The issue of tax has become a clear line of debate for mainstream politics in Australia. The general malaise of global capitalism expresses itself in Australia in slowing growth and rising state debt. As 2016 came to an end, we have saw the first negative quarter of GDP growth in years, stagnating wage and profit growth and rising state debt and deficits (and Australia’s AAA rating is still vulnerable)(AAP 2016) . The decline in mining construction investment has not been effectively offset by resource exports, services exports or the inner-city off-the-plan unit investment boom. Apart from the drop in investment we saw during the early 1990s recession, investment as a percentage of GDP is currently at its lowest point in 50 years

Category: Crisis

On Budget Eve: Deflation & The Limits to Privatised Keynesianism

Tuesday 3rd May will see the first budget of the Turnbull-Morrison Coalition government. It is also the date of the Reserve Bank’s next monetary policy decision. So it is an important day for fiscal and monetary policy. Like most people (including the well paid opinion-makers of the commentariat) I have no idea what the budget will contain. It is unlikely that the government will be able to break the impasse facing the state: a general tendency of slowing growth , rising state debt and a pool of sullen and largely inchoate opposition amongst the population to various attempts by the state to address both. The picture is complex. On this blog I have written a lot about ‘Capital’s Plan A’– the stimulation of the economy via infrastructure spending to be financed in part by cuts to social reproduction and through the ‘recycling’ (read privatisation or leasing) of state owned assets. This plan, at a Federal level is stalled, due in part to the 2015 defeat of the Qld LNP government on the question of leasing power assets. However the recent Victorian state budget is built around increased infrastructure spending financed by the leasing of a port and a higher level of debt[i]. Preceding the Federal budget there has been a warning from JPMorgan and from Moody’s about the potential for Australia to lose its AAA rating, projections from Deloitte about the size of the increase in both debt and deficit and,what surprised everyone, the release by the Australian Bureau of Statistics of the latest CPI figures showing .2% deflation in the last quarter (Australian Bureau of Statistics 2016d, Greber 2016, Janda 2016, Martin 2016). It is this last point I want to look at. What does this latest news tell us about the both the direction of capital accumulation and the tensions and fault-lines of antagonism that constitute capitalist society in Australia?

Continue reading “On Budget Eve: Deflation & The Limits to Privatised Keynesianism”

Another Day in The Sun: The National Accounts, Growth and Malfunction

The work of the critique of political economy is a thankless task: especially when reality comes and fucks up your theorising. Over the last year on this blog I have been trying to address a number of interrelated phenomena: the end of the mining boom as a symptom of the global recession, rising state debt and the difficulties this presents to facilitating social reproduction and the failure of the Government to implement ‘Plan A’ – the stimulation of the economy via infrastructure spending financed by asset sales and cuts to services. Then the Australian Bureau of Statistics comes along and publishes the National Accounts which detail higher than predicted growth rates for the last quarter: 0.7% trend and 0.6% seasonally adjusted. Calendar year growth is then up to 3.0% rather than the forecasted 2.5% (Scutt 2016).

This would indicated healthy growth rather than malfunctioning – and this is despite the continual end of the mining boom which was the engine that drove capital accumulation in Australia for the last two decades. And GDP growth is, I would attest, a mystified indicator of profitability. If the economy is growing it is because firms are investing; and they are investing because of a sufficient level of profit today and expectations of them tomorrow. So much for declining profitability then, so much for over-accumulation too, so much for looming crisis…

Continue reading “Another Day in The Sun: The National Accounts, Growth and Malfunction”

Australia you’re standing in it part 2: Debt & Social Reproduction

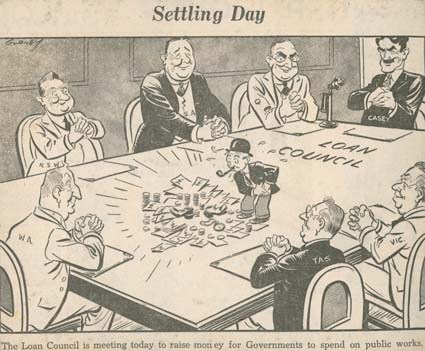

In part two of Australia You’re Standing In It I’m going to attempt analyse the relationships between state debt and social reproduction. In particular I want to argue that rising debts and continuing deficits provide a challenge to how social reproduction is carried out by the state. This directly flows on from the previous chapter as the core of my argument is that the rising debt and deficit of the Australian state are at least in part a product of the global stagnation of capital accumulation. This manifests in the drop in revenue caused by the winding down of the mining boom.

I want to emphasise the stakes of my argument. In mainstream debates in Australia debt is most often framed in one of the following two ways. For the Right debt is a cause, if not the cause, of economic stagnation and crisis. For the Left Australia’s debt levels are unproblematic and the panic over debt is a production of the fetid imagination of the neoliberals and/or a cynical manoeuvre to justify the sort of policies the Right always carry in their back pockets. Here I wish to reject both these arguments. Debt is not the cause of crisis but a particular manifestation or expression of it; but it is a manifestation that has its own contradictions. And debt levels whilst overblown by the Right do present a serious challenge to the state’s abilities to finance and carry out social reproduction. Also a new revelation for me, one often ignored in the debates about debt, but one that is obvious when you think about it, is the role that sovereign debt in the form of state bonds plays in the financial markets. The debate over state debt is also always a debate about securing the value and the profits generated by financial assets.

A limitation of my investigation so far is that since my methodology looks at the movements of capital from ‘above’ there is the risk that I can slip into a form of presentation that ignores the class struggle that goes on ‘below’ and throughout capitalism. There is a danger, from Marx on, that our analysis can be too ‘objective’ and not grasp the subjective role struggle plays in the corresponding unfolding of the dynamics of capitalism(Shortall 1994). (Perhaps it is possible to see class struggle as the struggle of humanity against its entrapment in the objective categories of capitalism). My challenge is to express how the ways the state funds social reproduction and the shapes social reproduction take are products and sites of class struggle. Spiralling state debt is an expression of our power – even if it is latent. We need to enlarge our understanding of class struggle beyond a model that sees it primarily happening within the confrontation between labour and capital in the work-place proper, that is move beyond a ‘factory-office-farm’ model (Caffentzis 2013, 242). We need to understand the complex and multifaceted struggles that happen across all of society.

Continue reading “Australia you’re standing in it part 2: Debt & Social Reproduction”

Australia you’re standing in it part 1: the pulse rate of accumulation

Something is going on. Something is changing. There is a shift in the trajectory that capitalism in Australia is taking. At the recent National Reform Summit Martin Parkinson, a former head of Treasury remarked that ‘Unless we actually grab this challenge by the horns and really get concrete about what are the priority issues, we are actually going to find ourselves sleepwalking into a real mess’(Martin 2015). The metaphor of Australia sleepwalking towards recession is now resonating in the echo chamber of the political class and sums up their dual concerns: on the one hand a decline in the accumulation of capital; and on the other that the political apparatus and the broader society seems unable to do anything to change course, perhaps is even aware, and is moving without, or despite of, conscious control. Australia is slouching towards, or is already sunk in, political and economic malfunction.

Whilst the political class wants to address these dilemmas and act to save capitalism from itself we want to understand what is going on so we can overcome it all. Here I want to grasp the current conjuncture of capitalist society in Australia: in particular the current malaise of capital accumulation and the malfunctioning of official politics. What do these phenomena tell us about the current moment in Australian capitalism and the possibilities, overt or covert, for a radically different kind of society?

This is part one of a six party study to try to sketch an outline of the current conjuncture of capitalism in Australia. Part two will focus on debt, part three the crisis of mainstream politics, part four on the end of the ‘high credit, high work, high consumption deal’, part five on gender and social reproduction and part six on the most prominent fault lines of struggle. But here we will start by posing a hypothesis about capital accumulation in Australia and also try to take its pulse-rate.

Continue reading “Australia you’re standing in it part 1: the pulse rate of accumulation”

Roads to Nowhere – Capital’s Plan A

Australia will be quite different in a few years’ time…

-Tony Abbott(2013)The tendency is a general schema that takes as its starting point an analysis of the elements that make up a given historical situations. On the basis of that analysis, it defines a method, an orientation, a direction for mass political action (Negri, 2005, p. 27)

What does it mean to think in the conjuncture?(Althusser, 2000, p. 18)

(I have been working on this post for many months now. It has been slow going as I have only been able to commit small amounts of time to research and writing as some pretty major – and excellent – developments in my life have distracted me from my computer: namely the birth of my son who is without a doubt the major focus of my time and energy. I have been eking this piece out in half-an-hour lunch breaks at work and this I think has added to its troubled narrative. Also since becoming a father my ability to successfully construct long sentences has diminished. Perhaps this change will be seen as ‘punchy’ rather than moronic…. I also think since so much of the research of this piece has involved stepping on the terrain of dominant mainstream thought and summarising it that some of the radical elements of the critique of political economy have become muted.

Readers will probably find this piece fairly dry, structurally incoherent, and laborious but I hope useful and I intend to use it as background for more work here and political interventions published at The Word From Struggle Street.

As usual there remain far too many typos for me to be happy about but I wish to get this out in a timely matter.)

Incomes, Inequality and Class Composition – ( still a bit drafty)

Firstly I would like to apologise to those of you who read my blog for the long time it has been since my last post. It is a difficulty finding time to even read systematically at the moment let alone write. I don’t mean this as just a simple whinge –because I think that it is symptomatic of one of the problems afflicting the possibility of class organising right now – we need the time in our lives to think about what is happening to time in our lives. More broadly, unlike perhaps workers in much of Europe who face the impact of rising unemployment, workers in Australia labour under a condition of too much labour – at least at the moment (though of course any amount of wage-labour is really too much wage-labour). It is too early to tell if the proposed closure of the Ford plant and the entry into voluntary administration of Swann Services are anomalies and growth will continue or signs that winter is coming (since I have written this lines the first time it was become far more clear that with the decline of the rate of growth of industrial production in China that the mining boom, which has underscored growth in Australia for 20 years, is ending). Marx quotes the Congress of the International Working Men’s Association ‘ We declare that the limitation of the working day is a preliminary condition without which all further attempts at improvement and emancipation must prove abortive…’(Marx 1990, 415). Now I don’t know if the IWMA was thinking about having the time to write and discuss but perhaps they were. I must admit that I am not sure how an effort like this blog actually fits into the process of class recomposition because I am not sure what the role of ‘ideas’ really has in the messy processes of struggle. I am sure that it has some role but what that is I am confused about (and welcome comments and debate.) But if the attempts to theorise the world we live do play some part in the self-emancipation of the class then it is clear that the lack of time we have to engage in this activity (snatched between moments of work, time with those we love, socialising and resting, acts of political militancy) is contributing to just how outgunned we are in relation to capital. Reading The Poorer Nations (Prashad 2012) I am struck by the huge size and financial capacity of the intellectual apparatus capital has to think, theorise and popularise its understand of the world. Even in Australia it is a struggle to find the time to read the reports that come out of the Productivity Commission, the various business groups and economic think tanks let along attempt to think them through and write about them. (Thus my outrage that the Qld government wasn’t going to release the 1000 page Queensland Commission of Audit quickly turns to dread when they decide to – ‘oh my god I have to read a 1000 page report!’)

Continue reading “Incomes, Inequality and Class Composition – ( still a bit drafty)”