- published: 14 Sep 2011

- views: 2563

-

remove the playlistBond (finance)

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistBond (finance)

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 19 Aug 2013

- views: 29336

- published: 12 Nov 2010

- views: 134480

- published: 25 Jun 2012

- views: 19584

- published: 24 Jun 2012

- views: 4399

- published: 10 Jul 2014

- views: 56870

- published: 19 Sep 2011

- views: 4553

- published: 07 Feb 2010

- views: 85983

- published: 24 Jun 2012

- views: 103054

- published: 03 Feb 2009

- views: 494373

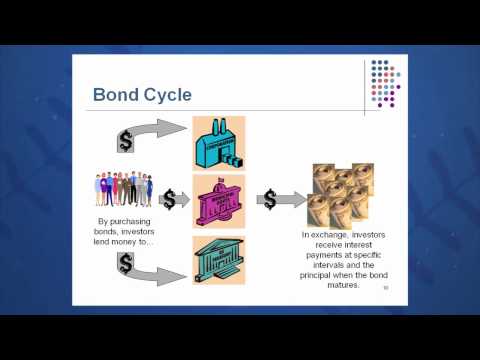

In finance, a bond is a debt security, in which the authorized issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay interest (the coupon) to use and/or to repay the principal at a later date, termed maturity. A bond is a formal contract to repay borrowed money with interest at fixed intervals (semi annual, annual, sometimes monthly).

Thus a bond is like a loan: the holder of the bond is the lender (creditor), the issuer of the bond is the borrower (debtor), and the coupon is the interest. Bonds provide the borrower with external funds to finance long-term investments, or, in the case of government bonds, to finance current expenditure. Certificates of deposit (CDs) or commercial paper are considered to be money market instruments and not bonds.

Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in the company (i.e., they are owners), whereas bondholders have a creditor stake in the company (i.e., they are lenders). Another difference is that bonds usually have a defined term, or maturity, after which the bond is redeemed, whereas stocks may be outstanding indefinitely. An exception is a consol bond, which is a perpetuity (i.e., bond with no maturity).

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Bond, bonds, bonded, and bonding may refer to:

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

1:50

1:50What is a Bond? - 2 Minute Finance

What is a Bond? - 2 Minute FinanceWhat is a Bond? - 2 Minute Finance

Bonds and stocks are talked about together like they're long-lost brothers. But their relationship is more like distant second cousins. 2MF's Hunter Patterson will show you what a bond is and how it works in less than 2 minutes. For more information and resources, visit our website at 2MinuteFinance.com. Also, find us on Facebook (Facebook.com/2MinuteFInance) or Twitter (@2MinuteFInance). -

2:05

2:05Not Your Mama's Finance Lesson: "What the Heck is a Bond?"

Not Your Mama's Finance Lesson: "What the Heck is a Bond?"Not Your Mama's Finance Lesson: "What the Heck is a Bond?"

Nicole Lapin—financial expert, CNN, CNBC, and Bloomberg anchor, and founder of Recessionista.com—explains what a bond is...in plain English. © 2013 Nothing But Gold Productions -

11:21

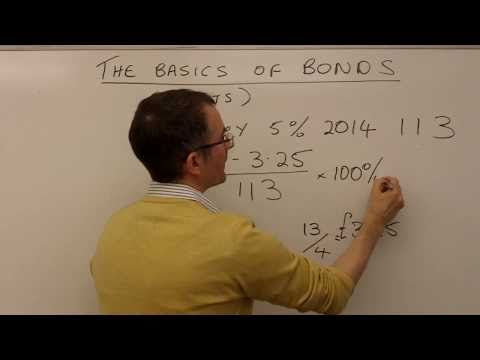

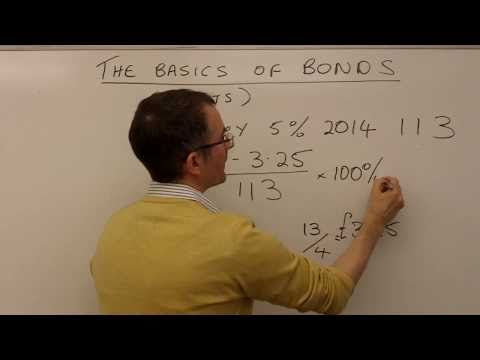

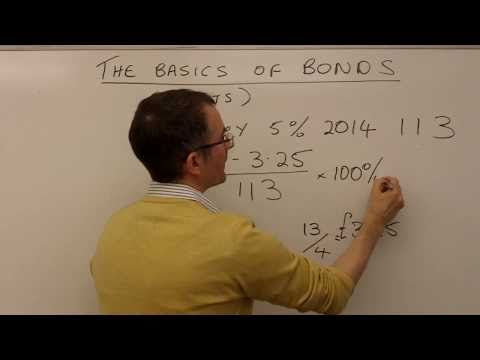

11:21The basics of bonds - MoneyWeek Investment Tutorials

The basics of bonds - MoneyWeek Investment TutorialsThe basics of bonds - MoneyWeek Investment Tutorials

Tim Bennett explains the basics of bonds - what they are and how they work. Don't miss out on Tim Bennett's video tutorials -- get the latest video sent straight to your inbox each week, before it's released on YouTube: http://bit.ly/TimBSubscribe To receive Tim's 50 FREE MoneyWeek Basics emails: http://bit.ly/mwk-basics Watch over 100 of Tim's videos for free: http://MoneyWeek.com/tutorials Or download them to your mobile device: http://bit.ly/TimBpodcast For the most important financial stories and how to profit from them: http://MoneyWeek.com http://Facebook.com/pages/MoneyWeek/110326662354766 http://Twitter.com/moneyweek Video series by CFA UK Highly Commended journalist Tim Bennett. http://twitter.com/TimMoneyweek -

16:08

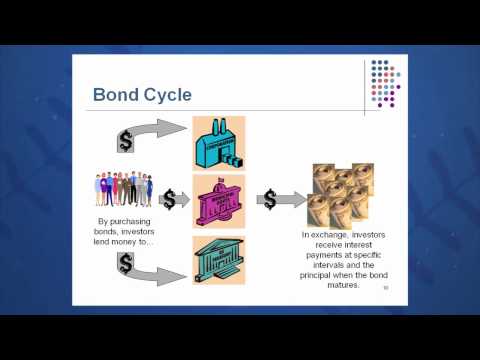

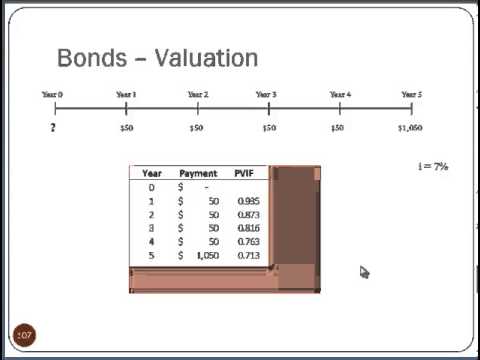

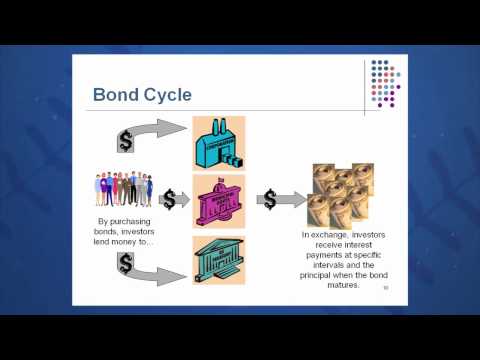

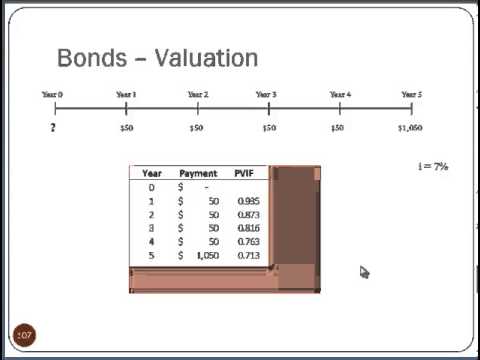

16:08Session 07: Objective 1 - Bonds and Bond Valuation

Session 07: Objective 1 - Bonds and Bond ValuationSession 07: Objective 1 - Bonds and Bond Valuation

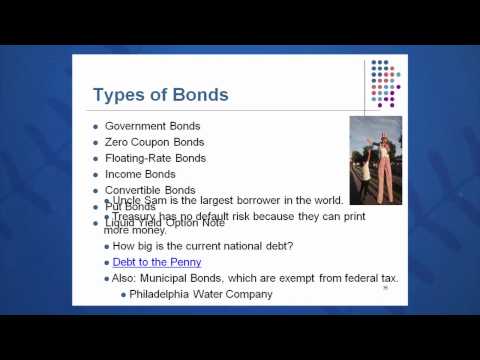

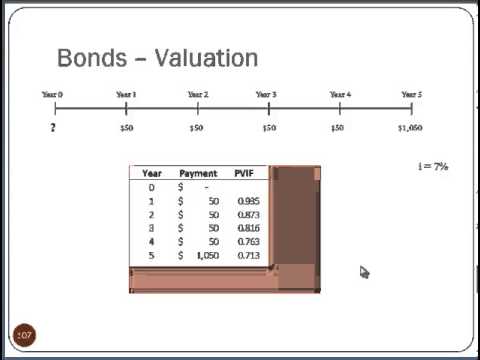

The Finance Coach: Introduction to Corporate Finance with Greg Pierce Textbook: Fundamentals of Corporate Finance Ross, Westerfield, Jordan Chapter 7: Interest Rates and Bond Valuation Objective 1 - Key Objective: Bonds Bond Cycle Inverse relationship between bond value and interest rate Face Value vs. Discount vs. Premium Bond To minimize interest rate risk purchase a bond with 1) shorter time to maturity 2) higher coupon rate Semiannual vs. Annual Coupons Bond Value Formula Coupon (C) Time to Maturity (t) Yield to Maturity (r) Face value paid at maturity (FV) Fisher Effect (Exact vs. Approximate) Nominal Rate (R) Real Rate (r) Inflation Rate (h) More Information at: http://thefincoach.com/ -

3:31

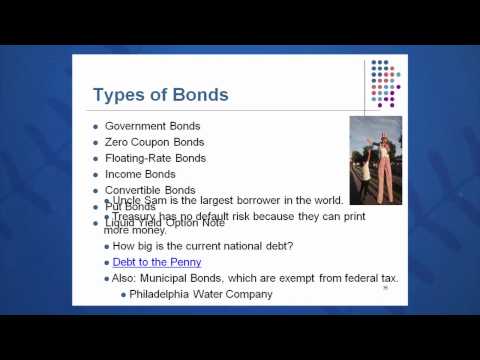

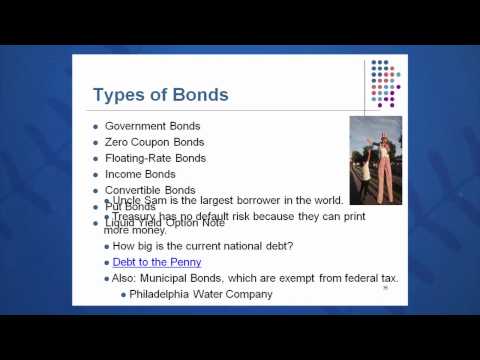

3:31Session 07: Objective 4 - Types of Bonds

Session 07: Objective 4 - Types of BondsSession 07: Objective 4 - Types of Bonds

The Finance Coach: Introduction to Corporate Finance with Greg Pierce Textbook: Fundamentals of Corporate Finance Ross, Westerfield, Jordan Chapter 7: Interest Rates and Bond Valuation Objective 4 - Key Concepts: National Debt Goverment Bonds Income Bonds Convertible Bonds Zero-Coupon Bonds Floating Rate Bonds More Information at: http://thefincoach.com/ -

3:57

3:57Investing Basics: Bonds

Investing Basics: BondsInvesting Basics: Bonds

Learn the basics of bonds, such as what they are, the three bond types, how you can invest in them, and how they might play a part in your portfolio. Experience Premier Investing Education: http://bit.ly/investools For the last 25 years, Investools from TD Ameritrade Holding Corp. has helped more than half a million students take control of their finances. With our step-by-step process, you can pursue a comprehensive investing education at your own pace -- and on your own terms. -

44:45

44:45Finance Lecture - Bonds and Stocks

Finance Lecture - Bonds and Stocks -

1:50

1:50What Is a Bond? | Financial Terms

What Is a Bond? | Financial TermsWhat Is a Bond? | Financial Terms

Will your kids just not sit still for photos? Check out this short video to learn to shoot them like a pro http://bit.ly/1PDkrcx Watch more How to Understand Personal Finance Terms videos: http://www.howcast.com/videos/491841-What-Is-a-Bond-Financial-Terms A bond is basically an I.O.U. I'm loaning you money, you are paying me interest, and at the end of the deal, I get my money back. That's what a bond really is. And you can get a bond from the federal government, like a savings bond or a treasury bond. You can get a bond from a big corporation, that's called a corporate bond. And you can even get a bond from a state like New York or a city like Los Angeles. Those are called municipal bonds. But the reason that someone invests in bonds is bonds tend to be more conservative than the stock market; they tend to be a little more predictable; and yet a bond is typically going to pay more money than a cash investment. So the reason to invest in bonds is to diversify your money. If I have all of my money in the stock market and the stock market goes down, then I'm in trouble. But by having some money in bonds, I can balance out my investment portfolio and make sure I'm not taking too much risk. A general rule-of-thumb for you watching out there is that when you are looking at your entire investment portfolio, take your age, and that's the percentage of money that should be invested in bonds. So for example, if I'm 40 years old, 40% of my account would be invested in bonds. I want you to take a look at your investment portfolio and ask yourself that question "How much of my portfolio is in bonds?" And particularly during turbulent times with a lot of volatility in the market, having some portion of your money invested conservatively in a way that is not impacted by the stock market can really make a lot of sense. -

3:59

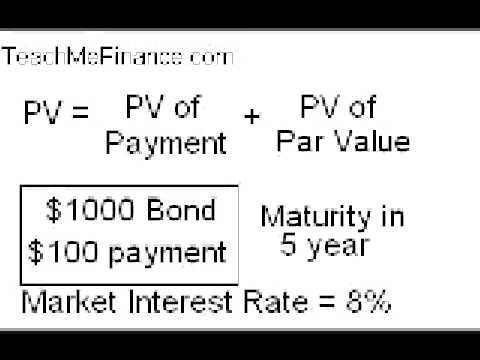

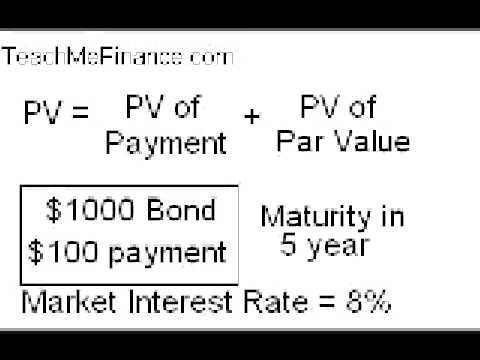

3:59Bond Valuation

Bond Valuation -

4:46

4:46Finding Bond Price and YTM on a Financial Calculator

Finding Bond Price and YTM on a Financial CalculatorFinding Bond Price and YTM on a Financial Calculator

A brief demonstration on calculating the price of a bond and its YTM on a financial calculator -

7:33

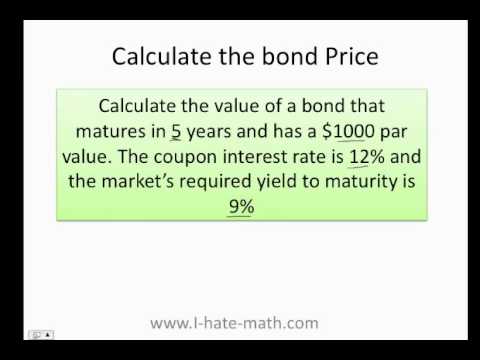

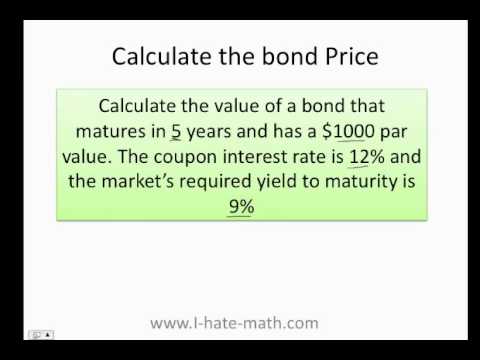

7:33How to calculate the bond price and yield to maturity

How to calculate the bond price and yield to maturityHow to calculate the bond price and yield to maturity

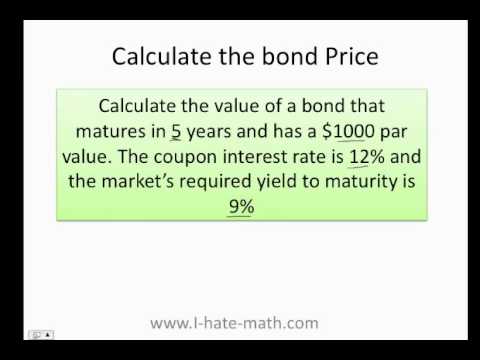

This video will show you how to calculate the bond price and yield to maturity in a financial calculator. If you need to find the Present value by hand please watch this video :) http://youtu.be/5uAICRPUzsM There are more videos for EXCEL as well Like and subscribe :) Please visit us at http://www.i-hate-math.com Thanks for learning -

9:21

9:21Bonds vs. Stocks

Bonds vs. StocksBonds vs. Stocks

The difference between a bond and a stock. More free lessons at: http://www.khanacademy.org/video?v=rs1md3e4aYU -

13:15

13:15Corporate Finance: Lecture - 003, Bond Valuation

Corporate Finance: Lecture - 003, Bond ValuationCorporate Finance: Lecture - 003, Bond Valuation

This lecture discusses about corporate and government bonds, valuation, and yield to maturity. If you need private lessons you may contact at: hr@Leprofesseur.org Do not forget to subscribe { Leprofesseur } YouTube Channel. Sincerely, H. -

7:00

7:00Paul Wilmott on Quantitative Finance, Chapter 13, Bond math

Paul Wilmott on Quantitative Finance, Chapter 13, Bond mathPaul Wilmott on Quantitative Finance, Chapter 13, Bond math

In chapter 13 I learned how to compare bonds using yield, yield to maturity, and Macaulay duration.

- Accrued interest

- Agency debt

- Agency security

- Arirang bond

- Associate company

- Bad debt

- Bank

- Bankrupt

- Bankruptcy

- Bearer bond

- Bid-ask spread

- Bond (finance)

- Bond convexity

- Bond credit rating

- Bond duration

- Bond fund

- Bond market

- Bond market index

- Bond option

- Bond valuation

- Book building

- Bookrunner

- Brady Bonds

- Build America Bonds

- Business valuation

- Buy side

- Call option

- Call premium

- Callable bond

- Callable bonds

- Capital gain

- Capital structure

- Central banks

- Chapter 11

- Charge-off

- Citigroup BIG

- Clean price

- Climate bond

- Closed-end fund

- Collection agency

- Commercial paper

- Commodity market

- Consols

- Consumer debt

- Consumer lending

- Contract

- Control premium

- Convertible bond

- Corporate bond

- Corporate debt

- Corporate finance

- Cost of capital

- Counterparty

- Coupon (bond)

- Credit derivative

- Credit rating agency

- Credit risk

- Credit spread (bond)

- Credit-linked note

- Criticism of debt

- Current yield

- Debenture

- Debt

- Debt bondage

- Debt buyer

- Debt collection

- Debt compliance

- Debt consolidation

- Debt evasion

- Debt management plan

- Debt relief

- Debt restructuring

- Debt-snowball method

- Debtors' prison

- Default (finance)

- Demerger

- Deposit account

- Derivative (finance)

- Dim sum bond

- DIP financing

- Dirty price

- Discounted cash flow

- Distressed debt

- Divestment

- Dividend

- Drag-along right

- Economic Value Added

- Embedded option

- Emerging market debt

- Enterprise value

- Equity (finance)

- Equity carve-out

- Equity-linked note

- Euribor

- Eurobond

- Eurodollar

- Event risk

- Exchange rate risk

- Exchange-traded fund

- Exchangeable bond

- Extendible bond

- External debt

- Fairness opinion

- Finance

- Financial market

- Financial modeling

- Financial sponsor

- Fixed income

- Fixed rate bond

- Floating rate note

- Follow-on offering

- Formosa bond

- Forward contract

- Free cash flow

- Future interest

- Futures contract

- Futures market

- Garnishment

- GDP

- GDP-linked bond

- Gilts

- Government bond

- Government debt

- Greenshoe

- Hedge (finance)

- Hedge fund

- High-yield bond

- High-yield debt

- Huaso bond

- Hybrid security

- I-spread

- ICMA

- Income tax

- Indenture

- Index fund

- Inflation risk

- Insolvency

- Insurance companies

- Interest

- Interest rate

- Interest rate risk

- Internal debt

- Investment

- Investment banking

- Investopedia

- Junk bonds

- Kansas

- Kauri bond

- Kimchi bond

- Leverage (finance)

- Leveraged buyout

- LIBOR

- Liquidation

- Liquidator (law)

- Liquidity risk

- Loan

- Loan shark

- Lottery Bond

- Macaulay Duration

- Majority

- Marked to market

- Market liquidity

- Market price

- Market value added

- Matrioshka

- Maturity (finance)

- MCI Inc.

- Mezzanine capital

- Minority interest

- Money market

- Moody's

- Mortgage yield

- Municipal bond

- Municipal debt

- Mutual fund

- Net present value

- Nominal yield

- Option (finance)

- Option style

- Panda bond

- Par value

- Pari passu

- Payday loan

- Pension funds

- Perpetual bond

- Perpetual bonds

- Perpetuities

- Perpetuity

- Pfandbrief

- Phantom debt

- Pitch book

- Poison pill

- Portfolio (finance)

- Pre-emption right

- Predatory lending

- Preferred stock

- Prepayment of loan

- Present value

- Primary market

- Private equity

- Private placement

- Project finance

- Promissory note

- Proxy fight

- Put option

- Putable bond

- Puttable bond

- Rate of return

- Recovery amount

- Reference rate

- Reinvestment risk

- Revenue bond

- Reverse convertible

- Reverse greenshoe

- Reverse takeover

- Rights issue

- Russell Indexes

- S&P; 500

- Samurai bond

- Second lien loan

- Secured loan

- Securitization

- Security (finance)

- Segregated fund

- Sell side

- Senior debt

- Serial bond

- Share (finance)

- Shareholder loan

- Short (finance)

- Short rate model

- SIFMA

- South Carolina

- Spin out

- Spot market

- Squeeze out

- Standard & Poor's

- Stock

- Stock market

- Stock valuation

- Stocks

- Strategic default

- Structured finance

- Subordinated bonds

- Subordinated debt

- Supermajority

- Supranational

- Swap (finance)

- Syndicate

- Tag-along right

- Takeover

- Tax advantage

- Tax shield

- Template Bond market

- Template Debt

- Template Securities

- Template talk Debt

- Tender offer

- Time deposit

- Tranche

- Tranches

- Treasury Bill

- Treasury bond

- Treasury security

- Underwriter

- Underwriting

- United Kingdom

- United States

- United States entity

- Unsecured debt

- Uridashi bonds

- Usury

- Valuation (finance)

- Venture debt

- Volatility risk

- War bond

- Warrant (finance)

- Yield (finance)

- Yield curve

- Yield to maturity

- Z-spread

- Zero-coupon bond

-

What is a Bond? - 2 Minute Finance

Bonds and stocks are talked about together like they're long-lost brothers. But their relationship is more like distant second cousins. 2MF's Hunter Patterson will show you what a bond is and how it works in less than 2 minutes. For more information and resources, visit our website at 2MinuteFinance.com. Also, find us on Facebook (Facebook.com/2MinuteFInance) or Twitter (@2MinuteFInance). -

Not Your Mama's Finance Lesson: "What the Heck is a Bond?"

Nicole Lapin—financial expert, CNN, CNBC, and Bloomberg anchor, and founder of Recessionista.com—explains what a bond is...in plain English. © 2013 Nothing But Gold Productions -

The basics of bonds - MoneyWeek Investment Tutorials

Tim Bennett explains the basics of bonds - what they are and how they work. Don't miss out on Tim Bennett's video tutorials -- get the latest video sent straight to your inbox each week, before it's released on YouTube: http://bit.ly/TimBSubscribe To receive Tim's 50 FREE MoneyWeek Basics emails: http://bit.ly/mwk-basics Watch over 100 of Tim's videos for free: http://MoneyWeek.com/tutorials Or download them to your mobile device: http://bit.ly/TimBpodcast For the most important financial stories and how to profit from them: http://MoneyWeek.com http://Facebook.com/pages/MoneyWeek/110326662354766 http://Twitter.com/moneyweek Video series by CFA UK Highly Commended journalist Tim Bennett. http://twitter.com/TimMoneyweek -

Session 07: Objective 1 - Bonds and Bond Valuation

The Finance Coach: Introduction to Corporate Finance with Greg Pierce Textbook: Fundamentals of Corporate Finance Ross, Westerfield, Jordan Chapter 7: Interest Rates and Bond Valuation Objective 1 - Key Objective: Bonds Bond Cycle Inverse relationship between bond value and interest rate Face Value vs. Discount vs. Premium Bond To minimize interest rate risk purchase a bond with 1) shorter time to maturity 2) higher coupon rate Semiannual vs. Annual Coupons Bond Value Formula Coupon (C) Time to Maturity (t) Yield to Maturity (r) Face value paid at maturity (FV) Fisher Effect (Exact vs. Approximate) Nominal Rate (R) Real Rate (r) Inflation Rate (h) More Information at: http://thefincoach.com/ -

Session 07: Objective 4 - Types of Bonds

The Finance Coach: Introduction to Corporate Finance with Greg Pierce Textbook: Fundamentals of Corporate Finance Ross, Westerfield, Jordan Chapter 7: Interest Rates and Bond Valuation Objective 4 - Key Concepts: National Debt Goverment Bonds Income Bonds Convertible Bonds Zero-Coupon Bonds Floating Rate Bonds More Information at: http://thefincoach.com/ -

Investing Basics: Bonds

Learn the basics of bonds, such as what they are, the three bond types, how you can invest in them, and how they might play a part in your portfolio. Experience Premier Investing Education: http://bit.ly/investools For the last 25 years, Investools from TD Ameritrade Holding Corp. has helped more than half a million students take control of their finances. With our step-by-step process, you can pursue a comprehensive investing education at your own pace -- and on your own terms. -

-

What Is a Bond? | Financial Terms

Will your kids just not sit still for photos? Check out this short video to learn to shoot them like a pro http://bit.ly/1PDkrcx Watch more How to Understand Personal Finance Terms videos: http://www.howcast.com/videos/491841-What-Is-a-Bond-Financial-Terms A bond is basically an I.O.U. I'm loaning you money, you are paying me interest, and at the end of the deal, I get my money back. That's what a bond really is. And you can get a bond from the federal government, like a savings bond or a treasury bond. You can get a bond from a big corporation, that's called a corporate bond. And you can even get a bond from a state like New York or a city like Los Angeles. Those are called municipal bonds. But the reason that someone invests in bonds is bonds tend to be more conservative than the st... -

-

Finding Bond Price and YTM on a Financial Calculator

A brief demonstration on calculating the price of a bond and its YTM on a financial calculator -

How to calculate the bond price and yield to maturity

This video will show you how to calculate the bond price and yield to maturity in a financial calculator. If you need to find the Present value by hand please watch this video :) http://youtu.be/5uAICRPUzsM There are more videos for EXCEL as well Like and subscribe :) Please visit us at http://www.i-hate-math.com Thanks for learning -

Bonds vs. Stocks

The difference between a bond and a stock. More free lessons at: http://www.khanacademy.org/video?v=rs1md3e4aYU -

Corporate Finance: Lecture - 003, Bond Valuation

This lecture discusses about corporate and government bonds, valuation, and yield to maturity. If you need private lessons you may contact at: hr@Leprofesseur.org Do not forget to subscribe { Leprofesseur } YouTube Channel. Sincerely, H. -

Paul Wilmott on Quantitative Finance, Chapter 13, Bond math

In chapter 13 I learned how to compare bonds using yield, yield to maturity, and Macaulay duration. -

Wu-Tang Financial - Chappelle's Show

Wu-Tang Financial | Chappelle's Show Chappelle's Show: Nat King Cole Christmas: http://bit.ly/NatKingColeXmas Subscribe to Comedy Central: http://bit.ly/SubscribeCC ---------------------- Chappelle's Show: Blackzilla: http://bit.ly/Black-zilla ---------------------- Check out the Comedy Central UK website: http://bit.ly/1iBXF6j ---------------------- -

Financial English Vocabulary VV 29 - Bonds (Lesson 2) | English Vocabulary for Finance & Economics

http://VideoVocab.TV In this lesson Business English vocabulary lesson, we'll look at financial English vocabulary related to different types of bonds. And we'll explain some of the key financial English vocabulary related to how bonds are priced and traded. -

Financial Accounting - Long-term Liabilities - Bonds

-

Calculating Duration on Financial Calculator

A demonstration on how to use the financial calculator to find a bond's duration -

ESD Bond Finance Committee 11/23/15 11:00 AM

11/23/20154: Meeting of the Bond Finance Committee of the Directors of the New York State Urban Development Corporation d/b/a Empire State Development. -

ESD Bond Finance Committee 11/14/2014 11:00 AM

11/17/2014: Meeting of the Bond Finance Committee of the New York State Urban Development Corporation d/b/a Empire State Development. -

-

-

What is a Bond? - 2 Minute Finance

- Order: Reorder

- Duration: 1:50

- Updated: 14 Sep 2011

- views: 2563

- published: 14 Sep 2011

- views: 2563

Not Your Mama's Finance Lesson: "What the Heck is a Bond?"

- Order: Reorder

- Duration: 2:05

- Updated: 19 Aug 2013

- views: 29336

- published: 19 Aug 2013

- views: 29336

The basics of bonds - MoneyWeek Investment Tutorials

- Order: Reorder

- Duration: 11:21

- Updated: 12 Nov 2010

- views: 134480

- published: 12 Nov 2010

- views: 134480

Session 07: Objective 1 - Bonds and Bond Valuation

- Order: Reorder

- Duration: 16:08

- Updated: 25 Jun 2012

- views: 19584

- published: 25 Jun 2012

- views: 19584

Session 07: Objective 4 - Types of Bonds

- Order: Reorder

- Duration: 3:31

- Updated: 24 Jun 2012

- views: 4399

- published: 24 Jun 2012

- views: 4399

Investing Basics: Bonds

- Order: Reorder

- Duration: 3:57

- Updated: 10 Jul 2014

- views: 56870

- published: 10 Jul 2014

- views: 56870

Finance Lecture - Bonds and Stocks

- Order: Reorder

- Duration: 44:45

- Updated: 17 Feb 2013

- views: 17241

What Is a Bond? | Financial Terms

- Order: Reorder

- Duration: 1:50

- Updated: 19 Sep 2011

- views: 4553

- published: 19 Sep 2011

- views: 4553

Bond Valuation

- Order: Reorder

- Duration: 3:59

- Updated: 20 Dec 2008

- views: 104749

Finding Bond Price and YTM on a Financial Calculator

- Order: Reorder

- Duration: 4:46

- Updated: 07 Feb 2010

- views: 85983

- published: 07 Feb 2010

- views: 85983

How to calculate the bond price and yield to maturity

- Order: Reorder

- Duration: 7:33

- Updated: 24 Jun 2012

- views: 103054

- published: 24 Jun 2012

- views: 103054

Bonds vs. Stocks

- Order: Reorder

- Duration: 9:21

- Updated: 03 Feb 2009

- views: 494373

- published: 03 Feb 2009

- views: 494373

Corporate Finance: Lecture - 003, Bond Valuation

- Order: Reorder

- Duration: 13:15

- Updated: 22 Sep 2015

- views: 209

- published: 22 Sep 2015

- views: 209

Paul Wilmott on Quantitative Finance, Chapter 13, Bond math

- Order: Reorder

- Duration: 7:00

- Updated: 22 Feb 2011

- views: 6678

- published: 22 Feb 2011

- views: 6678

Wu-Tang Financial - Chappelle's Show

- Order: Reorder

- Duration: 2:03

- Updated: 14 Oct 2015

- views: 356147

- published: 14 Oct 2015

- views: 356147

Financial English Vocabulary VV 29 - Bonds (Lesson 2) | English Vocabulary for Finance & Economics

- Order: Reorder

- Duration: 8:11

- Updated: 01 Apr 2012

- views: 53600

- published: 01 Apr 2012

- views: 53600

Financial Accounting - Long-term Liabilities - Bonds

- Order: Reorder

- Duration: 15:41

- Updated: 24 Nov 2013

- views: 2197

- published: 24 Nov 2013

- views: 2197

Calculating Duration on Financial Calculator

- Order: Reorder

- Duration: 5:53

- Updated: 02 Feb 2010

- views: 45900

- published: 02 Feb 2010

- views: 45900

ESD Bond Finance Committee 11/23/15 11:00 AM

- Order: Reorder

- Duration: 15:15

- Updated: 30 Nov 2015

- views: 10

- published: 30 Nov 2015

- views: 10

ESD Bond Finance Committee 11/14/2014 11:00 AM

- Order: Reorder

- Duration: 15:13

- Updated: 09 Oct 2015

- views: 4

- published: 09 Oct 2015

- views: 4

Excel Finance Class 48: Calculate YTM and Effective Annual Yield From Bond Cash Flows RATE & EFFECT

- Order: Reorder

- Duration: 3:54

- Updated: 25 Oct 2010

- views: 15304

Excel Finance Class 52: Bond Discount Or Premium Amortization Table.

- Order: Reorder

- Duration: 6:59

- Updated: 25 Oct 2010

- views: 11231

JAIIB-Accouning Finance for Bankers : Bond-value-calculation

- Order: Reorder

- Duration: 7:37

- Updated: 24 Mar 2013

- views: 4252

-

ESD Bond Finance Committee Directors Meeting 03/01/2016

ESD Bond Finance Committee Directors Meeting 03/01/2016 -

BTM Interview : Director of Finance Mark Milne 2/24/2016

Barnstable Director of Finance Mark Milne explains a recent bond sale and the re-affirmation of the Town's AAA bond rating from Standard & Poor's. -

Bail Bond Industry, Post-Work, The Anthropocene, Personal Finance

Support TDPS by clicking (bookmark it too!) this link before shopping on Amazon: http://www.amazon.com/?tag=thedavpaksho-20 Website: https://www.davidpakman.com Become a Member: https://www.davidpakman.com/membership Be our Patron on Patreon: http://www.patreon.com/davidpakman Discuss This on Reddit: http://www.reddit.com/r/thedavidpakmanshow/ Facebook: http://www.facebook.com/davidpakmanshow TDPS Twitter: http://www.twitter.com/davidpakmanshow David's Twitter: http://www.twitter.com/dpakman TDPS Gear: http://www.davidpakman.com/gear 24/7 Voicemail Line: (219)-2DAVIDP Subscribe to The David Pakman Show for more: http://www.youtube.com/subscription_center?add_user=midweekpolitics Timely news is important! We upload new clips every day, 6-8 stories! Make sure to subscribe! Broadcast on F... -

Stillwater ISD 834 - Exec. Finance Director on the "Repurposing" Bond funds of Students

Mike Ptacek "this is what we said we were going to do. What happens if we do not do it." -

Sean Kidney - Green Bonds: Rethinking the Financing Solutions for Climate Change

19 January 2016 - About the Speech: The green bond market is emerging rapidly as an instrument for investors to channel resources into environmentally friendly projects. According to Environmental Finance over $40 billion in green bonds were issued in 2015. In this address, Sean Kidney, who is at the forefront of this emerging market, considered the potential of green bond financing as a means to tackle the climate problem, renew aging infrastructure and create an economically viable future. He also discussed the outcome of COP 21 and how green bonds can help to realise the commitments made in Paris. Please note that this event will take place in the ISI Centre Office, DDDA Building, Custom House Quay, Dublin 1. Click here for directions This event is supported by the ISI Centre’s Sus... -

Session 07: Objective 7 - Determinants of Bond Yield (2016)

The Finance Coach: Introduction to Corporate Finance with Greg Pierce Textbook: Fundamentals of Corporate Finance Ross, Westerfield, Jordan Chapter 7: Interest Rates and Bond Valuation Objective 7 - Key Concepts: Term of Structure of Interest Rates Long term rates vs. short term rates More Information at: http://thefincoach.com/ -

Session 07: Objective 1 - Bonds and Bond Valuation (2016)

The Finance Coach: Introduction to Corporate Finance with Greg Pierce Textbook: Fundamentals of Corporate Finance Ross, Westerfield, Jordan Chapter 7: Interest Rates and Bond Valuation Objective 1 - Key Objective: Bonds Bond Cycle Inverse relationship between bond value and interest rate Face Value vs. Discount vs. Premium Bond To minimize interest rate risk purchase a bond with 1) shorter time to maturity 2) higher coupon rate Semiannual vs. Annual Coupons Bond Value Formula Coupon (C) Time to Maturity (t) Yield to Maturity (r) Face value paid at maturity (FV) Fisher Effect (Exact vs. Approximate) Nominal Rate (R) Real Rate (r) Inflation Rate (h) More Information at: http://thefincoach.com/ -

Session 07: Objective 4 - Types of Bonds (2016)

The Finance Coach: Introduction to Corporate Finance with Greg Pierce Textbook: Fundamentals of Corporate Finance Ross, Westerfield, Jordan Chapter 7: Interest Rates and Bond Valuation Objective 4 - Key Concepts: National Debt Goverment Bonds Income Bonds Convertible Bonds Zero-Coupon Bonds Floating Rate Bonds More Information at: http://thefincoach.com/ -

Session 07: Objective 3 - Bond Ratings (2016)

The Finance Coach: Introduction to Corporate Finance with Greg Pierce Textbook: Fundamentals of Corporate Finance Ross, Westerfield, Jordan Chapter 7: Interest Rates and Bond Valuation Objective 3 - Key Concepts: Bond Ratings High Grade Bonds Low Grade Bonds Junk Bonds Risk More Information at: http://thefincoach.com/ -

Council Update Ice Arena and Bond Rating

January 2016 Cottage Grove City Administrator Charlene Stevens and Mayor Myron Bailey discuss the Ice Arena and the City's Bond rating. www.cottage-grove.org Video created by swctc: www.swctc.org -

Tax and Finance - Bond Vote 2016

The district has worked very hard over the past year to minimize the tax and financial impact of the proposed 2016 Bond Issue. This plan will provide much needed classroom space, safety upgrades and mechanical system upgrades at a very moderate cost to local taxpayers. For more information, please visit PrairiePride.org/2016bond -

-

VALUATION OF BONDS - Accounting and Finance for Bankers (for JAIIB Examination)

FINANCIAL MANAGEMENT – A COMPLETE STUDY If you enjoyed this content, make sure to check full course. Here is a huge discount to get the course only for $10 (Rs.640) only instead of $125 (Rs.8000). Click on the following link to avail discount. https://www.udemy.com/financial-management-a-complete-study/?couponCode=YTB Indepth Analysis through 300+ lectures and case studies for CA / CFA / CPA / CMA / MBA Finance Exams and Professionals ------------------------------------------------------------------------------------------------------------------------ Welcome to one of the comprehensive ever course on Financial Management – relevant for any one aspiring to understand Financial Management and useful for students pursing courses like CA / CMA / CS / CFA / CPA, etc. A Course with close to 3... -

Webinar: Introduction to Green Bonds

Green bonds have been touted as a key financial instrument able to fund the vast clean energy and sustainable infrastructure needs of corporations, cities, municipalities, and states. The green bond market has grown rapidly since its inception in 2008, and is expected to exceed $40 billion in 2015. Governments and public agencies in Massachusetts, Connecticut, Washington D.C., and Los Angeles, among others, have recently issued green bonds to fund a range of verified green projects. What are green bonds? How do they differ from other environmental bonds and what is their potential to have a positive financial and environmental impact? Who can issue these bonds and what is the general process? This one hour webinar covered the basics of green bonds and how they may be able to fit into your... -

The ins and outs of the Bond Market

For those often confused by the bond market and how it operates, Otto Dichtl, Managing Director at Stifel Nicolaus Europe Ltd, joined Nick Batsford on the Tip TV Finance Show to help explain the bond market, how it works, and the basics behind the market in general. Tip TV Finance is a live video show, broadcasted weekdays from 10 am sharp. Based in St Paul's, in the heart of the City of London, Tip TV prides itself on being able to attract the very best quality guests on the show to offer viewers informed, insightful and actionable infotainment. The Tip TV Daily Finance Show covers all asset classes ranging from currencies (forex), equities, bonds, commodities, futures and options. Guests share their high conviction market opportunities, covering fundamental, technical, inter-market a... -

The biggest challenge facing sustainable investment finance. Daniel Bond.

The UN Secretary General’s Executive Office convened two pre-CoP21 Regional Workshops in South Africa and Thailand under the umbrella theme: “Mobilising Capital for Climate Smart Infrastructure”. As part of the preparations for the pivotal United Nations Climate Change Conference (Cop21) the objective of the workshops was to forge recommendations for a “Bangkok-Johannesburg Blueprint” which took centre stage at the conference. A select group of major investors, policy-makers, financial institutions and corporations came together in Johannesburg and Bangkok to formulate the Blueprint which recommended to CoP21 how to mobilize deep pools of capital to finance climate-proofed and low-carbon, urban infrastructure. Conversations conducted by Dominic Wilhelm. -

What does sustainable infrastructure look like? Daniel Bond, Bangkok.

The UN Secretary General’s Executive Office convened two pre-CoP21 Regional Workshops in South Africa and Thailand under the umbrella theme: “Mobilising Capital for Climate Smart Infrastructure”. As part of the preparations for the pivotal United Nations Climate Change Conference (Cop21) the objective of the workshops was to forge recommendations for a “Bangkok-Johannesburg Blueprint” which took centre stage at the conference. A select group of major investors, policy-makers, financial institutions and corporations came together in Johannesburg and Bangkok to formulate the Blueprint which recommended to CoP21 how to mobilize deep pools of capital to finance climate-proofed and low-carbon, urban infrastructure. Conversations conducted by Dominic Wilhelm. -

How Oakland Can Use IDBs To Privately Finance Raiders, A's Stadiums

How Oakland Can Use IDBs To Privately Finance Raiders, A's Stadiums Website: http://zennie62.wix.com/coliseumreboot The basics: the Oakland Coliseum City project would be financed via an Industrial Development Lease Revenue Series of bond issues (IDBs) let by the Oakland-Alameda County Joint Powers Authority but on behalf of a specially formed corporation, an LLC, that would be a partnership of the City of Oakland, the A's and the Raiders and a Hotel Corporation. If the City of Oakland elected to buy out the County, then the JPA name would be called the "Oakland Coliseum JPA". Because of the use of an Industrial Development Lease Revenue Series of bond issues, the City and County (or City) would not have to pay for defaults. The Raiders / A's / City / Hotel Company owns the project... -

Centaur Natural Resources Bond III

The Centaur Natural Resources Bond III is a ‘bond’ or ‘debt security’ issued by Centaur Group Finance Ltd, acting in respect of its ‘segregated account’ #3 ‘Centaur Natural Resources Bond III’ (the “Issuer”). The Issuer is a wholly owned subsidiary of Centaur Holdings Ltd (”Centaur”), a global investment holding company with interests in sectors ranging from asset management, wealth management, private equity, venture capital, mining and natural resources and agricultural investments. Investments Highlights: - Monthly coupon payments - Minimum investment from US$20,000 - US$ denominated - Suitable for ISA, SIPP, SSAS, QROPS, Portfolio Bond and Investment Platforms - Investment Advisor actively manages security of the Bond - Bond and Investment Platforms - Flexibility to choose the term... -

-

Bond Market: Serious worry about lack of liquidity

Bond market liquidity and volatility dead because of zero rates?, Watch today’s interview with Marcus Ashworth, Head of Fixed Income for Haitong Securities, as he speaks on the bond market scenario, and why the central bank QE is more about rearranging debt than easing. US and UK bond market Ashworth notes how the US bonds did very little across October, while the European bunds saw good action after ECB Draghi’s hints towards further easing. Ashworth further says how they look at the relative performance between countries, with most liquidity and volatility in the bond markets being drained out. He adds that this remains a serious concern. ECB and Bundesbank taking bonds out of the market? Ashworth comments that the central bank QE is only resulting in rearranging of debt rather tha... -

Bootstrapping (finance)

Not to be confused with Bootstrapping. In finance, bootstrapping is a method for constructing a fixed-income yield curve from the prices of a set of coupon-bearing products, e.g. bonds and swaps.[1] A bootstrapped curve, correspondingly, is one where the prices of the instruments used as an input to the curve, will be an exact output, when these same instruments are valued using this curve. Here, the term structure of spot returns is recovered from the bond yields by solving for them recursively, by forward substitution: this iterative process is called the Bootstrap Method. The usefulness of bootstrapping is that using only a few carefully selected zero-coupon products, it becomes possible to derive par swap rates for all maturities given the solved curve. This video is targeted to blin...

ESD Bond Finance Committee Directors Meeting 03/01/2016

- Order: Reorder

- Duration: 9:09

- Updated: 01 Mar 2016

- views: 5

BTM Interview : Director of Finance Mark Milne 2/24/2016

- Order: Reorder

- Duration: 9:08

- Updated: 25 Feb 2016

- views: 0

- published: 25 Feb 2016

- views: 0

Bail Bond Industry, Post-Work, The Anthropocene, Personal Finance

- Order: Reorder

- Duration: 3:14

- Updated: 14 Feb 2016

- views: 56

- published: 14 Feb 2016

- views: 56

Stillwater ISD 834 - Exec. Finance Director on the "Repurposing" Bond funds of Students

- Order: Reorder

- Duration: 7:35

- Updated: 11 Feb 2016

- views: 18

- published: 11 Feb 2016

- views: 18

Sean Kidney - Green Bonds: Rethinking the Financing Solutions for Climate Change

- Order: Reorder

- Duration: 42:13

- Updated: 03 Feb 2016

- views: 11

- published: 03 Feb 2016

- views: 11

Session 07: Objective 7 - Determinants of Bond Yield (2016)

- Order: Reorder

- Duration: 4:17

- Updated: 29 Jan 2016

- views: 15

- published: 29 Jan 2016

- views: 15

Session 07: Objective 1 - Bonds and Bond Valuation (2016)

- Order: Reorder

- Duration: 16:24

- Updated: 29 Jan 2016

- views: 51

- published: 29 Jan 2016

- views: 51

Session 07: Objective 4 - Types of Bonds (2016)

- Order: Reorder

- Duration: 3:47

- Updated: 29 Jan 2016

- views: 28

- published: 29 Jan 2016

- views: 28

Session 07: Objective 3 - Bond Ratings (2016)

- Order: Reorder

- Duration: 1:39

- Updated: 29 Jan 2016

- views: 11

- published: 29 Jan 2016

- views: 11

Council Update Ice Arena and Bond Rating

- Order: Reorder

- Duration: 5:54

- Updated: 27 Jan 2016

- views: 75

- published: 27 Jan 2016

- views: 75

Tax and Finance - Bond Vote 2016

- Order: Reorder

- Duration: 2:22

- Updated: 26 Jan 2016

- views: 45

- published: 26 Jan 2016

- views: 45

Fun with Finance: Baby Bonds

- Order: Reorder

- Duration: 0:21

- Updated: 16 Dec 2015

- views: 626

VALUATION OF BONDS - Accounting and Finance for Bankers (for JAIIB Examination)

- Order: Reorder

- Duration: 4:25

- Updated: 16 Dec 2015

- views: 20

- published: 16 Dec 2015

- views: 20

Webinar: Introduction to Green Bonds

- Order: Reorder

- Duration: 61:16

- Updated: 15 Dec 2015

- views: 46

- published: 15 Dec 2015

- views: 46

The ins and outs of the Bond Market

- Order: Reorder

- Duration: 13:08

- Updated: 11 Dec 2015

- views: 79

- published: 11 Dec 2015

- views: 79

The biggest challenge facing sustainable investment finance. Daniel Bond.

- Order: Reorder

- Duration: 0:45

- Updated: 29 Nov 2015

- views: 13

- published: 29 Nov 2015

- views: 13

What does sustainable infrastructure look like? Daniel Bond, Bangkok.

- Order: Reorder

- Duration: 1:21

- Updated: 29 Nov 2015

- views: 6

- published: 29 Nov 2015

- views: 6

How Oakland Can Use IDBs To Privately Finance Raiders, A's Stadiums

- Order: Reorder

- Duration: 9:44

- Updated: 17 Nov 2015

- views: 307

- published: 17 Nov 2015

- views: 307

Centaur Natural Resources Bond III

- Order: Reorder

- Duration: 2:41

- Updated: 10 Nov 2015

- views: 617403

- published: 10 Nov 2015

- views: 617403

Why Invest in Centaur Bonds?

- Order: Reorder

- Duration: 3:07

- Updated: 06 Nov 2015

- views: 519

Bond Market: Serious worry about lack of liquidity

- Order: Reorder

- Duration: 8:05

- Updated: 03 Nov 2015

- views: 145

- published: 03 Nov 2015

- views: 145

Bootstrapping (finance)

- Order: Reorder

- Duration: 5:00

- Updated: 29 Oct 2015

- views: 263

- published: 29 Oct 2015

- views: 263

-

ESD Bond Finance Committee 12/02/2014 11:00 AM

12/02/2014: Meeting of the Bond Finance Committee of the New York State Urban Development Corporation d/b/a Empire State Development. -

Excel Finance Class 46: Bonds: Just Set Of Cash Flows Discounted At Market Rate, Coupon or Zero

Download Excel workbook http://people.highline.edu/mgirvin/ExcelIsFun.htm Learn how to think of a Bond as just a set of future cash flows that are discounted at a market rate. See examples of both a Coupon Bond and a Zero Coupon Bond. Learn About Yield To Maturity rates. See Math Formulas for Bond Valuation and PV function in Excel for both Coupon Bond and Zero Coupon Bond. -

Money & Morals: Finance From the Founding Fathers to Junk Bond Traders (1998)

The holder of any debt is subject to interest rate risk and credit risk, inflationary risk, currency risk, duration risk, convexity risk, repayment of principal risk, streaming income risk, liquidity risk, default risk, maturity risk, reinvestment risk, market risk, political risk, and taxation adjustment risk. Interest rate risk refers to the risk of the market value of a bond changing due to changes in the structure or level of interest rates or credit spreads or risk premiums. The credit risk of a high-yield bond refers to the probability and probable loss upon a credit event (i.e., the obligor defaults on scheduled payments or files for bankruptcy, or the bond is restructured), or a credit quality change is issued by a rating agency including Fitch, Moody's, or Standard & Poors. A cre... -

Bond (finance)

In finance, a bond is an instrument of indebtedness of the bond issuer to the holders. It is a debt security, under which the issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay them interest (the coupon) and/or to repay the principal at a later date, termed the maturity date. Interest is usually payable at fixed intervals (semiannual, annual, sometimes monthly). Very often the bond is negotiable, i.e. the ownership of the instrument can be transferred in the secondary market. This means that once the transfer agents at the bank medallion stamp the bond, it is highly liquid on the second market. Thus a bond is a form of loan or IOU (sounded "I owe you"): the holder of the bond is the lender (creditor), the issuer of the bond is the borrower (debtor), ... -

The Community Bond: An Innovation In Social Finance 2012

Tonya Surman, the CEO of the Centre for Social Innovation, speaking about Community Bonds in 2012. The Community Bond is an innovation in social finance that allows a nonprofit or charity to leverage its community of supporters to pursue its mission, build its resiliency, and create more vibrant communities. See the Community Bond guidebook at http://communitybonds.ca/ -

Valuation of Stocks and Bonds, James Tompkins

This is the fourth lecture in the "Corporate Finance" series in which I talk about both the concept and the valuation of financial securities. For example, what do I mean by Apple "stock" and why is it valued at $X per share. Many textbooks will emphasize stocks and bonds, but in this discussion I highlight the fact that there is in fact a whole spectrum of numerous different types of financial securities for the investor that range from relatively low risk (eg IBM bonds) to higher risk (eg IBM stock). However, no matter what type of financial security you are talking about, what it is worth today is in theory related to future expected cash flows and the risk inherent in those cash flows. Many textbooks will have some fancy names applied to these "valuation" formulas; however, they are no... -

Social Finance Webinar - Social Impact Bond Futures: The Development of Outcome Based Finance

Toby Eccles sets out his vision for the scaling of Social Impact Bond and the growth of outcomes finance market. He discusses the potential application of Social Impact Bonds in different social areas, the investor appetite for Social Impact Bonds, the need for new organisations suited to an outcomes based financing environment and the challenges of developing the market to scale. The webinar includes a presentation from Toby followed by Q&A;. www.socialfinance.org.uk -

The Insider-Trading Scandal That Nearly Destroyed Wall Street: U.S. Finance (1991)

Drexel Burnham Lambert was a major Wall Street investment banking firm, which first rose to prominence and then was forced into bankruptcy in February 1990 by its involvement in illegal activities in the junk bond market, driven by Drexel employee Michael Milken. At its height, it was the fifth-largest investment bank in the United States. http://en.wikipedia.org/wiki/Drexel_Burnham_Lambert Ivan Frederick Boesky (born March 6, 1937) is an American stock trader who is notable for his prominent role in a Wall Street insider trading scandal that occurred in the United States in the mid-1980s. The character of Gordon Gekko in the 1987 movie Wall Street is based at least in part on Boesky, especially regarding a famous speech he delivered on the positive aspects of greed at the Universit... -

Social Finance Webinar: Introduction to the MTFC Social Impact Bond

This webinar looks at Social Impact Bonds in Children's services, focusing on the Manchester Multi-dimensional Treatment Foster care Social Impact Bond. The slides can also be downloaded here: http://www.socialfinance.org.uk/sites/default/files/introduction_to_the_mtfc_social_impact_bond.pdf -

Comptroller Hegar Speaks to The Bond Buyer’s Texas Public Finance Conference [Official]

Texas Comptroller Glenn Hegar discussed the state of the Texas economy with attendees of the Bond Buyer’s Texas Public Finance Conference on Feb. 10, 2015. Visit the Texas Comptroller of Public Accounts online at Comptroller.Texas.Gov -

David Hutchison, CEO Social Finance - How the Development Impact Bond evolved.

The CEO of Social Finance, David Hutchison OBE, talks about how Social Finance developed the Social Impact Bond, and how the Development Impact Bond evolved from that work. -

THE BOND MARKET IS IMPLODING - US FINANCE IN TURMOIL

From Wall Street, gold price and US finance to conspiracies, latest global news, Alex Jones, Gerald Celente, David Icke Illuminati, a potential World War 3, Elite government cover - ups and much more, Bigeyenews is the place to be. Financial pundit Max Keiser also joins Alex Jones on today's show to analyze the imploding bond market. We talk about things such as (deep breathnews 2013 pastor lindsey williams elite nwo new world order illuminati pencil paper financial collapse obama ron paul election united states america radio show usd gold silver bullion investment ww3 war iran earth ''control the world'' secret society bilderberg bohemian grove oil future trendy cancer intelligence government price food water mr from end of 2012 end of the dollar usd timeline book dvd oil pipeline china... -

Learn Finance C++, Lesson 30, Bond Class Part IV, else-if structure

We clean up and finish our Bond class to provide real bond prices. Along the way, we also use an example of an else-if structure. http://andyjamesduncan.wordpress.com Finished code blocks: http://andyjamesduncan.wordpress.com/2013/02/19/learn-finance-c-lesson-30-bond-class-part-iv-else-if-structure/ -

Chap 15 Lecture: Bonds Payable

This presentation covers long-term liabilities including determining the selling price of a bond, terminology regarding interest rates (contract, coupon, stated, effective, market), and journal entries for issuing the bond at face, premium, and discount. The follow-up video covers amortization concepts (straight-line, effective interest method). -

Martin Armstrong-Big Losses Coming in the Bond Market

Renowned financial analyst Martin Armstrong says you can forget about the U.S. dollar crashing in value. Armstrong contends, “No, that’s absurd. The euro is in terrible shape. The yen is in terrible shape, and honestly, you can’t park money in yuan or Russian rubles, yet. I mean, let’s be realistic here, but eventually--yes.” Armstrong says the bond market is a different story as the Fed is going to be forced to raise rates. He contends just a few percentage points in rising rates are going to cause big losses and big changes. Armstrong predicts, “People will be losing huge money. We are looking at a few percentage points, and you are going to blow the national debts of all these countries way out of whack, and that’s what’s going to force political change.” Join Greg Hunter as he... -

Finance Minister On Government Bond Issue, Aug 5 2013

http://bernews.com Finance Minister On Government Bond Issue, Aug 5 2013 Info: http://bernews.com/2013/07/bermuda-government-borrows-750-million/ ------------------------------------------------------------------------- Join us on Facebook: http://facebook.com/bernews Join us on Twitter: http://twitter.com/bernewsdotcom Join us on Instagram: http://instagram.com/bernews Sign up for our email list: http://bernews.com/emaileditions Download our iPhone & Android app: http://bernews.com/app/ -

DNCA Finance / Webinar DNCA Invest European Bond Opportunities

Jacques Sudre, Gérant -

CGD and Social Finance Webinar - Development Impact Bonds: What's Next?

On June 5th the Development Impact Bond Working Group launched a consultation of their report at an event to coincide with the G8 Social Investment Forum in London. Since then we have been overwhelmed by the interest in this new financial mechanism, and we are grateful for the thoughtful responses we have received. The consultation report was just the beginning of a process which we hope will spur the development of a viable market for Development Impact Bonds (DIBs). DIBs are a new funding approach that bring together private investors, service delivery organisations, governments and donors to deliver cost-effective development outcomes. Based on the model of Social Impact Bonds spreading in the UK, the US and elsewhere, DIBs engage the private sector to increase innovation, flexibility,... -

-

President Reagan on the Stock Market: Black Monday - World Market Crash, Finance (1987)

In finance, Black Monday refers to Monday, October 19, 1987, when stock markets around the world crashed, shedding a huge value in a very short time. The crash began in Hong Kong and spread west to Europe, hitting the United States after other markets had already declined by a significant margin. The Dow Jones Industrial Average (DJIA) dropped by 508 points to 1738.74 (22.61%).[1] In Australia and New Zealand the 1987 crash is also referred to as Black Tuesday because of the timezone difference. The terms Black Monday and Black Tuesday are also applied to October 28 and 29, 1929, which occurred after Black Thursday on October 24, which started the Stock Market Crash of 1929. Possible causes for the decline included program trading, overvaluation, illiquidity, and market psychology. A popu... -

Social Impact Bonds Webinar Panel

On May 15, 2012, McKinsey hosted a webinar to discuss the launch of a new report, From Potential to Action: Bringing Social Impact Bonds to the U.S. The panel was moderated by the Washington Post's Matt Miller and included report co-author Laura Callanan, McKinsey & Company, Tracy Palandjian, Social Finance, Inc., and Jeffrey Liebman, Harvard University. There is considerable buzz in the United States about whether Social Impact Bonds, a new "pay for success" model of financing social solutions currently being piloted across the Atlantic, could work on American soil. For more information on the report, please visit: http://mckinseyonsociety.com/social-impact-bonds/

ESD Bond Finance Committee 12/02/2014 11:00 AM

- Order: Reorder

- Duration: 20:05

- Updated: 09 Sep 2015

- views: 4

- published: 09 Sep 2015

- views: 4

Excel Finance Class 46: Bonds: Just Set Of Cash Flows Discounted At Market Rate, Coupon or Zero

- Order: Reorder

- Duration: 27:38

- Updated: 25 Oct 2010

- views: 7992

- published: 25 Oct 2010

- views: 7992

Money & Morals: Finance From the Founding Fathers to Junk Bond Traders (1998)

- Order: Reorder

- Duration: 58:50

- Updated: 04 Aug 2015

- views: 296

- published: 04 Aug 2015

- views: 296

Bond (finance)

- Order: Reorder

- Duration: 33:12

- Updated: 15 Jul 2014

- views: 72

- published: 15 Jul 2014

- views: 72

The Community Bond: An Innovation In Social Finance 2012

- Order: Reorder

- Duration: 22:09

- Updated: 20 Jan 2014

- views: 153

- published: 20 Jan 2014

- views: 153

Valuation of Stocks and Bonds, James Tompkins

- Order: Reorder

- Duration: 60:19

- Updated: 25 Feb 2014

- views: 3992

- published: 25 Feb 2014

- views: 3992

Social Finance Webinar - Social Impact Bond Futures: The Development of Outcome Based Finance

- Order: Reorder

- Duration: 65:20

- Updated: 25 Aug 2011

- views: 1311

- published: 25 Aug 2011

- views: 1311

The Insider-Trading Scandal That Nearly Destroyed Wall Street: U.S. Finance (1991)

- Order: Reorder

- Duration: 55:38

- Updated: 23 Dec 2014

- views: 12297

- published: 23 Dec 2014

- views: 12297

Social Finance Webinar: Introduction to the MTFC Social Impact Bond

- Order: Reorder

- Duration: 49:28

- Updated: 13 Jan 2014

- views: 364

- published: 13 Jan 2014

- views: 364

Comptroller Hegar Speaks to The Bond Buyer’s Texas Public Finance Conference [Official]

- Order: Reorder

- Duration: 20:59

- Updated: 01 Apr 2015

- views: 50

- published: 01 Apr 2015

- views: 50

David Hutchison, CEO Social Finance - How the Development Impact Bond evolved.

- Order: Reorder

- Duration: 45:38

- Updated: 31 Dec 2014

- views: 192

- published: 31 Dec 2014

- views: 192

THE BOND MARKET IS IMPLODING - US FINANCE IN TURMOIL

- Order: Reorder

- Duration: 27:12

- Updated: 06 Jul 2013

- views: 618

- published: 06 Jul 2013

- views: 618

Learn Finance C++, Lesson 30, Bond Class Part IV, else-if structure

- Order: Reorder

- Duration: 29:19

- Updated: 20 Jan 2013

- views: 641

- published: 20 Jan 2013

- views: 641

Chap 15 Lecture: Bonds Payable

- Order: Reorder

- Duration: 51:57

- Updated: 08 Feb 2012

- views: 26539

- published: 08 Feb 2012

- views: 26539

Martin Armstrong-Big Losses Coming in the Bond Market

- Order: Reorder

- Duration: 26:33

- Updated: 12 Apr 2015

- views: 103112

- published: 12 Apr 2015

- views: 103112

Finance Minister On Government Bond Issue, Aug 5 2013

- Order: Reorder

- Duration: 21:28

- Updated: 05 Aug 2013

- views: 148

- published: 05 Aug 2013

- views: 148

DNCA Finance / Webinar DNCA Invest European Bond Opportunities

- Order: Reorder

- Duration: 33:08

- Updated: 10 Feb 2015

- views: 208

CGD and Social Finance Webinar - Development Impact Bonds: What's Next?

- Order: Reorder

- Duration: 67:50

- Updated: 11 Sep 2013

- views: 448

- published: 11 Sep 2013

- views: 448

MBA Intro Finance: 1. Bond Valuation

- Order: Reorder

- Duration: 120:28

- Updated: 05 Sep 2012

- views: 3246

President Reagan on the Stock Market: Black Monday - World Market Crash, Finance (1987)

- Order: Reorder

- Duration: 34:36

- Updated: 02 Apr 2014

- views: 2130

- published: 02 Apr 2014

- views: 2130

Social Impact Bonds Webinar Panel

- Order: Reorder

- Duration: 31:27

- Updated: 23 May 2012

- views: 2869

- published: 23 May 2012

- views: 2869

- Playlist

- Chat

- Playlist

- Chat

What is a Bond? - 2 Minute Finance

- Report rights infringement

- published: 14 Sep 2011

- views: 2563

Not Your Mama's Finance Lesson: "What the Heck is a Bond?"

- Report rights infringement

- published: 19 Aug 2013

- views: 29336

The basics of bonds - MoneyWeek Investment Tutorials

- Report rights infringement

- published: 12 Nov 2010

- views: 134480

Session 07: Objective 1 - Bonds and Bond Valuation

- Report rights infringement

- published: 25 Jun 2012

- views: 19584

Session 07: Objective 4 - Types of Bonds

- Report rights infringement

- published: 24 Jun 2012

- views: 4399

Investing Basics: Bonds

- Report rights infringement

- published: 10 Jul 2014

- views: 56870

Finance Lecture - Bonds and Stocks

- Report rights infringement

- published: 17 Feb 2013

- views: 17241

What Is a Bond? | Financial Terms

- Report rights infringement

- published: 19 Sep 2011

- views: 4553

Finding Bond Price and YTM on a Financial Calculator

- Report rights infringement

- published: 07 Feb 2010

- views: 85983

How to calculate the bond price and yield to maturity

- Report rights infringement

- published: 24 Jun 2012

- views: 103054

Bonds vs. Stocks

- Report rights infringement

- published: 03 Feb 2009

- views: 494373

Corporate Finance: Lecture - 003, Bond Valuation

- Report rights infringement

- published: 22 Sep 2015

- views: 209

Paul Wilmott on Quantitative Finance, Chapter 13, Bond math

- Report rights infringement

- published: 22 Feb 2011

- views: 6678

- Playlist

- Chat

ESD Bond Finance Committee Directors Meeting 03/01/2016

- Report rights infringement

- published: 01 Mar 2016

- views: 5

BTM Interview : Director of Finance Mark Milne 2/24/2016

- Report rights infringement

- published: 25 Feb 2016

- views: 0

Bail Bond Industry, Post-Work, The Anthropocene, Personal Finance

- Report rights infringement

- published: 14 Feb 2016

- views: 56

Stillwater ISD 834 - Exec. Finance Director on the "Repurposing" Bond funds of Students

- Report rights infringement

- published: 11 Feb 2016

- views: 18

Sean Kidney - Green Bonds: Rethinking the Financing Solutions for Climate Change

- Report rights infringement

- published: 03 Feb 2016

- views: 11

Session 07: Objective 7 - Determinants of Bond Yield (2016)

- Report rights infringement

- published: 29 Jan 2016

- views: 15

Session 07: Objective 1 - Bonds and Bond Valuation (2016)

- Report rights infringement

- published: 29 Jan 2016

- views: 51

Session 07: Objective 4 - Types of Bonds (2016)

- Report rights infringement

- published: 29 Jan 2016

- views: 28

Session 07: Objective 3 - Bond Ratings (2016)

- Report rights infringement

- published: 29 Jan 2016

- views: 11

Council Update Ice Arena and Bond Rating

- Report rights infringement

- published: 27 Jan 2016

- views: 75

Tax and Finance - Bond Vote 2016

- Report rights infringement

- published: 26 Jan 2016

- views: 45

VALUATION OF BONDS - Accounting and Finance for Bankers (for JAIIB Examination)

- Report rights infringement

- published: 16 Dec 2015

- views: 20

Webinar: Introduction to Green Bonds

- Report rights infringement

- published: 15 Dec 2015

- views: 46

- Playlist

- Chat

ESD Bond Finance Committee 12/02/2014 11:00 AM

- Report rights infringement

- published: 09 Sep 2015

- views: 4

Excel Finance Class 46: Bonds: Just Set Of Cash Flows Discounted At Market Rate, Coupon or Zero

- Report rights infringement

- published: 25 Oct 2010

- views: 7992

Money & Morals: Finance From the Founding Fathers to Junk Bond Traders (1998)

- Report rights infringement

- published: 04 Aug 2015

- views: 296

Bond (finance)

- Report rights infringement

- published: 15 Jul 2014

- views: 72

The Community Bond: An Innovation In Social Finance 2012

- Report rights infringement

- published: 20 Jan 2014

- views: 153

Valuation of Stocks and Bonds, James Tompkins

- Report rights infringement

- published: 25 Feb 2014

- views: 3992

Social Finance Webinar - Social Impact Bond Futures: The Development of Outcome Based Finance

- Report rights infringement

- published: 25 Aug 2011

- views: 1311

The Insider-Trading Scandal That Nearly Destroyed Wall Street: U.S. Finance (1991)

- Report rights infringement

- published: 23 Dec 2014

- views: 12297

Social Finance Webinar: Introduction to the MTFC Social Impact Bond

- Report rights infringement

- published: 13 Jan 2014

- views: 364

Comptroller Hegar Speaks to The Bond Buyer’s Texas Public Finance Conference [Official]

- Report rights infringement

- published: 01 Apr 2015

- views: 50

David Hutchison, CEO Social Finance - How the Development Impact Bond evolved.

- Report rights infringement

- published: 31 Dec 2014

- views: 192

THE BOND MARKET IS IMPLODING - US FINANCE IN TURMOIL

- Report rights infringement

- published: 06 Jul 2013

- views: 618

Learn Finance C++, Lesson 30, Bond Class Part IV, else-if structure

- Report rights infringement

- published: 20 Jan 2013

- views: 641

Chap 15 Lecture: Bonds Payable

- Report rights infringement

- published: 08 Feb 2012

- views: 26539

Some Think Clinton's 'Absolute' Promises Are Absolutely Wrong

Edit WorldNews.com 04 Mar 2016China Accuses the U.S. of ‘Militarizing’ the South China Sea

Edit Time Magazine 04 Mar 2016North Korea's Kim Jong-un Raises Rhetoric Ahead Of Pre-Emptive Attack Mode Orders

Edit WorldNews.com 04 Mar 2016Trump Reaffirms His Intention To Order War Crimes

Edit Huffington Post 04 Mar 2016Reports: Brazil police making arrest at ex-president's home

Edit The Associated Press 04 Mar 2016China shows the way in green standards

Edit China Daily 04 Mar 2016China on track to build world's largest green bond market

Edit China Daily 04 Mar 2016Successful State Bond Sale Saves Taxpayers Over $8M (State of Delaware Department of Finance)

Edit Public Technologies 04 Mar 2016China's green bond initiative well-supported by political will

Edit China Daily 04 Mar 2016Successful State Bond Sale Saves Taxpayers Over $8M (State of Delaware)

Edit Public Technologies 04 Mar 2016Government to Issue Third Tranche of Sovereign Gold Bonds (Ministry of Finance of the Republic of India)

Edit Public Technologies 04 Mar 2016Fitch Affirms Renaissance Charter School (Florida) Series 2010 Revs at 'BB+'; Outlook Stable (Fitch Inc)

Edit Public Technologies 04 Mar 2016Fitch: New Rules in China Ensure Sustainability of Land Capitalisation (Fitch Inc)

Edit Public Technologies 04 Mar 2016Fitch Affirms Renaissance Charter School (Florida) Series 2011 Revs at 'BB-'; Outlook Stable (Fitch Inc)

Edit Public Technologies 04 Mar 2016Quoting of Treasury bonds on electronic trading platform E-Bond Morocco (03/03/2016) (Ministry of Economy and Finance of Morocco)

Edit Public Technologies 04 Mar 2016Third tranche of Gold bond scheme to open on Tuesday

Edit The Times of India 04 Mar 2016Notice to Bondholders (ISE - The Irish Stock Exchange plc)

Edit Public Technologies 04 Mar 2016Austria Suffers Heta Blow as Deutsche Bank Rejects Bond Offer

Edit Bloomberg 04 Mar 2016- 1

- 2

- 3

- 4

- 5

- Next page »