- published: 11 Nov 2014

- views: 106774

-

remove the playlistHealth Insurance

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistHealth Insurance

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 09 Jun 2011

- views: 141069

- published: 03 Nov 2013

- views: 77485

- published: 06 Jan 2014

- views: 20215

- published: 21 Sep 2012

- views: 6051

- published: 23 Sep 2014

- views: 36536

- published: 22 Dec 2014

- views: 19210

- published: 31 Oct 2013

- views: 7009

- published: 08 Oct 2013

- views: 769962

- published: 22 Oct 2013

- views: 479660

Health insurance is insurance against the risk of incurring medical expenses among individuals. By estimating the overall risk of health care expenses among a targeted group, an insurer can develop a routine finance structure, such as a monthly premium or payroll tax, to ensure that money is available to pay for the health care benefits specified in the insurance agreement. The benefit is administered by a central organization such as a government agency, private business, or not-for-profit entity.

1) a contract between an insurance provider (e.g. an insurance company or a government) and an individual or his sponsor (e.g. an employer or a community organization). The contract can be renewable (e.g. annually, monthly) or lifelong in the case of private insurance, or be mandatory for all citizens in the case of national plans. The type and amount of health care costs that will be covered by the health insurance provider are specified in writing, in a member contract or "Evidence of Coverage" booklet for private insurance, or in a national health policy for public insurance.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

5:25

5:25Health Insurance Explained – The YouToons Have It Covered

Health Insurance Explained – The YouToons Have It CoveredHealth Insurance Explained – The YouToons Have It Covered

This cartoon explains health insurance using fun, easy-to-understand scenarios. It breaks down important insurance concepts, such as premiums, deductibles and provider networks. The video explains how individuals purchase and obtain medical care and prescription drugs when enrolled in various types of health insurance, including HMOs and PPOs. This is the third YouToons video written and produced by the Kaiser Family Foundation. The video is narrated by former U.S. Senate Majority Leader Bill Frist, a nationally-recognized surgeon and Foundation trustee. Also available in Spanish: http://youtu.be/mDPhCo11z0E To download the video, please visit: http://www.kff.org/youtoons-health-insurance-explained This year's open enrollment period begins on Sunday, November 1, 2015, and ends Sunday, January 31, 2016. -

6:31

6:31How Health Insurance Works

How Health Insurance WorksHow Health Insurance Works

When I consider purchasing an individual health insurance plan for myself or my family, do I have any financial obligations beyond the monthly premium and annual deductible? Answers: It depends on the plan, but some plans have the following cost-sharing elements that you should be aware of. Co-Payments: Some plans include a co-payment, which is typically a specific flat fee you pay for each medical service, such as $30 for an office visit. After the co-payment is made, the insurance company typically pays the remainder of the covered medical charges. Deductibles: Some plans include a deductible, which typically refers to the amount of money you must pay each year before your health insurance plan starts to pay for covered medical expenses. Coinsurance: Some plans include coinsurance. Coinsurance is a cost sharing requirement that makes you responsible for paying a certain percentage of any costs. The insurance company pays the remaining percentage of the covered medical expenses after your insurance deductible is met. Out-of-pocket limit: Some plans include an out-of-pocket limit. Typically, the out-of-pocket limit is the maximum amount you will pay out of your own pocket for covered medical expenses in a given year. The out-of-pocket limit typically includes deductibles and coinsurance. But, out-of-pocket limits don't typically apply to co-payments. Lifetime maximum: Most plans include a lifetime maximum. Typically the lifetime maximum is the amount your insurance plan will pay for covered medical expenses in the course of your lifetime. Exclusions & Limitations: Most health insurance carriers disclose exclusions & limitations of their plans. It is always a good idea to know what benefits are limited and which services are excluded on your plan. You will be obligated to pay for 100% of services that are excluded on your policy. Beginning September 23, 2010, the Patient Protection and Affordable Care Act (health care reform) begins to phase out annual dollar limits. Starting on September 23, 2012, annual limits on health insurance plans must be at least $2 million. By 2014 no new health insurance plan will be permitted to have an annual dollar limit on most covered benefits. Some health insurance plans purchased before March 23, 2010 have what is called "grandfathered status." Health Insurance Plans with Grandfathered status are exempt from several changes required by health care reform including this phase out of annual limits on health coverage. If you purchased your health insurance policy after March 23, 2010 and you're due for a routine preventive care screening like a mammogram or colonoscopy, you may be able to receive that preventive care screening without making a co-payment. You can talk to your insurer or your licensed eHealthInsurance agent if you need help determining whether or not you qualify for a screening without a co-payment. There are five important changes that occurred with individual and family health insurance policies on September 23, 2010. Those changes are: 1. Added protection from rate increases: Insurance companies will need to publically disclose any rate increases and provide justification before raising your monthly premiums. 2. Added protection from having insurance canceled: An insurance company cannot cancel your policy except in cases of intentional misrepresentations or fraud. 3. Coverage for preventive care: Certain recommended preventive services, immunizations, and screenings will be covered with no cost sharing requirement. 4. No lifetime maximums on health coverage: No lifetime limits on the dollar value of those health benefits deemed to be essential by the Department of Health and Human Services. 5. No pre-existing condition exclusions for children: If you have children under the age of 19 with pre-existing medical conditions, their application for health insurance cannot be declined due to a pre-existing medical condition. In some states a child may need to wait for the state's open-enrollment period before their application will be approved. -

8:18

8:18What is Health Insurance, and Why Do You Need It?: Health Care Triage #2

What is Health Insurance, and Why Do You Need It?: Health Care Triage #2What is Health Insurance, and Why Do You Need It?: Health Care Triage #2

You can directly support Healthcare Triage on Patreon: http://vid.io/xqXr If you can afford to pay a little every month, it really helps us to continue producing great content. In this episode of Healthcare Triage, Dr. Aaron Carroll gets some surprised questions from "friend of Obama" John Green who is still waiting for his big government giveaway . Unfortunately, insurance still costs money, and it's still really complicated. Aaron explains how the insurance system we have today came to be, and why most of us get coverage through our jobs. He talks about why we need insurance, which basically boils down to the fact that health care is really, really, really expansive. More importantly, he explains why you need to know what premiums, networks, deductibles, co-pays, and co-insurance are, and how they have to be considered in the true cost of insurance. Also, ground unicorn horn. Make sure you subscribe above so you don't miss any upcoming episodes! Read more on Aaron's blog: http://theincidentaleconomist.com/ John Green -- Executive Producer Stan Muller -- Director, Producer Aaron Carroll -- Writer Mark Olsen - Graphics http://www.twitter.com/aaronecarroll http://www.twitter.com/crashcoursestan http://www.twitter.com/realjohngreen http://www.twitter.com/olsenvideo -

3:52

3:52Obamacare: The BIGGEST Mistake You Can Make When Choosing a Health Insurance Plan

Obamacare: The BIGGEST Mistake You Can Make When Choosing a Health Insurance PlanObamacare: The BIGGEST Mistake You Can Make When Choosing a Health Insurance Plan

This video discusses a huge problem that has been seen nationwide with the new Obamacare health plan (and it isn't the Obamacare website). It is the fact that so many new enrollments seem to just be picking the cheapest monthly premium package instead of looking at all of the variables. Most importantly, the deductible that goes with that package. This video gives some specific examples that what some Americans are paying per month and also what the corresponding deductible is. Keep in mind, the most important thing to do when picking your health insurance plan is to find out the TOTAL cost of owning that obamacare plan, not just the monthly premium. For more on this and other retirement frequently asked questions, check out our site with new FREE retirement material for you to download every month. http://www.retirethinktank.com -

21:25

21:25Know the benefits of health insurance Business Videos - India Today

Know the benefits of health insurance Business Videos - India TodayKnow the benefits of health insurance Business Videos - India Today

Know the benefits of health insurance Business Videos - India Today -

2:07

2:07Health Insurance Coverage 101 - the Basics Explained in Two Minutes

Health Insurance Coverage 101 - the Basics Explained in Two MinutesHealth Insurance Coverage 101 - the Basics Explained in Two Minutes

http://onphr.ma/1mpAUZJ Health Insurance Coverage 101 - the Basics Explained in Two Minutes We know insurance jargon can be confusing and consumers may have a hard time cutting through the clutter. In order to make informed decisions about health coverage and ensure patients have access to needed services and treatments, knowing the language of insurance is critical. That’s why we created a back-to-basics video walking through some basic insurance terms. -

4:55

4:55Understanding Your Health Insurance Costs | Consumer Reports

Understanding Your Health Insurance Costs | Consumer ReportsUnderstanding Your Health Insurance Costs | Consumer Reports

Baffled by premiums, deductibles and out-of-pocket maximums? Here is an overview of health insurance that will help clear things up and give you a better sense of how your money is spent. -

11:20

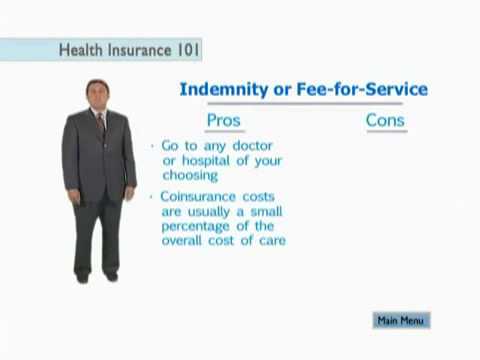

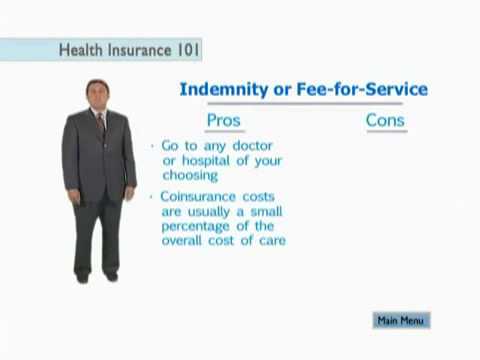

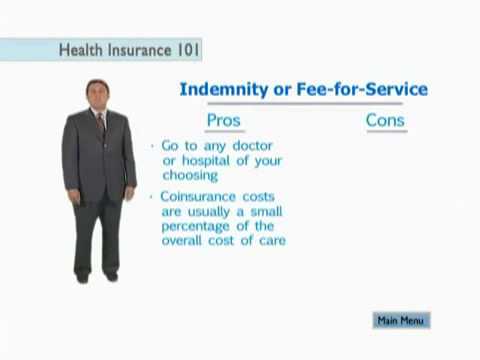

11:20Health Insurance 101: The Basics

Health Insurance 101: The Basics -

4:31

4:31Health Insurance 101: Types of plans

Health Insurance 101: Types of plansHealth Insurance 101: Types of plans

Choosing a health care plan can be overwhelming. It helps to know how you like to manage your care and if you want a plan that helps you save on taxes. Our health plan advisors can help you decide. Watch this video and visit http://www.bcbsm.com/101 to get started. -

6:05

6:05Applying for Health Insurance: Then and Now

Applying for Health Insurance: Then and NowApplying for Health Insurance: Then and Now

In which John Green attempts to apply for new health insurance coverage using the Affordable Care Act's insurance exchanges and then through a private insurer that existed before the ACA (aka Obamacare) went into effect. It's of course too soon to tell which of these options will be cheaper, which will offer the best coverage, and so on, but I wanted to explore how the (still very glitchy) exchanges compare to the pre-ACA experience of trying to get approved for coverage. Yes, I realize this video is over 4 minutes. I think it meets the definition of an educational video, but I'll leave it up to y'all to discuss in Our Pants: http://nerdfighteria.vanillaforums.com/ -

1:50

1:50How to choose a plan in the Health Insurance Marketplace

How to choose a plan in the Health Insurance MarketplaceHow to choose a plan in the Health Insurance Marketplace

When you compare Marketplace insurance plans, they're put into 5 categories based on how you and the plan can expect to share the costs of care: Bronze, Silver, Gold, Platinum, and Catastrophic. The category you choose affects how much your premium costs each month and what portion of the bill you pay for things like hospital visits or prescription medications. Visit HealthCare.gov to see if you can get coverage outside Open Enrollment: http://hlthc.re/R6AlFe -

9:57

9:57Buying Individual Health Insurance Tips

Buying Individual Health Insurance Tips -

3:51

3:51My Health Insurance

My Health InsuranceMy Health Insurance

A man endures shabby treatment and inflated costs from a profit driven health insurance system. The HD version of the animation. Subscribe to this YouTube Channel http://www.youtube.com You can always watch T.V. at AndyM.tv http://www.andym.tv -

4:54

4:54How To Fit Health Insurance Into Budget?

How To Fit Health Insurance Into Budget?How To Fit Health Insurance Into Budget?

★ FREE money tools and forms: http://daveramsey.com/tools ★ Daily wisdom and tips from Dave: http://daveramsey.com/blog ★ Books, CDs, DVDs, and classes: http://daveramsey.com/store ★ Subscribe: http://www.youtube.com/subscription_center?add_user=DaveRamseyShow ● Watch online 24/7: http://daveramsey.com/show ● Download our app: https://itunes.apple.com/us/app/dave-ramsey-show-where-debt/id675135060?mt=8 ● The Dave Ramsey Show Twitter: http://twitter.com/ramseyshow ● Dave's Twitter: http://twitter.com/daveramsey ● Facebook: http://facebook.com/daveramsey

- Alcohol

- Australian Greens

- Australian Unity

- Aviation insurance

- Aviva

- AXA

- Blue Cross

- Bond insurance

- Bupa

- Casualty insurance

- Category Insurance

- Chaoulli v. Quebec

- Co-payment

- Coinsurance

- Communist

- Computer insurance

- Contents insurance

- Cost-effective

- Cost-shifting

- Crime insurance

- Crop insurance

- Deductible

- Dental insurance

- Dentistry

- Disability insurance

- Earthquake insurance

- Economic capital

- Employer

- Equalization pool

- Exercise

- Fee-for-service

- Fidelity bond

- Flood insurance

- Formulary

- Gaullist

- Group insurance

- Group policies

- Groupama Healthcare

- Hard and soft drugs

- HCF Health Insurance

- Health

- Health advocacy

- Health Advocate

- Health care

- Health care compared

- Health care in Japan

- Health care politics

- Health care reform

- Health care systems

- Health crisis

- Health economics

- Health insurance

- Health policy

- HelpMeChoose

- History of insurance

- HMO

- Home insurance

- Hospice

- Hospital

- Incentives

- Injury cover

- Insurance

- Insurance contract

- Insurance law

- Insurance policy

- ISelect

- Joint Commission

- Junk food

- Kevin Rudd

- Landlords insurance

- Liability insurance

- Life insurance

- Long term care

- Long-term care

- Low income countries

- Managed care

- Marine insurance

- Medi-Cal

- Medicaid

- Medical debt

- Medicare (Australia)

- Medicare (Canada)

- Minority government

- Moneytime

- Mortgage insurance

- Nationalisation

- No-fault insurance

- OECD

- Ophthalmology

- Otto von Bismarck

- Outline of finance

- Patients

- Pet insurance

- Physician

- Pregnancy

- Primary care

- Private insurance

- Property insurance

- ProtectSeniors.Org

- PruHealth

- Public health

- PubMed Central

- PubMed Identifier

- Registered nurse

- Reinsurance

- Researchers

- Right to life

- Satellite insurance

- SCHIP

- Social insurance

- Social security

- Social welfare

- Spinal manipulation

- Subscription

- Template Insurance

- Term life insurance

- Terrorism insurance

- Title insurance

- Tobacco smoking

- Travel insurance

- TRICARE

- UK

- Umbrella insurance

- Utilization review

- Vehicle insurance

- Vision insurance

- Wage insurance

- Weather insurance

- Whole life insurance

- Wikipedia Link rot

- William Beveridge

- World War II

- YouCompare

-

Health Insurance Explained – The YouToons Have It Covered

This cartoon explains health insurance using fun, easy-to-understand scenarios. It breaks down important insurance concepts, such as premiums, deductibles and provider networks. The video explains how individuals purchase and obtain medical care and prescription drugs when enrolled in various types of health insurance, including HMOs and PPOs. This is the third YouToons video written and produced by the Kaiser Family Foundation. The video is narrated by former U.S. Senate Majority Leader Bill Frist, a nationally-recognized surgeon and Foundation trustee. Also available in Spanish: http://youtu.be/mDPhCo11z0E To download the video, please visit: http://www.kff.org/youtoons-health-insurance-explained This year's open enrollment period begins on Sunday, November 1, 2015, and ends Sunday,... -

How Health Insurance Works

When I consider purchasing an individual health insurance plan for myself or my family, do I have any financial obligations beyond the monthly premium and annual deductible? Answers: It depends on the plan, but some plans have the following cost-sharing elements that you should be aware of. Co-Payments: Some plans include a co-payment, which is typically a specific flat fee you pay for each medical service, such as $30 for an office visit. After the co-payment is made, the insurance company typically pays the remainder of the covered medical charges. Deductibles: Some plans include a deductible, which typically refers to the amount of money you must pay each year before your health insurance plan starts to pay for covered medical expenses. Coinsurance: Some plans include coin... -

What is Health Insurance, and Why Do You Need It?: Health Care Triage #2

You can directly support Healthcare Triage on Patreon: http://vid.io/xqXr If you can afford to pay a little every month, it really helps us to continue producing great content. In this episode of Healthcare Triage, Dr. Aaron Carroll gets some surprised questions from "friend of Obama" John Green who is still waiting for his big government giveaway . Unfortunately, insurance still costs money, and it's still really complicated. Aaron explains how the insurance system we have today came to be, and why most of us get coverage through our jobs. He talks about why we need insurance, which basically boils down to the fact that health care is really, really, really expansive. More importantly, he explains why you need to know what premiums, networks, deductibles, co-pays, and co-insurance are, an... -

Obamacare: The BIGGEST Mistake You Can Make When Choosing a Health Insurance Plan

This video discusses a huge problem that has been seen nationwide with the new Obamacare health plan (and it isn't the Obamacare website). It is the fact that so many new enrollments seem to just be picking the cheapest monthly premium package instead of looking at all of the variables. Most importantly, the deductible that goes with that package. This video gives some specific examples that what some Americans are paying per month and also what the corresponding deductible is. Keep in mind, the most important thing to do when picking your health insurance plan is to find out the TOTAL cost of owning that obamacare plan, not just the monthly premium. For more on this and other retirement frequently asked questions, check out our site with new FREE retirement material for you to down... -

Know the benefits of health insurance Business Videos - India Today

Know the benefits of health insurance Business Videos - India Today -

Health Insurance Coverage 101 - the Basics Explained in Two Minutes

http://onphr.ma/1mpAUZJ Health Insurance Coverage 101 - the Basics Explained in Two Minutes We know insurance jargon can be confusing and consumers may have a hard time cutting through the clutter. In order to make informed decisions about health coverage and ensure patients have access to needed services and treatments, knowing the language of insurance is critical. That’s why we created a back-to-basics video walking through some basic insurance terms. -

Understanding Your Health Insurance Costs | Consumer Reports

Baffled by premiums, deductibles and out-of-pocket maximums? Here is an overview of health insurance that will help clear things up and give you a better sense of how your money is spent. -

-

Health Insurance 101: Types of plans

Choosing a health care plan can be overwhelming. It helps to know how you like to manage your care and if you want a plan that helps you save on taxes. Our health plan advisors can help you decide. Watch this video and visit http://www.bcbsm.com/101 to get started. -

Applying for Health Insurance: Then and Now

In which John Green attempts to apply for new health insurance coverage using the Affordable Care Act's insurance exchanges and then through a private insurer that existed before the ACA (aka Obamacare) went into effect. It's of course too soon to tell which of these options will be cheaper, which will offer the best coverage, and so on, but I wanted to explore how the (still very glitchy) exchanges compare to the pre-ACA experience of trying to get approved for coverage. Yes, I realize this video is over 4 minutes. I think it meets the definition of an educational video, but I'll leave it up to y'all to discuss in Our Pants: http://nerdfighteria.vanillaforums.com/ -

How to choose a plan in the Health Insurance Marketplace

When you compare Marketplace insurance plans, they're put into 5 categories based on how you and the plan can expect to share the costs of care: Bronze, Silver, Gold, Platinum, and Catastrophic. The category you choose affects how much your premium costs each month and what portion of the bill you pay for things like hospital visits or prescription medications. Visit HealthCare.gov to see if you can get coverage outside Open Enrollment: http://hlthc.re/R6AlFe -

-

My Health Insurance

A man endures shabby treatment and inflated costs from a profit driven health insurance system. The HD version of the animation. Subscribe to this YouTube Channel http://www.youtube.com You can always watch T.V. at AndyM.tv http://www.andym.tv -

How To Fit Health Insurance Into Budget?

★ FREE money tools and forms: http://daveramsey.com/tools ★ Daily wisdom and tips from Dave: http://daveramsey.com/blog ★ Books, CDs, DVDs, and classes: http://daveramsey.com/store ★ Subscribe: http://www.youtube.com/subscription_center?add_user=DaveRamseyShow ● Watch online 24/7: http://daveramsey.com/show ● Download our app: https://itunes.apple.com/us/app/dave-ramsey-show-where-debt/id675135060?mt=8 ● The Dave Ramsey Show Twitter: http://twitter.com/ramseyshow ● Dave's Twitter: http://twitter.com/daveramsey ● Facebook: http://facebook.com/daveramsey -

Why I Don't Have Health Insurance

A lot of people have asked me about my views on Health Insurance and why choose not to have it. In this video I share my thoughts from my experiences on this subject. Thanks for your interest! I'm honored to share with all of you. As always, I so encourage everyone to do what feels right for them and to rock their unique lives! Want to go minimalist, overhaul your life and start living your dreams? Check out Simplify, a self-guided program I created for your unique journey! http://www.simplelivingandtravel.com/simplify Looking for support in becoming the most authentic version of yourself? Learn more about coaching with me here: http://www.simplelivingandtravel.com/coaching Check out my website for more on minimalism inspiration, simple living ideas and healthy practices: http://simplel... -

How Does Health Insurance Work?

The more you know about insurance, the better prepared you'll be to choose the plan that's right for you. We'll help you understand the technical language like copays and deductibles. Be sure to check out http://trks.it/Cfrv7 for more information. Be sure to follow Humana on Twitter: http://twitter.com/humana and Facebook: http://on.fb.me/1JfVL6D -

How to Shop for Health Insurance

Open enrollment for the federal health insurance marketplace begins November 1, 2015. The Pennsylvania Insurance Department is here to help you navigate the shopping process and choose a plan that’s right for you. For more information on how to purchase health insurance, visit the Pennsylvania Insurance Department website → http://www.insurance.pa.gov -

How To Choose The Best Individual Health Insurance Plan

Contact Info: Reggie Delaney @ Phone: 347-669-2447 Web: http://www.mybestinsuranceplans.com reginalddelaney@rldelaneyinsurance.com Servicing all of Texas! With the current state of the economy, many individuals are seeking to procure their own health insurance for the first time. Many individuals will find it rather confusing to determine just how to go about find the best individual health insurance plans with respect to meeting their needs. There are many health insurance plans on the market. A single insurance carrier can have hundreds of individual insurance plans. Sometimes it can be a real challenge to determine which health insurance plans provide the best quality. This is where it becomes very beneficial to have a knowledgeable insurance professional like me walk you through ... -

Fox's Chris to Ted Cruz: 'More people have jobs and health insurance' after Obamacare

via Fox News Sunday -

Health Insurance in the US

This short video explains the various ways that people obtain health insurance in the United States. We explore both public and private health insurance programs, as well as a few changes that we may see under the Affordable Care Act. -

Did Obamacare Cancel Ted Cruz’s Health Insurance?

Ted Cruz is in New Hampshire, and in an effort to relate to voters he said that Obamacare caused his health insurance to be cancelled. However, that turns out to be completey untrue. Cenk Uygur and John Iadarola (ThinkTank) host of The Young Turks discuss. Why do you think Cruz does well with voters when he tells lies like this? Let us know in the comments below. Read more here: http://www.bloomberg.com/politics/articles/2016-01-23/ted-cruz-finds-out-he-has-health-insurance-after-all “One day after Ted Cruz told college students in New Hampshire that he had no health insurance because President Barack Obama's health care law caused the cancellation of his coverage, the Republican presidential candidate's campaign walked back that assertion late Friday. Contrary to what Cruz, a top cont... -

Health Insurance: Understanding Deductibles and Coinsurance

An educational video about health insurance deductibles and coinsurance. What a deductible is, what coinsurance is, and how they work. And the differences in health insurance plan types when it comes to deductibles and coinsurance. If you want to know about the nuts and bolts of health insurance plans, you've come to the right place. David Hoxworth is "The Insurance Coach", an independent life and health insurance broker in Arizona. 480.276.7456 david.hoxworth@gmail.com -

How Do Deductibles and Copays Work?

Be sure to check out http://trks.it/Cfrv7 for more information around reform | Deductibles and copays define the different ways health insurance companies pay most of the costs to keep you healthy. Check out http://youtube.com/Humana for more videos or http://bit.ly/14yfhqg for more videos on healthcare reform. Be sure to follow Humana on Twitter: http://twitter.com/humana and Facebook: http://on.fb.me/1JfVL6D

Health Insurance Explained – The YouToons Have It Covered

- Order: Reorder

- Duration: 5:25

- Updated: 11 Nov 2014

- views: 106774

- published: 11 Nov 2014

- views: 106774

How Health Insurance Works

- Order: Reorder

- Duration: 6:31

- Updated: 09 Jun 2011

- views: 141069

- published: 09 Jun 2011

- views: 141069

What is Health Insurance, and Why Do You Need It?: Health Care Triage #2

- Order: Reorder

- Duration: 8:18

- Updated: 03 Nov 2013

- views: 77485

- published: 03 Nov 2013

- views: 77485

Obamacare: The BIGGEST Mistake You Can Make When Choosing a Health Insurance Plan

- Order: Reorder

- Duration: 3:52

- Updated: 06 Jan 2014

- views: 20215

- published: 06 Jan 2014

- views: 20215

Know the benefits of health insurance Business Videos - India Today

- Order: Reorder

- Duration: 21:25

- Updated: 21 Sep 2012

- views: 6051

- published: 21 Sep 2012

- views: 6051

Health Insurance Coverage 101 - the Basics Explained in Two Minutes

- Order: Reorder

- Duration: 2:07

- Updated: 23 Sep 2014

- views: 36536

- published: 23 Sep 2014

- views: 36536

Understanding Your Health Insurance Costs | Consumer Reports

- Order: Reorder

- Duration: 4:55

- Updated: 22 Dec 2014

- views: 19210

- published: 22 Dec 2014

- views: 19210

Health Insurance 101: The Basics

- Order: Reorder

- Duration: 11:20

- Updated: 02 Jul 2013

- views: 24109

Health Insurance 101: Types of plans

- Order: Reorder

- Duration: 4:31

- Updated: 31 Oct 2013

- views: 7009

- published: 31 Oct 2013

- views: 7009

Applying for Health Insurance: Then and Now

- Order: Reorder

- Duration: 6:05

- Updated: 08 Oct 2013

- views: 769962

- published: 08 Oct 2013

- views: 769962

How to choose a plan in the Health Insurance Marketplace

- Order: Reorder

- Duration: 1:50

- Updated: 22 Oct 2013

- views: 479660

- published: 22 Oct 2013

- views: 479660

Buying Individual Health Insurance Tips

- Order: Reorder

- Duration: 9:57

- Updated: 29 Dec 2009

- views: 12584

My Health Insurance

- Order: Reorder

- Duration: 3:51

- Updated: 13 Apr 2015

- views: 16544

- published: 13 Apr 2015

- views: 16544

How To Fit Health Insurance Into Budget?

- Order: Reorder

- Duration: 4:54

- Updated: 25 Nov 2015

- views: 2542

- published: 25 Nov 2015

- views: 2542

Why I Don't Have Health Insurance

- Order: Reorder

- Duration: 8:00

- Updated: 28 Oct 2015

- views: 8392

- published: 28 Oct 2015

- views: 8392

How Does Health Insurance Work?

- Order: Reorder

- Duration: 2:14

- Updated: 25 Jun 2013

- views: 21534

- published: 25 Jun 2013

- views: 21534

How to Shop for Health Insurance

- Order: Reorder

- Duration: 4:59

- Updated: 15 Oct 2015

- views: 1099

- published: 15 Oct 2015

- views: 1099

How To Choose The Best Individual Health Insurance Plan

- Order: Reorder

- Duration: 6:21

- Updated: 13 Sep 2010

- views: 9856

- published: 13 Sep 2010

- views: 9856

Fox's Chris to Ted Cruz: 'More people have jobs and health insurance' after Obamacare

- Order: Reorder

- Duration: 4:41

- Updated: 31 Jan 2016

- views: 87157

Health Insurance in the US

- Order: Reorder

- Duration: 7:24

- Updated: 18 Sep 2013

- views: 3499

- published: 18 Sep 2013

- views: 3499

Did Obamacare Cancel Ted Cruz’s Health Insurance?

- Order: Reorder

- Duration: 6:55

- Updated: 26 Jan 2016

- views: 64637

- published: 26 Jan 2016

- views: 64637

Health Insurance: Understanding Deductibles and Coinsurance

- Order: Reorder

- Duration: 22:15

- Updated: 27 May 2013

- views: 19286

- published: 27 May 2013

- views: 19286

How Do Deductibles and Copays Work?

- Order: Reorder

- Duration: 2:39

- Updated: 25 Jun 2013

- views: 55214

- published: 25 Jun 2013

- views: 55214

-

Fountain Hills man dropped from health insurance because of Obamacare

Being dropped under new healthcare regulations. Source: Tearful Brain Cancer Patient Loses Health Plan Due to . -

-

Parameters of Health Insurance Plan

View more details at https://www.tvcmatrix.com/jokolie -

What Is Social Protection

What Is Social Protection,https://goo.gl/r1938O Social protection Social protection, as defined by the United Nations Research Institute For Social Development, is concerned with preventing, managing, and overcoming situations that adversely affect people’s well being.[1] Social protection consists of policies and programs designed to reduce poverty and vulnerability by promoting efficient labour markets, diminishing people's exposure to risks, and enhancing their capacity to manage economic and social risks, such as unemployment, exclusion, sickness, disability and old age.[2] Most common types of social protection: • Labor market interventions are policies and programs designed to promote employment, the efficient operation of labor markets and the protection of workers. • Social Insura... -

Hidden Fees in Health Insurance

Join Dr. Taffy as she discusses Hidden Fees in Health Insurance on Blab. Complaints from insured consumers lead to this Blab. Health insurance does not guarantee that all of your medical bills will be paid. The people who have the majority of unpaid medical bills are the insured. Facebook: http://www.facebook.com/SelfEmployedHealthBenefits Twitter: http://www.twitter.com/ownurhealthcare Website: http://www.ownyourhealthcare.com -

Download Health Insurance: Navigating Traps & Gaps PDF

http://j.mp/1pvbehv -

The auto insurance car insurance liability coverage 01

The auto insurance car insurance liability coverage,car insurance quotes, auto insurance quotes, auto insurance companies, car insurance companies, cheap car insurance, life insurance, insurance, health insurance, farmers insurance. -

The Theory of Demand for Health Insurance Stanford Business Books

-

Health Insurance

-

-

Mount Juliet Health Insurance

Mount Juliet Health Insurance | (615) 562-5100 | Health Insurance Agent in Mt Juliet, TN -

Together and unequal —LGBT access to health care

The American health-care system is complicated and difficult to navigate at best. The LGBT community often finds the system additionally burdensome because of their sexual orientation. With health insurance largely tied to a person’s employer—or to their spouse’s employer—how many are left uninsured because of discriminatory hiring practices or unequal marriage laws? What difficulties do LGBT people face once in the health-care system? What obstacles must transgender people overcome to access appropriate health care? How can health-care practitioners be better equipped to deal with LGBT people’s needs? -

Choosing a Plan on the Health Insurance Marketplace

-

Credit Card life insurance - health insurance - Term and whole life insurance policies

-

Medi-Cal Program Overview - Covered California

Health insurance is a type of insurance coverage that covers the cost of an insured individual's medical and surgical expenses. Depending on the type of health ... -

Sobriety Chronicles

Day 2 / Health Insurance -

Justin Bieber & Selena Gomez ‘Forgive Him’ & Find Love

Justin Bieber & Selena Gomez ‘Forgive Him’ & Find Love Selena Gomez is scared to date again because of all the hard times she went through with Justin Bieber and HollywoodLife.com has learned that Justin feels terrible that Selena has such a negative outlook on dating. auto insurance calculator ,florida insurance ,insurance companies for auto banner life insurance ,credit insurance healthinsurance ,health insurance broker Vidoes ... https://www.youtube.com/watch?v=o1kWcB9hEGM https://www.youtube.com/watch?v=1VqAH4K2740 https://www.youtube.com/watch?v=i-CRLK_cYTY https://youtu.be/O7jLKRyaQ2A https://www.youtube.com/watch?v=scE3LpUI7gU https://www.youtube.com/watch?v=ixAZf3p1sKU&edit; Twiter Link... https://twitter.com/us_heros http://bit.ly/1QqI9tD... Youtube Channel https://www.youtub... -

Rihanna Twerks On Drake During Surprise ‘Anti’ & Super Hot

Rihanna Twerks On Drake During Surprise ‘Anti’ Show Duet & It’s Super Hot Fans attending Rihanna’s concert in Miami on March 15 got quite a treat…because Drake showed up as a surprise guest! As always, when the two performed together, their chemistry was off the charts and it was beyond sexy. Watch their duet of ‘Work’ here brit awards, brits, brits 2016, brit awards 2016, rihanna, rihanna work, rihanna work live, rihanna work brit awards, rihanna brit awards, rihanna brit awards performane, rihanna drake work, rihanna drake work brit awards, rihanna sza, rihanna consideration, rihanna dancing drake, trophy life, news feed, clevver news uto insurance calculator ,florida insurance ,insurance companies for auto banner life insurance ,credit insurance healthinsurance ,health insurance broke... -

-

Private Health Insurance Companies Australia

Medibank offers private health insurance options for every kind of individual, couple and family. We support better health for everybody. Get a quote. -

-

International Health Insurance Uk Citizens

Get free quotes on Washington medical insurance plans from WA insurance ... eHealth - Affordable Obamacare health insurance for individuals and families ... Health Insurance Coverage of the Total Population, states (2007-2008), U.S. (2008) -

Family Health Insurance Plans Washington State

Premera offers a range of health plans accepted by a wide network of doctors and ... However, if you qualify, you may be able to apply for coverage now, in a special ... you'll be asked to provide proof that you're a Washington state resident. .... the health plan that works best for you and your family, every step of the way.

Fountain Hills man dropped from health insurance because of Obamacare

- Order: Reorder

- Duration: 3:53

- Updated: 17 Mar 2016

- views: 0

- published: 17 Mar 2016

- views: 0

Don't Buy That Health Insurance by K. R. Woodfield

- Order: Reorder

- Duration: 0:21

- Updated: 17 Mar 2016

- views: 0

Parameters of Health Insurance Plan

- Order: Reorder

- Duration: 5:14

- Updated: 17 Mar 2016

- views: 0

What Is Social Protection

- Order: Reorder

- Duration: 2:24

- Updated: 17 Mar 2016

- views: 0

- published: 17 Mar 2016

- views: 0

Hidden Fees in Health Insurance

- Order: Reorder

- Duration: 52:10

- Updated: 17 Mar 2016

- views: 0

- published: 17 Mar 2016

- views: 0

Download Health Insurance: Navigating Traps & Gaps PDF

- Order: Reorder

- Duration: 0:32

- Updated: 17 Mar 2016

- views: 0

The auto insurance car insurance liability coverage 01

- Order: Reorder

- Duration: 133:06

- Updated: 16 Mar 2016

- views: 4

- published: 16 Mar 2016

- views: 4

The Theory of Demand for Health Insurance Stanford Business Books

- Order: Reorder

- Duration: 1:11

- Updated: 16 Mar 2016

- views: 0

- published: 16 Mar 2016

- views: 0

Health Insurance

- Order: Reorder

- Duration: 1:23

- Updated: 16 Mar 2016

- views: 2

- published: 16 Mar 2016

- views: 2

Health Insurance 2016

- Order: Reorder

- Duration: 5:22

- Updated: 16 Mar 2016

- views: 3

Mount Juliet Health Insurance

- Order: Reorder

- Duration: 1:10

- Updated: 16 Mar 2016

- views: 3

- published: 16 Mar 2016

- views: 3

Together and unequal —LGBT access to health care

- Order: Reorder

- Duration: 31:17

- Updated: 16 Mar 2016

- views: 9

- published: 16 Mar 2016

- views: 9

Choosing a Plan on the Health Insurance Marketplace

- Order: Reorder

- Duration: 3:53

- Updated: 16 Mar 2016

- views: 0

- published: 16 Mar 2016

- views: 0

Credit Card life insurance - health insurance - Term and whole life insurance policies

- Order: Reorder

- Duration: 6:36

- Updated: 16 Mar 2016

- views: 0

- published: 16 Mar 2016

- views: 0

Medi-Cal Program Overview - Covered California

- Order: Reorder

- Duration: 0:31

- Updated: 16 Mar 2016

- views: 0

- published: 16 Mar 2016

- views: 0

Sobriety Chronicles

- Order: Reorder

- Duration: 1:05

- Updated: 16 Mar 2016

- views: 0

Justin Bieber & Selena Gomez ‘Forgive Him’ & Find Love

- Order: Reorder

- Duration: 1:00

- Updated: 16 Mar 2016

- views: 0

- published: 16 Mar 2016

- views: 0

Rihanna Twerks On Drake During Surprise ‘Anti’ & Super Hot

- Order: Reorder

- Duration: 2:33

- Updated: 16 Mar 2016

- views: 44

- published: 16 Mar 2016

- views: 44

Health care: health insurance

- Order: Reorder

- Duration: 5:36

- Updated: 16 Mar 2016

- views: 0

Private Health Insurance Companies Australia

- Order: Reorder

- Duration: 0:49

- Updated: 16 Mar 2016

- views: 0

- published: 16 Mar 2016

- views: 0

Health Insurance Policy

- Order: Reorder

- Duration: 0:36

- Updated: 16 Mar 2016

- views: 0

International Health Insurance Uk Citizens

- Order: Reorder

- Duration: 0:46

- Updated: 16 Mar 2016

- views: 0

- published: 16 Mar 2016

- views: 0

Family Health Insurance Plans Washington State

- Order: Reorder

- Duration: 0:37

- Updated: 16 Mar 2016

- views: 0

- published: 16 Mar 2016

- views: 0

-

JAPAN RANT: Health Insurance & Taxes. (Answering Your Stupid Questions)

More info on this coming out in the next 24 hours on this channel: https://www.youtube.com/user/JayMiz91 国民保険 国民保険 kokumin hoken = National Health Insurance 税金 zeikin = taxes Check out: http://www.patreon.com/gimmeabreakman for more personalized interaction & prioritized attention. Or support me directly: Paypal: gimmeabreakmanemail@yahoo.com Merch: http://gimmeabreakman.spreadshirt.com/ I just joined BITCOIN! http://gimmeabreakman.tip.me This channel is now for (almost completely) unedited videos. Edited videos: http://youtube.com/gimmeabreakman ►My Facebook◄ http://www.facebook.com/Gimmeabreakman -- Please ask your questions here: http://www.reddit.com/r/moronarmy/ --- Email: gimmeabreakman@gmail.com - 2.5 Oyajis is broadcast live at 10:30pm EVERY Wednesday JAPAN TIME. We alter... -

Health Insurance Marketplace 101

An overview of the accomplishments of the Affordable Care Act and a basic introduction to the Marketplace (Exchanges) highlighting who is eligible and how the Marketplace will work. This session is not part of any CMS certification program We accept comments in the spirit of our comment policy: http://newmedia.hhs.gov/standards/comment_policy.html As well, please view the HHS Privacy Policy: http://www.hhs.gov/Privacy.html -

Reinventing the Health Insurance Business

In a 2012 article in The New York Times, Zeke Emanuel predicted the extinction of the American health insurance industry by 2020, as changes render traditional payer business models obsolete. In this presentation, Mark Bertolini, CEO of Aetna, describes how his company is actively reinventing itself against this backdrop to diversify its core business and transform the way they engage with customers. The session also explores the role that health-related information technology is playing in helping Aetna realize its new strategy. This presentation, and the audience Q&A; that follows, took place at the 2013 Healthcare Innovation Summit sponsored by the Stanford GSB's Program in Healthcare Innovation. -

"Moral Hazard in Health Insurance: Developments Since Arrow (1963)" Amy Finkelstein

Background: 5th Annual Arrow Lecture in Economics Delivered by Amy Finkelstein (MIT) on April 10th, 2012 with discussants Jonathan Gruber (MIT), Joseph E. Stiglitz (Columbia) and Kenneth J. Arrow (Stanford) This event was co-sponsored by the Committee on Global Thought, Columbia University Press, and the Program for Economic Research. -

ANC On The Money: Health Insurance: Protection of Health & Wealth

Guest: Darwin Uyco AIM-Sun Life Financial Planner Sun Life Financial Philippines October 11, 2012 -

Prof. David Sanders on Making the National Health Insurance Work for All South Africans

On 2 August 2013, The South African Civil Society Information Service and the Friedrich Ebert Foundation South Africa Office (FES) co-hosted a panel discussion on the theme, "Making the National Health Insurance Scheme (NHI) Work for All South Africans - Can It Be Achieved?" The South African government's NHI scheme presents an important opportunity to develop a better healthcare system that works for all its citizens. It is a once in a lifetime opportunity to close the gap between public and private healthcare and develop a unified world-class healthcare system that all South Africans could have confidence in -- but how do we achieve this goal? The questions we put to our panelists were: How does our government intend to develop a unified healthcare system that all South Africans feel ... -

Take Care, Mr. Elson: A Hard Road to Health Insurance | Times Documentaries | The New York Times

Times Documentaries presents the story of one man’s hard path to health insurance in the age of the Affordable Care Act. Produced by: Emma Cott, John Woo and Abby Goodnough Read the story here: http://nyti.ms/1JXGexO Subscribe to the Times Video newsletter for free and get a handpicked selection of the best videos from The New York Times every week: http://bit.ly/timesvideonewsletter Subscribe on YouTube: http://bit.ly/U8Ys7n Watch more videos at: http://nytimes.com/video --------------------------------------------------------------- Want more from The New York Times? Twitter: https://twitter.com/nytvideo Instagram: http://instagram.com/nytvideo Facebook: https://www.facebook.com/nytimes Google+: https://plus.google.com/+nytimes Whether it's reporting on conflicts abroad and p... -

Health Insurance 101: Understanding the System and Your Rights

In this presentation, Juliette Forstenzer Espinosa of the Health Care Rights Initiative shares valuable information about the different kinds of health insurance in the U.S. and discuss the different rights patients have depending on their kind of coverage (or lack of coverage). The session addresses big picture issues, such as getting and keeping health insurance coverage and changes at the state and federal level under the Affordable Care Act. In addition, we discuss practical strategies for handling "on the ground" challenges such as insurance denials and appeals, medical billing, and medical record issues. We need your input! After you watch this Webinar, please take a moment to give us feedback on this session at http://thesamfund.polldaddy.com/s/healthins2. -

How to choose a best Health Insurance Policy - Finance Doctor

Finance Doctor is an exclusive program by a Financial Specialist where he suggests solutions about the health policy and family planning. This program is telecasted in CVR Health TV. For a better health, Subscribe - https://www.youtube.com/CVRHealthTV Like - https://www.facebook.com/cvrhealth.tv Follow - https://twitter.com/CVRHealthTV -

118: Health Insurance for the Self-Employed with Michelle Katz

http://howtoquitworking.com/health-insurance-self-employed Healthcare is complicated and confusing. Not only that, Obamacare has changed it in a big way. Since healthcare for the self-employed is an important consideration for anyone starting a business, I asked Michelle Katz, author of the upcoming book, Healthcare Made Easy, to join us to talk about insurance implications of becoming self-employed. -

Health Insurance for Full Time RVers - ACA for Younger Non-Medicare Travelers

Join Cherie of Technomadia.com and Nina of WheelingIt.Us for a chat about healthcare on the road. We’ll cover health insurance considerations for RVers, finding healthcare on the road and touch some on self care options too. Our focus will be options for folks like us – not yet eligible for Medicare. Additional resources: Technomadia's articles: Healthcare: http://www.technomadia.com/healtchare Domicile: http://www.technomadia.com/domicile WheelingIt's healthcare series: http://www.wheelingit.us/category/health-care-2/ RVer Health Insurance: http://www.rverhealthinsurance.com Captured during our monthly live video cast. For more of our chats and to sign up to join one live: http://www.technomadia.com/video . -

Kung Fu Health Insurance, ObamaCare! Must Watch!

Jake Mace's "Kung Fu Health Insurance". What you think of "ObamaCare" or "Obama Care" doesn't matter! Don't go to the doctor, or the hospital, or the pharmacist! Use "Kung Fu Health Insurance" Today! I love Doctors and the M.D. profession but I will not give them my time or money. My Health Insurance takes Guts, Time, and Effort the literal meaning of Kung Fu! I got around the car insurance requirement or mandate by selling my car and using a bicycle 30 - 40 miles a day instead. Better shape, no money, and I'm sticking it to THE MAN! How do I OPT OUT of "Obama Care" or the "ObamaCare" insurance mandate like I opted out of my mandated car insurance??? Maybe I don't have all the education, expertise, and answers! I do know that I use "Kung Fu", "Tai Chi", "Qi Gong" or "Qigong", Her... -

President Obama: Address to Congress on Health Insurance Reform

The President delivers an address to a joint session of Congress, explaining just how he wants to bring peace of mind to Americans who have insurance, and affordable coverage to those who don't. September 9, 2009. (Public Domain) -

BILL MOYERS JOURNAL | Single Payer Health Insurance | PBS

Buy the DVD: http://www.shoppbs.org/entry.point?entry=3574816&source;=PBSCS_YOUTUBE_ BMJL4306_052209:N:DGR:N:N:609:QPBS Washington's abuzz about health care, but why isn't a single-payer plan an option on the table? Public Citizen's Dr. Sidney Wolfe and Physicians for a National Health Program's Dr. David Himmelstein on the political and logistical feasibility of health care reform. -

PolicyBazaar.com Special on Health insurance with the MD of Cigna Health Insurance

In this episode of PolicyBazaar on Headlines Today on 19 July 2014, Mr Yashish Dahiya CEO, Policybazaar.com is in conversation with Sandeep Patel, the MD of Cigna Health Insurance -

BA HEALTHCARE Domain Training - LIVE DEMO

More Info on HealthCare Domain visit, http://www.zarantech.com/course-list/ba/healthcare-domain More info on BA Training visit, http://www.zarantech.com/course-list/ba/business-analyst Contact Info: 515-978-9777 (or) Email - bipin@zarantech.com HEALTHCARE DOMAIN TRAINING TOPICS COVERED: Health Insurance - Overview: 1. What is Health Insurance 2. Components of Health Insurance 3. Types of Health Insurance Coverages 4. Types of Health Insurance (HMO, PPO, POS) 5. Provider vs. Payer, and NPI Claims Process: 1. Claims Process Flow 2. Claims Submission 3. Claims Adjudication Processing 4. Encounters Submission 5. Compliance Check EDI Transactions-I: 1. 837 EDI Claims; 835 Remittance 2. Edits and Validations 3. Reports and Acknowledgements EDI Transact... -

APRUB - Philippine Health Insurance Corporation (June 6)

Ang National Health Insurance Act of 1995 o Republic Act 7875 na nilagdaan ng dating Pangulong Fidel V. Ramos noong February 14, 1995- ay nagtalaga sa Philhealth upang magbigay ng mga social Health Insurance Coverage sa lahat ng mga Pilipino. Ito ay kailangang matupad ng Philhealth sa loob ng labinlimang taon. Ang iba't ibang serbisyo ng Philhealth ay nagbibigay sa bawat indibidwal ng naaayon sa kani-kaniyang pangangailangan. APRUB Every Tuesday and Thursday 5:30 ng hapon dito lang sa Net 25 Please Like us on FB: http://www.facebook.com/AprubNet25 Follow us on Twitter: https://twitter.com/aprubnet25 -

The Great Debate: Single Payer Health Coverage vs. Traditional Health Insurance

A debate between single payer health coverage and traditional health insurance. Pros and cons. Speakers: Joanne Spetz, PhD, James G. Kahn, MD, MPH, Philip R. Lee Institute for Health Policy Studies, University of California San Francisco. -

Future of Health Insurance in India by Mr. Antony Jacob,CEO of Apollo Munich

"We dream of 5 star 'check in' process in hospitals and every kid learning wellness a subject in schools" ...many such steps to 'uncomplicate' health Insurance discussed in "The Appointment" show on Zee Business News. Check this out. #LetsUncomplicate. -

Lesson 13: Insurance 3: Health Insurance, Insurance 4: Auto, Home & Liability Insurance

This lesson is based off Chapters 13 and 14 of the text for Finance 418. Professor Bryan Sudweeks of Brigham Young University teaches this lesson. All lesson materials are available online at: http://personalfinance.byu.edu/content/health-long-term-care-and-disability-insurance-1 Objectives for Chapter 13: 1. Understand how health insurance relates to your personal financial plan 2. Understand basic health insurance coverage and provisions 3. Understand how to control health care costs Objectives for Chapter 14: 1. Understand how homeowners, liability, and auto insurance fit into your personal financial plan 2. Understand the key areas of Auto Insurance 3. Understand the key areas of Homeowners Insurance 4. Understand the key areas of Liability Insurance -

JAPAN RANT: Health Insurance & Taxes. (Answering Your Stupid Questions)

- Order: Reorder

- Duration: 20:05

- Updated: 26 Aug 2015

- views: 10881

- published: 26 Aug 2015

- views: 10881

Health Insurance Marketplace 101

- Order: Reorder

- Duration: 28:44

- Updated: 25 Nov 2013

- views: 9037

- published: 25 Nov 2013

- views: 9037

Reinventing the Health Insurance Business

- Order: Reorder

- Duration: 53:20

- Updated: 29 Apr 2013

- views: 10937

- published: 29 Apr 2013

- views: 10937

"Moral Hazard in Health Insurance: Developments Since Arrow (1963)" Amy Finkelstein

- Order: Reorder

- Duration: 110:03

- Updated: 24 Apr 2012

- views: 4490

- published: 24 Apr 2012

- views: 4490

ANC On The Money: Health Insurance: Protection of Health & Wealth

- Order: Reorder

- Duration: 23:05

- Updated: 16 Oct 2012

- views: 7149

- published: 16 Oct 2012

- views: 7149

Prof. David Sanders on Making the National Health Insurance Work for All South Africans

- Order: Reorder

- Duration: 23:29

- Updated: 08 Aug 2013

- views: 559

- published: 08 Aug 2013

- views: 559

Take Care, Mr. Elson: A Hard Road to Health Insurance | Times Documentaries | The New York Times

- Order: Reorder

- Duration: 36:05

- Updated: 20 Jun 2015

- views: 4737

- published: 20 Jun 2015

- views: 4737

Health Insurance 101: Understanding the System and Your Rights

- Order: Reorder

- Duration: 58:47

- Updated: 11 Feb 2014

- views: 475

- published: 11 Feb 2014

- views: 475

How to choose a best Health Insurance Policy - Finance Doctor

- Order: Reorder

- Duration: 30:07

- Updated: 26 Jun 2014

- views: 300

- published: 26 Jun 2014

- views: 300

118: Health Insurance for the Self-Employed with Michelle Katz

- Order: Reorder

- Duration: 33:30

- Updated: 09 Oct 2014

- views: 996

- published: 09 Oct 2014

- views: 996

Health Insurance for Full Time RVers - ACA for Younger Non-Medicare Travelers

- Order: Reorder

- Duration: 50:43

- Updated: 19 Nov 2014

- views: 11062

- published: 19 Nov 2014

- views: 11062

Kung Fu Health Insurance, ObamaCare! Must Watch!

- Order: Reorder

- Duration: 23:40

- Updated: 02 Jul 2012

- views: 11987

- published: 02 Jul 2012

- views: 11987

President Obama: Address to Congress on Health Insurance Reform

- Order: Reorder

- Duration: 47:02

- Updated: 10 Sep 2009

- views: 159845

- published: 10 Sep 2009

- views: 159845

BILL MOYERS JOURNAL | Single Payer Health Insurance | PBS

- Order: Reorder

- Duration: 32:51

- Updated: 04 Jun 2009

- views: 26803

- published: 04 Jun 2009

- views: 26803

PolicyBazaar.com Special on Health insurance with the MD of Cigna Health Insurance

- Order: Reorder

- Duration: 22:04

- Updated: 01 Aug 2014

- views: 1508

- published: 01 Aug 2014

- views: 1508

BA HEALTHCARE Domain Training - LIVE DEMO

- Order: Reorder

- Duration: 131:43

- Updated: 10 Feb 2013

- views: 48462

- published: 10 Feb 2013

- views: 48462

APRUB - Philippine Health Insurance Corporation (June 6)

- Order: Reorder

- Duration: 27:06

- Updated: 07 Jun 2013

- views: 1205

- published: 07 Jun 2013

- views: 1205

The Great Debate: Single Payer Health Coverage vs. Traditional Health Insurance

- Order: Reorder

- Duration: 76:18

- Updated: 23 Oct 2012

- views: 3749

- published: 23 Oct 2012

- views: 3749

Future of Health Insurance in India by Mr. Antony Jacob,CEO of Apollo Munich

- Order: Reorder

- Duration: 22:26

- Updated: 07 Jan 2015

- views: 1130

- published: 07 Jan 2015

- views: 1130

Lesson 13: Insurance 3: Health Insurance, Insurance 4: Auto, Home & Liability Insurance

- Order: Reorder

- Duration: 72:16

- Updated: 22 Feb 2013

- views: 1176

- published: 22 Feb 2013

- views: 1176

Health Insurance myths in India

- Order: Reorder

- Duration: 46:03

- Updated: 02 Aug 2011

- views: 2976

- Playlist

- Chat

- Playlist

- Chat

Health Insurance Explained – The YouToons Have It Covered

- Report rights infringement

- published: 11 Nov 2014

- views: 106774

How Health Insurance Works

- Report rights infringement

- published: 09 Jun 2011

- views: 141069

What is Health Insurance, and Why Do You Need It?: Health Care Triage #2

- Report rights infringement

- published: 03 Nov 2013

- views: 77485

Obamacare: The BIGGEST Mistake You Can Make When Choosing a Health Insurance Plan

- Report rights infringement

- published: 06 Jan 2014

- views: 20215

Know the benefits of health insurance Business Videos - India Today

- Report rights infringement

- published: 21 Sep 2012

- views: 6051

Health Insurance Coverage 101 - the Basics Explained in Two Minutes

- Report rights infringement

- published: 23 Sep 2014

- views: 36536

Understanding Your Health Insurance Costs | Consumer Reports

- Report rights infringement

- published: 22 Dec 2014

- views: 19210

Health Insurance 101: The Basics

- Report rights infringement

- published: 02 Jul 2013

- views: 24109

Health Insurance 101: Types of plans

- Report rights infringement

- published: 31 Oct 2013

- views: 7009

Applying for Health Insurance: Then and Now

- Report rights infringement

- published: 08 Oct 2013

- views: 769962

How to choose a plan in the Health Insurance Marketplace

- Report rights infringement

- published: 22 Oct 2013

- views: 479660

Buying Individual Health Insurance Tips

- Report rights infringement

- published: 29 Dec 2009

- views: 12584

My Health Insurance

- Report rights infringement

- published: 13 Apr 2015

- views: 16544

How To Fit Health Insurance Into Budget?

- Report rights infringement

- published: 25 Nov 2015

- views: 2542

- Playlist

- Chat

Fountain Hills man dropped from health insurance because of Obamacare

- Report rights infringement

- published: 17 Mar 2016

- views: 0

Don't Buy That Health Insurance by K. R. Woodfield

- Report rights infringement

- published: 17 Mar 2016

- views: 0

Parameters of Health Insurance Plan

- Report rights infringement

- published: 17 Mar 2016

- views: 0

What Is Social Protection

- Report rights infringement

- published: 17 Mar 2016

- views: 0

Hidden Fees in Health Insurance

- Report rights infringement

- published: 17 Mar 2016

- views: 0

Download Health Insurance: Navigating Traps & Gaps PDF

- Report rights infringement

- published: 17 Mar 2016

- views: 0

The auto insurance car insurance liability coverage 01

- Report rights infringement

- published: 16 Mar 2016

- views: 4

The Theory of Demand for Health Insurance Stanford Business Books

- Report rights infringement

- published: 16 Mar 2016

- views: 0

Health Insurance

- Report rights infringement

- published: 16 Mar 2016

- views: 2

Health Insurance 2016

- Report rights infringement

- published: 16 Mar 2016

- views: 3

Mount Juliet Health Insurance

- Report rights infringement

- published: 16 Mar 2016

- views: 3

Together and unequal —LGBT access to health care

- Report rights infringement

- published: 16 Mar 2016

- views: 9

Choosing a Plan on the Health Insurance Marketplace

- Report rights infringement

- published: 16 Mar 2016

- views: 0

Credit Card life insurance - health insurance - Term and whole life insurance policies

- Report rights infringement

- published: 16 Mar 2016

- views: 0

- Playlist

- Chat

JAPAN RANT: Health Insurance & Taxes. (Answering Your Stupid Questions)

- Report rights infringement

- published: 26 Aug 2015

- views: 10881

Health Insurance Marketplace 101

- Report rights infringement

- published: 25 Nov 2013

- views: 9037

Reinventing the Health Insurance Business

- Report rights infringement

- published: 29 Apr 2013

- views: 10937

"Moral Hazard in Health Insurance: Developments Since Arrow (1963)" Amy Finkelstein

- Report rights infringement

- published: 24 Apr 2012

- views: 4490

ANC On The Money: Health Insurance: Protection of Health & Wealth

- Report rights infringement

- published: 16 Oct 2012

- views: 7149

Prof. David Sanders on Making the National Health Insurance Work for All South Africans

- Report rights infringement

- published: 08 Aug 2013

- views: 559

Take Care, Mr. Elson: A Hard Road to Health Insurance | Times Documentaries | The New York Times

- Report rights infringement

- published: 20 Jun 2015

- views: 4737

Health Insurance 101: Understanding the System and Your Rights

- Report rights infringement

- published: 11 Feb 2014

- views: 475

How to choose a best Health Insurance Policy - Finance Doctor

- Report rights infringement

- published: 26 Jun 2014

- views: 300

118: Health Insurance for the Self-Employed with Michelle Katz

- Report rights infringement

- published: 09 Oct 2014

- views: 996

Health Insurance for Full Time RVers - ACA for Younger Non-Medicare Travelers

- Report rights infringement

- published: 19 Nov 2014

- views: 11062

Kung Fu Health Insurance, ObamaCare! Must Watch!

- Report rights infringement

- published: 02 Jul 2012

- views: 11987

President Obama: Address to Congress on Health Insurance Reform

- Report rights infringement

- published: 10 Sep 2009

- views: 159845

BILL MOYERS JOURNAL | Single Payer Health Insurance | PBS

- Report rights infringement

- published: 04 Jun 2009

- views: 26803

Trump presidency rated among top 10 global risks: EIU

Edit BBC News 17 Mar 2016Discovery Of Oldest Human DNA Could Rewrite Evolutionary History Of Mankind

Edit WorldNews.com 16 Mar 2016Scientists Solve 58-Year-Old Mystery Surrounding Alien-Looking Tully Monster

Edit WorldNews.com 16 Mar 2016Queen Nefertiti: Hiding in plain sight?

Edit CNN 17 Mar 2016Best and worst health insurers revealed in AMA report card

Edit Sydney Morning Herald 17 Mar 2016Doctors' lobby weighs in on private health insurance debate

Edit Sydney Morning Herald 17 Mar 2016Health insurance customers enjoy peace of mind

Edit Scoop 17 Mar 2016Long-term Care Insurance: Less Bang, More Buck

Edit Springfield News-Sun 17 Mar 2016Medical Debt Rains Pain On Families, Even In the Sunshine State

Edit National Public Radio 17 Mar 2016VIENNA INSURANCE GROUP HAS AN APPETITE FOR MORE (Vienna Insurance Group AG)

Edit Public Technologies 17 Mar 2016Oklahoma business briefs

Edit The Oklahoman 17 Mar 2016Danang 2016 announces first sponsors for 5th Asian Beach Games (OCA - Olympic Council of Asia)

Edit Public Technologies 17 Mar 2016Netizens’ top concern relayed to Premier (The Central People's Government of the People's Republic of China)

Edit Public Technologies 17 Mar 2016Whose healthy ASEAN Community?

Edit Jakarta Post 17 Mar 2016GMC to get 450-bed super specialty block

Edit The Times of India 17 Mar 2016- 1

- 2

- 3

- 4

- 5

- Next page »