- published: 18 Sep 2013

- views: 118594

-

remove the playlistIrr

- remove the playlistIrr

- published: 08 Jun 2014

- views: 3174

- published: 27 Feb 2010

- views: 295162

- published: 20 Apr 2013

- views: 91377

- published: 17 Aug 2012

- views: 286455

- published: 15 Aug 2013

- views: 43577

- published: 08 Apr 2015

- views: 26555

- published: 18 Oct 2010

- views: 38413

- published: 15 Jun 2015

- views: 2023

- published: 05 Aug 2014

- views: 9636

- REDIRECT IRR

wn.com/Irr

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

7:23

7:23IRR (Internal Rate of Return)

IRR (Internal Rate of Return)IRR (Internal Rate of Return)

This video explains the concept of IRR (the internal rate of return) and illustrates how to calculate the IRR via an example. -

23:30

23:30การบัญชีต้นทุน 2 การตัดสินใจจ่ายลงทุน((6/8)ผลตอบแทนภายใน(Internal Rate of Return : IRR)

การบัญชีต้นทุน 2 การตัดสินใจจ่ายลงทุน((6/8)ผลตอบแทนภายใน(Internal Rate of Return : IRR)การบัญชีต้นทุน 2 การตัดสินใจจ่ายลงทุน((6/8)ผลตอบแทนภายใน(Internal Rate of Return : IRR)

สอนการบัญชีต้นทุน 2(Cost Accounting II) ผู้เขียน รศ.เบญจมาศ อภิสิทธิ์ภิญโญ ตรงตามหลักสูตรของสำนักงานคณะกรรมการการอาชีวศึกษา ระดับ ปวส. สอนโดย อ.มานพ สีเหลือง สถาบันYellowการบัญชี -

9:58

9:583 Easy Steps! IRR Internal Rate of Return Lecture on How to Calculate Internal Rate of Return

3 Easy Steps! IRR Internal Rate of Return Lecture on How to Calculate Internal Rate of Return3 Easy Steps! IRR Internal Rate of Return Lecture on How to Calculate Internal Rate of Return

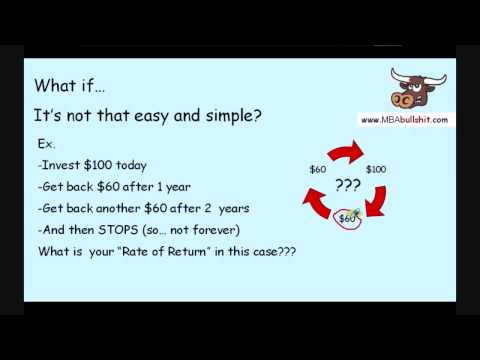

OMG wow! Soooo easy I subscribed here http://www.youtube.com/subscription_center?add_user=mbabullshitdotcom for Internal Rate of Return or IRR. In advance of going deeper into this approach, we need to evaluate the definition of "Rate of Return" (with no "internal" yet). Rate of Return would be the "speed" you are going to earn back profit on an annual basis, every twelve months, endlessly, in contrast to an amount you in the beginning invest. With the intention that it can be compared to the invested bigger sum, this is written just like a percent (%). By way of example, if you invest 100 dollars, and you earn back 3 dollars per annum endlessly, then the "rate of return" is 3%. Trouble-free, is it not? But let us alter the situation somewhat. Suppose, on the same $100 investment previously mentioned, you will definitely make money for a couple of years... and not all in identical amounts in each year? And what if the money coming in will likely stop after a certain number of years? For instance, you are going to get $5 on your 1st year, possibly $8 on your 2nd year, $3 around the third year, and $95 during the fourth year (which could become a final year... so it's not ad infinitum). What is the rate of return now? As you can tell, on this most recent problem, it isn't really easy to find the percentage rate. This is because it's not as simple as in the initial case above for the reason that the annual cash flow is not just a standardizedsum (similar to the $3 in the initial situation above) and it's not without end. This percentage within this newest situation has become popularly known as Internal Rate of Return. Given that it is really not simple to get the percentage, we can easily declare it really is like "a hidden" percent... therefore the term "internal"... due to the reason that the word "internal" is similar to a formal way of expressing "hidden". How is the principle beneficial? If the IRR of your respective undertaking or business enterprise is less than your cost of debt or the total interest rate you would pay to your bank (in case you raise funds money coming from the bank to do the investment or plan), then it is a foul deal. Exactly why? Remember! Because if you will pay 3% to your bank to accomplish a venture or make an investment decision, and then it produces an IRR of only 2%, then you definitely lose 1%. Then again, when your IRR or Internal Rate of Return is above the percentage at which one would borrow from the bank to cover an investment or task, then it is a fine deal, as a result of the helpful "spread" in between your rate of return and cost of debt. Similarly, in case your IRR is the same thing as the interest one would pay to your bank, then you're break-even. This, in summary, is really a simple clarification of IRR. Note that in more difficult problems, you might weigh up your internal rate of return not simply to your cost of debt, but to you cost of equity or weighted average cost of capital or WACC instead. http://www.youtube.com/watch?v=KKqzSGMz9Sk what is irr, the internal rate of return, what is internal rate of return, irr, internal rate of return, khan academy, investopedia -

3:27

3:273 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example

3 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example3 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example

omg WOW so easy I subscribed here http://www.youtube.com/subscription_center?add_user=mbabullshitdotcom IRR Internal Rate of Return in 3 minutes Imagine you found a wizard with a boat on a magic river... For every $100 you gave the wizard.. He would give you back $10/year FOREVER and ever! So how much % do you get every year? 10%. Because $10 is 10% of $100. Guess what? This 10% is called your RATE of RETURN (careful, this is not yet your INTERNAL rate of return...) So this 10% Rate of Return tells you HOW QUICKLY you get back your money in EXACTLY 1 year... compared to your original $100. So this 10% Rate of Return tells you HOW QUICKLY you get back your money in EXACTLY 1 year... compared to your original $100. Now what if... It wasn't that simple... What if the wizard brought you back a different amount every year? http://www.youtube.com/watch?v=7w-UWuDi0fY On some lucky years, he might bring back $70 On other years, he might bring back only $5.. And what if... It was NOT forever? What if it was for exactly 7 years? What is your % Rate of Return now? Not so easy to know now, right? It's like the rate of return is now HIDDEN... This "hidden" rate of return is now called the INTERNAL Rate of Return or simply IRR. To find the exact %, we use the IRR Formula. Don't panic! I promise it's much easier that it looks! So if you know your business' Internal Rate of Return, how do you use it? This simplest example is this: Let's say you borrowed money to buy a candy machine for business. When you compare the money you earn from the candy machine with the amount you paid for the candy machine, you can compute your candy machine's IRR... ... and when you know your candy machine's IRR, you can then compare it to your borrowing cost. If your business borrows money from the bank at a 4% interest rate and your Internal Rate of Return is 10%, then you WIN 6%... Because 10% minus 4% is 6%. On the other hand, if your business borrows money at a 4% interest rate, but your candy machine's IRR is only 3%, then you LOSE. -

9:00

9:00NPV and IRR in Excel 2010

NPV and IRR in Excel 2010NPV and IRR in Excel 2010

Download the excel file here: http://www.codible.com/pages/38. Description: How to calculate net present value (NPV) and internal rate of return (IRR) in excel with a simple example. -

8:00

8:00NPV vs IRR

NPV vs IRR -

5:15

5:15Episode 127: How to Calculate the Internal Rate of Return | Part 1

Episode 127: How to Calculate the Internal Rate of Return | Part 1Episode 127: How to Calculate the Internal Rate of Return | Part 1

Go Premium for only $9.99 a year and access exclusive ad-free videos from Alanis Business Academy. Click here for a 14 day free trial: http://bit.ly/1Iervwb View additional videos from Alanis Business Academy and interact with us on our social media pages: YouTube Channel: http://bit.ly/1kkvZoO Website: http://bit.ly/1ccT2QA Facebook: http://on.fb.me/1cpuBhW Twitter: http://bit.ly/1bY2WFA Google+: http://bit.ly/1kX7s6P The Internal Rate of Return, or IRR for short, is the discount rate that causes the net present value to equal zero. As a type of capital budgeting tool, the IRR allows managers and business owners the ability to weight a variety of different capital budgeting projects. The video provides a brief description and purpose of IRR in addition to showing how to calculate the internal rate of return. It is recommended that viewers have an understanding of the time value of money and how to calculate both the present value and NPV prior to learning IRR. The following videos are resources that will detail these topics. The Time Value of Money: http://youtu.be/35RkSTjCCx0 How the Calculate the Net Present Value: http://youtu.be/jylJ2r9bklE -

34:20

34:20NPV - Net Present Value, IRR - Internal Rate of Return, Payback Period.

NPV - Net Present Value, IRR - Internal Rate of Return, Payback Period.NPV - Net Present Value, IRR - Internal Rate of Return, Payback Period.

Project management topic on Capital budgeting techniques - NPV - Net Present Value, IRR - Internal Rate of Return, Payback Period, Profitability Index or Benefit Cost Ratio. -

9:39

9:39Internal Rate of Return - Defined

Internal Rate of Return - DefinedInternal Rate of Return - Defined

The Internal Rate of Return, or IRR, is an important calculation used in real estate to compare investments to each other. When we invest in real estate, we are typically dealing with properties that provide cash flow streams. The IRR takes into account the benefit and timing of these cash flows and provides us with a great measure of our investments performance. -

1:25

1:25Calculate IRR using Excel

Calculate IRR using ExcelCalculate IRR using Excel

-

2:57

2:57Sharp EL-738: Internal Rate of Return (IRR)

Sharp EL-738: Internal Rate of Return (IRR)Sharp EL-738: Internal Rate of Return (IRR)

This video will show you how to calculate the Internal rate of return (i.e. IRR) of an investment by way of an example. We will use the Sharp El-738 financial calculator to do this. -

14:01

14:01IRR vs. Cash on Cash Multiples in Leveraged Buyouts and Investments

IRR vs. Cash on Cash Multiples in Leveraged Buyouts and InvestmentsIRR vs. Cash on Cash Multiples in Leveraged Buyouts and Investments

In this IRR vs Cash tutorial, you’ll learn the key distinctions between the internal rate of return (IRR). By http://breakingintowallstreet.com/ "Financial Modeling Training And Career Resources For Aspiring Investment Bankers" You will also learn further distinctions on the cash-on-cash multiple or money-on multiple when evaluating deals and investments – and you’ll understand why venture capital (VC) firms target one set of numbers, whereas private equity (PE) firms target a different set of numbers. http://youtube-breakingintowallstreet-com.s3.amazonaws.com/109-05-IRR-vs-Cash-on-Cash-Multiples.xlsx Table of Contents: 1:35 Why Do IRR and Cash-on-Cash Multiples Both Matter? 3:05 What Do Private Equity vs. Venture Capital vs. Other Firms Care About? 8:30 How to Use These Metrics in Real Life 11:08 Key Takeaways Lesson Outline: 1. Why Does This Matter? Because there are DIFFERENT ways to judge the success of a deal - 2 of the main ones for leveraged buyouts (LBOs), growth equity investments, and venture capital investments are the internal rate of return (IRR) and the cash-on-cash (CoC) or money-on-money (MoM) multiple. Many investment firms will care a lot about one of these, but not the other, and will try to find investments that yield a high IRR or a high multiple… but not both. The Difference: IRR factors in the time value of money - it's the effective, compounded interest rate on an investment. Whereas the multiple is simpler and ignores timing (e.g., $1000 / $100 = 10x multiple). 2. What Do Different Firms Care About? Most venture capital (VC) firms and early-stage investors want to earn a multiple of their money back - they don't care that much about IRR, because they're going to be invested for a VERY LONG time and it's not exactly liquid… and they don't care what the stock market does. VC firms must be able to cover their losses with “the winners”! If they get 2x their capital back in 1 year (100% IRR) and then lose everything on another investment in 5 years’ time (0% IRR), the first result is completely irrelevant because they've only earned back 1x their capital. Perfect Example: Harmonix, maker of Guitar Hero - got VC investment in the mid-1990's, generated $0 in revenue for 5+ years, and then in 2005 released the hit video game Guitar Hero. Sold for $175 million to Viacom in 2006! Massive multiple, but likely a pathetic IRR since it took 10+ years to get there. Later-stage investors and private equity firms care more about IRR because the multiples will never be that high in late-stage deals, and because they are benchmarked against the public markets (e.g., the S&P; 500) more. If the firm's IRR can't beat the stock market, why should you invest? Most PE firms target at least a 20-25% IRR depending on the economy, deal environment, valuations, etc… less when things are bad, more in frothy times. This makes it common to do "quick flip" deals where the company is bought and then sold at a MUCH higher multiple right after - simply to get a high IRR. Real-Life Example: Thoma Bravo (mid-market tech PE firm) bought Digital Insight from Intuit for $1.025 billion, and then sold it 4 months later for $1.65 billion to NCR. VERY high IRR - 316%! But only a ~1.6x money multiple, assuming no debt / no debt repayment. http://dealbook.nytimes.com/2013/12/02/sale-to-ncr-is-a-quick-profitable-flip-for-a-private-equity-firm/ 3. How Do You Use These Metrics In Real Life? How to calculate them: see the Atlassian or J.Crew models. IRR is straightforward and uses built-in Excel functions, but for the CoC or MoM multiple, you need to sum up all positive cash flows in the period and divide by the sum of all negative cash flows in that period, and flip the sign. In the case of Atlassian, the deal is great for Accel because they earn a 15x multiple, even though the IRR is "only" 35%... they do not care AT ALL because they are targeting the multiple, not the IRR. For T. Rowe Price, the multiple of 1.9x isn't great, but they do at least get a 14% IRR which is probably what they care about more since they are late-stage investors. For the J. Crew deal, both the IRR and the multiple are very low and below what PE firms typically target, so this deal would be problematic to pursue, at least with these assumptions. 4. Key Takeaways IRR and Cash-on-Cash or Money-on-Money multiples are related, but often move in opposite directions when the time period changes. Different firms target different rates and metrics (VC/early stage - multiples, ideally over 10x or 3-5x later on; PE/late stage - IRR, ideally 20%+). Calculation: IRR is simple, use the built-in IRR or XIRR in Excel; for the multiple, sum the positive returns/cash flows, divide by the negative returns/cash flows and flip the sign. Judging deals: Focus on multiples for earlier stage deals (and if you're pitching VCs to fund your company), and focus on IRR for later stage / growth equity / PE deals. -

9:41

9:41Incremental IRR

Incremental IRRIncremental IRR

Due to differences in the scale, timing, and riskiness of projects, we cannot simply compare the IRRs (incremental rates of return) of two projects. However, we can compute the incremental cash flows of choosing one project versus the other and compute an incremental IRR for these cash flows. This incremental IRR can then be compared to the discount rate to determine which project is more profitable. That being said, the incremental IRR is problematic when some of the negative cash flows do not precede the positive cash flows. Furthermore, the incremental IRR tells us which project is more profitable but it does not tell us whether each of the projects has a positive NPV on a stand-alone basis. And, if the projects have different costs of capital, then we have the additional problem of not knowing the cost of capital to which we should be comparing the incremental IRR. -

7:01

7:01Net Present Value (NPV) and Internal Rate of Return (IRR)

Net Present Value (NPV) and Internal Rate of Return (IRR)Net Present Value (NPV) and Internal Rate of Return (IRR)

Net Present Value and Internal Rate of Return

-

IRR (Internal Rate of Return)

This video explains the concept of IRR (the internal rate of return) and illustrates how to calculate the IRR via an example. -

การบัญชีต้นทุน 2 การตัดสินใจจ่ายลงทุน((6/8)ผลตอบแทนภายใน(Internal Rate of Return : IRR)

สอนการบัญชีต้นทุน 2(Cost Accounting II) ผู้เขียน รศ.เบญจมาศ อภิสิทธิ์ภิญโญ ตรงตามหลักสูตรของสำนักงานคณะกรรมการการอาชีวศึกษา ระดับ ปวส. สอนโดย อ.มานพ สีเหลือง สถาบันYellowการบัญชี -

3 Easy Steps! IRR Internal Rate of Return Lecture on How to Calculate Internal Rate of Return

OMG wow! Soooo easy I subscribed here http://www.youtube.com/subscription_center?add_user=mbabullshitdotcom for Internal Rate of Return or IRR. In advance of going deeper into this approach, we need to evaluate the definition of "Rate of Return" (with no "internal" yet). Rate of Return would be the "speed" you are going to earn back profit on an annual basis, every twelve months, endlessly, in contrast to an amount you in the beginning invest. With the intention that it can be compared to the invested bigger sum, this is written just like a percent (%). By way of example, if you invest 100 dollars, and you earn back 3 dollars per annum endlessly, then the "rate of return" is 3%. Trouble-free, is it not? But let us alter the situation somewhat. Suppose, on the same $100 investment previo... -

3 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example

omg WOW so easy I subscribed here http://www.youtube.com/subscription_center?add_user=mbabullshitdotcom IRR Internal Rate of Return in 3 minutes Imagine you found a wizard with a boat on a magic river... For every $100 you gave the wizard.. He would give you back $10/year FOREVER and ever! So how much % do you get every year? 10%. Because $10 is 10% of $100. Guess what? This 10% is called your RATE of RETURN (careful, this is not yet your INTERNAL rate of return...) So this 10% Rate of Return tells you HOW QUICKLY you get back your money in EXACTLY 1 year... compared to your original $100. So this 10% Rate of Return tells you HOW QUICKLY you get back your money in EXACTLY 1 year... compared to your original $100. Now what if... It wasn't that simple... What if the wizard brought you bac... -

NPV and IRR in Excel 2010

Download the excel file here: http://www.codible.com/pages/38. Description: How to calculate net present value (NPV) and internal rate of return (IRR) in excel with a simple example. -

-

Episode 127: How to Calculate the Internal Rate of Return | Part 1

Go Premium for only $9.99 a year and access exclusive ad-free videos from Alanis Business Academy. Click here for a 14 day free trial: http://bit.ly/1Iervwb View additional videos from Alanis Business Academy and interact with us on our social media pages: YouTube Channel: http://bit.ly/1kkvZoO Website: http://bit.ly/1ccT2QA Facebook: http://on.fb.me/1cpuBhW Twitter: http://bit.ly/1bY2WFA Google+: http://bit.ly/1kX7s6P The Internal Rate of Return, or IRR for short, is the discount rate that causes the net present value to equal zero. As a type of capital budgeting tool, the IRR allows managers and business owners the ability to weight a variety of different capital budgeting projects. The video provides a brief description and purpose of IRR in addition to showing how to calculate the... -

NPV - Net Present Value, IRR - Internal Rate of Return, Payback Period.

Project management topic on Capital budgeting techniques - NPV - Net Present Value, IRR - Internal Rate of Return, Payback Period, Profitability Index or Benefit Cost Ratio. -

Internal Rate of Return - Defined

The Internal Rate of Return, or IRR, is an important calculation used in real estate to compare investments to each other. When we invest in real estate, we are typically dealing with properties that provide cash flow streams. The IRR takes into account the benefit and timing of these cash flows and provides us with a great measure of our investments performance. -

Calculate IRR using Excel

-

Sharp EL-738: Internal Rate of Return (IRR)

This video will show you how to calculate the Internal rate of return (i.e. IRR) of an investment by way of an example. We will use the Sharp El-738 financial calculator to do this. -

IRR vs. Cash on Cash Multiples in Leveraged Buyouts and Investments

In this IRR vs Cash tutorial, you’ll learn the key distinctions between the internal rate of return (IRR). By http://breakingintowallstreet.com/ "Financial Modeling Training And Career Resources For Aspiring Investment Bankers" You will also learn further distinctions on the cash-on-cash multiple or money-on multiple when evaluating deals and investments – and you’ll understand why venture capital (VC) firms target one set of numbers, whereas private equity (PE) firms target a different set of numbers. http://youtube-breakingintowallstreet-com.s3.amazonaws.com/109-05-IRR-vs-Cash-on-Cash-Multiples.xlsx Table of Contents: 1:35 Why Do IRR and Cash-on-Cash Multiples Both Matter? 3:05 What Do Private Equity vs. Venture Capital vs. Other Firms Care About? 8:30 How to Use These Metrics in R... -

Incremental IRR

Due to differences in the scale, timing, and riskiness of projects, we cannot simply compare the IRRs (incremental rates of return) of two projects. However, we can compute the incremental cash flows of choosing one project versus the other and compute an incremental IRR for these cash flows. This incremental IRR can then be compared to the discount rate to determine which project is more profitable. That being said, the incremental IRR is problematic when some of the negative cash flows do not precede the positive cash flows. Furthermore, the incremental IRR tells us which project is more profitable but it does not tell us whether each of the projects has a positive NPV on a stand-alone basis. And, if the projects have different costs of capital, then we have the additional problem o... -

Net Present Value (NPV) and Internal Rate of Return (IRR)

Net Present Value and Internal Rate of Return -

How to calculate NPV and IRR (Net Present Value and Internal Rate Return) EXCEL

HI Guys, This video will teach you how to calculate NPV (Net Present Value) and Internal Rate of Return (IRR) in Excel. Please go to our website www.i-hate-math.com for more tutorials. http://www.i-hate-math.com Thanks for learning ! -

Capital Budgeting - Net Present Value (NPV) and Internal Rate of Return (IRR)

Get our latest video feeds directly in your browser - add our Live bookmark feeds - http://goo.gl/SXUApX For Chorme users download Foxish live RSS to use the Live Feed - http://goo.gl/fd8MPl Academy of Financial Training's Tutorials on Level 1 2014 CFA® Program -- Corporate Finance Here we understand the concepts of Net Present Value (NPV) and Internal Rate of Return (IRR). There are some of the methods for evaluating projects for Capital Budgeting Decision making process. Full Course Available on http://goo.gl/XCUK4Q SUBSCRIBE for Updates on our Upcoming Training Videos Visit us: http://www.ftacademy.in/ About Us: Academy of Financial Training is training services company that specializes in providing a complete range of finance training services and solutions Since its incorporat... -

-

Capital Budgeting Part Two (HP10BII) -- Calculating Internal Rate of Return

This video walks through an example of calculating IRR for two capital budgeting projects using the HP10BII financial calculator. This is the second video in a four-part series. -

คำนวณผลตอบแทนภายใน(IRR) ใน Excel

สอนการบัญชีต้นทุน 2(Cost Accounting II) ผู้เขียน รศ.เบญจมาศ อภิสิทธิ์ภิญโญ ตรงตามหลักสูตรของสำนักงานคณะกรรมการการอาชีวศึกษา ระดับ ปวส. สอนโดย อ.มานพ สีเหลือง สถาบันYellowการบัญชี -

TI BA ii Plus IRR Function

In this video I will show you how to calculate in internal rate of return (the IRR) using your Texas Instruments BA II Plus financial calculator. -

Calculate NPV and IRR in Excel

How to calculate net present value (NPV) and internal rate of return (IRR) in excel, NPV and IRR function in Excel 2003, Excel 2007, Excel 2010, Excel 2013 Watch more at: http://goo.gl/jvtTAI or http://goo.gl/SDfsvT -

NPV and IRR calculations using the TI BAII Plus calculator

-

Part 2 - IRR How to Calculate Internal Rate of Return Explained (new)

IRR (Internal Rate of Return)

- Order: Reorder

- Duration: 7:23

- Updated: 18 Sep 2013

- views: 118594

- published: 18 Sep 2013

- views: 118594

การบัญชีต้นทุน 2 การตัดสินใจจ่ายลงทุน((6/8)ผลตอบแทนภายใน(Internal Rate of Return : IRR)

- Order: Reorder

- Duration: 23:30

- Updated: 08 Jun 2014

- views: 3174

- published: 08 Jun 2014

- views: 3174

3 Easy Steps! IRR Internal Rate of Return Lecture on How to Calculate Internal Rate of Return

- Order: Reorder

- Duration: 9:58

- Updated: 27 Feb 2010

- views: 295162

- published: 27 Feb 2010

- views: 295162

3 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example

- Order: Reorder

- Duration: 3:27

- Updated: 20 Apr 2013

- views: 91377

- published: 20 Apr 2013

- views: 91377

NPV and IRR in Excel 2010

- Order: Reorder

- Duration: 9:00

- Updated: 17 Aug 2012

- views: 286455

- published: 17 Aug 2012

- views: 286455

NPV vs IRR

- Order: Reorder

- Duration: 8:00

- Updated: 18 Sep 2013

- views: 60416

Episode 127: How to Calculate the Internal Rate of Return | Part 1

- Order: Reorder

- Duration: 5:15

- Updated: 15 Aug 2013

- views: 43577

- published: 15 Aug 2013

- views: 43577

NPV - Net Present Value, IRR - Internal Rate of Return, Payback Period.

- Order: Reorder

- Duration: 34:20

- Updated: 08 Apr 2015

- views: 26555

- published: 08 Apr 2015

- views: 26555

Internal Rate of Return - Defined

- Order: Reorder

- Duration: 9:39

- Updated: 18 Oct 2010

- views: 38413

- published: 18 Oct 2010

- views: 38413

Calculate IRR using Excel

- Order: Reorder

- Duration: 1:25

- Updated: 26 Feb 2011

- views: 219335

- published: 26 Feb 2011

- views: 219335

Sharp EL-738: Internal Rate of Return (IRR)

- Order: Reorder

- Duration: 2:57

- Updated: 15 Jun 2015

- views: 2023

- published: 15 Jun 2015

- views: 2023

IRR vs. Cash on Cash Multiples in Leveraged Buyouts and Investments

- Order: Reorder

- Duration: 14:01

- Updated: 05 Aug 2014

- views: 9636

- published: 05 Aug 2014

- views: 9636

Incremental IRR

- Order: Reorder

- Duration: 9:41

- Updated: 04 Apr 2015

- views: 6288

- published: 04 Apr 2015

- views: 6288

Net Present Value (NPV) and Internal Rate of Return (IRR)

- Order: Reorder

- Duration: 7:01

- Updated: 20 Oct 2012

- views: 32433

How to calculate NPV and IRR (Net Present Value and Internal Rate Return) EXCEL

- Order: Reorder

- Duration: 6:42

- Updated: 25 Jun 2012

- views: 145921

- published: 25 Jun 2012

- views: 145921

Capital Budgeting - Net Present Value (NPV) and Internal Rate of Return (IRR)

- Order: Reorder

- Duration: 13:21

- Updated: 18 Jun 2014

- views: 14419

- published: 18 Jun 2014

- views: 14419

IRR-Internal Rate of Return with example

- Order: Reorder

- Duration: 13:56

- Updated: 20 Jan 2013

- views: 20456

Capital Budgeting Part Two (HP10BII) -- Calculating Internal Rate of Return

- Order: Reorder

- Duration: 8:28

- Updated: 18 Jul 2012

- views: 43461

- published: 18 Jul 2012

- views: 43461

คำนวณผลตอบแทนภายใน(IRR) ใน Excel

- Order: Reorder

- Duration: 3:16

- Updated: 10 Jun 2014

- views: 13891

- published: 10 Jun 2014

- views: 13891

TI BA ii Plus IRR Function

- Order: Reorder

- Duration: 1:54

- Updated: 04 Sep 2015

- views: 931

- published: 04 Sep 2015

- views: 931

Calculate NPV and IRR in Excel

- Order: Reorder

- Duration: 8:44

- Updated: 27 Jan 2015

- views: 14309

- published: 27 Jan 2015

- views: 14309

NPV and IRR calculations using the TI BAII Plus calculator

- Order: Reorder

- Duration: 5:19

- Updated: 17 Feb 2009

- views: 202110

- published: 17 Feb 2009

- views: 202110

Part 2 - IRR How to Calculate Internal Rate of Return Explained (new)

- Order: Reorder

- Duration: 19:36

- Updated: 24 Jul 2011

- views: 123260

- published: 24 Jul 2011

- views: 123260

- Playlist

- Chat

- Playlist

- Chat

IRR (Internal Rate of Return)

- Report rights infringement

- published: 18 Sep 2013

- views: 118594

การบัญชีต้นทุน 2 การตัดสินใจจ่ายลงทุน((6/8)ผลตอบแทนภายใน(Internal Rate of Return : IRR)

- Report rights infringement

- published: 08 Jun 2014

- views: 3174

3 Easy Steps! IRR Internal Rate of Return Lecture on How to Calculate Internal Rate of Return

- Report rights infringement

- published: 27 Feb 2010

- views: 295162

3 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example

- Report rights infringement

- published: 20 Apr 2013

- views: 91377

NPV and IRR in Excel 2010

- Report rights infringement

- published: 17 Aug 2012

- views: 286455

NPV vs IRR

- Report rights infringement

- published: 18 Sep 2013

- views: 60416

Episode 127: How to Calculate the Internal Rate of Return | Part 1

- Report rights infringement

- published: 15 Aug 2013

- views: 43577

NPV - Net Present Value, IRR - Internal Rate of Return, Payback Period.

- Report rights infringement

- published: 08 Apr 2015

- views: 26555

Internal Rate of Return - Defined

- Report rights infringement

- published: 18 Oct 2010

- views: 38413

Calculate IRR using Excel

- Report rights infringement

- published: 26 Feb 2011

- views: 219335

Sharp EL-738: Internal Rate of Return (IRR)

- Report rights infringement

- published: 15 Jun 2015

- views: 2023

IRR vs. Cash on Cash Multiples in Leveraged Buyouts and Investments

- Report rights infringement

- published: 05 Aug 2014

- views: 9636

Incremental IRR

- Report rights infringement

- published: 04 Apr 2015

- views: 6288

Net Present Value (NPV) and Internal Rate of Return (IRR)

- Report rights infringement

- published: 20 Oct 2012

- views: 32433

-

Lyrics list:lyrics

-

So Light Is Her Football

-

Ce Matin-la

-

New Star In The Sky

-

Somewhere Between Waking And Sleeping

-

Kelly Watch The Stars

-

Heaven's Light

-

Venus

-

Playground Love

-

Sex Born Poison

-

The Way you Look Tonight

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

So Light Is Her Football

So light is her footfall

She walks like a bird

She's an angel

Such a familiar stranger

I wish I could help her

She's in danger

She's all alone alone alone alone alone alone

All alone alone alone alone

So light is her footfall

She moves like a ghost

And I lost her

In the mist of dawn

She's already gone

And I miss her

She's all alone alone alone alone alone alone

All alone alone alone alone

And I miss her

And I miss her

She's all alone alone alone alone alone alone

All alone alone alone alone

So light was her footfall

So light was her footfall

So light was her footfall

China Blocks US Navy Ships' Access to Hong Kong Port

Edit Voa News 30 Apr 2016Will easily defeat Hillary Clinton in November, says Donald Trump

Edit One India 30 Apr 2016In Malawi, people with albinism face ‘total extinction’– UN rights expert

Edit United Nations 29 Apr 2016State of emergency declared in Baghdad as protesters take Iraqi parliament

Edit Stars and Stripes 01 May 2016Forget corporate sector lenders, NBFCs are better: Ajay Bagga, Market Expert

Edit The Times of India 30 Apr 2016IAEA Mission Says Lithuania Committed to Nuclear and Radiation Safety Regulation, Sees Challenges Ahead (IAEA - International Atomic Energy Agency)

Edit Public Technologies 29 Apr 2016Oyemade Wants 'Dead' Capital for Economic Devt

Edit All Africa 29 Apr 2016Argonaut boosts Mexico gold project's economics

Edit BN Americas 29 Apr 2016ARIN DDoS Attack (ARIN - American Registry for Internet Numbers)

Edit Public Technologies 29 Apr 201629.04.2016: Annual Financial Report 2015 Press Release (Trader Media East Ltd)

Edit Public Technologies 29 Apr 2016Argonaut Gold Announces $30 Million Revolving Credit Facility, Updated Preliminary Economic Assessment and Permitting Advancement at San Agustin (Argonaut Gold Inc)

Edit Public Technologies 29 Apr 2016Argonaut Gold Announces $30 Million Revolving Credit Facility, Updated Preliminary Economic Assessment and Permitting Advancement ...

Edit Stockhouse 29 Apr 2016Electra Partners announces the sale of its interest in Kalle (Electra Private Equity plc)

Edit Public Technologies 29 Apr 2016Quarterly Activities and Cashflow Report (Red Mountain Mining Limited)

Edit Public Technologies 29 Apr 2016Overseas Regulatory Announcement: Press release filed by PT Indofood Sukses Makmur Tbk ("Indofood"), a 50.1% owned subsidiary of First Pacific Company Limited, to the Indonesia Stock Exchange, in relation to Indofood's financial results for the period ended 31 March 2016, together with the relevant Consolidated Financial Statements in the newspaper format (First Pacific Company Limited)

Edit Public Technologies 29 Apr 2016Canadian Metals Announces Positive Preliminary Economic Assessment of Langis Project

Edit Stockhouse 29 Apr 2016Avnel Gold Receives Approval of ESIA for the Kalana Main Project

Edit Stockhouse 29 Apr 2016- 1

- 2

- 3

- 4

- 5

- Next page »