the quality of the director and other parties, etc. Even if a film looks like it will be a commercial success "on paper", there is still no accurate method of determining the levels of revenue the film will generate. In the past, risk mitigation was based on pre-sales, box office projections and ownership of negative rights. Along with strong ancillary markets in DVD, CATV, and other electronic media (like streaming video on demand -SVOD... -

Warren Buffet on the Estate Tax, Carried Interest, Capital Gains, Hedge Funds (2007)

Carried interest or carry, in finance, specifically in alternative investments (i.e., private equity and hedge funds), is a share of the profits of an investment or investment fund that is paid to the investment manager in excess of the amount that the manager contributes to the partnership. In private equity, in order to receive carried interest, the manager must first return all capital contributed by the investors, and, in certain cases, the fund must also return a previously agreed-upon rate of return (the "hurdle rate" or "preferred return") to investors.[1] Private equity funds only distribute carried interest to the manager upon successfully exiting an investment, which may take years. The customary hurdle rate in private equity is 7--8% per annum. In a hedge fund environment, carri... -

Neng Wang: The Economics of Hedge Funds

On November 9, 2010, Neng Wang, Chong Khoon Lin professor of real estate and chair of the finance subdivision at Columbia Business School, presented The Economics of Hedge Funds. The presentation was part of the Program for Financial Studies' No Free Lunch Seminar Series. The November 9 event was centered on Current Research about Asset Management. The Program for Financial Studies' No Free Lunch Seminar Series provides broader community access to Columbia Business School faculty research. At each seminar, attended by invited MBA and PhD students, faculty members introduce their current research within an informal lunch setting. Learn more at http://www4.gsb.columbia.edu/financialstudies -

Webcast: IFRS 9 - Financial Instruments and Hedge Accounting

PwC is pleased to present IFRS 9 - Financial instruments and Hedge Accounting. This session provides an overview of IFRS 9 with a focus on the recently finalized hedge accounting standard. -

Hedge Funds and the Financial Market (Part 2 of 2)

Hedge Funds and the Financial Market (Part 2 of 2) - Committee on Oversight and Government Reform - Tape Deck 15 - 2008-11-13 - The Committee held a hearing titled, "Hedge Funds and the Financial Market" on Thursday, November 13, 2008. The hearing examined systemic risks to the financial markets posed by hedge funds and proposals for regulatory and tax reforms. Video provided by the U.S. House of Representatives.

Foreign Exchange Hedging, James Tompkins

- Order: Reorder

- Duration: 120:36

- Updated: 26 Mar 2014

- views: 9715

- published: 26 Mar 2014

- views: 9715

Hedge (finance)

- Order: Reorder

- Duration: 20:35

- Updated: 22 Jan 2016

- views: 0

- published: 22 Jan 2016

- views: 0

Financial System 2.0 London 2013: Panel on Hedge Funds 2.0

- Order: Reorder

- Duration: 44:39

- Updated: 16 Dec 2015

- views: 22

- published: 16 Dec 2015

- views: 22

Hedge Fund Regulation, Fund Managers Panel

- Order: Reorder

- Duration: 126:15

- Updated: 27 Dec 2010

- views: 17985

- published: 27 Dec 2010

- views: 17985

How Should the Financial Industry Be Regulated? Pension/Hedge Funds, Investment Banks (2009)

- Order: Reorder

- Duration: 177:52

- Updated: 21 Sep 2013

- views: 397

- published: 21 Sep 2013

- views: 397

Make Money Like Top Hedge Fund Managers: Secrets of America's Finance Industry

- Order: Reorder

- Duration: 71:06

- Updated: 28 Oct 2015

- views: 24

- published: 28 Oct 2015

- views: 24

ATG Best. Вебинар от 07.07.15. Программы Finance (Рента) и Hedge Fund.

- Order: Reorder

- Duration: 56:58

- Updated: 07 Jul 2015

- views: 29

- published: 07 Jul 2015

- views: 29

ATG Best. Вебинар от 14.07.15. Программы Finance (Рента) и Hedge Fund

- Order: Reorder

- Duration: 78:47

- Updated: 14 Jul 2015

- views: 23

- published: 14 Jul 2015

- views: 23

Wall Street & Movies: Film Financing, Banks, Hedge Funds, Private Equity (1998)

- Order: Reorder

- Duration: 97:43

- Updated: 25 Apr 2015

- views: 579

- published: 25 Apr 2015

- views: 579

Warren Buffet on the Estate Tax, Carried Interest, Capital Gains, Hedge Funds (2007)

- Order: Reorder

- Duration: 122:49

- Updated: 01 Jun 2013

- views: 3899

- published: 01 Jun 2013

- views: 3899

Neng Wang: The Economics of Hedge Funds

- Order: Reorder

- Duration: 28:24

- Updated: 15 Jul 2011

- views: 5238

- published: 15 Jul 2011

- views: 5238

Webcast: IFRS 9 - Financial Instruments and Hedge Accounting

- Order: Reorder

- Duration: 66:13

- Updated: 30 Dec 2013

- views: 19258

- published: 30 Dec 2013

- views: 19258

Hedge Funds and the Financial Market (Part 2 of 2)

- Order: Reorder

- Duration: 125:47

- Updated: 13 Feb 2011

- views: 3151

- published: 13 Feb 2011

- views: 3151

- Playlist

- Chat

- Playlist

- Chat

AC3059 Financial Management - Money Market Hedge

- Report rights infringement

- published: 03 May 2013

- views: 9179

Hedge funds and Investment: What is hedging in Finance?

- Report rights infringement

- published: 27 Jul 2014

- views: 989

5 (Financial Instrument) What is Hedge ? Give a Example

- Report rights infringement

- published: 05 May 2014

- views: 1076

How to Make Money Like Top Hedge Fund Managers: Secrets of America's Finance Industry (2013)

- Report rights infringement

- published: 07 Aug 2013

- views: 346027

Hedge Fund Series #2 - What is Hedging?

- Report rights infringement

- published: 12 Feb 2014

- views: 650

How Do Hedge Funds Operate? Financial Markets, Compensation, Taxes, Regulations, Risks (2008)

- Report rights infringement

- published: 23 Oct 2013

- views: 20244

Hedge Accounting IAS 39 vs. IFRS 9

- Report rights infringement

- published: 05 Dec 2013

- views: 34651

30 Under 30: Wall Street Veteran

- Report rights infringement

- published: 17 Dec 2012

- views: 117920