- published: 27 Nov 2012

- views: 16315

-

remove the playlistNet Asset Value

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistNet Asset Value

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 21 Jun 2013

- views: 38824

- published: 27 Sep 2014

- views: 1029

- published: 29 Apr 2015

- views: 928

- published: 03 Feb 2014

- views: 151354

- published: 24 Feb 2016

- views: 15

- published: 25 Nov 2015

- views: 1920

- published: 25 Feb 2014

- views: 11713

Net asset value (NAV) is a term used to describe the value of an entity's assets less the value of its liabilities. The term is most commonly used in relation to open-ended or mutual funds because shares of such funds registered with the U.S. Securities and Exchange Commission are redeemed at their net asset value. However, the term may also be used as a synonym for book value or the equity value of a business. Net asset value may represent the value of the total equity, or it may be divided by the number of shares outstanding held by investors and, thereby, represent the net asset value per share.

Net asset values and other accounting and recordkeeping activities are the result of the process of Fund Accounting, sometimes called securities accounting, investment accounting and/or portfolio accounting. Fund Accounting systems are sophisticated computerized systems used to account for investor capital flows in and out of a fund, purchases and sales of investments and related investment income, gains, losses and operating expenses of the fund. The fund's investments and other assets are valued on a regular schedule such as daily, weekly or monthly, depending on the fund and associated regulatory or sponsor requirements. There is no universal method or basis of valuing assets and liabilities for the purposes of calculating net asset value used throughout the world, and the criteria used for the valuation will depend upon the circumstances, the purposes of the valuation and any regulatory and/or accounting principles that may apply. For example, for US registered open-ended funds, investments are commonly valued each day the New York Stock Exchange is open, using closing prices (meant to represent fair value), typically 4:00 PM Eastern Time. For US registered money market funds, investments are often carried or valued at 'amortized cost' as opposed to market value for expedience and other purposes, provided various requirements are continually met.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

2:57

2:57What is NAV of a mutual fund and how is it calculated? - SmarterWithMoney

What is NAV of a mutual fund and how is it calculated? - SmarterWithMoneyWhat is NAV of a mutual fund and how is it calculated? - SmarterWithMoney

The net asset value (NAV) of a mutual fund indicates the price at which the units of that mutual fund are bought or sold. It represents the fund's market value after subtracting the liabilities. -

10:13

10:13How to value a company using net assets - MoneyWeek Investment Tutorials

How to value a company using net assets - MoneyWeek Investment TutorialsHow to value a company using net assets - MoneyWeek Investment Tutorials

Like this MoneyWeek Video? Want to find out more on net assets? Go to: http://www.moneyweekvideos.com/how-to-value-a-company-using-net-assets/ now and you'll get free bonus material on this topic, plus a whole host of other videos. Search our whole archive of useful MoneyWeek Videos, including: · The six numbers every investor should know... http://www.moneyweekvideos.com/six-numbers-every-investor-should-know/ · What is GDP? http://www.moneyweekvideos.com/what-is-gdp/ · Why does Starbucks pay so little tax? http://www.moneyweekvideos.com/why-does-starbucks-pay-so-little-tax/ · How capital gains tax works... http://www.moneyweekvideos.com/how-capital-gains-tax-works/ · What is money laundering? http://www.moneyweekvideos.com/what-is-money-laundering/ -

8:50

8:50Calculating Net Asset Value (NAV) of a Mutual fund

Calculating Net Asset Value (NAV) of a Mutual fund -

1:56

1:56Net Asset Value

Net Asset ValueNet Asset Value

-

8:32

8:32Net asset value

Net asset valueNet asset value

Net asset value (NAV) is the value of an entity's assets minus the value of its liabilities, often in relation to open-end or mutual funds, since shares of such funds registered with the U.S. Securities and Exchange Commission are redeemed at their net asset value. This may also be the same as the book value or the equity value of a business. Net asset value may represent the value of the total equity, or it may be divided by the number of shares outstanding held by investors and, thereby, represent the net asset value per share. Net asset value and other accounting and recordkeeping activities are the result of the process of Fund Accounting, sometimes called securities accounting, investment accounting and/or portfolio accounting. Fund Accounting systems are sophisticated computerized systems used to account for investor capital flows in and out of a fund, purchases and sales of investments and related investment income, gains, losses and operating expenses of the fund. The fund's investments and other assets are valued on a regular schedule such as daily, weekly or monthly, depending on the fund and associated regulatory or sponsor requirements. There is no universal method or basis of valuing assets and liabilities for the purposes of calculating the net asset value used throughout the world, and the criteria used for the valuation will depend upon the circumstances, the purposes of the valuation and any regulatory and/or accounting principles that may apply. For example, for US registered open-ended funds, investments are commonly valued each day the New York Stock Exchange is open, using closing prices (meant to represent fair value), typically 4:00 PM Eastern Time. For US registered money market funds, investments are often carried or valued at 'amortized cost' as opposed to market value for expedience and other purposes, provided various requirements are continually met. This video is targeted to blind users. Attribution: Article text available under CC-BY-SA Creative Commons image source in video -

7:05

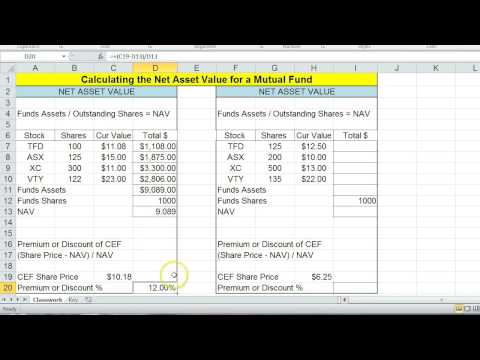

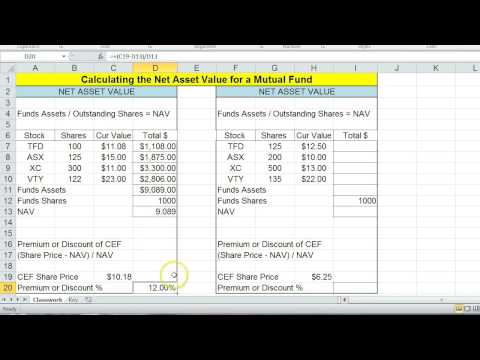

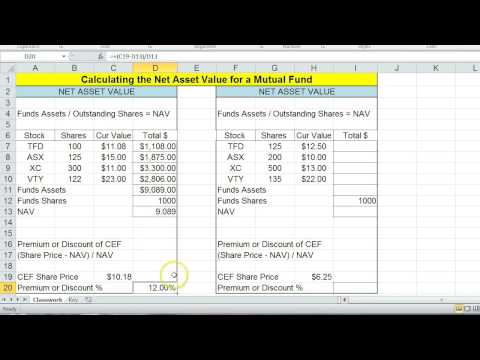

7:05Net Asset Value of a Mutual Fund

Net Asset Value of a Mutual FundNet Asset Value of a Mutual Fund

This video explains how to calculate the Net Asset Value and Net Asset Value per share of a mutual fund. The video also discusses how and why the NAV per share often differs significantly from the market price of closed-end funds, whereas the NAV per share is the price paid to purchase shares in an open-end fund. -

3:57

3:57Net Asset Value (NAV) Demystified

Net Asset Value (NAV) DemystifiedNet Asset Value (NAV) Demystified

Visit our website: http://franklintempeltonindia.com NAV Demystified What is NAV? Ughh, this is one term that has scared and confused people more than anything else when it comes to mutual funds! It’s a value, that’s pretty obvious, but value of what? What does it include? What does it show? It always seems confusing… Time for a short story… Say you have this 1000 sq. ft house that you want to sell. So you find this real estate expert who has got a buyer for the house at Rs. 35 lakhs. But this includes a commission of Rs. 50,000 for helping you sell the house, which means the true value per sq ft that you got for the house is Rs.3,450 . How’s that? Well, you take the selling price of the house , deducted any expenses from it and then divide it by the size of the house. (Ta-da) The price that you arrive at is the true value per sq ft! Just like that, the NAV per unit of a mutual fund scheme is the sum total of the market value of all the assets held in the portfolio including cash, less expenses, divided by the total number of units held by all the investors. So say the market value of all the assets of the scheme, after deducting expenses, is Rs. 100 lakhs and the scheme has issued 5 lakh units to investors, then the NAV per unit of the fund is Rs. 20. The market value of these assets may change every day, which is reflected by the fluctuations in the NAV per unit. And the Asset Management Company will be required to disclose this NAV on a regular basis. . Now why is this number important? Well, for three reasons… When an investor invests in a scheme, it helps to calculate how many units he can buy. So if the NAV of the scheme is Rs. 25 and the amount being invested is Rs. 25,000, the investor will receive 1000 units. Correspondingly when you redeem your investments, meaning when you take your money out of the scheme, if the applicable NAV per unit of the scheme at that time is Rs. 50, you will receive Rs. 50,000 for your 1000 units. The third reason the NAV is important, is to gauge the performance of the scheme. This is done by comparing the NAV of the scheme over two different points to know how well or poorly the scheme has performed. For e.g. If the NAV per unit of the scheme today is Rs. 25 and 2 years ago it was Rs 15 you know that the scheme has delivered an absolute return of 66.67% over 2 years or 29.10% every year over a period of 2 years. Many of us think that if a fund with an NAV of Rs. 10 is cheaper than another Fund with an NAV of Rs. 200? Umm, not really: Say you know of two schemes, ‘A’ and ‘B’ with the NAV of Rs. 10 and Rs. 200 respectively. You invest Rs. 10,000 in each scheme at the beginning of the year, giving you 1000 units of scheme A and 50 units of scheme B. That year both schemes perform well, making the portfolio value rise by 20%. The value of the 1000 units in scheme A is now Rs. 12,000 and of the 50 units in scheme B is now also Rs. 12,000 . So you see, although the NAV of scheme A was significantly lower than that of scheme B, the value of the investment eventually grew to be the same amount. Meaning it’s not as important how high or low the NAV of the scheme is, but what the growth of that NAV is once invested in the scheme. Returns are higher if the portfolio of that scheme has performed better than the rest. It’s that simple. Does that clear things up? Basically the NAV per unit is the price that you pay for investing in the Mutual Fund scheme! Quite like the rate per square feet that you got for selling your house. So don't be hassled and confused, just break it down. We hope you enjoyed watching this video! Watch more, and we’ll help you learn about different investing concepts. You can also write to us with your feedback (editor@templeton.com) -

6:00

6:00Calculating Mutual Fund Net Asset Value

Calculating Mutual Fund Net Asset ValueCalculating Mutual Fund Net Asset Value

-

2:56

2:56How to calculate NAV ? ( Net Asset Value )

How to calculate NAV ? ( Net Asset Value )How to calculate NAV ? ( Net Asset Value )

-

1:36

1:36InterTrader Direct - What is Net Asset Value (NAV)

InterTrader Direct - What is Net Asset Value (NAV)InterTrader Direct - What is Net Asset Value (NAV)

An introduction to what Net Asset Value (NAV) is and how it works in the trading landscape. For more trader education videos and tools, visit www.IntertraderDirect.com The NAV of a share offers traders another method to measure the value of a company. InterTrader Direct is a 100% market neutral broker, offering a No Dealing Desk service and transparent execution. Apply to open a Spread Betting account in minutes! Visit www.IntertraderDirect.com Losses can exceed your deposits. -

![Valuation of Shares [ Net asset method, Yield method and Fair value ] with solved problem; updated 25 Nov 2015; published 25 Nov 2015](http://web.archive.org./web/20160428032156im_/http://i.ytimg.com/vi/EK4_DjTdKBI/0.jpg) 26:38

26:38Valuation of Shares [ Net asset method, Yield method and Fair value ] with solved problem

Valuation of Shares [ Net asset method, Yield method and Fair value ] with solved problemValuation of Shares [ Net asset method, Yield method and Fair value ] with solved problem

(*)If you like this video please: like, comment, share and subscribe (*)For any accounting tasks (it may have charge) contact @ kauserwiseacdiscussions@gmail.com (*)To view my tutorial collections and get email alert for my upcoming video uploads pls visit and subscribe(free subscription) my channel: https://www.youtube.com/c/kauserwise Valuation of Shares, Net asset method, Yield method, Fair value method, -

24:28

24:28NAV Model (Oil & Gas): Production Decline Curve

NAV Model (Oil & Gas): Production Decline CurveNAV Model (Oil & Gas): Production Decline Curve

When you're valuing an E&P; (Exploration & Production) company, the Net Asset Value (NAV) Model is the key methodology. By http://breakingintowallstreet.com/ "Financial Modeling Training And Career Resources For Aspiring Investment Bankers" UNLIKE in a DCF, where cash flow growth is assumed into infinity, in a NAV model you assume the company's cash flows go to $0 eventually as it completely produces all of its reserves and has nothing left. A granular NAV model is complex, but it comes down to a 2-step process: Step 1: Model the company's existing production from wells it already has... and assume a decline rate for the annual production each year, also assuming commodity prices to determine revenue, and linking operating expenses to production and calculating cash flow like that. Step 2: Assume the company drills new wells in its PUD (Proved Undeveloped), PROB (Probable), and POSS (Possible) reserves. The second step involves dozens of sub-steps and assumptions, but here we're just going to focus on ONE small part of this process: estimating the decline rate of a new well the company drills. It starts off at a very high production rate, but then declines quickly within even the first year of its useful life - and we need to estimate the decline rates each year to build the rest of the model. You COULD do lots of complicated math, try fitting hyperbolic or exponential functions, run a regression analysis, etc., but we suggest a much simpler approach here: if the company doesn't disclose data on its decline rates for individual wells, find data from another company operating in the same region and fit it to your company's "average" wells. How to Do That: Step 1: Find the company's key data, such as the EUR per well and IP rate per well in the region you're looking at. Step 2: Now, see if the company discloses data on its own decline rates... if so, you're set! If not, or if it's not enough, find another company operating in the region that discloses more data (EQT here), and go to that company's investor presentations to get the numbers. Step 3: In the first year, assume that production is some % of 365 * IP Rate per Well... because there is a huge drop-off in daily production from Month 1 to Month 12 in that first year. EQT's data shows 45%; we assume 60% here since UPL has a slightly flatter decline curve. Step 4: Copy and paste the other company's decline rates into each year of your decline curve. Step 5: Enter the correct formula for calculating annual production each year AFTER the initial year... here: =MIN(AU129*(1+AT130),$AT$126-SUM(AU$129:AU129)) Want to take either Last Year Production * (1 + Decline Rate) (the first part), or the total remaining reserves in this well (the second part). Step 6: Set up Subtotal / Remainder / Total math and ensure that everything is produced. Step 7: "Fit the data" using Goal Seek and the Factor - multiply each decline rate by a certain factor and use Goal Seek (Alt + A + W + G) to solve for the factor that makes the Subtotal equal to the EUR. Step 8: Build in support for a different EUR by scaling the production up or down in the "Total" column. Step 9: Allocate the production to oil vs. gas. vs. NGLs. Step 10: Complete the Subtotal / Remainder / Total math at the bottom. What Next? Next, we'd complete this process for all the wells the company drills in every region, estimate revenue, expenses, and cash flow for each one, and then aggregate the discounted cash flow values in every region across all reserve types... Which brings us closer to the implied NAV per share, which is what the NAV model is really all about. Stay tuned for more! -

0:27

0:27Net asset value (NAV) - defined

Net asset value (NAV) - definedNet asset value (NAV) - defined

Net Asset Value is the book value of a company's assets divided by the number of shares on issue. - created at http://www.b2bwhiteboard.com -

2:00

2:00What is NAV (Net Asset Value) for Mutual Funds| Net Asset Value Explained by Yadnya

What is NAV (Net Asset Value) for Mutual Funds| Net Asset Value Explained by YadnyaWhat is NAV (Net Asset Value) for Mutual Funds| Net Asset Value Explained by Yadnya

Net asset value (NAV) is a mutual fund's price per share. It is calculated by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of fund shares outstanding. Find us on Social Media and stay connected: Facebook Page - https://www.facebook.com/yadnyaacademy/?fref=ts Facebook Group - https://goo.gl/y57Qcr Twitter - https://mobile.twitter.com/investyadnya

- Amortization

- Asset

- Bid price

- Book value

- Closed-end fund

- Exchange-traded fund

- Financial statements

- Fund of funds

- Going concern

- Growth investing

- Hedge fund

- Historical cost

- ICVC

- Impact investing

- Index fund

- Investment

- Investment trust

- Market value

- Mutual fund

- Net asset value

- Net assets

- Offshore fund

- Open-end fund

- Open-ended fund

- Partnership

- Passive management

- Portfolio (finance)

- Price-to-book ratio

- PropertyMall

- Public company

- Shareholders' equity

- Shares

- Shares outstanding

- SICAV

- Umbrella fund

- Unit trust

- Valuation (finance)

- Value investing

- Variable annuity

- Wiktionary less

-

What is NAV of a mutual fund and how is it calculated? - SmarterWithMoney

The net asset value (NAV) of a mutual fund indicates the price at which the units of that mutual fund are bought or sold. It represents the fund's market value after subtracting the liabilities. -

How to value a company using net assets - MoneyWeek Investment Tutorials

Like this MoneyWeek Video? Want to find out more on net assets? Go to: http://www.moneyweekvideos.com/how-to-value-a-company-using-net-assets/ now and you'll get free bonus material on this topic, plus a whole host of other videos. Search our whole archive of useful MoneyWeek Videos, including: · The six numbers every investor should know... http://www.moneyweekvideos.com/six-numbers-every-investor-should-know/ · What is GDP? http://www.moneyweekvideos.com/what-is-gdp/ · Why does Starbucks pay so little tax? http://www.moneyweekvideos.com/why-does-starbucks-pay-so-little-tax/ · How capital gains tax works... http://www.moneyweekvideos.com/how-capital-gains-tax-works/ · What is money laundering? http://www.moneyweekvideos.com/what-is-money... -

-

Net Asset Value

-

Net asset value

Net asset value (NAV) is the value of an entity's assets minus the value of its liabilities, often in relation to open-end or mutual funds, since shares of such funds registered with the U.S. Securities and Exchange Commission are redeemed at their net asset value. This may also be the same as the book value or the equity value of a business. Net asset value may represent the value of the total equity, or it may be divided by the number of shares outstanding held by investors and, thereby, represent the net asset value per share. Net asset value and other accounting and recordkeeping activities are the result of the process of Fund Accounting, sometimes called securities accounting, investment accounting and/or portfolio accounting. Fund Accounting systems are sophisticated computerized sy... -

Net Asset Value of a Mutual Fund

This video explains how to calculate the Net Asset Value and Net Asset Value per share of a mutual fund. The video also discusses how and why the NAV per share often differs significantly from the market price of closed-end funds, whereas the NAV per share is the price paid to purchase shares in an open-end fund. -

Net Asset Value (NAV) Demystified

Visit our website: http://franklintempeltonindia.com NAV Demystified What is NAV? Ughh, this is one term that has scared and confused people more than anything else when it comes to mutual funds! It’s a value, that’s pretty obvious, but value of what? What does it include? What does it show? It always seems confusing… Time for a short story… Say you have this 1000 sq. ft house that you want to sell. So you find this real estate expert who has got a buyer for the house at Rs. 35 lakhs. But this includes a commission of Rs. 50,000 for helping you sell the house, which means the true value per sq ft that you got for the house is Rs.3,450 . How’s that? Well, you take the selling price of the house , deducted any expenses from it and then divide it by the size of the house. (Ta-da) The pri... -

Calculating Mutual Fund Net Asset Value

-

How to calculate NAV ? ( Net Asset Value )

-

InterTrader Direct - What is Net Asset Value (NAV)

An introduction to what Net Asset Value (NAV) is and how it works in the trading landscape. For more trader education videos and tools, visit www.IntertraderDirect.com The NAV of a share offers traders another method to measure the value of a company. InterTrader Direct is a 100% market neutral broker, offering a No Dealing Desk service and transparent execution. Apply to open a Spread Betting account in minutes! Visit www.IntertraderDirect.com Losses can exceed your deposits. -

Valuation of Shares [ Net asset method, Yield method and Fair value ] with solved problem

(*)If you like this video please: like, comment, share and subscribe (*)For any accounting tasks (it may have charge) contact @ kauserwiseacdiscussions@gmail.com (*)To view my tutorial collections and get email alert for my upcoming video uploads pls visit and subscribe(free subscription) my channel: https://www.youtube.com/c/kauserwise Valuation of Shares, Net asset method, Yield method, Fair value method, -

NAV Model (Oil & Gas): Production Decline Curve

When you're valuing an E&P; (Exploration & Production) company, the Net Asset Value (NAV) Model is the key methodology. By http://breakingintowallstreet.com/ "Financial Modeling Training And Career Resources For Aspiring Investment Bankers" UNLIKE in a DCF, where cash flow growth is assumed into infinity, in a NAV model you assume the company's cash flows go to $0 eventually as it completely produces all of its reserves and has nothing left. A granular NAV model is complex, but it comes down to a 2-step process: Step 1: Model the company's existing production from wells it already has... and assume a decline rate for the annual production each year, also assuming commodity prices to determine revenue, and linking operating expenses to production and calculating cash flow like that. Step ... -

Net asset value (NAV) - defined

Net Asset Value is the book value of a company's assets divided by the number of shares on issue. - created at http://www.b2bwhiteboard.com -

What is NAV (Net Asset Value) for Mutual Funds| Net Asset Value Explained by Yadnya

Net asset value (NAV) is a mutual fund's price per share. It is calculated by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of fund shares outstanding. Find us on Social Media and stay connected: Facebook Page - https://www.facebook.com/yadnyaacademy/?fref=ts Facebook Group - https://goo.gl/y57Qcr Twitter - https://mobile.twitter.com/investyadnya -

Admiral's REIT Primer (11A) - What is NAV?

Victor Yeung, Admiral's Chief Investment Officer, discusses the basic calculations behind Net Asset Value. NAV is the cash value that represents the value an investor would receive if a company is broken up today. This is the beginning point of valuation. The playlist of the REIT Primer (English version) - https://www.youtube.com/playlist?list=PLdOyVQwFLbT1_wNa1u36BY2u8Lv1Me087 The playlist of the REIT Primer (Cantonese version) - http://www.youtube.com/playlist?list=PLdOyVQwFLbT0adov7NCWxeC3WYk5C-0qI The playlist of the REIT Primer (Mandarin version) - https://www.youtube.com/playlist?list=PLdOyVQwFLbT2Lf0B8AvGXh7Yzobhh1PDQ Admiral Investment is licensed by the Securities and Futures Commission. Visit Admiral Investment's website at http://www.admiralinv.com/ Like Admiral ... -

Mutual Funds: Pricing and NAVs

Learn about Net Asset Values and Unit prices, and how they are calculated for Mutual funds in India. This is part of MarketVision's free Mutual Fund Video module, and many more videos are on the way. Also check out the Introduction to Mutual Funds at http://www.marketvision.in/short-takes/introduction-mutual-funds.html And do register, comment and browse more Short Takes at http://www.marketvision.in. -

CalTRUST Education Program - Discussion of Net Asset Value (NAV)

CalTRUST informational webinar on the fundamentals and nuances of Net Asset Value (NAV) including: - Money market funds: stable or floating NAV? An update; - The benefits of unitizing funds; - Floating NAV: principal, interest, and total return; - Drivers of NAV volatility; and - CalTRUST portfolio strategy in today's environment. Webinar held July 17, 2013 -

-

Jargon Buster: Net Asset Value

The net asset value of a company is the value shareholders can really count as their own. It is the amount left over once all a company's liabilities are deducted from its assets. -

Money Market Funds' "Shadow" Net Asset Values (NAVs) Are In The Spotlight Again

With money market funds moving toward more frequent reporting of their shadow NAVs (i.e.,the true, nonrounded marked-to-market NAV per share) increased transparency and potential reforms are key factors. In this CreditMatters TV segment, Standard & Poor's Senior Director Joel Friedman and Fund Ratings Analyst Madeleine Parish discuss possible implications of these developments on money market funds and our ratings. -

Net Asset Value -- Learn How To Earn ( or Lose Money ) in a Mutual Fund

PERATree.com -- Mutual Fund Investing Series A Mutual Fund's investment value is measured in a unit called Net Asset Value (Net Asset Value) and this is computed on a daily basis. As an investor, you can determine the value of your investment at any given date by simply multiplying the total number of shares that you own by the Net Asset Value Per Share (NAVPS). When investing in a mutual fund, you have to be prepared of the fact that the Net Asset Value rises and falls on a daily basis. In other words, your investment also gains or loses it's value almost daily. This is a very important concept to understand. Please watch the video closely to learn more. If you are an investor of the FAMI Family of Mutual Funds in the Philippines, please pay attention to the lessons here. -

甚麼是資產淨值(Net Asset Value NAV)?-施凌教學第二百零九集

甚麼是資產淨值(NAV)? *甚麼是資產淨值? *NAV如何判斷基金價格 *股票與基金價格的分別 *甚麼是資產淨值? 投資世界內其中較經常見的術語便是資產淨值或是NAV(Net Asset Value),可以用在基金投資內或評估公司的價值,按照定義資產淨值是指一家公司的總資產扣除負債,剩下來的便是資產淨值,有一些基本會計知識的朋友應該察覺得到這與股東權益(Equity)同一意思。在金融學內,兩大的估值計算方式為市盈率(PE)和市賬率(PB),而市賬率內的PB內的"B"即是Book Value,就是以資產淨值來計算出來。施凌部署中班的同學們應該知道,我們就是以PB的估值模型來計算出現內銀的合理價。 *NAV如何判斷基金價格 投資基金時都需要關注NAV這個名詞,但基金本身理論上不會擁有負債,那麼NAV又如何計算出來?根據定義,基金或ETF的價格都是從NAV衍生出來,基金公司每天於交易時段結束後都會追踪組合持有的股價,然後根據組合每股於組合的比例加起來,再扣除任何負責後得出來的便是基金的NAV,而基金價格就是以NAV除以已發行單位核算出來。 *股票與基金價格的分別 基本買賣與股票其中最大不同之處就是,股票能在交易所簡單地執行買賣,而基金同樣都能在不同的平台買賣單位,但分別就在於基金是會以下一日的NAV價格作交易,因為基金價格計算是需要時間和保持電腦保持處理,要有專業的基金會計師(Fund Accountant)保持更新。大家投資基金時可以留意一些基金簡介(Fund Fact Sheet),內裡應該有指出他的NAV。 撰文:馮智淇 —施凌教學第二百零九集 教學類別:基本分析篇—財務報表 *筆者為證監持牌人,以上分析均為教學實例及分享,並不涉及投資要約及建議 對「施凌部署」有興趣朋友可以: 1) 透過「施凌課室」、「茶敘」及「分享會」等活動施凌親身分享、交流及探討市... -

What is an ETF? | Fidelity

In this video, learn more about what an ETF actually is, and how investing in ETFs can affect your portfolio. To learn more about ETFs, visit https://www.fidelity.com/learning-center/investment-products/etf/overview To get started investing with ETFs, visit https://www.fidelity.com/etfs/overview. To see more videos from Fidelity Investments, subscribe to: https://www.youtube.com/fidelityinvestments Facebook: https://www.facebook.com/fidelityinvestments Twitter: https://www.twitter.com/fidelity Google+: https://plus.google.com/+fidelity LinkedIn: https://www.linkedin.com/company/fidelity-investments What is an exchange-traded fund? It’s simple, really. ETFs are baskets of securities designed to provide exposure to different areas of the market. If used correctly, ETFs m...

What is NAV of a mutual fund and how is it calculated? - SmarterWithMoney

- Order: Reorder

- Duration: 2:57

- Updated: 27 Nov 2012

- views: 16315

- published: 27 Nov 2012

- views: 16315

How to value a company using net assets - MoneyWeek Investment Tutorials

- Order: Reorder

- Duration: 10:13

- Updated: 21 Jun 2013

- views: 38824

- published: 21 Jun 2013

- views: 38824

Calculating Net Asset Value (NAV) of a Mutual fund

- Order: Reorder

- Duration: 8:50

- Updated: 04 Jul 2014

- views: 6164

Net Asset Value

- Order: Reorder

- Duration: 1:56

- Updated: 26 Aug 2014

- views: 2575

- published: 26 Aug 2014

- views: 2575

Net asset value

- Order: Reorder

- Duration: 8:32

- Updated: 27 Sep 2014

- views: 1029

- published: 27 Sep 2014

- views: 1029

Net Asset Value of a Mutual Fund

- Order: Reorder

- Duration: 7:05

- Updated: 29 Apr 2015

- views: 928

- published: 29 Apr 2015

- views: 928

Net Asset Value (NAV) Demystified

- Order: Reorder

- Duration: 3:57

- Updated: 03 Feb 2014

- views: 151354

- published: 03 Feb 2014

- views: 151354

Calculating Mutual Fund Net Asset Value

- Order: Reorder

- Duration: 6:00

- Updated: 18 Sep 2015

- views: 185

- published: 18 Sep 2015

- views: 185

How to calculate NAV ? ( Net Asset Value )

- Order: Reorder

- Duration: 2:56

- Updated: 23 Jan 2015

- views: 1605

- published: 23 Jan 2015

- views: 1605

InterTrader Direct - What is Net Asset Value (NAV)

- Order: Reorder

- Duration: 1:36

- Updated: 24 Feb 2016

- views: 15

- published: 24 Feb 2016

- views: 15

Valuation of Shares [ Net asset method, Yield method and Fair value ] with solved problem

- Order: Reorder

- Duration: 26:38

- Updated: 25 Nov 2015

- views: 1920

- published: 25 Nov 2015

- views: 1920

NAV Model (Oil & Gas): Production Decline Curve

- Order: Reorder

- Duration: 24:28

- Updated: 25 Feb 2014

- views: 11713

- published: 25 Feb 2014

- views: 11713

Net asset value (NAV) - defined

- Order: Reorder

- Duration: 0:27

- Updated: 17 Mar 2013

- views: 777

- published: 17 Mar 2013

- views: 777

What is NAV (Net Asset Value) for Mutual Funds| Net Asset Value Explained by Yadnya

- Order: Reorder

- Duration: 2:00

- Updated: 25 Mar 2016

- views: 4

- published: 25 Mar 2016

- views: 4

Admiral's REIT Primer (11A) - What is NAV?

- Order: Reorder

- Duration: 6:30

- Updated: 23 Jun 2014

- views: 609

- published: 23 Jun 2014

- views: 609

Mutual Funds: Pricing and NAVs

- Order: Reorder

- Duration: 7:02

- Updated: 26 Jan 2011

- views: 29251

- published: 26 Jan 2011

- views: 29251

CalTRUST Education Program - Discussion of Net Asset Value (NAV)

- Order: Reorder

- Duration: 40:19

- Updated: 22 Jul 2013

- views: 271

- published: 22 Jul 2013

- views: 271

Net Asset Value Explained

- Order: Reorder

- Duration: 1:09

- Updated: 30 Oct 2012

- views: 1545

Jargon Buster: Net Asset Value

- Order: Reorder

- Duration: 3:09

- Updated: 25 Jun 2013

- views: 346

- published: 25 Jun 2013

- views: 346

Money Market Funds' "Shadow" Net Asset Values (NAVs) Are In The Spotlight Again

- Order: Reorder

- Duration: 5:46

- Updated: 04 Apr 2013

- views: 217

- published: 04 Apr 2013

- views: 217

Net Asset Value -- Learn How To Earn ( or Lose Money ) in a Mutual Fund

- Order: Reorder

- Duration: 1:17

- Updated: 28 Mar 2016

- views: 1

- published: 28 Mar 2016

- views: 1

甚麼是資產淨值(Net Asset Value NAV)?-施凌教學第二百零九集

- Order: Reorder

- Duration: 5:55

- Updated: 26 May 2015

- views: 2079

- published: 26 May 2015

- views: 2079

What is an ETF? | Fidelity

- Order: Reorder

- Duration: 3:44

- Updated: 05 Nov 2015

- views: 4073

- published: 05 Nov 2015

- views: 4073

-

Valuation Modeling | Financial Modeling Training | Financial Modeling Tutorial

This video explains about valuation modeling Summary of the video : Valuation modeling is the study of elements used for financial analysis. Basic valuation techniques as follows 1. Past performance : Past performance informs us on the historical average level of turnovers and net profit and cash-flows and volatility of these numbers through time. 2. Current structure of the balance sheet : The current structure of the balance sheet provides us with some key financial ratios that can provide a quick diagnosis of how healthy a business is 3. Current structure of the future cash-flows : Finally the current structure of the future cash-flows enables to relate the value of a business to how it is expected to continue doing it's business. Profitability tells us whether a company has been gen... -

Net Asset Value (NAV) Demystified

Visit our website: NAV Demystified What is NAV? Ughh, this is one term that has scared and confused people more than . Understand the concept of Net Asset Value (NAV) with this simple video. Click the play button to learn more. Understand the concept of Net Asset Value (NAV) with this simple video. Click the play button to learn more. Understand the concept of Net Asset Value (NAV) with this simple video. Click the play button to learn more. Understand the concept of Net Asset Value (NAV) with this simple video. Click the play button to learn more. -

Net Asset Value Full HD

-

Retirement Catastrophe- shift the mind-set from asset value to income

Retirement Catastrophe- shift the mind-set from asset value to income. Our approach to saving is all wrong: We need to think about monthly income, not net worth. More dangerous yet is the shift in focus away from retirement income to return on investment that has come with the introduction of saver-managed plans: Investment decisions are now focused on the value of the funds, the returns on investment they deliver, and how volatile those returns are. The seeds of the coming pension crisis lie in the fact that investment decisions are being made with a misguided view of risk. Putting complex investment decisions in the hands of individuals with little or no financial expertise is problematic. Retirement Catastrophe- shift the mind-set from asset value to income is an excellent introductio... -

Avoid Retirement Catastrophe- shift the mind-set from asset value to income

Avoid Retirement Catastrophe- shift the mind-set from asset value to income. Our approach to saving is all wrong: We need to think about monthly income, not net worth. More dangerous yet is the shift in focus away from retirement income to return on investment that has come with the introduction of saver-managed plans: Investment decisions are now focused on the value of the funds, the returns on investment they deliver, and how volatile those returns are. The seeds of the coming pension crisis lie in the fact that investment decisions are being made with a misguided view of risk. Putting complex investment decisions in the hands of individuals with little or no financial expertise is problematic. Avoid Retirement Catastrophe- shift the mind-set from asset value to income is an excellent... -

Sustainability Adds Value to Real Estate Assets, Liberty Executive Says

Billy Grayson, director of sustainability at Liberty Property Trust (NYSE: LPT), joined REIT.com for a video interview at NAREIT’s 2016 Leader in the Light Working Forum at the Ritz Carlton – Coconut Grove in Miami. Liberty owns office and industrial space throughout the United States and the United Kingdom. Grayson highlighted the importance Liberty places on sustainability goals and benchmarks. He noted that the company’s sustainability program is more than a decade old. In the early days, Liberty used Energy Star as its first tool to drive corporate energy efficiency, Grayson said: “Energy Star was really the cornerstone of our sustainability program.” Over the years, Liberty has tried to broaden its program to include more environmental factors and different metrics, Grayson noted. ... -

-

Don’t avoid risk. Manage it.

Don’t avoid risk. Manage it. Visit www.opportunityknocks.co.za for more information Important information: Collective investment schemes (CIS) are traded at ruling prices and can engage in borrowing, up to 10% of portfolio net asset value to bridge insufficient liquidity, and scrip lending. A schedule of charges, fees and advisor fees is available on request from the Manager, Investec Fund Managers SA (RF) (Pty) Ltd which is registered under the CIS Control Act. Additional advisor fees may be paid and if so, are subject to the relevant FAIS disclosure requirements. CISs are generally medium to long-term investments and the manager gives no guarantee with respect to the capital or the return of the Fund. Performance shown is that of the Fund and individual investor performance may differ ... -

Fairway Investments - Who We Are

The primary objective of Fairway’s investment strategy is to pursue growth in the net asset value and cash flow of its property portfolio. This short video explains their approach and philosophy through interviews with key executives. www.fairwayinvestments.com -

Attacq Posts A 5.1% Growth In Net Asset Value

Morne Wilken, CEO of Attacq, discusses the property fund’s latest results; -

What is a Discount?

Investment trusts trade at either a discount or a premium to their net asset value. We explain the jargon. http://www.morningstar.co.uk -

Module 4: Timber Stand Rotation Harvest Timing

In this video we demonstrate the core of the FRASS Approach, integrating biometric and econometric forecasting, with its focus shifted to an extended time horizon. Linear and Sequential Quadratic Programming are used as tools to find the highest asset value combinations, analyzed through multiple rotations on each timber stand. Timber stand harvest timing on multiple rotations determines the net asset value - FRASS takes you there by design. -

What is an Asset?

What is an Asset? - Please take a moment to Like, Subscribe, and Comment on this video! View Our Channel To See More Helpful Finance Videos - https://www.youtube.com/user/FinanceWisdomForYou liquid assets asset definition debt to asset ratio fixed asset accounting assets definition define asset what are assets financial asset management best assets capital asset intangible assets define assets net fixed assets liquid assets definition quick assets definition of asset liquid asset contra asset asset purchase agreement deferred tax asset fixed assets capital assets long term assets what are fixed assets assets and liabilities total assets list of assets fixed assets accounting definition of assets debt to assets ratio fixed asset toxic assets operating assets wha... -

EITF 14-B, Fair Value Hierarchy for Certain Investments Measured at Net Asset Value

EITF Issue 2014 B, Fair Value Hierarchy for Certain Investments Measured at Net Asset Value

Valuation Modeling | Financial Modeling Training | Financial Modeling Tutorial

- Order: Reorder

- Duration: 9:28

- Updated: 26 Apr 2016

- views: 4

- published: 26 Apr 2016

- views: 4

Net Asset Value (NAV) Demystified

- Order: Reorder

- Duration: 7:11

- Updated: 19 Apr 2016

- views: 0

- published: 19 Apr 2016

- views: 0

Net Asset Value Full HD

- Order: Reorder

- Duration: 1:56

- Updated: 29 Mar 2016

- views: 1

- published: 29 Mar 2016

- views: 1

Retirement Catastrophe- shift the mind-set from asset value to income

- Order: Reorder

- Duration: 1:01

- Updated: 25 Mar 2016

- views: 6

- published: 25 Mar 2016

- views: 6

Avoid Retirement Catastrophe- shift the mind-set from asset value to income

- Order: Reorder

- Duration: 1:01

- Updated: 25 Mar 2016

- views: 18

- published: 25 Mar 2016

- views: 18

Sustainability Adds Value to Real Estate Assets, Liberty Executive Says

- Order: Reorder

- Duration: 3:33

- Updated: 17 Feb 2016

- views: 3

- published: 17 Feb 2016

- views: 3

ASU 2015 07 Disclosures for investments in certain entities that calculate net asset value per share

- Order: Reorder

- Duration: 10:07

- Updated: 22 Jul 2015

- views: 193

Don’t avoid risk. Manage it.

- Order: Reorder

- Duration: 0:41

- Updated: 22 Jun 2015

- views: 46069

- published: 22 Jun 2015

- views: 46069

Fairway Investments - Who We Are

- Order: Reorder

- Duration: 5:19

- Updated: 03 Jun 2015

- views: 5

- published: 03 Jun 2015

- views: 5

Attacq Posts A 5.1% Growth In Net Asset Value

- Order: Reorder

- Duration: 7:36

- Updated: 17 Mar 2015

- views: 16

- published: 17 Mar 2015

- views: 16

What is a Discount?

- Order: Reorder

- Duration: 1:08

- Updated: 13 Feb 2015

- views: 22

- published: 13 Feb 2015

- views: 22

Module 4: Timber Stand Rotation Harvest Timing

- Order: Reorder

- Duration: 16:17

- Updated: 05 Dec 2014

- views: 2

- published: 05 Dec 2014

- views: 2

What is an Asset?

- Order: Reorder

- Duration: 1:43

- Updated: 07 Nov 2014

- views: 2721

- published: 07 Nov 2014

- views: 2721

EITF 14-B, Fair Value Hierarchy for Certain Investments Measured at Net Asset Value

- Order: Reorder

- Duration: 8:55

- Updated: 31 Oct 2014

- views: 190

- published: 31 Oct 2014

- views: 190

-

F7 Lecture 6 Fair Value of Net Assets

-

Oil & Gas Stock Pitch: How to Research and Present It

In this tutorial, you'll learn how to research, structure, and present an oil & gas stock pitch. More at http://www.mergersandinquisitions.com/oil-gas-stock-pitch/ You'll also learn how it's different from investment recommendations and stock pitches in other industries. We'll use Ultra Petroleum [UPL] as the example company, and present a SHORT recommendation based on a detailed analysis of their filings, investor presentations, and earnings call transcripts, along with a complex Net Asset Value (NAV) Model, based on individual wells drilled in different regions. Table of Contents: 1:19 The Structure of an Oil & Gas Stock Pitch 3:15 Investment Thesis 6:19 Catalysts 10:42 Valuation 13:38 Risk Factors 15:51 Why This Recommendation Was Wrong 19:25 Recap and Summary Investment Thesi... -

Value or value trap? Keith McLachlan helps us spot the difference

Often when a share price collapses the share may appear to offer great value, especially it is now trading below net asset value (NAV) and even more so if trading below tangible net asset value (TNAV). But is this always the case? How do we identify those that really offer value vs. those that are a value trap? Keith McLachlan will help us spot the difference between real value and the dreaded value trap. The presentation includes practical examples using Sanyati (value trap and now in liquidation) and POY (real value as the share is up over 500% in the last year). -

Financial Ratios -- Profitability and Market Value Ratios

This video walks through the calculation and interpretation of the gross profit margin, operating profit margin, net profit margin, return on assets, return on equity, price-earnings, market-book, and dividend-yield ratios -

How to Predict the Stock Market: Finance, Trends, Money, Investment, Indicators (2002)

Two famous early stock market bubbles were the Mississippi Scheme in France and the South Sea bubble in England. Both bubbles came to an abrupt end in 1720, bankrupting thousands of unfortunate investors. Those stories, and many others, are recounted in Charles Mackay's 1841 popular account, "Extraordinary Popular Delusions and the Madness of Crowds." The two most famous bubbles of the twentieth century, the bubble in American stocks in the 1920s just before the Great Depression and the Dot-com bubble of the late 1990s were based on speculative activity surrounding the development of new technologies. The 1920s saw the widespread introduction of an amazing range of technological innovations including radio, automobiles, aviation and the deployment of electrical power grids. The 1990s was ... -

Valuation of Shares Net Asset Method B Com Hons. Class 1

-

Not For Profit Accounting (Understanding Reclassification Of Temporary Restricted Assets, Etc.)

Not For Profit Accounting & understanding reclassification of Temporary Restricted Assets, To transfer from a Temporary Restricted to Unrestricted use an Acct. "Net Assets Released From Restrictions" thru "Reclassification-Out" to "Reclassification-In", NARFR is not Just one acct., these accts are in all Net Assets or Funds, NARFR Accts. Always "Zero Out" No Impact On Financial Statements (Bottom Line), Increases One Net Asset & Decreases Another,"Zero Out" but Reclassification Matches Operating Expense on F/S, Releasing of Donor-Imposed Restrictions (reclassification) Simultaneously decreases temporary restricted net assets & increases unrestricted net assets in order to match the Expense they support (operating expenses, depreciation, Etc. which decreases net assets), detailed accounting... -

HDB-AG:(29/07/2012) HDB AG, GREEK DEBT. OUR PUBLIC PROPOSAL

Project Metropolitan – Thematic – Residential Park “Ellinon Politeia” Mother Company of Cross-Border Group of Companies Www.hdb-ag.de Purpose 26/02/2014 , Our new OUR PUBLIC PROPOSAL (HERE) http://www.hdb-ag.de/?p=3237 Greek real estate value. Request for Issuance of Cross-Border Order Prosecution (18/02/2015) “Ellinon Politeia” Metropolitan – Theme – Residential Park Project Prosecutor, connected to the protection of the European Currency (Euro) by the competent Public Prosecutor of Greece (competent authority according to the loan agreement on fraud investigation). We present as new Evidence the relevant Intercreditor Agreement (ref. 1), which the Hellenic Republic is not a party to and on which the Legal Council of the Greek State has not issued a legal opinion. The implementation a... -

2005-2006: The Latest in Ways to Improve Asset Value through Better Water Management

Steven K. Cheung of Chevron Energy Technology Co. presented “The Latest in Ways to Improve Asset Value through Better Water Management” during the 2005-2006 Society of Petroleum Engineers Distinguished Lecturer Series. About the Lecture Many wells and reservoirs are prematurely abandoned due to excess water production, resulting in lost production and recovery. We need ways to delay water production in new fields, and to maximize efficiency in mature producing fields. This talk highlights some of the latest technology in prevention, diagnosis, mechanical/chemical methods, and with supporting field case history. Specific applications for injector, producer, reservoir-wide, and facility-related will be communicated. New near-wellbore and reservoir in-depth treatments will be particularly d... -

Using an Excel Codeunit to create Excel Reports from Microsoft Dynamics NAV

Shows how to use the Excel Codeunit (made available for free from the associated blog post at www.archerpoint.com) in Microsoft Dynamics NAV to write Excel reports, such as the Inventory Valuation report. -

Enterprise Value: Why You Add and Subtract Items

In this Enterprise Value lesson we take a look at the rules of thumb to figure out what should be added or subtracted when you calculate it. By http://breakingintowallstreet.com/ "Financial Modeling Training And Career Resources For Aspiring Investment Bankers" This also covers a short case study based on Vivendi (a leading media/telecom conglomerate based in France), Everyone knows the definition of Enterprise Value: Take Equity Value, add Debt and Preferred Stock (and others), and subtract Cash... But WHY do you do any of that? Enterprise Value represents the value of the company's CORE BUSINESS OPERATIONS to ALL THE INVESTORS in the company - equity, debt, preferred stock, etc. So focus on OPERATIONAL ITEMS and ALL INVESTORS when thinking about what to include... and what to exclu... -

Valuation of Share Net Asset Method BCH JRM Class 2

-

Corporate Governance, the Stock Market Bubble & Combating Corporate Corruption (2003)

Emotional and cognitive biases (see behavioral finance) seem to be the causes of bubbles, but often, when the phenomenon appears, pundits try to find a rationale, so as not to be against the crowd. Thus, sometimes, people will dismiss concerns about overpriced markets by citing a new economy where the old stock valuation rules may no longer apply. This type of thinking helps to further propagate the bubble whereby everyone is investing with the intent of finding a greater fool. Still, some analysts cite the wisdom of crowds and say that price movements really do reflect rational expectations of fundamental returns. Large traders become powerful enough to rock the boat, generate stock market bubbles.[5] To sort out the competing claims between behavioral finance and efficient markets theor... -

Up Close with Sandile Zungu, 29 August 2013

Up Close with Sandile Zungu, the Chairman of Zungu Investments Company Limited, Zico. This business executive extraordinaire first completed a BSc Mechanical Engineering degree before he realized his calling was business and financial management. Since then he acquired a Masters in Business Administration (MBA) from UCT and completed the Program for Global Leadership certificate at the Harvard Business School in Boston, USA. Amongst many achievements, he stunned the business world when he established an investment Holdings company, growing it from a zero asset base to more than R400 million, in net asset value! -

Relevant Cash Flows for an Asset Investment, James Tompkins

Net present value, internal rate of return and other analyses pertinent to the asset investment decision (capital budgeting) are applied to a timeline of cash flows. But how do you calculate these cash flows? This is what I explore in this video. -

Hedge Funds: Investment Pools, Advisers, Trading Practices, Monitoring, Regulation (2006)

A hedge fund is a pooled investment vehicle administered by a professional management firm, and often structured as a limited partnership, limited liability company, or similar vehicle. They are usually distinguished from private equity funds, which use the more illiquid investment strategies associated with private equity. Hedge funds invest in a diverse range of markets and use a wide variety of investment styles and financial instruments. The name "hedge fund" refers to the hedging techniques traditionally used by hedge funds, but hedge funds today do not necessarily hedge. Hedge funds are made available only to certain sophisticated or accredited investors and cannot be offered or sold to the general public. As such, they generally avoid direct regulatory oversight, bypass licensing re... -

Financial Institutions, Lecture 05

Mutual Funds, Diversification, Professional Management, Liquidity, Redemption, Mutuals, Prospectus, Investment Objectives, Net Asset Value, Equity Funds, Bond Funds, Hybrid Funds, REITs, Commodity Funds, Fund Family, Management Fees, Expense Ratio, Load Funds, No-Load Funds, Open-end Funds, Close-end Funds, Asset Allocation, -

Energy Retrofits: Does Ignoring Green Building Upgrades Decrease Property Asset Values?

Speakers: Daniel Egan Vornado Realty Trust Director, Energy and Sustainability Nicholas Stolatis TIAA-CREF Sr Director - Global Sustainability & Enterprise Initiatives Hussain Ali-Khan CBRE Director, Strategy Moderators: Jay Raphaelson EnergyWatch Inc. President Fortune 500 Companies are not only setting targets—they are achieving GHG reduction commitments through energy efficiency improvements and renewable energy projects. Implementing energy efficiency standards has now become an important financial investment, not just a sustainability fad. Studies show that the most efficient buildings have higher occupancy rates and increased asset value compared to those that don’t. Increased demand from developers, owners, and tenants is a result of higher sale prices, slower depreciation, and... -

The Asset Investment Decision (Capital Budgeting), James Tompkins

This is the third lecture of the Corporate Finance series in which I discuss what I call the "Asset Investment" decision or what is more commonly referred to as "Capital Budgeting". For example, the decision that Apple made to spend money developing the iPhone would be an asset investment decision. I begin by assuming the "relevant" cash flows for the asset investment decision and discuss analytical techniques including net present value, payback period, internal rate of return and profitability index. I then discuss other issues such as the optimal time to make such a decision and "equivalent annual cost". I conclude with a determination of the "relevant" cash flows for the asset investment decision. As always, my goal is not to have you memorize a bunch of formulas, but rather to underst... -

Andrew Brenton, Turtle Creek Asset Management - Ben Graham Centre Value Investing 2015

Mr. Brenton is the CEO and a co-founder of Turtle Creek Asset Management, a Toronto-based independent investment management firm that invests in publically listed equities. Turtle Creek is focused on long term capital growth for a clientele of high net worth individuals, families and institutions and has an exceptional 15 year investment track record. Previously, Mr. Brenton founded and was the CEO of the private equity subsidiary of The Bank of Nova Scotia where he invested $300 million in control positions of a dozen Canadian mid-market private companies. In the early 1990's, Mr. Brenton was head of the high technology investment banking practice of Scotia Capital and prior to that, he was a founding member and Managing Director in the firm’s mergers and acquisitions practice. Mr. Brento...

F7 Lecture 6 Fair Value of Net Assets

- Order: Reorder

- Duration: 21:23

- Updated: 21 Aug 2012

- views: 5443

- published: 21 Aug 2012

- views: 5443

Oil & Gas Stock Pitch: How to Research and Present It

- Order: Reorder

- Duration: 22:11

- Updated: 07 May 2014

- views: 10134

- published: 07 May 2014

- views: 10134

Value or value trap? Keith McLachlan helps us spot the difference

- Order: Reorder

- Duration: 26:51

- Updated: 22 Sep 2015

- views: 120

- published: 22 Sep 2015

- views: 120

Financial Ratios -- Profitability and Market Value Ratios

- Order: Reorder

- Duration: 24:29

- Updated: 29 Jun 2012

- views: 15947

- published: 29 Jun 2012

- views: 15947

How to Predict the Stock Market: Finance, Trends, Money, Investment, Indicators (2002)

- Order: Reorder

- Duration: 44:49

- Updated: 09 Dec 2015

- views: 466

- published: 09 Dec 2015

- views: 466

Valuation of Shares Net Asset Method B Com Hons. Class 1

- Order: Reorder

- Duration: 57:26

- Updated: 27 Mar 2016

- views: 169

- published: 27 Mar 2016

- views: 169

Not For Profit Accounting (Understanding Reclassification Of Temporary Restricted Assets, Etc.)

- Order: Reorder

- Duration: 22:17

- Updated: 08 Nov 2013

- views: 3182

- published: 08 Nov 2013

- views: 3182

HDB-AG:(29/07/2012) HDB AG, GREEK DEBT. OUR PUBLIC PROPOSAL

- Order: Reorder

- Duration: 40:21

- Updated: 04 Dec 2013

- views: 247

- published: 04 Dec 2013

- views: 247

2005-2006: The Latest in Ways to Improve Asset Value through Better Water Management

- Order: Reorder

- Duration: 36:31

- Updated: 16 Oct 2014

- views: 141

- published: 16 Oct 2014

- views: 141

Using an Excel Codeunit to create Excel Reports from Microsoft Dynamics NAV

- Order: Reorder

- Duration: 22:49

- Updated: 25 May 2012

- views: 3062

- published: 25 May 2012

- views: 3062

Enterprise Value: Why You Add and Subtract Items

- Order: Reorder

- Duration: 23:40

- Updated: 03 Jun 2014

- views: 8737

- published: 03 Jun 2014

- views: 8737

Valuation of Share Net Asset Method BCH JRM Class 2

- Order: Reorder

- Duration: 72:01

- Updated: 31 Mar 2016

- views: 101

- published: 31 Mar 2016

- views: 101

Corporate Governance, the Stock Market Bubble & Combating Corporate Corruption (2003)

- Order: Reorder

- Duration: 58:27

- Updated: 25 Jan 2015

- views: 155

- published: 25 Jan 2015

- views: 155

Up Close with Sandile Zungu, 29 August 2013

- Order: Reorder

- Duration: 24:59

- Updated: 16 Sep 2013

- views: 1468

- published: 16 Sep 2013

- views: 1468

Relevant Cash Flows for an Asset Investment, James Tompkins

- Order: Reorder

- Duration: 31:20

- Updated: 04 May 2015

- views: 644

- published: 04 May 2015

- views: 644

Hedge Funds: Investment Pools, Advisers, Trading Practices, Monitoring, Regulation (2006)

- Order: Reorder

- Duration: 98:55

- Updated: 04 Jan 2014

- views: 3132

- published: 04 Jan 2014

- views: 3132

Financial Institutions, Lecture 05

- Order: Reorder

- Duration: 67:28

- Updated: 05 Jul 2011

- views: 5211

- published: 05 Jul 2011

- views: 5211

Energy Retrofits: Does Ignoring Green Building Upgrades Decrease Property Asset Values?

- Order: Reorder

- Duration: 90:20

- Updated: 26 Feb 2015

- views: 68

- published: 26 Feb 2015

- views: 68

The Asset Investment Decision (Capital Budgeting), James Tompkins

- Order: Reorder

- Duration: 130:42

- Updated: 25 Feb 2014

- views: 5299

- published: 25 Feb 2014

- views: 5299

Andrew Brenton, Turtle Creek Asset Management - Ben Graham Centre Value Investing 2015

- Order: Reorder

- Duration: 50:38

- Updated: 08 Dec 2015

- views: 1313

- published: 08 Dec 2015

- views: 1313

- Playlist

- Chat

- Playlist

- Chat

What is NAV of a mutual fund and how is it calculated? - SmarterWithMoney

- Report rights infringement

- published: 27 Nov 2012

- views: 16315

How to value a company using net assets - MoneyWeek Investment Tutorials

- Report rights infringement

- published: 21 Jun 2013

- views: 38824

Calculating Net Asset Value (NAV) of a Mutual fund

- Report rights infringement

- published: 04 Jul 2014

- views: 6164

Net Asset Value

- Report rights infringement

- published: 26 Aug 2014

- views: 2575

Net asset value

- Report rights infringement

- published: 27 Sep 2014

- views: 1029

Net Asset Value of a Mutual Fund

- Report rights infringement

- published: 29 Apr 2015

- views: 928

Net Asset Value (NAV) Demystified

- Report rights infringement

- published: 03 Feb 2014

- views: 151354

Calculating Mutual Fund Net Asset Value

- Report rights infringement

- published: 18 Sep 2015

- views: 185

How to calculate NAV ? ( Net Asset Value )

- Report rights infringement

- published: 23 Jan 2015

- views: 1605

InterTrader Direct - What is Net Asset Value (NAV)

- Report rights infringement

- published: 24 Feb 2016

- views: 15

Valuation of Shares [ Net asset method, Yield method and Fair value ] with solved problem

- Report rights infringement

- published: 25 Nov 2015

- views: 1920

NAV Model (Oil & Gas): Production Decline Curve

- Report rights infringement

- published: 25 Feb 2014

- views: 11713

Net asset value (NAV) - defined

- Report rights infringement

- published: 17 Mar 2013

- views: 777

What is NAV (Net Asset Value) for Mutual Funds| Net Asset Value Explained by Yadnya

- Report rights infringement

- published: 25 Mar 2016

- views: 4

- Playlist

- Chat

Valuation Modeling | Financial Modeling Training | Financial Modeling Tutorial

- Report rights infringement

- published: 26 Apr 2016

- views: 4

Net Asset Value (NAV) Demystified

- Report rights infringement

- published: 19 Apr 2016

- views: 0

Net Asset Value Full HD

- Report rights infringement

- published: 29 Mar 2016

- views: 1

Retirement Catastrophe- shift the mind-set from asset value to income

- Report rights infringement

- published: 25 Mar 2016

- views: 6

Avoid Retirement Catastrophe- shift the mind-set from asset value to income

- Report rights infringement

- published: 25 Mar 2016

- views: 18

Sustainability Adds Value to Real Estate Assets, Liberty Executive Says

- Report rights infringement

- published: 17 Feb 2016

- views: 3

ASU 2015 07 Disclosures for investments in certain entities that calculate net asset value per share

- Report rights infringement

- published: 22 Jul 2015

- views: 193

Don’t avoid risk. Manage it.

- Report rights infringement

- published: 22 Jun 2015

- views: 46069

Fairway Investments - Who We Are

- Report rights infringement

- published: 03 Jun 2015

- views: 5

Attacq Posts A 5.1% Growth In Net Asset Value

- Report rights infringement

- published: 17 Mar 2015

- views: 16

What is a Discount?

- Report rights infringement

- published: 13 Feb 2015

- views: 22

Module 4: Timber Stand Rotation Harvest Timing

- Report rights infringement

- published: 05 Dec 2014

- views: 2

What is an Asset?

- Report rights infringement

- published: 07 Nov 2014

- views: 2721

EITF 14-B, Fair Value Hierarchy for Certain Investments Measured at Net Asset Value

- Report rights infringement

- published: 31 Oct 2014

- views: 190

- Playlist

- Chat

F7 Lecture 6 Fair Value of Net Assets

- Report rights infringement

- published: 21 Aug 2012

- views: 5443

Oil & Gas Stock Pitch: How to Research and Present It

- Report rights infringement

- published: 07 May 2014

- views: 10134

Value or value trap? Keith McLachlan helps us spot the difference

- Report rights infringement

- published: 22 Sep 2015

- views: 120

Financial Ratios -- Profitability and Market Value Ratios

- Report rights infringement

- published: 29 Jun 2012

- views: 15947

How to Predict the Stock Market: Finance, Trends, Money, Investment, Indicators (2002)

- Report rights infringement

- published: 09 Dec 2015

- views: 466

Valuation of Shares Net Asset Method B Com Hons. Class 1

- Report rights infringement

- published: 27 Mar 2016

- views: 169

Not For Profit Accounting (Understanding Reclassification Of Temporary Restricted Assets, Etc.)

- Report rights infringement

- published: 08 Nov 2013

- views: 3182

HDB-AG:(29/07/2012) HDB AG, GREEK DEBT. OUR PUBLIC PROPOSAL

- Report rights infringement

- published: 04 Dec 2013

- views: 247

2005-2006: The Latest in Ways to Improve Asset Value through Better Water Management

- Report rights infringement

- published: 16 Oct 2014

- views: 141

Using an Excel Codeunit to create Excel Reports from Microsoft Dynamics NAV

- Report rights infringement

- published: 25 May 2012

- views: 3062

Enterprise Value: Why You Add and Subtract Items

- Report rights infringement

- published: 03 Jun 2014

- views: 8737

Valuation of Share Net Asset Method BCH JRM Class 2

- Report rights infringement

- published: 31 Mar 2016

- views: 101

Corporate Governance, the Stock Market Bubble & Combating Corporate Corruption (2003)

- Report rights infringement

- published: 25 Jan 2015

- views: 155

Up Close with Sandile Zungu, 29 August 2013

- Report rights infringement

- published: 16 Sep 2013

- views: 1468

Trump On Charles Koch: I Don't Need Him. I Have My Own Money. Won't Be A 'Puppet'

Edit WorldNews.com 27 Apr 2016ISIS Covering Streets Of Raqqa With Sheets To Prevent Coalition Drone Attacks

Edit WorldNews.com 27 Apr 2016Old and New Ghosts Of Crimean War Haunts Russia

Edit WorldNews.com 27 Apr 2016Looting, Protests As Venezuelans Experience Rolling Blackouts, 2-Day Government Workweek

Edit WorldNews.com 27 Apr 2016Net Asset Value(s) (link is external) (Troy Income & Growth Trust plc)

Edit Public Technologies 28 Apr 2016DISCLOSEABLE TRANSACTION - FURTHER ACQUISITION OF SHARES IN SHENGJING BANK (Evergrande Real Estate Group Limited)

Edit Public Technologies 28 Apr 2016BRIEF-Pershing Square Holdings says NAV per share as of April 26 was $17.29

Edit Reuters 28 Apr 2016Stone Harbor Emerging Markets Income Fund Declares Monthly Distributions of $0.18 Per Share

Edit Stockhouse 28 Apr 2016Stone Harbor Emerging Markets Total Income Fund Declares Monthly Distributions of $0.1511 Per Share

Edit Stockhouse 28 Apr 2016Edinburgh Worldwide Inv Trust PLC - Net Asset Value(s) (Edinburgh Worldwide Investment Trust plc)

Edit Public Technologies 27 Apr 2016Baillie Gifford Shin Nippon PLC - Net Asset Value(s) (Baillie Gifford Shin Nippon plc)

Edit Public Technologies 27 Apr 2016Monks Investment Trust PLC - Net Asset Value(s) (The Monks Investment Trust plc)

Edit Public Technologies 27 Apr 2016Scottish American Investment Co PLC - Net Asset Value(s) (Scottish American Investment Company plc)

Edit Public Technologies 27 Apr 2016Scottish Mortgage Inv Tst PLC - Net Asset Value(s) (Scottish Mortgage Investment Trust plc)

Edit Public Technologies 27 Apr 2016Net Asset Value(s) (Fundsmith Emerging Equities Trust plc)

Edit Public Technologies 27 Apr 2016BLACKROCK INCOME AND GROWTH INVESTMENT TRUST PLC - Net Asset Value(s) (BlackRock Income and Growth Investment Trust plc)

Edit Public Technologies 27 Apr 2016- 1

- 2

- 3

- 4

- 5

- Next page »