- published: 12 May 2014

- views: 6493

-

remove the playlistTransaction Costs

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistTransaction Costs

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 04 Oct 2010

- views: 33775

- published: 10 Jun 2015

- views: 967

- published: 02 Jan 2014

- views: 10581

- published: 08 Jan 2014

- views: 1845

- published: 09 Feb 2007

- views: 5388

- published: 03 Apr 2012

- views: 8900

- published: 18 Mar 2015

- views: 18001

- published: 08 Jan 2014

- views: 871

- published: 12 Aug 2015

- views: 323

- published: 09 Aug 2014

- views: 2154

In economics and related disciplines, a transaction cost is a cost incurred in making an economic exchange (restated: the cost of participating in a market). For example, most people, when buying or selling a stock, must pay a commission to their broker; that commission is a transaction cost of doing the stock deal. Or consider buying a spatula from a store; to purchase the spatula, your costs will be not only the price of the spatula itself, but also the energy and effort it requires to find out which of the various spatula products you prefer, where to get them and at what price, the cost of traveling from your house to the store and back, the time waiting in line, and the effort of the paying itself; the costs above and beyond the cost of the spatula are the transaction costs. When rationally evaluating a potential transaction, it is important to consider transaction costs that might prove significant.

A number of kinds of transaction cost have come to be known by particular names:

The idea that transactions form the basis of an economic thinking was introduced by the institutional economist John R. Commons (1931). He says that,

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

4:36

4:365 steps to : Transaction costs- why do firms exist? by: Ismail Jeilani

5 steps to : Transaction costs- why do firms exist? by: Ismail Jeilani5 steps to : Transaction costs- why do firms exist? by: Ismail Jeilani

This video on transaction costs is part of a series of Economics videos that will hopefully make your studies a lot easier. Tweet me directly @ismailjeilani for any questions or video suggestions. -

5:09

5:09LSBF ACCA P1: Transaction Cost Theory with Paul Merison

LSBF ACCA P1: Transaction Cost Theory with Paul MerisonLSBF ACCA P1: Transaction Cost Theory with Paul Merison

London School of Business and Finance (LSBF) http://www.LSBF.org.uk/programmes/professional/acca - Paul Merison presents a lecture on 'Transaction Cost Theory', from the ACCA P1 exam. Watch now for an overview of this topic. The London School of Business and Finance (LSBF) is a dynamic educational institution delivering undergraduate, postgraduate and professional qualifications. Our innovative programmes are constantly reviewed to ensure they accurately reflect the conditions of the global economy, and we offer the flexibility to tailor your studies to suit your own career aspirations. To learn more about LSBF, watch some of our -

11:29

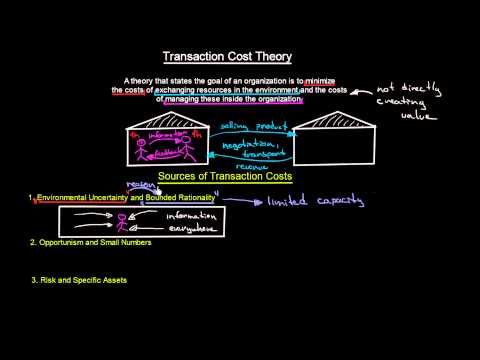

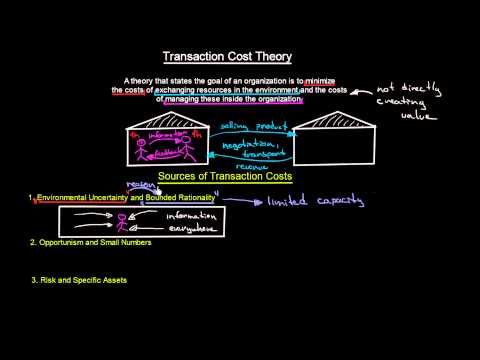

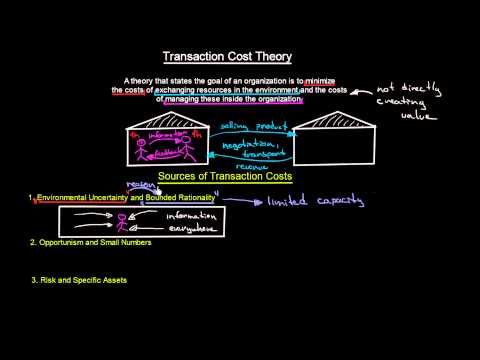

11:29Transaction Cost Theory and Transaction Costs Sources | Introduction To Organisations | MeanThat

Transaction Cost Theory and Transaction Costs Sources | Introduction To Organisations | MeanThatTransaction Cost Theory and Transaction Costs Sources | Introduction To Organisations | MeanThat

Come interact with our lessons on Curious and get 20% off as my student (they also have a free trial): https://curious.com/meanthat/resource-dependence-theory/in/introduction-to-organizational-theory?ref=XGkNhZBeCsU -

8:41

8:41Transaction Cost Theory and Transaction Cost Sources

Transaction Cost Theory and Transaction Cost SourcesTransaction Cost Theory and Transaction Cost Sources

Come interact with our lessons on Curious and get 20% off as my student (they also have a free trial): https://curious.com/meanthat/resource-dependence-theory/in/introduction-to-organizational-theory?ref=XGkNhZBeCsU -

1:31

1:31Step 3a: Transaction Costs for Sellers

Step 3a: Transaction Costs for SellersStep 3a: Transaction Costs for Sellers

How to calculate your full transaction costs before you sell your YeboYethu shares. -

1:44

1:4444. Transaction Costs

44. Transaction Costs44. Transaction Costs

One of the things that can damage our returns is transaction costs - a brief video on this subject. -

23:47

23:47Session 3 Agency Theory and Transaction Cost Theory

Session 3 Agency Theory and Transaction Cost TheorySession 3 Agency Theory and Transaction Cost Theory

-

63:20

63:20Chicago's Best Ideas: "Contract Law, Transaction Costs, and the Boundary of the Firm"

Chicago's Best Ideas: "Contract Law, Transaction Costs, and the Boundary of the Firm"Chicago's Best Ideas: "Contract Law, Transaction Costs, and the Boundary of the Firm"

Anup Malani, professor at the University of Chicago Law School, describes a number of surprising contract provisions that can be used to tackle the holdup problem, where a buyer and seller agree on a price for a future date, but the seller later demands a higher price. He also discusses how contract law can affect the scope and ownership of firms. In 1937, Ronald Coase asked: if markets are so efficient at allocating resources, why are so many resources allocated within firms? His answer was that market allocation entailed transactions costs and, when these were very high, transactions will take place within firms. Oliver Hart, with Sa -

8:16

8:16The Coase Theorem

The Coase TheoremThe Coase Theorem

In this video, we show how bees and pollination demonstrate the Coase Theorem in action: when transaction costs are low and property rights are clearly defined, private arrangements ensure that the market works even when there are externalities. Under these conditions, the market properly manages externalities. Microeconomics Course: http://mruniversity.com/courses/principles-economics-microeconomics Ask a question about the video: http://mruniversity.com/courses/principles-economics-microeconomics/coase-theorem-example#QandA Next video: http://mruniversity.com/courses/principles-economics-microeconomics/clean-air-act-pollution-control H -

1:56

1:56Step 3b: Transaction Costs for Buyers

Step 3b: Transaction Costs for BuyersStep 3b: Transaction Costs for Buyers

How to calculate your full transaction costs before you buy YeboYethu shares. -

9:23

9:23DT≻ 5/6-15: Transaction Cost Theory

DT≻ 5/6-15: Transaction Cost TheoryDT≻ 5/6-15: Transaction Cost Theory

Part of the University of California course: "Digital Technology & Social Change" Official course at: http://crossenroll.universityofcalifornia.edu http://extension.ucdavis.edu/online-learning Instructor: http://MartinHilbert.net/ -

0:24

0:24Miliband admits currency transaction costs

Miliband admits currency transaction costsMiliband admits currency transaction costs

Labour leader Ed Miliband admits English businesses will pay hundreds of millions if there isn't a currency union. See more at http://news.stv.tv/ -

4:06

4:06M-Pesa lowers transaction costs, sparks entrepreneurship in Kenya

M-Pesa lowers transaction costs, sparks entrepreneurship in KenyaM-Pesa lowers transaction costs, sparks entrepreneurship in Kenya

Transaction costs can be a significant drag on developing economies, but an innovative new technology is changing that for Kenyans. M-Pesa, a mobile payment system launched by Safaricom and Vodaphone, allows the instantaneous transfer of funds between customers and their providers of goods and services — transactions that used to take hours or even days to clear. Atlas Network partner the Eastern Africa Policy Centre has produced a new video explaining how M-Pesa lowers the costs of trade, making economic activity faster and far more cost-effective. Introduction by Atlas Network CEO Brad Lips. To learn more: AtlasNetwork.org -

5:30

5:30195. Online Futures Trading Transaction Costs

195. Online Futures Trading Transaction Costs195. Online Futures Trading Transaction Costs

http://www.informedtrades.com/f153/ The next lesson in my free online futures trading course which covers transaction costs that traders pay when trading futures.

- Bid and ask

- Bilateral monopoly

- Bounded Rationality

- Bounded rationality

- Buying

- Contract

- Cost

- Diseconomy of scale

- Economics

- Efficiency

- Franchising

- Game of chicken

- Game theory

- Gift

- Harold Demsetz

- Herbert A. Simon

- Hyperrationality

- Institution

- John R. Commons

- Legal system

- Market

- Market maker

- Monopoly

- Monopsony

- Morton Glantz

- Oliver E. Williamson

- Production function

- Profit maximization

- Robert Kissell

- Robinson Crusoe

- Ronald Coase

- Search cost

- Selling

- Steven N. S. Cheung

- Stock

- Stock broker

- Switching costs

- Theory of the firm

- Transaction cost

-

5 steps to : Transaction costs- why do firms exist? by: Ismail Jeilani

This video on transaction costs is part of a series of Economics videos that will hopefully make your studies a lot easier. Tweet me directly @ismailjeilani for any questions or video suggestions. -

LSBF ACCA P1: Transaction Cost Theory with Paul Merison

London School of Business and Finance (LSBF) http://www.LSBF.org.uk/programmes/professional/acca - Paul Merison presents a lecture on 'Transaction Cost Theory', from the ACCA P1 exam. Watch now for an overview of this topic. The London School of Business and Finance (LSBF) is a dynamic educational institution delivering undergraduate, postgraduate and professional qualifications. Our inn -

Transaction Cost Theory and Transaction Costs Sources | Introduction To Organisations | MeanThat

Come interact with our lessons on Curious and get 20% off as my student (they also have a free trial): https://curious.com/meanthat/resource-dependence-theory/in/introduction-to-organizational-theory?ref=XGkNhZBeCsU -

Transaction Cost Theory and Transaction Cost Sources

Come interact with our lessons on Curious and get 20% off as my student (they also have a free trial): https://curious.com/meanthat/resource-dependence-theory/in/introduction-to-organizational-theory?ref=XGkNhZBeCsU -

Step 3a: Transaction Costs for Sellers

How to calculate your full transaction costs before you sell your YeboYethu shares. -

44. Transaction Costs

One of the things that can damage our returns is transaction costs - a brief video on this subject. -

Session 3 Agency Theory and Transaction Cost Theory

-

Chicago's Best Ideas: "Contract Law, Transaction Costs, and the Boundary of the Firm"

Anup Malani, professor at the University of Chicago Law School, describes a number of surprising contract provisions that can be used to tackle the holdup problem, where a buyer and seller agree on a price for a future date, but the seller later demands a higher price. He also discusses how contract law can affect the scope and ownership of firms. In 1937, Ronald Coase asked: if markets are so -

The Coase Theorem

In this video, we show how bees and pollination demonstrate the Coase Theorem in action: when transaction costs are low and property rights are clearly defined, private arrangements ensure that the market works even when there are externalities. Under these conditions, the market properly manages externalities. Microeconomics Course: http://mruniversity.com/courses/principles-economics-microecon -

Step 3b: Transaction Costs for Buyers

How to calculate your full transaction costs before you buy YeboYethu shares. -

DT≻ 5/6-15: Transaction Cost Theory

Part of the University of California course: "Digital Technology & Social Change" Official course at: http://crossenroll.universityofcalifornia.edu http://extension.ucdavis.edu/online-learning Instructor: http://MartinHilbert.net/ -

Miliband admits currency transaction costs

Labour leader Ed Miliband admits English businesses will pay hundreds of millions if there isn't a currency union. See more at http://news.stv.tv/ -

M-Pesa lowers transaction costs, sparks entrepreneurship in Kenya

Transaction costs can be a significant drag on developing economies, but an innovative new technology is changing that for Kenyans. M-Pesa, a mobile payment system launched by Safaricom and Vodaphone, allows the instantaneous transfer of funds between customers and their providers of goods and services — transactions that used to take hours or even days to clear. Atlas Network partner the Eastern -

195. Online Futures Trading Transaction Costs

http://www.informedtrades.com/f153/ The next lesson in my free online futures trading course which covers transaction costs that traders pay when trading futures. -

Don't let your return be dragged down by transaction costs

Don't let your return be dragged down by transaction costs. Lower your costs to maximize your return. Trade up to Interactive Brokers and improve your return today. For more information visit www.interactivebrokers.com/lowercost Interactive Brokers LLC is a member of NYSE, FINRA, SIPC. Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that -

New FXCM Transaction Cost

FXCM has recently rolled out a new pricing model that can significantly reduce transaction costs for their traders. In this video, James Stanley of DailyFX teaches how the new pricing model works using an example with the most liquid currency pair in the world: The EUR/USD. For more information on the new pricing model from FXCM, along with the commission schedule and average spreads, please -

Transaction Cost Analysis Webinar: The Next Generation of TCA

This is a replay of our Transaction Cost Analysis (TCA) Webinar from June: Best Practices for Best Execution and The Next Generation of Transaction Cost Analysis. In this 20 minute video, TradingScreen's Jon Fatica, head of analytics for TradingScreen, discusses: - What "Next Generation" TCA looks like - How it differs from traditional TCA - How to use real-time TCA to avoid mistakes in a multi- -

More On Transaction Cost Theory

Come interact with our lessons on Curious and get 20% off as my student (they also have a free trial): https://curious.com/meanthat/resource-dependence-theory/in/introduction-to-organizational-theory?ref=XGkNhZBeCsU -

Reducing transaction costs in catfish exports to Europe - Source VTV4

Vietnamese pangasius producers have made efforts in improving the fish quality however pangasius prices in the EU are still low. Many of them now target to approach directly to end users to reduce costs in distribution with hope that they can get more benefits from the potential fish. -

How the Stock Market Works 14. Minimizing Transaction Costs & Taxes

The stock market is a way for anyone to own the valuable assets of a company and, as investments, stocks historically have offered a good chance for long-ter. How capital gains tax works | Investment Strategies How capital gains tax works | Investment Strategies In finance, an investment strategy is a set of rules,. Tobin tax - The 'Robin Hood' tax | Investment Strategies Tobin tax - The 'Ro -

Aquecimento global, Transaction costs e Libertarianismo

Links: http://www.libertarianismo.org/livros/aedl.pdf http://pt.wikipedia.org/wiki/Custo_de_transa%C3%A7%C3%A3o http://en.wikipedia.org/wiki/Class_action -

Organizational Strategies in Transaction Cost Theory | Introduction To Organisations | MeanThat

Come interact with our lessons on Curious and get 20% off as my student (they also have a free trial): https://curious.com/meanthat/resource-dependence-theory/in/introduction-to-organizational-theory?ref=XGkNhZBeCsU -

134. Choosing a Forex Broker Part III: Transaction Costs

http://www.informedtrades.com -- A look at the transaction costs involved in forex trading (the bid ask spread, commissions, and how trades are executed) so that FX traders can properly understand how much their currency broker is charging them.

5 steps to : Transaction costs- why do firms exist? by: Ismail Jeilani

- Order: Reorder

- Duration: 4:36

- Updated: 12 May 2014

- views: 6493

- published: 12 May 2014

- views: 6493

LSBF ACCA P1: Transaction Cost Theory with Paul Merison

- Order: Reorder

- Duration: 5:09

- Updated: 04 Oct 2010

- views: 33775

- published: 04 Oct 2010

- views: 33775

Transaction Cost Theory and Transaction Costs Sources | Introduction To Organisations | MeanThat

- Order: Reorder

- Duration: 11:29

- Updated: 10 Jun 2015

- views: 967

- published: 10 Jun 2015

- views: 967

Transaction Cost Theory and Transaction Cost Sources

- Order: Reorder

- Duration: 8:41

- Updated: 02 Jan 2014

- views: 10581

- published: 02 Jan 2014

- views: 10581

Step 3a: Transaction Costs for Sellers

- Order: Reorder

- Duration: 1:31

- Updated: 08 Jan 2014

- views: 1845

- published: 08 Jan 2014

- views: 1845

44. Transaction Costs

- Order: Reorder

- Duration: 1:44

- Updated: 09 Feb 2007

- views: 5388

- published: 09 Feb 2007

- views: 5388

Session 3 Agency Theory and Transaction Cost Theory

- Order: Reorder

- Duration: 23:47

- Updated: 21 May 2013

- views: 12879

- published: 21 May 2013

- views: 12879

Chicago's Best Ideas: "Contract Law, Transaction Costs, and the Boundary of the Firm"

- Order: Reorder

- Duration: 63:20

- Updated: 03 Apr 2012

- views: 8900

- published: 03 Apr 2012

- views: 8900

The Coase Theorem

- Order: Reorder

- Duration: 8:16

- Updated: 18 Mar 2015

- views: 18001

- published: 18 Mar 2015

- views: 18001

Step 3b: Transaction Costs for Buyers

- Order: Reorder

- Duration: 1:56

- Updated: 08 Jan 2014

- views: 871

- published: 08 Jan 2014

- views: 871

DT≻ 5/6-15: Transaction Cost Theory

- Order: Reorder

- Duration: 9:23

- Updated: 12 Aug 2015

- views: 323

- published: 12 Aug 2015

- views: 323

Miliband admits currency transaction costs

- Order: Reorder

- Duration: 0:24

- Updated: 09 Aug 2014

- views: 2154

- published: 09 Aug 2014

- views: 2154

M-Pesa lowers transaction costs, sparks entrepreneurship in Kenya

- Order: Reorder

- Duration: 4:06

- Updated: 23 Jul 2015

- views: 403

- published: 23 Jul 2015

- views: 403

195. Online Futures Trading Transaction Costs

- Order: Reorder

- Duration: 5:30

- Updated: 18 Feb 2009

- views: 4423

- published: 18 Feb 2009

- views: 4423

Don't let your return be dragged down by transaction costs

- Order: Reorder

- Duration: 0:31

- Updated: 16 Sep 2013

- views: 3098

- published: 16 Sep 2013

- views: 3098

New FXCM Transaction Cost

- Order: Reorder

- Duration: 3:54

- Updated: 30 Oct 2014

- views: 1070

- published: 30 Oct 2014

- views: 1070

Transaction Cost Analysis Webinar: The Next Generation of TCA

- Order: Reorder

- Duration: 20:46

- Updated: 30 Jul 2012

- views: 1762

- published: 30 Jul 2012

- views: 1762

More On Transaction Cost Theory

- Order: Reorder

- Duration: 6:02

- Updated: 02 Jan 2014

- views: 1887

- published: 02 Jan 2014

- views: 1887

Reducing transaction costs in catfish exports to Europe - Source VTV4

- Order: Reorder

- Duration: 2:42

- Updated: 23 May 2014

- views: 349

- published: 23 May 2014

- views: 349

How the Stock Market Works 14. Minimizing Transaction Costs & Taxes

- Order: Reorder

- Duration: 31:12

- Updated: 09 Jun 2014

- views: 932

- published: 09 Jun 2014

- views: 932

Aquecimento global, Transaction costs e Libertarianismo

- Order: Reorder

- Duration: 10:59

- Updated: 21 Apr 2014

- views: 455

- published: 21 Apr 2014

- views: 455

Organizational Strategies in Transaction Cost Theory | Introduction To Organisations | MeanThat

- Order: Reorder

- Duration: 11:15

- Updated: 10 Jun 2015

- views: 308

- published: 10 Jun 2015

- views: 308

134. Choosing a Forex Broker Part III: Transaction Costs

- Order: Reorder

- Duration: 6:13

- Updated: 30 Jul 2008

- views: 6033

- published: 30 Jul 2008

- views: 6033

-

How to Develop and Utilize a Transaction Costs Fund

2015 RCP Network Gathering | How to Develop and Utilize a Transaction Costs Fund Speakers: Brian Hotz, Society for the Protection of NH Forests Dea Brickner-Wood, Great Bay Resource Protection Partnership Robert O'Connor, MA Office of Energy and Environmental Affairs Moderator: Brian Hotz -

The Economics of the Internet

Old economics explains the new economy well. When we buy something, we spend time and money searching for it, comparing it with other products, negotiating a price, and ensuring that we get what we paid for. This is what economists call ‘transaction costs.’ The internet dramatically reduces these costs, making it cheaper for people, businesses and governments to do business. Visit: http://www.wor -

Transaction Costs & Intermediation

-

ACCA P1 Transaction Cost Theory

This video covers the topic of Transaction Cost for ACCA’s Paper P1 Governance, Risk & Ethics -

Corporate Governance and Social Accountability lecture 2 Part 1 Transaction Costs

-

Transaction cost

In economics and related disciplines, a transaction cost is a cost incurred in making an economic exchange. This video is targeted to blind users. Attribution: Article text available under CC-BY-SA Creative Commons image source in video -

Stock Market Insider Trading: High Frequency Trading Transactions (2014)

High-frequency trading (HFT) is a primary form of algorithmic trading in finance. Specifically, it is the use of sophisticated technological tools and computer . Various studies have reported that high-frequency reduces volatility and does not pose a systemic risk, and lowers transaction costs for retail investors, without . High-frequency trading (HFT) is the use of sophisticated algorithms -

Learn Stock Trading How the Stock Market Works Part 14 Minimizing Transaction Costs And Taxes

-

Rotman Strategy (Prof Kevin Bryan) Recap Video 23

Firms integrate to avoid transaction costs in relationships which are worth continuing -

Transaction Costs when investing: hidden charges

A simple introduction to transaction costs and how investors are charged when making investments. -

Transaction Costs and Potential Revenue of Carbon Projects

I created this video with the YouTube Video Editor (https://www.youtube.com/editor) -

Part I Element 5: Transaction Costs are an Obstacle to Trade

-

2015 GPF: Approaching Financial Inclusion's Last Frontier, Serving the Rural Poor

The promises of technology in lowering transaction costs for traditional and nontraditional financial service providers have undeniably started to materialize, and its positive impact on financial inclusion is evident in many developing and emerging countries. However, significant portions of poor people have not yet benefited from these advances particularly those living in rural or remote areas. -

Transaction costs and incentive mechanisms of community based carbon projects

http://www.fao.org/forestry/en/ Chris Stephenson speaks at the Economics of Climate Change Mitigation Options in the Forest Sector international online conference. Organized by the Food and Agriculture Organization of the United Nations in February 2015, the conference explored how a wide range of different interventions in the forest sector might help to mitigate climate change, based on existin -

WHAT ARE CLOSING COSTS ?

The expenses, over and above the price of the property that buyers and sellers normally incur to complete a real estate transaction. Costs incurred include loan processing fee, title searches, surveys & site visits, taxes, stamp duty, registration charges and credit report charges. Also known as “settlement costs.” Real Estate Glossary By: http://www.zricks.com -

CRITICAL DIMENSIONS

http://academlib.com/3814/management/critical_dimensions#393 In addition to basic assumptions, there are other critical dimensions to the theory, that, when combined with the basic assumptions, are elemental to creating transaction costs. ... -

WHAT ARE TRANSACTION COSTS?

http://academlib.com/3813/management/transaction_costs#681 As Coase first suggested in 1937, every transaction made by a firm has a cost.7 Williamson and others later determined that the costs may be external (market costs) or internal (bureaucracy costs).8 External costs can be in the form of searching for a trading partner, negotiating contracts, making sure those contracts are enforced, ensuri -

Transaction Cost Economics

http://academlib.com/3799/management/evolution_theories_strategic_management#919 Based on the seminal work of Coase (1937), Williamson developed a new theory in strategic management called transaction cost economics (TCE). TCE describes the firm in organizational terms (i.e., governance structure) and not in traditional microeconomics terms (i.e., production function). The basic tenet of TCE is t -

INTRODUCTION

http://academlib.com/3812/management/strategy_theories#244 Strategy Theories Transaction Cost Economics Transaction cost economics (also referred to as transaction cost theory of the firm, transaction costs, TC or TCE) is the theory of firm governance that specifically addresses the "make or buy" question—should a firm internally make or externally buy (or some combination) a specific product, in -

Transaction Frequency

http://academlib.com/3814/management/critical_dimensions#286 The frequency with which trading partners interact can affect transaction costs in two ways: setup costs and reputation.19 Setup costs may be as simple as writing a contract or as complex as hiring specialized employees or creating custom dies. In this case, something like economies of scale occur. The more often two partners interact, -

M Pesa lowers transaction costs, sparks entrepreneurship in Kenya

As the Global Enterprise Summit 2015 comes to Nairobi, we need to evaluate how enterprise and innovation changes lives. Why is M-pesa, a mobile phone based financial service succeed in Kenya, but is not quite as successful everywhere else?

How to Develop and Utilize a Transaction Costs Fund

- Order: Reorder

- Duration: 74:26

- Updated: 02 Feb 2016

- views: 4

- published: 02 Feb 2016

- views: 4

The Economics of the Internet

- Order: Reorder

- Duration: 3:24

- Updated: 28 Jan 2016

- views: 621

- published: 28 Jan 2016

- views: 621

Transaction Costs & Intermediation

- Order: Reorder

- Duration: 5:32

- Updated: 26 Jan 2016

- views: 4

- published: 26 Jan 2016

- views: 4

ACCA P1 Transaction Cost Theory

- Order: Reorder

- Duration: 3:15

- Updated: 25 Jan 2016

- views: 9

- published: 25 Jan 2016

- views: 9

Corporate Governance and Social Accountability lecture 2 Part 1 Transaction Costs

- Order: Reorder

- Duration: 14:56

- Updated: 15 Jan 2016

- views: 30

- published: 15 Jan 2016

- views: 30

Transaction cost

- Order: Reorder

- Duration: 11:58

- Updated: 07 Jan 2016

- views: 6

- published: 07 Jan 2016

- views: 6

Stock Market Insider Trading: High Frequency Trading Transactions (2014)

- Order: Reorder

- Duration: 312:15

- Updated: 23 Nov 2015

- views: 4

- published: 23 Nov 2015

- views: 4

Learn Stock Trading How the Stock Market Works Part 14 Minimizing Transaction Costs And Taxes

- Order: Reorder

- Duration: 5:01

- Updated: 19 Nov 2015

- views: 0

- published: 19 Nov 2015

- views: 0

Rotman Strategy (Prof Kevin Bryan) Recap Video 23

- Order: Reorder

- Duration: 2:14

- Updated: 30 Oct 2015

- views: 354

- published: 30 Oct 2015

- views: 354

Transaction Costs when investing: hidden charges

- Order: Reorder

- Duration: 2:43

- Updated: 09 Oct 2015

- views: 5

- published: 09 Oct 2015

- views: 5

Transaction Costs and Potential Revenue of Carbon Projects

- Order: Reorder

- Duration: 21:44

- Updated: 19 Sep 2015

- views: 5

- published: 19 Sep 2015

- views: 5

Part I Element 5: Transaction Costs are an Obstacle to Trade

- Order: Reorder

- Duration: 6:48

- Updated: 13 Sep 2015

- views: 176

- published: 13 Sep 2015

- views: 176

2015 GPF: Approaching Financial Inclusion's Last Frontier, Serving the Rural Poor

- Order: Reorder

- Duration: 71:39

- Updated: 10 Sep 2015

- views: 35

- published: 10 Sep 2015

- views: 35

Transaction costs and incentive mechanisms of community based carbon projects

- Order: Reorder

- Duration: 7:27

- Updated: 28 Aug 2015

- views: 5

- published: 28 Aug 2015

- views: 5

WHAT ARE CLOSING COSTS ?

- Order: Reorder

- Duration: 0:29

- Updated: 14 Aug 2015

- views: 8

- published: 14 Aug 2015

- views: 8

CRITICAL DIMENSIONS

- Order: Reorder

- Duration: 0:14

- Updated: 04 Aug 2015

- views: 0

- published: 04 Aug 2015

- views: 0

WHAT ARE TRANSACTION COSTS?

- Order: Reorder

- Duration: 1:51

- Updated: 04 Aug 2015

- views: 24

- published: 04 Aug 2015

- views: 24

Transaction Cost Economics

- Order: Reorder

- Duration: 0:54

- Updated: 04 Aug 2015

- views: 327

- published: 04 Aug 2015

- views: 327

INTRODUCTION

- Order: Reorder

- Duration: 1:04

- Updated: 04 Aug 2015

- views: 3

- published: 04 Aug 2015

- views: 3

Transaction Frequency

- Order: Reorder

- Duration: 1:57

- Updated: 04 Aug 2015

- views: 3

- published: 04 Aug 2015

- views: 3

M Pesa lowers transaction costs, sparks entrepreneurship in Kenya

- Order: Reorder

- Duration: 4:06

- Updated: 24 Jul 2015

- views: 57

- published: 24 Jul 2015

- views: 57

-

Day 1 P&L; and transaction costs

Segunda sesión de la II Jornada FAIF: " Day 1 P&L; and transaction costs" Intervienen: PONENTE: José Morales. Grupo de Instrumentos Financieros de Ernst & Young. PANELISTAS: - Margarita Torrent. Profesora de la Universidad Autónoma de Barcelona. - Jorge Hinojosa. Grupo de Instrumentos Financieros de Ernst & Young. MODERADOR: Constancio Zamora. Profesor Universidad de Sevilla. -

Scott E. Masten on Transaction Cost Orientation at BI Norwegian Business School

Oliver Williamson: Viewing Organization Through a Transaction Cost Lens. Professor Scott E. Masten, Ross School of business, University of Michigan, Ann Arbour, MI, USA. Research Symposium in Honor of Oliver E Williamson, December 4th 2009 at BI Norwegian Business School -

Modeling Transaction Costs for Algorithmic Strategies

Tom Bok gave a informative and fascinating presentation about modeling transaction costs in algorithms at our Boston Algorithmic Finance Meetup. You can see the slides for this talk, and sample models to work with at https://www.quantopian.com/posts/custom-slippage-modeling-transaction-costs-for-algorithmic-strategies?c=1 -

Managing FX Transaction Costs

Good information is the best tool for managing transaction costs in the FX and other markets. Technology has enabled information to move from newspapers and tip sheets to online terminals and trading portals Big data offers further power to users seeking to control costs in the FX market. This webinar covers the components of FX transaction costs and demonstrates models for controlling these costs -

Yan Dolinsky: Convex Duality with Transaction Costs

Two different super-replication problems in a continuous time financial market with proportional transaction cost are considered. In this market, static hedging in a finite number of options, in addition to usual dynamic hedging with the underlying stock, are also allowed. The first one the problems considered is model-independent hedging that requires the super-replication to hold for every conti -

Approximate hedging problem with transaction costs in stochastic volatility markets

http://ilqf.hse.ru/ -

The Financial Planner: What is the transaction cost?

This week The Financial Planner takes a look at the transaction cost, what it means and how it will affect you. -

Documentary: The Bitcoin Gospel (VPRO Backlight)

Is bitcoin the blueprint for a bankless currency, or the biggest pyramid scheme ever? What if we could create money ourselves, without the need for banks? Money that can’t be forged, that will appreciate rather than depreciate, and that can be used worldwide without transaction costs. It exists, and some people consider it to be the digital version of gold: bitcoin. Is this really a perfect bankl -

Mod-01 Lec-32 Transaction cost and Economic Anthropology approaches

History of Economic Theory by Dr. Shivakumar, Department of Humanities and Social Sciences IIT Madras, For more details on NPTEL visit http://nptel.iitm.ac.in -

Ronald Coase: "Markets, Firms and Property Rights"

This address by Ronald Coase (Clifton R. Musser Professor Emeritus of Economics at the University of Chicago Law School) to the conference "Markets, Firms and Property Rights: A Celebration of the Research of Ronald Coase" was recorded November 23, 2009. -

Propertarianism - Trust and Demand for the State.

Conversations on aristocratic egalitarian philosophy with Roman Skaskiw and Curt Doolittle. As long as people demonstrate demand for the state, the market will provide a state. In this conversation we discuss how humans use organized application of power to suppress the transaction costs of criminal. unethical, immoral and conspiratorial behavior -but in doing so create the state, with high indir -

Marina Gorbis: The Social Economy

Big government and centralized organizations have long enabled the provision of goods and services to be cheap, efficient and reliable. This is changing. The internet has lowered transaction costs, pointing to a future that favours peer-to-peer interactions and social solutions to our needs and intractable problems. Marina Gorbis, author of "The Nature of the Future: Dispatches from the Socialstru -

12. Accountability and Greed in Investment Banking

Capitalism: Success, Crisis and Reform (PLSC 270) Professor Rae explores the creation of incentives and disincentives for individual action. The discussion begins with the Coase Theorem, which outlines three conditions for efficient transactions: 1) clear entitlements to property, 2) transparency, and 3) low transaction costs. Professor Rae then tells the story of a whaling law case from 1881 t -

Panel: Blockchain as New Infrastructure - COALA's Blockchain Workshops

Panelists: Henning Diedrich (IBM), Kasek Galgal (ISOC), Eric Jennings (Filament), Gustav Simonsson (Ethereum), Vlad Zamfir (Ethereum), Guy Zyskind (Enigma) Moderated by Constance Choi (Seven Advisory/CNRS) Do blockchains represent fundamentally new infrastructure? Can blockchains support and optimize today’s institutions and communities, improving real-time efficiency and allowing for significant -

Managing the Downside

Shun the financial predators and take control of your financial destiny. Save hard, and avoid giving up too much of your savings to transaction costs. -

Why Free Markets Work: Milton Friedman on Political Economy (1996)

The Friedman rule is a monetary policy rule proposed by Milton Friedman.[1] Essentially, Friedman advocated setting the nominal interest rate at zero. According to the logic of the Friedman rule, the opportunity cost of holding money faced by private agents should equal the social cost of creating additional fiat money. It is assumed that the marginal cost of creating additional money is zero (or

Day 1 P&L; and transaction costs

- Order: Reorder

- Duration: 76:54

- Updated: 29 Nov 2011

- views: 189

- published: 29 Nov 2011

- views: 189

Scott E. Masten on Transaction Cost Orientation at BI Norwegian Business School

- Order: Reorder

- Duration: 26:33

- Updated: 22 Jun 2012

- views: 1244

- published: 22 Jun 2012

- views: 1244

Modeling Transaction Costs for Algorithmic Strategies

- Order: Reorder

- Duration: 36:09

- Updated: 27 Jun 2013

- views: 572

- published: 27 Jun 2013

- views: 572

Managing FX Transaction Costs

- Order: Reorder

- Duration: 50:25

- Updated: 18 May 2015

- views: 34

- published: 18 May 2015

- views: 34

Yan Dolinsky: Convex Duality with Transaction Costs

- Order: Reorder

- Duration: 40:44

- Updated: 13 Mar 2015

- views: 55

- published: 13 Mar 2015

- views: 55

Approximate hedging problem with transaction costs in stochastic volatility markets

- Order: Reorder

- Duration: 91:44

- Updated: 28 Oct 2014

- views: 73

- published: 28 Oct 2014

- views: 73

The Financial Planner: What is the transaction cost?

- Order: Reorder

- Duration: 20:50

- Updated: 04 Aug 2011

- views: 568

- published: 04 Aug 2011

- views: 568

Documentary: The Bitcoin Gospel (VPRO Backlight)

- Order: Reorder

- Duration: 48:53

- Updated: 01 Nov 2015

- views: 100106

- published: 01 Nov 2015

- views: 100106

Mod-01 Lec-32 Transaction cost and Economic Anthropology approaches

- Order: Reorder

- Duration: 49:49

- Updated: 24 Jul 2012

- views: 636

- published: 24 Jul 2012

- views: 636

Ronald Coase: "Markets, Firms and Property Rights"

- Order: Reorder

- Duration: 25:41

- Updated: 20 Apr 2012

- views: 13071

- published: 20 Apr 2012

- views: 13071

Propertarianism - Trust and Demand for the State.

- Order: Reorder

- Duration: 22:33

- Updated: 16 Aug 2014

- views: 1062

- published: 16 Aug 2014

- views: 1062

Marina Gorbis: The Social Economy

- Order: Reorder

- Duration: 25:00

- Updated: 05 Jul 2013

- views: 1591

- published: 05 Jul 2013

- views: 1591

12. Accountability and Greed in Investment Banking

- Order: Reorder

- Duration: 50:52

- Updated: 01 Apr 2011

- views: 8333

- published: 01 Apr 2011

- views: 8333

Panel: Blockchain as New Infrastructure - COALA's Blockchain Workshops

- Order: Reorder

- Duration: 62:16

- Updated: 08 Feb 2016

- views: 3

- published: 08 Feb 2016

- views: 3

Managing the Downside

- Order: Reorder

- Duration: 20:53

- Updated: 12 Mar 2014

- views: 4278

- published: 12 Mar 2014

- views: 4278

Why Free Markets Work: Milton Friedman on Political Economy (1996)

- Order: Reorder

- Duration: 70:23

- Updated: 14 Nov 2015

- views: 1509

- published: 14 Nov 2015

- views: 1509

- Playlist

- Chat

- Playlist

- Chat

5 steps to : Transaction costs- why do firms exist? by: Ismail Jeilani

- Report rights infringement

- published: 12 May 2014

- views: 6493

LSBF ACCA P1: Transaction Cost Theory with Paul Merison

- Report rights infringement

- published: 04 Oct 2010

- views: 33775

Transaction Cost Theory and Transaction Costs Sources | Introduction To Organisations | MeanThat

- Report rights infringement

- published: 10 Jun 2015

- views: 967

Transaction Cost Theory and Transaction Cost Sources

- Report rights infringement

- published: 02 Jan 2014

- views: 10581

Step 3a: Transaction Costs for Sellers

- Report rights infringement

- published: 08 Jan 2014

- views: 1845

44. Transaction Costs

- Report rights infringement

- published: 09 Feb 2007

- views: 5388

Session 3 Agency Theory and Transaction Cost Theory

- Report rights infringement

- published: 21 May 2013

- views: 12879

Chicago's Best Ideas: "Contract Law, Transaction Costs, and the Boundary of the Firm"

- Report rights infringement

- published: 03 Apr 2012

- views: 8900

The Coase Theorem

- Report rights infringement

- published: 18 Mar 2015

- views: 18001

Step 3b: Transaction Costs for Buyers

- Report rights infringement

- published: 08 Jan 2014

- views: 871

DT≻ 5/6-15: Transaction Cost Theory

- Report rights infringement

- published: 12 Aug 2015

- views: 323

Miliband admits currency transaction costs

- Report rights infringement

- published: 09 Aug 2014

- views: 2154

M-Pesa lowers transaction costs, sparks entrepreneurship in Kenya

- Report rights infringement

- published: 23 Jul 2015

- views: 403

195. Online Futures Trading Transaction Costs

- Report rights infringement

- published: 18 Feb 2009

- views: 4423

- Playlist

- Chat

How to Develop and Utilize a Transaction Costs Fund

- Report rights infringement

- published: 02 Feb 2016

- views: 4

The Economics of the Internet

- Report rights infringement

- published: 28 Jan 2016

- views: 621

Transaction Costs & Intermediation

- Report rights infringement

- published: 26 Jan 2016

- views: 4

ACCA P1 Transaction Cost Theory

- Report rights infringement

- published: 25 Jan 2016

- views: 9

Corporate Governance and Social Accountability lecture 2 Part 1 Transaction Costs

- Report rights infringement

- published: 15 Jan 2016

- views: 30

Transaction cost

- Report rights infringement

- published: 07 Jan 2016

- views: 6

Stock Market Insider Trading: High Frequency Trading Transactions (2014)

- Report rights infringement

- published: 23 Nov 2015

- views: 4

Learn Stock Trading How the Stock Market Works Part 14 Minimizing Transaction Costs And Taxes

- Report rights infringement

- published: 19 Nov 2015

- views: 0

Rotman Strategy (Prof Kevin Bryan) Recap Video 23

- Report rights infringement

- published: 30 Oct 2015

- views: 354

Transaction Costs when investing: hidden charges

- Report rights infringement

- published: 09 Oct 2015

- views: 5

Transaction Costs and Potential Revenue of Carbon Projects

- Report rights infringement

- published: 19 Sep 2015

- views: 5

Part I Element 5: Transaction Costs are an Obstacle to Trade

- Report rights infringement

- published: 13 Sep 2015

- views: 176

2015 GPF: Approaching Financial Inclusion's Last Frontier, Serving the Rural Poor

- Report rights infringement

- published: 10 Sep 2015

- views: 35

Transaction costs and incentive mechanisms of community based carbon projects

- Report rights infringement

- published: 28 Aug 2015

- views: 5

- Playlist

- Chat

Day 1 P&L; and transaction costs

- Report rights infringement

- published: 29 Nov 2011

- views: 189

Scott E. Masten on Transaction Cost Orientation at BI Norwegian Business School

- Report rights infringement

- published: 22 Jun 2012

- views: 1244

Modeling Transaction Costs for Algorithmic Strategies

- Report rights infringement

- published: 27 Jun 2013

- views: 572

Managing FX Transaction Costs

- Report rights infringement

- published: 18 May 2015

- views: 34

Yan Dolinsky: Convex Duality with Transaction Costs

- Report rights infringement

- published: 13 Mar 2015

- views: 55

Approximate hedging problem with transaction costs in stochastic volatility markets

- Report rights infringement

- published: 28 Oct 2014

- views: 73

The Financial Planner: What is the transaction cost?

- Report rights infringement

- published: 04 Aug 2011

- views: 568

Documentary: The Bitcoin Gospel (VPRO Backlight)

- Report rights infringement

- published: 01 Nov 2015

- views: 100106

Mod-01 Lec-32 Transaction cost and Economic Anthropology approaches

- Report rights infringement

- published: 24 Jul 2012

- views: 636

Ronald Coase: "Markets, Firms and Property Rights"

- Report rights infringement

- published: 20 Apr 2012

- views: 13071

Propertarianism - Trust and Demand for the State.

- Report rights infringement

- published: 16 Aug 2014

- views: 1062

Marina Gorbis: The Social Economy

- Report rights infringement

- published: 05 Jul 2013

- views: 1591

12. Accountability and Greed in Investment Banking

- Report rights infringement

- published: 01 Apr 2011

- views: 8333

Panel: Blockchain as New Infrastructure - COALA's Blockchain Workshops

- Report rights infringement

- published: 08 Feb 2016

- views: 3

Former Obama intel official: Hillary Clinton should drop out

Edit CNN 13 Feb 2016Pope, Russian patriarch hold historic meeting

Edit The Japan News 13 Feb 2016Canadian Man Missing For 30 Years Remembers Who He Is

Edit WorldNews.com 12 Feb 2016US Defence Secretary Ash Carter says Britain must renew Trident to maintain ‘outsized’ role in world

Edit The Independent 13 Feb 2016How Bernie Sanders' Wall Street Tax Would Work

Edit National Public Radio 13 Feb 2016SHAREHOLDER ALERT: Brodsky & Smith, LLC Announces Investigation of The Board of Directors of Apollo Education Group, Inc. -APOL

Edit PR Newswire 13 Feb 2016SHAREHOLDER ALERT: Brodsky & Smith, LLC Announces Investigation of The Board of Directors of Apollo ...

Edit Stockhouse 13 Feb 2016Prepare for serious competition, from new entrants, banks told

Edit The Hindu 13 Feb 2016Exports in 3 states surge under VSEZ, says zonal development commissioner

Edit The Times of India 13 Feb 2016e-money transactions reach Rp5.2 trillion: Bank Indonesia

Edit Antara News 13 Feb 2016Unaudited Results For The Second Quarter and Half-Year Ended 31 December 2015 (Eu Yan Sang ...

Edit Public Technologies 13 Feb 2016Oklahoma Real Deals transactions for Feb. 13

Edit The Oklahoman 13 Feb 2016Eurozone considering whether to remove €500 banknote over fraud, laundering fears

Edit The Malta Independent 13 Feb 2016Eu Yan Sang shows marginal improvement in 2QFY16 revenue to S$85.61 million, operating profit at ...

Edit Public Technologies 13 Feb 2016Crossgates Mall resumes buying homes off Western Avenue

Edit Times Union 13 Feb 2016Number of Scottish house movers rises, but at slower rate

Edit BBC News 13 Feb 2016Two for £40 for Huddersfield, members tickets only £15 (Milton Keynes Dons Ltd)

Edit Public Technologies 13 Feb 2016- 1

- 2

- 3

- 4

- 5

- Next page »