- published: 19 Sep 2014

- views: 15659

-

remove the playlistWealth Management

- remove the playlistWealth Management

- published: 07 May 2012

- views: 34808

- published: 30 Apr 2015

- views: 285

- published: 31 Oct 2012

- views: 26522

- published: 10 May 2015

- views: 2095

- published: 13 Jun 2013

- views: 5227

- published: 18 Mar 2015

- views: 8378

- published: 12 Dec 2013

- views: 5951

- published: 05 Dec 2014

- views: 2327

- published: 21 Nov 2014

- views: 513

Wealth management is an investment advisory discipline that incorporates financial planning, investment portfolio management and a number of aggregated financial services. High Net worth Individuals (HNWIs), small business owners and families who desire the assistance of a credentialed financial advisory specialist call upon wealth managers to coordinate retail banking, estate planning, legal resources, tax professionals and investment management. Wealth managers can be an independent Certified Financial Planner, MBAs, Chartered Strategic Wealth Professional,CFA Charterholders or any credentialed professional money manager who works to enhance the income, growth and tax favored treatment of long-term investors. Wealth management is often referred to as a high-level form of private banking for the especially affluent. One must already have accumulated a significant amount of wealth for wealth management strategies to be effective.

Private wealth management (PWM) is the term generally used to describe highly customized and sophisticated investment management and financial planning services delivered to high net worth investors. Generally, this includes advice on the use of trusts and other estate planning, vehicles, business succession or stock option planning, and the use of hedging derivatives for large blocks of stock.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

8:47

8:47Wealth Management | Explained!

Wealth Management | Explained!Wealth Management | Explained!

What are the 6 Cubes of understanding Wealth Management? The term wealth management has been thrown around the financial industry to mean many different things to different people. But to break it down it’s simply just managing your wealth, or understanding the elements of a financial plan. To download your FREE eBook called, “The 5 Biggest Fears All Retirees Have Explained”, go here: http://www.onlinefinancialadvisor.net. Simply sign up for our Free Newsletter at the top and you will receive the download in your email. In this video we are going to talk about the 6 basic cubes of putting together a wealth management and financial plan. I am going to show you the different cubes here to Financial Planning. However, you may hear a financial advisor talk about wealth management by itself and what they really are referring to, is managing your portfolio of investments. I want to everyone to understand that I view wealth management as managing ALL aspects of your personal finance as done through a Financial Plan. Did you know that your debt doesn't just go away if you were to pass away tomorrow? A lot of times, that debt can flow through to your spouse, your children and more depending upon who the creditors go after. That’s why looking into Life and even disability insurance may be worth it to you. The thing to remember about long term care is that although Medicare does take care of some of your nursing home and other expenses, it does not cover deteriorating cognitive diseases such as Alzheimer’s, or dementia. Social Security is the single largest source of retirement income for about 64% of retirees. However, according to the social security administration’s website, social security should only be taken as a part of a total retirement plan. Most common employer plan is the 401(k) where the company even matches a certain percentage of what the employee puts into the plan. Estates and Trusts are important sides to the cube. The main question here is how do you want your wealth distributed when you are no longer around? Maybe you have a family, children, grandchildren and you want to ensure that everyone is taken care of when you are gone. Do you even have a will set up, or an estate or trust for that matter? Regardless these are topics a financial planner or advisor can help you out with understanding, but you will also need the help from a lawyer who can legally prepare the necessary documents to execute the papers. When it comes to taxes we have to understand that with a little planning we can help reduce the burden of them when it comes to tax season with just a little planning and guidance from our tax professional. Many people however couldn't even tell you what tax bracket they are in for starters. What about Tax-Harvesting, do you know what that means when it comes to investments? Personally I don’t want to lose any money in my portfolio but if it were to suffer a loss I would want to use that to my advantage and my tax professional could inform me more about that subject. Investing is our next Cube. Now remember I talked about wealth management is sometimes referred to by a financial advisor as managing an investment portfolio. For the purposes of this presentation I am keeping that out of this cube on investing. Here we are talking about the different investments that one could understand to build a total package of wealth management. What you need to understand is what asset allocation, diversification, and dollar cost averaging means. Asset allocation is the division of your portfolio based on the various asset classes in the market. Diversification is giving your portfolio a proportionate share among the various asset classes so that you are not set in just one single or just a few asset classes. http://www.onlinefinancialadvisor.net CALL TOLL FREE: 1 (888) 560-3353 Portfolio Strategy Building can vary depending upon the financial firm that you talk to. Everyone has various methods for building your portfolio and there are different fees associated with those methods. The best thing to do is to shop around or even get a second opinion from another advisor before you settle down. What would happen if life threw a little surprise at you good or bad? Just putting together a simple budget can help you build the foundation for everything we have talked about today. So there you have it, the 6 cubes that make Wealth Management and Financial Planning. Simply go: www.onlinefinancialadvisor.net to learn more, read many of our blog posts, or watch other educational videos. Disclaimer: Nothing in this video or free report can be or should be construed as investment, tax or legal advice. This is purely educational and there is not enough information in here or the report to make educated investment decisions. Always consult with a financial advisor before making any investment decisions. -

53:14

53:14Fundamentals of Wealth Management

Fundamentals of Wealth ManagementFundamentals of Wealth Management

The complete lesson. Dow Wealth Management offers the services of a world-class investment firm dedicated to improving clients' financial lives and making their futures more secure. As an independent firm, Dow Wealth Management provides objective advice and is committed to excellence for its clients. The Dow family has been investing traditionally in the securities markets since 1937. Before attempting to structure a portfolio that might be capable of delivering long-term investment success, we must first understand the nature of the financial markets in which we will operate and the inherent limitations we are sure to confront as investors. This video, Fundamentals in Wealth Management, will help to acquaint the investor with these dynamics and then illustrate how Dow Wealth Management seeks to position its clients' portfolios for long-term investment success. We could call it "How to survive bad markets...and thrive in good ones." Website: http://www.dow.us *** Accounts are held at and transactions are cleared through Pershing, LLC, a Bank of New York Mellon Affiliate. Securities offered through Bolton Global Capital, Inc. 579 Main St, Bolton MA 01740 800-649-3883. FINRA, SIPC. Advisory services offered through Bolton Global Asset Management, an SEC Registered Investment Advisor. State securities laws require that your investment professional be registered in the state in which you are a resident. Our representatives are licensed to sell and or discuss securities products to residents of the following states: AK AL AZ CA CO CT DC FL GA IL IN LA MA ME MD MI MO MT NC NH NJ NM NV NY OH OK OR PA RI SC TN TX VA VT WA WI. -

8:29

8:29What is Wealth Management?

What is Wealth Management? -

6:50

6:50What is wealth management?

What is wealth management?What is wealth management?

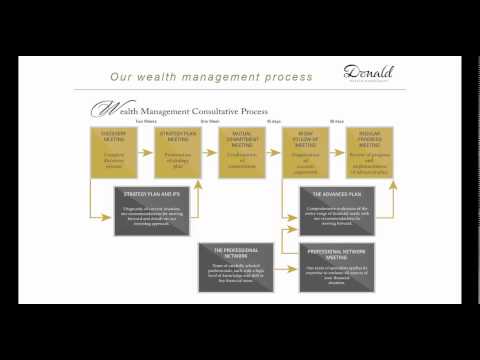

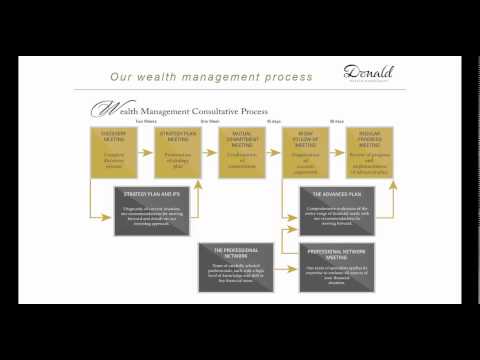

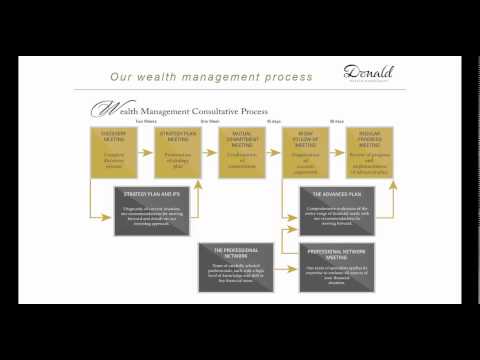

The Donald Wealth Management presentation describing our wealth management process and how we can help clients. If you would like further details about our service please contact the office on 0121 308 8034. -

3:18

3:18Private Wealth Management Careers at Goldman Sachs

Private Wealth Management Careers at Goldman SachsPrivate Wealth Management Careers at Goldman Sachs

See how a career in Private Wealth Management offers you an entrepreneurial environment to help clients turn opportunities into successes. -

35:31

35:31Disruption in Wealth Management

Disruption in Wealth ManagementDisruption in Wealth Management

Mandell Crawley, Global CMO, Morgan Stanley Hardeep Walia, Founder & Chief Executive Officer, Motif Investing Eli Broverman, Co-Founder, COO, Betterment Rachel Perkel, Head of Marketing, Wells Fargo Wealth Brokerage & Retirement Mark Murray, Chief Marketing Officer, BT Financial Group Chip Cutter, Senior Editor, LinkedIn As they introduce new operational efficiencies while enabling personalization and enhanced client service, digital disruptors are challenging traditional elements of the Wealth Management value chain. What does the future of wealth management look like as conventional firms recalibrate their business models and harness digital technology and the power of Big Data to transform their business? -

4:55

4:55A Video Animation Series - Part 1: An Introduction to Monument Wealth Management

A Video Animation Series - Part 1: An Introduction to Monument Wealth ManagementA Video Animation Series - Part 1: An Introduction to Monument Wealth Management

The first in a three part series of whiteboard animations that explain Monument Wealth Management's process. In this video you will meet Blake & Sandra Shepard - fictional characters who represent typical Monument Wealth Management clients. ___ Meet Blake Shepherd. Blake's a smart guy. He owns a data privacy and security firm in Reston, Virginia where he also lives with his wife Sandra and two kids. Blake started this successful business about 15 years ago and has worked hard to build it into something great. He's proud of his success. Blake's about to turn 45, and a major defense contractor has approached him with an offer to buy his business. He's super excited -- his whole life will change. Blake knows he's on the cusp of this massive liquidity event, and now he has to get more serious about planning for his future. Blake and Sandra already have a financial advisor at one of the big Wall Street brokerages who manages their portfolio of assets, but as for a proper financial plan for the future -- well, they feel a little bit in the woods. Whenever Blake meets with his current advisor at the brokerage, he feels like he's getting the same plain vanilla asset allocation strategy steeped in an ongoing sales pitch to buy the brokerage's products. He feels like it's the same guys in the same suits pedaling the idea of the day, without much concern for his personal situation, or doing real financial planning to chart a long-term course for Blake and his family. Blake's got a lot of friends who are entrepreneurs like him. One of his friends -- Kevin -- told him a story about the day a few years ago when he sold his own business and came into a financial windfall much like the one Blake is about to experience. On the brink of this major event, Kevin made a very strategic decision about financial planning. In fact, he felt so good about it that he recommended the same course of action to his own mom and dad. So what, exactly, was the decision that left Kevin feeling prepared, comfortable, knowledgeable, and armed with a dedicated partner who had his back? He enlisted the team at Monument Wealth Management. Blake was all ears. He really values Kevin's opinion and was intrigued by his story, so Blake and Sandra decided to go visit the guys at Monument. Blake booked the appointment, and they went in the following Monday. Blake and Sandra were immediately impressed that they met all four founding partners -- Dave, Dean, Tim and Tim - at their very first meeting. They also learned that they would continue to have direct access to all of them through the course of their relationship with Monument. The guys explained to Blake and Sandra exactly what it would be like to choose Monument as their partner. The team explained their independent model, which allows clients to access investment strategies from all corners of Wall Street. Then, the team walked through their process which would include understanding Blake's family situation and financial goals for the future. Part of the process would be to develop courses of action for them, and corresponding investment strategies. Monument also clearly understood the need to be fast-paced and nimble with regard to technology. They struck Blake and Sandra as really ahead-of-the-curve, and super focused on reaping the benefits of quickly-evolving technology for their clients -- whether it be improving user interfaces using account aggregation technology, providing mobile apps, or simply communicating insights and intelligence to their clients via social networks. The meeting was really resonating with Sandra. Not only was the family's current advisor at the brokerage constantly trying to get them to buy his company's own proprietary financial products, but he also seemed way more focused on asset allocation versus true forward-looking financial planning, which is what they really wanted and needed. Monument seemed totally different and the perfect fit. The guys were also really transparent with Blake and Sandra about their fee schedule and structure. An annual planning retainer fee would ensure they weren't "running up a tab" every time they picked up the phone to ask a question or talk to the team, and what's more, they never felt pressure to move their assets over to Monument. Blake and Sandra walked out of that first meeting feeling really good about Monument -- not only were these guys smart and savvy, but they seemed united as a team and totally committed to achieving the best results for their clients. This was the first time they felt the power of a collegial team, four equal partners, banded together to help them achieve their goals. Blake and Sandra couldn't help but feel that Monument wasn't just a better vanilla -- it was an entirely new flavor. -

3:11

3:11Summer Associate Program | Global Wealth Management Careers | J.P. Morgan

Summer Associate Program | Global Wealth Management Careers | J.P. MorganSummer Associate Program | Global Wealth Management Careers | J.P. Morgan

SUBSCRIBE: http://jpm.com/x/i/NFPWfK0 As a potential future leader at J.P. Morgan, our Global Wealth Management Summer Associates have limitless opportunities to own their own career path, develop new skills and network with peers beyond the center of the business to build global relationships for future success. Watch this video to learn more about the training program. About J.P. Morgan: J.P. Morgan is a leader in financial services, offering solutions to clients in more than 100 countries with one of the most comprehensive global product platforms available. We have been helping our clients to do business and manage their wealth for more than 200 years. Our business has been built upon our core principle of putting our clients' interests first. Connect with J.P. Morgan Online: Visit the J.P. Morgan Website: http://jpm.com/x/d/LPdzH4w Follow @jpmorgan on Twitter: http://jpm.com/x/i/NFPWLIB Visit our J.P. Morgan Facebook page: http://jpm.com/x/i/NFQoLBw Follow J.P. Morgan on LinkedIn: http://jpm.com/x/i/NFQoLGt Summer Associate Program | Global Wealth Management Careers | J.P. Morgan http://youtu.be/eknI7hRZsRo -

2:08

2:08What is Private Wealth Management?

What is Private Wealth Management?What is Private Wealth Management?

A short description of Private Wealth Management and what it means to clients. www.nexusprivate.com Ph: 1300 473 347 Level 13, 340 Adelaide Street, Brisbane. QLD. 4000. -

23:18

23:18Wealth management for freedom town...

Wealth management for freedom town... -

2:46

2:46Meet our graduates: Chris, Wealth Management Americas

Meet our graduates: Chris, Wealth Management AmericasMeet our graduates: Chris, Wealth Management Americas

UBS Graduate Training Programs (http://www.ubs.com/graduates) help prepare talented graduates for an engaging career at UBS and for employment within a target function. As a graduate at UBS, you'll experience a business specific development pathway that includes on and off the job learning opportunities, as well as mentoring and networking opportunities. In this video, you'll experience a typical work day for Chris, a graduate in UBS Wealth Management Americas. -

52:34

52:34Starting a Career in Wealth Management

Starting a Career in Wealth ManagementStarting a Career in Wealth Management

What is wealth management and how does it fit into the broader Banking sector? How can your skills be best utilised for the industry? Daryl Grundy from Argent Ltd will talk us through his role as Head of Investment Management and his many years of experience at board level. Daryl will also discuss career development and the different opportunities available in the sector. -

6:49

6:49Wealth Management | Financial Budget

Wealth Management | Financial BudgetWealth Management | Financial Budget

Wealth Management and Financial Budget Need help with your personal wealth management? Do you need a personalized financial plan? We have a new years special just for you: http://www.onlinefinancialadvisor.net/2015-promotion In this video we talk about how a Wealth Management Plan can encompass many aspects of having a well rounded financial plan or budget, as well as how a person can go about starting a wealth management plan? The U.S. household consumer debt profile shows that the average credit card debt is around $15,600, average mortgage debt is around $155,000, and the average student loan debt is around $32,000. So let’s take a look at why we get into debt how we can avoid debt for not only ourselves, but the for future generations. Most people get into debt because either they want something they cannot afford, or else they get trapped into paying for something such as an unexpected costs that they didn't plan for. Student loans which can take well into adult years to pay off are another example of people getting into debt and financial trouble. Having a well thought out wealth management plan or financial plan and budget can help mitigate these strains if followed properly. So what if we changed the way we look at money today so that we wouldn't be in debt anymore? What if even future generations would be able to stay out of debt and never have to get a loan or ever use a credit card? It’s quite simple, look at a one dollar bill and break it up into four quarters. Now think of each quarter representing a different area of financial responsibility. So if twenty five cents were to go towards home expenses, another twenty five cents can go towards an emergency account, another twenty five cents can go towards a retirement account, and the final twenty five cents can go towards other major purchase. We can break this down a little more for you but let's keep it simplistic for now. Just think about keeping things simple and breaking up your money in a way that is understandable and you will know what you can and cannot afford before you ever make a purchase. Keeping the wealth management or financial plan and budget in line can really keep things in perspective! So Imagine, what if you could afford various life events such as purchasing a car, buying your home, going on that vacation you have always wanted to, paying for your son’s or daughters college tuition, and having enough money for retirement? Putting together a solid plan is really what it's all about. Wealth Management is something we should all consider practicing on a daily basis and implementing the full financial plan and budget should be a mainstay. I hope that this video on video on wealth management and financial budgets helped enlighten many of you to start thinking of the way you use money each and everyday. However, I understand that everyone is in a different situation and to get on track with your current situation and start employing a money management and wealth management system such as this can be a little overwhelming and difficult if you don’t know where to start. That is why I am putting together a new year special for those that need help setting up a personal wealth management and financial budget. Not only will we go over all of the bills that you currently are paying, but we will give you a guide to help get you on track to save the way we showed you earlier as well as help educate your family and children on how they can do the same thing. Our New Year’s special is only $99 which is a savings of over $500 as we normally charge $600 for a full financial budget and planner that is specific towards your situation. I am including a special bonus for those that act quickly, and it’s called our Legacy account service. This is where you can provide a legacy for future generations utilizing the special financial plan that we create with you. But it’s only for the first 10 people that participate in this offer each day. So everyday in January we are going to give away this promotion to the first 10 people. But after that it will expire so you must act quickly. Simply log onto: http://www.onlinefinancialadvisor.net/2015-promotion If you know of anyone that you think would benefit from a wealth management or financial budget service, please don’t hesitate to share this link or video with them. We hope you found this video helpful yourself and hope to work with you on your new financial budget for the new year soon! Lastly, a quick disclaimer: Nothing in this video can be or should be construed as investment, tax or legal advice. This is purely educational and there is not enough information in here to make educated investment decisions. Always consult with a financial advisor before making any investment decisions. -

33:46

33:46Topical Issues in Wealth Management

Topical Issues in Wealth ManagementTopical Issues in Wealth Management

Discover topical issues affecting the Wealth Management industry and get a closer look at the current FCA activity on Training & Compliance covering thematic and policy work, issues arising from the accredited bodies and impact of the European legislation. For more information, please visit http://www.fitchlearning.com/uk/courses/mwm for the CISI Chartered Wealth Manager Qualification and http://www.fitchlearning.com/uk/corporate-solutions/private-wealth-management1 for bespoke training solutions.

- Brokerage

- Buy and hold

- CFA Institute

- Columbia University

- Dean Witter Reynolds

- Estate planning

- Financial planning

- Goldman Sachs

- Investment portfolio

- Mass affluent

- MBA

- Merrill Lynch

- Morgan Stanley

- Portfolio (finance)

- Private banking

- Retail banking

- Small business

- Stanford University

- UBS

- Value investing

- Wealth management

-

Wealth Management | Explained!

What are the 6 Cubes of understanding Wealth Management? The term wealth management has been thrown around the financial industry to mean many different things to different people. But to break it down it’s simply just managing your wealth, or understanding the elements of a financial plan. To download your FREE eBook called, “The 5 Biggest Fears All Retirees Have Explained”, go here: http://www.onlinefinancialadvisor.net. Simply sign up for our Free Newsletter at the top and you will receive the download in your email. In this video we are going to talk about the 6 basic cubes of putting together a wealth management and financial plan. I am going to show you the different cubes here to Financial Planning. However, you may hear a financial advisor talk about wealth management by ... -

Fundamentals of Wealth Management

The complete lesson. Dow Wealth Management offers the services of a world-class investment firm dedicated to improving clients' financial lives and making their futures more secure. As an independent firm, Dow Wealth Management provides objective advice and is committed to excellence for its clients. The Dow family has been investing traditionally in the securities markets since 1937. Before attempting to structure a portfolio that might be capable of delivering long-term investment success, we must first understand the nature of the financial markets in which we will operate and the inherent limitations we are sure to confront as investors. This video, Fundamentals in Wealth Management, will help to acquaint the investor with these dynamics and then illustrate how Dow Wealth Manageme... -

-

What is wealth management?

The Donald Wealth Management presentation describing our wealth management process and how we can help clients. If you would like further details about our service please contact the office on 0121 308 8034. -

Private Wealth Management Careers at Goldman Sachs

See how a career in Private Wealth Management offers you an entrepreneurial environment to help clients turn opportunities into successes. -

Disruption in Wealth Management

Mandell Crawley, Global CMO, Morgan Stanley Hardeep Walia, Founder & Chief Executive Officer, Motif Investing Eli Broverman, Co-Founder, COO, Betterment Rachel Perkel, Head of Marketing, Wells Fargo Wealth Brokerage & Retirement Mark Murray, Chief Marketing Officer, BT Financial Group Chip Cutter, Senior Editor, LinkedIn As they introduce new operational efficiencies while enabling personalization and enhanced client service, digital disruptors are challenging traditional elements of the Wealth Management value chain. What does the future of wealth management look like as conventional firms recalibrate their business models and harness digital technology and the power of Big Data to transform their business? -

A Video Animation Series - Part 1: An Introduction to Monument Wealth Management

The first in a three part series of whiteboard animations that explain Monument Wealth Management's process. In this video you will meet Blake & Sandra Shepard - fictional characters who represent typical Monument Wealth Management clients. ___ Meet Blake Shepherd. Blake's a smart guy. He owns a data privacy and security firm in Reston, Virginia where he also lives with his wife Sandra and two kids. Blake started this successful business about 15 years ago and has worked hard to build it into something great. He's proud of his success. Blake's about to turn 45, and a major defense contractor has approached him with an offer to buy his business. He's super excited -- his whole life will change. Blake knows he's on the cusp of this massive liquidity event, and now he has to get more ... -

Summer Associate Program | Global Wealth Management Careers | J.P. Morgan

SUBSCRIBE: http://jpm.com/x/i/NFPWfK0 As a potential future leader at J.P. Morgan, our Global Wealth Management Summer Associates have limitless opportunities to own their own career path, develop new skills and network with peers beyond the center of the business to build global relationships for future success. Watch this video to learn more about the training program. About J.P. Morgan: J.P. Morgan is a leader in financial services, offering solutions to clients in more than 100 countries with one of the most comprehensive global product platforms available. We have been helping our clients to do business and manage their wealth for more than 200 years. Our business has been built upon our core principle of putting our clients' interests first. Connect with J.P. Morgan Online: Visit... -

What is Private Wealth Management?

A short description of Private Wealth Management and what it means to clients. www.nexusprivate.com Ph: 1300 473 347 Level 13, 340 Adelaide Street, Brisbane. QLD. 4000. -

-

Meet our graduates: Chris, Wealth Management Americas

UBS Graduate Training Programs (http://www.ubs.com/graduates) help prepare talented graduates for an engaging career at UBS and for employment within a target function. As a graduate at UBS, you'll experience a business specific development pathway that includes on and off the job learning opportunities, as well as mentoring and networking opportunities. In this video, you'll experience a typical work day for Chris, a graduate in UBS Wealth Management Americas. -

Starting a Career in Wealth Management

What is wealth management and how does it fit into the broader Banking sector? How can your skills be best utilised for the industry? Daryl Grundy from Argent Ltd will talk us through his role as Head of Investment Management and his many years of experience at board level. Daryl will also discuss career development and the different opportunities available in the sector. -

Wealth Management | Financial Budget

Wealth Management and Financial Budget Need help with your personal wealth management? Do you need a personalized financial plan? We have a new years special just for you: http://www.onlinefinancialadvisor.net/2015-promotion In this video we talk about how a Wealth Management Plan can encompass many aspects of having a well rounded financial plan or budget, as well as how a person can go about starting a wealth management plan? The U.S. household consumer debt profile shows that the average credit card debt is around $15,600, average mortgage debt is around $155,000, and the average student loan debt is around $32,000. So let’s take a look at why we get into debt how we can avoid debt for not only ourselves, but the for future generations. Most people get into debt because eithe... -

Topical Issues in Wealth Management

Discover topical issues affecting the Wealth Management industry and get a closer look at the current FCA activity on Training & Compliance covering thematic and policy work, issues arising from the accredited bodies and impact of the European legislation. For more information, please visit http://www.fitchlearning.com/uk/courses/mwm for the CISI Chartered Wealth Manager Qualification and http://www.fitchlearning.com/uk/corporate-solutions/private-wealth-management1 for bespoke training solutions. -

SBI Exclusif: Wealth management service

No need to look beyond your bank for your wealth management requirements. SBI launches “SBI Exclusif” an unique banking experience for our Wealth Customers where you can avail of wealth management services backed by high values and strong research. It will help you create, grow, secure and enjoy your wealth for generations. Launched at Bengaluru, will come to select cities shortly. To know more please click here: https://www.sbi.co.in/portal/web/personal-banking/wealth-management For further details or any queries, kindly contact us at Email: exclusif@sbi.co.in -

Wealth Management : An Islamic Perspective | 2015 Lecture | Muhammad Tim Humble

Like The Reminders Network Facebook Page: https://www.facebook.com/theremindersnetwork Subscribe To Our Other Channels: Reminders For Humanity: https://www.youtube.com/c/RemindersForHumanity Reminders From Mohammad Hoblos: https://www.youtube.com/c/RemindersFromBrotherMohammadHoblos Reminders From Bilal Assad: https://www.youtube.com/c/RemindersFromBilalAssad Reminders From Shady Al Suleiman: https://www.youtube.com/c/RemindersFromShadyAlSuleiman Reminders From Mufti Menk: http://www.youtube.com/c/RemindersFromMuftiMenk Reminders From Nouman Ali Khan: https://www.youtube.com/c/RemindersFromNoumanAliKhan Reminders From Muhammad Tim Humble: https://www.youtube.com/c/RemindersFromMuhammadTimHumble Reminders From Hamza Tzortzis: https://www.youtube.com/c/RemindersFromHamzaTzortzis R... -

Guardian Wealth Management Recruitment Video -DUBAI-

Guardian Wealth Management is a wealth management company who are recruiting in their Dubai office. For more information about jetting off to Dubai to start your career with Guardian, email: careers@gwm-intl.com Video produce by Keyholevisuals.co.uk -

Wharton Private Wealth Management Program -- Professor Richard Marston

Wharton Finance Professor Richard Marston talks about Wharton's Private Wealth Management program (http://whr.tn/1jFaVL0). This joint program, offered by Wharton Executive Education and the Institute for Private Investors (IPI), provides wealth management education to high net-worth individuals and families. -

Charles Schwab Wealth Management Digital Video – “Money Back“ :15

In life, you question everything. The same should be true when it comes to managing your wealth. Are you asking enough questions about the way your wealth is managed? Learn more at Schwab.com/Wealth 1115-9ZPH -

TVC: Recruitment for SBI Wealth Management

Recruitment of Officers in Specialised Positions for Wealth Management in SBI on contract basis. Online registration of Applications is now open. We are looking for talents like you! Join the most trusted bank today. For more information, visit: http://bit.ly/SBI-Careers-WealthManagement16 -

Careers in Wealth Management (with Bonus Job Hunting Tips) - David Edwards, Heron Financial Group

David Edwards presented these tips on seeking a career in Wealth Management: 1. You don't know what you don't know! 2. No matter what you think your job is, ultimately you are in sales! 3. Life is an "Elevator Pitch" 4. Plot your Career Path 5. Know divisions of the industry cold 6. Win the Gong Show! 7. Fun at the Movies! The slides from this presentation are here http://bit.ly/1ggYk0r -

Finance and Wealth Management Questions | Best Financial Advice | Investment Q & A

All your finance questions answered with Christopher Haydel from Haydel, Biel & Associates - one of the top financial and wealth management firms in southern California. http://www.hbawealth.com California Wealth management, pasadena financial advisor, best california financial advisors, top wealth management company, top california investment management, pasadena financial planning, top southern california investment advisor, Pasadena wealth management firms,Top Los Angeles financial advisors, southern california investment advisory firm, Chris Haydel, Ricky Biel, top retirement planning advisors, retirement management agency southern california, top pasadena financial company, top pasadena wealth management, top pasadena financial advisor, top pasadena financial advisors, top califo... -

MSc Investment & Wealth Management

Learn about the MSc Investment & Wealth Management Programme at Imperial College Business School. For more information see the Programme webpages: www.imperial.ac.uk/business-school/programmes/msc-investment-wealth-management/

Wealth Management | Explained!

- Order: Reorder

- Duration: 8:47

- Updated: 19 Sep 2014

- views: 15659

- published: 19 Sep 2014

- views: 15659

Fundamentals of Wealth Management

- Order: Reorder

- Duration: 53:14

- Updated: 07 May 2012

- views: 34808

- published: 07 May 2012

- views: 34808

What is Wealth Management?

- Order: Reorder

- Duration: 8:29

- Updated: 10 Jun 2013

- views: 14407

What is wealth management?

- Order: Reorder

- Duration: 6:50

- Updated: 30 Apr 2015

- views: 285

- published: 30 Apr 2015

- views: 285

Private Wealth Management Careers at Goldman Sachs

- Order: Reorder

- Duration: 3:18

- Updated: 31 Oct 2012

- views: 26522

- published: 31 Oct 2012

- views: 26522

Disruption in Wealth Management

- Order: Reorder

- Duration: 35:31

- Updated: 10 May 2015

- views: 2095

- published: 10 May 2015

- views: 2095

A Video Animation Series - Part 1: An Introduction to Monument Wealth Management

- Order: Reorder

- Duration: 4:55

- Updated: 13 Jun 2013

- views: 5227

- published: 13 Jun 2013

- views: 5227

Summer Associate Program | Global Wealth Management Careers | J.P. Morgan

- Order: Reorder

- Duration: 3:11

- Updated: 18 Mar 2015

- views: 8378

- published: 18 Mar 2015

- views: 8378

What is Private Wealth Management?

- Order: Reorder

- Duration: 2:08

- Updated: 12 Dec 2013

- views: 5951

- published: 12 Dec 2013

- views: 5951

Wealth management for freedom town...

- Order: Reorder

- Duration: 23:18

- Updated: 23 Mar 2016

- views: 105

Meet our graduates: Chris, Wealth Management Americas

- Order: Reorder

- Duration: 2:46

- Updated: 05 Dec 2014

- views: 2327

- published: 05 Dec 2014

- views: 2327

Starting a Career in Wealth Management

- Order: Reorder

- Duration: 52:34

- Updated: 21 Nov 2014

- views: 513

- published: 21 Nov 2014

- views: 513

Wealth Management | Financial Budget

- Order: Reorder

- Duration: 6:49

- Updated: 01 Jan 2015

- views: 805

- published: 01 Jan 2015

- views: 805

Topical Issues in Wealth Management

- Order: Reorder

- Duration: 33:46

- Updated: 16 Jul 2014

- views: 470

- published: 16 Jul 2014

- views: 470

SBI Exclusif: Wealth management service

- Order: Reorder

- Duration: 5:20

- Updated: 29 Jan 2016

- views: 46542

- published: 29 Jan 2016

- views: 46542

Wealth Management : An Islamic Perspective | 2015 Lecture | Muhammad Tim Humble

- Order: Reorder

- Duration: 105:53

- Updated: 12 Aug 2015

- views: 2541

- published: 12 Aug 2015

- views: 2541

Guardian Wealth Management Recruitment Video -DUBAI-

- Order: Reorder

- Duration: 3:36

- Updated: 30 Apr 2015

- views: 923

- published: 30 Apr 2015

- views: 923

Wharton Private Wealth Management Program -- Professor Richard Marston

- Order: Reorder

- Duration: 4:38

- Updated: 28 Jan 2014

- views: 928

- published: 28 Jan 2014

- views: 928

Charles Schwab Wealth Management Digital Video – “Money Back“ :15

- Order: Reorder

- Duration: 0:16

- Updated: 01 Dec 2015

- views: 1715360

- published: 01 Dec 2015

- views: 1715360

TVC: Recruitment for SBI Wealth Management

- Order: Reorder

- Duration: 0:16

- Updated: 18 Mar 2016

- views: 36907

- published: 18 Mar 2016

- views: 36907

Careers in Wealth Management (with Bonus Job Hunting Tips) - David Edwards, Heron Financial Group

- Order: Reorder

- Duration: 42:27

- Updated: 19 May 2014

- views: 937

- published: 19 May 2014

- views: 937

Finance and Wealth Management Questions | Best Financial Advice | Investment Q & A

- Order: Reorder

- Duration: 16:55

- Updated: 11 Jun 2012

- views: 5317

- published: 11 Jun 2012

- views: 5317

MSc Investment & Wealth Management

- Order: Reorder

- Duration: 2:05

- Updated: 23 Jun 2014

- views: 4410

- published: 23 Jun 2014

- views: 4410

- Playlist

- Chat

- Playlist

- Chat

Wealth Management | Explained!

- Report rights infringement

- published: 19 Sep 2014

- views: 15659

Fundamentals of Wealth Management

- Report rights infringement

- published: 07 May 2012

- views: 34808

What is Wealth Management?

- Report rights infringement

- published: 10 Jun 2013

- views: 14407

What is wealth management?

- Report rights infringement

- published: 30 Apr 2015

- views: 285

Private Wealth Management Careers at Goldman Sachs

- Report rights infringement

- published: 31 Oct 2012

- views: 26522

Disruption in Wealth Management

- Report rights infringement

- published: 10 May 2015

- views: 2095

A Video Animation Series - Part 1: An Introduction to Monument Wealth Management

- Report rights infringement

- published: 13 Jun 2013

- views: 5227

Summer Associate Program | Global Wealth Management Careers | J.P. Morgan

- Report rights infringement

- published: 18 Mar 2015

- views: 8378

What is Private Wealth Management?

- Report rights infringement

- published: 12 Dec 2013

- views: 5951

Wealth management for freedom town...

- Report rights infringement

- published: 23 Mar 2016

- views: 105

Meet our graduates: Chris, Wealth Management Americas

- Report rights infringement

- published: 05 Dec 2014

- views: 2327

Starting a Career in Wealth Management

- Report rights infringement

- published: 21 Nov 2014

- views: 513

Wealth Management | Financial Budget

- Report rights infringement

- published: 01 Jan 2015

- views: 805

Topical Issues in Wealth Management

- Report rights infringement

- published: 16 Jul 2014

- views: 470

Explosions Heard In Schaerbeek As New Anti-Terror Raid Launched In Brussels

Edit WorldNews.com 25 Mar 2016March Polls Show Sanders Would Defeat All Challengers If November Election Held Today

Edit WorldNews.com 25 Mar 2016This man was arrested for mocking Burma’s military on Facebook. He’s still in prison.

Edit The Washington Post 25 Mar 2016“Galvanized Girl” Is No “Comeback Kid”

Edit WorldNews.com 25 Mar 2016Law360 interviews Doug Siegler about his move to Venable (Venable LLP)

Edit Public Technologies 25 Mar 2016Publication of the Annual Report 2015 of the MLP Group (MLP AG)

Edit Public Technologies 25 Mar 2016How to Invest Your Tax Refund So It Feels Like Splurging

Edit Huffington Post 25 Mar 2016Tech jobs at Fifth Third boast pay of over $100,000

Edit Springfield News-Sun 25 Mar 2016Bank of America Names David Hulse Market President for Tallahassee (Bank of America Corporation)

Edit Public Technologies 25 Mar 2016#7 Lessons from Ladies at the Top

Edit Huffington Post 25 Mar 20167 Lessons from Ladies at the Top

Edit Huffington Post 25 Mar 2016A Guide To Retiring Early For People Who Never Thought They Could

Edit Huffington Post 25 Mar 2016UBS Wealth Management Americas and UBS Asset Management Launch Outsourced Chief Investment Officer Program

Edit Business Wire 24 Mar 2016Wealth Management News - March 24

Edit Reuters 24 Mar 2016Sub Advisor Comments March 2016 (Madison Wealth Management)

Edit Public Technologies 24 Mar 2016Ipreo Appoints New Head of Asia-Pacific Operations (Ipreo Holdings LLC)

Edit Public Technologies 24 Mar 2016- 1

- 2

- 3

- 4

- 5

- Next page »