- published: 14 Apr 2013

- views: 8140

- published: 31 Jul 2014

- views: 2812

- published: 28 Oct 2015

- views: 23899

- published: 14 Sep 2015

- views: 3763

- published: 11 Jul 2016

- views: 1974

- published: 03 Feb 2015

- views: 2465

- published: 08 Sep 2016

- views: 1779

- published: 18 May 2016

- views: 2252

- published: 03 Sep 2014

- views: 3916

- Loading...

-

5:25

5:25Why You Should Invest in The S&P; 500 vs Individual Stocks

Why You Should Invest in The S&P; 500 vs Individual StocksWhy You Should Invest in The S&P; 500 vs Individual Stocks

So you want to manage your own money, but don't know a thing about stocks? Learn about the S&p; 500 and low cost mutual funds, and you could be on your way to a lucrative investing career. In this video I take you inside my actual portfolio using a site called Sigfig (http://www.sigfig.com). It's free, and can track your progress in the stock market. It's showing me that I suck, and should have chosen the S&P; rather than think I could choose some good individual stocks! -

1:28

1:28Dow Jones vs. S&P; 500: What’s the difference?

Dow Jones vs. S&P; 500: What’s the difference?Dow Jones vs. S&P; 500: What’s the difference?

What sets the Dow Jones industrial average and the S&P; 500 apart? CBS MoneyWatch contributor Ray Martin breaks it down as the two stock market indexes continue to reach new highs. -

4:54

4:54Watch Professional Trader Analyse Price Action On S&P; 500 Index (Live Trading)

Watch Professional Trader Analyse Price Action On S&P; 500 Index (Live Trading)Watch Professional Trader Analyse Price Action On S&P; 500 Index (Live Trading)

Watch More Of Nial Fuller's Price Action Trading Videos at http://www.LearnToTradeTheMarket.com -

10:34

10:34S&P; 500 (ISP) - Índice Contrato Futuro - Estratégias para investidores

S&P; 500 (ISP) - Índice Contrato Futuro - Estratégias para investidoresS&P; 500 (ISP) - Índice Contrato Futuro - Estratégias para investidores

S&P; 500 (ISP) Índice Contrato Futuro - Estratégias para investidores: http://www.tororadar.com.br Aprenda como investir na BMF Bovespa ↓ _(MOSTRAR MAIS)_ ↓ Clique e veja o material completo… DESCRIÇÃO: O S&P; 500 é considerado o Índice mais importante do Mundo. Isso porque ele representa a oscilação das 500 empresas mais importantes da maior economia do planeta: Os Estados Unidos da América. Isso quer dizer que quando você compra o contrato futuro de S&P; 500, estará negociando um índice atrelado a empresas como Coca Cola, Apple, Disney, Google, Mc Donalds, Microsoft, Nike, etc...O valor somado das empresas que fazem parte deste índice representa mais de 20 Trilhões de Dólares. Investir no S&P; 500 sem ter que enviar o dinheiro para o exterior é um grande privilégio para nós brasileiros. Além de ser excelente para operações especulativas de curto prazo e Day-Trade (já que é muito negociado e respeita muito bem os padrões técnicos), ele representa uma forma fácil, prática e inteligente de diversificar seus investimentos apostando nas empresas mais importantes do mundo e na economia Norte Americana. O funcionamento do contrato de S&P; 500 é muito simples: cada ponto vale U$ 50,00. Antes que você se assuste ao comparar o preço do ponto do S&P; 500 ao do Índice Bovespa, é importante saber que ele tem uma pontuação muito menor, por volta de 2.000 pontos. Além disso, ele apresenta uma volatilidade muito menor do que a do Índice Bovespa. Então se o contrato de S&P; 500 está em 2.000 pontos, isso quer dizer que cada contrato valeria U$ 100.000,00. Se ele subir 100 pontos e chegar a 2.100 pontos, ele passará a valer U$ 105.000. Assim como qualquer contrato futuro, para operar o S&P; 500 você não precisa do dinheiro todo, mas apenas uma pequena fração disso, que normalmente gira em torno de 10% do valor do contrato para operações que duram mais de um dia e de 3% para Day-Trade. Ou seja, se o contrato está valendo U$ 100.000, considerando uma cotação de R$ 2,50 para o Dólar, você precisaria de algo em torno de R$ 25.000 na conta por contrato que fosse operar para mais de um dia e de R$ 7.500 para Day-Trade. S&P; 500 Código: ISP Cotação: Cada ponto vale U$ 50,00 Tamanho do Contrato: U$ 50,00 X Pontos do S&P; 500 Meses de Vencimento: Março (H), Junho (M), Setembro (U) e Dezembro (Z) Data de Vencimento: 3a sexta-feira do mês de vencimento Horário de Negociação: 9h às 17h45min Margem de garantia para Day-Trade: 3% do valor do contrato Margem de garantia normal: 10% do valor do contrato CONTEÚDO COMPLETO SOBRE: Como investir em ações - http://www.tororadar.com.br/como-investir-na-bolsa-de-valores Aprenda tudo sobre Day-Trade - http://www.tororadar.com.br/day-trade-acoes Curso completo sobre investimentos - http://www.tororadar.com.br/cursos/lp E-BOOK PARA DOWNLOAD - Baixar em PDF: [E-book] Como investir na Bolsa de Valores - http://www.tororadar.com.br/ebook/como-investir-na-bolsa-de-valores [E-book] Guia de Sucesso no mercado de ações - http://www.tororadar.com.br/ebook/guia-de-sucesso-na-bolsa-de-valores [E-book] Como Investir no Mercado Futuro - http://www.tororadar.com.br/ebook/como-investir-no-mercado-futuro [E-book] Introdução à Análise Técnica de Ações - http://www.tororadar.com.br/ebook/introducao-a-analise-tecnica-de-acoes Acompanhe tudo sobre o Mercado Financeiro! -

4:09

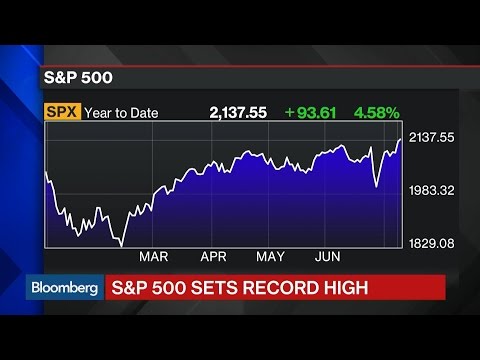

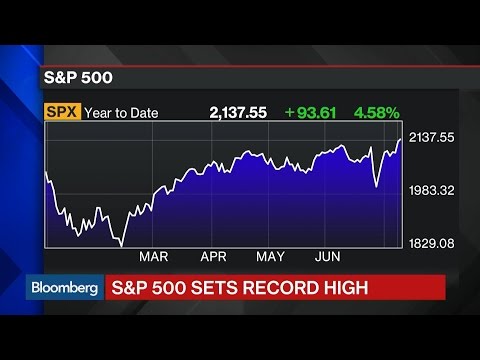

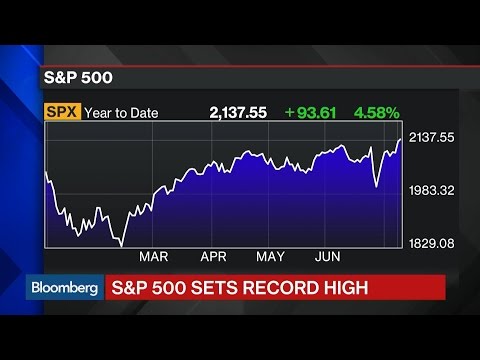

4:09S&P; 500 Hits Record High

S&P; 500 Hits Record HighS&P; 500 Hits Record High

July 11 -- Encima Global President David Malpass weighs in on the highs and lows in the markets. He speaks on "Bloomberg ‹GO›." -

3:47

3:47¿Qué es el SP500 (S&P500;, Mini S&P500; o Standard & Poors 500)? por @fca_serrano

¿Qué es el SP500 (S&P500;, Mini S&P500; o Standard & Poors 500)? por @fca_serrano¿Qué es el SP500 (S&P500;, Mini S&P500; o Standard & Poors 500)? por @fca_serrano

SP500 ¿por qué muchos consideran que es el más representativo de la situación real del mercado? Es el acrónimo de Standard and Poors 500, que incluye a las 500 empresas más representativas de la Bolsa neoyorkina. Tanto este como el Dow Jones, juegan en la plaza financiera más importante del planeta: Wall Street. Standard and Poors presentó su primer índice de la bolsa en 1923, antes de 1957 su principal índice bursátil diario era el SP90, que tenía 90 empresas. Un índice ponderado basado en 90 compañías. Además tenía un índice semanal de 423 empresas. La novedad es que el SP500 en su forma actual se inició el 4 de marzo de 1957. La tecnología ha permtido que el índice se calcule y se difunde en tiempo real. Es uno de los índices de renta variable más seguidos del mundo y muchos lo consideran un referente para conocer cómo está la salud de la economía de Estados Unidos. Esas 500 acciones están formadas por 400 compañías industriales, 20 de transportes, 40 de servicios públicos y 40 compañías financieras. Es uno de los más utilizados por inversores institucionales, porque incorpora una de las carteras más grandes de empresas, este es el motivo por el que es un reflejo real de lo que sucede en el mercado. Extraído de la bolsapedia de @ondainversion donde Francisca Serrano colabora. blog: http://www.escueladetradingybolsa.com web: http://www.tradingybolsaparatorpes.com Twitter: @fca_serrano Twitter: @tradingybolsa_ Facebook: /TradingyBolsa -

12:44

12:44S&P; 500 Elliott Wave Technical Analysis - 7th September, 2016

S&P; 500 Elliott Wave Technical Analysis - 7th September, 2016S&P; 500 Elliott Wave Technical Analysis - 7th September, 2016

www.elliottwavestockmarket.com Technical analysis of the S&P; 500 cash index with a focus on an Elliott wave perspective after market close of 7th September, 2016 -

22:43

22:43S&P; 500 Elliott Wave Technical Analysis - 17th May, 2016

S&P; 500 Elliott Wave Technical Analysis - 17th May, 2016S&P; 500 Elliott Wave Technical Analysis - 17th May, 2016

http://elliottwavestockmarket.com/?p=57157 Technical analysis of the S&P; 500 cash index with a focus on an Elliott wave perspective after market close of 17th May, 2016 -

9:35

9:35Why Negative Rates could send the S&P; 500 to 925

Why Negative Rates could send the S&P; 500 to 925Why Negative Rates could send the S&P; 500 to 925

For more information please visit Dynastywealth.com -

6:33

6:33How to profit from the Dow (DJIA) and S&P; 500 Indexes w/ Doug Flynn, CFP

How to profit from the Dow (DJIA) and S&P; 500 Indexes w/ Doug Flynn, CFPHow to profit from the Dow (DJIA) and S&P; 500 Indexes w/ Doug Flynn, CFP

It's important for you to understand market index differences when you are looking to make investment decisions that affect your long-term prosperity. Buying, selling, rebalancing... Billions of dollars of retirement money are tied to market indexes and there are differences in how each index is calculated. Doug Flynn, CFP of Flynn Zito Capital Management explains how it all works and, more importantly, how to profit from this information. On Real Money with Ali Velshi.

-

Why You Should Invest in The S&P; 500 vs Individual Stocks

So you want to manage your own money, but don't know a thing about stocks? Learn about the S&p; 500 and low cost mutual funds, and you could be on your way to a lucrative investing career. In this video I take you inside my actual portfolio using a site called Sigfig (http://www.sigfig.com). It's free, and can track your progress in the stock market. It's showing me that I suck, and should have chosen the S&P; rather than think I could choose some good individual stocks!

published: 14 Apr 2013 -

Dow Jones vs. S&P; 500: What’s the difference?

What sets the Dow Jones industrial average and the S&P; 500 apart? CBS MoneyWatch contributor Ray Martin breaks it down as the two stock market indexes continue to reach new highs.

published: 31 Jul 2014 -

Watch Professional Trader Analyse Price Action On S&P; 500 Index (Live Trading)

Watch More Of Nial Fuller's Price Action Trading Videos at http://www.LearnToTradeTheMarket.com

published: 28 Oct 2015 -

S&P; 500 (ISP) - Índice Contrato Futuro - Estratégias para investidores

S&P; 500 (ISP) Índice Contrato Futuro - Estratégias para investidores: http://www.tororadar.com.br Aprenda como investir na BMF Bovespa ↓ _(MOSTRAR MAIS)_ ↓ Clique e veja o material completo… DESCRIÇÃO: O S&P; 500 é considerado o Índice mais importante do Mundo. Isso porque ele representa a oscilação das 500 empresas mais importantes da maior economia do planeta: Os Estados Unidos da América. Isso quer dizer que quando você compra o contrato futuro de S&P; 500, estará negociando um índice atrelado a empresas como Coca Cola, Apple, Disney, Google, Mc Donalds, Microsoft, Nike, etc...O valor somado das empresas que fazem parte deste índice representa mais de 20 Trilhões de Dólares. Investir no S&P; 500 sem ter que enviar o dinheiro para o exterior é um grande privilégio para nós brasileiros....

published: 14 Sep 2015 -

S&P; 500 Hits Record High

July 11 -- Encima Global President David Malpass weighs in on the highs and lows in the markets. He speaks on "Bloomberg ‹GO›."

published: 11 Jul 2016 -

¿Qué es el SP500 (S&P500;, Mini S&P500; o Standard & Poors 500)? por @fca_serrano

SP500 ¿por qué muchos consideran que es el más representativo de la situación real del mercado? Es el acrónimo de Standard and Poors 500, que incluye a las 500 empresas más representativas de la Bolsa neoyorkina. Tanto este como el Dow Jones, juegan en la plaza financiera más importante del planeta: Wall Street. Standard and Poors presentó su primer índice de la bolsa en 1923, antes de 1957 su principal índice bursátil diario era el SP90, que tenía 90 empresas. Un índice ponderado basado en 90 compañías. Además tenía un índice semanal de 423 empresas. La novedad es que el SP500 en su forma actual se inició el 4 de marzo de 1957. La tecnología ha permtido que el índice se calcule y se difunde en tiempo real. Es uno de los índices de renta variable más seguidos del mundo y muchos lo consi...

published: 03 Feb 2015 -

S&P; 500 Elliott Wave Technical Analysis - 7th September, 2016

www.elliottwavestockmarket.com Technical analysis of the S&P; 500 cash index with a focus on an Elliott wave perspective after market close of 7th September, 2016

published: 08 Sep 2016 -

S&P; 500 Elliott Wave Technical Analysis - 17th May, 2016

http://elliottwavestockmarket.com/?p=57157 Technical analysis of the S&P; 500 cash index with a focus on an Elliott wave perspective after market close of 17th May, 2016

published: 18 May 2016 -

Why Negative Rates could send the S&P; 500 to 925

For more information please visit Dynastywealth.com

published: 05 Apr 2016 -

How to profit from the Dow (DJIA) and S&P; 500 Indexes w/ Doug Flynn, CFP

It's important for you to understand market index differences when you are looking to make investment decisions that affect your long-term prosperity. Buying, selling, rebalancing... Billions of dollars of retirement money are tied to market indexes and there are differences in how each index is calculated. Doug Flynn, CFP of Flynn Zito Capital Management explains how it all works and, more importantly, how to profit from this information. On Real Money with Ali Velshi.

published: 03 Sep 2014

Why You Should Invest in The S&P; 500 vs Individual Stocks

- Order: Reorder

- Duration: 5:25

- Updated: 14 Apr 2013

- views: 8140

- published: 14 Apr 2013

- views: 8140

Dow Jones vs. S&P; 500: What’s the difference?

- Order: Reorder

- Duration: 1:28

- Updated: 31 Jul 2014

- views: 2812

- published: 31 Jul 2014

- views: 2812

Watch Professional Trader Analyse Price Action On S&P; 500 Index (Live Trading)

- Order: Reorder

- Duration: 4:54

- Updated: 28 Oct 2015

- views: 23899

- published: 28 Oct 2015

- views: 23899

S&P; 500 (ISP) - Índice Contrato Futuro - Estratégias para investidores

- Order: Reorder

- Duration: 10:34

- Updated: 14 Sep 2015

- views: 3763

- published: 14 Sep 2015

- views: 3763

S&P; 500 Hits Record High

- Order: Reorder

- Duration: 4:09

- Updated: 11 Jul 2016

- views: 1974

- published: 11 Jul 2016

- views: 1974

¿Qué es el SP500 (S&P500;, Mini S&P500; o Standard & Poors 500)? por @fca_serrano

- Order: Reorder

- Duration: 3:47

- Updated: 03 Feb 2015

- views: 2465

- published: 03 Feb 2015

- views: 2465

S&P; 500 Elliott Wave Technical Analysis - 7th September, 2016

- Order: Reorder

- Duration: 12:44

- Updated: 08 Sep 2016

- views: 1779

- published: 08 Sep 2016

- views: 1779

S&P; 500 Elliott Wave Technical Analysis - 17th May, 2016

- Order: Reorder

- Duration: 22:43

- Updated: 18 May 2016

- views: 2252

- published: 18 May 2016

- views: 2252

Why Negative Rates could send the S&P; 500 to 925

- Order: Reorder

- Duration: 9:35

- Updated: 05 Apr 2016

- views: 9206

- published: 05 Apr 2016

- views: 9206

How to profit from the Dow (DJIA) and S&P; 500 Indexes w/ Doug Flynn, CFP

- Order: Reorder

- Duration: 6:33

- Updated: 03 Sep 2014

- views: 3916

- published: 03 Sep 2014

- views: 3916

- Playlist

- Chat

- Playlist

- Chat

Why You Should Invest in The S&P; 500 vs Individual Stocks

- Report rights infringement

- published: 14 Apr 2013

- views: 8140

Dow Jones vs. S&P; 500: What’s the difference?

- Report rights infringement

- published: 31 Jul 2014

- views: 2812

Watch Professional Trader Analyse Price Action On S&P; 500 Index (Live Trading)

- Report rights infringement

- published: 28 Oct 2015

- views: 23899

S&P; 500 (ISP) - Índice Contrato Futuro - Estratégias para investidores

- Report rights infringement

- published: 14 Sep 2015

- views: 3763

S&P; 500 Hits Record High

- Report rights infringement

- published: 11 Jul 2016

- views: 1974

¿Qué es el SP500 (S&P500;, Mini S&P500; o Standard & Poors 500)? por @fca_serrano

- Report rights infringement

- published: 03 Feb 2015

- views: 2465

S&P; 500 Elliott Wave Technical Analysis - 7th September, 2016

- Report rights infringement

- published: 08 Sep 2016

- views: 1779

S&P; 500 Elliott Wave Technical Analysis - 17th May, 2016

- Report rights infringement

- published: 18 May 2016

- views: 2252

Why Negative Rates could send the S&P; 500 to 925

- Report rights infringement

- published: 05 Apr 2016

- views: 9206

How to profit from the Dow (DJIA) and S&P; 500 Indexes w/ Doug Flynn, CFP

- Report rights infringement

- published: 03 Sep 2014

- views: 3916

Austrian government to demolish house of Hitler’s birth

Edit Japan Times 18 Oct 2016Iraqis push toward IS-held Mosul in long-awaited offensive

Edit Deccan Herald 18 Oct 2016Melania Trump dismisses Donald Trump's 'grab them by the p****' remarks as 'boy talk'

Edit Mail Guardian South Africa 18 Oct 2016Don’t Drink the Kool-Aid, Clinton Is The Real Spoiler Warns Jill Stein

Edit WorldNews.com 17 Oct 2016[VIDEO]: Great Pyramid Scans Reveal Two Possible New Rooms – Or Do They?

Edit WorldNews.com 17 Oct 2016Market cues buzzing at breakfast tables this morning

Edit The Times of India 17 Oct 2016Six important triggers that changed your market while you were sleeping

Edit The Times of India 18 Oct 2016What's D-Street talking about before Opening Bell

Edit The Times of India 18 Oct 2016Seven important factors that changed your market while you were sleeping

Edit The Times of India 13 Oct 2016Short-listed Candidates for JACT Examination :- Department of African Studies (University of Delhi)

Edit Public Technologies 13 Oct 2016Microsoft Corp: This Is a Big Threat to MSFT Stock

Edit Profit Confidential 12 Oct 2016Morning Brief – 10/12/16 (CAPIS - Capital Institutional Services Inc)

Edit Public Technologies 12 Oct 2016Seven important triggers that changed your market while you were sleeping

Edit The Times of India 10 Oct 2016Walk-in-interview for the post of Tabla Player in Music Department :- Mata Sundri College for Women (University of Delhi)

Edit Public Technologies 09 Oct 2016What's buzzing on breakfast tables before Opening Bell

Edit The Times of India 07 Oct 2016Eight important factors that changed your market while you were sleeping

Edit The Times of India 07 Oct 2016Eight important triggers that changed your market while you were sleeping

Edit The Times of India 06 Oct 2016- 1

- 2

- 3

- 4

- 5

- Next page »