- published: 07 Jan 2016

- views: 4078965

-

remove the playlistLien

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistLien

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 09 Mar 2016

- views: 262

- published: 09 Mar 2016

- views: 5769

- published: 02 Oct 2014

- views: 9396442

- published: 09 Mar 2016

- views: 609

- published: 06 Mar 2016

- views: 4000

- published: 08 Mar 2016

- views: 14306

In law, a lien (UK /ˈliːən/ or US /ˈliːn/) is a form of security interest granted over an item of property to secure the payment of a debt or performance of some other obligation. The owner of the property, who grants the lien, is referred to as the lienor and the person who has the benefit of the lien is referred to as the lienee.

The etymological root is Anglo-French lien, loyen "bond", "restraint", from Latin ligamen, from ligare "to bind".

In the United States, the term lien generally refers to a wide range of encumbrances and would include other forms of mortgage or charge. In the USA, a lien characteristically refers to non-possessory security interests (see generally: Security interest—categories).

In other common-law countries, the term lien refers to a very specific type of security interest, being a passive right to retain (but not sell) property until the debt or other obligation is discharged. In contrast to the usage of the term in the USA, in other countries it refers to a purely possessory form of security interest; indeed, when possession of the property is lost, the lien is released. However, common-law countries also recognize a slightly anomalous form of security interest called an "equitable lien" which arises in certain rare instances.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

83:03

83:03Liên Khúc Nhạc Trữ Tình Remix - Nhạc Vàng Remix Hay Nhất 2016 - Tổng Hợp Gái Xinh - P1

Liên Khúc Nhạc Trữ Tình Remix - Nhạc Vàng Remix Hay Nhất 2016 - Tổng Hợp Gái Xinh - P1Liên Khúc Nhạc Trữ Tình Remix - Nhạc Vàng Remix Hay Nhất 2016 - Tổng Hợp Gái Xinh - P1

Liên Khúc Nhạc Trữ Tình Remix - Nhạc Vàng Remix Hay Nhất 2016 - Tổng Hợp Gái Xinh - P1 ➤Nhạc Trữ Tình Remix: https://goo.gl/w45wW7 ➤Liên Khúc Nhạc Vàng Remix Hay Nhất : https://goo.gl/W5i6ux ➤ Đăng Ký Kênh Nhạc Trữ Tình Remix: https://goo.gl/bEo9GQ ➤ Fanpage : https://goo.gl/CjeFvB ➤ Maker by: TTmusic ---------------------------------------------------------- -

0:21

0:21Live du mercredi soir de 20h30 à 22h (lien dans la description)

Live du mercredi soir de 20h30 à 22h (lien dans la description)Live du mercredi soir de 20h30 à 22h (lien dans la description)

lien vers le live : https://www.twitch.tv/fonkyfouine Pour choisir le jeu de ce soir : http://strawpoll.me/7036287 -

132:36

132:36LK Tình Yêu 1 2 3 4 Ngọc Lan,Trung Hành,Kiều Nga

LK Tình Yêu 1 2 3 4 Ngọc Lan,Trung Hành,Kiều NgaLK Tình Yêu 1 2 3 4 Ngọc Lan,Trung Hành,Kiều Nga

"Mùa xuân hát tình ca" -

1:03

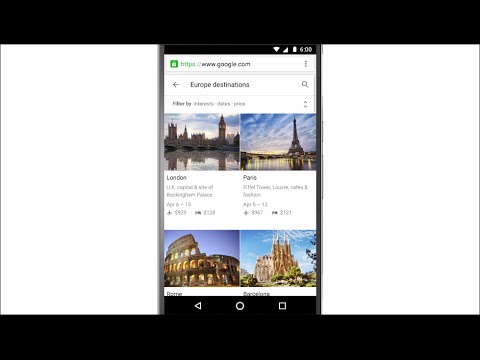

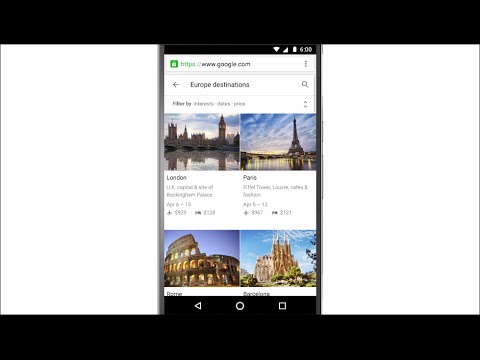

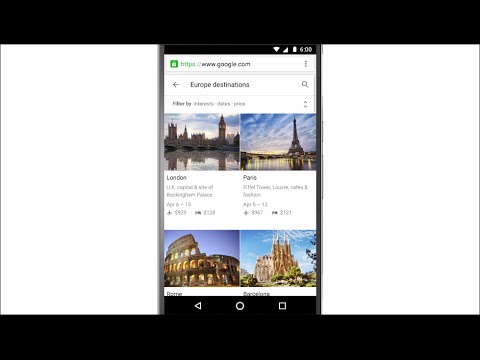

1:03Introducing Destinations on Google

Introducing Destinations on GoogleIntroducing Destinations on Google

Meet Destinations on Google. It's designed to help you discover and plan your perfect vacation on the go by doing the heavy lifting for you. Simply search with Google on your mobile for a state, country, or continent you'd like to travel to and add the word "vacation" or "destination" to get the stuff you need at your fingertips. -

60:40

60:40Liên Khúc Hồ Quang Hiếu Remix Hay Nhất 2016 Tuyển Chọn

Liên Khúc Hồ Quang Hiếu Remix Hay Nhất 2016 Tuyển ChọnLiên Khúc Hồ Quang Hiếu Remix Hay Nhất 2016 Tuyển Chọn

Liên Khúc Nonstop Hồ Quang Hiếu Remix Hay Mới Nhất 2016 2015 tuyển chọn nonstop lien khuc ho quang hieu remix hay moi nhat nhat 2016 2015 tuyen chon ♫ Đăng ký kênh: http://www.youtube.com/subscription_center?add_user=nhacDJvn ♫ Channel Nhạc DJ: http://youtube.com/nhacDJvn ♫ Facebook Page: https://www.facebook.com/nhacdjfc ♫ Playlist Liên Khúc Việt Mix Hay Nhất: http://www.youtube.com/playlist?list=PL2ZbFswbAD-_nfD_3Qy99zw7c1lOBacQE -

![[LIVE] Aznching [20H30] Lien dans la description; updated 09 Mar 2016; published 09 Mar 2016](http://web.archive.org./web/20160310233124im_/http://i.ytimg.com/vi/wGUVduz2nqs/0.jpg) 0:19

0:19[LIVE] Aznching [20H30] Lien dans la description

[LIVE] Aznching [20H30] Lien dans la description[LIVE] Aznching [20H30] Lien dans la description

https://www.twitch.tv/azndark https://www.twitch.tv/azndark https://www.twitch.tv/azndark https://www.twitch.tv/azndark https://www.twitch.tv/azndark https://www.twitch.tv/azndark -

2:49

2:49ニンテンドー3DS『逆転裁判6』2nd プロモーション映像

ニンテンドー3DS『逆転裁判6』2nd プロモーション映像ニンテンドー3DS『逆転裁判6』2nd プロモーション映像

『逆転裁判』シリーズ最新作、『逆転裁判6』が2016年6月9日(木)に発売!! 物語の始まりは神秘と信仰の国、クライン王国。弁護士不在という異国の法廷で、成歩堂龍一が新たな逆転劇を繰り広げる!! 公式サイトでは、PCがあれば『逆転裁判6』が無料で遊べるWEB体験版を公開中! 公式サイト⇒http://www.capcom.co.jp/gyakutensaiban/6/ 逆転裁判6 ■発売日:2016年6月9日(木)予定 ■対応ハード: ニンテンドー3DS ■希望小売価格:パッケージ版 5,800円+税 / ダウンロード版 5,546円+税 ■ジャンル:法廷バトル ■CEROレーティング:B(12才以上対象) ■数量限定特典:遊べる! 逆転劇場 2本セット ■早期購入特典:特選コスチューム 3種パック -

17:36

17:36Tax Lien Investing Pros and Cons

Tax Lien Investing Pros and Cons -

2:52

2:52Super Mario Maker - Key Update!

Super Mario Maker - Key Update!Super Mario Maker - Key Update!

Like Nintendo on Facebook: http://www.facebook.com/Nintendo Follow us on Twitter: http://twitter.com/NintendoAmerica Follow us on Instagram: http://instagram.com/Nintendo Follow us on Pinterest: http://pinterest.com/Nintendo Follow us on Google+: http://google.com/+Nintendo -

6:09

6:09De Jeugd van Tegenwoordig - Tante Lien live

De Jeugd van Tegenwoordig - Tante Lien live -

0:01

0:01VENEZ ! LIEN DANS LA DESCRIPTION !

VENEZ ! LIEN DANS LA DESCRIPTION ! -

7:30

7:30Lien Khuc Tinh Yeu

Lien Khuc Tinh Yeu -

0:00

0:00Live OVERWATCH (LIEN DESCRIPTION)

Live OVERWATCH (LIEN DESCRIPTION)Live OVERWATCH (LIEN DESCRIPTION)

Par soucis technique le Live est ici : https://www.twitch.tv/xeleko -

58:28

58:28Conférence C. Bourguignon : "Garder le lien avec la terre"

Conférence C. Bourguignon : "Garder le lien avec la terre"Conférence C. Bourguignon : "Garder le lien avec la terre"

Congrès des Herboristes (2015) Hypothèse sur le rôle du sol et de sa biologie dans la synthèse des arômes et des substances actives. "Un arbre évapore par ces feuilles, émets des microbes, qui vont entrer en contact avec les nuages qui génère de la pluie. Les forêts régulent le climat. Notre civilisation a peur de la forêt et l'a détruite à souhait. L'arbre tempère le climat et adoucit le climat." Claude Bourguignon, ingénieur agronome fondateur du LAMS (Laboratoire d'Analyse Microbiologique des Sols) Congrès des Herboristes 25 & 26 avril 2015 - Toulouse, Espaces Vanel Connecté par http://www.dFUSION.fr - webcast Capté et réalisé sur site le 25 avril 2015

- Admiralty law

- Adverse possession

- Agistment

- Allodial title

- American English

- Architect

- Assignment (law)

- Bailment

- Bank

- Bankruptcy

- Blackacre

- Board of directors

- Bona fide purchaser

- British English

- Cargo

- Chattel

- Chattel mortgage

- Chose in action

- Common law

- Common-law

- Company (law)

- Concurrent estate

- Condominium

- Contract

- Conveyancing

- Covenant (law)

- Creditor

- Criminal law

- Debt

- Deed

- Defeasible estate

- Demurrage

- Discovery doctrine

- Easement

- Encumbrance

- Enforceable

- Equitable charge

- Equitable conversion

- Equitable servitude

- Equity (law)

- Escheat

- Estate in land

- Estoppel by deed

- Etymological

- Evidence (law)

- Factoring (finance)

- False lien

- Fee simple

- Fee tail

- Floating charge

- Future interest

- Garnishment

- Gift (law)

- HMO

- Hospital

- Hotel

- In rem

- Inchoate lien

- Judgment (law)

- Law

- Lawyer

- Leasehold estate

- Legal remedy

- License

- Lien

- Life estate

- Maritime lien

- Mechanic's lien

- Mortgage law

- Mortgage loan

- Operation of law

- Partition (law)

- Perfection (law)

- Property

- Property law

- Quiet title

- Quitclaim deed

- Real estate

- Real property

- Right of conquest

- Sea

- Security interest

- Ship

- Solicitor

- Solicitor's lien

- Statute

- Strata title

- Subrogation

- Sui generis

- Tax

- Tax lien

- Testator

- Torrens title

- Tort

- Treasure trove

- Trustee

- Trusts and estates

- United States

- Waste (law)

- Will (law)

LieN

ALBUMS

- .hack//Link GAME MUSIC O.S.T. released: 2010

.hack//Link GAME MUSIC O.S.T.

Released 2010- add to main playlist Play in Full Screen Title

- add to main playlist Play in Full Screen Destiny

- add to main playlist Play in Full Screen Kite VS Fluegel

- add to main playlist Play in Full Screen Sea of Memories - First Movement

- add to main playlist Play in Full Screen Obey Me!

- add to main playlist Play in Full Screen Akasha Records

- add to main playlist Play in Full Screen Obsession

- add to main playlist Play in Full Screen Hideout of Schicksa

- add to main playlist Play in Full Screen Trommel

- add to main playlist Play in Full Screen To Beyond an Era

- add to main playlist Play in Full Screen That Name is Sora

- add to main playlist Play in Full Screen AIKA

- add to main playlist Play in Full Screen Stairs of Time

- add to main playlist Play in Full Screen Geist

- add to main playlist Play in Full Screen Sea of Memories - Second Movement

- add to main playlist Play in Full Screen edge

- add to main playlist Play in Full Screen Posaune

- add to main playlist Play in Full Screen Sea of Memories - Third Movement

- add to main playlist Play in Full Screen Silly-Go-Round

- add to main playlist Play in Full Screen Ovan

- add to main playlist Play in Full Screen Coite-Bodher Battlefield Ruins

- add to main playlist Play in Full Screen Orgel

- add to main playlist Play in Full Screen Klarinette

- add to main playlist Play in Full Screen I'm No Hero

- add to main playlist Play in Full Screen The hero of Gear

-

Liên Khúc Nhạc Trữ Tình Remix - Nhạc Vàng Remix Hay Nhất 2016 - Tổng Hợp Gái Xinh - P1

Liên Khúc Nhạc Trữ Tình Remix - Nhạc Vàng Remix Hay Nhất 2016 - Tổng Hợp Gái Xinh - P1 ➤Nhạc Trữ Tình Remix: https://goo.gl/w45wW7 ➤Liên Khúc Nhạc Vàng Remix Hay Nhất : https://goo.gl/W5i6ux ➤ Đăng Ký Kênh Nhạc Trữ Tình Remix: https://goo.gl/bEo9GQ ➤ Fanpage : https://goo.gl/CjeFvB ➤ Maker by: TTmusic ---------------------------------------------------------- -

Live du mercredi soir de 20h30 à 22h (lien dans la description)

lien vers le live : https://www.twitch.tv/fonkyfouine Pour choisir le jeu de ce soir : http://strawpoll.me/7036287 -

LK Tình Yêu 1 2 3 4 Ngọc Lan,Trung Hành,Kiều Nga

"Mùa xuân hát tình ca" -

Introducing Destinations on Google

Meet Destinations on Google. It's designed to help you discover and plan your perfect vacation on the go by doing the heavy lifting for you. Simply search with Google on your mobile for a state, country, or continent you'd like to travel to and add the word "vacation" or "destination" to get the stuff you need at your fingertips. -

Liên Khúc Hồ Quang Hiếu Remix Hay Nhất 2016 Tuyển Chọn

Liên Khúc Nonstop Hồ Quang Hiếu Remix Hay Mới Nhất 2016 2015 tuyển chọn nonstop lien khuc ho quang hieu remix hay moi nhat nhat 2016 2015 tuyen chon ♫ Đăng ký kênh: http://www.youtube.com/subscription_center?add_user=nhacDJvn ♫ Channel Nhạc DJ: http://youtube.com/nhacDJvn ♫ Facebook Page: https://www.facebook.com/nhacdjfc ♫ Playlist Liên Khúc Việt Mix Hay Nhất: http://www.youtube.com/playlist?list=PL2ZbFswbAD-_nfD_3Qy99zw7c1lOBacQE -

[LIVE] Aznching [20H30] Lien dans la description

https://www.twitch.tv/azndark https://www.twitch.tv/azndark https://www.twitch.tv/azndark https://www.twitch.tv/azndark https://www.twitch.tv/azndark https://www.twitch.tv/azndark -

ニンテンドー3DS『逆転裁判6』2nd プロモーション映像

『逆転裁判』シリーズ最新作、『逆転裁判6』が2016年6月9日(木)に発売!! 物語の始まりは神秘と信仰の国、クライン王国。弁護士不在という異国の法廷で、成歩堂龍一が新たな逆転劇を繰り広げる!! 公式サイトでは、PCがあれば『逆転裁判6』が無料で遊べるWEB体験版を公開中! 公式サイト⇒http://www.capcom.co.jp/gyakutensaiban/6/ 逆転裁判6 ■発売日:2016年6月9日(木)予定 ■対応ハード: ニンテンドー3DS ■希望小売価格:パッケージ版 5,800円+税 / ダウンロード版 5,546円+税 ■ジャンル:法廷バトル ■CEROレーティング:B(12才以上対象) ■数量限定特典:遊べる! 逆転劇場 2本セット ■早期購入特典:特選コスチューム 3種パック -

-

Super Mario Maker - Key Update!

Like Nintendo on Facebook: http://www.facebook.com/Nintendo Follow us on Twitter: http://twitter.com/NintendoAmerica Follow us on Instagram: http://instagram.com/Nintendo Follow us on Pinterest: http://pinterest.com/Nintendo Follow us on Google+: http://google.com/+Nintendo -

-

-

-

Live OVERWATCH (LIEN DESCRIPTION)

Par soucis technique le Live est ici : https://www.twitch.tv/xeleko -

Conférence C. Bourguignon : "Garder le lien avec la terre"

Congrès des Herboristes (2015) Hypothèse sur le rôle du sol et de sa biologie dans la synthèse des arômes et des substances actives. "Un arbre évapore par ces feuilles, émets des microbes, qui vont entrer en contact avec les nuages qui génère de la pluie. Les forêts régulent le climat. Notre civilisation a peur de la forêt et l'a détruite à souhait. L'arbre tempère le climat et adoucit le climat." Claude Bourguignon, ingénieur agronome fondateur du LAMS (Laboratoire d'Analyse Microbiologique des Sols) Congrès des Herboristes 25 & 26 avril 2015 - Toulouse, Espaces Vanel Connecté par http://www.dFUSION.fr - webcast Capté et réalisé sur site le 25 avril 2015 -

Final Notice of Commercial Obligation Lien to World Bank/IBRD/IMF

Final Notice of Commercial Obligation Lien to World Bank/IBRD/IMF By: Anna Von Reitz http://www.annavonreitz.com/ Excerpt from Cosmic Voice http://www.blogtalkradio.com/drakebailey -

What makes the Galaxy S7 Waterproof? - Ultimate Test

How is the Samsung Galaxy S7 Water Resistant? What keeps the internal components dry? In this video, I show how each component of the Galaxy S7 can stay dry when submerged under water. The charging port, the headphone jack, the power button, all possible entries of water into this phone are protected. Even thought the phone is 'water resistant' it would not be wise to always trust that it will stay that way. Even a small drop of your device, or a bend in the frame will dislodge a component enough to ruin the iP68 rating. A dry phone is better than a broken phone any day. Better safe than sorry! Here is a cool explanation of the iP 68 rating means, that Samsung achieved with this phone.: http://www.dsmt.com/resources/ip-rating-chart/ The camera I used to film this video: http://amzn.t... -

Le lien corps-esprit

Par Nicolas PROUPAIN -

Sensational Strings: Empathy & Malice | Christen Lien | TEDxBoulder

Think you have heard a viola before? Think again. Christen Lien's incredible performance stitches together strums, plucks, loops, legatos, and staccatos to achieve magical expressive performance art. Travel to another world with us. Christen Lien is a contemporary, classically infused multi-instrumentalist who creates an innovative brand of musical storytelling. She performs original compositions primarily on viola that are a beautiful mixture of musical traditions and innovative acoustic and electronic sounds. Lien incorporates the use of guitar effect processors and looping pedals with her instruments (which also include bass guitar, harmonica, Moog synthesizer, drums and kalimba), creating hybrid, melodic music and haunting, evocative performance art. Lien’s music has been used in the ... -

Tax Sales and Tax Liens - Pros and Cons of Investing in a Tax Sale/Lien

http://www.REIClub.com - Are Tax Sales a Good Investment For Real Estate Investors? Here Is A Quick Video On The Pros And Cons Of Investing in a Tax Sale Hi, this is Frank Chen with REIClub.com, the only site you need as a real estate investor. Today I've got quick video on the Pros and Cons of Investing in Tax Sale Properties. Tax Sale vs. Tax Lien - Tax Lien: A lien in general is a claim or security of interest placed on personal property to secure the repayment of debt. Therefore, a tax lien is a lien imposed by Federal or state law to secure payment of back taxes. As the investor: You buy the rights to the money owed in taxes and the interest and penalties that have accrued. - Tax Sale: (also known as a a 'Tax Deed Sale') Refers to property, in this case real estate, b... -

Lien Le Zap de Spi0n n°302

Le Zap : https://www.youtube.com/watch?v=40ENeAqqXEw La nouvelle chaÎne : https://www.youtube.com/channel/UC8FM2r1gQOanIRpPZ0ikO6w Abonnez-vous : http://www.youtube.com/subscription_center?add_user=Spi0nd0tcom Website : http://www.spi0n.com/ Twitter : http://www.twitter.com/Spi0n Facebook : http://www.facebook.com/Spi0n iPhone Application Spi0n : http://itunes.apple.com/fr/app/id491157710 -

Why I like Tax Deed Investing Vs Tax Lien Investing

http://www.thelandgeek.com In this episode I discuss why I like tax deed investing versus tax lien investing. You can also download my free report at http://www.3fatallandbuyingmistakes.com. Subscribe to the free weekly podcast on iTunes here-- http://bit.ly/1boXTsy Want to learn how to flip land? Get Art of The Land Flip today for $5 at http://fiverr.com/landgeek/teach-you-how-to-flip-land-for-quick-profits. Invest in Wholesale land at http://www.frontierpropertiesusa.com http://youtu.be/ttO8r2rRmPI -

ニンテンドー3DS『逆転裁判6』特典紹介プロモーション映像

『逆転裁判』シリーズ最新作、『逆転裁判6』が2016年6月9日(木)に発売!! 物語の始まりは神秘と信仰の国、クライン王国。弁護士不在という異国の法廷で、成歩堂龍一が新たな逆転劇を繰り広げる!! 公式サイトでは、PCがあれば『逆転裁判6』が無料で遊べるWEB体験版を公開中! 公式サイト⇒http://www.capcom.co.jp/gyakutensaiban/6/ 逆転裁判6 ■発売日:2016年6月9日(木)予定 ■対応ハード: ニンテンドー3DS ■希望小売価格:パッケージ版 5,800円+税 / ダウンロード版 5,546円+税 ■ジャンル:法廷バトル ■CEROレーティング:B(12才以上対象) ■数量限定特典:遊べる! 逆転劇場 2本セット ■早期購入特典:特選コスチューム 3種パック -

『ドラゴンクエストモンスターズ ジョーカー3』プロモーション映像②

ニンテンドー3DS用ソフト『ドラゴンクエストモンスターズ ジョーカー3』のプロモーション映像②です。 『ドラゴンクエストモンスターズ ジョーカー3』公式サイト http://www.dragonquest.jp/dqm-j3/ === この動画は株式会社スクウェア・エニックスを代表とする共同著作者が権利を所有する著作物を利用しております。また、動画に使用されている楽曲はスギヤマ工房有限会社が権利を所有する著作物です。権利者の許諾を得ることなく当該動画および楽曲を二次利用することを禁止いたします。 ===

Liên Khúc Nhạc Trữ Tình Remix - Nhạc Vàng Remix Hay Nhất 2016 - Tổng Hợp Gái Xinh - P1

- Order: Reorder

- Duration: 83:03

- Updated: 07 Jan 2016

- views: 4078965

- published: 07 Jan 2016

- views: 4078965

Live du mercredi soir de 20h30 à 22h (lien dans la description)

- Order: Reorder

- Duration: 0:21

- Updated: 09 Mar 2016

- views: 262

- published: 09 Mar 2016

- views: 262

LK Tình Yêu 1 2 3 4 Ngọc Lan,Trung Hành,Kiều Nga

- Order: Reorder

- Duration: 132:36

- Updated: 17 Mar 2014

- views: 6314458

- published: 17 Mar 2014

- views: 6314458

Introducing Destinations on Google

- Order: Reorder

- Duration: 1:03

- Updated: 09 Mar 2016

- views: 5769

- published: 09 Mar 2016

- views: 5769

Liên Khúc Hồ Quang Hiếu Remix Hay Nhất 2016 Tuyển Chọn

- Order: Reorder

- Duration: 60:40

- Updated: 02 Oct 2014

- views: 9396442

- published: 02 Oct 2014

- views: 9396442

[LIVE] Aznching [20H30] Lien dans la description

- Order: Reorder

- Duration: 0:19

- Updated: 09 Mar 2016

- views: 609

- published: 09 Mar 2016

- views: 609

ニンテンドー3DS『逆転裁判6』2nd プロモーション映像

- Order: Reorder

- Duration: 2:49

- Updated: 06 Mar 2016

- views: 4000

- published: 06 Mar 2016

- views: 4000

Tax Lien Investing Pros and Cons

- Order: Reorder

- Duration: 17:36

- Updated: 20 Dec 2013

- views: 41925

Super Mario Maker - Key Update!

- Order: Reorder

- Duration: 2:52

- Updated: 08 Mar 2016

- views: 14306

- published: 08 Mar 2016

- views: 14306

De Jeugd van Tegenwoordig - Tante Lien live

- Order: Reorder

- Duration: 6:09

- Updated: 11 Apr 2011

- views: 174700

VENEZ ! LIEN DANS LA DESCRIPTION !

- Order: Reorder

- Duration: 0:01

- Updated: 09 Mar 2016

- views: 61

Lien Khuc Tinh Yeu

- Order: Reorder

- Duration: 7:30

- Updated: 10 Oct 2008

- views: 1495203

Live OVERWATCH (LIEN DESCRIPTION)

- Order: Reorder

- Duration: 0:00

- Updated: 09 Mar 2016

- views: 0

Conférence C. Bourguignon : "Garder le lien avec la terre"

- Order: Reorder

- Duration: 58:28

- Updated: 21 Jun 2015

- views: 49567

- published: 21 Jun 2015

- views: 49567

Final Notice of Commercial Obligation Lien to World Bank/IBRD/IMF

- Order: Reorder

- Duration: 42:38

- Updated: 31 Jan 2016

- views: 5117

- published: 31 Jan 2016

- views: 5117

What makes the Galaxy S7 Waterproof? - Ultimate Test

- Order: Reorder

- Duration: 3:27

- Updated: 05 Mar 2016

- views: 149800

- published: 05 Mar 2016

- views: 149800

Le lien corps-esprit

- Order: Reorder

- Duration: 77:07

- Updated: 24 Sep 2012

- views: 19565

- published: 24 Sep 2012

- views: 19565

Sensational Strings: Empathy & Malice | Christen Lien | TEDxBoulder

- Order: Reorder

- Duration: 18:42

- Updated: 05 Oct 2015

- views: 2633

- published: 05 Oct 2015

- views: 2633

Tax Sales and Tax Liens - Pros and Cons of Investing in a Tax Sale/Lien

- Order: Reorder

- Duration: 6:12

- Updated: 08 Sep 2011

- views: 55062

- published: 08 Sep 2011

- views: 55062

Lien Le Zap de Spi0n n°302

- Order: Reorder

- Duration: 0:16

- Updated: 06 Mar 2016

- views: 1019

- published: 06 Mar 2016

- views: 1019

Why I like Tax Deed Investing Vs Tax Lien Investing

- Order: Reorder

- Duration: 2:53

- Updated: 28 Oct 2013

- views: 11650

- published: 28 Oct 2013

- views: 11650

ニンテンドー3DS『逆転裁判6』特典紹介プロモーション映像

- Order: Reorder

- Duration: 2:18

- Updated: 06 Mar 2016

- views: 21030

- published: 06 Mar 2016

- views: 21030

『ドラゴンクエストモンスターズ ジョーカー3』プロモーション映像②

- Order: Reorder

- Duration: 4:50

- Updated: 09 Mar 2016

- views: 7963

- published: 09 Mar 2016

- views: 7963

-

lien khuc nhac che 2016

-

-

♥J'ouvre un lien♥

♡ Déroule la barre d'info pour plus d'info ♡ ................................................................................................................................. Alors vous avez aimé ? Dites moi tout en commentaire. ♡ .................................................................................................................. ♡Mes réseaux sociaux♡ ››Google + : Stéphanie de msp ››Hangouts : Stéphanie de msp ››Twitter: https://twitter.com/bellatika2016 .................................................................................................................................... N'hésitez pas a vous abonner pour être au courant de mes nouvelles vidéos ✌ Je vous aime. ♡ Steph ♡ -

VIDEO Nguyen Th Bich Lien Nho Quan Ninh Binh

video_details -

-

-

Kiem cua dai ca vinh chi tiet lien he 01692540790

Hfhdygjudtdchduh -

【 Le Lien 】 みんなー!Le Lienと語ろう!の会【2016,03,03】

2016/03/10 音ズレあります。 LeLien オフィシャルサイト http://www.lelien.jp/ -

Ban acc truy kich sieu re lien he 0988635896

-

Lien khuc nhac tre buon va tam trang

Khac hung 2016 -

Top Tax Lien Mistakes

-

DJ Nonstop Remix Nhac Tre Lien Khuc -Tuyen Chon Xuat Sac Nhat 2016 (PART 01)

DJ Nonstop Remix Nhac Tre Lien Khuc -Tuyen Chon Xuat Sac Nhat 2016 (PART 01) kikilu girl beautiful hoi cau do kho -ai tra loi duoc tiep theo la vay do Xuất bản 8 thg 3, 2016 Tong Lien Khuc kikilu nonstop remix Nhac San Tuyen Chon Gai Xinh Nhay Cuc Hay https://youtu.be/1SSuRHNpMccdj nonstop remix nhac tre tuyen chon oi dong nhat trong thoi dai kikilu remix VN Hot New -Nhac chon tuyen chon VN hay nhat kikilu khmer song remix hot news kikilu khmer music remix news love https://youtu.be/tnL8rJUQyLQ https://youtu.be/xXCsmr7Jiwk kikilu khmer remix hot news khmer song - I love You Knhum nuerk Neak + kom los yem yom kro mom yeh yav khmer song -Chkea Krong Chkae Srae -Yub Nis Oun Uop Neak Na,Peak me https://youtu.be/_wDh9ssP_No https://youtu.be/s2TdFuTy4mQ kikilu khmer remix hot khmer tra vinhK... -

League of Legends 2016 03 02 19 lien minh huyen thoai - lmht

lien minh huyen thoai - lmht -

lien minh huyen thoai - lmht

lien minh huyen thoai - lmht -

Lien N3

-

Lien N1

-

Lien N2

-

Lien N7

-

Lien N5

-

Lien N6

-

Lien N4

-

Karl-Heinz Schäfer - Le lien (extrait de la musique du film "Les Gants Blancs du Diable")

✔ Abonnez-vous à Ciné Music Club → http://bit.ly/1JOo9CO ⇓ Téléchargez la BO sur iTunes → https://itunes.apple.com/album/id320428231 ♫ Ecoutez la Bande Originale complète → https://www.youtube.com/watch?v=ao-ScEqL4ZU&list;=PLzhk329J-YhJF-CbLATuGwLRbG5GXVP74 -

01 lien hoan

lien khuc nhac che 2016

- Order: Reorder

- Duration: 3:51

- Updated: 10 Mar 2016

- views: 0

- published: 10 Mar 2016

- views: 0

nicole aniston gym ass sexy( click in a lien)

- Order: Reorder

- Duration: 0:50

- Updated: 10 Mar 2016

- views: 2

♥J'ouvre un lien♥

- Order: Reorder

- Duration: 1:34

- Updated: 10 Mar 2016

- views: 1

- published: 10 Mar 2016

- views: 1

VIDEO Nguyen Th Bich Lien Nho Quan Ninh Binh

- Order: Reorder

- Duration: 10:40

- Updated: 10 Mar 2016

- views: 0

- published: 10 Mar 2016

- views: 0

Clash of Clans Générateur Lien dans la description

- Order: Reorder

- Duration: 0:55

- Updated: 10 Mar 2016

- views: 0

COC Générateur HD Lien dans la description

- Order: Reorder

- Duration: 0:51

- Updated: 10 Mar 2016

- views: 0

Kiem cua dai ca vinh chi tiet lien he 01692540790

- Order: Reorder

- Duration: 4:33

- Updated: 10 Mar 2016

- views: 1

- published: 10 Mar 2016

- views: 1

【 Le Lien 】 みんなー!Le Lienと語ろう!の会【2016,03,03】

- Order: Reorder

- Duration: 54:22

- Updated: 10 Mar 2016

- views: 5

Ban acc truy kich sieu re lien he 0988635896

- Order: Reorder

- Duration: 1:08

- Updated: 10 Mar 2016

- views: 1

- published: 10 Mar 2016

- views: 1

Lien khuc nhac tre buon va tam trang

- Order: Reorder

- Duration: 49:55

- Updated: 10 Mar 2016

- views: 3

- published: 10 Mar 2016

- views: 3

Top Tax Lien Mistakes

- Order: Reorder

- Duration: 0:05

- Updated: 10 Mar 2016

- views: 0

- published: 10 Mar 2016

- views: 0

DJ Nonstop Remix Nhac Tre Lien Khuc -Tuyen Chon Xuat Sac Nhat 2016 (PART 01)

- Order: Reorder

- Duration: 45:43

- Updated: 10 Mar 2016

- views: 4

- published: 10 Mar 2016

- views: 4

League of Legends 2016 03 02 19 lien minh huyen thoai - lmht

- Order: Reorder

- Duration: 12:53

- Updated: 10 Mar 2016

- views: 2

- published: 10 Mar 2016

- views: 2

lien minh huyen thoai - lmht

- Order: Reorder

- Duration: 7:35

- Updated: 10 Mar 2016

- views: 0

- published: 10 Mar 2016

- views: 0

Lien N3

- Order: Reorder

- Duration: 1:00

- Updated: 10 Mar 2016

- views: 1

- published: 10 Mar 2016

- views: 1

Lien N1

- Order: Reorder

- Duration: 1:36

- Updated: 10 Mar 2016

- views: 6

- published: 10 Mar 2016

- views: 6

Lien N2

- Order: Reorder

- Duration: 1:52

- Updated: 10 Mar 2016

- views: 3

- published: 10 Mar 2016

- views: 3

Lien N7

- Order: Reorder

- Duration: 3:35

- Updated: 10 Mar 2016

- views: 1

- published: 10 Mar 2016

- views: 1

Lien N5

- Order: Reorder

- Duration: 1:41

- Updated: 10 Mar 2016

- views: 1

- published: 10 Mar 2016

- views: 1

Lien N6

- Order: Reorder

- Duration: 2:11

- Updated: 10 Mar 2016

- views: 1

- published: 10 Mar 2016

- views: 1

Lien N4

- Order: Reorder

- Duration: 1:31

- Updated: 10 Mar 2016

- views: 1

- published: 10 Mar 2016

- views: 1

Karl-Heinz Schäfer - Le lien (extrait de la musique du film "Les Gants Blancs du Diable")

- Order: Reorder

- Duration: 1:19

- Updated: 10 Mar 2016

- views: 0

01 lien hoan

- Order: Reorder

- Duration: 7:19

- Updated: 10 Mar 2016

- views: 1

- published: 10 Mar 2016

- views: 1

-

Liên Khúc Tuấn Vũ trọn bộ FULL

Download từng bài tại đây: http://nhacso.net/nghe-playlist/lien-khuc-tuan-vu.X11ZUUBa.html Tracklist: Ai Cho Tôi Tinh Yêu (Trúc Phương) Biệt Kinh Kỳ (Minh Kỳ) Gió Cuốn Mây Bay (Việt Phương) Xin Thời Gian Qua Mau (Lam Phương) Người Ngoài Phố (Anh Việt Thu) Sao Em Nỡ Vô Tình (Nguyễn Hữu Sáng) Kể Chuyện Trong Đêm (Hoàng Trang) Mười Năm Tái Ngộ (Thanh Sơn) Giọt Lệ Đài Trang (Châu Kỳ) Trăm Mến Ngàn Thương (Hoài Linh) Trường Cũ Tình Xưa (Thanh Sơn) Thành Phố Mưa Bay (Bằng Giang) Hai Vì Sao Lạc (Anh Việt Thu) Bài Tango Cho Em (Lam Phương) Chỉ Có Em (Lam Phương) Để Quên Con Tim (Đức Huy) Vĩnh biệt (Lam Phương) Ngày Sau Sẽ Ra Sao (Minh Kỳ & Lê Dinh) Mưa nửa đêm (Trúc Phương) Ngày Mai Tôi Về Ai Cho Tôi Tinh Yêu (Trúc Phương) Bông Cỏ May (Trúc Phương) Kiếp Cầm Ca (Huỳnh Anh) Nếu Anh Về Bên Em (Huỳ... -

Liên Khúc Nhạc Trẻ Hay Nhất 2015 Nonstop - Việt Mix - V.I.P - Bass Căng Đốt Cháy Cây Xăng

Liên Khúc Nhạc Trẻ Hay Nhất 2015 Nonstop - Việt Mix - V.I.P - Bass Căng Đốt Cháy Cây Xăng Xem Video Khác : http://goo.gl/wQDcJg Fanpage: https://www.facebook.com/RAPVN2 Link Mp3: http://bit.ly/13U97sd --------------------------------------- TRACK LIST: 01. Thời Gian Sẽ Trả Lời 02. Vừa Đi Vừa Khóc 03. Sự Thật Sau Một Lời Hứa 04. Quên Người Đã Quá Yêu 05. Nắng Ấm Xa Dần 06. Ký Ức Còn Đâu 07. Thói Quen Của Anh 08. Nếu Có Quay Về 09. Đến Khi Nào 10. Cơn Mưa Ngang Qua 11. Anh Nhớ Em Người Yêu Cũ 12. Anh Xin Lỗi 13. Nơi Đâu Tìm Thấy Em 14. Thu Cuối 15. Tìm Em 16. Tình Yêu Khép Lại 17. Anh Yêu Người Khác Rồi 18. Nhìn Lại Anh Em Nhé 19. Yêu Thương Quay Về 20. Cơn Đau Cuối Cùng 21. Có Anh Ở Đây Rồi 22. Đắng Lòng 23. Tìm 24. Yêu Em Là Định Mệnh 25. Anh Nhớ Em 26. Vợ Yêu... -

Liên Khúc Nhạc Trẻ Hay Nhất 2015 Nonstop - Việt Mix - H.O.T - Căng Xung Tuyệt Đối

Liên Khúc Nhạc Trẻ Hay Nhất 2015 Nonstop - Việt Mix - H.O.T - Căng Xung Tuyệt Đối Xem Video Khác : http://goo.gl/wQDcJg Fanpage: https://www.facebook.com/RAPVN2 Link Mp3: http://bit.ly/1D02Kj2 --------------------------------------- TRACK LIST: 01. Người Đã Yêu Ai 02. Quên Người Đã Quá Yêu 03. Vừa Đi Vừa Khóc 04. Không Quan Tâm 05. Sự Thật Sau Một Lời Hứa 06. Giấc Mơ Không Phải Anh 07. Hối Hận Trong Anh 08. Chia Đôi Con Đường 09. Chỉ Yêu Mình Em 10. Có Khi Nào Rời Xa 11. Điều Ngọt Ngào Nhất 12. Cứ Thế Mong Chờ 13. Khi Phải Quên Đi 14. Quên 15. Ước Mưa 16. Thu Cuối 17. Chính Là Anh 18. Chỉ Còn Trong Mơ 19. Em Làm Gì Tối Nay 20. Dân Chơi 21. Mambo Italiano 22. Chỉ Riêng Mình Ta -

Liên Khúc Nhạc Trẻ Remix Hay Nhất 2016 Nonstop - ViệtMix - Gái Xinh Lung Linh ( P. 1 )

► Xem Nhiều Hơn Tại Đây: https://goo.gl/y6WQEx -

lien khuc nhac xuan remix 2016 Những Ca Khúc Nhạc Xuân Hay Nhất 2016

lien khuc nhac xuan remix 2016 Những Ca Khúc Nhạc Xuân Hay Nhất 2016 --------------------------------------- TracK List : 01. Lắng Nghe Mùa Xuân Về 02. Đón Xuân Này Nhớ Xuân Xưa 03. Thì Thầm Mùa Xuân 04. Đón Xuân 05. Thần Tài Đến 06. Xuân Họp Mặt 07. Xuân Yêu Thương 08. Khúc Giao Mùa 09. Bài Ca Tết Cho Em 10. Xuân Này Con Không Về 11. Trường Sơn Đông Trường Sơn Tây 12. Bay 13. Lắng Nghe Mùa Xuân Về 14. Đoản Xuân Ca 15. Khúc Giao Mùa 16. Xuân Họp Mặt 17. Thần Tài Đến 18. Thì Thầm Mùa Xuân -

.hack//シリーズ 三谷朋世(LieN)の歌う全曲集 (G.U. TRILOGY Link).mp4

-

Mr.Bolero Dance - Quách Tuấn Du

POPS Music - Kênh âm nhạc trực tuyến hàng đầu Việt Nam. Follow POPS Music: ♫ Subscribe: https://www.youtube.com/user/POPSVIETNAM?sub_confirmation=1 ♫ Website: http://www.pops.vn ♫ Facebook : https://www.facebook.com/popsvietnamchannel ♫ Google Plus : https://plus.google.com/+PopsVnpage ♫ Apps: http://company.pops.vn/popsworldwide/vietnam/music/games-apps POPS Music là kênh giải trí âm nhạc trực tuyến lớn nhất tại Việt Nam. Giới thiệu đến người xem những sản phẩm mới và hot nhất thị trường âm nhạc hiện nay. Hãy đồng hành cùng chúng tôi để thưởng thức những sản phẩm âm nhạc tuyệt vời nhất. -

-

-

Nhạc đánh LIÊN MINH phần 1- Nhac danh lien minh phan 1- Cập nhập

Nhạc đánh LIÊN MINH phần 1- Nhac danh lien minh phan 1- Cập nhập Tải nhạc : https://goo.gl/5M9xSe Các bạn đã biết đến kênh của mình với bài" lien minh phan 1" hay "nhac lien minh" hay "lien minh phan 3" và giờ mình đưa ra bản cập nhập của mình " Nhạc đánh LIÊN MINH phần 1- Nhac danh lien minh phan 1- Cập nhập". Nếu thích video này, các bạn hoàn toàn có thể tìm thấy video bằng cách seach trên youtube.com hoặc google.com với nội dung: "Nhạc đánh liên minh phần 1- Cập nhập". và sau đó click vào video. Giới thiệu về nội dung, thì đây là nhạc đánh liên minh giống với bản phần một gồm những bài hát: 1, Alan Walker - Fade 2, Alan Walker - Spectre 3, TheFatRat - Unity 4, TheFatRat – Windfall 5, Kuba Oms - My love tuy nhiên khác ở chỗ tốc độ của nó là 1.25 theo yêu cầu của các thành viên đã đăng k... -

LIEN KHUC CHIEU MUA 3 - LIEN KHUC NHAC VANG HAI NGOAI

LIEN KHUC CHIEU MUA 3 - LIEN KHUC NHAC VANG HAI NGOAI Lien khuc chieu mua 3, Liên khúc chiều mưa 3, năm 2002, Lk chuyen hoa sim 1-2-3-4, Lien khuc chieu mua 1,2,3,4, nhac vang, nhac tru tinh, nhac hay nhat, ca nhac hay nhat, am nhac ket noi, lien khuc nhac song, lien khuc nhac khong loi, nhac que huong, nhac dong que, lk chuyen hoa sim, lk hoa sim, lien khuc hoa sim, chieu mua 1-2-3-4, Độ nét cao FULL HD 1280x720p -

[05.03.2016] SAJ vs BM [CCCS 2016 Mùa Xuân]

Vietnam Esports (vetv.vn) là đơn vị duy nhất giữ bản quyền sản xuất toàn bộ giải đấu chuyên nghiệp LMHT tại VN. VETV7 là kênh truyền hình thể thao điện tử trực thuộc Vietnam Esports TV. VETV7 cung cấp toàn bộ các trận đấu chuyên nghiệp LMHT trên toàn thế giới như LCK, LPL, LMS, LCS và VCS A. Hãy subscribe để đừng bỏ lỡ những trận đấu thể thao điện tử hấp dẫn nhất nhé. Để thưởng thức thêm các chương trình thú vị, đặc sắc về eSports, các bạn vui lòng truy cập: http://vetv.vn. VETV sẽ phát sóng trực tiếp trên hệ thống cáp HTV Thể Thao từ thứ 4 đến chủ nhật hàng tuần từ 15h - 18h các trận đấu trong khuôn khổ giải King of SEA và Coca Cola Championship Serie của LMHT. Facebook: https://www.facebook.com/vnesportstv Liên Minh Huyền Thoại Facebook: https://www.facebook.com/LienMinhHuyenThoai... -

Liên Khúc Nhạc Trẻ Remix Hay Nhất Tháng 3 2016 | LK Nhạc Trẻ Remix | Lk nhac tre remix 2015 (19)

Liên Khúc Nhạc Trẻ Remix Hay Nhất Tháng 3 2016 | LK Nhạc Trẻ Remix | Lk nhac tre remix 2015 (19) ----------------------------------------------- Track List : 01. Em Của Quá Khứ 02. Cứ Thế Mong Chờ 03. Chưa Bao Giờ 04. Thất Tình 05. Tội Cho Cô Gái Đó 06. Nếu Em Còn Tồn Tại 07. Dưới Những Cơn Mưa 08. Tâm Sự Với Người Lạ 09. Vô Tình Trong Tim Em 10. Yêu Em 11. Hold Me Tonight 12. Khi Phải Quên 13. Nỗi Đau Nhẹ Nhàng 14. Hãy Tin Anh Lần Nữa 15.Xin Lỗi Anh Sẽ Ra Đi 16. Tân Sự Với Người Lạ 17. Như Ngày Hôm Qua 18. Ăn Gì Đây 19. Đừng Bắt Anh Mạnh Mẽ 20. Lời Hứa Em Đã Quên 21. Còn Nhiều -

Bản nhạc EDM hay nhất - Nhac Choi Game Lien Minh Huyen Thoai

► Nhạc chơi game LMHT hay nhất : Alan Walker - Fade [NCS Release] - 1 Tiếng . ► Hi mọng Young Music And Free Flow sẽ đem lại sự thoải mái và phiêu linnh nhất cho các bạn khi vừa choi game lien minh vừa nghe các bản nhạc edm hay nhat 2015 . ► Link down bản mp3 về máy : http://goo.gl/nk8ycO NCS ► Spotify http://bit.ly/SpotifyNCS ► SoundCloud http://soundcloud.com/nocopyrightsounds ► Facebook http://facebook.com/NoCopyrightSounds ► Twitter http://twitter.com/NCSounds ►Google+ http://google.com/+nocopyrightsounds ► Instagram http://instagram.com/nocopyrightsounds_ Alan Walker ► Facebook https://www.facebook.com/DJWalkzz ► SoundCloud https://soundcloud.com/walkzz ► Twitter https://twitter.com/IAmAlanWalker ► YouTube https://www.youtube.com/user/DjWalkzz Hình nền : xrazerxd.deviantart.com -

Liên Khúc Nhạc Trẻ Remix Hay Nhất Tháng 1 2016 - Nonstop Việt Mix - LK Nhạc Trẻ Remix Hay 2016

Liên Khúc Nhạc Trẻ Remix Hay Nhất Tháng 1 2016 - Nonstop Việt Mix - LK Nhạc Trẻ Remix Hay 2016 ------------------------------------------ TracK List : 01. Khi nỗi đau quá lớn 02. Quên người đã quá yêu 03. Yêu em nhưng không với tới 04. Có anh ở đây rồi 05. Nắm chặt tay anh 06. Làm vợ anh nhé 07. Để anh rời xa 08. Chia tay để em bình yên 09. Chợt Nhận Ra 10. Xóa Tên Anh 11. Làm Vợ Anh Nhé 12. Điều Ngọt Ngào Nhất 13. Tan Theo Mưa Bay 14. Cơn Mưa Nước Mắt 15. Anh Buông Rồi Đó Em Đi Đi 16. Dối Lừa 17. Gã Điên Cua Gái 18. Em Là Gì Trong Anh 19. Em Phải Sống Thế Nào 20. Có Không Giữ Mất Đừng Tìm 21. Vợ Người Ta 22. Biết Nói Là Tại Sao -

Nhac Choi game Lien Minh Huyen Thoai - Album Nhạc EDM dành cho game thủ

► Nhạc chơi game LMHT hay nhất : Alan Walker - Spectre [NCS Release] - 1 Tiếng - Album nhạc EDM dành cho game thủ . ► Hi mọng Young Music And Free Flow sẽ đem lại sự thoải mái và phiêu linnh nhất cho các bạn khi vừa choi game lien minh vừa nghe các bản nhạc edm hay nhat 2015 . ► Link mp3 : http://goo.gl/mwuskU NCS ► Spotify http://bit.ly/SpotifyNCS ► SoundCloud http://soundcloud.com/nocopyrightsounds ► Facebook http://facebook.com/NoCopyrightSounds ► Twitter http://twitter.com/NCSounds ►Google+ http://google.com/+nocopyrightsounds ► Instagram http://instagram.com/nocopyrightsounds_ Alan Walker ► Facebook https://www.facebook.com/DJWalkzz ► SoundCloud https://soundcloud.com/walkzz ► Twitter https://twitter.com/IAmAlanWalker ► YouTube https://www.youtube.com/user/DjWalkzz -

Lien Khuc Nhac Tru Tinh Que Huong Remix || Nhac Que Huong Hay Nhat Nam 2015 || Nhac Tru Tinh Remix

Lien Khuc Nhac Tru Tinh Que Huong Remix || Nhac Que Huong Hay Nhat Nam 2015 || Nhac Tru Tinh Remix Âm nhạc là cuộc sống, Hãy đăng ký ngay bây giờ để nhận được tất cả âm nhạc mới nhất hiện nay: https://www.youtube.com/channel/UCfpk9AYYRI0QoQOqnMr5noA/videos ------------------------------ Các bạn có thể trao đổi nhận xét bằng cách comment dưới video để mình hỗ trợ được tốt hơn. Rất mong được sự ủng hộ từ các bạn, Chúc các bạn nghe nhạc Vui vẻ & Hạnh Phúc bên người mình thân yêu nhé. ------------------------------ MTV Music Remix Dance Dj Nonstop Cám Ơn! -

Thuy Nga Lien Khuc Tinh Collections DVDrip YouTube

-

-

Liên khúc nhạc trữ tình quê hương miền tây remix đặc sắc nhất – Đậm chất miền tây [Full HD 320kbps]

Liên khúc nhạc trữ tình quê hương miền tây remix đặc sắc nhất – Đậm chất miền tây [Full HD 320kbps] Bạn đang xem tại: http://www.youtube.com/c/MTVMusicRemixDanceDjNonstopChatLuongCao GG+: https://plus.google.com/+MTVMusicRemixDanceDjNonstopChatLuongCao FB: https://www.facebook.com/MTVMusicRemix Twitter: https://twitter.com/MTVMusicRemix =):): ): Đăng Ký (Subscribe) ngay, Để nhận được nội dung mới nhất từ chúng tôi. + Các bạn có thể trao đổi nhận xét bằng cách comment dưới videos để chúng tôi hỗ trợ được tốt hơn, Cảm ơn. + Rất mong nhận được sự ủng hộ từ các bạn, Chúc các bạn có những giây phút giải trí thật vui vẻ và hạnh phúc. ------------------------------ MTV Music – Remix Dance Dj Nonstop Cảm Ơn ): !!!

Liên Khúc Tuấn Vũ trọn bộ FULL

- Order: Reorder

- Duration: 214:52

- Updated: 15 May 2014

- views: 5122695

- published: 15 May 2014

- views: 5122695

Liên Khúc Nhạc Trẻ Hay Nhất 2015 Nonstop - Việt Mix - V.I.P - Bass Căng Đốt Cháy Cây Xăng

- Order: Reorder

- Duration: 116:20

- Updated: 08 Nov 2014

- views: 11567661

- published: 08 Nov 2014

- views: 11567661

Liên Khúc Nhạc Trẻ Hay Nhất 2015 Nonstop - Việt Mix - H.O.T - Căng Xung Tuyệt Đối

- Order: Reorder

- Duration: 86:33

- Updated: 27 Dec 2014

- views: 4308867

- published: 27 Dec 2014

- views: 4308867

Liên Khúc Nhạc Trẻ Remix Hay Nhất 2016 Nonstop - ViệtMix - Gái Xinh Lung Linh ( P. 1 )

- Order: Reorder

- Duration: 90:22

- Updated: 07 Jul 2015

- views: 6723809

- published: 07 Jul 2015

- views: 6723809

lien khuc nhac xuan remix 2016 Những Ca Khúc Nhạc Xuân Hay Nhất 2016

- Order: Reorder

- Duration: 115:52

- Updated: 12 Dec 2015

- views: 761475

- published: 12 Dec 2015

- views: 761475

.hack//シリーズ 三谷朋世(LieN)の歌う全曲集 (G.U. TRILOGY Link).mp4

- Order: Reorder

- Duration: 49:26

- Updated: 08 Jul 2013

- views: 134739

- published: 08 Jul 2013

- views: 134739

Mr.Bolero Dance - Quách Tuấn Du

- Order: Reorder

- Duration: 68:44

- Updated: 03 Jun 2015

- views: 10220498

- published: 03 Jun 2015

- views: 10220498

Lien khuc Che Linh - Truong Vu - Duy Khanh - Tuan Ngoc || Lien khuc nhac vang chon loc

- Order: Reorder

- Duration: 112:53

- Updated: 26 Jul 2015

- views: 209699

Thu Dam Uy Long-ly lien kiet{ruacon}

- Order: Reorder

- Duration: 100:55

- Updated: 18 Mar 2013

- views: 55712

Nhạc đánh LIÊN MINH phần 1- Nhac danh lien minh phan 1- Cập nhập

- Order: Reorder

- Duration: 60:07

- Updated: 09 Dec 2015

- views: 59536

- published: 09 Dec 2015

- views: 59536

LIEN KHUC CHIEU MUA 3 - LIEN KHUC NHAC VANG HAI NGOAI

- Order: Reorder

- Duration: 44:54

- Updated: 05 Jun 2015

- views: 23501

- published: 05 Jun 2015

- views: 23501

[05.03.2016] SAJ vs BM [CCCS 2016 Mùa Xuân]

- Order: Reorder

- Duration: 57:47

- Updated: 05 Mar 2016

- views: 12952

- published: 05 Mar 2016

- views: 12952

Liên Khúc Nhạc Trẻ Remix Hay Nhất Tháng 3 2016 | LK Nhạc Trẻ Remix | Lk nhac tre remix 2015 (19)

- Order: Reorder

- Duration: 117:03

- Updated: 05 Mar 2016

- views: 662

- published: 05 Mar 2016

- views: 662

Bản nhạc EDM hay nhất - Nhac Choi Game Lien Minh Huyen Thoai

- Order: Reorder

- Duration: 61:37

- Updated: 14 Aug 2015

- views: 390361

- published: 14 Aug 2015

- views: 390361

Liên Khúc Nhạc Trẻ Remix Hay Nhất Tháng 1 2016 - Nonstop Việt Mix - LK Nhạc Trẻ Remix Hay 2016

- Order: Reorder

- Duration: 116:17

- Updated: 19 Dec 2015

- views: 1376043

- published: 19 Dec 2015

- views: 1376043

Nhac Choi game Lien Minh Huyen Thoai - Album Nhạc EDM dành cho game thủ

- Order: Reorder

- Duration: 61:22

- Updated: 15 Aug 2015

- views: 99510

- published: 15 Aug 2015

- views: 99510

Lien Khuc Nhac Tru Tinh Que Huong Remix || Nhac Que Huong Hay Nhat Nam 2015 || Nhac Tru Tinh Remix

- Order: Reorder

- Duration: 58:06

- Updated: 19 Jun 2015

- views: 983290

- published: 19 Jun 2015

- views: 983290

Thuy Nga Lien Khuc Tinh Collections DVDrip YouTube

- Order: Reorder

- Duration: 100:43

- Updated: 07 Sep 2013

- views: 42883

- published: 07 Sep 2013

- views: 42883

lien khuc Saka Truong Tuyen ft Kim Tieu Long [Girls xinh]

- Order: Reorder

- Duration: 46:17

- Updated: 29 Jun 2014

- views: 125819

Liên khúc nhạc trữ tình quê hương miền tây remix đặc sắc nhất – Đậm chất miền tây [Full HD 320kbps]

- Order: Reorder

- Duration: 45:09

- Updated: 12 Dec 2015

- views: 2082022

- published: 12 Dec 2015

- views: 2082022

- Playlist

- Chat

- Playlist

- Chat

Liên Khúc Nhạc Trữ Tình Remix - Nhạc Vàng Remix Hay Nhất 2016 - Tổng Hợp Gái Xinh - P1

- Report rights infringement

- published: 07 Jan 2016

- views: 4078965

Live du mercredi soir de 20h30 à 22h (lien dans la description)

- Report rights infringement

- published: 09 Mar 2016

- views: 262

LK Tình Yêu 1 2 3 4 Ngọc Lan,Trung Hành,Kiều Nga

- Report rights infringement

- published: 17 Mar 2014

- views: 6314458

Introducing Destinations on Google

- Report rights infringement

- published: 09 Mar 2016

- views: 5769

Liên Khúc Hồ Quang Hiếu Remix Hay Nhất 2016 Tuyển Chọn

- Report rights infringement

- published: 02 Oct 2014

- views: 9396442

[LIVE] Aznching [20H30] Lien dans la description

- Report rights infringement

- published: 09 Mar 2016

- views: 609

ニンテンドー3DS『逆転裁判6』2nd プロモーション映像

- Report rights infringement

- published: 06 Mar 2016

- views: 4000

Tax Lien Investing Pros and Cons

- Report rights infringement

- published: 20 Dec 2013

- views: 41925

Super Mario Maker - Key Update!

- Report rights infringement

- published: 08 Mar 2016

- views: 14306

De Jeugd van Tegenwoordig - Tante Lien live

- Report rights infringement

- published: 11 Apr 2011

- views: 174700

VENEZ ! LIEN DANS LA DESCRIPTION !

- Report rights infringement

- published: 09 Mar 2016

- views: 61

Lien Khuc Tinh Yeu

- Report rights infringement

- published: 10 Oct 2008

- views: 1495203

Live OVERWATCH (LIEN DESCRIPTION)

- Report rights infringement

- published: 09 Mar 2016

- views: 0

Conférence C. Bourguignon : "Garder le lien avec la terre"

- Report rights infringement

- published: 21 Jun 2015

- views: 49567

- Playlist

- Chat

lien khuc nhac che 2016

- Report rights infringement

- published: 10 Mar 2016

- views: 0

nicole aniston gym ass sexy( click in a lien)

- Report rights infringement

- published: 10 Mar 2016

- views: 2

♥J'ouvre un lien♥

- Report rights infringement

- published: 10 Mar 2016

- views: 1

VIDEO Nguyen Th Bich Lien Nho Quan Ninh Binh

- Report rights infringement

- published: 10 Mar 2016

- views: 0

Clash of Clans Générateur Lien dans la description

- Report rights infringement

- published: 10 Mar 2016

- views: 0

COC Générateur HD Lien dans la description

- Report rights infringement

- published: 10 Mar 2016

- views: 0

Kiem cua dai ca vinh chi tiet lien he 01692540790

- Report rights infringement

- published: 10 Mar 2016

- views: 1

【 Le Lien 】 みんなー!Le Lienと語ろう!の会【2016,03,03】

- Report rights infringement

- published: 10 Mar 2016

- views: 5

Ban acc truy kich sieu re lien he 0988635896

- Report rights infringement

- published: 10 Mar 2016

- views: 1

Lien khuc nhac tre buon va tam trang

- Report rights infringement

- published: 10 Mar 2016

- views: 3

Top Tax Lien Mistakes

- Report rights infringement

- published: 10 Mar 2016

- views: 0

DJ Nonstop Remix Nhac Tre Lien Khuc -Tuyen Chon Xuat Sac Nhat 2016 (PART 01)

- Report rights infringement

- published: 10 Mar 2016

- views: 4

League of Legends 2016 03 02 19 lien minh huyen thoai - lmht

- Report rights infringement

- published: 10 Mar 2016

- views: 2

lien minh huyen thoai - lmht

- Report rights infringement

- published: 10 Mar 2016

- views: 0

- Playlist

- Chat

Liên Khúc Tuấn Vũ trọn bộ FULL

- Report rights infringement

- published: 15 May 2014

- views: 5122695

Liên Khúc Nhạc Trẻ Hay Nhất 2015 Nonstop - Việt Mix - V.I.P - Bass Căng Đốt Cháy Cây Xăng

- Report rights infringement

- published: 08 Nov 2014

- views: 11567661

Liên Khúc Nhạc Trẻ Hay Nhất 2015 Nonstop - Việt Mix - H.O.T - Căng Xung Tuyệt Đối

- Report rights infringement

- published: 27 Dec 2014

- views: 4308867

Liên Khúc Nhạc Trẻ Remix Hay Nhất 2016 Nonstop - ViệtMix - Gái Xinh Lung Linh ( P. 1 )

- Report rights infringement

- published: 07 Jul 2015

- views: 6723809

lien khuc nhac xuan remix 2016 Những Ca Khúc Nhạc Xuân Hay Nhất 2016

- Report rights infringement

- published: 12 Dec 2015

- views: 761475

.hack//シリーズ 三谷朋世(LieN)の歌う全曲集 (G.U. TRILOGY Link).mp4

- Report rights infringement

- published: 08 Jul 2013

- views: 134739

Mr.Bolero Dance - Quách Tuấn Du

- Report rights infringement

- published: 03 Jun 2015

- views: 10220498

Lien khuc Che Linh - Truong Vu - Duy Khanh - Tuan Ngoc || Lien khuc nhac vang chon loc

- Report rights infringement

- published: 26 Jul 2015

- views: 209699

Thu Dam Uy Long-ly lien kiet{ruacon}

- Report rights infringement

- published: 18 Mar 2013

- views: 55712

Nhạc đánh LIÊN MINH phần 1- Nhac danh lien minh phan 1- Cập nhập

- Report rights infringement

- published: 09 Dec 2015

- views: 59536

LIEN KHUC CHIEU MUA 3 - LIEN KHUC NHAC VANG HAI NGOAI

- Report rights infringement

- published: 05 Jun 2015

- views: 23501

[05.03.2016] SAJ vs BM [CCCS 2016 Mùa Xuân]

- Report rights infringement

- published: 05 Mar 2016

- views: 12952

Liên Khúc Nhạc Trẻ Remix Hay Nhất Tháng 3 2016 | LK Nhạc Trẻ Remix | Lk nhac tre remix 2015 (19)

- Report rights infringement

- published: 05 Mar 2016

- views: 662

Bản nhạc EDM hay nhất - Nhac Choi Game Lien Minh Huyen Thoai

- Report rights infringement

- published: 14 Aug 2015

- views: 390361

-

Lyrics list:text lyricsplay full screenplay karaoke

Pentagon Silent Over Report Questioning If Air Strike Killed Top Islamic State Commander

Edit WorldNews.com 10 Mar 2016

T-Rex Fossil Skull 'Discovery' on Mars Excites UFO Community On Earth

Edit WorldNews.com 09 Mar 2016Gallup Poll Reveals American Anxiety Concerning Economy, Government Dissatisfaction

Edit WorldNews.com 10 Mar 2016The question Trump can't dodge in Florida

Edit CNN 10 Mar 2016LRES Releases White Paper Offering Advice for Mortgage Servicers to Prevent HOA Liens from Destroying ...

Edit Business Wire 10 Mar 2016Spring is tax lien season in NYC, when unpaid debts blossom into burden for homeowners (The Center for New York City Neighborhood Inc)

Edit Public Technologies 10 Mar 2016Fitch Rates First Data's Senior Secured 1st Lien Notes 'BB/RR1'; Outlook Positive (Fitch Inc)

Edit Public Technologies 10 Mar 2016Alabama Couple Pleads Guilty to Bank Fraud (Federal Bureau of Investigation - Memphis Field Office)

Edit Public Technologies 10 Mar 2016Alabama Couple Pleads Guilty to Bank Fraud (United States Attorney's Office for the Middle District of Tennessee)

Edit Public Technologies 10 Mar 2016PLS Now Helps Clients with Permit Resolutions

Edit PR Newswire 10 Mar 2016Federal Tax Liens

Edit Tulsa World 10 Mar 2016State Tax Liens

Edit Tulsa World 10 Mar 2016Bismarck Unit Welcomes New Command Sergeant Major (3/9/2016) (North Dakota National Guard)

Edit Public Technologies 10 Mar 2016CoreLogic Reports 1 Million US Borrowers Regained Equity in 2015 (CoreLogic Inc)

Edit Public Technologies 10 Mar 2016Car ownership isn't dead, yet

Edit The Los Angeles Times 10 Mar 2016Grant of Share Options (Hysan Development Co Ltd)

Edit Public Technologies 10 Mar 2016THL Credit Reports Fourth Quarter 2015 Financial Results and Declares a Dividend of $0.34 Per Share (THL Credit Inc)

Edit Public Technologies 10 Mar 2016- 1

- 2

- 3

- 4

- 5

- Next page »