-

What Is The International Monetary Fund (IMF)?

Will The European Union Fall Apart? BIT.LY LINK

Subscribe! http://bitly.com/1iLOHml

In June, Greece missed a deadline to pay back emergency loans from the International Monetary Fund. So, what is the IMF and what does it do?

Learn More:

Why the IMF was created and how it works

https://www.imf.org/external/about.htm

"The IMF, also known as the Fund, was conceived at a UN conference

-

What is The International Monetary Fund (IMF) ?

The International Monetary Fund, is often referred to as the IMF and is headed by Christine LaGarde at present and she has been one of the most active and public leaders helping with the global recovery along with loans to distressed countries during the financial crisis. The IMF is an organization of 187 countries based in Washington D.C. It is designed to assist countries in financial trouble. M

-

International Monetary System - New Economic Slavery

A brief about paper money, 1. How paper money is created 2. policy of using it, 3. debt, 4. inflation 5. Interest International Monetary system is called mod...

-

The Secret World of Financial Institutions: World Bank, International Monetary Fund (2002)

The World Bank has long been criticized by non-governmental organizations, such as the indigenous rights group Survival International, and academics, including its former Chief Economist Joseph Stiglitz, Henry Hazlitt and Ludwig Von Mises. Henry Hazlitt argued that the World Bank along with the monetary system it was designed within would promote world inflation and "a world in which international

-

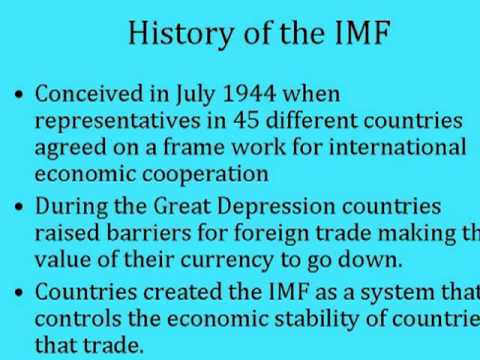

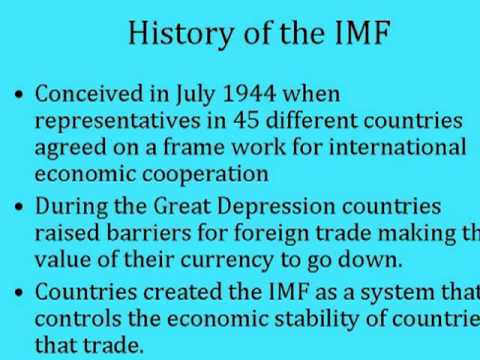

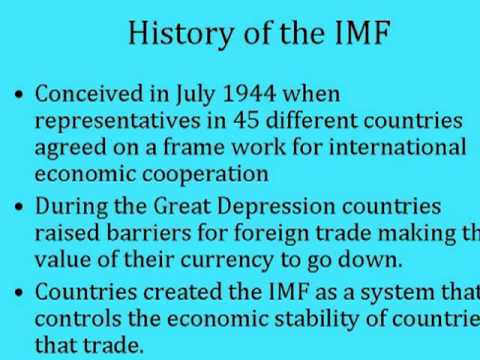

International Monetary Fund

A project that me and my friends did haha... remember IMF.

-

What do the World Bank and the International Monetary Fund actually do?

Dr. Roslyn Fuller explains the original purpose of both the World Bank and the International Monetary Fund (IMF). (c) Video / Audio: Sergio Angulo Bujanda.

-

The World Bank (WB) & The International Monetary Fund (IMF)

A clip from the documentary "The New Rulers of The World" by film maker John Pilger. The WB and the IMF control most of the world's cash flow. Please check o...

-

The History of the International Monetary Fund (IMF)

This brief clips traces the history of the IMF from the rubble of Europe after WWII to the Third World in the 1970s and 80s. (Source: Banking on Life and Debt).

-

How do the WTO, World Bank and IMF work?

Susan George explains what the World Bank, the International Monetary Fund (IMF) and the World Trade Organization (WTO) are and how they work. They operate in the interests of rich nations at the expense of the poor. She cautions against the current trend to privatise public services such as transport, health and water.

-

The International Monetary Fund

Grade 9 Project: Global Organizations.

-

The International Monetary Fund Adds China’s Yuan to Reserve Currency Basket

The International Monetary Fund’s decision to include China’s yuan currency in its special drawing rights basket won’t amount to a whole lot for investors, according to one expert. ‘It’s not like when a stock gets added to the S&P; 500, where all of a sudden there are fund managers that need to buy it,’ said Greg Anderson, head of FX strategy at BMO Capital Markets, based in New York. ‘Nobody needs

-

The International Monetary Fund's Kalpana Kochhar: Whats Ahead for the Indian Economy

IMF Economist Kalpana Kochhar discusses the resilience of the Indian market, hurdles to growth and why the pace of reform must accelerate.

-

Exposing the International Monetary Fund

Stop the IMF bailouts! Sign the FreedomWorks petition: http://action.freedomworks.org/4173/stop-international-monetary-fund-imf-bailouts/ To read Dr. Judy Sh...

-

IAS(UPSC) Economics Lectures;IMF Part-1

In this lecture i have explained International Monetary Fund and World Bank..

-

Free Trade, Flaws of a Market Economy, International Monetary Fund: Joseph Sitglitz (2006)

The first major protest in Seattle, Washington against the World Trade Organization (WTO) and its role in promoting economic globalization came as a surprise to many, considering the positive impacts globalization was supposed to bring. According to Stiglitz, this was the first step in a widespread recognition that globalization was all "too good to be true." Along with globalization comes a myria

-

WORLD BANK IMF DOCUMENTARY FULL MOVIE

Learn Pascal Programming Free! WWW.LEARNPASCAL.COM

ron paul alex jones illuminati nwo globalist libertarian republican obama democrat liberal history

-

Wall Street, the International Monetary Fund, and the Bankrupting of Argentina (2005)

The Argentine economic crisis (1999--2002) was a major downturn in Argentina's economy. It began in 1999 with a decrease of real Gross Domestic Product (GDP). The crisis caused the fall of the government, default on the country's foreign debt, widespread unemployment, riots, the rise of alternative currencies and the end of the peso's fixed exchange rate to the US dollar.

By 2002 GDP growth had r

-

Confronting Crisis - Global Cooperation and the International Monetary Fund

A brief animated video about multilateralism and the origins of the IMF

Finance & Development Magazine: http://www.imf.org/external/pubs/ft/fandd/2014/09/index.htm

-

$100 Billion BRICS Monetary Fund Now Operational

www.undergroundworldnews.com

The $100 billion BRICS Contingent Reserve Arrangement (CRA) has become fully operational following the inaugural meetings of the BRICS CRA Board of Governors and the Standing Committee in the Turkish capital of Ankara.

“The first meetings of the governing bodies mark the start of a full-scale operation of the BRICS Contingent Reserve Arrangement as an international ins

-

Islam & The International Monetary Fund- Sheikh Imran Nazar Hosein. Indonesia 23 Dec 2011

ইসলাম এবং আন্তর্জাতিক মনেটারি ফান্ড ২৭ মুহাররাম ১৪৩৩ হিজরি (২৩ ডিসেম্বর ২০১১) ইন্দোনেশিয়ায় ধারনকৃত আন্তর্জাতিক খ্যাতিসম্পন্ন বিশিষ্ট ইসলামিক স্কলার, দার্শনিক...

-

The IMF(International Monetary Fund)/Global Economic Collapse With A One World Currency Almost Here

The IMF(International Monetary Fund)/Global Economic Collapse With A One World Currency Almost Here/Mark Of The Beast On The Way. God Bless & Jesus Saves. Accept Jesus As Your Lord & Saviour Today. Romans 10:9 That if thou shalt confess with thy mouth the Lord Jesus, and shalt believe in thine heart that God hath raised him from the dead, thou shalt be saved. America In Bible Prophecy Revelation 1

-

International Monetary Fund Says "China Will Overtake America" 2016 Prophecy!

Theologian Paul Begley explains that 666 "Mark of the Beast" soon as International Monetary Fund predicts "China will overtake America" in 2016! Begley reads...

-

Buhari Meets MD Of International Monetary Fund

The Managing Director of the International monetary fund, IMF Christine Lagarde has extolled the steps being taken by Nigeria to address her economic challenges as she continued her 3-day visit with a meeting with the Minister of Finance, Mrs Kemi Adeosun at the Federal Ministry of Finance Headquarters.

What Is The International Monetary Fund (IMF)?

Will The European Union Fall Apart? BIT.LY LINK

Subscribe! http://bitly.com/1iLOHml

In June, Greece missed a deadline to pay back emergency loans from t...

Will The European Union Fall Apart? BIT.LY LINK

Subscribe! http://bitly.com/1iLOHml

In June, Greece missed a deadline to pay back emergency loans from the International Monetary Fund. So, what is the IMF and what does it do?

Learn More:

Why the IMF was created and how it works

https://www.imf.org/external/about.htm

"The IMF, also known as the Fund, was conceived at a UN conference in Bretton Woods, New Hampshire, United States, in July 1944."

IMF Members' Quotas and Voting Power, and IMF Board of Governors

https://www.imf.org/external/np/sec/memdir/members.aspx

"The Board of Governors, the highest decision-making body of the IMF, consists of one governor and one alternate governor for each member country."

Can The IMF Solve Global Economic Problems?

http://www.investopedia.com/articles/economics/09/international-monetary-fund-imf.asp

"The International Monetary Fund (IMF) was founded in 1944 with a primary mission to watch over the monetary system, guarantee exchange rate stability and eliminate restrictions that prevent or slow trade."

Subscribe to TestTube Daily!

http://bitly.com/1iLOHml

_________________________

TestTube News is committed to answering the smart, inquisitive questions we have about life, society, politics and anything else happening in the news. It's a place where curiosity rules and together we'll get a clearer understanding of this crazy world we live in.

Watch more TestTube: http://testtube.com/testtubenews

Subscribe now! http://www.youtube.com/subscription_center?add_user=testtubenetwork

TestTube on Twitter https://twitter.com/TestTube

Trace Dominguez on Twitter https://twitter.com/TraceDominguez

TestTube on Facebook https://facebook.com/testtubenetwork

TestTube on Google+ http://gplus.to/TestTube

Download the New TestTube iOS app! http://testu.be/1ndmmMq

Special thanks to Evan Puschak for hosting TestTube!

Check Evan out on Twitter: https://twitter.com/TheeNerdwriter/media

wn.com/What Is The International Monetary Fund (Imf)

Will The European Union Fall Apart? BIT.LY LINK

Subscribe! http://bitly.com/1iLOHml

In June, Greece missed a deadline to pay back emergency loans from the International Monetary Fund. So, what is the IMF and what does it do?

Learn More:

Why the IMF was created and how it works

https://www.imf.org/external/about.htm

"The IMF, also known as the Fund, was conceived at a UN conference in Bretton Woods, New Hampshire, United States, in July 1944."

IMF Members' Quotas and Voting Power, and IMF Board of Governors

https://www.imf.org/external/np/sec/memdir/members.aspx

"The Board of Governors, the highest decision-making body of the IMF, consists of one governor and one alternate governor for each member country."

Can The IMF Solve Global Economic Problems?

http://www.investopedia.com/articles/economics/09/international-monetary-fund-imf.asp

"The International Monetary Fund (IMF) was founded in 1944 with a primary mission to watch over the monetary system, guarantee exchange rate stability and eliminate restrictions that prevent or slow trade."

Subscribe to TestTube Daily!

http://bitly.com/1iLOHml

_________________________

TestTube News is committed to answering the smart, inquisitive questions we have about life, society, politics and anything else happening in the news. It's a place where curiosity rules and together we'll get a clearer understanding of this crazy world we live in.

Watch more TestTube: http://testtube.com/testtubenews

Subscribe now! http://www.youtube.com/subscription_center?add_user=testtubenetwork

TestTube on Twitter https://twitter.com/TestTube

Trace Dominguez on Twitter https://twitter.com/TraceDominguez

TestTube on Facebook https://facebook.com/testtubenetwork

TestTube on Google+ http://gplus.to/TestTube

Download the New TestTube iOS app! http://testu.be/1ndmmMq

Special thanks to Evan Puschak for hosting TestTube!

Check Evan out on Twitter: https://twitter.com/TheeNerdwriter/media

- published: 13 Jul 2015

- views: 95756

What is The International Monetary Fund (IMF) ?

The International Monetary Fund, is often referred to as the IMF and is headed by Christine LaGarde at present and she has been one of the most active and publi...

The International Monetary Fund, is often referred to as the IMF and is headed by Christine LaGarde at present and she has been one of the most active and public leaders helping with the global recovery along with loans to distressed countries during the financial crisis. The IMF is an organization of 187 countries based in Washington D.C. It is designed to assist countries in financial trouble. Member countries contribute to the fund, relative to their economies, when assistance is needed.

By Barry Norman, Investors Trading Academy.

wn.com/What Is The International Monetary Fund (Imf)

The International Monetary Fund, is often referred to as the IMF and is headed by Christine LaGarde at present and she has been one of the most active and public leaders helping with the global recovery along with loans to distressed countries during the financial crisis. The IMF is an organization of 187 countries based in Washington D.C. It is designed to assist countries in financial trouble. Member countries contribute to the fund, relative to their economies, when assistance is needed.

By Barry Norman, Investors Trading Academy.

- published: 26 May 2014

- views: 13021

International Monetary System - New Economic Slavery

A brief about paper money, 1. How paper money is created 2. policy of using it, 3. debt, 4. inflation 5. Interest International Monetary system is called mod......

A brief about paper money, 1. How paper money is created 2. policy of using it, 3. debt, 4. inflation 5. Interest International Monetary system is called mod...

wn.com/International Monetary System New Economic Slavery

A brief about paper money, 1. How paper money is created 2. policy of using it, 3. debt, 4. inflation 5. Interest International Monetary system is called mod...

- published: 28 Oct 2011

- views: 100195

-

author: Abu Musa

The Secret World of Financial Institutions: World Bank, International Monetary Fund (2002)

The World Bank has long been criticized by non-governmental organizations, such as the indigenous rights group Survival International, and academics, including ...

The World Bank has long been criticized by non-governmental organizations, such as the indigenous rights group Survival International, and academics, including its former Chief Economist Joseph Stiglitz, Henry Hazlitt and Ludwig Von Mises. Henry Hazlitt argued that the World Bank along with the monetary system it was designed within would promote world inflation and "a world in which international trade is State-dominated" when they were being advocated. Stiglitz argued that the so-called free market reform policies which the Bank advocates are often harmful to economic development if implemented badly, too quickly ("shock therapy"), in the wrong sequence or in weak, uncompetitive economies.

One of the strongest criticisms of the World Bank has been the way in which it is governed. While the World Bank represents 188 countries, it is run by a small number of economically powerful countries. These countries (which also provide most of the institution's funding) choose the leadership and senior management of the World Bank, and so their interests dominate the bank. Titus Alexander argues that the unequal voting power of western countries and the World Bank's role in developing countries makes it similar to the South African Development Bank under apartheid, and therefore a pillar of global apartheid.

In the 1990s, the World Bank and the IMF forged the Washington Consensus, policies which included deregulation and liberalization of markets, privatization and the downscaling of government. Though the Washington Consensus was conceived as a policy that would best promote development, it was criticized for ignoring equity, employment and how reforms like privatization were carried out. Joseph Stiglitz argued that the Washington Consensus placed too much emphasis on the growth of GDP, and not enough on the permanence of growth or on whether growth contributed to better living standards.

The United States Senate Committee on Foreign Relations report criticized the World Bank and other international financial institutions for focusing too much "on issuing loans rather than on achieving concrete development results within a finite period of time" and called on the institution to "strengthen anti-corruption efforts."

Criticism of the World Bank often takes the form of protesting as seen in recent events such as the World Bank Oslo 2002 Protests, the October Rebellion, and the Battle of Seattle. Such demonstrations have occurred all over the world, even amongst the Brazilian Kayapo people.

Another source of criticism has been the tradition of having an American head the bank, implemented because the United States provides the majority of World Bank funding. "When economists from the World Bank visit poor countries to dispense cash and advice," observed The Economist, as Jim Yong Kim said in 2012, "they routinely tell governments to reject cronyism and fill each important job with the best candidate available. It is good advice. The World Bank should take it." Jim Yong Kim is the most recently appointed president of the World Bank.

Some critics,[60] most prominently the author Naomi Klein, are of the opinion that the World Bank Group's loans and aid have unfair conditions attached to them that reflect the interests, financial power and political doctrines (notably the Washington Consensus) of the Bank and, by extension, the countries that are most influential within it. Amongst other allegations, Klein says the Group's credibility was damaged "when it forced school fees on students in Ghana in exchange for a loan; when it demanded that Tanzania privatise its water system; when it made telecom privatisation a condition of aid for Hurricane Mitch; when it demanded labour "flexibility" in Sri Lanka in the aftermath of the Asian tsunami; when it pushed for eliminating food subsidies in post-invasion Iraq."[61]

The World Bank requires sovereign immunity from countries it deals with.[62][63][64] Sovereign immunity waives a holder from all legal liability for their actions. It is proposed that this immunity from responsibility is a "shield which [The World Bank] wants to resort to, for escaping accountability and security by the people."[62] As the United States has veto power, it can prevent the World Bank from taking action against its interests.[62]

http://en.wikipedia.org/wiki/World_Bank

wn.com/The Secret World Of Financial Institutions World Bank, International Monetary Fund (2002)

The World Bank has long been criticized by non-governmental organizations, such as the indigenous rights group Survival International, and academics, including its former Chief Economist Joseph Stiglitz, Henry Hazlitt and Ludwig Von Mises. Henry Hazlitt argued that the World Bank along with the monetary system it was designed within would promote world inflation and "a world in which international trade is State-dominated" when they were being advocated. Stiglitz argued that the so-called free market reform policies which the Bank advocates are often harmful to economic development if implemented badly, too quickly ("shock therapy"), in the wrong sequence or in weak, uncompetitive economies.

One of the strongest criticisms of the World Bank has been the way in which it is governed. While the World Bank represents 188 countries, it is run by a small number of economically powerful countries. These countries (which also provide most of the institution's funding) choose the leadership and senior management of the World Bank, and so their interests dominate the bank. Titus Alexander argues that the unequal voting power of western countries and the World Bank's role in developing countries makes it similar to the South African Development Bank under apartheid, and therefore a pillar of global apartheid.

In the 1990s, the World Bank and the IMF forged the Washington Consensus, policies which included deregulation and liberalization of markets, privatization and the downscaling of government. Though the Washington Consensus was conceived as a policy that would best promote development, it was criticized for ignoring equity, employment and how reforms like privatization were carried out. Joseph Stiglitz argued that the Washington Consensus placed too much emphasis on the growth of GDP, and not enough on the permanence of growth or on whether growth contributed to better living standards.

The United States Senate Committee on Foreign Relations report criticized the World Bank and other international financial institutions for focusing too much "on issuing loans rather than on achieving concrete development results within a finite period of time" and called on the institution to "strengthen anti-corruption efforts."

Criticism of the World Bank often takes the form of protesting as seen in recent events such as the World Bank Oslo 2002 Protests, the October Rebellion, and the Battle of Seattle. Such demonstrations have occurred all over the world, even amongst the Brazilian Kayapo people.

Another source of criticism has been the tradition of having an American head the bank, implemented because the United States provides the majority of World Bank funding. "When economists from the World Bank visit poor countries to dispense cash and advice," observed The Economist, as Jim Yong Kim said in 2012, "they routinely tell governments to reject cronyism and fill each important job with the best candidate available. It is good advice. The World Bank should take it." Jim Yong Kim is the most recently appointed president of the World Bank.

Some critics,[60] most prominently the author Naomi Klein, are of the opinion that the World Bank Group's loans and aid have unfair conditions attached to them that reflect the interests, financial power and political doctrines (notably the Washington Consensus) of the Bank and, by extension, the countries that are most influential within it. Amongst other allegations, Klein says the Group's credibility was damaged "when it forced school fees on students in Ghana in exchange for a loan; when it demanded that Tanzania privatise its water system; when it made telecom privatisation a condition of aid for Hurricane Mitch; when it demanded labour "flexibility" in Sri Lanka in the aftermath of the Asian tsunami; when it pushed for eliminating food subsidies in post-invasion Iraq."[61]

The World Bank requires sovereign immunity from countries it deals with.[62][63][64] Sovereign immunity waives a holder from all legal liability for their actions. It is proposed that this immunity from responsibility is a "shield which [The World Bank] wants to resort to, for escaping accountability and security by the people."[62] As the United States has veto power, it can prevent the World Bank from taking action against its interests.[62]

http://en.wikipedia.org/wiki/World_Bank

- published: 13 Jan 2014

- views: 5142

International Monetary Fund

A project that me and my friends did haha... remember IMF....

A project that me and my friends did haha... remember IMF.

wn.com/International Monetary Fund

A project that me and my friends did haha... remember IMF.

What do the World Bank and the International Monetary Fund actually do?

Dr. Roslyn Fuller explains the original purpose of both the World Bank and the International Monetary Fund (IMF). (c) Video / Audio: Sergio Angulo Bujanda....

Dr. Roslyn Fuller explains the original purpose of both the World Bank and the International Monetary Fund (IMF). (c) Video / Audio: Sergio Angulo Bujanda.

wn.com/What Do The World Bank And The International Monetary Fund Actually Do

Dr. Roslyn Fuller explains the original purpose of both the World Bank and the International Monetary Fund (IMF). (c) Video / Audio: Sergio Angulo Bujanda.

The World Bank (WB) & The International Monetary Fund (IMF)

A clip from the documentary "The New Rulers of The World" by film maker John Pilger. The WB and the IMF control most of the world's cash flow. Please check o......

A clip from the documentary "The New Rulers of The World" by film maker John Pilger. The WB and the IMF control most of the world's cash flow. Please check o...

wn.com/The World Bank (Wb) The International Monetary Fund (Imf)

A clip from the documentary "The New Rulers of The World" by film maker John Pilger. The WB and the IMF control most of the world's cash flow. Please check o...

- published: 17 Nov 2007

- views: 164431

-

author: Darganot

The History of the International Monetary Fund (IMF)

This brief clips traces the history of the IMF from the rubble of Europe after WWII to the Third World in the 1970s and 80s. (Source: Banking on Life and Debt)...

This brief clips traces the history of the IMF from the rubble of Europe after WWII to the Third World in the 1970s and 80s. (Source: Banking on Life and Debt).

wn.com/The History Of The International Monetary Fund (Imf)

This brief clips traces the history of the IMF from the rubble of Europe after WWII to the Third World in the 1970s and 80s. (Source: Banking on Life and Debt).

- published: 12 May 2015

- views: 5

How do the WTO, World Bank and IMF work?

Susan George explains what the World Bank, the International Monetary Fund (IMF) and the World Trade Organization (WTO) are and how they work. They operate in t...

Susan George explains what the World Bank, the International Monetary Fund (IMF) and the World Trade Organization (WTO) are and how they work. They operate in the interests of rich nations at the expense of the poor. She cautions against the current trend to privatise public services such as transport, health and water.

wn.com/How Do The Wto, World Bank And Imf Work

Susan George explains what the World Bank, the International Monetary Fund (IMF) and the World Trade Organization (WTO) are and how they work. They operate in the interests of rich nations at the expense of the poor. She cautions against the current trend to privatise public services such as transport, health and water.

- published: 05 May 2011

- views: 95047

The International Monetary Fund

Grade 9 Project: Global Organizations....

Grade 9 Project: Global Organizations.

wn.com/The International Monetary Fund

Grade 9 Project: Global Organizations.

The International Monetary Fund Adds China’s Yuan to Reserve Currency Basket

The International Monetary Fund’s decision to include China’s yuan currency in its special drawing rights basket won’t amount to a whole lot for investors, acco...

The International Monetary Fund’s decision to include China’s yuan currency in its special drawing rights basket won’t amount to a whole lot for investors, according to one expert. ‘It’s not like when a stock gets added to the S&P; 500, where all of a sudden there are fund managers that need to buy it,’ said Greg Anderson, head of FX strategy at BMO Capital Markets, based in New York. ‘Nobody needs to go out and buy renminbi tomorrow because it was put in the SDR basket - no one buys the SDR basket, but it’s a symbol that the IMF approves of what the reformers have been doing with the currency.’ The yuan’s reserve status puts it on similar footing as the dollar, euro, pound and the Japanese yen, currencies already included in the prestigious basket. But with this, the pressure is on for China to become transparent and allow its currency to trade more freely. ‘The reformers in China have won a big victory,’ Anderson said. ‘I think it is an important step along the path towards what I think everyone wants them to get to eventually, which is a freely traded and floating currency.’ TheStreet’s Scott Gamm has details from New York.

Subscribe to TheStreetTV on YouTube: http://t.st/TheStreetTV

For more content from TheStreet visit: http://thestreet.com

Check out all our videos: http://youtube.com/user/TheStreetTV

Follow TheStreet on Twitter: http://twitter.com/thestreet

Like TheStreet on Facebook: http://facebook.com/TheStreet

Follow TheStreet on LinkedIn: http://linkedin.com/company/theStreet

Follow TheStreet on Google+: http://plus.google.com/+TheStreet

wn.com/The International Monetary Fund Adds China’S Yuan To Reserve Currency Basket

The International Monetary Fund’s decision to include China’s yuan currency in its special drawing rights basket won’t amount to a whole lot for investors, according to one expert. ‘It’s not like when a stock gets added to the S&P; 500, where all of a sudden there are fund managers that need to buy it,’ said Greg Anderson, head of FX strategy at BMO Capital Markets, based in New York. ‘Nobody needs to go out and buy renminbi tomorrow because it was put in the SDR basket - no one buys the SDR basket, but it’s a symbol that the IMF approves of what the reformers have been doing with the currency.’ The yuan’s reserve status puts it on similar footing as the dollar, euro, pound and the Japanese yen, currencies already included in the prestigious basket. But with this, the pressure is on for China to become transparent and allow its currency to trade more freely. ‘The reformers in China have won a big victory,’ Anderson said. ‘I think it is an important step along the path towards what I think everyone wants them to get to eventually, which is a freely traded and floating currency.’ TheStreet’s Scott Gamm has details from New York.

Subscribe to TheStreetTV on YouTube: http://t.st/TheStreetTV

For more content from TheStreet visit: http://thestreet.com

Check out all our videos: http://youtube.com/user/TheStreetTV

Follow TheStreet on Twitter: http://twitter.com/thestreet

Like TheStreet on Facebook: http://facebook.com/TheStreet

Follow TheStreet on LinkedIn: http://linkedin.com/company/theStreet

Follow TheStreet on Google+: http://plus.google.com/+TheStreet

- published: 30 Nov 2015

- views: 0

The International Monetary Fund's Kalpana Kochhar: Whats Ahead for the Indian Economy

IMF Economist Kalpana Kochhar discusses the resilience of the Indian market, hurdles to growth and why the pace of reform must accelerate....

IMF Economist Kalpana Kochhar discusses the resilience of the Indian market, hurdles to growth and why the pace of reform must accelerate.

wn.com/The International Monetary Fund's Kalpana Kochhar Whats Ahead For The Indian Economy

IMF Economist Kalpana Kochhar discusses the resilience of the Indian market, hurdles to growth and why the pace of reform must accelerate.

- published: 21 Apr 2010

- views: 8486

Exposing the International Monetary Fund

Stop the IMF bailouts! Sign the FreedomWorks petition: http://action.freedomworks.org/4173/stop-international-monetary-fund-imf-bailouts/ To read Dr. Judy Sh......

Stop the IMF bailouts! Sign the FreedomWorks petition: http://action.freedomworks.org/4173/stop-international-monetary-fund-imf-bailouts/ To read Dr. Judy Sh...

wn.com/Exposing The International Monetary Fund

Stop the IMF bailouts! Sign the FreedomWorks petition: http://action.freedomworks.org/4173/stop-international-monetary-fund-imf-bailouts/ To read Dr. Judy Sh...

IAS(UPSC) Economics Lectures;IMF Part-1

In this lecture i have explained International Monetary Fund and World Bank.....

In this lecture i have explained International Monetary Fund and World Bank..

wn.com/Ias(Upsc) Economics Lectures Imf Part 1

In this lecture i have explained International Monetary Fund and World Bank..

Free Trade, Flaws of a Market Economy, International Monetary Fund: Joseph Sitglitz (2006)

The first major protest in Seattle, Washington against the World Trade Organization (WTO) and its role in promoting economic globalization came as a surprise to...

The first major protest in Seattle, Washington against the World Trade Organization (WTO) and its role in promoting economic globalization came as a surprise to many, considering the positive impacts globalization was supposed to bring. According to Stiglitz, this was the first step in a widespread recognition that globalization was all "too good to be true." Along with globalization comes a myriad of concerns and problems, says Stiglitz.

The first concern being that the rules governing globalization favors developed countries, while the developing countries sink even lower.

Second, globalization only regards monetary value of items, rather than other factors involved; one being the environment.

The next concern is how developing countries are controlled by globalization and the negative effects it can have on their democracies. Developing countries borrow a large amount of funds from other countries and the World Bank which essentially causes them to give up the benefits of their democracy because of the strings attached to the loan repayment.

The fourth concern regarding globalization is the notion that it does not live up to its original expectations. Globalization was advertised to boost countries economically; however, it has not shown improvement in developed nor developing countries.

Last but not least, the new system of globalization has basically forced a new economic system on developing countries. This new economic system is seen as the "Americanization" (Stiglitz, Page 9) of their policies as well as culture. This has caused quite a bit of resentment and financial damage.

In addition to these concerns, Stiglitz highlights that individual persons and whole countries are being victimized by globalization.

Globalization had succeeded in unifying people from around the world — against globalization. Factory workers in the United States saw their jobs being threatened by competition from China. Farmers in developing countries saw their jobs being threatened by the highly subsidized corn and other crops from the United States. Workers in Europe saw hard-fought-for job protections being assailed in the name of globalization. AIDS activists saw a new trade agreement raising the prices of drugs to levels that were unaffordable in much of the world. Environmentalists felt that globalization undermined their decade long struggle to establish regulations to preserve our natural heritage. Those who wanted to protect and develop their own cultural heritage saw too the intrusions of globalization.

— Stiglitz, 2006, p. 7

Stiglitz then goes on to provide an overview of how we might "reform" globalization, by noting representatives of the world's national governments attended the Millennium Summit and signed the Millennium Development Goals, pledging to cut poverty in half by 2015. Additionally, the International Monetary Fund (IMF) had previously been focusing more on inflation, rather than employment and income; however, they have shifted their focus in hopes of reducing poverty. Stiglitz states that countries who seek financial assistance have in the past been asked to meet an outrageous number of conditions, in exchange for the aid. This was one of the most common complaints towards the IMF and the World Bank. They have heard these complaints and have since greatly reduced the conditionality. The G8 group met for their annual meeting in 2005 and had agreed to write off debt owed by the 18 poorest countries in the world as an attempt to help with the global poverty issue. As regards the aspiration to make trade fair,

originally, opening the market was done in hopes of helping the economy; however, the rights between the developing and developed countries have been skewed, and

the last trade agreement actually put the poorest countries in a situation in which they were worse off than to begin with.

Stiglitz focuses on the limitations of liberalization briefly to say the results of liberalization never lived up to the expectations; the developing countries were not able to follow through because their economic and political systems simply could not cope with the pressures.

Finally, Stiglitz also argues that protecting the environment is one of the most important issues and countries must work together to lessen the effects of global warming. Successful development in countries such as India and China has only increased energy usage and also the use of natural resources. People from all over the world must adjust their lifestyle in order to reverse the effects of global warming.

http://en.wikipedia.org/wiki/Making_Globalization_Work

Image By World Economic Forum [CC-BY-SA-2.0 (http://creativecommons.org/licenses/by-sa/2.0)], via Wikimedia Commons

wn.com/Free Trade, Flaws Of A Market Economy, International Monetary Fund Joseph Sitglitz (2006)

The first major protest in Seattle, Washington against the World Trade Organization (WTO) and its role in promoting economic globalization came as a surprise to many, considering the positive impacts globalization was supposed to bring. According to Stiglitz, this was the first step in a widespread recognition that globalization was all "too good to be true." Along with globalization comes a myriad of concerns and problems, says Stiglitz.

The first concern being that the rules governing globalization favors developed countries, while the developing countries sink even lower.

Second, globalization only regards monetary value of items, rather than other factors involved; one being the environment.

The next concern is how developing countries are controlled by globalization and the negative effects it can have on their democracies. Developing countries borrow a large amount of funds from other countries and the World Bank which essentially causes them to give up the benefits of their democracy because of the strings attached to the loan repayment.

The fourth concern regarding globalization is the notion that it does not live up to its original expectations. Globalization was advertised to boost countries economically; however, it has not shown improvement in developed nor developing countries.

Last but not least, the new system of globalization has basically forced a new economic system on developing countries. This new economic system is seen as the "Americanization" (Stiglitz, Page 9) of their policies as well as culture. This has caused quite a bit of resentment and financial damage.

In addition to these concerns, Stiglitz highlights that individual persons and whole countries are being victimized by globalization.

Globalization had succeeded in unifying people from around the world — against globalization. Factory workers in the United States saw their jobs being threatened by competition from China. Farmers in developing countries saw their jobs being threatened by the highly subsidized corn and other crops from the United States. Workers in Europe saw hard-fought-for job protections being assailed in the name of globalization. AIDS activists saw a new trade agreement raising the prices of drugs to levels that were unaffordable in much of the world. Environmentalists felt that globalization undermined their decade long struggle to establish regulations to preserve our natural heritage. Those who wanted to protect and develop their own cultural heritage saw too the intrusions of globalization.

— Stiglitz, 2006, p. 7

Stiglitz then goes on to provide an overview of how we might "reform" globalization, by noting representatives of the world's national governments attended the Millennium Summit and signed the Millennium Development Goals, pledging to cut poverty in half by 2015. Additionally, the International Monetary Fund (IMF) had previously been focusing more on inflation, rather than employment and income; however, they have shifted their focus in hopes of reducing poverty. Stiglitz states that countries who seek financial assistance have in the past been asked to meet an outrageous number of conditions, in exchange for the aid. This was one of the most common complaints towards the IMF and the World Bank. They have heard these complaints and have since greatly reduced the conditionality. The G8 group met for their annual meeting in 2005 and had agreed to write off debt owed by the 18 poorest countries in the world as an attempt to help with the global poverty issue. As regards the aspiration to make trade fair,

originally, opening the market was done in hopes of helping the economy; however, the rights between the developing and developed countries have been skewed, and

the last trade agreement actually put the poorest countries in a situation in which they were worse off than to begin with.

Stiglitz focuses on the limitations of liberalization briefly to say the results of liberalization never lived up to the expectations; the developing countries were not able to follow through because their economic and political systems simply could not cope with the pressures.

Finally, Stiglitz also argues that protecting the environment is one of the most important issues and countries must work together to lessen the effects of global warming. Successful development in countries such as India and China has only increased energy usage and also the use of natural resources. People from all over the world must adjust their lifestyle in order to reverse the effects of global warming.

http://en.wikipedia.org/wiki/Making_Globalization_Work

Image By World Economic Forum [CC-BY-SA-2.0 (http://creativecommons.org/licenses/by-sa/2.0)], via Wikimedia Commons

- published: 17 Nov 2013

- views: 2658

WORLD BANK IMF DOCUMENTARY FULL MOVIE

Learn Pascal Programming Free! WWW.LEARNPASCAL.COM

ron paul alex jones illuminati nwo globalist libertarian republican obama democrat liberal history...

Learn Pascal Programming Free! WWW.LEARNPASCAL.COM

ron paul alex jones illuminati nwo globalist libertarian republican obama democrat liberal history

wn.com/World Bank Imf Documentary Full Movie

Learn Pascal Programming Free! WWW.LEARNPASCAL.COM

ron paul alex jones illuminati nwo globalist libertarian republican obama democrat liberal history

- published: 05 Aug 2013

- views: 49363

Wall Street, the International Monetary Fund, and the Bankrupting of Argentina (2005)

The Argentine economic crisis (1999--2002) was a major downturn in Argentina's economy. It began in 1999 with a decrease of real Gross Domestic Product (GDP). T...

The Argentine economic crisis (1999--2002) was a major downturn in Argentina's economy. It began in 1999 with a decrease of real Gross Domestic Product (GDP). The crisis caused the fall of the government, default on the country's foreign debt, widespread unemployment, riots, the rise of alternative currencies and the end of the peso's fixed exchange rate to the US dollar.

By 2002 GDP growth had returned, surprising economists and the business media. As of 2012, the default had not been completely resolved, although the government had repaid its IMF loans in full.

Since the early 1990s, Argentina had relied on the IMF to provide the country with reliable access to credit and to guide its economic reforms. When the recession began, the national deficit widened to 2.5% of GDP in 1999 and its external debt surpassed 50% of GDP.[13] Seeing these levels as excessive, the IMF advised the government to balance its budget by implementing austerity measures to sustain investor confidence. The De la Rúa administration implemented US$1.4 billion in cuts in its first weeks in office in late 1999. In June 2000, with unemployment at 14% and projections of 3.5% GDP growth for the year, austerity was furthered by US$938 million in spending cuts and US$2 billion in tax increases.[14] Following vice president Carlos Álvarez' resignation in October 2000 over bribery suspicions in the Upper House,[15] the crisis accelerated.[citation needed]

GDP growth projections proved to be overly optimistic (instead of growing, real GDP shrank 0.8%), and lagging tax receipts prompted the government to freeze spending and cut retirement benefits again in November 2000.[16][not in citation given] In early November, Standard & Poor's placed Argentina on a credit watch, and a treasury bill auction required paying 16% interest (up from 9% in July); this was the second highest rate of any country in South America at the time.[17]

Rising bond yields forced the country to turn to major international lenders, such as the IMF, World Bank and the U.S. Treasury, which would lend to the government at below-market rates, and to comply with the accompanying conditions. Several more rounds of belt-tightening followed. José Luis Machinea resigned as Minister of Economy in February 2001. He was replaced with Ricardo López Murphy, who lasted 8 days in the office before being replaced with Cavallo. In July 2001, Standard and Poor's cut the credit rating of the country to B--.[18]

In July 2001 the government instituted an unpopular across-the-board pay cut of up to 13% to all civil servants and an equivalent cut to government pension benefits—De la Rúa's seventh austerity round[19]—triggering nationwide strikes,[20] and, starting in August, it paid salaries of the highest-paid employees in I.O.U.s instead of money.[21] This further depressed the weakened economy. The unemployment rate rose to 16.4% in August 2001[22] up from a 14.7% a month earlier,[23] and it reached 20% by December.[24] In October 2001, public discontent with the economic conditions was expressed in the nationwide election. President Fernando de la Rúa's alliance lost seats in both chambers of the Argentine National Congress, leaving it in the minority. Over 20% of voters chose to enter so-called "anger votes", returning blank or defaced ballots rather than indicate support of any candidate.[25]

The crisis intensified when, on 5 December 2001, the IMF refused to release a US$1.3 billion tranche of its loan, citing the failure of the Argentine government to reach previously agreed-upon budget deficit targets,[26] and demanded further budget cuts, amounting to 10% of the federal budget.[27] On 4 December, Argentine bond yields stood at 34% over U.S. treasury bonds, and, by 11 December, the spread jumped to 42%.[28][29]

By the end of November 2001, people began withdrawing large sums of dollars from their bank accounts, turning pesos into dollars and sending them abroad, causing a bank run. On 2 December 2001 the government enacted measures, informally known as the corralito,[30][31] that effectively froze all bank accounts for twelve months,[32][33] allowing for only minor sums of cash to be withdrawn, initially $250 a week.[34]

The freeze enraged many Argentines who took to the streets of important cities, especially Buenos Aires. They engaged in protests that became known as cacerolazo (banging pots and pans). These protests occurred especially in 2001 and 2002. At first the cacerolazos were simply noisy demonstrations, but soon they included property destruction, often directed at banks, foreign-owned privatized companies, and especially big American and European companies.

http://en.wikipedia.org/wiki/Argentine_economic_crisis_%281999%E2%80%932002%29

Image by Emiism (Own work) [CC-BY-SA-3.0 (http://creativecommons.org/licenses/by-sa/3.0)], via Wikimedia Commons

wn.com/Wall Street, The International Monetary Fund, And The Bankrupting Of Argentina (2005)

The Argentine economic crisis (1999--2002) was a major downturn in Argentina's economy. It began in 1999 with a decrease of real Gross Domestic Product (GDP). The crisis caused the fall of the government, default on the country's foreign debt, widespread unemployment, riots, the rise of alternative currencies and the end of the peso's fixed exchange rate to the US dollar.

By 2002 GDP growth had returned, surprising economists and the business media. As of 2012, the default had not been completely resolved, although the government had repaid its IMF loans in full.

Since the early 1990s, Argentina had relied on the IMF to provide the country with reliable access to credit and to guide its economic reforms. When the recession began, the national deficit widened to 2.5% of GDP in 1999 and its external debt surpassed 50% of GDP.[13] Seeing these levels as excessive, the IMF advised the government to balance its budget by implementing austerity measures to sustain investor confidence. The De la Rúa administration implemented US$1.4 billion in cuts in its first weeks in office in late 1999. In June 2000, with unemployment at 14% and projections of 3.5% GDP growth for the year, austerity was furthered by US$938 million in spending cuts and US$2 billion in tax increases.[14] Following vice president Carlos Álvarez' resignation in October 2000 over bribery suspicions in the Upper House,[15] the crisis accelerated.[citation needed]

GDP growth projections proved to be overly optimistic (instead of growing, real GDP shrank 0.8%), and lagging tax receipts prompted the government to freeze spending and cut retirement benefits again in November 2000.[16][not in citation given] In early November, Standard & Poor's placed Argentina on a credit watch, and a treasury bill auction required paying 16% interest (up from 9% in July); this was the second highest rate of any country in South America at the time.[17]

Rising bond yields forced the country to turn to major international lenders, such as the IMF, World Bank and the U.S. Treasury, which would lend to the government at below-market rates, and to comply with the accompanying conditions. Several more rounds of belt-tightening followed. José Luis Machinea resigned as Minister of Economy in February 2001. He was replaced with Ricardo López Murphy, who lasted 8 days in the office before being replaced with Cavallo. In July 2001, Standard and Poor's cut the credit rating of the country to B--.[18]

In July 2001 the government instituted an unpopular across-the-board pay cut of up to 13% to all civil servants and an equivalent cut to government pension benefits—De la Rúa's seventh austerity round[19]—triggering nationwide strikes,[20] and, starting in August, it paid salaries of the highest-paid employees in I.O.U.s instead of money.[21] This further depressed the weakened economy. The unemployment rate rose to 16.4% in August 2001[22] up from a 14.7% a month earlier,[23] and it reached 20% by December.[24] In October 2001, public discontent with the economic conditions was expressed in the nationwide election. President Fernando de la Rúa's alliance lost seats in both chambers of the Argentine National Congress, leaving it in the minority. Over 20% of voters chose to enter so-called "anger votes", returning blank or defaced ballots rather than indicate support of any candidate.[25]

The crisis intensified when, on 5 December 2001, the IMF refused to release a US$1.3 billion tranche of its loan, citing the failure of the Argentine government to reach previously agreed-upon budget deficit targets,[26] and demanded further budget cuts, amounting to 10% of the federal budget.[27] On 4 December, Argentine bond yields stood at 34% over U.S. treasury bonds, and, by 11 December, the spread jumped to 42%.[28][29]

By the end of November 2001, people began withdrawing large sums of dollars from their bank accounts, turning pesos into dollars and sending them abroad, causing a bank run. On 2 December 2001 the government enacted measures, informally known as the corralito,[30][31] that effectively froze all bank accounts for twelve months,[32][33] allowing for only minor sums of cash to be withdrawn, initially $250 a week.[34]

The freeze enraged many Argentines who took to the streets of important cities, especially Buenos Aires. They engaged in protests that became known as cacerolazo (banging pots and pans). These protests occurred especially in 2001 and 2002. At first the cacerolazos were simply noisy demonstrations, but soon they included property destruction, often directed at banks, foreign-owned privatized companies, and especially big American and European companies.

http://en.wikipedia.org/wiki/Argentine_economic_crisis_%281999%E2%80%932002%29

Image by Emiism (Own work) [CC-BY-SA-3.0 (http://creativecommons.org/licenses/by-sa/3.0)], via Wikimedia Commons

- published: 04 Aug 2013

- views: 8171

Confronting Crisis - Global Cooperation and the International Monetary Fund

A brief animated video about multilateralism and the origins of the IMF

Finance & Development Magazine: http://www.imf.org/external/pubs/ft/fandd/2014/09/index...

A brief animated video about multilateralism and the origins of the IMF

Finance & Development Magazine: http://www.imf.org/external/pubs/ft/fandd/2014/09/index.htm

wn.com/Confronting Crisis Global Cooperation And The International Monetary Fund

A brief animated video about multilateralism and the origins of the IMF

Finance & Development Magazine: http://www.imf.org/external/pubs/ft/fandd/2014/09/index.htm

- published: 10 Oct 2014

- views: 125

$100 Billion BRICS Monetary Fund Now Operational

www.undergroundworldnews.com

The $100 billion BRICS Contingent Reserve Arrangement (CRA) has become fully operational following the inaugural meetings of the BR...

www.undergroundworldnews.com

The $100 billion BRICS Contingent Reserve Arrangement (CRA) has become fully operational following the inaugural meetings of the BRICS CRA Board of Governors and the Standing Committee in the Turkish capital of Ankara.

“The first meetings of the governing bodies mark the start of a full-scale operation of the BRICS Contingent Reserve Arrangement as an international institution with activities set to enhance and strengthen cooperation,” said a Russian Central Bank statement on Friday.

BRICS leaders Xi Jinping, Vladimir Putin, Jacob Zuma, Narendra Modi and Dilma Rousseff witnessed the signing of the agreement on the CRA in the Brazilian city of Fortaleza in July 2014.

The agreement entered into force on July 30, 2015.

China will provide the bulk of the funding with $41 billion, Brazil, Russia and India with $18 billion each, and South Africa with $5 billion.

The CRA is meant to provide an alternative to International Monetary Fund’s emergency lending. In the CRA, emergency loans of up to 30 per cent of a member nation’s contribution will be decided by a simple majority. Bigger loans will require the consent of all CRA members.

http://thebricspost.com/100bn-brics-monetary-fund-now-operational/#.Vexnu_lVhBf

wn.com/100 Billion Brics Monetary Fund Now Operational

www.undergroundworldnews.com

The $100 billion BRICS Contingent Reserve Arrangement (CRA) has become fully operational following the inaugural meetings of the BRICS CRA Board of Governors and the Standing Committee in the Turkish capital of Ankara.

“The first meetings of the governing bodies mark the start of a full-scale operation of the BRICS Contingent Reserve Arrangement as an international institution with activities set to enhance and strengthen cooperation,” said a Russian Central Bank statement on Friday.

BRICS leaders Xi Jinping, Vladimir Putin, Jacob Zuma, Narendra Modi and Dilma Rousseff witnessed the signing of the agreement on the CRA in the Brazilian city of Fortaleza in July 2014.

The agreement entered into force on July 30, 2015.

China will provide the bulk of the funding with $41 billion, Brazil, Russia and India with $18 billion each, and South Africa with $5 billion.

The CRA is meant to provide an alternative to International Monetary Fund’s emergency lending. In the CRA, emergency loans of up to 30 per cent of a member nation’s contribution will be decided by a simple majority. Bigger loans will require the consent of all CRA members.

http://thebricspost.com/100bn-brics-monetary-fund-now-operational/#.Vexnu_lVhBf

- published: 06 Sep 2015

- views: 1035

Islam & The International Monetary Fund- Sheikh Imran Nazar Hosein. Indonesia 23 Dec 2011

ইসলাম এবং আন্তর্জাতিক মনেটারি ফান্ড ২৭ মুহাররাম ১৪৩৩ হিজরি (২৩ ডিসেম্বর ২০১১) ইন্দোনেশিয়ায় ধারনকৃত আন্তর্জাতিক খ্যাতিসম্পন্ন বিশিষ্ট ইসলামিক স্কলার, দার্শনিক....

ইসলাম এবং আন্তর্জাতিক মনেটারি ফান্ড ২৭ মুহাররাম ১৪৩৩ হিজরি (২৩ ডিসেম্বর ২০১১) ইন্দোনেশিয়ায় ধারনকৃত আন্তর্জাতিক খ্যাতিসম্পন্ন বিশিষ্ট ইসলামিক স্কলার, দার্শনিক...

wn.com/Islam The International Monetary Fund Sheikh Imran Nazar Hosein. Indonesia 23 Dec 2011

ইসলাম এবং আন্তর্জাতিক মনেটারি ফান্ড ২৭ মুহাররাম ১৪৩৩ হিজরি (২৩ ডিসেম্বর ২০১১) ইন্দোনেশিয়ায় ধারনকৃত আন্তর্জাতিক খ্যাতিসম্পন্ন বিশিষ্ট ইসলামিক স্কলার, দার্শনিক...

- published: 28 Dec 2011

- views: 2030

-

author: DaringDeen

The IMF(International Monetary Fund)/Global Economic Collapse With A One World Currency Almost Here

The IMF(International Monetary Fund)/Global Economic Collapse With A One World Currency Almost Here/Mark Of The Beast On The Way. God Bless & Jesus Saves. Accep...

The IMF(International Monetary Fund)/Global Economic Collapse With A One World Currency Almost Here/Mark Of The Beast On The Way. God Bless & Jesus Saves. Accept Jesus As Your Lord & Saviour Today. Romans 10:9 That if thou shalt confess with thy mouth the Lord Jesus, and shalt believe in thine heart that God hath raised him from the dead, thou shalt be saved. America In Bible Prophecy Revelation 14:8-13, 16:17-20, 17, & 18, Isaiah 13, 14, 18, 47, & 48, Jeremiah 50 & 51, Habakkuk 1 & 2. Ephesians 5:11-16 And have no fellowship with the unfruitful works of darkness, but rather reprove them. For it is a shame even to speak of those things which are done of them in secret. But all things that are reproved are made manifest by the light: for whatsoever doth make manifest is light. Wherefore he saith, Awake thou that sleepest, and arise from the dead, and Christ shall give thee light. See then that ye walk circumspectly, not as fools, but as wise, Redeeming the time, because the days are evil. Ezekiel 33:2-9 Son of man, speak to the children of thy people, and say unto them, When I bring the sword upon a land, if the people of the land take a man of their coasts, and set him for their watchman: If when he seeth the sword come upon the land, he blow the trumpet, and warn the people; Then whosoever heareth the sound of the trumpet, and taketh not warning; if the sword come, and take him away, his blood shall be upon his own head. He heard the sound of the trumpet, and took not warning; his blood shall be upon him. But he that taketh warning shall deliver his soul. But if the watchman see the sword come, and blow not the trumpet, and the people be not warned; if the sword come, and take any person from among them, he is taken away in his iniquity; but his blood will I require at the watchman's hand. So thou, O son of man, I have set thee a watchman unto the house of Israel; therefore thou shalt hear the word at my mouth, and warn them from me. When I say unto the wicked, O wicked man, thou shalt surely die; if thou dost not speak to warn the wicked from his way, that wicked man shall die in his iniquity; but his blood will I require at thine hand. Nevertheless, if thou warn the wicked of his way to turn from it; if he do not turn from his way, he shall die in his iniquity; but thou hast delivered thy soul.

wn.com/The Imf(International Monetary Fund) Global Economic Collapse With A One World Currency Almost Here

The IMF(International Monetary Fund)/Global Economic Collapse With A One World Currency Almost Here/Mark Of The Beast On The Way. God Bless & Jesus Saves. Accept Jesus As Your Lord & Saviour Today. Romans 10:9 That if thou shalt confess with thy mouth the Lord Jesus, and shalt believe in thine heart that God hath raised him from the dead, thou shalt be saved. America In Bible Prophecy Revelation 14:8-13, 16:17-20, 17, & 18, Isaiah 13, 14, 18, 47, & 48, Jeremiah 50 & 51, Habakkuk 1 & 2. Ephesians 5:11-16 And have no fellowship with the unfruitful works of darkness, but rather reprove them. For it is a shame even to speak of those things which are done of them in secret. But all things that are reproved are made manifest by the light: for whatsoever doth make manifest is light. Wherefore he saith, Awake thou that sleepest, and arise from the dead, and Christ shall give thee light. See then that ye walk circumspectly, not as fools, but as wise, Redeeming the time, because the days are evil. Ezekiel 33:2-9 Son of man, speak to the children of thy people, and say unto them, When I bring the sword upon a land, if the people of the land take a man of their coasts, and set him for their watchman: If when he seeth the sword come upon the land, he blow the trumpet, and warn the people; Then whosoever heareth the sound of the trumpet, and taketh not warning; if the sword come, and take him away, his blood shall be upon his own head. He heard the sound of the trumpet, and took not warning; his blood shall be upon him. But he that taketh warning shall deliver his soul. But if the watchman see the sword come, and blow not the trumpet, and the people be not warned; if the sword come, and take any person from among them, he is taken away in his iniquity; but his blood will I require at the watchman's hand. So thou, O son of man, I have set thee a watchman unto the house of Israel; therefore thou shalt hear the word at my mouth, and warn them from me. When I say unto the wicked, O wicked man, thou shalt surely die; if thou dost not speak to warn the wicked from his way, that wicked man shall die in his iniquity; but his blood will I require at thine hand. Nevertheless, if thou warn the wicked of his way to turn from it; if he do not turn from his way, he shall die in his iniquity; but thou hast delivered thy soul.

- published: 10 Feb 2015

- views: 286

International Monetary Fund Says "China Will Overtake America" 2016 Prophecy!

Theologian Paul Begley explains that 666 "Mark of the Beast" soon as International Monetary Fund predicts "China will overtake America" in 2016! Begley reads......

Theologian Paul Begley explains that 666 "Mark of the Beast" soon as International Monetary Fund predicts "China will overtake America" in 2016! Begley reads...

wn.com/International Monetary Fund Says China Will Overtake America 2016 Prophecy

Theologian Paul Begley explains that 666 "Mark of the Beast" soon as International Monetary Fund predicts "China will overtake America" in 2016! Begley reads...

Buhari Meets MD Of International Monetary Fund

The Managing Director of the International monetary fund, IMF Christine Lagarde has extolled the steps being taken by Nigeria to address her economic challenges...

The Managing Director of the International monetary fund, IMF Christine Lagarde has extolled the steps being taken by Nigeria to address her economic challenges as she continued her 3-day visit with a meeting with the Minister of Finance, Mrs Kemi Adeosun at the Federal Ministry of Finance Headquarters.

wn.com/Buhari Meets Md Of International Monetary Fund

The Managing Director of the International monetary fund, IMF Christine Lagarde has extolled the steps being taken by Nigeria to address her economic challenges as she continued her 3-day visit with a meeting with the Minister of Finance, Mrs Kemi Adeosun at the Federal Ministry of Finance Headquarters.

- published: 06 Jan 2016

- views: 32

-

ICMC2015 - Opening Address by Mitsuhiro Furusawa...

Address by Mitsuhiro Furusawa, Deputy Managing Director of the International Monetary Fund, in International Capital Markets Conference (ICMC) on “Building Regional Capital Markets: Global Experiences, GMS Aspirations” ON November 30, 2015.

-

Reporting live- ALPHA TV NEWS

International Monetary Fund, Greece, US, Greek crisis

ALPHA TV NEWS

-

IMF Looks forward to Collaboration with AIIB

The International Monetary Fund (IMF) is looking forward to cooperating with the China-initiated Asian Infrastructure Investment Bank (AIIB), said an IMF official on Tuesday.

Chikahisa Sumi, assistant director of the Asia and Pacific Department of the IMF, made the remarks at a forum attended by IMF officials and members of U.S. think tanks in Washington, D.C.

"Infrastructure investment need i

-

IMF urges Nigeria to diversify its revenue

As Africa's biggest economy, Nigeria is battling its way out of an economic crisis fuelled by fall in oil prices.

The International Monetary Fund (IMF) chief, Christine Lagarde has called on Nigeria to diversify its revenue.

Lagarde made this call at the presidential villa in Abuja, moments after holding talks with President Muhammadu Buhari during her four-day visit to the West African countr

-

IMF boss arrives in Nigeria for talks with Buhari

The head of the International Monetary Fund (IMF), Christine Lagarde arrived in Nigeria on Monday for a four-day visit that will see her hold talks with President Muhammadu Buhari in the wake of an economic crisis that has hit the west African nation fuelled by plunging oil prices.

The visit is part of a two-nation West African region tour to engage policy makers and top officials of Nigeria and

-

Cameroon economy on the right path - IMF head

The head of the International Monetary Fund (IMF), Christine Lagarde, has made it clear that her visit to Cameroon was not to negotiate a "new loan".

The IMF boss has been in the west African nation since Thursday for a three-day visit and held talks with Cameroon's president Paul Biya and other government officials.

During a dinner that was hosted on her behalf, the Cameroonian Head of State sa

-

Can we print money to save the planet? | Michael Metcalfe | TED Institute

Will we do whatever it takes to tackle climate change? In combatting the financial crisis of 2008, the 188 countries of the International Monetary Fund adopted a “whatever it takes" commitment to monetary recovery, issuing 250 billion dollars’ worth of international currency to safe guard the financial system. Michael Metcalfe suggests we can use these monetary tools to fund our global commitment

-

ALERT: IMF Chinese Yuan Unseat Dollar As New World Reserve Currency

I NEED YOUR HELP! - Please Support Us, Become A Patreon & Get Extra Content SUBSCRIBE to ELITE NWO .

Check out the new website SOURCE: .

The International Monetary Fund has given the greenlight to include China′s currency, the yuan in its basket of reserve currencies. Joining this elite club .

The International Monetary Fund has approved China's yuan into its elite reserve currency, in a decisi

-

The International Monetary Fund Politics of Conditional Lending

-

Analysis On International Monetary Fund | News Angle By Prof Nageshwar | Epi 14 | HMTV

Watch Prof Nageshwar analysis on International Monetary Fund (IMF), IMF danger bells to all countries over economical growth, IMF survey on India and China growth rates, things need to to by India to achieve two digits growth rate. New Angle By Prof Nageshwar.

SUBSCRIBE Us : http://goo.gl/f9lm5E

Like us on FB : https://www.facebook.com/hmtvnewslive

Follow us on Twitter : https://twitter.com/hmtv

-

05 International Monetary Fund IMF

-

Newstellers _ China's Yuan / Christmas Controversy _ Part 1

China's Yuan

The International Monetary Fund has decided to add the Chinese yuan to its Special Drawing Rights (SDR) currency basket. The IMF's recent decision will allow the yuan to become one of the top three major international currencies – a peer to the U.S. dollar and the euro. With the establishment of the Asian Infrastructure Investment Bank and the inclusion of the Chinese yuan as a world

-

Newstellers _ China's Yuan / Christmas Controversy _ Part 2

China's Yuan

The International Monetary Fund has decided to add the Chinese yuan to its Special Drawing Rights (SDR) currency basket. The IMF's recent decision will allow the yuan to become one of the top three major international currencies – a peer to the U.S. dollar and the euro. With the establishment of the Asian Infrastructure Investment Bank and the inclusion of the Chinese yuan as a world

-

► US Congress approves IMF quota reforms

The US Congress has approved a spending plan for the International Monetary Fund. The move paves the way for approving long-delayed reforms to increase the representation of China and other emerging economies in the IMF.

The US Senate and the House of Representatives on Friday passed a spending bill for fiscal 2016 that includes language on authorizing the IMF quota reforms.

Under the changes, t

-

IMF says Rwanda economy to expand by 6.5% in 2016

Both Rwanda's government and the International Monetary Fund forecast the country's economy will expand by between 6 and 6.5 per cent in 2016, slowing from a projected 7 percent in 2015.

-

International monetary fund

Brief explanation of the IMF for final project.

-

The Death of Money - China and the International Monetary Fund Ready to Move Away from the Dollar

The Death of Money - China and the International Monetary Fund Ready to Move Away from the Dollar

The Coming Collapse of the International

Monetary System

James Rickards

-

BUSI 604 Module 4 International Monetary Fund (Liberty)

BUY HERE⬊

http://www.homeworkmade.com/liberty-4/busi-604/busi-604-module-4-international-monetary-fund/

-

Greek PM says IMF not ‘constructive’ in bailout deal

Greek Prime Minister Alexis Tsipras said on Monday the International Monetary Fund was not playing a constructive role in Greece's bailout and should make up its mind whether it wants to stay in the program.

He accused the Washington-based global lender of making unrealistic demands both on Greece for tough reforms and on its eurozone partners for debt relief beyond what they can accept.

"This i

-

IMF Managing Director Christine Lagarde at GU-Q

Georgetown University in Qatar (GU-Q), in conjunction with the Qatar Ministry of Finance, co-hosted the Managing Director of the International Monetary Fund (IMF) , Christine Lagarde.

-

Adding Chinese Yuan To SDR Basket Is A ‘Mistake’ By IMF Says Professor

Monday, the International Monetary Fund announced that the yuan — the Chinese currency, also known as the renminbi — would join the organization’s basket of reserve currencies known as special drawing rights (SDRs). The yuan will now sit side by side with the U.S. dollar, the Japanese yen, the British pound and the euro as one of the most significant currencies forming part of the global economy.

-

The Big Picture – GDP numbers & Monetary Policy

Guests: S P Sharma, Chief of Economist, PHD Chamber of Commerce & Industry ; Renu Kohli, Former Staff Member, RBI & International Monetary Fund (IMF) ; Priya Ranjan Dash, Senior Journalist ; Ajay Dua, Former Secretary, Ministry of Commerce & Industry

Anchor: Frank Pereira

Air date: Dec 1, 2015

ICMC2015 - Opening Address by Mitsuhiro Furusawa...

Address by Mitsuhiro Furusawa, Deputy Managing Director of the International Monetary Fund, in International Capital Markets Conference (ICMC) on “Building Regi...

Address by Mitsuhiro Furusawa, Deputy Managing Director of the International Monetary Fund, in International Capital Markets Conference (ICMC) on “Building Regional Capital Markets: Global Experiences, GMS Aspirations” ON November 30, 2015.

wn.com/Icmc2015 Opening Address By Mitsuhiro Furusawa...

Address by Mitsuhiro Furusawa, Deputy Managing Director of the International Monetary Fund, in International Capital Markets Conference (ICMC) on “Building Regional Capital Markets: Global Experiences, GMS Aspirations” ON November 30, 2015.

- published: 14 Jan 2016

- views: 7

Reporting live- ALPHA TV NEWS

International Monetary Fund, Greece, US, Greek crisis

ALPHA TV NEWS...

International Monetary Fund, Greece, US, Greek crisis

ALPHA TV NEWS

wn.com/Reporting Live Alpha Tv News

International Monetary Fund, Greece, US, Greek crisis

ALPHA TV NEWS

- published: 13 Jan 2016

- views: 47

IMF Looks forward to Collaboration with AIIB

The International Monetary Fund (IMF) is looking forward to cooperating with the China-initiated Asian Infrastructure Investment Bank (AIIB), said an IMF offici...

The International Monetary Fund (IMF) is looking forward to cooperating with the China-initiated Asian Infrastructure Investment Bank (AIIB), said an IMF official on Tuesday.

Chikahisa Sumi, assistant director of the Asia and Pacific Department of the IMF, made the remarks at a forum attended by IMF officials and members of U.S. think tanks in Washington, D.C.

"Infrastructure investment need is huge, is simply huge. And then infrastructure investment is very productive investment. And then, it has the potential of crowding in private-sector investment. So, developing countries usually lack that funding mechanism for that needed infrastructure investment," Sumi said.

"We are looking forward to the collaboration with AIIB. We also welcome any help to finance this vast, vast need to upgrade and solve the infrastructure bottleneck, which is constraining that growth on the supply-side at the moment," he said.

Sumi is one of the authors of the book "The Future of Asian Finance", which was released by the IMF in August of 2015.

The inaugurating ceremony of the AIIB will be held in Beijing on January 16.

The AIIB was formally established in Beijing on December 25, 2015. Headquartered in Beijing, it has 57 members.

More on: http://newscontent.cctv.com/NewJsp/news.jsp?fileId=336385

Subscribe us on Youtube: https://www.youtube.com/channel/UCmv5DbNpxH8X2eQxJBqEjKQ

CCTV+ official website: http://newscontent.cctv.com/

LinkedIn: https://www.linkedin.com/company/cctv-news-content?

Facebook: https://www.facebook.com/pages/CCTV/756877521031964

Twitter: https://twitter.com/NewsContentPLUS

wn.com/Imf Looks Forward To Collaboration With Aiib

The International Monetary Fund (IMF) is looking forward to cooperating with the China-initiated Asian Infrastructure Investment Bank (AIIB), said an IMF official on Tuesday.

Chikahisa Sumi, assistant director of the Asia and Pacific Department of the IMF, made the remarks at a forum attended by IMF officials and members of U.S. think tanks in Washington, D.C.

"Infrastructure investment need is huge, is simply huge. And then infrastructure investment is very productive investment. And then, it has the potential of crowding in private-sector investment. So, developing countries usually lack that funding mechanism for that needed infrastructure investment," Sumi said.

"We are looking forward to the collaboration with AIIB. We also welcome any help to finance this vast, vast need to upgrade and solve the infrastructure bottleneck, which is constraining that growth on the supply-side at the moment," he said.

Sumi is one of the authors of the book "The Future of Asian Finance", which was released by the IMF in August of 2015.

The inaugurating ceremony of the AIIB will be held in Beijing on January 16.

The AIIB was formally established in Beijing on December 25, 2015. Headquartered in Beijing, it has 57 members.

More on: http://newscontent.cctv.com/NewJsp/news.jsp?fileId=336385

Subscribe us on Youtube: https://www.youtube.com/channel/UCmv5DbNpxH8X2eQxJBqEjKQ

CCTV+ official website: http://newscontent.cctv.com/

LinkedIn: https://www.linkedin.com/company/cctv-news-content?

Facebook: https://www.facebook.com/pages/CCTV/756877521031964

Twitter: https://twitter.com/NewsContentPLUS

- published: 13 Jan 2016

- views: 39

IMF urges Nigeria to diversify its revenue

As Africa's biggest economy, Nigeria is battling its way out of an economic crisis fuelled by fall in oil prices.

The International Monetary Fund (IMF) chief, ...

As Africa's biggest economy, Nigeria is battling its way out of an economic crisis fuelled by fall in oil prices.

The International Monetary Fund (IMF) chief, Christine Lagarde has called on Nigeria to diversify its revenue.

Lagarde made this call at the presidential villa in Abuja, moments after holding talks with President Muhammadu Buhari during her four-day visit to the West African country to discuss plans on sustaining its economy.

The IMF boss also discussed the challenges faced by A…

READ MORE : http://www.africanews.com/2016/01/05/imf-urges-nigeria-to-diversify-its-revenue

Africanews is a new pan-African media pioneering multilingual and independent news telling expertise in Sub-Saharan Africa.

Subscribe on ourYoutube channel : https://www.youtube.com/c/africanews

Africanews is available in English and French.

Website : www.africanews.com

Facebook : https://www.facebook.com/africanews.channel/

Twitter : https://twitter.com/africanews

wn.com/Imf Urges Nigeria To Diversify Its Revenue

As Africa's biggest economy, Nigeria is battling its way out of an economic crisis fuelled by fall in oil prices.

The International Monetary Fund (IMF) chief, Christine Lagarde has called on Nigeria to diversify its revenue.

Lagarde made this call at the presidential villa in Abuja, moments after holding talks with President Muhammadu Buhari during her four-day visit to the West African country to discuss plans on sustaining its economy.

The IMF boss also discussed the challenges faced by A…

READ MORE : http://www.africanews.com/2016/01/05/imf-urges-nigeria-to-diversify-its-revenue

Africanews is a new pan-African media pioneering multilingual and independent news telling expertise in Sub-Saharan Africa.

Subscribe on ourYoutube channel : https://www.youtube.com/c/africanews

Africanews is available in English and French.

Website : www.africanews.com

Facebook : https://www.facebook.com/africanews.channel/

Twitter : https://twitter.com/africanews

- published: 12 Jan 2016

- views: 3

IMF boss arrives in Nigeria for talks with Buhari

The head of the International Monetary Fund (IMF), Christine Lagarde arrived in Nigeria on Monday for a four-day visit that will see her hold talks with Preside...

The head of the International Monetary Fund (IMF), Christine Lagarde arrived in Nigeria on Monday for a four-day visit that will see her hold talks with President Muhammadu Buhari in the wake of an economic crisis that has hit the west African nation fuelled by plunging oil prices.