-

Fiscal Year, "Calendar Fiscal"

What does a company's Fiscal Year establish? What relevance is my Fiscal Year year have to the timing of my reporting? What does Calendar Fiscal mean? Why do...

-

SAP FICO FISCAL YEAR

SAP FICO FISCAL YEAR POSTING PERIOD FONT FORMAT VIEW TRANSACTION CODES.

-

Carter Addresses Fiscal Year 2017 at China Lake

Defense Secretary Ash Carter spoke with troops at Naval Air Station China Lake, Calif., while previewing the proposed fiscal year 2017 defense budget and its impact on the defense community. For more information on the 2017 budget proposal, visit: http://www.defense.gov/News/Special-Reports/0216_budget

-

How to create Fiscal year variant in SAP FICO

Next configuration step is defining fiscal year variant in SAP.

What is fiscal year variant? - It is used to define financial year, it contains 12 posting periods and 4 special periods. Special periods are used to perform year end activities.

We can create fiscal year variant by using transaction code "OB29" or

Menu path: - Reference IMG – Financial Accounting – Global Settings – Fiscal Year – M

-

SAP FICO Fiscal Year Variant and Posting Period Variant

Sekhar Gem

Mobile 0091-9177234578

Email: sekhar.gem@gmail.com

Skype : sekhar.gem

-

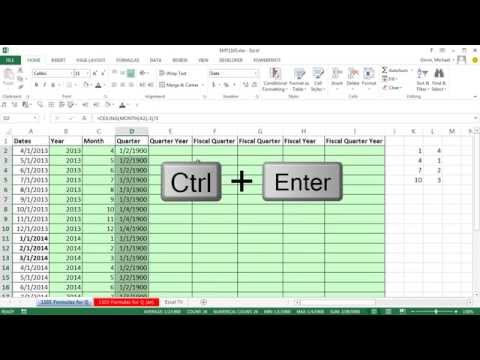

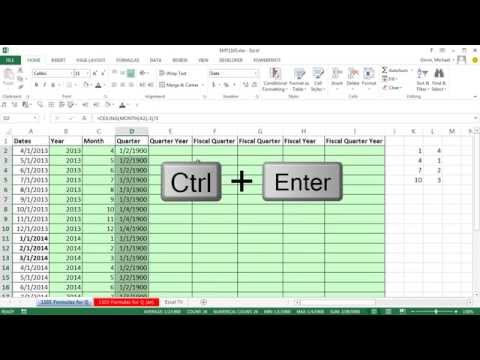

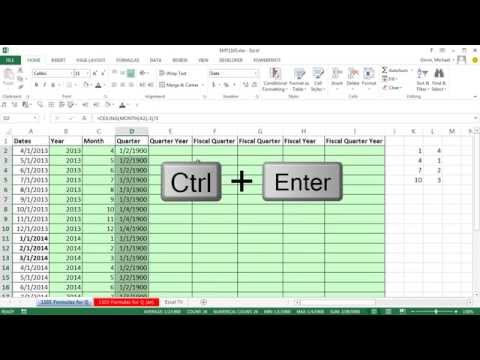

Excel Magic Trick 1103: Formulas for Quarters, Fiscal Quarters & Fiscal Years

Download Excel File: http://people.highline.edu/mgirvin/ExcelIsFun.htm Formulas for Quarters, Fiscal Quarters & Fiscal Years: 1. (00:07 min) Quarters using C...

-

Microsoft Access Fiscal Year Calculations

This video tutorial will teach you how to calculate a simple fiscal year in Microsoft Access (also called a tax year, or financial year). To learn more about...

-

SAP FICO Training - Basic Settings-Variants Fiscal Year (video4) | SAP FICO

SAP FICO Financial Accounting Training

Please email to - info@studynest.org , call +61413159465 (Australia) or directly enroll here http://studynest.org/

SAP FICO - SAP Financial Accounting is one the largest functional core Module in SAP. It handles all the processes from “Record to Report”. The main operations this module handles are general ledger accounting, accounts payable, asset accounti

-

lexwill 2016: a new fiscal year

-

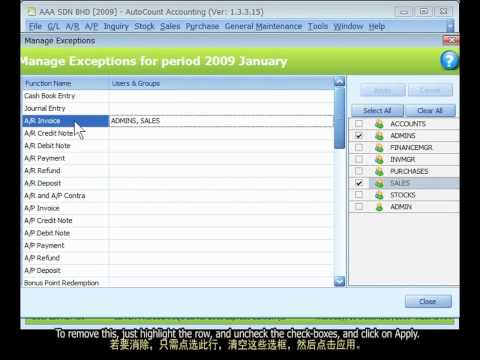

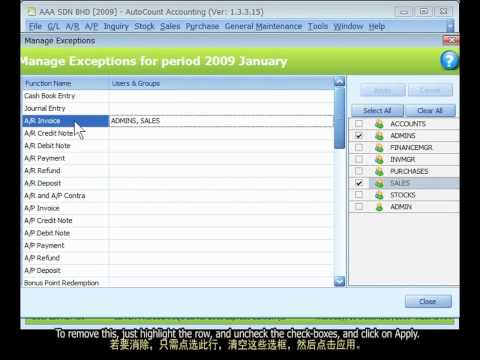

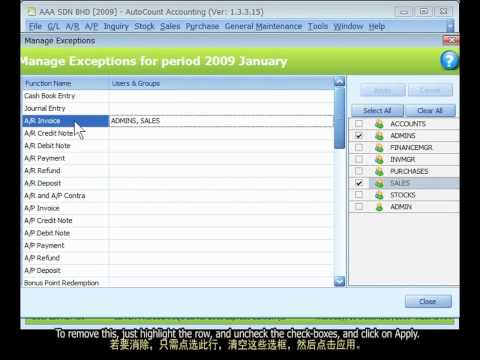

AutoCount Video 07 Manage Fiscal Year (with subtitle).wmv

-

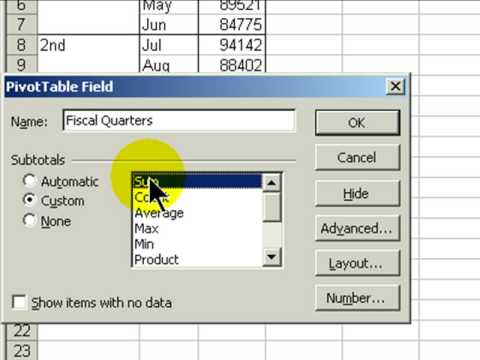

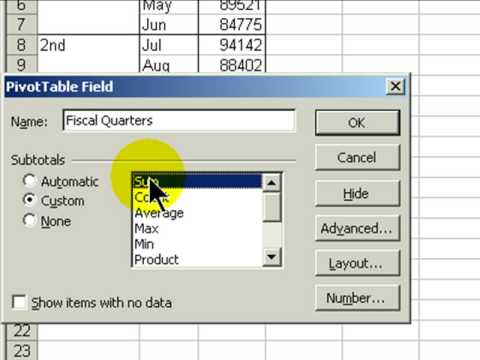

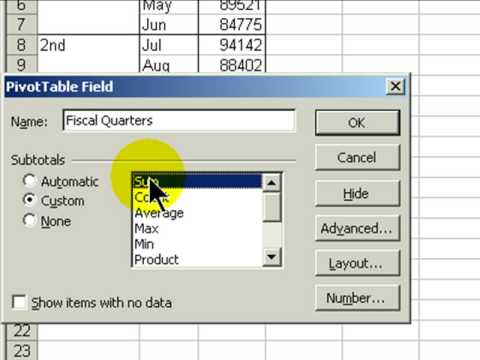

Change to a Fiscal Year Grouping in Excel Pivot Table

Recently, one of my clients asked me how to change Excel's Pivot Table Grouping to reflect a Fiscal Year. I know many corporations and non-profit organizatio...

-

AutoCount Video 07: Manage Fiscal Year

Maintaining Current, Previous and Next Fiscal Year; Manage Period Lock and Exception; Lock Opening Balance.

-

Maintain Fiscal year Variant

-

Excel 2010 Working with Dates and Times Calculating fiscal years and quarters

Essential Training.

-

Starting a New Fiscal Year with Sage 50 2015

This video tutorial will walk you through the steps to start a new fiscal year in Sage 50 2015

-

SAP Business One - How To- Closing the Fiscal Year

How to perform an end of Period close in SAP Business One 2007.

-

Executive Budget Recommendation - Fiscal Year 2017

Executive Budget Recommendation

Fiscal Year 2017

-

SAP FICO VIDEO TRAINING TUTORIALS 0009 MAINTAIN FISCAL YEAR VARIANT ECC6 - BAYISETTI

Maintain Fiscal Year Variant....Come n visit my blog WWW.SAPVIDEOS.NET for more....

-

President Obama Announces the Fiscal Year 2014 Budget

The President's Fiscal Year 2014 Budget demonstrates that we can make critical investments to strengthen the middle class, create jobs, and grow the economy ...

-

Trudeau refuses to accept news that Canada finished last fiscal year in surplus

The Liberals have spent months telling us that Canada is in deficit.

That it is all Stephen Harper's fault. Well it turns out they are wrong.

Watch Brian Lilley of TheRebel.Media as he brings you Liberals in their own words, their reaction to the news and a good dose of the truth.

JOIN TheRebel.media for more fearless news and commentary you won’t find anywhere else.

http://www.TheRebel.med

-

Mayor Bill de Blasio Presents Fiscal Year 2017 Preliminary Budget

Mayor Bill de Blasio Presents Fiscal Year 2017 Preliminary Budget

Blue Room

City Hall

New York, NY 10007

-

Gloria Larkin Federal Fiscal Year End Sales Tactics

Hi I’m Gloria Larkin, President of TargetGov. We help you Plan, Position, Pursue, and Win federal contracts. As a matter of fact, in just the last five years we’ve helped our clients win over 3.2 billion dollars in federal contracts and we want to help you!

Today’s topic is helping you with Fiscal Year End Spending Contracts

The fiscal year end is an interesting time in the federal government mark

-

Closing the Fiscal Year In Microsoft Dynamics NAV 2009

An Advanced Business Systems LLC tutorial video on Year End Closing in Dynamics NAV 2009 Classic Client. The process is similar in the RoleTailored Client (R...

Fiscal Year, "Calendar Fiscal"

What does a company's Fiscal Year establish? What relevance is my Fiscal Year year have to the timing of my reporting? What does Calendar Fiscal mean? Why do......

What does a company's Fiscal Year establish? What relevance is my Fiscal Year year have to the timing of my reporting? What does Calendar Fiscal mean? Why do...

wn.com/Fiscal Year, Calendar Fiscal

What does a company's Fiscal Year establish? What relevance is my Fiscal Year year have to the timing of my reporting? What does Calendar Fiscal mean? Why do...

- published: 11 Jun 2010

- views: 1159

-

author: Quatere

SAP FICO FISCAL YEAR

SAP FICO FISCAL YEAR POSTING PERIOD FONT FORMAT VIEW TRANSACTION CODES....

SAP FICO FISCAL YEAR POSTING PERIOD FONT FORMAT VIEW TRANSACTION CODES.

wn.com/Sap Fico Fiscal Year

SAP FICO FISCAL YEAR POSTING PERIOD FONT FORMAT VIEW TRANSACTION CODES.

Carter Addresses Fiscal Year 2017 at China Lake

Defense Secretary Ash Carter spoke with troops at Naval Air Station China Lake, Calif., while previewing the proposed fiscal year 2017 defense budget and its im...

Defense Secretary Ash Carter spoke with troops at Naval Air Station China Lake, Calif., while previewing the proposed fiscal year 2017 defense budget and its impact on the defense community. For more information on the 2017 budget proposal, visit: http://www.defense.gov/News/Special-Reports/0216_budget

wn.com/Carter Addresses Fiscal Year 2017 At China Lake

Defense Secretary Ash Carter spoke with troops at Naval Air Station China Lake, Calif., while previewing the proposed fiscal year 2017 defense budget and its impact on the defense community. For more information on the 2017 budget proposal, visit: http://www.defense.gov/News/Special-Reports/0216_budget

- published: 03 Feb 2016

- views: 4

How to create Fiscal year variant in SAP FICO

Next configuration step is defining fiscal year variant in SAP.

What is fiscal year variant? - It is used to define financial year, it contains 12 posting perio...

Next configuration step is defining fiscal year variant in SAP.

What is fiscal year variant? - It is used to define financial year, it contains 12 posting periods and 4 special periods. Special periods are used to perform year end activities.

We can create fiscal year variant by using transaction code "OB29" or

Menu path: - Reference IMG – Financial Accounting – Global Settings – Fiscal Year – Maintain Fiscal Year Variant.

For more details- http://www.saponlinetutorials.com/create-fiscal-year-variant-in-sap-fiscal-year-accounting-period/

wn.com/How To Create Fiscal Year Variant In Sap Fico

Next configuration step is defining fiscal year variant in SAP.

What is fiscal year variant? - It is used to define financial year, it contains 12 posting periods and 4 special periods. Special periods are used to perform year end activities.

We can create fiscal year variant by using transaction code "OB29" or

Menu path: - Reference IMG – Financial Accounting – Global Settings – Fiscal Year – Maintain Fiscal Year Variant.

For more details- http://www.saponlinetutorials.com/create-fiscal-year-variant-in-sap-fiscal-year-accounting-period/

- published: 01 Dec 2014

- views: 2

SAP FICO Fiscal Year Variant and Posting Period Variant

Sekhar Gem

Mobile 0091-9177234578

Email: sekhar.gem@gmail.com

Skype : sekhar.gem...

Sekhar Gem

Mobile 0091-9177234578

Email: sekhar.gem@gmail.com

Skype : sekhar.gem

wn.com/Sap Fico Fiscal Year Variant And Posting Period Variant

Sekhar Gem

Mobile 0091-9177234578

Email: sekhar.gem@gmail.com

Skype : sekhar.gem

- published: 31 Jan 2015

- views: 6

Excel Magic Trick 1103: Formulas for Quarters, Fiscal Quarters & Fiscal Years

Download Excel File: http://people.highline.edu/mgirvin/ExcelIsFun.htm Formulas for Quarters, Fiscal Quarters & Fiscal Years: 1. (00:07 min) Quarters using C......

Download Excel File: http://people.highline.edu/mgirvin/ExcelIsFun.htm Formulas for Quarters, Fiscal Quarters & Fiscal Years: 1. (00:07 min) Quarters using C...

wn.com/Excel Magic Trick 1103 Formulas For Quarters, Fiscal Quarters Fiscal Years

Download Excel File: http://people.highline.edu/mgirvin/ExcelIsFun.htm Formulas for Quarters, Fiscal Quarters & Fiscal Years: 1. (00:07 min) Quarters using C...

- published: 25 Apr 2014

- views: 5044

-

author: ExcelIsFun

Microsoft Access Fiscal Year Calculations

This video tutorial will teach you how to calculate a simple fiscal year in Microsoft Access (also called a tax year, or financial year). To learn more about......

This video tutorial will teach you how to calculate a simple fiscal year in Microsoft Access (also called a tax year, or financial year). To learn more about...

wn.com/Microsoft Access Fiscal Year Calculations

This video tutorial will teach you how to calculate a simple fiscal year in Microsoft Access (also called a tax year, or financial year). To learn more about...

SAP FICO Training - Basic Settings-Variants Fiscal Year (video4) | SAP FICO

SAP FICO Financial Accounting Training

Please email to - info@studynest.org , call +61413159465 (Australia) or directly enroll here http://studynest.org/

SAP...

SAP FICO Financial Accounting Training

Please email to - info@studynest.org , call +61413159465 (Australia) or directly enroll here http://studynest.org/

SAP FICO - SAP Financial Accounting is one the largest functional core Module in SAP. It handles all the processes from “Record to Report”. The main operations this module handles are general ledger accounting, accounts payable, asset accounting, banking ledger etc.

WHO SHOULD ATTEND - Those interested in gaining in-depth knowledge of SAP FI. (Example: Business analyst, project team members, consultants, SAP end users etc.)

PREREQUISTIE - Basic knowledge of financial accounting is preferred.

LEVEL - Basic to Intermediate.

OBJECTIVES :

• Understand and configure the SAP FI Organizational units, Master Data and documents.

• Understand and utilise the SAP financial transactions involving General Ledger Accounting, Accounts Payable, Accounts Receivable and Banking.

• Understand the configuration and applications of Asset Accounting.

• Understand the integration between Asset Accounting and SAP Financials.

• Utilize validations and Substitutions.

wn.com/Sap Fico Training Basic Settings Variants Fiscal Year (Video4) | Sap Fico

SAP FICO Financial Accounting Training

Please email to - info@studynest.org , call +61413159465 (Australia) or directly enroll here http://studynest.org/

SAP FICO - SAP Financial Accounting is one the largest functional core Module in SAP. It handles all the processes from “Record to Report”. The main operations this module handles are general ledger accounting, accounts payable, asset accounting, banking ledger etc.

WHO SHOULD ATTEND - Those interested in gaining in-depth knowledge of SAP FI. (Example: Business analyst, project team members, consultants, SAP end users etc.)

PREREQUISTIE - Basic knowledge of financial accounting is preferred.

LEVEL - Basic to Intermediate.

OBJECTIVES :

• Understand and configure the SAP FI Organizational units, Master Data and documents.

• Understand and utilise the SAP financial transactions involving General Ledger Accounting, Accounts Payable, Accounts Receivable and Banking.

• Understand the configuration and applications of Asset Accounting.

• Understand the integration between Asset Accounting and SAP Financials.

• Utilize validations and Substitutions.

- published: 21 Jul 2015

- views: 8

Change to a Fiscal Year Grouping in Excel Pivot Table

Recently, one of my clients asked me how to change Excel's Pivot Table Grouping to reflect a Fiscal Year. I know many corporations and non-profit organizatio......

Recently, one of my clients asked me how to change Excel's Pivot Table Grouping to reflect a Fiscal Year. I know many corporations and non-profit organizatio...

wn.com/Change To A Fiscal Year Grouping In Excel Pivot Table

Recently, one of my clients asked me how to change Excel's Pivot Table Grouping to reflect a Fiscal Year. I know many corporations and non-profit organizatio...

AutoCount Video 07: Manage Fiscal Year

Maintaining Current, Previous and Next Fiscal Year; Manage Period Lock and Exception; Lock Opening Balance....

Maintaining Current, Previous and Next Fiscal Year; Manage Period Lock and Exception; Lock Opening Balance.

wn.com/Autocount Video 07 Manage Fiscal Year

Maintaining Current, Previous and Next Fiscal Year; Manage Period Lock and Exception; Lock Opening Balance.

- published: 30 Dec 2009

- views: 725

Starting a New Fiscal Year with Sage 50 2015

This video tutorial will walk you through the steps to start a new fiscal year in Sage 50 2015...

This video tutorial will walk you through the steps to start a new fiscal year in Sage 50 2015

wn.com/Starting A New Fiscal Year With Sage 50 2015

This video tutorial will walk you through the steps to start a new fiscal year in Sage 50 2015

- published: 19 Jan 2015

- views: 6

SAP Business One - How To- Closing the Fiscal Year

How to perform an end of Period close in SAP Business One 2007....

How to perform an end of Period close in SAP Business One 2007.

wn.com/Sap Business One How To Closing The Fiscal Year

How to perform an end of Period close in SAP Business One 2007.

Executive Budget Recommendation - Fiscal Year 2017

Executive Budget Recommendation

Fiscal Year 2017...

Executive Budget Recommendation

Fiscal Year 2017

wn.com/Executive Budget Recommendation Fiscal Year 2017

Executive Budget Recommendation

Fiscal Year 2017

- published: 15 Jan 2016

- views: 280

President Obama Announces the Fiscal Year 2014 Budget

The President's Fiscal Year 2014 Budget demonstrates that we can make critical investments to strengthen the middle class, create jobs, and grow the economy ......

The President's Fiscal Year 2014 Budget demonstrates that we can make critical investments to strengthen the middle class, create jobs, and grow the economy ...

wn.com/President Obama Announces The Fiscal Year 2014 Budget

The President's Fiscal Year 2014 Budget demonstrates that we can make critical investments to strengthen the middle class, create jobs, and grow the economy ...

Trudeau refuses to accept news that Canada finished last fiscal year in surplus

The Liberals have spent months telling us that Canada is in deficit.

That it is all Stephen Harper's fault. Well it turns out they are wrong.

Watch Brian Li...

The Liberals have spent months telling us that Canada is in deficit.

That it is all Stephen Harper's fault. Well it turns out they are wrong.

Watch Brian Lilley of TheRebel.Media as he brings you Liberals in their own words, their reaction to the news and a good dose of the truth.

JOIN TheRebel.media for more fearless news and commentary you won’t find anywhere else.

http://www.TheRebel.media

VISIT our NEW group blog The Megaphone!

It’s your one-stop shop for rebellious commentary from independent and fearless readers and writers.

http://www.TheRebel.Media/TheMegaphone

Ontario will end up like Greece unless the reckless spending and borrowing stops!

SIGN THE PETITION to restore fiscal sanity: OntarioNotGreece.ca

http://www.OntarioNotGreece.ca

wn.com/Trudeau Refuses To Accept News That Canada Finished Last Fiscal Year In Surplus

The Liberals have spent months telling us that Canada is in deficit.

That it is all Stephen Harper's fault. Well it turns out they are wrong.

Watch Brian Lilley of TheRebel.Media as he brings you Liberals in their own words, their reaction to the news and a good dose of the truth.

JOIN TheRebel.media for more fearless news and commentary you won’t find anywhere else.

http://www.TheRebel.media

VISIT our NEW group blog The Megaphone!

It’s your one-stop shop for rebellious commentary from independent and fearless readers and writers.

http://www.TheRebel.Media/TheMegaphone

Ontario will end up like Greece unless the reckless spending and borrowing stops!

SIGN THE PETITION to restore fiscal sanity: OntarioNotGreece.ca

http://www.OntarioNotGreece.ca

- published: 14 Sep 2015

- views: 3503

Mayor Bill de Blasio Presents Fiscal Year 2017 Preliminary Budget

Mayor Bill de Blasio Presents Fiscal Year 2017 Preliminary Budget

Blue Room

City Hall

New York, NY 10007...

Mayor Bill de Blasio Presents Fiscal Year 2017 Preliminary Budget

Blue Room

City Hall

New York, NY 10007

wn.com/Mayor Bill De Blasio Presents Fiscal Year 2017 Preliminary Budget

Mayor Bill de Blasio Presents Fiscal Year 2017 Preliminary Budget

Blue Room

City Hall

New York, NY 10007

- published: 21 Jan 2016

- views: 734

Gloria Larkin Federal Fiscal Year End Sales Tactics

Hi I’m Gloria Larkin, President of TargetGov. We help you Plan, Position, Pursue, and Win federal contracts. As a matter of fact, in just the last five years we...

Hi I’m Gloria Larkin, President of TargetGov. We help you Plan, Position, Pursue, and Win federal contracts. As a matter of fact, in just the last five years we’ve helped our clients win over 3.2 billion dollars in federal contracts and we want to help you!

Today’s topic is helping you with Fiscal Year End Spending Contracts

The fiscal year end is an interesting time in the federal government marketplace. In just the three months of July, August, and September the federal government will spend over $150 Billion with companies of all sizes: single individual companies as well as companies with thousands or tens of thousands of employees. In order for you to see results at the federal fiscal year end, it takes planning. And one of the key factors is building relationships with the layers of decision makers in the federal government space. We actually have a video that identifies all of those layers of decision makers; take a look for it - available on TargetGov website.

In the meantime, let’s focus in on the four top tactics for you to win federal government business at the federal fiscal year end between July and September.

1. Before you reach out, identify the contract vehicle that the government agency is using. I know, now we’re getting into jargon – but this is an important piece of jargon. “Contract vehicle” is the method with which the government buys. It could be something as simple as a credit card, or something as complicated as a GSA Schedule, or if you’re working for Navy something called SeaPort-e. Various agencies use specific contract vehicles. So you want to make sure that the agency you’re targeting is using a specific vehicle and that you have it or that you have access to it. We can help you with that, reach out to TargetGov and I’ll give you the contact information in just a few minutes and we’ll help you find what contract vehicles are used by what agencies.

2. When you reach out to decision makers, make sure that you already have a relationship with them. That is because the first time that you reach out to them, if that’s during the federal fiscal year end and they don’t know you, they’ve never heard of you, they don’t know your company, your chances of winning any business really are minimal. So building a strong relationship to the point where they not only know your company name, but they know your name, they know your voice when you call, and they’ll open up your email – that is a sure way to increase your win probability at the federal fiscal year end.

3. Reach out to those decision-makers who already have a budget with your products or services. And, this is something that isn’t necessarily easy to find, but it’s something that we can help you find and you can use resources that are available at no cost. Just reach out to us at TargetGov and we will help you identify where those resources are. There are federal websites and therefore at no cost to you. We’ll be happy to tell you just reach out to us at www.TargetGov.com.

Now, we’ve talked about having the right contacts, having the right relationships, and knowing the contract vehicle…

4. The right tools to each out. It can be something as simple as using the telephone effectively. Using an email on a regular basis, but not spamming – never send mass emails; always make sure they’re sent to the individual. But the most important tool to use is your Capability Statement. And a Capability Statement is a single page document that is unique in the federal government marketplace. As a matter of fact, because you’re watching this video if you shoot us an email we will send you a free Capability Statement guide. Send an email to FAST@TargetGov.com and we will send you a free Capability Statement guide to help you get started in creating your one page powerful Capability Statement that will help you win business at the federal fiscal year end.

In addition to these four tactics, you can continue to build relationships by using the tools that we provide for you at our website which is www.TargetGov.com. We also have classes available for you through our Government Contracting Institute. And we have free resources if you go to our website and sign up as a Preferred Client, it costs you nothing, there is no commitment. We just want to send you free resources so that you’ll be more successful in the federal government marketplace.

If you’d like to have help right now, you can call our toll free number: 866-579-1346. And remember our website, its simple www.TargetGov.com.

I am Gloria Larkin, president of TargetGov, we want to help you Plan, Position, Pursue, and Win federal contracts. Here’s to your continued success!

wn.com/Gloria Larkin Federal Fiscal Year End Sales Tactics

Hi I’m Gloria Larkin, President of TargetGov. We help you Plan, Position, Pursue, and Win federal contracts. As a matter of fact, in just the last five years we’ve helped our clients win over 3.2 billion dollars in federal contracts and we want to help you!

Today’s topic is helping you with Fiscal Year End Spending Contracts

The fiscal year end is an interesting time in the federal government marketplace. In just the three months of July, August, and September the federal government will spend over $150 Billion with companies of all sizes: single individual companies as well as companies with thousands or tens of thousands of employees. In order for you to see results at the federal fiscal year end, it takes planning. And one of the key factors is building relationships with the layers of decision makers in the federal government space. We actually have a video that identifies all of those layers of decision makers; take a look for it - available on TargetGov website.

In the meantime, let’s focus in on the four top tactics for you to win federal government business at the federal fiscal year end between July and September.

1. Before you reach out, identify the contract vehicle that the government agency is using. I know, now we’re getting into jargon – but this is an important piece of jargon. “Contract vehicle” is the method with which the government buys. It could be something as simple as a credit card, or something as complicated as a GSA Schedule, or if you’re working for Navy something called SeaPort-e. Various agencies use specific contract vehicles. So you want to make sure that the agency you’re targeting is using a specific vehicle and that you have it or that you have access to it. We can help you with that, reach out to TargetGov and I’ll give you the contact information in just a few minutes and we’ll help you find what contract vehicles are used by what agencies.

2. When you reach out to decision makers, make sure that you already have a relationship with them. That is because the first time that you reach out to them, if that’s during the federal fiscal year end and they don’t know you, they’ve never heard of you, they don’t know your company, your chances of winning any business really are minimal. So building a strong relationship to the point where they not only know your company name, but they know your name, they know your voice when you call, and they’ll open up your email – that is a sure way to increase your win probability at the federal fiscal year end.

3. Reach out to those decision-makers who already have a budget with your products or services. And, this is something that isn’t necessarily easy to find, but it’s something that we can help you find and you can use resources that are available at no cost. Just reach out to us at TargetGov and we will help you identify where those resources are. There are federal websites and therefore at no cost to you. We’ll be happy to tell you just reach out to us at www.TargetGov.com.

Now, we’ve talked about having the right contacts, having the right relationships, and knowing the contract vehicle…

4. The right tools to each out. It can be something as simple as using the telephone effectively. Using an email on a regular basis, but not spamming – never send mass emails; always make sure they’re sent to the individual. But the most important tool to use is your Capability Statement. And a Capability Statement is a single page document that is unique in the federal government marketplace. As a matter of fact, because you’re watching this video if you shoot us an email we will send you a free Capability Statement guide. Send an email to FAST@TargetGov.com and we will send you a free Capability Statement guide to help you get started in creating your one page powerful Capability Statement that will help you win business at the federal fiscal year end.

In addition to these four tactics, you can continue to build relationships by using the tools that we provide for you at our website which is www.TargetGov.com. We also have classes available for you through our Government Contracting Institute. And we have free resources if you go to our website and sign up as a Preferred Client, it costs you nothing, there is no commitment. We just want to send you free resources so that you’ll be more successful in the federal government marketplace.

If you’d like to have help right now, you can call our toll free number: 866-579-1346. And remember our website, its simple www.TargetGov.com.

I am Gloria Larkin, president of TargetGov, we want to help you Plan, Position, Pursue, and Win federal contracts. Here’s to your continued success!

- published: 30 Jul 2015

- views: 12

Closing the Fiscal Year In Microsoft Dynamics NAV 2009

An Advanced Business Systems LLC tutorial video on Year End Closing in Dynamics NAV 2009 Classic Client. The process is similar in the RoleTailored Client (R......

An Advanced Business Systems LLC tutorial video on Year End Closing in Dynamics NAV 2009 Classic Client. The process is similar in the RoleTailored Client (R...

wn.com/Closing The Fiscal Year In Microsoft Dynamics Nav 2009

An Advanced Business Systems LLC tutorial video on Year End Closing in Dynamics NAV 2009 Classic Client. The process is similar in the RoleTailored Client (R...

-

One Brooklyn-- Borough President's $3.1 million investment towards education

Brooklyn Borough President Eric L. Adams unveiled his $3.1 million investment towards education in his capital budget for Fiscal Year 2015 during a press conference at the New York City College of Technology (City Tech) in Downtown Brooklyn. The college is one of sixteen recipients of his capital budget allocations for education. The educational institutions receiving funding represent nearly one-

-

Pentagon Slush Fund is Draining the Economy and Militarizing Foreign Policy

Late last year, congress authorized $514 billion in baseline defense spending for fiscal year 2016. However, on top of the baseline budget, another $59 billion was authorized for the war budget, also known as the Overseas Contingency Operations (OCO) fund. These budgets combined give the pentagon a total of $573 billion to spend this fiscal year.

However, the Pentagon is the only government agen

-

COMMENTARY: Obama's 2016 fiscal budget, Republican-controlled congress

ORIGINAL AIR DATE: 2/28/15

Although Dr. Bonati is a world renown orthopedic surgeon, he is an American citizen, concerned about President Obama's 2016 fiscal year, a $4T budget that forecasts a $474B decificit. If you think that's outrageous, it's actually Obama's lowest deficit of any previous budget. Fortunately, the spending plan will have to make it through the now fully controlled Republican

-

United States Marine Corps Physical Fitness Test

The United States Marine Corps requires that all Marines perform a Physical Fitness Test and a Combat Fitness Test once per fiscal year. Each test must have an interval of 6 months. The PFT ensures that Marines are keeping physically fit and in a state of physical readiness. It consists of pull-ups, crunches and a 3-mile run for males. For females it consists of flexed arm hang, crunches and a 3-m

-

Welcome to the "Gloss"

This will be the first in what I plan to be many videos on explaining financial terms. In this video we will define what a "Fiscal Year" is. A fiscal year is a period that a company or government uses for accounting purposes and the preparing of financial statements. The fiscal year may or may not be the same as a calendar year. For tax purposes, companies can chose to be calendar year taxpayers o

-

Senator Durbin Restoring US Commitment to Biomedical Research

Based on the funding set forth in Senator Durbin's America Cures Act, the senator was able to secure a $2b increase for the National Institutes of Health in the Ominbus Appropriation Bill for Fiscal Year 2016. Increases in funding for the Centers for Disease Control, the Department of Defense Health Program, and the Veterans Medical & Prosthetics Research Program, was also included in the Omnibus.

-

How to compute Inventory Turnover Ratio & Days Sales in Inventory

Inventory Turnover Ratio is one of the efficiency ratios and measures the number of times, on average, the inventory is sold and replaced during the fiscal year. Inventory Turnover Ratio measures company's efficiency in turning its inventory into sales. Its purpose is to measure the liquidity of the inventory. Inventory Turnover Ratio is figured as "turnover times". Average inventory should be use

-

FINC 221 Week 2 Quiz (UMUC)

BUY HERE⬊

http://www.homeworkmade.com/umuc/finc-221/finc-221-week-2-quiz-umuc/

FINC 221 Week 2 Quiz (UMUC)

1. Which of the following is a correct statement regarding a method of drafting a company's income statement?

2. Which of the following is NOT a correct definition of a basic type of financial ratios?

3. During a fiscal year, a company has $20,000,000 in revenue. Its operating expenses a

-

Video Recording of President William Jefferson Clinton Delivering Remarks on the Fiscal Year 200...

This item is a video recording of President William Jefferson Clinton delivering remarks on the fiscal year 2000 budget.

Date: 1/20/1993 - 1/20/2001

Creators: Department of Defense. Defense Information Systems Agency. White House Communications Agency. 6/25/1991- (Most Recent)

From: Series: Video Recordings Relating to the Clinton Administration, 1 1/20 20/1993 1993 - 1 1/20 20/2001 2001

Collecti

-

SAP FICO Training Basic Settings2 Variants Fiscal Year Video4 SAP FICO

-

State of the Bangladesh Economy in FY2015-16 (First Reading)

Centre for Policy Dialogue (CPD) undertakes several interim reviews of the economy throughout every fiscal year. Accordingly, CPD has prepared an assessment report titled “State of the Bangladesh Economy in FY2015-16 (First Reading).”

-

SAP FI - Assign Company Code to Fiscal Year Variant

The company codes have to be assigned to an FYV (already defined in the system or custom)

-

2015 Oldham County Fiscal Court year in pictures.

-

SAP FI - Maintain Fiscal Year Variant

Used to maintain fiscal year variants (FYV), like creating new variants or modifying existing

FYVs can include year dependent, independent, and/or shortened variations

-

Last Saturday of the month at fiscal year end of Accounting period Top 5 Facts

-

52–53-week fiscal year of Accounting period Top 10 Facts

-

Alan Greenspan Fiscal Year 1990 Budget Proposals 1989 edit

-

Alan Greenspan: Fiscal Year 1989 Budget - Debt, Finance, Economics (1988)

Since 1976, Grassley has repeatedly introduced measures that increase the level of taxation on American citizens living abroad, including retroactive tax hikes. Grassley was eventually able to attach an amendment to a piece of legislation that went into effect in 2006, which increased taxes on Americans abroad by targeting housing and living incentives paid by foreign employers and held them accou

-

PNoy Signs the General Appropriations Act (GAA) for Fiscal Year 2016, 22 Dec. 2016

Rizal Hall, Malacañan Palace,

-

Fiscal fights fade as U.S. Congress backs huge budget bill

Brushing aside concerns about deepening the budget deficit, U.S. lawmakers approved $1.8 trillion worth of federal spending and tax breaks on Friday in a rare case of bipartisan action after years of damaging fiscal fights in Congress.

The Senate voted 65-33 to approve sweeping legislation that averted a government shutdown, locked in billions of dollars of tax breaks and scrapped a 40-year-old b

-

Sitka Training Video - Acquisitions Fiscal Year Close-out (Year End)

This video shows how to run the Acquisitions Year End Procedure in Sitka Evergreen. Sitka, a group of the BC Libraries Cooperative, is a consortium of libraries in British Columbia and Manitoba who all share a single integrated library system using the open source Evergreen software for their integrated library system. The presenter is Christine Burns.

-

Van Hill Furniture Fiscal Year End Sept 2015 HD

One Brooklyn-- Borough President's $3.1 million investment towards education

Brooklyn Borough President Eric L. Adams unveiled his $3.1 million investment towards education in his capital budget for Fiscal Year 2015 during a press confer...

Brooklyn Borough President Eric L. Adams unveiled his $3.1 million investment towards education in his capital budget for Fiscal Year 2015 during a press conference at the New York City College of Technology (City Tech) in Downtown Brooklyn. The college is one of sixteen recipients of his capital budget allocations for education. The educational institutions receiving funding represent nearly one-seventh of the total capital budget for Fiscal Year 2015. Borough President Adams made the announcement along with other elected officials, who partnered with him to secure the funding, as well as education professionals, whose organizations were among the recipients of the investments.

The 16 capital projects funded by Borough President Adams’ budget included $400,000 for the Fabrication Laboratory, a 3D printing lab at City Tech; $257,000 for disability access improvements to Memorial Hall at the Pratt Institute; $200,000 for classroom technology upgrades at St. Francis College; $550,000 to the Brooklyn Kindergarten Society to convert a former NYCHA space into a community center; $350,000 to James Madison High School for upgrades to the school’s library and media centers; $300,000 to repair the sound system in the auditorium used by the five schools at the Wingate Campus; $225,000 for improvements to the library at Sheepshead Bay High School; $200,000 for classroom technology purchases at Joseph B. Cavallaro I.S. 281; $150,000 for classroom technology purchases at P.S./I.S. 262 El Hajj Malik El Shabazz; $133,000 for the roof greenhouse project at P.S. 84 the Magnet School for Visual Arts and Sciences; $100,000 for classroom technology purchases at P.S./I.S. 73; $100,000 for classroom technology purchases at P.S. 169; $52,000 for improvements to STEM curriculum at P.S. 249 the Caton School; $50,000 for classroom technology purchases and improvements for STEM curriculum at P.S. 325 the Fresh Creek School; $50,000 for improvements to STEM curriculum at P.S. 315K; and $50,000 for classroom technology purchases at Brownsville Collaborative Middle School.

Following remarks by recipients, Borough President Adams presented each of them with an honorary check with the seal of Brooklyn Borough Hall and an oversized check, made out to “One Brooklyn,” for education.

wn.com/One Brooklyn Borough President's 3.1 Million Investment Towards Education

Brooklyn Borough President Eric L. Adams unveiled his $3.1 million investment towards education in his capital budget for Fiscal Year 2015 during a press conference at the New York City College of Technology (City Tech) in Downtown Brooklyn. The college is one of sixteen recipients of his capital budget allocations for education. The educational institutions receiving funding represent nearly one-seventh of the total capital budget for Fiscal Year 2015. Borough President Adams made the announcement along with other elected officials, who partnered with him to secure the funding, as well as education professionals, whose organizations were among the recipients of the investments.

The 16 capital projects funded by Borough President Adams’ budget included $400,000 for the Fabrication Laboratory, a 3D printing lab at City Tech; $257,000 for disability access improvements to Memorial Hall at the Pratt Institute; $200,000 for classroom technology upgrades at St. Francis College; $550,000 to the Brooklyn Kindergarten Society to convert a former NYCHA space into a community center; $350,000 to James Madison High School for upgrades to the school’s library and media centers; $300,000 to repair the sound system in the auditorium used by the five schools at the Wingate Campus; $225,000 for improvements to the library at Sheepshead Bay High School; $200,000 for classroom technology purchases at Joseph B. Cavallaro I.S. 281; $150,000 for classroom technology purchases at P.S./I.S. 262 El Hajj Malik El Shabazz; $133,000 for the roof greenhouse project at P.S. 84 the Magnet School for Visual Arts and Sciences; $100,000 for classroom technology purchases at P.S./I.S. 73; $100,000 for classroom technology purchases at P.S. 169; $52,000 for improvements to STEM curriculum at P.S. 249 the Caton School; $50,000 for classroom technology purchases and improvements for STEM curriculum at P.S. 325 the Fresh Creek School; $50,000 for improvements to STEM curriculum at P.S. 315K; and $50,000 for classroom technology purchases at Brownsville Collaborative Middle School.

Following remarks by recipients, Borough President Adams presented each of them with an honorary check with the seal of Brooklyn Borough Hall and an oversized check, made out to “One Brooklyn,” for education.

- published: 05 Jan 2016

- views: 1

Pentagon Slush Fund is Draining the Economy and Militarizing Foreign Policy

Late last year, congress authorized $514 billion in baseline defense spending for fiscal year 2016. However, on top of the baseline budget, another $59 billion ...

Late last year, congress authorized $514 billion in baseline defense spending for fiscal year 2016. However, on top of the baseline budget, another $59 billion was authorized for the war budget, also known as the Overseas Contingency Operations (OCO) fund. These budgets combined give the pentagon a total of $573 billion to spend this fiscal year.

However, the Pentagon is the only government agency that benefits from having two separate budgets. While the OCO budget is theoretically to be used for wartime needs only, Gordon Adams, emeritus professor of international politics at American University, tells Reason TV that this second budget is ruining fiscal responsibility at the pentagon.

"Pentagon civil servants and admirals and generals are no more stupid than anybody else. They figured out over time that this was great," says Adams, "if [they] could not get some of the stuff they wanted in the regular budget, well [they] put it in the extra budget." For instance, OCO spent about $300 million dollars for new propellers for nuclear submarines -- a cost that probably did not help the war efforts in Iraq and Afghanistan. Studies by the Center for Strategic and Budgetary Assessments and the Project on Government Oversight indicates that approximately $30 billion was spent on non-war related items from the OCO budget in 2014.

"[OCO] completely destroys budget discipline," says Gordon, "saying 'there's always more money' simply conveys the message to the department 'you don't have to make choices, you can always find a way to raise money for the things you want to do."

Gordon sat down with Reason TV's Nick Gillespie to discuss how OCO has led to fiscal irresponsibility at the Pentagon and a more militarized view of foreign policy.

About 10 minutes.

Camera by Amanda Winkler and Joshua Swain. Edited by Winkler. Music by Jingle Punks.

Go to https://reason.com/reasontv/2016/01/05/the-pentagon-slush-fund-how-its-harming for downloadable links and subscribe to ReasonTV's YouTube Channel to receive notification when new material goes live.

wn.com/Pentagon Slush Fund Is Draining The Economy And Militarizing Foreign Policy

Late last year, congress authorized $514 billion in baseline defense spending for fiscal year 2016. However, on top of the baseline budget, another $59 billion was authorized for the war budget, also known as the Overseas Contingency Operations (OCO) fund. These budgets combined give the pentagon a total of $573 billion to spend this fiscal year.

However, the Pentagon is the only government agency that benefits from having two separate budgets. While the OCO budget is theoretically to be used for wartime needs only, Gordon Adams, emeritus professor of international politics at American University, tells Reason TV that this second budget is ruining fiscal responsibility at the pentagon.

"Pentagon civil servants and admirals and generals are no more stupid than anybody else. They figured out over time that this was great," says Adams, "if [they] could not get some of the stuff they wanted in the regular budget, well [they] put it in the extra budget." For instance, OCO spent about $300 million dollars for new propellers for nuclear submarines -- a cost that probably did not help the war efforts in Iraq and Afghanistan. Studies by the Center for Strategic and Budgetary Assessments and the Project on Government Oversight indicates that approximately $30 billion was spent on non-war related items from the OCO budget in 2014.

"[OCO] completely destroys budget discipline," says Gordon, "saying 'there's always more money' simply conveys the message to the department 'you don't have to make choices, you can always find a way to raise money for the things you want to do."

Gordon sat down with Reason TV's Nick Gillespie to discuss how OCO has led to fiscal irresponsibility at the Pentagon and a more militarized view of foreign policy.

About 10 minutes.

Camera by Amanda Winkler and Joshua Swain. Edited by Winkler. Music by Jingle Punks.

Go to https://reason.com/reasontv/2016/01/05/the-pentagon-slush-fund-how-its-harming for downloadable links and subscribe to ReasonTV's YouTube Channel to receive notification when new material goes live.

- published: 05 Jan 2016

- views: 1355

COMMENTARY: Obama's 2016 fiscal budget, Republican-controlled congress

ORIGINAL AIR DATE: 2/28/15

Although Dr. Bonati is a world renown orthopedic surgeon, he is an American citizen, concerned about President Obama's 2016 fiscal y...

ORIGINAL AIR DATE: 2/28/15

Although Dr. Bonati is a world renown orthopedic surgeon, he is an American citizen, concerned about President Obama's 2016 fiscal year, a $4T budget that forecasts a $474B decificit. If you think that's outrageous, it's actually Obama's lowest deficit of any previous budget. Fortunately, the spending plan will have to make it through the now fully controlled Republican congress.

SHOW 27

wn.com/Commentary Obama's 2016 Fiscal Budget, Republican Controlled Congress

ORIGINAL AIR DATE: 2/28/15

Although Dr. Bonati is a world renown orthopedic surgeon, he is an American citizen, concerned about President Obama's 2016 fiscal year, a $4T budget that forecasts a $474B decificit. If you think that's outrageous, it's actually Obama's lowest deficit of any previous budget. Fortunately, the spending plan will have to make it through the now fully controlled Republican congress.

SHOW 27

- published: 04 Jan 2016

- views: 2

United States Marine Corps Physical Fitness Test

The United States Marine Corps requires that all Marines perform a Physical Fitness Test and a Combat Fitness Test once per fiscal year. Each test must have an ...

The United States Marine Corps requires that all Marines perform a Physical Fitness Test and a Combat Fitness Test once per fiscal year. Each test must have an interval of 6 months. The PFT ensures that Marines are keeping physically fit and in a state of physical readiness. It consists of pull-ups, crunches and a 3-mile run for males. For females it consists of flexed arm hang, crunches and a 3-mile run.

On 1 October 2008 the Marine Corps introduced the additional pass/fail Combat Fitness Test to the fitness requirements. The CFT is designed to measure abilities demanded of Marines in a war zone.

This video is targeted to blind users.

Attribution:

Article text available under CC-BY-SA

Creative Commons image source in video

wn.com/United States Marine Corps Physical Fitness Test

The United States Marine Corps requires that all Marines perform a Physical Fitness Test and a Combat Fitness Test once per fiscal year. Each test must have an interval of 6 months. The PFT ensures that Marines are keeping physically fit and in a state of physical readiness. It consists of pull-ups, crunches and a 3-mile run for males. For females it consists of flexed arm hang, crunches and a 3-mile run.

On 1 October 2008 the Marine Corps introduced the additional pass/fail Combat Fitness Test to the fitness requirements. The CFT is designed to measure abilities demanded of Marines in a war zone.

This video is targeted to blind users.

Attribution:

Article text available under CC-BY-SA

Creative Commons image source in video

- published: 04 Jan 2016

- views: 1

Welcome to the "Gloss"

This will be the first in what I plan to be many videos on explaining financial terms. In this video we will define what a "Fiscal Year" is. A fiscal year is a ...

This will be the first in what I plan to be many videos on explaining financial terms. In this video we will define what a "Fiscal Year" is. A fiscal year is a period that a company or government uses for accounting purposes and the preparing of financial statements. The fiscal year may or may not be the same as a calendar year. For tax purposes, companies can chose to be calendar year taxpayers or fiscal year taxpayers.

wn.com/Welcome To The Gloss

This will be the first in what I plan to be many videos on explaining financial terms. In this video we will define what a "Fiscal Year" is. A fiscal year is a period that a company or government uses for accounting purposes and the preparing of financial statements. The fiscal year may or may not be the same as a calendar year. For tax purposes, companies can chose to be calendar year taxpayers or fiscal year taxpayers.

- published: 04 Jan 2016

- views: 3273

Senator Durbin Restoring US Commitment to Biomedical Research

Based on the funding set forth in Senator Durbin's America Cures Act, the senator was able to secure a $2b increase for the National Institutes of Health in the...

Based on the funding set forth in Senator Durbin's America Cures Act, the senator was able to secure a $2b increase for the National Institutes of Health in the Ominbus Appropriation Bill for Fiscal Year 2016. Increases in funding for the Centers for Disease Control, the Department of Defense Health Program, and the Veterans Medical & Prosthetics Research Program, was also included in the Omnibus.

wn.com/Senator Durbin Restoring US Commitment To Biomedical Research

Based on the funding set forth in Senator Durbin's America Cures Act, the senator was able to secure a $2b increase for the National Institutes of Health in the Ominbus Appropriation Bill for Fiscal Year 2016. Increases in funding for the Centers for Disease Control, the Department of Defense Health Program, and the Veterans Medical & Prosthetics Research Program, was also included in the Omnibus.

- published: 04 Jan 2016

- views: 2

How to compute Inventory Turnover Ratio & Days Sales in Inventory

Inventory Turnover Ratio is one of the efficiency ratios and measures the number of times, on average, the inventory is sold and replaced during the fiscal year...

Inventory Turnover Ratio is one of the efficiency ratios and measures the number of times, on average, the inventory is sold and replaced during the fiscal year. Inventory Turnover Ratio measures company's efficiency in turning its inventory into sales. Its purpose is to measure the liquidity of the inventory. Inventory Turnover Ratio is figured as "turnover times". Average inventory should be used for inventory level to minimize the effect of seasonality.

The days sales of inventory value, or DSI, is a financial measure of a company's performance that gives investors an idea of how long it takes a company to turn its inventory (including goods that are a work in progress, if applicable) into sales.

wn.com/How To Compute Inventory Turnover Ratio Days Sales In Inventory

Inventory Turnover Ratio is one of the efficiency ratios and measures the number of times, on average, the inventory is sold and replaced during the fiscal year. Inventory Turnover Ratio measures company's efficiency in turning its inventory into sales. Its purpose is to measure the liquidity of the inventory. Inventory Turnover Ratio is figured as "turnover times". Average inventory should be used for inventory level to minimize the effect of seasonality.

The days sales of inventory value, or DSI, is a financial measure of a company's performance that gives investors an idea of how long it takes a company to turn its inventory (including goods that are a work in progress, if applicable) into sales.

- published: 04 Jan 2016

- views: 1

FINC 221 Week 2 Quiz (UMUC)

BUY HERE⬊

http://www.homeworkmade.com/umuc/finc-221/finc-221-week-2-quiz-umuc/

FINC 221 Week 2 Quiz (UMUC)

1. Which of the following is a correct statement...

BUY HERE⬊

http://www.homeworkmade.com/umuc/finc-221/finc-221-week-2-quiz-umuc/

FINC 221 Week 2 Quiz (UMUC)

1. Which of the following is a correct statement regarding a method of drafting a company's income statement?

2. Which of the following is NOT a correct definition of a basic type of financial ratios?

3. During a fiscal year, a company has $20,000,000 in revenue. Its operating expenses are $17,000,000. What is the company's operating margin?

4. During a fiscal year, a company had $25,000,000 in total sales. It had a cost of goods sold (COGS) of $18,000,000 and $4,000,000 in additional expenses. What is the company's gross profit margin?

5. A company had $5,000,000 in total revenues for its fiscal year. Its expenses for the year were $3,500,000. Its total assets were $12,500,000. What is the company's return on assets for the fiscal year?

6. A company has assets of $2,000,000, net sales of $3,000,000, and $1,500,000 in equity. Its net income is $10,000,000. What is its return on equity?

7. A business begins its fiscal year with an inventory balance of $1,000,000. During that year its cost of goods sold is $3,500,000. Its inventory balance at the end of the year is $500,000. What is its inventory turnover for the year?

8. A business has $1,250,000 in accounts receivable. Its annual sales for the fiscal year is $30,000,000. What is its days sales outstanding ratio?

wn.com/Finc 221 Week 2 Quiz (Umuc)

BUY HERE⬊

http://www.homeworkmade.com/umuc/finc-221/finc-221-week-2-quiz-umuc/

FINC 221 Week 2 Quiz (UMUC)

1. Which of the following is a correct statement regarding a method of drafting a company's income statement?

2. Which of the following is NOT a correct definition of a basic type of financial ratios?

3. During a fiscal year, a company has $20,000,000 in revenue. Its operating expenses are $17,000,000. What is the company's operating margin?

4. During a fiscal year, a company had $25,000,000 in total sales. It had a cost of goods sold (COGS) of $18,000,000 and $4,000,000 in additional expenses. What is the company's gross profit margin?

5. A company had $5,000,000 in total revenues for its fiscal year. Its expenses for the year were $3,500,000. Its total assets were $12,500,000. What is the company's return on assets for the fiscal year?

6. A company has assets of $2,000,000, net sales of $3,000,000, and $1,500,000 in equity. Its net income is $10,000,000. What is its return on equity?

7. A business begins its fiscal year with an inventory balance of $1,000,000. During that year its cost of goods sold is $3,500,000. Its inventory balance at the end of the year is $500,000. What is its inventory turnover for the year?

8. A business has $1,250,000 in accounts receivable. Its annual sales for the fiscal year is $30,000,000. What is its days sales outstanding ratio?

- published: 04 Jan 2016

- views: 0

Video Recording of President William Jefferson Clinton Delivering Remarks on the Fiscal Year 200...

This item is a video recording of President William Jefferson Clinton delivering remarks on the fiscal year 2000 budget.

Date: 1/20/1993 - 1/20/2001

Creators: ...

This item is a video recording of President William Jefferson Clinton delivering remarks on the fiscal year 2000 budget.

Date: 1/20/1993 - 1/20/2001

Creators: Department of Defense. Defense Information Systems Agency. White House Communications Agency. 6/25/1991- (Most Recent)

From: Series: Video Recordings Relating to the Clinton Administration, 1 1/20 20/1993 1993 - 1 1/20 20/2001 2001

Collection WJC-WHTV: Video Recordings of the White House Television Office (Clinton Administration)

localIdentifier:

naId: 6850860

More at http://www.FLYKVNY.com

wn.com/Video Recording Of President William Jefferson Clinton Delivering Remarks On The Fiscal Year 200...

This item is a video recording of President William Jefferson Clinton delivering remarks on the fiscal year 2000 budget.

Date: 1/20/1993 - 1/20/2001

Creators: Department of Defense. Defense Information Systems Agency. White House Communications Agency. 6/25/1991- (Most Recent)

From: Series: Video Recordings Relating to the Clinton Administration, 1 1/20 20/1993 1993 - 1 1/20 20/2001 2001

Collection WJC-WHTV: Video Recordings of the White House Television Office (Clinton Administration)

localIdentifier:

naId: 6850860

More at http://www.FLYKVNY.com

- published: 03 Jan 2016

- views: 2

State of the Bangladesh Economy in FY2015-16 (First Reading)

Centre for Policy Dialogue (CPD) undertakes several interim reviews of the economy throughout every fiscal year. Accordingly, CPD has prepared an assessment rep...

Centre for Policy Dialogue (CPD) undertakes several interim reviews of the economy throughout every fiscal year. Accordingly, CPD has prepared an assessment report titled “State of the Bangladesh Economy in FY2015-16 (First Reading).”

wn.com/State Of The Bangladesh Economy In Fy2015 16 (First Reading)

Centre for Policy Dialogue (CPD) undertakes several interim reviews of the economy throughout every fiscal year. Accordingly, CPD has prepared an assessment report titled “State of the Bangladesh Economy in FY2015-16 (First Reading).”

- published: 03 Jan 2016

- views: 101

SAP FI - Assign Company Code to Fiscal Year Variant

The company codes have to be assigned to an FYV (already defined in the system or custom)...

The company codes have to be assigned to an FYV (already defined in the system or custom)

wn.com/Sap Fi Assign Company Code To Fiscal Year Variant

The company codes have to be assigned to an FYV (already defined in the system or custom)

- published: 30 Dec 2015

- views: 0

SAP FI - Maintain Fiscal Year Variant

Used to maintain fiscal year variants (FYV), like creating new variants or modifying existing

FYVs can include year dependent, independent, and/or shortened var...

Used to maintain fiscal year variants (FYV), like creating new variants or modifying existing

FYVs can include year dependent, independent, and/or shortened variations

wn.com/Sap Fi Maintain Fiscal Year Variant

Used to maintain fiscal year variants (FYV), like creating new variants or modifying existing

FYVs can include year dependent, independent, and/or shortened variations

- published: 28 Dec 2015

- views: 0

Alan Greenspan: Fiscal Year 1989 Budget - Debt, Finance, Economics (1988)

Since 1976, Grassley has repeatedly introduced measures that increase the level of taxation on American citizens living abroad, including retroactive tax hikes....

Since 1976, Grassley has repeatedly introduced measures that increase the level of taxation on American citizens living abroad, including retroactive tax hikes. Grassley was eventually able to attach an amendment to a piece of legislation that went into effect in 2006, which increased taxes on Americans abroad by targeting housing and living incentives paid by foreign employers and held them accountable for federal taxes, even though they did not currently reside in the United States. Critics of the amendment felt that the move hurt Americans competing for jobs abroad by putting an unnecessary tax burden on foreign employers. Others felt that the move was only to offset the revenue deficit caused by domestic tax cuts of the Bush Administration.[9][10][11]

In March 2009, amid the scandal involving various AIG executives receiving large salary bonuses from the taxpayer-funded bailout of the corporate giant, Grassley suggested that those AIG employees receiving large bonuses should follow the so-called 'Japanese example', resign immediately or commit suicide. After some criticism, he dismissed the comments as rhetoric.

In May 2009, Grassley cosponsored a resolution to amend the US Constitution to prohibit flag-burning.

When President Barack Obama and the Democratic Party proposed a health reform bill featuring mandated health insurance, Grassley opposed the health insurance mandate, saying that it was a deal breaker.[16] In response to an audience question at an August 12, 2009, meeting in Iowa, about the end-of-life counseling provisions in the House health care bill, H.R. 3200, Grassley said people were right to fear that the government would "pull the plug on grandma."[17][18][19][20] Grassley had previously supported covering end-of-life counseling, having voted for the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, which stated: "The covered services are: evaluating the beneficiary's need for pain and symptom management, including the individual's need for hospice care; counseling the beneficiary with respect to end-of-life issues and care options, and advising the beneficiary regarding advanced care planning."[21] In December 2009, Grassley voted against the Patient Protection and Affordable Care Act (commonly called ObamaCare or the Affordable Care Act).

Grassley opposed the Manchin-Toomey gun control amendment, and instead proposed alternative legislation to increase prosecutions of gun violence and increase reporting of mental health data in background checks.[22]

As of December 2013, Grassley has cast 6,806 consecutive roll call votes,[23] placing him second behind the all-time consecutive vote record holder, Senator William Proxmire (D-Wis). Grassley has not missed a roll call vote since 1993, when he was touring Iowa with President Bill Clinton to survey flood damage. He has, as of July 2012, cast almost 11,000 votes and had at that time only missed 35 votes in his Senate career.[24]

In June 2015, Grassley introduced legislation to help protect taxpayers from abuses by the Internal Revenue Service. The legislation was proposed in response to recent events involving "mismanagement and inappropriate conduct" by employees at the IRS.

https://en.wikipedia.org/wiki/Chuck_Grassley

wn.com/Alan Greenspan Fiscal Year 1989 Budget Debt, Finance, Economics (1988)

Since 1976, Grassley has repeatedly introduced measures that increase the level of taxation on American citizens living abroad, including retroactive tax hikes. Grassley was eventually able to attach an amendment to a piece of legislation that went into effect in 2006, which increased taxes on Americans abroad by targeting housing and living incentives paid by foreign employers and held them accountable for federal taxes, even though they did not currently reside in the United States. Critics of the amendment felt that the move hurt Americans competing for jobs abroad by putting an unnecessary tax burden on foreign employers. Others felt that the move was only to offset the revenue deficit caused by domestic tax cuts of the Bush Administration.[9][10][11]

In March 2009, amid the scandal involving various AIG executives receiving large salary bonuses from the taxpayer-funded bailout of the corporate giant, Grassley suggested that those AIG employees receiving large bonuses should follow the so-called 'Japanese example', resign immediately or commit suicide. After some criticism, he dismissed the comments as rhetoric.

In May 2009, Grassley cosponsored a resolution to amend the US Constitution to prohibit flag-burning.

When President Barack Obama and the Democratic Party proposed a health reform bill featuring mandated health insurance, Grassley opposed the health insurance mandate, saying that it was a deal breaker.[16] In response to an audience question at an August 12, 2009, meeting in Iowa, about the end-of-life counseling provisions in the House health care bill, H.R. 3200, Grassley said people were right to fear that the government would "pull the plug on grandma."[17][18][19][20] Grassley had previously supported covering end-of-life counseling, having voted for the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, which stated: "The covered services are: evaluating the beneficiary's need for pain and symptom management, including the individual's need for hospice care; counseling the beneficiary with respect to end-of-life issues and care options, and advising the beneficiary regarding advanced care planning."[21] In December 2009, Grassley voted against the Patient Protection and Affordable Care Act (commonly called ObamaCare or the Affordable Care Act).

Grassley opposed the Manchin-Toomey gun control amendment, and instead proposed alternative legislation to increase prosecutions of gun violence and increase reporting of mental health data in background checks.[22]

As of December 2013, Grassley has cast 6,806 consecutive roll call votes,[23] placing him second behind the all-time consecutive vote record holder, Senator William Proxmire (D-Wis). Grassley has not missed a roll call vote since 1993, when he was touring Iowa with President Bill Clinton to survey flood damage. He has, as of July 2012, cast almost 11,000 votes and had at that time only missed 35 votes in his Senate career.[24]

In June 2015, Grassley introduced legislation to help protect taxpayers from abuses by the Internal Revenue Service. The legislation was proposed in response to recent events involving "mismanagement and inappropriate conduct" by employees at the IRS.

https://en.wikipedia.org/wiki/Chuck_Grassley

- published: 26 Dec 2015

- views: 5

Fiscal fights fade as U.S. Congress backs huge budget bill

Brushing aside concerns about deepening the budget deficit, U.S. lawmakers approved $1.8 trillion worth of federal spending and tax breaks on Friday in a rare c...

Brushing aside concerns about deepening the budget deficit, U.S. lawmakers approved $1.8 trillion worth of federal spending and tax breaks on Friday in a rare case of bipartisan action after years of damaging fiscal fights in Congress.

The Senate voted 65-33 to approve sweeping legislation that averted a government shutdown, locked in billions of dollars of tax breaks and scrapped a 40-year-old ban on the export of U.S. oil.

Negotiations on Capitol Hill were mostly free of the acrimony that has blighted similar talks for the past five years and forced lawmakers to produce a succession of stopgap measures just to keep the government running.

"I think the system worked" this time, President Barack Obama said during a White House news conference.

He later signed the bill into law in a low-key Oval Office ceremony.

It was a win for new House of Representatives Speaker Paul Ryan, who managed to keep fiscal hawks in his Republican caucus under control during weeks of talks and avoid the kind of infighting that plagued his predecessor, John Boehner.

Obama gave Ryan's efforts a nod during a White House news conference.

"Kudos to him as well," Obama said, along with "all the leaders and appropriators who were involved in this process."

The Democratic president acknowledged he still had basic policy differences with Ryan but described "a good working relationship" between the two.

At more than 2,000 pages long, the spending portion of the bill funds the government through next September, preventing a shutdown and effectively taking difficult budget disputes off the table as the 2016 presidential campaign enters the primary season.

Most of the U.S. senators running for the White House voted against the bill, including Republicans Ted Cruz and Rand Paul and Democrat Bernie Sanders. Republican Lindsey Graham voted in favor. Republican Senator Marco Rubio, who had been criticized by campaign rivals for missing votes, was absent from Congress on Friday.

Dozens of previously temporary tax breaks will now be permanent under the tax segment of the bill, which will cost $680 billion over 10 years and was promoted by corporate lobbyists and low-tax Republicans.

Middle-class Americans also gain. Students, low-income parents and teachers will receive tax aid, attracting support for the legislation from the White House and congressional Democrats.

Lawmakers also lifted a four-decade-old ban on U.S. crude oil exports, a historic move that nevertheless will have little immediate effect on oil markets.

"I'm not wild about everything in it," Obama said of the legislation. "I'm sure that's true for everybody. But it is a budget that, as I insisted, invests in our military and our middle class without ideological provisions that would have weakened Wall Street reform or rules on big polluters."

DEFICIT WORRIES

Some Republicans worry that the $1.15 trillion spending provisions add to the federal budget deficit and erode the fiscal discipline that House Republicans have championed, particularly since lawmakers aligned with the conservative Tea Party movement did well in 2010 congressional elections.

But Tea Party momentum has slowed as the federal deficit drops from its peak of $1.41 trillion in 2009 due to the economic recovery. The deficit was $439 billion for the fiscal year that ended on Sept. 30.

The congressional Joint Committee on Taxation estimates the legislation passed on Friday will increase the 2016 fiscal year budget deficit by $157 billion and by $95 billion in 2017.

Tim Huelskamp of Kansas, a leading House Republican fiscal hawk, said the bill was “an early Christmas present for Donald Trump," the billionaire businessman seeking the Republican presidential nomination, because it will fuel the anti-establishment mood in the country.

Conservatives complained that Republican leaders agreed on the bill's spending and tax provisions behind closed doors and then rushed the bill through the Senate on Friday morning.

"A rotten process yields a rotten result, and this 2,000-page, trillion-dollar bill is rotten to its core," Republican Senator Tom Cotton of Arkansas said. "Corporate lobbyists had a field day, but working Americans lost out," Cotton said.

Some Democrats criticized the tax cuts, saying they give more aid to large corporations and wealthy business owners than to working families.

The largest component of the tax package is the business research and development tax credit, which will cost $113 billion over a decade in lost government revenues.

The bill ratifies International Monetary Fund reforms aimed at boosting the representation of emerging economies within the international lender.

wn.com/Fiscal Fights Fade As U.S. Congress Backs Huge Budget Bill

Brushing aside concerns about deepening the budget deficit, U.S. lawmakers approved $1.8 trillion worth of federal spending and tax breaks on Friday in a rare case of bipartisan action after years of damaging fiscal fights in Congress.

The Senate voted 65-33 to approve sweeping legislation that averted a government shutdown, locked in billions of dollars of tax breaks and scrapped a 40-year-old ban on the export of U.S. oil.

Negotiations on Capitol Hill were mostly free of the acrimony that has blighted similar talks for the past five years and forced lawmakers to produce a succession of stopgap measures just to keep the government running.

"I think the system worked" this time, President Barack Obama said during a White House news conference.

He later signed the bill into law in a low-key Oval Office ceremony.

It was a win for new House of Representatives Speaker Paul Ryan, who managed to keep fiscal hawks in his Republican caucus under control during weeks of talks and avoid the kind of infighting that plagued his predecessor, John Boehner.

Obama gave Ryan's efforts a nod during a White House news conference.

"Kudos to him as well," Obama said, along with "all the leaders and appropriators who were involved in this process."

The Democratic president acknowledged he still had basic policy differences with Ryan but described "a good working relationship" between the two.

At more than 2,000 pages long, the spending portion of the bill funds the government through next September, preventing a shutdown and effectively taking difficult budget disputes off the table as the 2016 presidential campaign enters the primary season.

Most of the U.S. senators running for the White House voted against the bill, including Republicans Ted Cruz and Rand Paul and Democrat Bernie Sanders. Republican Lindsey Graham voted in favor. Republican Senator Marco Rubio, who had been criticized by campaign rivals for missing votes, was absent from Congress on Friday.

Dozens of previously temporary tax breaks will now be permanent under the tax segment of the bill, which will cost $680 billion over 10 years and was promoted by corporate lobbyists and low-tax Republicans.

Middle-class Americans also gain. Students, low-income parents and teachers will receive tax aid, attracting support for the legislation from the White House and congressional Democrats.

Lawmakers also lifted a four-decade-old ban on U.S. crude oil exports, a historic move that nevertheless will have little immediate effect on oil markets.

"I'm not wild about everything in it," Obama said of the legislation. "I'm sure that's true for everybody. But it is a budget that, as I insisted, invests in our military and our middle class without ideological provisions that would have weakened Wall Street reform or rules on big polluters."

DEFICIT WORRIES

Some Republicans worry that the $1.15 trillion spending provisions add to the federal budget deficit and erode the fiscal discipline that House Republicans have championed, particularly since lawmakers aligned with the conservative Tea Party movement did well in 2010 congressional elections.

But Tea Party momentum has slowed as the federal deficit drops from its peak of $1.41 trillion in 2009 due to the economic recovery. The deficit was $439 billion for the fiscal year that ended on Sept. 30.

The congressional Joint Committee on Taxation estimates the legislation passed on Friday will increase the 2016 fiscal year budget deficit by $157 billion and by $95 billion in 2017.

Tim Huelskamp of Kansas, a leading House Republican fiscal hawk, said the bill was “an early Christmas present for Donald Trump," the billionaire businessman seeking the Republican presidential nomination, because it will fuel the anti-establishment mood in the country.

Conservatives complained that Republican leaders agreed on the bill's spending and tax provisions behind closed doors and then rushed the bill through the Senate on Friday morning.

"A rotten process yields a rotten result, and this 2,000-page, trillion-dollar bill is rotten to its core," Republican Senator Tom Cotton of Arkansas said. "Corporate lobbyists had a field day, but working Americans lost out," Cotton said.

Some Democrats criticized the tax cuts, saying they give more aid to large corporations and wealthy business owners than to working families.

The largest component of the tax package is the business research and development tax credit, which will cost $113 billion over a decade in lost government revenues.

The bill ratifies International Monetary Fund reforms aimed at boosting the representation of emerging economies within the international lender.

- published: 18 Dec 2015

- views: 15

Sitka Training Video - Acquisitions Fiscal Year Close-out (Year End)

This video shows how to run the Acquisitions Year End Procedure in Sitka Evergreen. Sitka, a group of the BC Libraries Cooperative, is a consortium of libraries...

This video shows how to run the Acquisitions Year End Procedure in Sitka Evergreen. Sitka, a group of the BC Libraries Cooperative, is a consortium of libraries in British Columbia and Manitoba who all share a single integrated library system using the open source Evergreen software for their integrated library system. The presenter is Christine Burns.

wn.com/Sitka Training Video Acquisitions Fiscal Year Close Out (Year End)

This video shows how to run the Acquisitions Year End Procedure in Sitka Evergreen. Sitka, a group of the BC Libraries Cooperative, is a consortium of libraries in British Columbia and Manitoba who all share a single integrated library system using the open source Evergreen software for their integrated library system. The presenter is Christine Burns.

- published: 18 Dec 2015

- views: 13

-

Congressional Hearing: NASA Fiscal Year 2015 Budget Request

Committee on Science, Space and Technology Subcommittee on Space - A Review of the National Aeronautics and Space Administration Budget for Fiscal Year 2015.

-

The Energy Department's Fiscal Year 2015 Budget Request

Learn More: http://go.usa.gov/KYZV Energy Secretary Ernest Moniz hosts a media briefing on the Energy Department's Fiscal Year 2015 Budget Request, outlining...

-

The Energy Department's Fiscal Year 2016 Budget Request

U.S. Secretary of Energy Ernest Moniz detailed President Barack Obama’s $30 billion Fiscal Year 2016 Budget Request for the Energy Department. This Budget continues the Administration’s efforts to invest in America’s future, making critical investments in research, energy and infrastructure that will help support continued economic growth and job creation, in national and energy security, and in

-

Excel 2013 PowerPivot Basics 7: Calendar Table Calculated Columns: Month Year Quarter Fiscal Quarter

Download file: http://people.highline.edu/mgirvin/excelisfun.htm Scroll to down to PowerPivot Section.

See how to:

1. (00:17 min mark) Calendar Table in Diagram View with no Calculated Fields

2. (00:58 min mark) Format Date Column

3. (01:08 min mark) Create Calculated Column #01: Month Number using MONTH function.

4. (01:53 min mark) Create Calculated Column #02: Month Name using FORMAT function

-

Media Briefing: Fiscal Year 2012 Budget

US Department of Energy Secretary Steven Chu holds a media briefing on the Fiscal Year 2011 Budget.

-

President's Fiscal Year 2016 NASA Budget Request, Senate Space Subcommittee, March 12, 2015